Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - TELEFLEX INC | exhibit991to12-2x20168xkxp.htm |

| 8-K - 8-K - TELEFLEX INC | a12-2x20168xkreprojectviol.htm |

1

Teleflex Incorporated

Acquisition of Vascular Solutions Conference Call

December 2, 2016

Exhibit 99.2

2

This presentation and our discussion contain forward-looking information and statements. These forward looking statements are

subject to risks and uncertainties that may cause actual results to differ materially from those projected or implied in the forward-

looking statements, including, but not limited to, the failure of Vascular Solution’s shareholders to approve the proposed

acquisition of Vascular Solutions by Teleflex and the possibility that the acquisition does not close; unanticipated costs and

length of time required to comply with legal requirements and regulatory approvals applicable to the transaction; unanticipated

difficulties and expenditures in connection with integration programs; customer and shareholder reaction to the transaction;

risks associated with the financing of the transaction; disruption from the transaction making it more difficult to maintain

business and operational relationships; significant transaction costs; unknown liabilities; the risk of litigation and/or regulatory

actions related to the proposed acquisition; changes in general and international economic conditions, including fluctuations in

foreign currency exchange rates and the impact of the United Kingdom's vote to leave the European Union; and other factors

described or incorporated in our filings with the Securities and Exchange Commission (“SEC”), including our Annual Report on

Form 10-K for the year ended December 31, 2015.

In connection with the proposed transaction, Vascular Solutions will file with the SEC and mail or otherwise provide to its

stockholders a proxy statement regarding the proposed transaction. BEFORE MAKING ANY VOTING DECISION, VASCULAR

SOLUTION’S SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT IN ITS ENTIRETY WHEN IT BECOMES

AVAILABLE AND ANY OTHER DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER OR

INCORPORATED BY REFERENCE THEREIN BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE

PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION. Investors and security holders will be able

to obtain these documents free of charge at the SEC’s website, www.sec.gov, or from Vascular Solutions at its website,

www.vasc.com, or by contacting Phil Nalbone at (763) 656-4371.

Vascular Solutions and its directors and executive officers are participants in the solicitation of proxies from Vascular Solutions’

shareholders with respect to the proposed acquisition. Information regarding the interests of such individuals in the proposed

acquisition of Vascular Solutions by Teleflex will be included in the proxy statement relating to such acquisition when it is filed

with the SEC. You may obtain information about Vascular Solutions directors and executive officers in Vascular Solutions’

definitive proxy statement for its 2016 annual meeting of stockholders, which was filed with the SEC on March 25, 2016.

Forward Looking Statements

Additional Information

Participants in the Solicitation

3

Agenda

1. Strategic Rationale

2. Transaction Overview

3. Vascular Solutions Overview

4. Financial Summary

5. Transaction Summary

4

Strategic Rationale

1. Highly strategic and complementary acquisition

− Significantly advances Teleflex’s offering of vascular and interventional solutions

− Adds over 90 proprietary products and services that are sold to interventional cardiologists, interventional

radiologists, electrophysiologists and vein specialists

− Combined company will offer more than 150 cardiac, vascular and interventional products globally

2. Accelerates Teleflex’s sales growth trajectory and provides significant sales channel opportunity

− Vascular Solutions has consistently generated > 10% revenue growth per year

− Positions Teleflex to enter new, fast-growing markets

− Ability to capitalize on Teleflex’s existing international infrastructure to drive further O.U.S. penetration of

Vascular Solutions product offerings

3. Improves R&D pipeline

− Acquisition provides a robust pipeline of new and next-generation products that address complex

interventions, radial artery catheterizations and embolization procedures

− Provides differentiated, high-growth and high-margin product offerings with demonstrable clinical benefits

4. Compelling financial profile that substantially improves Teleflex’s revenue growth, margins, earnings and cash

flow generation capabilities

− Expected to be accretive to adjusted earnings per share1 in 2017, including the impact of incremental interest

expense associated with financing the transaction

− Fits into existing strategic business unit franchises and call points allowing for synergies

1 - Adjusted earnings per share excludes specified items such as amortization of acquired intangibles, inventory step-up, restructuring costs and other costs incurred to execute

the transaction. Adjusted earnings per share is a non-GAAP financial measure and should not be considered a replacement for GAAP results.

