Attached files

| file | filename |

|---|---|

| EX-31 - CERTIFICATIONS UNDER SECTION 302 OF THE SARBANES-OXELY ACT OF 2002 - FASTENAL CO | fast1231201610-kexhibit31.htm |

| 10-K - 10-K - FASTENAL CO | fast1231201610-k.htm |

| EX-32 - CERTIFICATIONS UNDER SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002 - FASTENAL CO | fast1231201610-kexhibit32.htm |

| EX-23 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - FASTENAL CO | fast1231201610-kexhibit23.htm |

| EX-21 - LIST OF SUBSIDIARIES - FASTENAL CO | fast1231201610-kexhibit21.htm |

2016

Annual

Report

2016

ANNUAL

REPO

RT

2016 ANNUAL REPORT

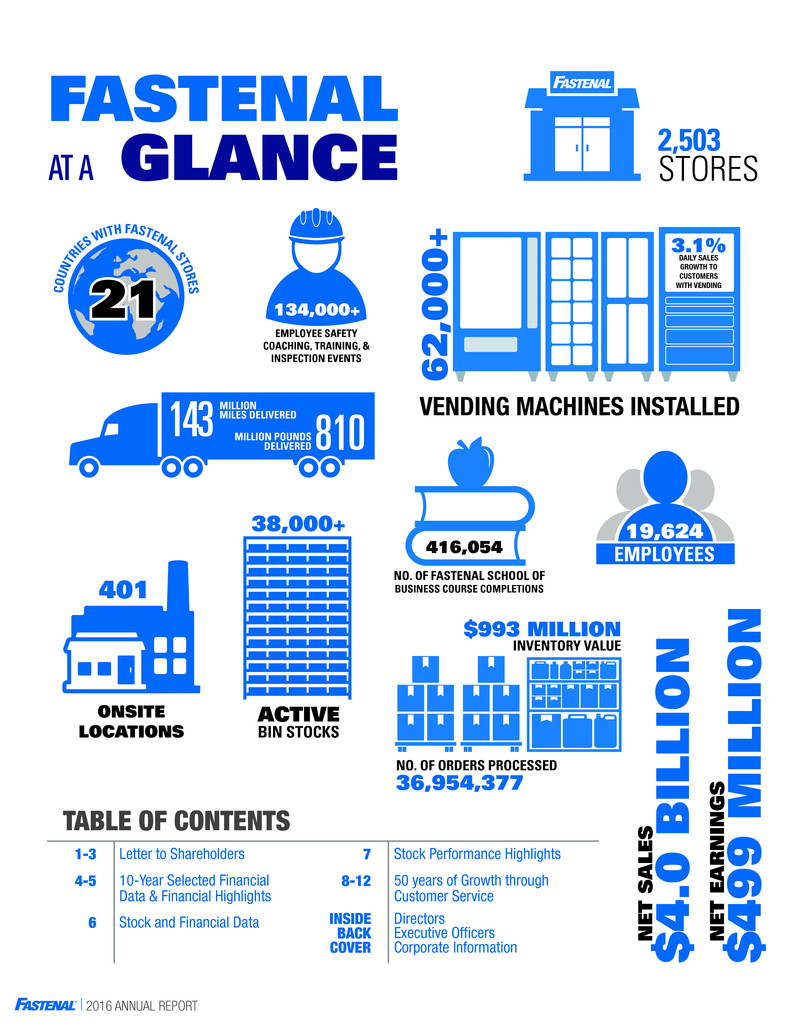

$4.0 BILLIO

N

NET SALE

S

NET EARNING

S

$499 MILLIO

N

TABLE OF CONTENTS

1-3 Letter to Shareholders

4-5 10-Year Selected Financial

Data & Financial Highlights

6 Stock and Financial Data

NO. OF FASTENAL SCHOOL OF

BUSINESS COURSE COMPLETIONS

416,054

STORES

2,503

INVENTORY VALUE

$993 MILLION

NO. OF ORDERS PROCESSED

36,954,377

19,624

EMPLOYEES

134,000+

EMPLOYEE SAFETY

COACHING, TRAINING, &

INSPECTION EVENTS

GLANCE

FASTENAL

AT A

143 MILLIONMILES DELIVERED 810DELIVEREDMILLION POUNDS

38,000+

BIN STOCKS

ACTIVEONSITE

401

ONSITE

LOCATIONS

62,000

+

VENDING MACHINES INSTALLED

DAILY SALES

GROWTH TO

CUSTOMERS

WITH VENDING

3.1%

CO

UN

TR

IES

W IT

H FASTENAL STORES21

7 Stock Performance Highlights

8-12 50 years of Growth through

Customer Service

INSIDE

BACK

COVER

Directors

Executive Officers

Corporate Information

2016 ANNUAL REPORT

1

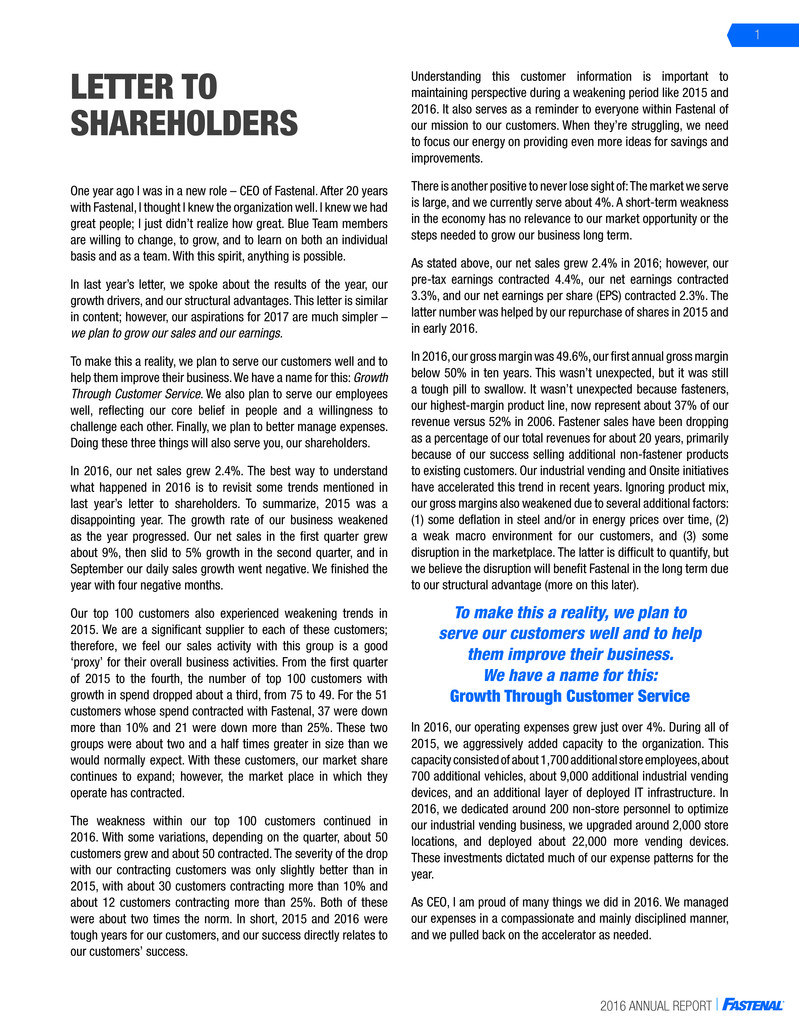

LETTER TO

SHAREHOLDERS

One year ago I was in a new role – CEO of Fastenal. After 20 years

with Fastenal, I thought I knew the organization well. I knew we had

great people; I just didn’t realize how great. Blue Team members

are willing to change, to grow, and to learn on both an individual

basis and as a team. With this spirit, anything is possible.

