Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Aleris Corp | alerisform8-k3q16earningsr.htm |

| EX-99.1 - EXHIBIT 99.1 - Aleris Corp | a3q16earningsrelease.htm |

1

Third Quarter 2016

Earnings Presentation

November 14, 2016

2

IMPORTANT INFORMATION

This information is current only as of its date and may have changed. We undertake no obligation to update this information in light of new information, future events or otherwise. This

information contains certain forecasts and other forward looking information concerning our business, prospects, financial condition and results of operations, and we are not making any

representation or warranty that this information is accurate or complete. See “Forward-Looking Information” below.

BASIS OF PRESENTATION

We completed the sale of our recycling and specification alloys and extrusions businesses in the first quarter of 2015. We have reported these businesses as discontinued operations for all

periods presented, and reclassified the results of operations of these businesses as discontinued operations. Except as otherwise indicated, the discussion of the Company’s business and

financial information throughout this presentation refers to the Company’s continuing operations and the financial position and results of operations of its continuing operations.

FORWARD-LOOKING INFORMATION

Certain statements contained in this presentation are “forward-looking statements” within the meaning of the federal securities laws. Statements under headings with “Outlook” in the title and

statements about our beliefs and expectations and statements containing the words “may,” “could,” “would,” “should,” “will,” “believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,”

“project,” “look forward to,” “intend” and similar expressions intended to connote future events and circumstances constitute forward-looking statements. Forward-looking statements include

statements about, among other things, the pending acquisition of the Company by Zhongwang USA LLC, future costs and prices of commodities, production volumes, industry trends,

anticipated cost savings, anticipated benefits from new products, facilities, acquisitions or divestitures, projected results of operations, achievement of production efficiencies, capacity

expansions, future prices and demand for our products and estimated cash flows and sufficiency of cash flows to fund capital expenditures. Forward-looking statements involve known and

unknown risks and uncertainties, which could cause actual results to differ materially from those contained in or implied by any forward-looking statement. Some of the important factors that

could cause actual results to differ materially from those expressed or implied by forward-looking statements include, but are not limited to, the following: (1) our ability to successfully

implement our business strategy; (2) the success of past and future acquisitions and divestitures; (3) the cyclical nature of the aluminum industry, material adverse changes in the aluminum

industry or our end-uses, such as global and regional supply and demand conditions for aluminum and aluminum products, and changes in our customers’ industries; (4) increases in the

cost, or limited availability, of raw materials and energy; (5) our ability to enter into effective metal, energy and other commodity derivatives or arrangements with customers to manage

effectively our exposure to commodity price fluctuations and changes in the pricing of metals, especially London Metal Exchange-based aluminum prices; (6) our ability to generate sufficient

cash flows to fund our capital expenditure requirements and to meet our debt service obligations; (7) our ability to fulfill our substantial capital investment requirements; (8) competitor pricing

activity, competition of aluminum with alternative materials and the general impact of competition in the industry end-uses we serve; (9) our ability to retain the services of certain members of

our management; (10) the loss of order volumes from any of our largest customers; (11) our ability to retain customers, a substantial number of whom do not have long-term contractual

arrangements with us; (12) risks of investing in and conducting operations on a global basis, including political, social, economic, currency and regulatory factors; (13) variability in general

economic conditions on a global or regional basis; (14) current environmental liabilities and the cost of compliance with and liabilities under health and safety laws; (15) labor relations (i.e.,

disruptions, strikes or work stoppages) and labor costs; (16) our internal controls over financial reporting and our disclosure controls and procedures may not prevent all possible errors that

could occur; (17) our levels of indebtedness and debt service obligations, including changes in our credit ratings, material increases in our cost of borrowing or the failure of financial

institutions to fulfill their commitments to us under committed credit facilities; (18) our ability to access the credit or capital markets; (19) the possibility that we may incur additional

indebtedness in the future; (20) limitations on operating our business as a result of covenant restrictions under our indebtedness, and our ability to pay amounts due under the Senior Notes;

(21) risks related to the Merger (including the possibility that the merger may not be consummated or, that, if the Merger does close, our stockholders may not realize the anticipated benefits

from the Merger) and (22) other factors discussed in our filings with the Securities and Exchange Commission, including the sections entitled “Risk Factors” contained therein. Investors,

potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-

looking statements. We undertake no obligation to publicly update or revise any forward-looking statements, whether in response to new information, futures events or otherwise, except as

otherwise required by law.

