Attached files

| file | filename |

|---|---|

| 8-K - 8-K - John Bean Technologies CORP | bairdconference.htm |

JBT Investor Presentation

Baird 2016 Global Industrial Conference

November 9, 2016

Tom Giacomini, Chairman, President & CEO

Brian Deck, EVP & CFO

These slides and the accompanying presentation contain “forward-looking”

statements which represent management’s best judgment as of the date

hereof, based on currently available information. Actual results may differ

materially from those contained in such forward-looking statements.

JBT Corporation’s (the “Company”) most recent filings with the Securities

and Exchange Commission include information concerning factors that may

cause actual results to differ from those anticipated by these forward-looking

statements. The Company undertakes no obligation to update or revise

these forward-looking statements to reflect new events or uncertainties.

Although the Company reports its results using US GAAP, the Company

uses non-GAAP measures when management believes those measures

provide useful information for its stockholders. The appendices to this

presentation provide reconciliations to US GAAP for any non-GAAP

measures referenced in this presentation.

Forward-Looking Statements

2

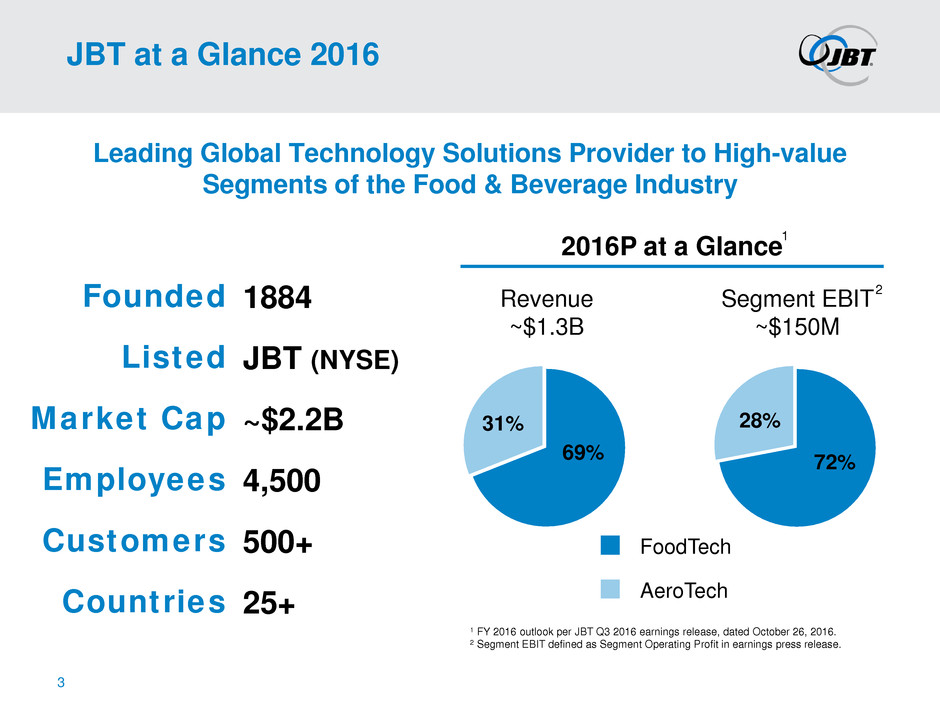

JBT at a Glance 2016

Leading Global Technology Solutions Provider to High-value

Segments of the Food & Beverage Industry

69%

31%

Revenue

~$1.3B

Segment EBIT

~$150M

72%

28%

2016P at a Glance

AeroTech

FoodTech

1 FY 2016 outlook per JBT Q3 2016 earnings release, dated October 26, 2016.

2 Segment EBIT defined as Segment Operating Profit in earnings press release.

3

1

2 Founded

Listed

Market Cap

Employees

Customers

Countries

1884

JBT (NYSE)

~$2.2B

4,500

500+

25+

If you ate or drank something

today…

There’s a good chance JBT

technology played a critical role

in its preparation.

