Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Santander Consumer USA Holdings Inc. | d267011d8k.htm |

December 8, 2016 SANTANDER CONSUMER USA HOLDINGS INC. 2016 ABS Investor Day Exhibit 99.1

IMPORTANT INFORMATION Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements about our expectations, beliefs, plans, predictions, forecasts, objectives, assumptions, or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as anticipates, believes, can, could, may, predicts, potential, should, will, estimates, plans, projects, continuing, ongoing, expects, intends, and similar words or phrases. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements are not guarantees of future performance and involve risks and uncertainties that are subject to change based on various important factors, some of which are beyond our control. For additional discussion of these risks, refer to the section entitled Risk Factors and elsewhere in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q filed by us with the U.S. Securities and Exchange Commission (SEC). Among the factors that could cause the forward-looking statements in this press release and/or our financial performance to differ materially from that suggested by the forward-looking statements are (a) the inherent limitations in internal controls over financial reporting; (b) our ability to remediate any material weaknesses in internal controls over financial reporting completely and in a timely manner; (c) continually changing federal, state, and local laws and regulations could materially adversely affect our business; (d) adverse economic conditions in the United States and worldwide may negatively impact our results; (e) our business could suffer if our access to funding is reduced; (f) significant risks we face implementing our growth strategy, some of which are outside our control; (g) unexpected costs and delays in connection with exiting our personal lending business; (h) our agreement with Fiat Chrysler Automobiles US LLC may not result in currently anticipated levels of growth and is subject to certain performance conditions that could result in termination of the agreement; (i) our business could suffer if we are unsuccessful in developing and maintaining relationships with automobile dealerships; (j) our financial condition, liquidity, and results of operations depend on the credit performance of our loans; (k) loss of our key management or other personnel, or an inability to attract such management and personnel; (l) certain regulations, including but not limited to oversight by the Office of the Comptroller of the Currency, the Consumer Financial Protection Bureau, the European Central Bank, and the Federal Reserve, whose oversight and regulation may limit certain of our activities, including the timing and amount of dividends and other limitations on our business; and (m) future changes in our relationship with Banco Santander that could adversely affect our operations. If one or more of the factors affecting our forward-looking information and statements proves incorrect, our actual results, performance or achievements could differ materially from those expressed in, or implied by, forward-looking information and statements. Therefore, we caution not to place undue reliance on any forward-looking information or statements. The effect of these factors is difficult to predict. Factors other than these also could adversely affect our results, and the reader should not consider these factors to be a complete set of all potential risks or uncertainties. New factors emerge from time to time, and management cannot assess the impact of any such factor on our business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements only speak as of the date of this document, and we undertake no obligation to update any forward-looking information or statements, whether written or oral, to reflect any change, except as required by law. All forward-looking statements attributable to us are expressly qualified by these cautionary statements.

AGENDA CORPORATE OVERVIEW AND STRATEGY ORIGINATIONS, UNDERWRITING AND DEALER MANAGEMENT SERVICING, COLLECTIONS AND REMARKETING

VEHICLE FINANCE LEVERAGING TECHNOLOGY IS INTEGRAL TO THE FOUR PILLARS OF OUR FOCUSED BUSINESS MODEL FOCUSED BUSINESS MODEL DISCIPLINED APPROACH TO MARKET SIMPLE, PERSONAL, FAIR APPROACH WITH CUSTOMERS, EMPLOYEES AND ALL CONSTITUENCIES SERVICED FOR OTHERS FUNDING AND LIQUIDITY CULTURE OF COMPLIANCE

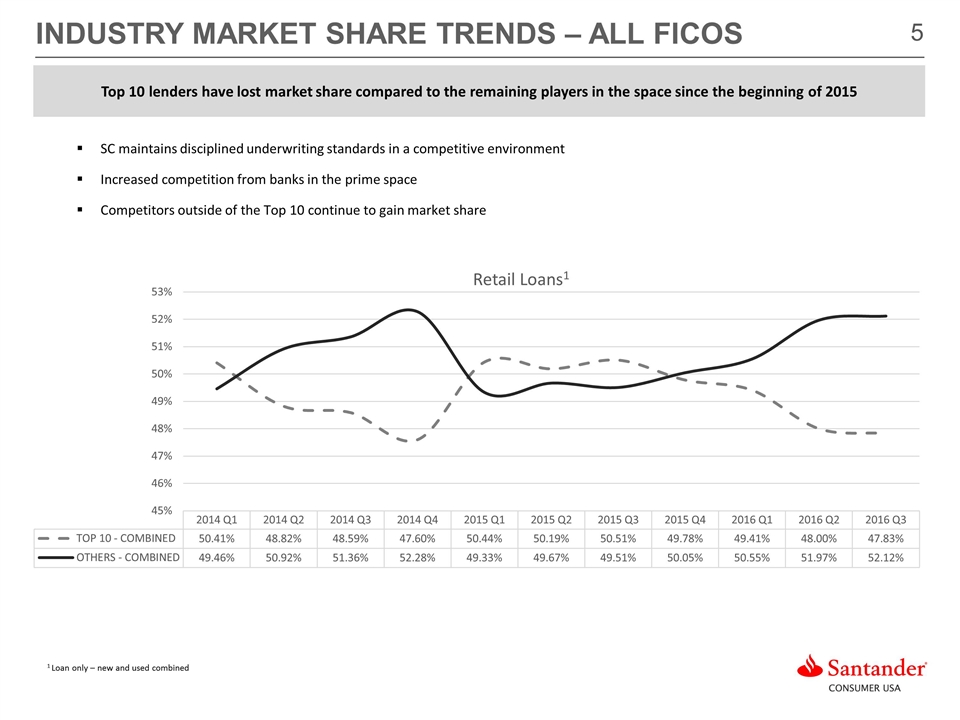

INDUSTRY MARKET SHARE TRENDS – ALL FICOs SC maintains disciplined underwriting standards in a competitive environment Increased competition from banks in the prime space Competitors outside of the Top 10 continue to gain market share Top 10 lenders have lost market share compared to the remaining players in the space since the beginning of 2015 1 Loan only – new and used combined

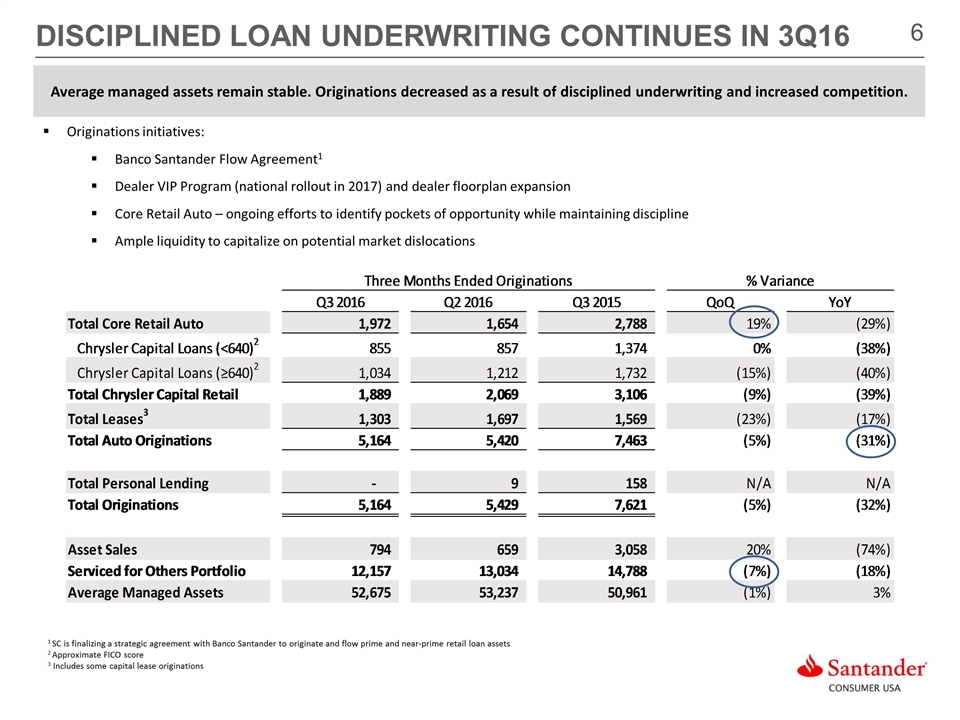

DISCIPLINED LOAN UNDERWRITING CONTINUES IN 3Q16 1 SC is finalizing a strategic agreement with Banco Santander to originate and flow prime and near-prime retail loan assets 2 Approximate FICO score 3 Includes some capital lease originations Average managed assets remain stable. Originations decreased as a result of disciplined underwriting and increased competition. Originations initiatives: Banco Santander Flow Agreement1 Dealer VIP Program (national rollout in 2017) and dealer floorplan expansion Core Retail Auto – ongoing efforts to identify pockets of opportunity while maintaining discipline Ample liquidity to capitalize on potential market dislocations

