Attached files

| file | filename |

|---|---|

| EX-99.2 - EX 99.2 - CROWN CASTLE INTERNATIONAL CORP | q42016supplement.htm |

| 8-K - 8-K - CROWN CASTLE INTERNATIONAL CORP | q420168-k.htm |

Exhibit 99.1

| NEWS RELEASE January 25, 2017 | |

Contacts: Dan Schlanger, CFO | |

Son Nguyen, VP & Treasurer | |

FOR IMMEDIATE RELEASE | Crown Castle International Corp. |

713-570-3050 | |

CROWN CASTLE REPORTS FOURTH QUARTER AND FULL YEAR 2016 RESULTS, RAISES OUTLOOK FOR FULL YEAR 2017

January 25, 2017 - HOUSTON, TEXAS - Crown Castle International Corp. (NYSE: CCI) ("Crown Castle") today reported results for the quarter and year ended December 31, 2016.

"Our strong fourth quarter and full year 2016 results and increased Outlook for 2017 demonstrates our continued focus on executing for our customers," stated Jay Brown, Crown Castle’s Chief Executive Officer. "During 2016, we increased our dividends per share by 8%, exceeding our long-term goal of 6% to 7% annual growth. With our recent acquisition of FiberNet, which closed in January, we now own approximately 40,000 towers and over 26,500 route miles of fiber in key metro markets throughout the US. We believe our extensive portfolio of shared wireless infrastructure positions us well to continue to serve our customers’ needs as they seek to upgrade and enhance network quality and capacity to meet increasing demand for wireless connectivity. We believe the expected substantial growth in demand for mobile data over the next several years provides us the opportunity to drive organic growth through higher utilization of our existing assets, while allowing us to deploy capital towards new assets that we expect will enhance long-term growth in our dividends per share."

RESULTS FOR THE QUARTER

The table below sets forth select financial results for the three month period ended December 31, 2016. For further information, refer to the financial statements and non-GAAP and other calculation reconciliations included in this press release.

(in millions) | Actual | Midpoint Q4 2016 Outlook(b) | Actual Compared to Outlook | |||

Q4 2016 | Q4 2015 | $ Change | % Change | |||

Site rental revenues | $817 | $785 | +$32 | 4% | $814 | +$3 |

Site rental gross margin | $556 | $538 | +$18 | 3% | $559 | -$3 |

Net income (loss) | $125 | $141 | -$16 | -11% | $100 | +$25 |

Adjusted EBITDA(a) | $575 | $540 | +$35 | 6% | $569 | +$6 |

AFFO(a) | $406 | $372 | +$34 | 9% | $406 | +$1 |

Weighted-average common shares outstanding - diluted | 353 | 334 | +19 | 6% | 346 | +7 |

Note: Figures may not tie due to rounding

(a) | See reconciliation of this non-GAAP financial measure to net income (loss) included herein. |

(b) | As issued on October 20, 2016. |

The Foundation for a Wireless World.

CrownCastle.com

News Release continued: | Page 2 | |

HIGHLIGHTS FROM THE QUARTER

• | Site rental revenues. Site rental revenues grew approximately 4%, or $32 million, from fourth quarter 2015 to fourth quarter 2016, inclusive of approximately $39 million in Organic Contribution to Site Rental Revenues plus $10 million in contributions from acquisitions and other items, less a $17 million reduction in straight-line revenues. The $39 million in Organic Contribution to Site Rental Revenues represents approximately 5% growth, comprised of approximately 8% growth from new leasing activity and contracted tenant escalations, net of approximately 3% from tenant non-renewals. |

• | Capital expenditures. Capital expenditures during the quarter were approximately $260 million, comprised of approximately $17 million of land purchases, approximately $42 million of sustaining capital expenditures and approximately $201 million of revenue generating capital expenditures. |

• | Common stock dividend. During the quarter, Crown Castle paid common stock dividends of approximately $343 million in the aggregate, or $0.95 per common share. |

• | Share count. Per share results during fourth quarter and full year 2016 were impacted by 11.4 million shares of common stock issued in November 2016 in contemplation of funding the previously announced acquisition of FPL FiberNet Holdings, LLC and certain other subsidiaries of NextEra Energy, Inc. (collectively, “FiberNet”). The acquisition of FiberNet was completed on January 17, 2017 and did not contribute to results during 2016. The share issuance in November 2016 increased the weighted-average common share outstanding on a diluted basis for fourth quarter and full year 2016 by approximately 7 million shares and 2 million shares, respectively. |

RESULTS FOR THE YEAR

The table below sets forth select financial results for the year ended December 31, 2016. For further information, refer to the financial statements and non-GAAP and other calculation reconciliations included in this press release.

(in millions) | Actual | |||

2016 | 2015 | $ Change | % Change | |

Site rental revenues | $3,233 | $3,018 | +$215 | 7% |

Site rental gross margin | $2,210 | $2,055 | +$155 | 8% |

Net income (loss) | $357 | $1,524 | -$1,167 | -77% |

Adjusted EBITDA(a) | $2,228 | $2,119 | +$109 | 5% |

AFFO(a) | $1,610 | $1,437 | +$173 | 12% |

Weighted-average common shares outstanding - diluted | 341 | 334 | +7 | 2% |

Note: Figures may not tie due to rounding

(a) | See reconciliation of this non-GAAP financial measure to net income (loss) included herein. |

The Foundation for a Wireless World.

CrownCastle.com

News Release continued: | Page 3 | |

HIGHLIGHTS FROM THE YEAR

• | Site rental revenues. Site rental revenues grew approximately 7%, or $215 million, from full year 2015 to full year 2016, inclusive of approximately $189 million in Organic Contribution to Site Rental Revenues plus $90 million in contributions from acquisitions and other items, less a $64 million reduction in straight-line revenues. The $189 million in Organic Contribution to Site Rental Revenues represents approximately 6% growth, comprised of approximately 9% growth from new leasing activity and contracted tenant escalations, net of approximately 3% from tenant non-renewals. |

• | Capital expenditures. Capital expenditures during the year were approximately $874 million, comprised of approximately $75 million of land purchases, approximately $90 million of sustaining capital expenditures and approximately $709 million of revenue generating capital expenditures. |

• | Common stock dividend. During the year, Crown Castle paid common stock dividends of approximately $1.2 billion in the aggregate, or $3.605 per common share. |

"In addition to generating strong results during 2016, we also enhanced our leading portfolio of wireless infrastructure with the acquisition of Tower Development Corporation and continued expansion of our small cell footprint, including announcing the acquisition of FiberNet and completing the integration of Sunesys," stated Dan Schlanger, Crown Castle's Chief Financial Officer. "During the year, we also made significant progress in increasing our financial flexibility by increasing the average maturity of our debt, lowering our average interest rate and achieving investment grade credit ratings, which reflect the quality and stability of our business and cash flows. With these accomplishments, together with our position as the leading wireless infrastructure provider in the US, we believe we are well-positioned to continue our track record of delivering on our goal of generating 6% to 7% long-term annual growth in dividends per share."

The Foundation for a Wireless World.

CrownCastle.com

News Release continued: | Page 4 | |

OUTLOOK

This Outlook section contains forward-looking statements, and actual results may differ materially. Information regarding potential risks which could cause actual results to differ from the forward-looking statements herein is set forth below and in Crown Castle's filings with the SEC.

The following table sets forth Crown Castle's current Outlook for first quarter 2017 and full year 2017:

(in millions) | First Quarter 2017 | Full Year 2017 | ||||

Site rental revenues | $851 | to | $856 | $3,468 | to | $3,498 |

Site rental cost of operations | $263 | to | $268 | $1,063 | to | $1,093 |

Site rental gross margin | $586 | to | $591 | $2,391 | to | $2,421 |

Net income (loss) | $88 | to | $108 | $360 | to | $410 |

Adjusted EBITDA(a) | $575 | to | $580 | $2,358 | to | $2,388 |

Interest expense and amortization of deferred financing costs(b) | $132 | to | $137 | $540 | to | $570 |

FFO(a) | $395 | to | $400 | $1,616 | to | $1,646 |

AFFO(a) | $440 | to | $445 | $1,801 | to | $1,831 |

Weighted-average common shares outstanding - diluted(c) | 361 | 361 | ||||

(a) | See reconciliation of this non-GAAP financial measure to net income (loss) included herein. |

(b) | See the reconciliation of "components of interest expense and amortization of deferred financing costs" herein for a discussion of non-cash interest expense. |

(c) | The assumption for first quarter 2017 and full year 2017 diluted weighted-average common shares outstanding is based on diluted common shares outstanding as of December 31, 2016. |

Full Year 2017 Outlook

The table below compares the results for full year 2016, the midpoint of the current full year 2017 Outlook and the midpoint of the previously provided full year 2017 Outlook for select metrics.

