Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Zendesk, Inc. | zen_8-kxq4x2016xfinal.htm |

| EX-99.3 - EXHIBIT 99.3 - Zendesk, Inc. | q416tweetsec02.htm |

| EX-99.1 - EXHIBIT 99.1 - Zendesk, Inc. | zen_8-kxq4x2016xex991.htm |

Shareholder Letter

Fourth Quarter 2016

February 08, 2017

Exhibit 99.2

Zendesk Sharehoder Letter Q4 2016 - 2

Introduction

One year ago, we set an ambitious long-term growth target: to become a $1 billion

revenue company in 2020. We’re proud of the progress we’ve made toward that goal.

Our results in the 2016 fiscal year and our plans for 2017 move us closer to achieving that

ambition. We ended 2016 with $312 million in revenue, and we project 2017 revenue to

be in the range of $415-$425 million. Our performance keeps us on track to continue to

deliver year-over-year GAAP and non-GAAP operating margin improvement as well as

have positive net cash from operating activities and be free cash flow positive for the full

year of 2017, consistent with what we outlined a year ago.

2016 Revenue

$312 million

2017 Guidance

$415-425 million in revenue, which represents

growth of 33-36%

Continuation of year-over-year GAAP and

non-GAAP operating margin improvement

Positive net cash from operating activities

Free cash flow positive for the full year

Mikkel Svane

CEO

Elena Gomez

CFO

Marc Cabi

Strategy & IR

Zendesk Sharehoder Letter Q4 2016 - 3

2016 Review

Reaching our $1 billion goal requires us to think more boldly and more

broadly about our business and the products we build. Above all else, we

must expand beyond our success in our core customer service business to

more broadly address the entire customer relationship. We want to help

organizations of all sizes not only support their customers but also build

better, long-term relationships with them. We view 2016 as a critical year

in that transition as we elevated our brand, became a multi-product

company, and further grew our reach in mid-size and enterprise

businesses. It was a year of rapid change and momentum for us.

Throughout its history, the Zendesk brand was synonymous with our

customer service product and was perhaps best known for the smiling,

headset-wearing monk figure—known as the Mentor—that symbolized our

beautifully simple approach to software. Today, our brand is dynamic and

sophisticated, represented by a series of “Relationshapes” that both identify

individual products and come together in a “Z” to form our new corporate

identity. Our launch of the new Zendesk in the fourth quarter of 2016 was

named as one of the best rebrands of the year by Fast Company.

We entered 2016 as a primarily single-product company with a couple of

acquired products being integrated into our core. Today, we have a

full-fledged family of products under the Zendesk umbrella and a growing

set of shared services that is intended to make them all work seamlessly

together. Zendesk Support, Chat, and Talk are widely available, while

Zendesk Message, Explore, and Connect are in early access programs and

are being prepared for general availability in 2017.

Zendesk Sharehoder Letter Q4 2016 - 4

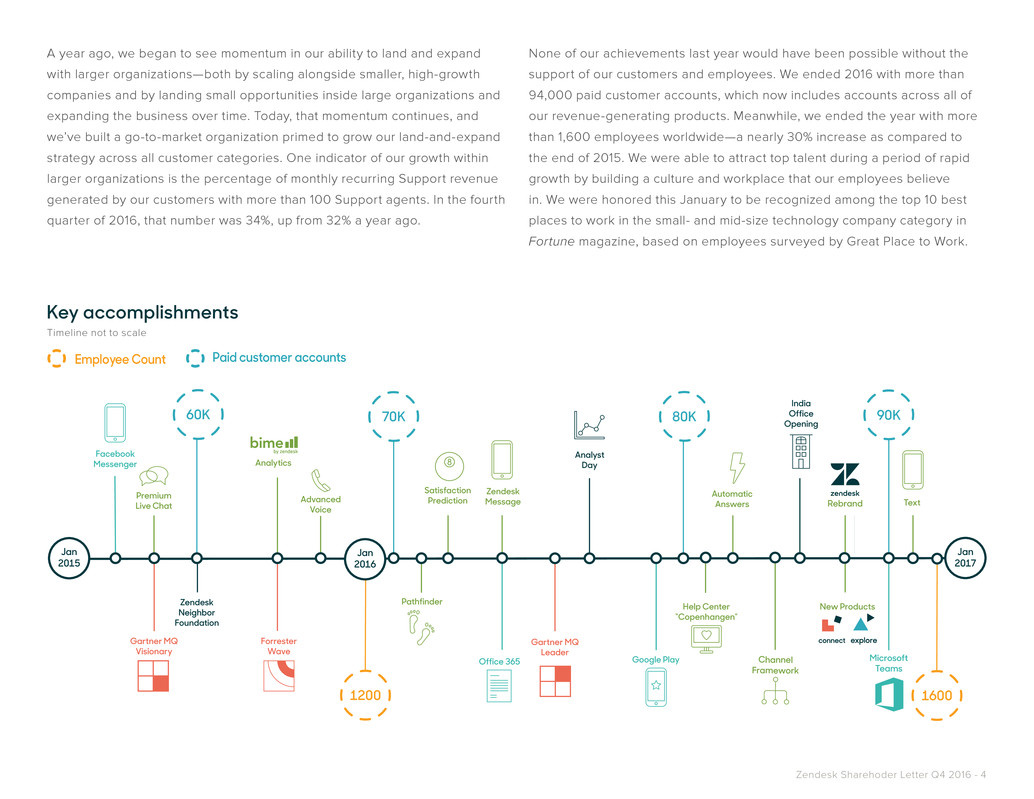

A year ago, we began to see momentum in our ability to land and expand

with larger organizations—both by scaling alongside smaller, high-growth

companies and by landing small opportunities inside large organizations and

expanding the business over time. Today, that momentum continues, and

we’ve built a go-to-market organization primed to grow our land-and-expand

strategy across all customer categories. One indicator of our growth within

larger organizations is the percentage of monthly recurring Support revenue

generated by our customers with more than 100 Support agents. In the fourth

quarter of 2016, that number was 34%, up from 32% a year ago.

None of our achievements last year would have been possible without the

support of our customers and employees. We ended 2016 with more than

94,000 paid customer accounts, which now includes accounts across all of

our revenue-generating products. Meanwhile, we ended the year with more

than 1,600 employees worldwide—a nearly 30% increase as compared to

the end of 2015. We were able to attract top talent during a period of rapid

growth by building a culture and workplace that our employees believe

in. We were honored this January to be recognized among the top 10 best

places to work in the small- and mid-size technology company category in

Fortune magazine, based on employees surveyed by Great Place to Work.

Help Center

“Copenhangen”

Advanced

Voice

Automatic

Answers

Channel

Framework

80K

Zendesk

Message

Satisfaction

Prediction

70K

Premium

Live Chat

60K

Facebook

Messenger Analytics

Analyst

Day

Text

Microsoft

Teams

Rebrand

90K

1600

Google Play

New Products

Gartner MQ

Leader

Office 365

Pathfinder

Gartner MQ

Visionary

1200

Forrester

Wave

Zendesk

Neighbor

Foundation

India

Office

Opening

Jan

2015

Jan

2016

Jan

2017

Key accomplishments

Employee Count Paid customer accounts

Timeline not to scale

Zendesk Sharehoder Letter Q4 2016 - 5

2017 Priorities

We’ve come a long way in a year, and we’re proud of the foundation we’ve

created with our new brand, new product family, and growing opportunities

with larger organizations. As we look ahead to 2017, we are committed to our

mission of building better customer relationships.

We believe customer relationships have never been more important. Brands

today are being defined first and foremost by the customer experiences they

deliver, rather than through the mass marketing of yesterday. This shift has

transformed how organizations and customers engage with each other. It

requires organizations to focus on greater responsiveness, transparency, and

empowerment in their customer relationships and to seek technology to help

them improve those relationships.

As a result, business software must change dramatically to address changing

customer expectations and to build successful long-term customer relation-

ships. Historically, business software has been built for organizations at the

expense of their customers and designed around departments rather than

the single, seamless experience that customers demand today. We believe

that modern business software must be designed starting with the customer

experience and built for relationships first. We design our products to foster

the proactivity, cohesiveness, and contextual awareness that allow for the

development of deeper customer relationships.

PLACEHOLDER FOR GRAPHIC

Zendesk Sharehoder Letter Q4 2016 - 6

For 2017, we are redoubling our efforts to improve customer relationships for

organizations of all sizes by focusing on key growth drivers for our business.

Building out an expansive and cohesive product family

Continuing to expand our family of products to serve other aspects of the

customer relationship is an important part of our growth. We will continue

to build and release new products in 2017, as well as broaden the shared

services that underpin them so our products both work well together and

offer organizations a unified view of their customers. A major focus for 2017

is expanding the adoption of multiple products among our customer base.

Enabling customer innovation

Our customers are transforming their relationships with their customers

through innovations in the customer experiences they deliver. Our products

and developer platform are powering that innovation and providing the

scalability and flexibility needed for companies at any stage of their growth

and maturity. We have invested in a highly extendable developer platform

to drive further innovation through our technology. Our powerful and open

APIs, substantial library of ready-to-deploy integrations, and Embeddables

continue to empower our customers to develop new and innovative ways to

transform the customer experience.

Expanding our markets

We built Zendesk on the premise that our products should be easy to

discover, deploy, and purchase so that any organization—from startup to

large enterprise—can realize its value. That principle of democratizing

software has developed into a highly efficient business model represented

by short sales cycles, significant expansion within customer accounts,

and organic growth through promotion by our customers. Over the years

we have built a compelling brand and leadership position among both

small-to-medium sized organizations and larger enterprises for which our

ease of use, quick return on investment, and flexible pricing are important

differentiators. Ultimately, we believe that more and more of the enterprise

software market will be served by this type of democratized approach. We

work with a growing number of forward-thinking enterprises looking to

more broadly transform their customer experiences across a broad range

of potential use cases. In 2017, we intend to focus on building out our core

transactional sales and marketing strategies while capitalizing on these

significant opportunities within larger organizations as the market increas-

ingly embraces this democratized model.

