Attached files

| file | filename |

|---|---|

| 8-K - CUSTOMERS BANCORP, INC. FORM 8-K - Customers Bancorp, Inc. | customers8k.htm |

Exhibit 99.1

Highly Focused, Low Risk, Above Average Growth Bank Holding Company Investor PresentationFebruary, 2017NYSE: CUBI Member FDIC

Forward-Looking Statements This presentation, as well as other written or oral communications made from time to time by us, contains forward-looking information within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements relate to future events or future predictions, including events or predictions relating to future financial performance, and are generally identifiable by the use of forward-looking terminology such as “believe,” “expect,” “may,” “will,” “should,” “plan,” “intend,” or “anticipate” or the negative thereof or comparable terminology. Forward- looking statements in this presentation include, among other matters, guidance for our financial performance, and our financial performance targets. Forward-looking statements reflect numerous assumptions, estimates and forecasts as to future events. No assurance can be given that the assumptions, estimates and forecasts underlying such forward-looking statements will accurately reflect future conditions, or that any guidance, goals, targets or projected results will be realized. The assumptions, estimates and forecasts underlying such forward-looking statements involve judgments with respect to, among other things, future economic, competitive, regulatory and financial market conditions and future business decisions, which may not be realized and which are inherently subject to significant business, economic, competitive and regulatory uncertainties and known and unknown risks, including the risks described under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2015 and subsequent Quarterly Reports on Form 10-Q, as such factors may be updated from time to time in our filings with the SEC. Our actual results may differ materially from those reflected in the forward-looking statements.In addition to the risks described under “Risk Factors” in our filings with the SEC, important factors to consider and evaluate with respect to our forward-looking statements include:changes in external competitive market factors that might impact our results of operations;changes in laws and regulations, including without limitation changes in capital requirements under Basel III;changes in our business strategy or an inability to execute our strategy due to the occurrence of unanticipated events;our ability to identify potential candidates for, and consummate, acquisition or investment transactions;the timing of acquisition, investment or disposition transactions;constraints on our ability to consummate an attractive acquisition or investment transaction because of significant competition for these opportunities;local, regional and national economic conditions and events and the impact they may have on us and our customers;costs and effects of regulatory and legal developments, including the results of regulatory examinations and the outcome of regulatory or other governmental inquiries and proceedings, such as fines or restrictions on our business activities;our ability to attract deposits and other sources of liquidity;changes in the financial performance and/or condition of our borrowers;changes in the level of non-performing and classified assets and charge-offs;changes in estimates of future loan loss reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; inflation, interest rate, securities market and monetary fluctuations;timely development and acceptance of new banking products and services and perceived overall value of these products and services by users, including the products and services being developed and introduced to the market by the BankMobile division of Customers Bank;changes in consumer spending, borrowing and saving habits;technological changes;

Forward-Looking Statements our ability to increase market share and control expenses;continued volatility in the credit and equity markets and its effect on the general economy;effects of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight Board, the Financial Accounting Standards Board and other accounting standard setters;the businesses of Customers Bank and any acquisition targets or merger partners and subsidiaries not integrating successfully or such integration being more difficult, time-consuming or costly than expected;material differences in the actual financial results of merger and acquisition activities compared with our expectations, such as with respect to the full realization of anticipated cost savings and revenue enhancements within the expected time frame;our ability to successfully implement our growth strategy, control expenses and maintain liquidity;Customers Bank's ability to pay dividends to Customers Bancorp;that integration of the Higher One Disbursements business with BankMobile may be less successful, more difficult, time-consuming or costly than expected, and that BankMobile may be unable to realize anticipated cost savings and revenue enhancements within the expected time frame or at all;the number of existing student customers who transfer their accounts to BankMobile from one of Higher One's former bank partners;material variances in the adoption rate of BankMobile's services by new students and/or the usage rate of BankMobile's services by current student customers compared to our expectations;material variances in the number of BankMobile student accounts retained following graduation compared to our expectations;the levels of usage of other BankMobile student customers following graduation of additional product and service offerings of BankMobile or Customers Bank, including mortgages and consumer loans, and the mix of products and services used;our ability to implement changes to BankMobile's product and service offerings under current and future regulations and governmental policies;our ability to effectively manage revenue and expense fluctuations that may occur with respect to BankMobile's student-oriented business activities, which result from seasonal factors related to the higher-education academic year;our ability to implement our strategy regarding BankMobile, including with respect to our intent to sell or otherwise dispose of the BankMobile business in the future, depending upon market conditions and opportunities; andBankMobile's ability to successfully implement its growth strategy and control expenses.You are cautioned not to place undue reliance on any forward-looking statements we make, which speak only as of the date they are made. We do not undertake any obligation to release publicly or otherwise provide any revisions to any forward-looking statements we may make, including any forward-looking financial information, to reflect events or circumstances occurring after the date hereof or to reflect the occurrence of unanticipated events, except as may be required under applicable law.

