Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Unilife Corp | d280444d8k.htm |

Exhibit 99.1

Industry-Leading Wearable Injectors, People and Partners

November 17, 2016

Unilife

Forward Looking Statements

This presentation contains forward-looking statements. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future are forward-looking statements. These forward-looking statements are based on management’s beliefs and assumptions and on information currently available to our management. Our management believes that these forward-looking statements are reasonable as and when made. However, you should not place undue reliance on any such forward-looking statements because such statements speak only as of the date when made.

We do not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results, events and developments to differ materially from our historical experience and our present expectations or projections.

These risks and uncertainties include, but are not limited to, those described in “Item 1A. Risk Factors” and elsewhere in our Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (“SEC”) on October 24, 2016, those described from time to time in other reports which we file with the SEC, and other risks and uncertainties including, without limitation: that Amgen may not purchase the remaining $5 million balance of the senior secured convertible note in January 2017 or the additional $10 million senior secured convertible note in January 2018; and that the Company’s focus on wearable injector programs with key pharmaceutical customers may not be successful and / or result in the commercialization and sale of the Company’s products.

Unilife

Introduction

Industry-Leading Wearable Injectors, People and Partners

An Attractive, Growing and Under-Served Market

Wearable injectors to deliver biologics

Large biopharma seek platform-based systems for use with multiple target drugs

Platforms support effective lifecycle management of multiple target therapies

The Industry’s Best Wearable Injector Portfolio

The first pre-filled, pre-assembled wearable injector portfolio

Fully integrated, ready-to-inject therapies

Customers can expect unique therapy brand identity via wearable platform use

The Right People and Partners for Commercial Success

Focused on programs and path to sales

Rigorous cost controls, reduced cash burn

Strategic collaboration with Amgen

Strong partnership with OrbiMed

Established base of customers, programs

Unilife 3

Business Leadership Strong, Disciplined Team with Deep Industry and Business Experience

John Ryan

President and CEO David Hastings

SVP and CFO Ian Hanson

SVP and COO Michael Ratigan

SVP, Chief Commercial Officer Stephanie Walters

SVP, GC and Secretary Rick Bente

VP, Combination Products Molly Weaver, PhD

VP Quality & Regulatory Affairs

Strengthened Board with Substantial Life Sciences Experience

Mary Kate Wold, Chair Rosemary Crane Duane DeSisto Harry Hamill Mike Kamarck, PhD John Lund Jeff Carter

Unilife

Focused Operations

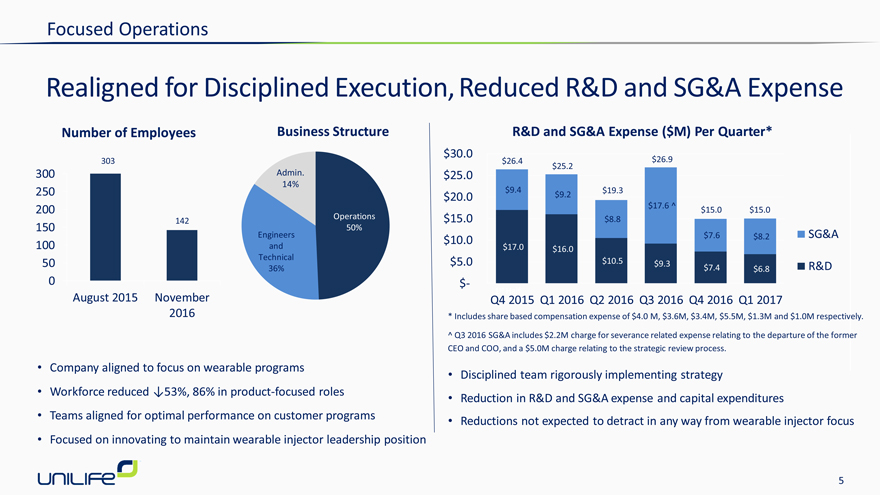

Realigned for Disciplined Execution, Reduced R&D and SG&A Expense

Number of Employees

Company aligned to focus on wearable programs

Workforce reduced ?53%, 86% in product-focused roles

Teams aligned for optimal performance on customer programs

Focused on innovating to maintain wearable injector leadership position

| * |

|

Includes share based compensation expense of $4.0 M, $3.6M, $3.4M, $5.5M, $1.3M and $1.0M respectively. |

^ Q3 2016 SG&A includes $2.2M charge for severance related expense relating to the departure of the former CEO and COO, and a $5.0M charge relating to the strategic review process.

