Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION OF CEO AND CFO (906) - CROWN CASTLE INTERNATIONAL CORP | exhibit321063018.htm |

| EX-31.2 - CERTIFICATION OF CFO (302) - CROWN CASTLE INTERNATIONAL CORP | exhibit312063018.htm |

| EX-31.1 - CERTIFICATION OF CEO (302) - CROWN CASTLE INTERNATIONAL CORP | exhibit311063018.htm |

| EX-10.2 - AMENDED AND RESTATED EXTENDED SERVICE SEPARATION PROGRAM - CROWN CASTLE INTERNATIONAL CORP | exhibit102063018.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________

FORM 10-Q

____________________________________

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2018

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period to

Commission File Number 001-16441

____________________________________

CROWN CASTLE INTERNATIONAL CORP.

(Exact name of registrant as specified in its charter)

Delaware | 76-0470458 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

1220 Augusta Drive, Suite 600, Houston, Texas 77057-2261 (Address of principal executives office) (Zip Code) | |

(713) 570-3000 (Registrant's telephone number, including area code) | |

____________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | x | Accelerated filer | o | |||

Non-accelerated filer | o | (Do not check if a smaller reporting company) | Smaller reporting company | o | ||

Emerging growth company | o | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Number of shares of common stock outstanding at August 3, 2018: 414,839,956

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

INDEX

Page | |||

ITEM 1. | |||

CONDENSED CONSOLIDATED BALANCE SHEET (Unaudited) | |||

ITEM 2. | |||

ITEM 3. | |||

ITEM 4. | |||

ITEM 1. | LEGAL PROCEEDINGS | ||

ITEM 1A. | |||

ITEM 2. | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | ||

ITEM 6. | |||

EXHIBIT INDEX | |||

SIGNATURES | |||

Cautionary Language Regarding Forward-Looking Statements

This Quarterly Report on Form 10-Q ("Form 10-Q") contains forward-looking statements that are based on our management's expectations as of the filing date of this report with the Securities and Exchange Commission ("SEC"). Statements that are not historical facts are hereby identified as forward-looking statements. In addition, words such as "estimate," "anticipate," "project," "plan," "intend," "believe," "expect," "likely," "predicted," "positioned," "continue" and any variations of these words and similar expressions are intended to identify forward-looking statements. Such statements include plans, projections and estimates contained in "Part I—Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations" ("MD&A") and "Part I—Item 3. Quantitative and Qualitative Disclosures About Market Risk" herein. Such forward-looking statements include (1) expectations regarding anticipated growth in the wireless industry, carriers' investments in their networks, tenant additions, and demand for data and our communications infrastructure, (2) expectations regarding our communications infrastructure and the potential benefits that may be derived therefrom, (3) expectations regarding non-renewals of tenant contracts, (4) availability and adequacy of cash flows and liquidity for, or plans regarding, future discretionary investments, including capital expenditures, (5) potential benefits of our discretionary investments, including acquisitions, (6) our full year 2018 outlook and the anticipated growth in our financial results, including future revenues and operating cash flows, (7) expectations regarding construction of small cells and fiber, (8) expectations regarding our capital structure and the credit markets, our availability and cost of capital, our leverage ratio and interest coverage targets, and our ability to service our debt and comply with debt covenants and the plans for and the benefits of any future refinancings, (9) expectations regarding loss on retirement of debt, (10) expectations related to remaining qualified as a real estate investment trust ("REIT") and the advantages, benefits or impact of, or opportunities created by, our REIT status, (11) the utilization of our net operating loss carryforwards ("NOLs"), (12) expectations related to the impact of customer consolidation or ownership changes, including the potential combination of T-Mobile and Sprint and (13) our dividend policy and the timing, amount, growth or tax characterization of any dividends. All future dividends are subject to declaration by our board of directors.

Such forward-looking statements should, therefore, be considered in light of various risks, uncertainties and assumptions, including prevailing market conditions, risk factors described in "Part II—Item 1A. Risk Factors" herein and "Item 1A. Risk Factors" of our Annual Report on Form 10-K for the fiscal year ended December 31, 2017 ("2017 Form 10-K") and other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those expected.

1

Interpretation

As used herein, the term "including," and any variation thereof, means "including without limitation." The use of the word "or" herein is not exclusive. Unless this Form 10-Q indicates otherwise or the context otherwise requires, the terms, "we," "our," "our company," "the company" or "us" as used in this Form 10-Q refer to Crown Castle International Corp. and its predecessor (organized in 1995), as applicable, each a Delaware corporation (together, "CCIC"), and their subsidiaries. Additionally, unless the context suggests otherwise, references to "U.S." are to the United States of America and Puerto Rico, collectively.

2

PART I—FINANCIAL INFORMATION

ITEM 1. | FINANCIAL STATEMENTS |

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEET (Unaudited)

(Amounts in millions, except par values)

June 30, 2018 | December 31, 2017 | ||||||

ASSETS | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 206 | $ | 314 | |||

Restricted cash | 125 | 121 | |||||

Receivables, net | 455 | 398 | |||||

Prepaid expenses | 197 | 162 | |||||

Other current assets | 181 | 139 | |||||

Total current assets | 1,164 | 1,134 | |||||

Deferred site rental receivables | 1,303 | 1,300 | |||||

Property and equipment, net of accumulated depreciation of $8,023 and $7,500, respectively | 13,218 | 12,933 | |||||

Goodwill | 10,075 | 10,021 | |||||

Other intangible assets, net | 5,729 | 5,962 | |||||

Long-term prepaid rent and other assets, net | 885 | 879 | |||||

Total assets | $ | 32,374 | $ | 32,229 | |||

LIABILITIES AND EQUITY | |||||||

Current liabilities: | |||||||

Accounts payable | $ | 272 | $ | 249 | |||

Accrued interest | 154 | 132 | |||||

Deferred revenues | 476 | 457 | |||||

Other accrued liabilities | 272 | 339 | |||||

Current maturities of debt and other obligations | 112 | 115 | |||||

Total current liabilities | 1,286 | 1,292 | |||||

Debt and other long-term obligations | 15,844 | 16,044 | |||||

Other long-term liabilities | 2,678 | 2,554 | |||||

Total liabilities | 19,808 | 19,890 | |||||

Commitments and contingencies (note 9) | |||||||

CCIC stockholders' equity: | |||||||

Common stock, $0.01 par value; 600 shares authorized; shares issued and outstanding: June 30, 2018—415 and December 31, 2017—406 | 4 | 4 | |||||

6.875% Mandatory Convertible Preferred Stock, Series A, $0.01 par value; 20 shares authorized; shares issued and outstanding: June 30, 2018—2 and December 31, 2017—2; aggregate liquidation value: June 30, 2018—$1,650 and December 31, 2017—$1,650 | — | — | |||||

Additional paid-in capital | 17,711 | 16,844 | |||||

Accumulated other comprehensive income (loss) | (5 | ) | (4 | ) | |||

Dividends/distributions in excess of earnings | (5,144 | ) | (4,505 | ) | |||

Total equity | 12,566 | 12,339 | |||||

Total liabilities and equity | $ | 32,374 | $ | 32,229 | |||

See notes to condensed consolidated financial statements.

3

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS AND

COMPREHENSIVE INCOME (LOSS) (Unaudited)

(Amounts in millions, except per share amounts)