JBT Every Day

Enjoy Lunch

Day

Ends

Drive to Airport

Day

Begins

Enjoy Dinner… …& Dessert

5

Fly to Meeting

Feed Pet

Grocery Shop Attend Meeting

Enjoy Breakfast

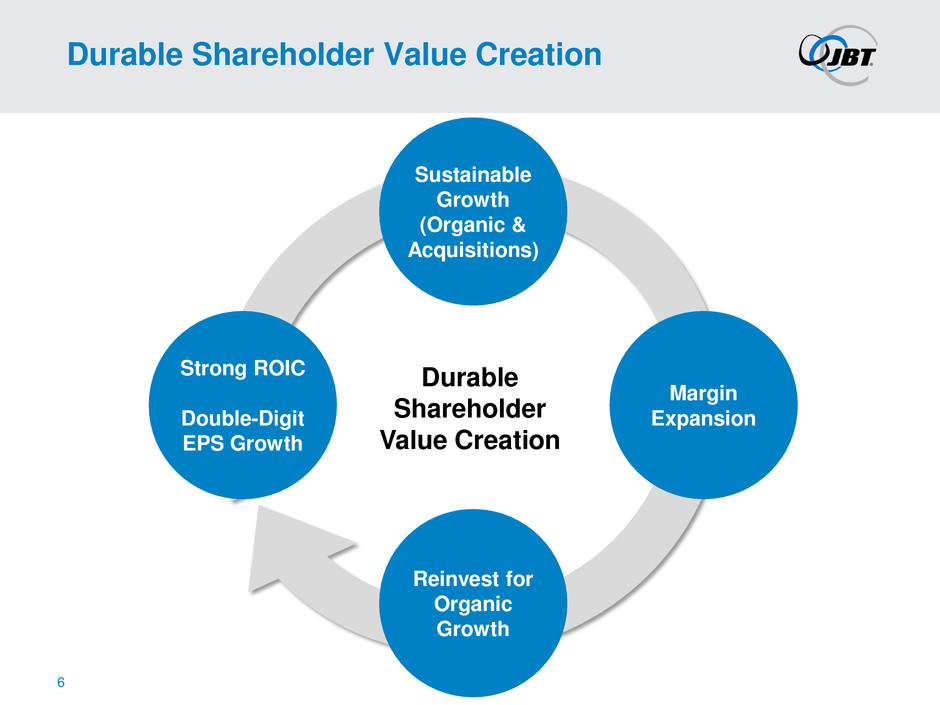

Durable Shareholder Value Creation

Sustainable

Growth

(Organic &

Acquisitions)

