Attached files

| file | filename |

|---|---|

| EX-99.1 - MEDIA RELEASE - IHS Markit Ltd. | exh991q416.htm |

| 8-K - 8-K - IHS Markit Ltd. | q4-16earningsrelease.htm |

Q4 16 Earnings

Supplemental Financials

January 17, 2017

Forward-looking statements

This presentation contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as

“expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” “aim” and similar expressions, and variations or negatives of these words. Without limiting the generality of the foregoing,

forward-looking statements contained in this presentation may include the expectations of management regarding plans, strategies, objectives and anticipated financial and operating results of IHS Markit.

IHS Markit’s estimates and forward-looking statements are mainly based on its current expectations and estimates of future events and trends, which affect or may affect its businesses and operations.

Although IHS Markit believes that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to several risks and uncertainties and are made in light of

information currently available to IHS Markit. These and other forward-looking statements are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual

results to differ materially from those expressed in any forward-looking statements. Important risk factors that may cause such a difference include, but are not limited to, those risks discussed in IHS Markit’s

filings with the US Securities and Exchange Commission (the “SEC”). IHS Markit’s SEC filings are available at www.sec.gov or on the investor relations section of its website, www.ihsmarkit.com. However,

those factors should not be considered to be a complete statement of all potential risks and uncertainties. Other factors may present significant additional obstacles to the realization of forward-looking

statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational

problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on IHS Markit’s consolidated financial condition, results of operations, credit rating or

liquidity. IHS Markit does not assume any obligation to publicly provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments or otherwise,

should circumstances change, except as otherwise required by securities and other applicable laws. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as

of the date of this presentation. All forward-looking statements are qualified in their entirety by this cautionary statement.

Important Information

IHS Inc. was the accounting acquirer in the merger with Markit Ltd. IHS operated, and IHS Markit operates, under a fiscal year that ends on November 30th of each year, while Markit operated under a fiscal

year that ended on December 31st of each year. As a result, financial results for the fiscal year ended November 30, 2016 will include 12 months of results of IHS and results of Markit from and after the July

12, 2016 closing date of the merger in the new Financial Services segment that IHS Markit has created.

Unless otherwise indicated in this presentation, the combined historical information presented is based on the reported GAAP results of IHS for its fiscal year ended November 30th and the historical IFRS

results of Markit (now reported as the Financial Services segment of IHS Markit) adjusted to reflect a fiscal year ended November 30th. The combined historical financial information set forth in this

presentation has not been prepared in accordance with SEC rules, including Article 11 of Regulation S-X, and it therefore does not reflect any of the pro forma adjustments that would be required by Article

11 of Regulation S-X. In addition, certain stand alone historical results of Markit (now reported as the Financial Services segment of IHS Markit) are presented based on the reported results of Markit for its

December 31st fiscal year without any adjustment for the new fiscal year.

Non-GAAP measures

Non-GAAP financial information is presented only as a supplement to IHS Markit’s financial information based on GAAP. Non-GAAP financial information is provided to enhance the reader’s understanding of

the financial performance of IHS Markit, but none of these non-GAAP financial measures are recognized terms under GAAP and should not be considered in isolation from, or as a substitute for, financial

measures calculated in accordance with GAAP. Definitions of IHS Markit non-GAAP measures to the most directly comparable GAAP measures are provided with the schedules to the most recent IHS

Markit quarterly earnings release and are available on IHS Markit’s website (www.ihsmarkit.com). This presentation also includes certain forward looking non-GAAP financial measures. IHS Markit is unable

to present a reconciliation of this forward looking non-GAAP financial information because management cannot reliably predict all of the necessary components of such measures. Accordingly, investors are

cautioned not to place undue reliance on this information.

IHS Markit uses non-GAAP measures in its operational and financial decision making, and believes that it is useful to exclude certain items in order to focus on what it regards to be a more reliable indicator

of the underlying operating performance of the business and its ability to generate cash flow from operations. As a result, internal management reports used during monthly operating reviews feature non-

GAAP measures. IHS Markit also believes that investors may find non-GAAP financial measures for IHS Markit useful for the same reasons, although investors are cautioned that non-GAAP financial

measures are not a substitute for GAAP disclosures.

Non-GAAP measures are frequently used by securities analysts, investors and other interested parties in their evaluation of companies comparable to IHS Markit, many of which present non-GAAP

measures when reporting their results. These measures can be useful in evaluating IHS Markit’s performance against its peer companies because it believes he measures provide users with valuable insight

into key components of GAAP financial disclosures. However, non-GAAP measures have limitations as an analytical tool. Non-GAAP measures are not necessarily comparable to similarly titled measures

used by other companies. They are not presentations made in accordance with GAAP, are not measures of financial condition or liquidity and should not be considered as an alternative to profit or loss for

the period determined in accordance with GAAP or operating cash flows determined in accordance with GAAP. As a result, you should not consider such performance measures in isolation from, or as a

substitute analysis for, results of operations as determined in accordance with GAAP.

