Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT-99.2 - Goodman Networks Inc | d288074dex992.htm |

| EX-10.1 - EXHIBIT-10.1 - Goodman Networks Inc | d288074dex101.htm |

| 8-K - FORM 8-K - Goodman Networks Inc | d288074d8k.htm |

Exhibit 99.1

Goodman Networks Financial Review

December 2, 2016

Goodman Networks

Network Knowledge…Delivered

Disclaimer

PROVIDED

PURSUANT TO NON-DISCLOSURE

AGREEMENT

DRAFT – SUBJECT TO REVISION

PREPARED AT DIRECTION OF COUNSEL

This presentation contains forward-looking statements, which are subject to various risks and uncertainties. Forward-looking statements are neither historical facts nor assurances

of future performance. They are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions,

which may be unreliable, and there can be no assurance that such statements will be reflective of actual outcomes. Our results could differ materially from those projected. Forward-looking statements can be identified by words such as:

“anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,”

“may,” “should,” “will” and similar references to future periods. No representation is made as to the accuracy, continued accuracy or completeness of such statements.

The financial forecasts included in this presentation:

are speculative by their nature and is

based upon numerous expectations, beliefs, opinions, and assumptions which are inherently uncertain and many of which are beyond the control of the Company and may not prove to be accurate;

does not reflect future changes in general business or economic conditions, or any other transaction or event that may occur and that was not anticipated at the time the

information was prepared;

may not reflect future performance, which may be significantly more favorable or less favorable than as set forth in the prospective

financial information; and

is not, and should not be regarded as, a representation that any of the expectations contained in, or forming a part of, the forecasts

will be achieved.

All of the financial information contained herein is forward-looking in nature. The information is subjective in many respects and thus subject

to interpretation. Further, the information relates to multiple future years and such information by its nature becomes less predictive with each succeeding day. The Company cannot provide assurance that the financial projections will be realized;

rather, actual future financial results may vary materially from the forward-looking information.

Except as required by law, the Company does not intend to update

or revise publicly any of the prospective financial information to reflect circumstances or other events occurring after the date the financial projections were prepared or to reflect the occurrence of future events. These considerations should be

taken into account in reviewing the financial projections, which were prepared as of an earlier date. For additional information on factors that may cause actual future financial results to vary materially from the prospective financial information,

see the section entitled “Cautionary Note Regarding Forward-Looking Statements” below. 2

Goodman Networks

Network

Knowledge…Delivered

Financial Summary

Financial Projections

PROVIDED PURSUANT TO NON-DISCLOSURE

AGREEMENT

DRAFT – SUBJECT TO REVISION

PREPARED AT DIRECTION OF COUNSEL

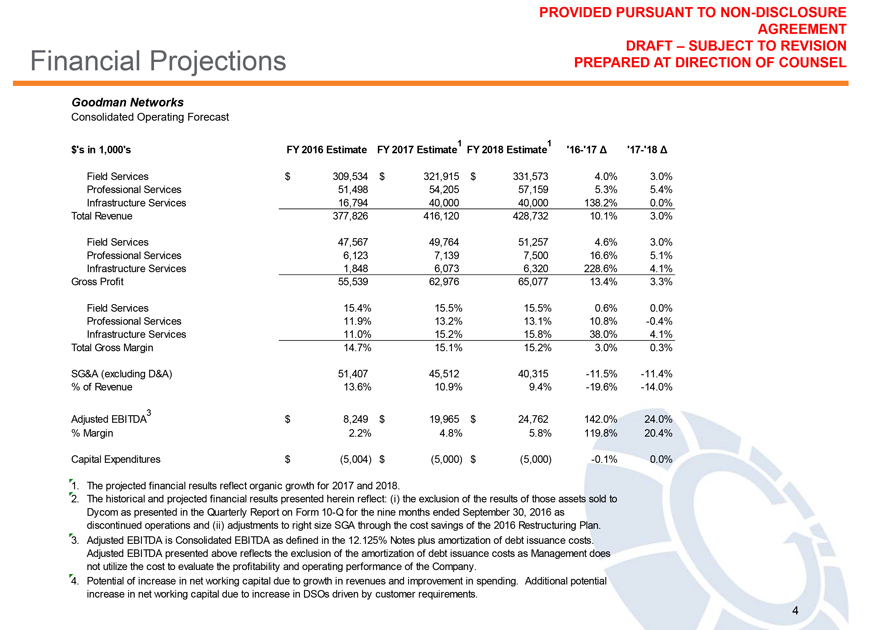

Goodman Networks

Consolidated Operating Forecast

$’s in 1,000’s FY 2016 Estimate FY 2017 Estimate1 FY

2018 Estimate1 ‘16-‘17 ‘17-‘18

Field Services $309,534 $321,915

$331,573 4.0% 3.0%

Professional Services 51,498 54,205 57,159 5.3% 5.4%

Infrastructure Services 16,794 40,000 40,000 138.2% 0.0%

Total Revenue

377,826 416,120 428,732 10.1% 3.0%

Field Services 47,567 49,764 51,257 4.6% 3.0%

Professional Services 6,123 7,139 7,500 16.6% 5.1%

Infrastructure Services 1,848 6,073 6,320

228.6% 4.1%

Gross Profit 55,539 62,976 65,077 13.4% 3.3%

Field Services 15.4%

15.5% 15.5% 0.6% 0.0%

Professional Services 11.9% 13.2% 13.1% 10.8% -0.4%

Infrastructure Services 11.0% 15.2% 15.8% 38.0% 4.1%

Total Gross Margin 14.7%

15.1% 15.2% 3.0% 0.3%

SG&A (excluding D&A) 51,407 45,512 40,315 -11.5% -11.4%

% of Revenue 13.6% 10.9% 9.4% -19.6% -14.0%

Adjusted EBITDA3 $8,249 $19,965 $24,762 142.0%

24.0%

% Margin 2.2% 4.8% 5.8% 119.8% 20.4%

Capital Expenditures $(5,004)

