Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE DATED NOVEMBER 9, 2016 - US GEOTHERMAL INC | ex99_1.htm |

| EX-3.1 - AMENDED CERTIFICATE OF INCORPORATION OF U.S. GEOTHERMAL INC. - US GEOTHERMAL INC | ex3_1.htm |

| 8-K - US GEOTHERMAL INC | usgeo8k_110816.htm |

EXHIBIT 99.2

The Most Reliable Renewable Q3 Earning Call November 10, 2016 1

The Most Reliable Renewable Q3 Earning Call November 10, 2016 1

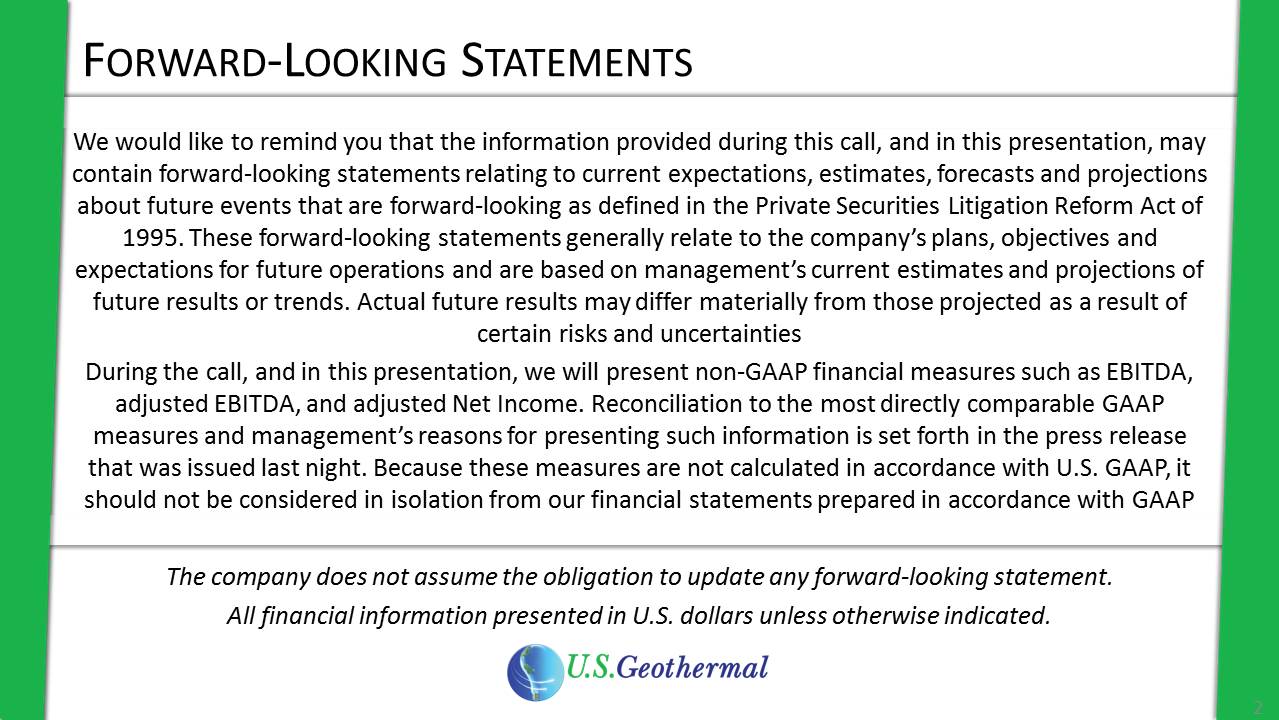

Forward-Looking Statements We would like to remind you that the information provided during this call, and in this presentation, may contain forward-looking statements relating to current expectations, estimates, forecasts and projections about future events that are forward-looking as defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally relate to the company’s plans, objectives and expectations for future operations and are based on management’s current estimates and projections of future results or trends. Actual future results may differ materially from those projected as a result of certain risks and uncertaintiesDuring the call, and in this presentation, we will present non-GAAP financial measures such as EBITDA, adjusted EBITDA, and adjusted Net Income. Reconciliation to the most directly comparable GAAP measures and management’s reasons for presenting such information is set forth in the press release that was issued last night. Because these measures are not calculated in accordance with U.S. GAAP, it should not be considered in isolation from our financial statements prepared in accordance with GAAPThe company does not assume the obligation to update any forward-looking statement.All financial information presented in U.S. dollars unless otherwise indicated. 2

