Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LILIS ENERGY, INC. | v457365_8k.htm |

Exhibit 99.1

OTC | LLEX Corporate Presentation January 2017

This presentation may contain forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1 995. The use of words such as “believes”, “expects”, “anticipates”, “intends”, “plans”, “estimates”, “should”, “likely” or similar expressions, indicates a forward - lookin g statement. These statements and all the projections in this presentation are subject to risks and uncertainties and are based on the beliefs and assumptions of manag eme nt, and information currently available to management. The actual results could differ materially from a conclusion, forecast or projection in the forward - looking informat ion. The identification in this presentation of factors that may affect the company’s future performance and the accuracy of forward - looking statements is meant to be illustrat ive and by no means exhaustive. These forward - looking statements are given only as of the date of this presentation. Except as required by law, we do not intend, and undertake no obligations to update any forward - looking statements. All forward - looking statements should be evaluated with the understanding of their inherent uncertainty. Factors that could caus e the company’s actual results to differ materially from those expressed or implied by forward - looking statements include, but are not limited to: The success of the com pany’s exploration and development efforts; the price of oil, gas and other produced gasses and liquids; the worldwide economic situation; changes in interest r ate s or inflation; the ability of the company to transport gas, oil and other products; the ability of the company to raise additional capital, as it may be affected by curre nt conditions in the stock market and competition in the oil and gas industry for risk capital; the company’s capital costs, which may be affected by delays or cost overruns; cos t o f production; environmental and other regulations, as the same presently exist or may later be amended; the company’s ability to identify, finance and integrate an y f uture acquisitions; and the volatility of the company’s stock price. See “Risk Factors” in the company’s 2015 Annual Report on Form 10 - K, Quarterly Reports on 10 - Q and other public filings and press releases. RESERVE/RESOURCE DISCLOSURE The SEC permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves th at meet the SEC’s definitions of such terms. Reserve estimates that are intended to meet SEC guidelines are included in our periodic reports filed with the SEC. In this pre sentation, we sometimes also refer to broader, less precise terms when characterizing reserve estimates, such as “resource potential” and “estimated ultimate recovery”, or “EU R”, which the SEC does not permit to be disclosed in SEC filings and are not intended to conform to SEC filing requirements. These estimates are by their nature mor e s peculative than those disclosed in our SEC filings and thus are subject to substantially greater uncertainty of being realized. They are based on internal estimates, a re not reviewed or reported upon by any independent third party and are subject to ongoing review. Actual quantities recovered will likely differ substantially from th ese estimates. Factors affecting ultimate recovery of reserves include the scope of our actual drilling program, which will be directly affected by the availability of ca pital, drilling and production costs, commodity prices (including prevailing oil and gas prices), availability of drilling services and equipment, lease expirations, transpo rta tion constraints, regulatory approvals, field spacing rules, actual recoveries of oil and natural gas in place, length of horizontal laterals, actual drilling results, including g eol ogical and mechanical factors affecting recovery rates, and other factors. These estimates may change significantly as the development of properties provides additional data. Inves tor s are urged to consider closely the oil and gas disclosures in the company’s 2015 Annual Report on Form 10 - K. Confidentiality. Information contained herein is confidential between the Recipient of this information and Lilis Energy, Inc. It is strictly understood that this information shall not be shared with any third party without the written permission from Lilis Energy, Inc. Any dissemination or distribution of any information contained herein is strictly prohibited. Informational Purposes. The Information contained herein as been prepared for informational purposes only and should not be construed as an offer to sel l or the solicitation of an offer to buy any security. Such information includes forward looking statements, estimates and projections , w hich are inherently uncertain, being based on assumptions and subjective judgments which may not prove to be accurate. No Liability . Recipients are urged to consult with their own independent financial advisors with respect to any investment. All informati on contained herein should be independently verified. Neither Lilis Energy, Inc. nor any of its officers, directors, members, employees or consultants, accept and liability whatsoever for any d ir ect or consequential loss arising from any use of information contain in this presentation. Investing in securities can be speculati ve and can carry a high degree of risk. IRS Circular 230 Disclosure. Lilis Energy, Inc. and its affiliates do not provide tax advice. Accordingly, and discussion of U.S. tax matters included herein (i nc luding any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recomm end ation by anyone not affiliated with Lilis Energy, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax - related penalties. Disclaimer Strictly Private and Confidential

