Attached files

| file | filename |

|---|---|

| EX-10.15 - EXHIBIT 10.15 - VARIAN MEDICAL SYSTEMS INC | fy16exhibit1015.htm |

| 10-K - 10-K - VARIAN MEDICAL SYSTEMS INC | varian10-k2016.htm |

| EX-32.2 - EXHIBIT 32.2 - VARIAN MEDICAL SYSTEMS INC | fy16exhibit_322.htm |

| EX-32.1 - EXHIBIT 32.1 - VARIAN MEDICAL SYSTEMS INC | fy16exhibit_321.htm |

| EX-31.2 - EXHIBIT 31.2 - VARIAN MEDICAL SYSTEMS INC | fy16exhibit_312.htm |

| EX-31.1 - EXHIBIT 31.1 - VARIAN MEDICAL SYSTEMS INC | fy16exhibit_311.htm |

| EX-23 - EXHIBIT 23 - VARIAN MEDICAL SYSTEMS INC | fy16exhibit23.htm |

| EX-21 - EXHIBIT 21 - VARIAN MEDICAL SYSTEMS INC | fy16exhibit21.htm |

EXHIBIT 10.50

AMENDMENT NO. 4 TO CREDIT AGREEMENT AND LIMITED CONSENT

This AMENDMENT NO. 4 TO CREDIT AGREEMENT AND LIMITED CONSENT (this “Amendment”), effective as of September 2, 2016, is entered into by and among VARIAN MEDICAL SYSTEMS, INC., a Delaware corporation (the “Borrower”), BANK OF AMERICA, N.A., in its capacity as administrative agent for the Lenders (as defined in the Credit Agreement) (in such capacity, the “Administrative Agent”), and as Swingline Lender and L/C Issuer, and each of the Lenders signatory hereto. Each capitalized term used and not otherwise defined in this Amendment has the definition specified in the Credit Agreement.

RECITALS

A. The Borrower, the Administrative Agent and the Lenders have entered into that certain Credit Agreement dated as of August 27, 2013 (as amended, modified, supplemented, restated, or amended and restated from time to time, the “Credit Agreement”), pursuant to which the Lenders have made available to the Borrower a term loan credit facility and a revolving credit facility;

B. The Borrower has informed the Administrative Agent that it wishes to transfer its imaging components business as more fully described in the Form 10 registration statement filed by Varex Imaging Corporation with the SEC on August 11, 2016 (as the same is in effect on the date hereof) (the “Form 10”) (the “Subject Assets”, any Subsidiary formed solely to hold such Subject Assets, the “Subject Subsidiary”, and such transfer of the Subject Assets and, to the extent formed, the Subject Subsidiary, collectively, the “Subject Disposition”);

C. In connection with the foregoing, the Borrower has requested that the Administrative Agent and the Lenders (i) consent to the Subject Disposition, (ii) waive any potential Default or Event of Default which may arise as a result of the Subject Disposition under the Credit Agreement, including, without limitation, any potential Default or Event of Default resulting from a breach of Sections 6.14, 7.04(d), 7.05(j), 7.06 and 7.08 of the Credit Agreement (collectively, the “Potential Defaults”) and (iii) amend certain provisions of the Credit Agreement as described below; and

D. Subject to the terms and conditions of this Amendment, the Administrative Agent and the Lenders signatory hereto are willing to effect such consents and amendments on the terms and conditions as set forth herein.

NOW, THEREFORE, for valuable consideration, the receipt and adequacy of which are hereby acknowledged, the parties hereto hereby agree as follows:

1.Limited Consent and Waiver. Subject to the terms and conditions set forth herein and in reliance on the representations and warranties of the Borrower herein contained, and notwithstanding anything to the contrary contained in the Credit Agreement or any of the other Loan Documents, the Administrative Agent and the Lenders hereby (a) consent to (i) the consummation of the Subject Disposition, (ii) if applicable, distribution of the Equity Interests of

1

the Subject Subsidiary in order to consummate the Subject Disposition, and (iii) the Borrower entering into a transition services or other similar arrangement with the Subject Subsidiary for a period of time not to exceed two (2) years after the consummation of the Subject Disposition, and (b) waive any Potential Default that may arise solely as a result of or in connection with the Subject Disposition; provided, that, (i) to the extent formed, the Subject Subsidiary shall not hold any assets other than the Subject Assets and (ii) the Subject Disposition shall be consummated pursuant to terms and conditions that are reasonably acceptable to Administrative Agent in its reasonable discretion.