Disciplined team rigorously implementing strategy

Reduction in R&D and SG&A expense and capital expenditures

Reductions not expected to detract in any way from wearable injector focus

R&D and SG&A Expense ($M) Per Quarter*

303

300 Admin. 14%

250 200

Operations 142 50%

150

Engineers

100 and

Technical

50

36%

0

August 2015 November 2016

$ 30.0

$26.4 $25.2 $26.9

$25.0

$9.4 $19.3

$20.0 $9.2

$17.6 ^ $15.0 $15.0

$15.0 $8.8

$7.6 $8.2 SG&A

$ 10.0

$17.0 $16.0 $5.0 $10.5 $9.3 $7.4 $6.8 R&D

$-

1st Half

Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

unilife

Strategic Partners and Customers

Leading healthcare-focused global investment firm with approximately $14 billion in assets under management

$70 million in debt financing provided since 2014

Global strategic collaboration signed February 2016

$75M provided to date with $5M convertible note contemplated in Jan. 2017 and $10M in Jan. 2018

Exclusive and non-exclusive access within defined areas

Development programs underway Long-term development and supply agreement signed 2013

Commercial supply agreement with minimum volumes for lead molecule signed in 2015

Agreement signed in 2014 for Unilife to be exclusive supplier for all Sanofi (non-cartridge) wearable drugs

Minimum 15 year term

Extends to drug collaboration partners

Unilife

Addressing Market Needs with Wearable Injectors

Improving Patient Experience to Optimize Therapy Compliance

+ +

Reducing Injection Frequency Reducing Injections Per Dose Reducing Pain and Discomfort

E.g. 1mL every two weeks E.g. Three injections per dose E.g. 180mg (1mL) in 10 sec. From to 2mL every month to 1 injection for full dose to 180mg (2mL) in 45 sec.

Ease of Use Improving Mobility Enabling Data Connectivity

Intuitive steps of use with patient- E.g. Shift from IV infusion in specialty Integration of device, drug focused, fully integrated drug- care center to subQ self-injection and data within a connected device combination products wherever the patient is health ecosystem

unilife

Significant Market Opportunity

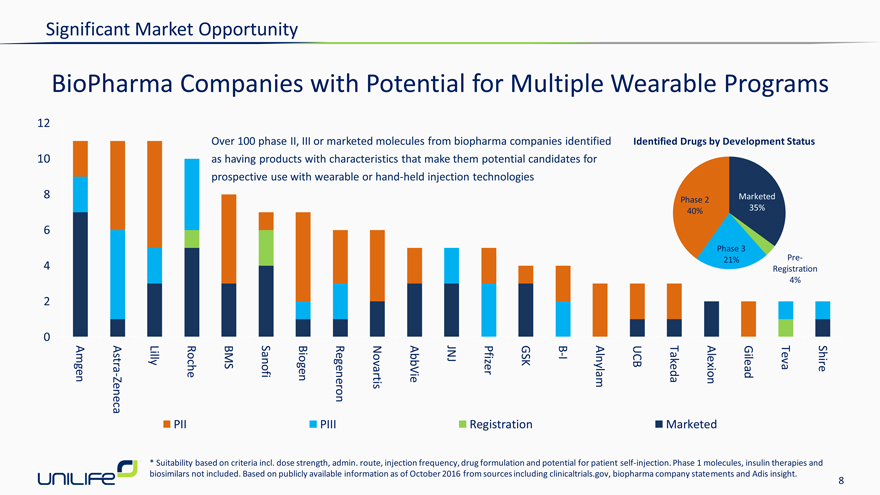

BioPharma Companies with Potential for Multiple Wearable Programs

12

Over 100 phase II, III or marketed molecules from biopharma companies identified Identified Drugs by Development Status 10 as having products with characteristics that make them potential candidates for prospective use with wearable or hand-held injection technologies

