Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Covisint Corp | a8-kq3fy17earningsrelease.htm |

| EX-99.1 - EXHIBIT 99.1 - Covisint Corp | exhibit991q32017.htm |

2/9/2017 1

Covisint Corporation

Third Quarter Fiscal 2017 Results

February 9, 2017

This presentation contains “forward-looking” statements that involve risks, uncertainties and assumptions. If the risks or uncertainties ever materialize or the

assumptions prove incorrect, our results may differ materially from those expressed or implied by such forward-looking statements. All statements other than

statements of historical fact could be deemed forward-looking, including, but not limited to, any projections of financial information; any statements about

historical results that may suggest trends for our business and results of operations; any statements of the plans, strategies and objectives of management for

future operations; any statements of expectation or belief regarding future events, potential markets or market size, technology developments, or enforceability

of our intellectual property rights; and any statements of assumptions underlying any of the foregoing.

These statements are based on estimates and information available to us at the time of this presentation and are not guarantees of future performance. Actual

results could differ materially from our current expectations as a result of many factors, including but not limited to: our ability to attract new customers; the

extent to which customers renew their contracts for our solutions; the extent we are able to maintain pricing with our customers at renewal; the seasonality of our

business; our ability to manage our growth; the continued growth of the market for our solutions; the success of our channel partner and certified partner

strategies; competition from current competitors and new market entrants; our ability to penetrate new vertical markets; unpredictable macro-economic

conditions; the loss of any of our key employees; the length of the sales and implementation cycles for our solutions; increased demands on our infrastructure

and costs associated with operating as a public company; and failure to protect our intellectual property. These and other risks and uncertainties associated with

our business are described in Item 1A “Risk Factors” in our Quarterly Report on Form 10-Q for the period ended December 31, 2016. We assume no obligation

and do not intend to update these forward-looking statements.

In addition to U.S. GAAP financials, this presentation includes certain non-GAAP financial measures. These historical and forward-looking non-GAAP measures

are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. A reconciliation between GAAP and

non-GAAP measures is included in the appendix to this presentation.

Covisint is a registered trademark of Covisint Corporation. This presentation also contains additional trademarks and service marks of ours and of other

companies. We do not intend our use or display of other companies’ trademarks or service marks to imply a relationship with, or endorsement or sponsorship of

us by, these other companies.

Forward Looking Statements

2

3

Q3 FY17: Financial Overview

Key Metrics ($ in thousands)

Guidance Summary

* Excludes the impact of stock compensation and the expensing of certain R&D costs (rather than capitalizing such costs), refer to the reconciliation of quarterly results

on slide 6 and the reconciliation of guidance on slide 7.

** Y/Y growth

FY17

Subscription Revenue** (3) - (5)%

About 15% of

Total Revenue

Non-GAAP Net Loss* $(11) – (12) mil

Cash on Hand (EOP) $33 mil

Total Shares Outstanding 41.0 mil

Services Revenue

Q3 FY 17 Y/Y Q/Q

Subscription Revenue $ 14,735 (3%) 1%

Services Revenue $ 1,911 (51%) (25%)

Total Revenue $ 16,646 (13%) (3%)

Q3 FY 17 Y/Y Q/Q

Gross Profit $ 8,146 (21%) (2%)

Gross Margin 49%

Stock Compensation Expense $ 16

Amortization of Capitalized Software $ 1,152

Non-GAAP Gross Profit* $ 9,314 (17%) (2%)

Non-GAAP Gross Margin 56%

Net Loss $ (4,400)

Stock Compensation Expense $ 491

Capitalized internal software costs $ (746)

Amortization of Capitalized Software $ 1,152

Non-GAAP Net Loss* $ (3,503)

Net Change in Cash $ (4,376)

Net proceeds from exercise of stock awards $ (118)

Vendor Financing Payment $ 245

Effect of Exchange Rate Changes on Cash $ 95

Free Cash Flow $ (4,154)

Highlights

• C sh at $30 million

• Non-GAAP Gross Margin in line with expectations

• Cash Flow better than expectations

• Expect Cash Flow break-even in Fiscal 2018

Q3 FY17 Highlights

4

• Market Continues to Develop Around Our Key Components

• Internet of Things

• Cloud Identity and Access Management

• Primary Focus Remains on Building Sales Momentum

• Increased focused on the automotive market

• Rebuilt sales and account executive teams with specific auto industry experience

• Improved pipeline of opportunity

• Manage Cash Position Through Strong Expense Management

• Finished Q3 FY17 with $30.4 million in cash

• Expect cash flow break-even for FY18

Appendix

6

Q3 FY17: Non-GAAP Reconciliation

($ in thousands, except per share)

Net Change in Cash $ (4,376)

Net proceeds from exercise of stock awards $ (118)