Margin

Expansion

Reinvest for

Organic

Growth

Strong ROIC

Double-Digit

EPS Growth

Durable

Shareholder

Value Creation

6

Debarshi Sengupta

EVP, Corporate

Development

Jason Clayton

EVP, Human

Resources

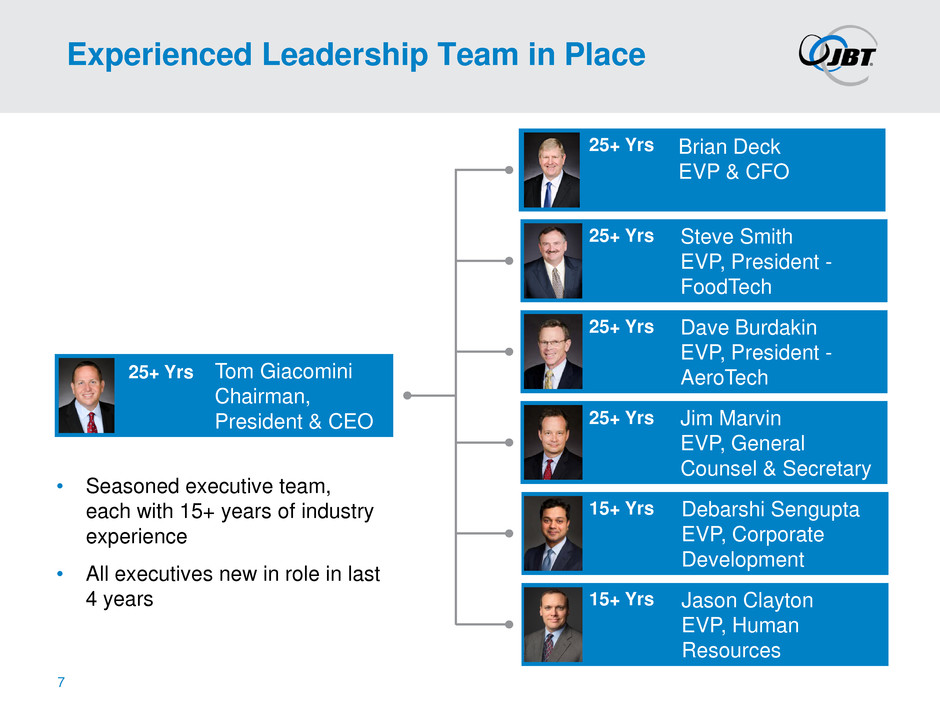

Experienced Leadership Team in Place

Jim Marvin

EVP, General

Counsel & Secretary

Brian Deck

EVP & CFO

Dave Burdakin

EVP, President -

AeroTech Tom Giacomini

Chairman,

President & CEO

25+ Yrs

Steve Smith

EVP, President -

FoodTech

• Seasoned executive team,

each with 15+ years of industry

experience

• All executives new in role in last

4 years

7

15+ Yrs

25+ Yrs

25+ Yrs

25+ Yrs

25+ Yrs

15+ Yrs

Building a Growth Culture: ONE JBT

8

ONE Purpose & Set of Values Across the Entire Organization

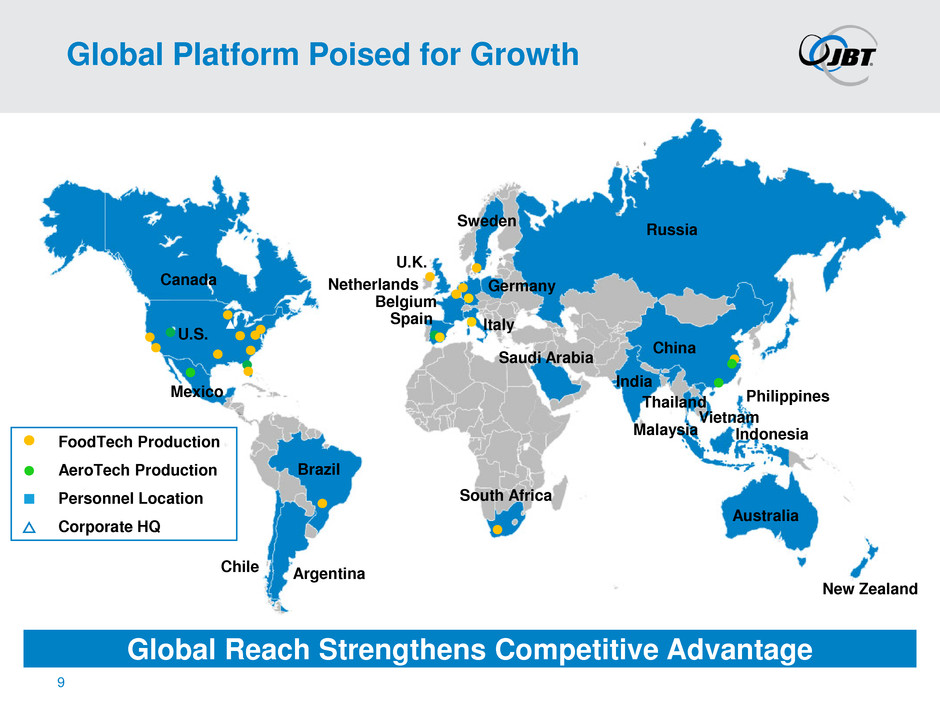

Canada

U.S.

Mexico

Brazil

Chile Argentina

U.K.