In last year’s letter, we spoke about the results of the year, our

growth drivers, and our structural advantages. This letter is similar

in content; however, our aspirations for 2017 are much simpler –

we plan to grow our sales and our earnings.

To make this a reality, we plan to serve our customers well and to

help them improve their business. We have a name for this: Growth

Through Customer Service. We also plan to serve our employees

well, reflecting our core belief in people and a willingness to

challenge each other. Finally, we plan to better manage expenses.

Doing these three things will also serve you, our shareholders.

In 2016, our net sales grew 2.4%. The best way to understand

what happened in 2016 is to revisit some trends mentioned in

last year’s letter to shareholders. To summarize, 2015 was a

disappointing year. The growth rate of our business weakened

as the year progressed. Our net sales in the first quarter grew

about 9%, then slid to 5% growth in the second quarter, and in

September our daily sales growth went negative. We finished the

year with four negative months.

Our top 100 customers also experienced weakening trends in

2015. We are a significant supplier to each of these customers;

therefore, we feel our sales activity with this group is a good

‘proxy’ for their overall business activities. From the first quarter

of 2015 to the fourth, the number of top 100 customers with

growth in spend dropped about a third, from 75 to 49. For the 51

customers whose spend contracted with Fastenal, 37 were down

more than 10% and 21 were down more than 25%. These two

groups were about two and a half times greater in size than we

would normally expect. With these customers, our market share

continues to expand; however, the market place in which they

operate has contracted.

The weakness within our top 100 customers continued in

2016. With some variations, depending on the quarter, about 50

customers grew and about 50 contracted. The severity of the drop

with our contracting customers was only slightly better than in

2015, with about 30 customers contracting more than 10% and

about 12 customers contracting more than 25%. Both of these

were about two times the norm. In short, 2015 and 2016 were

tough years for our customers, and our success directly relates to

our customers’ success.

Understanding this customer information is important to

maintaining perspective during a weakening period like 2015 and

2016. It also serves as a reminder to everyone within Fastenal of

our mission to our customers. When they’re struggling, we need

to focus our energy on providing even more ideas for savings and

improvements.

There is another positive to never lose sight of: The market we serve

is large, and we currently serve about 4%. A short-term weakness

in the economy has no relevance to our market opportunity or the

steps needed to grow our business long term.

As stated above, our net sales grew 2.4% in 2016; however, our

pre-tax earnings contracted 4.4%, our net earnings contracted

3.3%, and our net earnings per share (EPS) contracted 2.3%. The

latter number was helped by our repurchase of shares in 2015 and

in early 2016.

In 2016, our gross margin was 49.6%, our first annual gross margin

below 50% in ten years. This wasn’t unexpected, but it was still

a tough pill to swallow. It wasn’t unexpected because fasteners,

our highest-margin product line, now represent about 37% of our

revenue versus 52% in 2006. Fastener sales have been dropping

as a percentage of our total revenues for about 20 years, primarily

because of our success selling additional non-fastener products

to existing customers. Our industrial vending and Onsite initiatives

have accelerated this trend in recent years. Ignoring product mix,

our gross margins also weakened due to several additional factors:

(1) some deflation in steel and/or in energy prices over time, (2)

a weak macro environment for our customers, and (3) some

disruption in the marketplace. The latter is difficult to quantify, but

we believe the disruption will benefit Fastenal in the long term due

to our structural advantage (more on this later).

In 2016, our operating expenses grew just over 4%. During all of

2015, we aggressively added capacity to the organization. This

capacity consisted of about 1,700 additional store employees, about

700 additional vehicles, about 9,000 additional industrial vending

devices, and an additional layer of deployed IT infrastructure. In

2016, we dedicated around 200 non-store personnel to optimize

our industrial vending business, we upgraded around 2,000 store

locations, and deployed about 22,000 more vending devices.

These investments dictated much of our expense patterns for the

year.

As CEO, I am proud of many things we did in 2016. We managed

our expenses in a compassionate and mainly disciplined manner,

and we pulled back on the accelerator as needed.

To make this a reality, we plan to

serve our customers well and to help

them improve their business.

We have a name for this:

Growth Through Customer Service

2016 ANNUAL REPORT

2

As CEO, I am also learning, and there was one expense where we

underperformed: We did not manage our store occupancy expense

well. We will work to improve this in 2017 and 2018. Given the

previous discussion about gross margins, managing our operating

expenses will become more important over time.

Our growth drivers haven’t changed from twelve months ago. They

include the following:

National Accounts

This is really our company-wide key account program. National

account customers represent about 47% of our revenue, and this

moves closer to 60% if we expand the definition to include large

regional customers and government customers.

Today, about a quarter of this business is served by an Onsite team

or some other customer-specific location. We believe our global

capabilities provide a compelling advantage in the marketplace.

We believe this advantage allows Fastenal to push further and

faster with these customers, forcing our competitors to play catch-

up. We simply have to exceed our customers’ expectations every

day – not easy, but achievable.

Onsite Locations

An Onsite location is a ‘store’ within a customer’s facility, or

sometimes in a lower-cost facility near the customer. At the end

of 2014, we had just over 200 active Onsite locations. During

2015 we signed 80, and in 2016 we signed 176. Our success has

grown because our engagement, or participation, has grown. In

2015, about 25% of our district business units signed an Onsite

customer; in 2016, this doubled to just over 50%. Our goal in 2017

is to have 80% of our districts sign at least one Onsite customer.

If achieved, we believe this could result in 275 to 300 signings. It

might be questionable for us to publish this ambitious of a goal, but

that is the DNA of Fastenal – see the potential and challenge your

people to achieve that potential.

Industrial Vending

We started 2016 with about 55,500 vending devices installed at

customer sites and ended the year with about 62,800. The net

increase of 7,300 (or 13%) probably doesn’t sound like a big deal;

however, we ‘tuned up’ the business and removed around 9,300

underperforming devices. We think this was a good decision. It

improved the efficiency of the business, improved the financial

returns of the business, and positioned us to serve our customers

at a higher level – we like all three outcomes. As with Onsite, we

believe there is a significant growth opportunity remaining in the

industrial vending marketplace.

(For those of you possibly confused by the 7,300 vending machines

noted above versus the 22,000 devices discussed earlier in this

letter, the difference is about 15,000 devices deployed under a

locker leasing program during the year. We exclude these devices

from most of our disclosures as they don’t generate product sales,

but rather rental fees.)

Store Locations

Let’s talk about one of our basic growth drivers. Starting in late

2015, we invested heavily to upgrade about 2,000 stores through

our CSP 16 (Customer Service Project 2016) initiative. It involved

an infusion of about $54 million worth of inventory and a lot of hard

work at the local store level. We did this to improve our same-day

service capabilities and to allow our local teams to expand the

breadth of customers within their sales plans. A specific area of

The Customer Service Project really

involves a continuously evolving

inventory staging strategy, wisely

using the best available ‘shelf’ to

optimize our service.