NON-GAAP INFORMATION

The non-GAAP financial measures contained in this presentation (including, without limitation, EBITDA, Adjusted EBITDA, commercial margin, and variations thereof) are not measures of

financial performance calculated in accordance with U.S. GAAP and should not be considered as alternatives to net income and loss attributable to Aleris Corporation or any other

performance measure derived in accordance with GAAP or as alternatives to cash flows from operating activities as a measure of our liquidity. Non-GAAP measures have limitations as

analytical tools and should be considered in addition to, not in isolation or as a substitute for, or as superior to, our measures of financial performance prepared in accordance with GAAP.

Management believes that certain non-GAAP financial measures may provide investors with additional meaningful comparisons between current results and results in prior periods.

Management uses non-GAAP financial measures as performance metrics and believes these measures provide additional information commonly used by the holders of our senior debt

securities and parties to the 2015 ABL Facility with respect to the ongoing performance of our underlying business activities, as well as our ability to meet our future debt service, capital

expenditure and working capital needs. We calculate our non-GAAP financial measures by eliminating the impact of a number of items we do not consider indicative of our ongoing operating

performance, and certain other items. You are encouraged to evaluate each adjustment and the reasons we consider it appropriate for supplemental analysis. See “Appendix.”

INDUSTRY INFORMATION

Information regarding market and industry statistics contained in this presentation is based on information from third party sources as well as estimates prepared by us using certain

assumptions and our knowledge of these industries. Our estimates, in particular as they relate to our general expectations concerning the aluminum industry, involve risks and uncertainties

and are subject to changes based on various factors, including those discussed under “Risk Factors” in our filings with the Securities and Exchange Commission.

Forward-Looking and Other Information

3

Third Quarter Overview

3Q Adjusted EBITDA ($M)

$68

$53

3Q16 3Q15

Adjusted EBITDA per ton ($/t)

$306

$249

3Q15 3Q16

3Q16 Adjusted EBITDA of $53M

Strong building and construction demand; stable

global automotive volumes

Weak distribution demand; destocking aerospace

demand

Asia Pacific continuing to benefit from growing

aerospace share gains

North America performance negatively impacted

by production outages tied to Lewisport

transformation and tighter metal spreads

Continued progress on North America ABS

Project; meeting all customer milestones

Challenging Quarter

4

Announced on August 29 that Aleris is to be acquired by Zhongwang USA LLC

for $2.3B ($1.1B in equity and $1.2B in net debt)

− Zhongwang USA is controlled by a fund that is majority-owned by Mr. Liu

Zhongtian, the founder and chairman of China Zhongwang Holdings, the

second largest aluminum extrusions company in the world

Aleris will continue to be a stand alone company, maintaining name, brand and

management team

Zhongwang’s philosophy of disciplined investment will support Aleris’ long

term growth potential

Currently progressing through regulatory approvals; acquisition remains on

track for 1Q17 close

Aleris to be Acquired by Zhongwang USA

Acquisition supports Aleris in its long term growth strategy

5

Key Global End Uses

1IHS Global Insights, October 2016

Aleris YoY improvement driven by

growth in Asia Pacific volume

Backlogs remain healthy

Europe impacted by OEM inventory

destocking

Aerospace 2%

EU Premium auto builds up 2%1

Continued benefits from lightweighting

trends

Automotive

Customer destocking across supply

chain

Lower demand from Asian

customers

Heat

Exchanger

Aleris Volume Drivers

3Q YoY

Growth

4%

(9%)