Dennis Gilles, ceo Agenda Introduction: Dennis Gilles, ceo Financial Summary: Kerry Hawkley, cfo Ops/Development Update: Douglas Glaspey, president & coo Summary & Guidance: Dennis Gilles, ceo ExplplcePpLaplllent Pipeline of Development Projects Lpl Q&A 3

Approved 1 for 6 share consolidation Testing newly drilled wells at San Emidio II 16th quarter of positive ebitda and cash flow from operations Elected two, new independent directors to BOD Major Highlights Drilling and testing of first large diameter well at El Ceibillo Finalized award of $1.5 million grant by the DOE 4

FinancialSummary 5

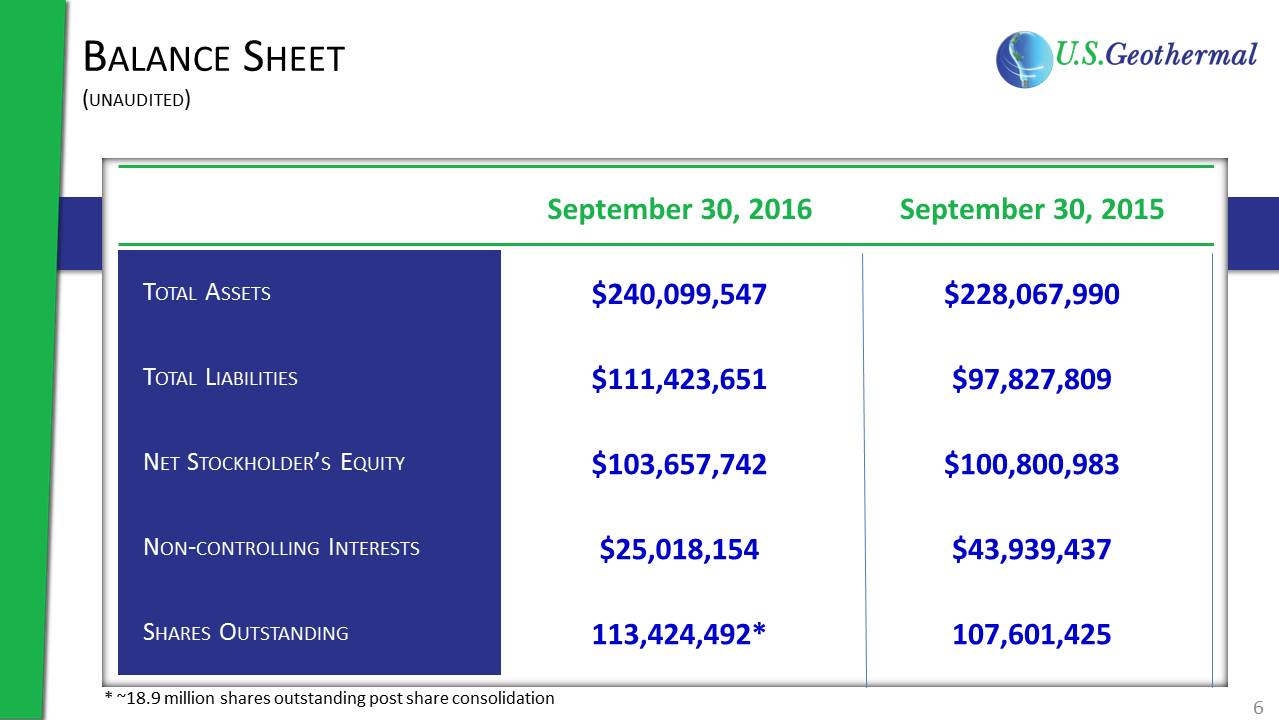

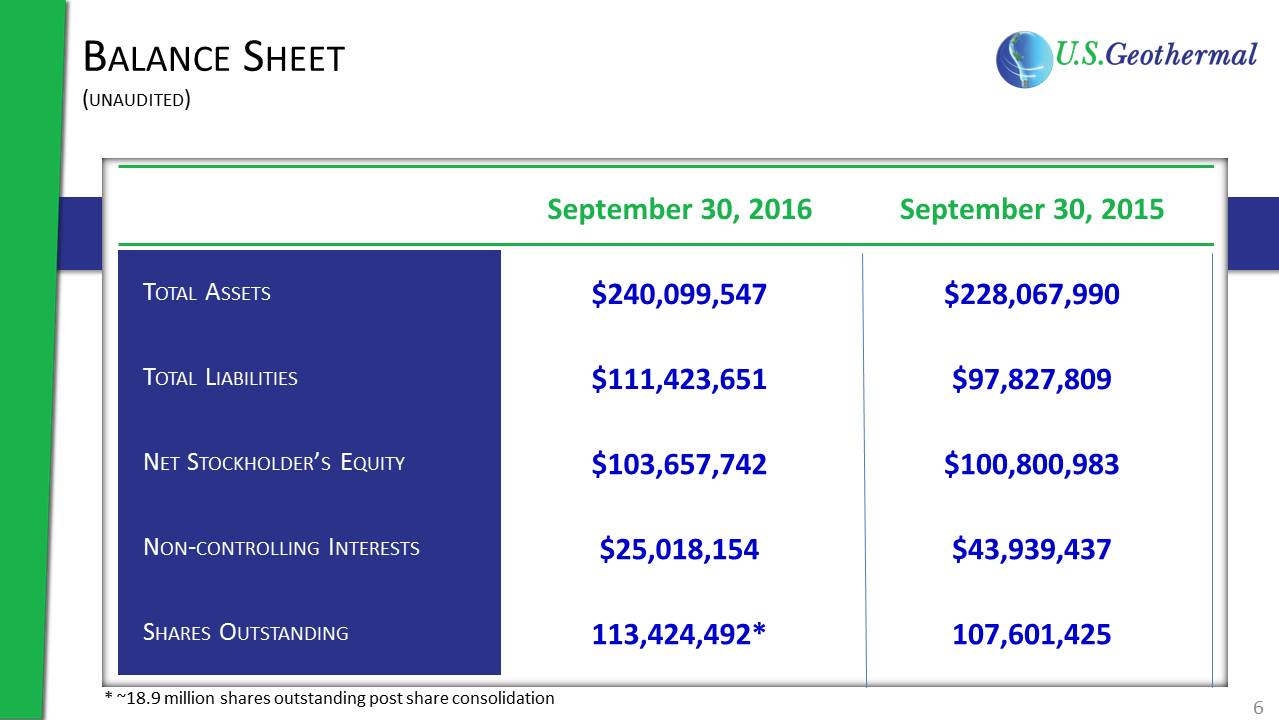

Balance Sheet(unaudited) September 30, 2016 September 30, 2015 Total Assets $240,099,547 $228,067,990 Total Liabilities $111,423,651 $97,827,809 Net Stockholder’s Equity $103,657,742 $100,800,983 Non-controlling Interests $25,018,154 $43,939,437 Shares Outstanding 113,424,492* 107,601,425 6 * ~18.9 million shares outstanding post share consolidation

Statement of Operations(unaudited) * See accompanying press release for definition of EBITDA and Adjusted EBITDA 3 Months Ending September 30 9 Months Ending September 30 2016 2015 2016 2015 Revenue $6,733,294 $6,929,847 $20,900,850 $21,264,888 Income Before Taxes $178,230 $765,079 $771,358 $2,283,113 Net Income Attributable to USG ($150,498) $280,864 ($492,823) $781,179 ($ Millions) EBITDA* (consolidated) 3.00 3.27 8.74 9.86 Adjusted EBITDA* (consolidated) 3.34 3.56 10.63 10.91 EBITDA* (USG portion) 1.66 1.95 4.39 6.01 Adjusted EBITDA* (USG portion) 2.00 2.24 6.28 7.06 7

