Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - EARNINGS RELEASE DATED 2.2.2017 - TRIUMPH GROUP INC | exhibit991q3fy2017.htm |

| 8-K - 8-K - DATED 2.2.2017 - TRIUMPH GROUP INC | form8-kq3fy2017earningsrel.htm |

Third Quarter FY 2017 Conference Call

Daniel J. Crowley

President, Chief Executive Officer

James F. McCabe, Jr.

Senior Vice President, Chief Financial Officer

February 2, 2017

TRIUMPH GROUP, INC. Q3’17 UPDATE // 2

FORWARD LOOKING STATEMENTS

Parts of this presentation contain forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These forward-looking statements involve known and

unknown risks, uncertainties, and other factors which may cause Triumph’s actual results,

performance, or achievements to be materially different from any expected future results,

performance, or achievements. For more information, see the risk factors described in Triumph’s

current Form 10-K and other SEC filings.

TRIUMPH GROUP, INC. Q3’17 UPDATE // 3

INTRODUCTION

Improving margins YOY in 2 of 4

business units

Improved execution and

operational performance

Improved cash performance

Increased competitive wins

Exceeding FY17 savings goals

Net sales $845M

Operating income $55M

Net income $29M

EPS $0.59

Adjusted EPS $1.01

Free cash use $37M

Reaffirming revenue and EPS

guidance, and updating cash

guidance

FY17 Q3 Operational &

Financial Summary Highlights

Q3 Builds on Q2 Success

P

P

P

P

P

TRIUMPH GROUP, INC. Q3’17 UPDATE // 4

TRANSFORMATION PROGRESS

Progress Against Plan

• Five facility consolidations underway

• Reductions in force ongoing

• New Senior Leadership Team in place

• Upgrading Operating Company leaders

• Cash Conversion focus improved free cash

use from $49M in Q2 to $37M in Q3

• Supply Chain Initiatives benefiting new bids

• Divesting Triumph Air Repair and APU

• Lean deployment accelerating

• Planning for FY18 savings underway

Transformation on track to exceed expected results

Realized Forecast Target

FY 17 In-Year CRI Savings (in Millions)

70

60

50

40

30

20

10

0

Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar

On Track to

Exceed FY17

savings target

TRIUMPH GROUP, INC. Q3’17 UPDATE // 5

BUSINESS UNIT HIGHLIGHTS

Integrated Systems Product Support

• 29% of TGI revenue – generates 57% of OI *

• 20% operating margin in Q3

• Broad platform participation

• Well positioned on ramping aircraft programs

• Engaged on new start programs

• Targeting “own” aftermarket

• Benefiting from aircraft refreshes (e.g. FADECs)

• Winning dual-source opportunities/takeaways

• Player in aircraft “electrification”

• TGI investment priority

Integrated Systems and Product Support Driving Shareholder Value

* YTD figures, OI excludes corporate costs

• 10% of TGI revenue – generates 17% of OI *

• 17% operating margin in Q3

• 6% revenue CAGR over the last three years

• Strong customer relationships

• Winning new MRO work

• Expanding customer base

• Partnering with OEMs on sustainment LTAs

• Partnering with leading distribution companies

• Supporting out of production and new fleets

• Piloting new business models

TRIUMPH GROUP, INC. Q3’17 UPDATE // 6

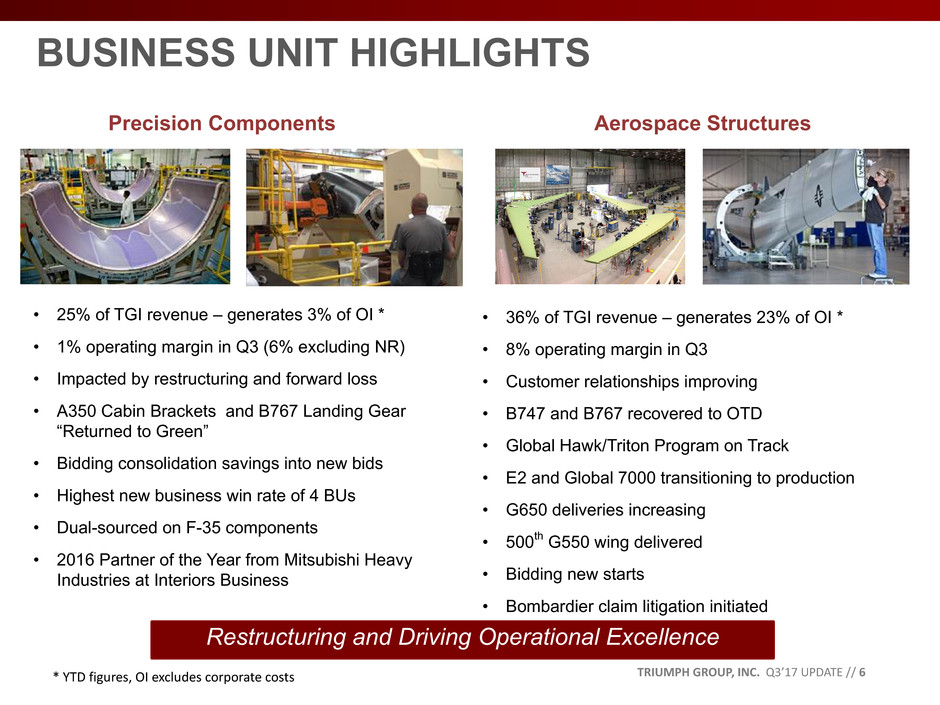

BUSINESS UNIT HIGHLIGHTS

Restructuring and Driving Operational Excellence

Precision Components Aerospace Structures

• 25% of TGI revenue – generates 3% of OI *

• 1% operating margin in Q3 (6% excluding NR)