Pure Play Permian Operator with Core Delaware Position 5,600 net contiguous acres (100% operated) in the core of the Delaware basin or ~35,000 net horizontal effective acres Multi - year inventory of over 450 potential horizontal net locations Generates strong returns in North America with 74% IRRs using the current strip (1) When compared to its public Permian peers, LLEX has the highest Permian Basin exposure per $1 million of enterprise value (2) - providing investors significant leverage to the Permian High Growth Rate with 12 - Month Plan Transform valuation proposition through conversion of resource potential to production, reserves, and cash flow Projected $46 million D&C development plan (3) calling for the drilling of 10 net wells intending to initially target the Wolfcamp B 12 vertical wellbores on acreage position allows for re - entry and cost savings of $2 million per well Recently completed and flowing back first of two operated horizontal wells drilled to the Wolfcamp B with initial results expected late January / early February, commencing frack on second well Estimate growing production to ~4,300 Boe /d by year end 2017 vs. Q3:2016 production of 459 Boe /d Actively growing Delaware Basin acreage position of 5,600 net acres with a target of 10,000 total Delaware Basin net acres by year end 2017 Track Record of Delaware Acreage Acquisition Assembled current 5,600 net acre position at an average cost of $4,100/acre (4) RSP Permian acquisition of Silver Hill transacted at $47,561 / net production adjusted acre (5) – RSPP/Silver Hill acreage surrounds Lilis acreage Since June of 2016 merger with Brushy Resources, have grown acreage footprint by ~53% Added 500 net acres in October of 2016 and an additional 860 net acres in November of 2016 Experienced and Aligned Management Team New management and board of directors own ~32% of the company – aligned with shareholder interests Current management and operational teams have worked with Anadarko, Cobalt, and Occidental, EOG, Burlington, SM Energy and Quantum Resources Investment Highlights 1. Based off of strip pricing as of 1/5/17 2. Peer group consists of CPE, PE, RSPP, FANG, REN, and SM; Uses publicly available information 3. Preliminary 2017 capital plan subject to continued internal evaluation and may rely on the availability of external financing 4. After adjusting for production using $30,000 per flowing boe 5. $/acre information taken from publicly available information and includes certain transaction adjustments 3 Strictly Private and Confidential

• Delaware Basin Based Operator • Delaware Basin is now in full scale development mode • 5,600 net contiguous acres in the core of the Delaware • 450+ net identified future drilling locations (3) • Average working interest of 80% • 100% operated • Entered Delaware Basin at an attractive valuation (4) • $30,000 per flowing barrel • $4,100 per acre • Recent strategic acquisitions transacting at between ~$30,000 and ~$48,000 / net production adjusted acre • Preliminary 2017 operating capital plan focused on meaningful production and acreage footprint growth • Contemplated $46 million D&C capex budget (5) • 10 wells planned for 2017, all targeting the Wolfcamp B • 6 of which are existing vertical wellbores, allowing for re - entry and cost savings of $2 million per well • Targeting 2017 exit rate of ~4,300 boe /d vs. Q3:2016 production of 459 Boe /d • Expect to aggressively grow undeveloped acreage position at attractive per acre valuations Delaware Basin Position 4 Lilis Energy Profile (1) Lilis Energy Overview Lilis Energy Overview Share Price $3.61 Shares Outstanding 19.0 million Market Cap $68.6 million Adjusted Shares Outstanding (2) 40.3 million Adjusted Market Cap $145.5 million 1. Based on closing price on January 20, 2017 and shares outstanding as of September 30, 2016 2. Assumes 18.5 million potentially converted preferred shares w/ accrued dividends and 2.8 million repriced warrants 3. Possible locations are calculated using required spacing as determined by observing results on wells, how they are being dril led within the play and analysis of Permeability and Porosity on well logs 4. Based on transaction value of $28.3 million, transaction value = consideration paid plus approx. fair value of net assets ass ume d 5. Preliminary 2017 capital plan subject to continued internal evaluation and may rely on the availability of external financing Strictly Private and Confidential