2016 ANNUAL REPORT

3

DANIEL L. FLORNESS

President and Chief Executive Officer

focus was the construction industry, positioning our stores to

provide same-day solutions for local contractors with a broader,

deeper inventory of tools, anchors, safety supplies, and other job

site needs. The higher-level goal was to improve the efficiency of

our existing distribution network. The Customer Service Project

really involves a continuously evolving inventory staging strategy,

wisely using the best available ‘shelf’ to optimize our service. This

could be in our customer’s location, a vending machine, an Onsite

location, a store, a distribution center, or at one of our suppliers –

all linked by one integrated network. Our in-house transportation

fleet connects the network. Our local presence extends it to

the ‘last mile.’

In 2017, we intend to use these four drivers to improve sales

growth and efficiencies. We also intend to focus our attention

on asset utilization, both working capital and fixed capital. After

five years of rapidly expanding our industrial vending business,

our distribution automation, and our trucking fleet, capped by an

ambitious upgrade to our store network in 2016, we have some

breathing room to improve our asset utilization and improve our

free cash flow.

Earlier we spoke about two distinct items: expense control and our

structural advantages. Let’s take a deeper dive.

In regards to expense control, two things jump out. The first

centers on occupancy. There are four primary components to our

occupancy expenses: store related (x-utilities), distribution and

manufacturing related, vending devices, and store utilities. We

didn’t do a great job managing the first one in 2016, and as noted

earlier, we will need to dig out of that hole in 2017 and 2018.

The second item centers on store employee costs. The Department

of Labor regulation changes published last spring were dramatic

and changed the economics and flexiblity of our smaller revenue

stores. We are a successful organization because we foster an

entrepreneurial environment. We felt these changes would stifle

the entrepreneurial environment for our employees and would

limit our ability to teach through success; therefore, we closed

110 stores during the second half of the year. This wasn’t the only

reason some of these locations closed, but it caused us to move

quickly and it did expand the list.

An important detail to note: We retained 95% of the customers and

employees after the store closings. We now serve these customers

out of nearby locations with the same employees.

We have discussed our structural advantage in previous

communications. The advantage includes great people close to the

customer and a frugal culture. This allows us to deliver superior

service, to provide ‘same-day’ product availability, and to maintain

a very efficient cost structure. This combination allows Fastenal to

generate a profit and a return on investment where others struggle.

It also creates avenues of opportunity in the future.

My letter has touched on people from the standpoint of culture,

but I left out one important detail: We believe in people and their

inherent ability to do great things if given the opportunity. We

also believe our odds improve if we challenge ourselves to

pursue a common goal. We intend to always give that opportunity

and to always pursue a common goal.

In 2017, our common goal is simple – grow our sales and

grow our earnings. To accomplish this, we must be focused

on our customers, on our Blue Team, and on our operating and

administrative expenses.

This year marks Fastenal’s 50th anniversary, and I suspect we will

take several opportunities to celebrate that milestone during 2017;

but rest assured, our energy will be focused on the first steps of

our next 50 years.

We thank you for your belief in Fastenal.

Sincerely,

* Mansfield

, Ohio

Fastenal stor

e

2016 ANNUAL REPORT

4

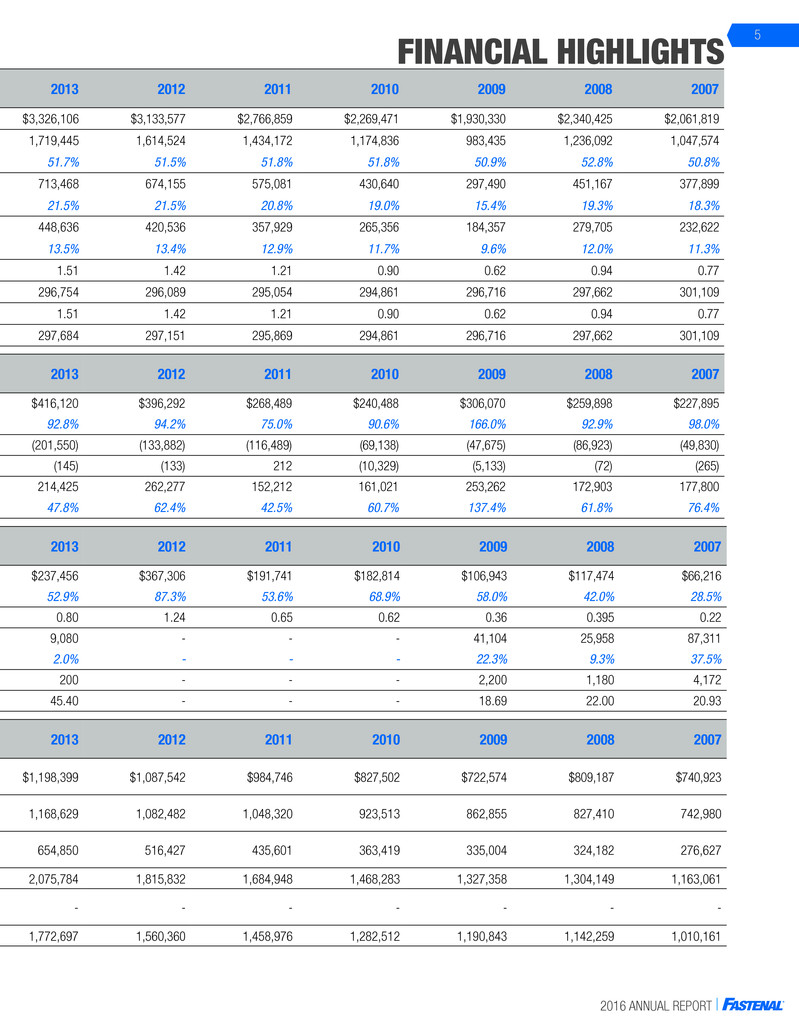

Operating Results 2016 Percent Change 2015 2014 2013 2012 2011 2010 2009 2008 2007

Net sales $ 3,962,036 2.4% $3,869,187 $3,733,507 $3,326,106 $3,133,577 $2,766,859 $2,269,471 $1,930,330 $2,340,425 $2,061,819

Gross profit $ 1,964,777 0.8% 1,948,934 1,897,402 1,719,445 1,614,524 1,434,172 1,174,836 983,435 1,236,092 1,047,574

% of net sales 49.6% 50.4% 50.8% 51.7% 51.5% 51.8% 51.8% 50.9% 52.8% 50.8%

Earnings before income taxes $ 789,729 -4.4% 826,020 787,434 713,468 674,155 575,081 430,640 297,490 451,167 377,899

% of net sales 19.9% 21.3% 21.1% 21.5% 21.5% 20.8% 19.0% 15.4% 19.3% 18.3%

Net earnings $ 499,478 -3.3% 516,361 494,150 448,636 420,536 357,929 265,356 184,357 279,705 232,622

% of net sales 12.6% 13.3% 13.2% 13.5% 13.4% 12.9% 11.7% 9.6% 12.0% 11.3%

Basic net earnings per share $ 1.73 -2.3% 1.77 1.67 1.51 1.42 1.21 0.90 0.62 0.94 0.77

Basic weighted average shares outstanding 288,950 -0.9% 291,453 296,490 296,754 296,089 295,054 294,861 296,716 297,662 301,109

Diluted net earnings per share $ 1.73 -2.3% 1.77 1.66 1.51 1.42 1.21 0.90 0.62 0.94 0.77

Diluted weighted average shares outstanding(1) 289,158 -1.0% 292,045 297,313 297,684 297,151 295,869 294,861 296,716 297,662 301,109

