Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF SINGERLEWAK LLP, INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - Ener-Core, Inc. | f10k2016ex23i_enercoreinc.htm |

| EX-32.2 - CERTIFICATION - Ener-Core, Inc. | f10k2016ex32ii_enercoreinc.htm |

| EX-32.1 - CERTIFICATION - Ener-Core, Inc. | f10k2016ex32i_enercoreinc.htm |

| EX-31.2 - CERTIFICATION - Ener-Core, Inc. | f10k2016ex31ii_enercoreinc.htm |

| EX-31.1 - CERTIFICATION - Ener-Core, Inc. | f10k2016ex31i_enercoreinc.htm |

| EX-10.65 - FIRST AMENDMENT TO COMMERCIAL AND MANUFACTURING LICENSE AGREEMENT BETWEEN THE CO - Ener-Core, Inc. | f10k2016ex10lxv_enercoreinc.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to _______________

Commission File Number: 001-37642

| ENER-CORE, INC. |

| (Exact name of issuer as specified in its charter) |

| Delaware | 46-0525350 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification Number) | |

8965 Research Drive Irvine, California |

92618 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (949) 616-3300

Securities registered pursuant to Section 12(b) of the Act:

Securities registered pursuant to Section 12(g) of the Act:

| Common stock, $0.0001 par value |

| (Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every, Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

| Large Accelerated Filer | ☐ | Accelerated Filer | ☐ | |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of June 30, 2016, the aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was approximately $14.7 million, based on a closing price of $3.94 per share of common stock as reported on the OTCQB Marketplace on such date.

As of April 10, 2017, the registrant had 4,063,660 shares of common stock outstanding.

TABLE OF CONTENTS

TO ANNUAL REPORT ON FORM 10-K

FOR YEAR ENDED DECEMBER 31, 2016

Forward Looking Statements

This report contains forward-looking statements. All forward-looking statements are inherently uncertain as they are based on current expectations and assumptions concerning future events or future performance of the registrant. Readers are cautioned not to place undue reliance on these forward-looking statements, which are only predictions and speak only as of the date hereof. Forward-looking statements usually contain the words “estimate,” “anticipate,” “believe,” “expect,” or similar expressions, and are subject to numerous known and unknown risks and uncertainties. In evaluating such statements, prospective investors should carefully review various risks and uncertainties identified in this report, including the matters set forth under the captions “Risk Factors” and in the registrant’s other SEC filings. These risks and uncertainties could cause the registrant’s actual results to differ materially from those indicated in the forward-looking statements. The registrant undertakes no obligation to update or publicly announce revisions to any forward-looking statements to reflect future events or developments.

Although forward-looking statements in this report reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the heading “Risks Relating to Our Business” below, as well as those discussed elsewhere in this report. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. We file reports with the Securities and Exchange Commission, or the SEC. You can read and copy any materials we file with the SEC at the SEC’s Public Reference Room located at 100 F. Street, NE, Washington, D.C. 20549, on official business days during the hours of 10 a.m. to 3 p.m. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including the registrant.

We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this report, which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

| ITEM 1. | BUSINESS. |

Overview

We design, develop, license, manufacture and have commercially deployed products based on proprietary technologies that generate industrial levels of usable heat in a pressure vessel using a wide variety of organic gases as fuel for an oxidation reaction. Our technology allows for the use of gases that, historically, were unusable as fuels for traditional industrial gas to energy conversion systems, such as combustion chambers, and that typically required costly pollution abatement equipment in order for industries to reduce the pollutant gas emissions and therefore to comply with increasingly stringent air pollution standards. Our technology facilitates a high-temperature oxidation reaction for a variety of organic gases which in turn allows our pressure vessels to extract heat energy from organic gases, including many “waste” gases considered to be air pollution by many industries.

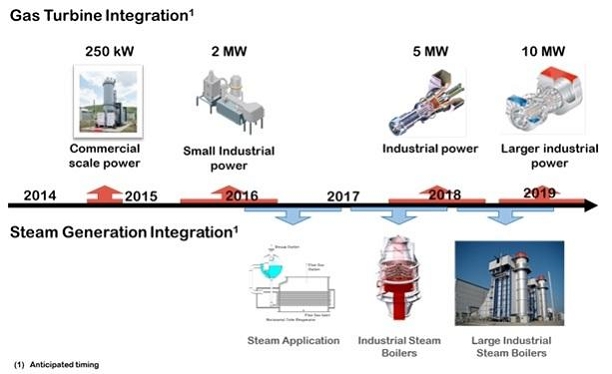

We refer to our technology as “Power Oxidation,” and refer to our products as “Power Oxidizers” or “Power Oxidation Vessels.” We develop applications for our technology by integrating our Power Oxidizers with traditional gas-fired industrial equipment (such as boilers, dryers, ovens, and chillers) that require steady and consistent heat sources. In our first deployed applications, our technology serves as a low-emissions alternative for combustion chambers used with gas-fired electric turbines. Our Power Oxidizers produce a steady heat source that can be used to (i) generate electricity by coupling our technology with a variety of modified gas turbines, (ii) produce steam by coupling our technology with a variety of modified steam boilers, or (iii) provide on-site heat at industrial facilities through heat exchanger applications.

Our proprietary and patented Power Oxidation technology is designed to create greater industrial efficiencies by providing the opportunity to convert low-quality organic waste gases generated from industrial processes into usable on-site energy, therefore decreasing both operating costs and significantly reducing environmentally harmful gaseous emissions. We design, develop, license, manufacture and market our Power Oxidizers, which, when bundled with an electricity generating turbine in the 250 kilowatt, or kW, and 2 megawatt, or MW, sizes, are called Powerstations. We currently partner and are pursuing partnerships with large established manufacturers to integrate our Power Oxidizer with their gas turbines, with the goal to open substantial new opportunities for our partners to market these modified gas turbines to industries for which traditional power generation technologies previously were not technically feasible. We currently manufacture our Powerstations in the 250 kW size and manufacture just the Power Oxidizer for the 2 MW size for the initial 2 units sold. Beginning in 2017, our 2 MW partner, Dresser-Rand a.s., a subsidiary of Dresser-Rand Group Inc., a Siemens company, or Dresser-Rand, will manufacture the 2 MW Power Oxidizers under a manufacturing license and will pay us a non-refundable license fee for each unit manufactured by Dresser-Rand.

Our Opportunity

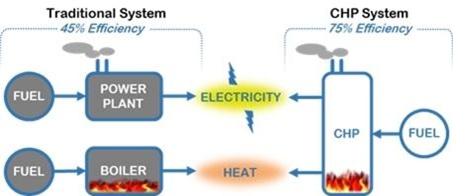

Our economic opportunity is an enhancement to the beneficial combination of combined heat and power equipment, or CHP. CHP is rapidly becoming the choice of new power equipment installations since it can provide a superior economic return, typically by combining electricity production generated by a natural gas turbine with the capture of the heat generated and used in industrial processes. Our CHP solutions provide this same economic advantage with the additional benefit of lower fuel costs through use of low-quality by product gases as fuels and with superior organic gas air pollution abatement.

The creation of organic gases is a by-product of many modern industries. Industrial by-product gases take many forms and are often subject to governmental or regulatory oversight via air quality or air standards boards. The rules and guidelines implemented by these boards lead to compliance costs for companies with industrial facilities that emit the waste gases. Our technology provides a cost-effective alternative to the typical economic and environmental costs of organic hydrocarbon pollution abatement by providing industrial facilities the option to generate power while simultaneously reducing the atmospheric pollution and avoid further pollution abatement costs.

| 1 |

Our Technology

Our technology involves the acceleration of a naturally occurring, gas oxidation process by injecting hydrocarbon gases into a pressure vessel under a controlled, high temperature, high pressure, and oxygen rich environment. Oxidation is a natural and commonly observed chemical change that occurs when a substance reacts with oxygen over a prolonged period of time. Under normal atmospheric conditions, oxidation is a slow reaction and is observed in nature as the rusting of metals or tarnishing of silver; however, oxidation also occurs during the decomposition of organic materials, including the decomposition of hydrocarbon gases into water, heat and carbon dioxide. Our research and development team has developed a process to accelerate the natural decomposition of hydrocarbon gases in a pressure vessel and, by doing so, accelerate the reduction of these waste gases to usable heat energy. The acceleration of the reaction allows our pressure vessels to provide for a low cost, low pollution, industrial heat source from waste gas streams, volatile organic compounds (such as paint thinners and solvents), or premium refined natural gas.

