Attached files

| file | filename |

|---|---|

| EX-99.4 - EXHIBIT 99.4 - LendingTree, Inc. | exhibit994.htm |

| EX-99.3 - EXHIBIT 99.3 - LendingTree, Inc. | ex993.htm |

| EX-23.1 - EXHIBIT 23.1 - LendingTree, Inc. | exhibit231.htm |

| 8-K/A - 8-K/A - LendingTree, Inc. | ihh8-ka.htm |

Iron Horse Holdings, LLC

Report on Financial Statements

For the year ended December 31, 2015

Iron Horse Holdings, LLC

Contents

Page

Independent Auditor’s Report ............................................................................................................................. 1 - 2

Financial Statements

Balance Sheet ....................................................................................................................................................... 3

Statement of Operations and Members’ Deficit ................................................................................................. 4

Statement of Cash Flows ..................................................................................................................................... 5

Notes to Financial Statements ...................................................................................................................... 6 - 10

Independent Auditor’s Report

To the Members

Iron Horse Holdings, LLC

Charleston, South Carolina

We have audited the accompanying financial statements of Iron Horse Holdings, LLC (the “Company”) which

comprise the balance sheet as of December 31, 2015, and the related statements of operations and members’

deficit, and cash flows for the year then ended, and the related notes to the financial statements.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in

accordance with accounting principles generally accepted in the United States of America; this includes the

design, implementation, and maintenance of internal control relevant to the preparation and fair presentation

of financial statements that are free from material misstatement, whether due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our

audit in accordance with auditing standards generally accepted in the United States of America. Those standards

require that we plan and perform the audit to obtain reasonable assurance about whether the financial

statements are free from material misstatement.

An audit involves performing procedures to obtain evidence about the amounts and disclosures in the financial

statements. The procedures selected depend on the auditor’s judgment, including the assessment of risks of

material misstatement of the financial statements, whether due to fraud or error. In making those risk

assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of

the financial statements in order to design audit procedures that are appropriate in the circumstances, but not

for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we

express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and

the reasonableness of significant accounting estimates made by management, as well as evaluating the overall

presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our

audit opinion.

2

Opinion

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial

position of Iron Horse Holdings as of December 31, 2015, and the results of its operations and its cash flows for

the year then ended in conformity with accounting principles generally accepted in the United States of

America.