Midpoint of FY 2017 Outlook to FY 2016 Actual Comparison | Previous Full Year 2017 Outlook(b) | Current Compared to Previous Outlook | ||||

($ in millions) | Current Full Year 2017 Outlook | Full Year 2016 Actual | $ Change | % Change | ||

Site rental revenues | $3,483 | $3,233 | +$250 | +8% | $3,329 | +$154 |

Site rental gross margin | $2,406 | $2,210 | +$196 | +9% | $2,291 | +$115 |

Net income (loss) | $385 | $357 | +$28 | +8% | $400 | -$15 |

Adjusted EBITDA(a) | $2,373 | $2,228 | +$145 | +7% | $2,278 | +$95 |

AFFO(a) | $1,816 | $1,610 | +$206 | +13% | $1,754 | +$62 |

Weighted-average common shares outstanding - diluted(c) | 361 | 341 | +20 | +6% | 350 | +11 |

(a) | See reconciliation of this non-GAAP financial measure to net income (loss) included herein. |

(b) | As issued on October 20, 2016. Represents midpoint of Outlook. |

(c) | The assumption for full year 2017 diluted weighted-average common shares outstanding is based on diluted common shares outstanding as of December 31, 2016. |

The Foundation for a Wireless World.

CrownCastle.com

News Release continued: | Page 5 | |

• | The increase in full year 2017 Outlook primarily reflects an expected increase in operating results before the acquisition of FiberNet and, separately, the expected contribution from FiberNet, which closed on January 17, 2017, partially offset by expected higher interest expense. |

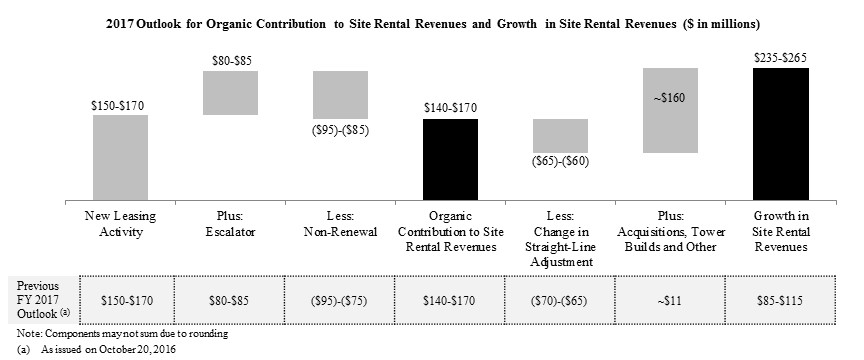

• | The chart below reconciles the components of expected growth from 2016 to 2017 in site rental revenues of $235 million to $265 million, including expected Organic Contribution to Site Rental Revenues of approximately $140 million to $170 million. |

• | At the midpoint and compared to the previously provided full year 2017 Outlook, the increases to full year 2017 Outlook for site rental revenues and site rental gross margin of $154 million and $115 million, respectively, include expected contribution to site rental revenues and site rental gross margin of approximately $150 million and approximately $105 million, respectively, from FiberNet. General and administrative expenses related to FiberNet are expected to be approximately $20 million at the midpoint of full year 2017 Outlook. |

The Foundation for a Wireless World.

CrownCastle.com

News Release continued: | Page 6 | |

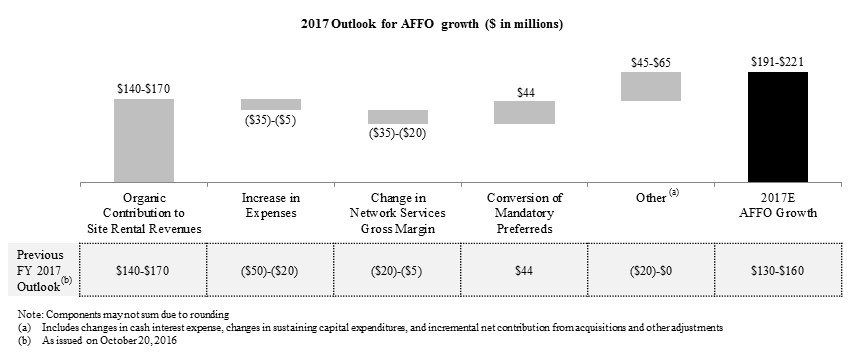

• | The chart below reconciles the components of expected growth in AFFO from 2016 to 2017 of approximately $206 million at the midpoint. |

• | Network services gross margin contribution for first quarter and full year 2017 is expected to be approximately $57 million to $62 million and $235 million to $255 million, respectively. |

• | Additional information is available in Crown Castle's quarterly Supplemental Information Package posted in the Investors section of its website. |

CONFERENCE CALL DETAILS

Crown Castle has scheduled a conference call for Thursday, January 26, 2017, at 10:30 a.m. Eastern time. The conference call may be accessed by dialing 800-475-6881 and asking for the Crown Castle call (access code 3091537) at least 30 minutes prior to the start time. The conference call may also be accessed live over the Internet at http://investor.crowncastle.com. Supplemental materials for the call have been posted on the Crown Castle website at http://investor.crowncastle.com.

A telephonic replay of the conference call will be available from 1:30 p.m. Eastern time on Thursday, January 26, 2017, through 1:30 p.m. Eastern time on Wednesday, April 26, 2017 and may be accessed by dialing 888-203-1112 and using access code 3091537. An audio archive will also be available on the company's website at http://investor.crowncastle.com shortly after the call and will be accessible for approximately 90 days.

ABOUT CROWN CASTLE

Crown Castle provides wireless carriers with the infrastructure they need to keep people connected and businesses running. With approximately 40,000 towers and 26,500 route miles of fiber supporting small cells, Crown Castle is the nation's largest provider of shared wireless infrastructure with a significant presence in the top 100 US markets. For more information on Crown Castle, please visit www.crowncastle.com.

The Foundation for a Wireless World.

CrownCastle.com

News Release continued: | Page 7 | |

Non-GAAP Financial Measures and Other Calculations

This press release includes presentations of Adjusted EBITDA, Adjusted Funds from Operations ("AFFO"), Funds from Operations ("FFO"), and Organic Contribution to Site Rental Revenues, which are non-GAAP financial measures. These non-GAAP financial measures are not intended as alternative measures of operating results or cash flow from operations (as determined in accordance with Generally Accepted Accounting Principles ("GAAP")).

Our measures of Adjusted EBITDA, AFFO, FFO, Organic Contribution to Site Rental Revenues, Segment Site Rental Gross Margin, Segment Network Services and Other Gross Margin and Segment Operating Profit may not be comparable to similarly titled measures of other companies, including other companies in the tower sector or other REITs. Our definition of FFO is consistent with guidelines from the National Association of Real Estate Investment Trusts with the exception of the impact of income taxes in periods prior to our REIT conversion.

Adjusted EBITDA, AFFO, FFO, and Organic Contribution to Site Rental Revenues are presented as additional information because management believes these measures are useful indicators of the financial performance of our business. Among other things, management believes that:

• | Adjusted EBITDA is useful to investors or other interested parties in evaluating our financial performance. Adjusted EBITDA is the primary measure used by management (1) to evaluate the economic productivity of our operations and (2) for purposes of making decisions about allocating resources to, and assessing the performance of, our operations. Management believes that Adjusted EBITDA helps investors or other interested parties meaningfully evaluate and compare the results of our operations (1) from period to period and (2) to our competitors, by excluding the impact of our capital structure (primarily interest charges from our outstanding debt) and asset base (primarily depreciation, amortization and accretion) from our financial results. Management also believes Adjusted EBITDA is frequently used by investors or other interested parties in the evaluation of REITs. In addition, Adjusted EBITDA is similar to the measure of current financial performance generally used in our debt covenant calculations. Adjusted EBITDA should be considered only as a supplement to net income computed in accordance with GAAP as a measure of our performance. |

• | AFFO is useful to investors or other interested parties in evaluating our financial performance. Management believes that AFFO helps investors or other interested parties meaningfully evaluate our financial performance as they include (1) the impact of our capital structure (primarily interest expense on our outstanding debt and dividends on our preferred stock) and (2) sustaining capital expenditures, and exclude the impact of our (1) asset base (primarily depreciation, amortization and accretion) and (2) certain non-cash items, including straight-lined revenues and expenses related to fixed escalations and rent free periods. GAAP requires rental revenues and expenses related to leases that contain specified rental increases over the life of the lease to be recognized evenly over the life of the lease. In accordance with GAAP, if payment terms call for fixed escalations, or rent free periods, the revenue or expense is recognized on a straight-lined basis over the fixed, non-cancelable term of the contract. Management notes that the Company uses AFFO only as a performance measure. AFFO should be considered only as a supplement to net income computed in accordance with GAAP as a measure of our performance and should not be considered as an alternative to cash flows from operations or as residual cash flow available for discretionary investment. |