6

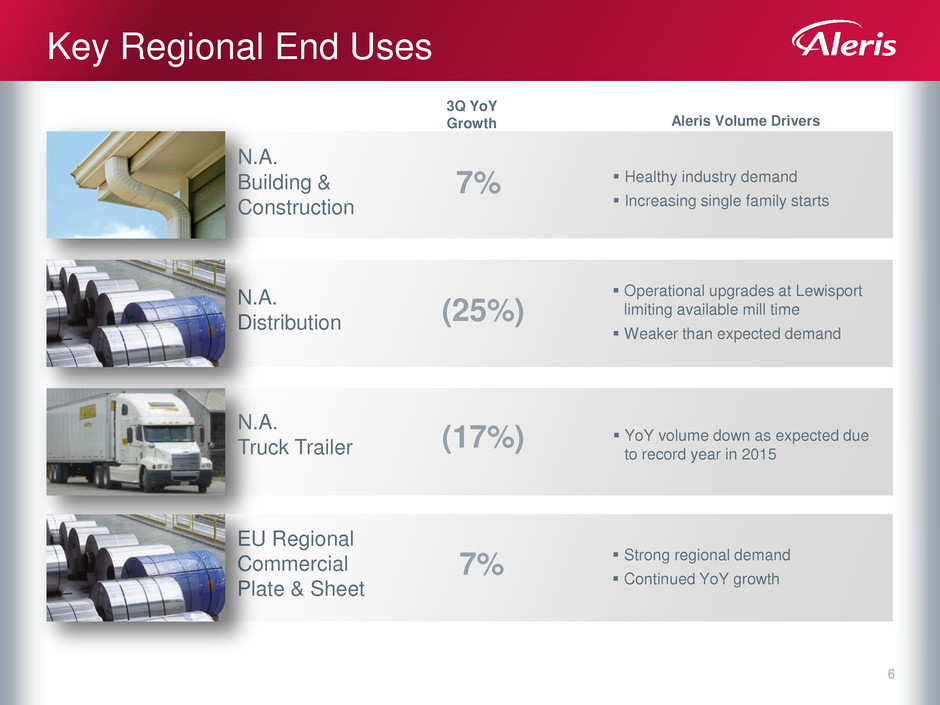

Key Regional End Uses

Healthy industry demand

Increasing single family starts

N.A.

Building &

Construction

7%

YoY volume down as expected due

to record year in 2015

N.A.

Truck Trailer

Strong regional demand

Continued YoY growth

EU Regional

Commercial

Plate & Sheet

Operational upgrades at Lewisport

limiting available mill time

Weaker than expected demand

N.A.

Distribution

3Q YoY

Growth

(25%)

(17%)

7%

Aleris Volume Drivers

7

Project remains on target for 2017 shipments

Deployed $342M as of 3Q16 for North America ABS Project in Lewisport

On target for all key milestones; first phase of commissioning complete

for CALP I

North America ABS Project Update

2014 2015 2016F

$14 $155 $200

ESTIMATED ABS PROJECT CAPEX ($M)

