Attached files

EXHIBIT 10.4

STOCK PURCHASE AGREEMENT

THIS STOCK PURCHASE AGREEMENT (this "Agreement") dated as of June 20, 2016, among IT’S DIVINE, INC., a Delaware corporation ("PURCHASER”), SPA ETERNITY PTE. LTD., a Singaporean corporation (“SPA ENTERNITY”), and SING WEI LUNG and HONGBO HUANG, as sellers of SPA ETERNITY (the “SELLERS”).

RECITALS

WHEREAS, the SELLERS are the owner of 100,100 ordinary shares of SPA ENTERNITY (the “Shares”), representing 100% of the issued and outstanding capital stock of SPA ENTERNITY.

WHEREAS, pursuant to the terms and conditions of this Agreement, SELLERS desire to sell, and PURCHASER desires to purchase, all of SELLERS’ rights, title, and interest in and to all of the Shares as further described herein.

NOW, THEREFORE, in consideration of the covenants, promises and representations set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, and intending to be legally bound hereby, the parties agree as follows:

1. Agreement to Purchase and Sell. Subject to the terms and conditions of this Agreement, simultaneous with the execution and delivery of this Agreement, SELLERS shall sell, assign, transfer, convey, and deliver to PURCHASER, and PURCHASER shall accept and purchase, the Shares and any and all rights in the Shares to which SELLERS are entitled, and by doing so SELLERS shall be deemed to have assigned all of their rights, titles and interest in and to the Shares to PURCHASER. Such sale of the Shares shall be evidenced by stock certificates, duly endorsed in blank or accompanied by stock powers duly executed in blank or other instruments of transfer in form and substance reasonably satisfactory to PURCHASER.

2. Consideration. In consideration for the sale of the Shares, the Purchaser shall (toward the purchase price of $2,147,000.00 (Singaporean Dollars) (“Purchase Price”)):

(a) deliver to Sellers an amount equal to an aggregate of $400,000.00 (Singaporean Dollars) payable as follows:

(i) $200,000.00 (Singaporean Dollars) in cash (“Cash Consideration”) at Closing as set forth in Exhibit A; and

(ii) $200,000.00 (Singaporean Dollars) in the form of a Promissory Note (“Note”). The Note shall be in the form attached hereto as Exhibit B. Pursuant to the terms of the Note, the (i) principal of the Note in the amount of $200,000.00 (Singaporean Dollars) is payable by PURCHASER to the SELLERS on August 1, 2016 and (ii) interest accruing at a rate of 2% per annum during the term of the loan is payable by PURCHASER to the SELLERS on August 1, 2016.

The payments of the Cash Consideration and payments of principal and interest under the Note shall be allocated among the SELLERS as described on Exhibit A.

(b) assume any and all indebtedness of the SELLERS to SPA ETERNITY outstanding as of the Closing, in the approximate aggregate amount of $1,747,000 (Singaporean Dollars) (“Assumed Indebtedness”), which is broken out per SELLER on Exhibit A.

| - 1 - |

3. Closing; Deliveries.

(a) Subject to the satisfaction or waiver of the conditions herein, the purchase and sale of the Shares shall be held on or before July 8, 2016 (the "Closing") or at such time, date or place as SELLERS and PURCHASER may agree.

(b) At the Closing:

(i) SELLERS shall deliver to PURCHASER (A) stock certificates evidencing the Shares, duly endorsed in blank or accompanied by stock powers duly executed in blank, or other instruments of transfer in form and substance reasonably satisfactory to PURCHASER, (B) any documentary evidence of the due recordation in SPA ETERNITY's share register of PURCHASER's full and unrestricted title to the Shares, and (C) such other documents as may be required under applicable law or reasonably requested by PURCHASER; and

(ii) PURCHASER shall deliver to SELLERS the Cash Consideration by wire transfer of immediately available funds to an account designated by SELLERS and PURCHASER shall deliver to SELLERS the Note.

(c) This Agreement may be terminated by PURCHASER or SELLERS only (a) in the event that PURCHASER or SELLERS do not meet the conditions precedent set forth in Sections 9 and 10 hereof or (b) if the Closing has not occurred by July 8, 2016.

4. Representations, Warranties and Covenants of SPA ETERNITY and SELLERS. As an inducement to PURCHASER to enter into this Agreement and to consummate the transactions contemplated herein, SPA ETERNITY and SELLERS represent and warrant to PURCHASER as follows:

(a) Authority. SELLERS have the right, power, authority and capacity to execute and deliver this Agreement, to consummate the transactions contemplated hereby and to perform their obligations under this Agreement. This Agreement constitutes the legal, valid and binding obligations of SELLERS, enforceable against SELLERS in accordance with the terms hereof.