• | FFO is useful to investors or other interested parties in evaluating our financial performance. Management believes that FFO may be used by investors or other interested parties as a basis to compare our financial performance with that of other REITs. FFO helps investors or other interested parties meaningfully evaluate financial performance by excluding the impact of our asset base (primarily depreciation, amortization and accretion). FFO is not a key performance indicator used by the Company. FFO should be considered only as a supplement to net income computed in accordance with GAAP as a measure of our performance and should not be considered as an alternative to cash flow from operations. |

• | Organic Contribution to Site Rental Revenues is useful to investors or other interested parties in understanding the components of the year-over year changes in our site rental revenues computed in accordance with GAAP. Management uses the Organic Contribution to Site Rental Revenues to assess year-over-year growth rates for our rental activities, to evaluate current performance, to capture trends in rental rates, new leasing activities and customer non-renewals in our core business, as well to forecast future results. Organic Contribution to Site Rental Revenues is not meant as an alternative measure of revenue and should be considered only as a supplement in understanding and assessing the performance of our site rental revenues computed in accordance with GAAP. |

The Foundation for a Wireless World.

CrownCastle.com

News Release continued: | Page 8 | |

In addition to the non-GAAP financial measures used herein, we also provide Segment Site Rental Gross Margin, Segment Network Services and Other Gross Margin and Segment Operating Profit, which are key measures used by management to evaluate our operating segments for purposes of making decisions about allocating capital and assessing performance. These segment measures are provided pursuant to GAAP requirements related to segment reporting. In addition, we provide the components of certain GAAP measures, such as capital expenditures.

We define our non-GAAP financial measures and other measures as follows:

Adjusted EBITDA. We define Adjusted EBITDA as net income (loss) plus restructuring charges (credits), asset write-down charges, acquisition and integration costs, depreciation, amortization and accretion, amortization of prepaid lease purchase price adjustments, interest expense and amortization of deferred financing costs, gains (losses) on retirement of long-term obligations, net gain (loss) on interest rate swaps, gains (losses) on foreign currency swaps, impairment of available-for-sale securities, interest income, other income (expense), benefit (provision) for income taxes, cumulative effect of a change in accounting principle, income (loss) from discontinued operations and stock-based compensation expense.

Adjusted Funds from Operations. We define Adjusted Funds from Operations as FFO before straight-lined revenue, straight-line expense, stock-based compensation expense, non-cash portion of tax provision, non-real estate related depreciation, amortization and accretion, amortization of non-cash interest expense, other (income) expense, gain (loss) on retirement of long-term obligations, net gain (loss) on interest rate swaps, gains (losses) on foreign currency swaps, acquisition and integration costs, and adjustments for noncontrolling interests, and less capital improvement capital expenditures and corporate capital expenditures.

Funds from Operations. We define Funds from Operations as net income plus real estate related depreciation, amortization and accretion and asset write-down charges, less noncontrolling interest and cash paid for preferred stock dividends, and is a measure of funds from operations attributable to CCIC common stockholders.

Organic Contribution to Site Rental Revenues. We define the Organic Contribution to Site Rental Revenues as the sum of the change in GAAP site rental revenues related to (1) new leasing activity including revenues from the construction of small cells and the impact of prepaid rent, (2) escalators and less (3) non-renewals of customer contracts.

Discretionary capital expenditures. We define discretionary capital expenditures as those capital expenditures made with respect to activities which we believe exhibit sufficient potential to enhance long-term stockholder value. They consist of (1) improvements to existing wireless infrastructure and construction of new wireless infrastructure (collectively referred to as "revenue generating") and (2) purchases of land assets under towers as we seek to manage our interests in the land beneath our towers.

Sustaining capital expenditures. We define sustaining capital expenditures as either (1) corporate related capital improvements, such as buildings, information technology equipment and office equipment or (2) capital improvements to tower sites that enable our customers' ongoing quiet enjoyment of the tower.

Segment Site Rental Gross Margin. We define Segment Site Rental Gross Margin as segment site rental revenues less segment site rental cost of operations, excluding stock-based compensation expense and prepaid lease purchase price adjustments recorded in cost of operations.

Segment Network Services and Other Gross Margin. We define Segment Network Services and Other Gross Margin as segment network services and other revenues less segment network services and other cost of operations, excluding stock-based compensation expense recorded in cost of operations.

Segment Operating Profit. We define Segment Operating Profit as segment revenues less segment cost of operations and segment general and administrative expenses, excluding stock-based compensation expense and prepaid lease purchase price adjustments recorded in cost of operations.

The tables set forth below reconcile the non-GAAP financial measures used herein to comparable GAAP financial measures. The components in these tables may not sum to the total due to rounding.

The Foundation for a Wireless World.

CrownCastle.com

News Release continued: | Page 9 | |

Reconciliations of Non-GAAP Financial Measures to Comparable GAAP Financial Measures and Other Calculations:

Reconciliation of Historical Adjusted EBITDA:

For the Three Months Ended | For the Twelve Months Ended | ||||||||||||||

December 31, 2016 | December 31, 2015 | December 31, 2016 | December 31, 2015 | ||||||||||||

(in millions) | |||||||||||||||

Net income (loss) | $ | 124.7 | $ | 141.1 | $ | 357.0 | $ | 1,524.3 | |||||||

Adjustments to increase (decrease) net income (loss): | |||||||||||||||

Income (loss) from discontinued operations | — | 1.7 | — | (999.0 | ) | ||||||||||

Asset write-down charges | 6.2 | 13.8 | 34.5 | 33.5 | |||||||||||

Acquisition and integration costs | 6.0 | 3.7 | 17.5 | 15.7 | |||||||||||

Depreciation, amortization and accretion | 273.8 | 269.6 | 1,108.6 | 1,036.2 | |||||||||||

Amortization of prepaid lease purchase price adjustments | 5.3 | 5.1 | 21.3 | 20.5 | |||||||||||

Interest expense and amortization of deferred financing costs(a) | 129.4 | 128.3 | 515.0 | 527.1 | |||||||||||

Gains (losses) on retirement of long-term obligations | — | — | 52.3 | 4.2 | |||||||||||

Interest income | (0.3 | ) | (0.7 | ) | (0.8 | ) | (1.9 | ) | |||||||

Other income (expense) | 4.2 | 1.5 | 8.8 | (57.0 | ) | ||||||||||

Benefit (provision) for income taxes | 4.1 | (42.1 | ) | 16.9 | (51.5 | ) | |||||||||

Stock-based compensation expense | 21.2 | 17.9 | 96.5 | 67.1 | |||||||||||

Adjusted EBITDA(b) | $ | 574.6 | $ | 539.8 | $ | 2,227.5 | $ | 2,119.2 | |||||||

(a) | See the reconciliation of "components of interest expense and amortization of deferred financing costs" herein for a discussion of non-cash interest expense. |

(b) | The above reconciliation excludes line items included in our definition which are not applicable for the periods shown. |

Reconciliation of Current Outlook for Adjusted EBITDA:

Q1 2017 | Full Year 2017 | ||||||

(in millions) | Outlook | Outlook | |||||

Net income (loss) | $88 | to | $108 | $360 | to | $410 | |

Adjustments to increase (decrease) net income (loss): | |||||||

Asset write-down charges | $9 | to | $11 | $35 | to | $45 | |

Acquisition and integration costs | $5 | to | $8 | $19 | to | $24 | |

Depreciation, amortization and accretion | $288 | to | $303 | $1,217 | to | $1,243 | |

Amortization of prepaid lease purchase price adjustments | $4 | to | $6 | $20 | to | $22 | |

Interest expense and amortization of deferred financing costs(a) | $132 | to | $137 | $540 | to | $570 | |

Interest income | $(1) | to | $0 | $(1) | to | $1 | |

Other income (expense) | $(1) | to | $2 | $2 | to | $4 | |

Benefit (provision) for income taxes | $2 | to | $6 | $14 | to | $22 | |

Stock-based compensation expense | $23 | to | $25 | $96 | to | $101 | |

Adjusted EBITDA(b) | $575 | to | $580 | $2,358 | to | $2,388 | |

(a) | See the reconciliation of "components of interest expense and amortization of deferred financing costs" herein for a discussion of non-cash interest expense. |

(b) | The above reconciliation excludes line items included in our definition which are not applicable for the periods shown. |

The Foundation for a Wireless World.

