Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - Goodman Networks Inc | gnet-ex312_7.htm |

| EX-32.1 - EX-32.1 - Goodman Networks Inc | gnet-ex321_8.htm |

| EX-21.1 - EX-21.1 - Goodman Networks Inc | gnet-ex211_6.htm |

| EX-31.1 - EX-31.1 - Goodman Networks Inc | gnet-ex311_9.htm |

| EX-10.82 - EX-10.82 - Goodman Networks Inc | gnet-ex1082_866.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

x |

Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Fiscal Year Ended December 31, 2015

or

|

¨ |

Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission File Number 333-186684

Goodman Networks Incorporated

(Exact name of registrant as specified in its charter)

|

Texas |

|

74-2949460 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

2801 Network Blvd., Suite 300 Frisco, TX |

|

75034 |

|

(Address of principal executive offices) |

|

(Zip Code) |

972-406-9692

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. YES x NO ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.* YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated filer |

¨ |

|

Accelerated Filer |

¨ |

|

Non-accelerated Filer |

x |

|

Smaller Reporting Company |

¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ¨ NO x

Shares of the registrant’s common equity are not, and were not on June 30, 2015, traded on or in any public market.

As of March 30, 2016, there were 912,754 shares of the registrant’s common stock, $0.01 par value, outstanding.

|

* |

The registrant has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, but is not required to file such reports under such sections. |

|

|

|

|

|

|

Item 1. |

|

4 |

|

|

Item 1A. |

|

12 |

|

|

Item 1B. |

|

29 |

|

|

Item 2. |

|

29 |

|

|

Item 3. |

|

29 |

|

|

Item 4. |

|

29 |

|

|

|

|

|

|

|

Item 5. |

|

30 |

|

|

Item 6. |

|

31 |

|

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

33 |

|

Item 7A. |

|

54 |

|

|

Item 8. |

|

55 |

|

|

Item 9. |

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

83 |

|

Item 9A. |

|

83 |

|

|

Item 9B. |

|

84 |

|

|

|

|

|

|

|

Item 10. |

|

85 |

|

|

Item 11. |

|

88 |

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

105 |

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

106 |

|

Item 14. |

|

110 |

|

|

|

|

|

|

|

Item 15. |

|

111 |

The terms “we,” “us” and “our” as used in this Annual Report on Form 10-K (this “Annual Report”) refer to Goodman Networks Incorporated and its directly and indirectly owned subsidiaries on a consolidated basis; references to “Goodman Networks” or our “Company” refer solely to Goodman Networks Incorporated; and references to “Multiband” refer to our former subsidiary, Multiband Corporation, which was merged into Goodman Networks in December 2015.

Cautionary Statement Regarding Forward-Looking Statements

Certain statements contained in this Annual Report are not statements of historical fact and are forward-looking statements. These forward-looking statements are included throughout this Annual Report, including the sections titled “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and relate to matters such as our industry, capital expenditures by wireless carriers, business strategy, goals and expectations concerning our market position, future operations, revenues, margins, cost savings initiatives, profitability, capital expenditures, liquidity and capital resources and other financial and operating information. Words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “would,” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. We have based these forward-looking statements on our current assumptions, expectations and projections about future events.

Forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from those anticipated in such statements. Most of these factors are outside our control and difficult to predict. Factors that may cause such differences include, but are not limited to:

|

|

· |

our reliance on a single customer for a vast majority of our revenues; |

|

|

· |

our ability to maintain a level of service quality satisfactory to this customer across a broad geographic area; |

|

|

· |

our ability to manage or refinance our substantial level of indebtedness and our ability to generate sufficient cash to service our indebtedness; |

|

|

· |

our ability to raise additional capital to fund our operations and meet our obligations; |

|

|

· |

our reliance on contracts that do not obligate our customers to undertake work with us and that are cancellable on limited notice; |

|

|

· |

our ability to translate amounts included in our estimated backlog into revenue or profits; |

|

|

· |

our ability to weather economic downturns and the cyclical nature of the telecommunications and subscription television service industries; |

|

|

· |

our ability to maintain our certification as a minority business enterprise; |

|

|

· |

our reliance on subcontractors to perform certain types of services; |

|

|

· |

our ability to maintain proper and effective internal controls; |

|

|

· |

our reliance on a limited number of key personnel who would be difficult to replace; |

|

|

· |

our ability to manage potential credit risk arising from unsecured credit extended to our customers; |

|

|

· |

our ability to weather economic downturns and the cyclical nature of the telecommunications and subscription television service industries; |

|

|

· |

our ability to compete in our industries; and |

|

|

· |

our ability to adapt to rapid regulatory and technological changes in the telecommunications and subscription television service industries. |

For a more detailed discussion of these and other factors that may affect our business and that could cause the actual results to differ materially from those anticipated in these forward-looking statements, see “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” herein. We caution that the foregoing list of factors is not exclusive, and new factors may emerge, or changes to the foregoing factors may occur, that could impact our business. All subsequent written and oral forward-looking statements concerning our business attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements above. We do not undertake any obligation to update any forward-looking statement, whether written or oral, relating to the matters discussed in this Annual Report except to the extent required by applicable securities laws.

3

Overview

Since our founding in 2000, we have grown to be a leading provider of end-to-end network infrastructure and professional services to the telecommunications industry and installation and maintenance services for satellite communications. Our wireless telecommunications services span the full network lifecycle, including the design, engineering, construction, deployment, integration, maintenance, and decommissioning of wireless networks. We perform these services across multiple network infrastructures, including traditional cell towers as well as small cell and distributed antenna systems (“DAS”). We serve the satellite television industry by providing onsite installation, upgrading and maintenance of satellite television systems to both residential and commercial market customers. These highly specialized and technical services are critical to the capability of our customers to deliver voice, data and video services to their end users. For the years ended December 31, 2013 and 2014, we generated revenues of $931.7 million and $1,199.2 and net losses of $43.2 million and $14.9 million, respectively. For the year ended December 31, 2015, we generated revenues of $725.1 million and a net loss of $66.5 million, respectively.

The wireless telecommunications industry has been characterized with favorable trends that have historically driven growth. This industry has benefitted from the rapid developments of mobile devices which has sustained a phase of expansion and increased the number of wireless devices and demand for greater speed and availability of mobile data. Users continue to upgrade to more advanced mobile devices, such as smartphones and tablets, and access more bandwidth-intensive applications. According to the Cisco Visual Networking Index, the Global Mobile Data Traffic Forecast Update for 2015-2020, or the Cisco VNI Mobile Update, mobile data traffic in North America will grow 6-fold from 2015 to 2020, a compound annual growth rate of 42%. North American mobile data traffic will reach 3.2 exabytes per month by 2020, and globally, expected to reach 30.6 exabytes by 2020. These developments created significant challenges for wireless carriers to manage increasing network congestion and continually deliver a high quality customer experience. In response, carriers, governments and other enterprises made substantial investments to upgrade their wireless infrastructures to the Long-Term Evolution (“4G-LTE”) wireless standard, which was largely completed in 2014, and they have since continued to increase the capacity and performance of their competing communications networks. Carriers have also announced that they believe that 4K video, virtual reality and the “Internet of Things” will generate a new wave of growth in data usage and in preparation that they plan to begin testing technology expected to become the next generation of wireless networks, or 5G, in 2016 for future deployment beginning in the next few years. In addition to deployment of wireless networks, multiple incumbent as well as new entrants are devoting significant capital expenditures to upgrade wireline/fiber networks to 1-gigabit speeds. We expect these dynamics in the mobile and wireline/fiber data markets to create continuing opportunities for providers of wireless and wireline/fiber infrastructure construction services in the United States.

