Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Ener-Core, Inc. | f8k120616_enercoreinc.htm |

Exhibit 99.1

OTCQB: ENCR December 2016 A New Opportunity to Profit From Industrial Waste Gas

2 Forward Looking Statements This presentation has been prepared by Ener - Core, Inc. (the "Company"). It should not be considered as an offer or invitation t o subscribe for or purchase any securities in the Company or as an inducement to make an offer or invitation with respect to those securities . No agreement to subscribe for securities in the Company will be entered into on the basis of this presentation or any information, opinion s o r conclusions expressed in the course of this presentation. This presentation is not a prospectus or other offering document under U.S. law or under any other law. It has been prepared fo r information purposes only. This presentation contains general summary information and does not take into account the investment objectiv es, financial situation and particular needs of any individual investor. It is not investment advice and prospective investors should obtain their own independent advice from qualified financial advisors regarding their own financial objectives, financial situation and needs. This presentation and information, opinions or conclusions expressed in the course of this presentation contains forecasts an d f orward - looking information. Such statements are based on a number of estimates and assumptions that, while considered reasonable by management at the time, are subject to significant business, economic and competitive uncertainties. These forecasts, projections and information are not a guarantee of future performance or expected results and involve unknown risks and uncertainties. Actual results and development s will almost certainly differ materially from those expected by the Company (either expressed or implied in this presentation). There are a number of risks, both specific to the Company and of a general nature, which may affect the future operating and financial performance of the Com pany as well as the value of an investment in the Company, including and not limited to the following: economic conditions; stock market f luc tuations; uncertainty of future revenues; limited operating history; uncertain market acceptance for our technology; potential difficul ty in managing growth; costs of sales and materials; intellectual property protection; disclosure of trade secrets; rapid technological chan ge among competitors; dependence on suppliers; risks of doing international business; state, federal and foreign legislative and regul ato ry initiatives, including costs of compliance with existing and future environmental requirements; costs and effects of legal and administrat ive proceedings, settlements, investigations and claims; the inherent risks associated with the operation and potential construction of power gen eration systems, including environmental, health, safety, regulatory and financial risks; the timing and extent of changes in commodi ty prices, interest rates and foreign currency exchange rates; unusual maintenance or repairs and electric transmission system constraints; the p erf ormance of electric generation facilities; and the need for and availability of future financing in order for the Company to carry out i ts business plan. The forward - looking information contained in this presentation are as of the date hereof and the Company does not expect to update t he forward looking information contained in this presentation. This presentation speaks as of October 2016. Neither the delivery of this presentation nor any further discussions by the Compa ny or its representatives with any of the recipients shall, under any circumstances, create any implication that there has been no chan ge in the affairs of the Company since such date. The Company does not intend, and does not assume any obligation, to update or correct any informat ion included in this presentation. © Copyright 2016 Ener - Core, Inc. All Rights Reserved.