(b) Ownership. SELLERS are the sole record and beneficial owner of the Shares, have good and marketable title to the Shares, free and clear of all Encumbrances (hereafter defined), other than applicable restrictions under applicable securities laws, and have full legal right and power to sell, transfer and deliver the Shares to PURCHASER in accordance with this Agreement. "Encumbrances" means any liens, pledges, hypothecations, charges, adverse claims, options, preferential arrangements or restrictions of any kind, including, without limitation, any restriction of the use, voting, transfer, receipt of income or other exercise of any attributes of ownership. Upon the execution and delivery of this Agreement, PURCHASER will receive good and marketable title to the Shares, free and clear of all Encumbrances, other than restrictions imposed pursuant to any applicable securities laws and regulations. There are no stockholders' agreements, voting trust, proxies, options, rights of first refusal or any other agreements or understandings with respect to the Shares.

(c) Valid Issuance. The Shares are duly authorized, validly issued, fully paid and non-assessable, and were not issued in violation of any preemptive or similar rights.

(d) No Conflict. None of the execution, delivery, or performance of this Agreement, and the consummation of the transactions contemplated hereby, conflicts or will conflict with, or (with or without notice or lapse of time, or both) result in a termination, breach or violation of (i) any instrument, contract or agreement to which any SELLER is a party or by which any SELLER is bound, or to which the Shares are subject; or (ii) any federal, state, local or foreign law, ordinance, judgment, decree, order, statute, or regulation, or that of any other governmental body or authority, applicable to SELLERS or the Shares.

| - 2 - |

(e) No Consent. No consent, approval, authorization or order of, or any filing or declaration with any governmental authority or any other person is required for the consummation by SELLERS of any of the transactions on their part contemplated under this Agreement.

(f) No Other Interest. Except as disclosed on Schedule 4(f) and the outstanding indebtedness of SELLERS to SPA ETERNITY in the approximate aggregate amount of $1,747,000 (Singaporean Dollars), neither SELLERS nor any of their affiliates have any interest, direct or indirect, in any shares of capital stock or other equity in SPA ETERNITY or have any other direct or indirect interest in any tangible or intangible property which SPA ETERNITY uses or have used in the business conducted by SPA ETERNITY, or have any direct or indirect outstanding indebtedness to or from SPA ETERNITY, or related, directly or indirectly, to its assets, other than the Shares.

(g) Organization and Good Standing of SPA ETERNITY. SPA ETERNITY is a corporation duly organized, validly existing, and in good standing under the laws of Singapore, with full corporate power and authority to conduct its business as it is now being conducted, to own or use the properties and assets that it purports to own or use, and to perform all its obligations under applicable contracts. SELLERS have disclosed to PURCHASER copies of the Memorandum and Articles of Association of SPA ETERNITY, as currently in effect.

(h) Capitalization. There is no limit on the number of shares SPA ETERNITY is authorized to issue. SPA ETERNITY may issue as many shares as it desires so long as it has obtained requisite approval pursuant to the Singapore Companies Act. The SPA ETERNITY shares have no par value. As of the date of this Agreement, there are 100,100 ordinary shares (“SPA ETERNITY Ordinary Shares”) issued and outstanding. The issued and outstanding ordinary shares have been duly authorized, issued, fully paid and non-assessable, free and clear of all liens, charges, pledges, security interests, encumbrances, right of first refusal, preemptive right or other restriction. No person, firm or corporation has any right, agreement, warrant or option, present or future, contingent or absolute, or any right capable of becoming a right, agreement or option to require SPA ETERNITY to issue any shares in its capital or to convert any securities of SPA ETERNITY or of any other company into shares in the capital of SPA ETERNITY.

(i) Assets. SPA ETERNITY has good and marketable title to all of its assets, and such assets are free and clear of any financial encumbrances.

(j) Registration/Anti-Dilution Rights. SPA ETERNITY is not a party to or bound by any agreement or understanding granting registration or anti-dilution rights to any person with respect to any of its equity or debt securities; no person has a right to purchase or acquire or receive any equity or debt security of SPA ETERNITY.

(k) Further Assistance. SELLERS agree to execute and deliver such other documents and to perform such other acts as shall be necessary to effectuate the purposes of this Agreement.

(l) Litigation. There are no actions, suits, proceedings, judgments, claims or investigations pending or threatened by or against SPA ETERNITY or affecting SPA ETERNITY or its properties, at law or in equity, before any court or other governmental agency or instrumentality, domestic or foreign, or before any arbitrator of any kind. SPA ETERNITY has no knowledge of any default on its part with respect to any judgment, order, writ, injunction, decree, award, rule or regulation of any court, arbitrator, or governmental agency or instrumentality or any circumstance which would result in the discovery of such default.