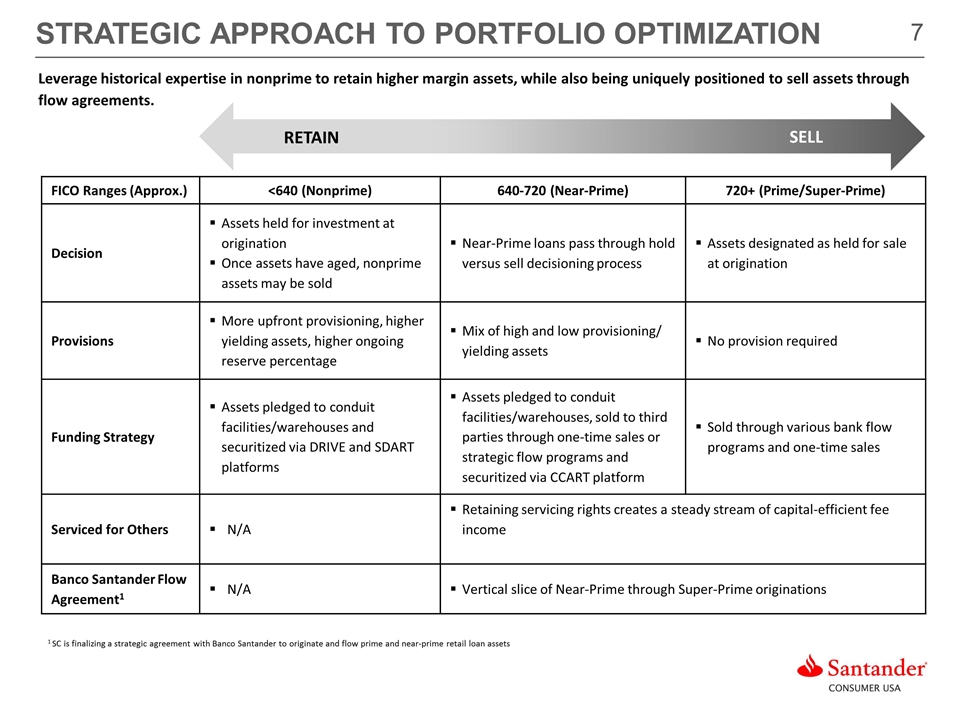

STRATEGIC approach to portfolio optimization SELL FICO Ranges (Approx.) <640 (Nonprime) 640-720 (Near-Prime) 720+ (Prime/Super-Prime) Decision Assets held for investment at origination Once assets have aged, nonprime assets may be sold Near-Prime loans pass through hold versus sell decisioning process Assets designated as held for sale at origination Provisions More upfront provisioning, higher yielding assets, higher ongoing reserve percentage Mix of high and low provisioning/ yielding assets No provision required Funding Strategy Assets pledged to conduit facilities/warehouses and securitized via DRIVE and SDART platforms Assets pledged to conduit facilities/warehouses, sold to third parties through one-time sales or strategic flow programs and securitized via CCART platform Sold through various bank flow programs and one-time sales Serviced for Others N/A Retaining servicing rights creates a steady stream of capital-efficient fee income Banco Santander Flow Agreement1 N/A Vertical slice of Near-Prime through Super-Prime originations RETAIN Leverage historical expertise in nonprime to retain higher margin assets, while also being uniquely positioned to sell assets through flow agreements. 1 SC is finalizing a strategic agreement with Banco Santander to originate and flow prime and near-prime retail loan assets

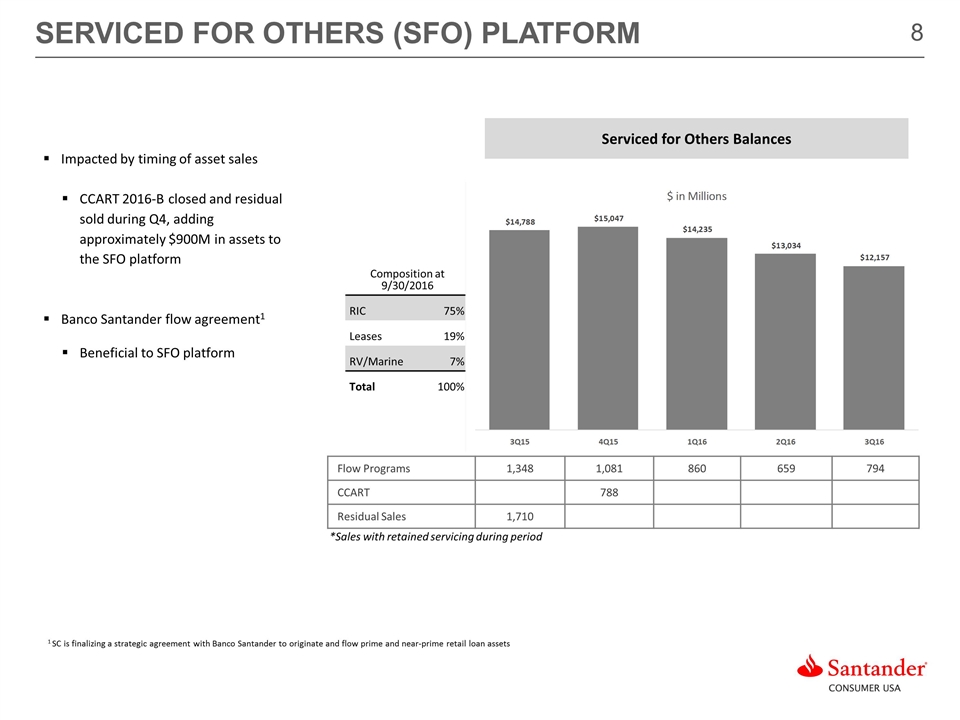

Flow Programs 1,348 1,081 860 659 794 CCART 788 Residual Sales 1,710 Impacted by timing of asset sales CCART 2016-B closed and residual sold during Q4, adding approximately $900M in assets to the SFO platform Banco Santander flow agreement1 Beneficial to SFO platform SERVICED FOR OTHERS (SFO) PLATFORM Composition at 9/30/2016 RIC 75 % Leases 19 % RV/Marine 7 % Total 100 % Serviced for Others Balances *Sales with retained servicing during period 1 SC is finalizing a strategic agreement with Banco Santander to originate and flow prime and near-prime retail loan assets

Q4 2016 FUNDING AND LIQUIDITY UPDATE More than $3.3 billion in new term ABS funding thus far in Q4, successfully executed across all platforms SDART 2016-3 ($1.3 billion) closed CCART 2016-B ($841 million) closed and residual sold DRIVE 2016-C ($1.3 billion) closed Lower credit spreads and overall cost of funds across the complete portfolio 2 previously retained subordinate classes of notes were sold to the market achieving better pricing and economics $6.2 billion in existing revolving warehouse lines renewed in Q4 $2.2 billion in new commitments established with third parties, including a $500 million commitment from a new lender On November 1, 2016, the unsecured portion of SHUSA’s committed liquidity facility was increased to $3.0 billion from $1.5 billion Demonstrated continued access to liquidity in the fourth quarter Asset-Backed Securities Credit Facilities

