Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PATRICK INDUSTRIES INC | patk20161114.htm |

Patrick Industries, Inc.

Investor Presentation

November 2016

NASDAQ: PATK

Forward-Looking Statements

This presentation contains certain statements related to future results or states

our intentions, beliefs and expectations or predictions for the future which are

forward-looking statements as that term is defined in the Private Securities

Litigation Reform Act of 1995. These forward-looking statements are subject to

certain risks and uncertainties that could cause actual results to differ materially

from either historical or anticipated results depending on a variety of factors.

Further information concerning the Company and its business, including factors

that potentially could materially affect the Company’s financial results, is

contained in the Company’s filings with the Securities and Exchange

Commission.

This presentation includes market and industry data, forecasts and valuations

that have been obtained from independent consultant reports, publicly available

information, various industry publications and other published industry sources.

Although we believe these sources are reliable, we have not independently

verified the information and cannot make any representation as to the accuracy

or completeness of such information.

We disclaim any obligation or undertaking to disseminate any updates or

revisions to any forward-looking statements contained in this presentation or to

reflect any change in our expectations after the date of this presentation or any

change in events, conditions or circumstances on which any statement is based.

2

Company Overview

4

Patrick History

1

9

5

9

1

9

6

1

1

9

6

8

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

2

0

1

4

2

0

1

5

2

0

1

6

Company issues shares in private

placement and conducts Rights Offering to

pay off subordinated debt

Company drives

its Organizational

Strategic Agenda

(OSA) and

Customer First

Performance

Oriented Culture

Completes Refinancing

$80MM Leverage Based

Credit Facility led by

Wells Fargo (10/12)

Company

founded

Company

taken public

(NASDAQ)

Date of

Incorporation

Acquires Adorn Holdings, Inc. – the

largest acquisition in the Company’s

history (5/07)

Refinances Credit

Facility led by

Wells Fargo in

various intervals:

$125MM (6/14);

$165MM (11/14);

$185MM (2/15);

$250MM (4/15);

$300MM (8/15) and

$360MM (7/16)

Acquisition Highlights (2010-2016):

29 companies

$391MM aggregate purchase price

$675MM annualized sales

Primarily RV industry-based

Announces Stock

Repurchase Plan

(2/13) with

increases

announced in

2/14 and 2/15;

New $50MM

Stock

Repurchase Plan

(1/16)

Completes 3-for-2

common stock

split (5/15)

Completes $110MM

Leverage Based

Credit Facility in an

8 bank syndication

led by JPMorgan

(5/07)

Raises capital from

majority shareholder and

completes Refinancing via

$50MM ABL Credit Facility

led by Wells Fargo to

execute on strategic growth

and acquisition plans (3/11)

Todd Cleveland named

President (‘08) / CEO (‘09)

Patrick at a Glance

Founded in 1959 and incorporated in Indiana in 1961

Headquartered in Elkhart, Indiana – the “RV Capital of the World”

Leading national manufacturer and supplier of building and component

products to the RV, MH and Industrial markets

Operates over 60 facilities in 16 states

Approximately 4,800 employees

Listed on the NASDAQ under ticker PATK

Acquired 29 companies from 2010 – 2016

$391 million aggregate purchase price

$675 million annualized sales (at time of acquisition)

2016 is focused on continued organic and acquisition growth, and

expanding geographical product reach

5

Strong Brands

6

P

ro

d

u

ct Port

fo

li

o

Industries Overview

7

RV

• 75% of 9M-2016 sales

• Shipment growth 14% 9M-2016

Wall and ceiling panels

Pressed and hardwood doors

Countertops

Fabricated aluminum & FRP products

Wrapped mouldings

Cabinet doors

Electrical, wiring, plumbing

Furniture and mattresses

Fiberglass products

RV painting

Electronics

MH

• 13% of 9M-2016 sales

• Shipment growth 14% 9M-2016

Wall and ceiling panels

Pressed and hardwood doors

Electrical, wiring, plumbing

Cement siding

Drywall & roofing products

Lighting

Wall coverings

Bath & shower surrounds

Trusses

Industrial

• 12% of 9M-2016 sales

• Housing starts growth 4% 9M-2016

• 50% residential housing

• 50% retail & commercial fixtures

Retail & commercial fixtures

Kitchen cabinets

Solid surface countertops

Office & residential furniture

Sources: RVIA, MHI, NAHB

Patrick Facility Profile

8

8

+13%

$24

+28%

$31

+38%

$42

$30

35%

$41

+11%

$1.49

+29%

$1.91

+42%

$2.72

$1.95

+37%

$2.68

2013 2014 2015 9M-15 9M-16

Earnings Growth

Net Income Diluted EPS

+36%

$595

+24%

$736

+25%

$920

$672

+34%

$898

2013 2014 2015 9M-15 9M-16

Sales Growth

Sales

Sales & Earnings Growth

9

($ in millions except per share amounts)