Investment Proposition Customers Bank’s BankMobile Division was Classified as Held for Sale in Customers Consolidated Financial Statements included in the January 2017 Earnings Release. Amounts presented are “Combined”, Including Both Continuing and Discontinued Operations, Unless Otherwise Indicated.

Investment Proposition Strong Organic Growth, Well Capitalized, Branch Lite Bank in Attractive Markets$9.4 billion asset bank with only 21 sales officesWell capitalized at 12.9% total risk based capital (estimated), 9.1% tier 1 leverage, and 6.7% tangible common equity to average tangible assets (1) Target market from Boston to Philadelphia along Interstate 95Strong Profitability, Growth & Efficient Operations2016 diluted earnings per share up 17.9% over 2015 with a ROAA of .86% and a ROACE of 12.41%Pre-tax, pre-provision ROAA (2) and ROACE(3) for 2016 was 1.40% and 21.19% respectively 2016 net income available to common shareholders of $69.2 million up 23.3% over 2015 2016 net interest margin was 2.84%Operating efficiencies offset tighter margins and generate sustainable profitability2016 efficiency ratio was 56.9% Strong Profitability, Growth & Efficient Continuing Operations2016 continuing operations diluted earnings per share up 23.7% over 2015 with a ROAA of .97% and a ROACE of 14.03%2016 continuing operations net income available to common shareholders of $78.2 million up 29.07% over 2015 Continuing operations DDA and total deposits compounded annual growth of 62% and 55% respectively since 2009 2016 continuing operations efficiency ratio was 46.9% Non-GAAP measure calculated as GAAP total shareholders equity less preferred stock, less goodwill and other intangibles divided by average total assets less average goodwill and other intangibles.Non-GAAP measure calculated as GAAP net income, plus provisions for loan losses and income tax expense divided by average total assets.Non-GAAP measure calculated as GAAP net income available to common shareholders, plus provision for loan losses and income tax expense divided by average common equity. Amounts presented are on a “Combined” basis unless otherwise noted.

Investment Proposition Strong Credit Quality & Low Interest Rate Risk0.22% non-performing loans at December 31, 2016Total reserves to non-performing loans of 215.31%Attractive ValuationDecember 31, 2016 share price of $35.82, 15.5x 2016 earningsCAGR of 23% in shareholder value since Dec 31, 2009December 31, 2016 tangible book value(1) of $20.49, up 78% since Dec 2011 with a CAGR of 12% Amounts presented are on a “Combined” basis. Non-GAAP measure calculated as GAAP total shareholders equity less preferred stock, less goodwill and other intangibles divided by common shares outstanding.

Key Q4 2016 Decisions Affecting Reported Amounts Classification of BankMobile as Held-For-SaleCustomers announced in October 2016 of its intent to sell BankMobile in 2017. Customers believes BankMobile can be sold at a substantial gain, further strengthening the Company’s capital and balance sheet. Accounting rules require that the assets and liabilities of the business to be sold be separately aggregated and reported as held-for-sale on the balance sheet. Accounting rules further stipulate that BankMobile be separately reported as discontinued operations on the income statement. These presentation changes also affect supporting schedules, and all changes are appropriately reflected in this document.Exit of Religare Enterprises Limited (“Religare”) Equity HoldingsCustomers has decided to exit its current approximately $22 million cost basis holdings in Religare Enterprises Limited, a financial services holding company headquartered near New Delhi, India. Customers had entered into its Religare equity investment in August 2013 with the expectation of Religare acquiring a bank charter in India and the company providing expanded financial services within that country. As Religare has not been able to acquire a banking license after three years, Customers has decided to exit or significantly reduce its equity holdings. Customers continues to study alternative strategies for exiting its Religare equity holdings. As a result of its decision to exit or significantly reduce its holdings of Religare equity securities, Customers recognized an impairment loss of $7.3 million in the fourth quarter of 2016. Adoption of ASU 2016-9, Improvements to Employee Share Based Accounting (“ASU 2016-9”)In the fourth quarter of 2016, Customers decided to early adopt ASU 2016-9. The decision combined with the vesting of a significant number of shares pursuant to Customers compensation programs in December 2016, resulted in the recognition of a benefit which reduces the income tax expense line item by $4.2 million for 2016, and a benefit which reduces the income tax expense line item by $3.6 million for Q4 2016. Amounts presented are on a “Combined” basis.