Dividends and Common

Stock Purchase Summary 2016

Percent

Change 2015 2014 2013 2012 2011 2010 2009 2008 2007

Dividends paid $ 346,588 6.0% $327,101 $296,581 $237,456 $367,306 $191,741 $182,814 $106,943 $117,474 $66,216

% of net earnings 69.4% 63.3% 60.0% 52.9% 87.3% 53.6% 68.9% 58.0% 42.0% 28.5%

Dividends paid per share $ 1.20 7.1% 1.12 1.00 0.80 1.24 0.65 0.62 0.36 0.395 0.22

Purchases of common stock $ 59,440 -79.7% 292,951 52,942 9,080 - - - 41,104 25,958 87,311

% of net earnings 11.9% 56.7% 10.7% 2.0% - - - 22.3% 9.3% 37.5%

Common stock shares purchased 1,600 -77.5% 7,100 1,200 200 - - - 2,200 1,180 4,172

Average price paid per share $ 37.15 -10.0% 41.26 44.12 45.40 - - - 18.69 22.00 20.93

Financial Position at Year End 2016 Percent Change 2015 2014 2013 2012 2011 2010 2009 2008 2007

Operational working capital

(accounts receivable, net and inventories) $ 1,492,705 8.0% $1,381,638 $1,331,301 $1,198,399 $1,087,542 $984,746 $827,502 $722,574 $809,187 $740,923

Net working capital

(current assets less current liabilities) $ 1,445,126 11.9% 1,291,610 1,207,912 1,168,629 1,082,482 1,048,320 923,513 862,855 827,410 742,980

Fixed capital

(property and equipment, net) $ 899,697 9.9% 818,889 763,889 654,850 516,427 435,601 363,419 335,004 324,182 276,627

Total assets $ 2,668,884 5.4% 2,532,462 2,359,102 2,075,784 1,815,832 1,684,948 1,468,283 1,327,358 1,304,149 1,163,061

Total debt

(current portion of debt and long-term debt) $ 390,000 6.8% 365,000 90,000 - - - - - - -

Total stockholders' equity $ 1,933,094 7.3% 1,801,289 1,915,217 1,772,697 1,560,360 1,458,976 1,282,512 1,190,843 1,142,259 1,010,161

All information contained in this Annual Report reflects the 2-for-1 stock split in 2011.

(1) Reflects impact of stock options issued by the Company that were in-the-money and outstanding during the period.

(Amounts in Thousands Except Per Share Information)

10-YEAR SELECTED FINANCIAL

DA

TA

Cash Flow Summary 2016 Percent Change 2015 2014 2013 2012 2011 2010 2009 2008 2007

Net cash provided by operating activities $ 513,999 -6.0% $546,940 $499,392 $416,120 $396,292 $268,489 $240,488 $306,070 $259,898 $227,895

% of net earnings 102.9% 105.9% 101.1% 92.8% 94.2% 75.0% 90.6% 166.0% 92.9% 98.0%

Less capital expenditures, net $ (182,946) 26.0% (145,227) (183,655) (201,550) (133,882) (116,489) (69,138) (47,675) (86,923) (49,830)

Acquisitions and other $ (5,147) -85.5% (35,400) (5,577) (145) (133) 212 (10,329) (5,133) (72) (265)

Free cash flow $ 325,906 -11.0% 366,313 310,160 214,425 262,277 152,212 161,021 253,262 172,903 177,800

% of net earnings 65.2% 70.9% 62.8% 47.8% 62.4% 42.5% 60.7% 137.4% 61.8% 76.4%

2016 ANNUAL REPORT

5

Operating Results 2016 Percent Change 2015 2014 2013 2012 2011 2010 2009 2008 2007

Net sales $ 3,962,036 2.4% $3,869,187 $3,733,507 $3,326,106 $3,133,577 $2,766,859 $2,269,471 $1,930,330 $2,340,425 $2,061,819

Gross profit $ 1,964,777 0.8% 1,948,934 1,897,402 1,719,445 1,614,524 1,434,172 1,174,836 983,435 1,236,092 1,047,574

% of net sales 49.6% 50.4% 50.8% 51.7% 51.5% 51.8% 51.8% 50.9% 52.8% 50.8%

Earnings before income taxes $ 789,729 -4.4% 826,020 787,434 713,468 674,155 575,081 430,640 297,490 451,167 377,899

% of net sales 19.9% 21.3% 21.1% 21.5% 21.5% 20.8% 19.0% 15.4% 19.3% 18.3%

Net earnings $ 499,478 -3.3% 516,361 494,150 448,636 420,536 357,929 265,356 184,357 279,705 232,622

% of net sales 12.6% 13.3% 13.2% 13.5% 13.4% 12.9% 11.7% 9.6% 12.0% 11.3%

Basic net earnings per share $ 1.73 -2.3% 1.77 1.67 1.51 1.42 1.21 0.90 0.62 0.94 0.77

Basic weighted average shares outstanding 288,950 -0.9% 291,453 296,490 296,754 296,089 295,054 294,861 296,716 297,662 301,109

Diluted net earnings per share $ 1.73 -2.3% 1.77 1.66 1.51 1.42 1.21 0.90 0.62 0.94 0.77

Diluted weighted average shares outstanding(1) 289,158 -1.0% 292,045 297,313 297,684 297,151 295,869 294,861 296,716 297,662 301,109

Dividends and Common

Stock Purchase Summary 2016

Percent

Change 2015 2014 2013 2012 2011 2010 2009 2008 2007

Dividends paid $ 346,588 6.0% $327,101 $296,581 $237,456 $367,306 $191,741 $182,814 $106,943 $117,474 $66,216

% of net earnings 69.4% 63.3% 60.0% 52.9% 87.3% 53.6% 68.9% 58.0% 42.0% 28.5%

Dividends paid per share $ 1.20 7.1% 1.12 1.00 0.80 1.24 0.65 0.62 0.36 0.395 0.22

Purchases of common stock $ 59,440 -79.7% 292,951 52,942 9,080 - - - 41,104 25,958 87,311

% of net earnings 11.9% 56.7% 10.7% 2.0% - - - 22.3% 9.3% 37.5%

Common stock shares purchased 1,600 -77.5% 7,100 1,200 200 - - - 2,200 1,180 4,172

Average price paid per share $ 37.15 -10.0% 41.26 44.12 45.40 - - - 18.69 22.00 20.93

Financial Position at Year End 2016 Percent Change 2015 2014 2013 2012 2011 2010 2009 2008 2007

Operational working capital

(accounts receivable, net and inventories) $ 1,492,705 8.0% $1,381,638 $1,331,301 $1,198,399 $1,087,542 $984,746 $827,502 $722,574 $809,187 $740,923

Net working capital

(current assets less current liabilities) $ 1,445,126 11.9% 1,291,610 1,207,912 1,168,629 1,082,482 1,048,320 923,513 862,855 827,410 742,980

Fixed capital

(property and equipment, net) $ 899,697 9.9% 818,889 763,889 654,850 516,427 435,601 363,419 335,004 324,182 276,627

Total assets $ 2,668,884 5.4% 2,532,462 2,359,102 2,075,784 1,815,832 1,684,948 1,468,283 1,327,358 1,304,149 1,163,061

Total debt

(current portion of debt and long-term debt) $ 390,000 6.8% 365,000 90,000 - - - - - - -

Total stockholders' equity $ 1,933,094 7.3% 1,801,289 1,915,217 1,772,697 1,560,360 1,458,976 1,282,512 1,190,843 1,142,259 1,010,161

All information contained in this Annual Report reflects the 2-for-1 stock split in 2011.

