UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 16, 2016

MB FINANCIAL, INC. | ||||

(Exact name of registrant as specified in its charter) | ||||

Maryland | 001-36599 | 36-4460265 | ||

(State or other jurisdiction of incorporation) | (Commission File No.) | (IRS Employer Identification No.) | ||

800 West Madison Street, Chicago, Illinois 60607 | ||||

(Address of principal executive offices) (Zip Code) | ||||

Registrant’s telephone number, including area code: (888) 422-6562 | ||||

N/A | ||||

(Former name or former address, if changed since last report) | ||||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17CFR 240.13e-4(c))

Item 7.01. Regulation FD Disclosure

Forward-Looking Statements

When used in this Current Report on Form 8-K and in other reports filed with or furnished to the Securities and Exchange Commission (the “SEC”), in press releases or other public stockholder communications, or in oral statements made with the approval of an authorized executive officer, the words or phrases “believe,” “will,” “should,” “will likely result,” “are expected to,” “will continue” “is anticipated,” “estimate,” “project,” “plans,” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date made. These statements may relate to our future financial performance, strategic plans or objectives, revenues or earnings projections, or other financial items. By their nature, these statements are subject to numerous uncertainties that could cause actual results to differ materially from those anticipated in the statements.

Important factors that could cause actual results to differ materially from the results anticipated or projected include, but are not limited to, the following: (1) expected revenues, cost savings, synergies and other benefits from the MB Financial-American Chartered merger might not be realized within the expected time frames or at all and costs or difficulties relating to integration matters, including but not limited to customer and employee retention, might be greater than expected; (2) the credit risks of lending activities, including changes in the level and direction of loan delinquencies and write-offs and changes in estimates of the adequacy of the allowance for loan losses, which could necessitate additional provisions for loan losses, resulting both from originated loans and loans acquired from other financial institutions; (3) competitive pressures among depository institutions; (4) interest rate movements and their impact on customer behavior, net interest margin and the value of our mortgage servicing rights; (5) the possibility that our mortgage banking business may experience increased volatility in its revenues and earnings and the possibility that the profitability of our mortgage banking business could be significantly reduced if we are unable to originate and sell mortgage loans at profitable margins or if changes in interest rates negatively impact the value of our mortgage servicing rights; (6) the impact of repricing and competitors’ pricing initiatives on loan and deposit products; (7) fluctuations in real estate values; (8) the ability to adapt successfully to technological changes to meet customers’ needs and developments in the market place; (9) the possibility that security measures implemented might not be sufficient to mitigate the risk of a cyber attack or cyber theft, and that such security measures might not protect against systems failures or interruptions; (10) our ability to realize the residual values of our direct finance, leveraged and operating leases; (11) our ability to access cost-effective funding; (12) changes in financial markets; (13) changes in economic conditions in general and in the Chicago metropolitan area in particular; (14) the costs, effects and outcomes of litigation; (15) new legislation or regulatory changes, including but not limited to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) and regulations adopted thereunder, changes in capital requirements pursuant to the Dodd-Frank Act, changes in the interpretation and/or application of laws and regulations by regulatory authorities, other governmental initiatives affecting the financial services industry and changes in federal and/or state tax laws or interpretations thereof by taxing authorities; (16) changes in accounting principles, policies or guidelines; (17) our future acquisitions of other depository institutions or lines of business; and (18) future goodwill impairment due to changes in our business, changes in market conditions, or other factors.

MB Financial does not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date on which the forward-looking statement is made.

Set forth below are investor presentation materials.

November 2016

NASDAQ: MBFI

Investor Presentation

Forward-Looking Statements

1

When used in this presentation and in reports filed with or furnished to the Securities and Exchange Commission (the "SEC"), in press releases or other

public stockholder communications, or in oral statements made with the approval of an authorized executive officer, the words or phrases “believe,”

“will,” “should,” “will likely result,” “are expected to,” “will continue” “is anticipated,” “estimate,” “project,” “plans,” or similar expressions are

intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You are cautioned not

to place undue reliance on any forward-looking statements, which speak only as of the date made. These statements may relate to our future

financial performance, strategic plans or objectives, revenues or earnings projections, or other financial items. By their nature, these statements are

subject to numerous uncertainties that could cause actual results to differ materially from those anticipated in the statements.

Important factors that could cause actual results to differ materially from the results anticipated or projected include, but are not limited to, the

following: (1) expected revenues, cost savings, synergies and other benefits from the MB Financial-American Chartered merger might not be realized

within the expected time frames or at all and costs or difficulties relating to integration matters, including but not limited to customer and employee

retention, might be greater than expected; (2) the credit risks of lending activities, including changes in the level and direction of loan delinquencies

and write-offs and changes in estimates of the adequacy of the allowance for loan losses, which could necessitate additional provisions for loan losses,

resulting both from originated loans and loans acquired from other financial institutions; (3) competitive pressures among depository institutions; (4)

interest rate movements and their impact on customer behavior, net interest margin and the value of our mortgage servicing rights; (5) the possibility

that our mortgage banking business may experience increased volatility in its revenues and earnings and the possibility that the profitability of our

mortgage banking business could be significantly reduced if we are unable to originate and sell mortgage loans at profitable margins or if changes in

interest rates negatively impact the value of our mortgage servicing rights; (6) the impact of repricing and competitors’ pricing initiatives on loan and

deposit products; (7) fluctuations in real estate values; (8) the ability to adapt successfully to technological changes to meet customers’ needs and

developments in the market place; (9) the possibility that security measures implemented might not be sufficient to mitigate the risk of a cyber attack

or cyber theft, and that such security measures might not protect against systems failures or interruptions; (10) our ability to realize the residual

values of our direct finance, leveraged and operating leases; (11) our ability to access cost-effective funding; (12) changes in financial markets; (13)

changes in economic conditions in general and in the Chicago metropolitan area in particular; (14) the costs, effects and outcomes of litigation; (15)

new legislation or regulatory changes, including but not limited to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the

“Dodd-Frank Act”) and regulations adopted thereunder, changes in capital requirements pursuant to the Dodd-Frank Act, changes in the

interpretation and/or application of laws and regulations by regulatory authorities, other governmental initiatives affecting the financial services

industry and changes in federal and/or state tax laws or interpretations thereof by taxing authorities; (16) changes in accounting principles, policies or

guidelines; (17) our future acquisitions of other depository institutions or lines of business; and (18) future goodwill impairment due to changes in our

business, changes in market conditions, or other factors.

We do not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date on which

the forward-looking statement is made.

Annualized operating return on average assets 1.15%

for year-to-date 3Q 2016 (1)

Solid capital ratios and a diversified loan portfolio

Top quartile peer performance (2):

Non-interest bearing DDA 45% of total deposits

as of 9/30/2016

Low cost of funds of 27 bps for YTD 3Q 2016

Annualized net loan charge-offs to average loans 0.08%

for YTD 3Q 2016

Double digit growth in key fee initiatives in each of the

last four years

One of 12 entities awarded President’s “E” Award (3)

for export services in 2015, presented by U.S.

Commerce Secretary Penny Pritzker

Core non-interest income as a percent of total revenue

41.7% for YTD 3Q 2016 – Top quartile peer performance

Very low turnover of “A” top-performing employees

Highly successful commercial banker training program

Mortgage Banking Segment ranked in the Top 50 of The

Detroit Free Press Top Work Places for midsized companies

in 2013, 2014 and 2015

Taylor Capital – completed August 2014

MSA Holdings – completed December 2015

American Chartered – completed August 2016

Company Strategy

2

Build a bank with lower risk and consistently better returns than peers

Develop balance sheet with superior profitability and lower risk

Add great customers, whether they borrow or not

Maintain low credit risk and low credit costs

Attract low-cost and stable funding

Maintain strong liquidity and capital

Focus intensely on fee income

Fees need to be high quality, recurring, and profitable

Not an easy task; requires meaningful investment

Emphasize leasing, capital markets, international banking, cards,

commercial deposit fees, treasury management, trust and asset

management, and mortgage

Grow select fee businesses nationally

Invest in human talent

Recruit and retain the best staff

Maintain strong training programs

Be an employer of choice

Make opportunistic acquisitions

Skilled and disciplined acquirer

Long track record of successful integrations

Banking Segment

3

Retail Banking

Provides a significant portion of funding for the banking segment; 45% of deposits

and 11% of loans

High percentage of low-cost funding with a low reliance on CDs

Focuses on small businesses in our market and individuals that live or work near our

banking centers

Key fee initiatives include card services and treasury management services for

business banking customers

Wealth Management

Provides customized private banking, trust, investment management and retirement

plan services through a team of experienced advisors

Specializes in serving business owners, high-net worth families, foundations, and

endowments

Focused on asset management, low-cost deposits, and private banking services

Manages and advises on more than $7.5 billion of client assets through trust and

asset management and subsidiaries (Cedar Hill Associates, LLC and MSA Holdings,

LLC)

Commercial Banking

Provides lending, depository and fee-based capital markets and international banking

services to middle-market companies with revenues from $10 to $500 million

“Relationship banking” culture; calling officers have 20+ years average experience

Commercial and industrial and commercial real estate loan portfolio – terms

generally range from 1 to 5 years, with total relationship carrying amount typically

$25 million or less; approximately 73% have a floating rate of interest indexed to

LIBOR or Prime

Expanding into specialized commercial areas such as healthcare and financial services

Note: Business line financial data as of September 30, 2016

Lease Banking

Provides discounted lease loans and other banking services to lessors located

throughout the country; these services include working capital loans, warehouse

loans, and lease equity investments

Lease banking has over $1.9 billion in loans outstanding

Lease loans are underwritten primarily on the creditworthiness of the lessee

Lessees include mostly investment grade “Fortune 1000” companies located

throughout the U.S. and large middle-market companies

Asset Based Lending

Through 18 sales offices in the U.S. and Canada targets national middle-market

companies, including manufacturers, distributors, and select service companies with

sales from $25 million to $500 million

Deal flow via marketing efforts and relationships with private equity firms, mezzanine

and second lien capital providers, investment banks, consultants and other trusted

advisors

Asset based and hybrid ABL cash flow loans from $5 to $50 million

Over $800 million of loans currently outstanding

Treasury Management

Focused on providing high quality and recurring collection and payment services to

commercial and business banking customers as well as strategic industry niches

Expanding nationally where we have distinguishable expertise and scalability

Broad suite of services including customized data reporting, payment and collection

automation, payment system access, and fraud/risk mitigation tools

See notes on page 33.

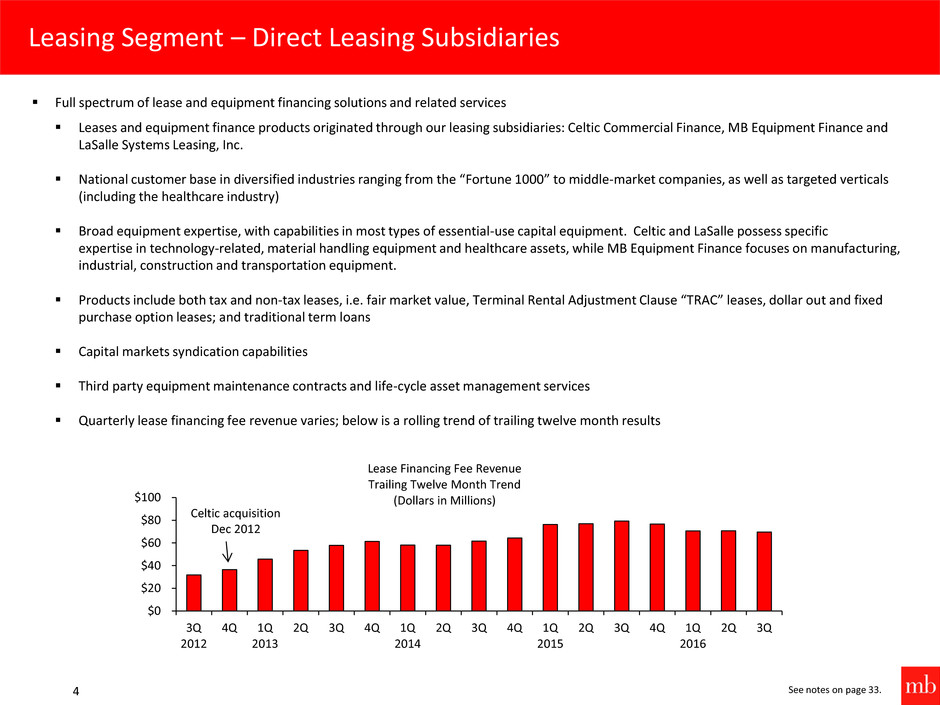

Leasing Segment – Direct Leasing Subsidiaries

4

$0

$20

$40

$60

$80

$100

3Q

2012

4Q 1Q

2013

2Q 3Q 4Q 1Q

2014

2Q 3Q 4Q 1Q

2015

2Q 3Q 4Q 1Q

2016

2Q 3Q

Lease Financing Fee Revenue

Trailing Twelve Month Trend

(Dollars in Millions)

Celtic acquisition

Dec 2012

Full spectrum of lease and equipment financing solutions and related services

Leases and equipment finance products originated through our leasing subsidiaries: Celtic Commercial Finance, MB Equipment Finance and

LaSalle Systems Leasing, Inc.