Sales continue to grow and outpace their respective markets, driven by

acquisitions, new products and extension growth, and market share gains

Net Income and EPS growth continue to outpace our sales growth driven by the

following:

Acquisition related revenue

Increased synergies and efficiencies with acquisitions

Leveraging of fixed costs and managing controllable expenses

Share buyback program

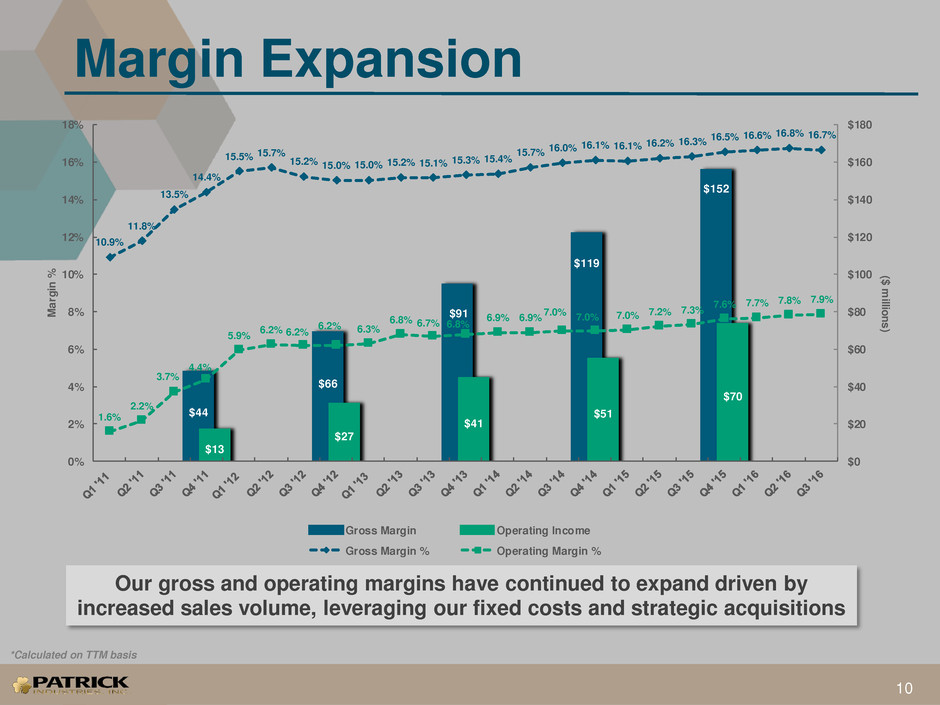

$44

$66

$91

$119

$152

$13

$27

$41

$51

$70

10.9%

11.8%

13.5%

14.4%

15.5% 15.7% 15.2% 15.0% 15.0% 15.2% 15.1%

15.3% 15.4%

15.7% 16.0%

16.1% 16.1% 16.2% 16.3%

16.5% 16.6% 16.8% 16.7%

1.6%

2.2%

3.7%

4.4%

5.9%

6.2% 6.2%

6.2% 6.3%

6.8% 6.7% 6.8%

6.9% 6.9%

7.0%

7.0% 7.0%

7.2% 7.3%

7.6% 7.7% 7.8%

7.9%

$0

$20

$40

$60

$80

$100

$120

$140

$160

$180

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

($ millions)M

arg

in

%

Gross Margin Operating Income

Gross Margin % Operating Margin %

Margin Expansion

10

Our gross and operating margins have continued to expand driven by

increased sales volume, leveraging our fixed costs and strategic acquisitions

*Calculated on TTM basis

RV Market

227

258

283

313

327

249

283

25

28

38

44

47

36

41

252

+13%

286

+12%

321

+11%

357

+5%

374

285

+14%

324

$187

+60%

$300

+43%

$430

+27%

$548

+26%

$691

$506

+33%

$674

2011 2012 2013 2014 2015 9M-15 9M-16

Towable Shipments Motorized Shipments Patrick RV Sales

RV Market

Sales Growth

12

Patrick RV sales growth has outpaced industry growth for four consecutive

years and remains strong through the first nine months of 2016

($ in millions, shipments in thousands)

Source: RVIA

RV Market

Drivers of Market Growth

13

Long-

Term

Market

Growth

Industry Strength

Economy

Demographics

Lifestyle

• Retail shipments outpaced wholesale shipments in 2015 allowing for healthy dealer inventories

• 2015 wrapped up 6th consecutive year of wholesale unit shipment growth – 2016FY projected

growth of 12%; Q3 YTD 2016 wholesale shipments grew 14%

• New innovative designs and products appealing to all age groups and attracting younger buyers