3Q16 3Q16 YTD

$33 $173

First CALP Line Second CALP Line

8

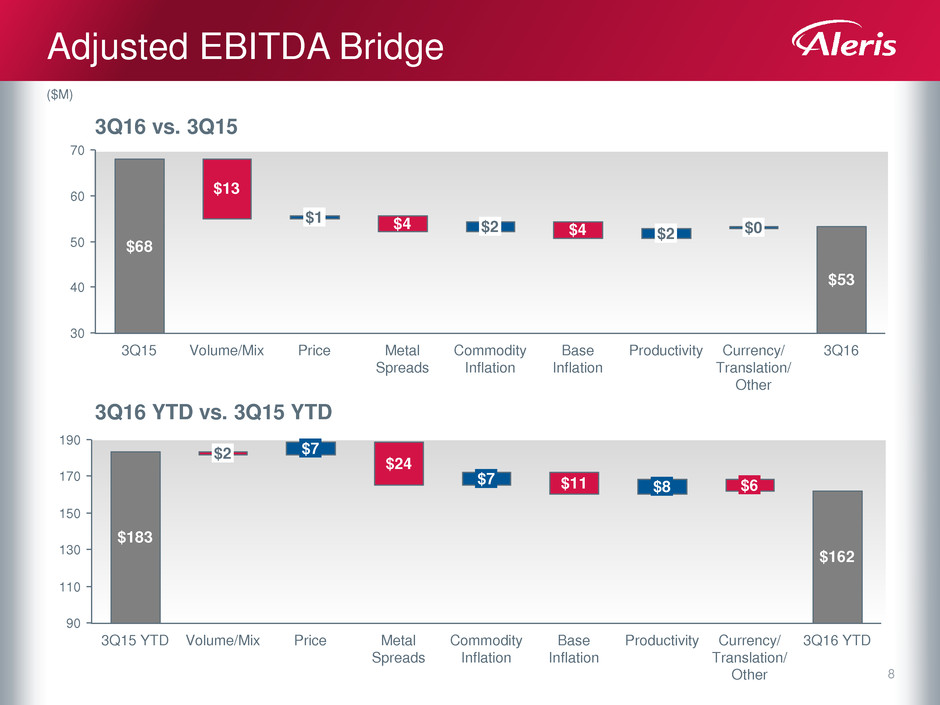

Adjusted EBITDA Bridge

$68

$13

$4 $4

$53

70

60

50

40

30

$1

Volume/Mix 3Q15 3Q16 Currency/

Translation/

Other

$0

Productivity

$2

Base

Inflation

Commodity

Inflation

$2

Metal

Spreads

Price

3Q16 YTD vs. 3Q15 YTD

($M)

$183

$24

$11

$162

130

110

90

190

150

170

3Q16 YTD Currency/

Translation/

Other

$6

Productivity

$2

3Q15 YTD

$8

Base

Inflation

Commodity

Inflation

$7

Metal

Spreads

Price Volume/Mix

$7

3Q16 vs. 3Q15

9

North America

Lewisport hot mill throughput impacted by both

planned and unplanned outages related to the

North America ABS Project

Improved B&C volumes more than offset by weaker

distribution and truck trailer volumes

Metal spread environment slow to improve;

continued lower scrap availability

Volume (kT) Segment Adjusted EBITDA ($M)

3Q16 Performance 3Q Adjusted EBITDA Bridge ($M)

137 127

(7%)

3Q16 3Q15

$34

$18

3Q16 3Q15

Adj. EBITDA / ton

$249 $143

$18

$2

$3

$11

$34

$10

$5

$0

$35

$30

$25

$20

$15

$1

$1

$1

Commodity

Inflation

Metal

Spreads

Price Volume/Mix 3Q15 3Q16 Productivity Base

Inflation

10

Spreads remain tight due to continued limited scrap availability

Metal Update

$0.30

$0.25

$0.20

$0.15

$1.20

$1.15

$1.10

$1.05

$1.00

$0.95

$0.90

$0.85

$0.80

$0.35

$0.75

$0.70

Sep

2016

Jun

2016

Mar

2016

Dec

2015

Sep

2015

Jun

2015

Mar

2015

Dec

2014

Sep

2014

1Platts, Aleris Management Analysis, October 2016

P1020 (left axis) Weighted Painted Siding, Mixed Low Copper, Sheet Spread

North America Scrap Spreads1

11

Europe

Overall stable volumes and demand environment

Unfavorable mix shift due to lower aerospace

volumes

Favorable productivity and lower natural gas costs

more than offset inflation

FX trends led to modest benefits

Volume (kT) Segment Adjusted EBITDA ($M)

3Q16 Performance 3Q Adjusted EBITDA Bridge ($M)

81 82

1%

3Q16 3Q15

$41 $42

3Q16 3Q15

Adj. EBITDA / ton

$505 $512

$42

$3$4

$41

$40

$35

$30

$25

$20

$15

$10

$5

$0

$45

3Q16 Currency/

Translation/

Other

$2

Productivity Base

Inflation

$1

Commodity

Inflation

$1

Metal

Spreads

$1

Price

$0

Volume/Mix 3Q15

12

Asia Pacific

Growth in aerospace shipments while commercial

plate volume remained flat

Favorable improvement in mix drove YoY Adjusted

EBITDA growth

Step-change performance improvement reflected in

Adjusted EBITDA / ton

Volume (kT) Segment Adjusted EBITDA ($M)

3Q16 Performance 3Q Adjusted EBITDA Bridge ($M)