2. Amendments to Credit Agreement. Subject to the covenants, terms and conditions set forth herein, the Credit Agreement is amended as follows:

(a) Section 1.01 of the Credit Agreement is amended by adding the following new defined terms in the appropriate alphabetical order:

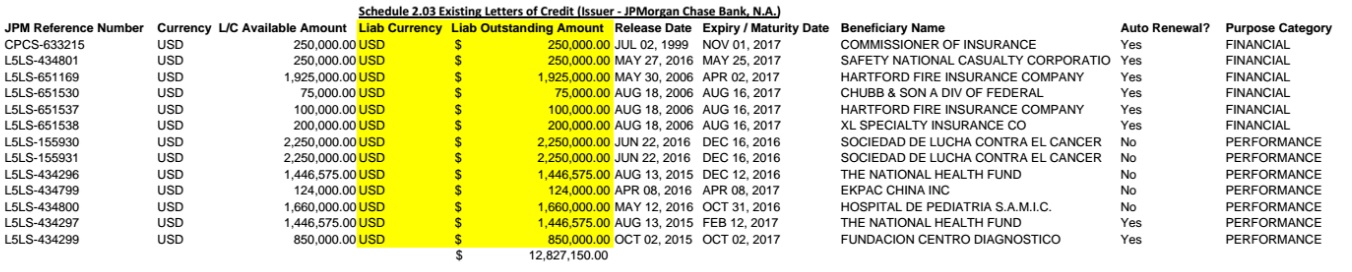

“‘Existing Letters of Credit’ means the letters of credit issued by JPMorgan Chase Bank, N.A. and identified on Schedule 2.03 attached to the Fourth Amendment.”

“‘Fourth Amendment’ means that certain Amendment No. 4 to Credit Agreement and Limited Consent, by and among the Borrower, the other Loan Parties signatories thereto, the Lenders signatories thereto and Administrative Agent.”

“‘Fourth Amendment Effective Date’ means the first date that all of the conditions precedent set forth in Section 4 of the Fourth Amendment are satisfied in accordance with the terms set forth in the Fourth Amendment.”

“‘Subject Disposition’ has the meaning set forth in the Fourth Amendment.”

(b) Section 1.01 of the Credit Agreement is further amended by amending and restating the following defined terms to read as follows:

“‘Change of Control’ means an event or series of events by which:

(a) any “person” or “group” (as such terms are used in Sections 13(d) and 14(d) of the Securities Exchange Act of 1934, but excluding any employee benefit plan of such person or its subsidiaries, and any person or entity acting in its capacity as trustee, agent or other fiduciary or administrator of any such plan) becomes the “beneficial owner” (as defined in Rules 13d-3 and 13d-5 under the Securities Exchange Act of 1934, except that a person or group shall be deemed to have “beneficial ownership” of all securities that such person or group has the right to acquire, whether such right is exercisable immediately or only after the passage of time (such right, an “option right”)), directly or indirectly, of 35% or more of the equity securities of the Borrower entitled to vote for members of the board of directors or equivalent governing body of the Borrower on a fully-diluted basis (and taking into account all such securities that such person or group has the right to acquire pursuant to any option right); or

2

(b) during any period of 12 consecutive months, a majority of the members of the board of directors or other equivalent governing body of the Borrower cease to be composed of individuals (i) who were members of that board or equivalent governing body on the first day of such period, (ii) whose election or nomination to that board or equivalent governing body was approved by individuals referred to in clause (i) above constituting at the time of such election or nomination at least a majority of that board or equivalent governing body or (iii) whose election or nomination to that board or other equivalent governing body was approved by individuals referred to in clauses (i) and (ii) above constituting at the time of such election or nomination at least a majority of that board or equivalent governing body.”