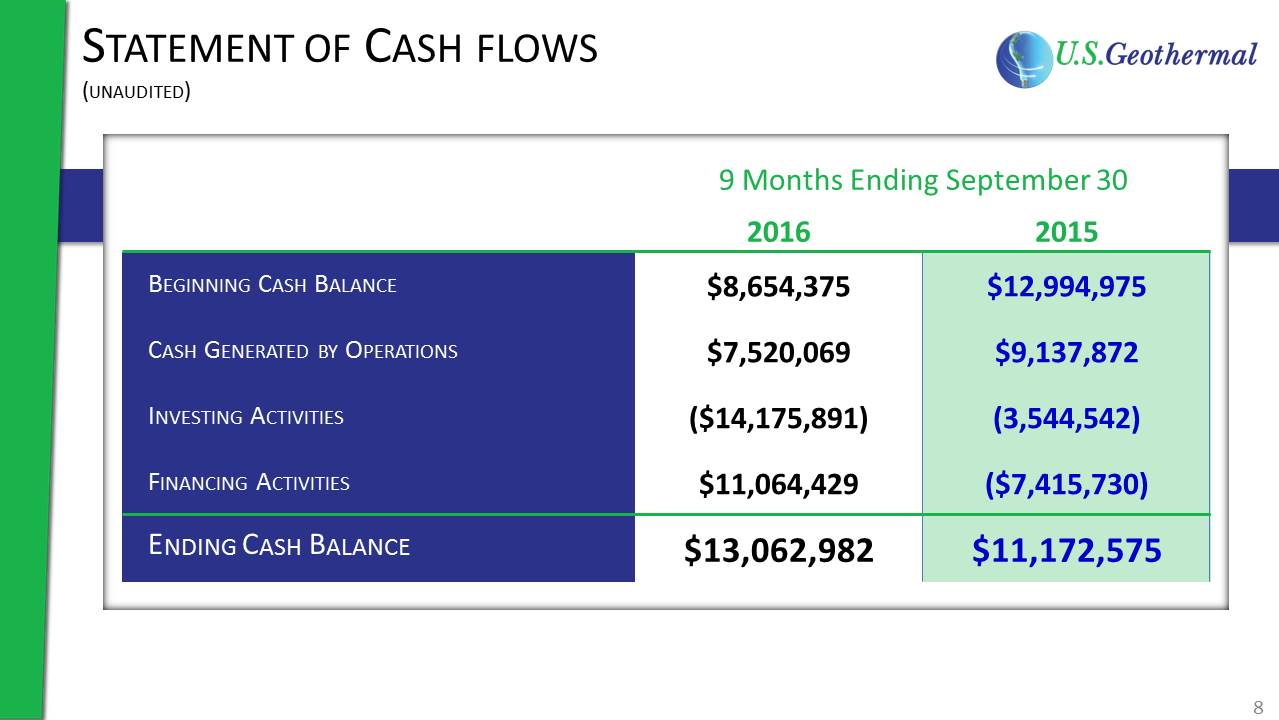

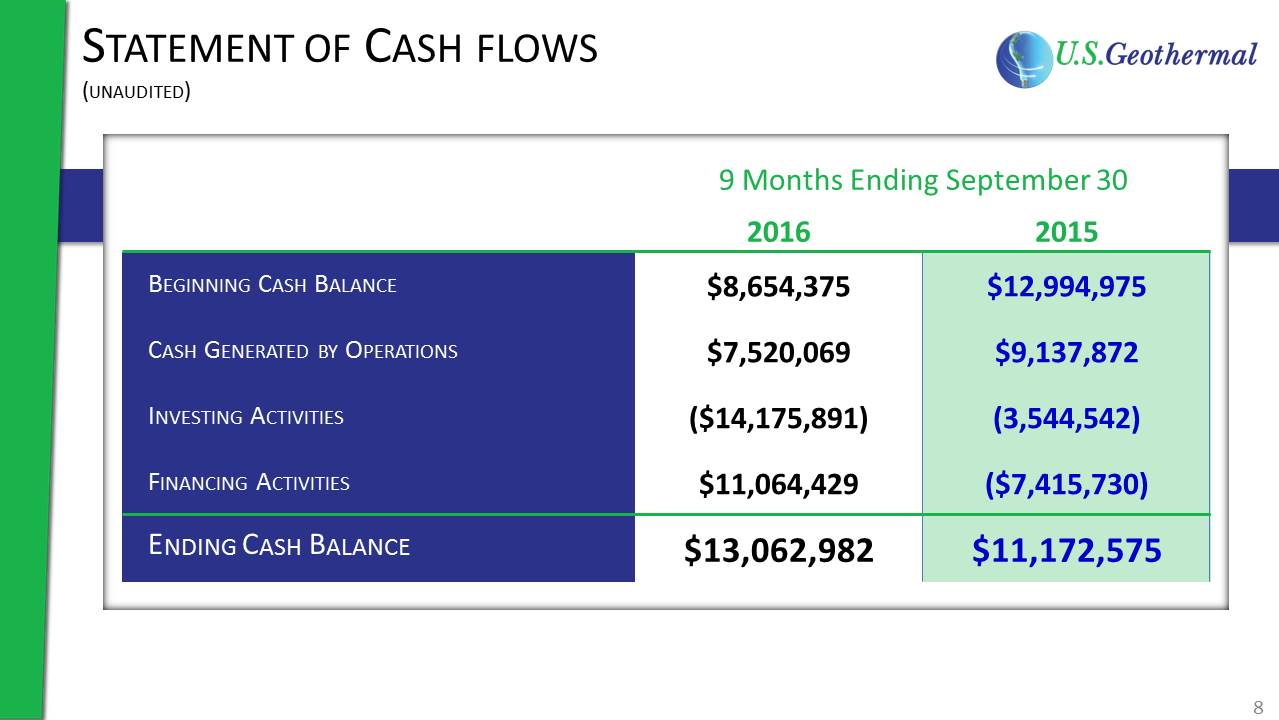

Statement of Cash flows(unaudited) 9 Months Ending September 30 2016 2015 Beginning Cash Balance $8,654,375 $12,994,975 Cash Generated by Operations $7,520,069 $9,137,872 Investing Activities ($14,175,891) (3,544,542) Financing Activities $11,064,429 ($7,415,730) Ending Cash Balance $13,062,982 $11,172,575 8

Operating Power Plants 9

All Operating Plants Fleet-wide Total 3 Months Ending Sept. 30 9 Months Ending Sept. 30 2016 2015 2016 2015 Availability Megawatt Hours 99.6%66,055 93.3%68,372 97.4%228,722 97.0%237,244 10