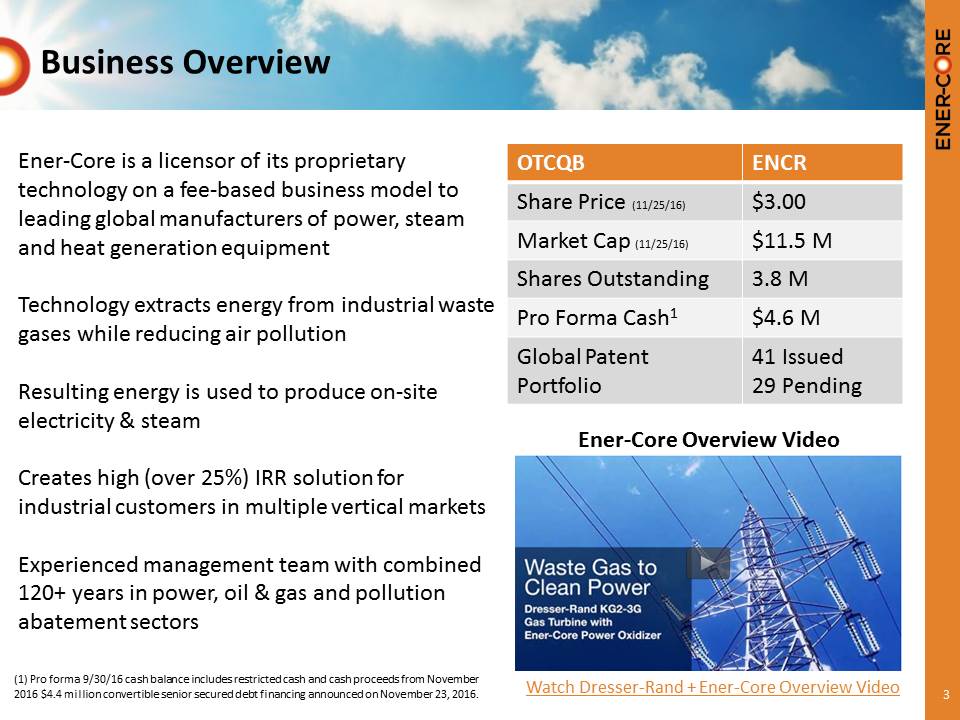

3 Business Overview Ener - Core is a licensor of its proprietary technology on a fee - based business model to leading global manufacturers of power, steam and heat generation equipment Technology extracts energy from industrial waste gases while reducing air pollution Resulting energy is used to produce on - site electricity & steam Creates high (over 25%) IRR solution for industrial customers in multiple vertical markets Experienced management team with combined 120+ years in power, oil & gas and pollution abatement sectors OTCQB ENCR Share Price (11/25/16) $3.00 Market Cap (11/25/16) $11.5 M Shares Outstanding 3.8 M Pro Forma Cash 1 $4.6 M Global Patent Portfolio 41 Issued 29 Pending Ener - Core Overview Video Watch Dresser - Rand + Ener - Core Overview Video (1) Pro forma 9/30/16 cash balance includes restricted cash and cash proceeds from November 2016 $4.4 million convertible senior secured debt financing announced on November 23, 2016.

4 Highlights • Disruptive Technology — Power Oxidizer provides a competitive advantage for customers, by generating on - site power, lowering OPEX and reducing emissions (air pollution) • Large Global Market — Growing $50 billion global industrial equipment market • First Global Licensee signed — Dresser - Rand, a division of Siemens, is the first global licensee of this technology; provides global sales force, validation, and product warranty • Licensing Model — High margin business that minimizes operating expenses and capital requirements, while accelerating global sales • Positioned for Financial Success — • All current and future turbine license agreements will require each licensee to achieve annual minimum sales that produce positive cash flows at current Ener - Core expense levels.

Disruptive Technology for Pollution Utilization

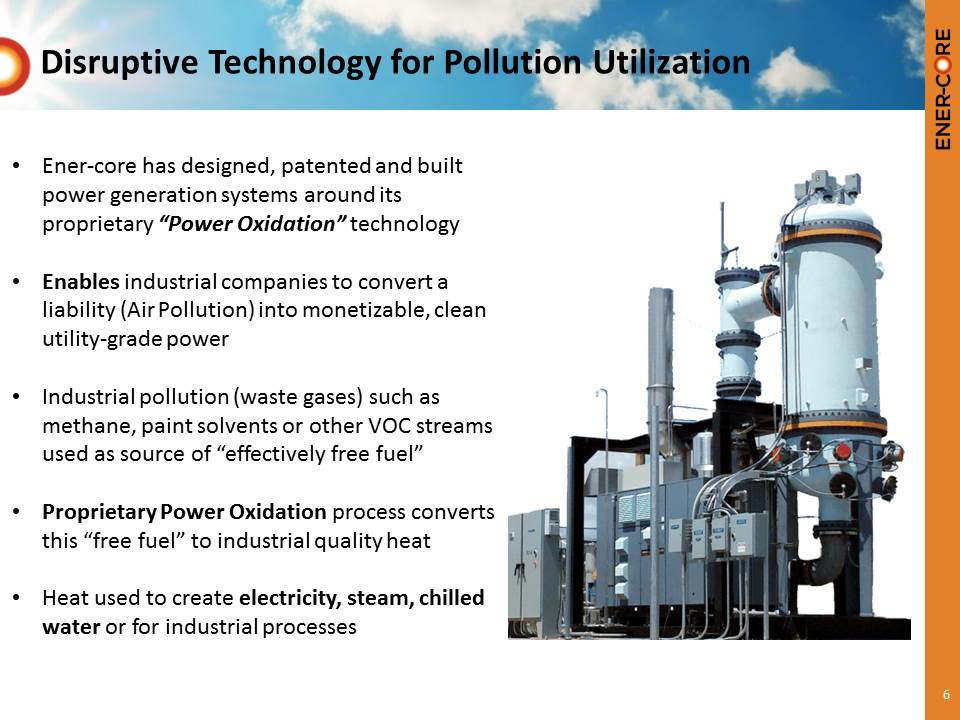

6 Disruptive Technology for Pollution Utilization • Ener - core has designed, patented and built power generation systems around its proprietary “Power Oxidation” technology • Enables industrial companies to convert a liability (Air Pollution) into monetizable, clean utility - grade power • Industrial pollution (waste gases) such as methane, paint solvents or other VOC streams used as source of “effectively free fuel” • Proprietary Power Oxidation process converts this “free fuel” to industrial quality heat • Heat used to create electricity, steam, chilled water or for industrial processes

7 Disruptive Technology for Pollution Utilization Ener - Core Power Oxidation Overview Video Watch Dresser - Rand + Ener - Core Overview Video