2

© 2016 IHS Markit. All Rights Reserved.

We are [reaffirming] 2016 guidance $ in millions, except for per share amounts 2017

IHS Markit Guidance

Low Mid High

Revenue $3,490 $3,525 $3,560

Total organic growth % 2% 3% 4%

Adjusted EBITDA $1,375 $1,388 $1,400

Adjusted EPS $2.02 $2.05 $2.08

Additional items of the following:

• Depreciation expense of $155 - $165 million

• Interest expense, net of $130 - $140 million

• Amortization (acquisition related intangibles) expense of $325 - $340 million

• Stock-based compensation expense of $200 - $220 million

• GAAP effective tax rate of 10% - 15%

• Adjusted effective tax rate of 21% - 24%

• Weighted average diluted shares between 413 - 417 million

We are reaffirming 2017 guidance

3

© 2017 IHS Markit. All Rights Reserved.

Quarterly Revenue by Reported Segment

Quarterly Revenue SEGMENT View

4

(1) Reflects combined IHS Markit results including Financial Services from December 1, 2015 – November 30, 2016

(2) Reflects reported IHS Markit results including Financial Services from July 12, 2016 – November 30, 2016

(3) Historical IFRS revenue results for legacy Markit from December 1, 2015 – July 11, 2016. No pro forma adjustments to revenue results required by Article 11 of

Regulation S-X

(4) Normalized for the shift in CERAWeek from Q1 to Q2, resources organic growth was (9%) in Q1 16 and (7%) in Q2 16

(5) Excluding impact of BPVC, normalized total CMS organic growth was (4%) in reported Q3 16

(6) Excluding impact of BPVC, normalized total IHS Markit organic growth was (1%) in reported Q3 16

For the period ended: Feb May Aug Nov Nov Feb May Aug Nov Nov

Q1 16 Q2 16 Q3 16 Q4 16 FY 16 Q1 16 Q2 16 Q3 16 Q4 16 FY 16

Total Revenue

Resources 216 221 210 214 861 216 221 210 214 861

Transportation 200 231 227 235 893 200 231 227 235 893

CMS 133 136 130 133 532 133 136 130 133 532

Total Revenue - Legacy IHS 548 588 568 582 2,286 548 588 568 582 2,286

Financial Services

(3) 285 294 294 292 1,165 157 292 449

Total IHS Markit Revenue 833$ 882$ 862$ 874$ 3,451$ 548$ 588$ 725$ 874$ 2,735$

Total Organic Growth %

Resources

(4)

-2% -13% -12% -9% -9% -2% -13% -12% -9% -9%

Transportation 10% 12% 9% 11% 10% 10% 12% 9% 11% 10%

CMS

(5)

4% 2% -9% -3% -2% 4% 2% -9% -3% -2%

Total Organic Growth % - Legacy IHS 3% -1% -4% 0% -1% 3% -1% -4% 0% -1%

Financial Services 2% 3% 3% 4% 3% 3% 4% 4%

Total Organic Growth %

(6) 3% 0% -1% 1% 1% 3% -1% -2% 1% 0%

2016 Combined Results (1) 2016 Reported Results (2)

© 2017 IHS Markit. All Rights Reserved.

Quarterly Revenue by Reported Category

Quarterly Revenue CATEGORY View

5

(1) Reflects reported IHS Markit results including Financial Services from July 12, 2016 – November 30, 2016

(2) Normalized for the shift in CERAWeek from Q1 to Q2, resources non-recurring organic growth was (23%) in Q1 16 and (5%) in Q2 16

(3) Excluding impact of BPVC, normalized CMS non-recurring organic growth was (23%) in reported Q3 16.

(4) Excluding impact of BPVC, normalized total IHS Markit non-recurring organic growth was (5%) in reported Q3 16.

For the period ended: Feb May Aug Nov Nov

Q1 16 Q2 16 Q3 16 Q4 16 FY 16

Recurring Organic Growth %

Resources -7% -8% -10% -10% -9%

Transportation 10% 10% 9% 9% 10%

CMS 4% 3% 0% 1% 2%

Subscription Organic Growth % - Legacy IHS 1% 1% -1% -1% 0%

Financial Services 3% 2% 2%

Recurring Fixed Organic Growth % 1% 1% -1% 0% 0%

Financial Services Recurring Variable Organic Growth % 3% 11% 8%

Total Recurring Organic Growth % 1% 1% 0% 1% 1%

Non-Recurring Organic Growth %

Resources

(2)

28% -36% -21% -3% -12%

Transportation 9% 19% 9% 14% 13%

CMS

(3)

3% -1% -44% -20% -19%

Non-Subs Organic Growth % - Legacy IHS 14% -6% -14% 2% -2%

Financial Services 10% -15% -8%

Total Non-Recurring Organic Growth %

(4) 14% -6% -12% -1% -3%

2016 Reported Results (1)

© 2017 IHS Markit. All Rights Reserved.