In nature, methane and other greenhouse gases react with oxygen in the air and are eventually decomposed through an oxidation reaction over a period of 10 to 20 years. The speed of the reaction is dependent on three primary variables: the temperature, the pressure of the gases, and the abundance of oxygen. The oxidation reaction is exothermic (i.e., generates heat as a natural output of the chemical reaction), but since the reaction occurs slowly in natural, ambient conditions, the heat generated by the reaction is dissipated and normally unnoticeable. Our Power Oxidizer accelerates the natural process by introducing a hydrocarbon-rich waste gas stream into a pressure vessel with a high concentration of air, under pressure, and at high temperature. The combination of these factors results in an oxidation reaction occurring in 0.5–1.25 seconds. By accelerating the reaction within the controlled, steady state environment of our Power Oxidizers, the heat generated from the reaction is compounded and provides a heat output within the heat profile ranges necessary to operate standard gas turbines and industrial equipment requiring heat, such as ovens, dryers, or chiller units. The process does not ignite the gaseous fuel, resulting in a much lower air pollution profile. The length (over 0.5 seconds) of resident time of the gases in our Power Oxidizers allows the reaction to not only extract thermal energy, but also serves as a highly efficient device to eliminate other air pollution that is increasingly regulated by air quality pollution regulations.

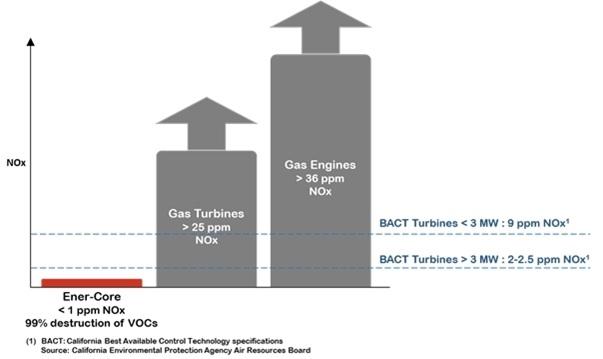

Traditionally, industrial heat is provided by the combustion of a hydrocarbon, which generates pollution such as nitrogen oxide (NO2, or NOX) as a by-product. NOX emissions are highly regulated and are often a significant barrier to industrial expansion by air pollution regulators in many of our target markets. By comparison, our Power Oxidizers provide sufficient and steady heat at temperatures lower than the temperatures at which NOX is generated in a combustion reaction. The combination of our ability to utilize a low quality or “waste” fuel with the elimination of NOX generation (as compared to combustion heat sources) makes our Power Oxidizers a superior alternative to traditional heat generation sources and provides a competitive advantage for our technology.

Further, our Power Oxidizers are designed to operate on gases with extremely low energy densities as compared to alternative chemical reactions, such as combustion, which typically require refined and high BTU concentration fuels. Our Power Oxidizers, by comparison, can operate on waste gases with extremely low BTU concentration of organic gases or, if required, on commercially available natural gas or other high quality hydrocarbon gas products. Our Power Oxidation technology, however, is not useful for combustion of exhaust gases emitted as the result of combustion reactions, such as carbon dioxide or carbon monoxide.

| 2 |

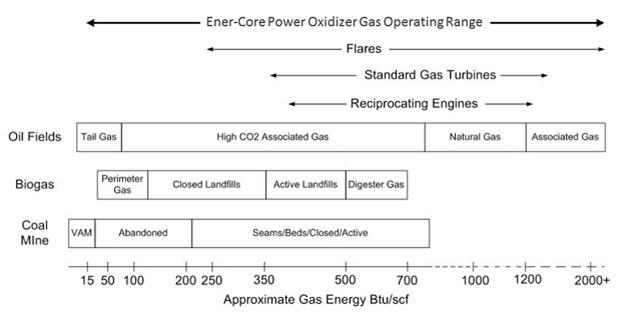

See Figure 1 below for the gas density operating range of our Power Oxidizers.

Figure 1

Our Products

Our first commercial product, or the EC Series, is the Ener-Core Powerstation EC250, or EC250, which consists of a combination of our Power Oxidizer and a 250 kW gas turbine. The gas turbine was initially developed by Ingersoll-Rand, plc, or Ingersoll-Rand, and subsequently enhanced by our predecessor, FlexEnergy, Inc., or FlexEnergy. The substitution of the Power Oxidizer for the combustor within a traditional turbine allows for the resulting, modified turbine to utilize low energy density waste gases as a fuel, in place of commercially purchased gases. The low energy density gases that the EC Series products can use as a fuel do not have an alternative commercial market as traditional combustion-based turbines require uncontaminated high energy fuels and thus cannot run on low energy density gases, and therefore such low energy density gases have no market value. In most of our targeted geographical markets, these low-quality gases would require pollution abatement equipment, often at considerable expense, to comply with air quality standards. Our products utilize the low quality gases as a fuel source and eliminate the gases to emissions level well below the current best practices pollution abatement alternatives.

Our second commercial product is currently sold under a contract manufacturing and commercial licensing agreement, or CMLA, to Dresser-Rand. In November 2014, we entered into a commercial license agreement, or CLA, with Dresser-Rand, pursuant to which we agreed to jointly develop a Powerstation that consisted of our Power Oxidizer integrated with a Dresser-Rand KG2 turbine rated up to 2 MW of power output. The resulting product is currently being marketed and sold by Dresser-Rand’s international teams under the Dresser-Rand brand and is called the KG2-3GEF/PO (or KG2 with Power Oxidizer, or KG2/PO). In June 2016, we executed the CMLA, which was intended to replace the CLA upon satisfaction of certain requirements. In April 2017, we amended the terms of the CMLA to make the CMLA effective as of January 1, 2017, at which time it superseded and replaced the CLA. The CLA required us to fulfill, sell and warranty any Power Oxidizers sold to Dresser-Rand. The first two systems sold to Dresser-Rand were shipped to a Stockton, California biorefinery site owned Pacific Ethanol, Inc., or Pacific Ethanol, in the fourth quarter of 2016. Any future 2MW systems are expected to be sold under the CMLA based on a per unit royalty payment payable to us and without a product warranty requirement by Ener-Core.

We believe our Power Oxidizers provide a significantly lower fuel cost per kilowatt hour since they can operate using both premium and refined natural gas, a wide variety of lower quality, low hydrocarbon gases, traditionally considered to be “waste” gases, as well as certain volatile organic compounds, or VOCs, such as paint solvents. These gases and compounds are typically seen as a waste by-product of industrial processes, which often represent a source of pollution and, in turn, require expensive waste abatement equipment and significant recurring operating costs. As such, our Power Oxidizers are designed to serve as an opportunity for our industrial customers to reduce their fuel costs.

| 3 |

We also believe our Power Oxidizers provide a superior air pollution waste abatement solution for industrial customers. Typically, industrial customers require electricity and steam for their operations and generate industrial gases as a by-product of their facility operations. Prior to the introduction of our Powerstations, these customers would purchase energy or produce energy using a traditional gas turbine, which uses a combustion chamber to ignite refined natural gas and generates air pollution in the form of carbon dioxide, carbon monoxide and nitrogen oxides. The gas turbine and by-product gases generally require pollution control equipment and recurring costs in order to comply with existing pollution standards, which vary by geography. Since both the natural gas fuel and the industrial by-product gases oxidize in our Power Oxidizers over a much longer time than combustion heat sources, the Power Oxidizer reduces both the gas fuels and by-products to levels below substantially all of the existing and proposed air quality emission standards in most areas of the world.