Belgium

Spain

Sweden

Germany

Italy

South Africa

Saudi Arabia

Russia

India

Malaysia

Philippines

Australia

New Zealand

Netherlands

China

Vietnam

Thailand

Indonesia

Global Platform Poised for Growth

Global Reach Strengthens Competitive Advantage

9

FoodTech Production

AeroTech Production

Personnel Location

Corporate HQ

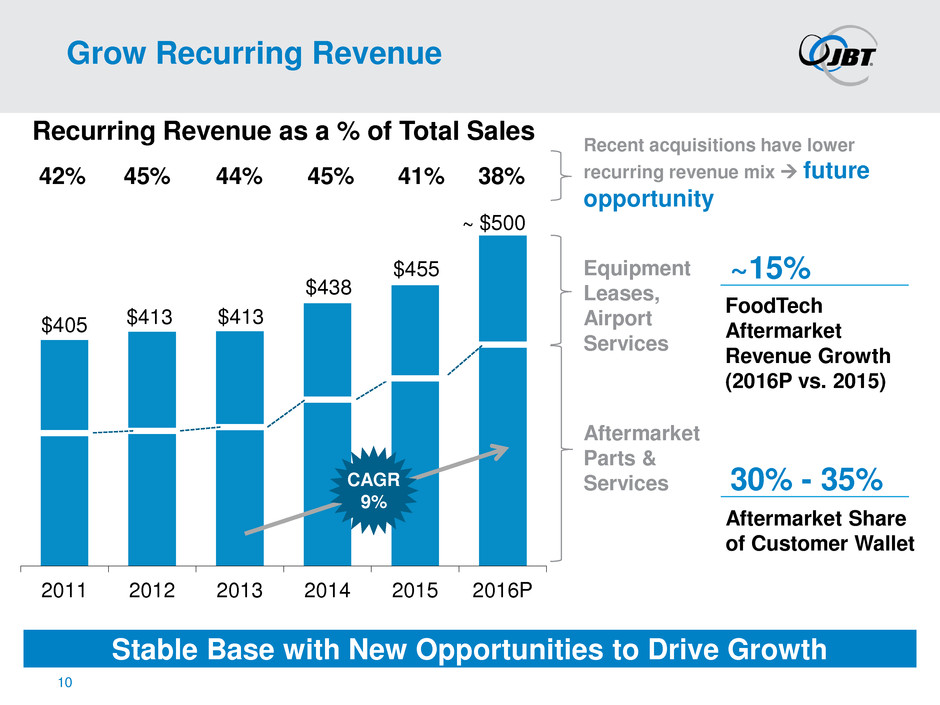

$405 $413 $413

$438

$455

$500

2011 2012 2013 2014 2015 2016P

Grow Recurring Revenue

Stable Base with New Opportunities to Drive Growth

FoodTech

Aftermarket

Revenue Growth

(2016P vs. 2015)

