Attached files

EXHIBIT 10.1

SHARE EXCHANGE AGREEMENT

Dated May 31, 2016

by and among

IT’S DIVINE, INC.,

a Delaware corporation,

as the Parent

and

HEALING TOUCH GLOBAL PTE. LTD.,

a Singaporean corporation

and

THE SHAREHOLDERS OF

HEALING TOUCH GLOBAL PTE. LTD.

| 1 |

TABLE OF CONTENTS

| PAGE | |||||

|

| |||||

ARTICLE I REPRESENTATIONS, COVENANTS, AND WARRANTIES OF HTG AND HTG SHAREHOLDERS. | 1 | |||||

Section 1.01 | Incorporation. | 1 | ||||

| Section 1.02 | Authorized Shares and Capital. | 2 | ||||

| Section 1.03 | Subsidiaries and Predecessor Corporations. | 2 | ||||

| Section 1.04 | Taxes. | 2 | ||||

| Section 1.05 | Books and Records. | 2 | ||||

| Section 1.06 | Information. | 2 | ||||

| Section 1.07 | Options or Warrants. | 2 | ||||

| Section 1.08 | Absence of Certain Changes or Events. | 2 | ||||

| Section 1.09 | Litigation and Proceedings. | 3 | ||||

| Section 1.10 | Contracts. | 3 | ||||

| Section 1.11 | Compliance With Laws and Regulations. | 3 | ||||

| Section 1.12 | Approval of Agreement | 3 | ||||

| Section 1.13 | HTG Schedules. | 4 | ||||

| Section 1.14 | Valid Obligation. | 4 | ||||

| Section 1.15 | Investment Representations. | 4 | ||||

| Section 1.16 | Elimination of Existing HTG Agreements upon the Exchange. | 6 | ||||

ARTICLE II REPRESENTATIONS, COVENANTS, AND WARRANTIES OF THE COMPANY | 6 | |||||

| Section 2.01 | Organization. | 6 | ||||

| Section 2.02 | Capitalization. | 6 | ||||

| Section 2.03 | Subsidiaries and Predecessor Corporations. | 6 | ||||

| Section 2.04 | Information. | 7 | ||||

| Section 2.05 | Options or Warrants. | 7 | ||||

| Section 2.06 | Absence of Certain Changes or Events. | 7 | ||||

| Section 2.07 | Litigation and Proceedings. | 8 | ||||

| Section 2.08 | Contracts. | 8 | ||||

| Section 2.09 | No Conflict With Other Instruments. | 8 | ||||

| Section 2.10 | Compliance With Laws and Regulations. | 8 | ||||

| Section 2.11 | Approval of Agreement | 8 | ||||

| Section 2.12 | The COMPANY Schedules. | 9 | ||||

| Section 2.13 | Valid Obligation. | 9 | ||||

ARTICLE III SHARE EXCHANGE. | 9 | |||||

| Section 3.01 | The Exchange. | 9 | ||||

| Section 3.02 | Closing. | 9 | ||||

| Section 3.03 | Closing Events. | 10 | ||||

| Section 3.04 | Termination. | 10 | ||||

ARTICLE IV SPECIAL COVENANTS. | 10 | |||||

| Section 4.01 | Access to Properties and Records. | 10 | ||||

| Section 4.02 | Delivery of Books and Records. | 10 | ||||

| Section 4.03 | Third Party Consents and Certificates. | 10 | ||||

| 2 |

| Section 4.04 | Covenant to Observe Terms of Investor Agreements between HTG. | 10 | ||||

| Section 4.05 | Actions Prior to Closing. | 10 | ||||

ARTICLE V CONDITIONS PRECEDENT TO OBLIGATIONS OF THE COMPANY. | 11 | |||||

| Section 5.01 | Accuracy of Representations and Performance of Covenants. | 11 | ||||

| Section 5.02 | No Governmental Prohibition. | 11 | ||||

| Section 5.03 | Approval by HTG’s Board of Directors. | 11 | ||||

| Section 5.04 | Minimum HTG Shareholders. | 11 | ||||

| Section 5.05 | Consents. | 11 | ||||

ARTICLE VI CONDITIONS PRECEDENT TO OBLIGATIONS OF HTG AND THE HTG SHAREHOLDERS | 12 | |||||

| Section 6.01 | Accuracy of Representations and Performance of Covenants. | 12 | ||||

