Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - ENBRIDGE ENERGY PARTNERS LP | eep12312017exhibit322.htm |

| EX-32.1 - EXHIBIT 32.1 - ENBRIDGE ENERGY PARTNERS LP | eep12312017exhibit321.htm |

| EX-31.2 - EXHIBIT 31.2 - ENBRIDGE ENERGY PARTNERS LP | eep12312017exhibit312.htm |

| EX-31.1 - EXHIBIT 31.1 - ENBRIDGE ENERGY PARTNERS LP | eep12312017exhibit311.htm |

| EX-21.1 - EXHIBIT 21.1 - ENBRIDGE ENERGY PARTNERS LP | eep12312017-exhibit211.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________

FORM 10-K

_______________________________

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2017 or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to

Commission file number 1-10934

_______________________________

ENBRIDGE ENERGY PARTNERS, L.P.

(Exact Name of Registrant as Specified in Its Charter)

_______________________________

Delaware | 39-1715850 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

5400 Westheimer Court Houston, Texas 77056

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code (713) 627-5400

_______________________________

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Class A common units | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: NONE

_______________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer x | Accelerated Filer o | |

Non-Accelerated Filer o (Do not check if a smaller reporting company) | Smaller reporting company o | |

Emerging growth company o | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).Yes o No x

The aggregate market value of the registrant’s Class A common units held by non-affiliates computed by reference to the price at which the common equity was last sold on June 30, 2017, was $5,223,268,544.

As of February 13, 2018 the registrant has 326,517,110 Class A common units outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: NONE

TABLE OF CONTENTS

Page | ||

In this report, unless the context requires otherwise, references to “we,” “us,” “our” or the “Partnership” are intended to mean Enbridge Energy Partners, L.P. and its consolidated subsidiaries. We refer to our general partner, Enbridge Energy Company, Inc., as our “General Partner.” References to “Enbridge” refer collectively to Enbridge Inc., and its subsidiaries other than us. References to “Enbridge Management” refer to Enbridge Energy Management, L.L.C., the delegate of our General Partner that manages our business and affairs.

This Annual Report on Form 10-K includes forward-looking statements, which are statements that frequently use words such as “anticipate,” “believe,” “consider,” “continue,” “could,” “estimate,” “evaluate,” “expect,” “explore,” “forecast,” “intend,” “may,” “opportunity,” “plan,” “position,” “projection,” “should,” “strategy,” “target,” “will” and similar words. Although we believe that such forward-looking statements are reasonable based on currently available information, such statements involve risks, uncertainties and assumptions and are not guarantees of performance. Future actions, conditions or events and future results of operations may differ materially from those expressed in these forward-looking statements. Any forward-looking statement made by us in this Annual Report on Form 10-K speaks only as of the date on which it is made, and we undertake no obligation to publicly update any forward-looking statement. Many of the factors that will determine these results are beyond our ability to control or predict. Specific factors that could cause actual results to differ from those in the forward-looking statements include: (1) the effectiveness of the various actions we have taken resulting from our strategic review process; (2) changes in the demand for the supply of, forecast data for, and price trends related to crude oil and liquid petroleum, including the rate of development of the Alberta Oil Sands; (3) our ability to successfully complete and finance expansion projects; (4) the effects of competition, in particular, by other pipeline systems; (5) shut-downs or cutbacks at our facilities or refineries, petrochemical plants, utilities or other businesses for which we transport products or to whom we sell products; (6) hazards and operating risks that may not be covered fully by insurance, including those related to Line 6B, (7) any fines, penalties and injunctive relief assessed in connection with any crude oil release; (8) changes in or challenges to our tariff rates; (9) changes in laws or regulations to which we are subject, including compliance with environmental and operational safety regulations that may increase costs of system integrity testing and maintenance; and (10) permitting at federal, state and local level or renewals of rights of way. Forward-looking statements regarding sponsor support transactions or sales of assets (to Enbridge or otherwise) are further qualified by the fact that Enbridge is under no obligation to provide additional sponsor support and neither Enbridge nor any third party is under any obligation to offer to buy or sell us assets, and we are under no obligation to buy or sell any such assets. As a result, we do not know when or if any such transactions will occur. Any statements regarding sponsor expectations or intentions are based on information communicated to us by Enbridge, but there can be no assurance that these expectations or intentions will not change in the future.

For additional factors that may affect results, see “Item 1A. Risk Factors” included elsewhere in this Annual Report on Form 10-K, which is available to the public over the Internet at the United States Securities and Exchange Commission’s (the SEC), website (www.sec.gov) and at our website (www.enbridgepartners.com).

i

GLOSSARY

The following abbreviations, acronyms and terms used in this Annual Report on Form 10-K are defined below:

Alberta Clipper Pipeline | The pipeline that runs from the Canadian international border near Neche, North Dakota to Superior, Wisconsin on our Lakehead System | |

AOCI | Accumulated other comprehensive income | |

ASU | Accounting Standards Update | |

Bpd | Barrels per day | |

CERCLA | Comprehensive Environmental Response, Compensation, and Liability Act | |

CFTC | Commodity Futures Trading Commission | |

CIAC | Contributions in aid of construction | |

Credit Facilities | 364-day Credit Facility and the senior unsecured revolving Credit Facility | |

DAPL | Dakota Access Pipeline | |

EA interests | Partnership interests of the OLP related to all the assets, liabilities and operations of the Eastern Access Projects | |

Eastern Access Projects | Multiple expansion projects that will provide increased access to refineries in the United States Upper Midwest and in Canada in the provinces of Ontario and Quebec for light crude oil produced in western Canada and the United States | |

EBITDA | Earnings Before Interest, Taxes, Depreciation and Amortization | |

EES | Enbridge Employee Services Inc., a subsidiary of our General Partner | |

Enbridge | Enbridge Inc., of Calgary, Alberta, Canada, the ultimate parent of the General Partner | |

Enbridge Management | Enbridge Energy Management, L.L.C. | |

Enbridge System | Canadian portion of the liquid petroleum mainline system | |

EP Act | Energy Policy Act of 1992 | |

EPA | United States Environmental Protection Agency | |

ETCOP | Energy Transfer Crude Oil Pipeline | |

EUS | Enbridge (U.S.) Inc. | |

Exchange Act | Securities Exchange Act of 1934, as amended | |

FERC | Federal Energy Regulatory Commission | |

FSM | Facility Surcharge Mechanism | |

General Partner | Enbridge Energy Company, Inc., the general partner of the Partnership | |

IEPC | Illinois Extension Pipeline Company, L.L.C. | |

ICA | Interstate Commerce Act | |

IDUs | Incentive Distribution Units | |

IRS | Internal Revenue Service | |

ISDA® | International Swaps and Derivatives Association, Inc. | |

i-units | Special class of our limited partner interests | |

Lakehead System | United States portion of the liquid petroleum Mainline system | |

LIBOR | London Interbank Offered Rate — British Bankers’ Association’s average settlement rate for deposits in United States dollars | |

Mainline System | The combined liquid petroleum pipeline operations of our Lakehead System and the Enbridge system, which is a crude oil and liquid petroleum pipeline system extending from western Canada through the upper and lower Great Lakes region of the United States to eastern Canada | |

MarEn | MarEn Bakken Company LLC | |

MEP | Midcoast Energy Partners, L.P. | |

Mid-Continent System | Crude oil pipelines and storage facilities located in the Mid-Continent region of the United States and includes the Cushing tank farm | |

MLP | Master Limited Partnership | |

MNPUC | Minnesota Public Utilities Commission | |

MPC | Marathon Petroleum Corporation | |

ii

NCI | Noncontrolling interest(s) | |

NGLs | Natural gas liquids | |

NDPC | North Dakota Pipeline Company, L.L.C. | |

Bakken Assets | Liquids petroleum pipeline gathering system and common carrier pipeline in the Upper Midwest United States that serves the Bakken formation within the Williston basin | |

NYSE | New York Stock Exchange | |

OLP | Enbridge Energy, Limited Partnership, also referred to as the Lakehead Partnership | |

OPA | Oil Pollution Act | |

PADD II | Consists of Illinois, Indiana, Iowa, Kansas, Kentucky, Michigan, Minnesota, Missouri, Nebraska, North Dakota, Ohio, Oklahoma, South Dakota, Tennessee and Wisconsin | |

PADD III | Consists of Alabama, Arkansas, Louisiana, Mississippi, New Mexico and Texas | |

PADD IV | Consists of Colorado, Idaho, Montana, Utah and Wyoming | |

PADD V | Consists of Alaska, Arizona, California, Hawaii, Nevada, Oregon and Washington | |

Partnership Agreement | Seventh Amended and Restated Agreement of Limited Partnership of Enbridge Energy Partners, L.P., also referred to as our partnership agreement | |

Partnership | Enbridge Energy Partners, L.P. and its consolidated subsidiaries | |

PHMSA | Pipeline and Hazardous Materials Safety Administration | |

SEC | United States Securities and Exchange Commission | |

Series AC interests | Partnership interests of the OLP related to all the assets, liabilities and operations of the Alberta Clipper Pipeline | |

Series EA interests | Partnership interests of the OLP related to all the assets, liabilities and operations of the Eastern Access Projects | |

Series ME interests | Partnership interests of the OLP related to all the assets, liabilities and operations of the U.S. Mainline Expansion projects | |

Southern Access | Southern Access Pipeline, a 42-inch pipeline that runs from Superior, Wisconsin to Flanagan, Illinois on our Lakehead System | |

U.S. GAAP | United States Generally Accepted Accounting Principles | |

U.S. L3R Program | The United States Line 3 Replacement Program | |

U.S. Mainline Expansion projects | Multiple projects that will expand access to new markets in North America for growing production from western Canada and the Bakken Formation | |

VIE(s) | Variable interest entity(entities) | |

WCSB | Western Canadian Sedimentary Basin | |

iii

PART I.

