Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BAY BANCORP, INC. | f8k_020717.htm |

Exhibit 99.1

Bay Bancorp, Inc . Presentation to Investors February 7, 2016 Joseph J. Thomas – President and CEO

2 This presentation contains forward - looking statements within the meaning of Section 21 E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995 concerning Bay Bancorp, Inc . ’ s plans, strategies, objectives, expectations, intentions, financial condition and results of operations . Statements that are not historical in nature, including those that include the words “anticipate”, “estimate”, “plan”, “focus”, “project”, “continue”, “ongoing”, “target”, “aim”, “expect”, “believe”, “intend”, “may”, “will”, “should”, “could”, or the negative of those words and other comparable words, and any financial projections used in connection with any discussion of future plans, strategies, objectives, actions, or events identify forward - looking statements . These forward - looking statements reflect management’s current views and intentions and are subject to known and unknown risks, uncertainties, assumptions and other factors that could cause the actual results to differ materially from those contemplated by the statements . The significant risks and uncertainties related to Bay Bancorp of which management is aware are discussed in detail in the periodic reports that Bay Bancorp files with the Securities and Exchange Commission (the “ SEC ” ), including in the “ Risk Factors ” section of its Annual Report on Form 10 - K for the year ended December 31 , 2015 . Investors are urged to review Bay Bancorp ’ s periodic reports, which are available at no charge through the SEC ’ s website at www . sec . gov and through Bay Bancorp’s website at www . baybankmd . com on the “ Investor Relations ” page . Bay Bancorp assumes no obligation to update any of these forward - looking statements to reflect a change in its views or events or circumstances that occur after the date of this presentation . Disclosure baybankmd.com

3 Agenda I. Overview of the Company II. Market Update III. 2016 Performance IV. Acquisition Overview V. Summary baybankmd.com

4 “All the banks sound the same. We need to change the conversation .” baybankmd.com I. Overview of the Company “We need to zig where others zag — Need to explore unique business areas.” “We want to be known as the business bank .”

5 Vision & Strengths “The bank built by entrepreneurs for entrepreneurs. ” • Pursue lead relationships with businesses, real estate investors and professionals • Possess the best talent and technology to provide differentiated service • Leverage acquisition track record to opportunistically buy banks and assets Strong Franchise Attributes • Exceptional management team and board of directors. • Vibrant, high - growth market filled with entrepreneurs along Baltimore Washington Corridor. • Balanced community banking strategy with strong credit and fee - based products. • Innovative culture and business model to achieve high organic C&I loan and core deposit growth. • Improving expense structure and scale attributes to drive core profitability. • Strong balance sheet with strong tier one leverage capital and moderate classified assets - to capital. • Proven and positioned to grow via acquisition to become $100 million in market capitalization . baybankmd.com

6 ▪ Financial Services Partners Fund I (FSPF) applies for and is approved for a shelf - charter by the Office of Thrift Supervision and the FDIC that can be used to acquired failed banks. ▪ Bay Bank, FSB was formed as a subsidiary of Jefferson Bancorp Inc. (JBI) by FSPF to purchase the assets and liabilities of Bay National Bank from the FDIC in July 2010 in a whole bank, no loss share transaction. ▪ Entered into a definitive agreement to acquire Carrollton Bancorp through a reverse merger transaction. Carrollton Bank was formed in 1903 and built a community bank franchise serving the Baltimore market. ▪ Following completion of the reverse merger, Carrollton Bank was rebranded and t h e holding company was renamed Bay Bancorp, Inc. and is listed on the NASDAQ under the ticker symbol “BYBK”. ▪ In May 2014, Bay Bank, FSB, purchased the assets and liabilities of Slavie FSB from the FDIC, adding nearly $124 million in assets, $90 million in loans and $110 million in deposits. Bay Bank retained Slavie’s Baltimore branch location in the transaction. ▪ Bay Bancorp rebrands itself under a new CEO as “the bank built by entrepreneurs for entrepreneurs,” relocates its corporate headquarters to Columbia, MD to better serve the Corridor, and achieves approximately $500 million in total assets. ▪ Bay Bancorp completes acquisition of Hopkins Bancorp. Hopkins is a 95 - year old bank with strong customer relationships in Pikesville market, boosting Bay’s position in Greater Baltimore to top 5 in deposits among local banks. The Evolution of Bay Bank 2009 2010 2012 2013 2014 baybankmd.com 2015 2016

Growth in Shareholder Value baybankmd.com 7 $4.65 $5.82 $6.05 $6.13 $6.30 $ 4.62 $5.39 $5.73 $5.88 $6.00 $4.00 $4.50 $5.00 $5.50 $6.00 $6.50 Dec-12 Dec-13 Dec-14 Dec-15 Dec-16 Book and Tangible Book Value Per Share Book Value per Share Tangible Book Value per Share Bay Bancorp, Inc. - Price Change (%)

