Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - US GEOTHERMAL INC | Financial_Report.xls |

| EX-31.2 - EXHIBIT 31.2 - US GEOTHERMAL INC | exhibit31-2.htm |

| EX-23.1 - EXHIBIT 23.1 - US GEOTHERMAL INC | exhibit23-1.htm |

| EX-31.1 - EXHIBIT 31.1 - US GEOTHERMAL INC | exhibit31-1.htm |

| EX-21.1 - EXHIBIT 21.1 - US GEOTHERMAL INC | exhibit21-1.htm |

| EX-32.1 - EXHIBIT 32.1 - US GEOTHERMAL INC | exhibit32-1.htm |

| EX-32.2 - EXHIBIT 32.2 - US GEOTHERMAL INC | exhibit32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the year ended December 31, 2014

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For transition period _______ to _______

Commission File Number 001-34023

U.S. GEOTHERMAL INC.

(Exact name of Registrant as specified in its

charter)

| Delaware | 84-1472231 |

| (State or Other Jurisdiction of | (I.R.S. Employer |

| Incorporation or Organization) | Identification No.) |

| 390 Parkcenter Blvd, Suite 250 | |

| Boise, Idaho | 83706 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code 208-424-1027

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered |

| Common Stock, $0.001 par value | NYSE MKT LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act

[ ]

Yes [X] No

Indicate by check mark if the registrant is not required to

file reports pursuant to Section 13 or Section 15(d) of the Act.

[ ]

Yes [X] No

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for at least the past 90 days.

[X]

Yes [ ] No

Indicate by check mark whether the registrant has

submitted electronically and posted on its corporate Website, if any, every

Interactive Data File required to be submitted and posted pursuant to Rule 405

of Regulations S-T (§232.405 of this chapter) during the preceding 12 months (or

for such shorter period that the registrant was required to submit and post such

files).

[X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Act).

[ ]

Yes [X] No

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of the end of the registrant’s most recent second quarter (taking into account the change in fiscal year end), based upon the closing sale price of the registrant’s common stock as reported by the NYSE MKT LLC on March 21, 2014, was $85,252,768

The number of shares outstanding of the registrant’s common stock as of March 6, 2015 was 107,063,029.

U.S. Geothermal Inc. and Subsidiaries

Form 10-K INDEX

For the Year Ended December 31, 2014

U.S. Geothermal Inc. and Subsidiaries

Form 10-K INDEX

For the Year Ended December 31, 2014

U.S. Geothermal Inc. and Subsidiaries

Form 10-K INDEX

For the Year Ended December 31, 2014

PART I

Item 1. Business

Information Regarding Forward Looking Statements

This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve a number of risks and uncertainties. We caution readers that any forward-looking statement is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking statement. These statements are based on current expectations of future events. You can find many of these statements by looking for words like “believes,” “expects,” “anticipates,” “intend,” “estimates,” “may,” “should,” “will,” “could,” “plan,” “predict,” “potential,” or similar expressions in this document or in documents incorporated by reference in this document. Examples of these forward-looking statements include, but are not limited to:

| • | our business and growth strategies; | |

| • | our future results of operations; | |

| • | anticipated trends in our business; | |

| • | the capacity and utilization of our geothermal resources; | |

| • | our ability to successfully and economically explore for and develop geothermal resources; | |

| • | our exploration and development prospects, projects and programs, including construction of new projects and expansion of existing projects; | |

| • | availability and costs of drilling rigs and field services; | |

| • | our liquidity and ability to finance our exploration and development activities; | |

| • | our working capital requirements and availability; | |

| • | our illustrative plant economics; | |

| • | market conditions in the geothermal energy industry; and | |

| • | the impact of environmental and other governmental regulation. |

These forward-looking statements are based on the current beliefs and expectations of our management and are subject to significant risks and uncertainties. If underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results may differ materially from current expectations and projections. The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements:

| • | the failure to obtain sufficient capital resources to fund our operations; | |

| • | unsuccessful construction and expansion activities, including delays or cancellations; | |

| • | incorrect estimates of required capital expenditures; | |

| • | increases in the cost of drilling and completion, or other costs of production and operations; | |

| • | the enforceability of the power purchase agreements (“PPAs”) for our projects; | |

| • | impact of environmental and other governmental regulation, including delays in obtaining permits; |

-6-

| • | hazardous and risky operations relating to the development of geothermal energy; | |

| • | our ability to successfully identify and integrate acquisitions; | |

| • | our dependence on key personnel; | |

| • | the potential for claims arising from geothermal plant operations; | |

| • | general competitive conditions within the geothermal energy industry; and | |

| • | financial market conditions. |

All subsequent written or oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We do not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events, except as may be required under applicable U.S. securities law. If we do update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

The U.S. dollar is the Company’s functional currency; however some transactions involved the Canadian dollar. All references to “dollars” or “$” are to United States dollars and all references to CDN$ are to Canadian dollars.

U.S. Geothermal Inc. (the “Company,” “we” or “us” or words of similar import) is in the renewable “green” energy business. Through our subsidiary, U.S. Geothermal Inc., an Idaho corporation (“Geo-Idaho,” although our references to the Company include and refer to our operations through Geo-Idaho), we are engaged in the acquisition, development and utilization of geothermal resources in the Western United States and the Republic of Guatemala. Geothermal energy is the natural heat energy stored within the earth’s crust. In some areas of the earth, economic concentrations of heat energy result from a combination of geological conditions that allow water to penetrate into hot rocks at depth, become heated, and then circulate to a near surface environment. In these settings, commercially viable extraction of the geothermal energy and its conversion to electricity become possible and a “geothermal resource” is present.

-7-

Development of Business

U.S. Geothermal Inc. was incorporated on March 10, 2000 in the State of Delaware. U.S. Geothermal Inc. – Idaho was formed in February 2002, and is the primary subsidiary through which the Company conducts its operations. The Company constructs, manages and operates power plants that utilize geothermal resources to produce energy. The Company’s operations have been, primarily, focused in the Western United States.

The Company currently owns and operates the following geothermal power plant projects: Raft River, Idaho; San Emidio, Nevada; and Neal Hot Springs, Oregon. The Company also has geothermal property interests in the Republic of Guatemala; the Geysers in California; Vale, Oregon; Crescent Valley, Nevada; Ruby Hot Springs, Nevada; Lee Hot Springs, Nevada; and Gerlach, Nevada, some of which are under development or exploration.

History

Geo-Idaho was formed as an Idaho corporation in February 2002 to conduct geothermal resource development.

U.S. Cobalt Inc. entered into a merger agreement with Geo-Idaho on February 28, 2002, which was amended and restated on November 30, 2003, and closed on the reverse take-over on December 19, 2003. In accordance with the merger agreement, the Company acquired Geo-Idaho through the merger of Geo-Idaho with a subsidiary, EverGreen Power Inc., an Idaho corporation formed for that purpose. Geo-Idaho was the surviving corporation and is the subsidiary through which the Company conducts operations. As part of this acquisition, the Company name was changed to U.S. Geothermal Inc.

Plan of Operations

Our business strategy is to operate, identify, evaluate, acquire, and develop geothermal assets and resources economically, safely and efficiently. Our management evaluates our operating projects based on revenues and expenses, and our projects under development, based on costs attributable to each project. We examine different factors when assessing projects at different stages of development or potential acquisitions, such as the internal rate of return of the investment, technical and geological matters and other relevant business considerations.