CrownCastle.com

News Release continued: | Page 10 | |

Reconciliation of Historical FFO and AFFO:

For the Three Months Ended | For the Twelve Months Ended | ||||||||||||||

(in millions) | December 31, 2016 | December 31, 2015 | December 31, 2016 | December 31, 2015 | |||||||||||

Net income (loss)(a) | $ | 124.7 | $ | 142.7 | $ | 357.0 | $ | 525.3 | |||||||

Real estate related depreciation, amortization and accretion | 267.0 | 264.7 | 1,082.1 | 1,018.3 | |||||||||||

Asset write-down charges | 6.2 | 13.8 | 34.5 | 33.5 | |||||||||||

Dividends on preferred stock | (11.0 | ) | (11.0 | ) | (44.0 | ) | (44.0 | ) | |||||||

FFO(b)(c)(d)(e) | $ | 386.9 | $ | 410.3 | $ | 1,429.5 | $ | 1,533.1 | |||||||

FFO (from above) | $ | 386.9 | $ | 410.3 | $ | 1,429.5 | $ | 1,533.1 | |||||||

Adjustments to increase (decrease) FFO: | |||||||||||||||

Straight-lined revenue | (5.0 | ) | (22.3 | ) | (47.4 | ) | (111.3 | ) | |||||||

Straight-lined expense | 23.1 | 24.8 | 94.2 | 98.7 | |||||||||||

Stock-based compensation expense | 21.2 | 17.9 | 96.5 | 67.1 | |||||||||||

Non-cash portion of tax provision | 2.1 | (43.7 | ) | 7.3 | (63.9 | ) | |||||||||

Non-real estate related depreciation, amortization and accretion | 6.9 | 4.8 | 26.5 | 17.9 | |||||||||||

Amortization of non-cash interest expense | 3.0 | 4.7 | 14.3 | 37.1 | |||||||||||

Other (income) expense | 4.2 | 1.5 | 8.8 | (57.0 | ) | ||||||||||

Gains (losses) on retirement of long-term obligations | — | — | 52.3 | 4.2 | |||||||||||

Acquisition and integration costs | 6.0 | 3.7 | 17.5 | 15.7 | |||||||||||

Capital improvement capital expenditures | (17.5 | ) | (14.3 | ) | (42.8 | ) | (46.8 | ) | |||||||

Corporate capital expenditures | (24.6 | ) | (15.2 | ) | (46.9 | ) | (58.1 | ) | |||||||

AFFO(b)(c)(d)(e) | $ | 406.4 | $ | 372.2 | $ | 1,609.9 | $ | 1,436.6 | |||||||

(a) | Exclusive of income (loss) from discontinued operations and related noncontrolling interest of $(1.7) million and $1.0 billion for the three months ended December 31, 2015 and twelve months ended December 31, 2015, respectively. |

(b) | See "Non-GAAP Financial Measures and Other Calculations" herein for a discussion of our definitions of FFO and AFFO. |

(c) | FFO and AFFO are reduced by cash paid for preferred stock dividends. |

(d) | Diluted weighted-average common shares outstanding were 352.9 million, 334.3 million, 340.9 million and 334.1 million for the three months ended December 31, 2016 and 2015, and the twelve months ended December 31, 2016 and 2015, respectively. The diluted weighted-average common shares outstanding for the three months ended December 31, 2015 and twelve months ended December 31, 2015 assumes no conversion of preferred stock in the share count. |

(e) | The above reconciliation excludes line items included in our definition which are not applicable for the periods shown. |

The Foundation for a Wireless World.

CrownCastle.com

News Release continued: | Page 11 | |

Reconciliation of Current Outlook for FFO and AFFO:

Q1 2017 | Full Year 2017 | ||||||

(in millions) | Outlook | Outlook | |||||

Net income (loss) | $88 | to | $108 | $360 | to | $410 | |

Real estate related depreciation, amortization and accretion | $282 | to | $295 | $1,193 | to | $1,214 | |

Asset write-down charges | $9 | to | $11 | $35 | to | $45 | |

FFO(a)(b)(c) | $395 | to | $400 | $1,616 | to | $1,646 | |

FFO (from above) | $395 | to | $400 | $1,616 | to | $1,646 | |

Adjustments to increase (decrease) FFO: | |||||||

Straight-lined revenue | $(4) | to | $1 | $8 | to | $23 | |

Straight-lined expense | $21 | to | $26 | $80 | to | $95 | |

Stock-based compensation expense | $23 | to | $25 | $96 | to | $101 | |

Non-cash portion of tax provision | $0 | to | $5 | $(3) | to | $12 | |

Non-real estate related depreciation, amortization and accretion | $6 | to | $8 | $24 | to | $29 | |

Amortization of non-cash interest expense | $3 | to | $6 | $11 | to | $17 | |

Other (income) expense | $(1) | to | $2 | $2 | to | $4 | |

Acquisition and integration costs | $5 | to | $8 | $19 | to | $24 | |

Capital improvement capital expenditures | $(16) | to | $(11) | $(50) | to | $(45) | |

Corporate capital expenditures | $(7) | to | $(2) | $(36) | to | $(31) | |

AFFO(a)(b)(c) | $440 | to | $445 | $1,801 | to | $1,831 | |

(a) | The assumption for first quarter 2017 and full year 2017 diluted weighted-average common shares outstanding is 361 million based on diluted common shares outstanding as of December 31, 2016. |

(b) | See "Non-GAAP Financial Measures and Other Calculations" herein for a discussion for our definitions of FFO and AFFO. |

(c) | The above reconciliation excludes line items included in our definition which are not applicable for the periods shown. |

The Foundation for a Wireless World.

CrownCastle.com

News Release continued: | Page 12 | |

For Comparative Purposes - Reconciliation of Previous Outlook for Adjusted EBITDA:

Previously Issued | Previously Issued | ||||||

Q4 2016 | Full Year 2016 | ||||||

(in millions) | Outlook | Outlook | |||||

Net income (loss) | $90 | to | $110 | $318 | to | $338 | |

Adjustments to increase (decrease) net income (loss): | |||||||

Asset write-down charges | $9 | to | $11 | $37 | to | $39 | |

Acquisition and integration costs | $3 | to | $6 | $14 | to | $17 | |

Depreciation, amortization and accretion | $283 | to | $298 | $1,123 | to | $1,138 | |

Amortization of prepaid lease purchase price adjustments | $4 | to | $6 | $20 | to | $22 | |

Interest expense and amortization of deferred financing costs | $128 | to | $133 | $514 | to | $519 | |

Gains (losses) on retirement of long-term obligations | $0 | to | $0 | $52 | to | $52 | |

Interest income | $(1) | to | $0 | $(2) | to | $(1) | |

Other income (expense) | $(1) | to | $2 | $3 | to | $6 | |

Benefit (provision) for income taxes | $4 | to | $8 | $18 | to | $22 | |

Stock-based compensation expense | $21 | to | $23 | $97 | to | $99 | |

Adjusted EBITDA(a) | $566 | to | $571 | $2,219 | to | $2,224 | |

(a) | The above reconciliation excludes line items included in our definition which are not applicable for the periods shown. |

For Comparative Purposes - Reconciliation of Previous Outlook for FFO and AFFO:

Previously Issued | Previously Issued | ||||||

Q4 2016 | Full Year 2016 | ||||||

(in millions) | Outlook | Outlook | |||||

Net income (loss) | $90 | to | $110 | $318 | to | $338 | |

Real estate related depreciation, amortization and accretion | $277 | to | $290 | $1,097 | to | $1,110 | |

Asset write-down charges | $9 | to | $11 | $37 | to | $39 | |

Dividends on preferred stock | $(11) | to | $(11) | $(44) | to | $(44) | |

FFO(a)(b)(c) | $383 | to | $388 | $1,426 | to | $1,431 | |

FFO (from above) | $383 | to | $388 | $1,426 | to | $1,431 | |

Adjustments to increase (decrease) FFO: | |||||||

Straight-line revenue | $(8) | to | $(3) | $(50) | to | $(45) | |

Straight-line expense | $20 | to | $25 | $90 | to | $95 | |

Stock-based compensation expense | $21 | to | $23 | $97 | to | $99 | |

Non-cash portion of tax provision | $2 | to | $7 | $9 | to | $14 | |

Non-real estate related depreciation, amortization and accretion | $6 | to | $8 | $26 | to | $28 | |

Amortization of non-cash interest expense | $3 | to | $6 | $12 | to | $15 | |

Other (income) expense | $(1) | to | $2 | $3 | to | $6 | |

Gains (losses) on retirement of long-term obligations | $0 | to | $0 | $52 | to | $52 | |

Acquisition and integration costs | $3 | to | $6 | $14 | to | $17 | |

Capital improvement capital expenditures | $(20) | to | $(15) | $(46) | to | $(41) | |

Corporate capital expenditures | $(20) | to | $(15) | $(43) | to | $(38) | |

AFFO(a)(b)(c) | $403 | to | $408 | $1,606 | to | $1,611 | |

(a) | Previously issued fourth quarter 2016 and full year 2016 outlook assumes diluted weighted average common shares outstanding of approximately 346 million shares and 340 million shares, respectively, based on (1) diluted common shares outstanding as of September 30, 2016 and (2) the assumed conversion of the mandatory convertible preferred stock in November 2016. |

(b) | See "Non-GAAP Financial Measures and Other Calculations" herein for a discussion for our definitions of FFO and AFFO. |

(c) | FFO and AFFO are reduced by cash paid for preferred stock dividends. |

(d) | The above reconciliation excludes line items included in our definition which are not applicable for the periods shown. |

The Foundation for a Wireless World.

