Attached files

| file | filename |

|---|---|

| EX-99.4 - EX-99.4 - ADVANCED DRAINAGE SYSTEMS, INC. | d348406dex994.htm |

| EX-99.3 - EX-99.3 - ADVANCED DRAINAGE SYSTEMS, INC. | d348406dex993.htm |

| EX-99.1 - EX-99.1 - ADVANCED DRAINAGE SYSTEMS, INC. | d348406dex991.htm |

| 8-K - FORM 8-K - ADVANCED DRAINAGE SYSTEMS, INC. | d348406d8k.htm |

Third Quarter Fiscal 2017 Financial Results Exhibit 99.2

Management Presenters Joe Chlapaty Chairman and Chief Executive Officer Scott Cottrill Executive Vice President, Chief Financial Officer, Secretary and Treasurer Mike Higgins Director, Investor Relations & Business Strategy *

Safe Harbor and Non-GAAP Financial Metrics Certain statements in this presentation may be deemed to be forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements include, but are not limited to, statements regarding the anticipated timing for the issuance of additional historic and future financial information and related filings. These statements are not historical facts but rather are based on the Company’s current expectations, estimates and projections regarding the Company’s business, operations and other factors relating thereto. Words such as “may,” “will,” “could,” “would,” “should,” “anticipate,” “predict,” “potential,” “continue,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” “confident” and similar expressions are used to identify these forward-looking statements. Factors that could cause actual results to differ from those reflected in forward-looking statements relating to our operations and business include: fluctuations in the price and availability of resins and other raw materials and our ability to pass any increased costs of raw materials on to our customers in a timely manner; volatility in general business and economic conditions in the markets in which we operate, including, without limitation, factors relating to availability of credit, interest rates, fluctuations in capital and business and consumer confidence; cyclicality and seasonality of the non-residential and residential construction markets and infrastructure spending; the risks of increasing competition in our existing and future markets, including competition from both manufacturers of high performance thermoplastic corrugated pipe and manufacturers of products using alternative materials; our ability to continue to convert current demand for concrete, steel and PVC pipe products into demand for our high performance thermoplastic corrugated pipe and Allied Products; the effect of weather or seasonality; the loss of any of our significant customers; the risks of doing business internationally; the risks of conducting a portion of our operations through joint ventures; our ability to expand into new geographic or product markets; our ability to achieve the acquisition component of our growth strategy; the risk associated with manufacturing processes; our ability to manage our assets; the risks associated with our product warranties; our ability to manage our supply purchasing and customer credit policies; the risks associated with our self-insured programs; our ability to control labor costs and to attract, train and retain highly-qualified employees and key personnel; our ability to protect our intellectual property rights; changes in laws and regulations, including environmental laws and regulations; our ability to project product mix; the risks associated with our current levels of indebtedness; our ability to meet future capital requirements and fund our liquidity needs; the risk that additional information may arise during the course of the Company’s ongoing accounting review that would require the Company to make additional adjustments or revisions or to restate further the financial statements and other financial data for certain prior periods and any future periods; a conclusion that the Company’s disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) of the Exchange Act) were ineffective; the review of potential weaknesses or deficiencies in the Company’s disclosure controls and procedures, and discovering further weaknesses of which we are not currently aware or which have not been detected; additional uncertainties related to accounting issues generally and other risks and uncertainties described in the Company’s filings with the Securities and Exchange Commission. New risks and uncertainties emerge from time to time and it is not possible for the Company to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this press release. In light of the significant uncertainties inherent in the forward-looking information included herein, the inclusion of such information should not be regarded as a representation by the Company or any other person that the Company’s expectations, objectives or plans will be achieved in the timeframe anticipated or at all. Investors are cautioned not to place undue reliance on the Company’s forward-looking statements and the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. This presentation includes certain non-GAAP financial measures to describe the Company’s performance. The reconciliation of those measures to GAAP measures are provided within the appendix of the presentation. Those disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. *

Third quarter net sales decline as expected due primarily to continued weakness in domestic and Canadian Ag markets. 1 Q3 2017 Highlights 2 3 4 Continued track record of delivering above market growth in non-residential construction. Benefit from lower resin cost offset by lower volume. Favorable cash flow generation supporting debt reduction, growth investments and cash returns to shareholders. *