We intend to execute this strategy in several steps outlined below:

| • |

Maximize Our Operations – Our operating power plants and operations team provide revenue to the Company through both power sales and Operations & Maintenance contracts. We strive to optimize plant operations though high safety standards, quality preventative maintenance programs, operator education, equipment selection and by exceeding our annual budgetary goals. |

-8-

| • |

Leverage Management Team Capabilities and Experience – Our strategy is focused on the identification and acquisition of resources that can be developed in a cost-effective manner to produce attractive returns. In particular, we seek to acquire projects that have already undergone geothermal resource discovery. In addition, we intend to operate and manage construction of the projects, while using internal personnel and third-party contractors to efficiently and cost-effectively develop those resources. We believe that we have the strategic personnel in place to determine which resources provide the greatest opportunity for efficient development and operation. We have developed relationships and employed personnel that will allow us to develop and utilize geothermal resources as efficiently as possible. |

|

| |

| • |

Develop Our Pipeline of Quality Projects – Our project pipeline currently consists of several projects that we believe are aligned with our growth strategy. We are currently engaged in negotiation for the acquisition of additional pipeline opportunities that are also aligned with our growth strategy. These projects typically have consulting reports from various industry experts supporting our belief in those projects’ potential. We are evaluating the potential of those projects and expect to negotiate Power Purchase Agreements (“PPAs”) for power deliveries with counterparties for some of these growth opportunities. If realized, our identified project pipeline will greatly expand our renewable power generation capacity as we move forward with the development of those opportunities. |

|

| |

| • |

Utilize Production Tax Credits, Investment Tax Credits and Other Incentives – Although geothermal power production can be cost competitive with fossil fuel power generating facilities on a life cycle cost basis, government incentives such as production tax credits (“PTC”) and Investment Tax Credits (“ITC”) available to geothermal power producers enhance the project economics and attract capital investment. For the Raft River Unit I project, we partnered with Goldman Sachs as a tax equity partner to fully utilize production tax credits available to the project. Our strategy going forward is to structure project ownership to be the primary beneficiary of project economics. Under current legislation, a company may elect to take 30% ITC for certain qualified investments provided construction of the project was started prior to the end of 2014. We believe that the second phase of our San Emidio project, our WGP Geysers project, and our Crescent Valley project each qualify for this credit. |

|

| |

| • |

Pursue Acquisition Strategy – The geothermal market, particularly in the United States, is fragmented and characterized by a few large players and a number of smaller ones. Geothermal exploration and development is capital intensive, technically challenging and requires long lead times before a project will produce revenue. We believe that geothermal technical and managerial talent is limited in the industry and that access to capital to develop projects will not be equally available to all participants. As a result, we believe that there will be opportunities in the future to pursue acquisitions of geothermal projects and/or geothermal development companies with attractive project pipelines. |

|

| |

| • |

Evaluate Other Potential Revenue Streams from Geothermal Resources – In addition to electricity generation, we may evaluate additional applications for our geothermal resources including industrial, agriculture, and aquaculture purposes. These uses generally constitute lower temperature applications where, after driving a turbine generator, residual hot water can be cycled for secondary processes before being returned to the geothermal reservoir by injection wells, which can provide incremental revenue streams. We may evaluate the optimal use for each geothermal resource and determine whether selling heat for industrial purposes or generating and subsequently selling power to a grid will generate the highest return on the asset. |

-9-

During the current year ended December 31, 2014, the Company was focused on these specific items:

| • |

operating and optimizing the Neal Hot Springs, San Emidio and Raft River power plants; |

| • |

completing the acquisition of the WGP Geysers project, pursuing PPA and steam sale opportunities, and optimizing power plant design; |

| • |

completing the acquisition of leases for the Vale project; |

| • |

completing the acquisition of Earth Power Resources; |

| • |

drilling of nine temperature gradient wells to define the target resource area for the El Ceibillo project, leasing surface lands, and working with the Guatemalan Ministry of Energy and Mines to adopt a new construction schedule; |

| • |

drilling two new wells, and constructing a tie in pipeline at San Emidio for Phase II; and |

| • |

evaluating potential new geothermal projects and acquisition opportunities. |

Projects in Operation

Although other factors may impact our operations and financial condition, including many that we do not or cannot foresee, we believe that our results of operations and financial condition for the foreseeable future will be affected by the factors discussed below. A summary of the Company’s operations is as follows:

| Projects in Operation | |||||||||||||||

| Generating | Contract | ||||||||||||||

| Project | Location | Ownership | Capacity (megawatts) | Power Purchaser | Expiration | ||||||||||

| Neal Hot Springs | Oregon | JV(1) | 22.0 | Idaho Power | 2036 | ||||||||||

| San Emidio (Unit I) | Nevada | 100% | 10.0 | Sierra Pacific | 2038 | ||||||||||

| Raft River (Unit I) | Idaho | JV(2) | 13.0(3) | Idaho Power | 2032 | ||||||||||

| (1) |

In September 2010, the Company’s wholly owned subsidiary (Oregon USG Holdings LLC) entered into agreements that formulated a strategic partnership with Enbridge (U.S.) Inc. (“Enbridge”). Enbridge contributed approximately $32.8 million to the Neal Hot Springs geothermal project. The Company’s equity interest in the project is 60% and Enbridge’s equity interest is 40%. |

| (2) |

As part of the financing package for Unit I of the Raft River project, we contributed $16.5 million in cash and approximately $1.4 million in property to Raft River Energy I LLC, the Unit I project joint venture company. Raft River I Holdings, LLC, a subsidiary of The Goldman Sachs Group, contributed $34 million to finance the construction of the project. |

| (3) |

Based on the designed annual average net output. The actual output of the Raft River Unit I plant currently is approximately 9.4 megawatts annual average. |

-10-

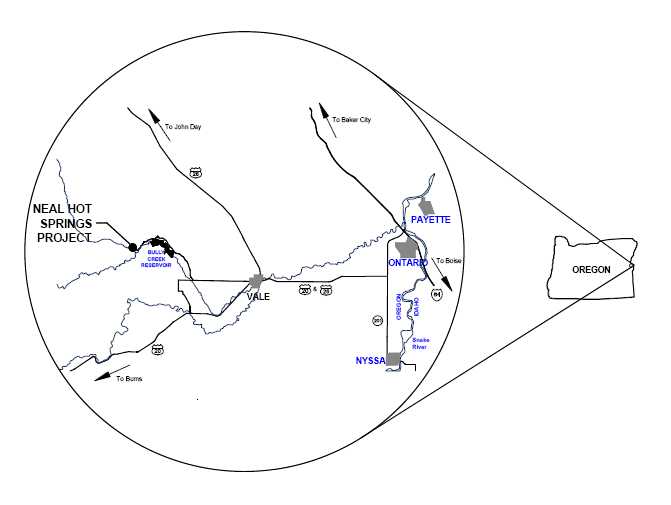

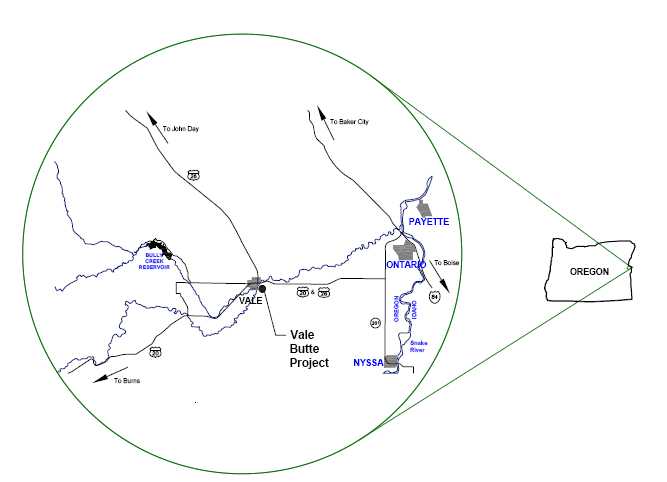

Neal Hot Springs, Oregon

Neal Hot Springs is located

in Eastern Oregon near the town of Vale, the county seat of Malheur County, and

achieved commercial operation on November 16, 2012. The Neal Hot Springs

facility is designed as a 22 megawatt net annual average power plant, consisting

of three separate 12.2 megawatt (gross) modules, with each module having a

design output of 7.33 megawatts (net) annual average based on a specific flow

and temperature of geothermal brine.

Generation from the facility during the fourth quarter of 2014 totaled 54,472 megawatt-hours with an average of 25.08 net megawatts per hour of operation. Plant availability was 98.3% during the quarter. Total generation at Neal Hot Springs for 2014 was 183,394 megawatt-hours. This compares to 155,428 megawatt-hours of generation for 2013, reflecting an 18% increase over the prior year.

The PPA for the project was signed on December 11, 2009 with the Idaho Power Company. It has a 25 year term, and a variable percentage annually price escalation. The PPA has a seasonal pricing structure that pays 120% of the average price for four months (July, August, November, December), 100% of the average price for five months (January, February, June, September, October) and 73.3% of the average price for three months (March, April, May). The average price paid under the PPA for 2014 was $102.78 per megawatt-hour and will increase to $106.79 per megawatt-hour in 2015.