“‘Consolidated EBITDA’ means, for any period, for the Borrower and its Subsidiaries on a consolidated basis, an amount equal to Consolidated Net Income for such period plus (a) the following to the extent deducted in calculating such Consolidated Net Income: (i) Consolidated Interest Charges for such period, (ii) the provision for Federal, state, local and foreign income taxes payable by the Borrower and its Subsidiaries for such period, (iii) depreciation and amortization expense, (iv) other non-recurring expenses of the Borrower and its Subsidiaries reducing such Consolidated Net Income which do not represent a cash item in such period or any future period, (v) cost of employee services received in share-based payment transactions (in accordance with FASB ASC 718) which do not represent a cash item in such period or any future period and (vi) costs and expenses directly incurred in connection with consummation of the Subject Disposition in an aggregate amount not to exceed $50,000,000 and minus (b) the following to the extent included in calculating such Consolidated Net Income: (i) Federal, state, local and foreign income tax credits of the Borrower and its Subsidiaries for such period and (ii) all non-cash items increasing Consolidated Net Income for such period.”

“‘Letter of Credit’ means any standby letter of credit issued hereunder providing for the payment of cash upon the honoring of a presentation thereunder, and shall include the Existing Letters of Credit.”

“‘Letter of Credit Sublimit’ means, (a) with respect to Bank of America and its Affiliates, an amount equal to $25,000,000, and (b) with respect to JPMorgan Chase Bank, N.A. and its Affiliates, an amount equal to $25,000,000. The Letter of Credit Sublimit is part of, and not in addition to, the Aggregate Revolving Credit Commitments.”

“‘Loan Notice’ means a notice of (a) a Term Loan Borrowing, (b) a Revolving Credit Borrowing, (c) a conversion of Loans from one Type to the other, or (d) a continuation of Eurodollar Rate Loans, pursuant to Section 2.02(a), which, if in writing, shall be substantially in the form of Exhibit A or such other form as may be approved by the Administrative Agent (including any form on an electronic platform or electronic transmission system as shall be approved by the Administrative Agent), appropriately completed and signed by a Responsible Officer of the Borrower.”

“‘Responsible Officer’ means the chief executive officer, president, chief financial officer, treasurer, assistant treasurer or controller of a Loan Party, solely for purposes of the

3

delivery of incumbency certificates pursuant to Section 4.01, the secretary or any assistant secretary of a Loan Party. Any document delivered hereunder that is signed by a Responsible Officer of a Loan Party shall be conclusively presumed to have been authorized by all necessary corporate, partnership and/or other action on the part of such Loan Party and such Responsible Officer shall be conclusively presumed to have acted on behalf of such Loan Party. To the extent requested by the Administrative Agent, each Responsible Officer will provide an incumbency certificate and to the extent requested by the Administrative Agent, appropriate authorization documentation, in form and substance satisfactory to the Administrative Agent.”

“‘Swing Line Loan Notice’ means a notice of a Swing Line Borrowing pursuant to Section 2.04(b), which, if in writing, shall be substantially in the form of Exhibit B or such other form as approved by the Administrative Agent (including any form on an electronic platform or electronic transmission system as shall be approved by the Administrative Agent), appropriately completed and signed by a Responsible Officer of the Borrower.”

(c) The definition of “Material Subsidiary” in Section 1.01 of the Credit Agreement is amended by deleting the last sentence of such definition in its entirety and replacing it with the following:

“For the avoidance of doubt (i) the Borrower’s Equity Interest in its Subsidiaries shall not be included in valuing the assets of the Borrower, and (ii) Varex Imaging Corporation and its Subsidiaries shall not constitute Material Subsidiaries.”

(d) Section 2.02(a) of the Credit Agreement is amended by deleting the first sentence thereof in its entirety and replacing it with the following:

“Each Term Loan Borrowing, each Revolving Credit Borrowing, each conversion of Term Loans or Revolving Credit Loans from one Type to the other, and each continuation of Eurodollar Rate Loans shall be made upon the Borrower’s irrevocable notice to the Administrative Agent, which may be given by (A) telephone, or (B) a Loan Notice; provided that any telephone notice must be confirmed immediately by delivery to the Administrative Agent of a Loan Notice.”