Banking Industry Trends……How Do We Deal with These Issues Impediments to Growth External Forces Role of traditional bank branches changing very rapidlyMobile banking fastest growing channelBanks of all sizes revisiting their business strategies, revenue generation models and cost structuresTechnology and customer needs, desires and style changing rapidlyStudents, underbanked and middle class paying lion’s share of fees to banks Traditional CRE lending very difficult to do and under regulatory scrutinyVery little consumer loan growth; headwinds for consumer credit qualityGrowth exists only at niche playersMortgage banking revenues are extremely volatilePressure to reduce or eliminate Overdraft and other nuisance fees by CFPBRegulators principally focus on strength of risk management and compliance and less on profitable growth Business Issues Shareholder Expectations Start bank and sell at 2 to 3x book no longer an option – what do shareholders of small privately held banks do?Equity markets not available to small banksBanks need to earn 10% or more ROE if they want to remain independentConsistent ROE of 12% or greater and ROA of 1% or greater being rewarded well by market Slow economic growth. Some credit quality concerns emergingFewer good quality consumer and business loan opportunities for non niche playersPressure continues on margin. Days of 3.5%-4.0% margin are gone. Banks need to reduce efficiency ratiosDifficult to attract good talentMust be excellent at risk management and complianceShareholders want 10%+ ROE, consistent quality growth and strong risk management infrastructure Issues facing Us What is our unique strategy for revenue and profitable growth?How do we attract and retain best talent?How do we take advantage of technology?How do we deal with growing compliance burden?How do we manage our risks better than peers?How do we lower our efficiency ratios?How do we identify and address regulatory matters associated with crossing $10b in total assets?

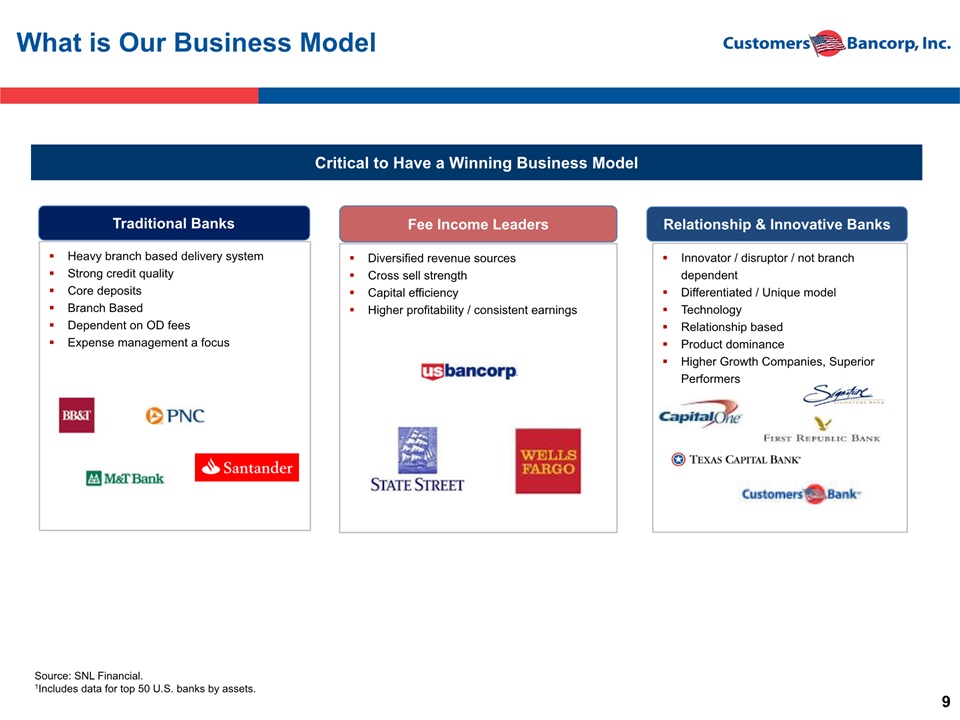

Innovator / disruptor / not branch dependentDifferentiated / Unique modelTechnologyRelationship basedProduct dominanceHigher Growth Companies, Superior Performers What is Our Business Model Critical to Have a Winning Business Model Heavy branch based delivery systemStrong credit qualityCore depositsBranch BasedDependent on OD feesExpense management a focus Traditional Banks Diversified revenue sourcesCross sell strengthCapital efficiencyHigher profitability / consistent earnings Fee Income Leaders Relationship & Innovative Banks Source: SNL Financial. 1Includes data for top 50 U.S. banks by assets.