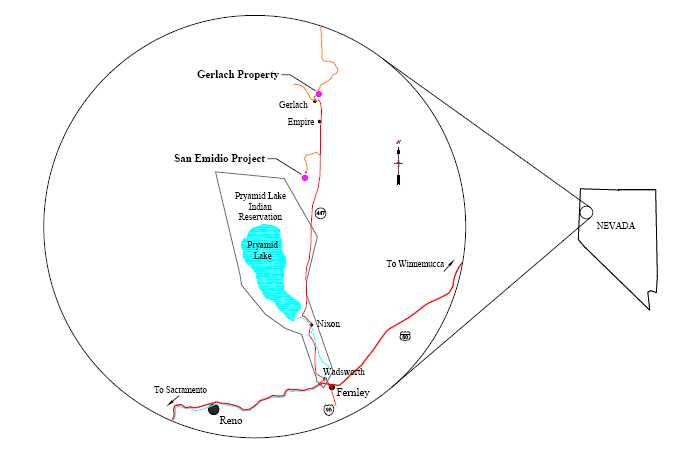

San Emidio Unit I, Nevada

The Unit I power plant at

San Emidio is located approximately 100 miles north-east of Reno, Nevada near

the town of Gerlach, and achieved commercial operation on May 25, 2012. The San

Emidio facility is a single 14.7 megawatt (gross) module, with a design output

of 9 megawatts (net) annual average based on a specific flow and temperature of

geothermal brine. Generation from the facility during the fourth quarter 2014

totaled 21,745 megawatt-hours, with an average of 9.93 net megawatts per hour of

operation. Plant availability was 99.2% during the quarter. Total generation for

2014 was 76,894 megawatt-hours. This compares to 76,697 megawatt-hours of

generation for 2013 reflecting continued, steady state operation of the

facility.

On June 1, 2011, an amended and restated PPA was signed with Sierra Pacific Power Company d/b/a NV Energy for the sale of up to 19.9 megawatts of electricity on an annual average basis. The PPA has a 25 year term with a base price of $89.75 per megawatt-hour, and an annual escalation rate of 1 percent. The average price paid under the PPA for 2014 was $91.17 per megawatt-hour and will increase to $92.08 per megawatt-hour in 2015.

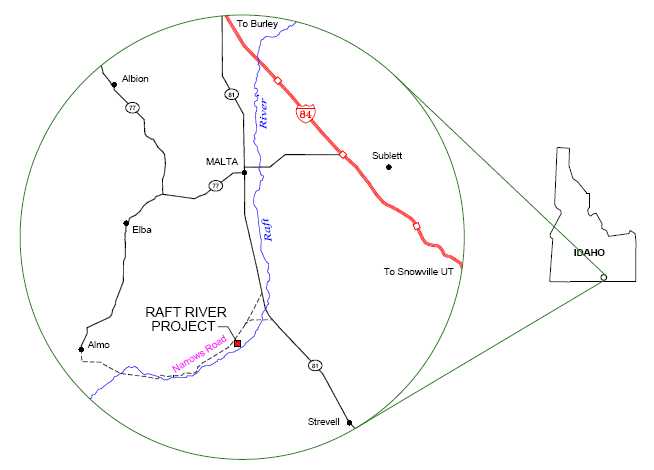

Raft River, Idaho

Raft River Unit I is located in

Southern Idaho, near the town of Malta, and achieved commercial operation on

January 3, 2008. The Raft River facility is a single 18 megawatt (gross) module,

with a design output of 13 megawatts (net) annual average based on a specific

flow and temperature of geothermal brine.

Generation from the facility during the fourth quarter 2014 totaled 20,614 megawatt-hours, with an average of 9.59 net megawatts per hour of operation. Plant availability was 97.3% during the quarter. Total generation for 2014 was 78,798 megawatt-hours. This compares to 77,560 megawatt-hours for the same period of 2013, reflecting continued steady state operation of the facility.

-11-

The PPA for the project was signed on September 24, 2007 with the Idaho Power Company. The PPA has a 25 year term with a starting average price for the year 2007 of $52.50 that escalates at 2.1% per year through 2020 and then at 0.6% per year until the end of the contract in 2034. The Idaho Power PPA has a seasonal pricing structure that pays 120% of the average price for four months (July, August, November, December), 100% of the average price for five months (January, February, June, September, October) and 73.5% of the average price for three months (March, April, May). The average price paid under the PPA for 2014 was $60.72 per megawatt-hour and will increase to $62.00 per megawatt-hour in 2015.

In addition to the price paid for energy by Idaho Power, Raft River Unit I currently receives $4.75 per megawatt-hour under a separate contract for the sale of Renewable Energy Credits (“RECs”) to Holy Cross Energy, a Colorado electric cooperative. Starting in calendar year 2018, 51% of the RECs are owned by Idaho Power and 49% by the project. For the RECs owned by Raft River, a new, 10 year REC contract with the Public Utility District No. 1 of Clallam County, Washington will replace the current contract.

Material Acquisitions/Development

In addition to our projects in operation, we have projects under development and under exploration. Projects under development have at least a geothermal resource discovery or may have wells in place, but require the drilling of new or additional production and injection wells in order to supply enough geothermal fluid sufficient to operate a commercial power plant. Projects under exploration do not have a geothermal resource discovery occurrence yet, but have significant thermal and other physical evidence that warrants the expenditure of capital in search of the discovery of a geothermal resource. Due to inflation and marketplace increases in the costs of labor and construction materials, estimates of property development costs may be low.

A summary of projects under development and under exploration is as follows:

| Projects Under Development | ||||||

| Estimated | ||||||

| Target | Projected | Capital | ||||

| Development | Commercial | Required | Power | |||

| Project | Location | Ownership | (Megawatts) | Operation Date | ($million) | Purchaser |

| El Ceibillo Phase I | Guatemala | 100% | 25 | 2nd Quarter 2018 | 138 | TBD |

| San Emidio Phase II | Nevada | 100% | 11 | 3rd Quarter 2017 | 65 | TBD |

| WGP Geysers | California | 100% | 30 | 2nd Quarter 2017 | 160 | TBD |

| Crescent Valley Phase I | Nevada | 100% | 25 | 1st Quarter 2018 | 141 | TBD |

-12-

|

Properties Under Exploration |

|||||||

| Target Development | |||||||

| Project | Location | Ownership | *(Megawatts) | ||||

| Gerlach | Nevada | 60% | 10 | ||||

| Vale | Oregon | 100% | 15 | ||||

| El Ceibillo Phase II | Guatemala | 100% | 25 | ||||

| Neal Hot Springs II | Oregon | 100% | 10 | ||||

| Raft River Unit II | Idaho | 100% | 13 | ||||

| Crescent Valley Phase II | Nevada | 100% | 25 | ||||

| Crescent Valley Phase III | Nevada | 100% | 25 | ||||

| Lee Hot Springs | Nevada | 100% | 20 | ||||

| Ruby Hot Springs Phase I | Nevada | 100% | 20 | ||||

Granite Creek – During the current year ended December 31, 2014, the Company elected to not continue exploration and development activities due to more attractive projects in its portfolio. The Company is in the process of releasing its interests in the area.

Neal Hot Springs Phase III, Raft River Phase III, and San Emidio Phase III – These projects were removed from the list of properties under exploration during the current year. Unfavorable market conditions and development time frames did not warrant the allocation of exploration or development resources.

* Target development sizes are predevelopment estimates of resource potential of unproven resources.