We have established long-standing relationships with Tier-1 wireless carriers and OEMs, including AT&T, Inc. and its subsidiaries or AT&T, which include AT&T Mobility and DIRECTV, Sprint/United Management Company, or Sprint and Alcatel-Lucent USA Inc., or Alcatel-Lucent. Over the last few years, we have sought to diversify our customer base within the telecommunications industry by leveraging our long-term success and reputation for quality to win new customers such as Century Link, Inc., and Verizon Wireless, or Verizon, although in each case at lower volumes than our work with AT&T. We generated nearly all of our revenues over the past several years under master service agreements, or MSAs, that establish a framework, including pricing and other terms, for providing ongoing services. Since 2013, we have strategically expanded our service offerings in each of the television industry, the small cell and DAS business and the wireline business. Through our acquisition of Multiband in 2013, we acquired a large technician workforce and began to install, maintain and upgrade satellite television systems for residential and commercial customers. We recently began using this workforce to install Digital Life systems for AT&T Inc. pursuant to an agreement we entered with AT&T Services, in January 2016. In 2013, we began providing end-to-end management of Sprint’s enterprise femtocells application, and we entered into a Cell Site Construction Agreement with a subsidiary of Verizon in 2013 to provide similar services. During 2014 and 2015, we provided small cell or DAS services to over 100 enterprises including higher education institutions, stadiums for professional and collegiate sports events, hotels and resorts, major retailers, hospitals and government agencies. Growth of the small cell and DAS markets slowed during 2015 as certain carriers, including AT&T, deferred their capital expenditures on such DAS programs as existing structures have largely been built out. Further reductions are expected in 2016 as AT&T shifts its capital expenditures from wireless to wireline in order to upgrade its wireline to fiber optic cable. While the Company has been awarded work to perform for AT&T wireline, the work will not begin until mid-2016. Although we have seen a significant reduction in the services we provide to AT&T in our infrastructure services segment, we have experienced strong growth from our field services segment, which includes services we provide to AT&T Inc.’s subsidiary DIRECTV.

Our relationship with AT&T Inc. began in 2002 with Cingular Wireless LLC and Southwestern Bell Telephone Company and has subsequently grown in scope. Currently, we provide various levels of site acquisition, construction, technology upgrades, Fiber to the Cell and maintenance services for AT&T in fourteen states, pursuant to the Mobility Turf Contract, a multi-year MSA that we entered into with AT&T and have amended and replaced from time to time. In September of 2014 we extended the term of our Mobility Turf Contract to August 31, 2017.

We have a long-standing relationship with DIRECTV which, through our acquisition of Multiband, extends for 18 years. In March 2015, we extended our MSA with DIRECTV for the installation and maintenance of residential satellite television systems to

4

provide for a term expiring in October 2018. In July 2015, AT&T Inc. acquired DIRECTV by merger, and DIRECTV became a subsidiary of AT&T Inc. As a result, our revenues have become more concentrated and dependent on our relationship with AT&T Inc. and to the extent that our performance does not meet this customer’s expectations, or our reputation or relationship with our key customer becomes impaired, we could lose future business with this customer, which would materially adversely affect our ability to generate revenue. Subsidiaries of AT&T Inc., including DIRECTV, collectively represented approximately 81.0%, 87.2% and 89.3% of revenues for the years ended December 31, 2013, 2014 and 2015, respectively.

Our Businesses

We primarily operate through three business segments, Infrastructure Services, Field Services and Professional Services. Through our Infrastructure Services and Professional Services segments, we help wireless carriers, OEMs and cable companies design, engineer, construct, deploy, integrate, maintain and decommission critical elements of wireless and wireline telecommunications networks. Through our Field Services segment, we install, upgrade and maintain satellite television systems for both residential and commercial customers.

For the years ended December 31, 2013, 2014 and 2015, our Infrastructure Services (IS) division generated 76.8%, 69.9% and 54.0% of our revenue, our Field Services (FS) division generated 9.5% , 21.8% and 36.1% of our revenue and our the Professional Service (PS) division generated 12.0%, 8.3% and 9.9% of our revenue, respectively. In the first quarter of 2014, we integrated the Engineering, Energy & Construction, or EE&C, line of business that comprised our Other Services segment with the Infrastructure Services and Professional Services segments, and as a result there is no longer an Other Services segment. We have not restated the corresponding items of segment information for the year ended December 31, 2013 because the employees that previously comprised the EE&C line of business are now serving customers within the Infrastructure Services segment and the remaining operations of the Other Services segment that were realigned to the Infrastructure Services, Professional Services or Field Services segments are not material to those segments individually. Revenues, cost of revenues, gross profit, gross margin and total assets by segment as of and for the years ended December 31, 2013, 2014 and 2015 were as follows (dollars in millions):

