Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Prestige Consumer Healthcare Inc. | v455702_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Prestige Consumer Healthcare Inc. | v455702_ex99-1.htm |

Announcement of Agreement to Acquire C.B. Fleet Company, Inc. December 23, 2016 Exhibit 99.2

Announcement of Agreement to Acquire C.B. Fleet Company, Inc. 2 This presentation contains certain “forward - looking” statements within the meaning of the Private Securities Litigation Reform A ct of 1995, such as statements regarding the expected timing for consummating the acquisition of Fleet; the acquisition’s impact on revenues, organic growth, cash flow, earnings per share and leverage; the expected growth and market position of the acquired brands; the impact of the acquisition on the Company’s brand - building and product development initiatives; the ability to achiev e synergies from the acquisition; the Company’s ability to leverage the Fleet manufacturing facility and R&D resources; the Com pan y’s expected financing for the transaction; and the success of the Company’s strategy of acquiring, integrating and building bran ds. Words such as "continue," "will," “expect,” “project,” “anticipate,” “estimate,” “may,” “should,” “could,” “would,” and simil ar expressions identify forward - looking statements. Such forward - looking statements represent the Company’s expectations and belief s and involve a number of known and unknown risks, uncertainties and other factors that may cause actual results to differ mate ria lly from those expressed or implied by such forward - looking statements. These factors include, among others, failure to satisfy the closing conditions for the acquisition including approval under the Hart - Scott Rodino Antitrust Improvements Act, general economic and business conditions, the failure to successfully integrate the Fleet brands, manufacturing facility and R&D resources, co mpe titive pressures, unexpected costs or liabilities, and disruptions resulting from the integration, and other risks set forth in Part I, Item 1A. Risk Factors in the Company’s Annual Report on Form 10 - K for the year ended March 31, 2016 and in Part II, Item 1A. Risk Factors in the Company’s Quarterly Report on Form 10 - Q for the quarter ended September 30, 2016. You are cautioned not to place undue reliance on these forward - looking statements, which speak only as of the date this presentation. Except to the extent required b y applicable law, the Company undertakes no obligation to update any forward - looking statement contained in this presentation, whether as a result of new information, future events, or otherwise. Safe Harbor Disclosure

Announcement of Agreement to Acquire C.B. Fleet Company, Inc. 3 Agenda for Today’s Discussion I. Transaction Summary II. Overview III. Strategic Rationale and Financial Highlights IV. The Road Ahead

I. Transaction Summary

Announcement of Agreement to Acquire C.B. Fleet Company, Inc. 5 Transaction Overview Prestige Brands announced an agreement to acquire C.B. Fleet Company, Inc. (“Fleet") for $825 million – Fleet has Revenue of approximately $205 (1) million – Purchase price represents ~11x Pro Forma Adjusted EBITDA, including expected synergies – Expected to be immediately accretive to EPS and Cash Flow from Operations exclusive of transaction, integration, and purchase accounting items (1) Revenue figure as of LTM ending September, 2016 (2) Pro Forma Leverage ratio reflects net debt / covenant defined EBITDA Overview Strategic Rationale Expected Financing Timing Highly complementary to Prestige’s current portfolio and categories of focus – Adds multiple market leading, scale consumer healthcare brands in attractive feminine hygiene, gastro - intestinal, and infant care categories – Adds another $100 million+, #1 power brand in women’s health Transaction is expected to be financed with cash on hand, availability through Prestige’s existing credit facilities, the issuance of additional debt, and/or potential equity based on prevailing market conditions – Bank defined leverage at closing expected to be approximately 5.8x (2) , consistent with level at time of Insight Pharmaceuticals Acquisition is targeted to close in the first quarter of calendar 2017, subject to regulatory approval