| 8 |

|

Marketed Phase 2 40% 35% |

| 6 |

|

Phase 3

| 4 |

|

21% Pre-Registration 4% |

| 2 |

|

0

- B

Astra Lilly BMS JNJ Pfizer GSK I UCB Teva Shire Amgen Zeneca—Roche Sanofi Biogen Regeneron Novartis AbbVie Alnylam Takeda Alexion Gilead PII PIII Registration Marketed

* Suitability based on criteria incl. dose strength, admin. route, injection frequency, drug formulation and potential for patient self-injection. Phase 1 molecules, insulin therapies and biosimilars not included. Based on publicly available information as of October 2016 from sources including clinicaltrials.gov, biopharma company statements and Adis insight.

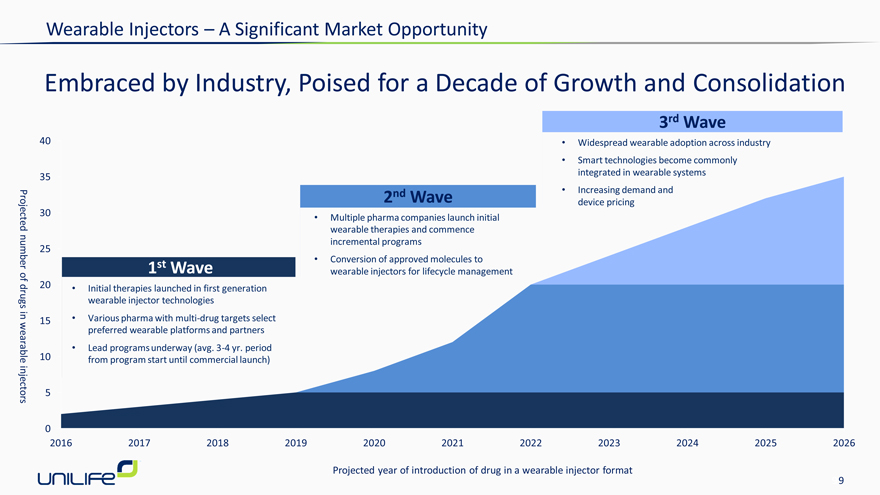

Wearable Injectors – A Significant Market Opportunity

Embraced by Industry, Poised for a Decade of Growth and Consolidation

1st Wave

| • |

|

Initial therapies launched in first generation wearable injector technologies |

| • |

|

Various pharma with multi-drug targets select preferred wearable platforms and partners |

| • |

|

Lead programs underway (avg. 3-4 yr. period from program start until commercial launch) |