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

|

|

2013 |

|

|

2014 |

|

2015 |

|||||||||||||||||||||||||||||||||||||||

|

|

PS |

|

|

IS |

|

|

FS |

|

|

Other |

|

|

PS |

|

|

IS |

|

|

FS |

|

Other |

|

PS |

|

|

IS |

|

|

FS |

|

Other |

|

|

||||||||||||

|

Revenues |

$ |

111.5 |

|

|

$ |

715.5 |

|

|

$ |

88.2 |

|

|

$ |

16.5 |

|

|

$ |

99.9 |

|

|

$ |

838.0 |

|

|

$ |

261.3 |

|

$ |

- |

|

$ |

71.7 |

|

|

$ |

391.8 |

|

|

$ |

261.6 |

|

$ |

- |

|

|

|

Cost of revenues |

$ |

91.6 |

|

|

$ |

622.4 |

|

|

$ |

77.9 |

|

|

$ |

14.2 |

|

|

$ |

92.4 |

|

|

$ |

707.6 |

|

|

$ |

225.4 |

|

$ |

- |

|

$ |

63.6 |

|

|

$ |

359.6 |

|

|

$ |

215.4 |

|

$ |

- |

|

|

|

Gross profit |

$ |

19.9 |

|

|

$ |

93.1 |

|

|

$ |

10.3 |

|

|

$ |

2.3 |

|

|

$ |

7.5 |

|

|

$ |

130.4 |

|

|

$ |

35.9 |

|

$ |

- |

|

$ |

8.1 |

|

|

$ |

32.2 |

|

|

$ |

46.2 |

|

$ |

- |

|

|

|

Gross margin |

|

17.8 |

% |

|

|

13.0 |

% |

|

|

11.7 |

% |

|

|

13.9 |

% |

|

|

7.5 |

% |

|

|

15.6 |

% |

|

|

13.7 |

% |

|

0.0 |

% |

|

11.2 |

% |

|

|

8.2 |

% |

|

|

17.7 |

% |

|

0.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2013 |

|

|

2014 |

|

2015 |

|||||||||||||||||||||||||||||||||||||||

|

|

PS |

|

|

IS |

|

|

FS |

|

|

Corporate |

|

|

PS |

|

|

IS |

|

|

FS |

|

Corporate |

|

PS |

|

|

IS |

|

|

FS |

|

Corporate |

|

|

||||||||||||

|

Total assets |

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

56.5 |

|

|

$ |

183.2 |

|

|

$ |

119.0 |

|

$ |

55.3 |

|

$ |

23.8 |

|

|

$ |

72.3 |

|

|

$ |

112.2 |

|

$ |

23.8 |

|

|

5

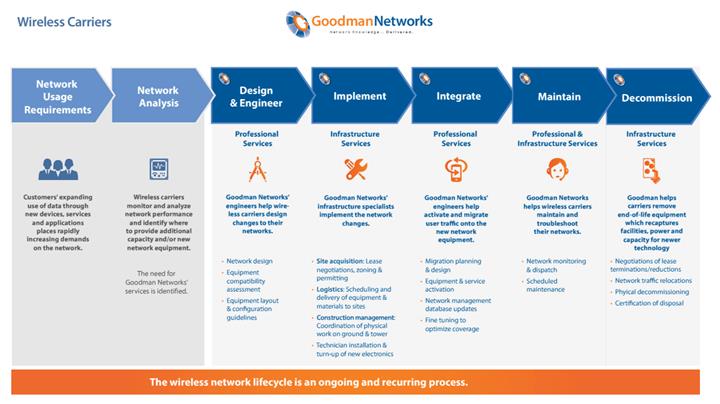

The following diagram illustrates our customers’ recurring need for the services we provide in our Infrastructure Services and our Professional Services segments:

As illustrated in the graphic above, wireless carriers continually monitor network traffic and usage patterns. As they identify network inefficiencies, service problems or capacity constraints, they often engage companies like us to perform maintenance or network enhancements, such as adding equipment to the network, to alleviate the issue.

Infrastructure Services. Our Infrastructure Services segment provides program management services of field projects necessary to deploy, upgrade, maintain or decommission wireless and wireline outdoor networks. We support wireless carriers in their implementation of critical technologies such as 4G-LTE, the addition of new macro cell sites and outdoor small cell sites, increases of capacity at their existing cell sites through additional spectrum allocations, as well as other optimization and maintenance activities at cell sites. Our Infrastructure Services segment is also positioned to assist with the future deployment of 5G networks that major carriers have announced plans to begin testing in 2016. When a network provider requests our services to build or modify a cell site, our Infrastructure Services segment is able to: (i) handle the required pre-construction leasing, zoning, permitting and entitlement activities for the acquisition of the cell site, (ii) prepare site designs, structural analysis and certified drawings, and (iii) manage the construction or modification of the site including tower-top and ground equipment installation. These services are managed by our wireless project and construction managers and are performed by a combination of scoping engineers, real estate specialists, ground crews, line and antenna crews and equipment technicians, either employed by us or retained by us as subcontractors.

Our Infrastructure Services segment also provides fiber and wireless backhaul services to carriers. We are also providing outside plant, engineering and related services to our wireline customers. Our fiber backhaul services, or Fiber to the Cell services, connect existing points in the fiber networks of wireline carriers to thousands of cell sites needing the bandwidth and ethernet capabilities for upgrading capacity. Our microwave backhaul services provide a turnkey solution offering site audit, site acquisition, microwave line of sight surveys, path design, installation, testing and activation services. This fiber and wireless backhaul work often involves planning, route engineering, right-of-way (for fiber work) and permitting, logistics, project management, construction inspection, and optical fiber splicing services. Backhaul work is performed to extend an existing optical fiber network, owned by a wireline carrier, typically between several hundred yards to a few miles, to the cell site.

6

Field Services. Our Field Services segment provides installation and maintenance services to DIRECTV, commercial customers and a provider of internet wireless service primarily to rural markets. We fulfilled over 1.5 million satellite television installations, upgrade or maintenance work orders during each of 2014 and 2015 for DIRECTV, representing 28.0% of DIRECTV’s outsourced work orders for residents of single-family homes for both years. We were the second largest DIRECTV in-home installation provider in the United States for each of the years ended December 31, 2014 and 2015. In addition to our residential MSA with DIRECTV, our MSA to install equipment for multi dwelling unit, or MDU, facilities was extended in 2015 through 2018. The MSA contains an automatic one-year renewal and may be terminated by either party upon a 180 days’ notice. In addition, on January 25, 2016, we signed a one-year agreement with AT&T Services to provide Digital Life installation and repair services in connection with our DIRECTV satellite television installation services. The contract renews annually but either party has the right to terminate the agreement upon 60 days’ notice.

Professional Services. Our Professional Services segment provides customers with highly technical services primarily related to the design, engineering, integration and performance optimization of transport, or “backhaul,” and core, or “central office,” equipment of enterprise and wireless carrier networks. When a network operator integrates a new element into its live network or performs a network-wide upgrade, a team of in-house engineers from our Professional Services segment can administer the complete network design, equipment compatibility assessments and configuration guidelines, the migration of data traffic onto the new or modified network and the network activation.

In addition, we provide services related to the engineering and installation of indoor small cell and DAS networks. Our enterprise small cell and DAS customers often require most or all of the services listed above and may also purchase consulting, post-deployment monitoring, performance optimization and maintenance services. Demand for DAS services declined in 2015 as DAS have largely been built out in existing structures, and we completed our large stadium DAS build in 2015. While we will continue to offer small cell and DAS services, we intend to focus our efforts to broaden our services with enterprise customers, where we believe there is more opportunity for growth.

Other Services. The Other Services segment included our EE&C line of business and, until we disposed of the assets related to our MDU line of business, or the MDU Assets, to an affiliate of DIRECTV on December 31, 2013, our MDU line of business. In the first quarter of 2014, we integrated our EE&C line of business with our Infrastructure Services and Professional Services segments. As a result of the disposition of the MDU Assets and the integration of our EE&C line of business, we no longer have an Other Services segment. We have not restated the corresponding items of segment information for the year ended December 31, 2013 because the employees that previously comprised the EE&C line of business immediately prior to such integration are now serving customers within the Infrastructure Services segment and the remaining operations of the Other Services segment that were reassigned to the Infrastructure Services, Professional Services or Field Services segments are not material to those segments individually.

Our Industries

We participate in the large and growing market for connectivity and essential wireless and wireline telecommunications infrastructure services. We also participate in the significant satellite television installation and maintenance market for both residential and commercial customers.