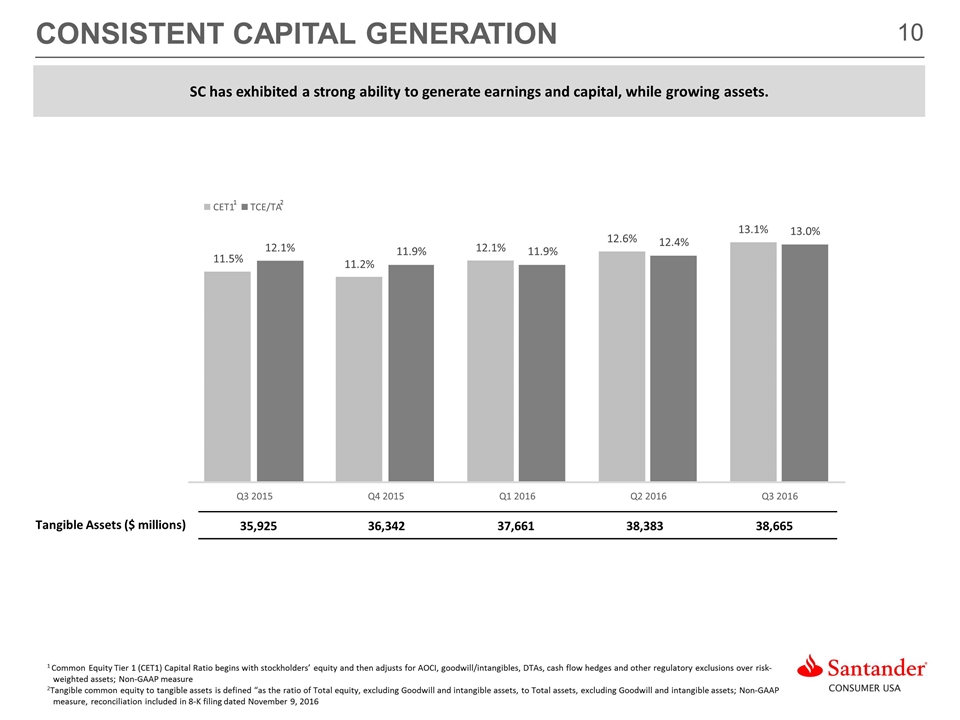

CONSISTENT CAPITAL GENERATION 1 Common Equity Tier 1 (CET1) Capital Ratio begins with stockholders’ equity and then adjusts for AOCI, goodwill/intangibles, DTAs, cash flow hedges and other regulatory exclusions over risk-weighted assets; Non-GAAP measure 2Tangible common equity to tangible assets is defined “as the ratio of Total equity, excluding Goodwill and intangible assets, to Total assets, excluding Goodwill and intangible assets; Non-GAAP measure, reconciliation included in 8-K filing dated November 9, 2016 1 2 SC has exhibited a strong ability to generate earnings and capital, while growing assets. Tangible Assets ($ millions) 35,925 36,342 37,661 38,383 38,665 11.5% 11.2% 12.1% 12.6% 13.1% 12.1% 11.9% 11.9% 12.4% 13.0% Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 CET1 TCE/TA

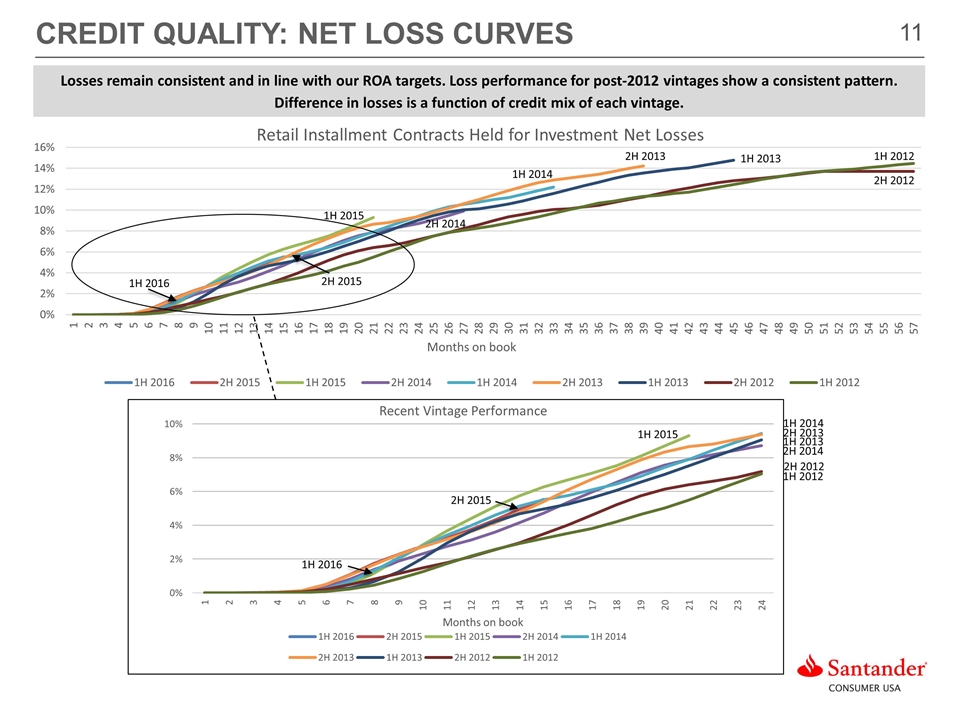

CREDIT QUALITY: NET LOSS CURVES Losses remain consistent and in line with our ROA targets. Loss performance for post-2012 vintages show a consistent pattern. Difference in losses is a function of credit mix of each vintage. 1H 2012 1H 2012 2H 2012 2H 2012 1H 2013 2H 2013 1H 2014 1H 2013 2H 2013 1H 2014 2H 2014 2H 2014 1H 2015 1H 2015 2H 2015 2H 2015 1H 2016 1H 2016

AGENDA CORPORATE OVERVIEW AND STRATEGY ORIGINATIONS, UNDERWRITING AND DEALER MANAGEMENT SERVICING, COLLECTIONS AND REMARKETING

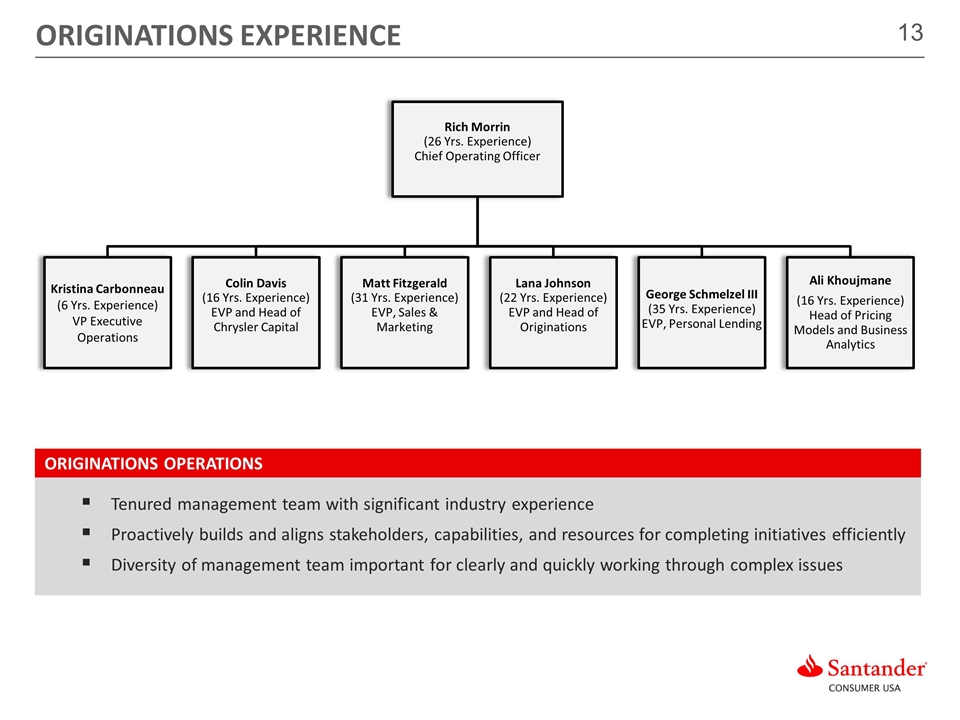

Tenured management team with significant industry experience Proactively builds and aligns stakeholders, capabilities, and resources for completing initiatives efficiently Diversity of management team important for clearly and quickly working through complex issues ORIGINATIONS OPERATIONS ORIGINATIONS EXPERIENCE Rich Morrin (26 Yrs. Experience) Chief Operating Officer Colin Davis (16 Yrs. Experience) EVP and Head of Chrysler Capital George Schmelzel III (35 Yrs. Experience) EVP, Personal Lending Matt Fitzgerald (31 Yrs. Experience) EVP, Sales & Marketing Lana Johnson (22 Yrs. Experience) EVP and Head of Originations Kristina Carbonneau (6 Yrs. Experience) VP Executive Operations Ali Khoujmane (16 Yrs. Experience) Head of Pricing Models and Business Analytics