Competitive Advantages

As compared to alternative technologies, Power Oxidation provides certain advantages over alternative energy-generation technologies, including the following:

| ● | Operates on a wider range of fuels. Our system is designed to operate on gases with energy densities as low as 50 BTU/scf (1700 kJ/m3). By comparison, most turbine, engine, and fuel cell systems require fuel quality of significantly higher energy densities. |

| ● | Lower air emissions. Our Power Oxidizer technology produces substantially lower emissions of NOX and Carbon Monoxide (CO) (< 1ppm) than, and destroys up to 99% of VOCs compared to, combustion-based systems like gas engines or gas turbines or other commonly deployed pollution abatement systems. |

Figure 2

| ● | No chemicals or catalysts for pollution abatement or control. Today, most of the low-quality waste gases produced by industries are processed through pollution abatement technologies that do not generate energy from the gases and are solely in place to reduce the volume of emissions to the atmosphere. Unlike other pollution abatement systems, such as selective catalytic reduction, our Power Oxidizer does not use chemicals or catalysts and, thus, cannot be rendered inactive from catalyst poisoning or degradation. |

| ● | Requires less fuel conditioning. Our system is capable of running on fuels with high levels of contaminants and is designed to require substantially less fuel pre-treatment than competing systems. In most cases, our system is able to process the waste gases from industrial processes without any of the fuel pre-treatment processes that are typically required by combustion-based methods to remove impurities and contaminants prior to generating energy from gases. |

| 4 |

Our Power Oxidation technologies also have certain disadvantages over alternative energy-generation technologies, including the following:

| ● | New and unproven technology. Our Power Oxidation technologies have only been demonstrated commercially in a 250 kW product and our technology has only been commercially available since 2013. Although we have received a purchase order for two of our larger 2 MW Power Oxidizers, we currently have no commercial deployments of these larger units and have not demonstrated their full commercial viability outside of our test facility. |

| ● | Commercial viability. Our Power Oxidation products have had limited commercial installation and to date have been produced on a limited scale. |

Material Product Commercialization to Date

| ● | Initial Commercial Unit—250 kW Unit: In June 2014, our first commercial EC250 Powerstation was installed at a landfill in the Netherlands that is owned and operated by Attero, one of the leading waste management companies in the Netherlands. | |

| ● | First Licensing Agreement: On November 14, 2014, we entered into the CLA to develop and market Dresser-Rand’s KG2-3GEF 2 MW gas turbine coupled with our Power Oxidizer. The CLA and ongoing integration provides for a scale-up of our technology into the larger utility grade sized turbines requested by our customers. Under the CLA, Dresser-Rand agreed to pay an initial license fee of $1.6 million, which was initially placed in escrow, and to commercialize the technology through its sales and distribution channels. In July 2015, we successfully completed the first of two technical milestones, which enabled Dresser-Rand to begin commercialization of the KG2-3GEF/PO turbines. |

| ● | Initial Order—2 MW Unit into Distillery Market: On January 12, 2015, Pacific Ethanol publicly announced that it had placed an order with Dresser-Rand that included two KG2-3GEF/PO units. The order represents the first two commercial KG2/PO units that are designed to include our Power Oxidizer units. In August 2015, after the completion of the first technical test, we received a formal purchase order for $2.1 million for two Power Oxidizer units. We delivered the units associated with this initial order to the Stockton, California biorefinery site owned by Pacific Ethanol in October 2016 and installed the units in December 2016. Final commissioning has been delayed due to project changes outside of the scope of our deliverables under the larger project installation, although we expect final commissioning to occur in the first half of 2017. |

| ● | Additional 250 kW Commercial Units: In May 2015, the Orange County Board of Supervisors approved a project to install an EC250 Powerstation at the Santiago Canyon landfill in Orange County, California, and in August 2015, we received a purchase order for $900,000 for the EC250 Powerstation unit. The order represents an entry into a closed landfill opportunity that we believe has the potential for additional sales in the future. In 2016, it was determined that the Santiago Canyon landfill site did not have sufficient power infrastructure on site. Alternative locations for the EC250 Powerstation are currently being evaluated. | |

| ● | Completion of Full Scale Acceptance Test—2 MW Unit: Under the CLA, the second technical test is the full-scale acceptance test, or FSAT, which is required after achievement of the first technical milestone, the “Sub-Scale Acceptance Test,” which we successfully completed in August 2015. The FSAT consists of the building and installation of a full prototype of a working 2 MW KG2/PO unit at a site in Southern California, and then the testing of the prototype under different operating conditions for performance and life cycle validation. We completed construction of the 2 MW Power Oxidizer in 2016 and began the field testing of the 2 MW unit in the first half of 2016. In September 2016, after initial testing results were received, the $1.6 million license fee payment from Dresser-Rand was released from escrow, from which we received $1.1 million in cash, representing the $1.6 million license fee net of $500,000 paid to Dresser-Rand for engineering services. We substantially completed field testing in the fourth quarter of 2016. In April 2017, we amended the CMLA to acknowledge completion of a substantial portion of the field tests and identified additional field tests to be conducted on the initial units currently being commissioned. These additional field tests must be conducted at an industrial facility with industrial waste gases and we expect to complete these additional tests in the second quarter of 2017. |

| 5 |

| ● | Fulfillment and Delivery of Existing Customer Order Backlog of Approximately $4.6 Million: As of March 12, 2017, and prior to recognition of revenues associated with these orders, we had a backlog of approximately $3.0 million for our Power Oxidizers and approximately $1.6 million of Dresser-Rand license fees. During 2016, we (i) assembled, shipped and installed the first two Power Oxidizers for the two KG2/PO units sold by Dresser-Rand to Pacific Ethanol and (ii) received the $1.6 million license fee payment from Dresser-Rand that was previously paid into escrow, less $500,000 paid to Dresser-Rand for engineering services. We are currently evaluating the revenue recognition on these orders in conjunction with the FSAT testing process described above. We expect to complete the commissioning for the Pacific Ethanol units in the first half of 2017. Additionally, while we received payments on the EC250 Powerstation unit for which we received a purchase order in August 2015, delivery of this unit (originally sourced to deliver at the Santiago Canyon landfill location) has been delayed pending a change of the delivery location by the customer. We expect the unit to be installed at an alternative site in 2017. |

Over the next year, we expect to continue our product commercialization efforts with the following deliverables and projects:

| ● | Commercialization of EC250 Powerstations and Additional KG2 Power Oxidizers: We have a pipeline of additional opportunities through Dresser-Rand for KG2/PO units and directly sold units for our EC250 Powerstations. We expect to receive additional purchase orders for these products in 2017. | |

| ● | New Partnerships for Additional Electric Turbine and Industrial Heat Application Manufacturers: We are in preliminary discussions with additional electric turbine partners, including a 5 MW Power Oxidizer partner and numerous industrial dryer, chiller, oven and boiler manufacturers that are interested in our 250 kW and 2 MW Power Oxidizers for use as heat sources for CHP applications. We anticipate signing definitive agreements with one or more of these partners in 2017 for initial deliveries beginning in 2018. | |

| ● | New Partnerships for Additional Fuel Stock Sources: We are in preliminary discussions with providers of equipment such as anaerobic digesters and rotary concentrators of exhaust fumes. We believe this equipment, once integrated with our Power Oxidizers, will expand our potential waste fuel sources to include bio-mass disposal and VOCs, such as paint fumes and solvents. We believe that our products and technology will allow end customers to reduce or eliminate pollution abatement expenses for these additional waste fuels, while also converting those waste fuels into useful energy, which we expect will provide these customers with a superior return and drive more rapid adoption of our products and technology. |

Commercial Sales Efforts

We are entering the CHP market, which is highly competitive and historically conservative in its acceptance of new technologies. To date, we have sold and delivered one 250 kW commercial Powerstation unit to the Netherlands and have sold one additional 250 kW Powerstation unit to a landfill site in Southern California, which is scheduled for delivery in 2017. We have also sold two 2 MW Power Oxidizers to Dresser-Rand, which were delivered to a Stockton, California biorefinery site owned by Pacific Ethanol in October 2016 and installed in December 2016, but which remain subject to final acceptance conditions that were not met as of December 31, 2016. These three systems, combined with the Dresser-Rand license fees of $1.6 million, represent our $4.6 million order backlog as of April 13, 2017. To date, we have billed $4.2 million and collected $4.1 million of our existing backlog.