~15%

Aftermarket Share

of Customer Wallet

30% - 35%

42% 45% 44% 45%

Recurring Revenue as a % of Total Sales

Aftermarket

Parts &

Services

41%

Equipment

Leases,

Airport

Services

10

38%

Recent acquisitions have lower

recurring revenue mix future

opportunity

~

CAGR

9%

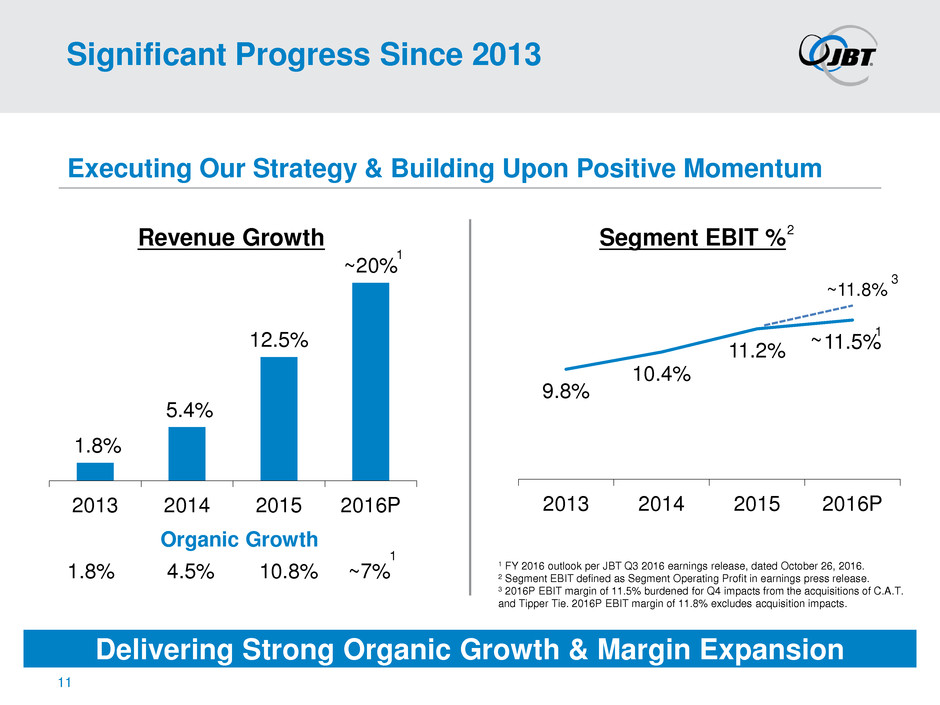

Significant Progress Since 2013

Executing Our Strategy & Building Upon Positive Momentum

Delivering Strong Organic Growth & Margin Expansion

1.8%

5.4%

12.5%

~20%

2013 2014 2015 2016P

Revenue Growth

9.8%

10.4%

11.2% 11.5%

2013 2014 2015 2016P

Segment EBIT %

11

1.8% 4.5% 10.8% ~7%

Organic Growth

~

1

1

1

1 FY 2016 outlook per JBT Q3 2016 earnings release, dated October 26, 2016.

2 Segment EBIT defined as Segment Operating Profit in earnings press release.

3 2016P EBIT margin of 11.5% burdened for Q4 impacts from the acquisitions of C.A.T.

and Tipper Tie. 2016P EBIT margin of 11.8% excludes acquisition impacts.

~11.8%

3

2

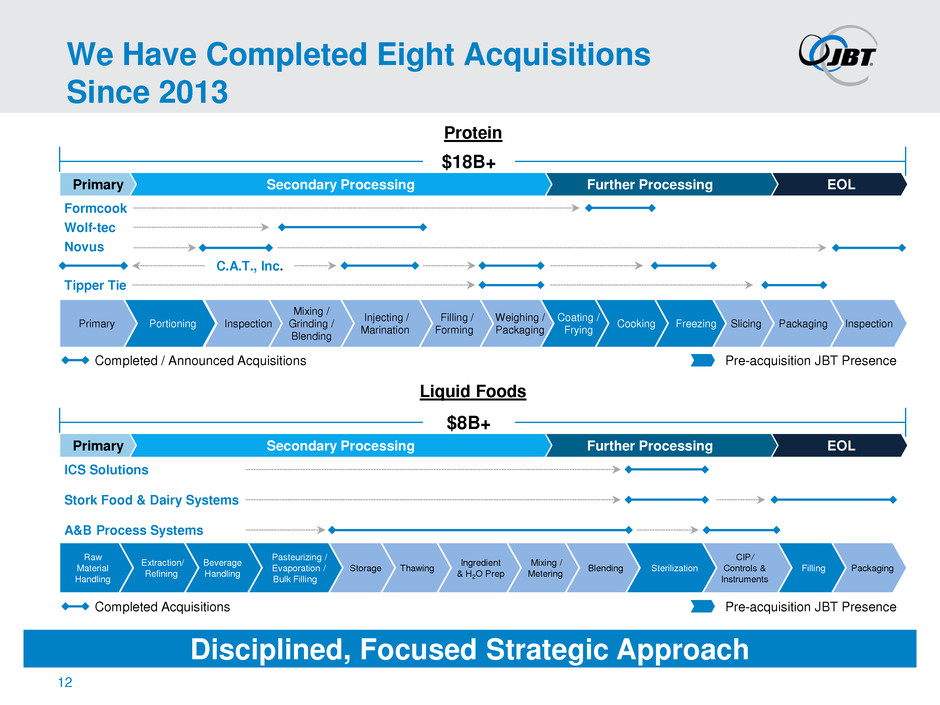

We Have Completed Eight Acquisitions

Since 2013

12

EOL Further Processing

$18B+

Liquid Foods

Packaging Filling

CIP/

Controls &

Instruments

Sterilization Blending Mixing / Metering

Ingredient

& H2O Prep

Thawing Storage

Pasteurizing /

Evaporation /

Bulk Filling

Beverage

Handling

Extraction/

Refining

Raw

Material

Handling

ICS Solutions

Wolf-tec

Formcook

A&B Process Systems

Stork Food & Dairy Systems

Novus

Secondary Processing

Tipper Tie

Primary

Protein

C.A.T., Inc.