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

Net revenues: | |||||||||||||||

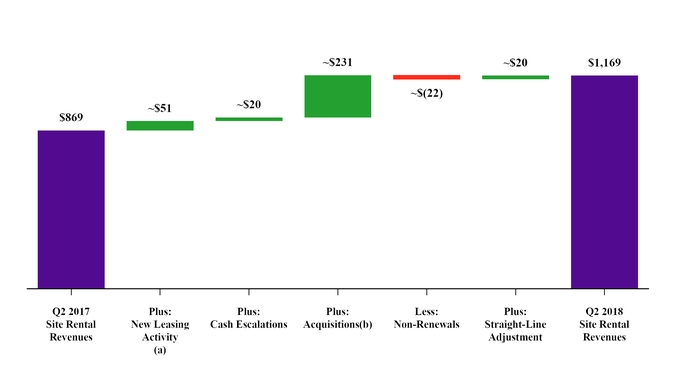

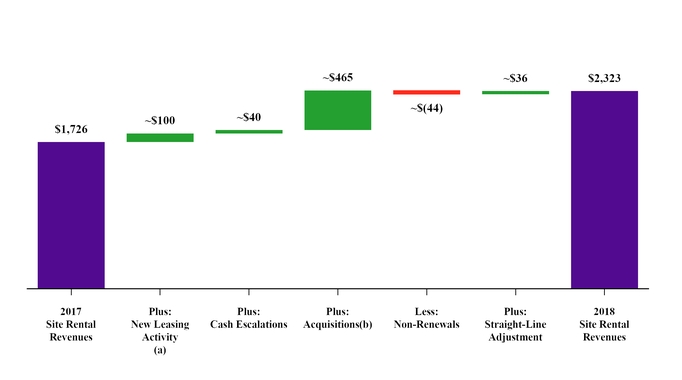

Site rental | $ | 1,169 | $ | 869 | $ | 2,323 | $ | 1,726 | |||||||

Network services and other | 161 | 169 | 307 | 328 | |||||||||||

Net revenues | 1,330 | 1,038 | 2,630 | 2,054 | |||||||||||

Operating expenses: | |||||||||||||||

Costs of operations(a): | |||||||||||||||

Site rental | 355 | 269 | 702 | 534 | |||||||||||

Network services and other | 99 | 104 | 185 | 203 | |||||||||||

General and administrative | 138 | 98 | 273 | 199 | |||||||||||

Asset write-down charges | 6 | 4 | 9 | 5 | |||||||||||

Acquisition and integration costs | 8 | 8 | 14 | 14 | |||||||||||

Depreciation, amortization and accretion | 379 | 296 | 753 | 584 | |||||||||||

Total operating expenses | 985 | 779 | 1,936 | 1,539 | |||||||||||

Operating income (loss) | 345 | 259 | 694 | 515 | |||||||||||

Interest expense and amortization of deferred financing costs | (158 | ) | (142 | ) | (318 | ) | (276 | ) | |||||||

Gains (losses) on retirement of long-term obligations | (3 | ) | — | (74 | ) | (4 | ) | ||||||||

Interest income | 1 | 1 | 2 | 1 | |||||||||||

Other income (expense) | — | (1 | ) | (1 | ) | 4 | |||||||||

Income (loss) before income taxes | 185 | 117 | 303 | 240 | |||||||||||

Benefit (provision) for income taxes | (5 | ) | (5 | ) | (9 | ) | (9 | ) | |||||||

Net income (loss) attributable to CCIC stockholders | 180 | 112 | 294 | 231 | |||||||||||

Dividends on preferred stock | (28 | ) | — | (57 | ) | — | |||||||||

Net income (loss) attributable to CCIC common stockholders | $ | 152 | $ | 112 | $ | 237 | $ | 231 | |||||||

Net income (loss) | $ | 180 | $ | 112 | $ | 294 | $ | 231 | |||||||

Other comprehensive income (loss): | |||||||||||||||

Foreign currency translation adjustments | (1 | ) | 1 | (1 | ) | 1 | |||||||||

Total other comprehensive income (loss) | (1 | ) | 1 | (1 | ) | 1 | |||||||||

Comprehensive income (loss) attributable to CCIC stockholders | $ | 179 | $ | 113 | $ | 293 | $ | 232 | |||||||

Net income (loss) attributable to CCIC common stockholders, per common share: | |||||||||||||||

Net income (loss) attributable to CCIC common stockholders—basic | $ | 0.37 | $ | 0.31 | $ | 0.58 | $ | 0.64 | |||||||

Net income (loss) attributable to CCIC common stockholders—diluted | $ | 0.36 | $ | 0.31 | $ | 0.57 | $ | 0.64 | |||||||

Weighted-average common shares outstanding: | |||||||||||||||

Basic | 415 | 364 | 412 | 363 | |||||||||||

Diluted | 416 | 366 | 413 | 364 | |||||||||||

Dividends/distributions declared per share of common stock | $ | 1.05 | $ | 0.95 | $ | 2.10 | $ | 1.90 | |||||||

________________

(a) | Exclusive of depreciation, amortization and accretion shown separately. |

See notes to condensed consolidated financial statements.

4

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS (Unaudited)

(In millions of dollars)

Six Months Ended June 30, | ||||||||

2018 | (a) | 2017 | (a) | |||||

Cash flows from operating activities: | ||||||||

Net income (loss) | $ | 294 | $ | 231 | ||||

Adjustments to reconcile net income (loss) to net cash provided by (used for) operating activities: | ||||||||

Depreciation, amortization and accretion | 753 | 584 | ||||||

(Gains) losses on retirement of long-term obligations | 74 | 4 | ||||||

Amortization of deferred financing costs and other non-cash interest | 4 | 5 | ||||||

Stock-based compensation expense | 47 | 45 | ||||||

Asset write-down charges | 9 | 5 | ||||||

Deferred income tax (benefit) provision | 1 | — | ||||||

Other non-cash adjustments, net | 1 | (3 | ) | |||||

Changes in assets and liabilities, excluding the effects of acquisitions: | ||||||||

Increase (decrease) in accrued interest | 22 | 11 | ||||||

Increase (decrease) in accounts payable | 3 | (17 | ) | |||||

Increase (decrease) in deferred revenues, deferred ground lease payables, other accrued liabilities and other liabilities | 53 | 23 | ||||||

Decrease (increase) in receivables | (59 | ) | 91 | |||||

Decrease (increase) in prepaid expenses, deferred site rental receivables, long-term prepaid rent and other assets | (91 | ) | (48 | ) | ||||

Net cash provided by (used for) operating activities | 1,111 | 931 | ||||||

Cash flows from investing activities: | ||||||||

Payments for acquisitions, net of cash acquired | (18 | ) | (2,104 | ) | ||||

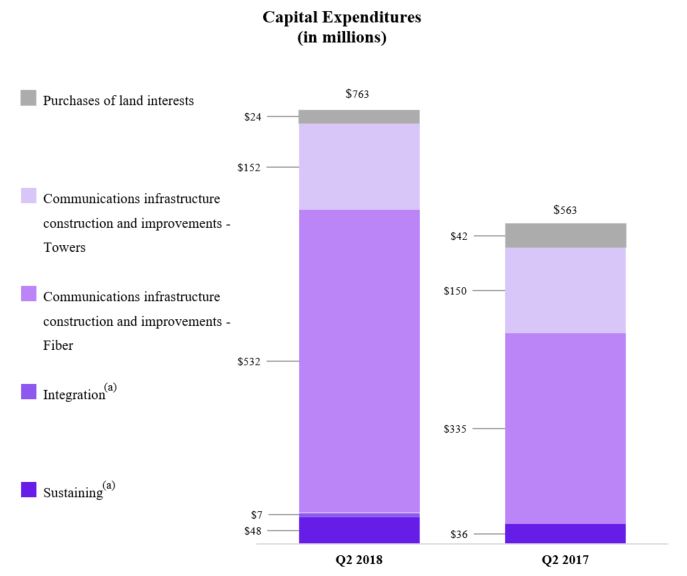

Capital expenditures | (763 | ) | (563 | ) | ||||

Other investing activities, net | 3 | (8 | ) | |||||

Net cash provided by (used for) investing activities | (778 | ) | (2,675 | ) | ||||

Cash flows from financing activities: | ||||||||

Proceeds from issuance of long-term debt | 1,743 | 1,345 | ||||||

Principal payments on debt and other long-term obligations | (47 | ) | (60 | ) | ||||

Purchases and redemptions of long-term debt | (1,318 | ) | — | |||||

Borrowings under revolving credit facility | 485 | 1,755 | ||||||

Payments under revolving credit facility | (1,150 | ) | (1,405 | ) | ||||

Payments for financing costs | (20 | ) | (11 | ) | ||||

Net proceeds from issuance of common stock | 841 | 464 | ||||||

Purchases of common stock | (34 | ) | (23 | ) | ||||

Dividends/distributions paid on common stock | (879 | ) | (696 | ) | ||||

Dividends paid on preferred stock | (57 | ) | — | |||||

Net cash provided by (used for) financing activities | (436 | ) | 1,369 | |||||

Net increase (decrease) in cash, cash equivalents, and restricted cash | (103 | ) | (375 | ) | ||||

Discontinued operations: | ||||||||

Net cash provided by (used for) operating activities | — | |||||||

Net cash provided by (used for) investing activities | — | |||||||

Net increase (decrease) in cash and cash equivalents and restricted cash—discontinued operations | — | — | ||||||

Effect of exchange rate changes | (1 | ) | 1 | |||||

Cash, cash equivalents, and restricted cash at beginning of period(a) | 440 | 697 | ||||||

Cash, cash equivalents, and restricted cash at end of period(a) | $ | 336 | $ | 323 | ||||

(a) | See "Recently Adopted Accounting Pronouncements" in note 2 to the condensed consolidated financial statements for a discussion of recently adopted restricted cash guidance, which impacted certain presentations on the condensed consolidated statement of cash flows. |

See notes to condensed consolidated financial statements.