In May 2016, we received a conditional purchase order for four 250 kW Powerstations expected to be installed on a landfill site in Southern California and scheduled for delivery in late 2017. This order is valued at approximately $4.0 million and is subject to additional pre-sales engineering and permitting requirements.

In April 2017, we executed an amendment to the CMLA with Dresser-Rand, pursuant to which Dresser-Rand agreed to pay us $1.2 million in April 2017. This payment represents an advance payment on future license fees for KG2/PO units to be sold under the CMLA. We have not, as yet, received a purchase order for any system subject to this license fee advance. As such, we do not consider the $1.2 million advance to be backlog as of April 13, 2017.

| 6 |

Licensing Approach

On November 14, 2014, we entered into the CLA with Dresser-Rand through our wholly-owned subsidiary, Ener-Core Power, Inc., which granted Dresser-Rand the right to market and sell the Dresser-Rand KG2-3GEF 2 MW gas turbine coupled with our Power Oxidizer, or a Combined System. The CLA grants Dresser-Rand exclusive rights to commercialize our Power Oxidizer, within the 1–4 MW range of power capacity, bundled with the Dresser-Rand KG2 gas-turbine product line. As part of the CLA, Dresser-Rand agreed to pay us a $1.6 million initial license fee, under the condition that we were able to successfully scale up the technology to a size of 2 MW. Dresser-Rand also agreed to achieve annual sales thresholds agreed to by both companies in order to retain the exclusivity of the commercial license. Upon payment of the initial license fee in full, Dresser-Rand obtained an exclusive license to sell our Power Oxidizer within the 1–4 MW range of power capacity, bundled with a gas-turbine to generate electricity.

On June 29, 2016, we entered into the CMLA with Dresser-Rand through Ener-Core Power, Inc., which both companies intended would supersede and replace the CLA. In April 2017, we amended the terms of the CMLA to make the CMLA effective as of January 1, 2017, at which time it superseded and replaced the CLA.

Under the CMLA, as amended, Dresser-Rand has a worldwide license to manufacture, market, commercialize and sell the Power Oxidizer as part of the Combined System within the 1 MW to 4 MW range of power capacity, or the License. Initially, the License will be exclusive, even as to us, and will remain exclusive for so long as Dresser-Rand sells a minimum of number of units of the Combined System, constituting the “Sales Threshold,” over a predetermined Sales Threshold time period. The initial Sales Threshold shall begin on the earlier of the “Initial System Completion Date” or July 15, 2017 and shall be fifteen months long. The Initial System Completion Date is the date at which the final operational field test is accepted by D-R and is expected in the second quarter of 2017. Each subsequent Sales Threshold time period shall be one year in length thereafter. If Dresser-Rand does not meet the Sales Threshold in any Sales Threshold time period, and the Sales Threshold is not otherwise waived, Dresser-Rand may maintain exclusivity of the License by making a true-up payment to us for each unit that is in deficit of the Sales Threshold, or a True-Up Payment; provided, however, that Dresser-Rand may not maintain an exclusive License by making a True-Up Payment for more than two consecutive Sales Threshold time period. In the event Dresser-Rand does not meet the Sales Threshold, does not qualify for a waiver and elects not to make the True-Up Payment, the License will convert to a nonexclusive License.

Upon a sale by Dresser-Rand of a Combined System unit to a customer, before any discounts, the CMLA requires Dresser-Rand to make a license fee payment to us equal to a percentage of the sales price of the Combined System purchased, in accordance with a predetermined fee schedule that is anticipated to result in a payment of between $370,000 and $650,000 per Combined System unit sold, or the License Fee. Payment terms to us from Dresser-Rand will be 50% of each License Fee within 30 days of order and 50% upon the earlier of the Combined System commissioning or twelve months after the order date.

In April 2017, we executed an amendment to the CMLA with Dresser-Rand, pursuant to which Dresser-Rand agreed to pay us $1.2 million in April 2017 in cash, which represents advance payments on license fees for KG2/PO units representing less than the required minimum number of licenses which would otherwise be required to maintain their exclusivity under the CMLA, as amended. In exchange for this payment, we have agreed to provide a total credit of $1,760,000 against future license payments associated for these KG2/PO units, consisting of a payment credit of $1,200,000 and an additional discount of $560,000.

Dresser-Rand may also request that we undertake design and development work on modifications to the Combined Systems, each referred to as a Bespoke Development. We and Dresser-Rand will negotiate any fees resulting from any such Bespoke Development on a case-by-case basis. Further, any obligation by us to undertake such Bespoke Development will be conditioned upon the execution of mutually agreed-upon documentation.

As long as the exclusive License remains in effect, we will provide certain ongoing sales and marketing support services, at no additional cost to Dresser-Rand, subject to certain restrictions. Any additional sales and marketing services agreed upon by us and Dresser-Rand will be compensated at an hourly rate to be upwardly adjusted annually.

Under the CLA, we were required to maintain our existing backstop security, or the Backstop Security, in favor of Dresser-Rand in support of all products manufactured, supplied or otherwise provided by us during the period beginning on the execution date of the CMLA, or the Execution Date, and continuing through the expiration of the warranty period for the Combined System units sold to customers as of the Execution Date. Concurrent with the execution of the amendment to the CMLA in April 2017, we and Dresser-Rand modified the Backstop Security requirement. As modified, we are required to maintain a $500,000 Backstop Security, reduced from $2.1 million, and the Backstop Security was extended from June 2017 to March 31, 2018.

| 7 |

Dresser-Rand must also: (i) develop the controls strategy for the Dresser-Rand gas turbine control system and integrate it with the Power Oxidizer control system; (ii) with support from us, manufacture and commercialize the Combined System; (iii) with support from us, develop and prioritize sales opportunities for the Combined System; (iv) assume the sales lead role with respect to each customer; and (v) take commercial lead in developing sales to customers. In addition, Dresser-Rand will be primarily responsible for overall warranty and other commercial conditions to Combined System customers, as well as sole project and service provider and interface with customers. Dresser-Rand will also be responsible for warranty, service and after-sales technical assistance for all portions of Combined Systems that comprise Dresser-Rand products. We, however, will be responsible for warranty and service for all products manufactured or otherwise provided by us prior to the execution of the Commercial and Manufacturing License Agreement.

The CMLA prohibits us from, without the prior written consent of Dresser-Rand, permitting the creation of any encumbrance, lien or pledge of its intellectual property which would result in any modification to, revocation of, impairment of or other adverse effect on Dresser-Rand’s rights with respect to the exclusive License. In addition, all intellectual property rights that are owned by either us or Dresser-Rand as of the Execution Date will remain the sole property of such party, subject to the licenses described in the CMLA. The CMLA also contains provisions that govern the treatment of process and technology developments and any joint inventions that (i) relate to the subject matter of the CMLA and (ii) occur after the Execution Date and during the term thereof.

The CMLA also contains certain restrictions on publicity and obligates Dresser-Rand to use its commercially reasonable efforts to include our name and logo and otherwise promote our brand and Power Oxidizers in a mutually agreed-upon manner. We and Dresser-Rand have also mutually agreed to withhold disclosure of certain commercial and technologically sensitive terms of the CMLA including technical specifications, License Fee percentages, and the Sales Threshold minimum annual quantities to maintain exclusivity.