Delaware Offset Well Map 5 • Lilis Energy acreage in Yellow • RSP Permian acquisition of Silver Hill in Blue LLEX Acreage and Offset Operators LLEX Acreage and Offset Operators • Contiguous acreage on Loving - Winkler County line in Texas and Lea County, New Mexico • 5,600 net acres, 73% HBP • 100% operated • Average working interest of 80% • 19 vertical wells & 2 Horizontal producing from multiple formations: Wolfcamp , Brushy Canyon, Bell Canyon, Strawn & Atoka • 10 horizontal re - entries planned for 12 month budget, initially targeting the Wolfcamp • Multiyear inventory with over 450 (1) possible Horizontal Locations with implying ~35,000 net horizontal effective acres • Acreage in blue to the right was purchased by RSP Permian from Silver Hill in 2016 for $47,561 / production adjusted acre (2) • Lilis acreage is adjacent to the Silver Hill acreage acquired by RSPP 1. Possible locations are calculated using required spacing as determined by observing results on wells, how they are being dril led within the play and analysis of Permeability and Porosity on well log 2. $/acre information taken from publicly available information and includes certain transaction adjustments Strictly Private and Confidential Lilis Energy Grizzly #1H 4,115’ 20 frac stages, 2,200’ per foot Lilis Energy Bison #1H 6,897’ 35 frac stages Currently testing

Strong Offset Well Results and Recent Transactions Support Value Mewbourne Harrison 43 W102 IP30: 977 Boepd Loving Lea Concho Gunner Fed 5H IP30: 1,306 Boepd Energen Falcon State #1H IP30: 818 Boepd Silver Hill Bullet 27 - 11 2H 7 - day IP: >1,000 Boepd Devon Ragin Cajun 2H IP30: 898 Boepd Anadarko H&T 75 - 24 2H IP30: 1,148 Boepd Silver Hill Ludeman D 302H IIP30: 1,335 Boepd Silver Hill Ludeman D 102H IP30: 1,361 Boepd 1 2 7 6 5 3 8 9 4 XTO Block 21 1801H IP30: 890 Boepd RSPP / Silver Hill $47,561 / acre 10/13/16 10 Concho Coachman Fee 4H IP30: 1,142 Boepd 6 Winkler 1 1. Publicly available information, corporate presentations and LLEX internal company database Strictly Private and Confidential Lilis Energy Grizzly #1H 4,115’ 20 frac stages, 2,200’ per foot Lilis Energy Bison #1H 6,897’ 35 frac stages Currently testing

7 RSPP / Silver Hill Transaction: Analogous to LLEX Assets Strictly Private and Confidential Wolfcamp Thickness: Delaware Basin (1) 1. RSPP /Silver Hill investor presentation: publicly available Information 2. $/Acre information taken from publicly available information and includes certain transaction adjustments RSPP / Silver Hill Transaction Overview • October 2016 – RSP Permian (RSPP) and Silver Hill Energy Partners I and II (Silver Hill) announced purchase and sale agreements in which RSPP acquired 41,000 net acres in the Delaware Basin for total consideration of ~$2.40 Billion • ~80% operated and over 80% working interest in operated acreage; conducive to long lateral development • Current production of ~15,000 boe/d (69% oil; 86% liquids) • ~250,000 net effective horizontal acres including Wolfcamp B, Lower and Upper (XY) Wolfcamp A, 3 rd Bone Spring, 2 Bone Spring, Avalon and Brushy Canyon • ~3,200 gross / ~1,950 net drilling locations • Assets directly offset LLEX’s assets • As illustrated in the map to the right, LLEX’s assets are identical in thickness to the Silver Hill acreage acquired by RSP Permian RSPP / Silver Hill Acreage $47,561 / acre (2) LLEX Acreage