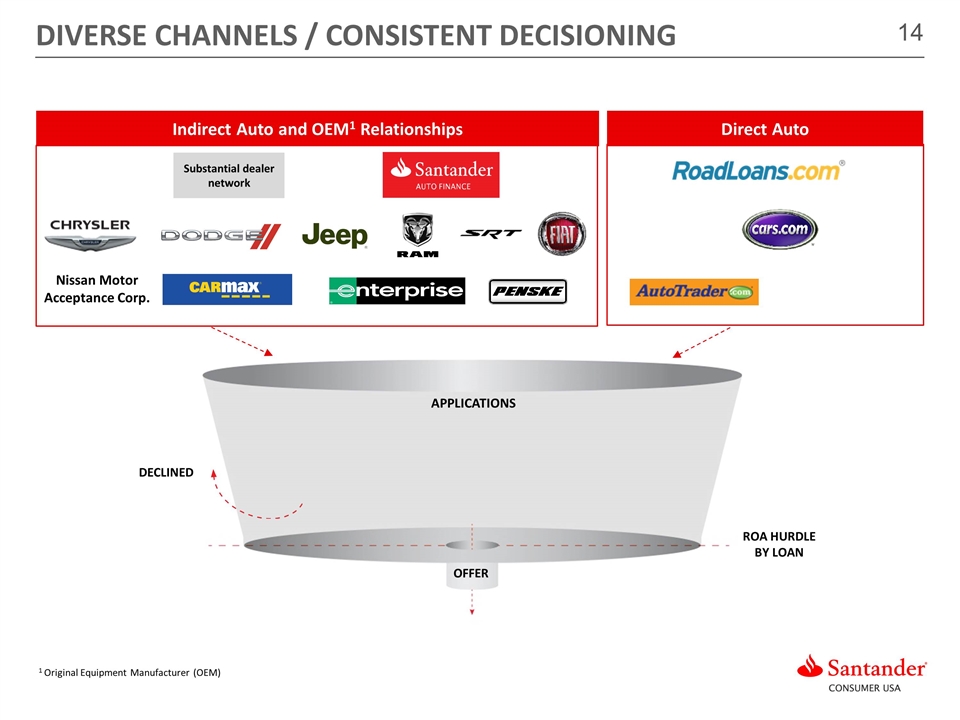

DIVERSE CHANNELS / CONSISTENT DECISIONING ROA HURDLE BY LOAN DECLINED OFFER Substantial dealer network 1 Original Equipment Manufacturer (OEM) Direct Auto Indirect Auto and OEM1 Relationships Nissan Motor Acceptance Corp. APPLICATIONs

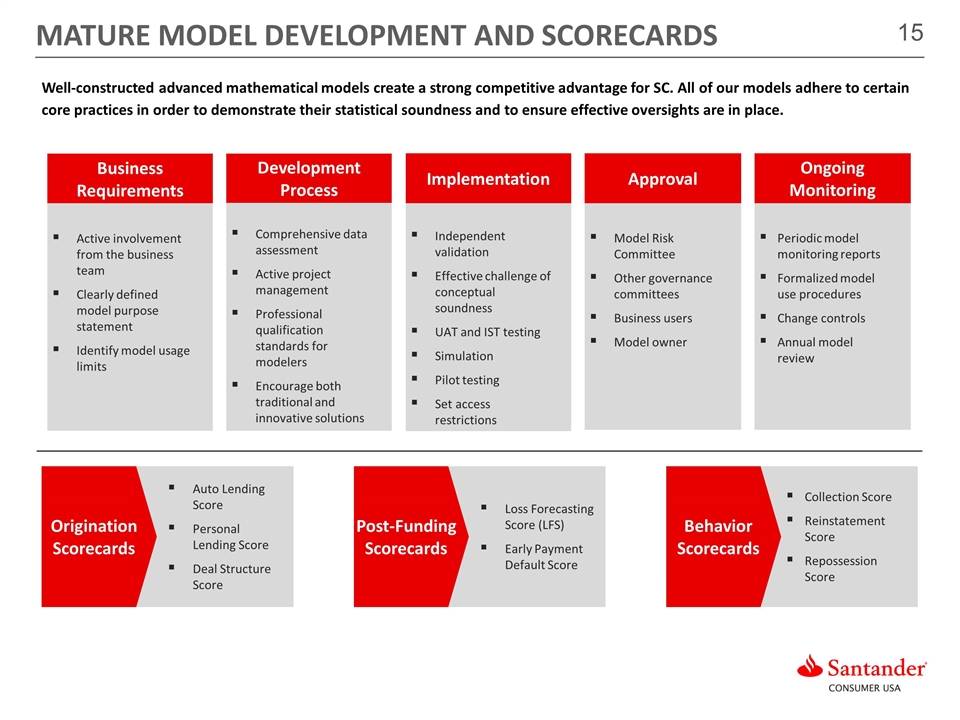

Well‐constructed advanced mathematical models create a strong competitive advantage for SC. All of our models adhere to certain core practices in order to demonstrate their statistical soundness and to ensure effective oversights are in place. Active involvement from the business team Clearly defined model purpose statement Identify model usage limits Business Requirements Comprehensive data assessment Active project management Professional qualification standards for modelers Encourage both traditional and innovative solutions Development Process Independent validation Effective challenge of conceptual soundness UAT and IST testing Simulation Pilot testing Set access restrictions Implementation Model Risk Committee Other governance committees Business users Model owner Approval Periodic model monitoring reports Formalized model use procedures Change controls Annual model review Ongoing Monitoring Auto Lending Score Personal Lending Score Deal Structure Score Origination Scorecards Loss Forecasting Score (LFS) Early Payment Default Score Post-Funding Scorecards Collection Score Reinstatement Score Repossession Score Behavior Scorecards MATURE MODEL DEVELOPMENT AND SCORECARDS Active involvement from the business team Clearly defined model purpose statement Identify model usage limits Comprehensive data assessment Active project management Professional qualification standards for modelers Encourage both traditional and innovative solutions Independent validation Effective challenge of conceptual soundness UAT and IST testing Simulation Pilot testing Set access restrictions