5

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF EQUITY

(Amounts in millions) (Unaudited)

Common Stock | 6.875% Mandatory Convertible Preferred Stock | Accumulated Other Comprehensive Income (Loss) ("AOCI") | |||||||||||||||||||||||||||

Shares | ($0.01 Par) | Shares | ($0.01 Par) | Additional paid-in capital | Foreign Currency Translation Adjustments | Dividends/Distributions in Excess of Earnings | Total | ||||||||||||||||||||||

Balance, April 1, 2018 | 415 | $ | 4 | 2 | — | $ | 17,690 | $ | (4 | ) | $ | (4,858 | ) | $ | 12,832 | ||||||||||||||

Stock-based compensation related activity, net of forfeitures | — | — | — | — | 24 | — | — | 24 | |||||||||||||||||||||

Purchases and retirement of common stock | — | — | — | — | (1 | ) | — | — | (1 | ) | |||||||||||||||||||

Net proceeds from issuance of common stock | — | — | — | — | (2 | ) | — | — | (2 | ) | |||||||||||||||||||

Other comprehensive income (loss)(a) | — | — | — | — | — | (1 | ) | — | (1 | ) | |||||||||||||||||||

Common stock dividends/distributions | — | — | — | — | — | — | (438 | ) | (438 | ) | |||||||||||||||||||

Preferred stock dividends | — | — | — | — | — | — | (28 | ) | (28 | ) | |||||||||||||||||||

Net income (loss) | — | — | — | — | — | — | 180 | 180 | |||||||||||||||||||||

Balance, June 30, 2018 | 415 | $ | 4 | 2 | $ | — | $ | 17,711 | $ | (5 | ) | $ | (5,144 | ) | $ | 12,566 | |||||||||||||

(a) | See the condensed statement of operations and other comprehensive income (loss) for the components of "other comprehensive income (loss)." |

Common Stock | 6.875% Mandatory Convertible Preferred Stock | AOCI | |||||||||||||||||||||||||||

Shares | ($0.01 Par) | Shares | ($0.01 Par) | Additional paid-in capital | Foreign Currency Translation Adjustments | Dividends/Distributions in Excess of Earnings | Total | ||||||||||||||||||||||

Balance, April 1, 2017 | 361 | $ | 4 | — | — | $ | 10,968 | $ | (6 | ) | $ | (3,603 | ) | $ | 7,363 | ||||||||||||||

Stock-based compensation related activity, net of forfeitures | — | — | — | — | 23 | — | — | 23 | |||||||||||||||||||||

Purchases and retirement of common stock | — | — | — | — | (1 | ) | — | — | (1 | ) | |||||||||||||||||||

Net proceeds from issuance of common stock | 5 | — | — | — | 442 | — | — | 442 | |||||||||||||||||||||

Other comprehensive income (loss)(a) | — | — | — | — | — | 1 | — | 1 | |||||||||||||||||||||

Common stock dividends/distributions | — | — | — | — | — | — | (350 | ) | (350 | ) | |||||||||||||||||||

Net income (loss) | — | — | — | — | — | — | 112 | 112 | |||||||||||||||||||||

Balance, June 30, 2017 | 366 | $ | 4 | — | $ | — | $ | 11,432 | $ | (5 | ) | $ | (3,841 | ) | $ | 7,590 | |||||||||||||

(a) | See the condensed statement of operations and other comprehensive income (loss) for the components of "other comprehensive income (loss)." |

6

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF EQUITY

(Amounts in millions) (Unaudited)

Common Stock | 6.875% Mandatory Convertible Preferred Stock | AOCI | |||||||||||||||||||||||||||

Shares | ($0.01 Par) | Shares | ($0.01 Par) | Additional paid-in capital | Foreign Currency Translation Adjustments | Dividends/Distributions in Excess of Earnings | Total | ||||||||||||||||||||||

Balance, January 1, 2018 | 406 | $ | 4 | 2 | — | $ | 16,844 | $ | (4 | ) | $ | (4,505 | ) | $ | 12,339 | ||||||||||||||

Stock-based compensation related activity, net of forfeitures | 1 | — | — | — | 60 | — | — | 60 | |||||||||||||||||||||

Purchases and retirement of common stock | — | — | — | — | (34 | ) | — | — | (34 | ) | |||||||||||||||||||

Net proceeds from issuance of common stock | 8 | — | — | — | 841 | — | — | 841 | |||||||||||||||||||||

Other comprehensive income (loss)(a) | — | — | — | — | — | (1 | ) | — | (1 | ) | |||||||||||||||||||

Common stock dividends/distributions | — | — | — | — | — | — | (876 | ) | (876 | ) | |||||||||||||||||||

Preferred stock dividends | — | — | — | — | — | — | (57 | ) | (57 | ) | |||||||||||||||||||

Net income (loss) | — | — | — | — | — | — | 294 | 294 | |||||||||||||||||||||

Balance, June 30, 2018 | 415 | $ | 4 | 2 | $ | — | $ | 17,711 | $ | (5 | ) | $ | (5,144 | ) | $ | 12,566 | |||||||||||||

(a) | See the condensed statement of operations and other comprehensive income (loss) for the components of "other comprehensive income (loss)." |

Common Stock | 6.875% Mandatory Convertible Preferred Stock | AOCI | |||||||||||||||||||||||||||

Shares | ($0.01 Par) | Shares | ($0.01 Par) | Additional paid-in capital | Foreign Currency Translation Adjustments | Dividends/Distributions in Excess of Earnings | Total | ||||||||||||||||||||||

Balance, January 1, 2017 | 361 | $ | 4 | — | — | $ | 10,938 | $ | (6 | ) | $ | (3,379 | ) | $ | 7,557 | ||||||||||||||

Stock-based compensation related activity, net of forfeitures | 1 | — | — | — | 53 | — | — | 53 | |||||||||||||||||||||

Purchases and retirement of common stock | — | — | — | — | (23 | ) | — | — | (23 | ) | |||||||||||||||||||

Net proceeds from issuance of common stock | 4 | — | — | — | 464 | — | — | 464 | |||||||||||||||||||||

Other comprehensive income (loss)(a) | — | — | — | — | — | 1 | — | 1 | |||||||||||||||||||||

Common stock dividends/distributions | — | — | — | — | — | — | (693 | ) | (693 | ) | |||||||||||||||||||

Net income (loss) | — | — | — | — | — | — | 231 | 231 | |||||||||||||||||||||

Balance, June 30, 2017 | 366 | $ | 4 | — | $ | — | $ | 11,432 | $ | (5 | ) | $ | (3,841 | ) | $ | 7,590 | |||||||||||||

(a) | See the condensed statement of operations and other comprehensive income (loss) for the components of "other comprehensive income (loss)." |

7

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-Unaudited

(Tabular dollars in millions, except per share amounts)

1. | General |

The information contained in the following notes to the consolidated financial statements is condensed from that which would appear in the annual consolidated financial statements; accordingly, the consolidated financial statements included herein should be reviewed in conjunction with the consolidated financial statements for the fiscal year ended December 31, 2017, and related notes thereto, included in the 2017 Form 10-K filed by Crown Castle International Corp. ("CCIC") with the SEC. Capitalized terms used but not defined in these notes to the condensed consolidated financial statements have the same meaning given to them in our 2017 Form 10-K. References to the "Company" include CCIC and its predecessor, as applicable, and their subsidiaries, unless otherwise indicated or the context indicates otherwise. As used herein, the term "including," and any variation thereof means "including without limitation." The use of the word "or" herein is not exclusive. Unless the context suggests otherwise, references to "U.S." are to the United States of America and Puerto Rico, collectively.

The Company owns, operates and leases shared communications infrastructure that is geographically dispersed throughout the U.S., including (1) towers and other structures, such as rooftops (collectively, "towers"), and (2) fiber primarily supporting small cell networks ("small cells") and fiber solutions. The Company's towers, fiber and small cells assets are collectively referred to herein as "communications infrastructure," and the Company's customers on its communications infrastructure are referred to herein as "tenants."

The Company's core business is providing access, including space or capacity, to its shared communications infrastructure via long-term contracts in various forms, including lease, license, sublease and service agreements (collectively, "contracts").

The Company's operating segments consist of (1) Towers and (2) Fiber. See note 11.

As part of the Company's effort to provide comprehensive communications infrastructure solutions, the Company offers certain network services relating to its communications infrastructure, consisting of (1) site development services primarily relating to existing or new tenant equipment installations on its towers and small cells, including: site acquisition, architectural and engineering, or zoning and permitting (collectively, "site development services") and (2) tenant equipment installation or subsequent augmentations (collectively, "installation services").

The Company operates as a REIT for U.S. federal income tax purposes. In addition, the Company has certain taxable REIT subsidiaries ("TRSs"). See note 7.

Approximately 53% of the Company's towers are leased or subleased or operated and managed under master leases, subleases, and other agreements with AT&T, Sprint, and T-Mobile. The Company has the option to purchase these towers at the end of their respective lease terms. The Company has no obligation to exercise such purchase options.