5.5

7.0

29%

3Q16 3Q15

$0.6

3Q16

$2.8

3Q15

Adj. EBITDA / ton

NM $398

$2.1

$0.4

$2.8

$0.4

$0.2

$0.0

$0.6

$0.0

$2.5

$3.0

$1.5

$2.0

$1.0

$0.5

3Q16 Currency/

Translation/

Other

Productivity Base

Inflation

($0.2)

Commodity

Inflation

Metal

Spreads

Price

($0.6)

Volume/Mix 3Q15

13

Cash Flow and LTM Working Capital

Net Cash Flow ($M)1

77 77 76

70

19%

21%21%21%

50

55

60

65

70

75

80

3Q16 2015 2014 2013

3Q15 3Q16

Cash provided by Operating Activities $145 $2

Capital Expenditures (54) (74)

Other / Sales Proceeds 12 (0)

Net Cash Before Financing $103 ($72)

ABL / Senior Notes / Other (129) 33

Net Cash Flow After Financing ($26) ($39)

Total LTM Working Capital Days2,3

1Reflects cash flows of continuing operations and discontinuing operations as permitted by US GAAP

2Nichols sales and working capital included in 2013 & 2014; See Appendix for more detail

3Pro forma for divestitures of Global Recycling and Extrusions businesses

14

Sufficient liquidity to support growth objectives

Capital & Liquidity Overview

9/30/2016

Cash $36

Availability under ABL Facility 251

Liquidity $288

Capital Structure ($M)

Liquidity Summary ($M)

$91 $82 $96 $88

$58

$234

$60

$201

$225

2014

$121

$14

2013

$188

$107

2012

$315

3Q16

YTD

$296

$4

3Q16

$74

$14

$0

2016E

$3752

$83

$280

2015

$298

Maintenance

North America ABS Project & Other Upgrades

Other Growth

Capital Expenditures Summary ($M)1

1Excludes discontinued operations CapEx of $75M, $50M, $43M, $15M in 2012-2015

2Guidance does not include capitalized interest

3Amounts exclude applicable discounts

4Other excludes $45M of exchangeable notes

5Excludes Non-Recourse China Loan Facilities

6Secured debt includes $140M of outstanding ABL Facility balance and $550M of 2021 Secured Notes

9/30/2016

Cash $36

ABL 140

Notes3 990

Non-Recourse China Loan Facilities3 194

Other3,4 5

Net Debt $1,293

LTM Adjusted EBITDA $202

Net Debt / Adj. EBITDA 6.4x

Net Recourse Debt5 / Adj. EBITDA 5.4x

Secured Debt6 / Adj. EBITDA 3.4x

15

Performance expected to be in line with the fourth quarter of 2015

Improved North America building and construction volumes

Minor weakness in Europe aerospace volumes will be offset by Asia

Pacific aerospace volumes

Continued weakness in distribution and heat exchanger volumes

4Q16 Outlook

16

Appendix

17

3Q Adjusted EBITDA Reconciliation

($M)

2016 2015 2016 2015

Adjusted EBITDA $53.3 $68.2 $162.3 $183.5

Unrealized gains (losses) on derivative financial instruments of continuing operations 8.8 (21.3) 23.6 (25.7)

Restructuring charges (0.3) (1.0) (1.8) (8.7)

Unallocated currency exchange (losses) gains on debt (0.4) (4.8) (1.0) 3.1

Stock-based compensation (expense) benefit (1.8) 1.5 (5.2) (3.9)

Start-up costs (14.1) (6.8) (30.4) (14.6)

Unfavorable metal price lag (1.2) (3.7) (0.6) (19.8)

Other (3.6) (2.8) (15.6) (15.9)

EBITDA 40.7 29.3 131.3 98.0

Int rest expense, net (19.2) (23.6) (58.4) (74.7)

(Provision for) benefit from income taxes (12.3) 1.0 (30.5) 16.0

Depreciation and amortization (26.2) (27.7) (78.8) (92.9)

(Loss) income from discontinued operations, net of tax (4.6) (4.4) (4.6) 115.0

Net (loss) income attributable to Aleris Corporation (21.6) (25.4) (41.0) 61.4

Net income from discontinued operations attributable to noncontrolling interest — — — 0.1