• Smaller units with lower price points reaching broader economic class of people

• Consumer confidence 97.9 avg. for 2015 compared to 86.8 avg. for 2014 – 2016

October YTD avg. 97.1

• 2016 October YTD average unemployment rate at ~4.9%

• Continued low fuel prices

• One in ten vehicle-owning households between 50 and 64 own at least one RV

• 11,000 Baby Boomers are projected to turn 65 years old each day over the next 15

years – highest rate of RV ownership

• 70% of current RV owners plan to purchase another RV to replace their current unit,

with over one-third planning a new purchase within the next 3 years

• Culture shift toward outdoor activities being embraced by all population segments, from

Boomers to Millennials

• More economical vacations with the typical RV family vacation being 27-62 percent less

expensive than a traditional vacation

• Large segment of population, Millennials, embracing active and outdoor lifestyle

• 2015 saw 5% growth in new campers

Sources: The Conference Board; Bureau of Labor Statistics & U.S. Census Bureau; U.S. Energy Information Administration; KOA Camping Report 2016

Industry Trends

14

9M-2016 Wholesale Shipments

Travel Trailer 65%

Fifth Wheel 19%

Camping Trailer 2%

Park Model 1%

Class A 5%

Class B & C 8%

Towables

87%

Motorized

13%

RV Market

Wholesale shipment growth is up 14% through 9M-16

Led by travel trailers

Double digit growth every quarter this year

Shipment composition remains steady from prior year

Towables is 87% of the market

Motorized is 13% of the market

Source: RVIA

Wholesale Shipment Growth vs. Prior Year

Q1 Q2 Q3 YTD

Travel Trailer 15% 14% 21% 16%

Fifth Wheel 0% 4% 17% 6%

Camping Trailer 0% 12% 22% 10%

Park Model (1%) (6%) (8%) (5%)

Towables 11% 11% 20% 13%

Class A 11% 6% (4%) 4%

Class B & C 23% 23% 33% 26%

Motorized 17% 16% 15% 16%

Wholesale 11% 12% 19% 14%

Retail vs. Wholesale

15

RV Market

Retail continues to be strong in 2016, up 9% for 9M-16, with wholesale units up 14% compared

to prior year

Growth of retail outpaced that of wholesale in 2015

Towable retail growth of 14% compared to wholesale shipment growth of 5%

Motorized retail growth of 15% compared to wholesale shipment growth of 8%

97.1

105.6

82.4

89.2

108.2

118.1

98.0

65.6

131.5

115.4

59.8

74.3

141.7

123.6

Q1-15 Q2-15 Q3-15 Q4-15 Q1-16 Q2-16 Q3-16

RV Shipments

Wholesale Retail

Source: RVIA

(shipments in thousands)

Content per Unit

16

RV Market

$697

$1,002

$1,271

$1,488

$1,739

$2,085

$5,600

RV unit content increased 20% in Q3-16 vs. prior year

Driven by new products, extension growth, acquisitions, and market share gain

100% market share in existing products would yield an estimated $5,600 RV content per unit

*Calculated on TTM basis

173

163

203

228

+21%

259

247 248

255

293

+24%

321

300

257

311 321

370

384

+22%

391

353

237

166

242

252

286

321

357

374

418

RV Wholesale Unit Shipments

Consumer Confidence RV Annual Shipments

476

Industry Outlook

17

Gulf War

9/11 Attacks Residential

Housing Crisis

It is our belief that trended shipment levels indicate that there continues to be potential for future growth based

on the depth of the last cycle, current demographic indicators, and overall economic conditions. Additionally,

average shipment increases over each of the last prior peaks point to an extended runway and the next

potential peak at over 476,000 units.

(shipments in thousands)

+22%

RV Shipments Source: 1990 – 2015 RVIA; 2016F – 2020F Company Estimates

RV Market

MH Market

Sales Growth

19

MH Market

50

+1%

50

+3%

52

+6%

55

+10%

60

+7%

64

+10%

71

52

+14%

60

$79

+0%

$79 -6%

$74

+15%

$85

+12%

$95

+14%

$109

+18%

$129

$92

+25%

$115

2009 2010 2011 2012 2013 2014 2015 9M-15 9M-16*

Wholesale Units Patrick MH Sales

Patrick MH sales growth has outpaced industry growth for four consecutive

years, and remains strong through the first nine months of 2016

($ in millions, shipments in thousands)

*Company estimate for September 2016

Market Conditions & Consumer Trends

20

Approximately 9 million households with 22 million people living in manufactured homes

(9% of nation’s single family housing stock)

Affordable form of home ownership:

Average structure cost per sq. ft. (2015): $47.55 (MH) vs. $100.65 (single family home)

Average MH retail price (2015): $68,000 for 1,430 sq. ft. (home only)