The wireless telecommunications industry is characterized by an escalation in both the number of wireless devices and the demand for those mobile devices to deliver and transmit larger quantities of mobile data traffic faster and more reliably. Although wireless carriers largely built out their 4G-LTE networks in 2014, they continue to upgrade the capacity and performance of their competing communications networks. Major carriers have also announced that they plan to begin testing 5G technology in 2016 for future deployment beginning in the next few years to address the next expected major wave of growth in data usage. In order to provide increased wireless network capacity and performance while maintaining flexibility, efficiency and lower costs, many wireless carriers have moved to outsourcing many of the services required to design, build and maintain their wireless networks.

The U.S market for satellite television subscribers is significant and we expect that the demand for our outsourced installation and maintenance services related to the satellite television market will remain steady as providers continue to upgrade technology and add customers by investing in competitive marketing efforts.

Customers

We served over 150 customers in 2015 and the vast majority of our revenues are from subsidiaries of AT&T Inc., including AT&T Mobility, AT&T Services and DIRECTV. Our customer list includes several of the largest carriers and OEMs in the telecommunications industry. Revenues earned from customers other than subsidiaries of AT&T Inc., were 19.0% of total revenues for the year ended December 31, 2013, 12.8% of total revenues for the year ended December 31, 2014 and 10.7% of total revenue for the year ended December 31, 2015. In July 2015, AT&T Inc. completed its previously announced acquisition of DIRECTV, and DIRECTV became a subsidiary of AT&T Inc. With the consummation of the merger, our revenues have become more concentrated

7

and dependent on our relationship with AT&T Inc., if our reputation or relationships with this key customer becomes impaired, we could lose future business with this customer, which could materially adversely affect our ability to generate revenue.

Revenue concentration by dollar amount and as a percentage of total consolidated revenue:

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

2013 |

|

|

2014 |

|

2015 |

|

|

||||||||||||||||||||||||||||||||||

|

|

Revenue |

|

|

Percent of Total |

|

|

Revenue |

|

|

Percent of Total |

|

Revenue |

|

Percent of Total |

|

|

||||||||||||||||||||||||||

|

Subsidiaries of AT&T Inc., other than DIRECTV |

$ |

662,758 |

|

|

|

71.1 |

% |

|

$ |

797,452 |

|

|

|

66.5 |

% |

$ |

388,566 |

|

|

53.6 |

% |

|

||||||||||||||||||||

|

DIRECTV |

|

92,425 |

|

|

|

9.9 |

% |

|

|

248,414 |

|

|

|

20.7 |

% |

|

258,851 |

|

|

35.7 |

% |

|

||||||||||||||||||||

|

|

$ |

755,183 |

|

|

|

81.0 |

% |

|

$ |

1,045,866 |

|

|

|

87.2 |

% |

$ |

647,417 |

|

|

89.3 |

% |

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

AT&T

Historically, we have provided site acquisition, construction, technology upgrades, Fiber to the Cell and maintenance services for AT&T, at cell sites in 11 of 31 distinct AT&T markets, or Turf Markets comprised of 11 states. In 2015, AT&T rebalanced certain markets where we were the primary vendor, but added 3 additional states where we are an approved vendor for a total of 14 states. We historically have acted as either the sole, primary or secondary vendor, pursuant to the multi-year MSA that we have entered into with AT&T and have amended and replaced from time to time. We refer to our MSAs with AT&T related to its turf program collectively as the “Mobility Turf Contract.” Our original Mobility Turf Contract provided for a term expiring on November 30, 2015, and AT&T had the option to renew the contract on a yearly basis thereafter.

In 2014, we restructured our Mobility Turf Contract to consist of a general MSA with subordinate MSAs governing the services we provide thereunder. Effective January 14, 2014, we entered into the general MSA and a subordinate MSA governing site acquisition services, and on September 1, 2014, we entered into a subordinate MSA governing program management, project management, architecture and engineering, construction management and equipment installation services, or the Subordinate Construction MSA. The services governed by these subordinate MSAs were formerly provided pursuant to our previous Mobility Turf Contract MSA. The general MSA provides for a term expiring on August 31, 2016, and the Subordinate Construction MSA provides for a term expiring on August 31, 2017. AT&T has the option to renew both contracts on a yearly basis thereafter. Aside from extending the term of our Mobility Turf Contract, we do not anticipate that its restructuring will have a material effect on our results of operations.

During the second quarter of 2014, AT&T deferred certain capital expenditures with us. We began to see an impact to the volume of services provided to subsidiaries of AT&T Inc. during the same quarter, due to the deferral of these AT&T capital expenditures and we expected this impact to continue into 2015. On November 7, 2014, AT&T announced that as a result of the substantial completion of the expansion of its 4G-LTE network, its capital expenditures would decrease in 2015, particularly with respect to its wireless infrastructure. Additionally, in 2015, AT&T reassigned certain of our Turf Markets to other vendors and, in an effort to diversify its supplier base, rebalanced the work assigned to us in certain other Turf Markets where we were the primary vendor to other vendors. The deferrals, the announced reduction in AT&T’s 2015 capital expenditures and the Turf Market reassignment and rebalancing reduced our 2015 revenues compared to 2014. With the completion of the build out of AT&T’s 4G-LTE network having occurred in 2014, we do not anticipate that the wireless revenues for our Infrastructure Services business will return to 2014 levels in 2016.

DIRECTV

We began providing satellite television installation services with our 2013 acquisition of Multiband. Our relationship DIRECTV extends for over 18 years through the Multiband acquisition and is essential to the success of our Field Services segment’s operations. We have been named the HSP partner of the year for the both 2014 and 2015 fiscal years. We are one of three in-home installation providers that DIRECTV utilizes in the United States, and during each of the years ended December 31, 2014 and 2015, we performed 28.0% of all DIRECTV’s outsourced installation, upgrade and maintenance activities. Our contract with DIRECTV has a term expiring on October 15, 2018, and contains an automatic one-year renewal. The contract may also be terminated by 180 days’ notice by either party. Until December 31, 2013, we also provided customer support and billing services to certain of DIRECTV’s customers through our Other Services segment pursuant to a separate arrangement. On January 25, 2016, we signed a one-year agreement with AT&T Services to provide Digital Life installation and repair services in connection with our satellite television installation services for DIRECTV. The contract renews annually but is terminable upon 60 days’ notice by either party.

8

Alcatel-Lucent

On July 15, 2014, we entered into a three-year MSA with Alcatel-Lucent, effective as of June 30, 2014, or the 2014 Alcatel-Lucent Contract. Pursuant to the 2014 Alcatel-Lucent Contract, we will provide, upon request, certain services, including deployment engineering, integration engineering, radio frequency engineering and other support services to Alcatel-Lucent that were formerly provided under the Alcatel-Lucent Contract. We have experienced a decline in the amount of legacy work that we have performed for Alcatel-Lucent and we expect this decline to continue, although with the announcement on January 4, 2016, of the Nokia and Alcatel-Lucent finalization of the merger of the two companies, we are also seeking to obtain work from Nokia on newer technologies. The 2014 Alcatel-Lucent Contract has an initial term ending June 30, 2017, after which the parties may mutually agree to extend the term on a yearly basis. During the years ended December 31, 2013, 2014 and 2015, we recognized $57.9 million, $42.6 million and $22.7 million of revenue related to the services provided to Alcatel-Lucent.