A summary of the property size, temperature, well-depth and power plant technology used or anticipated to be used at our properties is as follows:

|

Property Details |

|||||||||

| Property Size | |||||||||

| (square | |||||||||

| Property | miles) | Temperature (ºF) | Depth (Ft) | Technology | |||||

| Neal Hot Springs | 9.6 | 286-311 | 2,500-3,000 | Binary | |||||

| San Emidio | 27.9 | 289-316 | 1,500-3,000 | Binary | |||||

| Raft River | 10.8 | 275-302 | 4,500-6,000 | Binary | |||||

| Gerlach | 4.7 | 338-352 | 2,000-3,000 | Binary | |||||

| El Ceibillo | 38.6 | 410-526 | 1,800-TBD | Steam | |||||

| WGP Geysers | 6.0 | 380-598 | 6,000-10,000 | Steam | |||||

| Crescent Valley | 33.3 | 326-351 | 2,000-3,000 | Binary | |||||

| Lee Hot Springs | 4.0 | 280-320 | 1,250-5,000 | Binary | |||||

| Ruby Hot Springs | 3.3 | 315-340 | 1,670-4,500 | Binary | |||||

| Vale | 0.6 | 290-300 | 2,450-5,000 | Binary | |||||

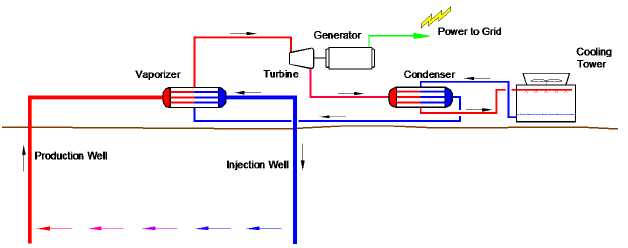

Binary Cycle Geothermal Power Plants

In a binary

cycle geothermal power plant hot water is produced to a piping and gathering

system from wells drilled into the geothermal reservoir. The hot water flows,

with to a heat exchanger called a vaporizer where it vaporizes a secondary

working fluid, with its heat extracted, causing the original hot water to become

cool. All of the cooled water is then pumped to injection wells where it is

injected back into the reservoir to help recharge the geothermal reservoir. The

vaporized working fluid passes through a turbine which drives an electrical

generator that is tied into the electrical transmission grid. Upon discharging

the turbine the secondary working fluid is condensed before piping it back to

the vaporizer where the process is repeated.

-13-

Dry Steam Geothermal Power Plants

An example of a

vapor dominated geothermal system is at The Geysers in central California. Dry

super-heated steam is produced from wells through a piping system and run

directly through a turbine. The turbine drives an electrical generator that

delivers power to the electrical transmission grid. Steam discharges from the

turbine into a condenser where it is condensed forming water. The water is

pumped to a cooling tower where it can be used as water for the cooling process.

The cooled water from the cooling tower is recycled back to the condenser to

repeat the process. Any excess water from the cooling tower is pumped through a

piping system to injection wells where it is injected back into the reservoir

which helps to recharge the geothermal reservoir.

-14-

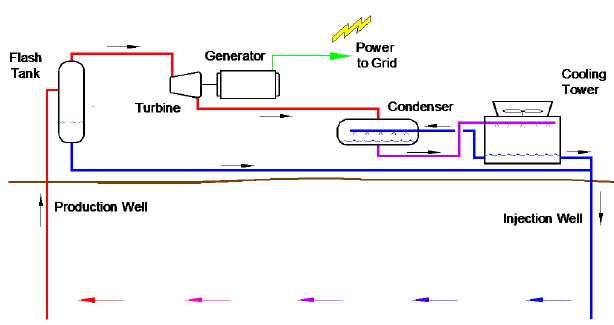

Flash Geothermal Power Plants

In hot water

geothermal systems (temperatures greater than approximately 400 degrees

Fahrenheit), flash production systems are often used. The hot water is produced

from wells drilled into the geothermal reservoir. The hot water from the various

production wells is piped to a flash tank where the pressure is reduced. The

reduction in pressure in the flash tank causes part of the hot water to flash to

form steam and part to remain as water. The flash tank also acts a separator,

separating the steam from the water. The hot water separated from the steam is

pumped through a pipeline system to injection wells and injected into the

reservoir for reservoir recharge. The steam coming off the flash tank/separator

is piped directly to a turbine where the process is identical to that used for

dry steam geothermal power plants.

San Emidio, Nevada

The Phase II expansion is

dependent on successful development of additional production and injection well

capacity. We expect that approximately 75% of the Phase II development may be

funded by project loans, with the remainder funded through equity financing. We

anticipate the project qualifying for the 30% Federal investment tax credit. As

a result of the delays experienced in permitting wells on BLM administered

leases, it was determined that it is not possible to complete the development of

the Phase II project within the development time frame required in the existing

19.9 megawatt NV Energy PPA.

A Small Generator Interconnection Agreement for 16 megawatts of transmission capacity was executed with Sierra Pacific Power Company on December 28, 2010. An application to increase the interconnection agreement to the full 19.9 megawatts allowed under the PPA was submitted to NV Energy on January 9, 2014. A System Impact Study (“SIS”) agreement, which is the next step in the interconnection process mandated by the Federal Energy Regulatory Commission, was signed on August 28, 2014. Results from the SIS were received on December 24, 2014. A second phase interconnection study, called the Facilities Study, was started in January of 2015.

-15-

On October 30, 2009, the Company was awarded $3.77 million in Recovery Act funding from the Department of Energy (“DOE”) for the exploration and development of its San Emidio geothermal power project using advanced geophysical exploration techniques. This award was categorized under the “Innovative Exploration and Drilling Projects” section of the American Recovery and Reinvestment Act. The first stage of the DOE project applied innovative, seismic and satellite imagery techniques along with state-of-the-art structural modeling, to locate large aperture fractures that represent high-productivity geothermal drilling targets and was completed in 2011. Two zones along the 4.5 mile long San Emidio fault structure were identified as high quality targets for drilling during the first phase of the DOE program, a South Zone and a North Zone.

The second stage of the DOE program was a 50-50 cost shared drilling plan that was intended to follow up on targets identified in the first stage. Drilling started in the South Zone, and two wells were completed by the Company. After approval of the drilling program by the DOE in November 2011, one of the first two wells was deepened and three additional wells were completed in the South Zone with the costs being shared on a 50-50 basis.

As part of the continuing DOE program, permitting was initiated early in the year with the Bureau of Land Management (“BLM”) for four new observation wells to be drilled in the South Zone to follow up on the high temperatures found in wells 61-21 (302°F) and 45-21 (316°F). As part of the permitting process, cultural and biological surveys were performed, and the well design and drilling program were submitted during the first quarter. Permits for three wells were issued by the BLM on April 29th and a drill rig was mobilized to the site on June 26th. Two additional wells were completed on the BLM administered land during the third quarter. Well OW-14 was drilled to a depth of 3,501 feet and had a bottomhole temperature of 265°F. Well OW-15 was drilled to a depth of 3,716 feet and had a maximum downhole temperature of 300°F. While the wells extended the high temperature outline of the South Zone, neither well encountered the commercial permeability seen in well 61-21 (OW-10). Geologic, geochemical and temperature data generated by the drilling program is being evaluated to determine the next phase of drilling.

A second round of permitting for an expanded temperature gradient drilling program is underway for an area south west of the current resource. Results from the recent OW drilling program combined with 1970s era, shallow temperature gradient data, indicate a high temperature trend into this south-west zone. Geophysical surveys have also identified structural trends in this area. Several 1,000 foot deep temperature gradient wells are being permitted to follow up on this portion of the resource.

Well 61-21 (formerly OW-10) in the South Zone, was reworked beginning on October 25, 2013 and was completed on November 2, 2013. Flow testing of 61-21 was completed during the second quarter of 2014. To allow for early, long term testing of the South Zone resource area, a cross tie pipeline was constructed between the Phase I and Phase II project areas and a production pump was installed in well 61-21 during the third quarter. Well 61-21 is currently producing 620 gallons per minute of 296°F fluid to the San Emidio Phase I power plant. San Emidio Phase I plant generation has increased approximately a half of megawatt. Hooking up and flow testing well 61-21 was the last work under the DOE Innovative Exploration and Drilling Project grant. The grant program was completed at the end of September 2014, with the DOE Geothermal Technologies Program having expended $3,772,560 and the Company $4,156,741.

-16-

A Request for Proposal (“RFP”) from NV Energy for 100 megawatts of renewable energy was issued on October 1, 2014. On November 12, we submitted a bid for an air cooled power plant to be developed on the Phase II project site. In early December, NV Energy submitted a request to the Nevada Public Utilities Commission (“NPUC”) to combine the 2014 solicitation with the 2015 solicitation for a total of 200 megawatts to be procured in 2014. The request also allows re-submittal of any projects that had been previously submitted for the original 2014 RFP. NV Energy’s request was approved by the NPUC, and Subsequent to the end of the year on February 16, 2015, we submitted an alternative option into the new NV Energy solicitation that uses a water cooled plant as the basis for the bid. We were notified on March 3rd that our bid was advanced to the initial short list for geothermal projects.

In parallel, we are continuing to investigate a power purchase agreement with California off-takers, where power prices are typically higher.