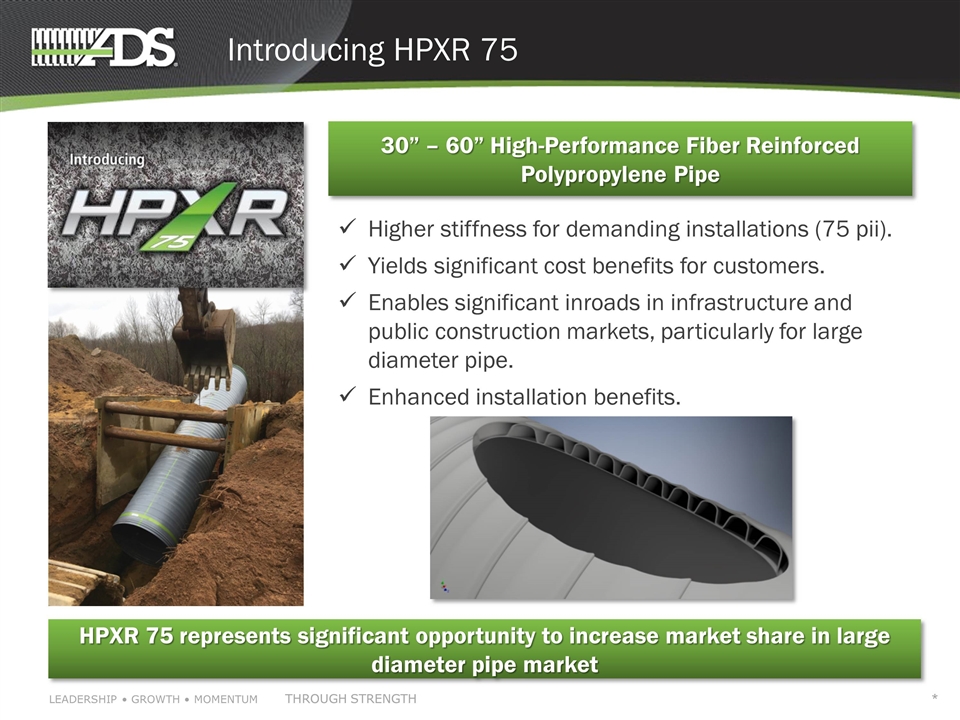

Introducing HPXR 75 Higher stiffness for demanding installations (75 pii). Yields significant cost benefits for customers. Enables significant inroads in infrastructure and public construction markets, particularly for large diameter pipe. Enhanced installation benefits. HPXR 75 represents significant opportunity to increase market share in large diameter pipe market 30” – 60” High-Performance Fiber Reinforced Polypropylene Pipe *