Sprint

In May 2012, we entered into an MSA with Sprint to provide decommissioning services for Sprint’s iDEN (push-to-talk) network. We are removing equipment from Sprint’s network that is no longer in use and restoring sites to their original condition. For the years ended December 31, 2013, 2014 and 2015 we recognized $34.0 million, $51.8 million and $17.5 million of revenue, respectively, related to the services we provide for Sprint. The Sprint Agreement has an initial term of five years, and automatically renews on a monthly basis thereafter unless notice of non-renewal is provided by either party. As of December 31, 2014, we completed iDEN decommissioning work of over 11,400 cell sites under the Sprint Agreement. During 2015, we started providing radio frequency engineering services to Sprint and on October 2, 2015, we received a project award to decommission Sprint’s WIMAX network for certain regions. We have established a strong performance record with Sprint and we are working to grow and evolve our relationship with them in the future.

Enterprise Customers

We provided services to over 100 enterprise customers through our Professional Services segment in 2015. These service offerings consist of the design, installation and maintenance of DAS systems to customers such as Fortune 500 companies, hotels, hospitals, college campuses, airports and sports stadiums.

9

Estimated Backlog

We refer to the amount of revenue we expect to recognize over the next 18 months from future work on uncompleted contracts, including MSAs and work we expect to be assigned to us under MSAs, and based on historical levels of work under such MSAs and new contractual agreements on which work has not begun, as our “estimated backlog.” We determine the amount of estimated backlog for work under MSAs based on historical trends, anticipated seasonal impacts and estimates of customer demand based upon communications with our customers. The following presents our 18-month estimated backlog by reportable segment as of the period indicated below:

|

|

|

December 31, 2014 |

|

|

December 31, 2015 |

|

||

|

Segments |

|

(In millions) |

|

|||||

|

Infrastructure Services |

|

$ |

919.0 |

|

|

$ |

531.8 |

|

|

Field Services |

|

|

391.2 |

|

|

|

445.9 |

|

|

Professional Services |

|

|

191.5 |

|

|

|

117.7 |

|

|

Estimated backlog |

|

$ |

1,501.7 |

|

|

$ |

1,095.4 |

|

We expect to recognize approximately 70% of our estimated backlog as of December 31, 2015 in the year ended December 31, 2016. The vast majority of estimated backlog as of December 31, 2015 originated from multi-year customer relationships, primarily with AT&T Inc. and its subsidiaries.

Because we use the completed contract method of accounting for revenues and expenses from our long-term construction contracts, our estimated backlog includes revenue related to projects that we have begun but not completed performance. Therefore, our estimated backlog contains amounts related to work that we have already performed but not completed.

While our estimated backlog includes amounts under MSAs and other service agreements, our customers are generally not contractually committed to purchase a minimum amount of services under these agreements, most of which can be cancelled on short or no advance notice. Therefore, our estimates concerning customers’ requirements may not be accurate. The timing of revenues for construction and installation projects included in our estimated backlog can be subject to change as a result of customer delays, regulatory requirements and other project related factors that may delay completion. Changes in timing could cause estimated revenues to be realized in periods later than originally expected, or not at all. Consequently, our estimated backlog as of any date is not a reliable indicator of our future revenues and earnings.

Seasonality and Variability of Results of Operations

Historically, we have experienced seasonal variations in our business, primarily due to the capital planning cycles of certain of our customers. Generally, AT&T’s initial annual capital plans are not finalized to the project level until sometime during the first three months of the year, resulting in reduced capital spending in the first quarter relative to the rest of the year. This results in a significant portion of contracts related to our Infrastructure Services segment being completed during the fourth quarter of each year. Because we have adopted the completed contract method, we do not recognize revenue or expenses on contracts until we have substantially completed the work required by a contract. Accordingly, the recognition of revenue and expenses on contracts that span quarters may also cause our reported results of operations to experience significant fluctuations.

Our Field Services segment’s results of operations may also fluctuate significantly from quarter to quarter. Variations in the Field Services segment’s revenues and operating results occur quarterly as a result of a number of factors, including the number of customer engagements, employee utilization rates, the size and scope of assignments and general economic conditions, however, we typically generate more revenues in our Field Services segment during the third quarter of each year due to favorable weather conditions and DIRECTV’s sports promotional efforts. Because a significant portion of the Field Services segment’s expenses are relatively fixed, a variation in the number of customer engagements or the timing of the initiation or completion of those engagements can cause significant fluctuations in operating results from quarter to quarter.

As a result, we have historically experienced, and may continue to experience, significant differences in our operating results from quarter to quarter. Due to these seasonal variations and our methodology for the recognition of revenue and expenses on projects, comparisons of operating measures between quarters may not be as meaningful as comparisons between longer reporting periods.

Sales and Marketing

Our customers’ selection of long-term managed services partners is often made at the most senior levels within their executive, operations and procurement teams. Our marketing and business development teams play an important role sourcing and supporting these opportunities as well as maintaining and developing middle-level management relationships with our existing customers. Additionally, our executives and operational leaders play a significant role in maintaining and developing executive-level relationships with our existing and potential customers.

10

Our corporate business development and diversification strategy is the responsibility of all of the business stakeholders, executive management, operation leaders and the business development organization.

Competition

The markets in which we operate are highly competitive. Several of our competitors are large companies that have significant financial, technical and marketing resources. Within the Infrastructure Services segment, we primarily compete with MasTec, Inc., Bechtel Corporation, Black & Veatch Corporation, Dycom Industries, Inc. and sometimes with OEMs. Within the Field Services segment, we primarily compete with MasTec, Inc. and UniTek Global Services, Inc. We and two of our competitors provide over 50% of DIRECTV’s installation services business, with the remaining 50% performed in-house by DIRECTV. DIRECTV provides in-house installation services primarily to rural areas of the United States where it is not profitable for independent installers such as us to operate. Within the Professional Services segment, we primarily compete with many smaller specialty engineering, installation and integration companies as well as the OEMs.

Relatively few significant barriers to entry exist in the markets in which we operate and, as a result, any organization that has adequate financial resources and access to technical expertise may become a competitor. Some of our customers employ personnel to self-perform infrastructure services of the type we provide. We compete based upon our industry experience, technical expertise, financial and operational resources, nationwide presence, industry reputation and customer service. While we believe our customers consider a number of factors when selecting a service provider, most of their work is awarded through a bid process. Consequently, price is often a principal factor in determining which service provider is selected.

Employees and Subcontractors

As of March 30, 2016, we employed approximately 3,400 persons. We also utilize an extensive network of subcontractor relationships to complete work on certain of our projects. The use of subcontractors allows us to quickly scale our workforce to meet varied levels of demand without significantly altering our full-time employee base.

We attract and retain employees by offering training, bonus opportunities, competitive salaries and a comprehensive benefits package. We believe that our focus on training and career development helps us to attract and retain quality employees. We provide opportunities for promotion and mobility within our organization that we also believe helps us to retain our employees.