Raft River, Idaho

The Raft River project was awarded an $11.4 million cost-shared, thermal fracturing program grant from the Department of Energy. The goal of the project is to create an Enhanced Geothermal System (“EGS”) by creating thermal fractures and developing a corresponding increase in permeability in the low permeability rock. Well RRG-9 was made available, and after installing four, 300 foot deep seismic monitoring wells with seismic geophones to allow for seismic monitoring, the first stage of injection into the well began in June 2013. Initially the well was only capable of receiving 20 gallons per minute (“gpm”) of water due to the low permeability of the rock. Injection continued through the quarter from power plant injectate, with flow into the well seeing a moderate increase to now over 450 gpm, indicating that significant additional permeability has developed. The EGS stimulation is expected to continue through 2015.

If the fracturing program is successful, and permeability is improved to a commercial level, well RRG-9 may be utilized as a production or injection well for the existing Raft River power plant. The Company’s contributions for the thermal fracturing program are made in-kind by the use of the RRG-9 well, well field data, and monitoring support.

Gerlach, Nevada

The Gerlach Joint Venture, located adjacent to the town of Gerlach in Washoe County, Nevada is made up of both private and BLM geothermal leases. The Peregrine well, a historic exploration slim hole that encountered a lost circulation zone at a depth of 975 feet, was redrilled in 2010 and the hole was opened from a 6.5 inch diameter well to a 12.5 inch diameter well. Lost circulation was confirmed within three zones through the 900 to 1,024 foot interval. The well was stopped at 1,070 feet total depth. Temperature surveys and a short clean out flow test were conducted on the well. The well flowed at an estimated 300-400 gallons per minute and the flowing temperature was 208°F. Geochemistry indicates an average potential source temperature of 374°F for the Gerlach site.

-17-

Drilling commenced on observation well 18-10a on October 30, 2014. 18-10a is a twin well to a well originally drilled in 1994 (the 18-10 well). The upper section of the well was drilled to 826 feet deep and an 8 inch liner was cemented in place. Temperature measurements in the well have provided the highest measured temperature in the field to date at 268°F within 160 feet of surface and a temperature gradient of 6.4°F per 100’ in the bottom section of the hole. There are two previously identified lost circulation targets from the original well at 1,600 and 2,800 feet deep that will be targeted when drilling is resumed.

Drilling resumed on well 18-10a on April 14, 2012 and was stopped on April 18, 2012 at 1,943 feet deep. Circulation was lost in minor zones at 1,530 and 1,595 feet deep. Drilling resumed again on well 18-10a on August 14, 2014, and was completed in late November. The well was drilled to a total depth of 2,889 feet and encountered a maximum temperature of 275°F. Further work is dependent upon additional funding from the partners.

El Ceibillo, Republic of Guatemala

A geothermal

energy rights concession, located 14 kilometers southwest of Guatemala City, was

awarded to U.S. Geothermal Guatemala S.A., a wholly owned subsidiary of the

Company in April 2010. The concession has a 5 year term for the development and

construction of a power plant. There are 24,710 acres (100 square kilometers) in

the concession which is at the center of the Aqua and Pacaya twin volcano

complex.

An office and staff are located in Guatemala City and a 17 acre plant site is under lease on land adjacent to the existing wells. A second surface lease for use of an additional 80 acre parcel was signed on October 15, bringing the total surface leasehold interest to 97 acres. Construction of a drill pad, pond and cellar for EC-2, our new well, was completed during the fourth quarter. EC-2 is located on the new surface leasehold. Drilling of EC-2 is expected to begin as soon as the approval to extend the development schedule contained in the concession agreement has been obtained from the Guatemalan Ministry of Energy and Mines.

Our attempts to obtain approval of our modified development schedule from the Guatemala Ministry of Energy (“MEM”) continue. Our request has been approved by the MEM legal department and, subsequent to the end of the year, the new schedule was approved by the technical department, and has been approved by the Vice-Minister. Final approval for the new schedule now awaits signature by the Minister of Energy.

El Ceibillo, the first development target on the concession, is located near the town of Amatitlan, in a developed industrial zone immediately adjacent to the highway that connects Guatemala City to the Port of San Jose on the Pacific coast. An initial development of a 25 megawatt (Phase I) power plant is planned in the El Ceibillo area of the concession, but the final size of the facility will be determined after drilling and resource delineation has advanced. Initial transmission studies have been completed, and identified the grid interconnection point approximately 1.2 miles (2 kilometers) from the site.

A temperature gradient (“TG”) drilling program was initiated during the first quarter of 2014 with a series of 656 foot (200 meter) deep wells planned. Nine TG wells have been completed with depths ranging from 656 to 1,312 feet (200 to 400 meters). Bottom-hole temperatures found in this shallow drilling program range from 176 to 413°F (80 to 211°C) with two of the wells encountering permeability and flowing brine. The data from these wells provided a more accurate temperature gradient map of the underlying geothermal resource which has assisted in identifying future drilling targets.

-18-

A first phase of drilling took place during the third quarter of 2013 when well EC-1 was drilled to a depth of 4,829 feet (1,472 meters) and encountered a bottom hole temperature of 491°F (255°C), with the temperature gradient at the bottom of the hole rising at a rate of 7.1°F/100 Feet (129.1°C/km) . High temperatures in excess of 392°F (>200°C) were encountered in the well beginning at a depth of 2,625 feet (800 meters), which represents a potential high temperature reservoir interval in excess of 2,204 feet (672 meters) thick. Due to the high temperature gradient found in the lower section of the well, the decision was made to deepen the well. The final depth of the well is 5,650 feet (1,722 meters) with a measured bottom-hole temperature of 526°F (274°C). Clean out and short term flow tests were conducted along with temperature surveys and have been incorporated in the geologic model of the reservoir. Well EC-1 did not encounter commercial permeability.

In early September 2013, the Guatemalan Ministry of the Environment and Natural Resources (“MARN”) issued the Environmental License for the construction and operation of the planned, first phase, 25 megawatt power plant at the El Ceibillo site. The license is based on the Environmental Impact Assessment Study that was submitted in December 2012, describing the initial design of the 25 megawatt facility, and requires the submittal of final design specifications for review by MARN prior to starting physical construction of the plant. Additionally, the license requires compliance with all legal and regulatory requirements under Guatemalan law, submittal of an air quality monitoring plan, and that final design comply with the strict guidelines for noise, dust and hydrogen sulfide emissions. Prior to issuance of the license, an environmental bond was posted with the Ministry of Environment and Natural Resources.

A binding Memorandum of Understanding (“MOU”) was signed on October 18, 2012 with one of the largest power brokers in Central America. The MOU established the framework for a PPA that included a 15-year term for an initial, estimated 25 megawatts of power generation up to a maximum of 50 megawatts of power generation to be developed in two phases. As a result of the delays in approval of the modified development schedule from MEM, we requested an extension of our MOU, which was allowed under the terms of the agreement, but our request was declined and the MOU is now terminated. We are continuing discussions with the broker to reinstate or renegotiate the agreement, and are approaching other power consumers in Guatemala and Central America.

WGP Geysers, California

The WGP Geysers project is located in the broader Geysers geothermal field located approximately 75 miles north of San Francisco, California. The broader Geysers geothermal field is the largest producing geothermal field in the world generating more than 850 megawatts of power for more than 30 years. Acquisition of the WGP Geysers Project from Ram Power was completed on April 22, 2014 for $6.4 million.

-19-

WGP Geysers is an advanced stage project that encompasses the former Pacific Gas and Electric Unit 15, which once had a 62 megawatt (gross) capacity geothermal power plant that was shut down in l989. The project includes 3,809 acres (6 square miles) of geothermal leases and property, development design plans, and permits for an up to 38.5(gross) megawatt power plant. There are four existing wells drilled in 2008-2009 which are immediately available for production or injection, with a fifth, historic well that has temporary plugs installed but can be reworked. The four new wells have been tested with an initial steam flow totaling 462,000 pounds per hour. A report prepared in 2012 by a third party reservoir engineering firm, states that the total initial power capacity from these wells is estimated at about 30 megawatts (gross).

A 12 month extension for the Sonoma County Conditional Use Permit to construct the up to 38.5 megawatt power plant was applied for and was approved on June 12, 2014. Additionally, an application was made to the Sonoma County Air Quality Board for a permit to conduct flow tests on the four production wells drilled in 2009. The Air Quality permit was approved on June 19, 2014. A new conditional use permit application is currently being prepared for submittal to local regulatory agencies to replace the recently extended conditional use permit that expires in July.

