Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - ENBRIDGE ENERGY PARTNERS LP | v457582_ex99-2.pdf |

| EX-99.1 - EXHIBIT 99.1 - ENBRIDGE ENERGY PARTNERS LP | v457582_ex99-1.htm |

| EX-10.1 - EXHIBIT 10.1 - ENBRIDGE ENERGY PARTNERS LP | v457582_ex10-1.htm |

| 8-K - 8-K - ENBRIDGE ENERGY PARTNERS LP | v457582_8k.htm |

Exhibit 99.2

2017 Financial Outlook and Strategic Review Update January 27, 2017 Enbridge Energy Partners, L.P.

Legal Notice SLIDE 2 This news release includes forward - looking statements and projections, which are statements that do not relate strictly to historical or current facts . These statements frequently use the following words, variations thereon or comparable terminology : “anticipate,” “believe,” “consider,” “continue,” “could,” “estimate,” “expect,” “explore,” “evaluate,” “forecast,” “intend,” “may,” “opportunity,” “plan,” “position,” “projection,” “should,” “strategy,” “target,” “will” and similar words . Although the Partnership believes that such forward - looking statements are reasonable based on currently available information, such statements involve risks, uncertainties and assumptions and are not guarantees of performance . Future actions, conditions or events and future results of operations may differ materially from those expressed in these forward - looking statements . Many of the factors that will determine these results are beyond the Partnership’s ability to control or predict . Specific factors that could cause actual results to differ from those in the forward - looking statements include : ( 1 ) changes in the demand for or the supply of, forecast data for, and price trends related to crude oil, liquid petroleum, natural gas and NGLs, including the rate of development of the Alberta Oil Sands and shut - downs or cutbacks at refineries, petrochemical plants, utilities or other businesses for which the Partnership transports products or to whom the Partnership sells products ; ( 2 ) the ability of the Partnership or its joint venture partners, as applicable, to successfully complete and finance projects, including the Bakken Pipeline transaction ; ( 3 ) the effects of competition, in particular, by other pipeline systems ; ( 4 ) hazards and operating risks that may not be covered fully by insurance ; ( 5 ) costs in connection with complying with the settlement consent decree related to Line 6 B and Line 6 A, which is still subject to court approval, and/or the failure to receive court approval of, or material modifications to, such decree ; ( 6 ) changes in or challenges to the Partnership’s tariff rates ; ( 7 ) changes in laws or regulations to which the Partnership is subject, including compliance with environmental and operational safety regulations that may increase costs of system integrity testing and maintenance ; and ( 8 ) permitting at federal, state and local levels or renewals of rights of way . F orward - looking statements regarding sponsor support transactions or sales of assets (to Enbridge or otherwise) are further qualified by the fact that Enbridge is under no obligation to provide additional sponsor support and neither Enbridge nor any third party is under any obligation to offer to buy or sell us assets, and we are under no obligation to buy or sell any such assets . As a result, we do not know when or if any such transactions will occur . Any statements regarding sponsor expectations or intentions are based on information communicated to us by Enbridge, but there can be no assurance that these expectations or intentions will not change in the future . Except to the extent required by law, we assume no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise . Reference should also be made to the Partnership’s filings with the U . S . Securities and Exchange Commission (the “SEC”), including its Annual Report on Form 10 - K , Current Reports on Form 8 - K and any subsequently filed Quarterly Report on Form 10 - Q for additional factors that may affect results . These filings are available to the public over the Internet at the SEC’s web site ( www . sec . gov ) and at the Partnership’s web site .

Agenda SLIDE 3 1. 2017 Financial Outlook 2. Strategic Review Update 3. Question & Answer