Flexible production process allows for more custom features at lower cost:

Multiple exterior options and interior floor plans available

Energy efficient materials, green and alternative energy home designs

Built with precision – three layers of quality oversight nationally administered by HUD

Engineered for wind safety and energy efficiency based on geographic region in which

homes are sold

Appreciate in value as with other forms of housing

Typical financing terms for MH loans on new homes:

5 – 20% down payment (based on inclusion of land in financing)

15 – 30 year loan terms – based on credit profile, home size,

and loan type

Source: Manufactured Housing Institute (MHI)

MH Market

Market Indicators

21

Long-

Term

Market

Growth

Quality

credit

standards

Number of

aging “Baby

Boomers”

Tax

incentives

Alternative

housing

availability

Consumer

Demand

Financing/

credit

availability

Dealer and

manufacturer

inventory

levels

Affordability

and quality

Consumer

confidence

Drivers of Consumer Demand Market Growth

Opportunity for moderate year-over-year growth; limited downside risk in near-term if volumes maintain

historical relationship with new housing starts

Unit shipments have averaged about 10% of single-family housing starts over the last 10 years

Potential gain from the recalibration of quality credit standards, job growth, and the significant number of

consumers in transitional housing and most likely to return to more permanent housing

Driving forces within the MH industry: technological advances, evolutionary designs, and a focus on delivering

quality homes that families can afford

Source: Manufactured Housing Institute (MHI)

MH Market

Content per Unit

22

MH Market

$1,500 $1,498

$1,599 $1,614

$1,820

$1,911

$6,200

MH unit content increased 5% in Q3-16 vs. prior year

Driven by new products, extension growth, acquisitions, and market share gain

100% market share in existing products would yield an estimated $6,200 MH content

per unit

*Calculated on TTM basis

193

168

131 131

147

118

96

82

50 50 52 55

60 64

71

80

MH Wholesale Unit Shipments

Industry Outlook

23

Source: 1990-2015: Manufactured Housing Institute (MHI); 2016F Company Estimate

The MH industry continues to perform at historical lows reflecting the residual impacts from the

residential housing market crash including tight credit standards and lending. We believe, however,

that there is pent up demand being created and significant upside potential for this market based on

current demographic trends including multi-family housing capacity and improving credit and

financing conditions, among other factors.

Residential

Housing Crisis

Restricted MH and Residential

Housing Credit & Lending Conditions

(shipments in thousands)

Needs updating MH Marke

Industrial Market

Sales Growth

25

Industrial Market

554

+6%

587

+4%

609

+28%

781

+18%

925

+8%

1,003

+11%

1,112

853

+4%

884

$40

-4%

$39

+19%

$46

+13%

$52

+33%

$70

+13%

$79

+28%

$101

$75

+46%

$109

2009 2010 2011 2012 2013 2014 2015 9M-15 9M-16

Residential Housing Starts Patrick Industrial Sales

Patrick industrial sales growth has outpaced industry growth for three

consecutive years and remains strong through the first nine months of 2016

($ in millions, housing starts in thousands)

-14%

-23% -4%

+5%

-1%

+10%

+12%

non-res construction spend (commercial), YoY chg.

+10%

+12%

Source: U.S. Census Bureau

Industry Conditions

26

Industrial Market

Residential

Housing

50%

Commercial &

Institutional

Fixtures

50%

Q3-2016 Sales Composition

Approximately 50% of the Company’s industrial revenue base is tied directly to the

residential housing market (new construction and remodel)

Our sales to the industrial market generally lag new residential housing starts by six to

nine months

Patrick has targeted certain sales efforts towards industrial market segments less tied

to new single and multi-family home construction, including the retail fixture, office,

medical, institutional furnishings, and countertop markets

Sources: New Housing Starts - U.S. Census Bureau; Existing Home Sales – National Association of Realtors

554

587 609

781 925

1,003

1,112

4,340

4,190

4,260

4,660

5,090

4,940

5,250

3,900

4,100

4,300

4,500

4,700

4,900

5,100

5,300

5,500

400

500

600

700

800

900

1,000

1,100

1,200

Existing Hom

e Sales (000's)Ne

w

Ho

us

ing

S

ta

rts

(0

00

's)

Growth in Housing Market Driving Demand

New Housing Starts Existing Home Sales

Industry Outlook

27

The residential housing market appears to have begun its recovery

NAHB is forecasting annual unit growth of:

3% for 2016

10% for 2017

9% for 2018

Source: 1990-2015: U.S. Census Bureau; 2016F-2018F: NAHB (as of October 28, 2016)

(housing starts in thousands)