(e) Section 2.02 of the Credit Agreement is further amended by adding the following new clause (f):

“(f) Notwithstanding anything to the contrary in this Agreement, any Lender may exchange, continue or rollover all of the portion of its Loans in connection with any refinancing, extension, loan modification or similar transaction permitted by the terms of this Agreement, pursuant to a cashless settlement mechanism approved by the Borrower, the Administrative Agent, and such Lender.”

(f) Section 2.03(a)(i) of the Credit Agreement is amended by deleting such section in its entirety and replacing it with the following:

4

“(i) Subject to the terms and conditions set forth herein, (A) the L/C Issuer agrees, in reliance upon the agreements of the Revolving Credit Lenders set forth in this Section 2.03, (1) from time to time on any Business Day during the period from the Closing Date until the Letter of Credit Expiration Date, to issue Letters of Credit for the account of the Borrower or its Subsidiaries, and to amend or extend Letters of Credit previously issued by it, in accordance with subsection (b) below, and (2) to honor drawings under the Letters of Credit; and (B) the Revolving Credit Lenders severally agree to participate in Letters of Credit issued for the account of the Borrower or its Subsidiaries and any drawings thereunder; provided that after giving effect to any L/C Credit Extension with respect to any Letter of Credit, (w) the Total Revolving Credit Outstandings shall not exceed the Aggregate Revolving Credit Commitments, (x) the Revolving Credit Exposure of any Revolving Credit Lender shall not exceed such Lender’s Revolving Credit Commitment, (y) the Outstanding Amount of the L/C Obligations issued by an L/C Issuer shall not exceed such L/C Issuer’s Letter of Credit Sublimit and (z) the Outstanding Amount of the L/C Obligations shall not exceed the Letter of Credit Sublimit. Each request by the Borrower for the issuance or amendment of a Letter of Credit shall be deemed to be a representation by the Borrower that the L/C Credit Extension so requested complies with the conditions set forth in the proviso to the preceding sentence. Within the foregoing limits, and subject to the terms and conditions hereof, the Borrower’s ability to obtain Letters of Credit shall be fully revolving, and accordingly the Borrower may, during the foregoing period, obtain Letters of Credit to replace Letters of Credit that have expired or that have been drawn upon and reimbursed. The Existing Letters of Credit shall be deemed to have been issued pursuant to this Agreement, and from and after the Fourth Amendment Effective Date shall be subject to and governed by the terms and conditions hereof.”

(g) Section 2.03(a)(iii) of the Credit Agreement is amended by (i) deleting the word “or” at the end of clause (E), (ii) deleting the period at the end of clause (F) and inserting “; or” in lieu thereof, and (iii) adding the following new clause (G):

“(G) after giving effect to the issuance of the Letter of Credit, the Outstanding Amount of the L/C Obligations issued by the applicable L/C Issuer exceeds such L/C Issuer’s Letter of Credit Sublimit.”

(h) Section 2.04(b) of the Credit Agreement is amended by deleting the first sentence thereof in its entirety and replacing it with the following:

“Each Swing Line Borrowing shall be made upon the Borrower’s irrevocable notice to the Swing Line Lender and the Administrative Agent, which may be given by (A) telephone or (B) by a Swing Line Loan Notice; provided that any telephonic notice must be confirmed promptly by delivery to the Swing Line Lender and the Administrative Agent of a Swing Line Loan Notice.”

(i) Section 7.11(a) of the Credit Agreement is amended by deleting such section in its entirety and replacing it with the following:

5

“(a) Consolidated Leverage Ratio. Permit the Consolidated Leverage Ratio as of the last day of any fiscal quarter of the Borrower to be greater than 2.50 to 1.00.”