(1) Reflects impact of stock options issued by the Company that were in-the-money and outstanding during the period.

FINANCIAL HIGHLIGHTS

Cash Flow Summary 2016 Percent Change 2015 2014 2013 2012 2011 2010 2009 2008 2007

Net cash provided by operating activities $ 513,999 -6.0% $546,940 $499,392 $416,120 $396,292 $268,489 $240,488 $306,070 $259,898 $227,895

% of net earnings 102.9% 105.9% 101.1% 92.8% 94.2% 75.0% 90.6% 166.0% 92.9% 98.0%

Less capital expenditures, net $ (182,946) 26.0% (145,227) (183,655) (201,550) (133,882) (116,489) (69,138) (47,675) (86,923) (49,830)

Acquisitions and other $ (5,147) -85.5% (35,400) (5,577) (145) (133) 212 (10,329) (5,133) (72) (265)

Free cash flow $ 325,906 -11.0% 366,313 310,160 214,425 262,277 152,212 161,021 253,262 172,903 177,800

% of net earnings 65.2% 70.9% 62.8% 47.8% 62.4% 42.5% 60.7% 137.4% 61.8% 76.4%

2016 ANNUAL REPORT

6

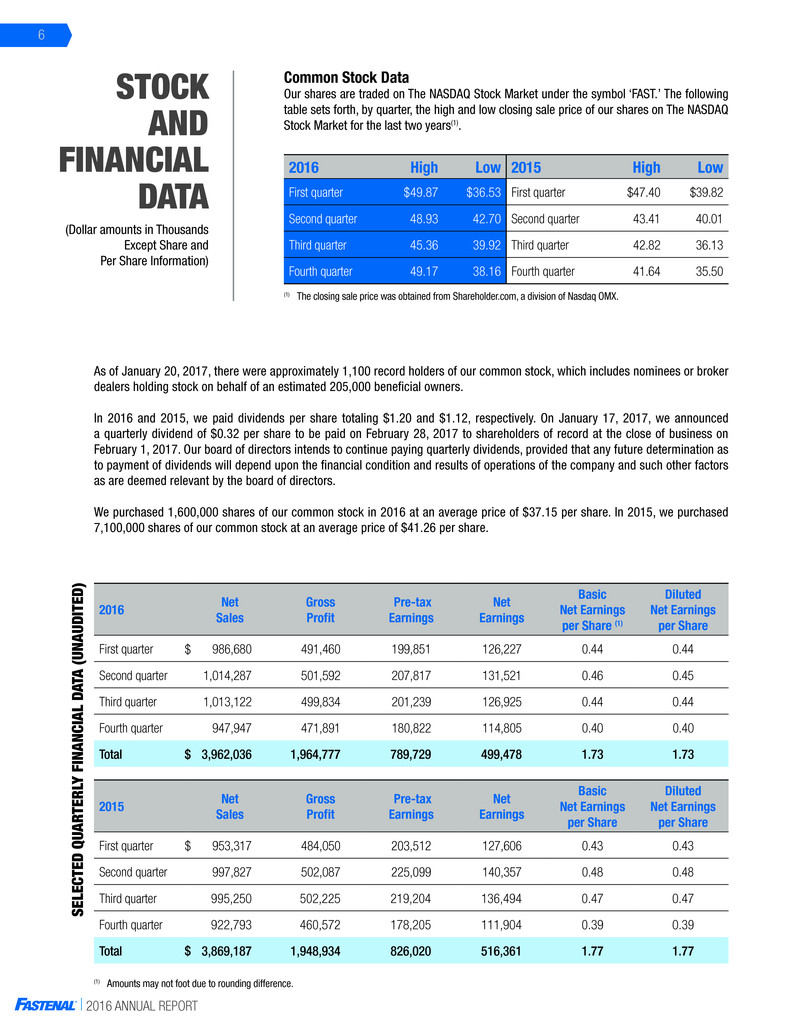

2016 High Low 2015 High Low

First quarter $49.87 $36.53 First quarter $47.40 $39.82

Second quarter 48.93 42.70 Second quarter 43.41 40.01

Third quarter 45.36 39.92 Third quarter 42.82 36.13

Fourth quarter 49.17 38.16 Fourth quarter 41.64 35.50

As of January 20, 2017, there were approximately 1,100 record holders of our common stock, which includes nominees or broker

dealers holding stock on behalf of an estimated 205,000 beneficial owners.

In 2016 and 2015, we paid dividends per share totaling $1.20 and $1.12, respectively. On January 17, 2017, we announced

a quarterly dividend of $0.32 per share to be paid on February 28, 2017 to shareholders of record at the close of business on

February 1, 2017. Our board of directors intends to continue paying quarterly dividends, provided that any future determination as

to payment of dividends will depend upon the financial condition and results of operations of the company and such other factors

as are deemed relevant by the board of directors.

We purchased 1,600,000 shares of our common stock in 2016 at an average price of $37.15 per share. In 2015, we purchased

7,100,000 shares of our common stock at an average price of $41.26 per share.

Common Stock Data

Our shares are traded on The NASDAQ Stock Market under the symbol ‘FAST.’ The following

table sets forth, by quarter, the high and low closing sale price of our shares on The NASDAQ

Stock Market for the last two years(1).

2015 Net Sales

Gross

Profit

Pre-tax

Earnings

Net

Earnings

Basic

Net Earnings

per Share

Diluted

Net Earnings

per Share

First quarter 953,317 484,050 203,512 127,606 0.43 0.43

Second quarter 997,827 502,087 225,099 140,357 0.48 0.48

Third quarter 995,250 502,225 219,204 136,494 0.47 0.47

Fourth quarter 922,793 460,572 178,205 111,904 0.39 0.39

Total 3,869,187 1,948,934 826,020 516,361 1.77 1.77

2016 Net Sales

Gross

Profit

Pre-tax

Earnings

Net

Earnings

Basic

Net Earnings

per Share (1)

Diluted

Net Earnings

per Share

First quarter 986,680 491,460 199,851 126,227 0.44 0.44

Second quarter 1,014,287 501,592 207,817 131,521 0.46 0.45

Third quarter 1,013,122 499,834 201,239 126,925 0.44 0.44

Fourth quarter 947,947 471,891 180,822 114,805 0.40 0.40

Total 3,962,036 1,964,777 789,729 499,478 1.73 1.73

(1) The closing sale price was obtained from Shareholder.com, a division of Nasdaq OMX.

STOCK

AND

FINANCIAL

DATA

SELECTED Q

UA

RTER

LY FINANCIAL

DA

TA (UN

AUDITED

)

(Dollar amounts in Thousands

Except Share and

Per Share Information)

(1) Amounts may not foot due to rounding difference.