Industrial Market

1,603

1,705

1,848

1,956

2,068

1,801

1,355

906

554

587

609

781

925

1,003

1,112 1,143

1,258

1,365

+3%

+10%

+9%

Strategy Execution

Debt Reduction

and Leverage

Position

Capital Allocation Strategy

29

Acquisitions

Geographic and

Product

Expansion

Stock Buyback

Program

Investments in

Infrastructure

and Capital

Expenditures

Our capital allocation strategy is centered around the utilization

of our leverage and capital resources to grow the business model

Debt increased $239 million from 2010 to Q3 2016 with $483 million

invested in capital allocation strategy over that time period

Leverage position relative to EBITDA remains just under 2x

Capital Allocation

30

($ in millions)

$42

$281

$391

$45

$47

($244)

2010

Beginning

Debt

Acquisitions Capital

Spending

Stock

Buybacks

Debt

Payments

Q3 2016

Ending Debt

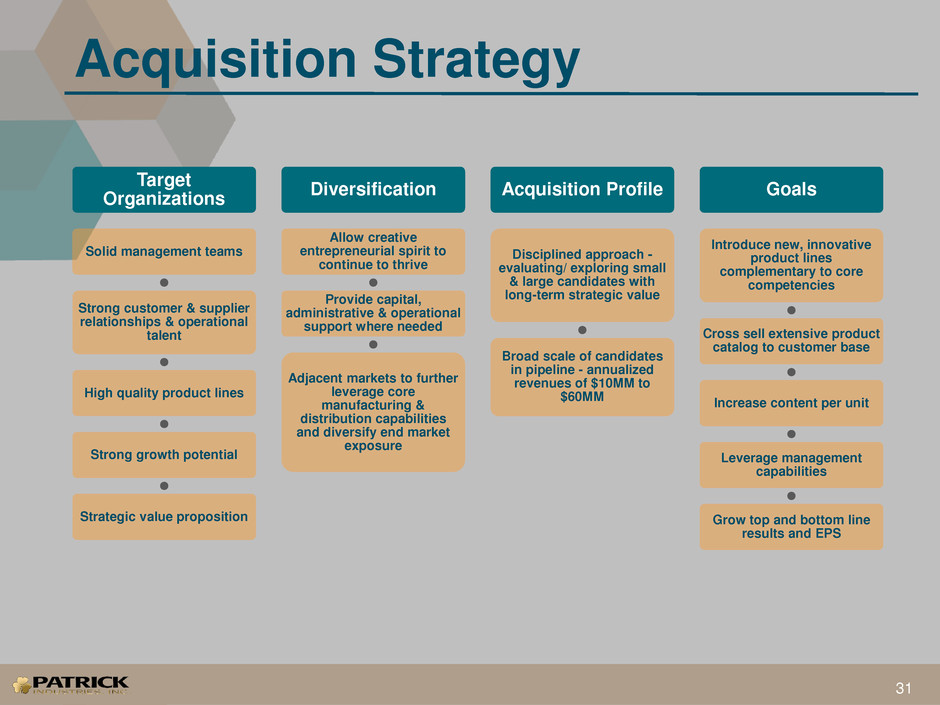

Acquisition Strategy

Target

Organizations

Solid management teams

Strong customer & supplier

relationships & operational

talent

High quality product lines

Strong growth potential

Strategic value proposition

Diversification

Allow creative

entrepreneurial spirit to

continue to thrive

Provide capital,

administrative & operational

support where needed

Adjacent markets to further

leverage core

manufacturing &

distribution capabilities

and diversify end market

exposure

Acquisition Profile

Disciplined approach -

evaluating/ exploring small

& large candidates with

long-term strategic value

Broad scale of candidates

in pipeline - annualized

revenues of $10MM to

$60MM

Goals

Introduce new, innovative

product lines

complementary to core

competencies

Cross sell extensive product

catalog to customer base

Increase content per unit

Leverage management

capabilities

Grow top and bottom line

results and EPS

31

2010 Acquisition Highlights 2014 Acquisition Highlights

• 2 companies • 7 companies

• $6MM aggregate purchase price • $72MM aggregate purchase price

• $22MM annualized sales • $126MM annualized sales

• Primarily RV market-based • Primarily RV market-based

2011 Acquisition Highlights 2015 Acquisition Highlights

• 3 companies • 4 companies

• $7MM aggregate purchase price • $146MM aggregate purchase price

• $26MM annualized sales • $233MM annualized sales

• Primarily RV & Industrial market-based • Primarily RV market-based

2012 Acquisition Highlights 2016 Acquisition Highlights

• 4 companies • 6 companies

• $30MM aggregate purchase price • $113MM aggregate purchase price

• $80MM annualized sales • $146MM annualized sales

• Primarily RV market-based • RV, MH & Industrial market-based

2013 Acquisition Highlights

• 3 companies

• $17MM aggregate purchase price

• $42MM annualized sales

• Primarily RV market-based

Acquisition Summary by Year

32

$88MM in average revenues acquired from

2010-2015

$134MM average revenues acquired the past 3

years 2013-2015

$146MM in annualized revenues acquired thus

far in 2016

Northeast

• Softw oods

• Fiberglass

• Solid Surface

• Hardw ood Products

• Slotw all Products

Southeast

• Lamination

• Fiberglass

• Solid Surface

Texas

• Softw oods

• Hardw ood Products

• Industrial

Southern California

• Softw oods

• Paint

• Solid Surface

• Hardw ood Products

• Pressed Products

Pacific Northwest

• Lamination

• Aluminum

• FRP

• Fiberglass

• Paint

• Solid Surface

• Hardw ood Products

• Pressed Products

• Industrial

• Interior Doors

33

Geographic & Product Expansion

Focus on expansion opportunities with $160MM potential, while