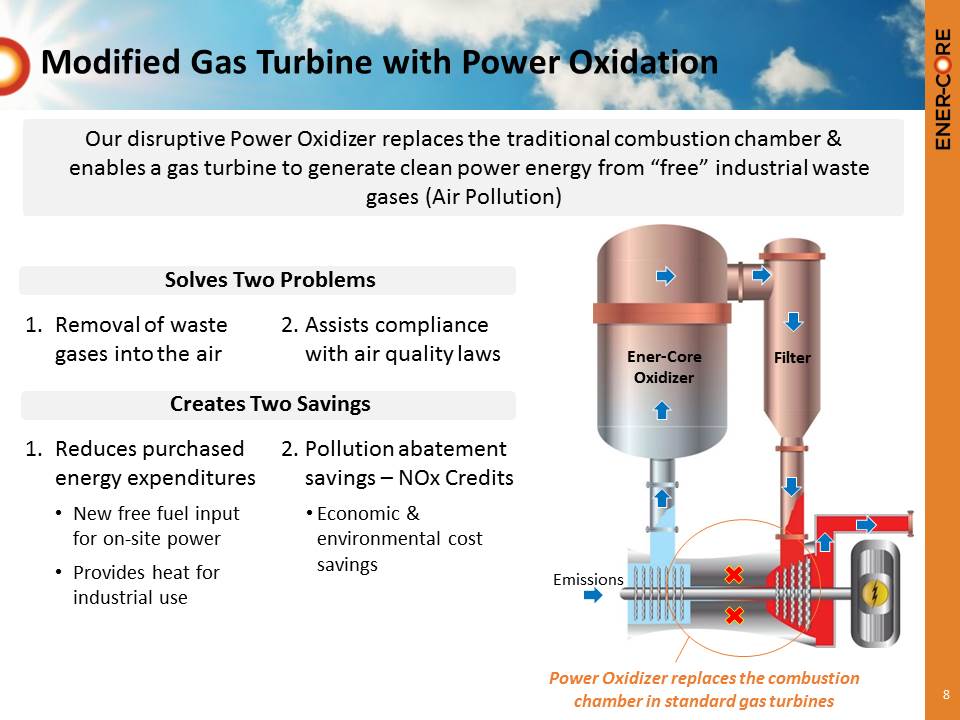

8 Ener - Core Oxidizer Emissions Filter Power Oxidizer replaces the combustion chamber in standard gas turbines Modified Gas Turbine with Power Oxidation Our disruptive Power Oxidizer replaces the traditional combustion chamber & enables a gas turbine to generate clean power energy from “free” industrial waste gases (Air Pollution) Solves Two Problems 1. Removal of waste gases into the air 2. Assists compliance with air quality laws Creates Two Savings 1. Reduces purchased energy expenditures • New free fuel input for on - site power • Provides heat for industrial use 2. Pollution abatement savings – NOx Credits • Economic & environmental cost savings