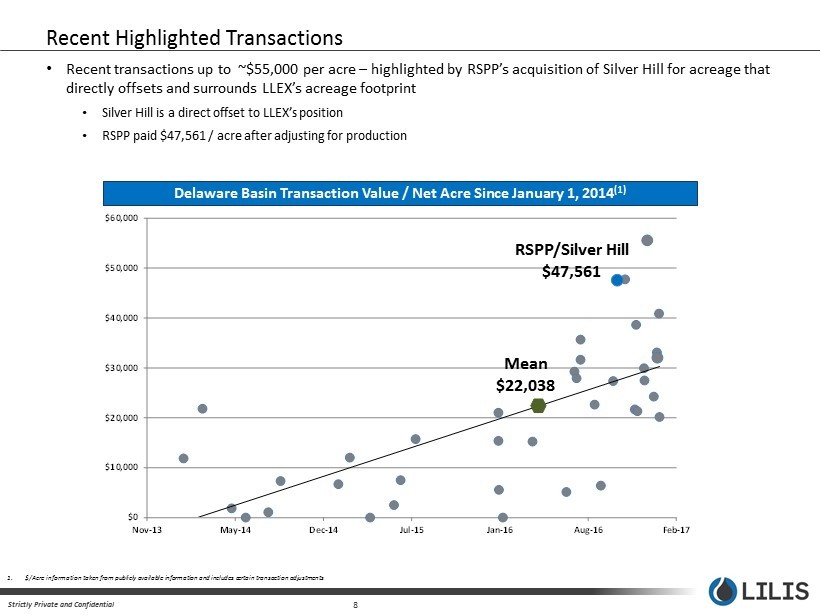

$0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 Nov-13 May-14 Dec-14 Jul-15 Jan-16 Aug-16 Feb-17 Recent Highlighted Transactions • Recent transactions up to ~$55,000 per acre – highlighted by RSPP’s acquisition of Silver Hill for acreage that directly offsets and surrounds LLEX’s acreage footprint • Silver Hill is a direct offset to LLEX’s position • RSPP paid $47,561 / acre after adjusting for production Delaware Basin Transaction Value / Net Acre Since January 1, 2014 (1) 1. $/Acre information taken from publicly available information and includes certain transaction adjustments Mean $22,038 RSPP/Silver Hill $47,561 8 Strictly Private and Confidential

9 Lilis Energy: Net Effective Acres and Drilling Locations Brushy Canyon Avalon Shale 2 nd Bone Spring 3rd Bone Spring/ Wolfcamp XY Wolfcamp A Wolfcamp B Wolfcamp C (1) Assumes 52 wells per section (640 acre section) (2) Source: RSPP / Silver Hill investor presentation, investor presentations, wall street research & Johnson Rice research • Internal geologic analysis suggests multi stacked pay development per section is approximately 52 wells • On current acreage position, stacked pay could result in over 450 net wells of inventory equating to up to ~35,000 net horizo nta l effective acres • Offset operators such as RSPP, CXO, MTDR, EOG, EGN, APA, and PDCE have touted the multi - stack potential in the Delaware Basin Over 450+ Net Delaware Well Locations Provide Multi - Year Inventory (1) Zones Being Touted by Offset Operators (2) Lilis Inventory Zones and Spacing Zones Lamar Bell Canyon Cherry Canyon Brushy Canyon x x x Avalon Shale x x x x x 1 st Bone Spring x x x x x x x x x 2 nd Bone Spring x x x x x x x x x 3 rd Bone Spring x x x x x x x x x x x Upper (XY)/Lower Wolfcamp A x x x x x x x x x x x x x x Wolfcamp B x x x x x x x x x x x x Wolfcamp C x x x x x Wolfcamp D x x Strawn Atoka Total 8 7 7 7 6 6 5 4 4 4 3 3 3 3 Strictly Private and Confidential

10 Lilis Energy – Strong Well Economics • Gross CapEx : $6.0 million • Lateral Length: 5,280’ (1mile) • IP BOPD: 1,000 • B factor (2 - stream): 1.2 • Well level IRR (1) : 74% • Cash on cash breakeven: 1.5 years • Near - term growth leveraged to oil projects • Wells targeting the Wolfcamp B are expected to generate strong returns at current pricing and beyond Oil 80% Dry Gas 20% EUR: 738mboe Wolfcamp B EUR 738 Mboe - Type Curve Assumptions (1) 1. Assumptions based off of internal geologist and reserve engineering reports; Based off of strip pricing as of 1/5/2017 2 - Stream Breakout (1) Expected IRR Sensitivities (1) Gross EUR ( Mboe ) 1 Mile Lateral 1.5 Mile Lateral Gross CWC Capex ($MM ) 738 923 $6 74% 77% $8 $7 46% 58% $9 $8 32% 45% $10 Strictly Private and Confidential