• Impacted by restructuring and forward loss

• A350 Cabin Brackets and B767 Landing Gear

“Returned to Green”

• Bidding consolidation savings into new bids

• Highest new business win rate of 4 BUs

• Dual-sourced on F-35 components

• 2016 Partner of the Year from Mitsubishi Heavy

Industries at Interiors Business

• 36% of TGI revenue – generates 23% of OI *

• 8% operating margin in Q3

• Customer relationships improving

• B747 and B767 recovered to OTD

• Global Hawk/Triton Program on Track

• E2 and Global 7000 transitioning to production

• G650 deliveries increasing

• 500th G550 wing delivered

• Bidding new starts

• Bombardier claim litigation initiated

* YTD figures, OI excludes corporate costs

TRIUMPH GROUP, INC. Q3’17 UPDATE // 7

DRIVING ORGANIC GROWTH

Q3 $350M Won*

Integrated Systems:

21%

Product Support:

30%

Precision

Components:

49%

YTD $710M Won*

Integrated Systems:

25%

Product Support:

26%

Precision

Components:

34%

Aerospace Structures:

14%

* Excludes contract continuations/extensions awarded in G650, Hale, C-17 and others

$16.5B PIPELINE

7,000

6,000

5,000

4,000

3,000

2,000

1,000

0

$

(M

illi

on

s)

OPPORTUNITY PURSUIT PROPOSAL CUST EVAL BEST & FINAL

• Strong pipeline with large % in final

customer review

• Increasing win rate

◦ Q3 wins ~ Q1 & Q2 combined

• Competitive wins YTD equivalent to 3%

net sales growth

Highlights

COMPETITIVE WINS

TRIUMPH GROUP, INC. Q3’17 UPDATE // 8

($ in thousands) FY2017 Q3 FY2016 Q3 Variance %

Net Sales $ 844,863 $ 913,866 (8)%

Operating Income (Loss) 55,166 (126,250) 144 %

Operating Margin 7% (14)%

Adjusted Operating Income 83,648 115,350

Adjusted Operating Margin 10% 13 %

Adjusted EBITDA 84,641 121,953 (31)%

Adjusted EBITDA Margin 10% 14 %

CONSOLIDATED RESULTS

• Net sales decrease due to:

◦ Rate reductions on 747-8, G450/550, C-17

◦ Partially offset by increased production on 767/Tanker and stronger sales in Product

Support

• Adjusted operating income excludes:

◦ $14.1M of restructuring costs

◦ $14.4M loss on assets held for sale

TRIUMPH GROUP, INC. Q3’17 UPDATE // 9

EARNINGS PER SHARE

Quarter Ended

(Shares in thousands) December 31,

2016

December 31,

2015

Earnings per share (GAAP - Diluted) $ 0.59 $ (1.80)

Adjustments to earnings per share:

Loss on assets held for sale 0.21 —

Tradename impairment — 3.02

Legal settlements — 0.17

Restructuring costs (non-cash) 0.05 —

Restructuring costs (cash) 0.16 —

Adjusted earnings per share (Non-GAAP - Diluted) $ 1.01 $ 1.39

Weighted-average shares outstanding (diluted) 49,440 49,228

TRIUMPH GROUP, INC. Q3’17 UPDATE // 10

INTEGRATED SYSTEMS

• Increased EBITDA margin driven by Cost Reduction Initiatives

• Net sales decrease due to:

• $5.7 million decline from unfavorable currency change in GBP,

• $4.5 million decline from Q2 divestiture, partially offset by $1.2 million

increase from the October 2015 acquisition of Fairchild Controls

• Continued softness in rotorcraft market (both commercial and military)

• Selected by Raytheon to provide U.S. Navy’s Next Generation

Jammer Pod Servo Control System.

• Received the “Excellence in the Use of Technology” Award for

Isle of Man facility

($ in thousands) FY2017 Q3 FY2016 Q3 Variance

Net Sales $ 256,080 $ 271,849 (6)%

Operating Income 51,596 52,321 (1)%

Operating Margin 20% 19%

Adjusted EBITDA 53,734 53,176 1 %

Adjusted EBITDA Margin 22% 20%

Integrated Systems will provide Servo Control System

for U.S. Navy’s Next Generation Jammer Increment 1

external jamming pod.