ITEM 1. BUSINESS

OVERVIEW

We are a publicly traded Delaware limited partnership that owns and operates crude oil and liquid petroleum transportation and storage assets in the United States of America. Our Class A common units are traded on the New York Stock Exchange (NYSE), under the symbol “EEP”

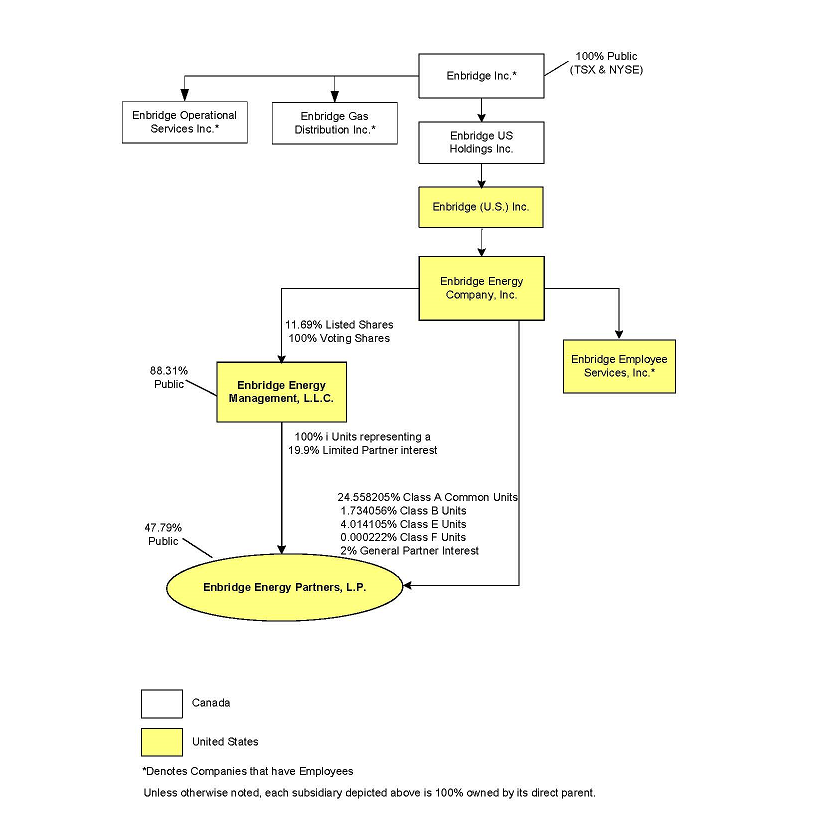

The following chart shows our organization and ownership structure as of December 31, 2017. The ownership percentages referred to below illustrate the relationships between us, Enbridge Energy Management, L.L.C., or Enbridge Management, Enbridge Energy Company, Inc., or our General Partner, and Enbridge Inc., or Enbridge, and its affiliates:

1

We were formed in 1991 by Enbridge Energy Company, Inc., the general partner of the Partnership (General Partner), initially to own and operate the Lakehead System, which is the United States portion of a crude oil and liquid petroleum pipeline system extending from western Canada through the upper and lower Great Lakes region of the United States to eastern Canada (Mainline System). A subsidiary of Enbridge Inc. (Enbridge) owns the Canadian portion of the Mainline system. Enbridge is the ultimate parent of our General Partner.

Enbridge Energy Management, L.L.C. (Enbridge Management) is a Delaware limited liability company that was formed in May 2002 to manage our business and affairs. Under a delegation of control agreement, our General Partner delegated substantially all of its power and authority to manage our business and affairs to Enbridge Management. Our General Partner, through its direct ownership of the voting shares of Enbridge Management, elects all of the directors of Enbridge Management. Enbridge Management is the sole owner of our i-units.

MIDCOAST GAS GATHERING AND PROCESSING DISPOSITION

In 2001, the Partnership acquired the East Texas system, which was the Partnership's first entry into the natural gas gathering and processing business. The Partnership continued expanding its natural gas assets, including the acquisition of the Midcoast system in 2002 and the acquisition of the North Texas system in 2003. In 2013, we formed Midcoast Energy Partners, L.P. (MEP) to serve as our primary vehicle for owning and growing our natural gas and NGL midstream business. MEP completed its initial public offering in 2013, and we continued to own all of the equity interests in MEP’s general partner, a majority limited partner interest in MEP and a minority limited partner interest in MEP’s operating subsidiary, Midcoast Operating, L.P. (Midcoast Operating).

On April 27, 2017, our General Partner acquired, for cash, all of the outstanding publicly held Class A common units of MEP, and shortly thereafter MEP ceased to be a publicly traded partnership. On June 28, 2017, we completed the sale of all of our ownership interest in our Midcoast gas gathering and processing business to our General Partner (the Midcoast Disposition). The sale included our 48.4% limited partnership interest in Midcoast Operating, our 51.9% limited partnership interest in MEP and our 100% interest in Midcoast Holdings, L.L.C., the general partner of MEP.

The natural gas business included natural gas and NGL gathering and transportation pipeline systems, natural gas processing and treating facilities, condensate stabilizers and an NGL fractionation facility, as well as rail and liquids marketing operations. The natural gas assets were primarily located in Texas and Oklahoma. The core basins are known as the East Texas basin, the Fort Worth basin and the Anadarko basin.

CONCLUSION AND RESULTS OF STRATEGIC REVIEW

On April 28, 2017, we announced the conclusion of our strategic review and undertook steps to position us as a pure-play liquids pipeline Master Limited Partnership (MLP) with a low-risk commercial profile, stable cash flows, a strong balance sheet, healthy distribution coverage, visible growth and limited external capital needs. Among the actions implemented as a result of the strategic review, we reduced our quarterly distribution from $0.583 per unit to $0.35 per unit or from $2.33 per unit to $1.40 per unit on an annualized basis, redeemed our outstanding Series 1 Preferred Units at a face value of $1.2 billion, commenced the sale of our interests in our Midcoast gas gathering and processing business, which was sold to our General Partner on June 28, 2017, repaid the deferred distribution balance on our Series 1 Preferred Units, restructured our capital structure and modified our incentive distribution rights and finalized a joint funding arrangement for our investment in the Bakken Pipeline System. See Part II. Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Strategic Review for further detail.

BUSINESS

We manage our business in one segment - Liquids. The remainder of our business is presented as “Other” and consists of certain unallocated corporate costs. The following describes the operations of our business. For financial information, see Part II. Item 8. Financial Statements and Supplementary Data — Note 5 - Segment Information.

LIQUIDS

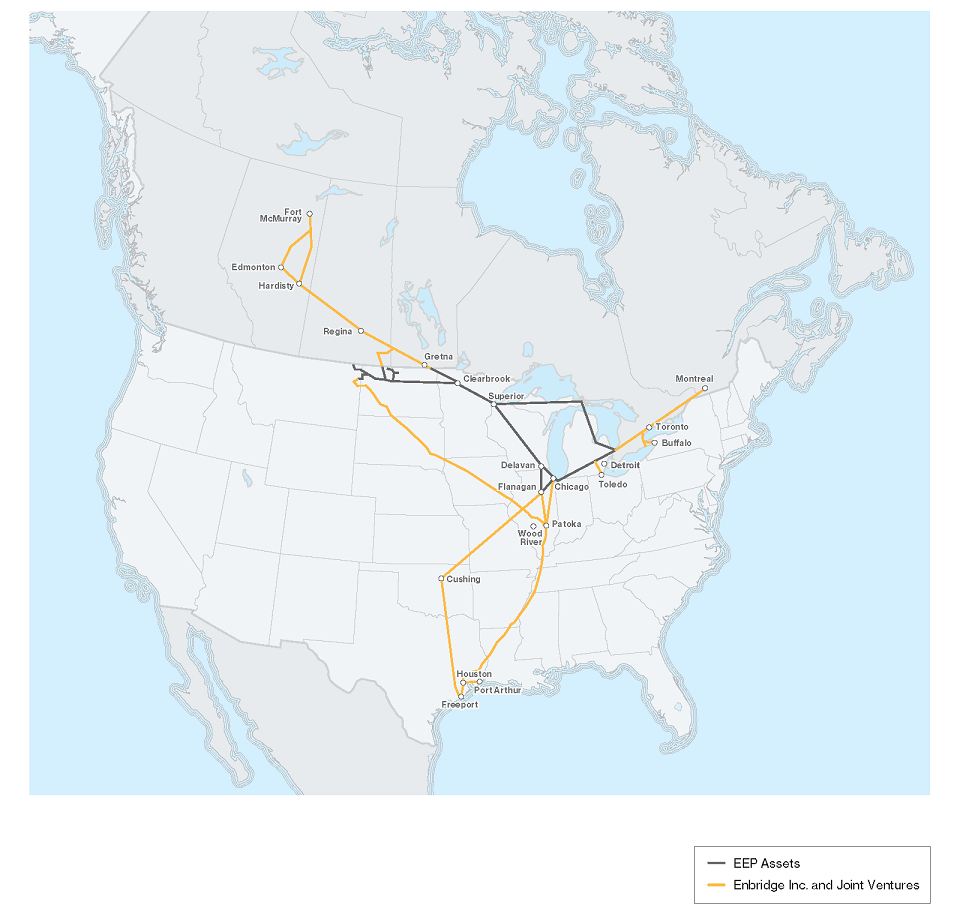

The map below presents the locations of our current Liquids systems’ assets and projects being constructed. The map also depicts some liquids pipelines assets owned by other Enbridge affiliates and projects being constructed to provide an understanding of how they interconnect with our Liquids systems.

