Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - SCANSOURCE, INC. | a2017-q2exhibit99112312016.htm |

| 8-K - 8-K - SCANSOURCE, INC. | a2017-q2form8xk12312016.htm |

Q2 FY17 FINANCIAL RESULTS

CONFERENCE CALL

February 7, 2017 at 5:00 pm ET

Exhibit 99.2

SAFE HARBOR AND NON-GAAP

Safe Harbor Statement

This presentation contains certain comments that are

“forward-looking” statements, including sales, GAAP diluted

EPS, and non-GAAP diluted EPS, that involve plans,

strategies, economic performance and trends, projections,

expectations, costs or beliefs about future events and other

statements that are not descriptions of historical facts.

Forward-looking information is inherently subject to risks and

uncertainties.

Any number of factors could cause actual results to differ

materially from anticipated results, including declines in sales

and margins, currency fluctuations, difficulties in integrating

acquisitions and general economic factors. For more

information concerning factors that could cause actual results

to differ from anticipated results, see the “Risk Factors”

included in the Company’s quarterly report on Form 10-Q for

the quarter ended December 31, 2016 and annual report on

Form 10-K for the fiscal year ended June 30, 2016, filed with

the Securities and Exchange Commission (“SEC”).

Although ScanSource believes the expectations in its

forward-looking statements are reasonable, it cannot

guarantee future results, levels of activity, performance or

achievement. ScanSource disclaims any obligation to

update or revise any forward-looking statements, whether as

a result of new information, future events, or otherwise,

except as may be required by law.

Non-GAAP Financial Information

In addition to disclosing results that are determined in

accordance with United States Generally Accepted

Accounting Principles (“GAAP”), the Company also discloses

certain non-GAAP measures, including non-GAAP operating

income, non-GAAP operating margin, non-GAAP net income,

non-GAAP diluted earnings per share, return on invested

capital (“ROIC”) and the percentage change in net sales

excluding the impact of foreign currency exchange rates. A

reconciliation of the Company's non-GAAP financial

information to GAAP financial information is provided in the

Appendix and in the Company’s Form 8-K, filed with the

SEC, with the quarterly earnings press release for the period

indicated.

2

HIGHLIGHTS

3

• GAAP diluted EPS of $0.91 and non-GAAP diluted EPS* of $0.75 exceed

forecast range

• Higher gross margins in both segments contribute to EPS upside

• Net sales of $905 million below forecast; miss primarily in Worldwide

Barcode, Networking and Security segment

Vs. Forecast:

EPS Up and

Net Sales

Down

Improved

Sequential

Financial

Results

Favorable

Cash Flows

and ROIC

• First full quarter of operations following our acquisition of Intelisys with

excellent results from recurring revenue model; drove sequential increases

in gross and operating margins

• In addition to Intelisys benefit, gross margin of 10.9% reflects an increased

mix of higher margin sales

• Q2 FY17 operating cash flow of $29 million, reflecting some working capital

efficiency; trailing 12-months operating cash flow of $128 million

• Adjusted return on invested capital of 13.8%*

• Outlook midpoint for Q3 FY17 reflects Y/Y organic sales growth

* See Appendix for calculation of non-GAAP measures and reconciliations to GAAP measures.

Q2 FY17 Q1 FY17 Q2 FY16

Y/Y

Change

Q/Q

Change

Net sales $904.8 $932.6 $993.5 -9% -3%

Gross profit 98.5 91.5 100.6 -2% +8%

Gross profit margin % (of net

sales)