Markets

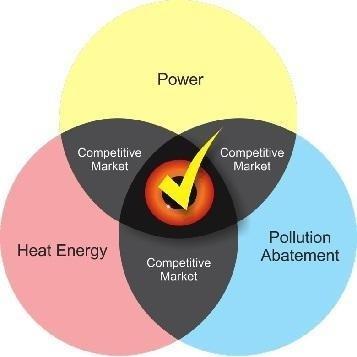

We see our total potential market consisting of industrial facilities with permanent waste gas emissions sufficient to operate our units on a constant basis. We evaluate our potential markets in two methods, geographically and vertically. Our most significant sales opportunities are those where a customer’s demand for power, heat energy, and pollution abatement intersect as presented in Figure 3 below (opportunities not to scale).

Figure 3

| 8 |

We believe the total addressable U.S. market size is at least $5 billion for our Power Oxidizer technology, based on our assumption that our 250 kW Power Oxidizer is most appropriate for landfills and our 2 MW Power Oxidizer is most appropriate for our other targeted markets. We also believe the total addressable market size in Europe, Japan and China provides us with potentially meaningful opportunities.

Geographic Target Markets

We initially identified our geographic target markets to consist of North America, Europe, Japan and China, with selective evaluations of other regions on a case-by-case basis. While we intend to focus primarily on the North American and European geographic markets over the next year, we expect and intend to evaluate commercial opportunities in other geographic markets.

In the United States, we are focused on opportunities where our low-quality fuels configuration and our ultra-low emissions configuration provide competitive advantages. We are also focused on specific states where the wholesale electricity prices are the highest, as this typically results in the most attractive return on investment scenarios for prospective customers. These states include California, New Jersey, New York, Maine, New Hampshire, Massachusetts, Connecticut, Rhode Island and Vermont.

Internationally, we have identified similar opportunities in Canada and western European countries with similar environmental and regulatory laws as the United States, such as the Netherlands, Belgium, the United Kingdom, Germany, Italy, France and Spain.

Vertical Markets

We believe that our current products provide a superior value proposition for two customer types: (i) open and closed existing landfills and (ii) industrial facilities that could benefit from on-site CHP generation coupled with waste gas pollution abatement, or collectively CHP+A. We also believe that larger sized Power Oxidizer turbines of 5 MW and above, once developed, will likely be met with demand from large industrial facilities such as oil and gas refineries and petrochemical plants. We also see the integration of third party equipment utilizing heat (boilers, chillers, ovens and dryers) and equipment providing additional fuel sources (digesters and rotary concentrators) as central to our strategy to provide superior CHP+A customer solutions.

Landfills

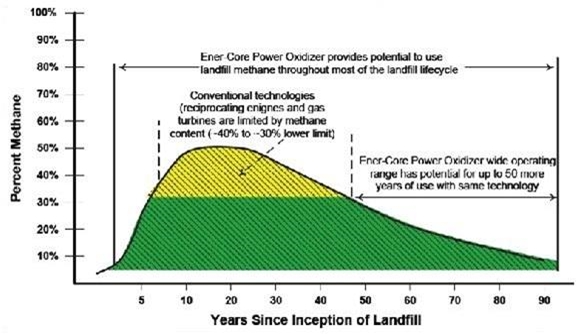

When solid waste is deposited in landfills, the organic materials within the waste decompose slowly over time, resulting in the generation and emissions of methane-based waste gases. Historically, the quality of gases that has been emitted by landfills during their open phase (i.e., while trash is still being added) has been high enough for the generation of power through the installation and operation of reciprocating engines. However, the increasing prevalence of recycling and the diversion of organic materials are resulting in a reduction in the quality of the gas that is emitted from newer landfills. In addition, as landfills reach their maximum allowable size, they are eventually closed and deemed inactive. Once a landfill becomes inactive, and trash is no longer being added, the quality of the emitted gas typically falls to levels that are well below the quality thresholds (~30% methane) that are required as an inlet fuel for combustion-based power generating equipment such as reciprocating engines or standard gas turbines. For this reason, the viable power generation phase of a landfill’s life-cycle is typically limited to the years of operation when the landfill is active, and then for a few years after the landfill is closed. However, even after a landfill is closed, methane gas continues to be emitted for an additional 50 to 70 years, just at lower concentration levels than required to run combustion-based power generating equipment.

Our technology enables operators of existing landfill projects that utilize reciprocating engines and gas turbines for the collection and disposal of landfill-generated gases, or LFGs, to generate electricity beyond the normal operating range of their engines and turbines. In newer landfills that begin their life with less organic material, and therefore produce less methane, our technology also enables the generation of electricity where it might have been otherwise uneconomic to do so. Closed (inactive) landfills continue to emit waste gases for 50 to 70 years after the closure of the landfill, but the predictable reduction in gas quality makes it difficult (and in most cases, impossible) to generate energy from the waste gases, unless the waste gases are supplemented/enriched with a premium fuel such as natural gas or propane in order to raise their energy density. In either case, our low-quality fuel capability allows a greater percentage of the LFGs created from landfill-waste to be used for local electricity generation, as can be seen in Figure 4.

| 9 |

Figure 4

Typical gas emissions profile of a landfill throughout its entire life-cycle. The entire shaded area (yellow and green) represents our Power Oxidizer’s operational range to use methane at varying percentage levels. The yellow area represents the operational range of traditional combustion based turbines relating to landfill gas.

Utilizing the market data that is available through the U.S. Environmental Protection Agency’s, or EPA, Landfill Methane Outreach Program, or LMOP, a voluntary assistance program that helps to reduce methane emissions from landfills by encouraging the recovery and beneficial use of landfill gas as a renewable energy source, we have been able to compile the data shown in Figure 5 regarding the age of the current closed landfills in California.

Figure 5

Closed California landfills as of March 2015, based on data provided by Landfill Methane Outreach Program (LMOP) available at www.epa.gov/lmop/.

| 10 |

Pollution abatement technologies (thermal oxidizers) appear to be one of the few alternative technologies for these older landfill sites once the hydrocarbon density in the LFG drops below the thresholds required by engines or other combustion technologies. Thermal oxidizers eliminate or treat waste gases but do not generate power. Closed landfills represent a large opportunity for us. We enable these older landfills to solve the pollution abatement problem and allows these sites to continue generating power (and hence revenue) from the LFG for several decades after traditional power generation technologies (reciprocating engines and gas turbines) are no longer able to operate due to the decrease in the quality of the gases.

Industrial Target Markets (excluding landfills)

Most industrial processes use heat energy in the form of heat, steam, or electricity for their operation. Many of these processes also generate by-product waste gases with many embedded contaminants and impurities that are then either vented directly into the atmosphere or put through a pollution abatement or treatment process prior to release into the atmosphere. For industries in which pollution abatement is mandated by applicable air pollution regulations, the facility typically purchases abatement equipment (scrubbers, thermal abatement, carbon absorber, etc.) separately from power production equipment, and such equipment destroys the waste gases, but does not utilize or monetize them. Our Power Oxidizers provide both functions in one unit and typically use waste gases as a partial or complete replacement of purchased commercial-grade gases. In applications where the waste gases have extremely low usable hydrocarbon content (or relatively low volumes of waste gases), significant values may still exist resulting from the coupling of power generation and pollution abatement that the Power Oxidizer provides (i.e., our CHP+A solution).

Figure 6

We reviewed the industries in which we believe the combination of pollution abatement requirements, power consumption requirements, and the generation of waste gases provides the potential for superior economic returns with our products. Using these key attributes, we have identified twelve targeted vertical markets, aside from landfill opportunities, in California that we believe may result in sales. According to the EPA, these twelve markets represent in excess of 1,100 facilities in California and over 8,000 facilities in the United States that we believe have the combination of attributes that may indicate a superior economic return from installation of a Power Oxidizer.