2

The following discussion provides an overview of North American production that is transported on our pipelines and the projects that we are pursuing to connect the growing supplies of this production to key refinery markets in the United States.

In 2017, we transported production from the Western Canadian Sedimentary Basin (WCSB) and the North Dakota Bakken formation. Western Canadian crude oil is an important source of supply for the United States. According to the latest available data for 2017 from the United States Department of Energy’s (DOE), Energy Information Administration (EIA), Canada supplied approximately 3.4 million barrels per day (Bpd), of crude oil to the United States, the largest source of United States imports. Over half of the Canadian crude oil moving into the United States was transported on the Enbridge Mainline system. The Canadian Association of Petroleum Producers (CAPP), a trade association representing a majority of our Lakehead System’s customers, forecasted as of June 2017 that future production from the Alberta oil sands will continue to experience steady growth during the next two decades with an additional 1 million Bpd of production by 2030, based on a subset of currently approved applications and announced expansions. We are well positioned to deliver growing volumes of crude oil that are expected from the WCSB to our existing as well as new markets.

3

Along with Enbridge, we are actively working with our customers to develop transportation options that will alleviate capacity constraints in addition to providing access to new markets in the United States. Our market strategy is to provide safe, timely, economic, competitive and integrated transportation solutions to connect growing supplies of North American crude oil production to key refinery markets in the United States and Canada. Together, with Enbridge, we believe that our existing and future plans advance our collective vision of being one of the leading energy delivery companies in North America. In addition to this vision, we have advanced our Operational Risk Management Program.

We have a multi-billion dollar growth program underway, with projects coming into service through 2019, in addition to options to increase our economic interest in projects that are jointly funded by us and Enbridge. This growth program includes expansions to our Mainline system as well as replacement of the Line 3 pipeline to ensure WCSB production has efficient and reliable access to markets in the United States Midwest and beyond. For further details regarding our growth program, refer to Part II. Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Growth Projects - Commercially Secured Projects

The United States Line 3 Replacement Program (U.S. L3R Program) will support the safety and operational reliability of the system, enhance system flexibility and allow us and Enbridge to optimize throughput from western Canada into Superior, Wisconsin. The U.S. L3R Program is expected to achieve the original capacity of approximately 760,000 Bpd. This project, along with the other projects on the Mainline, will provide increased market access for producers to refineries in the United States upper-Midwest, eastern Canada, and the United States Gulf Coast refining centers. For further details regarding our projects, refer to Part II. Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Results of Operations - By Segment.

In February 2017, we completed the acquisition of an effective 27.6% equity interest in the Bakken Pipeline System through our joint venture with Marathon Petroleum Corporation (MPC). This system was placed into service on June 1, 2017 and will further enhances our strategy of providing efficient market access solutions for Bakken production, while providing the opportunity for the implementation of joint tolls with the Energy Transfer Crude Oil Pipeline (ETCOP), enhancing market access opportunities for our customers and creating a new flow path through the Mainline system to the eastern United States Gulf Coast. Refer to Part II. Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Recent Developments for further details.

Our Liquids business includes the operations of our Lakehead System, Bakken Assets (formerly our North Dakota system) and Mid-Continent Systems. The following table provides selected information regarding our Liquids systems:

Pipeline Length (miles) | Storage Tanks | Storage Capacity (million barrels)(1) | Pump Stations | ||||||||

Lakehead | 4,212 | 77 | 18 | 74 | |||||||

Mid-Continent | — | 84 | 20 | — | |||||||

Bakken | 660 | 24 | 2 | 12 | |||||||

Total | 4,872 | 185 | 40 | 86 | |||||||

____________

(1) | Represents nominal shell capacity. |

Lakehead System

4

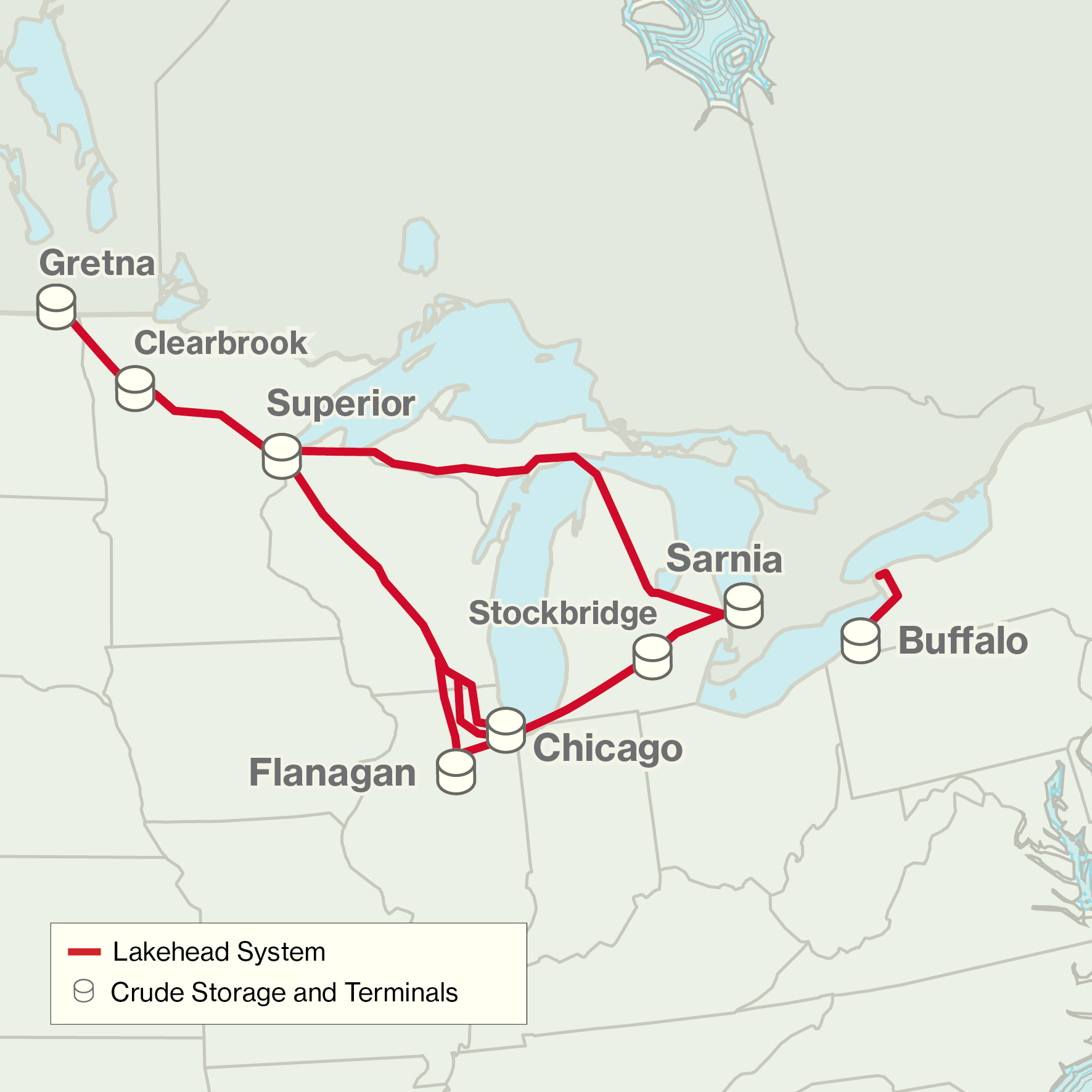

Our Lakehead System, together with the Enbridge system in Canada, form the Mainline system, which has been in operation for over 60 years and forms the longest liquid petroleum pipeline system in the world. The Mainline system operates in a segregated, or batch mode allowing the transportation of over 39 oil commodities typically classified as light, medium, or heavy crude oil, condensate, and natural gas liquids (NGLs). The Mainline system serves all of the major refining centers in the Great Lakes and Midwest regions of the United States and the provinces of Ontario and Quebec, Canada. The Lakehead System is the United States portion of the Mainline system. It is an interstate common carrier pipeline system regulated by the Federal Energy Regulatory Commission (FERC) and is the primary transporter of crude oil and liquid petroleum from western Canada to the United States.