Regulations

Our operations are subject to various federal, state, local and international laws and regulations including:

|

|

· |

licensing, permitting and inspection requirements applicable to contractors, electricians and engineers; |

|

|

· |

regulations relating to worker safety and environmental protection; |

|

|

· |

permitting and inspection requirements applicable to construction projects; |

|

|

· |

wage and hour regulations; |

|

|

· |

regulations relating to transportation of equipment and materials, including licensing and permitting requirements; |

|

|

· |

building and electrical codes; |

|

|

· |

telecommunications regulations relating to our fiber optic licensing business; and |

|

|

· |

special bidding, procurement and other requirements on government projects. |

We believe we have all the licenses materially required to conduct our operations, and we are in substantial compliance with applicable regulatory requirements. Our failure to comply with applicable regulations could result in substantial fines or revocation of our operating licenses, as well as give rise to termination or cancellation rights under our contracts or disqualify us from future bidding opportunities.

11

An investment in our 12.125% Senior Secured Notes due 2018, or the notes, involves risks. The risks and uncertainties described below are not the only risks and uncertainties we face. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. If any of these risks actually occur, our business, financial condition or results of operations would likely suffer. In such case, the value of the notes could decline, and you may lose all or part of the money you paid to buy the notes.

Risks Related to Our Business

We derive the vast majority of our revenues from subsidiaries of AT&T Inc. including DIRECTV. The loss of any of these customers or a reduction in their demand for our services would impair our business, financial condition and results of operations.

We derive the vast majority of our revenues from subsidiaries of AT&T Inc., including DIRECTV. We derived the following amounts of our revenue from these sources over the past three fiscal years (dollars in thousands):

|

|

|

|||||||||

|

|

2013 |

|

2014 |

2015 |

|

|||||

|

|

Revenue |

|

Percent of Total |

|

Revenue |

|

Percent of Total |

Revenue |

Percent of Total |

|

|

Subsidiaries of AT&T Inc., other than DIRECTV |

$ 662,758 |

|

71.1% |

|

$ 797,452 |

|

66.5% |

$ 388,566 |

53.6% |

|

|

DIRECTV |

92,425 |

|

9.9% |

|

248,414 |

|

20.7% |

258,851 |

35.7% |

|

|

|

$ 755,183 |

|

81.0% |

|

$ 1,045,866 |

|

87.2% |

$ 647,417 |

89.3% |

|

|

|

|

|

|

|

|

|||||

Because we derive the vast majority of our revenues from these customers, and certain of our services for AT&T are provided on a territory basis, with no required commitment for AT&T to spend a specified amount in such territory with us, we could experience a material adverse effect to our business, financial condition or results of operations if the amount of business we obtain from these customers is reduced. In July 2015, AT&T Inc. completed its previously announced acquisition by merger of DIRECTV, and DIRECTV became a subsidiary of AT&T Inc. With the consummation of the merger, our revenues have become more concentrated and dependent on our relationship with AT&T Inc. and to the extent that our performance does not meet this customer’s expectations, or our reputation or relationships with this key customer becomes impaired, we could lose future business with this customer, which could materially adversely affect our ability to generate revenue. During the second quarter of 2014, AT&T deferred certain capital expenditures with us. We began to see an impact to the volume of services provided to subsidiaries of AT&T Inc. during the same quarter, due to the deferral of these AT&T capital expenditures and we expected this impact to continue into 2015. On November 7, 2014, AT&T announced that as a result of the substantial completion of the expansion of its 4G-LTE network, its capital expenditures would decrease in 2015. Additionally, in 2015, AT&T reassigned certain of our Turf Markets to other vendors and, in an effort to diversify its supplier base, rebalanced the work assigned to us in certain other Turf Markets where we had been the primary vendor to other vendors. The deferrals, the reduction in AT&T’s 2015 capital expenditures and the Turf Market realignment and rebalancing reduced our 2015 revenues compared to 2014 and have had a material adverse impact to our business, financial condition and results of operations.

Most of our contracts do not obligate our customers to undertake a significant amount, if any, of infrastructure projects or other work with us and may be cancelled on limited notice, so our revenue is not guaranteed.

Substantially all of our revenue is derived from multi-year MSAs. Under our multi-year MSAs, we contract to provide customers with individual project services through work orders within defined geographic areas or scopes of work on a fixed fee. Under these agreements, our customers often have little or no obligation to undertake any infrastructure projects or other work with us. In addition, most of our contracts are cancellable on limited notice, even if we are not in default under the contract. We may hire employees permanently to meet anticipated demand for the anticipated projects that may be delayed or cancelled. DIRECTV also may change the terms, such as term, termination, pricing and services areas of our agreements, and has done so in the past, to terms that are more favorable to DIRECTV. In addition, many of our contracts, including our service agreements, are periodically open to public bid. We may not be the successful bidder on our existing contracts that are re-bid. We could face a significant decline in revenues and our business, financial condition or results of operations could be materially adversely affected if:

|

|

· |

we see a significant decline in the projects customers assign to us under our service agreements; |

|

|

· |

our customers cancel or defer a significant number of projects; |

|

|

· |

we fail to win our existing contracts upon re-bid; or |

12

|

|

· |

we complete the required work under a significant number of our non-recurring projects and cannot replace them with similar projects. |

Our business is seasonal and is affected by the capital planning and spending patterns of our customers, and we have adopted the completed contract method of accounting for construction and installation contracts, all of which expose us to variable quarterly results.

Our results of operations experience significant fluctuations because we have adopted the completed contract method of accounting for revenues and expenses from our construction and installation contracts. Substantially all of our revenues are generated from construction and installation contracts. Under the completed contract method, we do not recognize revenue or expenses on contracts until we have substantially completed the contract. The recognition of revenue and expenses on contracts that span quarters may also cause our reported results of operations to experience significant fluctuations.

Additionally, we have historically experienced seasonal variations in our business, primarily due to the capital planning cycles of certain of our customers. Generally, AT&T’s initial annual capital plans are not finalized to the project level until sometime during the first three months of the year, resulting in reduced capital spending in the first quarter relative to the rest of the year or they may defer their capital plans to future years. As a result, we have historically experienced, and may continue to experience, significant differences in operations results from quarter to quarter.

Our Field Services segment’s results of operations may also fluctuate significantly from quarter to quarter. Variations in our Field Services segment’s revenues and operating results occur quarterly as a result of a number of factors, including the number of customer engagements, employee utilization rates, the size and scope of assignments and general economic conditions. Because a significant portion of our Field Services segment’s expenses are relatively fixed, a variation in the number of customer engagements or the timing of the initiation or completion of those engagements can cause significant fluctuations in operating results from quarter to quarter.

As a result of these seasonal variations and our methodology for the recognition of revenue and expenses on projects, comparisons of operating measures between quarters may not be as meaningful as comparisons between longer reporting periods.

If we do not obtain additional capital to fund our operations and obligations, our growth may be limited.