8 Deposit Market Share & Branch Footprint BALTIMORE - TOWSON MARKET SHARE (Maryland domiciled banks ) BRANCH FOOTPRINT ** baybankmd.com As of June 30, 2016; (Source: FDIC, SNL) *The combined deposits of Bay Bank, FSB and Hopkins Federal Savings 2016 Rank Institution # of Branches Total Deposits 2016 ($000) % Total Deposit Share 1 Sandy Spring Bank 11 783,887 8.55 2 First Mariner Bank 15 770,008 8.40 3 Howard Bank 11 719,592 7.85 4 Rosedale Federal S&L 9 614,208 6.70 ( 5 )* Bay Bank & Hopkins Combined 13 555,080 6.01 5 Severn Bancorp Inc. 4 546,005 5.95 6 Capital Funding Bancorp Inc. 3 535,208 5.84 7 Hamilton Bancorp Inc. 7 433,779 4.73 8 Arundel Federal Savings Bank 7 392,225 4.28 9 Bay Bancorp Inc. 11 363,219 3.96 10 Queenstown Bancorp of MD 6 351,701 3.84 11 Glen Burnie Bancorp 8 337,952 3.69 12 Farmers and Merchants Bank 7 287,630 3.14 13 New Windsor Bancorp Inc. 7 263,971 2.88 14 Eastern Savings Bank FSB 5 253,883 2.77 15 Harford Bank 7 251,489 2.74 16 Shore Bancshares Inc. 5 236,969 2.58 17 Revere Bank 3 236,107 2.57 18 Harbor Bankshares Corp. 6 201,475 2.20 19 Old Line Bancshares Inc. 7 189,614 2.07 20 Hopkins Bancorp Inc. 2 187,861 2.05

9 Comprehensive & Diverse Business Units Commercial Banking • Seasoned team of Commercial Bankers ( 13) • Broad focus across the C & I, Business Banking and Commercial Real Estate markets • Robust Cash Management platform including remote deposit capture Community Banking • 11 branch network in Baltimore market • Solid core deposit base (73% of total deposits) • Strong business banking franchise (4.13% NIM for 2016) Mortgage Banking • Significant purchase money volume • Loan production of $53 million for 2016 • Extensive product offering including portfolio Entrepreneur Mortgage product Payments • Robust market share of network sponsorship for PIN - based transactions • Debit Sponsorships ( 87%), ATM and Check Card fees ( 13%), • Excellent fee income stream ($2.5MM as of 12/31/16) baybankmd.com

10 Executive Management Joseph J. Thomas – President and CEO - Mr . Thomas has extensive experience in the financial services industry. He was formerly Managing Director of Hovde Private Equity Advisors and had a distinguished 20+ year banking career with Wachovia Corporation, most recently as Managing Director and Head of Financial Institutions Investment Banking. Mr. Thomas was the founding chairman of the company. Larry Pickett – Chief Financial Officer - Mr . Pickett joined the Bank as its CFO in January 2014 from Susquehanna Bancshares, Inc. in Lititz, Pennsylvania where he was responsible for the financial operations of the $18 billion regional bank. Mr. Pic ket t spent over 20 years with Susquehanna and is a practicing CPA . James Kirschner – Chief Credit Officer/Special Assets - Mr. Kirschner has more than 30 years’ experience in banking and distressed investing having previously worked for Bank of America, Beltway Capital Management, and FirstCity Crestone. He has been a member of the Bank’s loan committee since 2011. He has extensive experience with credit underwriting, lending, and loan work - out. Mike Croxson – Chief Administrative Officer – Mr. Croxson has worked with growth - oriented public and privately - held financial services businesses in senior operating roles for nearly 30 years . His expertise is in tying growth strategies, human resources and management practices and operating and technology innovations to drive successful financial performance . Deanna Lintz – Chief Banking Officer - Mrs. Lintz joined the Bank is 2007 with nearly three decades of banking experience. She has held leadership positions with Bank of America, Provident Bank and M&T Bank working in the areas of consumer banking, private banking and business banking. baybankmd.com

11 Market Leadership Rich Ohnmacht – Corridor Market President & CRE – Mr. Ohnmacht has been working in banking and finance since 1991. He has principally worked in the Baltimore/Washington corridor markets managing large teams of commercial and real estate lenders. He is also experienced in treasury and wealth management. Todd Warren – Baltimore Market President & C&I – Mr. Warren has nearly 20 years of experience in the banking industry. He recently joined Bay Bank after serving as Senior Vice President and Senior Relationship Manager at Sandy Spring Bank. He has also held leadership and lending roles at K Bank, Susquehanna Bank and Bank of America. baybankmd.com

12 Board of Directors Pierre Abushacra – Mr. Abushacra is the founder and CEO of Firehook Bakery, a wholesale bakery and 10 company owned and operated cafes in the Washington DC metro area. Mr. Abushacra has been a director of the Company since May 2015 and of Bay Bank, FSB since April 2015. Robert J. Aumiller – Mr. Aumiller is the President of MacKenzie Commercial Real Estate Services, LLC, a commercial real estate brokerage where he has been for over 20 years. Mr. Aumiller served on the Carrollton board and joined the new board with the Carrollton Bank merger . Steven K. Breeden – Mr. Breeden is active in the local real estate industry with a focus in Howard County. He is a principal in Security Development Corporation. Mr. Breeden served on the Carrollton board and joined the new board with the Carrollton Bank merger . Michael Chiaramonte – Mr. Chiaramonte is the President and CEO of Michael Chiaramonte & Associates a consulting and advisory firm offering support to individuals, corporations and government in matters ranging from healthcare systems operations, healthcare policy, wealth management and hospitality services. Mr. Chiaramonte has been a director of the Company since May 2015 and of Bay Bank, FSB since April 2015. Mark M. Caplan – Mr. Caplan is a Baltimore native who has been very active in the multi - family real estate market and equipment lease business in the region. He has previously served on a local bank board and brings tremendous local knowledge to the Board. baybankmd.com