(Photo from Director Operational Test and Evaluation, FY2016 Annual Report)

TRIUMPH GROUP, INC. Q3’17 UPDATE // 11

AEROSPACE STRUCTURES

• Net sales decrease due to production rate

reductions on 747-8, G450/550 and C-17, partially

offset by the increase in 767/ Tanker

• $2.6M restructuring in Q3 in operating income

• Improved execution resulting in net favorable EAC

adjustments of $2.1M

• Negotiating key contract extensions

($ in thousands) FY2017 Q3 FY2016 Q3 Variance

Net Sales $ 304,235 $ 346,639 (12)%

Operating Income (Loss) 23,867 (210,938) (111)%

Operating Margin 8% (61)%

Adjusted Operating Income 23,867 28,762 (17)%

Adjusted Operating Margin 8% 8 %

Adjusted EBITDA 20,704 20,997 (1)%

Adjusted EBITDA Margin 7% 7 %

G600 first flight, Dec. 2016. Triumph Aerospace

Structures provides composite skins for the horizontal

tail on the Gulfstream G600.

(Photo: Gulfstream Aerospace Corp.)

TRIUMPH GROUP, INC. Q3’17 UPDATE // 12

PRECISION COMPONENTS

• TTM book to bill 1.2 : 1

• Restructuring of $4.8M and related inefficiencies

impacted Q3 margins

• $5M forward loss on an engine program in Q3

• New wins on Rolls Royce for Trent XWB Engine

Components & Cessna Citation Longitude

• Facility consolidations tracking close to plan

($ in thousands) FY2017 Q3 FY2016 Q3 Variance

Net Sales $ 226,294 $ 250,284 (10)%

Operating Income 2,942 24,106 (88)%

Operating Margin 1% 10%

Adjusted EBITDA 16,468 34,723 (53)%

Adjusted EBITDA Margin 7% 14%

Triumph Precision Components - Toronto facility

awarded $53 million agreement from Rolls Royce to

supply thrust links for the Trent 900/1000 engines.

TRIUMPH GROUP, INC. Q3’17 UPDATE // 13

PRODUCT SUPPORT FY17

• Net sales increase due primarily to key contract

wins with regional jet and commercial operators

for components and accessories

• Announced pending sale of APU/Engines

businesses

• Strong margins supported by increased organic

sales and cost reduction initiatives

• Facility consolidations and benefits ahead of

schedule

($ in thousands) FY2017 Q3 FY2016 Q3 Variance

Net Sales $ 87,292 $ 78,127 12%

Operating Income 14,662 12,402 18%

Operating Margin 17% 16%

Adjusted EBITDA 16,956 16,764 1%

Adjusted EBITDA Margin 19% 21%

Triumph Product Support to partner with L3 Technologies

for the KC-10 thrust reverser aerial refueling boom.

TRIUMPH GROUP, INC. Q3’17 UPDATE // 14

CASH

Operating Activities

($ in millions)

FY17 Q1 FY17 Q2 FY17 Q3 YTD 2017

Cash used in operations $ (84.0) $ (47.2) $ (41.4) $ (172.7)

Capital expenditures (12.7) (11.2) (9.2) (33.1)

Sale of assets 0.9 9.1 13.1 23.2

Free cash use $ (95.8) $ (49.4) $ (37.4) $ (182.6)

• Development programs used $48M

• G650/G280 used $22M

• Restructuring used $11M

• Customer advances provided $12M

Q3 Cash Drivers

Continued improvement in cash use

TRIUMPH GROUP, INC. Q3’17 UPDATE // 15

CAPITALIZATION, LEVERAGE & LIQUIDITY

($ in millions)

12/31/2016

Cash $ (35)

Revolver & Term Loan 773

Securitized Debt 215

2013 Senior Notes Due 2021 375

2014 Senior Notes Due 2022 300

Other Debt 8

Net Debt $ 1,636

Shareholders’ Equity 981

Total Book Capitalization $ 2,616

Net Debt-to-Capitalization 63%

Total Leverage Ratio 4.3x

Senior Secured Leverage Ratio 2.6x

Cash and Availability $ 284

Compliant with all financial covenants

TRIUMPH GROUP, INC. Q3’17 UPDATE // 16

FY 2017 GUIDANCE

Revenue $3.5 - $3.6B

EPS $3.15 - $3.45/share

($190 - $210M)

Free Cash Flow ($100 - $120M)

Capital Expenditures $40 - $60M*

Effective Tax Rate ~ 18%**

~ 7%***

Cash Tax Rate ~ 5%

* Net of leasing as reported

** Potential opportunity to lower through release of valuation allowance and use of deferred tax benefits from Newport News sale and risk

of increasing if projected pre-tax income not achieved; cash taxes would not be effected

*** Reflects expected tax payments in fiscal 2017

TRIUMPH GROUP, INC. Q3’17 UPDATE // 17

• Stabilizing operational and financial performance

• On track to exceed cost savings targets

• Pipeline and win rate improving

• Driving shareholder value

CONCLUDING REMARKS

MQ-4C Triton Unmanned Aircraft System.