| Section 6.02 | No Governmental Prohibition. | 12 | ||||

| Section 6.03 | Approval by the COMPANY Board of Directors. | 12 | ||||

| Section 6.04 | Consents. | 12 | ||||

ARTICLE VII COVENANTS AFTER CLOSING. | 12 | |||||

| Section 7.01 | Acquisition of Spa Eternity Pte. Ltd. | 12 | ||||

| Section 7.02 | Compensation of SING WEI LUNG. | 12 | ||||

ARTICLE VIII MISCELLANEOUS. | 13 | |||||

| Section 8.01 | Brokers. | 13 | ||||

| Section 8.02 | Governing Law. | 13 | ||||

| Section 8.03 | Notices. | 13 | ||||

| Section 8.04 | Attorney’s Fees. | 14 | ||||

| Section 8.05 | Confidentiality. | 14 | ||||

| Section 8.06 | Public Announcements and Filings. | 14 | ||||

| Section 8.07 | Schedules; Knowledge. | 14 | ||||

| Section 8.08 | Third Party Beneficiaries. | 14 | ||||

| Section 8.09 | Expenses. | 14 | ||||

| Section 8.10 | Entire Agreement | 14 | ||||

| Section 8.11 | Survival; Termination. | 14 | ||||

| Section 8.12 | Counterparts. | 14 | ||||

| Section 8.13 | Amendment or Waiver | 15 | ||||

| Section 8.14 | Best Efforts. | 15 | ||||

EXHIBITS

Exhibit A – HTG Shareholders’ Signature Pages

Exhibit B – Non-U.S. Person Certificate

Schedule 1.01 – Memorandum and Articles of Association of Healing Touch Global Pte. Ltd.

Schedule 2.01 – Certificate of Incorporation and Bylaws of It’s Divine, Inc.

| 3 |

SHARE EXCHANGE AGREEMENT

THISSHARE EXCHANGEAGREEMENT(hereinafter referred to as this “Agreement”) is entered into as of this 31st day of May 2016, by and between IT’S DIVINE, INC., a Delaware corporation (the “COMPANY”), with offices at 140 Paya Lebar Road, AZ Building #09-26, Singapore 409015, HEALING TOUCH GLOBAL PTE. LTD.,a Singaporean corporation (“HTG”), with offices at 140 Paya Lebar Road, AZ Building #09-26, Singapore 409015, and the shareholders of HTG set forth on Composite Exhibit A (the “HTGShareholders”), upon the following premises:

Premises

WHEREAS, the COMPANY is a privately held corporation organized under the laws of the State of Delaware in the United States.

WHEREAS, HTG is a privately held company limited by shares organized under the laws of the Republic of Singapore.

WHEREAS, the COMPANY agrees to acquire at least 19,750 and up to 22,025 shares of HTG’s Ordinary Shares (“HTG Ordinary Shares”), representing between approximately 89% to 100% of HTG’s issued and outstanding capital stock, in exchange for the issuance by the COMPANY to HTG Shareholders of at least 37,500,000 and up to 41,819,624 shares (“Exchange Shares”) of the COMPANY’S common stock, par value $0.0001 per share (“COMPANY Common Stock”), whereby each share of HTG Ordinary Shares will be exchanged for 1,898.7343473325766 shares of COMPANY Common Stock. On the Closing Date (as defined in Section 3.02 herein), the HTG Shareholders will become shareholders of the COMPANY and HTG will become a majority owned or wholly-owned subsidiary of the COMPANY. Immediately after the Exchange and other transactions set forth herein, there will be at least 37,500,100 and up to 41,819,724 shares of the COMPANY Common Stock issued and outstanding with at least 37,500,100 and up to 41,819,724 shares or approximately 100% thereof owned by the HTG Shareholders (who also include Sing Wei Lung, the founder of COMPANY, who currently holds 100 shares of the COMPANY Common Stock prior to the Exchange).

WHEREAS, for Federal income tax purposes, it is intended that the Exchange qualify as a reorganization under the provisions of Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”).