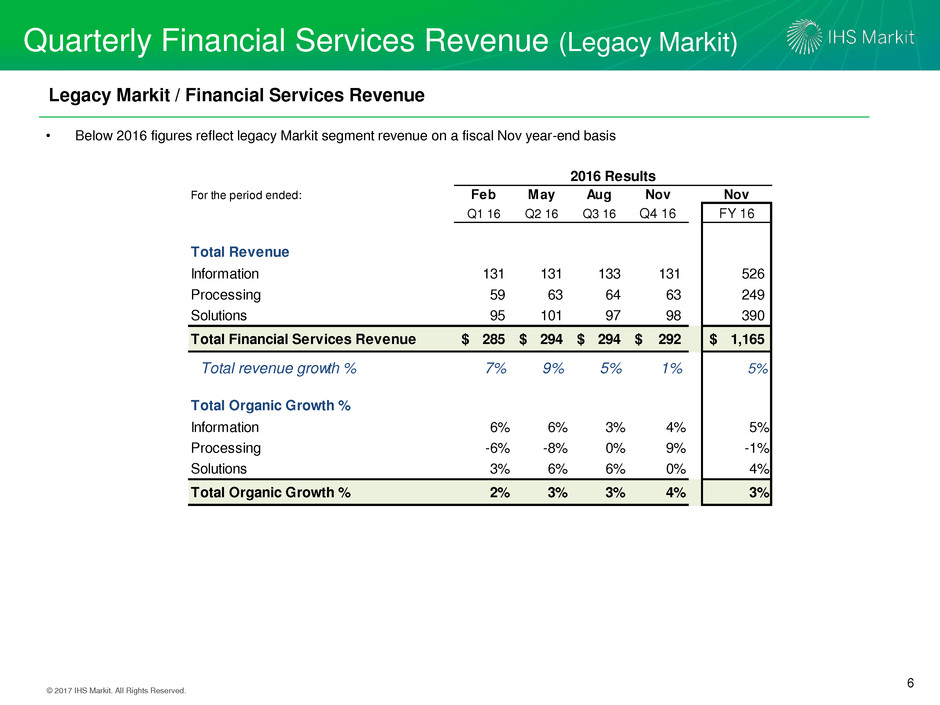

Quarterly Financial Services Revenue (Legacy Markit)

Legacy Markit / Financial Services Revenue

• Below 2016 figures reflect legacy Markit segment revenue on a fiscal Nov year-end basis

6

For the period ended: Feb May Aug Nov Nov

Q1 16 Q2 16 Q3 16 Q4 16 FY 16

Total Revenue

Information 131 131 133 131 526

Processing 59 63 64 63 249

Solutions 95 101 97 98 390

Total Financial Services Revenue 285$ 294$ 294$ 292$ 1,165$

Total revenue growth % 7% 9% 5% 1% 5%

Total Organic Growth %

Inform tion 6% 6% 3% 4% 5%

Processing -6% -8% 0% 9% -1%

Solutions 3% 6% 6% 0% 4%

Total Organic Growth % 2% 3% 3% 4% 3%

2016 Results

© 2017 IHS Markit. All Rights Reserved.

Quarterly Adjusted EBITDA by Reported Segment

Quarterly Adjusted EBITDA View*

7

(1) Reflects reported IHS Markit results including Financial Services from July 12, 2016 – November 30, 2016

* Refer to financial earnings releases on www.investor.IHSMarkit.com for Adjusted EBITDA reconciliations to the nearest GAAP reported measure

For the period ended: Feb May Aug Nov Nov

Q1 16 Q2 16 Q3 16 Q4 16 FY 16

Adjusted EBITDA

Resources 87 94 94 92 368

Transportation 73 91 89 101 353

CMS 28 31 33 36 128

Shared services (9) (14) (12) (16) (51)

Total Adjusted EBITDA - Legacy IHS 180 201 204 213 798

Financial Services 65 125 190

Total IHS Markit Adjusted EBITDA 180$ 201$ 269$ 338$ 988$

Adjusted EBITDA Margin %

Resources 40.4% 42.4% 44.9% 43.3% 42.7%

Transportation 36.7% 39.3% 39.0% 42.8% 39.6%

CMS 20.7% 22.6% 25.6% 27.0% 24.0%

djusted EBITDA Margin % - Legacy IHS 32.7% 34.2% 36.0% 36.6% 34.9%

Financial Services 41.4% 42.9% 42.4%

Total Adjusted EBITDA Margin % 32.7% 34.2% 37.1% 38.7% 36.1%

Total margin expansion (bps) 170 350 490 510 420

2016 Reported Results (1)