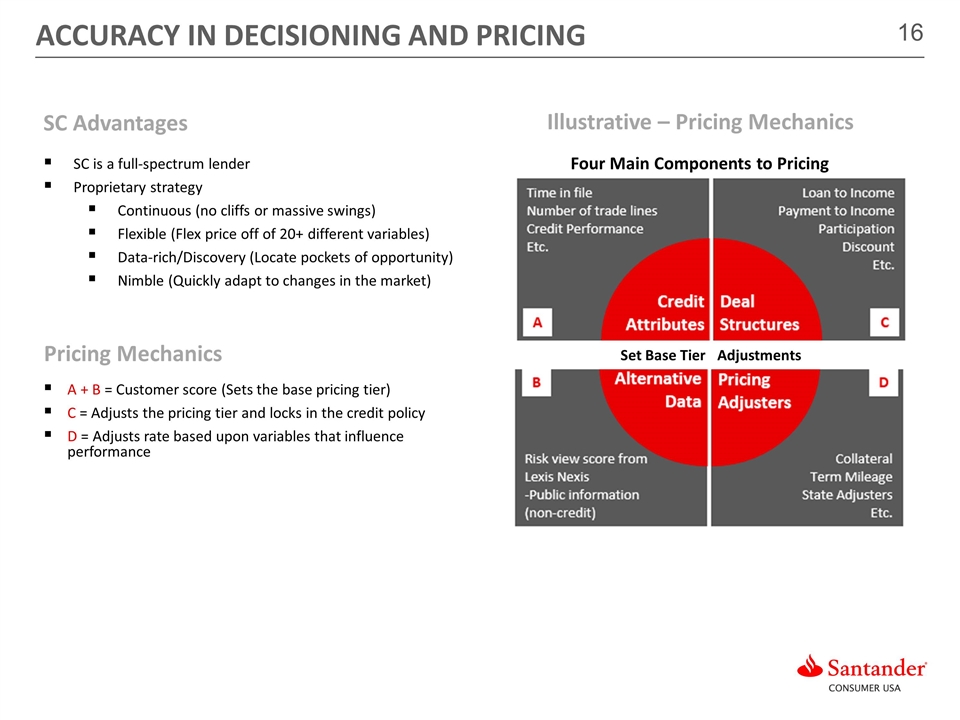

SC Advantages SC is a full-spectrum lender Proprietary strategy Continuous (no cliffs or massive swings) Flexible (Flex price off of 20+ different variables) Data-rich/Discovery (Locate pockets of opportunity) Nimble (Quickly adapt to changes in the market) Illustrative – Pricing Mechanics A + B = Customer score (Sets the base pricing tier) C = Adjusts the pricing tier and locks in the credit policy D = Adjusts rate based upon variables that influence performance Pricing Mechanics Adjustments Set Base Tier Four Main Components to Pricing ACCURACY IN DECISIONING AND PRICING

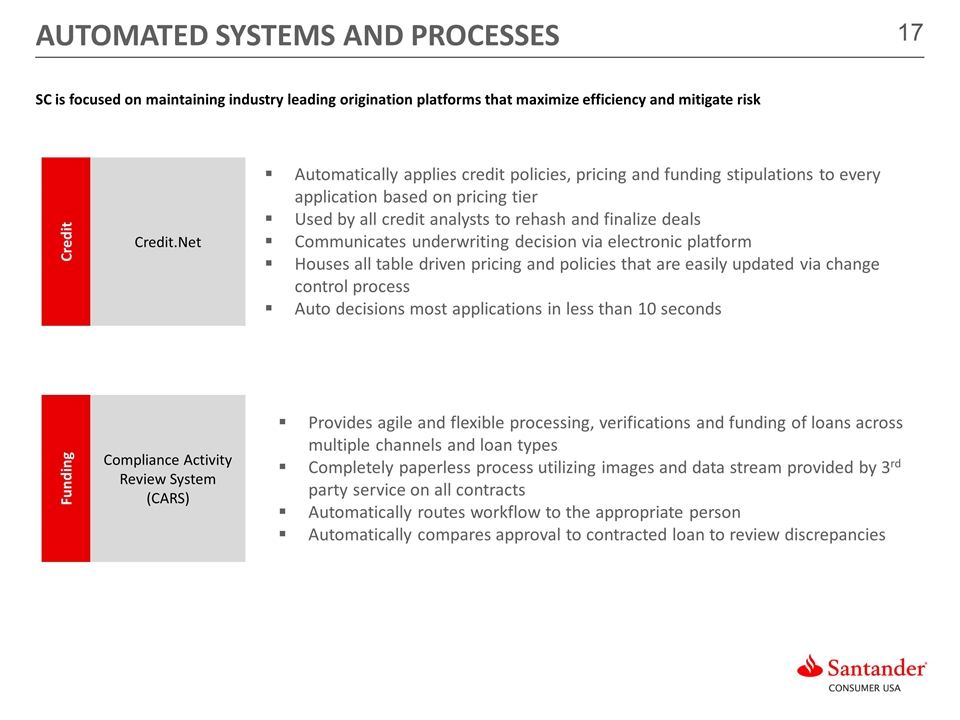

Provides agile and flexible processing, verifications and funding of loans across multiple channels and loan types Completely paperless process utilizing images and data stream provided by 3rd party service on all contracts Automatically routes workflow to the appropriate person Automatically compares approval to contracted loan to review discrepancies Funding Compliance Activity Review System (CARS) Automatically applies credit policies, pricing and funding stipulations to every application based on pricing tier Used by all credit analysts to rehash and finalize deals Communicates underwriting decision via electronic platform Houses all table driven pricing and policies that are easily updated via change control process Auto decisions most applications in less than 10 seconds Credit Credit.Net SC is focused on maintaining industry leading origination platforms that maximize efficiency and mitigate risk AUTOMATED SYSTEMS AND PROCESSES

Lexis Nexis (Risk view) and Credit bureau attributes cause contract stipulations to fire SSN discrepancies Applicants Date of Birth Residence validation SC’s Credit & Funding systems mitigate fraud, as well as ensure compliance with regulatory requirements Prevention KYC - Know your customer State specific regulations Fraud – Stated income manipulation Truth-in-Lending Act (Reg. z) Consumer credit bureau alerts Fee tables contain state specific rules that limit APR, back-end products, fee amounts and days to assess (if applicable) The Funding System prompts for state specific documents (if applicable) Systemic check ensures that the TILA box calculates CAC alerts are cleared prior to issuing an approval SC cross references income from previous applications & dealers. Changes greater than 20% fire a “Proof of income” stipulation Non-approved contracts Systemic control identifies submitted contracts that have not been approved by legal Contract discrepancies Any discrepancy between the “approved deal” and the “submitted deal” are identified within the funding system SYSTEMIC VERIFICATION PROCESS

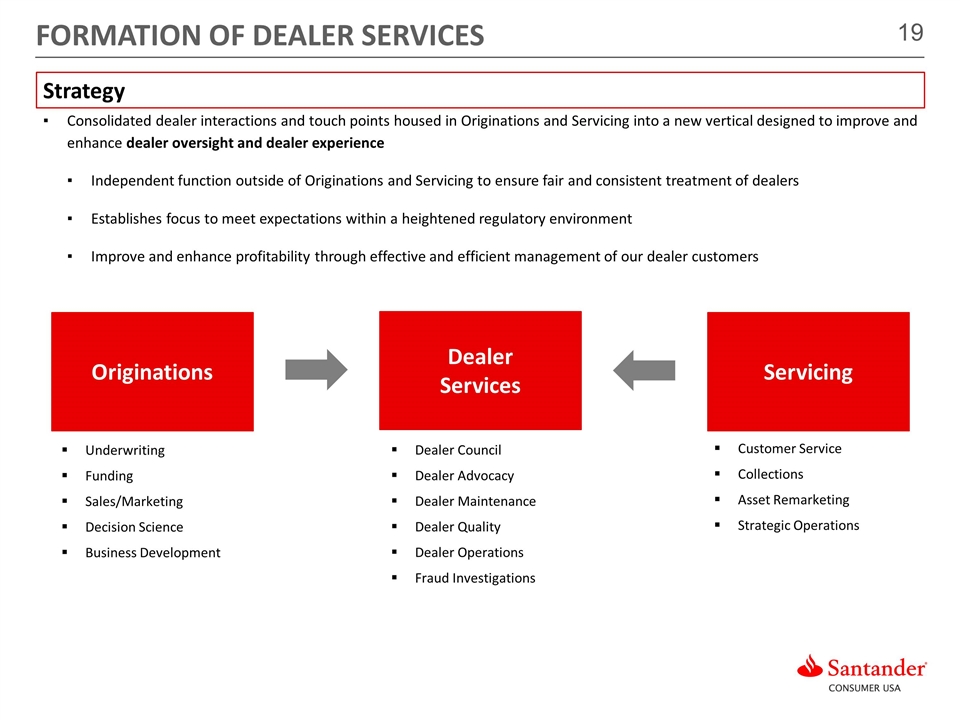

Originations Strategy Dealer Services Servicing Consolidated dealer interactions and touch points housed in Originations and Servicing into a new vertical designed to improve and enhance dealer oversight and dealer experience Independent function outside of Originations and Servicing to ensure fair and consistent treatment of dealers Establishes focus to meet expectations within a heightened regulatory environment Improve and enhance profitability through effective and efficient management of our dealer customers Formation of Dealer Services Underwriting Funding Sales/Marketing Decision Science Business Development Customer Service Collections Asset Remarketing Strategic Operations Dealer Council Dealer Advocacy Dealer Maintenance Dealer Quality Dealer Operations Fraud Investigations