National customer base in diversified industries ranging from the “Fortune 1000” to middle-market companies, as well as targeted verticals

(including the healthcare industry)

Broad equipment expertise, with capabilities in most types of essential-use capital equipment. Celtic and LaSalle possess specific

expertise in technology-related, material handling equipment and healthcare assets, while MB Equipment Finance focuses on manufacturing,

industrial, construction and transportation equipment.

Products include both tax and non-tax leases, i.e. fair market value, Terminal Rental Adjustment Clause “TRAC” leases, dollar out and fixed

purchase option leases; and traditional term loans

Capital markets syndication capabilities

Third party equipment maintenance contracts and life-cycle asset management services

Quarterly lease financing fee revenue varies; below is a rolling trend of trailing twelve month results

See notes on page 33.

Mortgage Segment

5

Multi-channel national mortgage platform

Multiple mortgage origination channels across a national sales footprint

Operates in 44 states and DC, with 50 retail branches located in 15 states as of 9/30/2016

Origination mix 52% purchase, 48% refinance for 3Q 2016

Channel mix 78% third party, 22% retail for 3Q 2016

In-house servicing platform

Diversified revenue streams

For the first nine months of the year, averaged over $500 million per month in residential mortgage origination volume

Servicing portfolio of $18.5 billion of home loans (notional) as of 9/30/2016

Mortgage Servicing Rights asset = $155 million and ratio of MSR asset/notional value of servicing portfolio = 0.84% as of 9/30/2016

Residential real estate loans of $544 million held for investment at 9/30/2016 consisting primarily of first lien adjustable rate mortgages

Strong credit quality since inception

Ranked in the Top 50 of The Detroit Free Press Top Work Places for midsized companies in 2013, 2014 and 2015

See notes on page 33.

51%

49%

C&I and

Lease Loans

CRE, Construction

& Consumer

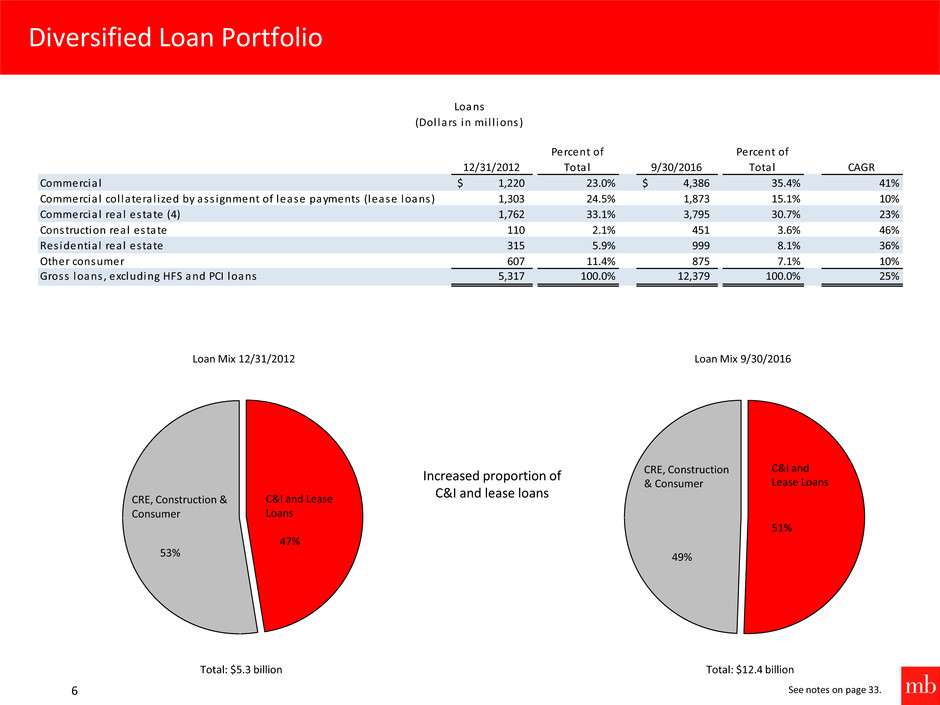

Diversified Loan Portfolio

Loan Mix 9/30/2016

Total: $12.4 billion

Loan Mix 12/31/2012

Total: $5.3 billion

Increased proportion of

C&I and lease loans

47%

53%

C&I and Lease

Loans

CRE, Construction &

Consumer

12/31/2012

Percent of

Total 9/30/2016

Percent of

Total CAGR

Commercia l $ 1,220 23.0% $ 4,386 35.4% 41%

Commercia l col latera l ized by ass ignment of lease payments (lease loans) 1,303 24.5% 1,873 15.1% 10%

Commercia l real estate (4) 1,762 33.1% 3,795 30.7% 23%

Construction real estate 110 2.1% 451 3.6% 46%

Res identia l real estate 315 5.9% 999 8.1% 36%

Other consumer 607 11.4% 875 7.1% 10%

Gross loans , excluding HFS and PCI loans 5,317 100.0% 12,379 100.0% 25%

Loans

(Dol lars in mi l l ions)

6 See notes on page 33.

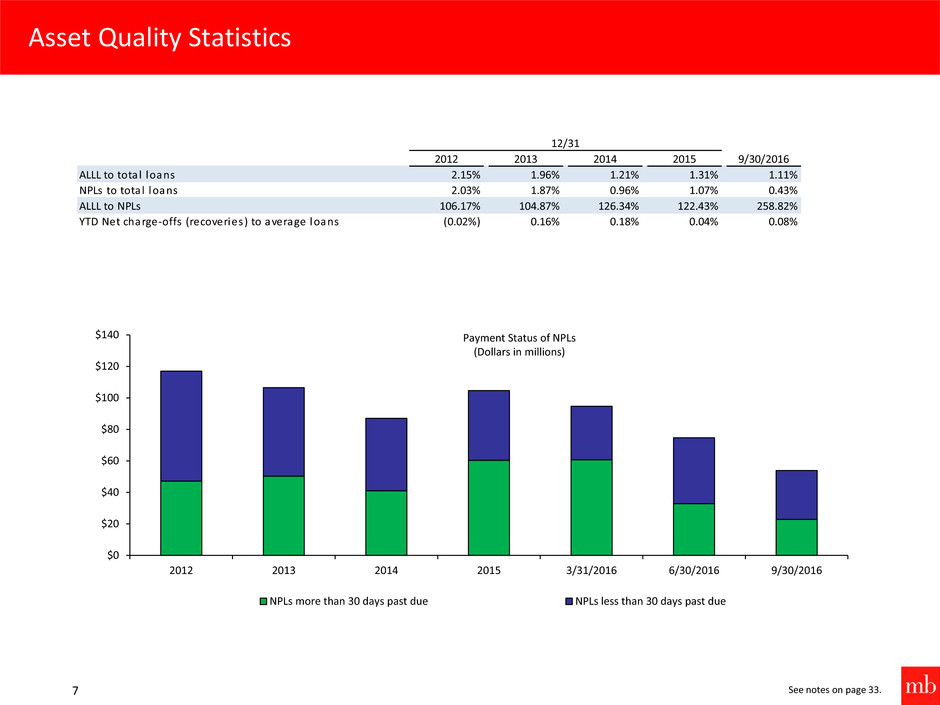

Asset Quality Statistics

7

$0

$20

$40

$60

$80

$100

$120

$140

2012 2013 2014 2015 3/31/2016 6/30/2016 9/30/2016

NPLs more than 30 days past due NPLs less than 30 days past due

Payment Status of NPLs

(Dollars in millions)

2012 2013 2014 2015 9/30/2016

ALLL to total loans 2.15% 1.96% 1.21% 1.31% 1.11%

NPLs to total loans 2.03 1.87 0.96 1.07 0.43

ALLL to NPLs 106.17% 104.87% 126.34% 122.43% 258.82%

YTD Net charge-offs (recoveries) to average loans (0.02%) 0.16 0.18 0.04 0.08

12/31

See notes on page 33.

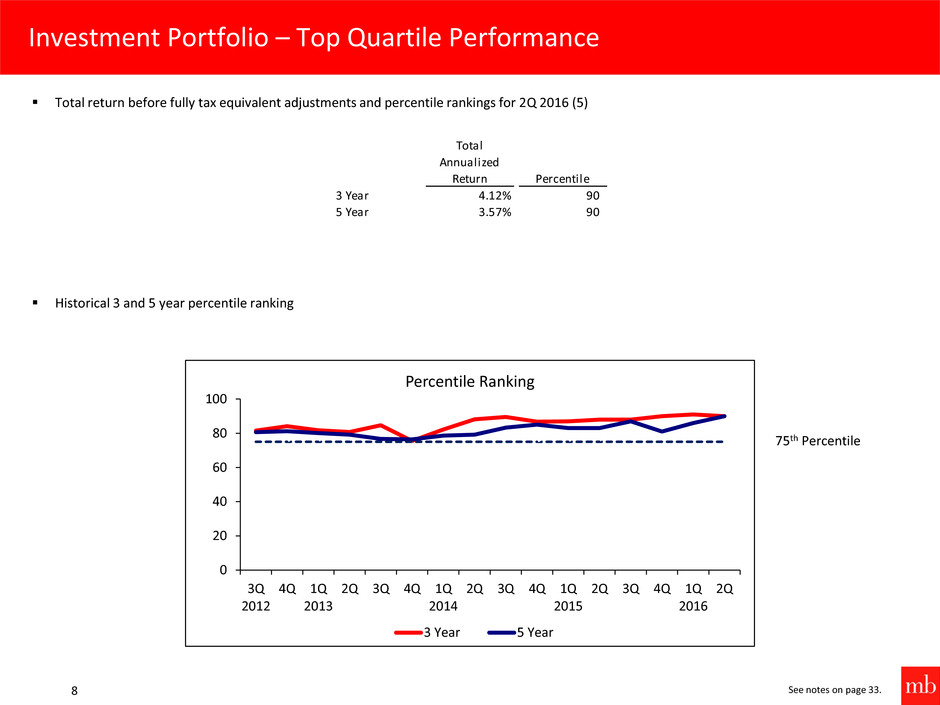

Total return before fully tax equivalent adjustments and percentile rankings for 2Q 2016 (5)

Historical 3 and 5 year percentile ranking

8

Investment Portfolio – Top Quartile Performance

0

20

40

60

80

100

3Q

2012

4Q 1Q

2013

2Q 3Q 4Q 1Q

2014

2Q 3Q 4Q 1Q

2015

2Q 3Q 4Q 1Q

2016

2Q

Percentile Ranking

3 Year 5 Year

75th Percentile

Total

Annualized

Return Percentile

3 Year 4.12% 90

5 Year 3.57% 90

See notes on page 33.