Our Approach to Developing a Winning Business Model Must focus on both “Relationship” or “High Touch” banking combined with “Highly Efficient” or “High Tech”. Strategy should be unique as to not be copied easilyAttract and retain best high quality talent. Business Bankers / Relationship Bankers with approximately 15 years+ experience who bring a book of business with themCompensate leaders based upon risk and profitability with both cash and equityNever deviate from following critical success factorsOnly focus on very strong credit quality nichesHave very strong risk management cultureHave significantly lower efficiency ratio than peers to deliver sustainable strong profitability and growth with lower margin and lower risk profileAlways attract and retain top quality talentCulture of innovation and continuous improvement

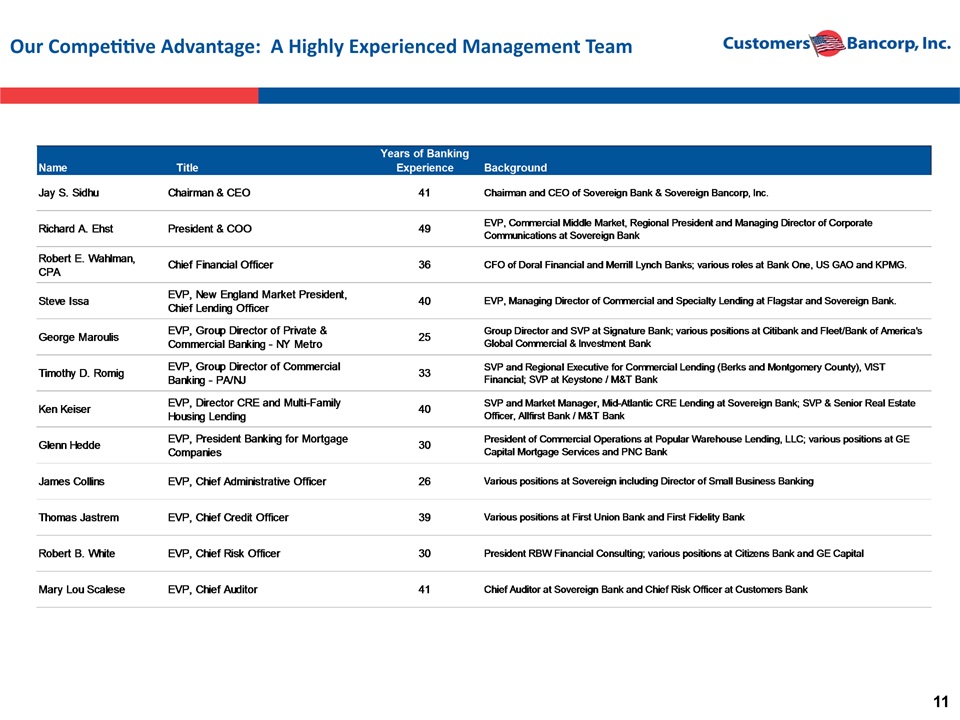

Our Competitive Advantage: A Highly Experienced Management Team

Customers Bank Executing On Our Unique High Performing Banking Model

Disciplined Model for Increasing Shareholder Value Strong organic revenue growth + scalable infrastructure = sustainable double digit EPS = growth and increased shareholder valueA very robust risk management driven business strategyBuild tangible book value per share each quarter via earningsAny book value dilution from any acquisitions must be overcome within 1-2 years; otherwise stick with organic growth strategySuperior execution through proven management team Disciplined Model for Superior Shareholder Value Creation

5 Year Performance Amounts presented are on a “Combined” basis. Source: SNL FinancialNote: Chart begins 2/21/2012, date of first public stock quote for CUBI CUBI KBW Regional Bank

Very Experienced Teams Exceptional Service Risk Based Incentive Compensation Banking Strategy – Community Business Banking Community Business Bank is Focused on businesses - ~95% of revenues come from businessesLoan and deposit business through these well diversified segments:Banking Privately Held Businesses – 42% of portfolio (including deferred costs and fees)Manufacturing, service, technology, wholesale, equipment financingPrivate mid size mortgage companiesBanking High Net Worth Families – 39% of portfolio (including deferred costs and fees)New York and regional multi family lendingSelected Commercial Real Estate – 15% of portfolio Amounts presented are on a continuing operations basis.

Results in: Organic Growth of Deposits with Controlled Costs Source: Company data. Total Deposit Growth ($mm) Average DDA Growth ($mm) Cost of Deposits Total Deposits per Branch ($mm) Customers’ strategies of single point of contact and recruiting known teams in target markets produce rapid deposit growth with low total cost Amounts presented are on a continuing operations basis.

Lending Strategy High Growth with Strong Credit QualityContinuous recruitment and retention of high quality teamsCentralized credit committee approval for all loansLoans are stress tested for higher rates and a slower economyInsignificant delinquencies on loans originated since new management team took overCreation of solid foundation for future earnings Source: Company data. Includes deferred costs and fees. Amounts presented are on a continuing operations basis.