Technology Addresses A $50 Billion Global Industrial Equipment Market

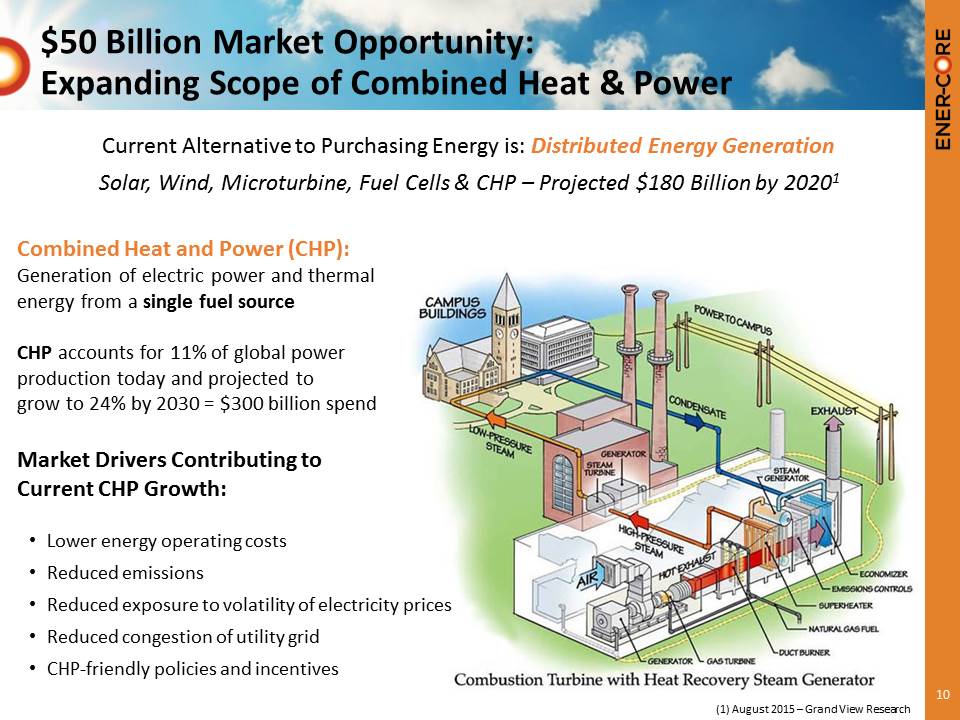

10 $50 Billion Market Opportunity: Expanding Scope of Combined Heat & Power Current Alternative to Purchasing Energy is: Distributed Energy Generation Solar, Wind, Microturbine, Fuel Cells & CHP – Projected $180 Billion by 2020 1 Combined Heat and Power (CHP): Generation of electric power and thermal energy from a single fuel source CHP accounts for 11% of global power production today and projected to grow to 24% by 2030 = $300 billion spend Market Drivers Contributing to Current CHP Growth: • Lower energy operating costs • Reduced emissions • Reduced exposure to volatility of electricity prices • Reduced congestion of utility grid • CHP - friendly policies and incentives (1) August 2015 – Grand View Research

11 Targeted Industries & Potential Applications Digesters Landfills Food Processing Chemicals Worldwide: $50 Billion Industrial Equipment Market United States: $10+ billion in ~15 vertical markets Oil & Gas Ethanol Plants / Distilleries Coal Mines Rendering & Animal Processing Byproducts Aerospace & Defense; Semiconductor & Electronics Manufacturing >600 U.S. facilities >500 U.S. facilities >1,000 U.S. mines >600 U.S. facilities >2,200 U.S. facilities

Significant End - Customer Value Proposition – Project IRRs in Excess of 25%

13 Macro - Economics • Global Market Opportunity – 3 million industrial facilities worldwide • $800 billion spend on energy to operate facilities (energy typically 10 - 30% of total industrial operating costs) • Monetary Value of Waste Gases = $65 Billion (enough electric power for all North America) • Site – Specific Opportunities - Industrial Facilities (Refineries, Petro Plants, Distilleries) targeted by Ener - Core incur average annual energy costs of $5 - $10 Million Macro and Site - Specific Economics of Industrial Sectors Shift from “Destruction” to “Utilization” of Waste Gases Waste Gas Power Oxidation Technology Power & Steam Increased Energy Efficiency 1 2 3 4 Near Zero Pollution Current Customer Projects Have Paybacks Between 1 - 4 Years We Target Unlevered Customer IRRs In Excess Of 25%

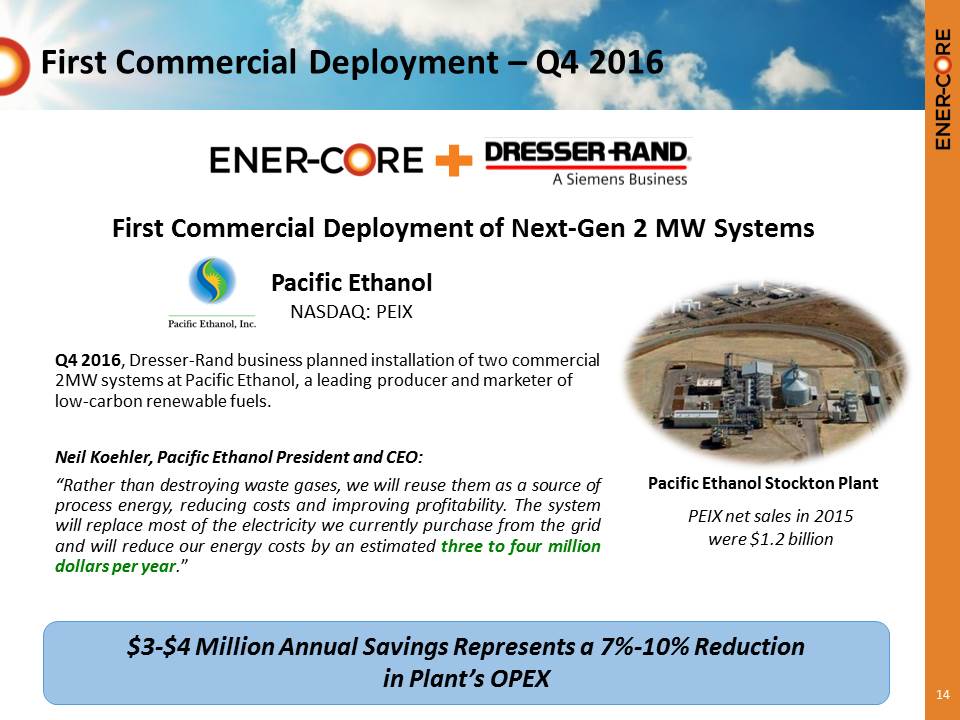

14 Pacific Ethanol Stockton Plant Q4 2016 , Dresser - Rand business planned installation of two commercial 2MW systems at Pacific Ethanol, a leading producer and marketer of low - carbon renewable fuels. Neil Koehler, Pacific Ethanol President and CEO: “Rather than destroying waste gases, we will reuse them as a source of process energy, reducing costs and improving profitability . The system will replace most of the electricity we currently purchase from the grid and will reduce our energy costs by an estimated three to four million dollars per year . ” First Commercial Deployment of Next - Gen 2 MW Systems First Commercial Deployment – Q4 2016 Pacific Ethanol NASDAQ: PEIX PEIX net sales in 2015 were $1.2 billion $3 - $4 Million Annual Savings Represents a 7% - 10% Reduction in Plant’s OPEX