5

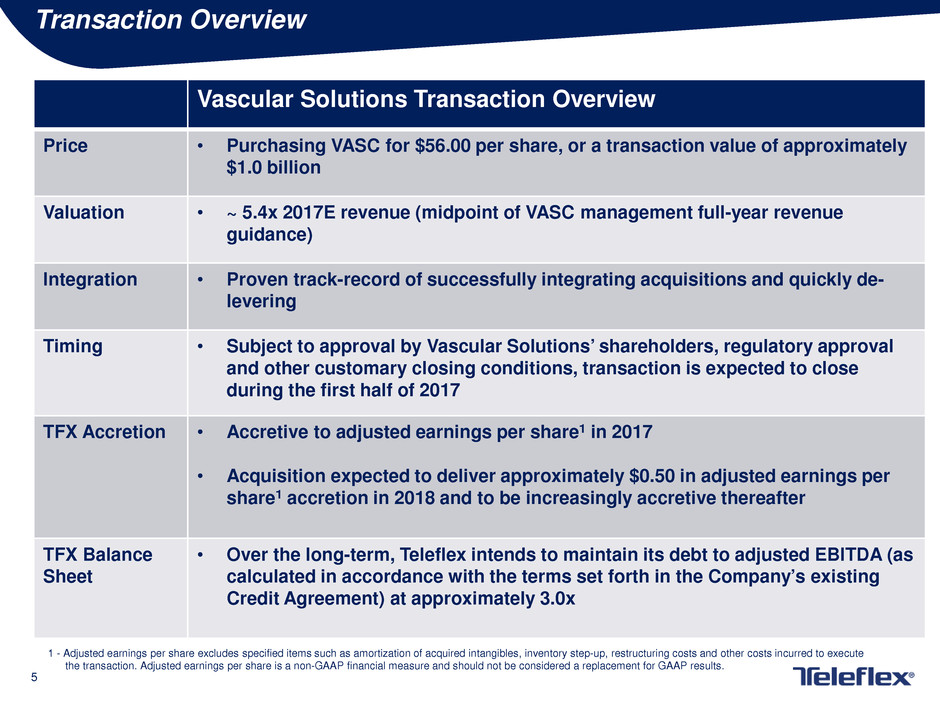

Vascular Solutions Transaction Overview

Price • Purchasing VASC for $56.00 per share, or a transaction value of approximately

$1.0 billion

Valuation • ~ 5.4x 2017E revenue (midpoint of VASC management full-year revenue

guidance)

Integration • Proven track-record of successfully integrating acquisitions and quickly de-

levering

Timing • Subject to approval by Vascular Solutions’ shareholders, regulatory approval

and other customary closing conditions, transaction is expected to close

during the first half of 2017

TFX Accretion • Accretive to adjusted earnings per share1 in 2017

• Acquisition expected to deliver approximately $0.50 in adjusted earnings per

share1 accretion in 2018 and to be increasingly accretive thereafter

TFX Balance

Sheet

• Over the long-term, Teleflex intends to maintain its debt to adjusted EBITDA (as

calculated in accordance with the terms set forth in the Company’s existing

Credit Agreement) at approximately 3.0x

Transaction Overview

1 - Adjusted earnings per share excludes specified items such as amortization of acquired intangibles, inventory step-up, restructuring costs and other costs incurred to execute

the transaction. Adjusted earnings per share is a non-GAAP financial measure and should not be considered a replacement for GAAP results.

6

Vascular Solutions Overview

• Innovative medical device company that focuses on

bringing clinically advanced solutions to the market for

treating coronary and peripheral diseases

• Product line consists of over 90 devices and services that

are sold to interventional cardiologists, interventional

radiologists, electrophysiologists and vein practices

worldwide

• Top 8 products constitute approximately 80% of September

30, 2016 year-to-date revenue

• R&D and corporate development programs focused in three

areas:

– Complex interventions

– Radial artery catheterization

– Embolization procedures

• Employees: ~570

– 106 direct sales employees in the U.S.

– 42 independent international distributors in 57

countries

Business Overview Revenue by segment & geography

Revenue performance

United

States

81%

International

19%

Call point Geography

Interventional

Radiology

9%

Source: FactSet as of 11/22/16 and Vascular Solutions information

Electrophysiology

4%

Interventional

Cardiology

74%

Phlebology

13%

Source: September 30, 2016 Form 10Q

$0

$50

$100

$150

$200

Single product Multiple products

7

Financial Summary

1. Similar to acquisition of Vidacare, the acquisition of Vascular Solutions accelerates Teleflex’s top-line

growth profile with high-margin, differentiated product offerings

2. Prudent use of existing balance sheet capacity

− Expect to fund at closing with $750 million senior secured term loan facility and $250 million of

borrowings under revolving credit facility

− Following the consummation of the transaction, Teleflex may seek to opportunistically issue senior

unsecured notes, the proceeds of which would be used to either repay borrowings under the revolving

credit or the new senior secured term loan facilities

3. Acquisition is expected to generate a return on invested capital that meets the Company’s cost of capital

in the fourth year and comfortably exceeds the Company’s cost of capital in the fifth year

4. Transaction is expected to be accretive to adjusted earnings per share1 in 2017, deliver approximately

$0.50 of adjusted earnings per share1 accretion in 2018, and to be increasingly accretive thereafter

5. Expect to generate synergies of between $40 million to $45 million by fiscal year 2019 (second full fiscal

year post-close)

6. The transaction is not conditioned on financing

1 - Adjusted earnings per share excludes specified items such as amortization of acquired intangibles, inventory step-up, restructuring costs and other costs incurred to execute

the transaction. Adjusted earnings per share is a non-GAAP financial measure and should not be considered a replacement for GAAP results.

8

Transaction Summary

1. Highly strategic and complementary acquisition

2. Accelerates Teleflex’s sales growth trajectory and provides significant sales channel

opportunity

3. Improves R&D pipeline

4. Compelling financial profile that substantially improves Teleflex’s revenue growth,

margins, earnings and cash flow generation capabilities

5. Creates shareholder value for Teleflex shareholders

9

Q&A