minimizing any potential risks or pitfalls

Capital Expenditures

34

We will continue to invest in our infrastructure to drive enterprise

wide efficiency and flex our capital spend when necessary to align

with our demand levels

($ in millions)

$0.3

$1.4

$2.4

$7.9

$8.7

$6.5

$8.0

$15.0

2009 2010 2011 2012 2013 2014 2015 2016F

2016 Capital Spending is focused on:

New Product / Process / Advanced

Automation

Geographical Expansion

Cost Reduction

Quality / Maintenance

Stock Buyback

35

388 223

- -

142 117

258 196

- -

423

71 40 -

$63.09*

$9.18 $9.95 $9.95 $9.95 $9.95

$12.97

$14.95

$17.73

$19.38 $19.38 $19.38

$24.41 $25.04 $25.47 $25.47

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

Q4-12 Q1-13 Q2-13 Q3-13 Q4-13 Q1-14 Q2-14 Q3-14 Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 Q1-16 Q2-16 Q3-16

$0.00

$10.00

$20.00

$30.00

$40.00

$50.00

$60.00

Sto

ck

Bu

yb

ac

k (

00

0's

)

Stock Price

Incremental Shares Repurchased Cumulative Shares Repurchased Avg. Close Share Price Cumulative Avg. Price of Share Buyback

*Quarterly average closing stock price

The 2013 Repurchase plan has been fully executed

Total of 1,817,313 shares repurchased at an average share price of $25.04 for a total cost of $45.5 million

The 2016 Repurchase plan approved in January 2016

Total of 40,102 shares repurchased at an average share price of $44.93 for a total cost of $1.8 million

$28.93

$43.98

$19.29

$29.32

$43.50

$57.35

12/31/13 12/31/14 12/31/15 10/31/16

Pre-Stock Split Close Price Post-Stock Split Close Price

Stock Performance

36

As of October 31, 2016, our split-adjusted closing stock price was $57.35, approximately

130% of our pre-split closing stock price of $43.98 on December 31, 2014, and generating

a 96% total shareholder return over that time period

Split Adjusted Stock Performance

Source: NASDAQ

37

PATK Highlights

Added to the SmallCap

600 Index

•Effective close of trading

August 18th

45 Year Anniversary

•Nasdaq Stock Exchange

Listing - July 29, 1971

Ranked #41 - Fortune

100’s Fastest Growing

Companies

•Fortune Magazine 2016

2016 Indiana Public

Company of the Year

Award Winner

•Award presented at

INVEST Indiana conference

luncheon September 15th

(Indianapolis)

Why Patrick Industries

38

• Approximately $17 billion addressable expanding RV & MH

markets

• Emerging industrial and housing market

Markets

• Continuously expanding product and company portfolio

through organic growth and growth through acquisitions

• Execution of strategic plan and balanced capital allocation

strategy

Business

Model

• Team driven by performance-oriented culture with

continuous improvement focus on driving margins and

profitability

• Strong relationships with broad array of customers

Leadership

• High variable cost concentration-based operating structure

providing ability to maximize levers to manage through

business cycles

Operations

• Strong financial performance focusing on revenue and

earnings growth while maintaining a healthy balance sheet

and delivering free cash flow

Financial

Performance

• Management focus on increasing shareholder value

• Returning capital to shareholders is strategic part of capital

allocation strategy

Shareholder

Returns

Appendix

Balance Sheet Strength

40

We expect and continue to utilize our leverage for strategic acquisitions, followed shortly

thereafter by an accelerated deleverage cycle based on strong operating cash flows. We are

confident in our ability to size the business model according to the revenue stream based on

our high variable cost mix.