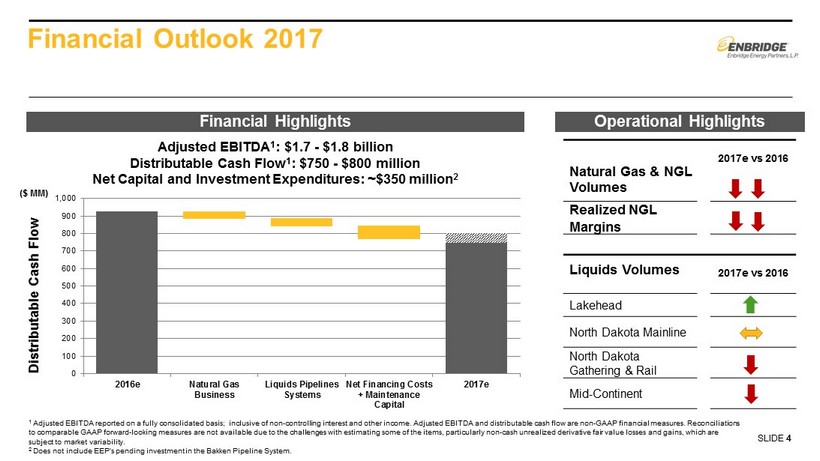

0 100 200 300 400 500 600 700 800 900 1,000 2016e Natural Gas Business Liquids Pipelines Systems Net Financing Costs + Maintenance Capital 2017e Distributable Cash Flow ($ MM) Financial Outlook 2017 SLIDE 4 1 Adjusted EBITDA reported on a fully consolidated basis; inclusive of non - controlling interest and other income . Adjusted EBITDA and distributable cash flow are non - GAAP financial measures. Reconciliations to comparable GAAP forward - looking measures are not available due to the challenges with estimating some of the items, particula rly non - cash unrealized derivative fair value losses and gains, which are subject to market variability. 2 Does not include EEP’s pending investment in the Bakken Pipeline System. Adjusted EBITDA 1 : $1.7 - $1.8 billion Distributable Cash Flow 1 : $750 - $800 million Net Capital and Investment Expenditures: ~$350 million 2 Liquids Volumes 2017e vs 2016 Lakehead North Dakota Mainline North Dakota Gathering & Rail Mid - Continent Operational Highlights Financial Highlights Natural Gas & NGL Volumes 2017e vs 2016 Realized NGL Margins

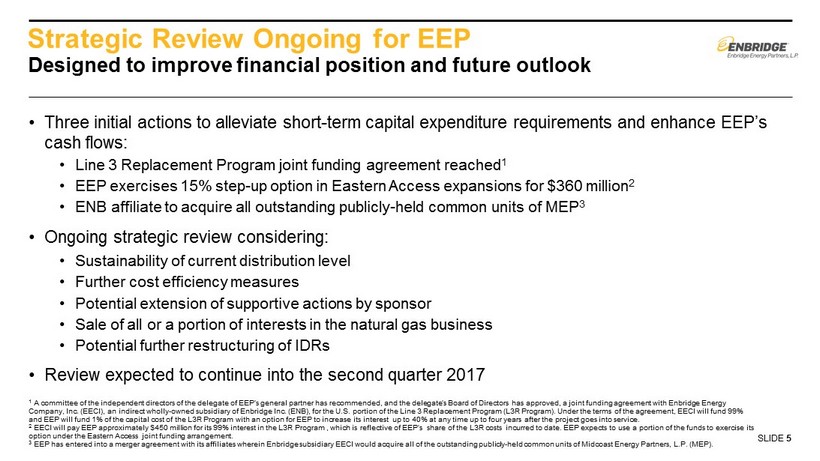

Strategic Review Ongoing for EEP • Three initial actions to alleviate short - term capital expenditure requirements and enhance EEP’s cash flows: • Line 3 Replacement Program joint funding agreement reached 1 • EEP exercises 15% step - up option in Eastern Access expansions for $360 million 2 • ENB affiliate to acquire all outstanding publicly - held common units of MEP 3 • Ongoing strategic review considering: • Sustainability of current distribution level • Further cost efficiency measures • Potential extension of supportive actions by sponsor • Sale of all or a portion of interests in the natural gas business • Potential further restructuring of IDRs • Review expected to continue into the second quarter 2017 SLIDE 5 Designed to improve financial position and future outlook 1 A committee of the independent directors of the delegate of EEP’s general partner has recommended, and the delegate’s Board o f Directors has approved, a joint funding agreement with Enbridge Energy Company, Inc. (EECI), an indirect wholly - owned subsidiary of Enbridge Inc. (ENB), for the U.S. portion of the Line 3 Replacement Program (L3R Program). Under the terms of the agreement, EECI will fund 99% and EEP will fund 1% of the capital cost of the L3R Program with an option for EEP to increase its interest up to 40% at any ti me up to four years after the project goes into service. 2 EECI will pay EEP approximately $450 million for its 99% interest in the L3R Program , which is reflective of EEP’s share of t he L3R costs incurred to date. EEP expects to use a portion of the funds to exercise its option under the Eastern Access joint funding arrangement. 3 EEP has entered into a merger agreement with its affiliates wherein Enbridge subsidiary EECI would acquire all of the outstan di ng publicly - held common units of Midcoast Energy Partners, L.P. (MEP).

Q&A Session