Over the past seven years, we have completed the largest pipeline expansion program in our history in order to accommodate the growing upstream supply that will feed our completed downstream market access projects. Our customers have long development timelines and need assurance that an adequate pipeline infrastructure will be in place in time to transport the additional production resulting from completion of their projects. We have successfully completed several projects over the years and have substantially completed our Mainline Expansion Project and commenced construction on components of the United States Line 3 Replacement Program, which will provide the needed incremental market access for both our producer and refiner customers located in our primary target markets.

Our Lakehead System is strategically interconnected to multiple refining centers and transportation hubs located within Petroleum Administration for Defense Districts (PADD), such as: Chicago, Illinois; Patoka, Illinois; and Cushing, Oklahoma (PADDII). In addition, we are also strategically connected to the largest U.S. refining center in the United States Gulf Coast through other pipelines owned by Enbridge and its affiliates. WCSB production in excess of Western Canadian demand moves on existing pipelines into primarily PADD II, with secondary markets including: the United States Gulf Coast (PADD III); the Rocky Mountain states (PADD IV); the Anacortes area of Washington state (PADD V); and Eastern Canada (Ontario and Quebec).The Lakehead System mainly serves the PADD II market directly and the PADD III market indirectly. Bakken production in excess of local demand primarily moves on existing pipelines into PADD II or is transported by rail to coastal Canadian and United States refining markets. The United States Gulf Coast continues to be an attractive market for WCSB producers due to the market’s large refining capacity designed to process heavy crude oil. The forecasted long-term incremental growth of Canadian oil sands and Bakken production

5

provides stability for existing pipeline throughputs to historical markets as well as creating new growth opportunities available to both us and our competitors.

Customers

Our Lakehead System operates under month-to-month transportation arrangements with our shippers. During 2017, approximately 40 shippers tendered crude oil and liquid petroleum for delivery through our Lakehead System. We consider multiple companies that are controlled by a common entity to be a single shipper for purposes of determining the number of shippers delivering crude oil and liquid petroleum on our Lakehead System. Our customers include integrated oil companies, major independent oil producers, refiners and marketers. For further details regarding revenues from our largest third party customers see Part II. Item 8. Financial Statements and Supplementary Data — Note 5 - Segment Information

Supply and Demand

Our Lakehead System is part of the longest crude oil pipeline in the world and is a critical component of the North American crude oil supply pipeline network. Lakehead is well positioned as the primary transporter of western Canadian crude oil and continues to benefit from past and anticipated future crude oil production growth from the Alberta Oil Sands, as well as recent development in tight oil production in North Dakota. Aside from the receipt locations on the Mainline system within Canada, our Lakehead System receives injections from locations within the United States. Clearbrook, Minnesota is the receipt location for United States Bakken production, and other United States sources are received at Lewiston, Michigan and Mokena, Illinois.

Crude oil originating from the WCSB comprises the majority of Lakehead System deliveries. According to Natural Resources Canada (NRCan), Canada is currently ranked third in the world for total proved reserves, just behind Venezuela and Saudi Arabia, respectively. NRCan estimates that 97% of Canada’s total proved reserves are attributed to Alberta’s oil sands bitumen, with the remainder being conventional oil sources. The Alberta Energy Regulator, estimates 166.6 billion total barrels, or approximately 165 billion and 1.6 billion barrels of established proved bitumen and conventional reserves, respectively, remain for the region. The National Energy Board (NEB) estimates that total production from the WCSB averaged approximately 4.0 million Bpd in 2017 and 3.6 million in 2016. Furthermore, these production levels are expected to grow in the future, as previously discussed.

The growth forecast in the oil sands will be primarily driven by steam assisted gravity drainage (SAGD), projects in the long-term. Mining projects are the main contributor to near-term growth, with other development projects on hold until prices recover and well economics improve. Based on projects currently under construction in western Canada, the incremental productive capacity that would have access to our systems is reported to increase over the next three years by approximately 404,000 Bpd.

Lakehead throughput volumes are primarily supplied by crude oil produced in the Canadian oil sands and Bakken resource plays. North Dakota’s Bakken/Three Forks resource play has become a major component of United States domestic supply. In 2017, production averaged 1.1 million Bpd and is expected to remain at that level through 2018. Forecasts of western Canadian crude oil supply are periodically completed by Enbridge, CAPP and the NEB, among others. The June 2017 CAPP forecast predicts western Canada oil sands production is expected to grow by 1 million Bpd to 3.7 million Bpd by 2030. This compares with an expected increase of 30,000 Bpd from conventional production sources over the same time frame. Compared to the 2016 forecast, CAPP kept its oil sands production forecast at 3.7 million Bpd due to the low oil price environment and constraints arising from oil sands cost competitiveness and delays in project schedules. The production growth forecasted out of our primary supply markets requires additional pipeline capacity.

PADD II is the primary demand market for our Lakehead System. Deliveries on our Lakehead System are negatively affected by periodic maintenance, other competitive transportation alternatives, or refinery turnarounds and other shutdowns at producing plants that supply crude oil. Based on growth in western Canada and Bakken crude oil supply and Lakehead operational performance improvements, deliveries on our Lakehead System are expected to be higher than the 2.7 million Bpd of actual deliveries experienced during 2017.

The latest data available from the EIA shows that total PADD II demand was 3.7 million Bpd. PADD II produced 1.7 million Bpd and imported 2.4 million Bpd from Canada and other regions located in the United States, with exports comprising the remaining difference between PADD II supply and demand. Imports from Canada comprised 99% of total PADD II crude oil imports, with approximately 65% or 1.5 million Bpd transported on our Lakehead System. The remaining barrels were imported via competitor pipelines from Alberta and offshore sources via the United States Gulf Coast or regional transfers from PADD III or PADD IV.

6

Lakehead System deliveries for 2017 were approximately 99,000 Bpd higher than delivery volumes for 2016. Total deliveries from our Lakehead System averaged 2.7 million Bpd in 2017, meeting approximately 71% of the refinery capacity in the greater Chicago area; 81% of the Minnesota refinery capacity; and 81% of Ontario refinery capacity. Refinery configurations and crude oil requirements within PADD II continue to create an attractive market for western Canada and Bakken supply. Crude oil demand in PADD II averaged 3.7 million Bpd, an increase of 134,000 Bpd from 2016, while overall refining utilization grew to 94% from 92% when compared to the prior year.

Competition

WCSB crude oil competes with local and imported crude oil. Of all the pipeline systems that transport crude oil out of Canada, the Mainline system transported approximately half of all Canadian crude oil imports into the United States in 2017.

Given the expected increase in crude oil production from the Alberta Oil Sands over the next 10 years, alternative transportation proposals have been presented to crude oil producers. Competitors’ proposals to WCSB and Bakken shippers include expanding, twinning, extending and building new pipeline assets. These proposals and projects are in various stages of regulatory approval.

Transportation of crude oil by rail has also emerged as a competitor primarily due to the lack of pipeline capacity for the WCSB and Bakken regions. As a result, a significant amount of rail loading capacity has been constructed and is proposed in both markets. Rail transportation becomes less competitive, however, as crude oil price differentials narrow between key markets due to high transportation costs relative to cost of transportation by pipeline.

These competing alternatives for delivering western Canada crude oil into the United States and other markets could erode shipper support for further expansion of our Lakehead System. Accordingly, competition could also impact throughput on and utilization of the Mainline system. The Mainline system, however, offers significant cost savings and flexibility to shippers.

Deliveries for our Lakehead System over the past five years were as follows:

2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||

(thousands of Bpd) | ||||||||||||||

United States | ||||||||||||||

Light crude oil | 416 | 492 | 500 | 496 | 473 | |||||||||

Medium and heavy crude oil | 1,606 | 1,471 | 1,364 | 1,167 | 948 | |||||||||

NGL | 5 | 5 | 5 | 6 | 6 | |||||||||

Total United States | 2,027 | 1,968 | 1,869 | 1,669 | 1,427 | |||||||||

Canada | ||||||||||||||

Light crude oil | 464 | 427 | 294 | 298 | 247 | |||||||||

Medium and heavy crude oil | 108 | 100 | 77 | 72 | 76 | |||||||||

NGL | 74 | 79 | 75 | 74 | 66 | |||||||||

Total Canada | 646 | 606 | 446 | 444 | 389 | |||||||||

Total Deliveries | 2,673 | 2,574 | 2,315 | 2,113 | 1,816 | |||||||||

Barrel miles (billions per year) | 756 | 724 | 640 | 582 | 487 | |||||||||

7

Mid-Continent System

Our Mid-Continent System, which we have owned since 2004, is located within PADD II and is comprised of storage terminals at Cushing, Oklahoma.