Zendesk Sharehoder Letter Q4 2016 - 7

Fourth quarter 2016 progress

We finished 2016 on solid footing with greatly improved execution across

both sales and marketing in the fourth quarter compared to the previous

quarter. For the fourth quarter of 2016, we achieved revenue of $88.6 million,

with annual growth of 41%. For the full year 2016, we achieved revenue of

$312.0 million, which represents 49% growth as compared to the prior year.

We remain committed to demonstrating ongoing leverage in our business

model, represented by operating margin improvement. During 2016, we

delivered on our goal by achieving both GAAP and non-GAAP operating

margin improvement, and by closing out the year with a solid fourth quarter

that generated both strong net cash from operating activities and free cash flow.

Our sales and marketing realignment activities, which began in July 2016,

began reaping rewards for us in the fourth quarter. We moved beyond

the disruption we saw late in the third quarter of 2016 and saw strong

operational performance during the fourth quarter. We closed more deals

in the quarter than expected, and we believe our realignment has created

a strong foundation for our sales teams to execute in 2017.

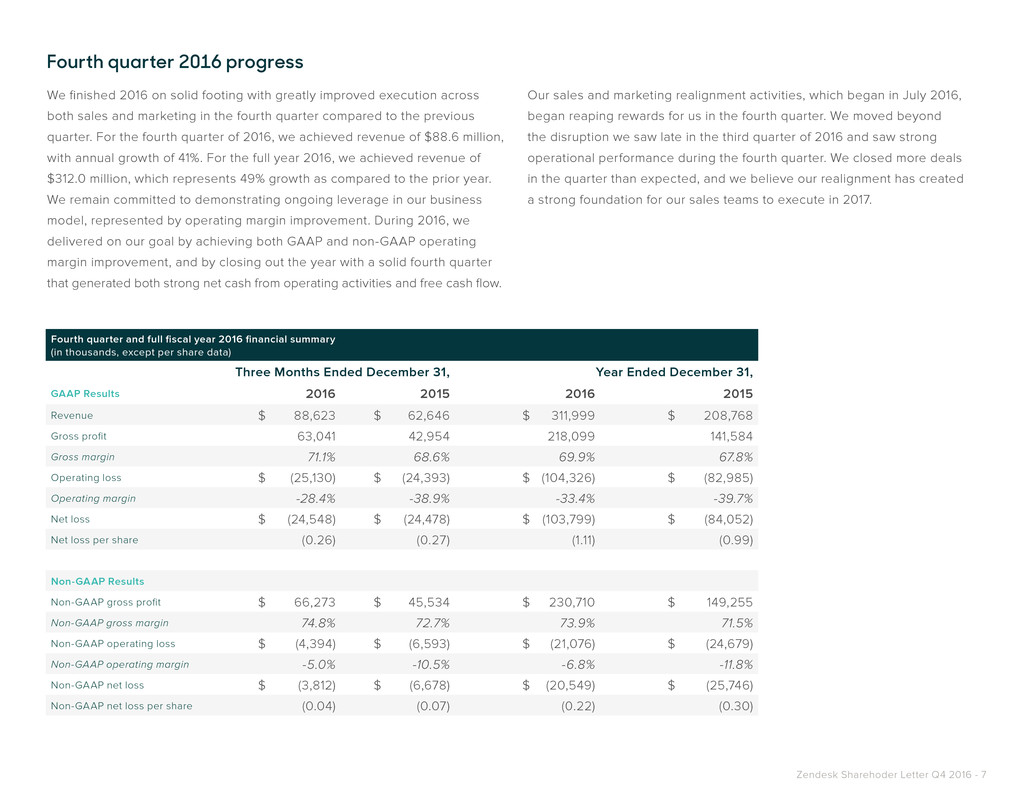

Fourth quarter and full fiscal year 2016 financial summary

(in thousands, except per share data)

Three Months Ended December 31, Year Ended December 31,

GAAP Results 2016 2015 2016 2015

Revenue $ 88,623 $ 62,646 $ 311,999 $ 208,768

Gross profit 63,041 42,954 218,099 141,584

Gross margin 71.1% 68.6% 69.9% 67.8%

Operating loss $ (25,130) $ (24,393) $ (104,326) $ (82,985)

Operating margin -28.4% -38.9% -33.4% -39.7%

Net loss $ (24,548) $ (24,478) $ (103,799) $ (84,052)

Net loss per share (0.26) (0.27) (1.11) (0.99)

Non-GAAP Results

Non-GAAP gross profit $ 66,273 $ 45,534 $ 230,710 $ 149,255

Non-GAAP gross margin 74.8% 72.7% 73.9% 71.5%

Non-GAAP operating loss $ (4,394) $ (6,593) $ (21,076) $ (24,679)

Non-GAAP operating margin -5.0% -10.5% -6.8% -11.8%

Non-GAAP net loss $ (3,812) $ (6,678) $ (20,549) $ (25,746)

Non-GAAP net loss per share (0.04) (0.07) (0.22) (0.30)

Zendesk Sharehoder Letter Q4 2016 - 8

• Text, the new SMS feature of Zendesk Talk,

became generally available in the fourth quarter

after a successful early access program, and

hundreds of customer service teams are now

using Text to support their customers via SMS

from within Zendesk Support.

• Use of Talk was strong in the fourth quarter.

We reached a new milestone over the holiday

season in 2016 during which we had weeks

where Talk was handling more than 1 million

calls per week.

• In November, we announced an integration of

Zendesk Support and Microsoft Teams—the

new chat-based workspace in Office 365—

allowing teams to collaborate to solve

customer inquiries more quickly and

share customer feedback.

• The Apps Marketplace continues to grow in

popularity. In the fourth quarter, Zendesk and

our partners added almost 40 new apps to the

marketplace, bringing the total number to 555

at the end of the year. Among the new additions

is a YouTube channel integration—built on our

Channel Framework announced in the third

quarter—which allows customers to pull channel

and video comments into Zendesk tickets.

• Our customers using Zendesk Help Center set

new records in 2016, creating almost 1.3 million

articles for their end customers, with nearly 1.7

billion article views last year.

• Looking at Embeddables momentum, mobile

chat adoption in particular continues to grow

at an impressive rate. In January 2017 our Chat

mobile SDK served more than seven times as

many chats as it did in January 2016, reflecting

worldwide trends of increasing mobile Internet

usage and chat popularity.

• More than 30% of our Support customer base is

now using the Web Widget on a monthly basis,

and in the fourth quarter, we surpassed 1,000

monthly active customers using the Support

mobile SDK.

From a product perspective, we had many new exciting developments in the fourth quarter following our

rebrand and announcement of Zendesk Explore and Connect in October.

Zendesk Sharehoder Letter Q4 2016 - 9

We finished the year with increased momentum in

cross-selling additional products to our existing

customer base. Heading into 2017, our evolution

into a multi-product company is well underway,

and we expect multi-product adoption to continue

growing as we release more products throughout

the year. We are working with many key custom-

ers in early access programs (EAPs) for Zendesk

Explore, Connect, and Message, all of whom

are providing us with valuable feedback that is

helping to refine our product development.

The EAP for Explore is generating broad interest,

and we are continuing to work with our EAP

customers to fully develop our offering before

making it generally available. We’re making great

strides with our existing EAP participants, gaining

a deeper understanding of where they place

value and ensuring that the product can scale

and serve our large customer base. We intend to

continue growing the number of customers on our

Explore EAP and to expand our inputs from

customers. While we are extending the EAP

program, we continue to target general availability

in 2017.

The EAP for Connect has also generated high

interest from our customers. Connect will initially

provide new segmentation and customer activity

history for our Support customers and provide

tools to upsell through proactive customer service

campaigns via email and through in-product

messaging on the web or natively on mobile.

We expect Connect to be generally available in

the summer of 2017. Additionally, we continue

to see good customer traction with the EAP for

Message, which we also expect to be generally

available in the summer of 2017, with plans to first

offer integration with Facebook and Twitter—and

eventually Line and WeChat.

Zendesk Sharehoder Letter Q4 2016 - 10

Customers

Our customers’ success was highlighted by

Forrester Consulting in December, when the firm

published The Total Economic Impact™ of

Zendesk. The Zendesk-commissioned study—

based on Forrester’s interviews with five custom-

ers and subsequent financial analysis—examined

the potential return on investment (ROI) that

organizations may realize by using Zendesk to

improve customer interactions. The study pointed

to average benefits of more than $3.1 million

versus costs of $0.7 million and an ROI of 365%

over three years.

2016 was also an exciting year for customer wins

and expansions, as we continued to build great

relationships with forward-thinking brands. These

companies are using us in many different and

innovative ways and are constantly challenging

us to think differently, improve our products,

and make our technology better. A few of the

many brands that recently joined us or continued

expanding with us include the companies on

this page.

Clover Health

A health insurance provider for seniors

Cook Children’s Health Care System

A Texas-based, not-for-profit pediatric

health care organization

Credit Karma

A free credit score, reports, and insights company

DreamHost

A web hosting provider and domain

name registrar

GO-JEK

An Indonesian transportation, delivery, logistics,

and payments company

Ola

An Indian online transportation network company

Rakuten

A Japanese electronic commerce and

Internet company

Selfit

A Brazilian chain of fitness centers

Slack

A popular work communication channel

Squarespace

An all-in-one platform for building and hosting

custom websites

Stripe

A software platform powering payments for online

businesses and marketplaces around the world,

including our own Apps Marketplace

Zendesk Sharehoder Letter Q4 2016 - 11

Growing our customer base

During the second half of 2016, we successfully improved the rate of growth

and predictability of our low-touch, high-velocity business. The full-featured

trial of our products is a key component of our success, and the low-touch

nature of this category yields favorable customer acquisition costs.