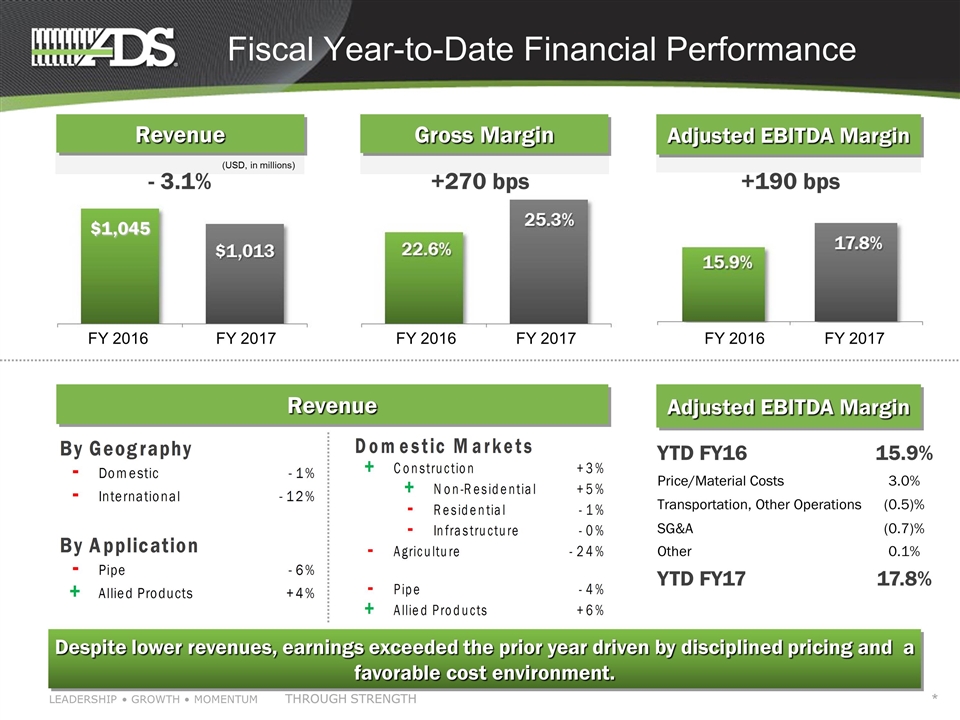

Fiscal Year-to-Date Financial Performance Revenue Gross Margin Adjusted EBITDA Margin Despite lower revenues, earnings exceeded the prior year driven by disciplined pricing and a favorable cost environment. FY 2017 FY 2016 FY 2017 FY 2016 FY 2017 FY 2016 - 3.1% +270 bps +190 bps (USD, in millions) $1,045 Revenue Adjusted EBITDA Margin YTD FY16 15.9% Price/Material Costs 3.0% Transportation, Other Operations (0.5)% SG&A (0.7)% Other 0.1% YTD FY17 17.8% *

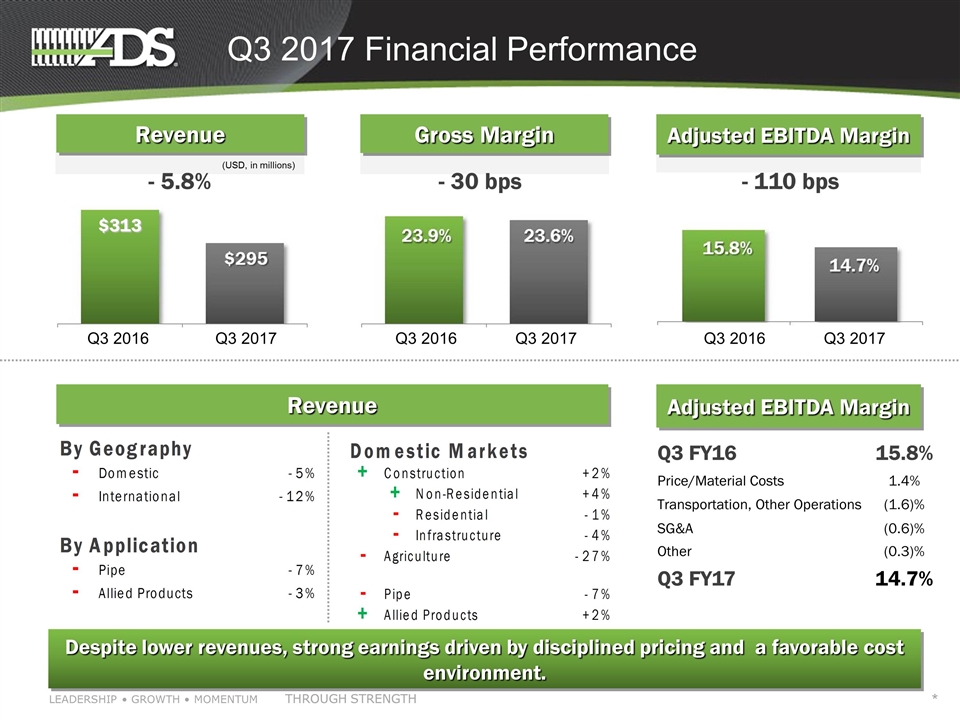

Q3 2017 Financial Performance Revenue Gross Margin Adjusted EBITDA Margin Despite lower revenues, strong earnings driven by disciplined pricing and a favorable cost environment. Q3 2017 Q3 2016 Q3 2017 Q3 2016 Q3 2017 Q3 2016 - 5.8% - 30 bps - 110 bps (USD, in millions) $313 Revenue Adjusted EBITDA Margin Q3 FY16 15.8% Price/Material Costs 1.4% Transportation, Other Operations (1.6)% SG&A (0.6)% Other (0.3)% Q3 FY17 14.7% *