| - 3 - |

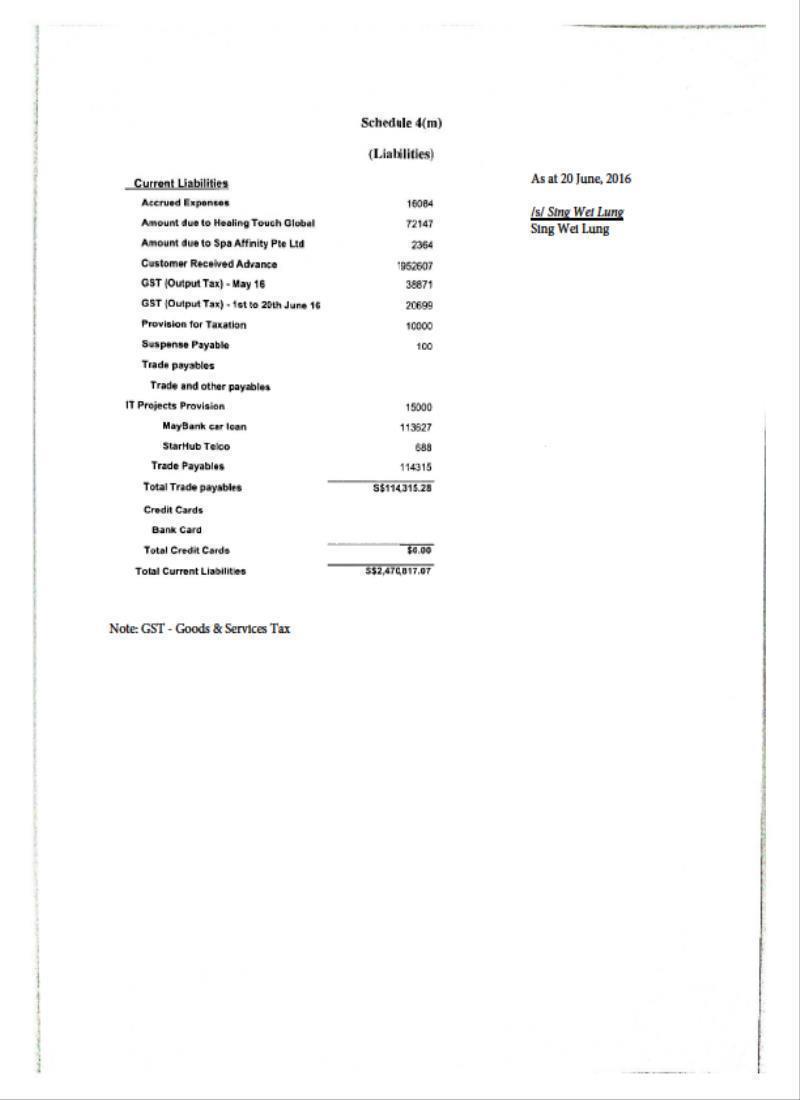

(m) Liabilities. Except as disclosed on Schedule 4(m), there are no trade payables, accrued expenses, liabilities, obligations or commitments which SPA ETERNITY would be required to accrue or reflect in its financial statements pursuant to GAAP as of the date hereof.

(n) Tax Returns. Except as disclosed on Schedule 4(n), SPA ETERNITY has timely filed all state, federal or local income and/or franchise tax returns required to be filed by it from inception to the date hereof. Each of such income tax returns reflects the taxes due for the period covered thereby, except for amounts which, in the aggregate, are immaterial. In addition, all such tax returns are correct and complete in all material respects. All taxes of SPA ETERNITY which are (i) shown as due on such tax returns, (ii) otherwise due and payable or (iii) claimed or asserted by any taxing authority to be due, have been paid, except for those taxes being contested in good faith and for which adequate reserves have been established in the financial statements included in the financial statements in accordance with GAAP. There are no liens for any taxes upon the assets of SPA ETERNITY, other than statutory liens for taxes not yet due and payable. SPA ETERNITY does not know of any proposed or threatened tax claims or assessments.

(o) No General Solicitation or Advertising. Neither any Seller nor any of its affiliates nor any person acting on its or their behalf (i) has conducted or will conduct any general solicitation (as that term is used in Rule 502(c) of Regulation D) or general advertising with respect to any of the Shares, or (ii) made any offers or sales of any security or solicited any offers to buy any security under any circumstances that would require registration of the Shares under the Securities Act of 1933, as amended (the "Securities Act").

(p) Books and Records. The books and records, financial and otherwise, of SPA ETERNITY are in all material aspects complete and correct and have been maintained in accordance with good business and accounting practices.

(q) Full Disclosure. No representation or warranty of SELLERS to PURCHASER in this Agreement omits to state a material fact necessary to make the statements herein, in light of the circumstances in which they were made, not misleading. There is no fact known to SELLERS that has specific application to the Shares or SPA ETERNITY that materially adversely affects or, as far as can be reasonably foreseen, materially threatens the Shares or SPA ETERNITY that has not been set forth in this Agreement.

(r) Residency. Each of SELLERS, a resident of Singapore, and SPA ETERNITY, a Singaporean corporation, represents and warrants to PURCHASER that SELLERS and SPA ETERNITY are not residents of the United States and will not be residents of the United States at the time of Closing.

5. Representations and Warranties of PURCHASER. As an inducement to SELLERS to enter into this Agreement and to consummate the transactions contemplated herein, PURCHASER represents and warrants to SELLERS as follows:

(a) Authority. PURCHASER has the right, power, authority and capacity to execute and deliver this Agreement, to consummate the transactions contemplated hereby and to perform its obligations under this Agreement. This Agreement constitutes the legal, valid and binding obligations of PURCHASER, enforceable against PURCHASER in accordance with the terms hereof.

| - 4 - |

(b) No Consent. No consent, approval, authorization or order of, or any filing or declaration with any governmental authority or any other person is required for the consummation by PURCHASER of any of the transactions on its part contemplated under this Agreement.