13 Board of Directors continued Harold “Hal” Hackerman – Mr. Hackerman is a Director at Ellen & Tucker, Chartered, a regional accounting firm headquartered in Baltimore. Mr. Hackerman has extensive experience in mergers and acquisitions, assisting companies in financially troubled situations and bankruptcies representing debtors, unsecured creditors, and secured lenders. Mr. Hackerman served on the Carrollton board and joined the new board with the Carrollton Bank merger . Eric D. Hovde – Mr. Hovde is the Chief Executive Officer of Hovde Capital Advisors LLC and has been an active participant in the financial services industry since the mid - 1990’s. Mr. Hovde has served on a number of bank boards and is currently the Chairman of the Board of Sunwest Bank in Southern California. Steve Hovde – Mr. Hovde is the Chairman and Chief Executive Officer of Hovde Group, a leading financial services and investment banking firm that provides a full - service suite of investment banking, capital raising and financial advisory service s exclusively for the banking and thrift industry. Mr. Hovde joined the Board in 2016. Charles L. Maskell Jr., CPA – Mr. Maskell leads a local corporate advisory and management consultant firm, Chesapeake Corporate Advisors, and is a CPA. Mr. Maskell is very active in the Baltimore business community and is a great advocate in the market. Joseph J. Thomas – President and CEO - See biography above. baybankmd.com

14 baybankmd.com II. Market Update

Baltimore Region Overview 15 baybankmd.com • Greater Baltimore has become a leading US metro areas for the start - up and growth of new businesses • The region’s educational attainment and research, strong incubator system, access to capital, supports growth • Strategically located in the Mid - Atlantic, Baltimore is the 26th largest city in the nation • Home to 13 colleges and universities • More than 60 federal agencies and research labs are within 30 miles, bringing substantial federal spending and jobs to the region • Thriving port and easy access via rail, air and highways • Professional sports teams, historic and cultural resources Entrepreneurial Climate Source: Economic Alliance of Greater Baltimore

16 Health care Greater Baltimore is a global center for health care services. The region is home to world class institutions and practitioners, has a high concentration of employment in the health care industry and is experiencing rapid expansion and investment in critical infrastructure. • Over 189,000 are employed in the region’s Health Care Services industry • Health care practitioner and technical occupations in the region earn an average of $66,160 • Maryland is providing nearly $2 million to Health Enterprise Zones to provide health care services across the region • Recent expansions at regional hospitals and medical centers have totaled nearly $3 billion • Health Care Services is also an anchor for growth in IT, cyber, biosciences, and finance (health care plans) Cyber Security The Baltimore - Washington region is among the top cyber security hubs in the US. The skilled technical workforce in the region ranks among the most concentrated in the country and nationally - ranked local colleges and universities continue to stock a talented pipeline of Cyber Security talent. • The Federal Government expects to spend over $40 billion on non - military IT • 8 Greater Baltimore colleges and universities are recognized as NSA Information Assurance Centers of Excellence • Maryland has over 19,000 job openings in cyber security, more than anywhere else in the country • Baltimore - Washington is home to over 200,000 Cyber Security professionals, with over 75,000 in Greater Baltimore/Central Maryland Industry Verticals baybankmd.com Source: Economic Alliance of Greater Baltimore

17 Manufacturing Manufacturing remains a top contributor to the US and Greater Baltimore economies. While employment has steadily declined since the 1970s, new innovations and technologies have led to significant increases in productivity, output, value added, and wages. • Over 57,000 are employed in Greater Baltimore’s 1,640 manufacturing establishments • Manufacturing employees in Greater Baltimore earned an average of $59,875 in 2011, compared to $52,330 nationally • 42% of manufacturing jobs in Greater Baltimore are considered at least moderately high - tech • Employees in very high - tech manufacturing jobs earn an average of $112,871, well above the national average. • Baltimore offers the #3 best tax environment for the manufacturing sector in the US, as ranked by KPMG Not - for - Profits Not - for - Profit organizations based in Greater Baltimore make strong contributions to the region’s economy and quality of life. They also have national and global impact by pursuing critical missions, such as scientific discovery, international disaster relief, affordable housing and civil rights . • Over 172,000 are employed in Greater Baltimore’s Not - for - Profit sector • The region ranks #7 in Not - for - Profit employment concentration among the 25 largest US metros • Annual payroll in the region’s Not - for - Profit sector is $7.25 billion • Maryland is the #2 most charitable state in the US and Canada. Maryland ranks #1 in percentage of tax filers donating to charity and #6 in percentage of aggregate income donated to charity Industry Verticals (continued) baybankmd.com Source: Economic Alliance of Greater Baltimore

18 Marketing Update baybankmd.com Significant growth in brand recognition with 23,000,000 in total impressions for 2016

19 baybankmd.com III. 2016 Performance We call it speed to market, it’s our competitive edge . “Your team was outstanding. To get from the initial meeting to close in that timeframe was very impressive – and I’ve been doing this a long time.”