2nd Wave

| • |

|

Multiple pharma companies launch initial |

wearable therapies and commence

incremental programs

| • |

|

Conversion of approved molecules to |

wearable injectors for lifecycle management

3rd Wave

| • |

|

Widespread wearable adoption across industry |

| • |

|

Smart technologies become commonly integrated in wearable systems |

| • |

|

Increasing demand and device pricing |

Projected number of drugs in wearable injectors

2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

Projected year of introduction of drug in a wearable injector format

unilife 9 9

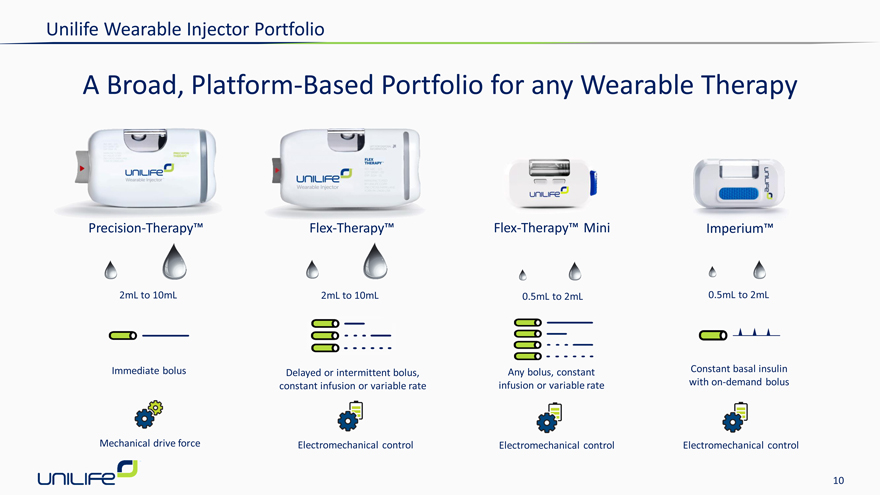

Unilife Wearable Injector Portfolio

A Broad, Platform-Based Portfolio for any Wearable Therapy

Precision-Therapy™ Flex-Therapy™ Flex-Therapy™ Mini Imperium™

2mL to 10mL 2mL to 10mL 0.5mL to 2mL 0.5mL to 2mL

Immediate bolus Delayed or intermittent bolus, Any bolus, constant Constant basal insulin constant infusion or variable rate infusion or variable rate with on-demand bolus

Mechanical drive force Electromechanical control Electromechanical control Electromechanical control

unilife

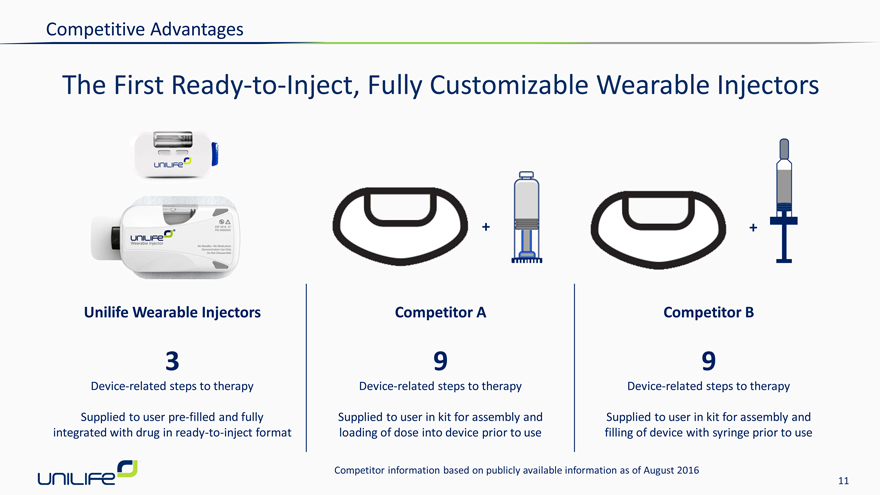

Competitive Advantages

The First Ready-to-Inject, Fully Customizable Wearable Injectors

+ +

Unilife Wearable Injectors Competitor A Competitor B

| 3 |

|

9 9 |

Device-related steps to therapy Device-related steps to therapy Device-related steps to therapy

Supplied to user pre-filled and fully Supplied to user in kit for assembly and Supplied to user in kit for assembly and integrated with drug in ready-to-inject format loading of dose into device prior to use filling of device with syringe prior to use

