Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - PACIFIC MERCANTILE BANCORP | pmbcinvestordeckpressrelea.htm |

| 8-K - 8-K - PACIFIC MERCANTILE BANCORP | pmbcjan2017investorpresent.htm |

INVESTOR PRESENTAT ION

F E B R U A R Y 2 0 1 7

1

This presentation contains statements regarding our expectations, beliefs and views about our future financial performance and our business, trends

and expectations regarding the markets in which we operate, and our future plans. Those statements constitute “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, can be

identified by the fact that they do not relate strictly to historical or current facts. Often, they include words such as “believe,” “expect,” “anticipate,”

“intend,” “plan,” “estimate,” “project,” or words of similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could,” or “may”.

Forward-looking statements are based on current information available to us and our assumptions about future events over which we do not have

control. Moreover, our business and our markets are subject to a number of risks and uncertainties which could cause our actual financial

performance in the future, and the future performance of our markets (which can affect both our financial performance and the market prices of our

shares), to differ, possibly materially, from our expectations as set forth in the forward-looking statements contained in this presentation. In addition to

the risk of incurring loan losses, which is an inherent risk of the banking business, these risks and uncertainties include, but are not limited to, the

following: the risk that the economic recovery in the United States, which is still relatively fragile, will be adversely affected by domestic or international

economic conditions, which could cause us to incur additional loan losses and adversely affect our results of operations in the future; the risk that our

results of operations in the future will continue to be adversely affected by our exit from the wholesale residential mortgage lending business and the

risk that our commercial banking business will not generate the additional revenues needed to fully offset the decline in our mortgage banking

revenues within the next two to three years; the risk that our interest margins and, therefore, our net interest income will be adversely affected by

changes in prevailing interest rates; the risk that we will not succeed in further reducing our remaining nonperforming assets, in which event we would

face the prospect of further loan charge-offs and write-downs of other real estate owned and would continue to incur expenses associated with the

management and disposition of those assets; the risk that we will not be able to manage our interest rate risks effectively, in which event our operating

results could be harmed; the prospect that government regulation of banking and other financial services organizations will increase, causing our costs

of doing business to increase and restricting our ability to take advantage of business and growth opportunities. Additional information regarding these

and other risks and uncertainties to which our business is subject are contained in our Annual Report on Form 10-K for the year ended December 31,

2015 which is on file with the SEC as well as subsequent Quarterly Reports on Form 10-Q that we file with the SEC. Due to these and other risks and

uncertainties to which our business is subject, you are cautioned not to place undue reliance on the forward-looking statements contained in this news

release, which speak only as of its date, or to make predictions about our future financial performance based solely on our historical financial

performance. We disclaim any obligation to update or revise any of the forward-looking statements as a result of new information, future events or

otherwise, except as may be required by law.

FORWARD LOOKING STATEMENTS

2

CORPORATE OVERVIEW

_________________________________

PACIFIC MERCANTILE BANK IS A

FULL SERVICE BUSINESS BANK

SERVING SOUTHERN CALIFORNIA

Bank founded in 1999

$1.1 billion in total assets

9 offices in Southern California

Focused on serving small- and

middle-market businesses

32% owned by Carpenter

Community BancFund

CORPORATE HEADQUARTERS

COSTA MESA, CALIFORNIA

3

OFFICE LOCATIONS

_________________________________

ONTARIO

BEVERLY HILLS

LA HABRA

COSTA MESA

IRVINE SPECTRUM

NEWPORT BEACH

SAN DIEGO

4

MARKET POSITIONING

_________________________________

“We Help Companies Succeed”

Differentiating Strategy to Target Business Clients

5

Small- to Medium-

Sized Businesses

•Need for financial

guidance

• Limited internal

financial sophistication

• Limited outside

advisory support

Horizon

Analytics

• Financial analysis

•Business planning

•Modeling and

forecasting

•Balance sheet

management

Service/Products

•Customized Commercial

Loans

•Asset Based Lending

•Owner Occupied RE

•Treasury Management

•Value driven pricing

LOAN PORTFOLIO

FOCUS ON RELATIONSHIP LENDING

_________________________________

CRE: all

other, 18.3%

CRE: owner-

occupied,

22.7%

Commercial,

35.2%

Multifamily,

[VALUE]

SFR,

[VALUE]

[CATEGORY

NAME]

[VALUE]

$ 947 Million as of

December 31, 2016

6

CRE: all

other, 20.6%

CRE: owner-

occupied,

22.7%

Commercial,

23.4%

Multifamily,

[VALUE]

SFR,

[VALUE]

Other,

7.0%

$ 731 Million as of

December 31, 2012

46.1% Relationship Loans

57.9% Relationship Loans

Increasing Loan Production

_________________________________

7

$51.4

$66.5

$137.7

$124.3

$167.0

68.6%

64.3%

63.1%

55.9% 58.1%

40%

45%

50%

55%

60%

65%

70%

75%

80%

$0.0

$50.0

$100.0

$150.0

$200.0

4Q15 1Q16 2Q16 3Q16 4Q16

New Loan Commitments

($ in millions)