Agreement

NOW THEREFORE, on the stated premises and for and in consideration of the mutual covenants and agreements hereinafter set forth and the mutual benefits to the parties to be derived herefrom, and intending to be legally bound hereby, it is hereby agreed as follows:

ARTICLE I

REPRESENTATIONS, COVENANTS, AND WARRANTIES OF HTG AND HTG SHAREHOLDERS

As an inducement to, and to obtain the reliance of the COMPANY, except as set forth in the HTG Schedules (as hereinafter defined), HTG and each of HTG Shareholders, where applicable, represents and warrants to the COMPANY that as of the date hereof and the Closing Date (as hereinafter defined), as follows:

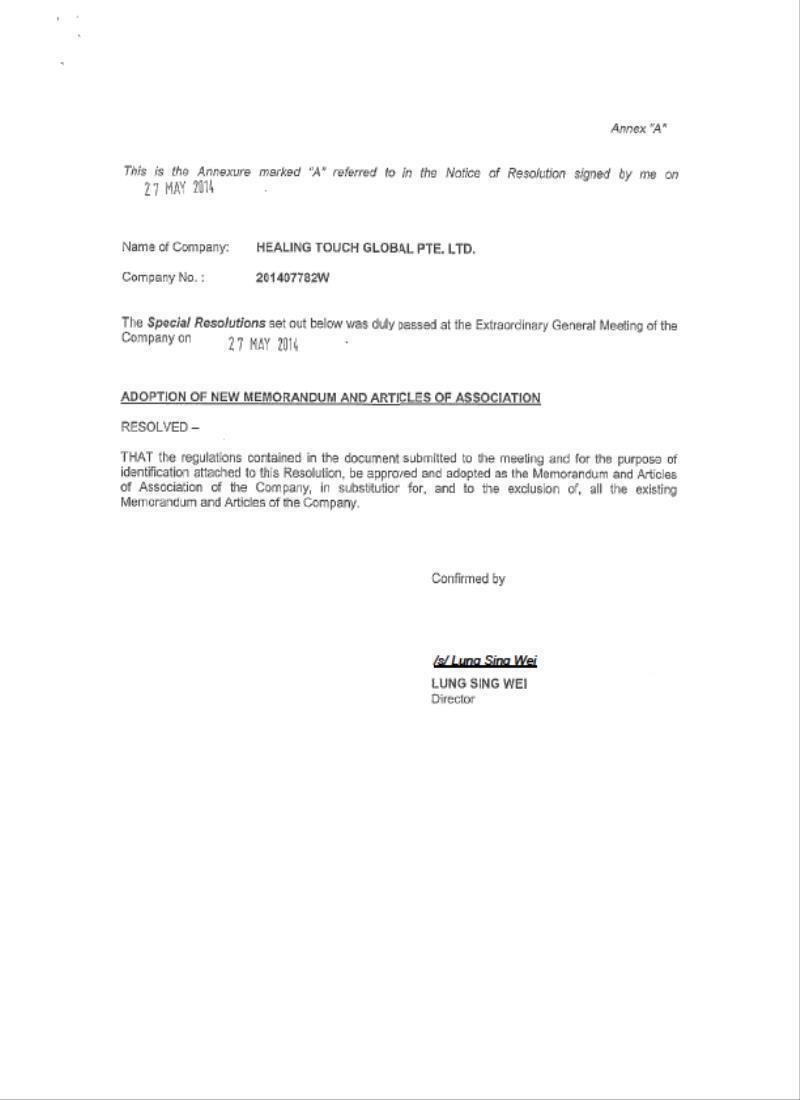

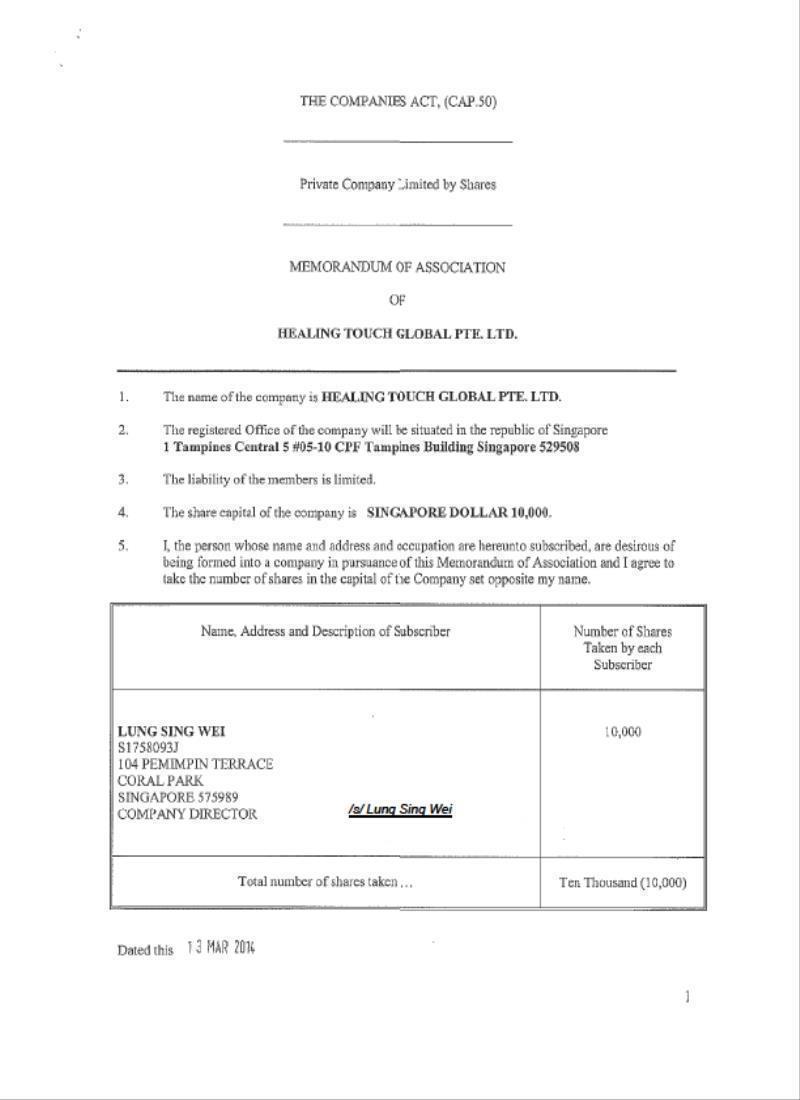

Section 1.01 Incorporation. HTG is a private company duly organized, validly existing, and in good standing under the laws of the Republic of Singapore and has the corporate power and is duly authorized under all applicable laws, regulations, ordinances, and orders of public authorities to carry on its business in all material respects as it is now being conducted. Attached hereto as Schedule 1.01 are complete and correct copies of the Memorandum and Articles of Association of the COMPANY as in effect on the date hereof. The execution and delivery of this Agreement does not, and the consummation of the transactions contemplated hereby will not, violate any provision of HTG’s Memorandum and Articles of Association or Bylaws. HTG has taken all actions required by law, its Memorandum and Articles of Association or Bylaws, or otherwise to authorize the execution, delivery and performance of this Agreement. HTG has full power, authority, and legal capacity and has taken all action required by law, it’s Memorandum and Articles of Association or Bylaws, and otherwise to consummate the transactions herein contemplated.