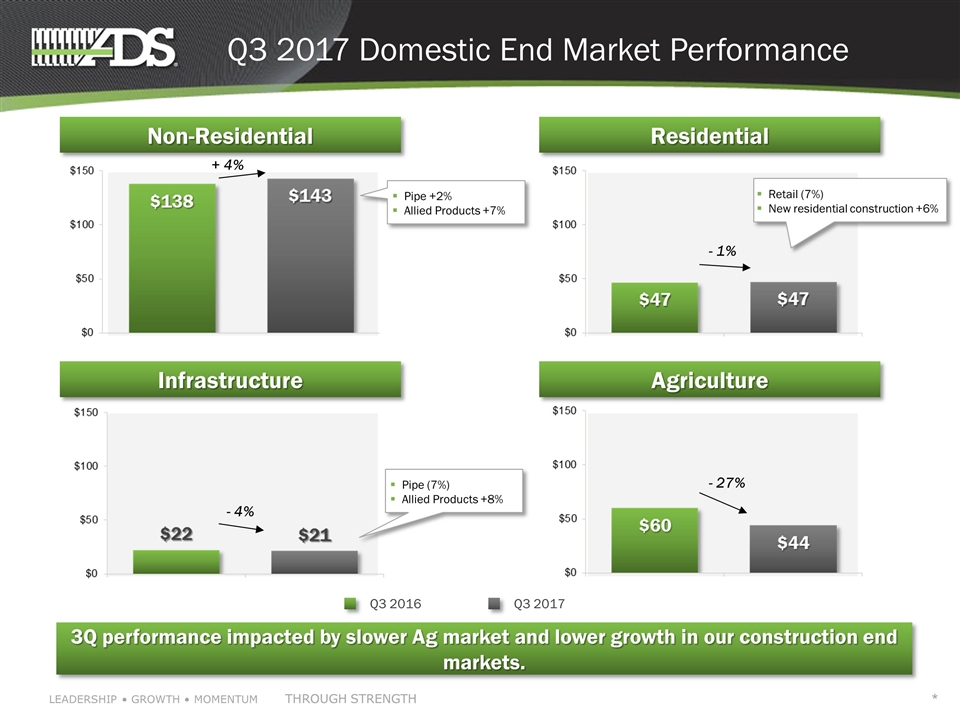

Q3 2016 Q3 2017 Q3 2017 Domestic End Market Performance Non-Residential Infrastructure Residential Agriculture 3Q performance impacted by slower Ag market and lower growth in our construction end markets. + 4% - 1% - 4% Pipe +2% Allied Products +7% Retail (7%) New residential construction +6% Pipe (7%) Allied Products +8% - 27% *