Basis of Presentation

The condensed consolidated financial statements included herein are unaudited; however, they include all adjustments (consisting only of normal recurring adjustments) which, in the opinion of management, are necessary to state fairly the consolidated financial position of the Company at June 30, 2018, and the consolidated results of operations and the consolidated cash flows for the six months ended June 30, 2018 and 2017. The year-end condensed consolidated balance sheet data was derived from audited financial statements, but does not include all disclosures required by GAAP. The results of operations for the interim periods presented are not necessarily indicative of the results to be expected for the full year.

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities as of the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

The Company has changed its presentation from thousands to millions and, as a result, any necessary rounding adjustments have been made to prior year disclosed amounts.

2. | Summary of Significant Accounting Policies |

The significant accounting policies used in the preparation of the Company's condensed consolidated financial statements are disclosed in the 2017 Form 10-K, other than as updated by certain recent accounting pronouncements described below.

8

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-Unaudited (Continued)

(Tabular dollars in millions, except per share amounts)

Recently Adopted Accounting Pronouncements

In May 2014, the FASB released updated guidance regarding the recognition of revenue from contracts with customers not otherwise addressed by specific guidance (commonly referred to as "ASC 606" or "the revenue recognition standard"). The core principle of the guidance is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. To achieve that core principle, an entity should apply the following steps: (1) identify the contracts with the customer; (2) identify the performance obligations in the contract; (3) determine the contract price; (4) allocate the transaction price to the performance obligations in the contract; and (5) recognize revenue when (or as) the entity satisfies a performance obligation. This guidance was effective for the Company on January 1, 2018. This guidance was required to be applied, at the Company's election, either (1) retrospectively to each prior reporting period presented or (2) under the modified retrospective method, with the cumulative effect being recognized at the date of initial application.

Given the nature of the Company’s contracts with customers, the Company’s pattern of revenue recognition is not impacted by the adoption of the revenue recognition standard. The Company adopted the revenue recognition standard under the modified retrospective method, and the Company's adoption of the revenue recognition standard did not result in any adjustment to the balance of dividends/distributions in excess of earnings as of January 1, 2018.

See note 4 for further discussion regarding the Company’s revenues.

In November 2016, the FASB issued new guidance which requires an entity's statement of cash flows to explain the change in restricted cash and restricted cash equivalents in addition to the change in cash and cash equivalents. This new guidance also requires an entity that includes cash, cash equivalents, restricted cash and restricted cash equivalents on multiple lines on its balance sheet to present a reconciliation of those line items between its statement of cash flows and its balance sheet. The Company adopted this guidance retrospectively, on January 1, 2018, and the impact of the new guidance is limited to certain changes in presentation on the condensed consolidated statement of cash flows and certain disclosures. See note 12.

In January 2017, the FASB issued new guidance which clarifies the definition of a business in order to assist companies in evaluating whether transactions should be accounted for as acquisitions or disposals of assets or businesses. The Company adopted the guidance on January 1, 2018, and the adoption of this guidance did not have a material impact on its condensed consolidated financial statements.

Recent Accounting Pronouncements Not Yet Adopted

In February 2016, the FASB issued new guidance on the recognition, measurement, presentation and disclosure of leases. The new guidance requires lessees to recognize a right-of-use asset and a lease liability, initially measured at the present value of the lease payments for all leases with a term greater than 12 months. The accounting for lessors remains largely unchanged from existing guidance. This guidance is effective for the Company as of January 1, 2019. This guidance is required to be applied, at the Company's election, either using a (1) modified retrospective approach for all leases existing at, or entered into after, the beginning of the earliest comparative period presented, or (2) cumulative-effect approach for all leases existing at, or entered into, after the effective date. The Company expects to apply the guidance using the cumulative-effect approach, thereby applying the new guidance at the effective date, without adjusting the comparative periods and, if necessary, recognizing a cumulative-effect adjustment to the opening balance of retained earnings in the period of adoption. Although early adoption is permitted, the Company will not adopt the new guidance prior to January 1, 2019.

With regard to the application of this guidance to the Towers segment, the Company expects that (1) its Towers lessee arrangements will continue to be classified as operating leases under the new guidance; (2) this guidance will have a material impact on its condensed consolidated balance sheet due to the addition of right-of-use assets and lease liabilities for lessee arrangements (which primarily consist of ground leases under the Company's towers); and (3) there will not be a material impact to its condensed consolidated statement of operations and condensed consolidated statement of cash flows. The Company is in the process of updating certain of its existing information technology systems to integrate the new guidance requirement with respect to its Tower segment. With regard to the application of this guidance to the Fiber segment, the Company (1) has established and is progressing through the various steps of a cross-functional project plan to assess the impact of the standard; (2) expects this guidance to have a material impact on its condensed consolidated balance sheet due to the addition of right-of-use assets and lease liabilities for lessee arrangements (which primarily consist of fiber-related leases); and (3) continues to assess additional impacts to its condensed consolidated financial statements, including the condensed consolidated statement of operations and the condensed consolidated statement of cash flows.

9

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-Unaudited (Continued)

(Tabular dollars in millions, except per share amounts)

3. | Acquisitions |

Lightower Acquisition

On July 18, 2017, the Company announced that it had entered into a definitive agreement to acquire LTS Group Holdings LLC ("Lightower") from Berkshire Partners, Pamlico Capital and other investors for approximately $7.1 billion in cash, subject to certain limited adjustments ("Lightower Acquisition"). Lightower owned or had rights to approximately 32,000 route miles of fiber located primarily in top metro markets in the Northeast, including Boston, New York and Philadelphia. On November 1, 2017, the Company closed the Lightower Acquisition.

The preliminary purchase price allocation for the Lightower Acquisition is shown below and is based upon a preliminary valuation which is subject to change as the Company obtains additional information with respect to fixed assets, intangible assets and certain liabilities.

Preliminary Purchase Price Allocation | |||

Current assets | $ | 99 | |

Property and equipment | 2,194 | ||

Goodwill(a) | 3,168 | ||

Other intangible assets, net(b) | 2,177 | ||

Other non-current assets | 30 | ||

Current liabilities | (174 | ) | |

Other non-current liabilities | (342 | ) | |

Net assets acquired(c) | $ | 7,152 | |

(a) | The preliminary purchase price allocation for the Lightower Acquisition resulted in the recognition of goodwill based on: |

• | the Company's expectation to leverage the Lightower fiber footprint to support new small cells and fiber solutions, |

• | the complementary nature of the Lightower fiber to the Company's existing fiber assets and its location where the Company expects to see wireless carrier network investments, |

• | the Company's belief that the acquired fiber assets are well-positioned to benefit from the continued growth trends in the demand for data, and |

• | other intangibles not qualified for separate recognition, including the assembled workforce. |

(b) | Predominately comprised of site rental contracts and customer relationships. |

(c) | The vast majority of the assets have been included in the Company's REIT. As such, no deferred taxes were recorded in connection with the Lightower Acquisition. |

4. | Revenues |

Site rental revenues

The Company generates site rental revenues from its core business by providing customers with access, including space or capacity, to its shared communications infrastructure via long-term contracts in various forms, including lease, license, sublease and service agreements. Providing such access over the length of the contract term represents the Company’s sole performance obligation under its site rental contracts.

Site rental revenues from the Company’s contracts are recognized on a straight-line, monthly basis over the fixed, non-cancelable term of the relevant contract, which generally ranges from five to 15 years for wireless customers and three to 20 years related to the Company's fiber solutions (including from organizations with high-bandwidth and multi-location demands), regardless of whether the payments from the tenant are received in equal monthly amounts during the life of a contract. Certain of the Company's contracts contain fixed escalation clauses (such as fixed-dollar or fixed-percentage increases) or inflation-based escalation clauses (such as those tied to the consumer price index). If the payment terms call for fixed escalations, upfront payments, or rent-free periods, the revenue is recognized on a straight-line basis over the fixed, non-cancelable term of the agreement. When calculating straight-line rental revenues, the Company considers all fixed elements of tenant contractual escalation provisions. The Company's assets related to straight-line site rental revenues include current amounts of $121 million included in "other current assets" and non-current amounts of $1.3 billion included in "deferred site rental receivables" for the period ended June 30, 2018. Amounts billed or received prior to being earned are deferred and reflected in "deferred revenues" and "other long-term liabilities." Amounts to which the Company has an unconditional right to payment, which are related to both satisfied or partially satisfied performance obligations, are recorded within "receivables, net" on the Company's condensed consolidated balance sheet.

10

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-Unaudited (Continued)

(Tabular dollars in millions, except per share amounts)

Network services and other revenues

As part of the Company’s effort to provide comprehensive communications infrastructure solutions, the Company offers certain network services, primarily relating to its towers and small cells, predominately consisting of (1) site development services and (2) installation services.