Our sales-driven approach to larger opportunities in the mid-market and

enterprise segment continues to expand and evolve. Our family of products

resonates with a broad set of customers, and we work with a growing

number of forward-thinking enterprises looking to transform their customer

experience across a wide range of potential use cases. The fact that it’s easy

to trial and purchase our products allows large enterprises to realize their

value and grow with us more efficiently. We intend to focus on building out

our enterprise sales and marketing strategies within larger organizations as

they—like their more agile small-company counterparts—increasingly seek

software that is easy to deploy and use, offers flexible pricing, and provides

a quick ROI.

As a proxy of our continued success within these larger opportunities, we

measure our number of contracts signed with an annual value of $50,000 or

greater. In the fourth quarter, we closed 19% more of these contracts versus

a year ago. We saw a decrease in the average size of these transactions as

compared to the same period last year, which is impacted by the anniversary

of some outsized wins in the fourth quarter of 2015. However, we saw more

than a 60% quarter-over-quarter increase in the average contract value when

compared to the third quarter of 2016.

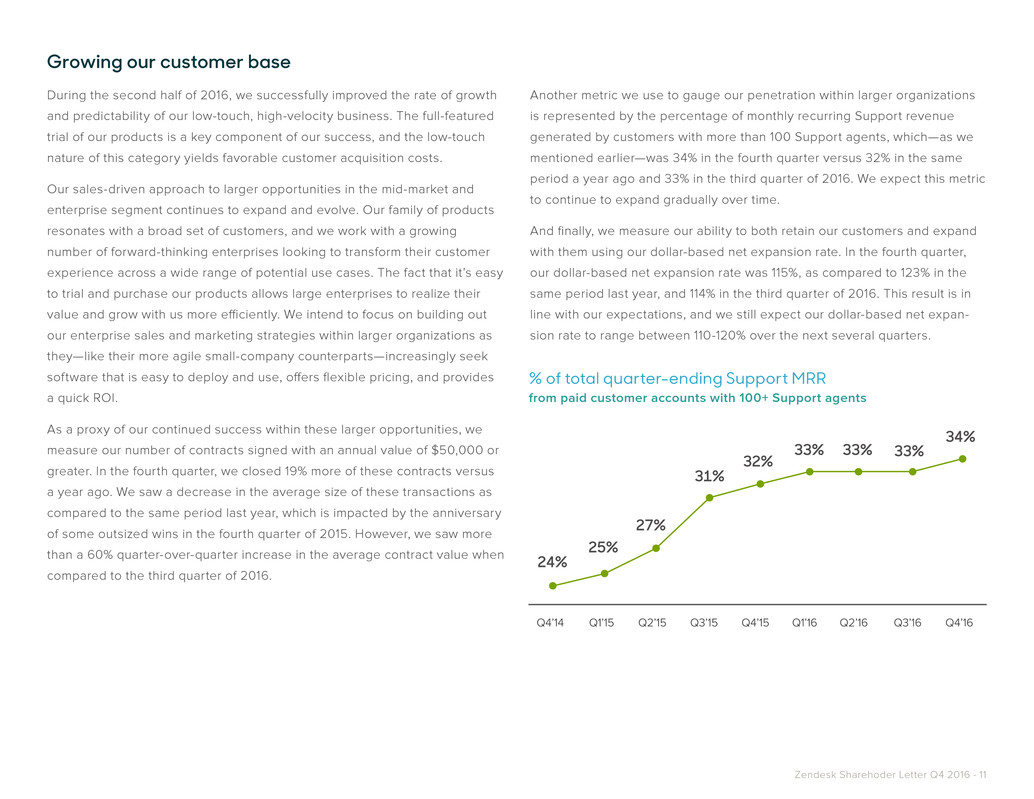

Another metric we use to gauge our penetration within larger organizations

is represented by the percentage of monthly recurring Support revenue

generated by customers with more than 100 Support agents, which—as we

mentioned earlier—was 34% in the fourth quarter versus 32% in the same

period a year ago and 33% in the third quarter of 2016. We expect this metric

to continue to expand gradually over time.

And finally, we measure our ability to both retain our customers and expand

with them using our dollar-based net expansion rate. In the fourth quarter,

our dollar-based net expansion rate was 115%, as compared to 123% in the

same period last year, and 114% in the third quarter of 2016. This result is in

line with our expectations, and we still expect our dollar-based net expan-

sion rate to range between 110-120% over the next several quarters.

% of total quarter-ending Support MRR

from paid customer accounts with 100+ Support agents

Zendesk Sharehoder Letter Q4 2016 - 12

Corporate Social Responsibility

In 2016, Zendesk contributed a combined $1.6

million to the Zendesk Neighbor Foundation

and organizations that it supports pursuant to

its Community Benefit Agreement with the City

and County of San Francisco. This allowed the

Zendesk Neighbor Foundation to greatly expand

a few of its more strategic partnerships, including

its work with St. Anthony’s, Second Harvest Food

Bank, Hands On Manila, and Spark, among others.

Employees also volunteered over 6,000 hours

around the globe with charities officially

supported by Zendesk, an increase from

3,500 hours in 2015.

In 2016, Zendesk vowed to more deeply inte-

grate corporate social responsibility (CSR) into

every employee’s experience. We expanded

volunteering via our new hire program globally

and increased the number of events offered to

connect employees with local businesses and

community partners. We also grew participation in

Pride parades to include three additional offices

as part of the company’s ongoing diversity and

inclusion efforts.

The Zendesk Neighbor Foundation also worked

to strengthen its support of diversity and inclusion

efforts, partnering with two new workforce

development programs in Melbourne and São

Paulo aimed at training and placing underrepre-

sented populations into the local workforce.

Zendesk’s global CSR team started sharing

research and data on how a CSR-driven culture

can impact a company’s customer relationships

and help deliver better customer service via talks

at Relate Live conferences and publication of

several blog posts as well as sales and

recruiting-focused newsletters.

Finally, in bringing our developers closer to

understanding and addressing community needs,

Zendesk launched a track for socially conscious

startups within our Zendesk Loves Startups

program, while the Foundation launched Link-

Dane in Madison, Wisconsin—our fifth instance of

the Link-SF styled portal.

In the first quarter of 2017, the Zendesk Neighbor

Foundation will form deeper and more strategic

partnerships with nonprofits near Zendesk’s

offices in Manila, Singapore, and Montpellier. In

Manila, the Zendesk Neighbor Foundation will

break ground on a day care center in Ususan,

Taguig City, which will be fully funded by a

Zendesk Neighbor Foundation grant and

constructed with the help of Zendesk employees.

Zendesk Sharehoder Letter Q4 2016 - 13

Financial measures and cash flows

We are proud of the financial progress we have made in 2016. While demon-

strating solid revenue growth, as indicated earlier, we continued to scale

our business by delivering year-over-year operating margin improvement. In

both the fourth quarter and full year 2016, we achieved GAAP and non-GAAP

operating margin expansion based on continued improvements across all of

our cost categories. We continue to focus on delivering high revenue growth

and achieving further scale.

Fourth quarter results

GAAP gross margin increased to 71.1% in the fourth quarter of 2016 compared

to 70.4% in the third quarter of 2016. GAAP gross margin in the fourth quarter

of 2015 was 68.6%. Non-GAAP gross margin increased to 74.8% in the fourth

quarter of 2016 compared to 74.4% in the third quarter of 2016. Non-GAAP

gross margin in the fourth quarter of 2015 was 72.7%.

GAAP operating loss for the fourth quarter of 2016 was $25.1 million

compared to GAAP operating loss for the third quarter of 2016 of $26.2

million. GAAP operating loss for the fourth quarter of 2015 was $24.4 million.

Non-GAAP operating loss for the fourth quarter of 2016 was $4.4 million,

compared to non-GAAP operating loss for the third quarter of 2016

of $4.3 million. Non-GAAP operating loss for the fourth quarter of 2015 was

$6.6 million.

GAAP operating margin improvement is attributed to improvements in gross

margin, and overall productivity gains in our operations. GAAP operating

margin for the fourth quarter of 2016 improved to -28.4% from -32.5% in the

third quarter of 2016. GAAP operating margin was -38.9% in the fourth quarter

of 2015. Non-GAAP operating margin improved to -5.0% in the fourth quarter

of 2016 from -5.3% in the third quarter of 2016. Non-GAAP operating margin

was -10.5% in the fourth quarter of 2015.

GAAP net loss for the fourth quarter of 2016 was $24.5 million or $0.26 per

share compared to GAAP net loss of $25.8 million or $0.27 per share for the

third quarter of 2016. GAAP net loss was $24.5 million or $0.27 per share for

the fourth quarter of 2015.

Non-GAAP net loss for the fourth quarter of 2016 was $3.8 million or $0.04

per share compared to non-GAAP net loss of $3.9 million or $0.04 per share

for the third quarter of 2016. Non-GAAP net loss was $6.7 million or $0.07

per share for the fourth quarter of 2015. Weighted average shares used to

compute both GAAP and non-GAAP net loss per share for the fourth quarter

of 2016 was 95.8 million.

Non-GAAP results for the fourth quarter of 2016 exclude $19.8 million in

share-based compensation and related expenses (including $1.8 million of

employer tax related to employee stock transactions and $0.6 million of

amortized share-based compensation capitalized in internal-use software),

and $0.9 million of amortization of purchased intangibles. Non-GAAP

results for the third quarter of 2016 exclude $21.0 million in share-based

compensation and related expenses (including $0.6 million of employer tax

related to employee stock transactions and $0.4 million of amortized share-

based compensation capitalized in internal-use software), and $1.0 million

of amortization of purchased intangibles. Non-GAAP results for the fourth

quarter of 2015 exclude $16.2 million in share-based compensation and

related expenses (including $0.3 million of employer tax related to employee

stock transactions and $0.3 million of amortized share-based compensation

capitalized in internal-use software), $0.7 million of acquisition related costs,

and $0.9 million of amortization of purchased intangibles.