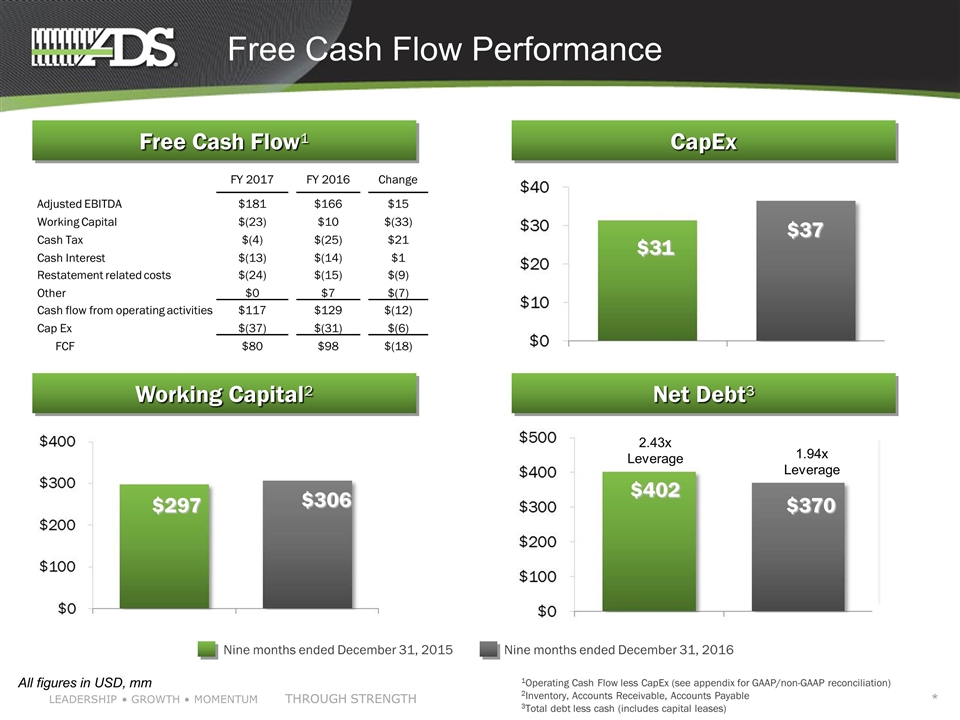

Nine months ended December 31, 2015 Nine months ended December 31, 2016 Free Cash Flow¹ Free Cash Flow Performance % of Sales 2.7% 3.5% All figures in USD, mm Working Capital² CapEx Net Debt³ $31 $37 $402 $370 $297 $306 FY 2017 FY 2016 Change Adjusted EBITDA $181 $166 $15 Working Capital $(23) $10 $(33) Cash Tax $(4) $(25) $21 Cash Interest $(13) $(14) $1 Restatement related costs $(24) $(15) $(9) Other $0 $7 $(7) Cash flow from operating activities $117 $129 $(12) Cap Ex $(37) $(31) $(6) FCF $80 $98 $(18) 1Operating Cash Flow less CapEx (see appendix for GAAP/non-GAAP reconciliation) 2Inventory, Accounts Receivable, Accounts Payable 3Total debt less cash (includes capital leases) 2.43x Leverage 1.94x Leverage *

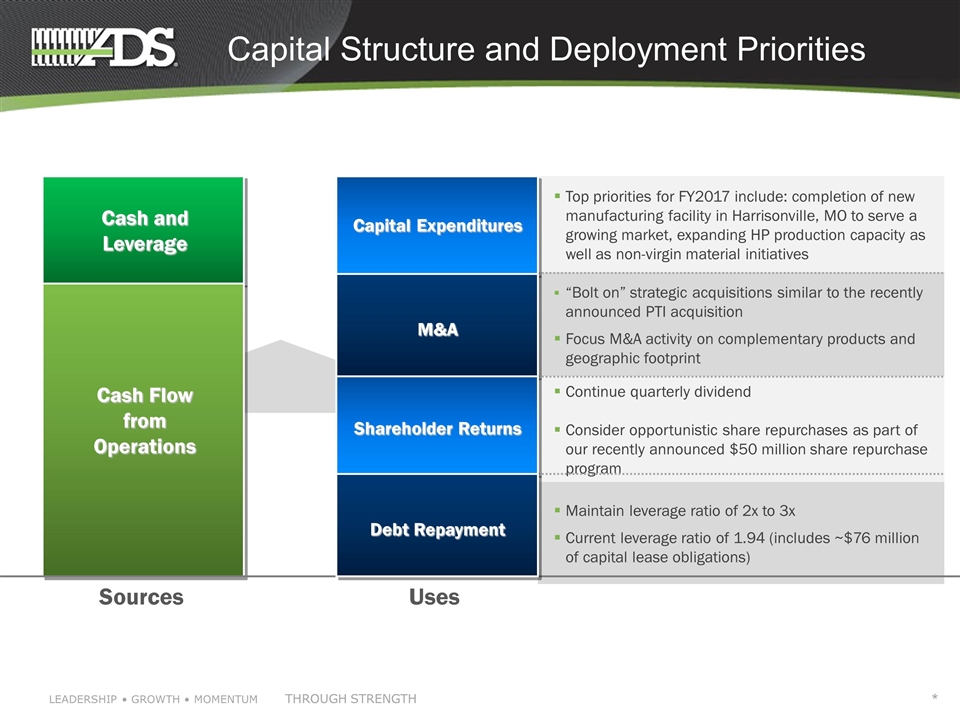

Capital Structure and Deployment Priorities Cash and Leverage Cash Flow from Operations Sources Uses Top priorities for FY2017 include: completion of new manufacturing facility in Harrisonville, MO to serve a growing market, expanding HP production capacity as well as non-virgin material initiatives “Bolt on” strategic acquisitions similar to the recently announced PTI acquisition Focus M&A activity on complementary products and geographic footprint Continue quarterly dividend Consider opportunistic share repurchases as part of our recently announced $50 million share repurchase program Maintain leverage ratio of 2x to 3x Current leverage ratio of 1.94 (includes ~$76 million of capital lease obligations) Capital Expenditures M&A Shareholder Returns Debt Repayment *