II. Overview

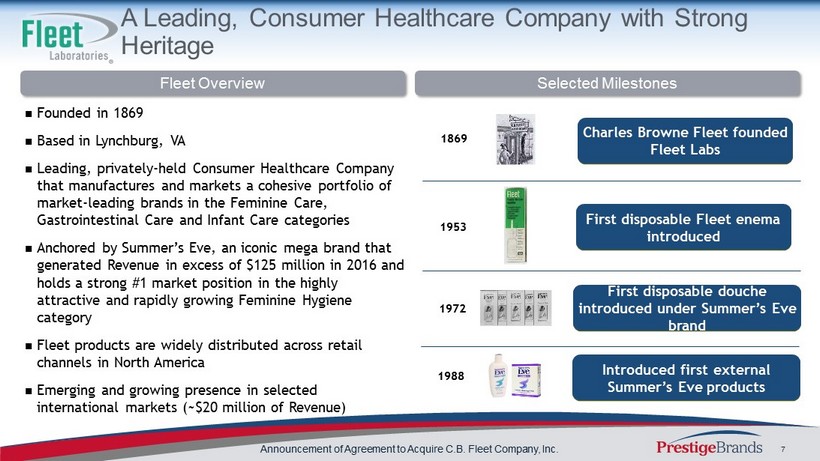

Announcement of Agreement to Acquire C.B. Fleet Company, Inc. 7 A Leading, Consumer Healthcare Company with Strong Heritage Founded in 1869 Based in Lynchburg, VA Leading , privately - held Consumer Healthcare Company that manufactures and markets a cohesive portfolio of market - leading brands in the Feminine Care, Gastrointestinal Care and Infant Care categories Anchored by Summer’s Eve, an iconic mega brand that generated Revenue in excess of $125 million in 2016 and holds a strong #1 market position in the highly attractive and rapidly growing Feminine Hygiene category Fleet products are widely distributed across retail channels in North America Emerging and growing presence in selected international markets (~$20 million of Revenue) Charles Browne Fleet founded Fleet Labs First disposable Fleet enema introduced 1869 Selected Milestones Fleet Overview 1953 First disposable douche introduced under Summer’s Eve brand 1972 Introduced first external Summer’s Eve products 1988

Announcement of Agreement to Acquire C.B. Fleet Company, Inc. 8 Infant Care Feminine Care Gastrointestinal Care Portfolio of Leading, Scale Consumer Healthcare Brands Category Rank: # 1 # 1 # 1 Source: IRI MULO L52 week period ending 11/27/16

Announcement of Agreement to Acquire C.B. Fleet Company, Inc. 9 2013A 2014A 2015A 2016 Sept. LTM 16.8% Feminine Care Gastrointestinal Care Infant Care A Focused, High Performing Portfolio Attractive Revenue Growth Focused Category Presence High Single Digits CAGR Note: Pie chart refers to Fleet Revenue mix by category as of LTM ending September, 2016

Announcement of Agreement to Acquire C.B. Fleet Company, Inc. 10 The Most Comprehensive Feminine Hygiene Offering

Announcement of Agreement to Acquire C.B. Fleet Company, Inc. 11 Feminine Hygiene Fastest Growing and Accelerating Feminine Hygiene Largest Segment Feminine Hygiene Role Within Feminine Care Competes in Largest and Fastest Growing Segment of Feminine Care Feminine Hygiene represents the largest segment in the nearly $850 million Feminine Care Category Feminine Hygiene g rowth is meaningfully outpacing other segments and accelerating behind shifts in consumers’ attitudes Unlike problem/solution vaginal treatments or intimacy enhancement products, Feminine Hygiene products are part of consumers’ daily usage regimen Feminine Hygiene segment consists o f both externa l (wash, cloths, sprays and powders) and internal (douche and suppositories) daily cleansing and freshness products Feminine Hygiene Vaginal Treatments Intimacy Enhancements Total Feminine Care: ~$850 million 4.9% 0.8% 0.9% 2.3% 5 - Yr CAGR Feminine Hygiene Intimacy Enhancement Vaginal Treatments Fem. Care Category Source : IRI MULO L52 week period ending 11/27/16 (Retail Dollar Sales) +2.1x

Announcement of Agreement to Acquire C.B. Fleet Company, Inc. 12 Other Brands Complement Current Categories of Focus Positioning Over 140 Years of Fast, Gentle, & Effective Relief Serious Relief for Serious Gas & Heartburn Keeping Kids Regular Let’s Kick Some Rash Year Launched 1953 1970 (Acquired 2012) 2008 1978 (Acquired in 2011) Key Categories Enemas, Glycerin Suppositories Anti - Gas Pediatric Laxatives Infant Care Market Position # 1 # 3 # 1 # 4 Gastro - Intestinal Care Infant Care Source: IRI MULO L52 week period ending 11/27/16

Announcement of Agreement to Acquire C.B. Fleet Company, Inc. 13 Opportunity to Leverage World Class Manufacturing Platform Wholly - owned 310,000 square foot facility in Lynchburg , VA on 14.9 acres Efficient and scalable manufacturing capabilities include blow molding, processing, filling and packaging ~ 65% of sales are manufactured in - house Strong network of trusted co - manufacturing partners largely located in the U.S. On - site R&D lab supports new product development Lynchburg, VA

III. Strategic Rationale and Financial Highlights

Announcement of Agreement to Acquire C.B. Fleet Company, Inc. 15 Transaction Meets Prestige’s Disciplined Strategic, Execution and Financial Acquisition Criteria Attractive brand and category – Leading positions in highly attractive product categories – Superior growth profile with meaningful runway Well aligned with Prestige’s core competencies – Comparable go - to - market model – Ability to leverage supply chain and manufacturing competencies Clear path for long - term value creation – Leverage Prestige’s sales and brand building capabilities to support growth – Fits with Prestige’s international distribution model Fleet Fits Prestige’s Disciplined Acquisition Strategy

Announcement of Agreement to Acquire C.B. Fleet Company, Inc. 16 Adds Another Large Scale Brand Averaging Over $100MM at Retail FY 10 FY 13 Today (Pro Forma for Fleet) Source: IRI MULO+C - Store (Retail Dollar Sales) +2.1x +1.6x

Announcement of Agreement to Acquire C.B. Fleet Company, Inc. 17 Sales & Distribution Leverage Prestige's scale to expand distribution Strengthen and accelerate international growth Brand Building Invest meaningfully in Fleet’s brands and accelerate new product pipeline Broaden established leadership in women’s health Supply Chain Optimize operations to derive significant synergies Identify opportunities to manufacture existing brands in - house and leverage R&D capabilities Clear Path for Value Creation