| 4 |

Section 1.02 Authorized Shares and Capital. There is no limit on the number of shares HTG is authorized to issue. HTG may issue as many shares as it desires so long as it has obtained requisite approval pursuant to the Singapore Companies Act. The HTG shares have no par value. As of the date of this Agreement, there are 22,025 ordinary shares (“HTG Ordinary Shares”) issued and outstanding. The issued and outstanding shares are validly issued, fully paid, and non-assessable and not issued in violation of the preemptive or other rights of any person. HTG has no obligation to issue any additional HTG Ordinary Shares or securities convertible or exchangeable for HTG Ordinary Shares, options or warrants for the purchase of any HTG Ordinary Shares or any securities convertible into or exchangeable for any HTG Ordinary Shares. HTG Shareholders hereby represent and warrant that they have held their HTG Ordinary Shares for a minimum of six (6) months since they acquired their HTG Ordinary Shares from HTG.

Section 1.03 Subsidiaries and Predecessor Corporations. HTG does not have any predecessor corporation(s), no subsidiaries, and does not own, beneficially or of record, any shares of any other corporation.

Section 1.04 Taxes. HTG has duly and punctually paid all governmental fees and taxes which it has become liable to pay and has duly allowed for all taxes reasonably foreseeable and is under no liability to pay any penalty or interest in connection with any claim for governmental fees or taxes and HTG has made any and all proper declarations and returns for tax purposes and all information contained in such declarations and returns is true and complete.