“Asset - Light” Licensing Model

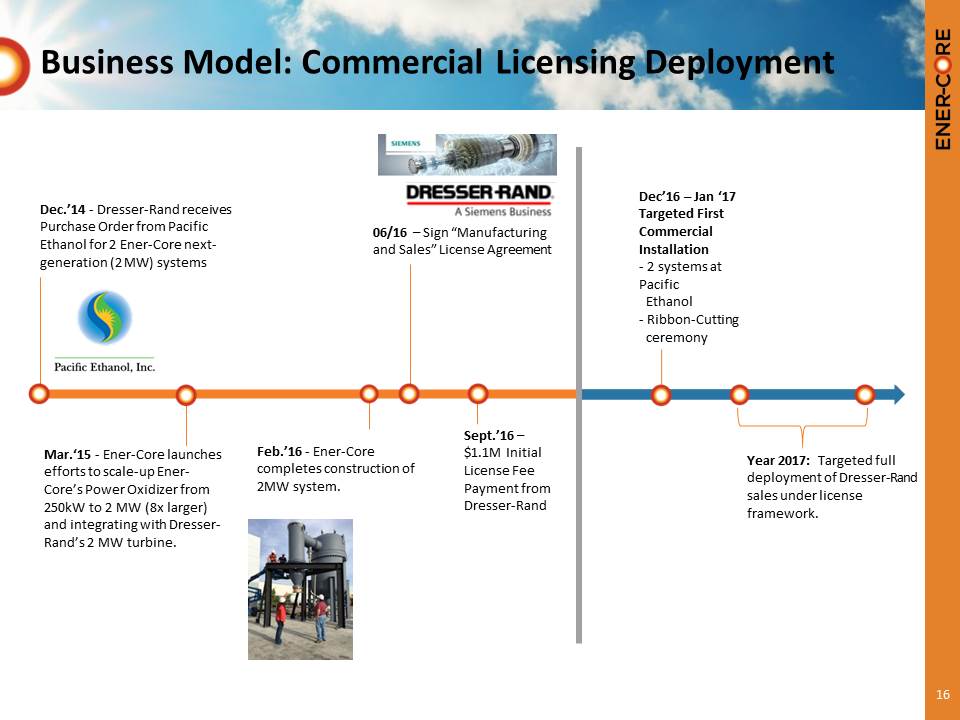

16 Dec.’14 - Dresser - Rand receives Purchase Order from Pacific Ethanol for 2 Ener - Core next - generation (2 MW) systems Mar.‘15 - Ener - Core launches efforts to scale - up Ener - Core’s Power Oxidizer from 250kW to 2 MW (8x larger) and integrating with Dresser - Rand’s 2 MW turbine. Feb.’16 - Ener - Core completes construction of 2MW system. Sept.’16 – $1.1M Initial License Fee Payment from Dresser - Rand Dec’16 – Jan ‘17 Targeted First Commercial Installation - 2 systems at Pacific Ethanol - Ribbon - Cutting ceremony 06/16 – Sign “Manufacturing and Sales” License Agreement Business Model: Commercial Licensing Deployment Year 2017: Targeted full deployment of Dresser - Rand sales under license framework.