NPL Source: SNL Financial, Company data. Peer data consists of Northeast and Mid-Atlantic banks and thrifts with comparable size in assets and loan portfolios (excluding banks with large residential mortgage loan portfolios). Industry data includes all commercial and savings banks. Peer and Industry data as of September 30, 2016 Build an Outstanding Loan Quality Portfolio Charge Offs Asset Quality Indicators Continue to be Strong Note: Customers 2015 charge-offs includes 12 bps for a $9 million fraudulent loan NPL amounts presented are on a Continuing Operations basis. Charge Off amounts presented are on a “Combined” basis and include $592 thousand of charge offs related to BankMobile.

C&I & Owner Occupied CRE Banking Strategy Private & Commercial BankingTarget companies with up to $100 million annual revenuesSingle point of contactNE, NY, PA & NJ marketsSBA loans originated by small business relationship managersBanking Mortgage CompaniesPrivate banking focused on privately held mortgage companies generally with equity of $5 to $10 million Very strong credit quality relationship business with good fee income and deposits~75 strong mortgage companies as clients All outstanding loans are variable rate and classified as held for saleNon-interest bearing DDA’s are about 10% of outstanding loans Banking Privately Held Business Commercial Loan and Deposit Growth ($mm) Source: Company data based on continuing operations. Amounts presented are on a continuing operations basis.

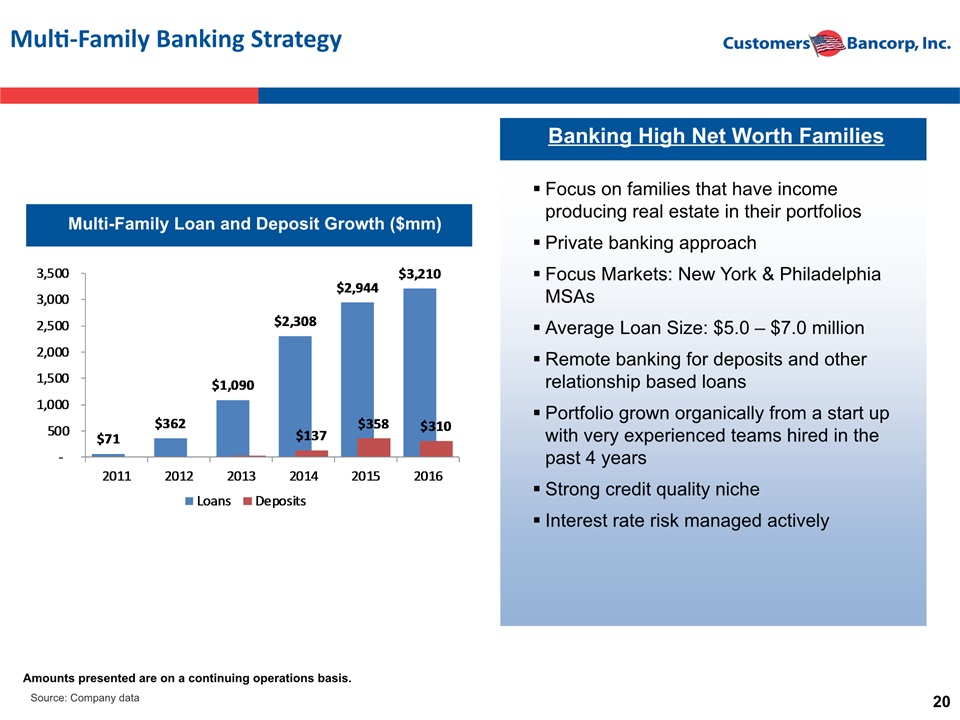

Multi-Family Banking Strategy Banking High Net Worth Families Multi-Family Loan and Deposit Growth ($mm) Focus on families that have income producing real estate in their portfoliosPrivate banking approachFocus Markets: New York & Philadelphia MSAsAverage Loan Size: $5.0 – $7.0 millionRemote banking for deposits and other relationship based loansPortfolio grown organically from a start up with very experienced teams hired in the past 4 yearsStrong credit quality nicheInterest rate risk managed actively Source: Company data Amounts presented are on a continuing operations basis.

Staff Expense Ratio Build Efficient Operations Source: SNL Financial, Company data based on continuing operations. Peer data consists of Northeast and Mid-Atlantic banks and thrifts with comparable size in assets and loan portfolios (excluding banks with large residential mortgage loan portfolios). Industry data includes SEC reporting banks. Peer and Industry data as of September 30, 2016. Occupancy Expense Ratio Total Costs as a % of Assets Total Revenue per Employee ($000s) Assets per Employee ($mm) Amounts presented are on a Continuing Operations basis.

Deposit, Lending and Efficiency Strategies Result in Disciplined & Profitable Growth Total Revenue ($mm) (1) Core Net Income ($mm) (1) (2) Net Interest Income ($mm) (1) Strategy execution has produced superior growth in revenues and earnings Core Income / Expense Growth ($mm) (1) (2) Source: Company dataNon-GAAP measure calculated as GAAP net income less/plus securities gains and losses (including the impairment loss recognized on the equity investment) . Amounts presented are on a Continuing Operations basis.