10.9% 9.8% 10.1% +76 bps +107 bps

Operating income 23.3 22.9 31.9 -27% +2%

Non-GAAP operating income 29.6 26.7 36.3 -18% +11%

GAAP net income 23.0 14.8 20.7 +12% +55%

Non-GAAP net income 19.1 17.5 23.7 -20% +9%

GAAP diluted EPS $0.91 $0.58 $0.77 +18% +57%

Non-GAAP diluted EPS $0.75 $0.68 $0.88 -15% +10%

HIGHLIGHTS – Q2 FY17

4

$ in millions, except EPS

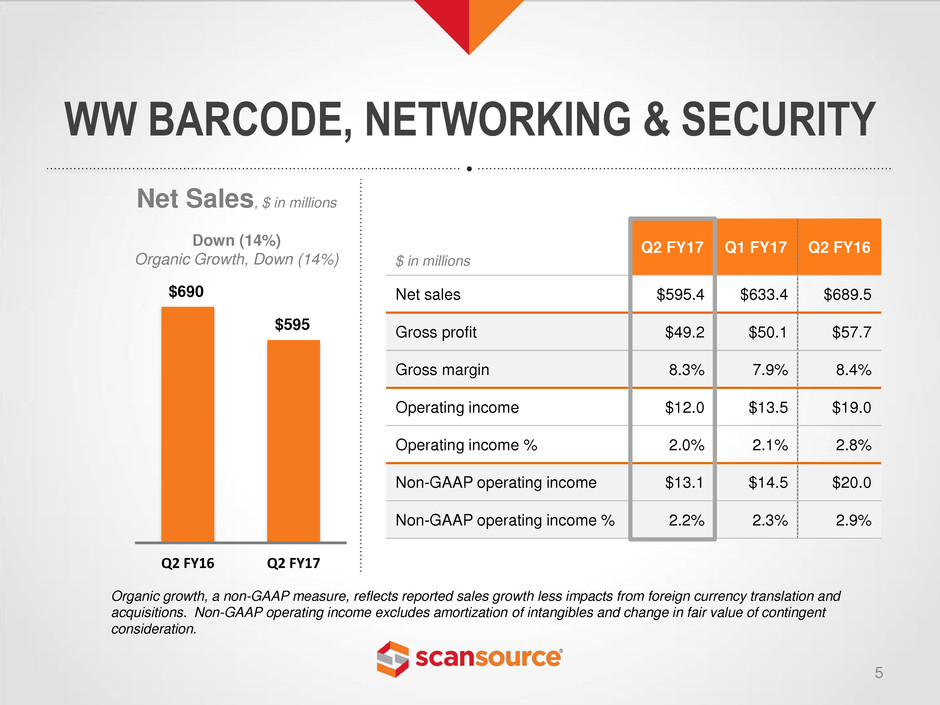

Q2 FY17 Q1 FY17 Q2 FY16

Net sales $595.4 $633.4 $689.5

Gross profit $49.2 $50.1 $57.7

Gross margin 8.3% 7.9% 8.4%

Operating income $12.0 $13.5 $19.0

Operating income % 2.0% 2.1% 2.8%

Non-GAAP operating income $13.1 $14.5 $20.0

Non-GAAP operating income % 2.2% 2.3% 2.9%

Q2 FY16 Q2 FY17

Net Sales, $ in millions

Down (14%)

Organic Growth, Down (14%)

WW BARCODE, NETWORKING & SECURITY

5

$ in millions

Organic growth, a non-GAAP measure, reflects reported sales growth less impacts from foreign currency translation and

acquisitions. Non-GAAP operating income excludes amortization of intangibles and change in fair value of contingent

consideration.

$690

$595

Q2 FY17 Q1 FY17 Q2 FY16

Net sales $309.4 $299.2 $304.0

Gross profit $49.3 $41.4 $42.9

Gross margin 15.9% 13.9% 14.1%

Operating income $11.6 $9.9 $12.9

Operating income % 3.8% 3.3% 4.2%

Non-GAAP operating income $16.5 $12.2 $16.2

Non-GAAP operating income % 5.3% 4.1% 5.3%

WW COMMUNICATIONS & SERVICES

6

Q2 FY16 Q2 FY17

Net Sales, $ in millions

Up 2%

Organic Growth, Down (2%)

$ in millions

$309 $304

Organic growth, a non-GAAP measure, reflects reported sales growth less impacts from foreign currency translation and

acquisitions. Non-GAAP operating income excludes amortization of intangibles and change in fair value of contingent

consideration.