We may require additional capital to fund our operations and obligations. As our business has grown, we have managed periods of tight liquidity by accessing capital from our shareholders and their affiliates, some of whom are no longer affiliated with us. Our capital requirements will depend on several factors, including:

|

|

· |

our ability to enter into new agreements with customers or to extend the terms of our existing agreements with customers, and the terms of such agreements; |

|

|

· |

the success rate of our sales efforts; |

|

|

· |

costs of recruiting and retaining qualified personnel; |

|

|

· |

expenditures and investments to implement our business strategy; and |

|

|

· |

the identification and successful completion of acquisitions. |

We may seek additional funds through equity or debt offerings and/or borrowings under lines of credit or other sources, including a possible increase in the borrowing base of or replacement of our amended and restated senior secured revolving credit facility, or the Credit Facility. If we cannot raise additional capital, we may have to implement one or more of the following remedies:

|

|

· |

curtail internal growth initiatives; and |

|

|

· |

forgo the pursuit of acquisitions. |

We do not know whether additional financing will be available on commercially acceptable terms, if at all, when needed. If adequate funds are not available or are not available on commercially acceptable terms, our ability to fund our operations, support the growth of our business or otherwise respond to competitive pressures could be significantly delayed or limited, which could materially adversely affect our business, financial condition or results of operations.

13

The Credit Facility and the Indenture impose significant operating and financial restrictions on us that may prevent us from engaging in transactions that might benefit us, including responding to changing business and economic conditions or securing additional financing, if needed.

The terms of the Credit Facility and the indenture governing the notes, or the Indenture, contain customary events of default and covenants that prohibit us and our subsidiaries from taking certain actions without satisfying certain conditions, financial tests (including a minimum fixed charge coverage ratio) or obtaining the consent of the lenders. These restrictions, among other things, limit our ability to:

|

|

· |

divest our assets; |

|

|

· |

incur additional indebtedness; |

|

|

· |

create liens against our assets; |

|

|

· |

enter into certain mergers, joint ventures, and consolidations or transfer all or substantially all of our assets; |

|

|

· |

make certain investments and acquisitions; |

|

|

· |

prepay indebtedness; |

|

|

· |

make certain payments and distributions; |

|

|

· |

pay dividends; |

|

|

· |

engage in certain transactions with affiliates; and |

|

|

· |

act outside the ordinary course of business. |

In particular, our Credit Facility permits us to borrow up to $50.0 million, subject to borrowing base determinations and certain other restrictions. The Credit Facility contains financial covenants that require that we not permit our annual capital expenditures to exceed $20.0 million (plus any permitted carry over). We are also required to comply with additional financial covenants upon the occurrence of a Triggering Event, as defined in the Credit Facility. A Triggering Event is deemed to have occurred when our undrawn availability under the Credit Facility fails to equal at least $10.0 million measured as of the last day of each month for two consecutive month-ends. A Triggering Event will cease to be continuing when our undrawn availability for three consecutive months equals at least $20.0 million measured as of the last day of each such month. Upon the occurrence and during the continuance of a Triggering Event, we are required to meet the following financial covenants:

|

|

· |

maintain, as of the end of each fiscal quarter, for the trailing four quarters then ended, a ratio of EBITDA (as defined in the Credit Facility) less non-financed capital expenditures (but only to the extent made after the occurrence of a Triggering Event) to Fixed Charges (as defined in the Credit Facility) of at least 1.25 to 1.00; and |

|

|

· |

not permit our ratio of total indebtedness to trailing twelve month EBITDA, as of the last day of a fiscal quarter, to exceed 5.00 to 1.00. |

Should we be unable to comply with the terms and covenants of the Credit Facility, we would be required to obtain further modifications of the Credit Facility or secure another source of financing to continue to operate our business. A default could also result in the acceleration of our obligations under the Credit Facility. If that should occur, we may be unable to repay all of our obligations under the Credit Facility, which could force us to sell significant assets or allow our assets to be foreclosed upon. In addition, these covenants may prevent us from engaging in transactions that benefit us, including responding to changing business and economic conditions or securing additional financing, if needed. To the extent we need additional financing, we may not be able to obtain such financing at all or on favorable terms, which may adversely affect our business, financial condition or results of operations. Had we been required to meet these ratio tests as of December 31, 2015, we would not have met either the Fixed Charge Coverage Ratio or the Leverage Ratio (each as defined in the Credit Facility).

Further, the terms of the Indenture governing the notes require us to meet certain ratio tests, on a pro forma basis giving effect to such transactions, before engaging in certain transactions, including incurring additional debt outside of the Credit Facility and making restricted payments, subject, in each case, to certain exceptions. We must meet a Fixed Charge Coverage Ratio of at least 2.00 to 1.00 in order to make restricted payments or incur additional debt, and we must meet a Total Leverage Ratio test of not greater than 2.50 to 1.00 in order to secure any additional debt (each defined in the Indenture). We have not entered into any transaction that requires us to meet these tests through December 31, 2015 other than our acquisition of Multiband, with respect to which holders of the notes waived compliance with both ratios. Had we been required to meet these ratio tests as of December 31, 2015, we would not have met either the Fixed Charge Coverage Ratio or the Total Leverage Ratio. We do not anticipate that we will meet the Fixed Charge Coverage Ratio unless our EBITDA is increased or until we are able to reduce our fixed charges such as by retiring debt. As a result, we would not be able to make certain restricted payments or incur indebtedness unless (i) we obtain an amendment or waiver to the

14

Indenture and related documents in order to make such restricted payment or incur such indebtedness or (ii) such additional indebtedness or restricted payment were specifically permitted by the Indenture, such as borrowings under the Credit Facility.

As a result of these covenants and restrictions, we are limited in how we conduct our business and we may be unable to raise additional debt financing to compete effectively or to take advantage of new business opportunities. The terms of any future indebtedness we may incur could include more restrictive covenants. We cannot assure you that we will be able to obtain or maintain compliance with these covenants in the future and, if we fail to do so, that we will be able to obtain waivers from the lender and/or amend these covenants.

Our revenues could be negatively affected by reduced support from DIRECTV.

DIRECTV conducts promotional and marketing activities on national, regional and local levels. Due to the Field Services segment’s substantial dependence on DIRECTV, the Field Services segment’s revenues depend, in significant part, on: (i) the overall reputation and success of DIRECTV; (ii) the incentive and discount programs provided by DIRECTV and its promotional and marketing efforts for its products and services; (iii) the goodwill associated with DIRECTV trademarks; (iv) the introduction of new and innovative products by DIRECTV; (v) the manufacture and delivery of competitively-priced, high quality equipment and parts by DIRECTV in quantities sufficient to meet customers’ requirements on a timely basis; (vi) the quality, consistency and management of the overall DIRECTV system; and (vii) the ability of DIRECTV to manage its risks and costs. If DIRECTV does not provide, maintain or improve any of the foregoing, if DIRECTV changes the terms of its incentive and discount programs, or if DIRECTV were sold or reduced or ceased operations, there could be a material adverse effect on our financial condition and results of operations.