CrownCastle.com

News Release continued: | Page 13 | |

The components of changes in site rental revenues for the quarters ended December 31, 2016 and 2015 are as follows:

Three Months Ended December 31, | |||||||

(in millions) | 2016 | 2015 | |||||

Components of changes in site rental revenues(f): | |||||||

Prior year site rental revenues exclusive of straight-line associated with fixed escalators(a)(c) | $ | 763 | $ | 685 | |||

New leasing activity(a)(c) | 38 | 47 | |||||

Escalators | 22 | 23 | |||||

Non-renewals | (21 | ) | (22 | ) | |||

Organic Contribution to Site Rental Revenues(d) | 39 | 48 | |||||

Straight-lined revenues associated with fixed escalators | 5 | 22 | |||||

Acquisitions and builds(b) | 10 | 30 | |||||

Other | — | — | |||||

Total GAAP site rental revenues | $ | 817 | $ | 785 | |||

Year-over-year changes in revenue: | |||||||

Reported GAAP site rental revenues | 4.1 | % | |||||

Organic Contribution to Site Rental Revenues(d)(e) | 5.1 | % | |||||

(a) | Includes revenues from amortization of prepaid rent in accordance with GAAP. |

(b) | The financial impact of acquisitions, as measured by the initial contribution, and tower builds is excluded from Organic Contribution to Site Rental Revenues until the one-year anniversary of the acquisition or build. |

(c) | Includes revenues from the construction of new small cell nodes, exclusive of straight-lined revenues related to fixed escalators. |

(d) | See "Non-GAAP Financial Measures and Other Calculations" herein. |

(e) | Calculated as the percentage change from prior year site rental revenues exclusive of straight-line associated with fixed escalations compared to Organic Contribution to Site Rental Revenues for the current period. |

(f) | Additional information regarding Crown Castle's site rental revenues including projected revenue from customer licenses, tenant non-renewals, straight-lined revenues and prepaid rent is available in Crown Castle's quarterly Supplemental Information Package posted in the Investors section of its website. |

The Foundation for a Wireless World.

CrownCastle.com

News Release continued: | Page 14 | |

The components of the changes in site rental revenues for the year ending December 31, 2017 is forecasted as follows:

(in millions) | Full Year 2017 Outlook | Full Year 2016 | |

Components of changes in site rental revenues(g): | |||

Prior year site rental revenues exclusive of straight-line associated with fixed escalators(a)(c) | $3,186 | $2,907 | |

New leasing activity(a)(c) | 150 - 170 | 174 | |

Escalators | 80 - 85 | 89 | |

Non-renewals | (95) - (85) | (74) | |

Organic Contribution to Site Rental Revenues(d) | 140 - 170 | 189 | |

Straight-lined revenues associated with fixed escalators | (20) - (10) | 47 | |

Acquisitions and builds(b) | 160 | 90 | |

Other | — | — | |

Total GAAP site rental revenues | $3,468 - $3,498 | $3,233 | |

Year-over-year changes in revenue: | |||

Reported GAAP site rental revenues | 7.7% | 7.1% | |

Organic Contribution to Site Rental Revenues(d)(e) | 4.8% (f) | 6.5% | |

(a) | Includes revenues from amortization of prepaid rent in accordance with GAAP. |

(b) | The financial impact of acquisitions, as measured by the initial contribution, and tower builds is excluded from Organic Contribution to Site Rental Revenues until the one-year anniversary of the acquisition or build. |

(c) | Includes revenues from the construction of new small cell nodes, exclusive of straight-lined revenues related to fixed escalators. |

(d) | See "Non-GAAP Financial Measures and Other Calculations" herein. |

(e) | Calculated as the percentage change from prior year site rental revenues exclusive of straight-lined associated with fixed escalations compared to Organic Contribution to Site Rental Revenues for the current period. |

(f) | Calculated based on midpoint of Full Year 2017 Outlook. |

(g) | Additional information regarding Crown Castle's site rental revenues including projected revenue from customer licenses, tenant non-renewals, straight-lined revenues and prepaid rent is available in Crown Castle's quarterly Supplemental Information Package posted in the Investors section of its website. |

The Foundation for a Wireless World.

CrownCastle.com

News Release continued: | Page 15 | |

Components of Historical Interest Expense and Amortization of Deferred Financing Costs:

For the Three Months Ended | |||||||

(in millions) | December 31, 2016 | December 31, 2015 | |||||

Interest expense on debt obligations | $ | 126.3 | $ | 123.6 | |||

Amortization of deferred financing costs and adjustments on long-term debt, net | 4.6 | 5.6 | |||||

Other, net | (1.5 | ) | (0.8 | ) | |||

Interest expense and amortization of deferred financing costs | $ | 129.4 | $ | 128.3 | |||

Components of Current Outlook for Interest Expense and Amortization of Deferred Financing Costs:

Q1 2017 | Full Year 2017 | ||||||

(in millions) | Outlook | Outlook | |||||

Interest expense on debt obligations | $131 | to | $133 | $534 | to | $549 | |

Amortization of deferred financing costs and adjustments on long-term debt, net | $4 | to | $7 | $17 | to | $21 | |

Other, net | $(1) | to | $(1) | $(6) | to | $(4) | |

Interest expense and amortization of deferred financing costs | $132 | to | $137 | $540 | to | $570 | |

Debt balances and maturity dates as of December 31, 2016 are as follows:

(in millions) | Face Value | Final Maturity | |||

Bank debt - variable rate: | |||||

2016 Revolver | $ | — | Jan. 2021 | ||

2016 Term Loan A | 1,962.5 | Jan. 2021 | |||

Total bank debt | 1,962.5 | ||||

Securitized debt - fixed rate: | |||||

Secured Notes, Series 2009-1, Class A-1(a) | 52.4 | Aug. 2019 | |||

Secured Notes, Series 2009-1, Class A-2(a) | 70.0 | Aug. 2029 | |||

Tower Revenue Notes, Series 2010-3(b) | 1,250.0 | Jan. 2040 | |||

Tower Revenue Notes, Series 2010-6(b) | 1,000.0 | Aug. 2040 | |||

Tower Revenue Notes, Series 2015-1(b) | 300.0 | May 2042 | |||

Tower Revenue Notes, Series 2015-2(b) | 700.0 | May 2045 | |||

Total securitized debt | 3,372.4 | ||||

Bonds - fixed rate: | |||||

5.250% Senior Notes | 1,650.0 | Jan. 2023 | |||

3.849% Secured Notes | 1,000.0 | Apr. 2023 | |||

4.875% Senior Notes | 850.0 | Apr. 2022 | |||

3.400% Senior Notes | 850.0 | Feb. 2021 | |||

4.450% Senior Notes | 900.0 | Feb. 2026 | |||

3.700% Senior Notes | 750.0 | June 2026 | |||

2.250% Senior Notes | 700.0 | Sept. 2021 | |||

Total bonds | 6,700.0 | ||||

Capital leases and other obligations | 226.8 | Various | |||

Total Debt(c) | $ | 12,261.7 | |||

Less: Cash and Cash Equivalents(d) | $ | 567.6 | |||

Net Debt | $ | 11,694.1 | |||

(a) | The Senior Secured Notes, Series 2009-1, Class A-1 principal amortizes during the period beginning January 2010 and ending in 2019 and the Senior Secured Notes, 2009-1, Class A-2 principal amortizes during the period beginning in 2019 and ending in 2029. |

(b) | The Senior Secured Tower Revenue Notes, Series 2010-3 and 2010-6 have anticipated repayment dates in 2020. The Senior Secured Tower Revenue Notes, Series 2015-1 and 2015-2 have anticipated repayment dates in 2022 and 2025, respectively. |

(c) | After giving effect to the closing of the FiberNet acquisition, the outstanding borrowings under the 2016 Revolver total approximately $1.1 billion. |

(d) | Excludes restricted cash. |

The Foundation for a Wireless World.