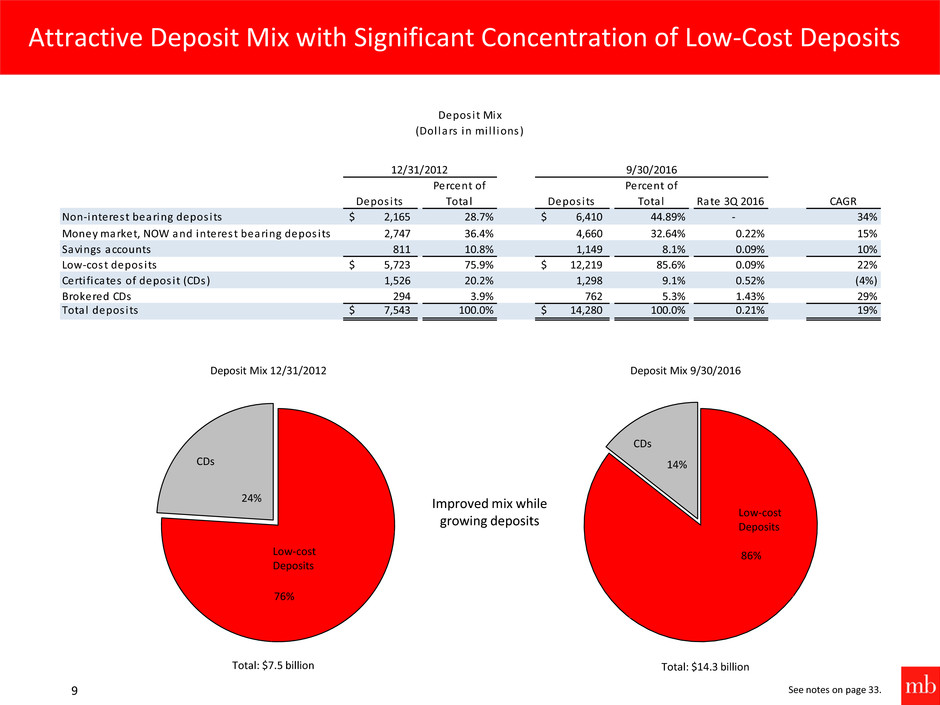

86%

14%

Low-cost

Deposits

CDs

Attractive Deposit Mix with Significant Concentration of Low-Cost Deposits

Deposit Mix 9/30/2016

Total: $14.3 billion

76%

24%

Low-cost

Deposits

CDs

Deposit Mix 12/31/2012

Total: $7.5 billion

Improved mix while

growing deposits

Depos its

Percent of

Total Depos its

Percent of

Total Rate 3Q 2016 CAGR

Non-interest bearing depos its $ 2,165 28.7% $ 6,410 44.89% - 34%

Money market, NOW and interest bearing depos its 2,747 36.4% 4,660 32.64% 0.22% 15%

Savings accounts 811 10.8% 1,149 8.1% 0.09% 10%

Low-cost depos its $ 5,723 75.9% $ 12,219 85.6% 0.09% 22%

Certi ficates of depos it (CDs) 1,526 20.2% 1,298 9.1% 0.52% (4%)

Brokered CDs 294 3.9% 762 5.3% 1.43% 29%

Total depos its $ 7,543 100.0% $ 14,280 100.0% 0.21% 19%

Depos it Mix

(Dol lars in mi l l ions)

12/31/2012 9/30/2016

9 See notes on page 33.

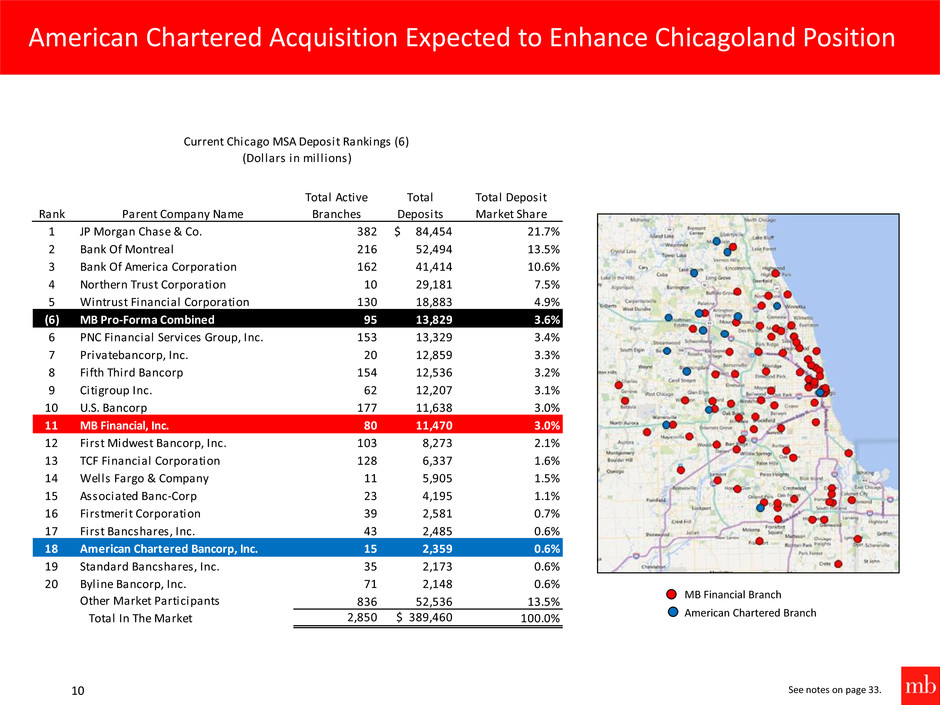

American Chartered Acquisition Expected to Enhance Chicagoland Position

10

Rank Parent Company Name

Total Active

Branches

Total

Deposits

Total Deposit

Market Share

1 JP Morgan Chase & Co. 382 $ 84,454 21.7%

2 Bank Of Montreal 216 52,494 13.5%

3 Bank Of America Corporation 162 41,414 10.6%

4 Northern Trust Corporation 10 29,181 7.5%

5 Wintrust Financial Corporation 130 18,883 4.9%

(6) MB Pro-Forma Combined 95 13,829 3.6%

6 PNC Financial Services Group, Inc. 153 13,329 3.4%

7 Privatebancorp, Inc. 20 12,859 3.3%

8 Fifth Third Bancorp 154 12,536 3.2%

9 Citigroup Inc. 62 12,207 3.1%

10 U.S. Bancorp 177 11,638 3.0%

11 MB Financial, Inc. 80 11,470 3.0%

12 First Midwest Bancorp, Inc. 103 8,273 2.1%

13 TCF Financial Corporation 128 6,337 1.6%

14 Wells Fargo & Company 11 5,905 1.5%

15 Associated Banc-Corp 23 4,195 1.1%

16 Firstmerit Corporation 39 2,581 0.7%

17 First Bancshares, Inc. 43 2,485 0.6%

18 American Chartered Bancorp, Inc. 15 2,359 0.6%

19 Standard Bancshares, Inc. 35 2,173 0.6%

20 Byline Bancorp, Inc. 71 2,148 0.6%

Other Market Participants 836 52,536 13.5%

Total In The Market 2,850 $ 389,460 100.0%

Current Chicago MSA Deposit Rankings (6)

(Dollars in mill ions)

MB Financial Branch

American Chartered Branch

See notes on page 33.

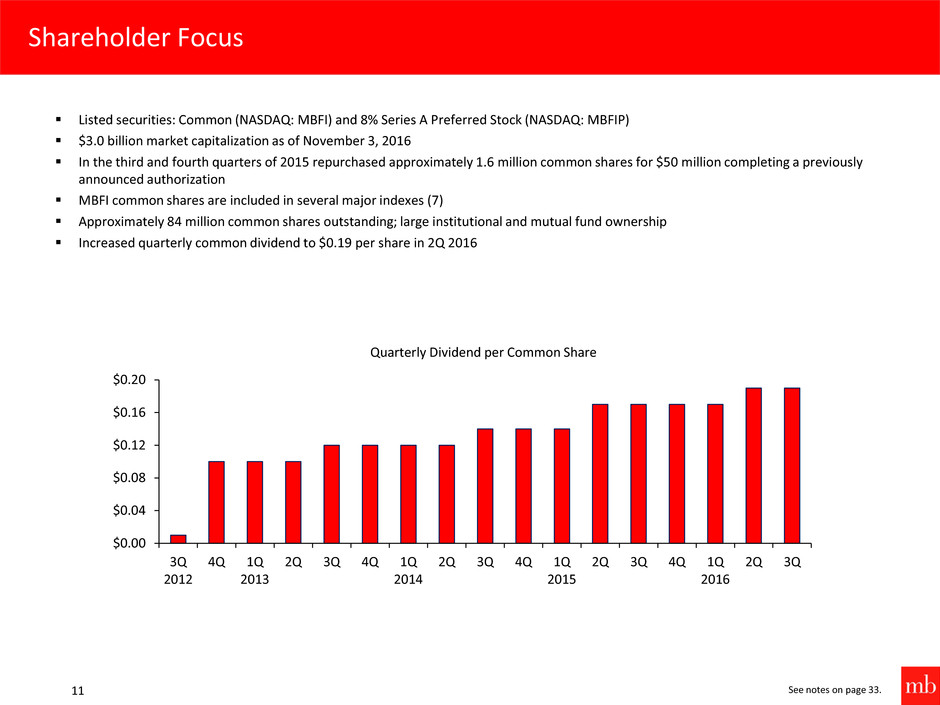

Shareholder Focus

11

$0.00

$0.04

$0.08

$0.12

$0.16

$0.20

3Q

2012

4Q 1Q

2013

2Q 3Q 4Q 1Q

2014

2Q 3Q 4Q 1Q

2015

2Q 3Q 4Q 1Q

2016

2Q 3Q

Quarterly Dividend per Common Share

Listed securities: Common (NASDAQ: MBFI) and 8% Series A Preferred Stock (NASDAQ: MBFIP)

$3.0 billion market capitalization as of November 3, 2016

In the third and fourth quarters of 2015 repurchased approximately 1.6 million common shares for $50 million completing a previously

announced authorization

MBFI common shares are included in several major indexes (7)

Approximately 84 million common shares outstanding; large institutional and mutual fund ownership

Increased quarterly common dividend to $0.19 per share in 2Q 2016

See notes on page 33.

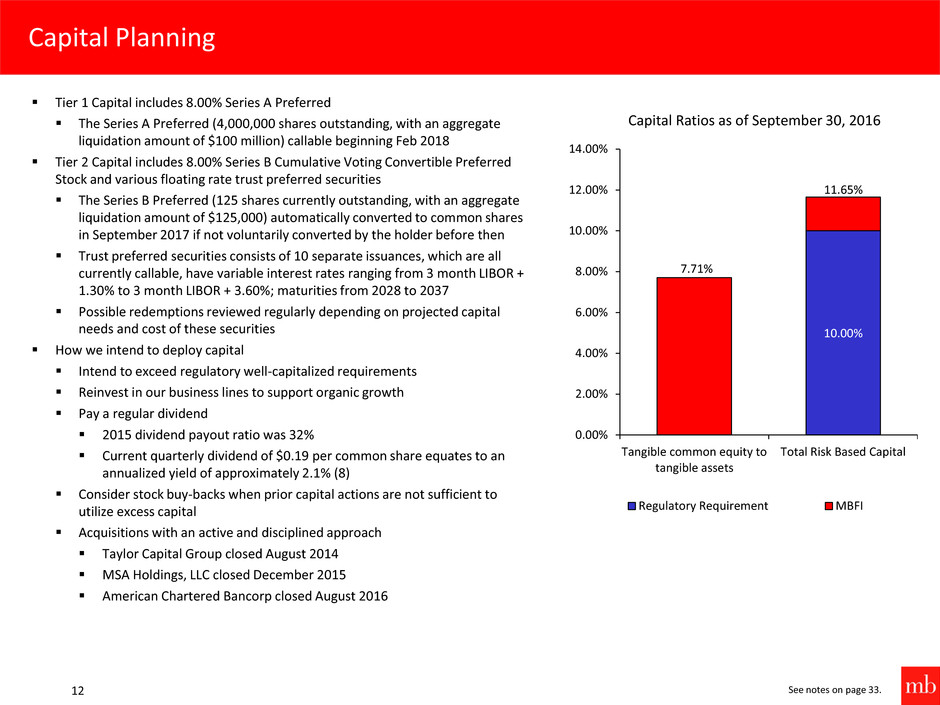

Capital Planning

12

10.00%

7.71%

11.65%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

Tangible common equity to

tangible assets

Total Risk Based Capital

Capital Ratios as of September 30, 2016

Regulatory Requirement MBFI

Tier 1 Capital includes 8.00% Series A Preferred

The Series A Preferred (4,000,000 shares outstanding, with an aggregate

liquidation amount of $100 million) callable beginning Feb 2018

Tier 2 Capital includes 8.00% Series B Cumulative Voting Convertible Preferred

Stock and various floating rate trust preferred securities

The Series B Preferred (125 shares currently outstanding, with an aggregate

liquidation amount of $125,000) automatically converted to common shares

in September 2017 if not voluntarily converted by the holder before then

Trust preferred securities consists of 10 separate issuances, which are all

currently callable, have variable interest rates ranging from 3 month LIBOR +

1.30% to 3 month LIBOR + 3.60%; maturities from 2028 to 2037

Possible redemptions reviewed regularly depending on projected capital

needs and cost of these securities

How we intend to deploy capital

Intend to exceed regulatory well-capitalized requirements

Reinvest in our business lines to support organic growth

Pay a regular dividend

2015 dividend payout ratio was 32%

Current quarterly dividend of $0.19 per common share equates to an

annualized yield of approximately 2.1% (8)

Consider stock buy-backs when prior capital actions are not sufficient to

utilize excess capital

Acquisitions with an active and disciplined approach

Taylor Capital Group closed August 2014

MSA Holdings, LLC closed December 2015

American Chartered Bancorp closed August 2016

See notes on page 33.