3. Representations and Warranties. In order to induce the Administrative Agent and the Lenders to enter into this Amendment, the Borrower represents and warrants to the Administrative Agent as follows:

(a) At the time of and immediately after giving effect to this Amendment, the representations and warranties made by the Borrower in Article V of the Credit Agreement, and in each of the other Loan Documents to which it is a party, are true and correct in all material respects (except that if a qualifier relating to materiality, Material Adverse Effect or a similar concept applies, such representation and warranty shall be true and correct in all respects) on and as of the date hereof, except to the extent that such representations and warranties expressly relate to an earlier date, in which case such representations and warranties are true and correct in all material respects (except that if a qualifier relating to materiality, Material Adverse Effect or a similar concept applies, such representation and warranty shall be true and correct in all respects) as of such earlier date;

(b) After giving effect to this Amendment, no Default or Event of Default has occurred and is continuing;

(c) Since the date of the most recent financial reports of the Borrower delivered pursuant to Section 6.01 of the Credit Agreement, no act, event, condition or circumstance has occurred or arisen which, singly or in the aggregate with one or more other acts, events, occurrences or conditions (whenever occurring or arising), has had or could reasonably be expected to have a Material Adverse Effect;

(d) As of the date hereof, there are no Persons that are required to be a party to the Guaranty pursuant to the terms of the Credit Agreement and the other Loan Documents;

(e) This Amendment has been duly authorized, executed and delivered by the Borrower and each other Loan Party and constitutes the legal, valid and binding obligations of such Loan Party enforceable against such Loan Party in accordance with its terms, subject to effect of any applicable bankruptcy, insolvency, reorganization, moratorium or other similar laws affecting creditors’ rights generally and subject to the effect of general principles of equity (regardless of whether such enforceability is considered in a proceeding in equity or at law);

(f) The Borrower is entering into this Amendment on the basis of its own investigation and for its own reasons, without reliance upon the Administrative Agent, any Lender or any other Person; and

(g) The obligations of the Borrower under the Credit Agreement and each other Loan Document are not subject to any defense, counterclaim, set-off, right of recoupment, abatement or other claim.

4. Effective Date. This Amendment will become effective on the date on which each of the conditions precedent set forth in this Section 4 has been satisfied (the “Effective Date”):

6

(a) The Administrative Agent shall have received each of the following documents or instruments in form and substance reasonably acceptable to the Administrative Agent:

(i) executed original counterparts of this Amendment, duly executed by the Borrower, the Administrative Agent and the Lenders; and

(ii) such other documents, instruments, opinions, certifications, undertakings, further assurances and other matters as the Administrative Agent shall reasonably request; and

(b) unless waived by the Administrative Agent, all fees and expenses of the Administrative Agent and the Lenders (including the reasonable fees and expenses of counsel to the Administrative Agent to the extent invoiced prior to the date hereof) in connection with this Amendment shall have been paid in full (without prejudice to final settling of accounts for such fees and expenses).

5. Reservation of Rights. The Borrower acknowledges and agrees that neither the execution nor the delivery by the Administrative Agent and the Lenders signatory hereto of this Amendment shall (a) be deemed to create a course of dealing or otherwise obligate the Administrative Agent or the Lenders to execute similar amendments, consents or waivers under the same or similar circumstances in the future or (b) be deemed to create any implied waiver of any right or remedy of the Administrative Agent or the Lenders with respect to any term or provision of any Loan Document, other than as expressly provided in Section 1 hereof.

6. Entire Agreement. This Amendment, together with the other Loan Documents (collectively, the “Relevant Documents”), sets forth the entire understanding and agreement of the parties hereto in relation to the subject matter hereof and supersedes any prior negotiations and agreements among the parties relating to such subject matter. No promise, condition, representation or warranty, express or implied, not set forth in the Relevant Documents shall bind any party hereto, and no such party has relied on any such promise, condition, representation or warranty. Each of the parties hereto acknowledges that, except as otherwise expressly stated in the Relevant Documents, no representations, warranties or commitments, express or implied, have been made by any party to any other party in relation to the subject matter hereof or thereof. None of the terms or conditions of this Amendment may be changed, modified, waived or canceled orally or otherwise, except in writing and in accordance with Section 10.01 of the Credit Agreement.