• Vertical wellbores allow for horizontal re - entry – Reducing completed well costs by ~$2 million per well • Extensive well control – No seismic or pilot holes required • Full suite of logs penetrate entire Wolfcamp interval • Target formation cuttings scientifically analyzed • Field infrastructure and takeaway capacity in - place 11 Strategic Advantage Significant Value in Delaware • Awaiting approvals for salt water disposal well – results in significant cost savings / LOE reduction • Energy Transfer Partners natural gas transportation capacity in 2017 and 2018 • Evaluating gas gathering options – Ensuring capacity – Removing existing rentals Cost Reduction Initiatives Existing Well Logs 10 14 16 19 Wolfcamp Bone Springs Avalon Delaware Strictly Private and Confidential

• Minimize D&C Cost • Oily asset base • Convert resource potential to production and cash flow • Grow acreage position Preliminary Development Strategy • Projected $46 million (2) D&C capex program to drill 10 net wells • Initially utilize 6 of existing 12 vertical wellbores to complete re - entry program, targeting the Wolfcamp formation • Re - entry strategy provides ~$2 million of cost savings per well, enhancing returns and well economics Maximizing Resource Recovery • Evolving drilling and completion techniques, lateral length and well spacing generating significant production and EUR enhancement • 6 re - entry locations capable of testing extended laterals • Exit 2017 production rate projected over 4,300 boe /d 12 Preliminary 2017 Development Plan 2017 Capital Allocation EUR (1) by Formation ( Mboe ) 100% Delaware Basin 923 738 500 500 Wolfcamp: 1.5 Mile Wolfcamp: 1 Mile Bone Springs Avalon Wolfcamp: 1.5 Mile Wolfcamp: 1 Mile Bone Springs Avalon 1. See forward looking statements for explanations of EUR and resource potential 2. Preliminary 2017 capital plan subject to continued internal evaluation and may rely on the availability of external financing Strictly Private and Confidential Budget Focus and Drivers

Closed Equity Financing • Raised $24 million of equity consisting of $20 million of Series B convertible and ~$4 million of convertible notes Closed Debt Financing • Initial draw of $31 million, 6% interest • $50 million term debt (currently has $19 million of potentially available funds) In connection with the merger, Lilis has restructured a total of ~ $60 million of debt and preferred securities 13 Recent Activity Financing Near - term Development Plans Bison #1H • Wolfcamp Re - Entry • Total Depth of 19,581’ • 6,897’ lateral • 35 frac stages, 2,200 pounds of proppant per foot • Currently testing well Grizzly #1H • Wolfcamp Re - Entry • Total Depth of 16,971’ • Estimated 4,115’ lateral to stimulate • 20 frac stages, 2,200 pounds of proppant per foot • Stimulation scheduled for late January 2017 Acquisitions Acreage Acquisitions • Since its merger, Lilis has increased its Delaware Basin acreage position by ~53% • November 7, 2016 – added 860 net contiguous acres further expanding Delaware Basin footprint • October 13, 2016 – added 500 net acres and ~690 net mcf per day Strictly Private and Confidential

- 5.0 10.0 15.0 20.0 25.0 30.0 35.0 40.0 Lilis Energy Peer 1 Peer 2 Peer 3 Average Peer 4 Peer 5 Peer 6 Pure Play Delaware Basin Operator: Leveraged to the Permian • When compared to other public Permian peers, LLEX has the highest Permian Basin exposure per $1 million of enterprise value (1) • LLEX’s leverage to the Permian is 2.4x greater than its peer average Net Permian Basin Acres Per $1 Million of Enterprise Value (2) 1. LLEX enterprise value assumes 18.5 million potentially converted preferred shares w/ accrued dividends and 2.8 million repriced warrants 2. Peers consist of CPE, PE, FANG, RSPP, REN, and SM. Publicly available information; Prices as of 1/20/17; Shares outstanding, out standing indebtedness, preferred stock, and cash as of Q3:2016 adjusted for certain business transactions 14 Strictly Private and Confidential