(c) No Conflict. None of the execution, delivery, or performance of this Agreement, and the consummation of the transactions contemplated hereby, conflicts or will conflict with, or (with or without notice or lapse of time, or both) result in a termination, breach or violation of (i) any instrument, contract or agreement to which PURCHASER is a party or by which he is bound; or (ii) any federal, state, local or foreign law, ordinance, judgment, decree, order, statute, or regulation, or that of any other governmental body or authority, applicable to PURCHASER.

(d) Residency. PURCHASER, a Delaware corporation, represents and warrants that it is a resident of the United States.

(e) Potential Loss of Investment. PURCHASER understands that an investment in the Shares is a speculative investment which involves a high degree of risk and the potential loss of its entire investment.

(f) Receipt of Information. PURCHASER has received all documents, records, books and other information pertaining to its investment that has been requested by PURCHASER.

(g) No Advertising. At no time was PURCHASER presented with or solicited by any leaflet, newspaper or magazine article, radio or television advertisement, or any other form of general advertising or solicited or invited to attend a promotional meeting otherwise than in connection and concurrently with such communicated offer.

(h) Investment Experience. PURCHASER (either by itself or with its advisors) is (i) experienced in making investments of the kind described in this Agreement, (ii) able, by reason of its business and financial experience to protect its own interests in connection with the transactions described in this Agreement, and (iii) able to afford the entire loss of its investment in the Shares.

(i) Investment Purposes. PURCHASER is acquiring the restricted Shares for its own account as principal, not as a nominee or agent, for investment purposes only, and not with a view to, or for, resale, distribution or fractionalization thereof in whole or in part and no other person has a direct or indirect beneficial interest in the amount of restricted Shares PURCHASER is acquiring herein. Further, PURCHASER does not have any contract, undertaking, agreement or arrangement with any person to sell, transfer or grant participations to such person or to any third person, with respect to the restricted Shares PURCHASER is acquiring.

(j) Private Placement. PURCHASER understands that (i) the Shares have not been registered under the Securities Act or any state securities laws, by reason of their sale by SELLERS to PURCHASER in a transaction exempt from the registration requirements thereof under Section 4(2) and/or Regulation D of the Securities Act and (ii) the Shares may not be sold unless such disposition is registered under the Securities Act and applicable state securities laws or is exempt from registration thereunder. PURCHASER represents that it is an “accredited investor” (as defined in Rule 501(a) of Regulation D under the Securities Act).

| - 5 - |

(j) Transfer or Resale. PURCHASER understands that (i) the sale or re-sale of the Shares has not been and is not being registered under the Securities Act or any applicable state securities laws, and the Shares may not be transferred unless (a) the Shares are sold pursuant to an effective registration statement under the Securities Act, (b) PURCHASER shall have delivered to SPA ETERNITY, at the cost of PURCHASER, an opinion of counsel that shall be in form, substance and scope customary for opinions of counsel in comparable transactions to the effect that the Shares to be sold or transferred may be sold or transferred pursuant to an exemption from such registration, which opinion shall be accepted by SPA ETERNITY, (c) the Shares are sold or transferred to an “affiliate” (as defined in Rule 144 promulgated under the Securities Act (or a successor rule) (“Rule 144”)) of PURCHASER, who agree to sell or otherwise transfer the Shares only in accordance with this Section and who is an accredited investor (as such term is defined in Rule 501 of Regulation D of the Securities Act), (d) the Shares are sold pursuant to Rule 144, or (e) the Shares are sold pursuant to Regulation S under the Securities Act (or a successor rule) (“Regulation S”), and PURCHASER shall have delivered to SPA ETERNITY, at the cost of PURCHASER, an opinion of counsel that shall be in form, substance and scope customary for opinions of counsel in corporate transactions, which opinion shall be accepted by SPA ETERNITY; (ii) any sale of such Shares made in reliance on Rule 144 may be made only in accordance with the terms of said Rule and further, if said Rule is not applicable, any re-sale of such Shares under circumstances in which the seller (or the person through whom the sale is made) may be deemed to be an underwriter (as that term is defined in the Securities Act) may require compliance with some other exemption under the Securities Act or the rules and regulations of the SEC thereunder; and (iii) neither SPA ETERNITY nor any other person is under any obligation to register such Shares under the Securities Act or any state securities laws or to comply with the terms and conditions of any exemption thereunder (in each case). Notwithstanding the foregoing or anything else contained herein to the contrary, the Shares may be pledged as collateral in connection with a bona fide margin account or other lending arrangement.