A new transmission interconnection agreement has been applied for to the California Independent System Operator. Engineering optimization of the power plant design continues. The current well field reservoir model is being updated to reflect a new hybrid plant design that includes both water and air cooling, which will dramatically increase the volume of water available for injection back into the reservoir. Traditional water cooled steam plants re-inject approximately 20% of the water that is removed during power generation, while a hybrid design may re-inject up to 65% of the water. This higher injection rate will provide longer term, stable steam production, and will result in increased power generation over the life of the project. A flow testing program for the production wells is being designed and will be scheduled during the first half of 2015.

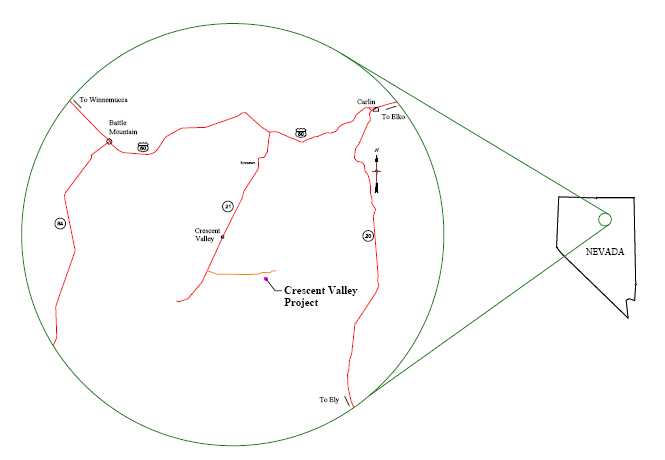

Crescent Valley, Nevada

The Crescent Valley prospect

consists of approximately 21,300 acres (33.3 square miles) of private and

Federal geothermal leases. It is located in Eureka County, Nevada, approximately

15 miles south of the Beowawe geothermal power plant and about 33 miles

southeast of Battle Mountain. The project was acquired as part of the Earth

Power Resources merger which was completed in November 2014.

Multiple geothermal and mineral exploration drilling programs have identified high temperatures and high temperature gradients in the shallow subsurface over an area greater than 30 square miles. Historic drill holes defining this area have anomalous temperature gradients of up to 40°F/100 feet of depth, and a recorded high temperature of 285°F at 395 feet below the surface. These drill holes define large areas of hydrothermal alteration that correspond to positive anomalies defined by gravity surveys that extend into undrilled areas of the valley.

A mineral exploration hole drilled in the mid-l990s near the Crescent Valley fault encountered geothermal fluid under pressure and the driller lost control the well. An oil field service company had to be contracted to regain control prior to the abandonment of the well. This well demonstrates that prospective permeability and commercial temperature are known from past minerals exploration.

-20-

Hot springs located on the property have discharge temperatures of up to 198°F and broad areas of hydrothermal alteration occur at both Hot Springs Point and along the Crescent Valley fault 8 miles to the southeast. Chemistry of the hot springs and the occurrence of silica sinter deposits at surface, and intersected by drilling in the shallow subsurface, suggest reservoir temperatures at depth of greater than 350°F. Chemistry of fluids from the Crescent Valley hot spring is permissive for even higher temperatures of greater than 400°F.

Anomalous temperature gradients extend up to 7 miles northwest from the Crescent Valley fault into Crescent Valley proper. Additional fracture controlled permeability may be present under the valley floor as horst-bounding fault systems interpreted from historic seismic studies are indicated to exist.

An independent geothermal consulting firm evaluated all of the available data for the Crescent Valley Prospect in late 2009. After evaluating the data, a recoverable, heat-in-place Monte Carlo method was used to estimate the generation potential of the prospect. The resulting estimate for the field was 71 megawatt with 90% probability and 186 megawatt with 50% probability over a 20 year period. The actual, producible power generation may be significantly different than the recoverable heat-in-place calculations, and will depend upon the discovery of commercial temperatures and permeability.

In light of federal legislation that extended the qualification for the 30% Investment Tax Credit to projects that began construction prior to December 31, 2014, drilling of the first production well CVP-001 (67-3) was initiated in December of 2014, following completion of gravity surveys, and analysis of prior temperature gradient drilling data. The first string of production casing was set and cemented before year end. Subsequent to the end of the year, the well was drilled to 730 feet and the production casing was cemented in place.

Lee Hot Springs, Nevada

Lee Hot Springs is in

Churchill County, 18 miles south of Fallon. The area was originally explored by

Occidental Geothermal Company, a subsidiary of the oil company Occidental

Petroleum Corporation. The project is comprised of 2,560 acres (four square

miles) of BLM leases. ENEL Green Energy, a subsidiary of ENEL Group, the Italian

based, multi-national power company, has completed a 15 megawatt binary plant at

Salt Wells, 6 miles to the east of Lee. The project was acquired as part of the

Earth Power Resources merger which was completed in November 2014.

Dating back to 1930, the area has had numerous water wells, thermal gradient holes, and geothermal slim hole tests. From 1977-1982 Occidental Geothermal, Inc. drilled four temperature gradient holes to depths of 500 feet, two stratigraphic test wells’ to 2,000-3,000 feet, and one large-diameter production test to 3,000 feet (well 72-33). The 3,000 foot test well flowed 280°F hot water from a zone at 1,200 ft. The A33-4 well, 1,000 feet southwest of well 72-33, was drilled to 2,400 feet and reportedly had temperatures in excess of 300°F and a steadily increasing temperature gradient.

-21-

The Great Basin Research Institute has had the leasehold mapped in detail, showing several large silica deposits. The reservoir temperature has been estimated using geochemistry as ranging from 320°F to 340°F by the US Geological Survey and other sources in the 1970s.

Ruby Hot Springs, Nevada

The property is located 30

miles southwest of Elko. EPR filed a BLM lease application for 2,140 acres in

February 2001 and the lease application was rejected by the BLM in December 2005

due to cultural issues. The decision was appealed to the Interior Board of Land

Appeals (“IBLA”) and the IBLA remanded the application back to the BLM for

further action. No further action has been taken by BLM on issuance of the lease

pending the completion of cultural and ethnographic studies that are required

for further review. The project was acquired as part of the Earth Power

Resources merger which was completed in November 2014.

The area around Ruby was first leased by Union Oil Company (now Chevron) in the late 1970s. The 3,000 foot test well mentioned above reportedly flowed at over 300°F. A drilling log shows hot temperatures escalating to depth.

The area around Ruby was first leased by Union Oil Company (now Chevron) in the late 1970s. A 3,149 foot test well was drilled and reportedly flowed at over 300°F. A second well in the area, Ruby Valley 65-10, was drilled to 1,075 feet deep and encountered lost circulation zones, but no temperature data is available. In the early 1980s, Aminoil drilled twelve 500 foot deep temperature gradient wells and two 1,000 foot stratigraphic test wells. Data from these wells have been incorporated into generalized heat-flow contour maps of the area.

Vale, Oregon

The property consists of 368 acres of

geothermal energy and surface rights located in Malheur County, located

approximately one-half mile east of the town of Vale, Oregon. The property is

within the Vale Butte geothermal resource area and provides the opportunity to

evaluate development of a known resource. A prolific, shallow reservoir located

along the north edge of the leasehold area has been used for many years in an

agricultural drying facility and a mushroom growing operation.

An extensive database of geophysical and geological information from previous geothermal exploration in the Vale Butte area was used in the evaluation of the prospect. Geochemical analysis of samples taken from shallow hot wells results in a calculated geothermometer that indicates a potential reservoir temperature of 311°F to 320°F. Past exploration drilling near the site by Trans Pacific Geothermal and Sandia National Laboratory encountered temperatures in excess of 300°F in the basement rocks. The leases for this project were acquired in January and February 2014.

-22-

Employees

At December 31, 2014, the Company had 48 full-time and one part time employees (14 administrative and project development, and 35 field and plant operations). The Company continuously considers acquisition opportunities, and if the Company is successful in making acquisitions, additional management and administrative staff may be added.

The Company did not experience any labor disputes or labor stoppages during the current fiscal year.

Principal Products

The principal product is based upon activities related to the production of electrical power from the utilization of the Company’s geothermal resources. The primary product will be the direct sale of power generated by our interests in our geothermal power plants. Currently, our principal revenues consist of energy sales and energy credit sales. All power plants currently in operation, as well as all sites under exploration or development, are sites located in the Western United States or in the Republic of Guatemala in Central America.