Section 1.05 Books and Records. The books and records, financial and otherwise, of HTG are in all material aspects complete and correct and have been maintained in accordance with good business and accounting practices.

Section 1.06 Information. The information concerning HTG set forth in this Agreement and in the HTG Schedules is complete and accurate in all material respects and does not contain any untrue statement of a material fact or omit to state a material fact required to make the statements made, in light of the circumstances under which they were made, not misleading. In addition, HTG has fully disclosed in writing to the COMPANY (through this Agreement or the HTG Schedules) all information relating to matters involving HTG or its assets or its present or past operations or activities which (i) indicated or may indicate, in the aggregate, the existence of a greater than $10,000 liability, (ii) have led or may lead to a competitive disadvantage on the part of HTG or (iii) either alone or in aggregation with other information covered by this Section, otherwise have led or may lead to a material adverse effect on HTG, its assets, or its operations or activities as presently conducted or as contemplated to be conducted after the Closing Date, including, but not limited to, information relating to governmental, employee, environmental, litigation and securities matters and transactions with affiliates.

Section 1.07 Options or Warrants. There are no existing options, warrants, calls, or commitments of any character relating to the authorized and unissued capital stock of HTG.

Section 1.08 Absence of Certain Changes or Events. Since the date of this Agreement or such other date as provided for herein:

(a) there has not been any material adverse change in the business, operations, properties, assets, or condition (financial or otherwise) of HTG;

| 5 |

(b) HTG has not (i) amended its Memorandum and Articles of Association since formation; (ii) declared or made, or agreed to declare or make, any payment of dividends or distributions of any assets of any kind whatsoever to stockholders or purchased or redeemed, or agreed to purchase or redeem, any of its shares; (iii) made any material change in its method of management, operation or accounting; (iv) entered into any other material transaction other than sales in the ordinary course of its business; or (v) made any increase in or adoption of any profit sharing, bonus, deferred compensation, insurance, pension, retirement, or other employee benefit plan, payment, or arrangement made to, for, or with its officers, directors, or employees; and

(c) HTG has not (i) granted or agreed to grant any options, warrants or other rights for its stocks, bonds or other corporate securities calling for the issuance thereof, (ii) borrowed or agreed to borrow any funds or incurred, or become subject to, any material obligation or liability (absolute or contingent) except as disclosed herein and except liabilities incurred in the ordinary course of business; sold or transferred, or agreed to sell or transfer, any of its assets, properties, or rights or canceled, or agreed to cancel, any debts or claims; or (iv) issued, delivered, or agreed to issue or deliver any stock, bonds or other corporate securities including debentures (whether authorized and unissued or held as treasury stock) except in connection with this Agreement.

Section 1.09 Litigation and Proceedings. There are no actions, suits, proceedings, or investigations pending or, to the knowledge of HTG after reasonable investigation, threatened by or against HTG or affecting HTG or its properties, at law or in equity, before any court or other governmental agency or instrumentality, domestic or foreign, or before any arbitrator of any kind. HTG does not have any knowledge of any material default on its part with respect to any judgment, order, injunction, decree, award, rule, or regulation of any court, arbitrator, or governmental agency or instrumentality or of any circumstances which, after reasonable investigation, would result in the discovery of such a default.

Section 1.10 Contracts.

(a) All “material” contracts, agreements, franchises, license agreements, debt instruments or other commitments to which HTG is a party or by which it or any of its assets, products, technology, or properties are bound other than those incurred in the ordinary course of business have been previously disclosed to the COMPANY. A “material” contract, agreement, franchise, license agreement, debt instrument or commitment is one which (i) will remain in effect for more than six (6) months after the date of this Agreement or (ii) involves aggregate obligations of at least ten thousand dollars ($10,000);

(b) All contracts, agreements, franchises, license agreements, and other commitments to which HTG is a party or by which its properties are bound and which are material to the operations of HTG taken as a whole are valid and enforceable by HTG in all respects, except as limited by bankruptcy and insolvency laws and by other laws affecting the rights of creditors generally; and

(c) HTG is not a party to any oral or written (i) contract for the employment of any officer or employee; (ii) profit sharing, bonus, deferred compensation, stock option, severance pay, pension benefit or retirement plan, (iii) agreement, contract, or indenture relating to the borrowing of money, (iv) guaranty of any obligation; (vi) collective bargaining agreement; or (vii) agreement with any present or former officer or director of HTG.