Vendor Financing Payment $ 245

Effect of Exchange Rate Changes on Cash $ 95

Free Cash Flow $ (4,154)

Q3'FY17

General and administrative 2,813

Adjustments:

Stock compensation expense 371

General and administrative, non-GAAP 2,442

Q3'FY17

Net loss (4,400)

Adjustments:

Capitalized internal software costs (746)

Stock compensation expense 491

Amortization of capitalized software and other intangibles 1,152

Net loss, non-GAAP (3,503)

Q3'FY17

Diluted EPS (0.11)

Adjustments:

Capitalized internal software costs (0.02)

Stock compensation expense 0.01

Amortization of capitalized software and other intangibles 0.03

Diluted EPS, non-GAAP (0.09)

Q3'FY17

Cost of revenue 8,500

Adjustments:

Stock compensation expense 16

Amortization of capitalized software and other intangibles 1,152

Cost of revenue, non-GAAP 7,332

Q3'FY17

Research and development 2,578

Adjustments:

Capitalized internal softwar costs (746)

Stock compensation expense 11

Research and development, non-GAAP 3,313

Q3'FY17

Sales and marketing 7,128

Adjustments:

Stock compensation expense 93

Sales and marketing, non-GAAP 7,035

7

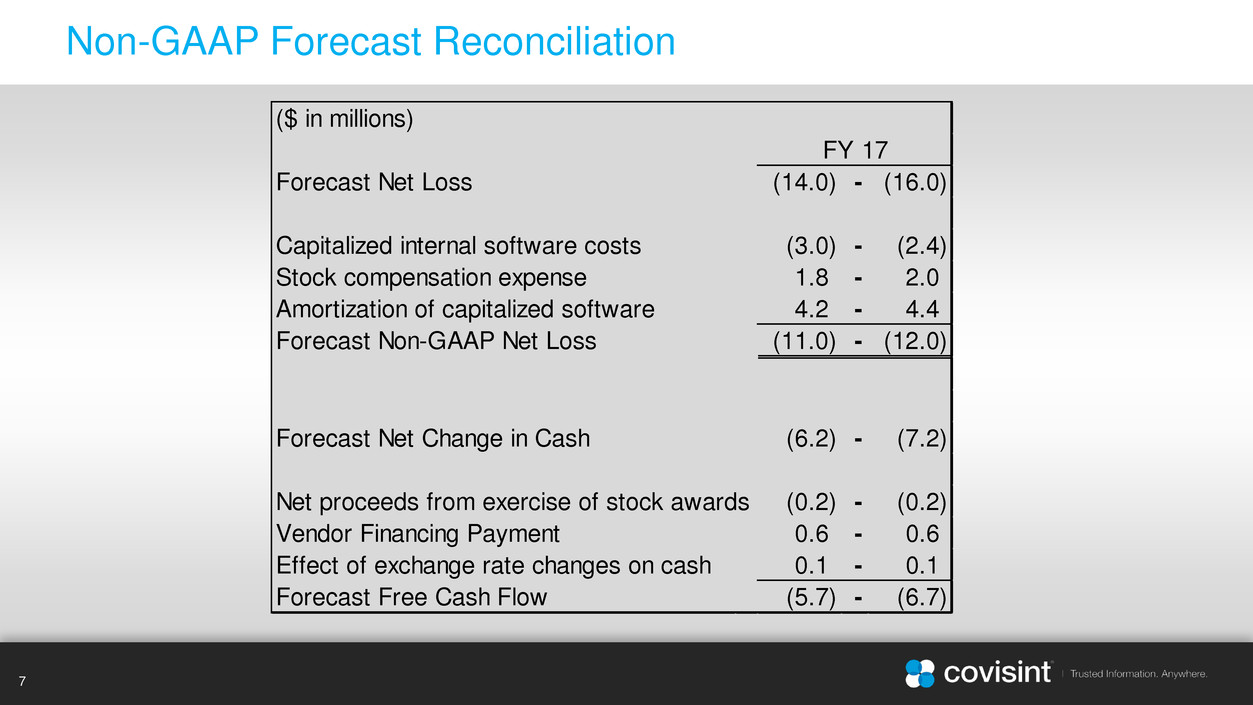

Non-GAAP Forecast Reconciliation

($ in millions)

Forecast Net Loss (14.0) - (16.0)

Capitalized internal software costs (3.0) - (2.4)

Stock compensation expense 1.8 - 2.0

Amortization of capitalized software 4.2 - 4.4

Forecast Non-GAAP Net Loss (11.0) - (12.0)

Forecast Net Change in Cash (6.2) - (7.2)

Net proceeds from exercise of stock awards (0.2) - (0.2)

Vendor Financing Payment 0.6 - 0.6

Effect of exchange rate changes on cash 0.1 - 0.1

Forecast Free Cash Flow (5.7) - (6.7)

FY 17