Financial Overview - Earnings 20 baybankmd.com Financial Overview - Earnings (GAAP) Income and Expense ($000) Q4 Q4 2012 2013 2014 2015 2016-Unaudited 2015 2016 Net Interest Income 9,253$ 17,758 22,858 21,375 21,177 5,106 5,865 Provision Expense 734 842 802 1,143 1,390 264 374 Non-Interest Income 413 8,945 7,706 5,374 9,214 1,095 2,887 Non-Interest Expense 8,229 22,115 27,456 22,541 26,035 5,193 7,246 Net Income Before Taxes 703 3,745 2,306 3,065 2,967 744 1,131 Net Income 58$ 3,241 3,033 1,931 1,747 512 738 Performance Ratios Basic and Diluted EPS 0.01 0.39 0.29 0.17 0.16 0.05 0.07 Return on Average Assets 0.05% 0.90% 0.66% 0.40% 0.36% 0.43% 0.53% Return on Average Equity 0.19% 6.68% 4.93% 2.94% 2.94% 3.10% 4.96% Net Interest Margin 7.43% 5.33% 5.30% 4.70% 4.13% 4.49% 4.05% Non-Int Income/Avg Assets (annualized) 0.32% 2.50% 1.68% 1.12% 1.49% 0.92% 1.91% Non-Int Expense /Avg Assets (annualized) 6.44% 6.17% 5.97% 4.68% 4.20% 4.37% 4.80% Efficiency Ratio 85.14% 82.82% 89.83% 84.27% 85.67% 83.73% 82.80% For Years Ended

21 Core Pre - Provision Earnings baybankmd.com Bay Bancorp, Inc. (Consolidated) Financial Summary - Core Pre - Provision Earnings ($000) (Non - GAAP) For the Years Ended Q4 Q4 (unaudited) 2012 2013 2014 2015 2016 2015 2016 Net Income Before Taxes $ 703 3,745 2,306 3,065 2,967 $ 744 1,131 Non - Core Adjustments: Less: Accelerated Accretion on acquired loans (1) (598) (1,566) (856) (47) (129) (10) Gain on Acquisitions (2) (2,860) (524) - (1,025) - 9 Income recognized from IRA Exit (3) (2,380) - - - - Income recognized from Reverse Mortgage (6) (3,089) - (1,679) Provision for Loan Loss 734 842 802 1,143 1,390 264 374 Plus: Amortization Expense on intangible assets - 791 993 854 791 198 235 Expense for Mergers and acquisitions (4) 916 2,042 1,028 22 1,758 22 49 Expense recognized from Reverse Mortgage (6) 2,971 - 1,654 Other non - recurring expenses (5) - - 1,523 - - - - Core Pre - tax, Pre - provision Net Income 2,353 3,962 2,181 4,228 5,715 1,100 1,764 Core Income Tax Expense (7) 894 1,506 829 1,607 2,172 418 670 Core Pre - Provision Net Income $ 1,459 2,456 1,352 2,621 3,544 $ 682 1,094 Key Core Pre - Provision Performance Ratios Diluted Earnings Per Share $ 0.25 0.26 0.12 0.24 0.33 $ 0.06 0.10 Return on Average Assets (annualized) 1.14% 0.69% 0.29% 0.54% 0.66% 0.57% 0.72% Return on Average Equity (annualized) 4.86% 5.06% 2.20% 3.99% 5.36% 4.16% 6.83% Net Interest Margin 7.43% 5.15% 4.94% 4.51% 4.13% 4.38% 4.04% Non - Interest Income /Average Assets (annualized) 0.32% 1.53% 0.70% 0.94% 0.95% 0.92% 0.81% Non - Interest Expense /Average Assets (annualized) 5.72% 5.38% 5.20% 4.50% 3.83% 4.18% 3.52% Efficiency Ratio 75.66% 82.95% 91.64% 83.67% 78.21% 81.89% 75.05%

22 Core Pre - Provision Earnings (Continued) Footnotes to core earnings baybankmd.com 1 Accelerated accretion from acquired loans – Acquired loans are carried net of purchase discount/premium which is amortized/accreted into earnings over the life of the loan. The discount/premium is accelerated and recognized as income or expense if the loan is paid off or otherwise settled prior to maturity. The income or expense acceleration is adjusted out of core earnings in this analysis. 2 Bargain purchase gain – Gain on acquisition/merger is the excess of the fair value of net assets acquired over consideration paid - 2013 Carrollton Merger, 2014 Slavie Acquisition and 2016 Hopkins Merger. 3 Individual Retirement Account (IRA) product line exit - The Company stopped offering IRAs and resigned as custodian for its existing IRAs. The IRA exit accelerated the recognition of the remaining interest rate mark - to - market. The income acceleration is adjusted out of core earnings in this analysis. 4 Merger/acquisition costs – These expenses primarily related to professional services, system conversions and integration of operations as well as other costs of completing the transactions. 5 Common stock award – A 2014 one - time award of common stock that vested immediately and was recognized as compensation expense for $1.07 million was adjusted out of core earnings in this analysis. 2014 Severance costs of $0.52 million recognized for executives due to a corporate reorganization were adjusted out of core earnings in this analysis. 6 Revenue and operating expense for reverse mortgage brokerage operation ( iReverse Home Loans) acquired through the Hopkins acquisition were excluded from core earnings for this analysis. 7 For comparison purposes, a consolidated tax rate of 38% was utilized for core income tax expense.