Net (loss) income ($21.6) ($25.4) ($41.0) $61.5

For the three months ended

September 30,

For the nine months ended

September 30,

18

3Q Adjusted EBITDA Reconciliation by

Segment

($M)

1Amounts may not foot as they represent the calculated totals based on actual amounts and not the rounded amounts presented in this table

2There was no difference between segment income and segment Adjusted EBITDA for this segment

2016 2015 2016 2015

North America

Segment income $18.1 $36.4 $69.8 $93.0

Unfavorable (favorable) metal price lag 0.1 (2.2) (2.6) 4.1

Segment Adjusted EBITDA1 $18.2 $34.2 $67.2 $97.1

Europe

Segment income $40.7 $35.1 $113.8 $99.5

Unfavorable metal price lag 1.1 5.9 3.1 15.6

Segment Adjusted EBITDA1 $41.7 $41.0 $116.9 $115.2

Asia Pacific

Segment income (loss) $2.8 $0.6 $6.2 ($1.2)

Segment Adjusted EBITDA2 $2.8 $0.6 $6.2 ($1.2)

For the three months ended

September 30,

For the nine months ended

September 30,

19

3Q Adjusted EBITDA Per Ton Reconciliation

($M, except per ton measures, volume in thousands of tons)

*Result is not meaningful

1See prior slides for a reconciliation to the applicable GAAP financial measures

2016 2015 2016 2015

Metric tons of finished product shipped:

North America 127.5 137.3 376.7 384.4

Europe 81.5 81.0 250.9 234.7

Asia Pacific 7.0 5.5 17.3 16.1

Intra-entity shipments (1.9) (0.7) (4.5) (1.8)

Total metric tons of finished product shipped 214.1 223.1 640.4 633.4

Segment Adjusted EBITDA:1

North America $18.2 $34.2 $67.2 $97.1

Europe $41.7 $41.0 $116.9 $115.2

Asia Pacific $2.8 $0.6 $6.2 ($1.2)

Corporate ($9.4) ($7.6) ($28.0) ($27.6)

Total Adjusted EBITDA $53.3 $68.2 $162.3 $183.5

Segment Adjusted EBITDA per ton shipped:

North America $142.7 $249.0 $178.4 $252.7

Europe $511.7 $505.5 $466.0 $490.7

Asia Pacific $398.0 * $359.0 *

Aleris Corporation $248.9 $305.5 $253.5 $289.6

For the three months ended

September 30,

For the nine months ended

September 30,

20

Robust risk management discipline minimizes commodity price exposure

Metal Hedging Practices

Pass through pricing and tolling

Minimize inventory levels

Sell 100% of open inventory forward

LME and regional premium volatility

(inventory exposure)

Risk Impact Mitigation Strategy

Lowers margin volatility

Minimizes earnings impact

Risk limited to turn of inventory

(“metal lag”)

Match sales with physical purchases or LME

forwards

Attempt to minimize LT fixed price sales

Forward price sales Locks in rolling margin

Reduces multiyear dated

derivatives

Adjusted EBITDA vs. Metal price lag

Adj. EBITDA including metal lag $47 $61 $39 $64 $40 $48 $62 $53

(–) Income / (expense) from metal

price lag

9 6 (22) (4) 1 4 (3) (1)

Adj. EBITDA as reported $39 $55 $60 $68 $39 $45 $65 $53

4Q 2014 1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016 3Q 2016

Metal price lag impact on gross

profit

$9 ($6) ($16) ($24) $0 $11 $6 $8

(+) Realized gains / (losses) on

metal derivatives

0 12 (6) 20 1 (7) (9) (9)

(Unfavorable) / favorable metal

price lag net of realized

derivative gains / losses

$9 $6 ($22) ($4) $1 $4 ($3) ($1)

21

Working Capital Excluding Nichols

84

78

21%

23%

50

55

60

65

70

75

80

85

90

2013 2014

Total Working Capital Days1

1Excludes management estimates of Nichols working capital and sales prior to acquisition