Legends. PURCHASER understands that the ordinary shares of SPA ETERNITY that comprise the Shares (the “Securities”) and, until such time as the Securities have been registered under the Securities Act may be sold pursuant to Rule 144 or Regulation S without any restriction as to the number of securities as of a particular date that can then be immediately sold, the Securities may bear a restrictive legend in substantially the following form (and a stop-transfer order may be placed against transfer of the certificates for such Securities):

NEITHER THE ISSUANCE AND SALE OF THE SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAWS. THE SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED OR ASSIGNED (I) IN THE ABSENCE OF (A) AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR (B) AN OPINION OF COUNSEL (WHICH COUNSEL SHALL BE SELECTED BY THE COMPANY), IN A GENERALLY ACCEPTABLE FORM, THAT REGISTRATION IS NOT REQUIRED UNDER SAID ACT OR (II) UNLESS SOLD PURSUANT TO RULE 144 OR RULE 144A UNDER SAID ACT.

The legend set forth above shall be removed and SPA ETERNITY shall issue a certificate without such legend to the holder of any Securities upon which it is stamped, if, unless otherwise required by applicable state securities laws, (a) the Securities are registered for sale under an effective registration statement filed under the Securities Act or otherwise may be sold pursuant to Rule 144 or Regulation S without any restriction as to the number of securities as of a particular date that can then be immediately sold, or (b) such holder provides SPA ETERNITY with an opinion of counsel, in form, substance and scope customary for opinions of counsel in comparable transactions, to the effect that a public sale or transfer of such Exchange Shares may be made without registration under the Securities Act, which opinion shall be accepted by SPA ETERNITY so that the sale or transfer is effected. PURCHASER agrees to sell all Securities, including those represented by a certificate(s) from which the legend has been removed, in compliance with applicable prospectus delivery requirements, if any.

| - 6 - |

6. Covenants.

(a) SPA ETERNITY shall afford to the officers and authorized representatives of PURCHASER full access to the properties, books and records of SPA ETERNITY in order that PURCHASER may have a full opportunity to make such reasonable investigation as it shall desire to make of the affairs of SPA ETERNITY, and SPA ETERNITY will furnish PURCHASER with such additional financial and operating data and other information as to the business and properties of SPA ETERNITY as PURCHASER shall from time to time reasonably request. As such, subject to applicable law, SPA ETERNITY shall allow PURCHASER and its auditor, legal counsel and other authorized representatives all reasonable opportunity and access during normal business hours to inspect and investigate the assets and information concerning the customers, suppliers, vendors, employees, and the business of the other for purposes of conducting due diligence. SPA ETERNITY shall be responsible for any of its due diligence costs incurred in conjunction with the proposed transactions hereunder.

(b) SPA ETERNITY will (i) conduct its business in the ordinary course in a manner consistent with past custom and practice; (ii) pay all accounts payable, purchase inventory, and collect all accounts receivable in the ordinary course of business consistent with past custom and practice; (iii) use reasonable efforts to maintain its business and employees, customers, assets, intellectual property, formulations, marketing, system of merchandising, customers and customer lists, and operations as an ongoing business and in accordance with past custom and practice; (iv) not pay any dividend, without notifying PURCHASER, or make any similar distribution or redeem, purchase, or otherwise acquire, directly or indirectly, any of SPA ETERNITY’s ownership interests; (v) not sell, transfer, or otherwise dispose, without notifying PURCHASER, of any of SPA ETERNITY’s assets (other than in the normal course of business); (vi) not grant any increase in the compensation or benefits of any employee or officer of SPA ETERNITY (other than in the ordinary course of business in accordance with past practice); and (vii) not enter into any transaction with any affiliate of SPA ETERNITY.

(c) After Closing, PURCHASER shall be responsible for the Assumed Indebtedness (and SELLERS will be released from any continuing liability under the Assumed Indebtedness).

7. Further Assurances.

The parties agree that from time to time, whether before, at or after the Closing, each of them will take such other action as reasonably necessary to:

(a) furnish, upon request to each other, such information as either may reasonably request;

(b) execute, acknowledge and deliver such contracts, deeds, or other documents as may be reasonably requested and necessary or appropriate to carry out the purposes and intent of this Agreement; and

(c) effect or evidence the transfer to PURCHASER of the Shares held by or in the name of SELLERS.

8. Conditions Precedent to PURCHASER Obligations to Close. The obligations of PURCHASER to consummate the transactions contemplated herein shall be subject to the fulfillment at or prior to Closing of the following additional conditions, except as PURCHASER may waive in writing:

(a) Upon confirmation that (i) the Cash Consideration (as defined in Section 2(a) hereof) has been paid in the manner set forth in Section 3(b) hereof and (ii) the Note has been issued by PURCHASER to SELLERS as set forth in Section 3(b) hereof, each of SELLERS shall have delivered, or caused to be delivered, to PURCHASER at the Closing certificates representing the Shares, duly endorsed for transfer or accompanied by stock powers executed in blank and/or other instruments of transfer, assignment and conveyance in form and substance satisfactory to PURCHASER and its counsel, evidencing the sale of the Shares to PURCHASE.

| - 7 - |

(b) PURCHASER shall have completed and be satisfied with, in PURCHASER’s sole discretion, its due diligence examination of all aspects of SPA ETERNITY’s financial condition, business and assets;

(c) This Agreement and all other agreements and documents required to be executed at the Closing shall have been duly executed by SELLERS and SPA ETERNITY.