The storage terminals consist of over 80 individual storage tanks ranging in size from 78,000 to 570,000 barrels. The total storage shell capacity of our Mid-Continent System is approximately 20 million barrels. A portion of the storage facilities are used for operational purposes, while we contract the remainder of the facilities with various crude oil market participants for their term storage requirements. Contract fees include fixed monthly storage fees, throughput fees for receiving and delivering crude to and from connecting pipelines and terminals and blending fees.

The Cushing Terminal continues to change with market dynamics and we are well positioned to capitalize on potential growth projects. We also see long-term strategic value for the terminals and plan to expand both its capacity and connectivity as market conditions improve.

In December 2016, we entered into an agreement to sell the Ozark Pipeline system to a subsidiary of MPLX LP. On March 1, 2017, we completed the sale of the Ozark Pipeline system to a subsidiary of MPLX LP for cash proceeds of approximately $220 million. For more information, refer to Part II. Item 8. Financial Statements and Supplementary Data — Note 9 - Property, Plant and Equipment.

Customers

Our Mid-Continent System operates under long-term storage arrangements with shippers. These arrangements are up to 10 years in length and include producers, refiners and marketers. Storage utilization depends on a variety of factors, including price differentials, supply and apportionment among others.

Supply and Demand

Demand for storage capacity at Cushing, Oklahoma has remained high as customers continue to value the flexibility and optionality available with this service as well as the superior connectivity that our terminal offers. Our storage

8

terminals rely on demand for storage service from numerous oil market participants. Producers, refiners, marketers and traders value our storage capacity in Cushing, Oklahoma for a number of different reasons, including batch scheduling, stream quality control, inventory management, blending and speculative trading opportunities.

Competition

Competitors to our storage facilities at Cushing, Oklahoma include large integrated oil companies, private entities and other midstream energy partnerships. Many of these competitors have the capability to expand in the future and be competitive on quality of service, reliability, increased connectivity and price.

Bakken Assets

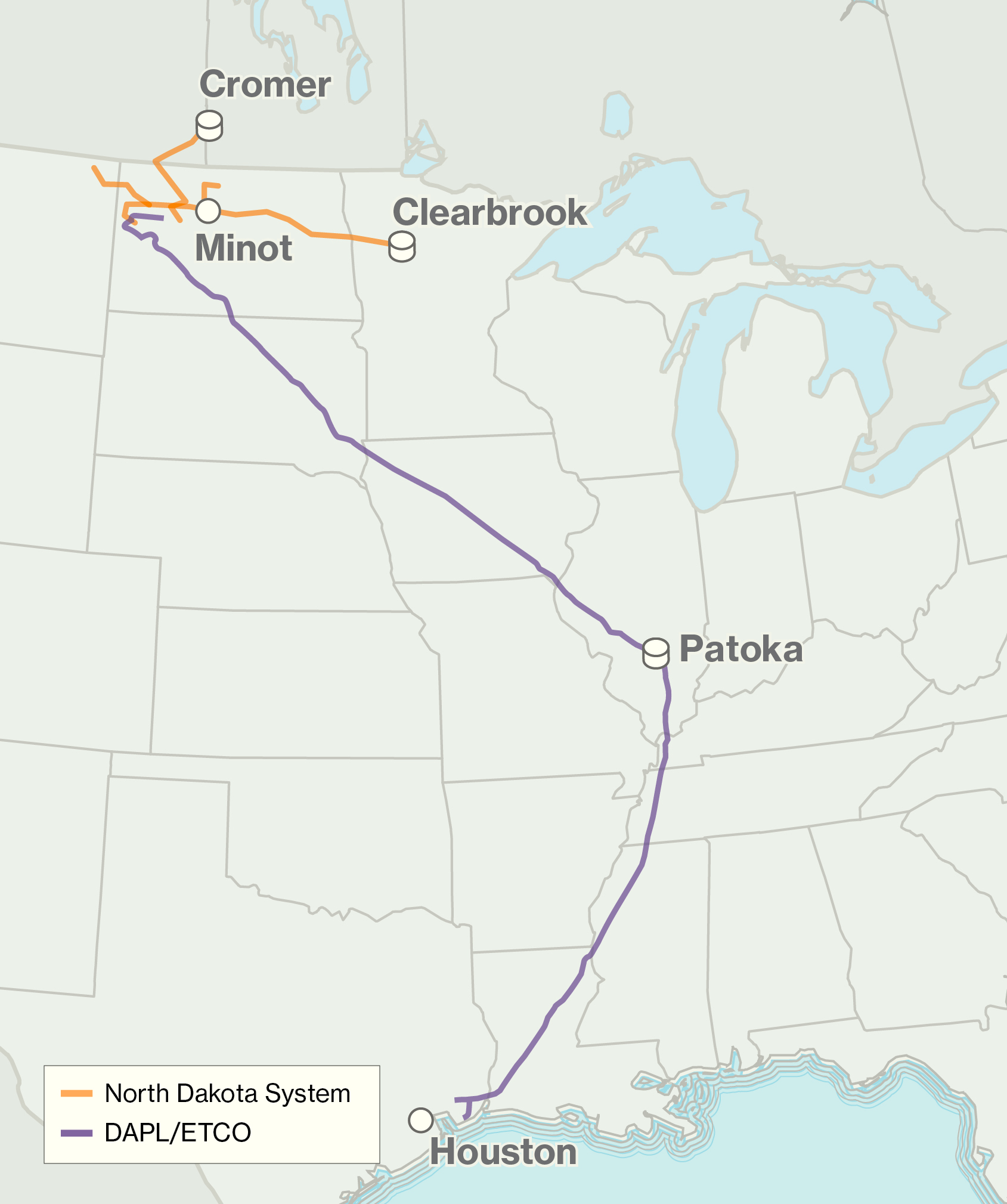

Our Bakken Assets consist of the North Dakota System and the Bakken Pipeline System. The North Dakota System is a joint operation that includes both a Canadian and United States portion. The United States portion of the North Dakota System is comprised of a crude oil gathering and interstate pipeline transportation system servicing the Williston Basin in North Dakota and Montana, which includes the Bakken and Three Forks formations. The gathering pipelines collect crude oil from nearly 80 different receipt facilities located throughout western North Dakota and eastern Montana, with delivery to Clearbrook for service on the Lakehead System or a variety of interconnecting pipeline and rail export facilities. The United States interstate portion of the pipeline extends from Berthold, North Dakota to the International Boundary near North Portal, North Dakota and connects to the Bakken Canadian entity at the border to bring crude oil into Cromer, Manitoba (the Bakken System).

9

Traditionally, the majority of our pipeline deliveries have been made into interconnecting pipelines at Clearbrook, Minnesota where two other pipelines originate: (i) a third-party pipeline serving St. Paul, Minnesota refinery markets; and (ii) our Lakehead System providing further pipeline transportation on the Enbridge system into the Great Lakes, eastern Canada and United States Midwest refinery markets that include Cushing, Oklahoma, Patoka, Illinois, and other pipelines delivering crude oil to the United States Gulf Coast. We have significantly increased the pipeline capacity of our North Dakota System through a series of projects in recent years while continuing to serve the system’s traditional markets in order to provide an array of market options and services.

On February 15, 2017, we announced the closing of our acquisition of an effective 27.6% ownership interest in the Bakken Pipeline System. We formed a joint venture with MPC to acquire a passive 49% equity interest in Bakken Pipeline Investments LLC (BPI) an affiliate of Energy Transfer Partners, L.P. and Sunoco Logistics Partners L.P., which owns 75% of the Bakken Pipeline System. We and MPC indirectly hold a 75% and 25%, respectively of our 49% passive interest in BPI. The Bakken Pipeline System connects the Bakken formation in North Dakota to markets in eastern PADD II and the United States Gulf Coast, providing customers with access to premium markets at a competitive cost. The Bakken Pipeline System consists of the Dakota Access Pipeline (DAPL) and the Energy Transfer Crude Oil Pipeline projects (ETCOP). DAPL consists of 1,172 miles of 30-inch pipeline from the Bakken/Three Forks production area in North Dakota to Patoka, Illinois. Initial capacity is in excess of 470,000 Bpd of crude oil with the potential to be expanded to 570,000 Bpd. The Energy Transfer Crude Oil Pipeline consists of 62 miles of new 30-inch diameter pipe, 686 miles of converted 30-inch diameter pipe and 40 miles of converted 24-inch diameter pipe from Patoka, Illinois to Nederland, Texas. The Bakken Pipeline System is anchored by long-term throughput commitments from a number of producers.

Customers

Customers of our North Dakota System include refiners of crude oil, producers of crude oil and purchasers of crude oil at the wellhead, such as marketers, that require crude oil gathering and transportation services. Producers range in size from small independent owner/operators to large integrated oil companies. During 2017, approximately 304 shippers tendered crude oil for service on our North Dakota System.

Supply and Demand

Similar to our Lakehead System, our North Dakota System depends upon demand for crude oil in the Great Lakes and Midwest regions of the United States and the ability of crude oil producers to maintain their crude oil production and exploration activities. The state of North Dakota reported production levels of 1.1 million Bpd as of November 2017 with projections remaining at that level through 2018.