Tangible BV per Share (1) Building Customers to Provide Superior Returns to Investors Recent Performance Results Financial Performance Targets Non-GAAP measure calculated as GAAP total shareholders equity less preferred stock, less goodwill and other intangibles divided by common shares outstanding. Amounts presented are on a “Combined” basis.

Customers BankCommunity Business Banking and BankMobile Business Segments

Business Segment Disclosures Customers Bank acquired the Disbursements Business of Higher One, Inc. on June 15, 2016The acquired Disbursements Business was combined with Customers Bank’s existing BankMobile product line in Q2 2016Effective for the 2016 fourth quarter and year end financial reports, Customers begins reporting BankMobile as discontinued operations/held for sale to the investor community

History of BankMobile 2014 – Customers Bank began development of a consumer bank in alignment with the future model of banking A completely branchless experience A fin-tech company with a bank charter10X better customer acquisition and retention strategy than traditional playersBetter product than what exists today Sustainable business model 2015 (January) – Launched BankMobile app 1.0Keep it simpleBest in class user experienceApp speaks with an authentic voice2016 (June) – Acquired Disbursements BusinessCombined Disbursements and BankMobile Transform students into customers for lifeLeverage platform to extend services to white label partners2016 (October) – Announced intent to divest BankMobile

Segment Financial Performance Results Comparable 2015 periods are not provided as BankMobile was not operating as a segment in 2015 and its operations were not material.Segment results presented above include an internal allocation from Community Business Banking to BankMobile of $2.5 million in Q4 2016 and $6.9 million year to date December 31, 2016 for interest on deposits generated by the BankMobile segment used to fund the Community Business Banking Segment. The discontinued operations loss disclosed in the income statement prepared in accordance with generally accepted accounting principles (“GAAP”) does not consider the funds transfer pricing benefits of deposits.Direct operating revenues and costs are captured separately in the accounting records for each business segment. All corporate overhead costs are assigned to the Community Business Banking segment as those costs are expected to stay with the segment following the sale of the BankMobile segment, currently anticipated to occur within 6 to 12 months. Amounts presented are on a “Combined” basis.

Other BankMobile Results Migrated 374,000 checking accounts previously with another Higher One, Inc. partner bank since acquisition at the customers’ election with transferred balances totaling approximately $700 million between starting balances and incoming deposits. Opened over 222,000 new checking accounts since June 16, 2016.38% of Title IV funds received by students at colleges to which BankMobile provided disbursement services in Fall 2016 were deposited into accounts with BankMobile. Other students receiving Title IV funds at these colleges requested the transfer of funds to existing accounts at other banks or received a check.Signed contracts to provide disbursement services to an additional 27 educational institutions with student enrollment totaling 173,000 since May 2016, which will be online for the fall 2017 student enrollment cycle.Funds received from educational institutions and processed to students totaled $1.56 billion during Q4, 2016.Active checking accounts (checking accounts with at least one transaction in the past year) serviced number 1.22 million as of December 31, 2016, with balances of $309.6 million on that date. Amounts presented are on a “Combined” basis.

Contacts Company:Robert Wahlman, CFO Tel: 610-743-8074 rwahlman@customersbank.comwww.customersbank.com Jay SidhuChairman & CEOTel: 610-301-6476 jsidhu@customersbank.comwww.customersbank.com