During the fourth quarter of 2016, net cash from operating activities was

$20.5 million, and we achieved positive free cash flow of $10.4 million. We

ended the fourth quarter of 2016 with $93.7 million of cash and equivalents,

and we had an additional $131.2 million of short-term marketable securities

and $75.2 million in long-term marketable securities.

Zendesk Sharehoder Letter Q4 2016 - 14

Full year 2016 results

GAAP gross margin increased to 69.9% in 2016 compared to 67.8% in 2015.

Non-GAAP gross margin increased to 73.9% in 2016 compared to 71.5%

in 2015.

GAAP operating loss for 2016 was $104.3 million compared to GAAP

operating loss for 2015 of $83.0 million. Non-GAAP operating loss for 2016

was $21.1 million, compared to non-GAAP operating loss for 2015 of $24.7

million.

GAAP operating margin in 2016 improved to -33.4% from -39.7% in 2015.

Non-GAAP operating margin improved to -6.8% in 2016 from -11.8% in 2015.

GAAP net loss in 2016 was $103.8 million or $1.11 per share compared to

GAAP net loss of $84.1 million or $0.99 per share for 2015. Non-GAAP net

loss in 2016 was $20.5 million or $0.22 per share compared to non-GAAP

net loss of $25.7 million or $0.30 per share in 2015. Weighted average shares

used to compute both GAAP and non-GAAP net loss per share for 2016 was

93.2 million.

Non-GAAP results for 2016 exclude $79.5 million in share-based compen-

sation and related expenses (including $3.9 million of employer tax related

to employee stock transactions and $1.8 million of amortized share-based

compensation capitalized in internal-use software), and $3.8 million of

amortization of purchased intangibles. Non-GAAP results for 2015 exclude

$55.1 million in share-based compensation and related expenses (including

$1.5 million of employer tax related to employee stock transactions and $1.1

million of amortized share-based compensation capitalized in internal-use

software), $1.0 million of acquisition related costs, and $2.2 million of

amortization of purchased intangibles.

For the full year 2016, net cash from operating activities was $24.5 million,

and we approached free cash flow breakeven at -$2.4 million.

Zendesk Sharehoder Letter Q4 2016 - 15

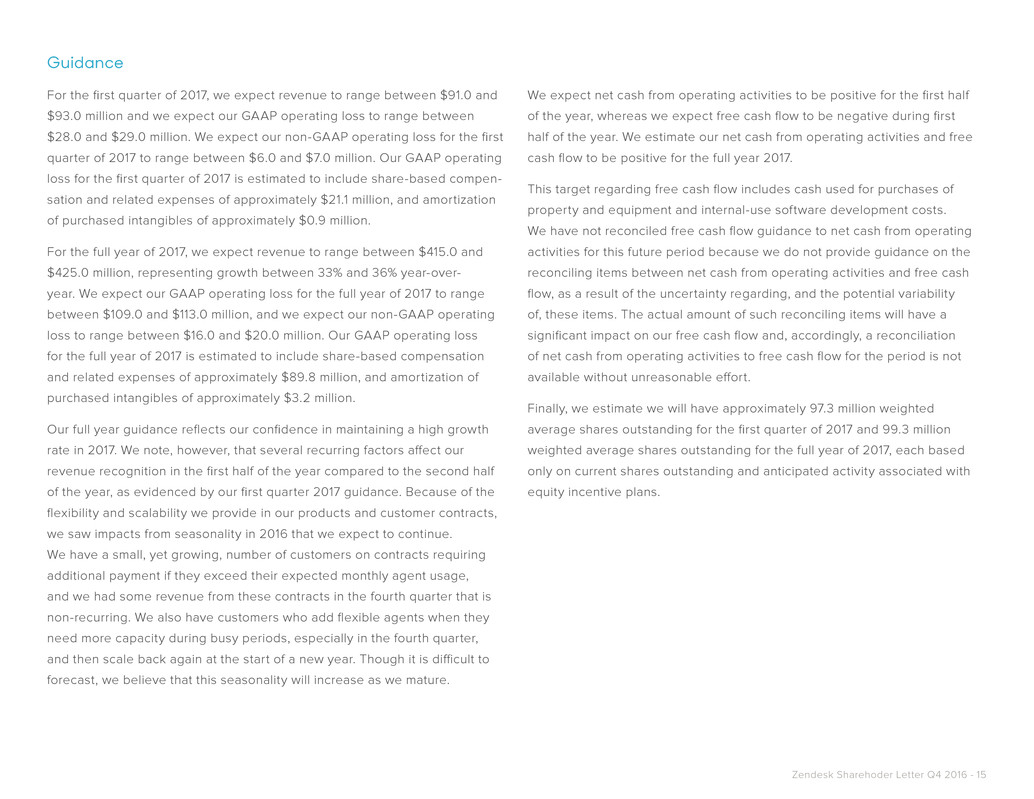

Guidance

For the first quarter of 2017, we expect revenue to range between $91.0 and

$93.0 million and we expect our GAAP operating loss to range between

$28.0 and $29.0 million. We expect our non-GAAP operating loss for the first

quarter of 2017 to range between $6.0 and $7.0 million. Our GAAP operating

loss for the first quarter of 2017 is estimated to include share-based compen-

sation and related expenses of approximately $21.1 million, and amortization

of purchased intangibles of approximately $0.9 million.

For the full year of 2017, we expect revenue to range between $415.0 and

$425.0 million, representing growth between 33% and 36% year-over-

year. We expect our GAAP operating loss for the full year of 2017 to range

between $109.0 and $113.0 million, and we expect our non-GAAP operating

loss to range between $16.0 and $20.0 million. Our GAAP operating loss

for the full year of 2017 is estimated to include share-based compensation

and related expenses of approximately $89.8 million, and amortization of

purchased intangibles of approximately $3.2 million.

Our full year guidance reflects our confidence in maintaining a high growth

rate in 2017. We note, however, that several recurring factors affect our

revenue recognition in the first half of the year compared to the second half

of the year, as evidenced by our first quarter 2017 guidance. Because of the

flexibility and scalability we provide in our products and customer contracts,

we saw impacts from seasonality in 2016 that we expect to continue.

We have a small, yet growing, number of customers on contracts requiring

additional payment if they exceed their expected monthly agent usage,

and we had some revenue from these contracts in the fourth quarter that is

non-recurring. We also have customers who add flexible agents when they

need more capacity during busy periods, especially in the fourth quarter,

and then scale back again at the start of a new year. Though it is difficult to

forecast, we believe that this seasonality will increase as we mature.

We expect net cash from operating activities to be positive for the first half

of the year, whereas we expect free cash flow to be negative during first

half of the year. We estimate our net cash from operating activities and free

cash flow to be positive for the full year 2017.

This target regarding free cash flow includes cash used for purchases of

property and equipment and internal-use software development costs.

We have not reconciled free cash flow guidance to net cash from operating

activities for this future period because we do not provide guidance on the

reconciling items between net cash from operating activities and free cash

flow, as a result of the uncertainty regarding, and the potential variability

of, these items. The actual amount of such reconciling items will have a

significant impact on our free cash flow and, accordingly, a reconciliation

of net cash from operating activities to free cash flow for the period is not

available without unreasonable effort.

Finally, we estimate we will have approximately 97.3 million weighted

average shares outstanding for the first quarter of 2017 and 99.3 million

weighted average shares outstanding for the full year of 2017, each based

only on current shares outstanding and anticipated activity associated with

equity incentive plans.

Zendesk Sharehoder Letter Q4 2016 - 16

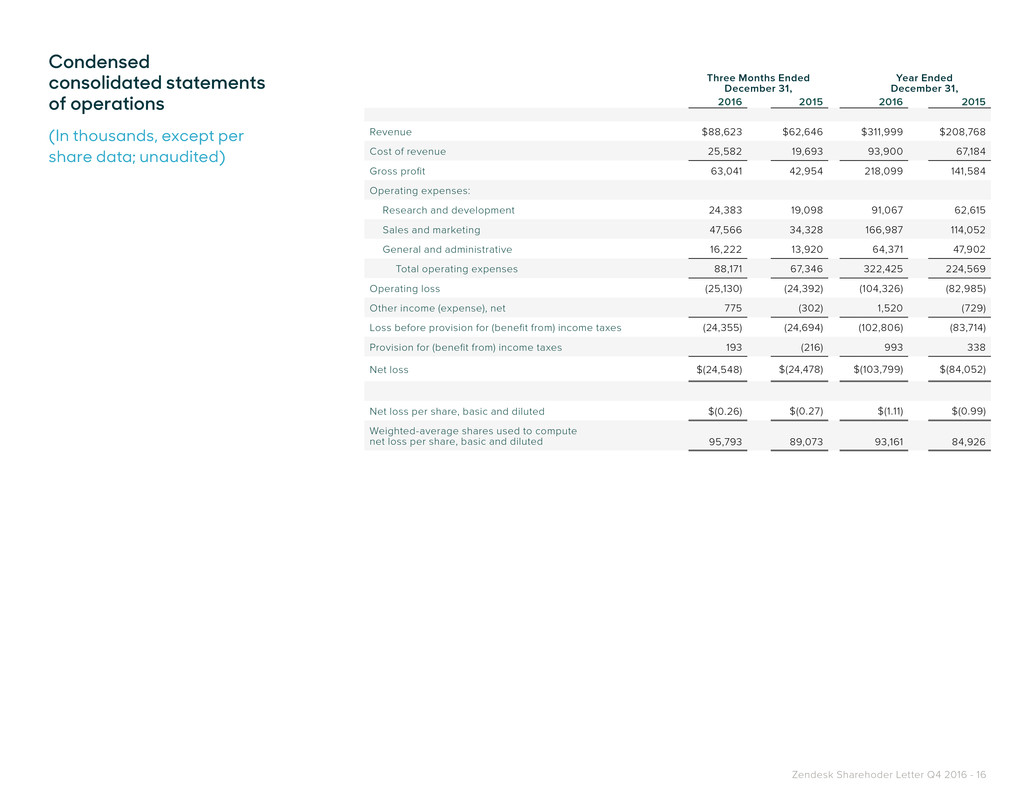

Condensed

consolidated statements

of operations

(In thousands, except per

share data; unaudited)