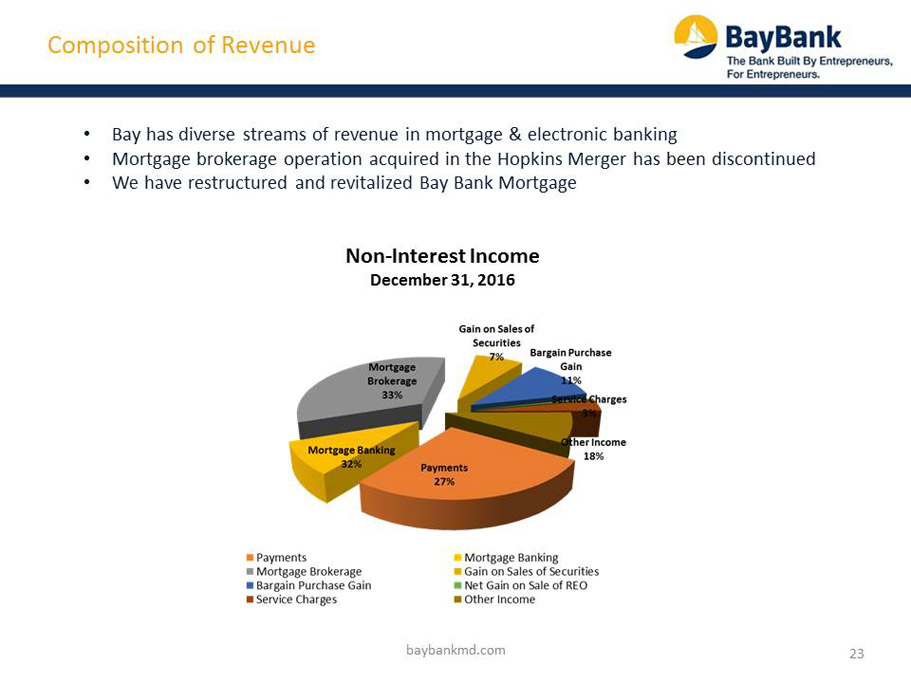

23 Composition of Revenue Non - Interest Income December 31, 2016 baybankmd.com • Bay has diverse streams of revenue in mortgage & electronic banking • Mortgage brokerage operation acquired in the Hopkins Merger has been discontinued • We have restructured and revitalized Bay Bank Mortgage