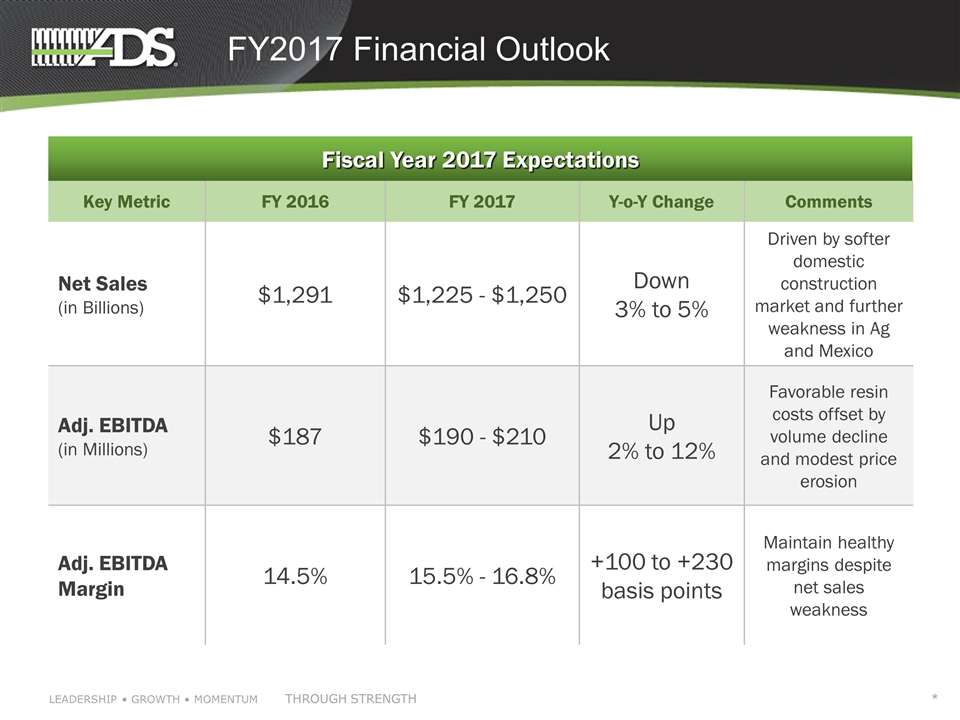

FY2017 Financial Outlook Key Metric FY 2016 FY 2017 Y-o-Y Change Comments Net Sales (in Billions) $1,291 $1,225 - $1,250 Down 3% to 5% Driven by softer domestic construction market and further weakness in Ag and Mexico Adj. EBITDA (in Millions) $187 $190 - $210 Up 2% to 12% Favorable resin costs offset by volume decline and modest price erosion Adj. EBITDA Margin 14.5% 15.5% - 16.8% +100 to +230 basis points Maintain healthy margins despite net sales weakness Fiscal Year 2017 Expectations *