Competition

Due to the growth in production from these formations over the last several years, competition has increased substantially. Traditional competitors of our North Dakota System include refiners, integrated oil companies, interstate and intrastate pipelines or their affiliates and other crude oil gatherers. Many crude oil producers in the oil fields served by our North Dakota System have alternative gathering facilities available to them or have the ability to build their own assets, including their own rail loading facilities.

Currently, the primary competition to our North Dakota System is DAPL. As discussed, we purchased a minority stake in the Bakken Pipeline System, including DAPL, which entered into service June 1, 2017.

SEASONALITY

Drilling activities of producers within areas of our liquids pipeline network increase in winter months as the ground on which their drilling rigs are placed is frozen and inaccessible terrain becomes available. Western Canada typically experiences an increase in production during the winter months to align with consumer demand for refined products. Demand for crude oil diminishes into the spring and early fall as mid-west and gulf coast refineries undergo maintenance and turnaround activities. Seasonality exposure on the Enbridge Mainline is typically limited to light barrels as strong heavy supply and demand have resulted in the Mainline being oversubscribed (apportioned) for heavy capacity. In addition, system optimization initiatives in 2017 have further improved Enbridge’s utilization on the Mainline system. These initiatives have added flexibility to allocate crude to various lines further mitigating any seasonality risk on light throughputs. In addition, any further exposure to fluctuations in revenue as a result of seasonality is partially mitigated on our Lakehead System through authoritative accounting provisions applicable to regulated operations.

REGULATION

10

REGULATION BY THE FERC OF INTERSTATE COMMON CARRIER LIQUIDS PIPELINES

The FERC regulates the interstate pipeline transportation of crude oil, petroleum products, and other liquids such as NGLs. Our Lakehead System, North Dakota and Bakken Systems are our primary interstate common carrier liquids pipelines subject to regulation by the FERC under the Interstate Commerce Act (ICA), the Energy Policy Act of 1992 (EP Act), and rules and orders promulgated thereunder. As common carriers in interstate commerce, these pipelines provide service to any shipper who makes a reasonable request for transportation services, provided that the shipper satisfies the conditions and specifications contained in the applicable tariff. The ICA requires us to maintain tariffs on file with the FERC that set forth the rates we charge for providing transportation services on our interstate common carrier pipelines, as well as the rules and regulations governing these services.

The ICA gives the FERC the authority to regulate the rates we can charge for service on interstate common carrier pipelines. The ICA requires, among other things, that such rates be “just and reasonable” and that they not be unduly discriminatory or unduly preferential to certain shippers. The ICA permits interested parties to challenge newly proposed or changed rates and authorizes the FERC to suspend the effectiveness of such rates for a period of up to seven months and to investigate the rates to determine if they are just and reasonable. If the FERC finds the new or changed rate unlawful, it is authorized to require the carrier to refund, with interest, the amount of any revenues in excess of the amount that would have been collected during the term of the investigation at the rate properly determined to be lawful. The FERC also may investigate, upon complaint or on its own motion, rates that are already in effect and may order a carrier to change its rates prospectively. Upon an appropriate showing, a shipper may obtain reparations for damages sustained for a period of up to two years prior to the filing of a complaint.

In October 1992, Congress passed the EP Act, which deemed petroleum pipeline rates that were in effect for the 365-day period ending on the date of enactment, or that were in effect on the 365th day preceding enactment and had not been subject to complaint, protest or investigation during the 365-day period, to be just and reasonable under the ICA (i.e., “grandfathered”). The EP Act also limited the circumstances under which a complaint can be made against such grandfathered rates. In order to challenge grandfathered rates, a party must show: (i) that it was contractually barred from challenging the rates during the relevant 365-day period; (ii) that there has been a substantial change after the date of enactment of the EP Act in the economic circumstances of the pipeline or in the nature of the services that were the basis for the rate, or (iii) that the rate is unduly discriminatory or unduly preferential.

The FERC determined our Lakehead System rates are not covered by the grandfathering provisions of the EP Act because they were subject to challenge prior to the effective date of the statute. The rates for our North Dakota System in effect at the time of the EP Act should be found to be subject to the grandfathering provisions of the EP Act because those rates were not suspended or subject to protest or complaint during the 365-day period established by the EP Act.

The EP Act required the FERC to issue rules establishing a simplified and generally applicable ratemaking methodology for petroleum pipelines and to streamline procedures in petroleum pipeline proceedings. The FERC responded to this mandate by issuing Order No. 561 which adopted an indexing rate methodology for petroleum pipelines. Under these regulations, which became effective January 1, 1995, petroleum pipelines are able to change their rates within prescribed ceiling levels that are tied to an inflation index. Rate increases made within the ceiling levels may be protested, but such protests generally must show that the rate increase resulting from application of the index is substantially in excess of the pipeline’s increase in costs. If the indexing methodology results in a reduced ceiling level that is lower than a pipeline’s filed rate, Order No. 561 requires the pipeline to reduce its rate to comply with the lower ceiling, although a pipeline is not required to reduce its rate below the level grandfathered under the EP Act. Under Order No. 561, a pipeline must as a general rule utilize the indexing methodology to change its rates. The FERC, however, uses cost-of-service ratemaking, market-based rates and settlement rates as alternatives to the indexing approach in certain specified circumstances.

The tariff rates for our Lakehead System are set using a combination of the FERC indexing rules (which apply to the base rates on that system) and FERC-approved surcharges for particular projects that were approved under the FERC’s settlement rules. The tariff rates for the North Dakota and Bakken Systems are set through a combination of the FERC indexing rules and contractual agreements.

The inflation index applied to those rates subject to the FERC indexing rules is determined by a formula that is established by FERC and is subject to review every five years. On December 18, 2015, the FERC set the index for the period from July 2016 through June 2021 at Producer Price Index for Finished Goods plus 1.23 percentage points. Based on this formula, the index resulted in an increase of approximately 0.2% for 2017 and a decrease of approximately 2.0% for 2016.

11

On October 20, 2016, the FERC issued an Advanced Notice of Proposed Rulemaking (ANOPR) seeking comments on proposed changes to its review of oil pipeline index rate filings and reporting requirements. Specifically, the FERC proposes to reject increases to indexed rates and indexed rate ceilings if certain criteria are met. Such rate increase rejections would be outright and would not be prompted by a shipper protest (as is the case currently) or involve a hearing into the merits of the rate increase. An ANOPR is an initial step taken by a regulatory agency to obtain comments from impacted parties. Before issuing a final rule regarding these issues the FERC must also undertake a Notice of Proposed Rulemaking (NOPR) process. Given the fact that the FERC did not have quorum for much of 2017, no action was taken regarding this ANOPR in 2017. It is unclear when this issue will be resolved.

FERC ALLOWANCE FOR INCOME TAXES IN INTERSTATE COMMON CARRIER PIPELINE RATES

Under current FERC policy, pipelines regulated by the FERC that are owned by entities organized as MLPs, may include an income tax allowance in their cost-of-service rates to the extent the income generated from regulated activities was subject to an actual or potential income tax liability. Pursuant to this policy, a FERC-regulated pipeline that is a tax pass-through entity seeking such an income tax allowance must establish that its owners, partners or members have an actual or potential income tax obligation on the partnership’s income from regulated activities. Whether a particular pipeline’s owners have an actual or potential income tax liability is reviewed by the FERC on a case-by-case basis. The MLP income tax allowance is relevant to those Lakehead projects whose costs are recovered on a cost-of-service based mechanism and would also be relevant to the extent any of our FERC regulated oil pipeline systems were to file cost-of-service rates. Entitlement to an income tax allowance is assessed under the FERC policy statement and the facts existing at the relevant time.

The current FERC income tax allowance policy has recently been drawn into question by a decision of the United States Court of Appeals (D.C. Circuit). In its July 1, 2016 decision in the United Airlines case the court found that the FERC had failed to demonstrate that its income tax policy statement - in conjunction with its rate of return policy statement - does not result in double recovery of taxes for partnerships and asked the FERC to establish an income tax recovery mechanism for which it can demonstrate that there is no double recovery. It is unclear at this point whether the current FERC income tax policy will be upheld or whether the FERC will need to change its policy and if so what the new mechanism might look like. On December 15, 2016 in Docket No. PL17-1-000, the FERC issued its Inquiry Regarding the Commission’s Policy for Recovery of Income Tax Costs, in which the FERC requested comments regarding how to address any double recovery resulting from the FERC’s current income tax allowance and rate of return policies. During 2017, numerous parties filed comments in response to the FERC’s request but the FERC has not yet acted on the comments. It is unclear when this issue will be resolved.

Further, effective January 2018, the "Tax Cuts and Jobs Act" (TCJA) changed several provisions of the federal tax code, including a reduction in the maximum corporate tax rate. Following the TCJA being signed into law, filings have been made at FERC requesting that FERC require pipelines regulated by FERC to lower their transportation rates to account for lower taxes. FERC may enact other regulations or issue further requests to pipelines regarding the impact of the corporate tax rate change on the rates. However, FERC’s establishment of a just and reasonable rate is based on many components, and the reduction in the corporate tax rate may only impact two of such components, the allowance for income taxes and the amount for accumulated deferred income taxes. Because our existing jurisdictional rates were established based on a higher corporate tax rate, FERC or our shippers may challenge these rates in the future, and the resulting new rate may be lower than the rates we currently charge.