Primary Portioning Weighing / Packaging

Coating /

Frying Cooking Freezing

Filling /

Forming Slicing

Injecting /

Marination Inspection Packaging Inspection

Mixing /

Grinding /

Blending

EOL Further Processing

$8B+

Secondary Processing Primary

Disciplined, Focused Strategic Approach

Completed / Announced Acquisitions Pre-acquisition JBT Presence

Completed Acquisitions Pre-acquisition JBT Presence

JBT

41%

0

50

100

150

200

250

300

350

400

450

500

(60) (40) (20) 0 20 40 60 80

1st Quartile

16%

2nd Quartile

8%

3rd Quartile

0%

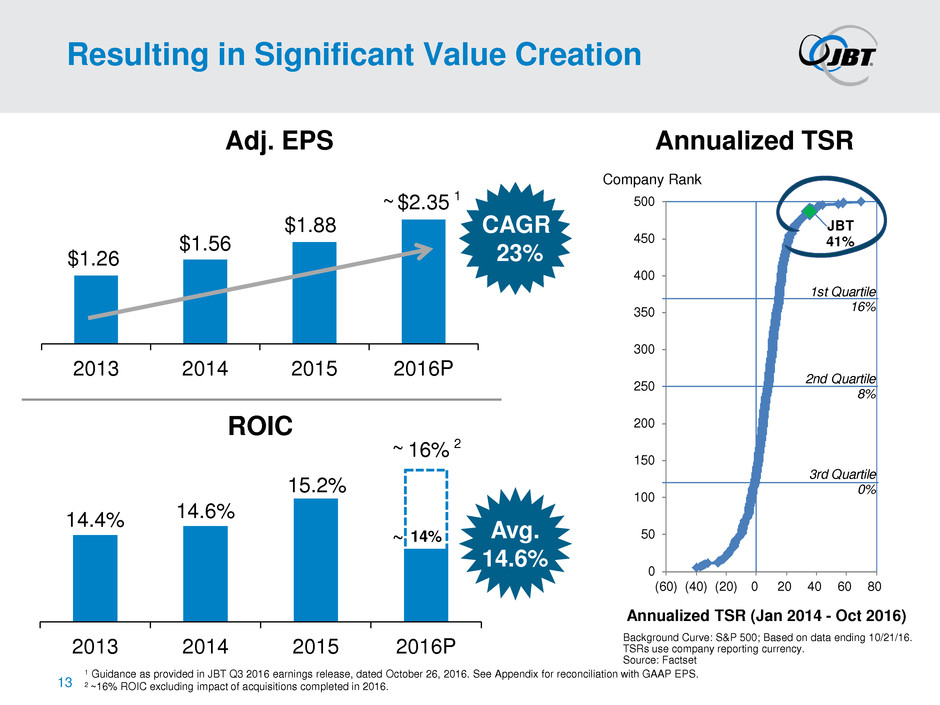

Resulting in Significant Value Creation

Annualized TSR

Company Rank

Annualized TSR (Jan 2014 - Oct 2016)

Background Curve: S&P 500; Based on data ending 10/21/16.

TSRs use company reporting currency.

Source: Factset

$1.26

$1.56

$1.88

$2.35

2013 2014 2015 2016P

Adj. EPS

14.4% 14.6%

15.2%

16%

2013 2014 2015 2016P

ROIC

CAGR

23%

13

Avg.

14.6%

1

14%

1 Guidance as provided in JBT Q3 2016 earnings release, dated October 26, 2016. See Appendix for reconciliation with GAAP EPS.

2 ~16% ROIC excluding impact of acquisitions completed in 2016.