In addition to landfill opportunities, we intend to first pursue the following five general vertical industrial markets, representing thousands of potential installation sites across the US, as we believe they are the most likely to benefit from the Power Oxidizer in its current sizes. We are marketing to these five vertical industrial markets, primarily for those facilities located in California, through direct contact from our sales department, tradeshow representation, and internet outreach and through Dresser-Rand’s sales and marketing efforts. Each is discussed in greater detail below:

| ● | Fuel-grade ethanol and beverage ethanol/alcohol distilleries and related products production (>500 facilities throughout the U.S.) | |

| ● | Rendering and animal processing by-products (>600 facilities) | |

| ● | Wastewater and sewage treatment (>3,500 facilities) | |

| ● | “High tech” aerospace and defense instruments and materials; semiconductor and electronics manufacturing (>2,200 facilities) | |

| ● | Petroleum and petrochemical storage, distillation and petroleum production (>600 facilities) |

| 11 |

As we continue to increase our pipeline of commercial opportunities with industrial facilities spanning across these vertical industrial markets, we expect the majority of the opportunities to be in relation to the 2 MW KG2/PO systems, with the exception of rendering opportunities, where we expect demand for both EC250 units and KG2/PO units.

Fuel-grade and beverage ethanol/alcohol distilleries and related products production (NAICS Code 325193)

Ethanol or beverage alcohol production represents over 500 facilities across the United States, including Pacific Ethanol’s fuel grade ethanol plant in Stockton, California that purchased the first two KG2/PO units from Dresser-Rand. Both fuel grade and beverage alcohol distilleries use electricity and steam and produce a steady stream of waste hydrocarbons that can be used with our Power Oxidizer to reduce the amount of natural gas that is purchased as a fuel source, as well as reduce the amount of electricity purchased to run the industrial plants. Although the details of Pacific Ethanol’s breakdown of savings are confidential, we believe that Pacific Ethanol selected our Power Oxidizer solution based on an economic return that consisted of the avoidance of power purchases and improved pollution abatement. In this regard, Pacific Ethanol has publicly stated that it expects to achieve annual savings of $3–$4 million per year after the on-site combined heat and power plant becomes operational.

Rendering and animal processing by-products (NAICS Codes 311111 and 311613)

Meat rendering plants process animal by-product materials for the production of tallow, grease and high-protein meat and bone meal used primarily in pet food. Rendering operations produce VOCs as air pollutants. Although some greenhouse gases are produced, the primary issues related to the emissions of VOCs is the foul odor nuisance when these facilities are in proximity to residential areas.

Typically, the emissions control technologies that are used for rendering plants are waste heat boilers (incinerators) and multi-stage wet scrubbers. Boiler incinerators are a common technology because boilers can be used not only as odor control devices, but also to generate steam for cooking and drying operations. The waste heat boilers convert the waste gases to steam by combusting the waste gases, but this process often faces resistance from air quality authorities. Multi-stage wet scrubbers are equally as effective as incineration for high intensity odor control, but they only serve to destroy the waste gas and do not actually convert it into useful energy.

We believe our Power Oxidizers provide a superior abatement function as compared to such emission control technologies, as our products also provide power generation. We believe that the combination of the abatement function and power generation results in a superior economic alternative for many rendering plants, to which we have actively begun to market our Powerstations.

Wastewater and sewage treatment facilities, anaerobic digestion (NAICS Codes 221310 and 221320)

Wastewater and sewage treatment facilities use anaerobic digester units to treat raw sewage with both methane gas generation and water intensive bio-solids by-products. Typically, the methane gas is eliminated by a thermal oxidizer and the bio-solids are either dried on-site with an industrial dryer or, in certain cases, the water heavy bio-solids are transported to another facility, often long distances from the treatment facility, which results in significant tipping fees and transportation costs to the facility, which is often a municipality.

| 12 |

We believe our Power Oxidizers, coupled with an anaerobic digester, a turbine, and using residual heat for an industrial dryer represents a significant positive economic solution by utilizing the waste methane to generate electricity and heat, allows for on-site drying with significantly lower emissions compared to a combustion dryer, and eliminates costly trucking and tipping fees for bio-solids that otherwise would have to transport these heavy waste products. We see significant sales opportunities for our solutions in nearly all of the larger metropolitan areas in California and other US locations.

Aerospace and defense instruments and materials manufacturing (NAICS Code 334511) and semiconductor and electronics manufacturing (NAICS Codes 334416, 334412 and 334417)

Manufacturers in the aerospace and defense instruments and materials industry and the semiconductor and electronics industry represent in excess of 2,200 facilities in the U.S., including nearly 600 in California. Many of these high tech manufacturers are well-capitalized and often represent industries with an increased focus on being “carbon neutral” or “green friendly.” The underlying economics are similar to the CHP+A economics of ethanol production, as described above, namely the extraction of heat energy from hydrocarbon by-product gases, the elimination of other waste gases and the avoidance of other abatement costs. To date, we have not had commercial success in the high-tech manufacturing market, but we have begun to market the solution to these manufacturers, with positive reception from some of the manufacturers with whom we have held discussions.

Petroleum gas and related petrochemical production (NAICS Code 32511)

There has been a strong, worldwide trend toward the reduction of venting, flaring, and waste of associated petroleum gas, also known as flared gas, due to concerns about its contribution to global warming. Associated petroleum gas is a form of natural gas that is commonly found within deposits of petroleum and is produced as an undesirable by-product during the extraction of the petroleum. Our technology not only destroys the harmful pollutants that reside within the associated petroleum gas, but it can also be installed to produce on-site electricity and/or steam, creating significant cost savings for oil and gas producers. We see multiple opportunities in the petroleum market sector, primarily in locations where low quality gas is permanently flared as unusable, such as tank farms, or in locations using industrial steam to produce and distill petroleum related products.

In September 2014, at the request of a major Canadian integrated oil company, in the first phase of a three phase commercial rollout, we successfully demonstrated the ability of our full-scale EC250 to operate on an ultra-low energy density fuel (~50 BTU/scf) similar in composition to the associated petroleum gases flared by many oil drilling sites around the world. The exhaust emissions and energy production were measured and independently verified by UCI’s combustion laboratory, and the oil company that retained us to perform the test deemed the demonstration to be successful enough to move to the next phase of its proposed commercial rollout. The customer has delayed the second phase due to internal budgetary requirements but remains interested in future commercial deployment. If the oil company deems the second phase of the rollout to be satisfactory, the oil company’s technology development team has indicated to us that there would be sufficient environmental and cost-savings advantages associated with our technology such that a large-scale, multi-year series of commercial installations at multiple sites in Canada would likely receive support from the oil company’s senior management.

| 13 |

Other vertical markets

We are in the early stages of evaluating opportunities in the following industries. We have begun initial marketing efforts to these seven markets for selected project opportunities:

| ● | Biological product (pharmaceutical) manufacturing (>400 facilities) |

| ● | Asphalt paving mixture and block manufacturing (>500 facilities) |

| ● | Nitrogenous fertilizer manufacturing (>400 facilities) |

| ● | Foam product manufacturing (>200 facilities) |

| ● | Paper mills (>400 facilities) |

| ● | Commercial printing (>2200 facilities) |

| ● | Commercial coatings and finishing (>50,000 facilities) |

For many of these opportunities, additional evaluation is required and our value proposition needs to be tailored to the market or industry where the opportunity is classified to ensure that the specific facility could be a qualified candidate for our current product line. For example, while there are over 50,000 commercial coating and finishing facilities, these facilities range in size from small facilities like local painting shops that generate VOCs in very small volumes to large facilities like auto assembly plants with multiple coating and painting facilities, each of which generates a significant amount of VOCs and represents a greater commercial opportunity.