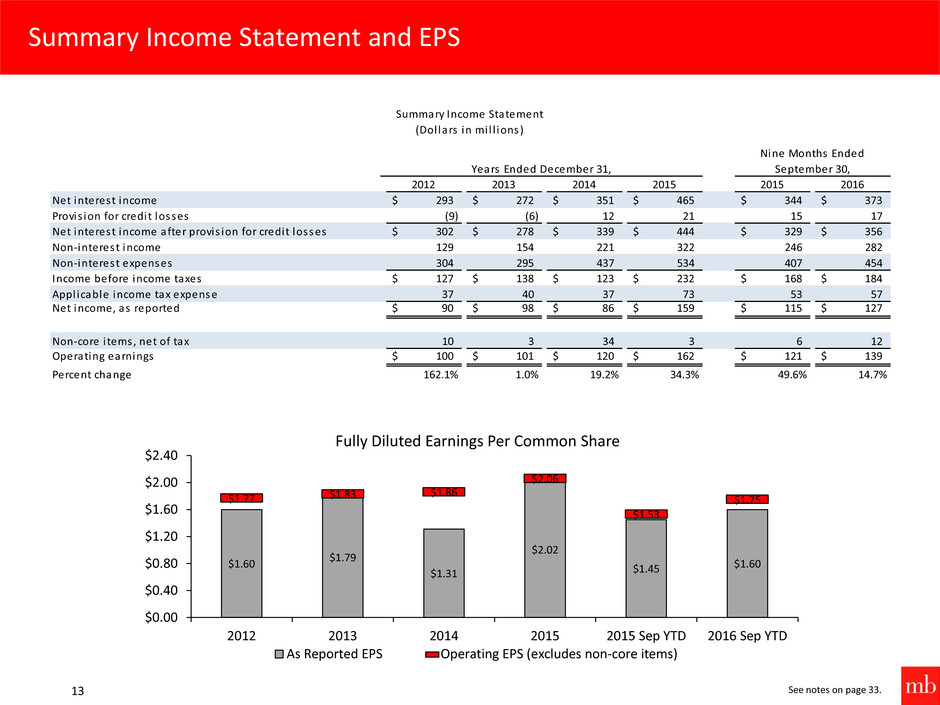

Summary Income Statement and EPS

$1.60

$1.79

$1.31

$2.02

$1.45 $1.60

$1.77 $1.83

$1.86

$2.06

$1.53

$1.75

$0.00

$0.40

$0.80

$1.20

$1.60

$2.00

$2.40

2012 2013 2014 2015 2015 Sep YTD 2016 Sep YTD

Fully Diluted Earnings Per Common Share

As Reported EPS Operating EPS (excludes non-core items)

13

2012 2013 2014 2015 2015 2016

Net interest income $ 293 $ 272 $ 351 $ 465 $ 344 $ 373

Provis ion for credit losses (9) (6) 12 21 15 17

Net interest income after provis ion for credit losses $ 302 $ 278 $ 339 $ 444 $ 329 $ 356

Non-interest income 129 154 221 322 246 282

Non-interest expenses 304 295 437 534 407 454

Inco e before income taxes $ 127 $ 138 $ 123 $ 232 $ 168 $ 184

Appl icable income tax expense 37 40 37 73 53 57

Net income, as reported $ 90 $ 98 $ 86 $ 159 $ 115 $ 127

Non-core i tems, net of tax 10 3 34 3 6 12

Operating earnings $ 100 $ 101 $ 120 $ 162 $ 121 $ 139

Percent change 162.1% 1.0% 19.2% 34.3% 49.6% 14.7%

Years Ended December 31,

Nine Months Ended

September 30,

Summary Income Statement

(Dol lars in mi l l ions)

See notes on page 33.

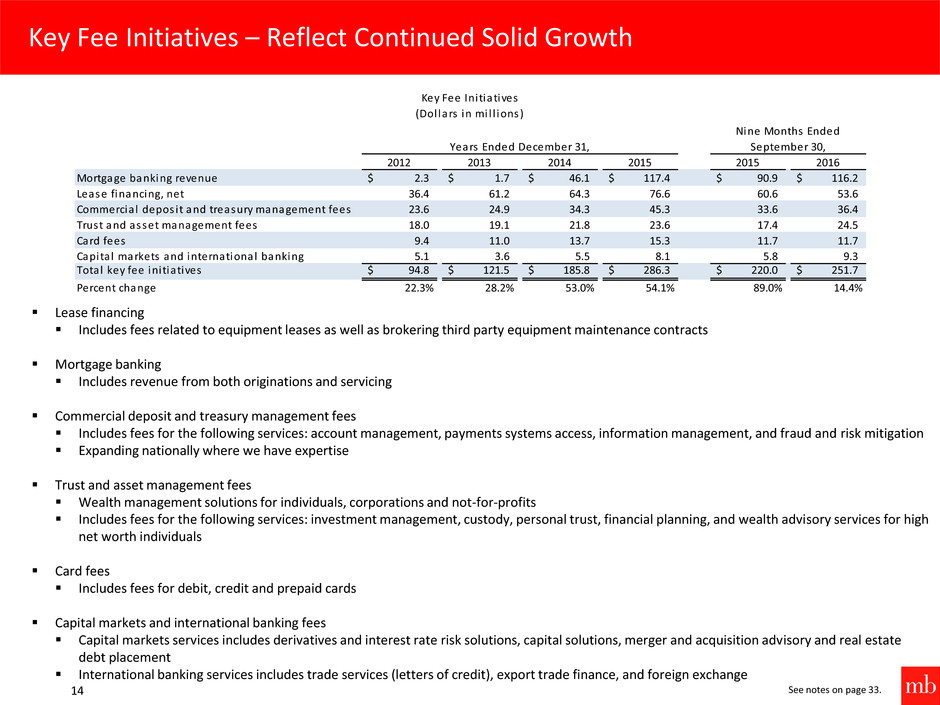

Key Fee Initiatives – Reflect Continued Solid Growth

14

2012 2013 2014 2015 2015 2016

Mortgag banking revenue $ 2.3 $ 1.7 $ 46.1 $ 117.4 $ 90.9 $ 116.2

Lease financing, net 36.4 61.2 64.3 76.6 60.6 53.6

Commercia l depos it and treasury management fees 23.6 24.9 34.3 45.3 33.6 36.4

Trust and asset management fees 18.0 19.1 21.8 23.6 17.4 24.5

Card fees 9.4 11.0 13.7 15.3 11.7 11.7

Capita l markets and international banking 5.1 3.6 5.5 8.1 5.8 9.3

Total key fee ini tiatives $ 94.8 $ 121.5 $ 185.8 $ 286.3 $ 220.0 $ 251.7

Percent change 22.3% 28.2% 53.0% 54.1% 89.0% 14.4%

Years Ended December 31,

Nine Months Ended

September 30,

Key Fee Ini tiatives

(Dol lars in mi l l ions)

Lease financing

Includes fees related to equipment leases as well as brokering third party equipment maintenance contracts

Mortgage banking

Includes revenue from both originations and servicing

Commercial deposit and treasury management fees

Includes fees for the following services: account management, payments systems access, information management, and fraud and risk mitigation

Expanding nationally where we have expertise

Trust and asset management fees

Wealth management solutions for individuals, corporations and not-for-profits

Includes fees for the following services: investment management, custody, personal trust, financial planning, and wealth advisory services for high

net worth individuals

Card fees

Includes fees for debit, credit and prepaid cards

Capital markets and international banking fees

Capital markets services includes derivatives and interest rate risk solutions, capital solutions, merger and acquisition advisory and real estate

debt placement

International banking services includes trade services (letters of credit), export trade finance, and foreign exchange

See notes on page 33.

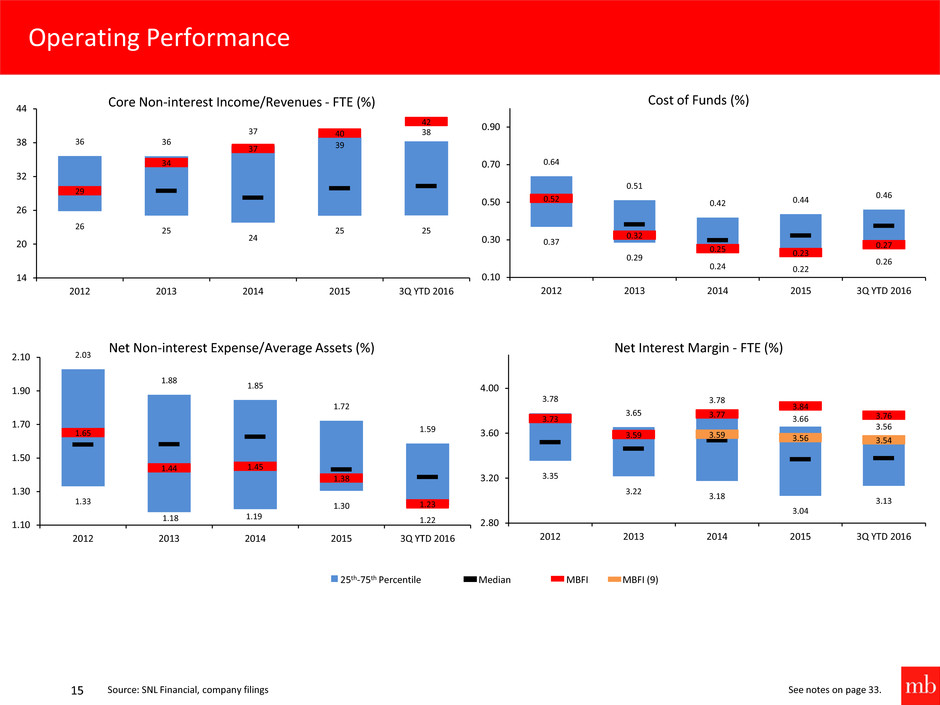

Operating Performance

15 Source: SNL Financial, company filings

25th-75th Percentile Median MBFI MBFI (9)

See notes on page 33.

26 25

24

25 25

29

34

37

40

42

36 36

37

39

38

14

20

26

32

38

44

2012 2013 2014 2015 3Q YTD 2016

Core Non-interest Income/Revenues - FTE (%)

0.37

0.29

0.24 0.22

0.26

0.52

0.32

0.25 0.23

0.27

0.64

0.51

0.42 0.44

0.46

0.10

0.30

0.50

0.70

0.90

2012 2013 2014 2015 3Q YTD 2016

Cost of Funds (%)

1.33

1.18 1.19

1.30

1.22

1.65

1.44 1.45

1.38

1.23

2.03

1.88

1.85

1.72

1.59

1.10

1.30

1.50

1.70

1.90

2.10

2012 2013 2014 2015 3Q YTD 2016

Net Non-interest Expense/Average Assets (%)

3.35

3.22

3.18

3.04

3.13

3.73

3.59

3.77

3.84

3.76

3.78

3.65

3.78

3.66

3.56

3.59 3.56 3.54

2.80

3.20

3.60

4.00

2012 2013 2014 2015 3Q YTD 2016

Net Interest Margin - FTE (%)

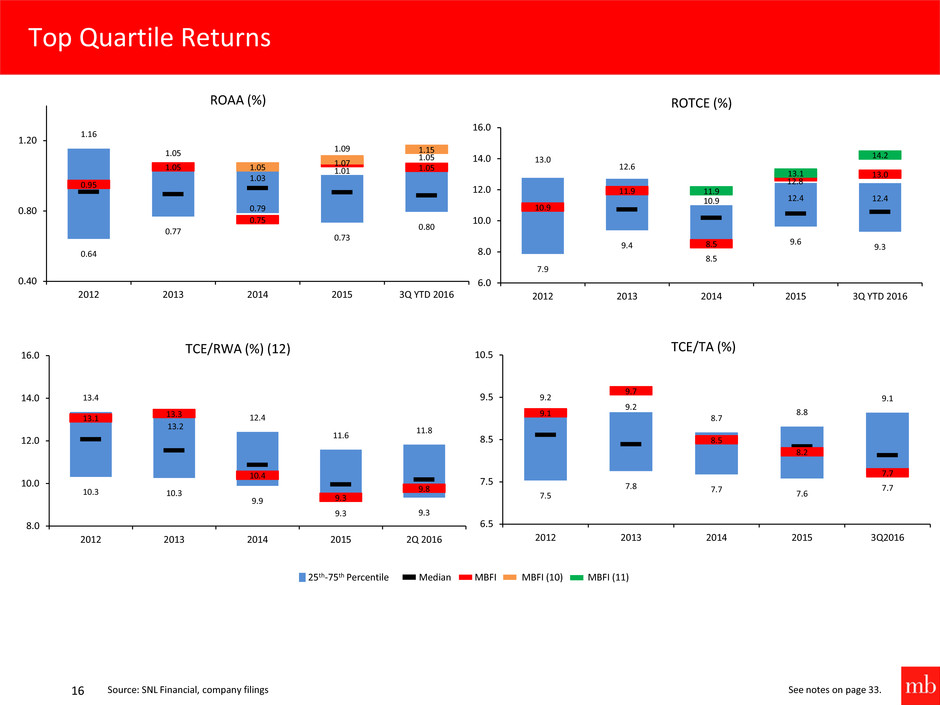

Top Quartile Returns

16

25th-75th Percentile Median MBFI MBFI (10) MBFI (11)

Source: SNL Financial, company filings See notes on page 33.