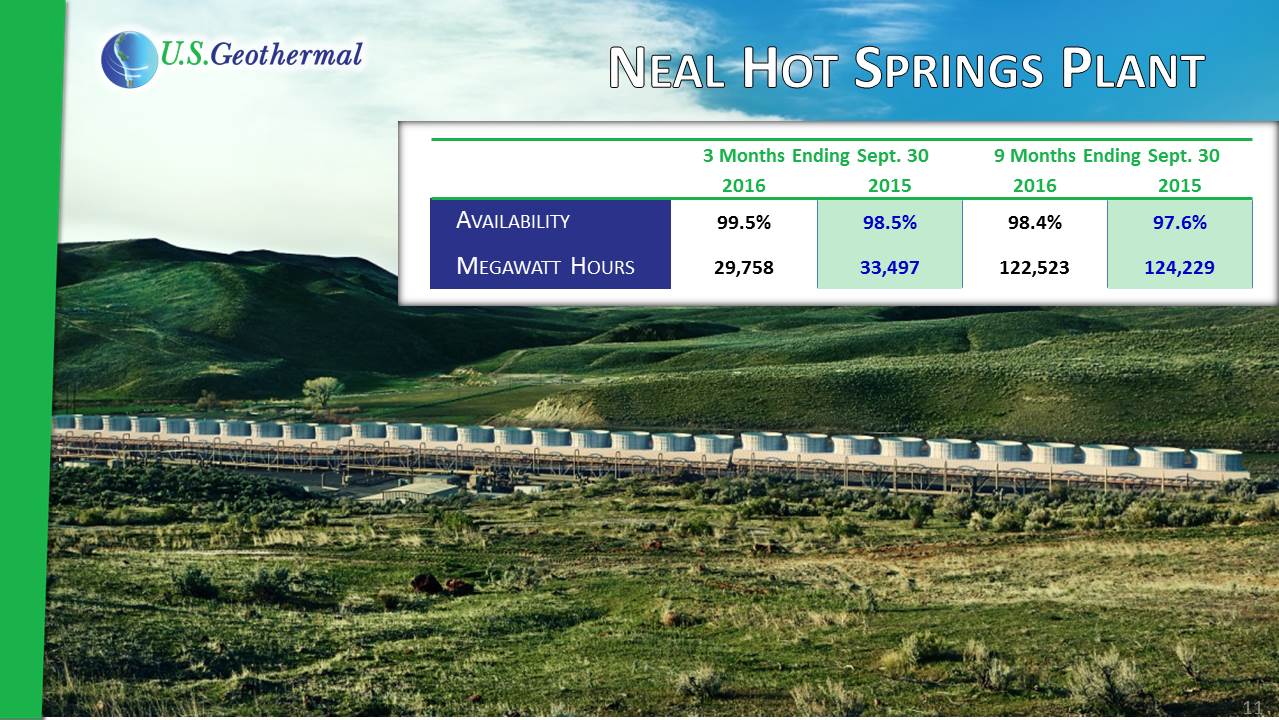

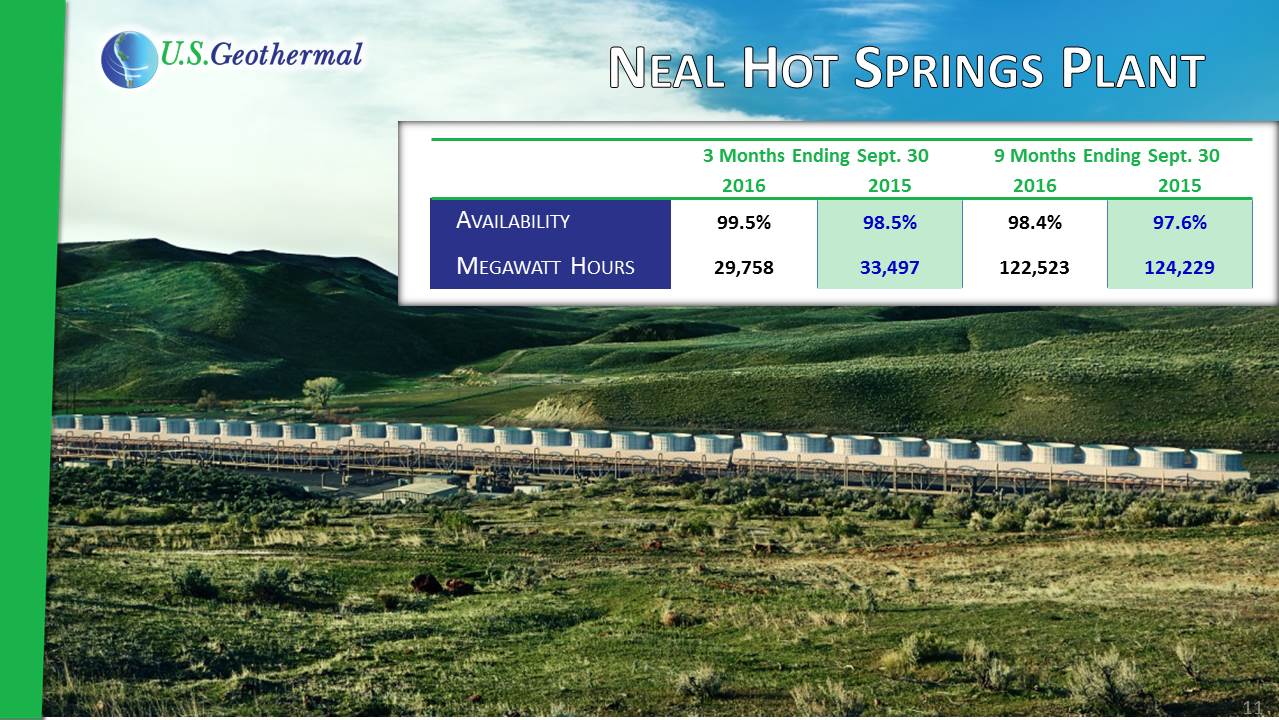

Neal Hot Springs Plant 3 Months Ending Sept. 30 9 Months Ending Sept. 30 2016 2015 2016 2015 Availability 99.5% 98.5% 98.4% 97.6% Megawatt Hours 29,758 33,497 122,523 124,229 11

San Emidio Plant 3 Months Ending Sept. 30 9 Months Ending Sept. 30 2016 2015 2016 2015 Availability 99.2% 98.9% 94.7% 99.6% Megawatt Hours 19,675 18,924 54,247 59,170 12

Raft River Plant Goldman Sachs (5%)Tax equity ownership structure5% Cash Flow, 99% Tax Credits 3 Months Ending Sept. 30 9 Months Ending Sept. 30 2016 2015 2016 2015 Availability 100% 82.7% 99.2% 93.8% Megawatt Hours 16,622 15,950 51,953 53,845 13

Growthupdate San Emidio II ProjectSan Emidio I in background 14

Recent Drilling Activities Completed deepening and testing of 2 existing temperature gradient wellsBoth wells encountered high permeability and a hotter resource than Phase I resourceInitial indication of larger than expected commercial resource San Emidio II Raft River Completed drilling leg off of well RRG-2Well returned to production and heat up is in progress – Expect to complete by end of NovemberTesting and evaluating RRG-5 for Supplemental Production Completed drilling and testing of a production size well Results indicate the shallow resource is commercialPlan to drill and test deep resource El Ceibillo, Guatemala 3 Drill rigs active 15