Competition

The target markets for the Power Oxidizer are highly developed and mature for solutions using combustion as a heat source but are new and fairly undeveloped for applications of our Power Oxidizer technologies. If a site already has a high quality waste gas with high enough energy density to generate power with this standard combustion-based equipment, and the resulting emissions levels do not exceed regulatory limits, then we deem such site to be outside of our target market.

Our technology represents a value-added pre-process for power generation equipment such as gas turbines, reciprocating engines or steam generation equipment such as steam boilers. We do not consider ourselves competitors with the providers of this equipment but rather consider ourselves as complementary to such providers.

We compete with existing co-generation solutions and other power generation solutions for our current and future customers. Those existing solutions typically have more mature technology and a lower equipment cost than our Power Oxidizer units. Our Power Oxidizers typically are more expensive per kilowatt of power capacity when compared to the initial cost of equipment, and competing products typically have lower upfront costs than our Power Oxidizers. However, we believe that, in many situations, once the total cost of a co-generation project, including fuel costs and the value of pollution abatement, is quantified, our Power Oxidizers provide a superior rate of return for our customers. Our Power Oxidizers often cost less than purchasing separately combustion-based CHP+A equipment.

| 14 |

We believe that there are very few, if any, companies that are actively pursuing the commercial utilization of oxidation technologies for generation of on-site energy, particularly in light of the technology patents we hold. In addition to our efforts to replace existing combustion technologies, we compete against other companies in two sectors, each with its distinct competitive landscape:

| ● | Low-quality fuels—Within applications where the gas source has an energy density (BTU/ft3) below the minimum level required by reciprocating engines and standard gas turbines, we believe that our Power Oxidizer does not have a direct technological or manufacturing competitor. In these situations, the prospective customer can elect to do nothing and allow low BTU gas to simply be emitted into the atmosphere, often at considerable expense for pollution abatement equipment and ongoing operating costs. Alternatively, the customer can purchase gas such as propane or natural gas, mix it with the low BTU gas to make combustion feasible, and then flare the mixture. Because this alternative results in the destruction of the low BTU gas instead of converting the gas into a form of energy that could be sold or monetized, we do not consider it to be a direct form of competition. |

| ● | Ultra-low emissions—Within applications where a customer is required to meet emissions regulations and controls limits, typically by national, regional or local legislation, our systems compete with pollution control technologies, such as Selective Catalytic Reduction, Dry-Low-NOx, or Dry-Low-Emissions systems, and in some cases, with low-emission flares and thermal oxidizers. As many of our competitors are large, well-established companies, they derive advantages from production economies of scale, worldwide presence, and greater resources, which they can devote to product development or promotion. |

Although we are occasionally compared to wind and solar power production, we do not consider existing renewable energy solutions to be direct competitors. Existing renewable sources such as wind and solar are economically feasible in particular geographic locations, whereas our solution is applicable to any area with a sufficient quantity of low quality gases. We expect our Power Oxidizers to be able to provide base-load power for more than 95% of the time, while wind and solar solutions typically provide intermittent power and can only provide power for 20–40% of the time. As a result, although the capital cost per kilowatt is similar, the availability of the Power Oxidizer provides a significantly lower overall cost of power produced.

Research and Development

Our engineering team is comprised of a group of experienced mechanical, electrical and chemical engineers who have worked together on the Power Oxidizer for the last eight years. Our engineers have worked in a number of larger firms, including Honeywell International, Inc., General Motors Company, Inc., AlliedSignal, Inc., Capstone Turbine Corporation, General Electric Company, and Underwriters Laboratories Inc. Combined, they have decades of experience developing and commercializing a number of gas turbines, reciprocating engines, and related products.

Since 2011, our research and development milestones include:

| ● | In November 2011, SRI commissioned the first EC250 field test unit at the U.S. Army base at Fort Benning, Georgia. The project was funded by the U.S. Department of Defense, or DoD, Environmental Security Technology Certification Program, or ESTCP, which seeks innovative and cost-effective technologies to address high-priority environmental and energy requirements for the DoD. As part of the ESTCP protocol, SRI conducted independent verification tests in October 2012. Exhaust emission measurements were taken in accordance with standard EPA reference methods. The EC250 emissions were far below the allowable NOx limits of the California Air Resources Board 2013 waste gas standards, which are considered to be among the strictest standards in the world. |

| ● | In June 2014, our first commercial EC250 Powerstation was installed at a landfill in the Netherlands that is owned and operated by Attero, one of the leading waste management companies in the Netherlands. |

| ● | In July 2015, we completed the installation of our self-constructed Multi-Fuel Test Facility, or MFTF, located next to our corporate offices in Irvine, California. The MFTF will become a critical element to our ongoing development initiatives, enabling our engineering team to continue to test a wider range of low-quality gases that could be used to fuel our Power Oxidizers in the future, and also to experiment with (and prove the feasibility of) different sizes of future Power Oxidizer systems. | |

| ● | In June 2016, we completed the integration of the Dresser-Rand KG2-GEF 2 MW gas turbine and our Power Oxidizer, which resulted in the first commercial KG2/PO unit. Between June and December 2016, we successfully conducted the FSAT protocols under the CLA. | |

| ● | In December 2016, the first two KG2/PO units were installed at a biorefinery site in Stockton, California owned by Pacific Ethanol. The two KG2/PO units were each energized and operated at power in late 2016 and operated as designed during commissioning work performed in the first quarter of 2017. Final commissioning, which we expect in the second quarter of 2017, has been delayed due to reasons outside of the scope of our involvement in the project. |

We have made, and will continue to make, substantial investments in research and development. Research and development costs for the years ended December 31, 2016 and 2015 were $3.6 million and $3.4 million, respectively.

| 15 |

Intellectual Property

Our success depends in part upon our ability to obtain and maintain proprietary protection for our products and technologies. Our goal is to develop a strong intellectual property portfolio that enables us to capitalize on the research and development that we have performed to date and will perform in the future, particularly for each of the products in our development pipeline and each of the products that we commercialize. We rely on a combination of patent, copyright, trademark and trade secret laws in the United States and other countries to obtain and maintain our intellectual property. We protect our intellectual property by, among other methods, filing patent applications with the U.S. Patent and Trademark Office and its foreign counterparts on inventions that are important to the development and conduct of our business.

We also rely on a combination of non-disclosure, confidentiality and other contractual restrictions to protect our technologies and intellectual property. We require our employees and consultants to execute confidentiality agreements in connection with their employment or consulting relationships with us. We also require them to agree to disclose and assign to us all inventions conceived in connection with the relationship.

We believe that Power Oxidation technology is a patent domain largely independent from combustion. Within the patent domain, the technology has been described as “Gradual Oxidation,” as the patents were filed prior to our management’s decision in late 2014 to change the process name to “Power Oxidation.” Our current patent grants and pending applications consist of:

| ● | Patents granted: 44 |

| ○ | 33 U.S. patents | |

| ○ | 11 non-U.S. patents |

| ● | Pending applications: 21 |

| ○ | 6 U.S. applications | |

| ○ | 15 non-U.S. applications |

We intend to continue to protect our Power Oxidation technology in current patent application filings and expect to file additional patent applications for various implementations, markets and uses as we continue to develop our technology.

Global Energy Market and Government Policies

As most countries around the world continue to industrialize, the industrial plants/facilities representing a broad range of industries result in a rapidly growing demand for more electricity and more on-site steam. Our market research indicates that there are approximately three million industrial facilities around the world that could potentially use over 250kW of power, and collectively they consume approximately $800 billion in energy costs in order to operate their plants. These same industrial facilities, located all around the world and across a broad range of industries, also represent about 36% of the world’s greenhouse gas emissions. These emissions have led to environmental concerns, political legislation geared towards promoting renewable power and policy trends for eliminating harmful gases and waste products.

The combination of these trends and challenges places us in a unique position to capitalize on a growing need for on-site power, steam and heat, while at the same time productively utilizing the low-quality industrial gases that are rapidly becoming a significant global concern.