2

~

~

~

The Elevate Plan

2016 – 2019

Strategy

JBT Is Positioned to Leverage Positive

Macro Drivers …

15

Growing Middle Class

Global middle class expected to double by

2030, with Asia a significant consumer of

value-added nutritional food

Consolidating Food Industry

Food industry increasingly served by fewer

global producers, spanning multiple food

verticals and channels

Demand for Air Travel

In 2015, global passenger traffic grew

6.5%, well above 10-year average annual

growth of 5.5%; underscoring continued

expansion of global air networks

Strong position in China (engineering,

manufacturing & innovation center)

complemented by co-located regional sales &

service delivers competitive advantage

JBT Advantage

Global footprint & comprehensive

offering provides significant operational benefits

to global food companies

Pre-positioning Jetway PBBs & high-speed

Ranger cargo loaders that airlines need to

efficiently & safely move high volume of

passengers & freight

… While Also Positioning to Capitalize on

Emerging Market Trends

16

Health, Safety & Convenience

Continued interest in home cooking inspiring

new product offerings that engage foodies with

premium solutions

Clean Labels

37% of US consumers find it very or extremely

important to understand ingredients on a

product label…91% believe food & beverage

options with recognizable ingredients are

healthier

The Organic Movement

Rising demand has fueled >10% annual growth

in organic foods spurring a $40B+ industry; still,

organic food sales make up only ~5% of total

food sales

Changing Geopolitical Landscape

Driving demand for military equipment

Wolf-tec protein injection technology that

enables use of fewer preservatives

Rapid evolution towards blended value-added

liquid foods combining nutritional attributes of

fruits, vegetables & dairy – as produced by

Stork solutions & ReadyGo Veggie skid

DSI waterjet portioners with iOPS capabilities

to provide customers with portioning flexibility

Sterilization solutions & emerging

technologies, such as aseptic filling, that extend

food shelf life without compromising taste

profiles & food safety

New SMEPP & HPC series products that

address challenging power & air needs for

military aircraft

JBT Advantage

Elevate Strategy Delivering Growth

& Margin Expansion

17

Grow Recurring Revenue

Disciplined Acquisition

Program

Accelerate New Product &

Service Development

Execute Impact Initiatives

Innovate to provide customers with

comprehensive solutions that enhance

their profitability

Capitalize on extensive installed base to

strengthen customer relationships

Select organic growth initiatives that move

the needle

Employ strategic & metrics-driven

approach

Four-pronged Approach

18

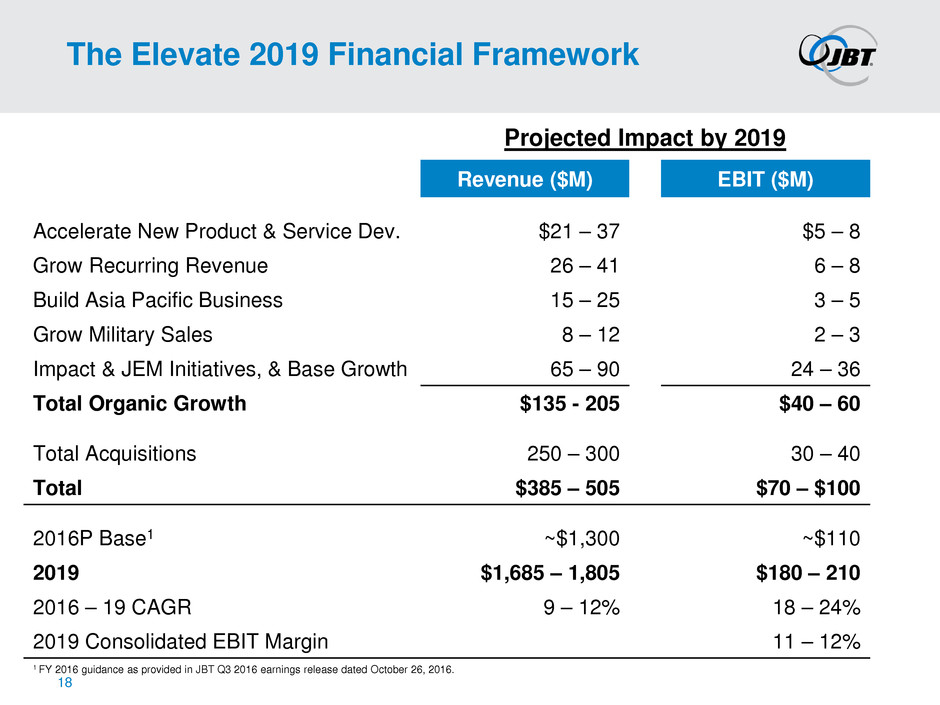

Projected Impact by 2019

Revenue ($M) EBIT ($M)