Appendix

Customers Bank Risk Management

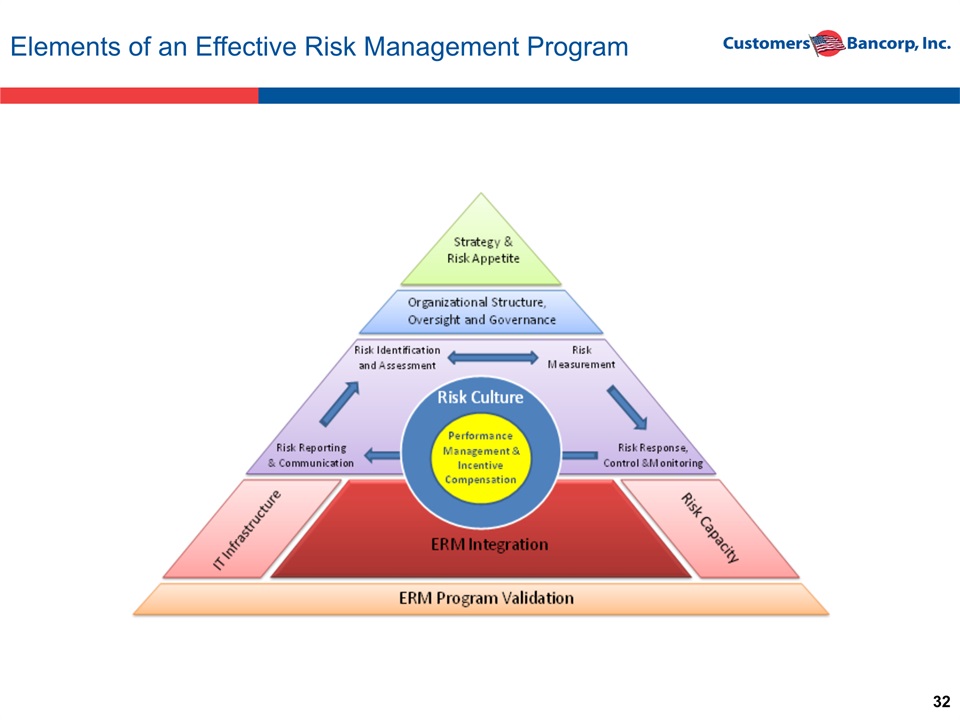

Elements of an Effective Risk Management Program

ERM Framework at Customers Bancorp, Inc. Well Defined ERM Plan – ERM Integration into CAMELS +++++