Sources and Availability of Raw Materials

Geothermal energy is natural heat energy stored within the Earth’s crust at economically accessible depth. In some areas of the Earth, economic concentrations of heat energy result from a combination of geological conditions that allow water to penetrate into hot rocks at depth, become heated, and then circulate to a near surface environment. In these settings, commercially viable extraction of the geothermal energy and its conversion to electricity become possible and a “geothermal resource” is present.

There are four major components (or factors) to a geothermal resource:

| 1. |

Heat source and temperature – The economic viability of a geothermal resource is related to the amount of heat generated. The higher the temperature, the more valuable the geothermal resource. |

| 2. |

Fluid – A geothermal resource is commercially viable only when the system contains water and/or steam as a medium to transfer the heat energy to the surface. |

| 3. |

Permeability – The fluid present underground must be able to move. In general, significant porosity and permeability within the rock formation are needed to create a viable reservoir. |

| 4. |

Depth – The cost of development increases with depth, as do resource temperatures. The proximity of the reservoir to the surface is therefore a key factor in the economic valuation of a geothermal resource. |

Electrical power is directly produced through the utilization of geothermal resources; however, these resources are not a direct component of the final product.

-23-

Unless major geological changes occur that impact the geothermal reservoirs, the condition of the existing resources is expected to remain relatively consistent over time.

Significant Government Permits

The Company has obtained permits for its three operational plants and at the WGP Geysers project.

Neal Hot Springs, Oregon. The Neal Hot Springs project has four primary permits that govern the continued operations at the Neal Hot Springs geothermal plant. The permits include:

| 1. |

Geothermal Well Permits; Department of Geology; Multiple API #’s | |

| 2. |

Right-of-Way; Bureau of Land Management, OR-65701 | |

| 3. |

Malheur County Conditional Use Permit; Malheur County, 10-21-2009 | |

| 4. |

Underground Injection Control Permit; Oregon Department of Environmental Quality, 13281-8 |

San Emidio, Nevada. The San Emidio project has five significant permits in place necessary for continued operations:

| 1. |

Geothermal well permits for production and injection wells issued by the Nevada Division of Minerals. | |

| 2. |

A Special Use Permit issued by the Washoe County Board of Commissioners on July 1, 1987. | |

| 3. |

An Air Quality Permit to Operate from Washoe County renewed on January 1, 2008. | |

| 4. |

A Surface Discharge Permit from Nevada Division of Environmental Protection issued on June 11, 2001. | |

| 5. |

An Underground Injection Permit from Nevada Division of Environmental Protection issued on August 18, 2000. |

Raft River, Idaho. The Raft River project has four significant permits in place necessary for continued operations:

| 1. |

Geothermal well permits for production and injection wells issued by the Idaho Department of Water Resources. | |

| 2. |

A Conditional Use Permit for the first two power plants was issued by the Cassia County Planning and Zoning Commission on April 21, 2005. | |

| 3. |

The Idaho Department of Environmental Quality issued the Air Quality Permit to Construct on May 26, 2006. | |

| 4. |

A Wastewater Reuse Permit issued by the Idaho Department of Environmental Quality on February 23, 2007 is being renewed with the agency. |

-24-

WGP Geysers, California. The Geysers Unit 15 property has local and state permits that authorize construction and operation of up to a 38.5 megawatt geothermal power plant. The significant permits include:

| 1. |

Four geothermal well permits for production and injection wells issued by the California Department of Oil, Gas, and Geothermal Resources. | |

| 2. |

A Conditional Use Permit issued by the Sonoma County along with preliminary design approval for a septic system. | |

| 3. |

Northern Sonoma Air Quality Board has issued permits for well and geothermal power plant operations. |

Seasonality of Business

The Company has been producing energy revenues under the terms of three PPAs. Two of these contracts specify favorable rate periods and all three plants experience changes in levels of production through the year. The Raft River Energy I LLC (Raft River, Idaho) and USG Oregon LLC (Neal Hot Springs, Oregon) contracts pay higher rates in the months of July/August and November/December. Energy production can be influenced by the seasonal temperatures. Generally, the Company’s binary geothermal plants can operate more efficiently in cooler temperatures. Cooler temperatures facilitate the cooling process of the secondary fluid that is used to power the turbines. The Neal Hot Springs plant, since it utilizes air cooling rather than water cooling, is impacted more in the summer (lower generation) than the Raft River or San Emidio plants. Conversely, Neal Hot Springs produces higher generation in the winter. Drilling and other construction activities can be negatively impacted by inclement weather that can occur, primarily, during the winter months.

Industry Practices/Needs for Working Capital

The Company is heavily involved in exploration and development operations. Once the decision is made to construct a project, high levels of working capital are committed, either directly or indirectly to the construction efforts. After a plant becomes commercially operational and the necessary operating reserves have been funded, the needs for working capital are typically low. The Company is expecting to be significantly involved in exploration and development activities for the next 5 to 10 years.

Dependence on a Few Customers

Ultimately, the market for electrical power is vast; however, the numbers of entities that can physically, logistically and economically purchase the commodity in large quantities in our areas of operation are limited. The Company’s primary revenues originate from energy sales and the sale of energy credits. Currently, the Company generates energy revenues and energy credits from three sources. Idaho Power Company purchases energy generated by both Raft River Energy I LLC and USG Oregon LLC. NV Energy purchases energy from USG Nevada LLC. Energy credits earned by Raft River plant are sold to Holy Cross Energy. Under the current PPAs, energy credits that are earned by USG Oregon LLC and USG Nevada LLC plants are bundled with energy sales. Even at planned levels of operation, it is expected that the Company and its interests will have a small number of direct customers that may amount to less than 5 or 6 over the next 5 to 10 years.

-25-

PPAs, energy credits that are earned by USG Oregon LLC and USG Nevada LLC plants are bundled with energy sales. Even at planned levels of operation, it is expected that the Company and its interests will have a small number of direct customers that may amount to less than 5 or 6 over the next 5 to 10 years.

Competitive Conditions

Although the market for different forms of energy is large and dominated by very powerful players, we perceive our industrial competition to be independent power producers and in particular those producers who provide “green” renewable power. Our definition of green power is electricity derived from a source that does not pollute the air, water or earth. Sources of green power, in addition to geothermal, include wind, solar, biomass and run-of-the river hydroelectric. A number of states have instituted renewable portfolio standards (“RPS”) that require utilities to purchase a minimum percentage of their power from renewable sources. For example, RPS statutes in California require 33% renewable and Nevada require 25% renewable. According to the Department of Energy’s Energy Efficiency and Renewable Energy department, approximately 38 states nationwide have established renewable portfolio standards or goals encouraging the procurement of green, renewable power. As a result, we believe green power is an important sub-market in the broader electric market, in which many power purchasers are increasing or committing to increase their investments. Accordingly, the conventional energy producers do not provide direct competition.

In the Pacific Northwest there are currently only two commercial geothermal facilities, both operated by the Company. There are a number of wind farms, as well as biomass and run-of-the river hydroelectric facilities. However, the Company believes that the combination of greater reliability and the baseload generation profile provided by geothermal power, with access to infrastructure for deliverability, and a low "full life" cost of power will allow geothermal to successfully compete for long term PPAs.

Factors that can influence the overall market for our product include some of the following:

| • | number of market participants buying and selling electricity; | |

| • | availability and cost of transmission; | |

| • | availability of low cost natural gas as an alternate fuel source | |

| • | amount of electricity normally available in the market; | |

| • | fluctuations in electricity supply due to planned and unplanned outages of competitors’ generators; | |

| • | fluctuations in electricity demand due to weather and other factors; | |

| • | cost of fuel used by generators, which could be impacted by efficiency of generation technology and fluctuations in fuel supply; | |

| • | environmental regulations that impact us and our competitors; | |

| • | availability of production tax credits and other benefits allowed by tax law; | |

| • | relative ease or difficulty of developing and constructing new facilities; and | |

| • | credit worthiness and risk associated with buyers. |

-26-

Environmental Compliance

Geothermal drilling, resource development and site construction is subject to federal, state and local environmental and construction oversight including state and local agencies in Idaho, Oregon, Nevada and California. Applicable laws may include the Clean Air Act, the Clean Water Act, the Emergency Planning and Community Right-to-Know Act, the Endangered Species Act, the National Environmental Policy Act, the Resource Conservation and Recovery Act, and geothermal drilling rules and local building codes.