Q2 FY17 Q1 FY17 Q2 FY16

Accounts receivable (Q/E) $620.6 $637.8 $588.4

Days sales outstanding in receivables* 60* 59* 53

Inventory (Q/E) $512.9 $567.3 $604.1

Inventory turns 6.0 6.0 6.0

Accounts payable (Q/E) $476.3 $533.0 $512.0

Paid for inventory days* 6.5* 6.0* 9.3

Working capital (Q/E) (AR+INV–AP) $657.1 $672.1 $680.5

WORKING CAPITAL MEASURES

$ in millions

7

* Excludes the impact of the Intelisys acquisition, which was completed 8/29/16

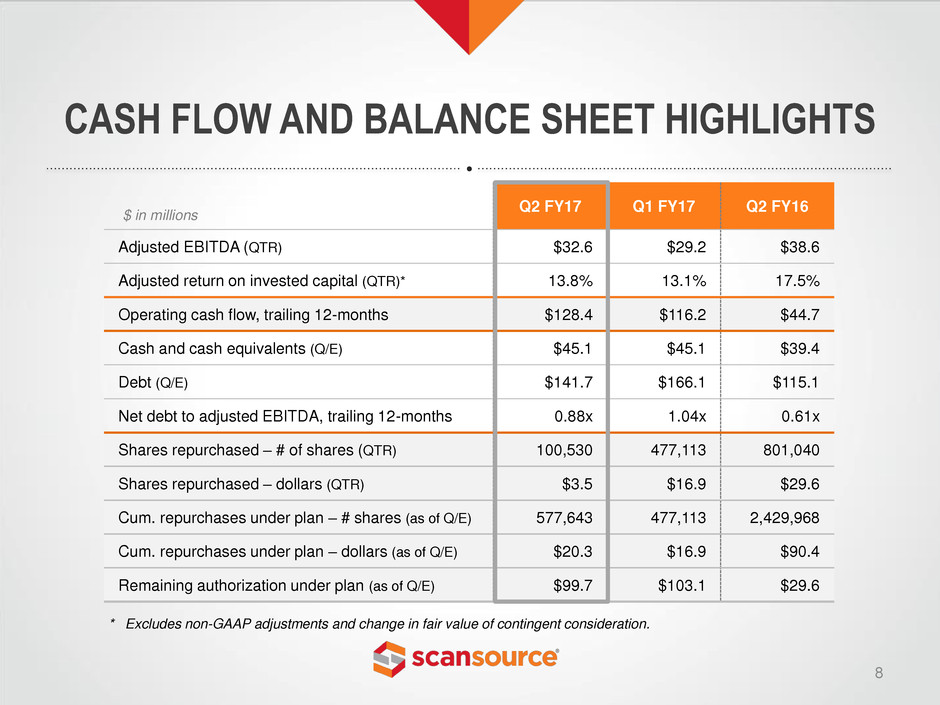

Q2 FY17 Q1 FY17 Q2 FY16

Adjusted EBITDA (QTR) $32.6 $29.2 $38.6

Adjusted return on invested capital (QTR)* 13.8% 13.1% 17.5%

Operating cash flow, trailing 12-months $128.4 $116.2 $44.7

Cash and cash equivalents (Q/E) $45.1 $45.1 $39.4

Debt (Q/E) $141.7 $166.1 $115.1

Net debt to adjusted EBITDA, trailing 12-months 0.88x 1.04x 0.61x

Shares repurchased – # of shares (QTR) 100,530 477,113 801,040

Shares repurchased – dollars (QTR) $3.5 $16.9 $29.6

Cum. repurchases under plan – # shares (as of Q/E) 577,643 477,113 2,429,968

Cum. repurchases under plan – dollars (as of Q/E) $20.3 $16.9 $90.4

Remaining authorization under plan (as of Q/E) $99.7 $103.1 $29.6

CASH FLOW AND BALANCE SHEET HIGHLIGHTS

$ in millions

8

* Excludes non-GAAP adjustments and change in fair value of contingent consideration.