Richmond, Virginia

November 11, 2016

See Notes to Financial Statements

3

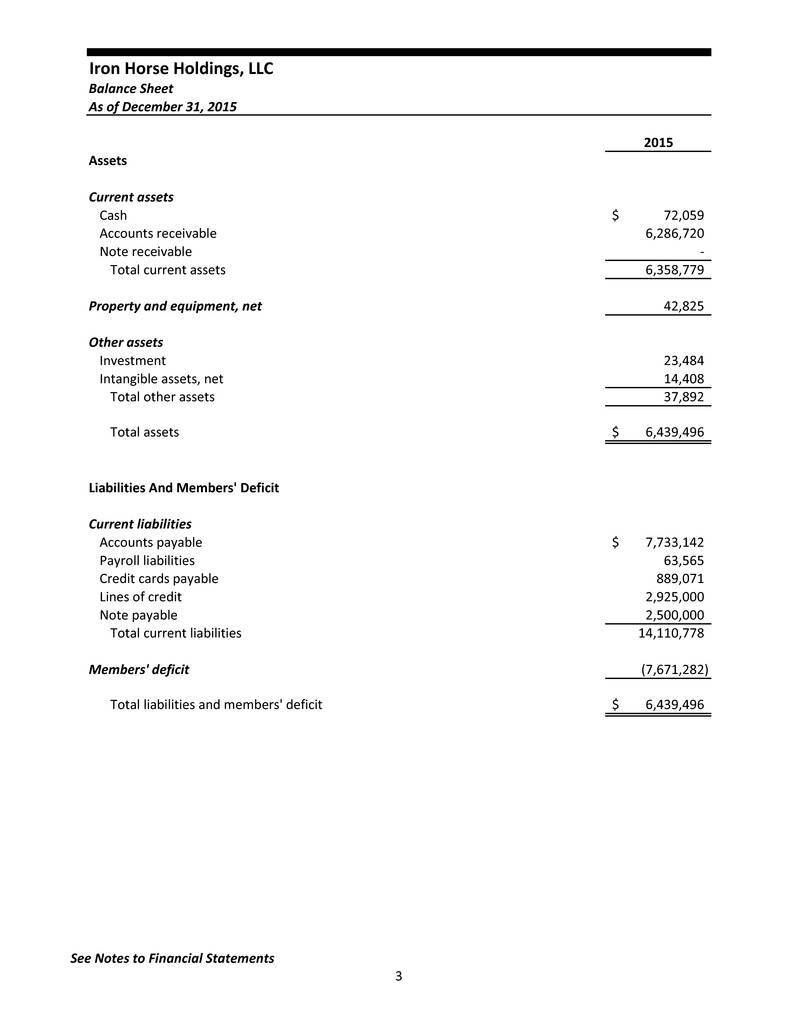

Iron Horse Holdings, LLC

Balance Sheet

As of December 31, 2015

2015

Assets

Current assets

Cash 72,059$

Accounts receivable 6,286,720

Note receivable -

Total current assets 6,358,779

Property and equipment, net 42,825

Other assets

Investment 23,484

Intangible assets, net 14,408

Total other assets 37,892

Total assets 6,439,496$

Liabilities And Members' Deficit

Current liabilities

Accounts payable 7,733,142$

Payroll liabilities 63,565

Credit cards payable 889,071

Lines of credit 2,925,000

Note payable 2,500,000

Total current liabilities 14,110,778

Members' deficit (7,671,282)

Total liabilities and members' deficit 6,439,496$

See Notes to Financial Statements

4

Iron Horse Holdings, LLC

Statement of Operations and Members' Deficit

For the year ended December 31, 2015

2015

Sales 54,430,789$

Selling and marketing expenses 53,482,651

Operating expenses

Salaries 1,019,011

Professional fees 907,635

Commissions 131,701

Rent 86,130

Payroll taxes 85,834

Website maintenance and related costs 45,366

Office supplies and postage 31,210

Employee benefits and insurance 25,758

Charitable contributions and scholarship 28,482

Travel 28,392

Dues and subscriptions 26,901

Miscellaneous 19,645

Depreciation and amortization 7,001

State license and filing fees 4,856

Storage 4,519

Utilities 4,172

Entertainment and meals 1,673

Automobile 339

Profit sharing 9,790

Total operating expenses 2,468,415

Operating income (loss) (1,520,277)

Other income (expense)

Guaranteed payments (260,000)

Interest expense (105,878)

Other income, net 31,441

Total other income (expense) (334,437)

Net income (loss) (1,854,714)

Beginning members' equity (deficit) (1,701,881)

Member distributions (4,114,687)

Ending members' deficit (7,671,282)$

See Notes to Financial Statements

5

Iron Horse Holdings, LLC

Statement of Cash Flows

For the year ended December 31, 2015

2015

Operating activities

Net income (loss) (1,854,714)$

Adjustments to reconcile net income (loss) to net cash

used for operating activities:

Depreciation and amortization 7,001

Loss on investment 6,181

Changes in operating assets and liabiltiies:

Accounts receivable (1,376,607)

Accounts payable 2,375,948

Payroll liabilities (189,739)

Credit cards payable 321,389

Net cash used for operating activities (710,541)

Investing activities

Purchases of equipment (21,268)

Payment from (issuance of) note receivable 232,502

Net cash provided by investing activities 211,234

Financing activities

Borrowings on lines of credit 2,500,000

Repayments on lines of credit (565,000)

Proceeds from note payable 2,500,000

Member distributions (4,114,687)

Net cash provided by financing activities 320,313

Net decrease in cash (178,994)

Cash, at beginning of year 251,053

Cash, at end of year 72,059$

Cash paid for interest 105,878$

Iron Horse Holdings, LLC

Notes to Financial Statements

December 31, 2015

6

Note 1. Summary of Significant Accounting Policies

Business activity:

Iron Horse Holdings, LLC (the “Company”), a Delaware limited liability company, was formed on February 28,

2011. The Company operates a website (comparecards.com) to help people make smarter, more informed,

healthier financial decisions based on a deeper knowledge of financial offers. The Company provides easy-to-

use, objective tools and educational resources that help consumers do everything from making side-by-side

credit card comparisons and managing their credit health to helping children in primary, middle, and high school

learn how to make wise financial decisions.