Section 1.11 Compliance With Laws and Regulations. To the best of its knowledge, HTG has complied with all applicable statutes and regulations of any federal, state, or other governmental entity or agency thereof, except to the extent that noncompliance would not materially and adversely affect the business, operations, properties, assets, or condition of HTG or except to the extent that noncompliance would not result in the occurrence of any material liability for HTG.

Section 1.12 Approval of Agreement. This Agreement has been duly and validly authorized and executed and delivered on behalf of HTG and the HTG Shareholders and this Agreement constitutes a valid and binding agreement of HTG and the HTG Shareholders enforceable in accordance with its terms.

| 6 |

Section 1.13 HTG Schedules. HTG has delivered to the COMPANY the following schedules, which are collectively referred to as the “HTG Schedules” and which consist of separate schedules dated as of the date of execution of this Agreement:

(a) a schedule containing complete and correct copies of the Memorandum and Articles of Association of HTG, as in effect as of the date of this Agreement;

(b) a schedule setting forth any information, together with any required copies of documents, required to be disclosed in the HTG Schedules by Sections 1.01 through 1.12.

HTG shall cause the HTG Schedules and the instruments and data delivered to the COMPANY hereunder to be promptly updated after the date hereof up to and including the Closing Date.

Section 1.14 Valid Obligation. This Agreement and all agreements and other documents executed by HTG in connection herewith constitute the valid and binding obligations of HTG, enforceable in accordance with its or their terms, except as may be limited by bankruptcy, insolvency, moratorium or other similar laws affecting the enforcement of creditors’ rights generally and subject to the qualification that the availability of equitable remedies is subject to the discretion of the court before which any proceeding therefore may be brought.

Section 1.15 Investment Representations.

(a) Investment Purpose. As of the date hereof, the HTG Shareholders understand and agree that the consummation of this Agreement including the delivery of the Exchange Consideration (as hereinafter defined) to the HTG Shareholders in exchange for the HTG Ordinary Shares as contemplated hereby constitutes the offer and sale of securities under the Securities Act of 1933, as amended (the “Securities Act ”) and applicable state statutes and that the Securities are being acquired for the HTG Shareholders’ own account and not with a present view towards the public sale or distribution thereof, except pursuant to sales registered or exempted from registration under the Securities Act; provided, however, that by making the representations herein, the HTG Shareholders do not agree to hold any of the Exchange Consideration for any minimum or other specific term and reserves the right to dispose of the Exchange Consideration at any time in accordance with or pursuant to a registration statement or an exemption under the Securities Act.

(b) Investor Status. Each of the HTG Shareholders is (i) an “accredited investor” as that term is defined in Rule 501(a) of Regulation D (an “Accredited Investor”), (ii) a sophisticated investor who has such knowledge and experience in financial and business matters to be capable of evaluating the merits and risks of this Agreement and the underlying transactions, and/or (iii) an exempt investor in accordance with the provisions of Regulation S promulgated under the Securities Act (where all of the acknowledgements, representations, warranties and covenants set out in Exhibit B hereto are true and correct as of the date hereof and as of the Closing Date). Each HTG Shareholder has been furnished with all documents and materials relating to the business, finances and operations of the COMPANY and its subsidiaries and information that such HTG Shareholder requested and deemed material to making an informed decision regarding this Agreement and the underlying transactions.

(c) Reliance on Exemptions. Each of the HTG Shareholders understands that the Exchange Consideration is being offered and sold to the HTG Shareholders in reliance upon specific exemptions from the registration requirements of United States federal and state securities laws and that the COMPANY is relying upon the truth and accuracy of, and the HTG Shareholders’ compliance with, the representations, warranties, agreements, acknowledgments and understandings of the HTG Shareholders set forth herein in order to determine the availability of such exemptions and the eligibility of the HTG Shareholders to acquire the Exchange Consideration.

| 7 |

(d) Information. The HTG Shareholders and its advisors, if any, have been furnished with all materials relating to the business, finances and operations of the COMPANY and materials relating to the offer and sale of the Exchange Consideration which have been requested by the HTG Shareholders or its advisors. The HTG Shareholders and its advisors, if any, have been afforded the opportunity to ask questions of the COMPANY. The HTG Shareholders understands that its investment in the Exchange Consideration involves a significant degree of risk. The HTG Shareholders is not aware of any facts that may constitute a breach of any of the COMPANY's representations and warranties made herein.