Dealer oversight Dealer Council - Established an official Dealer Council to review dealer issues and take action based on various risk criteria (complaints, regulatory violations, portfolio performance, fair lending reviews and monitoring of dealer principals). Maintenance – Regular updates to dealer information, ownership, contacts, activations and deactivations. Periodic Compliance Reviews– Dealer ownership is monitored weekly for OFAC (Office of Foreign Assets Control) and AML (Anti Money Laundering) by Compliance. Fair Lending reviews are conducted quarterly to identify dealer mark up concerns. Monthly Dealer Performance Management (DPM) – Dealer portfolio performance is reviewed periodically based on a rolling 13 months looking at loan performance. If a dealer is performing below the national average looking at EPD’s (Early Payment Defaults), 61 days plus delinquency, and actual to expected losses, then they are placed on DPM stipulation treatment and future performance is monitored. Annual Dealer Review – Dealers are reviewed every 2-3 years to validate that they are still active and in good standing with the Secretary of State and that the dealer principal is still connected to the dealership. Targeted Reviews – Various triggers will result in a targeted dealer review conducted by Dealer Quality Management. Current triggers include consumer complaints, income outliers, negative media coverage, regulatory violations, common employer phone numbers and escalations from Sales and Operations. Dealer Recoveries - Ongoing collection of outstanding participation, missing equipment, product cancellations, unwinds, lease disposition fees and review of early defaults (proof of down payment). Fraud Investigations – Investigates identity theft, fraud claims, dealer fraud, customer application fraud, etc. Provides fraud trend reports to senior management, Dealer Operations, and the Dealer Council to take corrective actions.

AGENDA CORPORATE OVERVIEW AND STRATEGY ORIGINATIONS, UNDERWRITING AND DEALER MANAGEMENT SERVICING, COLLECTIONS AND REMARKETING

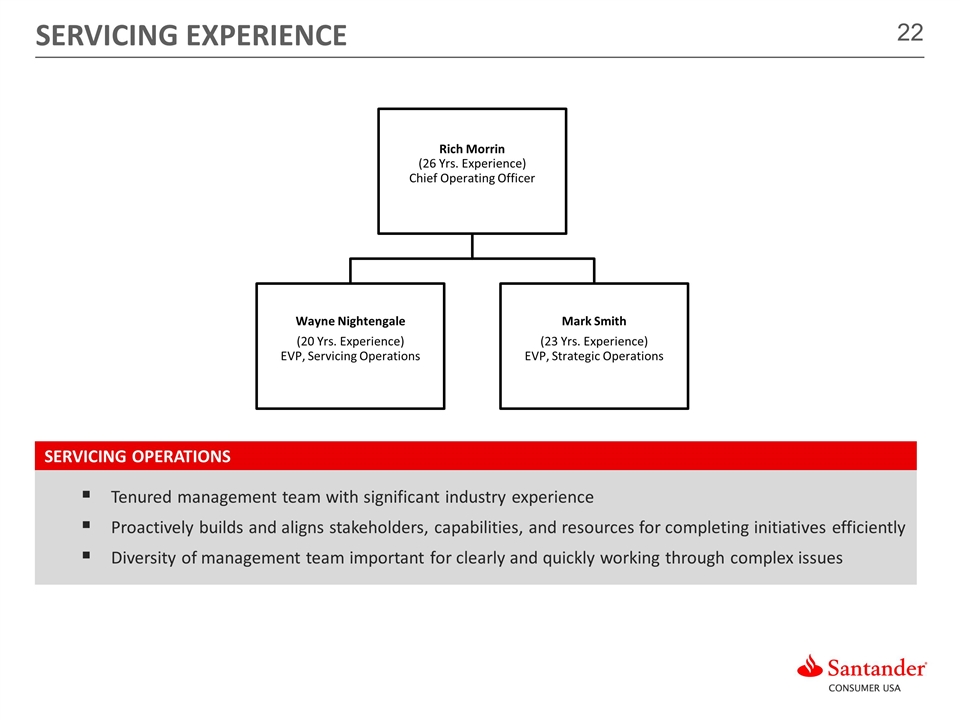

Tenured management team with significant industry experience Proactively builds and aligns stakeholders, capabilities, and resources for completing initiatives efficiently Diversity of management team important for clearly and quickly working through complex issues SERVICING OPERATIONS SERVICING EXPERIENCE Rich Morrin (26 Yrs. Experience) Chief Operating Officer Mark Smith (23 Yrs. Experience) EVP, Strategic Operations Wayne Nightengale (20 Yrs. Experience) EVP, Servicing Operations

SERVICING OVERVIEW SC is focused on maintaining an industry leading loan-servicing platform that maximizes efficiency and minimizes the need for customer contact. The platform provides loan-servicing tools, utilizing a best-in-class proprietary account management and collection technology system for a superior customer service experience. Model driven account management strategies based on custom scores and predictive modeling. Strategies leverage application characteristics, refreshed credit data and customer behavior to apply risk-driven treatment. Robust process and cutting-edge technology maximize efficiency, consistent loan treatment and cost control. Strategy Provides scoring on 100% of calls Emphasizes better speech habits which delivers more professional call results. 60% of the automated scorecard categories are designed to enhance the customer experience. Value of the Automated Scorecard

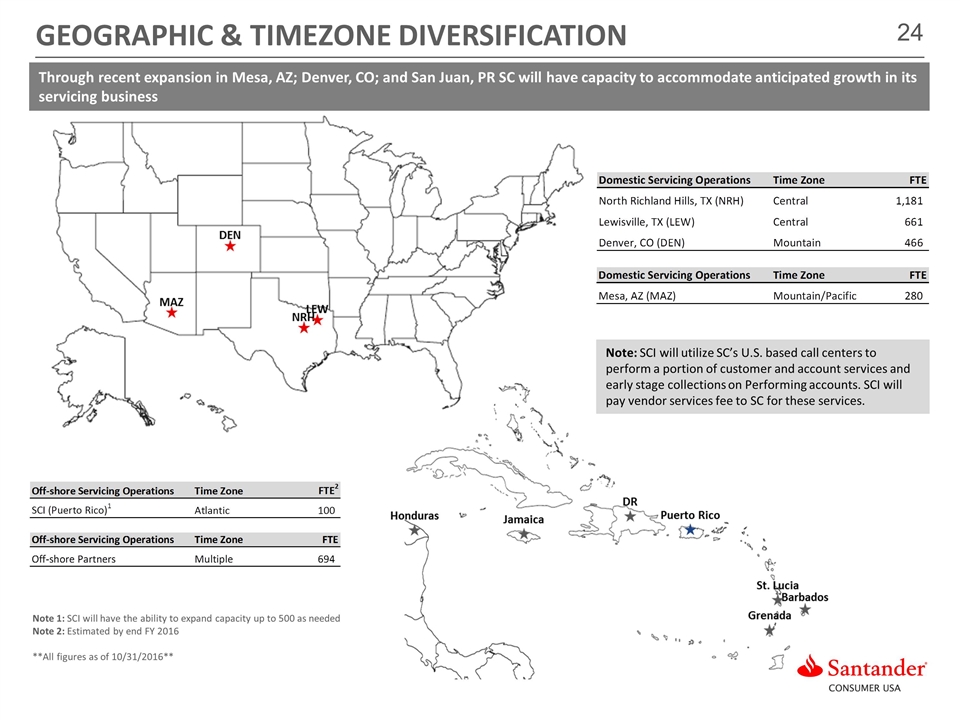

GEOGRAPHIC & TIMEZONE DIVERSIFICATION Note: SCI will utilize SC’s U.S. based call centers to perform a portion of customer and account services and early stage collections on Performing accounts. SCI will pay vendor services fee to SC for these services. Through recent expansion in Mesa, AZ; Denver, CO; and San Juan, PR SC will have capacity to accommodate anticipated growth in its servicing business Note 1: SCI will have the ability to expand capacity up to 500 as needed Note 2: Estimated by end FY 2016 **All figures as of 10/31/2016**