10.3 10.3

9.9

9.3 9.3

13.1 13.3

10.4

9.3

9.8

13.4

13.2

12.4

11.6

11.8

8.0

10.0

12.0

14.0

16.0

2012 2013 2014 2015 2Q 2016

TCE/RWA (%) (12)

0.64

0.77

0.79

0.73

0.80

0.95

1.05

0.75

1.07

1.05

1.16

1.05

1.03

1.01

1.05

1.05

1.09 1.15

0.40

0.80

1.20

2012 2013 2014 2015 3Q YTD 2016

ROAA (%)

7.9

9.4

8.5

9.6

9.3

10.9

11.9

8.5

12.8

13.0

13.0

12.6

10.9 12.4 12.4

11.9

13.1

14.2

6.0

8.0

10.0

12.0

14.0

16.0

2012 2013 2014 2015 3Q YTD 2016

ROTCE (%)

7.5

7.8 7.7 7.6

7.7

9.1

9.7

8.5

8.2

7.7

9.2

9.2

8.7

8.8

9.1

6.5

7.5

8.5

9.5

10.5

2012 2013 2014 2015 3Q2016

TCE/TA (%)

Reserves/Loans (%)

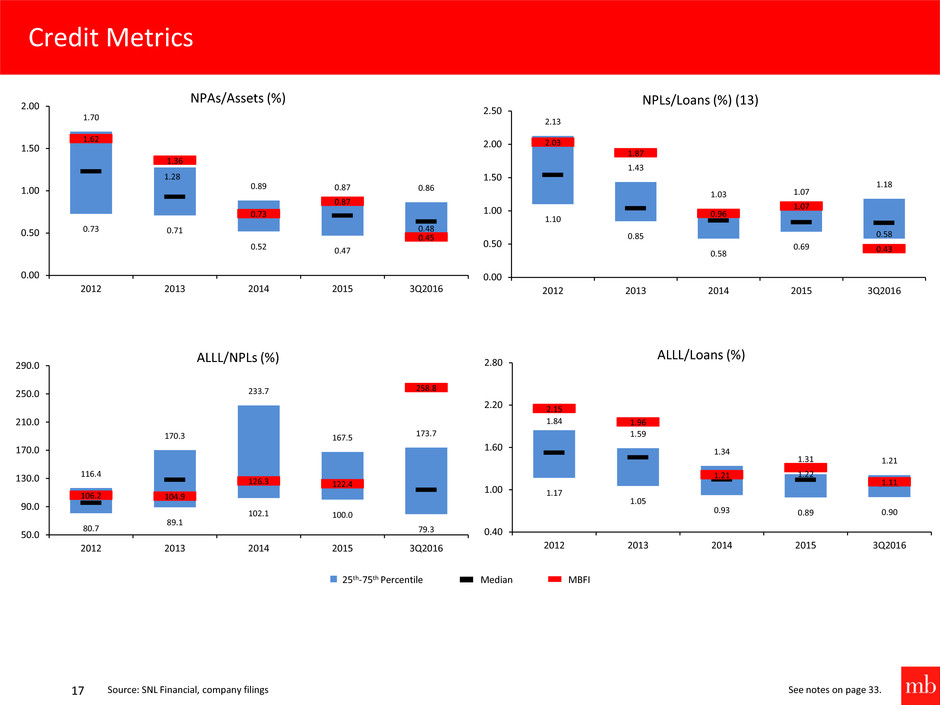

Credit Metrics

25th-75th Percentile Median MBFI

Source: SNL Financial, company filings 17 See notes on page 33.

0.73 0.71

0.52 0.47

0.48

1.62

1.36

0.73

0.87

0.45

1.70

1.28

0.89 0.87 0.86

0.00

0.50

1.00

1.50

2.00

2012 2013 2014 2015 3Q2016

NPAs/Assets (%)

1.10

0.85

0.58

0.69

0.58

2.03

1.87

0.96

1.07

0.43

2.13

1.43

1.03 1.07

1.18

0.00

0.50

1.00

1.50

2.00

2.50

2012 2013 2014 2015 3Q2016

NPLs/Loans (%) (13)

80.7

89.1

102.1 100.0

79.3

106.2 104.9

126.3 122.4

258.8

116.4

170.3

233.7

167.5 173.7

50.0

90.0

130.0

170.0

210.0

250.0

290.0

2012 2013 2014 2015 3Q2016

ALLL/NPLs (%)

1.17

1.05

0.93 0.89 0.90

2.15

1.96

1.21

1.31

1.11

1.84

1.59

1.34

1.22

1.21

0.40

1.00

1.60

2.20

2.80

2012 2013 2014 2015 3Q2016

ALLL/Loans (%)

Skilled Acquirer

Skilled acquirer of both depository and non-depository entities

Eighteen completed acquisitions since 2000

Disciplined financial analyses focused on

Internal rates of return and returns on invested capital

Long-term per share earnings accretion

Long track record of successful and rapid employee, customer and systems integrations

Branch network size and location makes acquired branch consolidations more likely to enhance expense savings opportunities

Company culture suited for acquisitions

18 See notes on page 33.

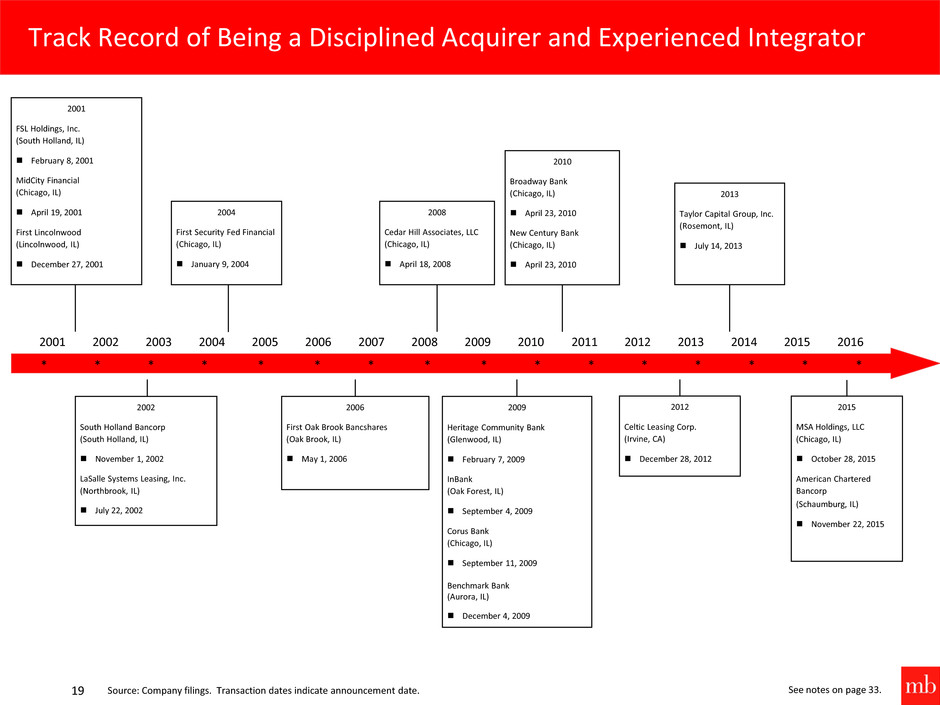

2002

South Holland Bancorp

(South Holland, IL)

November 1, 2002

LaSalle Systems Leasing, Inc.

(Northbrook, IL)

July 22, 2002

2006

First Oak Brook Bancshares

(Oak Brook, IL)

May 1, 2006

Track Record of Being a Disciplined Acquirer and Experienced Integrator

2012

Celtic Leasing Corp.

(Irvine, CA)

December 28, 2012

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

* * * * * * * * * * * * * * * *

2008

Cedar Hill Associates, LLC

(Chicago, IL)

April 18, 2008

2010

Broadway Bank

(Chicago, IL)

April 23, 2010

New Century Bank

(Chicago, IL)

April 23, 2010

2013

Taylor Capital Group, Inc.

(Rosemont, IL)

July 14, 2013

Source: Company filings. Transaction dates indicate announcement date. 19

2004

First Security Fed Financial

(Chicago, IL)

January 9, 2004

2001

FSL Holdings, Inc.

(South Holland, IL)

February 8, 2001

MidCity Financial

(Chicago, IL)

April 19, 2001

First Lincolnwood

(Lincolnwood, IL)

December 27, 2001

2015

MSA Holdings, LLC

(Chicago, IL)

October 28, 2015

American Chartered

Bancorp

(Schaumburg, IL)

November 22, 2015

2009

Heritage Community Bank

(Glenwood, IL)

February 7, 2009

InBank

(Oak Forest, IL)

September 4, 2009

Corus Bank

(Chicago, IL)

September 11, 2009

Benchmark Bank

(Aurora, IL)

December 4, 2009

See notes on page 33.

On August 24, 2016 we successfully completed the merger of American Chartered Bancorp, Inc., which had approximately $2.8 billion in total

assets, and converted their clients to MB data processing systems and products

Key earnings components comparisons to 2Q 2016

Net interest income increased 6.7% to $130.8 million primarily due to higher average loan balances

Net interest margin on a fully tax equivalent basis excluding discount accretion on acquired Taylor Capital and American Chartered loans

decreased 7bps to 3.50%

Core non-interest income increased 18.0% to $107.7 million primarily due to increased mortgage origination volume and higher gain on

sale margins and increased lease financing fees from the sale of third party equipment-maintenance contracts

On a fully tax-equivalent basis, core non-interest income was 44% of revenues in 3Q 2016 and was in the top quartile of our peer banks

Core non-interest expense increased 6.6% to $154.3 million due to increased salary and employee benefits expense primarily due to the

increased staff from the American Chartered merger and as a result of increased mortgage commission expense resulting from higher

origination volumes

Overall operating earnings increased 15.7% to $51.9 million (14)

Total legacy loans, which exclude loans acquired in the American Chartered merger and purchased credit-impaired loans but include loans

acquired in the Taylor Capital merger, grew 4.3% (17.2% annualized) in the 3Q 2016

Total legacy deposits, which exclude deposits assumed in the American Chartered merger but include deposits assumed in the Taylor Capital

merger, grew 3.8% (15.1% annualized) in the 3Q 2016

Credit quality metrics

The ratio of non-performing loans to total loans was 0.43% at 9/30/2016, a decrease from 0.73% at 6/30/2016

Annualized net loan charge-offs to average loans was 0.09% for 3Q 2016 unchanged from 2Q 2016

Provision for credit losses increased to $6.5 million in 3Q 2016 from $2.8 million in 2Q 2016 primarily due to loan growth

Recent Company Highlights – 3Q 2016

20 See notes on page 33.

Leasing Appendix

21

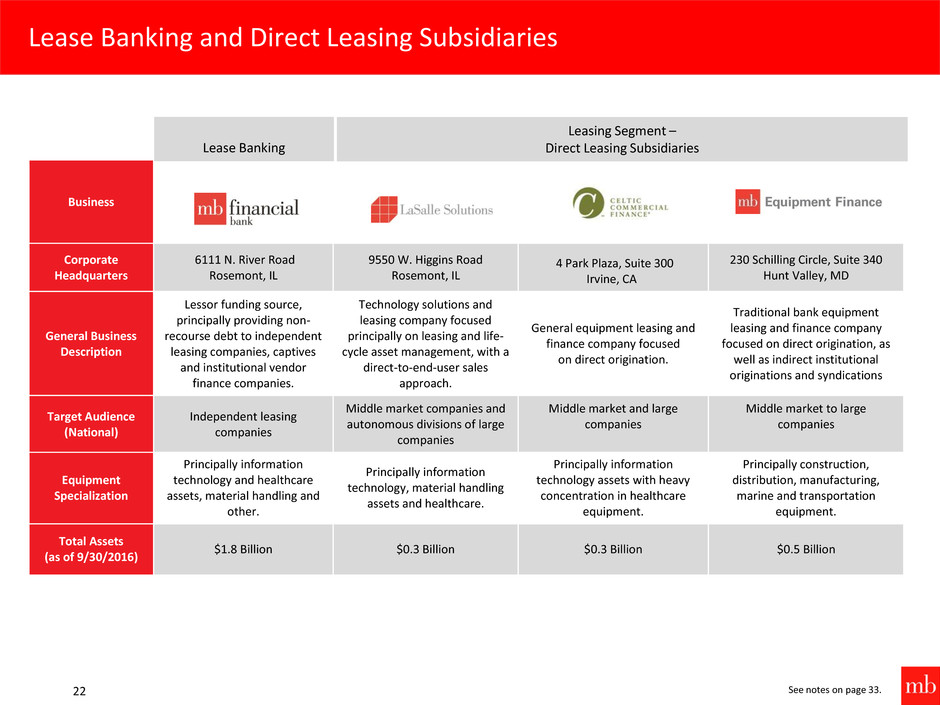

Lease Banking and Direct Leasing Subsidiaries

22

Business

Corporate

Headquarters

6111 N. River Road

Rosemont, IL

9550 W. Higgins Road

Rosemont, IL

4 Park Plaza, Suite 300

Irvine, CA

230 Schilling Circle, Suite 340

Hunt Valley, MD

General Business

Description

Lessor funding source,

principally providing non-

recourse debt to independent

leasing companies, captives

and institutional vendor

finance companies.