TRIUMPH GROUP, INC. Q3’17 UPDATE // 18

Q & A

TRIUMPH GROUP, INC. Q3’17 UPDATE // 19

APPENDIX

TRIUMPH GROUP, INC. Q3’17 UPDATE // 20

TOP PROGRAMS

Integrated Systems Aerospace Structures Precision Components

1. Airbus A320, A321 1. Gulfstream 1. Boeing 777

2. Boeing 737 2. Boeing 767, Tanker 2. Boeing 787

3. Boeing 787 3. Airbus A330, A340 3. Airbus A350

4. Boeing V-22 4. Boeing 747 4. Boeing 737

5. Sikorsky UH60 5. Bombardier Global 5. Boeing 767, Tanker

6. Boeing CH-47 6. Boeing 777 6. Boeing V-22

7. Lockheed Martin C-130 7. NG Global Hawk 7. Boeing F-15

8. Airbus A380 8. Boeing V-22 8. Sikorsky UH60

9. Boeing 777 9. Bell Helicopter 525 9. Bell Helicopter AH1

10. Boeing AH-64 10. Boeing C-17 10. Airbus A320, A321

Represents 56% of Integrated

Systems backlog

Represents 97% of

Aerospace Structures

backlog

Represents 76% of Precision

Components backlog

TRIUMPH GROUP, INC. Q3’17 UPDATE // 21

PENSION/OPEB ANALYSIS

Pension/OPEB Analysis Fiscal Year 2016 Fiscal Year 2017

Pension Expense (Income) ≈ ($57) million ≈ ($67) million

Cash Pension Contribution ≈ $0 ≈ $0

OPEB Expense (Income) ≈ ($8) million ≈ ($14) million

Cash OPEB Contribution ≈ $21 million ≈ $16 million

TRIUMPH GROUP, INC. Q3’17 UPDATE // 22

RESTRUCTURING COSTS BY SEGMENT

For the Three Months Ended December 31, 2016

($ in thousands)

Integrated

Systems

Aerospace

Structures

Precision

Components

Product

Support Corporate Total

Termination benefits $ — $ — $ 494 $ 57 $ — $ 551

Facility closure and other exit costs — 297 1,209 180 — 1,686

Other 49 2,296 133 121 6,231 8,830

49 2,593 1,836 358 6,231 11,067

Depreciation and Amortization 46 — 3,006 13 — 3,065

$ 95 $ 2,593 $ 4,842 $ 371 $ 6,231 $ 14,132

For the Nine Months Ended December 31, 2016

($ in thousands)

Integrated

Systems

Aerospace

Structures

Precision

Components

Product

Support Corporate Total

Termination benefits $ 286 $ 250 $ 966 $ 147 $ — $ 1,649

Facility closure and other exit costs — 297 1,456 215 — 1,968

Other 49 6,307 2,185 191 15,831 24,563

335 6,854 4,607 553 15,831 28,180

Depreciation and Amortization 139 — 9,854 303 — 10,296

$ 474 $ 6,854 $ 14,461 $ 856 $ 15,831 $ 38,476

TRIUMPH GROUP, INC. Q3’17 UPDATE // 23

SALES BY MARKET

($ in millions) Q3 FY 2017 Q3 FY 2016

Sales % of Total Sales % of Total $ Change % Change

Commercial $461 55% $499 55% $(38) (8)%

Military 202 24% 214 23% (12) (6)%

Business Jets 156 18% 169 19% (13) (8)%

Regional Jets 18 2% 18 2% — — %

Non-Aviation 8 1% 13 1% (5) (38)%

Total Sales $845 100% $913 100% $(68) (7)%

OEM 81% 82%

Aftermarket 18% 16%

Other 1% 2%

Total 100% 100%

TRIUMPH GROUP, INC. Q3’17 UPDATE // 24

Organic Sales

($ in millions)

FY2017 Q3 FY2016 Q3 Change

Integrated Systems $246 $258 (5)%

Aerospace Structures 304 347 (12)%

Precision Components 226 250 (10)%

Product Support 87 78 12 %

Total Organic Sales * $863 $933 (7)%

*Includes Intercompany sales

Export Sales

($ in millions)

FY2017 Q3 FY2016 Q3 Change

Export Sales $198 $194 2%

SALES ANALYSIS

TRIUMPH GROUP, INC. Q3’17 UPDATE // 25

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND SUBSIDIARIES

(dollars in thousands)

Non-GAAP Financial Measures Disclosures

We prepare and publicly release quarterly unaudited financial statements prepared in accordance with GAAP. In accordance with Securities and Exchange Commission (the

"SEC") guidance on Compliance and Disclosure Interpretations, we also disclose and discuss certain, non-GAAP financial measures in our public releases. Currently, the non-

GAAP financial measures that we disclose is Adjusted EBITDA, which is our net income before interest, income taxes, amortization of acquired contract liabilities, curtailments,

settlements and early retirement incentives, legal settlements, deprecation and amortization. We disclose Adjusted EBITDA on a consolidated and an operating segment basis in

our earnings releases, investor conference calls and filings with the SEC. The non-GAAP financial measures that we use may not be comparable to similarly titled measures

reported by other companies. Also, in the future, we may disclose different non-GAAP financial measures in order to help our investors more meaningfully evaluate and compare

our future results of operations to our previously reported results of operations.