ACCOUNTING FOR PIPELINE ASSESSMENT COSTS

The FERC’s policies describe how FERC-regulated companies should account for costs associated with implementing the pipeline integrity management requirements of the United States Department of Transportation (DOT) and the Pipeline and Hazardous Materials Safety Administration (PHMSA). FERC regulated companies are generally required to recognize costs incurred for performing pipeline assessments that are part of a pipeline integrity management program as a maintenance expense in the period in which the costs are incurred. Costs for items such as rehabilitation projects designed to extend the useful life of the system can continue to be capitalized to the extent permitted under the existing rules. Consistent with the FERC’s policies, we expense all internal inspection costs for all our pipeline systems, whether or not they are subject to the FERC’s regulation. Refer to Part II. Item 8. Financial Statements and Supplementary Data — Note 2 - Significant Accounting Policies included in our consolidated financial statements of this Annual Report on Form 10-K for additional discussion.

OTHER REGULATION

The governments of the United States and Canada have, by treaty, agreed to reduce barriers to foreign trade and stimulate the flow of goods and services between the United States and Canada, which includes the passage of oil

12

and natural gas through the pipelines of one country across the territory of the other. Individual international border crossing points require United States government permits that may be terminated or amended at the discretion of the United States Government. These permits provide that pipelines may be inspected by or subject to orders issued by federal and, on occasion, state government agencies.

Safety Regulation and Environmental

GENERAL

Our transmission pipelines, storage facilities and railcar operations are subject to extensive environmental, operational and safety regulation at the federal and state level. The added costs imposed by regulations are generally no different than those imposed on our competitors. The failure to comply with such rules and regulations can result in substantial penalties and/or enforcement actions and added operational costs.

PIPELINE SAFETY AND TRANSPORTATION REGULATION

Our transmission pipelines are subject to regulation by the DOT and the PHMSA, under the Pipeline Safety Act (PSA), specifically Volume 49 of the Code of Federal Regulations, Part 195 (hazardous liquids). The regulations pertain to the design, installation, testing, construction, operation, replacement and management of transmission pipeline facilities. PHMSA is the agency charged with regulating the safe transportation of hazardous materials under all modes of transportation, including interstate and intrastate pipelines. Periodically the PSA has been reauthorized and amended, imposing new mandates on the regulator to promulgate new regulations and imposing direct mandates on operators of pipelines. The most recent reauthorization occurred in 2016.

The National Transportation Safety Board (NTSB) has recommended that the PHMSA make a number of changes to its rules. Congress also has mandated that PHMSA adopt regulations to implement these recommendations, along with a number of additional regulatory measures. While we cannot predict the outcome of legislative or regulatory initiatives, such legislative and regulatory changes could have a material effect on our operations, particularly by extending through more stringent and comprehensive safety regulations (such as integrity management requirements) to pipelines and gathering lines not previously subject to such requirements. While we expect any legislative or regulatory changes to allow us time to become compliant with new requirements, costs associated with compliance may have a material effect on our operations.

We expect to incur increasing regulatory compliance costs, based on the intensification of the regulatory environment and upcoming changes to regulations as outlined above.

In addition to regulatory changes, costs may be incurred when there is an accidental release of a commodity transported by our system, or a regulatory inspection identifies a deficiency in our required programs.

When hydrocarbons are released into the environment or violations identified during an inspection, PHMSA may issue a civil penalty or enforcement action, which can require internal inspections, pipeline pressure reductions and other methods to manage or verify the integrity of a pipeline in the affected area. In addition, NTSB may perform an investigation of a significant accident to determine the probable cause and issue safety recommendations to prevent future accidents. Any release that results in an enforcement action or NTSB investigation, such as those associated with Line 6B near Marshall, Michigan could have a material impact on system throughput or compliance costs.

Where we have identified instances of non-compliance with respect to our pipeline and railcar operations, we have taken actions to remediate the situations. Nevertheless, significant operating expenses and capital expenditure could be incurred in the future if additional safety measures are required or if safety standards are raised and exceed the capabilities of our current pipeline control system or other safety equipment.

ENVIRONMENTAL REGULATION

General

Our operations are subject to complex federal, state and local laws and regulations relating to the protection of health and the environment, including laws and regulations that govern the handling, storage and release of crude oil and other liquid hydrocarbon materials. As with the pipeline and processing industry in general, complying with current and anticipated environmental laws and regulations increases our overall cost of doing business, including our capital costs to construct, maintain and upgrade equipment and facilities. While these laws and regulations affect our

13

maintenance capital expenditures and net income, we believe that they do not affect our competitive position since the operations of our competitors are generally similarly affected.

In addition to compliance costs, violations of environmental laws or regulations can result in the imposition of significant administrative, civil and criminal fines and penalties and, in some instances, injunctions, banning or delaying certain activities.

There are also risks of accidental releases into the environment associated with our operations, such as releases or spills of crude oil, NGLs, or other substances from our pipelines or storage facilities. Such accidental releases could, to the extent not insured, subject us to substantial liabilities arising from environmental cleanup and restoration costs, claims made by neighboring landowners and other third parties for personal injury and property damage and fines, penalties or damages for related violations of environmental laws or regulations.

Although we are entitled, in certain circumstances, to indemnification from third parties for environmental liabilities relating to assets we acquired from those parties, these contractual indemnification rights are limited, and accordingly, we may be required to bear substantial environmental expenses. However, we believe that through our due diligence process, we identify and manage substantial issues.

Air and Water Emissions

Our operations are subject to the Clean Air Act (CAA), the Clean Water Act (CWA) and comparable state and local statutes. We believe we are in material compliance with these laws and regulations. We anticipate that we will incur costs over the next several years for air pollution control equipment and spill prevention measures in connection with maintaining our existing facilities and obtaining permit approvals for any new or acquired facilities.

In June 2016, the United States Environmental Protection Agency (EPA) issued final rules specific to the oil and gas industry to regulate methane and volatile organic compound (VOC) emissions from new and modified facilities in transportation and storage, gathering and boosting, production and processing facilities, including fugitive emission leak detection and repair requirements. On April 19, 2017, the EPA announced its intent to administratively reconsider the methane rules, staying a June 3, 2017 effective date for certain provisions for 90 days. Petitioners challenged the administrative stay in the D.C. Circuit, and on July 3, 2017, the D.C. Circuit granted relief for the petitioners, which had the impact of making the previously-stayed rules effective. These methane regulations remain in effect until possible revision or repeal by separate EPA rulemaking in the future, which action is likely to be challenged in the courts. In November 2016, the EPA issued an Oil and Gas Information Collection Request (ICR) covering methane and VOC emissions from the oil and gas industry. Enbridge received notification of the request on November 22, 2016, but in March 2017 before we were required to respond, the EPA subsequently withdrew the ICR.

In June 2015, the EPA and the United States Army Corps of Engineers (Army Corps) published a final rule to clarify the federal jurisdictional reach over wetlands and waterbodies. This regulation is the subject of numerous ongoing legal challenges. The United States Sixth Circuit Court of Appeals stayed implementation of the rule nationwide in October 2015 pending review, but on January 22, 2018, the United States Supreme Court held that legal challenges to the rule must first be heard at the district court level rather than the appellate court level. Additionally, the EPA and the Army Corps proposed a rulemaking in June 2017 to repeal the June 2015 rule, and they announced their intent to issue a new rule defining the reach of federal jurisdiction. On February 6, 2018 the EPA and Army Corps issued a final rule amending the effective date of the 2015 rule to February 6, 2020. Challenges to this rule have been filed and remain pending in various federal courts. As a result, future implementation of the June 2015 rule is uncertain at this time. If implemented, this final rule has the potential to increase our operating and capital costs to construct, maintain and upgrade equipment and facilities.

The Oil Pollution Act (OPA) was enacted in 1990 and amends parts of the CWA and other statutes as they pertain to the prevention of and response to oil spills. Under the OPA, we could be subject to strict, joint and potentially unlimited liability for removal costs and other consequences of an oil spill from our facilities into navigable waters, along shorelines or in an exclusive economic zone of the United States. The OPA also imposes certain spill prevention, control and countermeasure requirements for many of our non-pipeline facilities, such as the preparation of detailed oil spill emergency response plans and the construction of dikes or other containment structures to prevent contamination of navigable or other waters in the event of an oil overflow, rupture or release. For our liquid pipeline facilities, the OPA imposes requirements for emergency plans to be prepared, submitted and approved by the DOT. For our non-transportation facilities, such as storage tanks that are not integral to our pipeline transportation system, the OPA regulations are promulgated by the EPA.

14

For all proposed rules, we will continue to track the progress through involvement in industry groups and will comply with any regulatory requirements that enter into force. We do not expect a material effect on our financial statements as a result of compliance efforts.