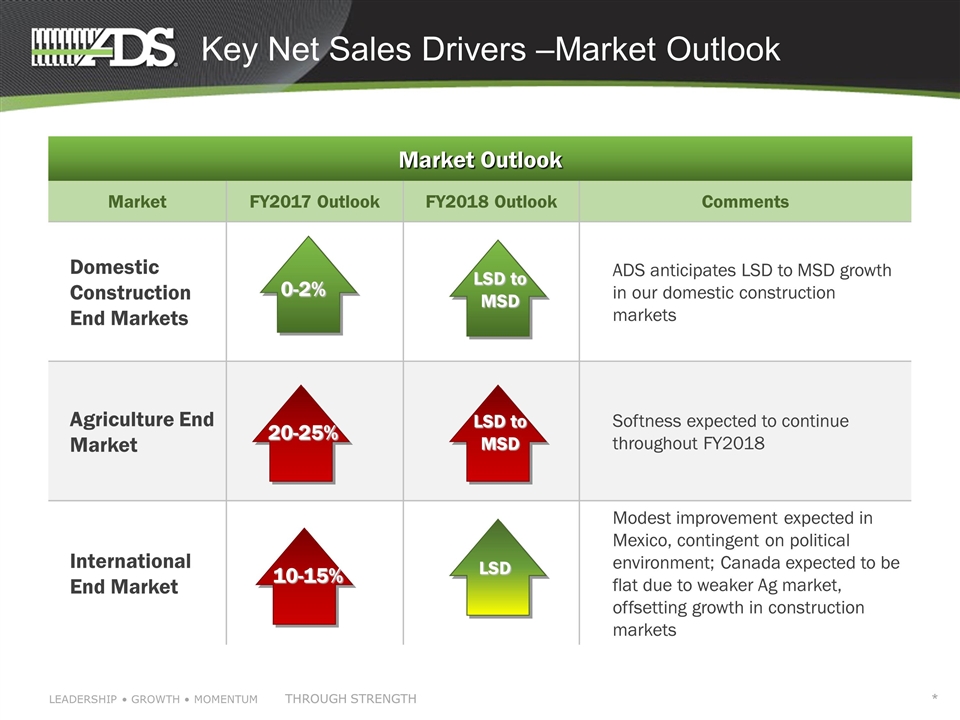

Market FY2017 Outlook FY2018 Outlook Comments Domestic Construction End Markets ADS anticipates LSD to MSD growth in our domestic construction markets Agriculture End Market Softness expected to continue throughout FY2018 International End Market Modest improvement expected in Mexico, contingent on political environment; Canada expected to be flat due to weaker Ag market, offsetting growth in construction markets Key Net Sales Drivers –Market Outlook Market Outlook 10-15% 20-25% 0-2% LSD to MSD LSD to MSD LSD *

Q&A Session *

Closing Remarks Strong results in non-residential and new residential construction markets 1 2 3 Generated double digit growth in HP Pipe sales as well as solid growth in Allied products Focused on accelerating growth through innovation and M&A 4 Committed to returning excess cash to shareholders through dividend and recently authorized share repurchase program. *