CrownCastle.com

News Release continued: | Page 16 | |

Net Debt to Last Quarter Annualized Adjusted EBITDA is computed as follows:

(in millions) | For the Three Months Ended December 31, 2016 | ||

Total face value of debt(a) | $ | 12,261.7 | |

Ending cash and cash equivalents(a)(b) | 567.6 | ||

Total Net Debt | $ | 11,694.1 | |

Adjusted EBITDA for the three months ended December 31, 2016 | $ | 574.6 | |

Last quarter annualized adjusted EBITDA | 2,298.5 | ||

Net Debt to Last Quarter Annualized Adjusted EBITDA | 5.1 | x | |

(a) | After giving effect to the closing of the FiberNet acquisition, the total face value of debt and ending cash and cash equivalents for the three months ended December 31, 2016 was $13.3 billion and $116 million, respectively. See full year 2017 outlook for further discussion of the impact of the FiberNet acquisition. |

(b) | Excludes restricted cash. |

Components of Capital Expenditures:

For the Three Months Ended | |||||||||||||||||||||||||

(in millions) | December 31, 2016 | December 31, 2015 | |||||||||||||||||||||||

Towers | Small Cells | Other | Total | Towers | Small Cells | Other | Total | ||||||||||||||||||

Discretionary: | |||||||||||||||||||||||||

Purchases of land interests | $ | 16.7 | $ | — | $ | — | $ | 16.7 | $ | 22.7 | $ | — | $ | — | $ | 22.7 | |||||||||

Wireless infrastructure construction and improvements | 77.0 | 123.9 | — | 200.9 | 100.3 | 98.2 | — | 198.5 | |||||||||||||||||

Sustaining: | |||||||||||||||||||||||||

Capital improvement and corporate | 16.9 | 6.3 | 18.9 | 42.1 | 14.3 | 3.5 | 11.7 | 29.5 | |||||||||||||||||

Total | $ | 110.6 | $ | 130.2 | $ | 18.9 | $ | 259.7 | $ | 137.3 | $ | 101.7 | $ | 11.7 | $ | 250.7 | |||||||||

The Foundation for a Wireless World.

CrownCastle.com

News Release continued: | Page 17 | |

Cautionary Language Regarding Forward-Looking Statements

This press release contains forward-looking statements and information that are based on our management's current expectations. Such statements include our Outlook and plans, projections, and estimates regarding (1) potential benefits, returns and shareholder value which may be derived from our business, assets, investments, dividends and acquisitions (including the FiberNet acquisition), including on a long-term basis, (2) our strategy, strategic position and strength of our business, (3) carrier network investments and upgrades, and the benefits which may be derived therefrom, (4) demand for mobile data and wireless connectivity and the benefits which may be derived therefrom, (5) our dividends, including our dividend plans and the amount and growth of our dividends, (6) leasing activity, (7) our investments, including in towers, small cells and other assets, and the potential growth, returns and benefits therefrom, (8) the contribution of FiberNet to our results, (9) demand for our wireless infrastructure and services, (10) our growth and long-term prospects, (11) tenant non-renewals, including the impact and timing thereof, (12) capital expenditures, including sustaining capital expenditures, (13) straight-line adjustments, (14) expenses, (15) site rental revenues, (16) site rental cost of operations, (17) site rental gross margin and network services gross margin, (18) net income (loss), (19) Adjusted EBITDA, (20) interest expense and amortization of deferred financing costs, (21) FFO, (22) AFFO, (23) Organic Contribution to Site Rental Revenues and Organic Contribution to Site Rental Revenue growth, (24) our common shares outstanding and (25) the utility of certain financial measures, including non-GAAP financial measures. Such forward-looking statements are subject to certain risks, uncertainties and assumptions prevailing market conditions and the following:

• | Our business depends on the demand for our wireless infrastructure, driven primarily by demand for wireless connectivity, and we may be adversely affected by any slowdown in such demand. Additionally, a reduction in carrier network investment may materially and adversely affect our business (including reducing demand for new tenant additions and network services). |

• | A substantial portion of our revenues is derived from a small number of customers, and the loss, consolidation or financial instability of any of our limited number of customers may materially decrease revenues or reduce demand for our wireless infrastructure and network services. |

• | The business model for our small cell operations contains differences from our traditional site rental business, resulting in different operational risks. If we do not successfully operate that business model or identify or manage those operational risks, such operations may produce results that are less than anticipated. |

• | Our substantial level of indebtedness could adversely affect our ability to react to changes in our business, and the terms of our debt instruments limit our ability to take a number of actions that our management might otherwise believe to be in our best interests. In addition, if we fail to comply with our covenants, our debt could be accelerated. |

• | We have a substantial amount of indebtedness. In the event we do not repay or refinance such indebtedness, we could face substantial liquidity issues and might be required to issue equity securities or securities convertible into equity securities, or sell some of our assets to meet our debt payment obligations. |

• | Sales or issuances of a substantial number of shares of our common stock may adversely affect the market price of our common stock. |

• | As a result of competition in our industry, we may find it more difficult to achieve favorable rental rates on our new or renewing tenant leases. |

• | New technologies may reduce demand for our wireless infrastructure or negatively impact our revenues. |

• | The expansion and development of our business, including through acquisitions, increased product offerings or other strategic growth opportunities, may cause disruptions in our business, which may have an adverse effect on our business, operations or financial results. |

• | If we fail to retain rights to our wireless infrastructure, including the land interests under our towers, our business may be adversely affected. |

• | Our network services business has historically experienced significant volatility in demand, which reduces the predictability of our results. |

• | New wireless technologies may not deploy or be adopted by customers as rapidly or in the manner projected. |

• | If we fail to comply with laws and regulations which regulate our business and which may change at any time, we may be fined or even lose our right to conduct some of our business. |

• | If radio frequency emissions from wireless handsets or equipment on our wireless infrastructure are demonstrated to cause negative health effects, potential future claims could adversely affect our operations, costs or revenues. |

• | Certain provisions of our restated certificate of incorporation, amended and restated by-laws and operative agreements, and domestic and international competition laws may make it more difficult for a third party to acquire control of us or for us to acquire control of a third party, even if such a change in control would be beneficial to our stockholders. |

• | We may be vulnerable to security breaches that could adversely affect our business, operations, and reputation. |

The Foundation for a Wireless World.

CrownCastle.com

News Release continued: | Page 18 | |

• | Future dividend payments to our stockholders will reduce the availability of our cash on hand available to fund future discretionary investments, and may result in a need to incur indebtedness or issue equity securities to fund growth opportunities. In such event, the then current economic, credit market or equity market conditions will impact the availability or cost of such financing, which may hinder our ability to grow our per share results of operations. |

• | Remaining qualified to be taxed as a REIT involves highly technical and complex provisions of the US Internal Revenue Code. Failure to remain qualified as a REIT would result in our inability to deduct dividends to stockholders when computing our taxable income, which would reduce our available cash. |

• | Complying with REIT requirements, including the 90% distribution requirement, may limit our flexibility or cause us to forgo otherwise attractive opportunities, including certain discretionary investments and potential financing alternatives. |

• | We have limited experience operating as a REIT. Our failure to successfully operate as a REIT may adversely affect our financial condition, cash flow, the per share trading price of our common stock, or our ability to satisfy debt service obligations. |

• | REIT related ownership limitations and transfer restrictions may prevent or restrict certain transfers of our capital stock. |

Should one or more of these or other risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those expected. More information about potential risk factors which could affect our results is included in our filings with the SEC. As used in this release, the term "including," and any variation thereof, means "including without limitation."

The Foundation for a Wireless World.