Three Months Ended

December 31,

Year Ended

December 31,

2016 2015 2016 2015

Revenue $88,623 $62,646 $311,999 $208,768

Cost of revenue 25,582 19,693 93,900 67,184

Gross profit 63,041 42,954 218,099 141,584

Operating expenses:

Research and development 24,383 19,098 91,067 62,615

Sales and marketing 47,566 34,328 166,987 114,052

General and administrative 16,222 13,920 64,371 47,902

Total operating expenses 88,171 67,346 322,425 224,569

Operating loss (25,130) (24,392) (104,326) (82,985)

Other income (expense), net 775 (302) 1,520 (729)

Loss before provision for (benefit from) income taxes (24,355) (24,694) (102,806) (83,714)

Provision for (benefit from) income taxes 193 (216) 993 338

Net loss $(24,548) $(24,478) $(103,799) $(84,052)

Net loss per share, basic and diluted $(0.26) $(0.27) $(1.11) $(0.99)

Weighted-average shares used to compute

net loss per share, basic and diluted 95,793 89,073 93,161 84,926

Zendesk Sharehoder Letter Q4 2016 - 17

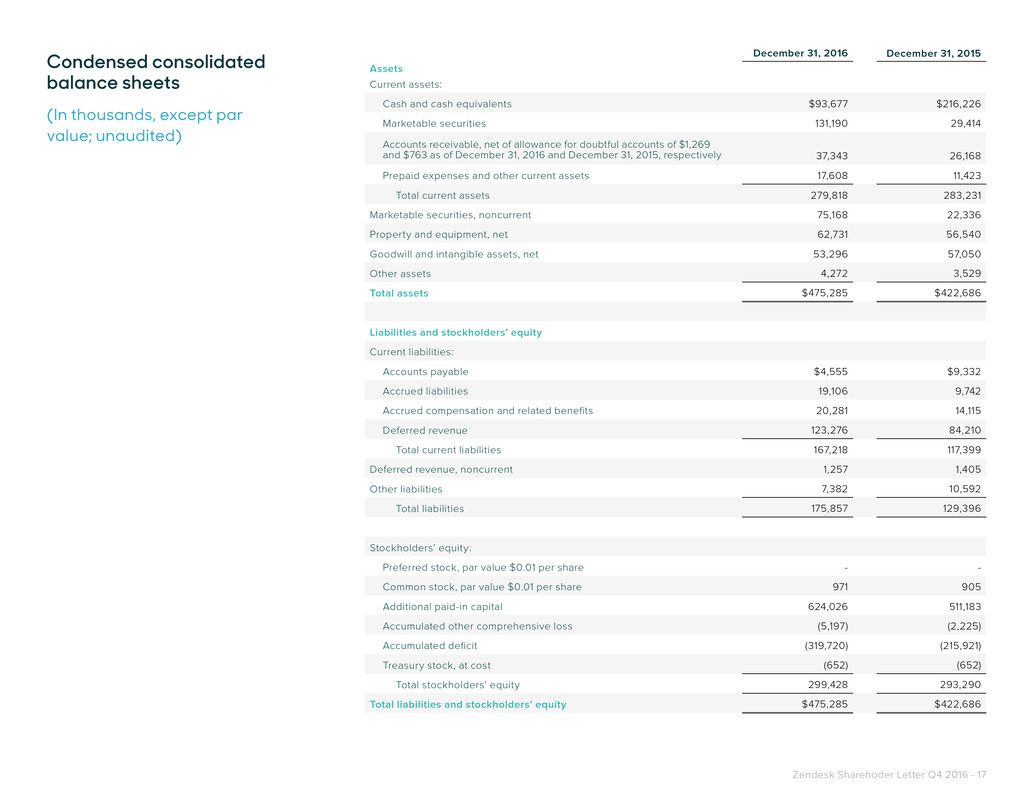

Condensed consolidated

balance sheets

(In thousands, except par

value; unaudited)

December 31, 2016 December 31, 2015

Assets

Current assets:

Cash and cash equivalents $93,677 $216,226

Marketable securities 131,190 29,414

Accounts receivable, net of allowance for doubtful accounts of $1,269

and $763 as of December 31, 2016 and December 31, 2015, respectively 37,343 26,168

Prepaid expenses and other current assets 17,608 11,423

Total current assets 279,818 283,231

Marketable securities, noncurrent 75,168 22,336

Property and equipment, net 62,731 56,540

Goodwill and intangible assets, net 53,296 57,050

Other assets 4,272 3,529

Total assets $475,285 $422,686

Liabilities and stockholders’ equity

Current liabilities:

Accounts payable $4,555 $9,332

Accrued liabilities 19,106 9,742

Accrued compensation and related benefits 20,281 14,115

Deferred revenue 123,276 84,210

Total current liabilities 167,218 117,399

Deferred revenue, noncurrent 1,257 1,405

Other liabilities 7,382 10,592

Total liabilities 175,857 129,396

Stockholders’ equity:

Preferred stock, par value $0.01 per share - -

Common stock, par value $0.01 per share 971 905

Additional paid-in capital 624,026 511,183

Accumulated other comprehensive loss (5,197) (2,225)

Accumulated deficit (319,720) (215,921)

Treasury stock, at cost (652) (652)

Total stockholders’ equity 299,428 293,290

Total liabilities and stockholders’ equity $475,285 $422,686

Zendesk Sharehoder Letter Q4 2016 - 18

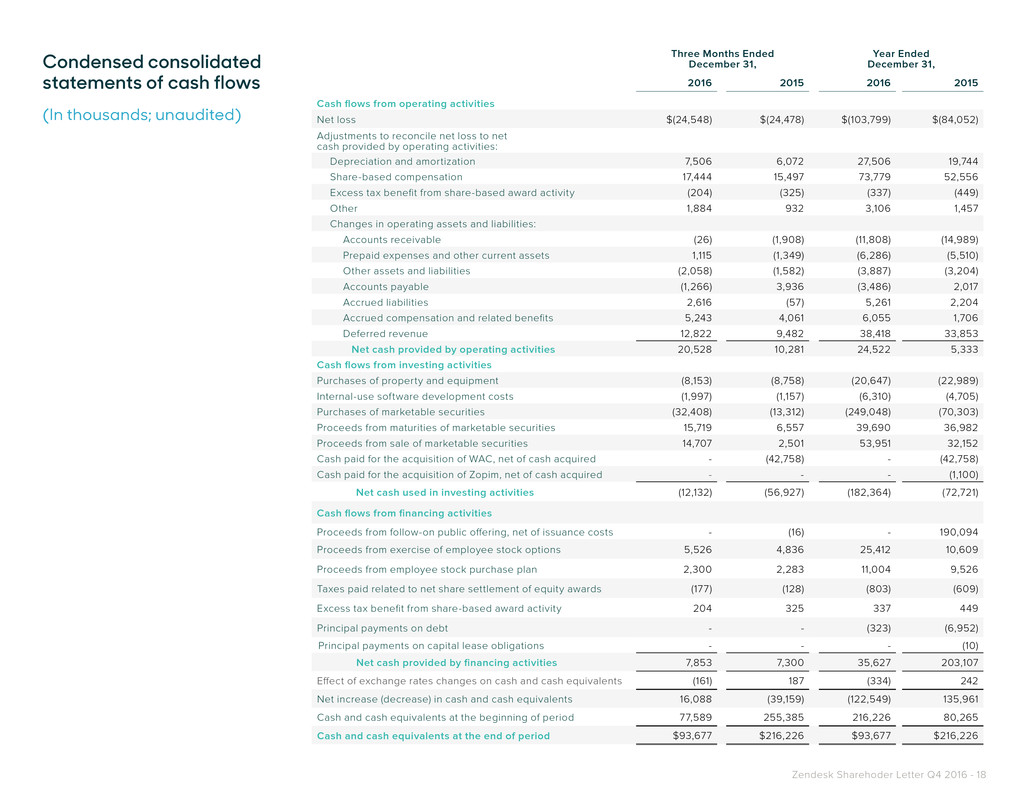

Three Months Ended

December 31,

Year Ended

December 31,

2016 2015 2016 2015

Cash flows from operating activities

Net loss $(24,548) $(24,478) $(103,799) $(84,052)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Depreciation and amortization 7,506 6,072 27,506 19,744

Share-based compensation 17,444 15,497 73,779 52,556

Excess tax benefit from share-based award activity (204) (325) (337) (449)

Other 1,884 932 3,106 1,457

Changes in operating assets and liabilities:

Accounts receivable (26) (1,908) (11,808) (14,989)

Prepaid expenses and other current assets 1,115 (1,349) (6,286) (5,510)

Other assets and liabilities (2,058) (1,582) (3,887) (3,204)

Accounts payable (1,266) 3,936 (3,486) 2,017

Accrued liabilities 2,616 (57) 5,261 2,204

Accrued compensation and related benefits 5,243 4,061 6,055 1,706

Deferred revenue 12,822 9,482 38,418 33,853

Net cash provided by operating activities 20,528 10,281 24,522 5,333

Cash flows from investing activities

Purchases of property and equipment (8,153) (8,758) (20,647) (22,989)

Internal-use software development costs (1,997) (1,157) (6,310) (4,705)

Purchases of marketable securities (32,408) (13,312) (249,048) (70,303)