Hazardous Substances and Waste Management

The Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA, or the “Superfund” law) and similar state laws impose liability without regard to fault or the legality of the original conduct, on certain classes of persons, including the owners or operators of waste disposal sites and companies that disposed or arranged for disposal of hazardous substances found at such sites. We may generate some wastes that fall within the definition of a “hazardous substance.” We may, therefore, be subject to strict, joint and several liability under CERCLA for all or part of any costs required to clean up and restore sites at which such wastes have been disposed, for damages to natural resources, and for the cost of certain health studies. In addition, it is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by hazardous substances or other pollutants released into the environment. Analogous state laws may apply to a broader range of substances than CERCLA and, in some instances, may offer fewer exemptions from liability. We have not received any notification that we may be potentially responsible for material cleanup costs under CERCLA or similar state laws.

Site Remediation

We own and operate a number of pipelines, gathering systems, and storage facilities that have been used to transport, distribute, store and process crude oil and other petroleum products. Many of our facilities were previously owned and operated by third parties whose handling, disposal and release of petroleum and waste materials were not under our control. The age of the facilities, combined with the past operating and waste disposal practices, which were standard for the industry and regulatory regime at the time, have resulted in soil and groundwater contamination at some facilities due to historical spills and releases. Such contamination is not unusual within the petroleum industry. Historical contamination found on, under or originating from our properties may be subject to CERCLA, the Resource Conservation & Recovery Act and analogous state laws as described above.

Under these laws, we could incur substantial expense to remediate such contamination, including contamination caused by prior owners and operators. In addition, Enbridge Management, as the entity with managerial responsibility for us, could also be liable for such costs to the extent that we are unable to fulfill our obligations. We have conducted site investigations at some of our facilities to assess historical environmental issues, and we are currently addressing soil and groundwater contamination at various facilities through remediation and monitoring programs, with oversight by the applicable governmental agencies where appropriate.

Endangered Species

New projects may require approvals and environmental analyses under federal or state laws, including the National Environmental Policy Act and the Endangered Species Act, that result in prohibitions on activities that can result in harm to specific species of plants and animals. The often lengthy regulatory review and project approval process, as well as prohibitions or requirements for capital expenditures to reduce a facility’s impacts on a species, may result in increased costs and liabilities that could materially and negatively affect the viability of a project.

EMPLOYEES

Neither we nor Enbridge Management have any employees. Our General Partner has delegated to Enbridge Management, pursuant to a delegation of control agreement, substantially all of the responsibility for our day-to-day management and operation. Our General Partner, however, retains certain functions and approval rights over our operations. To fulfill its management obligations, Enbridge Management has entered into agreements with Enbridge and several of its affiliates to provide Enbridge Management with the necessary services and support personnel who act on Enbridge Management’s behalf as its agents. We are ultimately responsible for reimbursing these service providers based on the costs that they incur in performing these services.

INSURANCE

Our operations are subject to many hazards inherent in the liquid petroleum gathering, treating, processing and transportation industry. Our assets may experience physical damage as a result of an accident or natural disaster. These hazards can also cause personal injury and loss of life, severe damage to and destruction of property and equipment, pollution or environmental damage, and suspension of operations. We are included in the comprehensive insurance program maintained by Enbridge for its subsidiaries. This program includes insurance coverage in types

15

and amounts and with terms and conditions that are generally consistent with coverage considered customary for our industry.

In the event of multiple insurable incidents occur which exceed coverage limits within the same insurance period, the total insurance coverage will be allocated among the Enbridge entities on an equitable basis based on an insurance allocation agreement we have entered into with Enbridge and other Enbridge subsidiaries.

We can make no assurance that the insurance coverage we maintain will be available or adequate for any particular risk or loss or that we will be able to maintain adequate insurance in the future at rates we consider reasonable. Although we believe that our assets are adequately covered by insurance, a substantial uninsured loss could have a material adverse effect on our financial position, results of operations and cash flows.

TAXATION

We are not a taxable entity for United States federal income tax purposes. Generally, United States federal and state income taxes on our taxable income are borne by our individual partners through the allocation of our taxable income. In a limited number of states, an income tax is imposed upon us and generally, not our individual partners. The income tax that we bear is reflected in our consolidated financial statements. The allocation of taxable income to our individual partners may vary substantially from net income reported in our consolidated statements of income.

AVAILABLE INFORMATION

We make available free of charge on or through our Internet website http://www.enbridgepartners.com our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other information statements, and if applicable, amendments to those reports filed or furnished pursuant to Section 13(a) of the Securities Exchange Act of 1934, as amended, or Exchange Act, as soon as reasonably practicable after we electronically file such material with the SEC. Information contained on our website is not part of this report.

ITEM 1A. RISK FACTORS

We encourage you to consider carefully the risk factors described below, in addition to the other information contained in or incorporated by reference into this Annual Report on Form 10-K.

RISKS RELATED TO OUR BUSINESS

WE MAY NOT HAVE SUFFICIENT CASH FLOWS TO ENABLE US TO CONTINUE TO PAY DISTRIBUTIONS AT THE CURRENT LEVEL.

We may not have sufficient available cash from operating surplus each quarter to enable us to pay distributions at the current level. As part of our previously completed strategic review, which concluded in April 2017, we considered the sustainability of our level of distributions, which had been adversely affected the performance of our natural gas business, cyclical downturns and other factors. Upon completion of the strategic review, we announced several actions intended to strengthen our financial position and outlook, including a reduction in our quarterly distribution.

The amount of cash we are able to distribute depends on the amount of cash we generate from our operations, which can fluctuate quarterly based upon a number of factors, including:

• | the operating performances of our assets; |

• | commodity prices; |

• | our ability to bring new assets into service at its expected time and projected cost; |

• | actions of governmental regulatory bodies; |

• | the level of capital expenditures we make; |

• | the amount of cash reserves established by Enbridge Management; |

• | our ability to access capital markets and borrow money; |

• | our debt service requirements and restrictions in our credit agreements; |

• | fluctuations in our working capital needs; and |

16

• | the cost of acquisitions; and |

• | actions of regulators. |

In addition, the amount of cash we distribute depends primarily on our cash flow rather than net income or net loss. Therefore, we may make cash distributions for periods in which we record net losses or may make no distributions for periods in which we record net income. Other than the requirement in our partnership agreement to distribute all of our available cash each quarter, we have no legal obligation to declare quarterly cash distributions, and our General Partner has considerable discretion to determine the amount of our available cash each quarter. In addition, our General Partner may change our cash distribution policy at any time, subject to the requirement in our partnership agreement to distribute all of our available cash quarterly.

OUR ACTUAL CONSTRUCTION AND DEVELOPMENT COSTS COULD EXCEED OUR FORECAST, AND OUR CASH FLOW FROM CONSTRUCTION AND DEVELOPMENT PROJECTS MAY NOT BE IMMEDIATE, WHICH MAY LIMIT OUR ABILITY TO MAINTAIN OR INCREASE CASH DISTRIBUTIONS.

Our strategy contemplates significant expenditures for the development, construction or other acquisition of energy infrastructure assets. The construction of new assets involves numerous regulatory, environmental, legal, political, federal, state and local permitting, material and labor cost and operational risks that are difficult to predict and beyond our control. As a result, we may not be able to complete our projects at the costs currently estimated or within the time periods we have projected. If we experience material cost overruns, we will have to finance these overruns using one or more of the following methods:

• | using cash from operations; |

• | delaying other planned projects; |

• | incurring additional indebtedness; or |

• | issuing additional equity. |

Any or all of these methods may not be available when needed or may adversely affect our future results of operations and cash flows.

Our revenues and cash flows may not increase immediately on our expenditure of funds on a particular project. For example, if we build a new pipeline or expand an existing facility, the design, construction, development and installation may occur over an extended period of time and we may not receive any material increase in revenue or cash flow from that project until after it is placed in service and customers begin using the systems. In addition, circumstances may occur from time to time, such as the inability to obtain a necessary permit, which could cause us to cancel a project. If our revenues and cash flow do not increase at projected levels because of substantial unanticipated delays, project cancellations or other factors, we may not meet our obligations as they become due, and we may need to reduce or re-prioritize our capital budget, sell non-strategic assets, access the capital markets or reassess our level of distributions to unitholders to meet our capital and other requirements.

OUR ABILITY TO ACCESS CAPITAL AND CREDIT MARKETS ON ATTRACTIVE TERMS TO OBTAIN FUNDING FOR OUR CAPITAL PROJECTS AND ACQUISITIONS MAY BE LIMITED.

Our ability to fund our capital projects and make acquisitions depends on whether we can access the necessary financing to fund these activities. Domestic and international economic conditions affect the functioning of capital markets and the availability of credit. Adverse economic conditions, such as the depressed levels of commodity prices experienced since the fall of 2014, can result in weakness and volatility in the capital markets, which in turn can limit, temporarily or for extended periods, our ability to raise capital through equity or debt offerings. Additionally, the availability and cost of obtaining credit commitments from lenders can change as economic conditions and banking regulations reduce the credit that lenders have available or are willing to lend. These conditions, can make it difficult to obtain funding for our capital needs from the capital markets on acceptable economic terms. As a result, we may be required to revise the timing and scope of capital projects as necessary to adapt to prevailing market and economic conditions.