Under network service agreements, the Company may have multiple performance obligations for site development services, which primarily include: structural analysis, zoning, permitting and construction drawings. Upon contract commencement, the Company assesses services to customers and identifies performance obligations for each promise to provide a distinct service. The volume and mix of site development services may vary among contracts, and may include a combination of some or all of the above performance obligations. For each of the above performance obligations, network services revenues are recognized at completion of the applicable performance obligation, which represents the point at which the Company believes it has transferred goods or services to the customer. The revenue recognized is based on an allocation of the transaction price among the performance obligations in a respective contract based on estimated standalone selling price. Payments generally are due within 45 days and generally do not contain variable-consideration provisions. Since performance obligations are typically satisfied prior to receiving payment from customers, the unconditional right to payment is recorded within "receivables, net" on the Company’s condensed consolidated balance sheet. The Company has one performance obligation for installation services, which is satisfied at the time of the respective installation or augmentation. This single performance obligation is typically completed in advance of receipt of payment from customers, and therefore the unconditional right to payment is recorded within “receivables, net” on the Company’s condensed consolidated balance sheet.

The vast majority of the Company’s network services relates to the Company’s Towers operating segment, and generally have a duration of one year or less.

Additional information on revenues

As of January 1, 2018 and June 30, 2018, $2.1 billion and $2.2 billion of unrecognized revenue, respectively, was reported in "deferred revenues" and "other non-current liabilities" on our condensed consolidated balance sheet. During the six months ended June 30, 2018, approximately $200 million of the January 1, 2018 unrecognized revenue balance was recognized as revenue.

The following table is a summary of the contracted amounts owed to the Company by customers pursuant to site rental contracts in effect as of June 30, 2018.

Six months ending December 31, | Years ending December 31, | |||||||||||||||||||||||||||

2018 | 2019 | 2020 | 2021 | 2022 | Thereafter | Total | ||||||||||||||||||||||

Contracted amounts(a) | $ | 2,039 | $ | 3,829 | $ | 3,552 | $ | 3,279 | $ | 3,054 | $ | 6,928 | $ | 22,681 | ||||||||||||||

(a) | Excludes amounts related to network services, as those contracts generally have a duration of one year or less. |

See note 11 for further information regarding the Company's operating segments.

11

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-Unaudited (Continued)

(Tabular dollars in millions, except per share amounts)

5. | Debt and Other Obligations |

Original Issue Date | Contractual Maturity Date (a) | Balance as of June 30, 2018 | Balance as of December 31, 2017 | Stated Interest Rate as of June 30, 2018(a) | |||||||||||

Bank debt - variable rate: | |||||||||||||||

2016 Revolver | Jan. 2016 | Jun. 2023 | (e) | $ | 315 | (b)(d)(e) | $ | 980 | 3.4 | % | (e) | ||||

2016 Term Loan A | Jan. 2016 | Jun. 2023 | (e) | 2,383 | 2,397 | 3.3 | % | (e) | |||||||

Total bank debt | 2,698 | 3,377 | |||||||||||||

Securitized debt - fixed rate: | |||||||||||||||

Secured Notes, Series 2009-1, Class A-1 | July 2009 | Aug. 2019 | 22 | 32 | 6.3 | % | |||||||||

Secured Notes, Series 2009-1, Class A-2 | July 2009 | Aug. 2029 | 70 | 70 | 9.0 | % | |||||||||

Tower Revenue Notes, Series 2010-3 | Jan. 2010 | Jan. 2040 | (c) | — | (d) | 1,246 | N/A | ||||||||

Tower Revenue Notes, Series 2010-6 | Aug. 2010 | Aug. 2040 | (c) (f) | 996 | 995 | 4.9 | % | ||||||||

Tower Revenue Notes, Series 2015-1 | May 2015 | May 2042 | (c) | 298 | 297 | 3.2 | % | ||||||||

Tower Revenue Notes, Series 2015-2 | May 2015 | May 2045 | (c) | 693 | 692 | 3.7 | % | ||||||||

Total securitized debt | 2,079 | 3,332 | |||||||||||||

Bonds - fixed rate: | |||||||||||||||

5.250% Senior Notes | Oct. 2012 | Jan. 2023 | 1,640 | 1,639 | 5.3 | % | |||||||||

3.849% Secured Notes | Dec. 2012 | Apr. 2023 | 993 | 993 | 3.9 | % | |||||||||

4.875% Senior Notes | Apr. 2014 | Apr. 2022 | 843 | 842 | 4.9 | % | |||||||||

3.400% Senior Notes | Feb./May 2016 | Feb. 2021 | 850 | 850 | 3.4 | % | |||||||||

4.450% Senior Notes | Feb. 2016 | Feb. 2026 | 892 | 891 | 4.5 | % | |||||||||

3.700% Senior Notes | May 2016 | June 2026 | 743 | 743 | 3.7 | % | |||||||||

2.250% Senior Notes | Sept. 2016 | Sept. 2021 | 696 | 695 | 2.3 | % | |||||||||

4.000% Senior Notes | Feb. 2017 | Mar. 2027 | 494 | 494 | 4.0 | % | |||||||||

4.750% Senior Notes | May 2017 | May 2047 | 343 | 343 | 4.8 | % | |||||||||

3.200% Senior Notes | Aug. 2017 | Sept. 2024 | 742 | 742 | 3.2 | % | |||||||||

3.650% Senior Notes | Aug. 2017 | Sept. 2027 | 991 | 991 | 3.7 | % | |||||||||

3.150% Senior Notes | Jan. 2018 | Jul. 2023 | 742 | (d) | — | 3.2 | % | ||||||||

3.800% Senior Notes | Jan. 2018 | Feb. 2028 | 988 | (d) | — | 3.8 | % | ||||||||

Total bonds | 10,957 | 9,223 | |||||||||||||

Other: | |||||||||||||||

Capital leases and other obligations | Various | Various | 222 | 227 | Various | ||||||||||

Total debt and other obligations | 15,956 | 16,159 | |||||||||||||

Less: current maturities and short-term debt and other current obligations | 112 | 115 | |||||||||||||

Non-current portion of long-term debt and other long-term obligations | $ | 15,844 | $ | 16,044 | |||||||||||

(a) | See the 2017 Form 10-K, including note 8, for additional information regarding the maturity and principal amortization provisions and interest rates relating to the Company's indebtedness. |

(b) | As of June 30, 2018, the undrawn availability under the 2016 Revolver was $3.9 billion. |

(c) | If the respective series of such debt is not paid in full on or prior to an applicable date, then Excess Cash Flow (as defined in the indenture) of the issuers of such notes will be used to repay principal of the applicable series, and additional interest (of an additional approximately 5% per annum) will accrue on the respective series. See the 2017 Form 10-K for additional information regarding these provisions. |

(d) | In January 2018, the Company issued $750 million aggregate principal amount of 3.150% senior unsecured notes due July 2023 ("3.15% Senior Notes") and $1.0 billion aggregate principal amount of 3.800% senior unsecured notes due February 2028 ("3.80% Senior Notes") (collectively, "January 2018 Senior Notes Offering"). The Company used the net proceeds of the January 2018 Senior Notes Offering to repay (1) in full the January 2010 Tower Revenue Notes and (2) a portion of the outstanding borrowings under the 2016 Revolver. |

(e) | In June 2018, the Company entered into an amendment to the Credit Facility to (1) increase commitments on the 2016 Revolver by $750 million,for total 2016 Revolver commitments of $4.25 billion, and (2) extend the maturity of the Credit Facility from August 2022 to June 2023. Additionally, pursuant to this amendment and with regards to the Credit Facility, the Company is obligated to pay (1) interest at a rate per annum equal to LIBOR plus a credit spread ranging from 1.00% to 1.75%, and (2) commitment fees ranging from 0.125% and 0.35%, each of which is based on the Company's senior unsecured debt rating. |

(f) | See note 13 for more information regarding the Company's July 2018 Tower Revenue Notes (as defined in note 13). |

12

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-Unaudited (Continued)

(Tabular dollars in millions, except per share amounts)

Contractual Maturities

The following are the scheduled contractual maturities of the total debt and other long-term obligations of the Company outstanding as of June 30, 2018. These maturities reflect contractual maturity dates and do not consider the principal payments that will commence following the anticipated repayment dates on the Tower Revenue Notes.

Six Months Ending December 31, | Years Ending December 31, | Unamortized Adjustments, Net | Total Debt and Other Obligations Outstanding | ||||||||||||||||||||||||||||||||

2018 | 2019 | 2020 | 2021 | 2022 | Thereafter | Total Cash Obligations | |||||||||||||||||||||||||||||

Scheduled contractual maturities | $ | 56 | $ | 105 | $ | 137 | $ | 1,699 | $ | 1,085 | $ | 12,984 | $ | 16,066 | $ | (110 | ) | $ | 15,956 | ||||||||||||||||

Purchases and Redemptions of Long-Term Debt

The following is a summary of purchases and redemptions of long-term debt during the six months ended June 30, 2018.