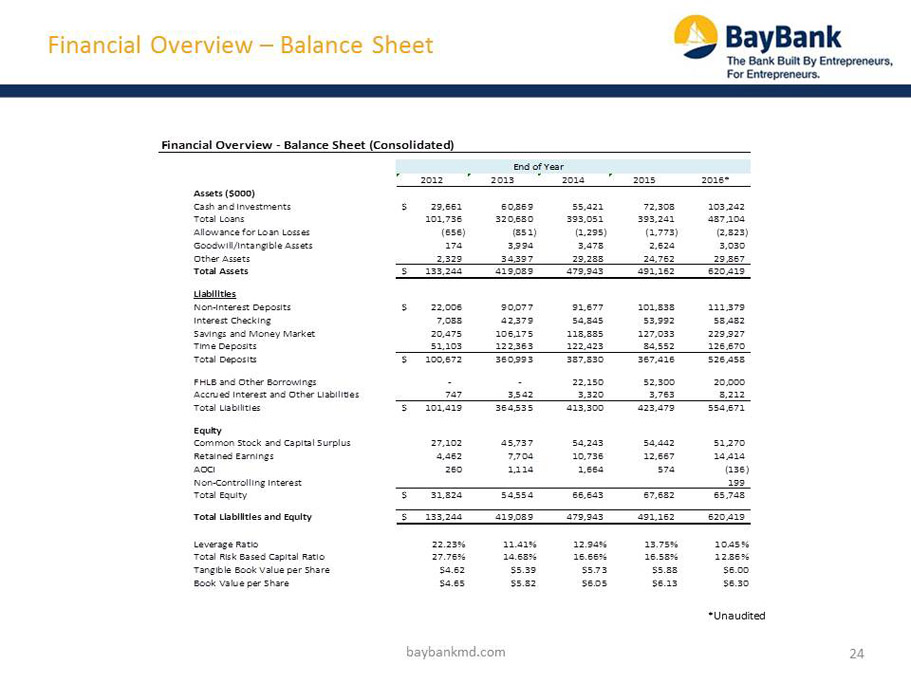

Financial Overview – Balance Sheet 24 baybankmd.com Financial Overview - Balance Sheet (Consolidated) 2012 2013 2014 2015 2016* Assets ($000) Cash and Investments 29,661$ 60,869 55,421 72,308 103,242 Total Loans 101,736 320,680 393,051 393,241 487,104 Allowance for Loan Losses (656) (851) (1,295) (1,773) (2,823) Goodwill/Intangible Assets 174 3,994 3,478 2,624 3,030 Other Assets 2,329 34,397 29,288 24,762 29,867 Total Assets 133,244$ 419,089 479,943 491,162 620,419 Liabilities Non-Interest Deposits 22,006$ 90,077 91,677 101,838 111,379 Interest Checking 7,088 42,379 54,845 53,992 58,482 Savings and Money Market 20,475 106,175 118,885 127,033 229,927 Time Deposits 51,103 122,363 122,423 84,552 126,670 Total Deposits 100,672$ 360,993 387,830 367,416 526,458 FHLB and Other Borrowings - - 22,150 52,300 20,000 Accrued Interest and Other Liabilities 747 3,542 3,320 3,763 8,212 Total Liabilities 101,419$ 364,535 413,300 423,479 554,671 Equity Common Stock and Capital Surplus 27,102 45,737 54,243 54,442 51,270 Retained Earnings 4,462 7,704 10,736 12,667 14,414 AOCI 260 1,114 1,664 574 (136) Non-Controlling Interest 199 Total Equity 31,824$ 54,554 66,643 67,682 65,748 Total Liabilities and Equity 133,244$ 419,089 479,943 491,162 620,419 Leverage Ratio 22.23% 11.41% 12.94% 13.75% 10.45% Total Risk Based Capital Ratio 27.76% 14.68% 16.66% 16.58% 12.86% Tangible Book Value per Share $4.62 $5.39 $5.73 $5.88 $6.00 Book Value per Share $4.65 $5.82 $6.05 $6.13 $6.30 End of Year *Unaudited

Core Deposit Base and Funding 25 baybankmd.com ● Non - Interest deposit balances are approximately 20% of total fundings as of 12/31/16. ● Core deposits (checking, money market, savings) are equal to approximately 73% of total funding as of 12/31/16. ● Core deposit balances have shown steady growth going from $265 million at 12/31/14 to $283 million at 12/31/15 to approximately $400 million as of 12/31/16. ● FHLB borrowing capacity of $151 million as of 12/31/16 provides flexibility and funding structure to manage interest rate and liquidity risk. ● Acquired deposits through the Hopkins merger in July 2016.

Loan Portfolio Growth 26 baybankmd.com Note: Excludes Loans Held for Sale ● New commercial loans originated in 2016 totaled $102 million compared to $77 million in 2015. ● Nonperforming assets (TDR, nonaccrual loans, accruing past due 90 days, real estate foreclosed) totaled $15.8 million at 12/31/16 (including Hopkins) compared to $10.3 million at 12/31/15 and $14.9 million at 12/31/14. ● Nonperforming assets represented 2.55% of total assets at 12/31/16 (including Hopkins) compared to 2.10% at 12/31/15 and 3.03% at 12/31/14. ● Acquired approximately $58 million in loans through the Hopkins merger in July 2016.

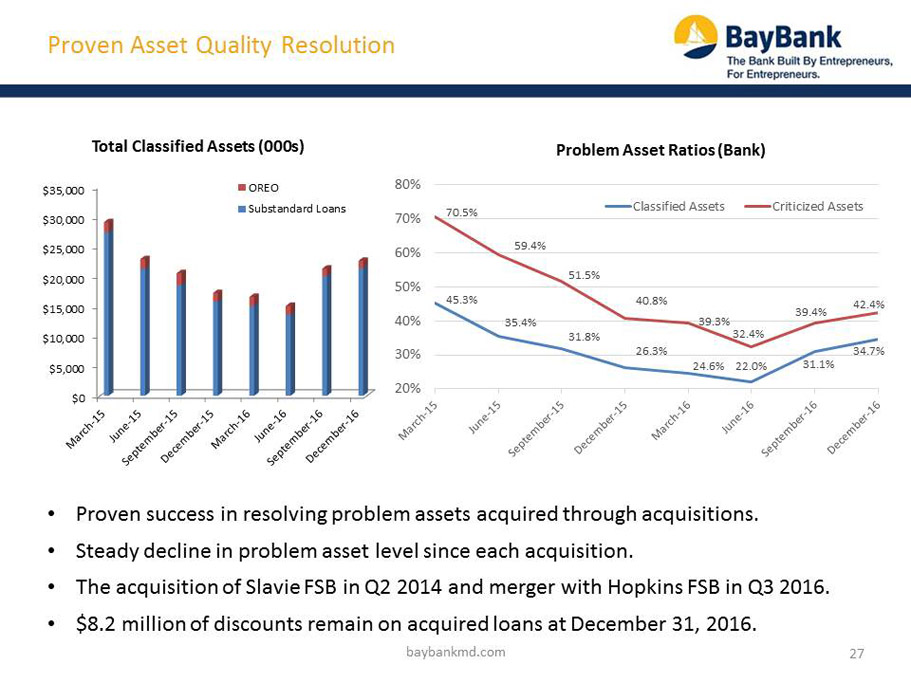

Proven Asset Quality Resolution Total Classified Assets (000s) Problem Asset Ratios (Bank) • Proven success in resolving problem assets acquired through acquisitions. • Steady decline in problem asset level since each acquisition. • The acquisition of Slavie FSB in Q2 2014 and merger with Hopkins FSB in Q3 2016. • $8.2 million of discounts remain on acquired loans at December 31, 2016. 27 baybankmd.com $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 OREO Substandard Loans 45.3% 35.4% 31.8% 26.3% 24.6% 22.0% 31.1% 34.7% 70.5% 59.4% 51.5% 40.8% 39.3% 32.4% 39.4% 42.4% 20% 30% 40% 50% 60% 70% 80% Classified Assets Criticized Assets

