Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STAAR SURGICAL CO | v456601_8k.htm |

Exhibit 99.1

INVESTOR PRESENTATION JANUARY 10 & 11, 2017 Evolution in Visual Freedom ™ STAA: NASDAQ

™ ™ BUILDING A FOUNDATION FOR CONSISTENT GROWTH F ORWARD - L OOKING S TATEMENTS All statements in this presentation that are not statements of historical fact are forward - looking statements, including stateme nts about any of the following: any projections of earnings, revenue, sales, profit margins, cash, working capital, effective tax rate or any other financial items; the plans, strategies , a nd objectives of management for future operations or prospects for achieving such plans; statements regarding new, existing, or improved products, including but not limited to, expectations fo r s ales, marketing and clinical initiatives, investment imperatives, expectations for success of new, existing, or improved products in the U.S. or international markets or government approval o f n ew or improved products (including the Toric ICL in the U.S.); the nature, timing and likelihood of resolving issues cited in the FDA’s 2014 Warning Letter or 2015 FDA Form 483; future eco nom ic conditions or size of market opportunities; expected costs of quality system or FDA remediation; statements of belief, including as to achieving 2017 plans; expected regulatory activit ies and approvals, product launches, and any statements of assumptions underlying any of the foregoing. Important additional factors that could cause actual results to differ material ly from those indicated by such forward - looking statements are set forth in the company’s Annual Report on Form 10 - K for the year ended January 1, 2016 under the caption “Risk Factors,” which is on file with the Securities and Exchange Commission and available in the “Investor Information” section of the company’s website under the heading “SEC Filings.” We disclaim any int ent ion or obligation to update or revise any financial projections or forward - looking statements due to new information or events. These statements are based on expectations and assumptions as of the date of this presentation and are subject to numerous ri sks and uncertainties, which could cause actual results to differ materially from those described in the forward - looking statements. The risks and uncertainties include the following: our limite d capital resources and limited access to financing; the negative effect of unstable global economic conditions on sales of products, especially products such as the ICL used in non - reimbursed e lective procedures; changes in currency exchange rates; the discretion of regulatory agencies to approve or reject new, existing or improved products, or to require additional actions b efo re approval (including but not limited to FDA requirements regarding the TICL and/or actions related to the 2014 FDA Warning Letter or 2015 FDA Form 483) or to take enforcement action; re search and development efforts will not be successful or may be delayed in delivering products for launch; the purchasing patterns of distributors carrying inventory in the market; the w ill ingness of surgeons and patients to adopt a new or improved product and procedure; and patterns of Visian ICL use that have typically limited our penetration of the refractive procedure ma rket. The Visian Toric ICL and the Visian ICL with CentraFLOW are not yet approved for sale in the United States. In addition, to supplement the GAAP numbers, this presentation includes supplemental non - GAAP financial information, which STAAR believes investors will find helpful in understanding its operating performance. “Adjusted Net Income or (Loss)” excludes the following items that are included in “Net Income (Loss)” as calculated in accordance with U.S. generally accepted accounting principles (“GAAP”): gain or loss on foreign currency transactions, stock - based compensation expenses and remediation expenses. A table reconciling the GAAP information to the non - GAAP information is included in our financial release which can be found in our Form 8 - K filed on November 3, 2016 and also available on our website.

™ ™ BUILDING A FOUNDATION FOR CONSISTENT GROWTH STAAR SURGICAL IS… … a Leading Developer, Manufacturer and Marketer of Premium Implantable Lenses for Refractive Vision Correction Implantable Collamer® Lens or “ICL”™ - A Premium Refractive Procedure Delivering Visual Freedom to the Patient in Need of Myopic (Distance Vision) Correction - > 640,000 Visian® ICLs Implanted - > 230,000 are EVO™ Visian ICL’s* with Aqueous Port Eliminating Need for Peripheral Iridotomy Pre - Implantation Procedure 75% Q3 YTD 2016 Lens Revenue *Not approved in the US

™ ™ BUILDING A FOUNDATION FOR CONSISTENT GROWTH STAAR SURGICAL IS ALSO… 25% Q3 YTD 2016 Lens Revenue … a Developer, Manufacturer and Marketer of Premium Implantable Lenses for Cataract Lens Replacement • Intraocular Lens (IOL) - Used to Replace the Natural Lens after Cataract Surgery