$

$

$

$

2016 ANNUAL REPORT

7

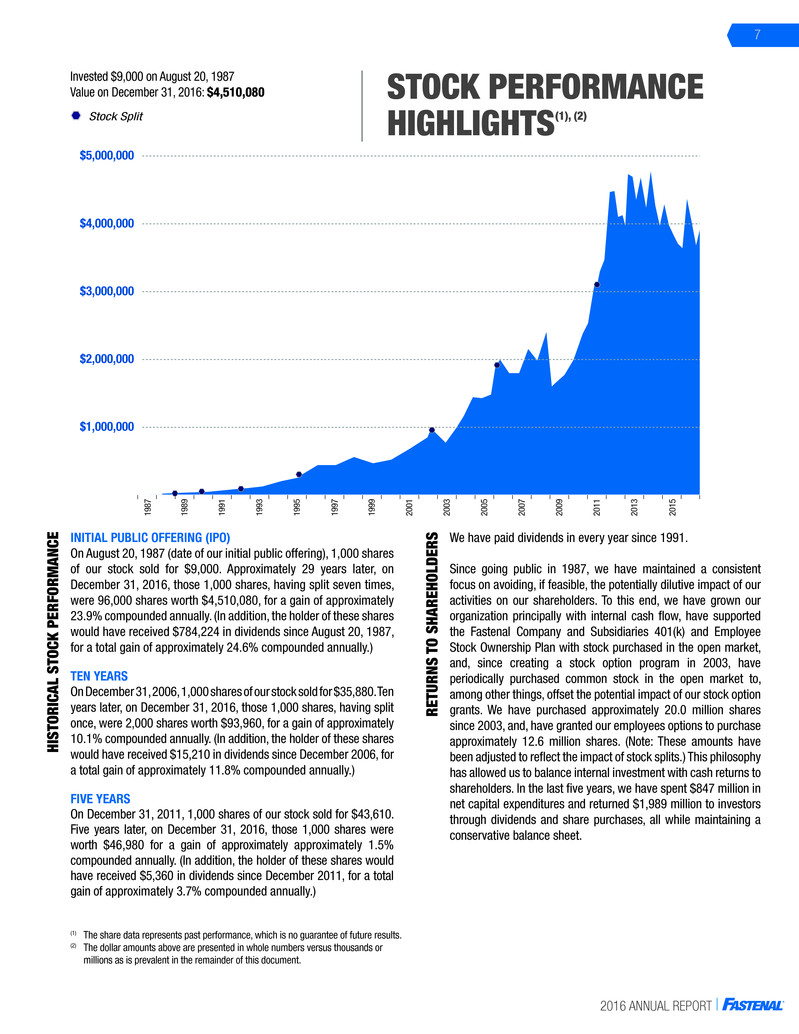

Invested $9,000 on August 20, 1987

Value on December 31, 2016: $4,510,080 STOCK PERFORMANCE

HIGHLIGHTS(1), (2)

(1) The share data represents past performance, which is no guarantee of future results.

(2) The dollar amounts above are presented in whole numbers versus thousands or

millions as is prevalent in the remainder of this document.

$1,000,000

$2,000,000

$3,000,000

$4,000,000

$5,000,000

198

7

198

9

199

1

199

3

199

5

199

7

199

9

200

1

200

3

200

5

200

7

200

9

201

1

201

3

201

5

201

7

Stock Split

INITIAL PUBLIC OFFERING (IPO)

On August 20, 1987 (date of our initial public offering), 1,000 shares

of our stock sold for $9,000. Approximately 29 years later, on

December 31, 2016, those 1,000 shares, having split seven times,

were 96,000 shares worth $4,510,080, for a gain of approximately

23.9% compounded annually. (In addition, the holder of these shares

would have received $784,224 in dividends since August 20, 1987,

for a total gain of approximately 24.6% compounded annually.)

TEN YEARS

On December 31, 2006, 1,000 shares of our stock sold for $35,880. Ten

years later, on December 31, 2016, those 1,000 shares, having split

once, were 2,000 shares worth $93,960, for a gain of approximately

10.1% compounded annually. (In addition, the holder of these shares

would have received $15,210 in dividends since December 2006, for

a total gain of approximately 11.8% compounded annually.)

FIVE YEARS

On December 31, 2011, 1,000 shares of our stock sold for $43,610.

Five years later, on December 31, 2016, those 1,000 shares were

worth $46,980 for a gain of approximately approximately 1.5%

compounded annually. (In addition, the holder of these shares would

have received $5,360 in dividends since December 2011, for a total

gain of approximately 3.7% compounded annually.)

HISTORICAL STOCK PERFORMANC

E

RETURNS

TO

SHAREHOLDER

S We have paid dividends in every year since 1991.

Since going public in 1987, we have maintained a consistent

focus on avoiding, if feasible, the potentially dilutive impact of our

activities on our shareholders. To this end, we have grown our

organization principally with internal cash flow, have supported

the Fastenal Company and Subsidiaries 401(k) and Employee

Stock Ownership Plan with stock purchased in the open market,

and, since creating a stock option program in 2003, have

periodically purchased common stock in the open market to,

among other things, offset the potential impact of our stock option

grants. We have purchased approximately 20.0 million shares

since 2003, and, have granted our employees options to purchase

approximately 12.6 million shares. (Note: These amounts have

been adjusted to reflect the impact of stock splits.) This philosophy

has allowed us to balance internal investment with cash returns to

shareholders. In the last five years, we have spent $847 million in

net capital expenditures and returned $1,989 million to investors

through dividends and share purchases, all while maintaining a

conservative balance sheet.

2016 ANNUAL REPORT

8

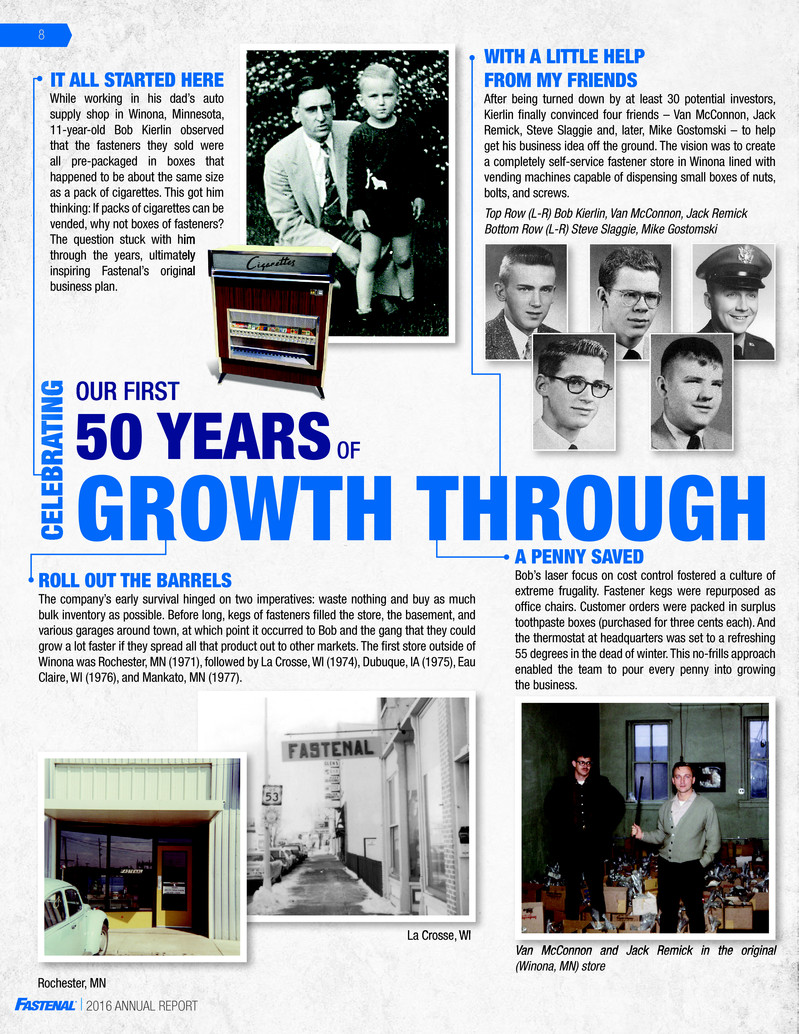

While working in his dad’s auto

supply shop in Winona, Minnesota,

11-year-old Bob Kierlin observed

that the fasteners they sold were

all pre-packaged in boxes that

happened to be about the same size

as a pack of cigarettes. This got him

thinking: If packs of cigarettes can be

vended, why not boxes of fasteners?