We view Adjusted EBITDA as an operating performance measure and as such we believe that the GAAP financial measure most directly comparable to it is net income. In

calculating Adjusted EBITDA, we exclude from net income the financial items that we believe should be separately identified to provide additional analysis of the financial

components of the day-to-day operation of our business. We have outlined below the type and scope of these exclusions and the material limitations on the use of these non-

GAAP financial measures as a result of these exclusions. Adjusted EBITDA is not a measurement of financial performance under GAAP and should not be considered as a

measure of liquidity, as an alternative to net income (loss), income from continuing operations, or as an indicator of any other measure of performance derived in accordance with

GAAP. Investors and potential investors in our securities should not rely on Adjusted EBITDA as a substitute for any GAAP financial measure, including net income (loss) or

income from continuing operations. In addition, we urge investors and potential investors in our securities to carefully review the reconciliation of Adjusted EBITDA to net

income set forth below, in our earnings releases and in other filings with the SEC and to carefully review GAAP financial information included as part of our Quarterly Reports

on Form 10-Q and our Annual Reports on Form 10-K that are filed with the SEC, as well as our quarterly earnings releases, and compare the GAAP financial information with

our Adjusted EBITDA.

Adjusted EBITDA is used by management to internally measure our operating and management performance and by investors as a supplemental financial measure to evaluate the

performance of our business that, when viewed with our GAAP results and the accompanying reconciliation, we believe provides additional information that is useful to gain an

understanding of the factors and trends affecting our business. We have spent more than 20 years expanding our product and service capabilities partially through acquisitions of

complementary businesses. Due to the expansion of our operations, which included acquisitions, our net income has included significant charges for depreciation and

amortization. Adjusted EBITDA excludes these charges and provides meaningful information about the operating performance of our business, apart from charges for

depreciation and amortization. We believe the disclosure of Adjusted EBITDA helps investors meaningfully evaluate and compare our performance from quarter to quarter and

from year to year. We also believe Adjusted EBITDA is a measure of our ongoing operating performance because the isolation of non-cash income and expenses, such as

amortization of acquired contract liabilities, depreciation and amortization, and non-operating items, such as interest and income taxes, provides additional information about our

cost structure, and, overtime, helps track our operating progress. In addition, investors, securities analysts and others have regularly relied on Adjusted EBITDA to provide a

financial measure by which to compare our operating performance against that of other companies in our industry.

Set forth below are descriptions of the financial items that have been excluded from our net income to calculate Adjusted EBITDA and the material limitations associated with

using this non-GAAP financial measure as compared to net income:

• Divestitures may be useful for investors to consider because they reflect gains or losses from sale of operating units. We do not believe these earnings necessarily reflect the

current and ongoing cash earnings related to our operations.

• Legal settlements may be useful to investors to consider because they reflect gains or losses from disputes with third parties. We do not believe that these gains or losses

necessarily reflect the current and ongoing cash earnings related to our operations.

• Curtailments, settlements and early retirement incentives may be useful to investors to consider because it represents the current period impact of the change in defined

benefit obligation due to the reduction in future service costs. We do not believe these charges (gains) necessarily reflect the current and ongoing cash earnings related to our

operations.

• Amortization of acquired contract liabilities may be useful for investors to consider because it represents the non-cash earnings on the fair value of below market contracts

acquired through acquisitions. We do not believe these earnings necessarily reflect the current and ongoing cash earnings related to our operations.

• Amortization expenses (including impairments) may be useful for investors to consider because it represents the estimated attrition of our acquired customer base and the

diminishing value of product rights and licenses. We do not believe these charges necessarily reflect the current and ongoing cash charges related to our operating cost

structure.

• Deprecation may be useful for investors to consider because they generally represent the wear and tear on our property and equipment used in our operations. We do not

believe these changes necessarily reflect the current and ongoing cash charges related to our operating cost structure.

-More-

NON-GAAP DISCLOSURE

TRIUMPH GROUP, INC. Q3’17 UPDATE // 26

(Continued)

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND SUBSIDIARIES

(dollars in thousands)

Non-GAAP Financial Measures Disclosures (continued)

• The amount of interest expense and other we incur may be useful for investors to consider and may result in current cash inflows or outflows. However, we do not

consider the amount of interest expense and other to be a representative component of the day-to-day operating performance of our business.

• Income tax expense may be useful for investors to consider because it generally represents the taxes which may be payable for the period and the change in

deferred income taxes during the period and may reduce the amount of funds otherwise available for use in our business. However, we do not consider the

amount of income tax expense to be a representative component of the day-to-day operating performance of our business.

Management compensates for the above-described limitations of using non-GAAP measures by using a non-GAAP measure only to supplement our GAAP results

and to provide additional information that is useful to gain an understanding of the factors and trends affecting our business.