Accelerate New Product & Service Dev. $21 – 37 $5 – 8

Grow Recurring Revenue 26 – 41 6 – 8

Build Asia Pacific Business 15 – 25 3 – 5

Grow Military Sales 8 – 12 2 – 3

Impact & JEM Initiatives, & Base Growth 65 – 90 24 – 36

Total Organic Growth $135 - 205 $40 – 60

Total Acquisitions 250 – 300 30 – 40

Total $385 – 505 $70 – $100

2016P Base1 ~$1,300 ~$110

2019 $1,685 – 1,805 $180 – 210

2016 – 19 CAGR 9 – 12% 18 – 24%

2019 Consolidated EBIT Margin 11 – 12%

The Elevate 2019 Financial Framework

1 FY 2016 guidance as provided in JBT Q3 2016 earnings release dated October 26, 2016.

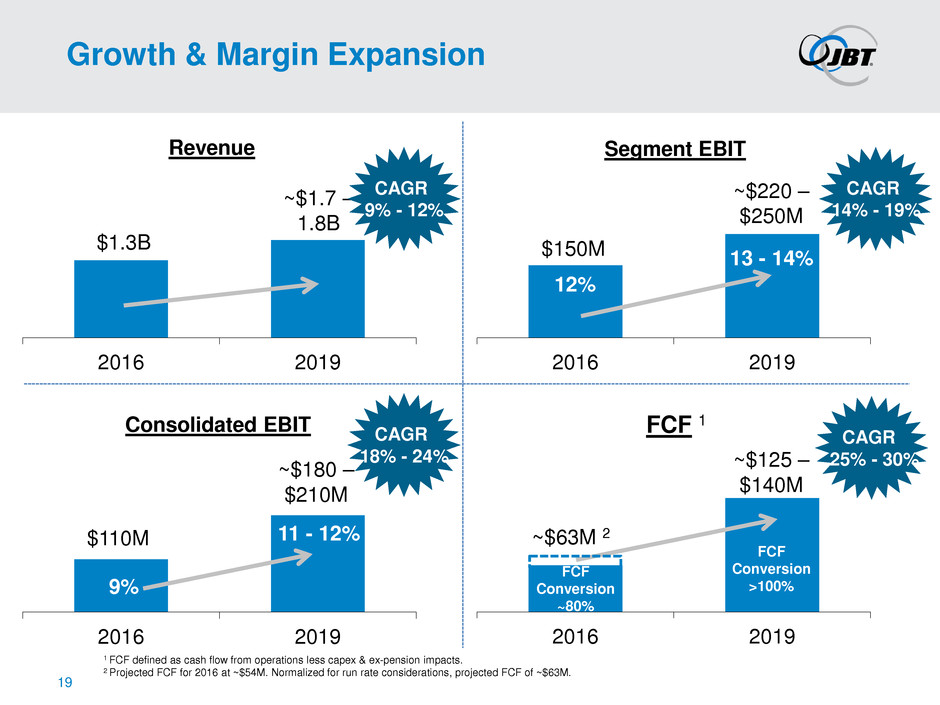

2016 2019

FCF 1

Growth & Margin Expansion

1 FCF defined as cash flow from operations less capex & ex-pension impacts.

2 Projected FCF for 2016 at ~$54M. Normalized for run rate considerations, projected FCF of ~$63M.

2016 2019

Revenue

$1.3B

~$1.7 –

1.8B

2016 2019

Segment EBIT

$150M

~$220 –

$250M

2016 2019

Consolidated EBIT

9%

11 - 12% $110M

~$180 –

$210M

FCF

Conversion

>100%

12%

13 - 14%

CAGR

9% - 12%

CAGR

25% - 30%

CAGR

18% - 24%

CAGR

14% - 19%

19

~$63M 2

~$125 –

$140M

FCF

Conversion

~80%

JBT: Elevate Framework

2019

• Leading food equipment solutions provider

• Sustained capability to grow organically &

meaningfully through acquisitions

• $1.7-1.8B in Sales | >10% EBIT Margin

• Annualized 3-5% Organic growth | 6-7%

Inorganic growth | ~15% EPS growth |

~15% ROIC

• Clear capital allocation priorities & investor

messaging

20

JBT Investor Presentation

Baird 2016 Global Industrial Conference

November 9, 2016