Principal Amount | Cash Paid(a) | Gains (Losses) | ||||||||||

January 2010 Tower Revenue Notes | $ | 1,250 | $ | 1,318 | $ | (71 | ) | (b) | ||||

2016 Term Loan A | $ | — | $ | — | $ | (3 | ) | (b) | ||||

Total | $ | 1,250 | $ | 1,318 | $ | (74 | ) | |||||

(a) | Exclusive of accrued interest. |

(b) | Inclusive of the write off of respective deferred financing costs. |

See note 13.

Interest Expense and Amortization of Deferred Financing Costs

The components of interest expense and amortization of deferred financing costs are as follows:

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

Interest expense on debt obligations | $ | 157 | $ | 139 | $ | 314 | $ | 271 | |||||||

Amortization of deferred financing costs and adjustments on long-term debt | 5 | 5 | 11 | 9 | |||||||||||

Other, net of capitalized interest | (4 | ) | (2 | ) | (7 | ) | (4 | ) | |||||||

Total | $ | 158 | $ | 142 | $ | 318 | $ | 276 | |||||||

6. | Fair Value Disclosures |

Level in Fair Value Hierarchy | June 30, 2018 | December 31, 2017 | |||||||||||||||

Carrying Amount | Fair Value | Carrying Amount | Fair Value | ||||||||||||||

Assets: | |||||||||||||||||

Cash and cash equivalents | 1 | $ | 206 | $ | 206 | $ | 314 | $ | 314 | ||||||||

Restricted cash, current and non-current | 1 | 130 | 130 | 126 | 126 | ||||||||||||

Liabilities: | |||||||||||||||||

Total debt and other obligations | 2 | 15,956 | 15,911 | 16,159 | 16,644 | ||||||||||||

The fair value of cash and cash equivalents and restricted cash approximate the carrying value. The Company determines the fair value of its debt securities based on indicative, non-binding quotes from brokers. Quotes from brokers require judgment and are based on the brokers' interpretation of market information, including implied credit spreads for similar borrowings on recent trades or bid/ask prices or quotes from active markets if available. There were no changes since December 31, 2017 in the Company's valuation techniques used to measure fair values.

13

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-Unaudited (Continued)

(Tabular dollars in millions, except per share amounts)

7. | Income Taxes |

The Company operates as a REIT for U.S. federal income tax purposes. As a REIT, the Company is generally entitled to a deduction for dividends that it pays and therefore is not subject to U.S. federal corporate income tax on its net taxable income that is currently distributed to its stockholders. The Company also may be subject to certain federal, state, local, and foreign taxes on its income and assets, including (1) taxes on any undistributed income, (2) taxes related to the TRSs, (3) franchise taxes, (4) property taxes, and (5) transfer taxes. In addition, the Company could in certain circumstances be required to pay an excise or penalty tax, which could be significant in amount, in order to utilize one or more relief provisions under the Internal Revenue Code of 1986, as amended, to maintain qualification for taxation as a REIT.

The Company's TRS assets and operations will continue to be subject, as applicable, to federal and state corporate income taxes or to foreign taxes in the jurisdictions in which such assets and operations are located. The Company's foreign assets and operations (including its tower operations in Puerto Rico) are subject to foreign income taxes in the jurisdictions in which such assets and operations are located, regardless of whether they are included in a TRS or not.

For the six months ended June 30, 2018 and 2017, the Company's effective tax rate differed from the federal statutory rate predominately due to the Company's REIT status, including the dividends paid deduction.

8. | Per Share Information |

Basic net income (loss) attributable to CCIC common stockholders, per common share, excludes dilution and is computed by dividing net income (loss) attributable to CCIC common stockholders by the weighted-average number of common shares outstanding during the period. For the three and six months ended June 30, 2018, diluted net income (loss) attributable to CCIC common stockholders, per common share is computed by dividing net income (loss) attributable to CCIC common stockholders by the weighted-average number of common shares outstanding during the period plus any potential dilutive common share equivalents, including shares issuable upon (1) the vesting of restricted stock units as determined under the treasury stock method and (2) conversion of the Company's 6.875% Mandatory Convertible Preferred Stock (as defined in note 10), as determined under the if-converted method. For the three and six months ended June 30, 2017, diluted net income (loss) attributable to CCIC common stockholders, per common share is computed by dividing net income (loss) attributable to CCIC common stockholders by the weighted-average number of common shares outstanding during the period plus any potential dilutive common share equivalents, including shares issuable upon the vesting of restricted stock units as determined under the treasury stock method.

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

Net income (loss) attributable to CCIC stockholders | $ | 180 | $ | 112 | $ | 294 | $ | 231 | |||||||

Dividends on preferred stock | (28 | ) | — | (57 | ) | — | |||||||||

Net income (loss) attributable to CCIC common stockholders for basic and diluted computations | $ | 152 | $ | 112 | $ | 237 | $ | 231 | |||||||

Weighted-average number of common shares outstanding (in millions): | |||||||||||||||

Basic weighted-average number of common stock outstanding | 415 | 364 | 412 | 363 | |||||||||||

Effect of assumed dilution from potential issuance of common shares relating to restricted stock units | 1 | 2 | 1 | 1 | |||||||||||

Diluted weighted-average number of common shares outstanding | 416 | 366 | 413 | 364 | |||||||||||

Net income (loss) attributable to CCIC common stockholders, per common share: | |||||||||||||||

Basic | $ | 0.37 | $ | 0.31 | $ | 0.58 | $ | 0.64 | |||||||

Diluted | $ | 0.36 | $ | 0.31 | $ | 0.57 | $ | 0.64 | |||||||

During the six months ended June 30, 2018, the Company granted one million restricted stock units. For both the three and six months ended June 30, 2018, 16 million common share equivalents related to the 6.875% Mandatory Convertible Preferred Stock were excluded from the dilutive common shares because the impact of such conversion would be anti-dilutive, based on the Company's common stock price as of June 30, 2018.

14

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-Unaudited (Continued)

(Tabular dollars in millions, except per share amounts)

9. | Commitments and Contingencies |

The Company is involved in various claims, lawsuits or proceedings arising in the ordinary course of business. While there are uncertainties inherent in the ultimate outcome of such matters and it is impossible to presently determine the ultimate costs or losses that may be incurred, if any, management believes the resolution of such uncertainties and the incurrence of such costs should not have a material adverse effect on the Company's consolidated financial position or results of operations. Additionally, the Company and certain of its subsidiaries are contingently liable for commitments or performance guarantees arising in the ordinary course of business, including certain letters of credit or surety bonds. In addition, the Company has the option to purchase approximately 53% of the Company's towers at the end of their respective lease terms. The Company has no obligation to exercise such purchase options.

10. | Equity |

Declaration and Payment of Dividends

During the six months ended June 30, 2018, the following dividends were declared or paid:

Equity Type | Declaration Date | Record Date | Payment Date | Dividends Per Share | Aggregate Payment Amount | ||||||||||

Common Stock | February 21, 2018 | March 16, 2018 | March 30, 2018 | $ | 1.05 | $ | 439 | (a) | |||||||

Common Stock | May 17, 2018 | June 15, 2018 | June 29, 2018 | $ | 1.05 | $ | 438 | (a) | |||||||

6.875% Mandatory Convertible Preferred Stock | December 15, 2017 | January 15, 2018 | February 1, 2018 | $ | 17.1875 | $ | 28 | ||||||||

6.875% Mandatory Convertible Preferred Stock | March 19, 2018 | April 15, 2018 | May 1, 2018 | $ | 17.1875 | $ | 28 | ||||||||

6.875% Mandatory Convertible Preferred Stock | June 22, 2018 | July 15, 2018 | August 1, 2018 | $ | 17.1875 | $ | 28 | ||||||||

(a) | Inclusive of dividends accrued for holders of unvested restricted stock units, which will be paid when and if the restricted stock units vest. |

See note 13.

Purchases of the Company's Common Stock

For the six months ended June 30, 2018, the Company purchased 0.3 million shares of its common stock utilizing $34 million in cash. The common stock shares purchased relate to shares withheld in connection with the payment of withholding taxes upon vesting of restricted stock units.

2015 "At the Market" Stock Offering Program

The Company previously maintained an "at the market" stock offering program ("2015 ATM Program") through which it had the right to issue and sell shares of its common stock having an aggregate gross sales price of up to $500 million to or through sales agents. The Company sold shares of its common stock under the 2015 ATM Program generating aggregate gross proceeds of approximately $350 million. The Company terminated its previously outstanding 2015 ATM Program in March 2018 with shares of its common stock having an aggregate offering price of approximately $150 million remaining unsold.