Our failure to continue to be certified as a minority business enterprise could reduce some of the opportunities available to us, which could reduce our revenue growth.

We are currently certified as a minority business enterprise by the National Minority Supplier Development Council. A substantial majority of our common stock is beneficially owned and controlled by persons deemed to be minorities. Certain of our current and potential customers consider the percentage of minority ownership and control of a company when awarding new business. If for any reason we cease to be certified as a minority business enterprise by the National Minority Supplier Development Council or similar organization, then we may lose an advantage and not be selected for future business from current or potential customers who may benefit from purchasing our services as a result of our status as a certified minority business enterprise. The failure to obtain a potential project or customer as a result of our not being a minority business enterprise in the future may have a material adverse effect on our business, financial condition or results of operations.

Project performance issues, including those caused by third parties, or certain contractual obligations may result in additional costs to us, reductions in revenues or the payment of liquidated damages.

Many projects involve challenging engineering, procurement, construction or installation phases that may occur over extended time periods, sometimes over several years. We may encounter difficulties as a result of delays in designs, engineering information or materials provided by the customer or a third party, delays or difficulties in equipment and material delivery, schedule changes, delays from our customer’s failure to timely obtain permits or rights-of-way or meet other regulatory requirements, weather-related delays and other factors, some of which are beyond our control, that impact our ability to complete the project in accordance with the original delivery schedule. In addition, we contract with third-party subcontractors to assist us with the completion of contracts. Any delay or failure by suppliers or by subcontractors in the completion of their portion of the project may result in delays in the overall progress of the project or may cause us to incur additional costs, or both. Delays and additional costs may be substantial and, in some cases, we may be required to compensate the customer for such delays. Delays may also disrupt the final completion of our contracts as well as the corresponding recognition of revenues and expenses therefrom. In certain circumstances, we guarantee project completion by a scheduled acceptance date or achievement of certain acceptance and performance testing levels. Failure to meet any of our schedules or performance requirements could also result in additional costs or penalties, including liquidated damages, and such amounts could exceed expected project profit. In extreme cases, the above-mentioned factors could cause project cancellations, and we may be unable to replace such projects with similar projects or at all. Such delays or cancellations may impact our reputation or relationships with customers, adversely affecting our ability to secure new contracts.

Our subcontractors may fail to satisfy their obligations to us or other parties, or we may be unable to maintain these relationships, either of which may have a material adverse effect on our business, financial condition and results of operations.

We depend on subcontractors to complete work on certain of our projects. There is a risk that we may have disputes with subcontractors arising from, among other things, the quality and timeliness of work performed by the subcontractor, customer concerns about the subcontractor or our failure to extend existing task orders or issue new task orders under a subcontract. In addition, if any of our subcontractors fail to deliver on a timely basis the agreed-upon supplies and/or perform the agreed-upon services, then our ability to fulfill our obligations as a prime contractor may be jeopardized. In addition, the absence of qualified subcontractors with

15

whom we have a satisfactory relationship could adversely affect the quality of our service and our ability to perform under some of our contracts. Any of these factors may have a material adverse effect on our business, financial condition or results of operations.

Material delays or defaults in customer payments could leave us unable to cover expenditures related to such customer’s projects, including the payment of our subcontractors.

Because of the nature of most of our contracts, we commit resources to projects prior to receiving payments from our customers in amounts sufficient to cover expenditures as they are incurred. In certain cases, these expenditures include paying our subcontractors who perform significant portions of our services. Delays in customer payments may require us to make a working capital investment or obtain advances from our Credit Facility. If a customer defaults in making its payments on a project or projects to which we have devoted significant resources, it could have a material adverse effect on our business, financial condition or results of operations and negatively impact the financial covenants with our lenders.

Certain of our employees and subcontractors work on projects that are inherently dangerous, and a failure to maintain a safe worksite could result in significant losses.

Certain of our project sites can place our employees and others in difficult or dangerous environments, including difficult and hard to reach terrain or locations high above the ground or near large or complex equipment, moving vehicles, high voltage or dangerous processes. Safety is a primary focus of our business and is critical to our reputation. Many of our clients require that we meet certain safety criteria to be eligible to bid on contracts. We maintain programs with the primary purpose of implementing effective health, safety and environmental procedures throughout our company. If we fail to implement appropriate safety procedures or if our procedures fail, our employees, subcontractors and others may suffer injuries. The failure to comply with such procedures, client contracts or applicable regulations could subject us to losses and liability and adversely impact our ability to obtain projects in the future.

Our failure to comply with the regulations of OSHA and other state and local agencies that oversee transportation and safety compliance could materially adversely affect our business, financial condition or results of operations.

The Occupational Safety and Health Administration, or OSHA, establishes certain employer responsibilities, including maintenance of a workplace free of recognized hazards likely to cause death or serious injury, compliance with standards promulgated by OSHA and various recordkeeping, disclosure and procedural requirements. Various standards, including standards for notices of hazards and safety in excavation and demolition work may apply to our operations. We have incurred, and will continue to incur, capital and operating expenditures and other costs in the ordinary course of business in complying with OSHA and other state and local laws and regulations, and could incur penalties and fines in the future, including in extreme cases, criminal sanctions.

While we have invested, and will continue to invest, substantial resources in occupational health and safety programs, our industry involves a high degree of operational risk and is subject to significant liability exposure. We have suffered employee injuries in the past and may suffer additional injuries in the future. Serious accidents of this nature may subject us to substantial penalties, civil litigation or criminal prosecution, and Multiband, which we recently acquired, has an OSHA incident rating higher than industry average. Personal injury claims for damages, including for bodily injury or loss of life, could result in substantial costs and liabilities, which could materially and adversely affect our business, financial condition or results of operations. In addition, if our safety record were to substantially deteriorate, or if we suffered substantial penalties or criminal prosecution for violation of health and safety regulations, customers could cancel existing contracts and not award future business to us, which could materially adversely affect our business, financial condition or results of operations.

We are self-insured against many potential liabilities.

Although we maintain insurance policies with respect to automobile liability, general liability, workers’ compensation and employee group health claims, those policies are subject to high deductibles, and we are self-insured up to the amount of the deductible. Because most claims against us do not exceed the deductibles under our insurance policies, we are effectively self-insured for substantially all claims. In addition, we are self-insured on our medical coverage up to a specified annual maximum of costs. If our insurance claims increase or if costs exceed our estimates of insurance liabilities, we could experience a decline in profitability and liquidity, which would materially adversely affect our business, financial condition or results of operations.

Warranty claims resulting from our services could have a material adverse effect on our business, financial condition or results of operations.

We generally warrant the work we perform within our Professional Services and Infrastructure Services segments for one- to two-year periods following substantial completion of a project, subject to further extensions of the warranty period following repairs or replacements. While costs that we have incurred historically under our warranty obligations have not been material, the costs

16

associated with such warranties, including any warranty related legal proceedings, could have a material adverse effect on our business, financial condition or results of operations.

Our operations may impact the environment or cause exposure to hazardous substances, our properties may have environmental contamination, and our failure to comply with environmental laws, each of which could result in material liabilities.