™ ™ BUILDING A FOUNDATION FOR CONSISTENT GROWTH OVER ONE MILLION LENS IMPLANTS (ICL’S AND IOL’S) WITH EXCLUSIVE COLLAMER® MATERIAL … » Collamer production is a remarkable process that requires an understanding of polymer chemistry, nuclear physics and optical physics. » The biocompatible Collamer material is bonded with UV absorbing chromophore into a poly - HEMA based copolymer that offers UV protection » A layer of fibronectin is believed to form around the lens, inhibiting white cell adhesion to the lens. This coating prevents the lens from being identified as a foreign object, and the lens remains unnoticed and “quiet in the eye” indefinitely. » Collamer is exclusive to STAAR Surgical. It has a proven history for over 20 years!

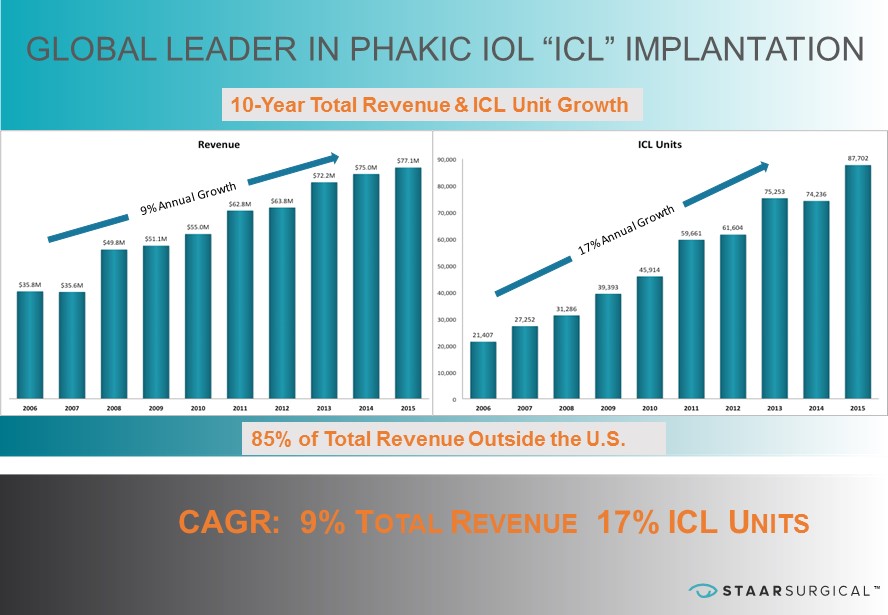

™ ™ GLOBAL LEADER IN PHAKIC IOL “ICL” IMPLANTATION CAGR: 9% T OTAL R EVENUE 17% ICL U NITS 10 - Year Total Revenue & ICL Unit Growth 85% of Total Revenue Outside the U.S.

™ ™ ▪ China 875,000 ▪ USA 630,000 ▪ India 180,677 ▪ Brazil 162,640 ▪ Germany 135,340 ▪ Italy 105,229 ▪ UK 97,540 ▪ Spain 92,920 ▪ Japan 82,650 ▪ South Korea 81,250 ▪ ROW 1,196,261 Source: 2015 Market Scope 3.6M Global LVC Refractive Procedures Current Market: LVC Refractive Procedures

™ ™ Myopia a Growing Concern in Asia: 30 Million in China Suffering from High Myopia * Excerpts from Published Articles on Myopia Adjusting Vision Health Policies: Now or Never -- A Research Report on the Vision Health of Chinese People "The number of people with high myopia alone is far greater than the totality of those with other types of vision defects. Myopia is particularly widespread among teenagers… There were totally 480 to 531 million people suffered from myopia, with as many as 29 to 30.4 million having high myopia.” *Author: The Research Group of Ms. LI Ling, China Health Development Research Center, Peking University. Published by Guangming Daily (5 th Edition, June 12, 2015).