CrownCastle.com

News Release continued: | Page 19 | |

| CROWN CASTLE INTERNATIONAL CORP. CONDENSED CONSOLIDATED BALANCE SHEET (UNAUDITED) (in thousands, except share amounts) |

December 31, 2016 | December 31, 2015 | ||||||

ASSETS | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 567,599 | $ | 178,810 | |||

Restricted cash | 124,547 | 130,731 | |||||

Receivables, net | 373,532 | 313,296 | |||||

Prepaid expenses | 128,721 | 133,194 | |||||

Other current assets | 130,362 | 225,214 | |||||

Total current assets | 1,324,761 | 981,245 | |||||

Deferred site rental receivables | 1,317,658 | 1,306,408 | |||||

Property and equipment, net | 9,805,315 | 9,580,057 | |||||

Goodwill | 5,757,676 | 5,513,551 | |||||

Other intangible assets, net | 3,650,072 | 3,779,915 | |||||

Long-term prepaid rent and other assets, net | 819,610 | 775,790 | |||||

Total assets | $ | 22,675,092 | $ | 21,936,966 | |||

LIABILITIES AND EQUITY | |||||||

Current liabilities: | |||||||

Accounts payable | $ | 188,516 | $ | 159,629 | |||

Accrued interest | 97,019 | 66,975 | |||||

Deferred revenues | 353,005 | 322,623 | |||||

Other accrued liabilities | 221,066 | 199,923 | |||||

Current maturities of debt and other obligations | 101,749 | 106,219 | |||||

Total current liabilities | 961,355 | 855,369 | |||||

Debt and other long-term obligations | 12,069,393 | 12,043,740 | |||||

Other long-term liabilities | 2,087,229 | 1,948,636 | |||||

Total liabilities | 15,117,977 | 14,847,745 | |||||

Commitments and contingencies | |||||||

CCIC stockholders' equity: | |||||||

Common stock, $.01 par value; 600,000,000 shares authorized; shares issued and outstanding: December 31, 2016—360,536,659 and December 31, 2015—333,771,660 | 3,605 | 3,338 | |||||

4.50% Mandatory Convertible Preferred Stock, Series A, $.01 par value; 20,000,000 shares authorized; shares issued and outstanding: December 31, 2016—0 and December 31, 2015—9,775,000; aggregate liquidation value: December 31, 2016—0 and December 31, 2015—$977,500 | — | 98 | |||||

Additional paid-in capital | 10,938,236 | 9,548,580 | |||||

Accumulated other comprehensive income (loss) | (5,888 | ) | (4,398 | ) | |||

Dividends/distributions in excess of earnings | (3,378,838 | ) | (2,458,397 | ) | |||

Total equity | 7,557,115 | 7,089,221 | |||||

Total liabilities and equity | $ | 22,675,092 | $ | 21,936,966 | |||

The Foundation for a Wireless World.

CrownCastle.com

News Release continued: | Page 20 | |

| CROWN CASTLE INTERNATIONAL CORP. CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS (UNAUDITED) (in thousands, except share and per share amounts) |

Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||

2016 | 2015 | 2016 | 2015 | ||||||||||||

Net revenues: | |||||||||||||||

Site rental | $ | 817,381 | $ | 785,336 | $ | 3,233,307 | $ | 3,018,413 | |||||||

Network services and other | 215,035 | 160,500 | 687,918 | 645,438 | |||||||||||

Net revenues | 1,032,416 | 945,836 | 3,921,225 | 3,663,851 | |||||||||||

Operating expenses: | |||||||||||||||

Costs of operations (exclusive of depreciation, amortization and accretion): | |||||||||||||||

Site rental | 261,127 | 247,625 | 1,023,350 | 963,869 | |||||||||||

Network services and other | 131,105 | 94,381 | 417,171 | 357,557 | |||||||||||

General and administrative | 92,122 | 87,042 | 371,031 | 310,921 | |||||||||||

Asset write-down charges | 6,202 | 13,817 | 34,453 | 33,468 | |||||||||||

Acquisition and integration costs | 5,994 | 3,677 | 17,453 | 15,678 | |||||||||||

Depreciation, amortization and accretion | 273,826 | 269,558 | 1,108,551 | 1,036,178 | |||||||||||

Total operating expenses | 770,376 | 716,100 | 2,972,009 | 2,717,671 | |||||||||||

Operating income (loss) | 262,040 | 229,736 | 949,216 | 946,180 | |||||||||||

Interest expense and amortization of deferred financing costs | (129,376 | ) | (128,346 | ) | (515,032 | ) | (527,128 | ) | |||||||

Gains (losses) on retirement of long-term obligations | — | — | (52,291 | ) | (4,157 | ) | |||||||||

Interest income | 342 | 736 | 796 | 1,906 | |||||||||||

Other income (expense) | (4,212 | ) | (1,482 | ) | (8,835 | ) | 57,028 | ||||||||

Income (loss) from continuing operations before income taxes | 128,794 | 100,644 | 373,854 | 473,829 | |||||||||||

Benefit (provision) for income taxes | (4,084 | ) | 42,077 | (16,881 | ) | 51,457 | |||||||||

Income (loss) from continuing operations | 124,710 | 142,721 | 356,973 | 525,286 | |||||||||||

Discontinued operations: | |||||||||||||||

Income (loss) from discontinued operations, net of tax | — | (1,659 | ) | — | 999,049 | ||||||||||

Net income (loss) | 124,710 | 141,062 | 356,973 | 1,524,335 | |||||||||||

Less: Net income (loss) attributable to the noncontrolling interest | — | — | — | 3,343 | |||||||||||

Net income (loss) attributable to CCIC stockholders | 124,710 | 141,062 | 356,973 | 1,520,992 | |||||||||||

Dividends on preferred stock | — | (10,997 | ) | (32,991 | ) | (43,988 | ) | ||||||||

Net income (loss) attributable to CCIC common stockholders | $ | 124,710 | $ | 130,065 | $ | 323,982 | $ | 1,477,004 | |||||||

Net income (loss) attributable to CCIC common stockholders, per common share: | |||||||||||||||

Income (loss) from continuing operations, basic | $ | 0.35 | $ | 0.39 | $ | 0.95 | $ | 1.45 | |||||||

Income (loss) from discontinued operations, basic | $ | — | $ | — | $ | — | $ | 2.99 | |||||||

Net income (loss) attributable to CCIC common stockholders, basic | $ | 0.35 | $ | 0.39 | $ | 0.95 | $ | 4.44 | |||||||

Income (loss) from continuing operations, diluted | $ | 0.35 | $ | 0.39 | $ | 0.95 | $ | 1.44 | |||||||

Income (loss) from discontinued operations, diluted | $ | — | $ | — | $ | — | $ | 2.98 | |||||||

Net income (loss) attributable to CCIC common stockholders, diluted | $ | 0.35 | $ | 0.39 | $ | 0.95 | $ | 4.42 | |||||||

Weighted-average common shares outstanding (in thousands): | |||||||||||||||

Basic | 352,116 | 333,107 | 340,349 | 333,002 | |||||||||||

Diluted | 352,878 | 334,320 | 340,879 | 334,062 | |||||||||||

The Foundation for a Wireless World.

CrownCastle.com

News Release continued: | Page 21 | |

| CROWN CASTLE INTERNATIONAL CORP. CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS (UNAUDITED) (in thousands) |

Twelve Months Ended December 31, | |||||||||||||

2016 | 2015 | ||||||||||||

Cash flows from operating activities: | |||||||||||||

Net income (loss) from continuing operations | $ | 356,973 | $ | 525,286 | |||||||||

Adjustments to reconcile net income (loss) from continuing operations to net cash provided by (used for) operating activities: | |||||||||||||

Depreciation, amortization and accretion | 1,108,551 | 1,036,178 | |||||||||||

Gains (losses) on retirement of long-term obligations | 52,291 | 4,157 | |||||||||||

Gains (losses) on settled swaps | 2,608 | (54,475 | ) | ||||||||||

Amortization of deferred financing costs and other non-cash interest | 14,333 | 37,126 | |||||||||||

Stock-based compensation expense | 79,338 | 60,773 | |||||||||||

Asset write-down charges | 34,453 | 33,468 | |||||||||||

Deferred income tax benefit (provision) | 8,603 | (60,618 | ) | ||||||||||

Other adjustments, net | 2,451 | (8,915 | ) | ||||||||||

Changes in assets and liabilities, excluding the effects of acquisitions: | |||||||||||||

Increase (decrease) in liabilities | 236,642 | 320,625 | |||||||||||

Decrease (increase) in assets | (113,979 | ) | (99,580 | ) | |||||||||

Net cash provided by (used for) operating activities | 1,782,264 | 1,794,025 | |||||||||||

Cash flows from investing activities: | |||||||||||||

Payments for acquisition of businesses, net of cash acquired | (556,854 | ) | (1,102,179 | ) | |||||||||

Capital expenditures | (873,883 | ) | (908,892 | ) | |||||||||

Net receipts from settled swaps | 8,141 | 54,475 | |||||||||||

Other investing activities, net | 12,364 | (3,138 | ) | ||||||||||

Net cash provided by (used for) investing activities | (1,410,232 | ) | (1,959,734 | ) | |||||||||

Cash flows from financing activities: | |||||||||||||

Proceeds from issuance of long-term debt | 5,201,010 | 1,000,000 | |||||||||||

Principal payments on debt and other long-term obligations | (95,787 | ) | (102,866 | ) | |||||||||

Purchases and redemptions of long-term debt | (4,044,834 | ) | (1,069,337 | ) | |||||||||

Borrowings under revolving credit facility | 3,440,000 | 1,790,000 | |||||||||||

Payments under revolving credit facility | (4,565,000 | ) | (1,360,000 | ) | |||||||||