Technology solutions and

leasing company focused

principally on leasing and life-

cycle asset management, with a

direct-to-end-user sales

approach.

General equipment leasing and

finance company focused

on direct origination.

Traditional bank equipment

leasing and finance company

focused on direct origination, as

well as indirect institutional

originations and syndications

Target Audience

(National)

Independent leasing

companies

Middle market companies and

autonomous divisions of large

companies

Middle market and large

companies

Middle market to large

companies

Equipment

Specialization

Principally information

technology and healthcare

assets, material handling and

other.

Principally information

technology, material handling

assets and healthcare.

Principally information

technology assets with heavy

concentration in healthcare

equipment.

Principally construction,

distribution, manufacturing,

marine and transportation

equipment.

Total Assets

(as of 9/30/2016)

$1.8 Billion $0.3 Billion $0.3 Billion $0.5 Billion

Lease Banking

Leasing Segment –

Direct Leasing Subsidiaries

See notes on page 33.

Lease Banking

23

Our lease banking group, which is part of the Banking Segment, has provided for over four decades the following banking services to

independent equipment lessors located throughout the U.S.

Debt financing

Working capital financing

Treasury management services

Equity/residual investment in leases through partnering with customers

Debt financings (Lease Loans) are non-recourse loans to lessors, collateralized by lease equipment and underwritten based on the financial

wherewithal of each lessee. They are included as commercial loans collateralized by assignment of lease payments (Lease Loans) in the

commercial-related loan section of the balance sheet for financial statement purposes.

Lessees generally consist of investment grade Fortune 1000, federal government, large middle-market and health care companies.

Most loans fully amortize over periods ranging from 30 to 60 months. No residual risk on Lease Loans funded with third parties.

Lease Banking’s results are included in the Banking Segment of our earnings release.

Credit experience has been solid. Non-performing loans/total loans were 0.26% as of 9/30/2016 and annualized net charge-offs were

0.21% for the nine months ended 9/30/2016.

Revenues from Lease Loans and working capital financing are reflected in interest income

See notes on page 33.

Direct Leasing Subsidiaries

24

Leases are originated directly throughout the U.S. by our three leasing subsidiaries, LaSalle Solutions, Celtic Equipment Finance and MB Equipment

Finance, which together form the Leasing Segment in our earnings release. LaSalle and Celtic are customers of our Lease Banking group and

generally finance much of their equipment cost with debt (85% to 95% of the original equipment cost). MB Equipment Finance sources 100% of

its capital internally.

The lease portfolio is comprised of various types of equipment including information technology, healthcare, material handling, general

manufacturing distribution, and transportation equipment.

Lease income is recognized over the life of the lease so that at the end of lease term the residual amount approximates the fair market value of

the leased equipment.

Balance sheet classification for financial reporting: Direct Finance and Leveraged Leases that transfer substantially all of the benefits and risk

related to the equipment ownership are grouped with Lease Loans in the loan section. By contrast, for Operating Leases, the underlying

equipment at cost and net of accumulated depreciation is reflected in Lease investments, net, which is part of other assets, and was $278 million

at 9/30/2016.

MB’s leasing subsidiaries offer a broad suite of lease products, which, at the end of a lease term, may permit the lease to be renewed/extended,

purchased, or the equipment may be returned and sold.

Income statement classification: Interest income on Direct Finance and Leveraged Leases and accreted residual income on these leases are

included in Interest Income. By contrast, Lease Payments on Operating Leases plus accreted residual income on these leases less any depreciation

expense on the equipment are included in non-interest income Lease Financing Fee Income. Proceeds received as a result of lease renewals and

equipment sales less any residual investment in the lease results in a gain or loss that is also reflected in Lease Financing Fee Income.

We also broker maintenance contracts sold by equipment manufacturers to our customers covering equipment leased from MB as well as other

equipment owned or leased by our clients. Equipment manufacturers are responsible for completing any maintenance covered by a maintenance

contract. Maintenance contract revenue is presented, net of the related cost of sales paid to the third party vendor, as part of Lease Financing Fee

Income for financial statement purposes.

See notes on page 33.

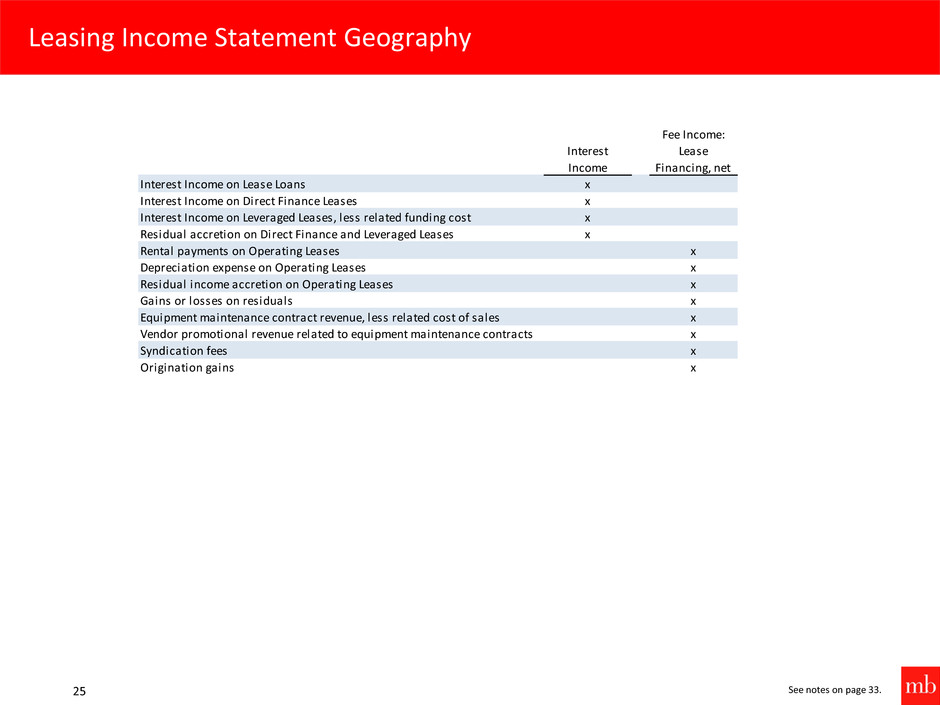

Leasing Income Statement Geography

25

Interest

Income

Fee Income:

Lease

Financing, net

Interest Income on Lease Loans x

Interest Income on Direct Finance Leases x

Interest Income on Leveraged Leases, less related funding cost x

Residual accretion on Direct Finance and Leveraged Leases x

Rental payments on Operating Leases x

Depreciation expense on Operating Leases x

Residual income accretion on Operating Leases x

Gains or losses on residuals x

Equipment maintenance contract revenue, less related cost of sales x

Vendor promotional revenue related to equipment maintenance contracts x

Syndication fees x

Origination gains x

See notes on page 33.

Non-GAAP Disclosure Appendix

26

Non-GAAP Disclosure Reconciliations

27

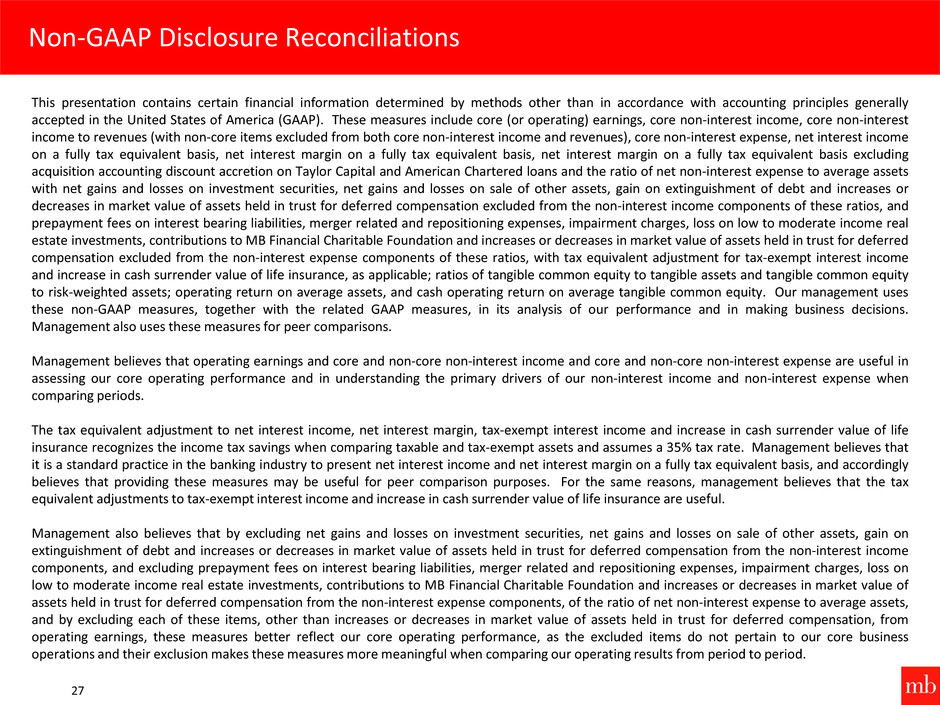

This presentation contains certain financial information determined by methods other than in accordance with accounting principles generally

accepted in the United States of America (GAAP). These measures include core (or operating) earnings, core non-interest income, core non-interest

income to revenues (with non-core items excluded from both core non-interest income and revenues), core non-interest expense, net interest income

on a fully tax equivalent basis, net interest margin on a fully tax equivalent basis, net interest margin on a fully tax equivalent basis excluding

acquisition accounting discount accretion on Taylor Capital and American Chartered loans and the ratio of net non-interest expense to average assets

with net gains and losses on investment securities, net gains and losses on sale of other assets, gain on extinguishment of debt and increases or

decreases in market value of assets held in trust for deferred compensation excluded from the non-interest income components of these ratios, and

prepayment fees on interest bearing liabilities, merger related and repositioning expenses, impairment charges, loss on low to moderate income real

estate investments, contributions to MB Financial Charitable Foundation and increases or decreases in market value of assets held in trust for deferred

compensation excluded from the non-interest expense components of these ratios, with tax equivalent adjustment for tax-exempt interest income

and increase in cash surrender value of life insurance, as applicable; ratios of tangible common equity to tangible assets and tangible common equity

to risk-weighted assets; operating return on average assets, and cash operating return on average tangible common equity. Our management uses

these non-GAAP measures, together with the related GAAP measures, in its analysis of our performance and in making business decisions.

Management also uses these measures for peer comparisons.

Management believes that operating earnings and core and non-core non-interest income and core and non-core non-interest expense are useful in

assessing our core operating performance and in understanding the primary drivers of our non-interest income and non-interest expense when

comparing periods.

The tax equivalent adjustment to net interest income, net interest margin, tax-exempt interest income and increase in cash surrender value of life

insurance recognizes the income tax savings when comparing taxable and tax-exempt assets and assumes a 35% tax rate. Management believes that

it is a standard practice in the banking industry to present net interest income and net interest margin on a fully tax equivalent basis, and accordingly

believes that providing these measures may be useful for peer comparison purposes. For the same reasons, management believes that the tax

equivalent adjustments to tax-exempt interest income and increase in cash surrender value of life insurance are useful.

Management also believes that by excluding net gains and losses on investment securities, net gains and losses on sale of other assets, gain on

extinguishment of debt and increases or decreases in market value of assets held in trust for deferred compensation from the non-interest income

components, and excluding prepayment fees on interest bearing liabilities, merger related and repositioning expenses, impairment charges, loss on

low to moderate income real estate investments, contributions to MB Financial Charitable Foundation and increases or decreases in market value of

assets held in trust for deferred compensation from the non-interest expense components, of the ratio of net non-interest expense to average assets,

and by excluding each of these items, other than increases or decreases in market value of assets held in trust for deferred compensation, from

operating earnings, these measures better reflect our core operating performance, as the excluded items do not pertain to our core business

operations and their exclusion makes these measures more meaningful when comparing our operating results from period to period.