™ ™ Myopia a Growing Concern in the U.S. Nearly 10 Million Adults Found to Be Severely Nearsighted Excerpts from Published Articles on Myopia A study was conducted jointly by investigators from the American Academy of Ophthalmology, Genentech, the National Institutes of Health and UC Davis. “ Among the findings: • Nearly 4 percent of adults in the United States have high myopia , defined as - 6.0 D or worse in their right eye. That is equivalent to 9.6 million people. • The prevalence of progressive high myopia is 0.33 percent. That is equivalent to 817,829 adults .” Ophthalmology, The Journal of the American Academy of Ophthalmology Published Online June 21, 2016

™ ™ Myopia a Growing Global Concern… High Myopia Could Impact Almost 1 Billion People by 2050 Excerpts from Published Articles on Myopia “ In the journal Ophthalmology, a new paper looks at worldwide trends in myopia by doing a meta - analysis of 145 studies involving 2.1 million total participants. It predicts that by the year 2050, 4.8 billion people will be nearsighted… And 938 million people (9.8 percent) will have high myopia, where their nearsightedness puts them at risk for more serious eye problems, like glaucoma, cataracts, macular degeneration, and retinal detachment. ” “Researchers expect eyesight to worsen across the globe thanks to more screens and less time outdoors.” The Atlantic February 19, 2016

™ ™ » Engender Culture of Quality - FDA Remediation and Systemic Change » Build R & D Continuum: Myopia/ Presbyopia/ Cataract Care » Develop Global Clinical Validation and Clinical Utility Competency » Create an Extraordinary Surgeon and Patient Experience » Invest in Proprietary Technology and Process Improvements » Properly Size Commercial Strategic Investment – People and Services » Deliver Shareholder Value BUILDING A FOUNDATION FOR CONSISTENT GROWTH O UR S TRATEGIC /T RANSFORMATIONAL F OCUS 2015 - 2017

™ ™ » Met all internal requirements on budget and on time for FDA Remediation and Systemic Change » Acquired and validated new Quality Management System … established Culture of Quality » Achieved Record Total Revenue and ICL Unit Sales (through Q3 2016) » Hired top talent in R&D, Clinical and Medical Affairs, Quality and Operations » Developed and Closed Transformational Agreements: ▪ Nine Large Strategic Cooperation Agreements Represent Committed Future Volume > 20% of ICL Business (through Q3 2016) BUILDING A FOUNDATION FOR CONSISTENT GROWTH 2015 & 2016 S TRATEGIC P RIORITIES /A CCOMPLISHMENTS

™ ™ » Created new strategic direction to position STAAR as a premium and primary provider of lenses delivering Visual Freedom to patients » Rebranded STAAR … launched Evolution in Visual Freedom™ global websites in all major markets… discovervisianicl.com and discoverEVO.com » Successfully launched EVO+™ expanded optic ICL lenses in Europe with clinical papers and patient experience data supporting lens performance » Received regulatory approval and launched EVO™ Spheric and Toric ICL lenses in Canada with surgeons trained and patient demand aligned for immediate target market adoption BUILDING A FOUNDATION FOR CONSISTENT GROWTH 2015 & 2016 S TRATEGIC P RIORITIES /A CCOMPLISHMENTS

™ ™ » Built Clinical and Medical Affairs competency… completed global meta analysis of all peer reviewed clinical data on ICL with published paper in Clinical Ophthalmology June 2016 » Finalized design for Extended Depth of Field (EDOF) next generation ICL’s currently in clinical evaluation with positive results Example of an initial patient outcome validating design freeze » Cataract Care Strategy completed … expanding current IOL line with nanoFLEX Toric IOL for middle markets and developing premium IOL on Collamer material lens with EDOF optic . BUILDING A FOUNDATION FOR CONSISTENT GROWTH 2015 & 2016 S TRATEGIC P RIORITIES /A CCOMPLISHMENTS