Q3 FY17 OUTLOOK*

9

* Outlook as of February 7, 2017. Non-GAAP diluted EPS excludes amortization of intangible assets, change in fair value of

contingent consideration, and acquisition costs. Reflects the following FX rates: $1.07 to EUR 1.00 for the Euro, $0.3125

to R$1.00 for the Brazilian real (R$3.20 to $1), and $1.25 to GBP 1.00 for the British pound.

For the quarter ending March 31, 2017, excluding amortization of intangible assets, change

in fair value of contingent consideration, and acquisition costs:

Range from $800 million to $860 million

Range from $0.42 to $0.49 per share

Net Sales

GAAP

Diluted EPS

Range from $0.62 to $0.69 per share

Non-GAAP

Diluted EPS

APPENDIX: NON-GAAP FINANCIAL INFORMATION

10

Operating Income, Pre-Tax Income, Net Income & EPS – QTR

($ in thousands) Quarter Ended December 31, 2016

Operating

Income

Pre-tax

income

Net

income

Diluted

EPS

GAAP measure $ 23,275 $ 35,781 $ 23,036 $ 0.91

Adjustments:

Amortization of intangible assets 4,165 4,165 2,740 0.11

Change in fair value of contingent consideration 1,791 1,791 1,000 0.04

Acquisition costs (a) 335 335 335 0.01

Legal settlement, net of attorney fees - (12,777) (8,047) (0.32)

Non-GAAP measure $ 29,566 $ 29,295 $ 19,064 $ 0.75

Quarter Ended September 30, 2016

Operating

Income

Pre-tax

income

Net

income

Diluted

EPS

GAAP measure $ 22,875 $ 22,724 $ 14,816 $ 0.58

Adjustments:

Amortization of intangible assets 3,154 3,154 2,108 0.08

Change in fair value of contingent consideration 169 169 46 0.00

Acquisition costs (a) 498 498 498 0.02

Non-GAAP measure $ 26,696 $ 26,545 $ 17,468 $ 0.68

Quarter Ended December 31, 2015

Operating

Income

Pre-tax

income

Net

income

Diluted

EPS

GAAP measure $ 31,852 $ 31,632 $ 20,656 $ 0.77

Adjustments:

Amortization of intangible assets 2,545 2,545 1,732 0.06

Change in fair value of contingent consideration 1,816 1,816 1,244 0.05

Acquisition costs (a) 60 60 60 0.00

Non-GAAP measure $ 36,273 $ 36,053 $ 23,692 $ 0.88

(a) Acquisition costs are nondeductible for tax purposes.

APPENDIX: NON-GAAP FINANCIAL INFORMATION

11

Net Sales, Constant Currency and Excluding Acquisitions – QTR

($ in thousands)

WW Barcode,

NW & Security

WW Comms.

& Services Consolidated

For the quarter ended December 31, 2016:

Q2 FY17 net sales, as reported $ 595,359 $ 309,433 $ 904,792

Foreign exchange impact (a) (3,257) (2,557) (5,814)

Q2 FY17 net sales, constant currency 592,102 306,876 898,978

Less: Acquisitions - (8,487) (8,487)

Q2 FY17 net sales, constant currency excluding acquisitions $ 592,102 $ 298,389 $ 890,491

Q2 FY16 net sales, as reported $ 689,530 $ 303,992 $ 993,522

Less: Acquisitions - - -

Q2 FY16 net sales, excluding acquisitions $ 689,530 $ 303,992 $ 993,522

Y/Y % Change:

As reported -13.7% 1.8% -8.9%

Constant currency -14.1% 0.9% -9.5%

Constant currency, excluding acquisitions (organic

growth) -14.1% -1.8% -10.4%

(a) Year-over-year sales growth excluding the translation impact of changes in foreign currency rates. Calculated by translating net sales for the quarter ended

December 31, 2016 into U.S. dollars using the weighted average foreign exchange rates for the quarter ended December 31, 2015.