Basis of accounting and presentation:

These financial statements are prepared in accordance with accounting principles generally accepted in the

United States of America (“GAAP”). The financial statements reflect all adjustments that are necessary for

presentation of the financial position, results of operations, and cash flows for the year presented.

Use of estimates:

The preparation of financial statements in conformity with GAAP requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and

liabilities at the date of the financial statements and the reported amounts of sales and expenses during the

reporting period. Actual results could differ from those estimates.

Cash and cash equivalents:

The Company considers all highly liquid investments with an initial maturity of three months or less to be cash

equivalents. There were no cash equivalents as of December 31, 2015. The Company’s cash balances are

maintained with high quality financial institutions. At times, deposits may exceed Federal Deposit Insurance

Corporation insurance limits.

Accounts receivable and allowance for doubtful accounts:

Accounts receivable are carried at their estimated collectible amounts and are periodically evaluated for

collectability based on management’s assessment of the status of each account. An allowance for doubtful

accounts is established as losses are estimated to have occurred through recognition of bad debt expense. When

management confirms an account receivable is not collectible, such amount is charged off against the allowance

for doubtful accounts. As of December 31, 2015, the Company does not have an allowance for doubtful accounts.

Revenue recognition:

The Company derives sales from commissions which are earned upon approval of credit card applications from

consumers which were referred to the financial institutions through the Company’s websites. The Company

recognizes sales when persuasive evidence of an arrangement exists, delivery has occurred, the fee is fixed or

determinable and collectability is reasonably assured. Delivery is deemed to have occurred at the time that the

financial institution generates the consumer’s credit card approval.

Iron Horse Holdings, LLC

Notes to Financial Statements

December 31, 2015

7

Note 1. Summary of Significant Accounting Policies, Continued

Property and equipment:

Property and equipment are stated at original cost less accumulated depreciation. Major renewals and

betterments are capitalized while routine maintenance and repair costs which do not extend the original useful

lives of the assets are charged to expense as incurred. Depreciation is computed using the straight-line method

over the estimated useful lives of the assets. The estimated useful lives are generally as follows:

Computers 5 years

Furniture and fixtures 5 to 10 years

Investment:

The Company accounts for its 30% investment in DVDs.com, LLC using the equity method. The Company’s initial

interest is recognized at cost, adjusted for the Company’s proportionate share of undistributed earnings or losses.

Intangible assets:

Intangible assets are comprised of expenses paid for the Company’s domain name. The domain name is

amortized over a period of 15 years. Amortization expense for the year ending December 31, 2015 was $1,731.

Advertising:

The Company expenses advertising costs as they are incurred, and reports them as selling and marketing

expenses. The Company had advertising costs of $53,482,651 for the year ended December 31, 2015.

Income taxes:

The Company is a limited liability company and with the consent of its members has elected to be taxed as a

partnership for federal and state income tax purposes. Accordingly, no provision for income taxes has been

made in the accompanying financial statements because the respective members are taxed on their

proportionate share of the Company’s taxable income.

Management evaluates the Company’s tax positions on a periodic basis and has concluded that the Company

has taken no uncertain tax positions that require adjustment to the financial statements. When incurred,

interest and penalties associated with unresolved income tax positions are included in other income and

expense. With few exceptions, the Company is no longer subject to income tax examinations by the U.S. federal,

state, or local tax authorities for all years prior to 2012.

Concentrations and credit risk:

For the year ended December 31, 2015, four financial institutions individually accounted for approximately 43%,

20%, 16% and 14% of total sales, respectively.

Iron Horse Holdings, LLC

Notes to Financial Statements

December 31, 2015

8

Note 1. Summary of Significant Accounting Policies, Continued

Concentrations and credit risk, continued:

Substantially all of the sales from these financial institutions pass through three clearing houses. Given the

timeliness of past payments and the absence of historical problems, management believes that accounts

receivable from these clearing houses are fully collectible in the normal course of business.

Substantially all of the Company’s selling and marketing expenses consist of pay-per-click advertising costs

incurred with three parties who are leaders in web search industry. Management believes that the Company’s

relationship with these parties is good and that the availability of their services will continue in the normal

course of business.

Note 2. Property and Equipment, net

Property and equipment consists of the following as of December 31:

2015

Computers $ 20,485

Furniture and fixtures 37,057

57,542

Less accumulated depreciation 14,717

$ 42,825

Depreciation expense totaled $5,270 for the year ended December 31, 2015.