28 • Restructured sales organization from CLO and Head of CRE to Market Presidents for two regions and business lines – the Corridor and CRE and Baltimore and C&I . • Launched industry groups (dental, cyber, transportation) and product lines (ABL, investor owned residential real estate, and SBA) to drive loan origination and deposit growth. • Transferred performing loans in Special Assets to the Commercial Group to maximize relationship potential and increase portfolio opportunities. • Orchestrated succession plan for CCO and COO with the internal promotions and additional organizational refinements . • Due to successful efforts in reducing our portfolio of problem assets we were able to reallocate resources from Special Assets to other growth opportunities. • Implemented the “Diamond Offense” to spread work across Credit Analysts for underwriting and annual reviews and Credit Admin for account management . • Graduated our first two credit analysts into new more senior positions on the line and in credit department and added two new future stars. • Developed promotion opportunity for Branch Managers to new role of Commercial Branch Manager and implemented new ‘Branch of the Month” program. • Transferred small balance loans in the Commercial Group to Branch Managers and provided training and development for small business lending. • Introduced a number of new small business products including RapidAdvance , credit card, merchant processing and payroll processing. baybankmd.com 2016 Performance Improvement Initiatives

29 • Reorganized mortgage to significantly reduce headcount and improve non - interest expense to asset ratio while enhancing on - balance sheet loan growth. • Relocated Arbutus branch to smaller space, sold Joppa Road branch, closing Overlea Branch and relocating Mortgage Company to Cockeysville under revised staffing. • Hired Chief Administrative Officer to lead all non - customer facing activities and add greater focus to leadership development and talent initiatives at Bay. • Reorganize HR following retirement of Head of HR and HR Administrator with more efficient and effective HR Team. • Implemented final version of Baker Hill to improve integrated sales team/internal referrals drive all sales, credit management, admin tracking and board reporting. • Reengineered marketing efforts to focus on constant email, social media and BBJ ads to improve awareness and Advisory Boards to build leads. • Implement Treasury Services Project to align cash management products , price and structure appropriately , and lead sales efforts on commercial accounts. • Introduced our first ever pricing increase in the Debit Sponsorship business with significantly improved due diligence and PCI compliance. • Streamlined Compliance function by leveraging certain functions with deposit operations, loan servicing, and Mortgage Company where possible. • Drove costs savings to reduce key overhead expenses through July (salary/benefits, real estate, and technology ) by $1,300,000, or a 10% below prior year. • Completed successful Hopkins acquisition as a total team effort and integration of challenging financial reporting with accretion to book value and earnings. 2016 Performance Improvement Initiatives (continued) baybankmd.com

30 Strategies in 2017 – Focus on Execution I. Optimize End - to - End Loan Process • Target Industry Groups • SBA/ Leasing / Asset Based Lending • Asset Purchase Strategies • Streamline & Track Credit Process II. Tap the Treasury Management Opportunities • Improve Treasury Services Sales • Merchant Processing / Payroll • Product & Pricing Redesign • Customer Profitability III. Enhance Client Relationship Penetration • Product Champions and Sales Sheets • RapidAdvance / Business Credit Card • Team Huddle Calendar • Onboarding Process for New Clients baybankmd.com IV. Deliver Differentiated Culture & Service to Clients • Inspire Alternative Solutions for Clients • Celebrate Service Culture • Reward Entrepreneurship by Teammates • Aggressive SEO and On - line Marketing V. Invest in Bay Bank Team with Training and Development • Develop Talent and Leadership Capabilities • Communicate Enterprise Activity and Goals • Enhance Staff Technology/Social Media IQ • Employee Communication Strategy