Customers Bancorp, Inc. Financial Statements

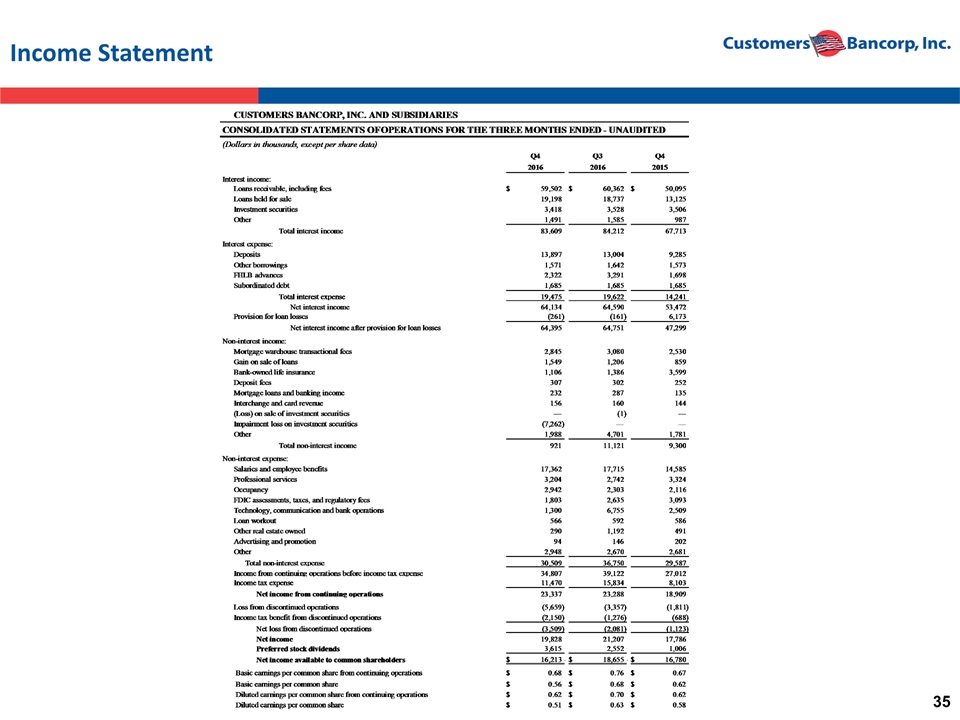

Income Statement

Income Statement

Balance Sheet

Net Interest Margin

Net Interest Margin

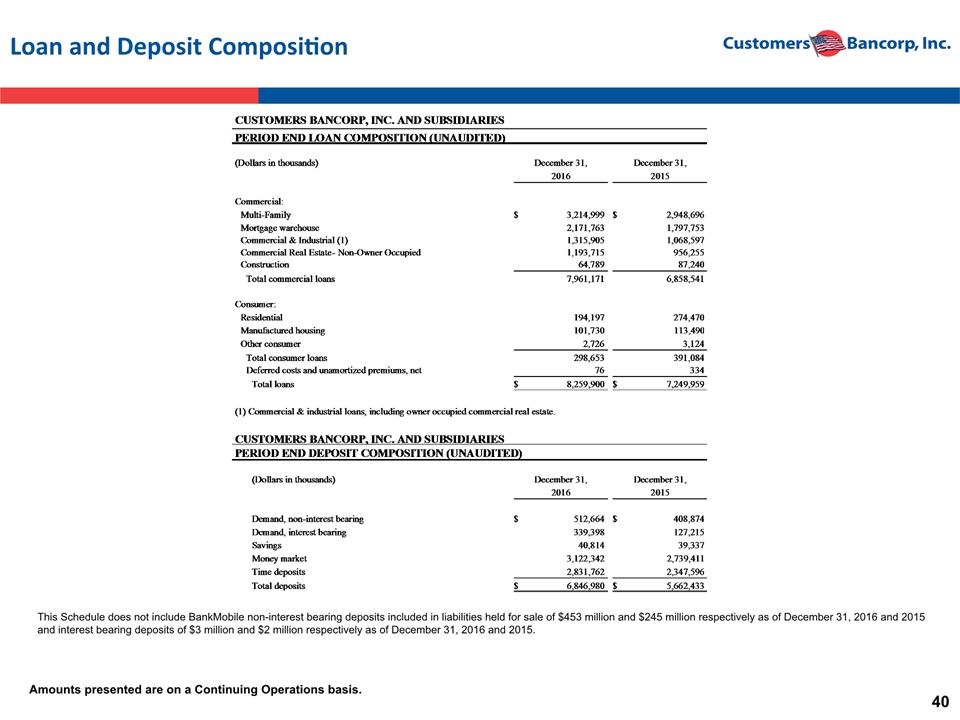

Loan and Deposit Composition This Schedule does not include BankMobile non-interest bearing deposits included in liabilities held for sale of $453 million and $245 million respectively as of December 31, 2016 and 2015 and interest bearing deposits of $3 million and $2 million respectively as of December 31, 2016 and 2015. Amounts presented are on a Continuing Operations basis.

Asset Quality Amounts presented are on a Continuing Operations basis.

Net Charge Offs Amounts presented are on a “Combined” basis.

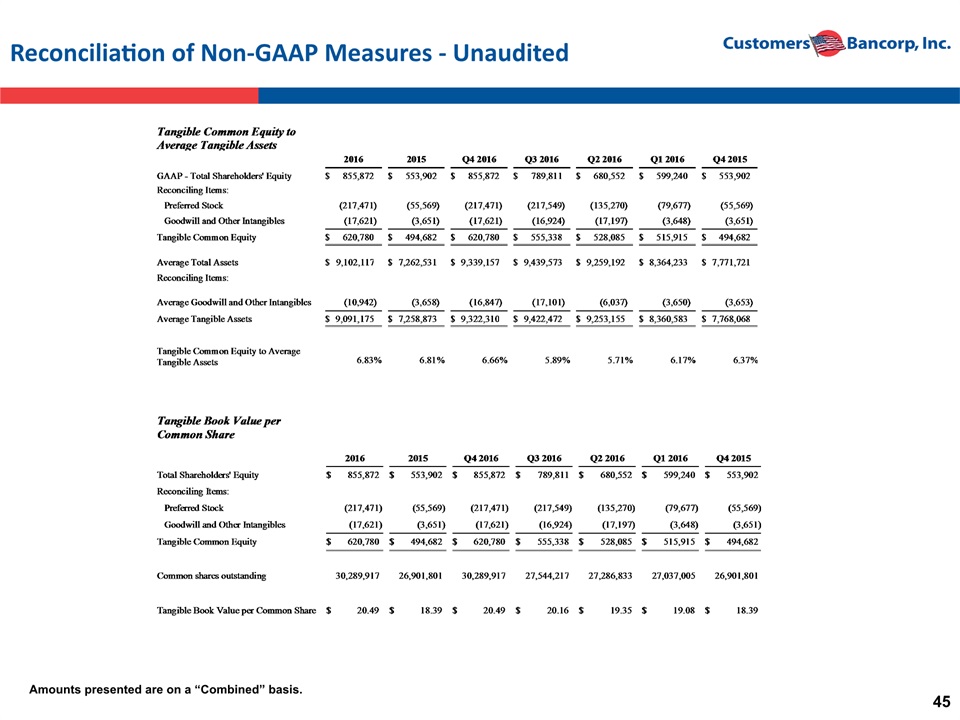

Reconciliation of Non-GAAP Measures - Unaudited (Dollars in thousands, except per share data)Customers believes that the non-GAAP measurements disclosed within this document are useful for investors, regulators, management and others to evaluate our results of operations and financial condition relative to other financial institutions. These non-GAAP financial measures exclude from corresponding GAAP measures the impact of certain elements that we do not believe are representative of our financial results, which we believe enhance an overall understanding of our performance. Investors should consider our performance and financial condition as reported under GAAP and all other relevant information when assessing our performance or financial condition. Although non-GAAP financial measures are frequently used in the evaluation of a company, they have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our results of operations or financial condition as reported under GAAP.The following tables present reconciliations of GAAP to Non-GAAP measures disclosed within this document. Amounts presented are on a “Combined” basis.

Reconciliation of Non-GAAP Measures - Unaudited Amounts presented are on a “Combined” basis.

Reconciliation of Non-GAAP Measures - Unaudited Amounts presented are on a “Combined” basis.