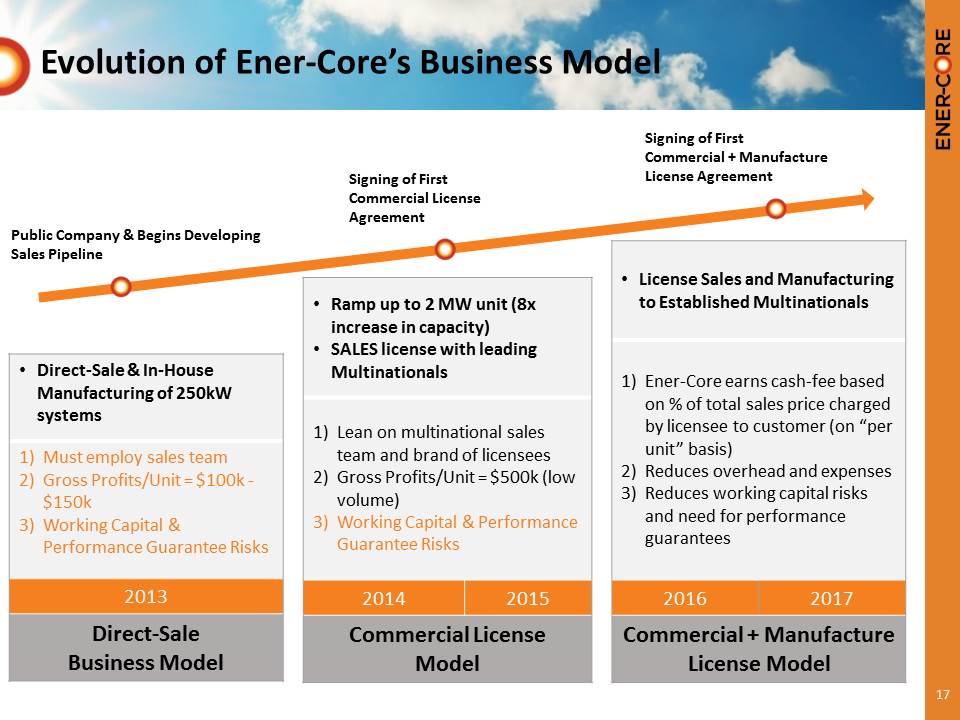

17 Evolution of Ener - Core’s Business Model Public Company & Begins Developing Sales Pipeline Signing of First Commercial License Agreement • Direct - Sale & In - House Manufacturing of 250kW systems 1) Must employ sales team 2) Gross Profits/Unit = $100k - $150k 3) Working Capital & Performance Guarantee Risks 2013 Direct - Sale Business Model • Ramp up to 2 MW unit (8x increase in capacity) • SALES license with leading Multinationals 1) Lean on multinational sales team and brand of licensees 2) Gross Profits/Unit = $500k (low volume) 3) Working Capital & Performance Guarantee Risks 2014 2015 Commercial License Model • License Sales and Manufacturing to Established Multinationals 1) Ener - Core earns cash - fee based on % of total sales price charged by licensee to customer (on “per unit” basis) 2) Reduces overhead and expenses 3) Reduces working capital risks and need for performance guarantees 2016 2017 Commercial + Manufacture License Model Signing of First Commercial + Manufacture License Agreement

18 5 to 10 MW 10+ MW Target Future Licensees Licensing Market Opportunity Target Future Steam Boiler Licensing Partners *Licensee to be Limited by Size* *Licensee to be Limited by Geography* 1 to 4 MW Current Licensee

19 First License Agreement June 30, 2016 – First commercial & manufacturing license agreement with Dresser - Rand business, part of Siemens Power and Gas Division Licensee will manufacture and sell the Power Oxidizers (integrated with their 2 MW KG2 gas turbine) directly to industrial customers Ener - Core collects a license fee payment of $400K - $600K per unit Dresser - Rand granted exclusivity within sizes ranging from 1 - 4 MW power capacity