Expand Existing Operating Projects Modify existing wells Increase generation up to 3 MWIncrease revenue by $1.0 - $1.8 million/yearTarget completion: Q1-2017 Total of 6 MW from Expanding Existing Projects Raft River: Neal Hot Springs: Install Hybrid CoolingIncrease summer generation by ~ 8 MW = Increase annual average by ~3 MWIncrease revenue by $2.5 – $3.0 million/yearTarget completion: Q3-2017 16

Anticipate Strong Q4 Performance Reaffirm Full-year 2016 Financial Guidance One-time Non-recurring Expenses - $0.99 M Impact Key Highlights Extraordinary Mechanical Challenges - $2.3 M Impact 17

2016 Full Year Guidance Consolidated ($ Millions) Operating Revenue 29 - 34 Adjusted EBITDA 15 - 19 EBITDA 14 - 18 Net Income, as Adjusted 4 - 8 US Geothermal Only (less minority interests) Adjusted EBITDA 9 - 12 Net Income, as Adjusted 1 - 4 Note: See accompanying press release for definition of EBITDA, Adjusted EBITDA, and Net Income As Adjusted. 18

Outlook for Power Purchase Agreements Increased outreach and market visibility Market Evolution – CCA’s and Large Industrials Additional highlights 96 MW of Advance Stage Development & Expansion Projects r Q & A jects Lpl 19

The Most Reliable Renewable NYSE MKT:HTM WGP Geysers Project 20