The following table shows our Adjusted EBITDA reconciled to our net income for the indicated periods (in thousands):

Three Months Ended December 31, Nine Months Ended December 31,

2016 2015 2016 2015

Adjusted Earnings before Interest, Taxes,

Depreciation and Amortization (EBITDA):

Net Income (Loss) $ 29,332 $ (88,649) $ 83,872 $ 35,695

Add-back:

Income Tax Expense 6,136 (53,393) 32,786 6,429

Interest Expense and Other 19,698 15,792 55,721 49,539

Curtailment Charge — — — 2,863

Loss on divestiture and assets held for sale 14,350 — 19,124 —

Legal settlement charges — 12,400 — 12,400

Amortization of Acquired Contract Liabilities (29,206) (34,425) (89,031) (99,928)

Depreciation and Amortization 44,331 270,228 135,080 356,337

Adjusted Earnings before Interest, Taxes,

Depreciation and Amortization ("Adjusted EBITDA") $ 84,641 $ 121,953 $ 237,552 $ 363,335

Net Sales # $ 844,863 $ 913,866 $ 2,612,885 $ 2,828,278

Adjusted EBITDA Margin # 10.4 % 13.9 % 9.4 % 13.3 %

# Net Sales includes Amortization of Acquired Contract Liabilities. Since Adjusted EBITDA excludes Amortization of Acquired

Contract Liabilities, we've also excluded it from Net Sales in arriving at Adjusted EBITDA margin throughout this document.

NON-GAAP DISCLOSURE

TRIUMPH GROUP, INC. Q3’17 UPDATE // 27

(Continued)

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND SUBSIDIARIES

(dollars in thousands)

Non-GAAP Financial Measures Disclosures (continued)

Adjusted Earnings before Interest, Taxes, For the Three Months Ended December 31, 2016

Depreciation and Amortization (EBITDA): Segment Data

Total Integrated Systems

Aerospace

Structures

Precision

Components Product Support

Corporate/

Eliminations

Net Income $ 29,332

Add-back:

Income Tax Expense 6,136

Interest Expense and Other 19,698

Operating Income (Loss) $ 55,166 $ 51,596 $ 23,867 $ 2,942 $ 14,662 $ (37,901)

Loss on assets held for sale 14,350 — — — — 14,350

Amortization of Acquired Contract Liabilities (29,206) (7,628) (21,105) (473) — —

Depreciation and Amortization 44,331 9,766 17,942 13,999 2,294 330

Adjusted Earnings (Losses) before Interest, Taxes,

Depreciation and Amortization ("Adjusted EBITDA") $ 84,641 $ 53,734 $ 20,704 $ 16,468 $ 16,956 $ (23,221)

Net Sales $ 844,863 $ 256,080 $ 304,235 $ 226,294 $ 87,292 $ (29,038)

Adjusted EBITDA Margin 10.4% 21.6% 7.3% 7.3% 19.4% n/a

NON-GAAP DISCLOSURE

TRIUMPH GROUP, INC. Q3’17 UPDATE // 28

(Continued)

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND SUBSIDIARIES

(dollars in thousands)

Non-GAAP Financial Measures Disclosures (continued)

Adjusted Earnings before Interest, Taxes, For the Nine Months Ended December 31, 2016

Depreciation and Amortization (EBITDA): Segment Data

Total Integrated Systems

Aerospace

Structures

Precision

Components Product Support

Corporate/

Eliminations

Net Income $ 83,872

Add-back:

Income Tax Expense 32,786

Interest Expense and Other 55,721

Operating Income (Loss) $ 172,379 $ 145,379 $ 57,898 $ 7,223 $ 42,986 $ (81,107)

Loss on divestiture and assets held for sale 19,124 — — — — 19,124

Amortization of Acquired Contract Liabilities (89,031) (27,101) (60,190) (1,740) — —

Depreciation and Amortization 135,080 30,228 54,289 42,344 7,230 989

Adjusted Earnings (Losses) before Interest, Taxes,

Depreciation and Amortization ("Adjusted EBITDA") $ 237,552 $ 148,506 $ 51,997 $ 47,827 $ 50,216 $ (60,994)

Net Sales $ 2,612,885 $ 758,803 $ 956,114 $ 740,354 $ 257,317 $ (99,703)

Adjusted EBITDA Margin 9.4% 20.3% 5.8% 6.5% 19.5% n/a

NON-GAAP DISCLOSURE

TRIUMPH GROUP, INC. Q3’17 UPDATE // 29

(Continued)

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND SUBSIDIARIES

(dollars in thousands)

Non-GAAP Financial Measures Disclosures (continued)

Adjusted Earnings before Interest, Taxes, For the Three Months Ended December 31, 2015

Depreciation and Amortization (EBITDA): Segment Data

Total Integrated Systems

Aerospace

Structures

Precision

Components Product Support

Corporate/

Eliminations

Net Loss $ (88,649)

Add-back:

Income Tax Expense (53,393)

Interest Expense and Other 15,792

Operating (Loss) Income $ (126,250) $ 52,321 $ (210,938) $ 24,106 $ 12,402 $ (4,141)

Legal settlement charges 12,400 — 10,500 — 1,900 —

Amortization of Acquired Contract Liabilities (34,425) (9,804) (23,831) (790) — —