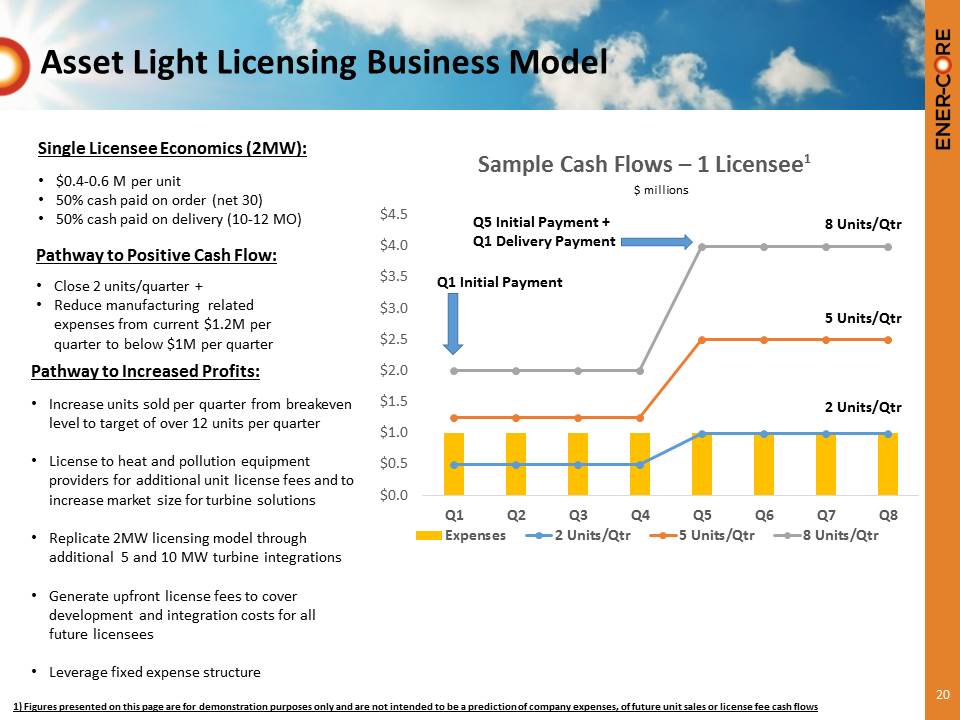

20 Asset Light Licensing Business Model Single Licensee Economics (2MW): • $0.4 - 0.6 M per unit • 50% cash paid on order (net 30) • 50% cash paid on delivery (10 - 12 MO) Pathway to Positive Cash Flow: • Close 2 units/quarter + • Reduce manufacturing related expenses from current $1.2M per quarter to below $1M per quarter 1) Figures presented on this page are for demonstration purposes only and are not intended to be a prediction of company expe nse s, of future unit sales or license fee cash flows Pathway to Increased Profits: • Increase units sold per quarter from breakeven level to target of over 12 units per quarter • License to heat and pollution equipment providers for additional unit license fees and to increase market size for turbine solutions • Replicate 2MW licensing model through additional 5 and 10 MW turbine integrations • Generate upfront license fees to cover development and integration costs for all future licensees • Leverage fixed expense structure $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 $4.5 Q1 Q2 Q3 Q4 Q5 Q6 Q7 Q8 Sample Cash Flows – 1 Licensee 1 Expenses 2 Units/Qtr 5 Units/Qtr 8 Units/Qtr Q1 Initial Payment Q5 Initial Payment + Q1 Delivery Payment $ millions 8 Units/Qtr 5 Units/Qtr 2 Units/Qtr

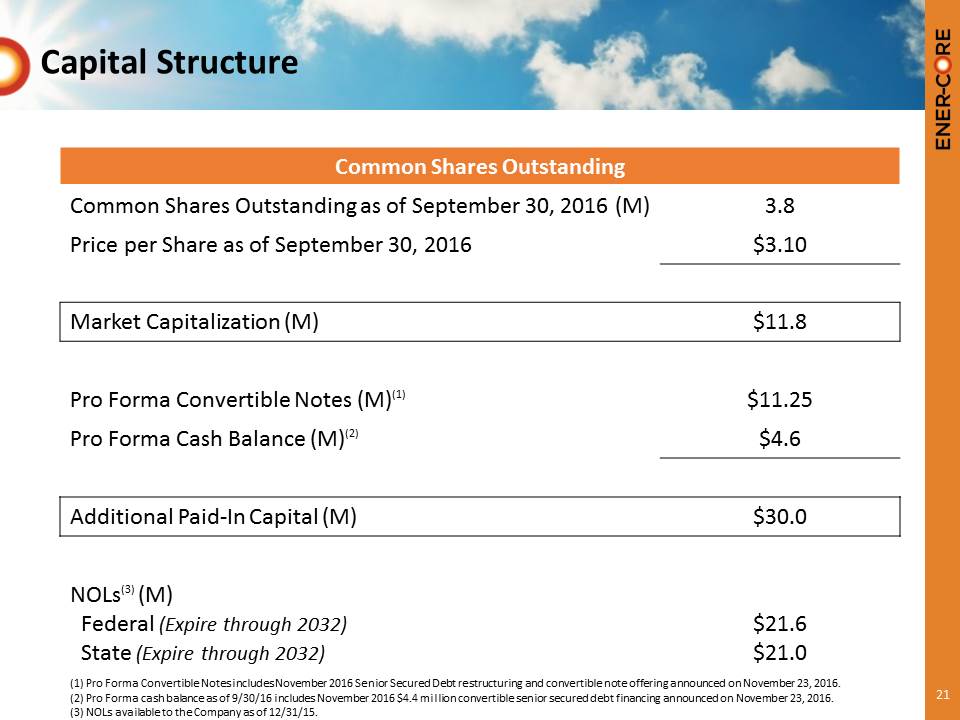

21 Capital Structure Common Shares Outstanding Common Shares Outstanding as of September 30, 2016 (M) 3.8 Price per Share as of September 30, 2016 $3.10 Market Capitalization (M) $11.8 Pro Forma Convertible Notes (M) (1) $11.25 Pro Forma Cash Balance (M) (2) $4.6 Additional Paid - In Capital (M) $30.0 NOLs (3) (M) Federal (Expire through 2032) State (Expire through 2032) $21.6 $21.0 (1) Pro Forma Convertible Notes includes November 2016 Senior Secured Debt restructuring and convertible note offering announ ced on November 23, 2016. (2) Pro Forma cash balance as of 9/30/16 includes November 2016 $4.4 million convertible senior secured debt financing announ ced on November 23, 2016. (3) NOLs available to the Company as of 12/31/15.