Proceeds from maturities of marketable securities 15,719 6,557 39,690 36,982

Proceeds from sale of marketable securities 14,707 2,501 53,951 32,152

Cash paid for the acquisition of WAC, net of cash acquired - (42,758) - (42,758)

Cash paid for the acquisition of Zopim, net of cash acquired - - - (1,100)

Net cash used in investing activities (12,132) (56,927) (182,364) (72,721)

Cash flows from financing activities

Proceeds from follow-on public offering, net of issuance costs - (16) - 190,094

Proceeds from exercise of employee stock options 5,526 4,836 25,412 10,609

Proceeds from employee stock purchase plan 2,300 2,283 11,004 9,526

Taxes paid related to net share settlement of equity awards (177) (128) (803) (609)

Excess tax benefit from share-based award activity 204 325 337 449

Principal payments on debt - - (323) (6,952)

Principal payments on capital lease obligations - - - (10)

Net cash provided by financing activities 7,853 7,300 35,627 203,107

Effect of exchange rates changes on cash and cash equivalents (161) 187 (334) 242

Net increase (decrease) in cash and cash equivalents 16,088 (39,159) (122,549) 135,961

Cash and cash equivalents at the beginning of period 77,589 255,385 216,226 80,265

Cash and cash equivalents at the end of period $93,677 $216,226 $93,677 $216,226

Condensed consolidated

statements of cash flows

(In thousands; unaudited)

Zendesk Sharehoder Letter Q4 2016 - 19

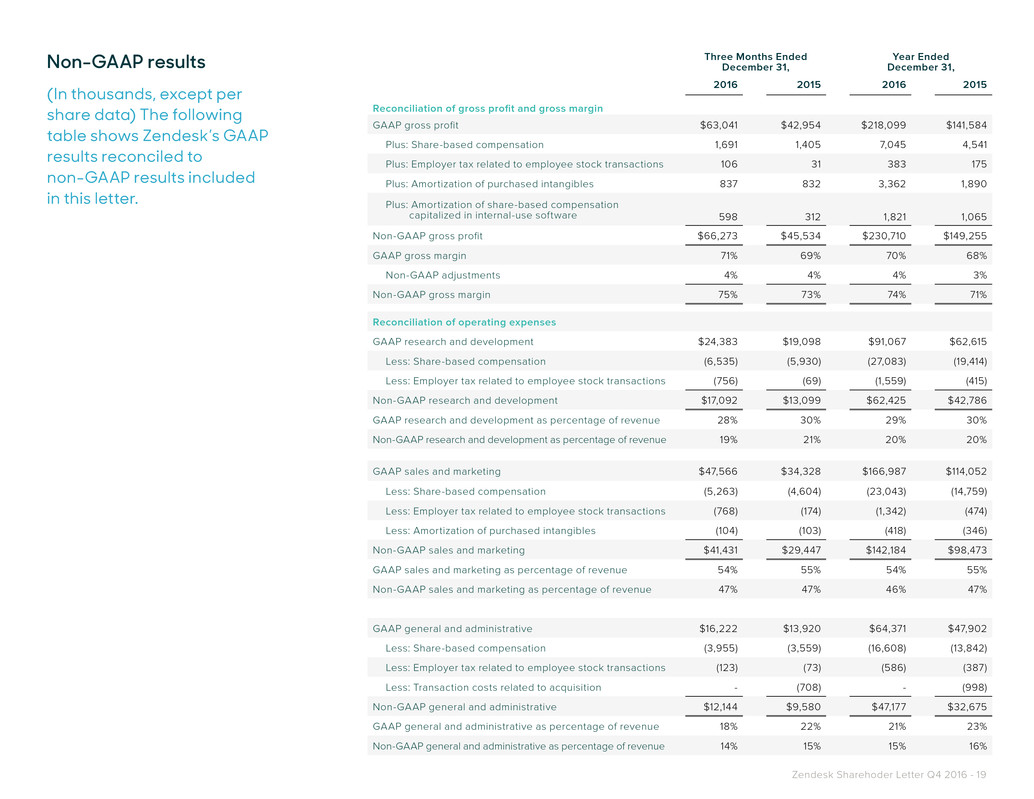

Non-GAAP results

(In thousands, except per

share data) The following

table shows Zendesk’s GAAP

results reconciled to

non-GAAP results included

in this letter.

Three Months Ended

December 31,

Year Ended

December 31,

2016 2015 2016 2015

Reconciliation of gross profit and gross margin

GAAP gross profit $63,041 $42,954 $218,099 $141,584

Plus: Share-based compensation 1,691 1,405 7,045 4,541

Plus: Employer tax related to employee stock transactions 106 31 383 175

Plus: Amortization of purchased intangibles 837 832 3,362 1,890

Plus: Amortization of share-based compensation

capitalized in internal-use software 598 312 1,821 1,065

Non-GAAP gross profit $66,273 $45,534 $230,710 $149,255

GAAP gross margin 71% 69% 70% 68%

Non-GAAP adjustments 4% 4% 4% 3%

Non-GAAP gross margin 75% 73% 74% 71%

Reconciliation of operating expenses

GAAP research and development $24,383 $19,098 $91,067 $62,615

Less: Share-based compensation (6,535) (5,930) (27,083) (19,414)

Less: Employer tax related to employee stock transactions (756) (69) (1,559) (415)

Non-GAAP research and development $17,092 $13,099 $62,425 $42,786

GAAP research and development as percentage of revenue 28% 30% 29% 30%

Non-GAAP research and development as percentage of revenue 19% 21% 20% 20%

GAAP sales and marketing $47,566 $34,328 $166,987 $114,052

Less: Share-based compensation (5,263) (4,604) (23,043) (14,759)

Less: Employer tax related to employee stock transactions (768) (174) (1,342) (474)

Less: Amortization of purchased intangibles (104) (103) (418) (346)

Non-GAAP sales and marketing $41,431 $29,447 $142,184 $98,473

GAAP sales and marketing as percentage of revenue 54% 55% 54% 55%

Non-GAAP sales and marketing as percentage of revenue 47% 47% 46% 47%

GAAP general and administrative $16,222 $13,920 $64,371 $47,902

Less: Share-based compensation (3,955) (3,559) (16,608) (13,842)

Less: Employer tax related to employee stock transactions (123) (73) (586) (387)

Less: Transaction costs related to acquisition - (708) - (998)

Non-GAAP general and administrative $12,144 $9,580 $47,177 $32,675

GAAP general and administrative as percentage of revenue 18% 22% 21% 23%

Non-GAAP general and administrative as percentage of revenue 14% 15% 15% 16%

Zendesk Sharehoder Letter Q4 2016 - 20

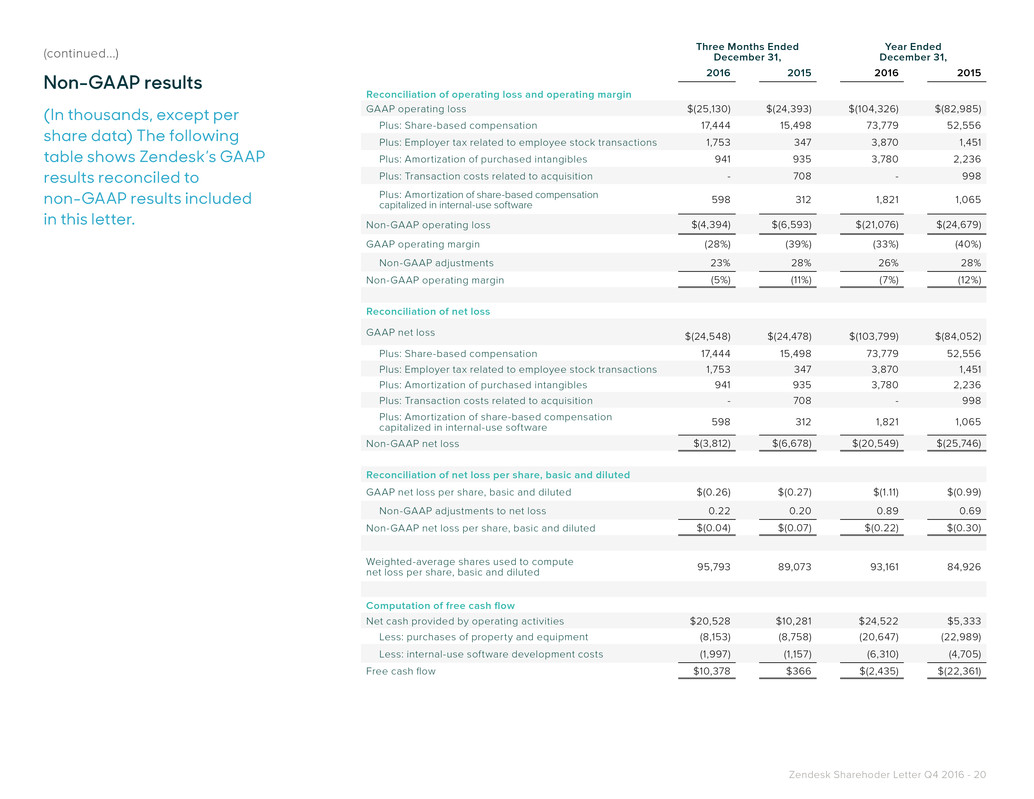

(continued...)

Non-GAAP results

(In thousands, except per

share data) The following

table shows Zendesk’s GAAP

results reconciled to

non-GAAP results included

in this letter.