Depreciation and Amortization 270,228 10,659 245,266 11,407 2,462 434

Adjusted Earnings (Losses) before Interest, Taxes,

Depreciation and Amortization ("Adjusted EBITDA") $ 121,953 $ 53,176 $ 20,997 $ 34,723 $ 16,764 $ (3,707)

Net Sales $ 913,866 $ 271,849 $ 346,639 $ 250,284 $ 78,127 $ (33,033)

Adjusted EBITDA Margin 13.9% 20.3% 6.5% 13.9% 21.5% n/a

NON-GAAP DISCLOSURE

TRIUMPH GROUP, INC. Q3’17 UPDATE // 30

(Continued)

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND SUBSIDIARIES

(dollars in thousands)

Non-GAAP Financial Measures Disclosures (continued)

Adjusted Earnings before Interest, Taxes, For the Nine Months Ended December 31, 2015

Depreciation and Amortization (EBITDA): Segment Data

Total Integrated Systems

Aerospace

Structures

Precision

Components Product Support

Corporate/

Eliminations

Net Income $ 35,695

Add-back:

Income Tax Expense 6,429

Interest Expense and Other 49,539

Operating Income (Loss) $ 91,663 $ 153,978 $ (132,458) $ 74,468 $ 31,514 $ (35,839)

Curtailment charge 2,863 — — — — 2,863

Legal settlement charges 12,400 — 10,500 — 1,900 —

Amortization of Acquired Contract Liabilities (99,928) (30,316) (67,039) (2,573) — —

Depreciation and Amortization 356,337 31,316 276,845 39,600 7,352 1,224

Adjusted Earnings (Losses) before Interest, Taxes,

Depreciation and Amortization ("Adjusted EBITDA") $ 363,335 $ 154,978 $ 87,848 $ 111,495 $ 40,766 $ (31,752)

Net Sales $ 2,828,278 $ 791,901 $ 1,127,230 $ 781,250 $ 226,649 $ (98,752)

Adjusted EBITDA Margin 13.3% 20.3% 8.3% 14.3% 18.0% n/a

NON-GAAP DISCLOSURE

TRIUMPH GROUP, INC. Q3’17 UPDATE // 31

(Continued)

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND SUBSIDIARIES

(dollars in thousands)

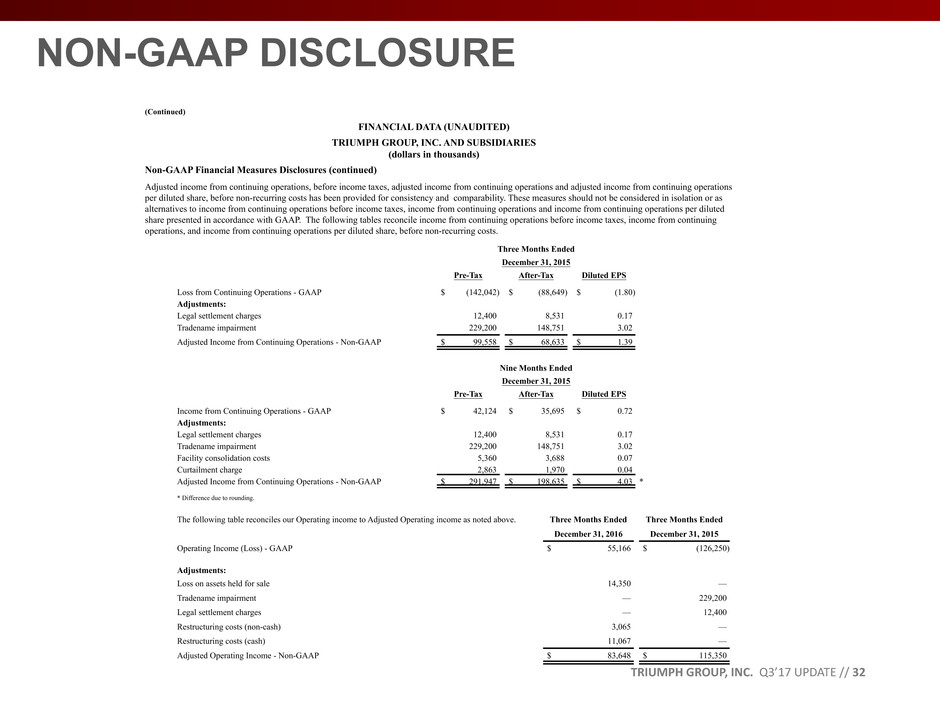

Non-GAAP Financial Measures Disclosures (continued)

Adjusted income from continuing operations, before income taxes, adjusted income from continuing operations and adjusted income from continuing operations

per diluted share, before non-recurring costs has been provided for consistency and comparability. These measures should not be considered in isolation or as

alternatives to income from continuing operations before income taxes, income from continuing operations and income from continuing operations per diluted

share presented in accordance with GAAP. The following tables reconcile income from continuing operations before income taxes, income from continuing

operations, and income from continuing operations per diluted share, before non-recurring costs.