Recent international agreements, policy announcements, and environmental legislation, either already enacted or proposed, support the continued commercialization and scale up of our Power Oxidizer technology. We believe that the capabilities of our technology fit well within the global focus on all of the following:

| ● | Maximizing methane usage from all sources to eliminate flared gas; |

| ● | Industrial waste gas destruction to prevent emissions of the waste gases into the atmosphere; and |

| ● | Efficient on-site energy generation, while minimizing emissions. |

| 16 |

We believe that our technology provides an attractive financial return on investment for industrial facilities in many regions of the world, without any financial incentives that are typically necessary for renewable power projects. In addition, we are seeing an increasing amount of significant new regulations, policies and international agreements being enacted globally that potentially benefit our business and potentially accelerate the decision-making process made by companies that are considering the deployment of our technology. Some of these regulations, policies and international agreements that we believe are the most pertinent to our value proposition are listed below. While most of these policies are either non-binding or carry limited penalties, we believe they represent the general direction of air quality standards for many geographic locations. Although such policies are generally non-binding or carry limited penalties, we believe that some industries are moving to comply with such policies, which often takes months or years to plan and implement. Companies that voluntarily comply with such policies often do so to generate positive public relations and/or to avoid public backlash. As public pressure through news and social media streams to reduce air pollution intensifies, we believe that some companies are beginning to voluntarily comply with these policies. We believe that such public pressure may encourage potential customers to consider our product solutions, which they may not otherwise have considered. Notwithstanding the foregoing, we are unable to predict the likely future course of relevant regulations and policies in the United States due to recent efforts by the current presidential administration and others to rescind or repeal certain existing goals, policies and regulations designed to address climate change and reduce certain gas emissions and the uncertain impact of such actions on both federal and state levels. Any successful efforts to rescind or repeal such goals, policies and regulations may negatively impact our value proposition and/or reduce or eliminate existing incentives to adopt our products.

Flaring Reduction

| ● | Zero Routine Flaring by 2030, endorsed by Russia, Norway, Angola, France, other countries and BP, Shell, Kuwait National Oil Company, ENI, and other major oil companies | |

| ● | North Dakota limiting flaring to 23% of all gas produced in 2015 with required reductions down to 10% of all gas produced by 2020. |

Ozone Pollution Reduction (NOx restrictions)

| ● | On November 25, 2014, the EPA proposed to strengthen the National Ambient Air Quality Standards for ground-level ozone, based on extensive scientific evidence about ozone’s effects on public health and welfare (reducing ozone required restricting NOX emissions to low levels). |

| ● | 558 counties in the U.S. would exceed the lower 65 ppb proposed standard, while 358 counties in the U.S. would exceed the 70 ppb proposed standard. |

| ● | “A Clean Air Programme for Europe” calls for action to control emissions of air polluting substances from combustion plants with a rated thermal input between 1 and 50 MW (i.e., medium combustion plants), thereby completing the regulatory framework for the combustion sector with a view of increasing the synergies between air pollution and climate change policies. Medium combustion plants are used for a wide variety of applications (including electricity generation, domestic/residential heating and cooling and providing heat/steam for industrial processes) and are an important source of emissions of sulfur dioxide, nitrogen oxides and particulate matter. The approximate number of medium combustion plants in the European Union, or EU, is 142,986. |

| 17 |

Carbon/Greenhouse Gas Levies

| ● | Alberta’s New Democratic Party government announced on June 25, 2015 a phased increase in the province’s carbon emissions levy from C$15 ($12) per tonne this year (2015) to C$20 next year and C$30 by 2017. | |

| ● | California and Quebec have announced the completion of their second joint carbon dioxide (CO2) allowance auction through a cap-and-trade system. Despite geographical distance and economic differences, California and Quebec have worked to align their CO2 emissions markets and policies. Previous auctions sold emissions allowances for electric generators and large industrial sources. The most recent auction, held in February 2015, also included allowances for the transportation sector, covering wholesale gasoline suppliers. The California and Quebec program is the first international carbon allowance program to be enacted at the subnational level (i.e., between parts of two different countries). Similar programs in Europe were the first to establish markets across several countries (the EU’s Emission Trading Scheme) and were also the first to cover certain transportation components. |

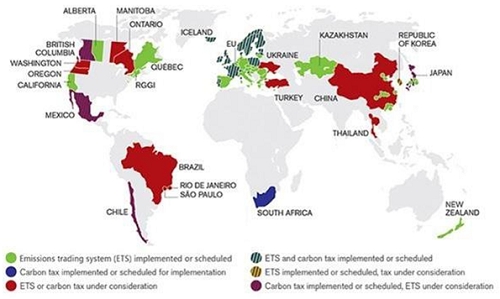

| ● | Figure 7 below displays the 40 countries and more than 20 cities, states and provinces now using or planning to use a price on carbon to bring down greenhouse gas emissions through emission trading systems or carbon credits or taxes. Altogether, the combined value of the carbon credits, taxes, and ETS initiatives in operation today are valued at almost $50 billion, according to the World Bank and Ecofys new Carbon Pricing Watch, which is an early brief previewing the annual State and Trends of Carbon Pricing report. |

Figure 7

The regulations, policies and international agreements above are examples of the evolving policy landscape for global energy as well as the pressures on industries to reduce their emissions. Our Power Oxidizer can enable many of the intensive industrial facilities worldwide to comply and benefit from these changing environmental and energy policies. The Power Oxidizer utilizes polluting methane and waste gases to efficiently produce the heat needed to generate energy (electricity and/or steam) on-site. This enables industrial facilities to offset their purchases of utility power and fuels, while also destroying polluting gases and drastically reducing their NOX emissions.

| 18 |

Current and Future Efforts

Our research and development efforts are currently focused on the following activities:

| ● | Commercializing and installing technology into vertical markets. We are currently working to successfully commercialize and install our technology into several of the five vertical industrial markets discussed under the subheading “Industrial Target Markets (excluding landfills).” Thus far, we have successfully commercialized our technology into old, inactive landfills and have worked with Dresser-Rand to commercialize our technology into a large fuel ethanol distillery. As we continue to evolve, we intend to demonstrate the technical feasibility and economic value of deploying our technology into a variety of additional industries that currently generate waste gases. |

| ● | Integration with heat applications. We are currently working to integrate our Power Oxidizer technology with a variety of industrial heat applications such as dryers, ovens, boilers, and water chillers and commercialized within industrial facilities (across the same broad base of industries we already target) in order to provide additional value propositions for our current and future gas turbine products. |

| ● | Scaling up to other sized gas turbines. We have already established close working relationships with several other gas turbine manufacturers and large industrial partners to facilitate the potential development of additional systems. |

| ● | Expanding the global reach of our technology. Further developing our technology to work with industrial heat applications will allow us to partner with global manufacturers of heat equipment and access new markets. |

| ● | Integration with anaerobic digesters. We believe that the partnership with anaerobic digesters will provide for a greater variety of waste feed stocks that can be converted to unrefined organic gas fuels which could be used as a fuel source for our Power Oxidizers. We see this integration as critical to penetrating some of our highest potential vertical markets such as wastewater treatment and animal rendering. |

Figure 8

| 19 |

Suppliers

For our Power Oxidizer units, our raw materials generally consist of readily available, pipes, tanks and machined metal products made of steel and other readily available commercial metals. We also purchase an integrated controls system that is configured from off-the-shelf units. For certain proprietary components, we use parts that are single-sourced from certain suppliers for machined parts designed and built to our specifications. We expect to move away from single-sourced suppliers as our production levels increase and with future modifications to our products.

For the EC250 units, we purchase gas turbines from a single supplier, FlexEnergy. The Power Oxidizers used in our KG2/PO units are bundled with Dresser-Rand gas turbines as a single sourced supplier.

Environmental Laws