(d) SELLERS and SPA ETERNITY shall have complied with and performed in all material respects all of the terms, covenants, agreements and conditions contained in this Agreement which are required to be complied with and performed on or prior to Closing; and

(e) the representations and warranties of SELLERS and SPA ETERNITY in this Agreement shall have been true and correct on the date hereof and such representations and warranties shall be true and correct on and at the Closing (except those, if any, expressly stated to be true and correct at an earlier date), with the same force and effect as though such representations and warranties had been made on and at the Closing.

9. Conditions Precedent to SELLERS’ Obligations to Close. The obligations of SELLERS to consummate the transactions contemplated herein shall be subject to the fulfillment at or prior to Closing of the following additional conditions, except as SELLERS may waive in writing:

(a) (i) paid, at the Closing, the Cash Consideration (as defined in Section 2(a) hereof) in the manner set forth in Section 3(b) hereof; (ii) issued, at the Closing, to SELLERS the Note as set forth in Section 3(b) hereof; and (iii) assumed all of the indebtedness of SELLERS to SPA ETERNITY outstanding as of the date of Closing (and SELLERS will be released from any continuing liability under such indebtedness assumed by PURCHASER).

(b) This Agreement and all other agreements and documents required to be executed at the Closing shall have been duly executed by PURCHASER;

(c) PURCHASER shall have complied with and performed in all material respects all of the terms, covenants, agreements and conditions contained in this Agreement which are required to be complied with and performed on or prior to Closing; and

(d) the representations and warranties of PURCHASER in this Agreement shall have been true and correct on the date hereof and such representations and warranties shall be true and correct on and at the Closing (except those, if any, expressly stated to be true and correct at an earlier date), with the same force and effect as though such representations and warranties had been made on and at the Closing.

10. Confidentiality. Each party hereto agrees with the other that, unless and until the transactions contemplated by this Agreement have been consummated, it and its representatives will hold in strict confidence all data and information obtained with respect to another party or any subsidiary thereof from any representative, officer, director or employee, or from any books or records or from personal inspection, of such other party, and shall not use such data or information or disclose the same to others, except (i) to the extent such data or information is published, is a matter of public knowledge, or is required by law to be published; or (ii) to the extent that such data or information must be used or disclosed in order to consummate the transactions contemplated by this Agreement. In the event of the termination of this Agreement, each party shall return to the other party all documents and other materials obtained by it or on its behalf and shall destroy all copies, digests, work papers, abstracts or other materials relating thereto, and each party will continue to comply with the confidentiality provisions set forth herein.

| - 8 - |

11. Public Announcements and Filings. Unless required by applicable law or regulatory authority, none of the parties will issue any report, statement or press release to the general public, to the trade, to the general trade or trade press, or to any third party (other than its advisors and representatives in connection with the transactions contemplated hereby) or file any document, relating to this Agreement and the transactions contemplated hereby, except as may be mutually agreed by the parties. Copies of any such filings, public announcements or disclosures, including any announcements or disclosures mandated by law or regulatory authorities, shall be delivered to each party at least one (1) business day prior to the release thereof.

12. Indemnification; Survival.

(a) Indemnification. Each party hereto shall jointly and severally indemnify and hold harmless the other party and such other party's agents, beneficiaries, affiliates, representatives and their respective successors and assigns (collectively, the "Indemnified Persons") from and against any and all damages, losses, liabilities, taxes and costs and expenses (including, without limitation, attorneys' fees and costs) (collectively, "Losses") resulting directly or indirectly from (a) any inaccuracy, misrepresentation, breach of warranty or nonfulfillment of any of the representations and warranties of such party in this Agreement, or any actions, omissions or statements of fact inconsistent with in any material respect any such representation or warranty, (b) any failure by such party to perform or comply with any agreement, covenant or obligation in this Agreement.

(b) Survival. All representations, warranties, covenants and agreements of the parties contained herein or in any other certificate or document delivered pursuant hereto shall survive the date hereof until the expiration of the applicable statute of limitations.

13. Miscellaneous.

(a) Further Assurances. From time to time, whether at or following the Closing, each party shall make reasonable commercial efforts to take, or cause to be taken, all actions, and to do, or cause to be done, all things reasonably necessary, proper or advisable, including as required by applicable laws, to consummate and make effective as promptly as practicable the transactions contemplated by this Agreement.

(b) Notices. All notices or other communications required or permitted hereunder shall be in writing shall be deemed duly given (a) if by personal delivery, when so delivered, (b) if mailed, three (3) business days after having been sent by registered or certified mail, return receipt requested, postage prepaid and addressed to the intended recipient as set forth below, or (c) if sent through an overnight delivery service in circumstances to which such service guarantees next day delivery, the day following being so sent to the addresses of the parties as indicated on the signature page hereto. Any party may change the address to which notices and other communications hereunder are to be delivered by giving the other parties notice in the manner herein set forth.