Appendix *

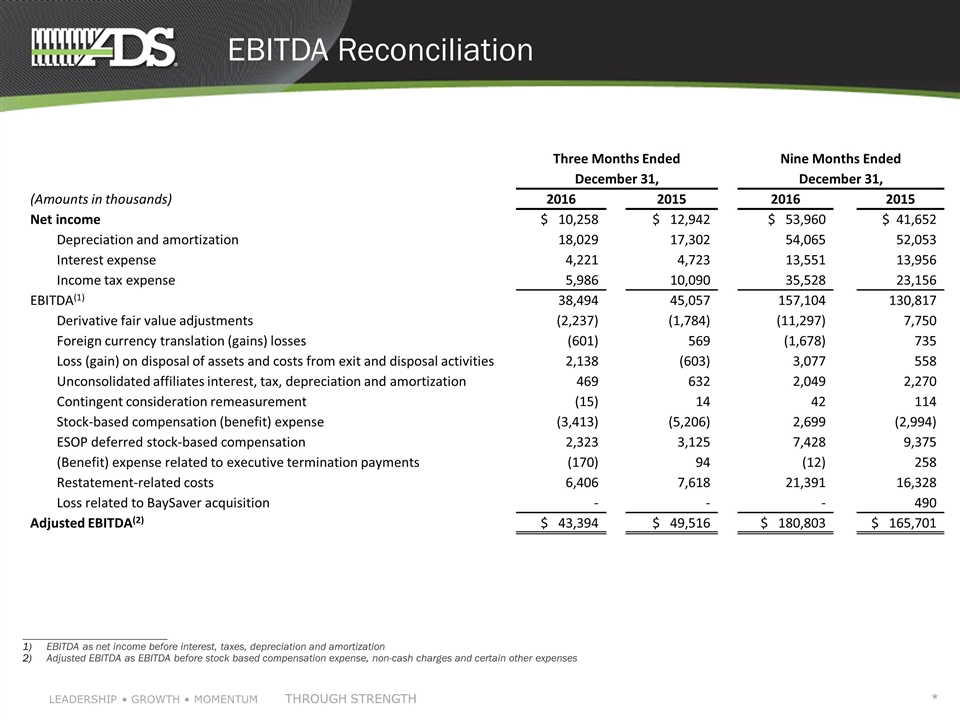

EBITDA Reconciliation ___________________________ EBITDA as net income before interest, taxes, depreciation and amortization Adjusted EBITDA as EBITDA before stock based compensation expense, non-cash charges and certain other expenses Three Months Ended Nine Months Ended December 31, December 31, (Amounts in thousands) 2016 2015 2016 2015 Net income $ 10,258 $ 12,942 $ 53,960 $ 41,652 Depreciation and amortization 18,029 17,302 54,065 52,053 Interest expense 4,221 4,723 13,551 13,956 Income tax expense 5,986 10,090 35,528 23,156 EBITDA(1) 38,494 45,057 157,104 130,817 Derivative fair value adjustments (2,237) (1,784) (11,297) 7,750 Foreign currency translation (gains) losses (601) 569 (1,678) 735 Loss (gain) on disposal of assets and costs from exit and disposal activities 2,138 (603) 3,077 558 Unconsolidated affiliates interest, tax, depreciation and amortization 469 632 2,049 2,270 Contingent consideration remeasurement (15) 14 42 114 Stock-based compensation (benefit) expense (3,413) (5,206) 2,699 (2,994) ESOP deferred stock-based compensation 2,323 3,125 7,428 9,375 (Benefit) expense related to executive termination payments (170) 94 (12) 258 Restatement-related costs 6,406 7,618 21,391 16,328 Loss related to BaySaver acquisition - - - 490 Adjusted EBITDA(2) $ 43,394 $ 49,516 $ 180,803 $ 165,701 *

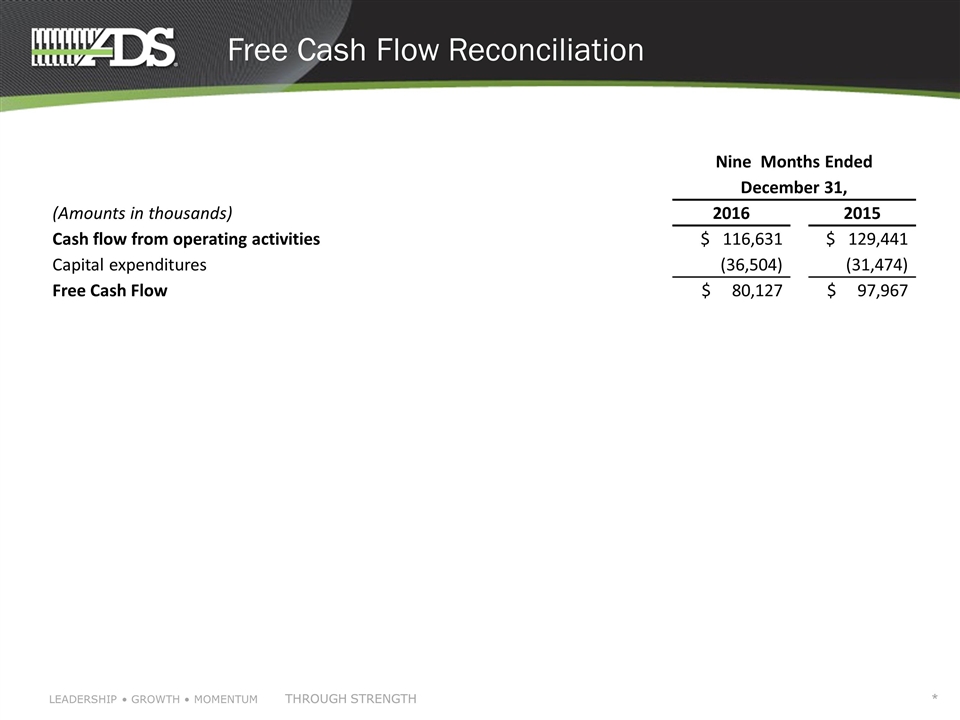

Free Cash Flow Reconciliation Nine Months Ended December 31, (Amounts in thousands) 2016 2015 Cash flow from operating activities $ 116,631 $ 129,441 Capital expenditures (36,504) (31,474) Free Cash Flow $ 80,127 $ 97,967 *