31 baybankmd.com IV. Acquisition Summary

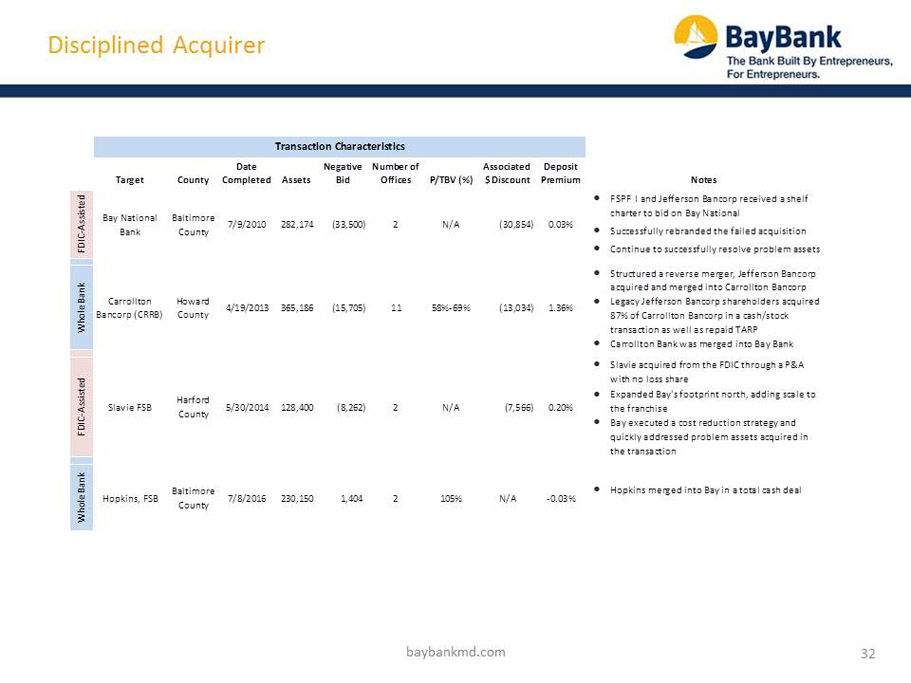

32 Disciplined Acquirer baybankmd.com Target County Date Completed Assets Negative Bid Number of Offices P/TBV (%) Associated $ Discount Deposit Premium • FSPF I and Jefferson Bancorp received a shelf charter to bid on Bay National • Successfully rebranded the failed acquisition • Continue to successfully resolve problem assets • Structured a reverse merger, Jefferson Bancorp acquired and merged into Carrollton Bancorp • Legacy Jefferson Bancorp shareholders acquired 87% of Carrollton Bancorp in a cash/stock transaction as well as repaid TARP • Carrollton Bank was merged into Bay Bank • Slavie acquired from the FDIC through a P&A with no loss share • Expanded Bay's footprint north, adding scale to the franchise • Bay executed a cost reduction strategy and quickly addressed problem assets acquired in the transaction • Hopkins merged into Bay in a total cash deal Notes Whole Bank Hopkins, FSB Baltimore County Transaction Characteristics 7/8/2016 230,150 1,404 2 FDIC-Assisted Bay National Bank Whole Bank Carrollton Bancorp (CRRB) FDIC-Assisted Slavie FSB 105% N/A -0.03% Baltimore County 7/9/2010 282,174 (33,500) 2 N/A (30,854) 0.03% Howard County 4/19/2013 365,186 (15,705) 11 58%-69% (13,034) 1.36% 2 N/A (7,566) 0.20% Harford County 5/30/2014 128,400 (8,262)

33 baybankmd.com V. Summary You’re in business to do great things. What a coincidence. So are we. The urge to leap out of bed and change the world. Yup, we finance that.

34 Operating Philosophy Superior Service High Quality Employees Financial Stewardship ▪ Service levels will always make a difference to the customer. ▪ Outstanding customer service will be our calling card in the market. ▪ Service will be the differentiator from the large bank experience. ▪ People are willing to pay for a superior customer service experience. ▪ The Bank will hire very high quality employees with positive reputations in the market. ▪ Only very experienced employees will represent the Bank. ▪ Employee retention will be a focus to ensure a consistent customer experience. ▪ Compensation is aligned with shareholder interest. ▪ We are committed to a long term view with safety and soundness paramount in our efforts. ▪ We intend to maintain strong capital levels. ▪ We intend to maintain a strong credit culture. ▪ We have developed a strong compliance culture. baybankmd.com

35 A Defined Path to Shareholder Value Acquisitions Growth and Performance Long - Term Strategy • Target distressed banks and failed banks • Focus on banks with strong deposit bases and strategic advantages • Focus on markets in the Baltimore/DC corridor • Creative deal structures to maximize value and minimize risk • Trained and experienced acquisition team • Proven ability to successfully integrate • Leverage current footprint and banking team to attract credit worthy entrepreneurs • Focus on niche lending verticals to maintain margin • Recruit successful lending teams • Bolster non - interest income streams • Generate income through the resolution of troubled assets • Achieve scale to generate operating leverage • Relationship driven banking strategy • High quality/high touch for local entrepreneurs • Keen focus on risk/reward with strong credit culture • Diversification of non - interest income streams • Achieve high returns on invested capital and shareholder equity Disciplined Acquisitions Scale and Profitability High Performance baybankmd.com

36 » Exceptional management team and board of directors that guides entrepreneurial culture and results orientation. » Vibrant, high - growth market filled with entrepreneurs along Baltimore Washington Corridor. » Balanced community banking strategy with diversified loan portfolio, low cost core deposits and strong fee - based products. » Innovative culture and business model to achieve high organic C&I loan and core deposit growth. » Improving expense structure and scale attributes to drive core profitability and returns to shareholders. » Strong balance sheet with high tier one capital ratio and moderate classified assets - to capital levels. » Proven and positioned to grow organically and via acquisition to become $100 million in market capitalization. Summary baybankmd.com

37 Contact Information Joseph J. Thomas, CFA President and CEO (410) 536 - 7336 jthomas@baybankmd.com 7151 Columbia Gateway Drive Suite A Columbia, MD 21046 baybankmd.com