Payments for financing costs | (41,533 | ) | (19,642 | ) | |||||||||

Net proceeds from issuance of capital stock | 1,325,865 | — | |||||||||||

Purchases of capital stock | (24,936 | ) | (29,657 | ) | |||||||||

Dividends/distributions paid on common stock | (1,239,158 | ) | (1,116,444 | ) | |||||||||

Dividends paid on preferred stock | (43,988 | ) | (43,988 | ) | |||||||||

Net (increase) decrease in restricted cash | (7,931 | ) | 16,458 | ||||||||||

Net cash provided by (used for) financing activities | (96,292 | ) | (935,476 | ) | |||||||||

Net increase (decrease) in cash and cash equivalents - continuing operations | 275,740 | (1,101,185 | ) | ||||||||||

Discontinued operations: | |||||||||||||

Net cash provided by (used for) operating activities | — | 2,700 | |||||||||||

Net cash provided by (used for) investing activities | 113,150 | 1,103,577 | |||||||||||

Net increase (decrease) in cash and cash equivalents - discontinued operations | 113,150 | 1,106,277 | |||||||||||

Effect of exchange rate changes | (101 | ) | (1,902 | ) | |||||||||

Cash and cash equivalents at beginning of period | 178,810 | 175,620 | (a) | ||||||||||

Cash and cash equivalents at end of period | $ | 567,599 | $ | 178,810 | |||||||||

Supplemental disclosure of cash flow information: | |||||||||||||

Interest paid | 470,655 | 489,970 | |||||||||||

Income taxes paid | 13,821 | 28,771 | |||||||||||

________________

(a) | Inclusive of cash and cash equivalents included in discontinued operations. |

The Foundation for a Wireless World.

CrownCastle.com

News Release continued: | Page 22 | |

| CROWN CASTLE INTERNATIONAL CORP. SEGMENT OPERATING RESULTS (UNAUDITED) (in thousands) |

SEGMENT OPERATING RESULTS | |||||||||||||||||||||||||||||

Three Months Ended December 31, 2016 | Three Months Ended December 31, 2015 | ||||||||||||||||||||||||||||

Towers | Small Cells | Other | Consolidated Total | Towers | Small Cells | Other | Consolidated Total | ||||||||||||||||||||||

Segment site rental revenues | $ | 712,549 | $ | 104,832 | $ | 817,381 | $ | 693,898 | $ | 91,438 | $ | 785,336 | |||||||||||||||||

Segment network services and other revenue | 169,647 | 45,388 | 215,035 | 145,972 | 14,528 | 160,500 | |||||||||||||||||||||||

Segment revenues | 882,196 | 150,220 | 1,032,416 | 839,870 | 105,966 | 945,836 | |||||||||||||||||||||||

Segment site rental cost of operations | 214,878 | 38,057 | 252,935 | 206,449 | 33,377 | 239,826 | |||||||||||||||||||||||

Segment network services and other cost of operations | 95,289 | 34,207 | 129,496 | 79,861 | 13,128 | 92,989 | |||||||||||||||||||||||

Segment cost of operations(a) | 310,167 | 72,264 | 382,431 | 286,310 | 46,505 | 332,815 | |||||||||||||||||||||||

Segment site rental gross margin(b) | 497,671 | 66,775 | 564,446 | 487,449 | 58,061 | 545,510 | |||||||||||||||||||||||

Segment network services and other gross margin(b) | 74,358 | 11,181 | 85,539 | 66,111 | 1,400 | 67,511 | |||||||||||||||||||||||

Segment general and administrative expenses(a) | 24,574 | 14,956 | 35,838 | 75,368 | 23,654 | 12,715 | 36,855 | 73,224 | |||||||||||||||||||||

Segment operating profit(b) | 547,455 | 63,000 | (35,838 | ) | 574,617 | 529,906 | 46,746 | (36,855 | ) | 539,797 | |||||||||||||||||||

Stock-based compensation expense | 21,241 | 21,241 | 17,866 | 17,866 | |||||||||||||||||||||||||

Depreciation, amortization and accretion | 273,826 | 273,826 | 269,558 | 269,558 | |||||||||||||||||||||||||

Interest expense and amortization of deferred financing costs | 129,376 | 129,376 | 128,346 | 128,346 | |||||||||||||||||||||||||

Other (income) expenses to reconcile to income (loss) from continuing operations before income taxes(c) | 21,380 | 21,380 | 23,383 | 23,383 | |||||||||||||||||||||||||

Income (loss) from continuing operations before income taxes | $ | 128,794 | $ | 100,644 | |||||||||||||||||||||||||

(a) | Segment cost of operations exclude (1) stock-based compensation expense of $4.5 million and $4.0 million for the three months ended December 31, 2016 and 2015, respectively and (2) prepaid lease purchase price adjustments of $5.3 million and $5.1 million for the three months ended December 31, 2016 and 2015, respectively. Segment general and administrative expenses exclude stock-based compensation expense of $16.8 million and $13.8 million for the three months ended December 31, 2016 and 2015, respectively. |

(b) See "Non-GAAP Financial Measures and Other Calculations" herein for a discussion of our definitions of segment site rental gross margin, segment network service and other gross margin and segment operating profit.

(c) | See condensed consolidated statement of operations for further information. |

The Foundation for a Wireless World.

CrownCastle.com

News Release continued: | Page 23 | |

SEGMENT OPERATING RESULTS | |||||||||||||||||||||||||||||

Twelve Months Ended December 31, 2016 | Twelve Months Ended December 31, 2015 | ||||||||||||||||||||||||||||

Towers | Small Cells | Other | Consolidated Total | Towers | Small Cells | Other | Consolidated Total | ||||||||||||||||||||||

Segment site rental revenues | $ | 2,830,708 | $ | 402,599 | $ | 3,233,307 | $ | 2,734,045 | $ | 284,368 | $ | 3,018,413 | |||||||||||||||||

Segment network services and other revenue | 603,689 | 84,229 | 687,918 | 591,655 | 53,783 | 645,438 | |||||||||||||||||||||||

Segment revenues | 3,434,397 | 486,828 | 3,921,225 | 3,325,700 | 338,151 | 3,663,851 | |||||||||||||||||||||||

Segment site rental cost of operations | 840,209 | 147,459 | 987,668 | 827,175 | 107,195 | 934,370 | |||||||||||||||||||||||

Segment network services and other cost of operations | 344,595 | 64,859 | 409,454 | 309,025 | 43,162 | 352,187 | |||||||||||||||||||||||

Segment cost of operations(a) | 1,184,804 | 212,318 | 1,397,122 | 1,136,200 | 150,357 | 1,286,557 | |||||||||||||||||||||||

Segment site rental gross margin(b) | 1,990,499 | 255,140 | 2,245,639 | 1,906,870 | 177,173 | 2,084,043 | |||||||||||||||||||||||

Segment network services and other gross margin(b) | 259,094 | 19,370 | 278,464 | 282,630 | 10,621 | 293,251 | |||||||||||||||||||||||

Segment general and administrative expenses(a) | 92,903 | 60,676 | 143,001 | 296,580 | 91,899 | 38,379 | 127,833 | 258,111 | |||||||||||||||||||||

Segment operating profit(b) | 2,156,690 | 213,834 | (143,001 | ) | 2,227,523 | 2,097,601 | 149,415 | (127,833 | ) | 2,119,183 | |||||||||||||||||||

Stock-based compensation expense | 96,538 | 96,538 | 67,148 | 67,148 | |||||||||||||||||||||||||

Depreciation, amortization and accretion | 1,108,551 | 1,108,551 | 1,036,178 | 1,036,178 | |||||||||||||||||||||||||

Interest expense and amortization of deferred financing costs | 515,032 | 515,032 | 527,128 | 527,128 | |||||||||||||||||||||||||

Other income (expenses) to reconcile to income (loss) from continuing operations before income taxes(c) | 133,548 | 133,548 | 14,900 | 14,900 | |||||||||||||||||||||||||

Income (loss) from continuing operations before income taxes | $ | 373,854 | $ | 473,829 | |||||||||||||||||||||||||

(a) | Segment cost of operations exclude (1) stock-based compensation expense of $22.1 million and $14.3 million for the twelve months ended December 31, 2016 and 2015, respectively and (2) prepaid lease purchase price adjustments of $21.3 million and $20.5 million for the twelve months ended December 31, 2016 and 2015, respectively. Segment general and administrative expenses exclude stock-based compensation expense of $74.5 million and $52.8 million for the twelve months ended December 31, 2016 and 2015, respectively. |

(b) See "Non-GAAP Financial Measures and Other Calculations" herein for a discussion of our definitions of segment site rental gross margin, segment network service and other gross margin and segment operating profit.

(c) | See condensed consolidated statement of operations for further information. |

The Foundation for a Wireless World.

CrownCastle.com