Non-GAAP Disclosure Reconciliations

28

Ratio 2012 2013 2014 2015 2015 2016

Net interest margin 3.49% 3.31% 3.54% 3.63% 3.62% 3.55%

Plus : tax equiva lent effect 0.24% 0.28% 0.23% 0.21% 0.21% 0.21%

Net interest margin, ful ly tax equiva lent (FTE) 3.73% 3.59% 3.77% 3.84% 3.83% 3.76%

Less : effect of excluding discount accretion on

acquired Taylor Capita l and American Chartered

loans 0.18% 0.28% 0.27% 0.22%

Net interest margin, FTE, excluding discount

accretion on acquired Taylor Capita l and

American Chartered loans 3.59% 3.56% 3.56% 3.54%

Years Ended December 31,

Nine Months Ended

September 30, (Annual ized)

Net Interest Margin

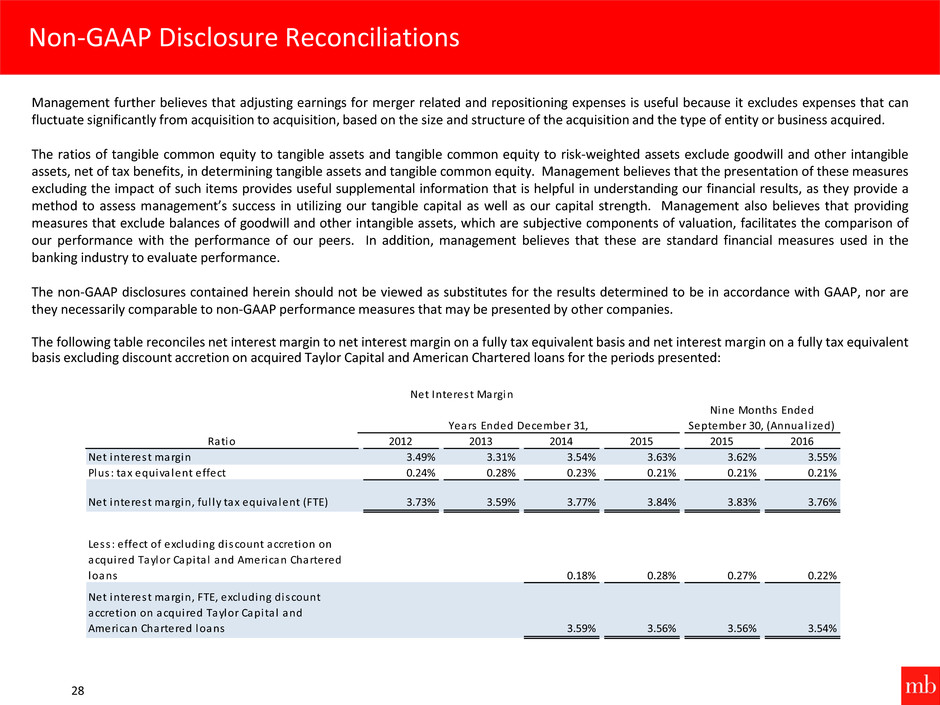

Management further believes that adjusting earnings for merger related and repositioning expenses is useful because it excludes expenses that can

fluctuate significantly from acquisition to acquisition, based on the size and structure of the acquisition and the type of entity or business acquired.

The ratios of tangible common equity to tangible assets and tangible common equity to risk-weighted assets exclude goodwill and other intangible

assets, net of tax benefits, in determining tangible assets and tangible common equity. Management believes that the presentation of these measures

excluding the impact of such items provides useful supplemental information that is helpful in understanding our financial results, as they provide a

method to assess management’s success in utilizing our tangible capital as well as our capital strength. Managem nt also believes that providing

measures that exclude balances of goodwill and other intangible assets, which are subjective components of valuation, facilitates the comparison of

our performance with the performance of our peers. In addition, management believes that these are standard financial measures used in the

banking industry to evaluate performance.

The non-GAAP disclosures contained herein should not be viewed as substitutes for the results determined to be in accordance with GAAP, nor are

they necessarily comparable to non-GAAP performance measures that may be presented by other companies.

The following table reconciles net interest margin to net interest margin on a fully tax equivalent basis and net interest margin on a fully tax equivalent

basis excluding discount accretion on acquired Taylor Capital and American Chartered loans for the periods presented:

Non-GAAP Disclosure Reconciliations

29

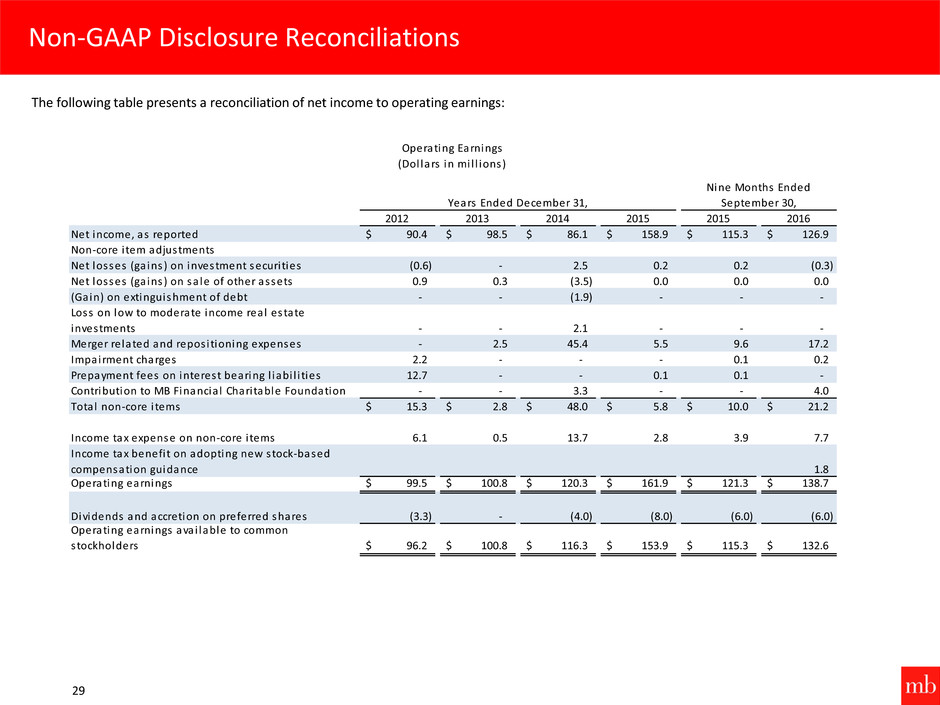

2012 2013 2014 2015 2015 2016

Net income, as reported $ 90.4 $ 98.5 $ 86.1 $ 158.9 $ 115.3 $ 126.9

Non-core i tem adjustments

Net losses (ga ins ) on investment securi ties (0.6) - 2.5 0.2 0.2 (0.3)

Net losses (ga ins ) on sa le of other assets 0.9 0.3 (3.5) 0.0 0.0 0.0

(Gain) on extinguishment of debt - - (1.9) - - -

Loss on low to moderate income real estate

investments - - 2.1 - - -

Merger related and repos i tioning expenses - 2.5 45.4 5.5 9.6 17.2

Impairment charges 2.2 - - - 0.1 0.2

Prepayment fees on interest bearing l iabi l i ties 12.7 - - 0.1 0.1 -

Contribution to MB Financia l Chari table Foundation - - 3.3 - - 4.0

Total non-core i tems $ 15.3 $ 2.8 $ 48.0 $ 5.8 $ 10.0 $ 21.2

Income tax expense on non-core i tems 6.1 0.5 13.7 2.8 3.9 7.7

Inc me tax benefi t on adopting new stock-based

compensation guidance 1.8

Operating earnings $ 99.5 $ 100.8 $ 120.3 $ 161.9 $ 121.3 $ 138.7

Dividends and accretion on preferred shares (3.3) - (4.0) (8.0) (6.0) (6.0)

Operating earnings avai lable to common

stockholders $ 96.2 $ 100.8 $ 116.3 $ 153.9 $ 115.3 $ 132.6

Years Ended December 31,

Nine Months Ended

September 30,

Operating Earnings

(Dol lars in mi l l ions)

The following table presents a reconciliation of net income to operating earnings:

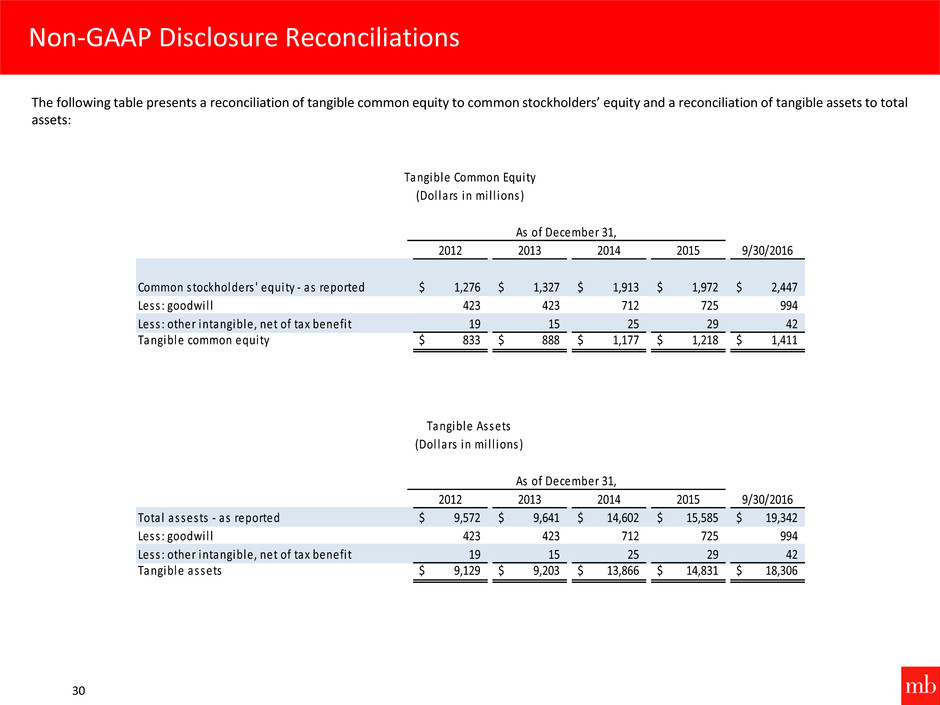

The following table presents a reconciliation of tangible common equity to common stockholders’ equity and a reconciliation of tangible assets to total

assets:

Non-GAAP Disclosure Reconciliations

30

2012 2013 2014 2015 9/30/2016

Common stockholders ' equity - as reported $ 1,276 $ 1,327 $ 1,913 $ 1,972 $ 2,447

Less : goodwi l l 423 423 712 725 994

Less : other intangible, net of tax benefi t 19 15 25 29 42

Tangible common equity $ 833 $ 888 $ 1,177 $ 1,218 $ 1,411

2012 2013 2014 2015 9/30/2016

Total assests - as reported $ 9,572 $ 9,641 $ 14,602 $ 15,585 $ 19,342

Less : goodwi l l 423 423 712 725 994

Less : other intangible, net of tax benefi t 19 15 25 29 42

Tangible assets $ 9,129 $ 9,203 $ 13,866 $ 14,831 $ 18,306

As of December 31,

Tangible Common Equity

(Dol lars in mi l l ions)

Tangible Assets

(Dol lars in mi l l ions)