0.0

1.0

2.0

3.0

4.0

5.0

Leverage Position Trend

$30MM of

Acquisitions

$17MM of

Acquisitions

$72MM of

Acquisitions

$146MM of

Acquisitions

$113MM of

Acquisitions

Currency USD

0

100,000

200,000

300,000

400,000

500,000

600,000

700,000

0.00

10.00

20.00

30.00

40.00

50.00

60.00

70.00

80.00

Jan-16 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Aug-16 Sep-16 Oct-16

Patrick Stock Price and Volume

Volume Price Close

Shareholder Value

41

Patrick had approximately 15.3

million shares outstanding and a

market capitalization of

approximately $880 million as of

October 31, 2016

Earnings Release

Acquisitions

General Information as of: 10/31/2016

Patrick Industries Inc

Price 57.35

Volume 130,517

52 Week High 69.53

52 Week High Date 7/28/2016

52 Week Low $29.28

52 Week Low Date 2/9/2016

Price % Change - 52 Weeks 41.33

Market Capitalization (Million) 878.91

Shares Outstanding (Million) 15

*

*Trade volume for 08/17/16 and 08/18/16 was approximately 0.9MM shares and 2.0MM shares, respectively, reflecting the announcement on 08/16/16 of the addition of PATK to the

S&P SmallCap 600 Index effective with the close of trading on 08/18/16, and the impact of a stock upgrade by CL King & Associates (analyst coverage firm) on 08/17/16.

Date

Completed

Business

Net Purchase

Price

Annualized

Sales*

Segment Industry Products

01/2010 Quality Hardwoods Sales $2.0 MM $2 MM Manufacturing RV Cabinet Doors

08/2010 Blazon International Group $3.8 MM $20 MM Distribution RV & MH

Wiring, electrical, plumbing, and

other building products

06/2011 The Praxis Group $0.5 MM $4 MM Distribution RV

Painted countertops, foam

products, and furniture products

09/2011 A.I.A. Countertops, LLC $5.5 MM $20 MM Manufacturing RV & Industrial

Solid surface countertops,

backsplashes, tables, and signs

12/2011

Infinity Graphics (formerly

Performance Graphics) $1.3 MM $2 MM Manufacturing RV & Industrial

Designer, producer, and installer of

exterior graphics

03/2012 Décor Mfg., LLC $4.3 MM $17 MM Manufacturing RV Laminated and wrapped products

07/2012 Gustafson Lighting $2.8 MM $12 MM Distribution RV

Interior and exterior lighting

products, ceiling fans and

accessories

09/2012 Creative Wood Designs, Inc. $3.0 MM $18 MM Manufacturing RV

Hardwood furniture including interior

hardwood tables, chairs, and

dinettes

10/2012

Middlebury Hardwood

Products, Inc. $19.8 MM $33 MM Manufacturing

RV, MH &

Industrial

Hardwood cabinet doors and other

hardwood products

Acquisition Summary

42

*Projected Annualized Sales as of the acquisition date

Date

Completed

Business

Net Purchase

Price

Annualized

Sales*

Segment Industry Products

09/2013 Frontline Mfg., Inc. $5.2 MM $15 MM Manufacturing

RV, MH &

Industrial

Fiberglass bath fixtures including

tubs and showers

09/2013 Premier Concepts, Inc. $2.6 MM $10 MM Manufacturing

RV, MH &

Industrial Solid surface countertops

09/2013 West Side Furniture $8.7 MM $17 MM Distribution RV

Recliners, mattresses, other

furniture products

06/2014 Precision Painting Group $16.0 MM $28 MM Manufacturing RV Exterior full body painting

06/2014 Foremost Fabricators, LLC $45.4 MM $75 MM

Manufacturing &

Distribution RV

Fabricated aluminum products, fiber

reinforced polyester (FRP) sheet &

coil

09/2014 PolyDyn3, LLC $1.3 MM $2.5 MM Manufacturing RV

Fabricated simulated wood and

stone products

11/2014 Charleston Corporation $9.5 MM $20 MM Manufacturing RV

Fiberglass and small plastic

components

Acquisition Summary

43

*Projected Annualized Sales as of the acquisition date

Acquisition Summary

44

*Projected Annualized Sales as of the acquisition date

Date

Completed

Business

Net Purchase

Price

Annualized

Sales*

Segment Industry Products

02/2015 Better Way Partners, LLC $40.5 MM $50 MM Manufacturing RV Fiberglass components

05/2015

Structural Composites of

Indiana, Inc. $20.1 MM $18 MM Manufacturing

RV, Marine &

Industrial

Fiberglass front and rear caps and

roofs and other specialty fiberglass

components

09/2015 North American $85.0 MM $165 MM Manufacturing

RV, MH &

Industrial

Profile wraps, custom mouldings,

laminated panels, raw/processed

softwood products, trusses,

industrial packaging materials

02/2016 Parkland Plastics $25.0 MM $30 MM Manufacturing RV & Industrial

Polymer-based products including

wall panels, lay-in ceiling panels,

coated & rolled floors, protective

moulding

03/2016 The Progressive Group $11.0 MM $23 MM Distribution RV & Industrial Electronics