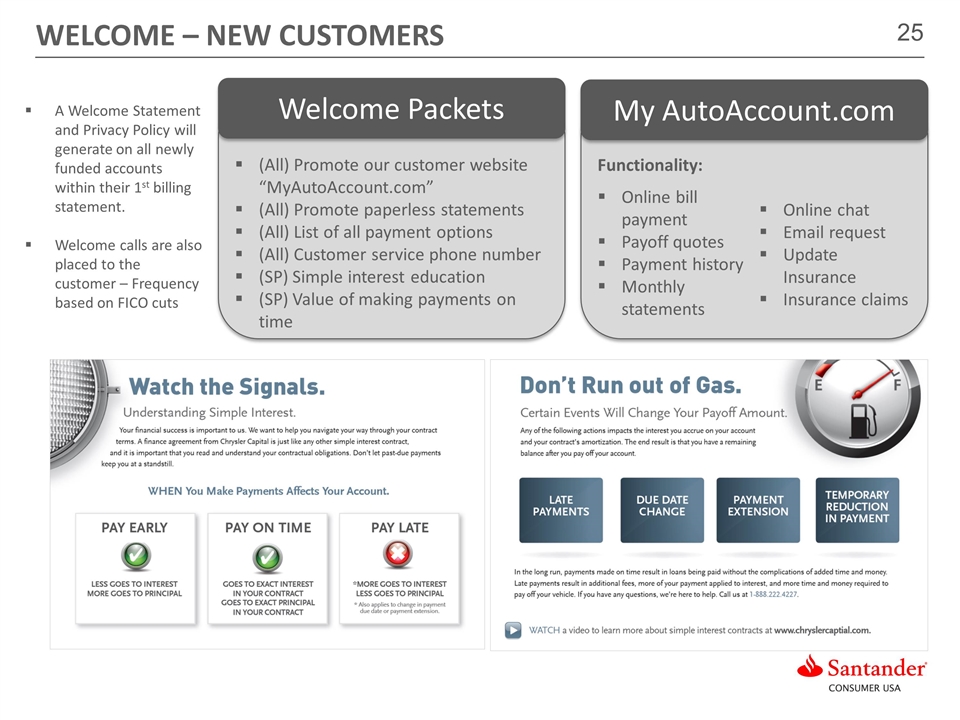

A Welcome Statement and Privacy Policy will generate on all newly funded accounts within their 1st billing statement. Welcome calls are also placed to the customer – Frequency based on FICO cuts (All) – Promote (All) Promote our customer website “MyAutoAccount.com” (All) Promote paperless statements (All) List of all payment options (All) Customer service phone number (SP) Simple interest education (SP) Value of making payments on time Welcome Packets Functionality: Online bill payment Payoff quotes Payment history Monthly statements Online chat Email request Update Insurance Insurance claims My AutoAccount.com WELCOME – NEW CUSTOMERS

One element of speech analytics is the ability to convert speech to text and analyze the text using search strings in order to match specific language. In addition, CallMiner’s analytics software can detect changes in voice tone and volume which are primary indicators of dissatisfaction. Our speech analytics tool allows us to approach Quality Assurance in two ways: Real-time alerts allow us to take action during a call to remedy situations before they are escalated. Events that trigger alerts are calibrated on a monthly basis. Targeted Quality Assurance. Can monitor compliance elements across all calls not just a random sample. Measures various quantitative aspects of calls. Allows for automated Call Performance Scorecards. Reduces head count needs for manual random call monitoring. Allows the ability to compare speech behavior to actual results. Real-time Speech Analytics Post-call Mining MULTIPLE APPROACHES TO SPEECH ANALYTICS

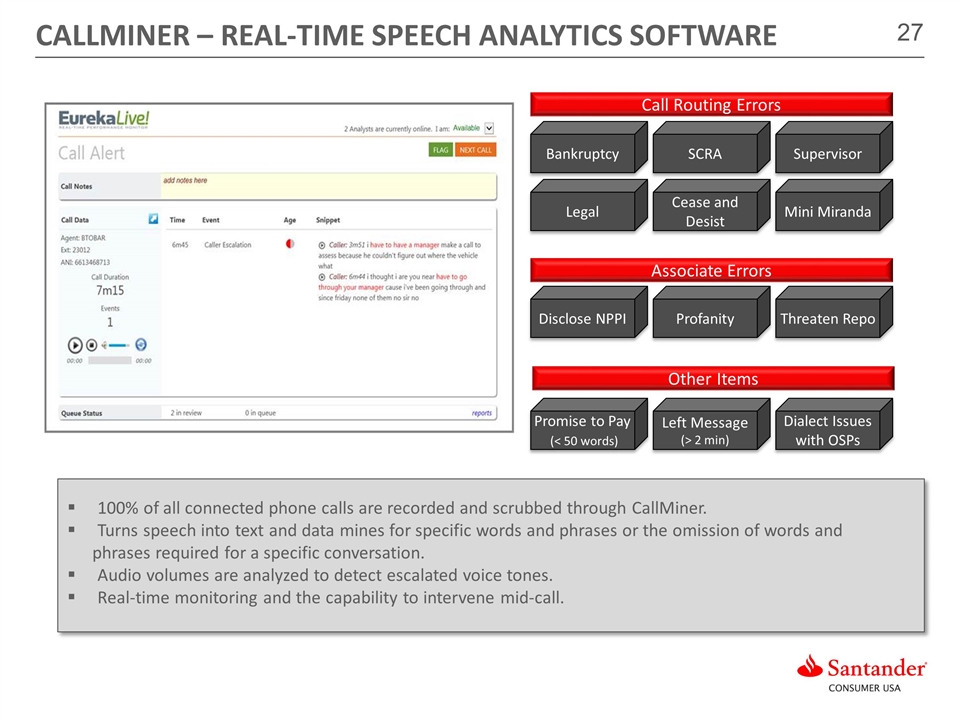

Bankruptcy SCRA Supervisor Cease and Desist Mini Miranda Legal Call Routing Errors Profanity Threaten Repo Disclose NPPI Promise to Pay (< 50 words) Left Message (> 2 min) Dialect Issues with OSPs Associate Errors Other Items 100% of all connected phone calls are recorded and scrubbed through CallMiner. Turns speech into text and data mines for specific words and phrases or the omission of words and phrases required for a specific conversation. Audio volumes are analyzed to detect escalated voice tones. Real-time monitoring and the capability to intervene mid-call. CALLMINER – REAL-TIME SPEECH ANALYTICS SOFTWARE