™ ™ » Complete Remediation Plan Actions and Quality System Overhaul » Continue to Build the Visual Freedom Market for Implantable Lenses ▪ Tangibly Impact Surgeon Engagement, Practice Development and Patient Desirability » Build Go - to - Market Strategy to Significantly Expand Market Share Globally » Deliver Global Clinical Validation & Clinical Utility Excellence » Innovate, Develop and Release to Market Premium Collamer Lenses and Delivery Systems _______________________________________________________________________ ________ » 2015 – 2017 Foundational Investments Targeted to Rebuild and Strengthen Base Business Model » Operating Expenses in 2017 Support Base Business and Investment in Strategic Priorities » Continued Double Digit ICL Unit Growth Projected for 2017 » Strategic Direction for 2018 – 2020 in Process BUILDING A FOUNDATION FOR CONSISTENT GROWTH 2017 STRATEGIC PRIORITIES

™ ™ F INANCIAL S UMMARY September YTD 2015 2016 NET SALES (IN MILLIONS) ICL UNIT GROWTH GROSS MARGIN $56.3 $60.3 8% 11% 67.6% 70.5% Record net sales through September 2016 driven by accelerated ICL unit growth Expanding gross margin reflects sales mix shift to higher margin ICL’s, manufacturing efficiencies and cost improvements Continued investments planned to bring promising new products to market and to further capitalize on large market opportunity with existing technologies September YTD 2015 2016 September YTD 2015 2016

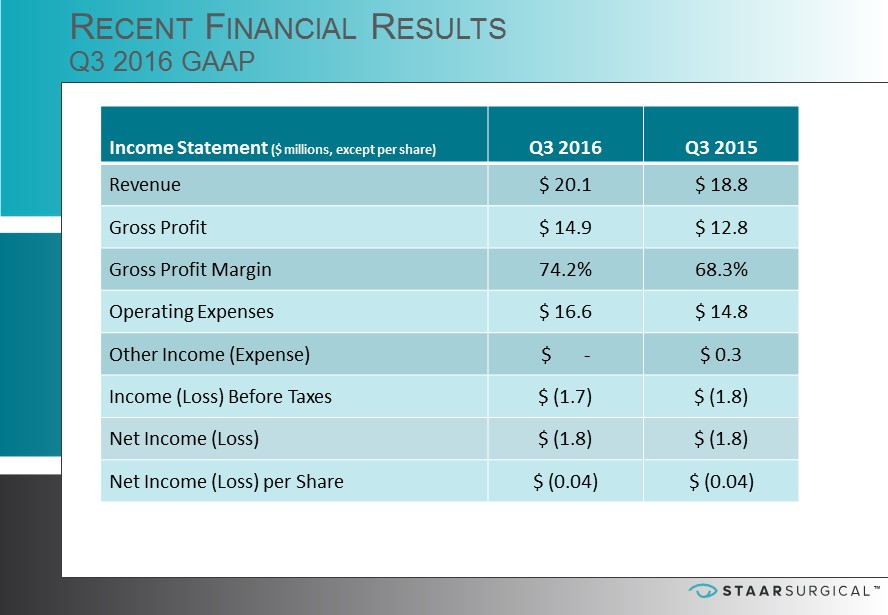

™ ™ Income Statement ($ millions, except per share) Q3 2016 Q3 2015 Revenue $ 20.1 $ 18.8 Gross Profit $ 14.9 $ 12.8 Gross Profit Margin 74.2% 68.3% Operating Expenses $ 16.6 $ 14.8 Other Income (Expense) $ - $ 0.3 Income (Loss) Before Taxes $ (1.7) $ (1.8) Net Income (Loss) $ ( 1.8) $ (1.8) Net Income (Loss) per Share $ (0.04) $ (0.04) R ECENT F INANCIAL R ESULTS Q3 2016 GAAP

™ ™ R ECENT F INANCIAL R ESULTS Q3 2016 N ON - GAAP Adjusted Net Income ($ millions, except per share) Q3 2016 Q3 2015 GAAP Net Income (Loss) $ (1.8) $ (1.8) Foreign Currency Impact $ - $ - Stock - Based Compensation Expense $ 0.4 $ 0.9 Remediation Expense $ 0.5 $ 0.8 Adjusted Net Income (Loss) $ (0.9) $ - Adjusted Net Income (Loss) per Share $ (0.02) $ -

INVESTOR PRESENTATION JANUARY 10 & 11, 2017 Evolution in Visual Freedom ™ STAA: NASDAQ