Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - STANLEY BLACK & DECKER, INC. | craftsmanbrandpressrelease.htm |

| 8-K - 8-K - STANLEY BLACK & DECKER, INC. | craftsmanbrand8-kdocument.htm |

Purchase Of

Craftsman Brand

January 5, 2017

2

Cautionary Statements

Stanley Black & Decker makes forward-looking statements in this presentation which represent its expectations or beliefs about future events and

financial performance. Forward-looking statements are identifiable by words such as "believe," "anticipate," "expect," "intend," "plan," "will,"

"may" and other similar expressions. In addition, any statements that refer to expectations, projections or other characterizations of future events

or circumstances are forward-looking statements. Forward looking statements made in this presentation, include, but are not limited to,

statements concerning: the consummation of the purchase; investment in, and rapid increase in sales and innovation of products carrying the

Craftsman brand; significantly increasing sales of Craftsman-branded products in untapped channels; expanding U.S. manufacturing footprint and

adding jobs in the U.S.; the Craftsman brand complementing and expanding Stanley Black & Decker’s existing operations; revenue opportunities;

and organic revenue growth and accretion to earnings per share.

You are cautioned not to place undue reliance on these forward-looking statements. These forward-looking statements are not guarantees of

future events and involve risks, uncertainties and other known and unknown factors that may cause actual results and performance to be

materially different from any future results or performance expressed or implied by such forward-looking statements, including, but not limited to,

the failure to consummate, or a delay in the consummation of, the transaction for various reasons; failure to successfully integrate the Craftsman

brand and achieve expected revenue opportunities; the seller becoming insolvent or entering bankruptcy proceedings; or the transaction-related

costs and charges being greater than anticipated.

Forward-looking statements made herein are also subject to risks and uncertainties, described in: Stanley Black & Decker's 2015 Annual Report on

Form 10-K, its subsequently filed Quarterly Reports on Form 10-Q; and other filings Stanley Black & Decker makes with the Securities and Exchange

Commission. In addition, actual results could differ materially from those suggested by the forward-looking statements, and therefore you should

not place undue reliance on the forward-looking statements. Stanley Black & Decker makes no commitment to revise or update any forward-

looking statements to reflect events or circumstances occurring or existing after the date of any forward-looking statement.

3

An Investment In Organic Growth

Stanley Black & Decker To Purchase Craftsman Brand From Sears Holdings…

…Enhances Company’s Rich Brand Portfolio With Addition Of Iconic Craftsman Brand

• Obtaining Rights To Develop, Manufacture And Sell Craftsman Brand In Non-Sears Retail, Industrial & Online Channels

• Sears To Continue Developing, Sourcing & Selling Craftsman In All Sears Retail Channels Under Perpetual License Agreement

• SBD To Significantly Increase Availability And Innovation Of Craftsman Products And Add Manufacturing In the U.S. To

Support Growth

• Strong Organic Revenue Growth Potential – To Contribute ~$100M Of Average Annual Revenue Growth Per Year For

Approximately Next Ten Years

• Agreement Consists Of $525M Cash Payment At Closing, $250M At End Of Year 3, & Annual Payments Of Between 2.5% And

3.5% On New SBD Craftsman Sales Through Year 15

• EPS Accretion, Excluding Charges – Year 1 ~$0.10-$0.15, Increasing To ~$0.35-$0.45 By Year 5 & ~$0.70-$0.80 By Year 10

• Transaction Structured To Minimize On-Going Risks Associated With Sears:

• SBD Assuming No Contractual Credit Risk From Sears Relative To Transaction

• No Tie To Sears Organic Growth Trajectory

• No Incremental Obligation To Supply Sears

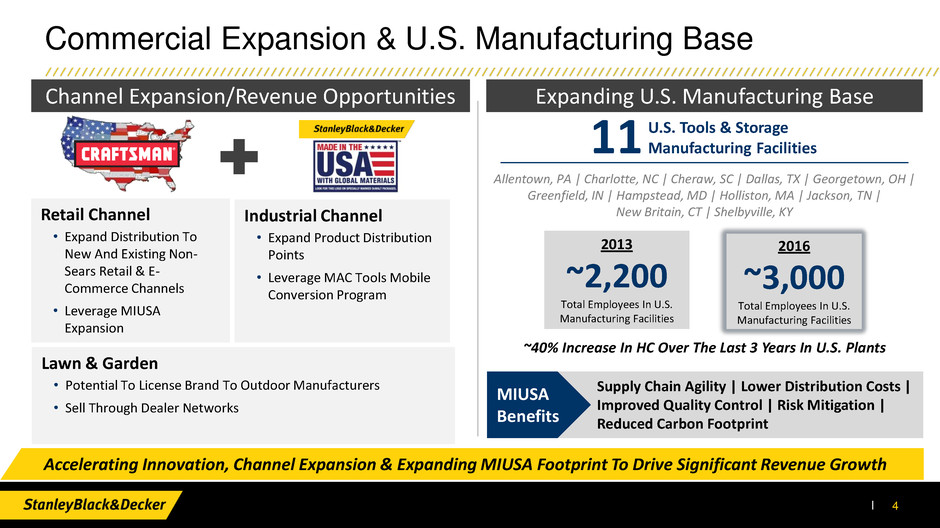

Commercial Expansion & U.S. Manufacturing Base

11 U.S. Tools & Storage Manufacturing Facilities

Allentown, PA | Charlotte, NC | Cheraw, SC | Dallas, TX | Georgetown, OH |

Greenfield, IN | Hampstead, MD | Holliston, MA | Jackson, TN |

New Britain, CT | Shelbyville, KY

Accelerating Innovation, Channel Expansion & Expanding MIUSA Footprint To Drive Significant Revenue Growth

2013

~2,200

Total Employees In U.S.