APPENDIX: NON-GAAP FINANCIAL INFORMATION

12

Highlights by Segment – Y/Y for Quarter

Quarter Ended December 31, 2016

($ in thousands) WW Barcode,

NW & Security

WW Comms.

& Services Corporate Consolidated

Net sales $ 595,359 $ 309,433 $ - $ 904,792

GAAP operating income $ 11,985 $ 11,625 $ (335) $ 23,275

Adjustments:

Amortization of intangible assets 1,079 3,086 - 4,165

Change in fair value of contingent consideration - 1,791 - 1,791

Acquisition costs - - 335 335

Non-GAAP operating income $ 13,064 $ 16,502 $ - $ 29,566

GAAP operating income % (of net sales) 2.0% 3.8% n/m 2.6%

Non-GAAP operating income % (of net sales) 2.2% 5.3% n/m 3.3%

Quarter Ended December 31, 2015

($ in thousands) WW Barcode,

NW & Security

WW Comms.

& Services Corporate Consolidated

Net sales $ 689,530 $ 303,992 $ - $ 993,522

GAAP operating income $ 19,000 $ 12,912 $ (60) $ 31,852

Adjustments:

Amortization of intangible assets 1,047 1,498 - 2,545

Change in fair value of contingent consideration - 1,816 - 1,816

Acquisition costs - - 60 60

Non-GAAP operating income $ 20,047 $ 16,226 $ - $ 36,273

GAAP operating income % (of net sales) 2.8% 4.2% n/m 3.2%

Non-GAAP operating income % (of net sales) 2.9% 5.3% n/m 3.7%

n/m = not meaningful

APPENDIX: NON-GAAP FINANCIAL INFORMATION

13

Highlights by Segment – Prior Quarter

Quarter Ended September 30, 2016

($ in thousands)

WW Barcode,

NW & Security

WW Comms.

& Services Corporate Consolidated

Net sales $ 633,405 $ 299,161 $ - $ 932,566

GAAP operating income $ 13,456 $ 9,917 $ (498) $ 22,875

Adjustments:

Amortization of intangible assets 1,085 2,069 - 3,154

Change in fair value of contingent consideration - 169 - 169

Acquisition costs - - 498 498

Non-GAAP operating income $ 14,541 $ 12,155 $ - $ 26,696

GAAP operating income % (of net sales) 2.1% 3.3% n/m 2.5%

Non-GAAP operating income % (of net sales) 2.3% 4.1% n/m 2.9%

n/m = not meaningful

APPENDIX: NON-GAAP FINANCIAL INFORMATION

14

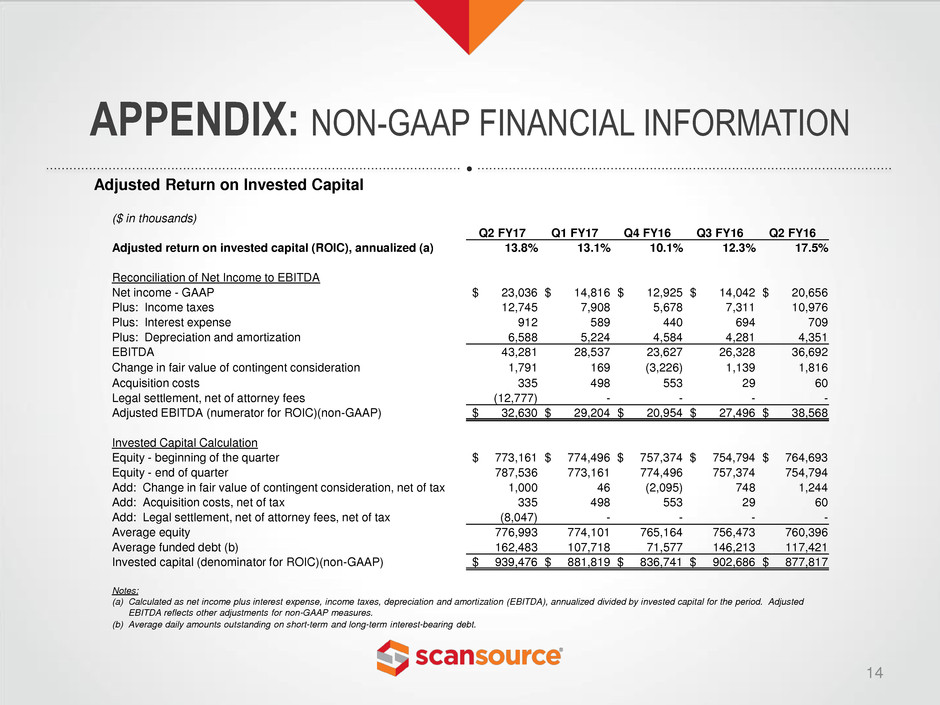

Adjusted Return on Invested Capital

($ in thousands)

Q2 FY17 Q1 FY17 Q4 FY16 Q3 FY16 Q2 FY16

Adjusted return on invested capital (ROIC), annualized (a) 13.8% 13.1% 10.1% 12.3% 17.5%

Reconciliation of Net Income to EBITDA

Net income - GAAP $ 23,036 $ 14,816 $ 12,925 $ 14,042 $ 20,656

Plus: Income taxes 12,745 7,908 5,678 7,311 10,976

Plus: Interest expense 912 589 440 694 709

Plus: Depreciation and amortization 6,588 5,224 4,584 4,281 4,351

EBITDA 43,281 28,537 23,627 26,328 36,692

Change in fair value of contingent consideration 1,791 169 (3,226) 1,139 1,816

Acquisition costs 335 498 553 29 60

Legal settlement, net of attorney fees (12,777) - - - -

Adjusted EBITDA (numerator for ROIC)(non-GAAP) $ 32,630 $ 29,204 $ 20,954 $ 27,496 $ 38,568

Invested Capital Calculation

Equity - beginning of the quarter $ 773,161 $ 774,496 $ 757,374 $ 754,794 $ 764,693

Equity - end of quarter 787,536 773,161 774,496 757,374 754,794

Add: Change in fair value of contingent consideration, net of tax 1,000 46 (2,095) 748 1,244

Add: Acquisition costs, net of tax 335 498 553 29 60

Add: Legal settlement, net of attorney fees, net of tax (8,047) - - - -

Average equity 776,993 774,101 765,164 756,473 760,396

Average funded debt (b) 162,483 107,718 71,577 146,213 117,421

Invested capital (denominator for ROIC)(non-GAAP) $ 939,476 $ 881,819 $ 836,741 $ 902,686 $ 877,817

Notes:

(a) Calculated as net income plus interest expense, income taxes, depreciation and amortization (EBITDA), annualized divided by invested capital for the period. Adjusted

EBITDA reflects other adjustments for non-GAAP measures.

(b) Average daily amounts outstanding on short-term and long-term interest-bearing debt.

APPENDIX: NON-GAAP FINANCIAL INFORMATION

15

Forecasted Range for EPS – Q3 FY17 Outlook

($ in thousands)

Forecast for Quarter ending

March 31, 2017

Range Low Range High

GAAP diluted EPS $ 0.42 $ 0.49

Adjustments:

Amortization of intangible assets 0.11 0.11

Change in fair value of contingent consideration 0.09 0.09

Non-GAAP diluted EPS $ 0.62 $ 0.69