2018 "At the Market" Stock Offering Program

In April 2018, the Company established a new "at the market" stock offering program ("2018 ATM Program") through which it may issue and sell shares of its common stock having an aggregate gross sales price of up to $750 million. Sales under the 2018 ATM Program may be made by means of ordinary brokers' transactions on the NYSE or otherwise at market prices prevailing at the time of sale, at prices related to prevailing market prices or, subject to our specific instructions, at negotiated prices. The Company intends to use the net proceeds from any sales under the 2018 ATM Program for general corporate purposes, which may include the funding of future acquisitions or investments and the repayment or repurchase of any outstanding indebtedness. The Company has not sold any shares of common stock under the 2018 ATM Program.

15

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-Unaudited (Continued)

(Tabular dollars in millions, except per share amounts)

March 2018 Equity Financing

In March 2018, the Company completed an offering of 8 million shares of its common stock, which generated net proceeds of $841 million ("March 2018 Equity Financing"). The Company used the net proceeds from the March 2018 Equity Financing for general corporate purposes, including repayment of outstanding indebtedness.

11. | Operating Segments |

The Company's operating segments are (1) Towers and (2) Fiber. The Towers segment provides access, including space or capacity, to the Company's approximately 40,000 towers geographically dispersed throughout the U.S. The Towers segment also reflects certain network services relating to the Company's towers, consisting of site development services and installation services. The Fiber segment provides access, including space or capacity, to the Company's approximately 60,000 route miles of fiber primarily supporting small cell networks and fiber solutions.

The measurements of profit or loss used by the Company's chief operating decision maker to evaluate the results of operations of its operating segments are (1) segment site rental gross margin, (2) segment network services and other gross margin and (3) segment operating profit. The Company defines segment site rental gross margin as segment site rental revenues less segment site rental cost of operations, which excludes stock-based compensation expense and prepaid lease purchase price adjustments recorded in consolidated cost of operations. The Company defines segment network services and other gross margin as segment network services and other revenues less segment network services and other cost of operations, which excludes stock-based compensation expense recorded in consolidated cost of operations. The Company defines segment operating profit as segment site rental gross margin plus segment network services and other gross margin, less general and administrative expenses attributable to the respective segment. All of these measurements of profit or loss are exclusive of depreciation, amortization and accretion, which are shown separately.

Costs that are directly attributable to Towers and Fiber are assigned to those respective segments. The "Other" column (1) represents amounts excluded from specific segments, such as asset write-down charges, acquisition and integration costs, depreciation, amortization and accretion, amortization of prepaid lease purchase price adjustments, interest expense and amortization of deferred financing costs, gains (losses) on retirement of long-term obligations, net gain (loss) on interest rate swaps, gains (losses) on foreign currency swaps, interest income, other income (expense), income (loss) from discontinued operations, and stock-based compensation expense, and (2) reconciles segment operating profit to income (loss) before income taxes, as the amounts are not utilized in assessing each segment’s performance. The "Other" total assets balance includes corporate assets such as cash and cash equivalents which have not been allocated to specific segments. There are no significant revenues resulting from transactions between the Company's operating segments.

16

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-Unaudited (Continued)

(Tabular dollars in millions, except per share amounts)

Three Months Ended June 30, 2018 | Three Months Ended June 30, 2017 | ||||||||||||||||||||||||||||||

Towers | Fiber | Other | Consolidated Total | Towers | Fiber | Other | Consolidated Total | ||||||||||||||||||||||||

Segment site rental revenues | $ | 771 | $ | 398 | $ | 1,169 | $ | 718 | $ | 151 | $ | 869 | |||||||||||||||||||

Segment network services and other revenues | 158 | 3 | 161 | 158 | 11 | 169 | |||||||||||||||||||||||||

Segment revenues | 929 | 401 | 1,330 | 876 | 162 | 1,038 | |||||||||||||||||||||||||

Segment site rental cost of operations | 216 | 130 | 346 | 211 | 52 | 263 | |||||||||||||||||||||||||

Segment network services and other cost of operations | 94 | 3 | 97 | 96 | 8 | 104 | |||||||||||||||||||||||||

Segment cost of operations(a)(b) | 310 | 133 | 443 | 307 | 60 | 367 | |||||||||||||||||||||||||

Segment site rental gross margin | 555 | 268 | 823 | 507 | 99 | 606 | |||||||||||||||||||||||||

Segment network services and other gross margin | 64 | — | 64 | 62 | 3 | 65 | |||||||||||||||||||||||||

Segment general and administrative expenses(b) | 27 | 44 | 71 | 23 | 19 | 42 | |||||||||||||||||||||||||

Segment operating profit (loss) | 592 | 224 | 816 | 546 | 83 | 629 | |||||||||||||||||||||||||

Other general and administrative expenses(b) | $ | 47 | 47 | $ | 41 | 41 | |||||||||||||||||||||||||

Stock-based compensation expense | 26 | 26 | 17 | 17 | |||||||||||||||||||||||||||

Depreciation, amortization and accretion | 379 | 379 | 296 | 296 | |||||||||||||||||||||||||||

Interest expense and amortization of deferred financing costs | 158 | 158 | 142 | 142 | |||||||||||||||||||||||||||

Other income (expenses) to reconcile to income (loss) before income taxes(c) | 21 | 21 | 16 | 16 | |||||||||||||||||||||||||||

Income (loss) before income taxes | $ | 185 | $ | 117 | |||||||||||||||||||||||||||

Capital expenditures | $ | 98 | $ | 289 | $ | 6 | $ | 393 | $ | 107 | $ | 188 | $ | 6 | $ | 301 | |||||||||||||||

Total assets (at period end) | $ | 17,780 | $ | 14,100 | $ | 494 | $ | 32,374 | $ | 18,208 | $ | 5,811 | $ | 465 | $ | 24,484 | |||||||||||||||

(a) | Exclusive of depreciation, amortization and accretion shown separately. |

(b) | Segment cost of operations excludes (1) stock-based compensation expense of $6 million and $2 million for the three months ended June 30, 2018 and 2017, respectively, and (2) prepaid lease purchase price adjustments of $5 million for both of the three months ended June 30, 2018 and 2017. General and administrative expenses exclude stock-based compensation expense of $20 million and $15 million for the three months ended June 30, 2018 and 2017, respectively. |

(c) | See condensed consolidated statement of operations for further information. |

17

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-Unaudited (Continued)

(Tabular dollars in millions, except per share amounts)

Six Months Ended June 30, 2018 | Six Months Ended June 30, 2017 | ||||||||||||||||||||||||||||||

Towers | Fiber | Other | Consolidated Total | Towers | Fiber | Other | Consolidated Total | ||||||||||||||||||||||||

Segment site rental revenues | $ | 1,536 | $ | 787 | $ | 2,323 | $ | 1,434 | $ | 292 | $ | 1,726 | |||||||||||||||||||

Segment network services and other revenues | 300 | 7 | 307 | 308 | 20 | 328 | |||||||||||||||||||||||||

Segment revenues | 1,836 | 794 | 2,630 | 1,742 | 312 | 2,054 | |||||||||||||||||||||||||

Segment site rental cost of operations | 427 | 256 | 683 | 420 | 99 | 519 | |||||||||||||||||||||||||

Segment network services and other cost of operations | 176 | 5 | 181 | 185 | 17 | 202 | |||||||||||||||||||||||||

Segment cost of operations(a)(b) | 603 | 261 | 864 | 605 | 116 | 721 | |||||||||||||||||||||||||

Segment site rental gross margin | 1,109 | 531 | 1,640 | 1,014 | 193 | 1,207 | |||||||||||||||||||||||||

Segment network services and other gross margin | 124 | 2 | 126 | 123 | 3 | 126 | |||||||||||||||||||||||||

Segment general and administrative expenses(b) | 53 | 87 | 140 | 47 | 36 | 83 | |||||||||||||||||||||||||

Segment operating profit (loss) | 1,180 | 446 | 1,626 | 1,090 | 160 | 1,250 | |||||||||||||||||||||||||

Other general and administrative expenses(b) | $ | 94 | 94 | $ | 80 | 80 | |||||||||||||||||||||||||

Stock-based compensation expense | 52 | 52 | 42 | 42 | |||||||||||||||||||||||||||

Depreciation, amortization and accretion | 753 | 753 | 584 | 584 | |||||||||||||||||||||||||||

Interest expense and amortization of deferred financing costs | 318 | 318 | 276 | 276 | |||||||||||||||||||||||||||

Other income (expenses) to reconcile to income (loss) before income taxes(c) | 106 | 106 | 28 | 28 | |||||||||||||||||||||||||||