Three Months Ended

December 31,

Year Ended

December 31,

2016 2015 2016 2015

Reconciliation of operating loss and operating margin

GAAP operating loss $(25,130) $(24,393) $(104,326) $(82,985)

Plus: Share-based compensation 17,444 15,498 73,779 52,556

Plus: Employer tax related to employee stock transactions 1,753 347 3,870 1,451

Plus: Amortization of purchased intangibles 941 935 3,780 2,236

Plus: Transaction costs related to acquisition - 708 - 998

Plus: Amortization of share-based compensation

capitalized in internal-use software 598 312 1,821 1,065

Non-GAAP operating loss $(4,394) $(6,593) $(21,076) $(24,679)

GAAP operating margin (28%) (39%) (33%) (40%)

Non-GAAP adjustments 23% 28% 26% 28%

Non-GAAP operating margin (5%) (11%) (7%) (12%)

Reconciliation of net loss

GAAP net loss

$(24,548) $(24,478) $(103,799) $(84,052)

Plus: Share-based compensation 17,444 15,498 73,779 52,556

Plus: Employer tax related to employee stock transactions 1,753 347 3,870 1,451

Plus: Amortization of purchased intangibles 941 935 3,780 2,236

Plus: Transaction costs related to acquisition - 708 - 998

Plus: Amortization of share-based compensation

capitalized in internal-use software 598 312 1,821 1,065

Non-GAAP net loss $(3,812) $(6,678) $(20,549) $(25,746)

Reconciliation of net loss per share, basic and diluted

GAAP net loss per share, basic and diluted $(0.26) $(0.27) $(1.11) $(0.99)

Non-GAAP adjustments to net loss 0.22 0.20 0.89 0.69

Non-GAAP net loss per share, basic and diluted $(0.04) $(0.07) $(0.22) $(0.30)

Weighted-average shares used to compute

net loss per share, basic and diluted 95,793 89,073 93,161 84,926

Computation of free cash flow

Net cash provided by operating activities $20,528 $10,281 $24,522 $5,333

Less: purchases of property and equipment (8,153) (8,758) (20,647) (22,989)

Less: internal-use software development costs (1,997) (1,157) (6,310) (4,705)

Free cash flow $10,378 $366 $(2,435) $(22,361)

Zendesk Sharehoder Letter Q4 2016 - 21

About Zendesk

Zendesk builds software for better customer relationships. It empowers organizations to im-

prove customer engagement and better understand their customers. More than 94,000 paid

customer accounts in over 150 countries and territories use Zendesk products. Based in San

Francisco, Zendesk has operations in the United States, Europe, Asia, Australia, and South

America. Learn more at www.zendesk.com.

Forward-Looking Statements

This press release contains forward-looking statements, including, among other things,

statements regarding Zendesk’s future financial performance, its continued investment to

grow its business, and progress towards its long-term financial objectives. The words such as

“may,” “should,” “will,” “believe,” “expect,” “anticipate,” “target,” “project,” and similar phrases

that denote future expectation or intent regarding Zendesk’s financial results, operations, and

other matters are intended to identify forward-looking statements. You should not rely upon

forward-looking statements as predictions of future events.

The outcome of the events described in these forward-looking statements is subject to

known and unknown risks, uncertainties, and other factors that may cause Zendesk’s actual

results, performance, or achievements to differ materially, including (i) adverse changes in

general economic or market conditions; (ii) Zendesk’s ability to adapt its products to chang-

ing market dynamics and customer preferences or achieve increased market acceptance of

its products; (iii) Zendesk’s expectation that the future growth rate of its revenues will decline,

and that, as its costs increase, Zendesk may not be able to generate sufficient revenues to

achieve or sustain profitability; (iv) Zendesk’s limited operating history, which makes it difficult

to evaluate its prospects and future operating results; (v) Zendesk’s ability to effectively

manage its growth and organizational change; (vi) the market in which Zendesk operates is

intensely competitive, and Zendesk may not compete effectively; (vii) the development of the

market for software as a service business software applications; (viii) Zendesk’s ability to in-

troduce and market new products and to support its products on a shared services platform;

(ix) breaches in Zendesk’s security measures or unauthorized access to its customers’ data;

(x) service interruptions or performance problems associated with Zendesk’s technology

and infrastructure; (xi) real or perceived errors, failures, or bugs in its products; (xii) Zendesk’s

substantial reliance on its customers renewing their subscriptions and purchasing additional

subscriptions; and (xiii) Zendesk’s ability to effectively expand its sales capabilities.

The forward-looking statements contained in this press release are also subject to additional

risks, uncertainties, and factors, including those more fully described in Zendesk’s filings

with the Securities and Exchange Commission, including its Quarterly Report on Form 10-Q

for the quarter ended September 30, 2016. Further information on potential risks that could

affect actual results will be included in the subsequent periodic and current reports and other

filings that Zendesk makes with the Securities and Exchange Commission from time to time,

including its Annual Report on Form 10-K for the year ended December 31, 2016.

Forward-looking statements represent Zendesk’s management’s beliefs and assumptions

only as of the date such statements are made. Zendesk undertakes no obligation to update

any forward-looking statements made in this press release to reflect events or circumstances

after the date of this press release or to reflect new information or the occurrence of unantici-

pated events, except as required by law.

About Non-GAAP Financial Measures

To provide investors and others with additional information regarding Zendesk’s results, the

following non-GAAP financial measures were disclosed: non-GAAP gross profit and gross

margin, non-GAAP operating expenses, non-GAAP operating loss and operating margin,

non-GAAP net loss, non-GAAP net loss per share, basic and diluted, and free cash flow.

Specifically, Zendesk excludes the following from its historical and prospective non-GAAP

financial measures, as applicable:

Share-based Compensation and Amortization of Share-based Compensation Capitalized

in Internal-use Software: Zendesk utilizes share-based compensation to attract and retain

employees. It is principally aimed at aligning their interests with those of its stockholders

and at long-term retention, rather than to address operational performance for any particular

period. As a result, share-based compensation expenses vary for reasons that are generally

unrelated to financial and operational performance in any particular period.

Employer Tax Related to Employee Stock Transactions: Zendesk views the amount of

employer taxes related to its employee stock transactions as an expense that is dependent

on its stock price, employee exercise and other award disposition activity, and other factors

that are beyond Zendesk’s control. As a result, employer taxes related to its employee stock

transactions vary for reasons that are generally unrelated to financial and operational perfor-

mance in any particular period.

Amortization of Purchased Intangibles and Acquisition Related Expenses: Zendesk views

amortization of purchased intangible assets, including the amortization of the cost associated

with an acquired entity’s developed technology, as items arising from pre-acquisition activi-

ties determined at the time of an acquisition. While these intangible assets are evaluated for

impairment regularly, amortization of the cost of purchased intangibles is an expense that is

not typically affected by operations during any particular period. Zendesk views acquisition

related expenses as events that are not necessarily reflective of operational performance

during a period. In particular, Zendesk believes the consideration of measures that exclude

such expenses can assist in the comparison of operational performance in different periods

which may or may not include such expenses.

Zendesk provides disclosures regarding its free cash flow, which is defined as net cash from

operating activities, less purchases of property and equipment and internal-use software

development costs. Zendesk uses free cash flow, among other measures, to evaluate the

ability of its operations to generate cash that is available for purposes other than capital

expenditures and capitalized software development costs. Zendesk believes that informa-

tion regarding free cash flow provides investors with an important perspective on the cash

available to fund ongoing operations.

Zendesk’s disclosures regarding its expectations for its non-GAAP operating margin include

adjustments to its expectations for its GAAP operating margin that exclude the expected

share-based compensation and related expenses and amortization of purchased intangibles

excluded from its expectations for non-GAAP operating loss as compared to its expectation

for GAAP operating loss for the same period.

Zendesk’s disclosures regarding its expectations for its non-GAAP gross margin include

adjustments to its expectations for its GAAP gross margin that exclude share-based com-

pensation and related expenses in Zendesk’s cost of revenue and amortization of purchased

intangibles related to developed technology. The share-based compensation and related

expenses excluded due to such adjustments are primarily comprised of the share-based

compensation and related expenses for employees associated with Zendesk’s platform

infrastructure, product support, and professional service organizations.

Zendesk Sharehoder Letter Q4 2016 - 22

Zendesk does not provide a reconciliation of its non-GAAP gross margin guidance to GAAP

gross margin for future periods because Zendesk does not provide guidance on the rec-

onciling items between GAAP gross margin and non-GAAP gross margin, as a result of the

uncertainty regarding, and the potential variability of, these items. The actual amount of such

reconciling items will have a significant impact on Zendesk’s non-GAAP gross margin and,

accordingly, a reconciliation of GAAP gross margin to non-GAAP gross margin guidance for

the period is not available without unreasonable effort.

Zendesk uses non-GAAP financial information to evaluate its ongoing operations and for

internal planning and forecasting purposes. Zendesk’s management does not itself, nor does

it suggest that investors should, consider such non-GAAP financial measures in isolation

from, or as a substitute for, financial information prepared in accordance with GAAP. Zendesk

presents such non-GAAP financial measures in reporting its financial results to provide inves-

tors with an additional tool to evaluate Zendesk’s operating results. Zendesk believes these

non-GAAP financial measures are useful because they allow for greater transparency with

respect to key metrics used by management in its financial and operational decision-making.

This allows investors and others to better understand and evaluate Zendesk’s operating

results and future prospects in the same manner as management.

Zendesk’s management believes it is useful for itself and investors to review, as applicable,

both GAAP information that may include items such as share-based compensation and

related expenses, amortization of purchased intangibles, transaction costs related to acqui-

sitions, and the non-GAAP measures that exclude such information in order to assess the

performance of Zendesk’s business and for planning and forecasting in subsequent periods.

When Zendesk uses such a non-GAAP financial measure with respect to historical periods,

it provides a reconciliation of the non-GAAP financial measure to the most closely compara-

ble GAAP financial measure. When Zendesk uses such a non-GAAP financial measure in a

forward-looking manner for future periods, and a reconciliation is not determinable without

unreasonable effort, Zendesk provides the reconciling information that is determinable

without unreasonable effort and identifies the information that would need to be added or

subtracted from the non-GAAP measure to arrive at the most directly comparable GAAP

measure. Investors are encouraged to review the related GAAP financial measures and the

reconciliation of these non-GAAP financial measures to their most directly comparable GAAP

financial measure as detailed above.