Proven Management Team With Combined 120 Years Experience in Power, Oil, Gas and Pollution Abatement Sectors

23 Alain Castro, Chief Executive Officer and Board Member • 23 years experience in energy sector • Previously, President of Akuo Energy Americas, which has developed and financed approx. € 1 Billion in renewable energy infrastructure projects • London Business School: Sloan Fellowship, Executive Masters Degree, Business and Management; University of Texas, B.S., Industrial and Mechanical Engineering Dr. Boris Maslov, President and Chief Technology Officer • Experienced energy technology company executive. Served as CEO of EnergyOne, CEO of Ecron Corp, EO of GlobalGate, as well as CTO of WaveCrest Labs • Moscow Institute of Physics and Technology: Ph.D., Electrical Engineering; B.S., M.S., Electrical Engineering and Computer Science Domonic J. Carney, Chief Financial Officer • Over 24 years of experience in high - growth environments including over eight years as the CFO for NYSE MKT and Nasdaq OTC public companies • Previous CFO of DeWind, a wind turbine manufacturing company • Dartmouth: Bachelors degrees in Economics; Northeastern University: Masters in Accounting Douglas Hamrin, VP Thermal Oxidizer Engineering • Over 20 years of experience in gas turbine solutions. Served as technical Manager, applications for Honeywell Turbo Technologies, the Director of Fuel Systems at Capstone Turbine Corporation, and Engineering at Generals Motors Powertrain Division • Massachusetts Institute of Technology: M.S., Mechanical Engineering; Illinois Institute of Technology, BS, Mechanical Engineering Mark Owen, Director of Sales • Over 30 years of experience in the commercialization, installation and operational servicing of various types of air pollution control and waste treatment systems within a long list of Fortune 500 companies worldwide • Recent projects include NGL processing, landfill leachate processing, and rail to barge crude oil transfer station Key Management

24 Michael Hammons, Chairman of the Board • Diverse domestic and international experience across multiple verticals such as telecommunications, energy, automotive, aeros pac e and defense, data storage, enterprise software, and electronic hardware. • Leadership positions including CEO at Vigilistics, CEO at Nexiant, CEO at ARGO Tracker, VP of Global Operations at Cogent Com mun ication, and Director of the South American Automotive Practice at Ernst & Young Consulting. Ian Copeland, Board Member • Previously, Partner and global Managing Director of Bechtel Enterprises and President of the firm’s Fossil Power, Communicati ons and Renewable Power businesses. • For more than 25 years developed, financed and managed privatization, independent power and infrastructure transactions and c omp anies in the Americas, the Caribbean, Asia, Australia, Europe and the Middle East. Jeffrey A. Horn, Board Member • 34 year career at Caterpillar, previously global Managing Director of Caterpillar Power Generation Systems, with senior management po si tions in Asia, Europe, South America and the U.S., with majority of focus being on the Power Generation and Mining markets. • Global responsibility for the design, sale, construction and operation & maintenance of power plants based on Caterpillar tec hno logy. Stephen Markscheid, Board Member • A partner at Wilton Partners, a Shanghai based boutique investment bank. He serves as non - executive director of CNinsure, Inc., Jinko Solar Inc., ChinaCast Education Corporation, and Asian Capital Holdings, Limited. Steve is also a trustee of Princeton - in - Asia. • From 1998 - 2006, Steve worked for GE Capital. During his time with GE, Steve led GE Capital’s business development activities in China and Asia Pacific, primarily acquisitions and direct investments. Prior to GE, Steve worked with the Boston Consulting Group. Bennet Tchaikovsky, Board Member • Served as a Chief Financial Officer for publically traded and privately held companies for the last 15 years including Skysta r B io - Pharmaceutical Company (NASDAQ: SKBI) and China Jo - Jo Drugstores Inc. (NASDAQ: CJJD). • Currently consults for publicly traded companies providing guidance as to reporting responsibilities, investor relations, and co st reduction strategies. The Hon. Dr. Stephen L. Johnson, Advisory Board Member • 11th Administrator, United States Environmental Protection Agency (2005 - 2009), where he controlled a $7.7 billion annual budget and managed over 17,000 employees. Worked at EPA from 1979 - 2009, and became the first career EPA employee to hold the position of Administra tor and the first scientist to head the Agency. Received the White House’s Presidential Rank Award, the highest award for civilian feder al employees. • Held a number of positions in laboratory and bio - technology companies, and was director of Hazelton Laboratories, now Covance. Board of Directors

25 Summary • Disruptive Technology — Power Oxidizer provides a competitive advantage for customers, by generating on - site power, lowering OPEX and eliminating emissions (air pollution) • Large Global Market — Growing $50 billion global industrial equipment market • First Global Licensee signed — Dresser - Rand, a division of Siemens, is the first global licensee of this technology; provides global sales force, validation, and product warranty • Licensing Model — High margin business that minimizes operating expenses and capital requirements, while accelerating global sales • Positioned for Financial Success — • All current and future turbine license agreements will require each licensee to achieve annual minimum sales that produce positive cash flows at current Ener - Core expense levels.

26 Contact Corporate Headquarters Ener - Core, Inc. 9400 Toledo Way Irvine, CA 92618 Office: (949) 616 - 3300 Investors Relations: ENCR@ener - core.com Investor Relations Chris Tyson Managing Director MZ North America Main: 949 - 491 - 8235 chris.tyson@mzgroup.us www.mzgroup.us www.ener - core.com OTCQB: ENCR