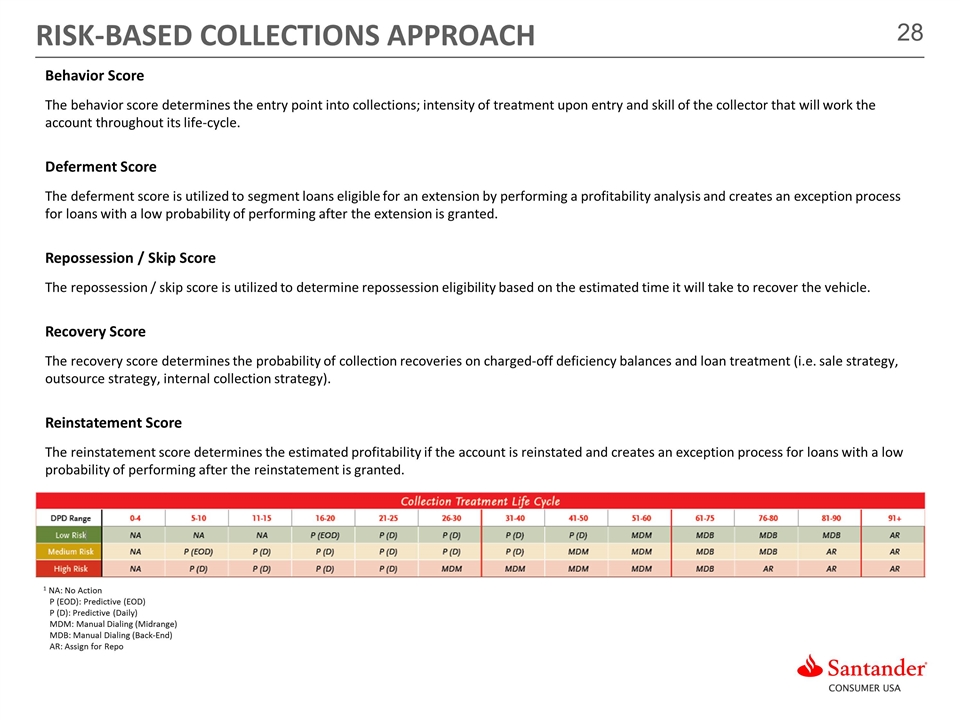

Behavior Score The behavior score determines the entry point into collections; intensity of treatment upon entry and skill of the collector that will work the account throughout its life-cycle. Deferment Score The deferment score is utilized to segment loans eligible for an extension by performing a profitability analysis and creates an exception process for loans with a low probability of performing after the extension is granted. Repossession / Skip Score The repossession / skip score is utilized to determine repossession eligibility based on the estimated time it will take to recover the vehicle. Recovery Score The recovery score determines the probability of collection recoveries on charged-off deficiency balances and loan treatment (i.e. sale strategy, outsource strategy, internal collection strategy). Reinstatement Score The reinstatement score determines the estimated profitability if the account is reinstated and creates an exception process for loans with a low probability of performing after the reinstatement is granted. RISK-BASED COLLECTIONS APPROACH 1 1 NA: No Action P (EOD): Predictive (EOD) P (D): Predictive (Daily) MDM: Manual Dialing (Midrange) MDB: Manual Dialing (Back-End) AR: Assign for Repo

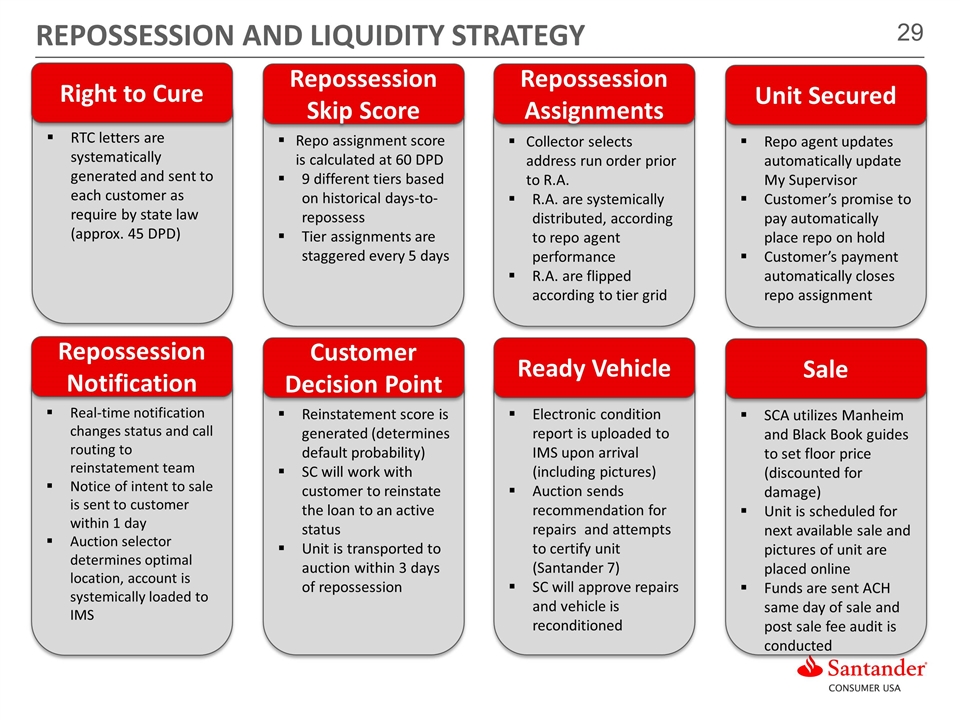

RTC letters are systematically generated and sent to each customer as require by state law (approx. 45 DPD) Right to Cure (All) – Promote Repo assignment score is calculated at 60 DPD 9 different tiers based on historical days-to-repossess Tier assignments are staggered every 5 days Repossession Skip Score Collector selects address run order prior to R.A. R.A. are systemically distributed, according to repo agent performance R.A. are flipped according to tier grid Repossession Assignments Repo agent updates automatically update My Supervisor Customer’s promise to pay automatically place repo on hold Customer’s payment automatically closes repo assignment Unit Secured (All) – Promote Real-time notification changes status and call routing to reinstatement team Notice of intent to sale is sent to customer within 1 day Auction selector determines optimal location, account is systemically loaded to IMS Repossession Notification (All) – Promote Reinstatement score is generated (determines default probability) SC will work with customer to reinstate the loan to an active status Unit is transported to auction within 3 days of repossession Customer Decision Point Electronic condition report is uploaded to IMS upon arrival (including pictures) Auction sends recommendation for repairs and attempts to certify unit (Santander 7) SC will approve repairs and vehicle is reconditioned Ready Vehicle SCA utilizes Manheim and Black Book guides to set floor price (discounted for damage) Unit is scheduled for next available sale and pictures of unit are placed online Funds are sent ACH same day of sale and post sale fee audit is conducted Sale REPOSSESSION AND LIQUIDITY STRATEGY

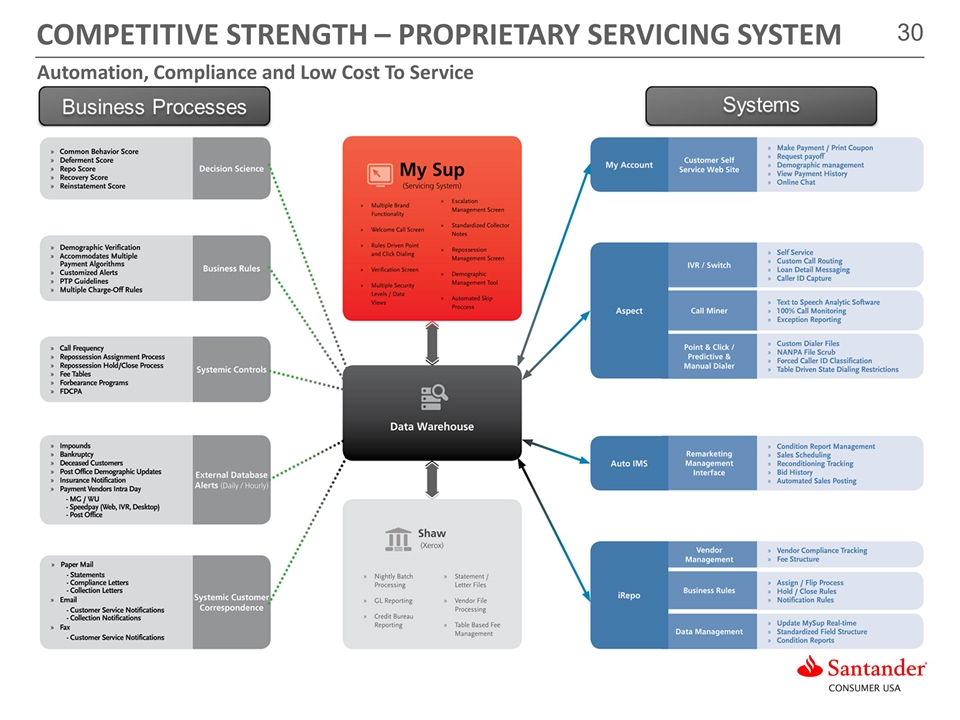

Automation, Compliance and Low Cost To Service COMPETITIVE STRENGTH – PROPRIETARY SERVICING SYSTEM