Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CONAGRA BRANDS INC. | d287168dex991.htm |

| 8-K - FORM 8-K - CONAGRA BRANDS INC. | d287168d8k.htm |

Exhibit 99.2

Exhibit 99.2

Q2 FISCAL 2017 EARNINGS

DECEMBER 22, 2016

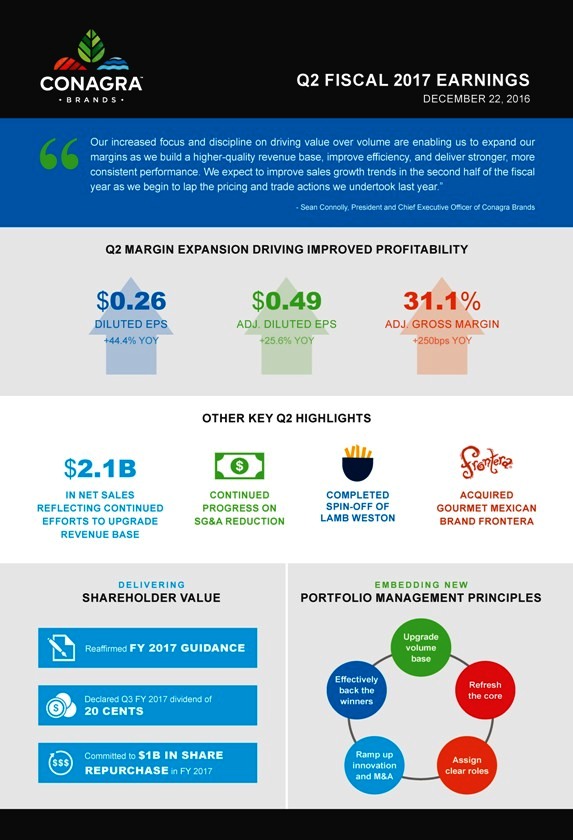

Our increased focus and discipline on driving value over volume are enabling us to expand our margins as we build a higher-quality revenue base, improve efficiency, and deliver stronger, more consistent performance. We expect to improve sales growth trends in the second half of the fiscal year as we begin to lap the pricing and trade actions we undertook last year.”