Pure Play Permian Operator with Core Delaware Position 5,600 net contiguous acres (100% operated) in the core of the Delaware basin or ~35,000 net horizontal effective acres Multi - year inventory of over 450 potential horizontal net locations Generates strong returns in North America with 74% IRRs using the current strip (1) When compared to its public Permian peers, LLEX has the highest Permian Basin exposure per $1 million of enterprise value (2) - providing investors significant leverage to the Permian High Growth Rate with 12 - Month Plan Transform valuation proposition through conversion of resource potential to production, reserves, and cash flow Projected $46 million D&C development plan (3) calling for the drilling of 10 net wells intending to initially target the Wolfcamp B 12 vertical wellbores on acreage position allows for re - entry and cost savings of $2 million per well Recently completed and flowing back first of two operated horizontal wells drilled to the Wolfcamp B with initial results expected late January / early February, commencing frack on second well Estimate growing production to ~4,300 Boe /d by year end 2017 vs. Q3:2016 production of 459 Boe /d Actively growing Delaware Basin acreage position of 5,600 net acres with a target of 10,000 total Delaware Basin net acres by year end 2017 Track Record of Delaware Acreage Acquisition Assembled current 5,600 net acre position at an average cost of $4,100/acre (4) RSP Permian acquisition of Silver Hill transacted at $47,561 / net production adjusted acre (5) – RSPP/Silver Hill acreage surrounds Lilis acreage Since June of 2016 merger with Brushy Resources, have grown acreage footprint by ~53% Added 500 net acres in October of 2016 and an additional 860 net acres in November of 2016 Experienced and Aligned Management Team New management and board of directors own ~32% of the company – aligned with shareholder interests Current management and operational teams have worked with Anadarko, Cobalt, and Occidental, EOG, Burlington, SM Energy and Quantum Resources Investment Highlights 1. Based off of strip pricing as of 1/5/17 2. Peer group consists of CPE, PE, RSPP, FANG, REN, and SM; Uses publicly available information 3. Preliminary 2017 capital plan subject to continued internal evaluation and may rely on the availability of external financing 4. After adjusting for production using $30,000 per flowing boe 5. $/acre information taken from publicly available information and includes certain transaction adjustments 15 Strictly Private and Confidential

Appendix Strictly Private and Confidential

17 Capitalization ($ in thousands) Actual 9/30/2016 Cash $29,989 Long Term Debt Term Debt (face value) $23,286 Note Payable – SOS Ventures $1,000 Total Debt $24,286 Conditionally Redeemable 6% Preferred Stock $1,817 Stockholders Equity Series B Preferred Equity (carrying value) $16,604 Common Equity (par value) $1,901 Additional Paid - On Capital $213,166 Accumulated Deficit ($212,657) Total Stockholders Equity $17,115 Total Capitalization $43,218 Strictly Private and Confidential Capitalization Term Debt $50,000 Less: Facility Outstanding 23,286 Plus: Cash 29,989 Liquidity $56,703

18 Equity Share Count Breakdown Shares Potential Proceeds Equity Shares outstanding at 9 - 30 - 16 19,013,602 6% Series B Convertible Preferred stock – w/ dividends 18,478,788 Warrants - Preferred Stock Series B ( $0.01 ) 2,840,912 $28,409 Adjusted Shares Outstanding 40,333,302 Dilutives Warrants - "in the money" Average Price ( $2.19 ) 5,200,904 $11,389,980 Warrants - Preferred Stock Series B ( $2.50 ) 6,249,997 15,624,993 Options - "in of the money" ( $1.38 ) 3,045,000 4,202,100 Restricted stock units 159,583 N/A Total 14,655,484 Total Net Diluted Shares 54,988,786 $31,245,482 Diluted Share Count as of 9/30/16 Strictly Private and Confidential

OTC | LLEX Wobbe Ploegsma VP of Investor Relations & Capital Markets ir@lilisenergy.com 210.999.5400 CorProminence David Boral davidb@coreir.com 512.222.2560