Manufacturing Facilities

2016

~3,000

Total Employees In U.S.

Manufacturing Facilities

~40% Increase In HC Over The Last 3 Years In U.S. Plants

4

Supply Chain Agility | Lower Distribution Costs |

Improved Quality Control | Risk Mitigation |

Reduced Carbon Footprint

Retail Channel

• Expand Distribution To

New And Existing Non-

Sears Retail & E-

Commerce Channels

• Leverage MIUSA

Expansion

Industrial Channel

• Expand Product Distribution

Points

• Leverage MAC Tools Mobile

Conversion Program

Lawn & Garden

• Potential To License Brand To Outdoor Manufacturers

• Sell Through Dealer Networks

Channel Expansion/Revenue Opportunities Expanding U.S. Manufacturing Base

MIUSA

Benefits

Existing Sales NetworkBrand Overview

• Iconic Brand Within U.S. In Power & Hand Tools And

Storage Products

• High Brand Awareness

• Strong Presence In Lawn & Garden

• External Sears Sales – Predominantly Through Ace

Hardware

• Diverse & Complementary Product Lines

The Craftsman Brand Today: Overview

5

Strong Brand With High Retail / Industrial Channel Customer Interest

Sears And Sears-Related Channels

~90% of Retail Sales

Sears

Sears

Hometown*

Kmart

~65%

Of Retail Sales

~20%

Of Retail Sales

~5%

Of Retail Sales

External Accounts

~10% of Retail Sales

Examples:

*Sears Hometown Is A Separate Publically Traded Company (NASDAQ: SHOS) That Sells Sears Merchandise

Tractors &

Mowers

L&G

Equipment

~25%

Of Retail

~15%

Of Retail

Craftsman Today: ~$1.9B At Retail

6

Tools (~35%) Lawn & Garden (~40%) Storage / Other (~25%)

Hand Tools Power Tools

~25%

Of Retail

~10%

Of Retail

Storage &

Garage

Related &

Other

~20%

Of Retail

~5%

Of Retail

Transaction Summary

7

Transaction Details Financial Information

EPS Accretion (Ex. 1-Time Charges) & CFROI

• EPS Accretion, Ex- Charges – Yr. 1 ~$0.10-$0.15, Increasing To ~$0.35-$0.45 By Yr. 5 & ~$0.70-$0.80 By Yr. 10

• CFROI: Mid-Teens By Year 10

Timing

• Subject To Customary Closing

Conditions, Including Regulatory

Approval – Expected To Close During

2017

• No Breakup Fees

Transaction Related Charges

• ~$20M In One-Time Charges, Primarily Incurred In Year One | ~$80M Of Capex

• ~$7M Of Annual Intangible Asset Amortization

Deal Structure & Purchase Price For Craftsman Brand

• $525M Cash Paid At Closing And $250M At End Of Year 3 | W/C Adjustment @ Closing TBD

• Annual Cash Payments Of Between 2.5% - 3.5% On New SBD Craftsman Sales Through Year 15 (2.5% Through

2020, 3% Through January 2023, And 3.5% Thereafter)

• NPV Of Cash Payments Totals ~$900M

• Perpetual License Allowing Sears To Continue Selling In Sears-Related Channels (Royalty-Free For 15 Years,

3% Thereafter)

• Assuming No Contractual Credit Risk From Sears Relative To This Transaction

Strategic Rationale

• Iconic Craftsman Brand Complements

SWK’s Portfolio Of Global Tools &

Storage Brands

• Accelerate Innovation And Expand

Distribution Channels To Generate

Growth Through External Non-Sears

Retailers, Both Existing and New (Only

~10% Of Craftsman-Branded Products

Currently Sold Outside Of Sears-

Related Channels)

Significant Organic Revenue Growth Potential

• To Contribute ~$100M Of Revenue Growth Per Year For Approximately Next Ten Years

Value Creation Model | Capital Allocation

Strong, Innovation-

Driven Businesses

In Diverse, Global

Markets

• Outsized, Capital-Efficient Organic Growth

• Attractive, Expandable OM Rate

• Outstanding FCF conversion

Powered By:

Investor-friendly Capital Allocation

~1/2 Return Cash To

Shareholders

~1/2 M&A

World Class Brands

Attractive Growth Platforms

Scalable, Defensible Franchises

Differentiable Through Innovation

Transaction Aligns With Our

Value Creation Model &

Reflects Effective Allocation

Of Capital When Taken In

Context With The Recent

Sale Of Mechanical Security:

Freeing Up Trapped Capital

From A Low-Growth Business

To Invest In Future Organic

Growth & EPS Accretion

8

Summary

Enhances Existing T&S Brand Portfolio With Addition Of Iconic Craftsman Brand

Presents Significant Organic Growth Opportunity – Increases Availability Of

Craftsman-Branded Products To Consumers In The U.S.

EPS Accretion, Ex-Charges – Year 1 ~$0.10-$0.15, Increasing To ~$0.35-$0.45 By

Year 5 & ~$0.70-$0.80 By Year 10

9

Effective Capital Allocation When Taken In Context With Recent Sale Of Mechanical

Security To Enhance T&S Franchise & Drive Organic Growth Within SWK

THANK YOU!