Competitor information based on publicly available information as of August 2016

11

unilife

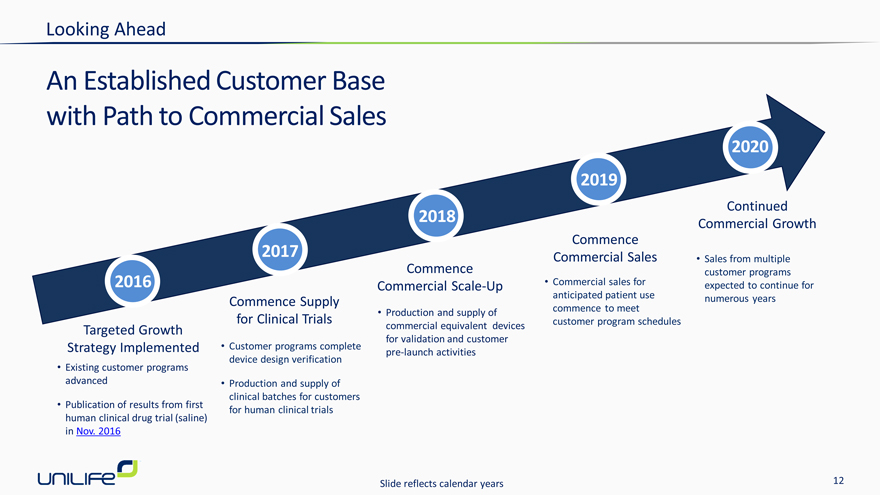

Looking Ahead

An Established Customer Base with Path to Commercial Sales

2020

2019

Continued

2018

Commercial Growth Commence 2017 Commercial Sales

Targeted Growth Strategy Implemented

| • |

|

Existing customer programs advanced |

| • |

|

Publication of results from first human clinical drug trial (saline) in Nov. 2016 |

Commence Supply for Clinical Trials

| • |

|

Customer programs complete device design verification |

| • |

|

Production and supply of clinical batches for customers for human clinical trials |

Commence Commercial Scale-Up

| • |

|

Production and supply of commercial equivalent devices for validation and customer pre-launch activities |

Commence Commercial Sales

| • |

|

Commercial sales for anticipated patient use commence to meet customer program schedules |

Continued Commercial Growth

| • |

|

Sales from multiple customer programs expected to continue for numerous years |

Slide reflects calendar years 12 unilife

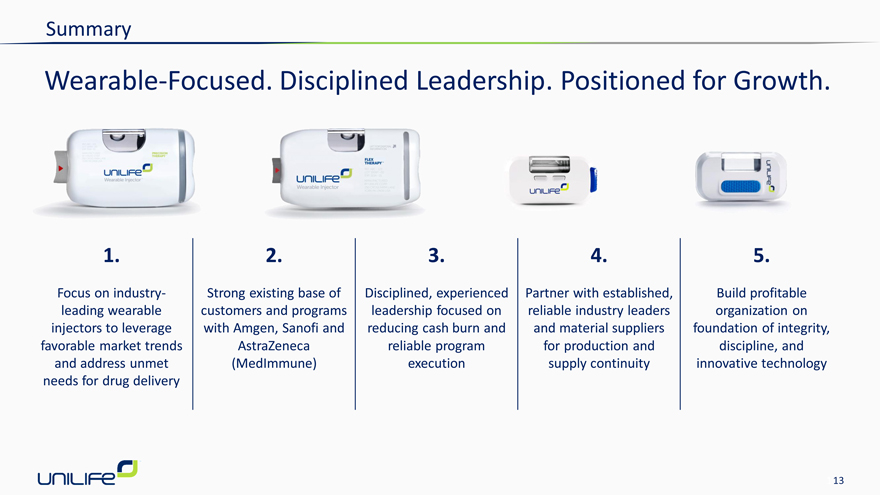

Summary

Wearable-Focused. Disciplined Leadership. Positioned for Growth.

1.

Focus on industry-leading wearable injectors to leverage favorable market trends and address unmet needs for drug delivery

2.

Strong existing base of customers and programs with Amgen, Sanofi and AstraZeneca (MedImmune)

3.

Disciplined, experienced leadership focused on reducing cash burn and reliable program execution

4.

Partner with established, reliable industry leaders and material suppliers for production and supply continuity

5.

Build profitable organization on foundation of integrity, discipline, and innovative technology

unilife