Three Months Ended

December 31, 2016

Pre-Tax After-Tax Diluted EPS

Income from Continuing Operations - GAAP $ 35,468 $ 29,332 $ 0.59

Transformation related costs:

Loss on assets held for sale 14,350 10,476 0.21

Restructuring costs (non-cash) 3,065 2,237 0.05

Restructuring costs (cash) 11,067 8,079 0.16

Adjusted Income from Continuing Operations - Non-GAAP $ 63,950 $ 50,124 $ 1.01

Nine Months Ended

December 31, 2016

Pre-Tax After-Tax Diluted EPS

Income from Continuing Operations - GAAP $ 116,658 $ 83,872 $ 1.70

Adjustments:

Triumph Precision Components - Strike related costs 15,701 11,462 0.23

Triumph Precision Components - Inventory write-down 6,089 4,445 0.09

Triumph Aerospace Structures - UAS program 14,200 10,366 0.21

Loss on divestiture and assets held for sale 19,124 15,250 0.31

Restructuring costs (non-cash) 10,296 7,516 0.15

Restructuring costs (cash) 28,180 20,571 0.42

Adjusted Income from Continuing Operations - Non-GAAP $ 210,248 $ 153,482 $ 3.11

NON-GAAP DISCLOSURE

TRIUMPH GROUP, INC. Q3’17 UPDATE // 32

(Continued)

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND SUBSIDIARIES

(dollars in thousands)

Non-GAAP Financial Measures Disclosures (continued)

Adjusted income from continuing operations, before income taxes, adjusted income from continuing operations and adjusted income from continuing operations

per diluted share, before non-recurring costs has been provided for consistency and comparability. These measures should not be considered in isolation or as

alternatives to income from continuing operations before income taxes, income from continuing operations and income from continuing operations per diluted

share presented in accordance with GAAP. The following tables reconcile income from continuing operations before income taxes, income from continuing

operations, and income from continuing operations per diluted share, before non-recurring costs.

Three Months Ended

December 31, 2015

Pre-Tax After-Tax Diluted EPS

Loss from Continuing Operations - GAAP $ (142,042) $ (88,649) $ (1.80)

Adjustments:

Legal settlement charges 12,400 8,531 0.17

Tradename impairment 229,200 148,751 3.02

Adjusted Income from Continuing Operations - Non-GAAP $ 99,558 $ 68,633 $ 1.39

Nine Months Ended

December 31, 2015

Pre-Tax After-Tax Diluted EPS

Income from Continuing Operations - GAAP $ 42,124 $ 35,695 $ 0.72

Adjustments:

Legal settlement charges 12,400 8,531 0.17

Tradename impairment 229,200 148,751 3.02

Facility consolidation costs 5,360 3,688 0.07

Curtailment charge 2,863 1,970 0.04

Adjusted Income from Continuing Operations - Non-GAAP $ 291,947 $ 198,635 $ 4.03 *

* Difference due to rounding.

NON-GAAP DISCLOSURE

The following table reconciles our Operating income to Adjusted Operating income as noted above. Three Months Ended Three Months Ended

December 31, 2016 December 31, 2015

Operating Income (Loss) - GAAP $ 55,166 $ (126,250)

Adjustments:

Loss on assets held for sale 14,350 —

Tradename impairment — 229,200

Legal settlement charges — 12,400

Restructuring costs (non-cash) 3,065 —

Restructuring costs (cash) 11,067 —

Adjusted Operating Income - Non-GAAP $ 83,648 $ 115,350

TRIUMPH GROUP, INC. Q3’17 UPDATE // 33

NON-GAAP DISCLOSURE

(Continued)

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND SUBSIDIARIES

(dollars in thousands)

Non-GAAP Financial Measures Disclosures (continued)

Cash provided by operations has been provided for consistency and comparability. We also use free cash flow available for debt reduction as a key factor in

planning for and consideration of strategic acquisitions, stock repurchases and the repayment of debt. This measure should not be considered in isolation, as a

measure of residual cash flow available for discretionary purposes, or as an alternative to operating results presented in accordance with GAAP. The following

table reconciles cash provided by operations to free cash flow available for debt reduction.

We use "Net Debt to Capital" as a measure of financial leverage. The following table sets forth the computation of Net Debt to Capital:

Three Months Ended Nine Months Ended

December 31, December 31,

2016 2016

Cash flow from operations $ (41,415) $ (172,651)

Less:

Capital expenditures (9,157) (33,123)

Sale of assets 13,141 23,185

Free cash flow available for debt reduction, acquisitions and share repurchases $ (37,431) $ (182,589)

December 31, March 31,

2016 2016

Calculation of Net Debt

Current portion $ 187,731 $ 42,441

Long-term debt 1,470,649 1,374,879

Total debt 1,658,380 1,417,320

Plus: Deferred debt issuance costs 12,493 8,971

Less: Cash (35,461) (20,984)

Net debt $ 1,635,412 $ 1,405,307

Calculation of Capital

Net debt $ 1,635,412 $ 1,405,307

Stockholders' equity 980,816 934,944

Total capital $ 2,616,228 $ 2,340,251

Percent of net debt to capital 62.5% 60.0%