Income (loss) before income taxes | $ | 303 | $ | 240 | |||||||||||||||||||||||||||

Capital expenditures | $ | 195 | $ | 552 | $ | 16 | $ | 763 | $ | 208 | $ | 342 | $ | 13 | $ | 563 | |||||||||||||||

(a) | Exclusive of depreciation, amortization and accretion shown separately. |

(b) | Segment cost of operations excludes (1) stock-based compensation expense of $13 million and $6 million for the six months ended June 30, 2018 and 2017, respectively, and (2) prepaid lease purchase price adjustments of $10 million for both of the six months ended June 30, 2018 and 2017. General and administrative expenses exclude stock-based compensation expense of $39 million and $36 million for the six months ended June 30, 2018 and 2017, respectively. |

(c) | See condensed consolidated statement of operations for further information. |

18

CROWN CASTLE INTERNATIONAL CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-Unaudited (Continued)

(Tabular dollars in millions, except per share amounts)

12. | Supplemental Cash Flow Information |

Six Months Ended June 30, | |||||||

2018 | 2017 | ||||||

Supplemental disclosure of cash flow information: | |||||||

Interest paid | $ | 292 | $ | 260 | |||

Income taxes paid | 12 | 10 | |||||

Supplemental disclosure of non-cash investing and financing activities: | |||||||

Increase (decrease) in accounts payable for purchases of property and equipment | 22 | (8 | ) | ||||

Purchase of property and equipment under capital leases and installment purchases | 17 | 18 | |||||

Preferred stock dividends declared but not paid (see note 10) | 28 | — | |||||

The reconciliation of cash, cash equivalents, and restricted cash reported within various lines on the condensed consolidated balance sheet to amounts reported in the condensed consolidated statement of cash flows is shown below.

June 30, 2018 | December 31, 2017 | ||||||

Cash and cash equivalents | $ | 206 | $ | 314 | |||

Restricted cash, current | 125 | 121 | |||||

Restricted cash reported within long-term prepaid rent and other assets, net | 5 | 5 | |||||

Cash, cash equivalents and restricted cash | $ | 336 | $ | 440 | |||

13. | Subsequent Events |

July 2018 Tower Revenue Notes

In July 2018, certain of the Company's indirect subsidiaries issued $1.0 billion aggregate principal amount of Senior Secured Tower Revenue Notes ("July 2018 Tower Revenue Notes"), which were issued pursuant to the existing indenture and having similar terms and security as the Company's existing Tower Revenue Notes.

The July 2018 Tower Revenue Notes consist of (1) $250 million aggregate principal amount of 3.720% senior secured tower revenue notes ("3.72% Notes") and have an expected life of five years with a final maturity of July 2043 and (2) $750 million aggregate principal amount of 4.241% senior secured tower revenue notes ("4.241% Notes") and have an expected life of 10 years with a final maturity of July 2048.

The Company used the proceeds of the July 2018 Tower Revenue Notes, together with cash on hand, to repay all of the previously outstanding Tower Revenue Notes, Series 2010-6 and to pay related fees and expenses. The Company expects to record a loss on retirement of long-term obligations during the third quarter of 2018 of approximately $33 million in connection with this repayment.

In addition to the July 2018 Tower Revenue Notes described above, in connection with Exchange Act risk retention requirements, an indirect subsidiary of the Company issued and a majority-owned affiliate of the Company purchased approximately $53 million of the Senior Secured Tower Revenue Notes, Series 2018-1, Class R-2028 to retain an "eligible horizontal residual interest" in an amount equal to at least 5% of the fair value of the July 2018 Tower Revenue Notes.

Common Stock Dividend

On August 2, 2018, the Company's board of directors declared a quarterly cash dividend of $1.05 per common share. The quarterly dividend will be paid on September 28, 2018 to common stockholders of record as of September 14, 2018.

19

ITEM 2. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion should be read in conjunction with the response to Part I, Item 1 of this report and the consolidated financial statements of the Company including the related notes and "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations" ("MD&A") included in our 2017 Form 10-K. Capitalized terms used but not defined in this Form 10-Q have the same meaning given to them in our 2017 Form 10-K.

General Overview

Overview

We own, operate and lease shared communications infrastructure that is geographically dispersed throughout the U.S., including (1) approximately 40,000 towers and (2) approximately 60,000 route miles of fiber primarily supporting small cell networks and fiber solutions. Our towers have a significant presence in the top 100 basic trading areas ("BTAs"), and the majority of our small cells and fiber is located in major metropolitan areas. Site rental revenues represented 88% of our second quarter 2018 consolidated net revenues. Our Towers operating segment and Fiber operating segment accounted for 66% and 34% of our second quarter 2018 site rental revenues, respectively. See note 11 to our condensed consolidated financial statements. The vast majority of our site rental revenues is of a recurring nature and is subject to long-term contracts with our customers.

Strategy

As a leading provider of shared communications infrastructure in the U.S., our strategy is to create long-term stockholder value via a combination of (1) growing cash flows generated from our portfolio of communications infrastructure, (2) returning a meaningful portion of our cash provided by operating activities to our common stockholders in the form of dividends and (3) investing capital efficiently to grow cash flows and long-term dividends per share. Our U.S. focused strategy is based, in part, on our belief that the U.S. is the most attractive market for shared communications infrastructure investment with the greatest long-term growth potential. We measure our efforts to create "long-term stockholder value" by the combined payment of dividends to stockholders and growth in our per share results. The key elements of our strategy are to:

• | Grow cash flows from our communications infrastructure. We seek to maximize our site rental cash flows by working with our customers to provide them quick access to our communications infrastructure and entering into associated long-term contracts. Tenant additions or modifications of existing tenant equipment (collectively, "tenant additions") enable our customers to expand coverage and capacity in order to meet increasing demand for data, while generating high incremental returns for our business. We believe our product offerings of towers and small cells provide a comprehensive solution to our wireless customers' growing network needs through our shared communications infrastructure model, which is an efficient and cost effective way to serve our customers. Additionally, we believe our ability to share our fiber assets across multiple customers to deploy both small cells and offer fiber solutions allows us to generate cash flows and increase stockholder return. We also believe that there will be considerable future demand for our communications infrastructure based on the location of our assets and the rapid growth in demand for data. |

• | Return cash provided by operating activities to common stockholders in the form of dividends. We believe that distributing a meaningful portion of our cash provided by operating activities appropriately provides common stockholders with increased certainty for a portion of expected long-term stockholder value while still retaining sufficient flexibility to invest in our business and deliver growth. We believe this decision reflects the translation of the high-quality, long-term contractual cash flows of our business into stable capital returns to common stockholders. |

• | Invest capital efficiently to grow cash flows and long-term dividends per share. We seek to invest our available capital, including the net cash provided by our operating activities and external financing sources, in a manner that will increase long-term stockholder value on a risk-adjusted basis. Our historical investments have included the following (in no particular order): |

◦ | acquisitions or construction of towers, fiber and small cells; |

◦ | acquisitions of land interests (which primarily relate to land assets under towers); |

◦ | improvements and structural enhancements to our existing communications infrastructure; |

◦ | purchases of shares of our common stock from time to time; and |

◦ | purchases, repayments or redemptions of our debt. |

20

Our strategy to create long-term stockholder value is based on our belief that additional demand for our communications infrastructure will be created by the expected continued growth in the demand for data. We believe that such demand for our communications infrastructure will continue, will result in growth of our cash flows due to tenant additions on our existing communications infrastructure, and will create other growth opportunities for us, such as demand for new communications infrastructure.

Business Fundamentals and Results

The following are certain highlights of our business fundamentals and results as of and for the six months ended June 30, 2018.

• | We operate as a REIT for U.S. federal income tax purposes |

◦ | As a REIT, we are generally entitled to a deduction for dividends that we pay and therefore are not subject to U.S. federal corporate income tax on our taxable income that is distributed to our stockholders. |

◦ | To remain qualified and be taxed as a REIT, we will generally be required to annually distribute to our stockholders at least 90% of our REIT taxable income, after the utilization of our NOLs (determined without regard to the dividends paid deduction and excluding net capital gain). |

◦ | See note 7 to our condensed consolidated financial statements for further discussion of our REIT status. |

• | Potential growth resulting from the increasing demand for data |

◦ | We expect U.S. wireless carriers will continue their focus on improving network quality and expanding capacity by utilizing a combination of towers and small cells. We believe our product offerings of towers and small cells provide a comprehensive wireless solution to our wireless customers' growing communications infrastructure needs. |

◦ | We expect organizations will continue to increase the usage of high-bandwidth applications that will require the utilization of more fiber infrastructure and fiber solutions, such as those we provide. |

◦ | Within our Fiber segment, we are able to generate growth and returns for our stockholders by deploying our fiber for both small cells and fiber solutions customers. |