Branch repositioning strategy

has put more of the staff in

business development roles

Better sales execution and

leveraging the competitive

advantages of Horizon Analytics

Improved coordination and

collaboration between

relationship managers and

credit administration

Increasing loan production

partially offset by declining

utilization rates

C&I Line Utilization

Asset Quality

_________________________________

8

$32.9

$38.8

$29.7

$68.5

$53.9

$0.0

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

$70.0

$80.0

12/31/15 3/31/16 6/30/16 9/30/16 12/31/16

Classified Assets

Complete overhaul of credit administration in

the first half of 2016

New CCO implemented improved loan

monitoring and underwriting standards

Comprehensive credit review resulted in

significant credit downgrades

Classified assets declined 21% in 4Q16,

primarily due to payoffs

Further credit improvement expected in 1H17

as other classified loans are paid off or

upgraded

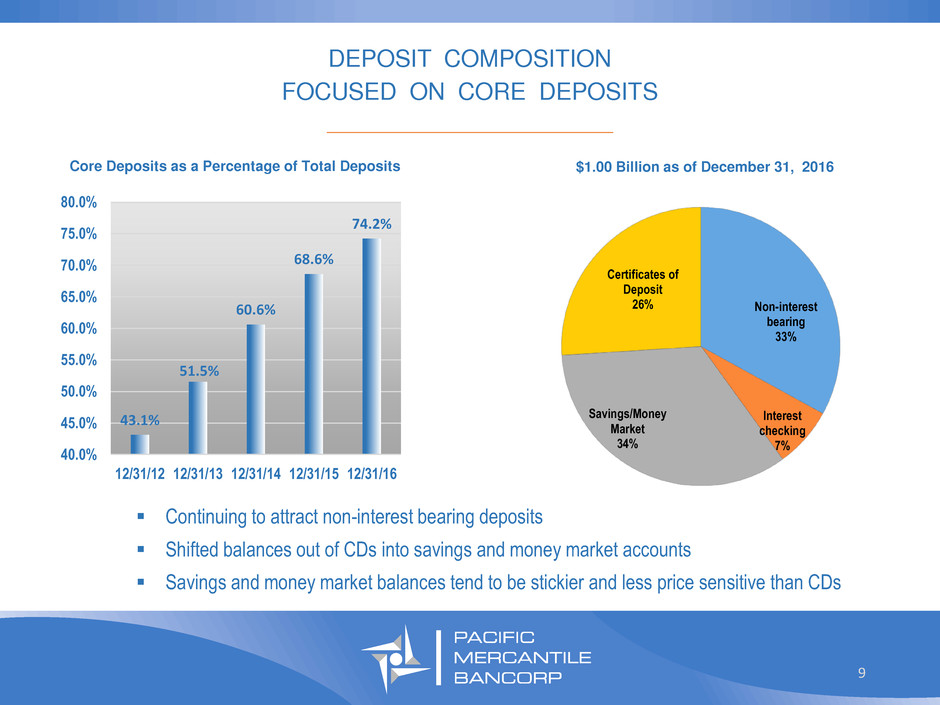

DEPOSIT COMPOSITION

FOCUSED ON CORE DEPOSITS

_________________________________

$1.00 Billion as of December 31, 2016

Continuing to attract non-interest bearing deposits

Shifted balances out of CDs into savings and money market accounts

Savings and money market balances tend to be stickier and less price sensitive than CDs

Non-interest

bearing

33%

Interest

checking

7%

Savings/Money

Market

34%

Certificates of

Deposit

26%

Core Deposits as a Percentage of Total Deposits

9

43.1%

51.5%

60.6%

68.6%

74.2%

40.0%

45.0%

50.0%

55.0%

60.0%

65.0%

70.0%

75.0%

80.0%

12/31/12 12/31/13 12/31/14 12/31/15 12/31/16

STRONG CAPITAL POSITION

_________________________________

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

TOTAL CAPITAL RATIO TIER 1 CAPITAL RATIO COMMON EQUITY TIER 1

CAPITAL RATIO

12.8%

11.5%

9.9% 10.0%

8.0%

6.5%

PMBC WELL-CAPITALIZED REQUIREMENT

10

As of December 31, 2016

OUTLOOK

_________________________________

Strong loan growth in 2017 and beyond

Growing business banking relationships

Increasing focus on larger operating companies ($5-$10 million credits)

Stable to increasing net interest margin

Well positioned to benefit from rising interest rates

Higher non-interest income

New business clients using more treasury management products

Relatively stable expense levels

Investment in infrastructure offset by a decline in professional fees

Improving credit quality with manageable credit costs

Continue moving lower quality credits out of the bank

Leading to steady increase in profitability

11

I n v e s t o r R e l a t i o n s :

C u r t C h r i s t i a n s s e n

( 7 1 4 ) 4 3 8 - 2 5 3 1

C u r t . c h r i s t i a n s s e n @ p m b a n k . c o m

12