About Operating Metrics

Zendesk reviews a number of operating metrics to evaluate its business, measure per-

formance, identify trends, formulate business plans, and make strategic decisions. These

include the number of paid customer accounts on Zendesk Support, Zendesk Chat, and its

other products, dollar-based net expansion rate, monthly recurring revenue represented by

its churned customers, and the percentage of its monthly recurring revenue from Support

originating from customers with more than 100 agents on Support.

Zendesk defines the number of paid customer accounts at the end of any particular period

as the sum of (i) the number of accounts on Support, exclusive of its legacy Starter plan, free

trials or other free services, (ii) the number of accounts using Chat, exclusive of free trials or

other free services, and (iii) the number of accounts on all of its other products, exclusive

of free trials and other free services, each as of the end of the period and as identified by

a unique account identifier. Use of Support, Chat, and Zendesk’s other products requires

separate subscriptions and each of these accounts are treated as a separate paid customer

account. Existing customers may also expand their utilization of Zendesk’s products by

adding new accounts and a single consolidated organization or customer may have multiple

accounts across each of Zendesk’s products to service separate subsidiaries, divisions, or

work processes. Each of these accounts is also treated as a separate paid customer account.

Zendesk’s dollar-based net expansion rate provides a measurement of its ability to increase

revenue across its existing customer base through expansion of authorized agents asso-

ciated with a paid customer account, upgrades in subscription plans, and the purchase of

additional products as offset by churn, contraction in authorized agents associated with a

paid customer account, and downgrades in subscription plans. Zendesk’s dollar-based net

expansion rate is based upon monthly recurring revenue for a set of paid customer accounts

on its products. Monthly recurring revenue for a paid customer account is a legal and

contractual determination made by assessing the contractual terms of each paid customer

account, as of the date of determination, as to the revenue Zendesk expects to generate

in the next monthly period for that paid customer account, assuming no changes to the

subscription and without taking into account any one-time discounts or any platform usage

above the subscription base, if any, that may be applicable to such subscription. Monthly

recurring revenue is not determined by reference to historical revenue, deferred revenue,

or any other United States generally accepted accounting principles, or GAAP, financial

measure over any period. It is forward-looking and contractually derived as of the date of

determination.

Zendesk calculates its dollar-based net expansion rate by dividing the retained revenue net

of contraction and churn by Zendesk’s base revenue. Zendesk defines its base revenue

as the aggregate monthly recurring revenue across its products for customers with paid

customer accounts on Support or Chat as of the date one year prior to the date of calcula-

tion. Zendesk defines the retained revenue net of contraction and churn as the aggregate

monthly recurring revenue across its products for the same customer base included in the

measure of base revenue at the end of the annual period being measured. The dollar-based

net expansion rate is also adjusted to eliminate the effect of certain activities that Zendesk

identifies involving the transfer of agents between paid customer accounts, consolidation of

customer accounts, or the split of a single paid customer account into multiple paid customer

accounts. In addition, the dollar-based net expansion rate is adjusted to include paid

customer accounts in the customer base used to determine retained revenue net of con-

traction and churn that share common corporate information with customers in the customer

base that are used to determine the base revenue. Giving effect to this consolidation results

in Zendesk’s dollar-based net expansion rate being calculated across approximately 79,600

customers, as compared to the approximately 94,300 total paid customer accounts as of

December 31, 2016.

To the extent that Zendesk can determine that the underlying customers do not share

common corporate information, Zendesk does not aggregate paid customer accounts

associated with reseller and other similar channel arrangements for the purposes of

determining its dollar-based net expansion rate. While not material, Zendesk believes the

failure to account for these activities would otherwise skew the dollar-based net expansion

metrics associated with customers that maintain multiple paid customer accounts across

its products and paid customer accounts associated with reseller and other similar channel

arrangements.

Zendesk does not currently incorporate operating metrics associated with its analytics

product into its measurement of dollar-based net expansion rate.

For a more detailed description of how Zendesk calculates its dollar-based net expansion

rate, please refer to Zendesk’s periodic reports filed with the Securities and

Exchange Commission.

Zendesk Sharehoder Letter Q4 2016 - 23

Zendesk calculates its monthly recurring revenue represented by its churned customers on

an annualized basis by dividing base revenue associated with paid customer accounts on

Support that churn, either by termination of the subscription or failure to renew, during the

annual period being measured, by Zendesk’s base revenue. Zendesk’s monthly recurring

revenue represented by its churned customers excludes expansion or contraction associ-

ated with paid customer accounts on Support and the effect of upgrades or downgrades

in subscription plan. The monthly recurring revenue represented by its churned customers

is adjusted to exclude paid customer accounts that churned from the customer base used

that share common corporate information with customer accounts that did not churn from

the customer base during the annual period being measured. While not material, Zendesk

believes the failure to make this adjustment could otherwise skew the monthly recurring

revenue represented by its churned customers as a result of customers that maintain

multiple paid customer accounts on Support.

Zendesk’s percentage of monthly recurring revenue from Support that is generated by

customers with 100 or more agents on Support is determined by dividing the monthly

recurring revenue from Support for paid customer accounts with more than 100 agents on

Support as of the measurement date by the monthly recurring revenue from Support for all

paid customer accounts on Support as of the measurement date. Zendesk determines the

customers with 100 or more agents on Support as of the measurement date based on the

number of activated agents on Support at the measurement date and includes adjustments

to aggregate paid customer accounts that share common corporate information.

Zendesk determines the annualized value of a contract by annualizing the monthly recurring

revenue for such contract.

Zendesk does not currently incorporate operating metrics associated with products other

than Support into its measurement of monthly recurring revenue represented by its churned

customers or the percentage of monthly recurring revenue from Support that is generated by

customers with 100 or more agents on Support.

Zendesk’s freemium plans include its legacy Starter plan for Support, its Lite plan for Chat,

and its Inbox service for facilitating and simplifying email collaboration on group email

aliases. Zendesk believes these services provide exposure to its brand and establish a

relationship that can facilitate further adoption of Support and Chat as organizations grow

in size and their service needs grow more complex. A customer account on Zendesk’s

freemium plans is considered active based on whether functionality of the service has been

utilized within the 90-day period preceding the measurement date. A single consolidated

organization or customer may have multiple freemium customer accounts across each of

Support, Chat, and Zendesk’s Inbox service. Each of these accounts is treated as a separate

customer account on Zendesk’s freemium products.

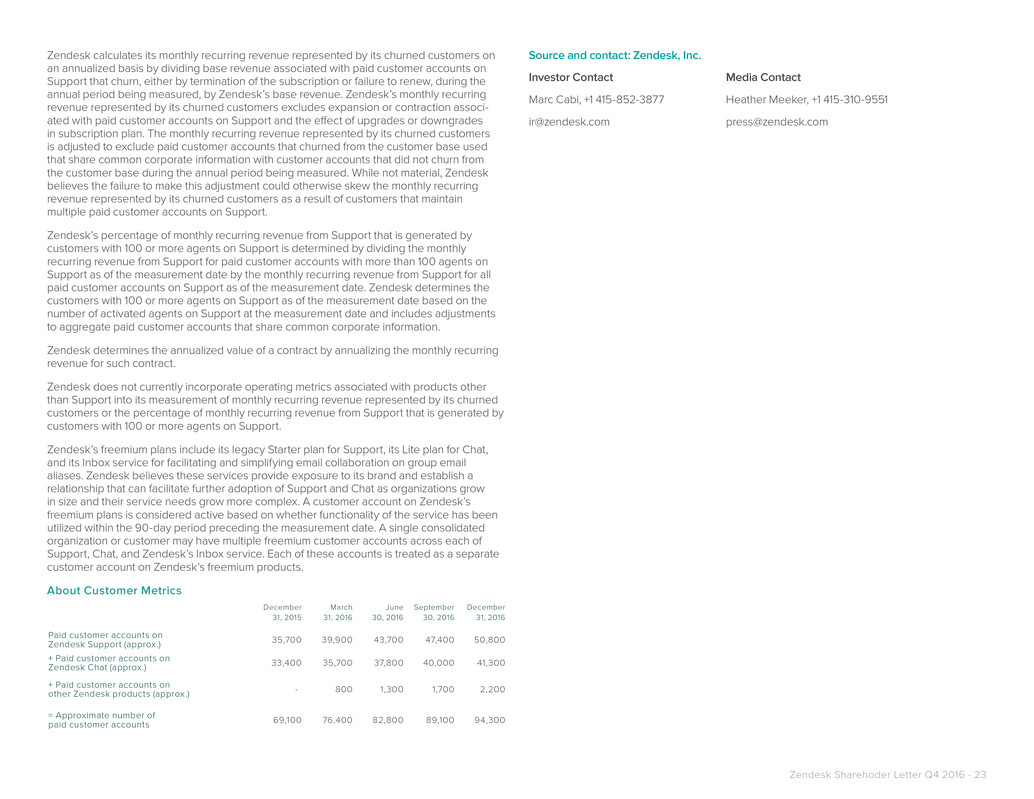

About Customer Metrics

December

31, 2015

March

31, 2016

June

30, 2016

September

30, 2016

December

31, 2016

Paid customer accounts on

Zendesk Support (approx.) 35,700 39,900 43,700 47,400 50,800

+ Paid customer accounts on

Zendesk Chat (approx.) 33,400 35,700 37,800 40,000 41,300

+ Paid customer accounts on

other Zendesk products (approx.) - 800 1,300 1,700 2,200

= Approximate number of

paid customer accounts 69,100 76,400 82,800 89,100 94,300

Source and contact: Zendesk, Inc.

Investor Contact

Marc Cabi, +1 415-852-3877

ir@zendesk.com

Media Contact

Heather Meeker, +1 415-310-9551

press@zendesk.com

Zendesk Sharehoder Letter Q4 2016 - 24