| - 9 - |

(c) Choice of Law; Jurisdiction. This Agreement shall be governed, construed and enforced in accordance with the laws of the State of Delaware, without giving effect to principles of conflicts of law. Each of the parties agree to submit to the jurisdiction of the federal or state courts located in Palm Beach County, Florida in any actions or proceedings arising out of or relating to this Agreement. Each of the parties, by execution and delivery of this Agreement, expressly and irrevocably (i) consents and submits to the personal jurisdiction of any of such courts in any such action or proceeding; (ii) consents to the service of any complaint, summons, notice or other process relating to any such action or proceeding by delivery thereof to such party and (iii) waives any claim or defense in any such action or proceeding based on any alleged lack of personal jurisdiction, improper venue or forum non conveniens or any similar basis. EACH OF THE UNDERSIGNED HEREBY WAIVES FOR ITSELF AND ITS PERMITTED SUCCESSORS AND ASSIGNS THE RIGHT TO TRIAL BY JURY IN ANY ACTION OR PROCEEDING INSTITUTED IN CONNECTION WITH THIS AGREEMENT.

(d) Entire Agreement. This Agreement sets forth the entire agreement and understanding of the parties in respect of the transactions contemplated hereby and supersedes all prior and contemporaneous agreements, arrangements and understandings of the parties relating to the subject matter hereof. No representation, promise, inducement, waiver of rights, agreement or statement of intention has been made by any of the parties which is not expressly embodied in this Agreement.

(e) Assignment. Each party's rights and obligations under this Agreement shall not be assigned or delegated, by operation of law or otherwise, without the other party's prior written consent, and any such assignment or attempted assignment shall be void, of no force or effect, and shall constitute a material default by such party.

(f) Amendments. This Agreement may be amended, modified, superseded, terminated or cancelled, and any of the terms, covenants, representations, warranties or conditions hereof may be waived, only by a written instrument executed by the parties hereto. For purposes of this Agreement, each of the SELLERS hereby appoint SING WEI LUNG as his, her or its agent and attorney-in-fact to make and execute and any all such amendments, modifications, supplements, termination and waivers and hereby acknowledge and agree that a decision by SING WEI LUNG shall be final, binding and conclusive on such SELLERS, as the case may be, and that the other parties may rely upon any act, decision, consent or instruction of SING WEI LUNG.

(g) Waivers. The failure of any party at any time or times to require performance of any provision hereof shall in no manner affect the right at a later time to enforce the same. No waiver by any party of any condition, or the breach of any term, covenant, representation or warranty contained in this Agreement, whether by conduct or otherwise, in any one or more instances shall be deemed to be or construed as a further or continuing waiver of any such condition or breach or a waiver of any other term, covenant, representation or warranty of this Agreement.

(h) Counterparts. This Agreement may be executed simultaneously in two or more counterparts and by facsimile or electronic copy, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

(i) Severability. If any term, provisions, covenant or restriction of this Agreement is held by a court of competent jurisdiction or other authority to be invalid, void or unenforceable, the remainder of the terms, provisions, covenants and restrictions of this Agreement shall remain in full force and effect and shall in no way be affected, impaired or invalidated so long as the economic or legal substance of the transactions contemplated hereby is not affected in any manner materially adverse to any party. Upon such determination, the parties shall negotiate in good faith to modify this Agreement so as to effect the original intent of the parties as closely as possible in an acceptable manner in order that the transactions contemplated hereby be consummated as originally contemplated to the fullest extent possible.

| - 10 - |

(j) Interpretation. The parties agree that this Agreement shall be deemed to have been jointly and equally drafted by them, and that the provisions of this Agreement therefore shall not be construed against a party or parties on the ground that such party or parties drafted or was more responsible for the drafting of any such provision(s). The parties further agree that they have each carefully read the terms and conditions of this Agreement, that they know and understand the contents and effect of this Agreement and that the legal effect of this Agreement has been fully explained to its satisfaction by counsel of its own choosing.

[Signature Pages Follows]

| - 11 - |

IN WITNESS WHEREOF, the parties have duly executed this Stock Purchase Agreement as of the date first above written.

PURCHASER:

IT’S DIVINE, INC. | |||

| By: | /s/ Sing Wei Lung | ||

| Name: | SING WEI LUNG | |

| Title: | Chief Executive Officer | ||

|

|

|

|

| SPA ETERNITY:

SPA ETERNITY PTE. LTD. |

| |

|

|

|

|

| By: | /s/ Sing Wei Lung |

|

| Name: | SING WEI LUNG |

|

| Title: | Director |

|

|

|

|

|

| SELLERS:

SING WEI LUNG | |||

|

|

|

|

| By: | /s/ Sing Wei Lung |

|

|

| SING WEI LUNG |

|

|

|

|

|

| HONGBO HUANG |

| |

|

|

|

|

| By: | /s/ Hongbo Huang |

|

|

| HONGBO HUANG |

|

| - 12 - |

Exhibit A

Sellers |

| No. Shares of Spa Eternity to be Sold to It’s Divine |

|

| Ownership Percentage of Spa Eternity |

|

| Cash Consideration from It’s Divine |

|

| Principal of Promissory Note from It’s Divine |

|

| Indebtedness to Spa Eternity Assumed by It’s Divine |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SING WEI LUNG |

|

| 100,050 |

|

|

| 99.95004 | % |

| $ | 199,900 |

|

| $ | 199,900 |

|

| $ | 1,746,127 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HONGBO HUANG |