Note 3. Intangible Assets, net

Intangible assets consist of the following as of December 31:

2015

Domain name $ 29,705

Less accumulated amortization 15,297

$ 14,408

Amortization expense totaled $1,731 for the year ended December 31, 2015.

Note 4. Debt

Note payable:

On October 14, 2015, the Company entered into a $2,500,000 term loan agreement with a financial institution.

The loan carries interest at the U.S. Prime Rate (3.25% as of December 31, 2015). The loan is payable in three

consecutive monthly principal installments of $625,000, beginning on January 14, 2016, with a final payment of

principal and interest due at maturity on April 14, 2016. As of December 31, 2015, the outstanding balance is

$2,500,000. The loan is secured by certain assets of the Company.

Iron Horse Holdings, LLC

Notes to Financial Statements

December 31, 2015

9

Note 4. Debt, Continued

Lines of credit:

On September 29, 2014, the Company opened a line of credit with a financial institution. The maximum amount

the Company can draw on this line of credit is $1,000,000. The line of credit matured on September 29, 2015

and was renewed on November 17, 2015, with an extended maturity date of November 16, 2016. The line of

credit incurs interest at an annual rate of 3.25%. The balance on the line of credit was $925,000 as of December

31, 2015. The line of credit is guaranteed by a member of the Company.

On February 27, 2015, the Company opened an additional line of credit with a different financial institution. The

maximum amount the Company can draw is $2,000,000. This line of credit matures on February 27, 2016 and

incurs interest at the U.S. Prime Rate (3.25% as of December 31, 2015). As of December 31, 2015, the

outstanding balance was $2,000,000. This line of credit is secured by certain assets of the Company.

Note 5. Leases

The Company leases office space in Illinois under an operating lease that expires on November 30, 2016 and

office space in Charleston under an operating lease that expires on March 31, 2017. Rent expense totaled

$86,130 for the year ended December 31, 2015.

Future minimum lease payments under operating leases as of December 31, 2015 are as follows:

2016 $ 78,052

2017 12,731

Total minimum lease payments $ 90,783

Note 6. Related Parties

Beginning January 1, 2013, the Company had a consulting agreement which provided the consultant with a

12.5% return on the taxable income of the Company (corresponding to a 12.5% membership interest in the

Company), as further defined in the respective consulting agreement. Distributions paid to the consultant

relating to the year ended December 31, 2015 are included in guaranteed payments as taxable income was not

sufficient to generate a return on the membership interests. The relationship with the consultant ceased in

2016 and remaining obligations were paid in a settlement in October 2016, the details of which are subject to a

confidentiality agreement. Such payments, however, had no significant impact on the overall financial position

of the Company.

As of December 31, 2014, the Company had an outstanding note receivable of $232,502 from a limited liability

company that is partially owned by a member of the Company. This note was paid in full during 2015.

The Company subleases space in its Charleston office on a month-to-month basis to a limited liability company

that is partially owned by a member of the Company. Rental income related to this lease totaled $15,000 for the

year ended December 31, 2015.

Iron Horse Holdings, LLC

Notes to Financial Statements

December 31, 2015

10

Note 7. Profit Sharing Plan

The Company has a profit sharing plan that covers substantially all employees, with the exception of union,

nonresident aliens, and leased employees, who meet certain age and length of service requirements. Eligible

employees may make salary deferral contributions to the plan. The Company's contribution was equal to up to

three percent of the participants' eligible compensation for the plan year ended December 31, 2015. The

Company may also make discretionary profit sharing contributions. The Company’s contribution expense totaled

approximately $9,790 for the year ended December 31, 2015.

Note 8. Subsequent Events

Management has evaluated events and transactions for potential recognition and/or disclosure through

November 11, 2016, which is the date these financial statements were available to be issued.

All outstanding lines of credit and the note payable outstanding at of December 31, 2015 were paid in full in

2016. In March 2016, the Company entered into a new promissory note with a principal amount of $3,775,000,

bearing interest at an annual interest rate of 4.5%. The new promissory note was scheduled to mature in March

2020, but was paid in full in October 2016.

The Company has received a letter of intent in connection with the potential sale of all of the business.

Assuming approval by all parties, the sale is scheduled to occur by the end of 2016.