Prior to acquiring a new property or project, USG has retained licensed environmental professionals to conduct Phase I Site Assessments and evaluate each property. The purpose of the site assessment is to identify, in accordance with federal standards, any existing environmental contaminant release or on-site contamination and prevent an unrecognized financial liability from being passed to U.S. Geothermal Inc. or our subsidiaries.

Our geothermal operations involve significant quantities of brine that is returned to the local subsurface, geologic formation. We also use isopentane and R-134A working fluids, and numerous industrial lubricants that are generally flammable and considered contaminants if released or spilled. We are not aware of any mismanagement of these materials and we are required to promptly report any release of specified volumes of oil, lubricants, and chemicals used in our operations.

The requisite approvals and permits for our operations have been independently reviewed and verified for the financing of each project. Independent legal review verified that USG and our subsidiaries are operated in accordance with applicable laws. Existing laws and regulations may be revised or reinterpreted, or new laws and regulations may become applicable to us. Under those circumstances we work with the appropriate agency or entity to ensure that our operations remain in compliance with the applicable rules. As of the date of this memorandum, all of the permits and approvals required to operate our plants have been obtained and are valid.

Neal Hot Springs, Oregon

The Neal Hot Springs

project is situated approximately 12 miles from Vale, Oregon in an area with

only one nearby resident. There are no unique plant or animal communities in the

area and no unique cultural or environmental constraints.

Because the power plant is air-cooled the only environmental reporting required is a monthly production and injection report and an annual water quality summary. Both reports are sent to the Oregon Department of Environmental Quality and Oregon Department of Geology and Mineral Industries. Semi-annual water monitoring has been conducted since 2008 and will continue throughout power plant operations. The Neal project files a quarterly energy generation report with the Federal Energy Regulatory Commission. An independent legal team has reviewed all regulatory requirements, permits and approvals for the project.

Adjoining rangelands are privately and federally managed and there are no rangeland or cropland management obligations.

-27-

The Neal project is in compliance with all environmental permitting, monitoring and reporting requirements and has received no formal or informal notices from any local, state, or federal agency.

San Emidio, Nevada

The San Emidio project is located

approximately 14 miles south of Gerlach Nevada. The nearest residence is over

four miles from the plant site.

The San Emidio staff files monthly, quarterly and annual water reports with the Department of Environmental Protection and Department of Water Resources. Similar to other projects the volume, quality, and disposition of geothermal water and cooling water is reported.

San Emidio is in compliance with all environmental permitting, monitoring and reporting requirements and has received no formal or informal notices from any local, state, or federal agency.

Raft River, Idaho

The Raft River project is located

approximately 12 miles from Malta, Idaho and is in a rural agricultural area

with the nearest residence approximately two miles from the plant site. There

are no unique plant or animal communities in the area and no unique cultural or

environmental constraints.

Key environmental reports include:

| 1) |

Monthly production and injection reports filed with the Idaho Department of Water Resources; | |

| 2) |

Annual land application and cooling water quality reports filed with the Idaho Department of Environmental Quality and Idaho Department of Water Resources. | |

| 3) |

Annual Tier II reporting filed with the Idaho Bureau of Homeland Security, Local Emergency Planning Committee, and the local fire department. |

The project’s most significant environmental compliance requirement is for water quality monitoring and reporting. The Company has added seven years of water monitoring data to a substantial volume of historical data developed by the US Department of Energy. The IDWR and Idaho Department of Environmental Quality concur with the Project’s findings that geothermal operations have no impact on water quality. The Project’s private lands must be managed on an ongoing basis for weed control, water management, irrigation, and fencing infrastructure. USG has leased the grazing rights and cropland rights to a local rancher who is responsible for the day to day farming and maintenance obligations.

The Raft River project is in compliance with all environmental permitting, monitoring and reporting requirements and has received no formal or informal notices from any local, state, or federal agency.

-28-

WGP Geysers, California

The Unit 15 property is

located approximately 30 minutes north of the city of Healdsburg, CA. The

property encompasses a ridgetop and a north facing hillside that has been

developed and was used for geothermal operations for over 10 years from l979 to

l989. There are no unique plant or animal communities on the project site and no

unique cultural or environmental constraints. The North Coast Regional Water

Quality Board (NCRWQB) has required WGP to remove approximately 25 yards of soil

that has been identified as having arsenic levels that exceed 150 parts per

million. The NCRWQB has accepted WGP’s proposal for the soil removal and we are

in compliance the NCRWQB’s requirements. The work is scheduled for completion

not later than June 2015.

WGP’s ongoing environmental reports include a monthly well report that is filed with the California Department of Oil, Gas and Geothermal Resources and an annual water quality report that is filed with the California Regional Water Board.

The Unit 15 project is in compliance with all environmental permitting, monitoring and reporting requirements and has received no formal or informal notices from any local, state, or federal agency.

Gerlach, El Ceibillo, Crescent Valley, Lee Hot Springs, Ruby

Hot Springs, and Vale

No power plant operations are being conducted on

these properties at this time. The Company is in compliance with all

environmental and regulatory requirements and has received no formal or informal

notices from any local, state, or federal agency. There are no monthly,

quarterly, or annual reporting requirements associated with these projects.

Financial Information about Geographic Areas

The Company has interests in operational power plants in three locations in the Western United States. The Raft River Energy I LLC power plant is located in the southeastern part of the State of Idaho. Raft River Unit I became operational on January 3, 2008. USG Nevada LLC constructed a new power plant located in the northwestern part of the State of Nevada in the San Emidio Desert. This power plant owned by USG Nevada LLC became commercially operational May 25, 2012. The three units owned by USG Oregon LLC became commercially operational November 16, 2012. These units are located in the Eastern part of the State of Oregon near the Idaho border. A summary of total energy and energy credit sales by location is as follows:

| For the Year Ended December 31, | ||||||

| 2014 | 2013 | |||||

| USG Oregon LLC located in Eastern Oregon | $ | 18,759,248 | $ | 15,566,409 | ||

| USG Nevada LLC located in Northwestern Nevada | 7,031,445 | 6,792,382 | ||||

| Raft River Energy I LLC located in Southeastern Idaho | 5,178,089 | 5,012,143 | ||||

| Total energy and energy credits sales | $ | 30,968,782 | $ | 27,370,934 | ||

-29-

Available Information

We file annual, quarterly and periodic reports, proxy statements and other information with the U.S. Securities and Exchange Commission (“SEC”). You may obtain and copy any document we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Room 1580;Washington D.C. 20549. You may obtain information on the operation of the SEC’s Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an internet website at http://www.sec.gov that contains reports, proxy and other information statements and other information regarding issuers that file electronically with the SEC. Our SEC filings are accessible via the internet at that website.

We make available, free of charge through our Internet website at http://www.usgeothermal.com, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 of 1934, as amended (the “Exchange Act”), as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. Information on our website is not incorporated into this report and is not a part of this report.

Governmental Approvals and Regulations

The geothermal energy industry in the United States is regulated by federal, state and local agencies and commissions. Those agencies and commissions regulate geothermal drilling, power generation activities and environmental protection, permitting, licensing and bonding requirements. The following information is a general summary of the electric utility industry and applicable regulations in the United States and is not a full statement of the law or all issues pertaining to electric industry requirements.

Regulatory oversight of the industry can be broadly divided between rules governing geothermal exploration and rules governing actual energy generation, power sales and delivery. Geothermal fluid production is regulated under federal and state rules and regulations that require permits for drilling operations, geothermal fluid production and injection, and well abandonment. Prior to drilling agencies will review plans and ensure that natural resource values such as air, water, wildlife and vegetation are protected. Geothermal energy generation is regulated under federal, state and local rules and regulations. Permits are required for power plant construction and operation and ensure that a project site is suitable and that natural resource values and community concerns, if any, are evaluated and mitigated during the planning and design phase.

Federal Electric Utility Industry Regulation. Electricity production and public utilities are regulated by both the federal government and state utility commissions. State utility commissions traditionally exercise their jurisdiction over an electric utility’s retail operations. There are two primary pieces of federal legislation that have governed public utilities since the 1930s, the Federal Power Act (“FPA”) and Public Utility Holding Company Act of 1935 (“PUHCA”). These statutes have been amended and supplemented by subsequent legislation, including Public Utility Regulatory Protection Act (“PURPA”), the Energy Policy Act of 1992, and Energy Policy Act of 2005 (“EPAct 2005”).

-30-