|

| 50 |

|

|

| 0.04996 | % |

| $ | 100 |

|

| $ | 100 |

|

| $ | 873 |

|

| - 13 - |

Exhibit B

Form of Promissory Note

| - 14 - |

PROMISSORY NOTE

$200,000.00 (Singaporean Dollars) | June 22, 2016 |

FOR VALUE RECEIVED, IT’S DIVINE, INC., a Delaware corporation (the “PURCHASER”), hereby promises to pay to the order of SING WEI LUNG and HONGBO HUANG (the “SELLERS”) at the location designated by SELLERS, in lawful money of Singapore, the principal aggregate sum of $200,000.00 (Singaporean Dollars), together with interest on the unpaid principal amount outstanding at a rate of 2% per annum in accordance with the terms hereof. This Promissory Note is given as partial consideration pursuant to the terms of that certain Stock Purchase Agreement, dated as of June 20, 2016, among PURCHASER, SPA ETERNITY PTE. LTD., a Singaporean corporation (“SPA ETERNITY”), and SELLERS (the “Stock Purchase Agreement”) and in consideration of the payment of $200,000.00 (Singaporean Dollars) to SELLERS under Section 2(a) of the Stock Purchase Agreement. Capitalized terms used but not otherwise defined herein have the meaning given them in the Stock Purchase Agreement.

The following terms shall apply to this Promissory Note:

| 1. | INTEREST. Interest shall accrue during the term of this loan and shall be payable to SELLERS (pro rata in accordance with their respective percentages set forth below) on August 1, 2016 along with the principal payments set forth in Section 2 hereof. |

SELLERS |

| PERCENTAGES |

| |

|

|

|

|

|

SING WEI LUNG |

|

| 99.95004 | % |

|

|

|

|

|

HONGBO HUANG |

|

| 0.04996 | % |

|

|

|

|

|

Total: |

|

| 100.0000 | % |

| 2. | PRINCIPAL. The principal amount of this Promissory Note is payable to SELLERS (pro rata in accordance with their respective percentages set forth above) on August 1, 2016. |

|

|

| 3. | MATURITY. Subject to the terms and conditions hereof, the principal amount of this Promissory Note plus the accrued interest shall be due and payable (“Maturity Date”) as stipulated in Sections 1 and 2 of this Promissory Note, and shall be paid by PURCHASER in cash, check, money order or by wire transfer. |

|

|

| 4. | PREPAYMENT. PURCHASER shall have the right at any time and from time to time to prepay this Promissory Note in whole or in part without premium or penalty. |

|

|

| 5. | DEFAULT. In the event PURCHASER does not satisfy payment due as stipulated in Sections 1 and 2 hereof and fully, faithfully, and punctually perform all of its obligations hereunder, PURCHASER will be in default of this Promissory Note. In the event of default by PURCHASER, SELLERS may, at their option, (i) declare the entire unpaid principal balance of this Promissory Note together with accrued and unpaid interest immediately due and payable and (ii) pursue any other remedy available to PURCHASER at law or in equity. |

| - 15 - |

| 6. | MISCELLANEOUS. |

| (a) | PURCHASER and all endorsers, sureties and guarantors now or hereafter becoming parties hereto or obligated in any manner for the debt represented hereby, jointly and severally waive demand, notice of non-payment and protest and agree that if this Promissory Note goes into default and is placed in the hands of an attorney for collection or enforcement of the undersigned's obligations hereunder, to pay attorney's fees and all other costs and expenses incurred in making such collection, including but not limited to attorney's fees and costs on appeal of any judg-ment or order. |

|

|

|

| (b) | The validity of this Promissory Note and the rights, obligations and relations of the parties hereunder shall be construed and determined under and in accordance with the laws of the State of Delaware, without regard to conflicts of law principles thereunder provided, however, that if any provision of this Promissory Note is determined by a court of competent jurisdiction to be in violation of any applicable law or otherwise invalid or unenforceable, such provision shall to such extent as it shall be determined to be illegal, invalid or unenforceable under such law be deemed null and void, but this Promissory Note shall otherwise remain in full force. Suit to enforce any provision of this Promissory Note, or any right, remedy or other matter arising therefrom, will be brought exclusively in the state or federal courts located in Palm Beach County, Florida. The Company and SELLERS agree and consent to venue in Palm Beach County, Florida and to the in personam jurisdiction of these courts and hereby irrevocably waives any right to a trial by jury. |

|

|

|

| (c) | This Promissory Note shall be binding upon the successors, assigns, heirs, administrators and executors of PURCHASER and inure to the benefit of SELLERS, their successors, endorsees, assigns, heirs, administrators and executors. |

IT’S DIVINE, INC., a Delaware corporation | ||

| By: | /s/ Sing Wei Lung | |

Name: | Sing Wei Lung | |

| Title: | Chief Executive Officer | |

| - 16 - |

Schedule 4(f)

(No Other Interest)

None

| - 17 - |

| - 18 - |

Schedule 4(n)

(Tax Returns)

None

- 19 - |