- Sean Connolly, President and Chief Executive Officer of Conagra Brands

Q2 MARGIN EXPANSION DRIVING IMPROVED PROFITABILITY

$0.26

DILUTED EPS

+44.4% YOY

$0.49

ADJ. DILUTED EPS

+25.6% YOY

31.1%

ADJ. GROSS MARGIN

+250bps YOY

OTHER KEY Q2 HIGHLIGHTS

$2.1B

IN NET SALES REFLECTING CONTINUED EFFORTS TO UPGRADE REVENUE BASE CONTINUED PROGRESS ON SG&A REDUCTION

COMPLETED SPIN-OFF OF

LAMB WESTON ACQUIRED GOURMET MEXICAN BRAND FRONTERA

DELIVERING SHAREHOLDER VALUE EMBEDDING N E W PORTFOLIO MANAGEMENT PRINCIPLES

Upgrade volume base

Reaffirmed FY 2017 GUIDANCE

Effectively back the winnersRefresh the core

Declared Q3 FY 2017 dividend of 20 CENTS

Committed to $1B IN SHARE Ramp up

Innovation and M&A Assign clear roles

REPURCHASE in FY 2017

Q2 FISCAL 2017 EARNINGS

DECEMBER 22, 2016

NOTE ON FORWARD-LOOKING STATEMENTS

This document contains forward-looking statements within the meaning of the federal securities laws. These forward-looking statements are based on management’s current expectations and are subject to uncertainty and changes in circumstances. We undertake no responsibility for updating these statements. Readers of this document should understand that these statements are not guarantees of performance or results. Many factors could affect our actual financial results and cause them to vary materially from the expectations contained in the forward-looking statements, including those set forth in this document. These risks and uncertainties include, among other things: our ability to achieve the intended benefits of the recent spin-off of our Lamb Weston business; general economic and industry conditions; our ability to successfully execute our long-term value creation strategy; our ability to access capital; our ability to execute our operating and restructuring plans and achieve our targeted operating efficiencies, cost-saving initiatives, and trade optimization programs; the effectiveness of our hedging activities, including volatility in commodities that could negatively impact our derivative positions and, in turn, our earnings; the competitive environment and related market conditions; our ability to respond to changing consumer preferences and the success of our innovation and marketing investments; the ultimate impact of any product recalls and litigation, including litigation related to the lead paint and pigment matters; actions of governments and regulatory factors affecting our businesses, including the Patient Protection and Affordable Care Act; the availability and prices of raw materials, including any negative effects caused by inflation or weather conditions; risks and uncertainties associated with intangible assets, including any future goodwill or intangible assets impairment charges; our ability to realize the synergies and benefits contemplated by the Ardent Mills joint venture; the costs, disruption, and diversion of management’s attention associated with campaigns commenced by activist investors; and other risks described in our reports filed from time to time with the Securities and Exchange Commission. We caution readers not to place undue reliance on any forward-looking statements included in this document, which speak only as of the date of this document.

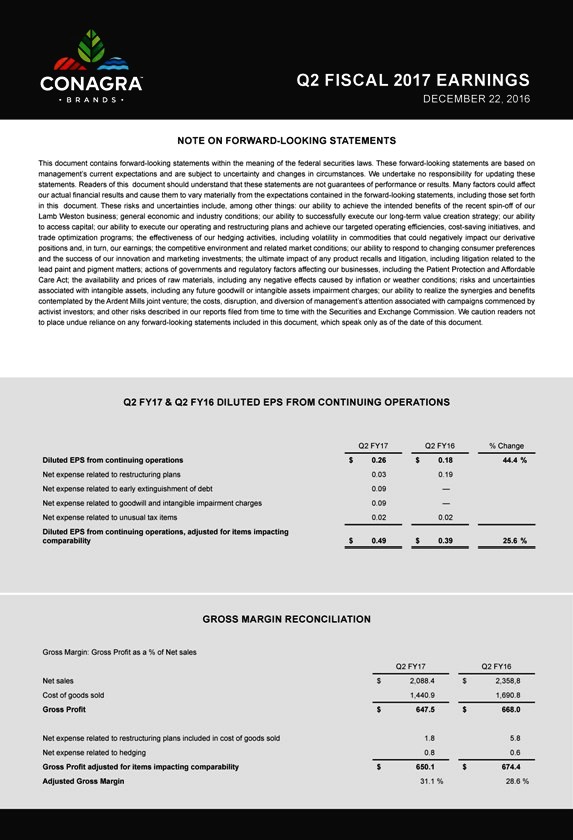

Q2 FY17 & Q2 FY16 DILUTED EPS FROM CONTINUING OPERATIONS

Diluted EPS from continuing operations

Net expense related to restructuring plans

Net expense related to early extinguishment of debt

Net expense related to goodwill and intangible impairment charges

Net expense related to unusual tax items

Diluted EPS from continuing operations, adjusted for items impacting comparability

Q2 FY17

$0.26

0.03

0.09

0.09

0.02

$0.49

Q2 FY16

$0.18

0.19

—

—

0.02

$0.39

% Change

44.4 %

25.6 %

GROSS MARGIN RECONCILIATION

Gross Margin: Gross Profit as a % of Net sales

Net sales

Cost of goods sold

Gross Profit

Net expense related to restructuring plans included in cost of goods sold

Net expense related to hedging

Gross Profit adjusted for items impacting comparability

Adjusted Gross Margin

Q2 FY17

$2,088.4

1,440.9

$647.5

1.8

0.8

$650.1

31.1 %

Q2 FY16

$2,358,8

1,690.8

$668.0

5.8

0.6

$674.4

28.6 %