05/2016 Cana Cabinetry $16.8 MM $18 MM Manufacturing MH & Industrial

Custom cabinetry including

hardwood and MDF doors, door

fronts and mouldings

06/2016 Mishawaka Sheet Metal $14.0 MM $28 MM Manufacturing RV & Industrial

Fabricated aluminum products,

aluminum alloys, galvanized and hot

rolled steel in common gauges and

pattern sizes

07/2016 L.S. Manufacturing, Inc. $11.0 MM $12 MM Manufacturing RV & Industrial

Thermoformed plastic parts and

components, including shower

surrounds/bases

07/2016 BH Electronics, Inc. $35.0 MM $35 MM Manufacturing Marine

Thermoformed dash panel

assemblies, center consoles and

trim panels, electrical systems

Patrick Product Lines – RV Interior

45

Additional Supplied Products:

Exit Lighting

Ceiling Fans

Power Cords & Inlets

RV Tank Heater Pads

Fire Extinguishers

Electric Fireplaces

Wiring, Electrical & Plumbing Products

Inverters

Tire Pressure Monitors

Electrical Switches, Receptacles, and Outlets

RV Transfer Switches

Battery Selector Switches

Cut to size, boring, foiling & edge-banding

Flooring Adhesive

Instrument Panel

Made-to-order laminated products including vinyl,

paper, veneers and high pressure laminates (HPL)

Electronics

Speakers

Microwaves

Furniture

Mattresses

Laminate &

Ceramic

Flooring

Closet

Hardware

Vanity Mirrors

Lighting

Closet & Passage Doors

Countertops

Drawer

Fronts &

Sides

Laminated Panels &

Printed Vinyl

Backsplashes

Hardwood

Accessories

Window Trim

Fiberglass Bath Fixtures

& Shower Doors Kitchen & Bath

Faucets & Sinks

Slide trim – foam,

hardwood, wrapped

Under

Cabinet

Lighting

Tile

Cabinet

Hardware

Dinettes,

Tables &

Chairs

Cabinet Doors

Patrick Product Lines – RV Exterior

46

Exterior Speakers

Paint & Paint

Mask

LED Lighting

Aluminum &

FRP Side

Walls

Laminated Side

Walls

Additional Product Lines:

Softwoods

Full Body Paint

Aluminum Gauges

Steel Gauges

Mill Finish & Pre- Painted

Aluminum and Steel

Slit & Embossed Steel

FRP Coil & Sheet

Motion Sensing

Lights

RV Power

Cords & Inlets

RV Grills & Accessories

Front and

Rear Caps

Bow Trusses

Patrick RV Products Growth Potential

47

Heating,

Ventilating,

Air Conditioning

Window

Coverings

Rolled Flooring

Bedding

Exterior

Mirrors

Carpeting

Windshield

Wipers

Holding Tanks

Captains

Chairs

Appliances

Toilets/Plumbing

Water Heaters

Gauges

Dashboards &

Components

Hardware

Tires & Rims

Roofing

Insulation

Aluminum

Framing

Patrick Product Lines – MH

48

Interior & Exterior Decorative

Lighting Fixtures

Interior Passage

Doors

Kitchen & Bath

Faucets & Sinks

Gypsum (Drywall &

Drywall Finishing

Products)

Laminate & Ceramic Flooring

Fiberglass Bath Fixtures & Shower

Doors

Cabinet Doors &

Components

Microwaves

Countertops

Electronics

Additional Supplied Products:

Building Arches

Closet Organization Products

Sealants

Innovative Lighting

Electrical Components

• Panels/Breakers

• Outlet Boxes

• Switches/Receptacles

Fireplaces and Surrounds

Made-to-order laminated products including

vinyl, paper, veneers and high pressure

laminates (HPL)

Cut to size, boring, foiling & edge-banding

Solid Surface, Granite and Quartz Fabrication

Flooring Adhesive

Tables & Signs

Roof Trusses

Siding

Shingles • Ventilation System & Ridge Cap

• Felt Paper

• Ice & Water Protection

• Drip Edge

• Flashing

• Roofing Membrane

• Soffit & Fascia

Wrapped Profile Moldings Plumbing Products

Backsplashes

Recessed Lighting

Fluorescent Lighting

Wiring/Electrical

Products

Ceiling Fans

Medicine

Cabinets

Under Cabinet

Lighting

Tile

Printed Vinyl

Trusses

Patrick MH Products Growth Potential

49

Composite

Decking

Carpet &

Carpet Pad

Hardware

Alternative

Roofing Insulation

Lumber

Windows

Additional Supplied Products:

• Water Heaters

• Appliances

• Toilets/Plumbing

• HVAC

Solar Panels

Brackets/Braces &

Hardware