$(5,000) $(5,000) -0.1% 0.0%

1. The projected financial results reflect organic growth for 2017 and 2018.

2. The historical and projected financial results presented herein reflect: (i) the exclusion of the results of those assets sold to Dycom as presented in the Quarterly Report on

Form 10-Q for the nine months ended September 30, 2016 as discontinued operations and (ii) adjustments to right size SGA through the cost savings of the 2016 Restructuring Plan.

3. Adjusted EBITDA is Consolidated EBITDA as defined in the 12.125% Notes plus amortization of debt issuance costs.

Adjusted EBITDA presented above reflects the exclusion of the amortization of debt issuance costs as Management does not utilize the cost to evaluate the profitability and

operating performance of the Company.

4. Potential of increase in net working capital due to growth in revenues and improvement in spending. Additional potential

increase in net working capital due to increase in DSOs driven by customer requirements. 4

Cash Walkforward

PROVIDED

PURSUANT TO NON-DISCLOSURE

AGREEMENT

DRAFT – SUBJECT TO REVISION

PREPARED AT DIRECTION OF COUNSEL

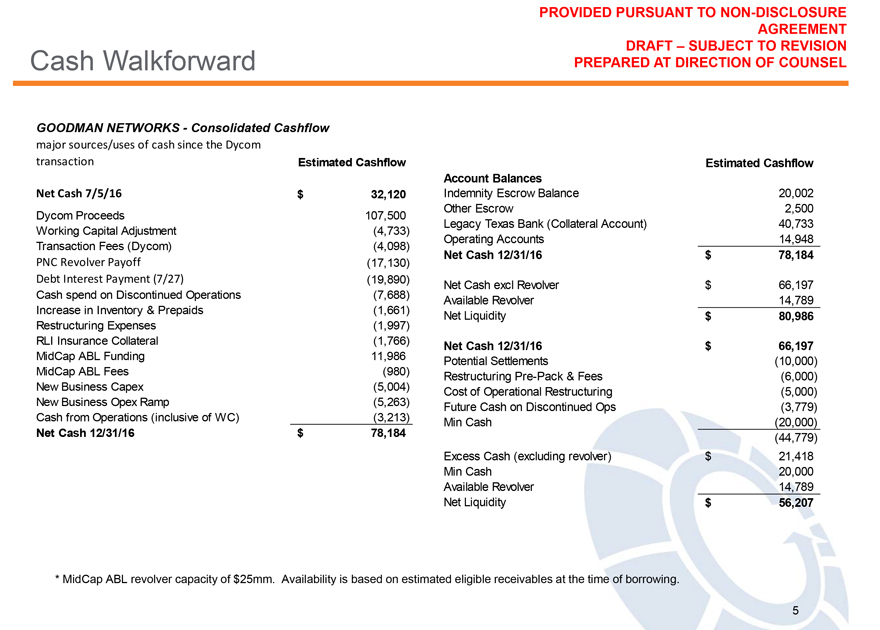

GOODMAN NETWORKS - Consolidated Cashflow major sources/uses of cash since the Dycom

transaction Estimated Cashflow

Net Cash 7/5/16 $32,120

Dycom Proceeds 107,500

Working Capital Adjustment (4,733)

Transaction Fees (Dycom) (4,098)

PNC Revolver Payoff (17,130)

Debt Interest Payment (7/27) (19,890)

Cash spend on Discontinued Operations

(7,688)

Increase in Inventory & Prepaids (1,661)

Restructuring

Expenses (1,997)

RLI Insurance Collateral (1,766)

MidCap ABL Funding 11,986

MidCap ABL Fees (980)

New Business Capex (5,004)

New Business Opex Ramp (5,263)

Cash from Operations (inclusive of WC) (3,213)

Net Cash 12/31/16 $78,184

Estimated Cashflow

Account Balances

Indemnity Escrow Balance 20,002

Other Escrow 2,500

Legacy Texas Bank (Collateral Account) 40,733

Operating Accounts 14,948

Net Cash 12/31/16 $78,184

Net Cash excl Revolver $66,197

Available Revolver 14,789

Net Liquidity $80,986

Net Cash 12/31/16 $66,197

Potential Settlements (10,000)

Restructuring

Pre-Pack & Fees (6,000)

Cost of Operational Restructuring (5,000)

Future Cash on Discontinued Ops (3,779)

Min Cash (20,000)

(44,779)

Excess Cash (excluding revolver) $21,418

Min Cash 20,000

Available Revolver 14,789

Net Liquidity $56,207

* MidCap ABL revolver capacity of $25mm. Availability is based on

estimated eligible receivables at the time of borrowing. 5