The question stuck with him

through the years, ultimately

inspiring Fastenal’s original

business plan.

After being turned down by at least 30 potential investors,

Kierlin fi nally convinced four friends – Van McConnon, Jack

Remick, Steve Slaggie and, later, Mike Gostomski – to help

get his business idea off the ground. The vision was to create

a completely self-service fastener store in Winona lined with

vending machines capable of dispensing small boxes of nuts,

bolts, and screws.

The company’s early survival hinged on two imperatives: waste nothing and buy as much

bulk inventory as possible. Before long, kegs of fasteners fi lled the store, the basement, and

various garages around town, at which point it occurred to Bob and the gang that they could

grow a lot faster if they spread all that product out to other markets. The fi rst store outside of

Winona was Rochester, MN (1971), followed by La Crosse, WI (1974), Dubuque, IA (1975), Eau

Claire, WI (1976), and Mankato, MN (1977).

Bob’s laser focus on cost control fostered a culture of

extreme frugality. Fastener kegs were repurposed as

offi ce chairs. Customer orders were packed in surplus

toothpaste boxes (purchased for three cents each). And

the thermostat at headquarters was set to a refreshing

55 degrees in the dead of winter. This no-frills approach

enabled the team to pour every penny into growing

the business.

IT ALL STARTED HERE

ROLL OUT THE BARRELS

A PENNY SAVED

WITH A LITTLE HELP

FROM MY FRIENDS

OUR FIRST

CELEBR

ATIN

G

GROWTH THROUGH

50 YEARS OF

Rochester, MN

Top Row (L-R) Bob Kierlin, Van McConnon, Jack Remick

Bottom Row (L-R) Steve Slaggie, Mike Gostomski

Van McConnon and Jack Remick in the original

(Winona, MN) store

La Crosse, WI

2016 ANNUAL REPORT

9

Bob envisioned that there would one day be hundreds of

machines set up across the country, all serviced by a fl eet

of gleaming semis bearing the company’s name: “Lightning

Bolts,” with a streak of lightning underlining the letters. … This

vision quickly evaporated when Steve and Jack threatened

to withdraw their money unless they came up with a better

name. After much head-scratching and debate, they fi nally

settled on “Fastenal” because they fi gured people would use

their products to “fasten all” kinds of things.

In 1967, they rented a space for the test store,

ordered 1,400 bags of fasteners to go into the yet-

to-be-built prototype machines, held a grand opening

to generate some cash … and promptly discovered

that customers wanted fastener sizes and quantities

that couldn’t possibly be vended. According to Van

McConnon, Bob seemed unfazed by the revelation:

“He just said, ‘Well, Van, why don’t you just start

making sales calls and sell some nuts and bolts?’”

With that, the vending concept was tabled and

Fastenal’s store-based, outside-sales-driven business

model was born.

With the launch of additional stores, the Winona location took on the role of

a (primitive) distribution center. John Newell, the assistant manager, would

fi eld phone calls from the other stores, jot down their product requests on

pieces of scrap paper, and stick them on a screw that had been drilled

through a two-by-four. Once a week, the Winona team would sift through

the impaled notes and pull all the orders. Store personnel would have to

drive to Winona to pick up their products, often letting themselves into the

store at night or over the weekend to fi nd their designated “pile.”

It wasn’t until 1975 that stores began receiving sporadic truck deliveries

from Winona (via a salvaged half-ton fl atbed truck known as “the White

Knight”). In 1981 we hired our fi rst full-time truck driver, Bob Wittenberg;

and within a few years, the rough contours of Fastenal’s distribution system

began to take shape, with a growing fl eet of trucks running increasingly

frequent routes to surrounding stores.

WHY “FASTENAL”?

The “Blue Team” may very well

have ended up as the “Yellow

Team” or even the “Red Team”

if it weren’t for an industrial

design textbook called Human

Engineering. This is where Bob

originally learned that blue on

white is the most legible and

impactful color combination

for text.

…AND WHY

SO BLUE?

A STORE IS BORN

WHEELS OF PROGRESS

CUSTOMER SERVICE

(Above) Fastenal’s fi rst semi drivers: Steve

Thicke, Rick Todd, and Bob Wittenberg

(Far left) Our fi rst truck after “the White

Knight” was a 135-horsepower Mercedes

capable of achieving speeds as high as 57

m.p.h.!

(Left) Steve Thicke, looking relieved that we

eventually moved on to bigger and better

trucks

2016 ANNUAL REPORT

10

For our fi rst 20 years, Winona was home

to Fastenal’s lone distribution center.

That changed in 1987 when a second

warehouse was opened in Indianapolis

with one driver and one guy running

the warehouse (the forebears of our

“I-Hub” master DC). For our next hub

opening, we traveled all the way to

Scranton, Pennsylvania, then to Dallas,

Atlanta, and eventually all over the

country (and beyond), gradually shifting

from a Winona-centric model to a truly

regionalized system. “It was all geared

toward taking care of the customer as

quickly as possible,” said Bob Kierlin.

“That’s really the goal of

everything we do with our

distribution network.”

Everyone who uses a fastener needs to apply it with

some kind of tool. … This simple truism spurred

Fastenal’s foray into non-fastener product lines

starting in the early 1990s. At fi rst, tools and other

MRO supplies were sold in separate “FastTool”

stores located adjacent to existing Fastenal

locations, but within a few years everything was

combined in our regular Fastenal stores. The tool

expansion essentially doubled our sales opportunity

in each market, in turn making it feasible to open

stores in towns half the size. Following the same

logic, each subsequent product line rollout brought

us closer to our customers.

MORE THAN JUST

NUTS & BOLTS

MEANWHILE, BACK

AT THE WAREHOUSE

OUR FIRST

CELEBR

ATIN

G

GROWTH THROUGH

50 YEARS OF

When Fastenal’s headquarters were relocated to a larger building

in 1982, two small rooms were set aside to accommodate a

vertical mill, a lathe, a horizontal grinding machine, a cut-off

machine, and a de-burring machine – all operated by a single

machinist. This added a critical dimension to our service,

enabling sales people to respond to customer demands for

hard-to-fi nd parts with two winning questions: How many do

you need? And when do you need them?

DO-IT-YOURSELF MANUFACTURING

Fastenal really began to

hit its stride in the early

1980s. The strategy was

pretty basic: place products and people close to the customer and

empower everyone in the organization to make decisions, take

risks, and share the success of their company. As Bob Kierlin later

refl ected, “Our growth was really driven by our belief in people and

what they could do if given an opportunity.”