7. Full Force and Effect of Credit Agreement. Except as hereby specifically amended, modified or supplemented, the Credit Agreement and all other Loan Documents are hereby confirmed and ratified in all respects and shall be and remain in full force and effect according to their respective terms. The execution, delivery and effectiveness of this Amendment shall not, except as expressly provided herein, operate as a waiver of any right, power or remedy of any Lender or the Administrative Agent under any of the Loan Documents, nor constitute a waiver of any provision of any of the Loan Documents. On and after the effectiveness of this Amendment, this Amendment shall for all purposes constitute a Loan Document.

7

8. Governing Law. This Amendment and any claims, controversy, dispute or cause of action (whether in contract or tort or otherwise) based upon, arising out of or relating to this Amendment shall in all respects be governed by, and construed in accordance with, the laws of the State of New York applicable to contracts executed and performed entirely within such State, and shall be further subject to the provisions of Sections 10.14 and 10.15 of the Credit Agreement.

9. Enforceability. Should any one or more of the provisions of this Amendment be determined to be illegal or unenforceable as to one or more of the parties hereto, all other provisions nevertheless shall remain effective and binding on the parties hereto.

10. References. From and after the date hereof, all references in the Credit Agreement and any of the other Loan Documents to the “Credit Agreement” shall mean the Credit Agreement, as amended hereby and as from time to time hereafter further amended, modified, supplemented, restated or amended and restated.

11. Successors and Assigns. This Amendment shall be binding upon and inure to the benefit of the Borrower, each other Loan Party, the Administrative Agent, each Lender and their respective successors and assignees to the extent such assignees are permitted assignees as provided in Section 10.06 of the Credit Agreement. No third party beneficiaries are intended in connection with this Amendment.

12. Counterparts. Section 10.10 of the Credit Agreement is hereby incorporated by reference as if fully set forth herein, mutatis mutandis.

[Remainder of this page intentionally left blank]

8

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed and effective as of the date first above written.

VARIAN MEDICAL SYSTEMS, INC. | |

By: /s/ Franco N. Palomba | |

Name: Franco N. Palomba | |

Title: SVP Finance & Treasurer | |

Signature Page to Amendment No. 4 to Credit Agreement and Limited Consent

BANK OF AMERICA, N.A., as | |

Administrative Agent | |

By: /s/ Linda Lov | |

Name: Linda Lov | |

Title: Assistant Vice President | |

Signature Page to Amendment No. 4 to Credit Agreement and Limited Consent

BANK OF AMERICA, N.A., as a Lender, L/C | |

Issuer and Swing Line Lender | |

By: /s/ Robert LaPorte | |

Name: Robert LaPorte | |

Title: Senior Vice President | |

Signature Page to Amendment No. 4 to Credit Agreement and Limited Consent

WELLS FARGO BANK, NATIONAL | |

ASSOCIATION, as a Lender | |

By: /s/ Matt Jurgens | |

Name: Matt Jurgens | |

Title: Senior Vice President | |

Signature Page to Amendment No. 4 to Credit Agreement and Limited Consent

SUMITOMO MITSUI BANKING | |

CORPORATION, as a Lender | |

By: /s/ David W. Kee | |

Name: David W. Kee | |

Title: Managing Director | |

Signature Page to Amendment No. 4 to Credit Agreement and Limited Consent

JPMORGAN CHASE BANK, N.A., as a Lender | |

and L/C Issuer | |

By: /s/ Vanessa Chiu | |

Name: Vanessa Chiu | |

Title: Executive Director | |

Signature Page to Amendment No. 4 to Credit Agreement and Limited Consent

MORGAN STANLEY BANK, N.A., as a Lender | |

By: /s/ Dmitriy Barskiy | |

Name: Dmitriy Barskiy | |

Title: Authorized Signatory | |

Signature Page to Amendment No. 4 to Credit Agreement and Limited Consent

Schedule 2.03 to Credit Agreement

Existing Letters of Credit

Signature Page to Amendment No. 4 to Credit Agreement and Limited Consent