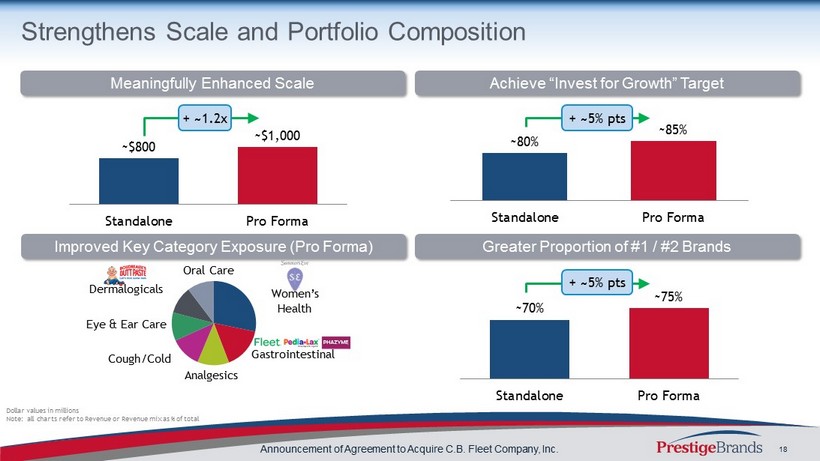

Announcement of Agreement to Acquire C.B. Fleet Company, Inc. 18 Achieve “Invest for Growth” Target Greater Proportion of #1 / #2 Brands Meaningfully Enhanced Scale Improved Key Category Exposure (Pro Forma) ~$800 ~$1,000 Standalone Pro Forma ~80% ~85% Standalone Pro Forma ~70% ~75% Standalone Pro Forma Women’s Health Gastrointestinal Analgesics Cough/Cold Eye & Ear Care Dermalogicals Oral Care Strengthens Scale and Portfolio Composition Dollar values in millions Note: all charts refer to Revenue or Revenue mix as % of total + ~ 1.2x + ~ 5 % pts + ~ 5 % pts

Announcement of Agreement to Acquire C.B. Fleet Company, Inc. 19 Industry Leading Free Cash Flow Provides Rapid Deleveraging Transactions Financing Transaction is expected to be financed with cash on hand, availability through Prestige’s existing credit facilities, the issuance of additional debt, and/or potential equity based on prevailing market conditions Bank defined Pro - Forma net debt / Pro Forma Adjusted EBITDA of approximately 5.8x (1) at closing Cash Generation Interest coverage of approximately 3.5x Expected to be immediately accretive to EPS and Cash Flow from Operations exclusive of transaction, integration, and purchase accounting items Expect rapid deleveraging and strong cash flow generation consistent with prior acquisitions 3.2x 3.5x 5.3x 5.0x 4.3x 4.3x 5.8x 5.2x 5.0x ~5.8x ~5.0x FY 10 FY 11 Q2 FY 11 FY 12 FY 13 FY 14 Q2 FY 15 FY 15 FY 16 FY 17E FY 18E North American Brands (1) Pro Forma Leverage ratio reflects net debt / covenant defined EBITDA Leverage Ratio (1)

IV. The Road Ahead

Announcement of Agreement to Acquire C.B. Fleet Company, Inc. 21 3 Key Drivers of Long - Term Shareholder Value Deliver Industry - Leading and Consistent Free Cash Flow Strategic and Disciplined M&A Strategy Grow Our Invest for Growth Portfolio Portfolio of recognizable brands in attractive consumer healthcare industry Established expertise in brand - building and product innovation Demonstrated ability to gain market share long - term Strong and consistent cash flow driven by industry leading EBITDA margins, capital - lite business model & significant benefit of deferred taxes Rapid deleveraging allows for expanded acquisition capacity and continued investment in brand building Non - core brands’ contribution to cash flow Debt repayment reduces cash interest expense and adds to EPS Demonstrated track record of 8 acquisitions during the past 6 years Effective consolidation platform positioned for consistent pipeline of opportunities Proven ability to source from varied sellers Fragmented industry and acquisition activity creates a consistent pipeline of opportunity

Announcement of Agreement to Acquire C.B. Fleet Company, Inc. 22 Repeatable and Consistently Disciplined Approach to M&A Eight Acquisitions in Past Six Years Platform Expansion Geographic Expansion 2010 2012 2013 2014 2011 April 2014 July 2013 April 2014 December 2011 December 2010 September 2010 November 2015 2015 North American Brands 2016 December 2016

Announcement of Agreement to Acquire C.B. Fleet Company, Inc. 23 Prestige’s Value Proposition Diversified Portfolio of Leading, Trusted Brands 1 Leading Branded Competitor Across Key Categories 2 Established Organic Growth Playbook 3 Scalable and Efficient Platform 4 Organic Growth Reinforced by M&A 5 Superior Shareholder Value Creation + + + +

Q&A Announcement of Agreement to Acquire C.B. Fleet Company, Inc. 24