THE POWER

OF FASTENAL

PEOPLE

Steve Jacobson and Jeff

Klint at Fastenal’s second

Twin Cities location

I-Hub (Indianapolis, IN), early 1990s

2016 ANNUAL REPORT

11

Fastenal faced some growing

pains heading into the mid-1980s.

A cash crunch was making it

diffi cult to grow the company at full throttle. Meanwhile, the founders were

struggling to fi nd a way to give employees an ownership stake in the business they

were all working so hard to build. With this as backdrop, in 1987 the decision was

made to take the company public. It was a modest IPO (one million shares sold for $9

per share), but it set the stage for remarkable growth. Fastenal’s sales soared from

roughly $20 million in 1987 to around $400 million in 1997; and our store count, which

stood at just over 50 at the time of the IPO, surpassed 800 by the end of the 1990s.

GOING PUBLIC

CUSTOMER SERVICE

The evolution of Fastenal’s business can be described as a journey deeper and deeper into

the service of our customers. In the 1980s we set up our fi rst jobsite trailers, providing a

mobile “store” in the middle of a construction site. In 1992, we added a new twist by opening

our fi rst store within a customer facility. This was a purely practical decision. The customer

needed more inventory than we could fi t in our local store in Manitowoc, WI, so they invited

us to move in – a fortuitous beginning to our Onsite service model.

MOVING CLOSER TO OUR CUSTOMERS… …AND EXPANDING

OUR HORIZONS

Our journey of service eventually led our teams beyond

the U.S. borders. In 1994, we opened our fi rst store in

Canada, planting a seed that within 20 years would

grow into a quarter-billion-dollar business with 1,200-

plus employees. In 2001, we started doing business in

Mexico. That same year we opened up in Singapore, our

fi rst Asia Pacifi c sales location. And we’ve since opened

sales locations all over the world, providing local service

to our customers as they globalized their operations.

2016 ANNUAL REPORT

12

OUR FIRST

CELEBR

ATIN

G

GROWTH THROUGH

CUSTOMER SERVICE

50 YEARS OF

Nearly forty years after starting the business, we fi nally realized Bob Kierlin’s

dream of dispensing industrial supplies out of vending machines. It took a while

for our vending program to gain traction when it fi rst rolled out in late 2008, but

as stores began to embrace the value of vending (as a customer solution and

a growth driver), the number of Fastenal machines installed at customer sites

skyrocketed – from just over 7,000 at the close of 2011, to nearly 63,000 by the

close of 2016.

Most analysts agree that the current North American market potential

for Fastenal is at least $100 billion, and many would say it’s closer to

$150 billion. Our current sales represent around four percent of that

market – i.e., for every four dollars we have today, there are 96 dollars

potentially to be gained. In short, as far as we’ve come during our fi rst

50 years, our journey is likely just beginning.

CELEBRATING OUR FIRST 50 YEARS.

FOCUSED ON OUR NEXT 50 YEARS.

COMING FULL CIRCLE

THE NEXT CHAPTER

By 2001, Fastenal had 1,000-plus stores spanning all 50 states, but most

of them were better suited for outside sales than walk-in business. A

dramatic transformation began in 2002 with the launch of the Customer

Service Project, better known as CSP. It involved relocating stores to

more prominent locations, shifting inventory from the hubs to the stores,

creating store front rooms with open fl oor plans and retail fi xtures, and

streamlining systems to speed up invoicing. It all added up to faster

service and a much more inviting customer experience.

AN EXTREME STORE MAKEOVER

FSB IS IN SESSION

Opening hundreds of new stores meant developing thousands of employees

to run them. … Enter the “Devos” (aka the Development Team), a group of

seasoned store managers tasked with traveling the country to train new

team members in store back rooms, distribution centers, and other makeshift

classrooms. In the late ‘90s we took our training efforts to the next level by

developing a full-fl edged corporate university, the Fastenal School of Business

(FSB). Launched in 1999 with just two classes, FSB later merged with the Devos

to provide an ever-expanding offering of courses via regional campuses and, in

recent years, a robust virtual campus.

Sioux Falls, South Dakota Fastenal store

2016 ANNUAL REPORT

JAMES C. JANSEN

Executive Vice President - Manufacturing

HOLDEN LEWIS

Executive Vice President and

Chief Financial Officer

LELAND J. HEIN

Senior Executive Vice President - Sales

SHERYL A. LISOWSKI

Controller, Chief Accounting Officer,

and Treasurer

DANIEL L. FLORNESS

President and Chief Executive Officer

WILLIAM J. DRAZKOWSKI

Executive Vice President -

National Accounts Sales

EXECUTIVE OFFICER

S

ANNUAL

MEETING

The annual meeting of shareholders

will be held at 10:00 a.m., central

time, April 25, 2017, at our home

office located at 2001 Theurer

Boulevard, Winona, Minnesota.

HOME

OFFICE

Fastenal Company

2001 Theurer Boulevard

Winona, Minnesota 55987-0978

Phone: (507) 454-5374

Fax: (507) 453-8049

LEGAL

COUNSEL

INDEPENDENT

REGISTERED PUBLIC

ACCOUNTING FIRM

Faegre Baker Daniels LLP

Minneapolis, Minnesota

KPMG LLP

Minneapolis, Minnesota

FORM

10-K

TRANSFER

AGENT

A copy of our 2016 Annual Report

on Form 10-K to the Securities and

Exchange Commission is available

without charge to shareholders

upon written request to internal

audit at the address of our home

office listed on this page.

Copies of our latest press releases,

unaudited supplemental company

information, and monthly sales

information are available at:

http://investor.fastenal.com.

Wells Fargo Bank, N.A.

Minneapolis, Minnesota

CORPOR

ATE INFORM

ATIO

N

MICHAEL J. DOLAN

Self-Employed Business Consultant,

Retired Executive Vice President and

Chief Operating Officer,

The Smead Manufacturing Company

SCOTT A. SATTERLEE

Retired President of North America

Surface Transportation Division, C.H.

Robinson Worldwide, Inc.

RITA J. HEISE

Self-Employed Business Consultant,

Retired Corporate Vice President and

Chief Information Officer of

Cargill, Incorporated

STEPHEN L. EASTMAN

President of the Parts, Garments,

and Accessories Division of

Polaris Industries Inc.

(recreational vehicle manufacturer)

DANIEL L. JOHNSON

President and Chief Executive Officer of

M.A. Mortenson Company (family owned

construction company)

REYNE K. WISECUP

DARREN R. JACKSON

Retired Chief Executive Officer,

Advance Auto Parts, Inc.

WILLARD D. OBERTON

Chairman of the Board, Retired President

and Chief Executive Officer,

Fastenal Company

MICHAEL J. ANCIUS

Director of Strategic Planning, Financing,

and Taxation, Kwik Trip, Inc.

(retail convenience store operator)DIRECTOR

S

DANIEL L. FLORNESS

NICHOLAS J. LUNDQUIST

Senior Executive Vice President -

Operations

GARY A. POLIPNICK

Executive Vice President -

FAST Solutions®

REYNE K. WISECUP

Senior Executive Vice President -

Human Resources

JEFFERY M. WATTS

Executive Vice President -

International Sales

TERRY M. OWEN

Senior Executive Vice President -

Sales Operations

JOHN L. SODERBERG

Executive Vice President -

Information Technology

CHARLES S. MILLER

Executive Vice President - Sales

2016

ANNUAL

REPO

RT

9705201 2016 Annual Report | 01.17 KS | Printed in the USA