As of December 31,

Non-GAAP Disclosure Reconciliations

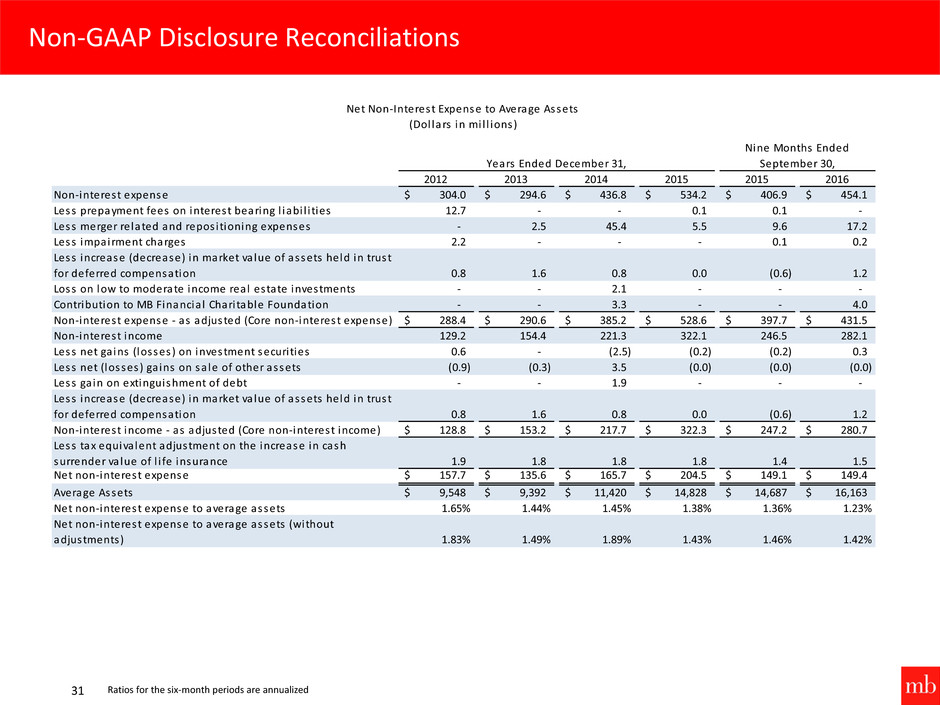

31

2012 2013 2014 2015 2015 2016

Non-interest expense $ 304.0 $ 294.6 $ 436.8 $ 534.2 $ 406.9 $ 454.1

Less prepayment fees on interest bearing l iabi l i ties 12.7 - - 0.1 0.1 -

Less merger related and repos i tioning expenses - 2.5 45.4 5.5 9.6 17.2

Less impairment charges 2.2 - - - 0.1 0.2

Less increase (decrease) in market va lue of assets held in trust

for deferred compensation 0.8 1.6 0.8 0.0 (0.6) 1.2

Loss on low to moderate income real estate investments - - 2.1 - - -

Contribution to MB Financia l Chari table Foundation - - 3.3 - - 4.0

Non-interest expense - as adjusted (Core non-interest expense) $ 288.4 $ 290.6 $ 385.2 $ 528.6 $ 397.7 $ 431.5

Non-interest income 129.2 154.4 221.3 322.1 246.5 282.1

Less net ga ins (losses) on investment securi ties 0.6 - (2.5) (0.2) (0.2) 0.3

Less net (losses) ga ins on sa le of other assets (0.9) (0.3) 3.5 (0.0) (0.0) (0.0)

Less ga in on extinguishment of debt - - 1.9 - - -

Less increase (decrease) in market va lue of assets held in trust

for deferred compensation 0.8 1.6 0.8 0.0 (0.6) 1.2

Non-interest income - as adjusted (Core non-interest income) $ 128.8 $ 153.2 $ 217.7 $ 322.3 $ 247.2 $ 280.7

Less tax equiva lent adjustment on the increase in cash

surrender va lue of l i fe insurance 1.9 1.8 1.8 1.8 1.4 1.5

Net non-interest expense $ 157.7 $ 135.6 $ 165.7 $ 204.5 $ 149.1 $ 149.4

Average Assets $ 9,548 $ 9,392 $ 11,420 $ 14,828 $ 14,687 $ 16,163

Net non-interest expense to average assets 1.65% 1.44% 1.45% 1.38% 1.36% 1.23%

Net non-interest expense to average assets (without

adjustments) 1.83% 1.49% 1.89% 1.43% 1.46% 1.42%

Years Ended December 31,

Nine Months Ended

September 30,

Net Non-Interest Expense to Average Assets

(Dol lars in mi l l ions)

Ratios for the six-month periods are annualized

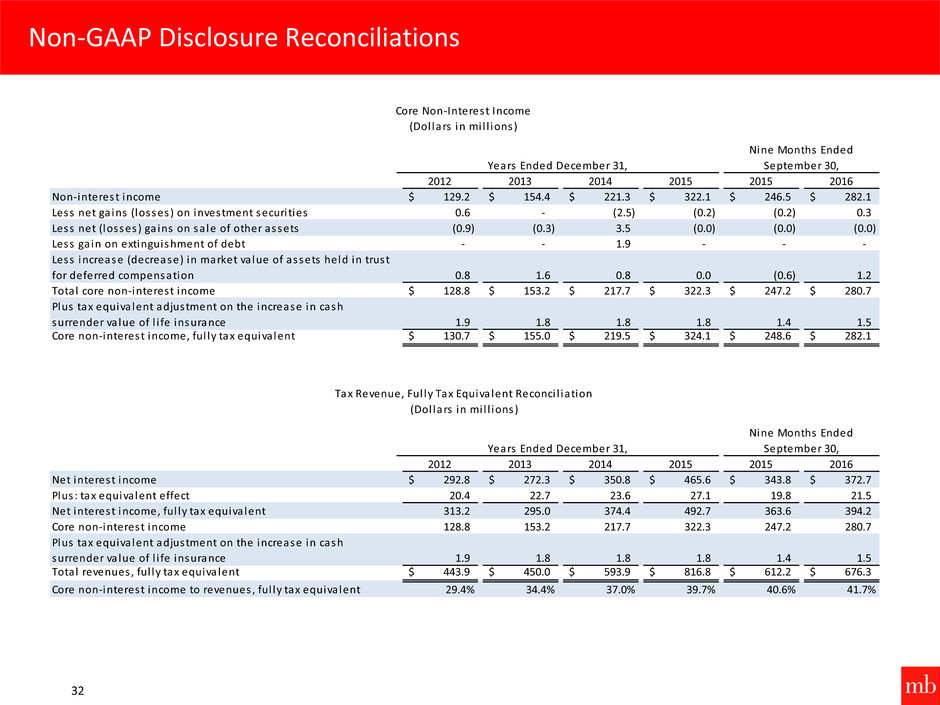

Non-GAAP Disclosure Reconciliations

32

2012 2013 2014 2015 2015 2016

Non-interest income $ 129.2 $ 154.4 $ 221.3 $ 322.1 $ 246.5 $ 282.1

Less net ga ins (losses) on investment securi ties 0.6 - (2.5) (0.2) (0.2) 0.3

Less net (losses) ga ins on sa le of other assets (0.9) (0.3) 3.5 (0.0) (0.0) (0.0)

Less ga in on extinguishment of debt - - 1.9 - - -

Less increase (decrease) in market va lue of assets held in trust

for deferred compensation 0.8 1.6 0.8 0.0 (0.6) 1.2

Total core non-interest income $ 128.8 $ 153.2 $ 217.7 $ 322.3 $ 247.2 $ 280.7

Plus tax equiva lent adjustment on the increase in cash

surrender va lue of l i fe insurance 1.9 1.8 1.8 1.8 1.4 1.5

Core non-interest income, ful ly tax equiva lent $ 130.7 $ 155.0 $ 219.5 $ 324.1 $ 248.6 $ 282.1

2012 2013 2014 2015 2015 2016

Net interest income $ 292.8 $ 272.3 $ 350.8 $ 465.6 $ 343.8 $ 372.7

Plus : tax equiva lent effect 20.4 22.7 23.6 27.1 19.8 21.5

Net interest income, ful ly tax equiva lent 313.2 295.0 374.4 492.7 363.6 394.2

Core non-interest income 128.8 153.2 217.7 322.3 247.2 280.7

Plus tax equiva lent adjustment on the increase in cash

surrender va lue of l i fe insurance 1.9 1.8 1.8 1.8 1.4 1.5

Total revenues , ful ly tax equiva lent $ 443.9 $ 450.0 $ 593.9 $ 816.8 $ 612.2 $ 676.3

Core non-interest income to revenues , ful ly tax equiva lent 29.4% 34.4% 37.0% 39.7% 40.6% 41.7%

Years Ended December 31,

Nine Months Ended

September 30,

Tax Revenue, Ful ly Tax Equiva lent Reconci l iation

(Dol lars in mi l l ions)

Core Non-Interest Income

(Dol lars in mi l l ions)

Years Ended December 31,

Nine Months Ended

September 30,

Footnotes

33

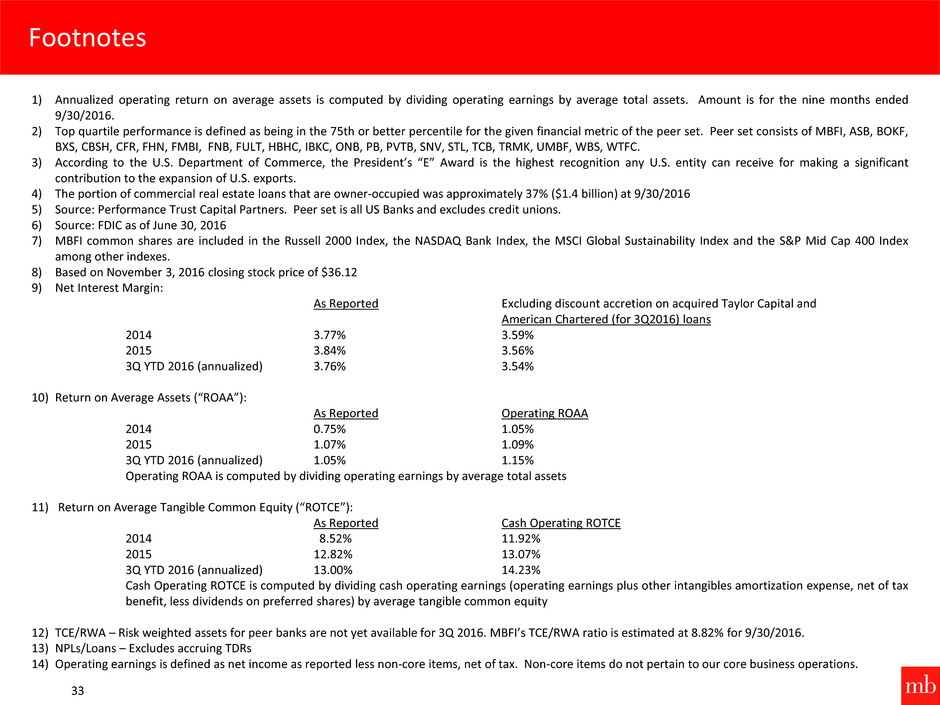

1) Annualized operating return on average assets is computed by dividing operating earnings by average total assets. Amount is for the nine months ended

9/30/2016.

2) Top quartile performance is defined as being in the 75th or better percentile for the given financial metric of the peer set. Peer set consists of MBFI, ASB, BOKF,

BXS, CBSH, CFR, FHN, FMBI, FNB, FULT, HBHC, IBKC, ONB, PB, PVTB, SNV, STL, TCB, TRMK, UMBF, WBS, WTFC.

3) According to the U.S. Department of Commerce, the President’s “E” Award is the highest recognition any U.S. entity can receive for making a significant

contribution to the expansion of U.S. exports.

4) The portion of commercial real estate loans that are owner-occupied was approximately 37% ($1.4 billion) at 9/30/2016

5) Source: Performance Trust Capital Partners. Peer set is all US Banks and excludes credit unions.

6) Source: FDIC as of June 30, 2016

7) MBFI common shares are included in the Russell 2000 Index, the NASDAQ Bank Index, the MSCI Global Sustainability Index and the S&P Mid Cap 400 Index

among other indexes.

8) Based on November 3, 2016 closing stock price of $36.12

9) Net Interest Margin:

As Reported Excluding discount accretion on acquired Taylor Capital and

American Chartered (for 3Q2016) loans

2014 3.77% 3.59%

2015 3.84% 3.56%

3Q YTD 2016 (annualized) 3.76% 3.54%

10) Return on Average Assets (“ROAA”):

As Reported Operating ROAA

2014 0.75% 1.05%

2015 1.07% 1.09%

3Q YTD 2016 (annualized) 1.05% 1.15%

Operating ROAA is computed by dividing operating earnings by average total assets

11) Return on Average Tangible Common Equity (“ROTCE”):

As Reported Cash Operating ROTCE

2014 8.52% 11.92%

2015 12.82% 13.07%

3Q YTD 2016 (annualized) 13.00% 14.23%

Cash Operating ROTCE is computed by dividing cash operating earnings (operating earnings plus other intangibles amortization expense, net of tax

benefit, less dividends on preferred shares) by average tangible common equity

12) TCE/RWA – Risk weighted assets for peer banks are not yet available for 3Q 2016. MBFI’s TCE/RWA ratio is estimated at 8.82% for 9/30/2016.

13) NPLs/Loans – Excludes accruing TDRs

14) Operating earnings is defined as net income as reported less non-core items, net of tax. Non-core items do not pertain to our core business operations.

November 2016

NASDAQ: MBFI

Investor Presentation

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

MB FINANCIAL, INC. | ||||

Date: | November 16, 2016 | By: | /s/Randall T. Conte | |

Randall T. Conte | ||||

Vice President and Chief Financial Officer | ||||

(Principal Financial Officer) | ||||