(e) Governmental Review. Each of the HTG Shareholders understands that no United States federal or state agency or any other government or governmental agency has passed upon or made any recommendation or endorsement of the Exchange Consideration.

(f) Transfer or Resale. Each of the HTG Shareholders understands that (i) the sale or re-sale of the Exchange Consideration has not been and is not being registered under the Securities Act or any applicable state securities laws, and the Exchange Consideration may not be transferred unless (a) the Exchange Consideration is sold pursuant to an effective registration statement under the Securities Act, (b) the HTG Shareholders shall have delivered to the COMPANY, at the cost of the HTG Shareholders, an opinion of counsel that shall be in form, substance and scope customary for opinions of counsel in comparable transactions to the effect that the Exchange Consideration to be sold or transferred may be sold or transferred pursuant to an exemption from such registration, which opinion shall be accepted by the Company, (c) the Exchange Consideration is sold or transferred to an “affiliate” (as defined in Rule 144 promulgated under the Securities Act (or a successor rule) (“Rule 144”)) of the HTG Shareholders who agree to sell or otherwise transfer the Exchange Consideration only in accordance with this Section and who is an Accredited Investor, (d) the Exchange Consideration is sold pursuant to Rule 144, or (e) the Exchange Consideration is sold pursuant to Regulation S under the Securities Act (or a successor rule) (“Regulation S”), and the HTG Shareholders shall have delivered to the COMPANY, at the cost of the HTG Shareholders, an opinion of counsel that shall be in form, substance and scope customary for opinions of counsel in corporate transactions, which opinion shall be accepted by the COMPANY; (ii) any sale of such Exchange Consideration made in reliance on Rule 144 may be made only in accordance with the terms of said Rule and further, if said Rule is not applicable, any re-sale of such Exchange Consideration under circumstances in which the seller (or the person through whom the sale is made) may be deemed to be an underwriter (as that term is defined in the Securities Act) may require compliance with some other exemption under the Securities Act or the rules and regulations of the SEC thereunder; and (iii) neither the COMPANY nor any other person is under any obligation to register such Exchange Consideration under the Securities Act or any state securities laws or to comply with the terms and conditions of any exemption thereunder (in each case). Notwithstanding the foregoing or anything else contained herein to the contrary, the Exchange Consideration may be pledged as collateral in connection with a bona fide margin account or other lending arrangement.

(g) Legends. Each of the HTG Shareholders understand that the shares of the COMPANY’s common stock that comprise the Exchange Consideration (the “Securities”) and, until such time as the Securities have been registered under the Securities Act may be sold pursuant to Rule 144 or Regulation S without any restriction as to the number of securities as of a particular date that can then be immediately sold, the Securities may bear a restrictive legend in substantially the following form (and a stop-transfer order may be placed against transfer of the certificates for such Securities):

NEITHER THE ISSUANCE AND SALE OF THE SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAWS. THE SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED OR ASSIGNED (I) IN THE ABSENCE OF (A) AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR (B) AN OPINION OF COUNSEL (WHICH COUNSEL SHALL BE SELECTED BY THE COMPANY), IN A GENERALLY ACCEPTABLE FORM, THAT REGISTRATION IS NOT REQUIRED UNDER SAID ACT OR (II) UNLESS SOLD PURSUANT TO RULE 144 OR RULE 144A UNDER SAID ACT.

| 8 |

The legend set forth above shall be removed and the COMPANY shall issue a certificate without such legend to the holder of any Securities upon which it is stamped, if, unless otherwise required by applicable state securities laws, (a) the Securities are registered for sale under an effective registration statement filed under the Securities Act or otherwise may be sold pursuant to Rule 144 or Regulation S without any restriction as to the number of securities as of a particular date that can then be immediately sold, or (b) such holder provides the COMPANY with an opinion of counsel, in form, substance and scope customary for opinions of counsel in comparable transactions, to the effect that a public sale or transfer of such Exchange Shares may be made without registration under the Securities Act, which opinion shall be accepted by the COMPANY so that the sale or transfer is effected. Each of the HTG Shareholders agrees to sell all Securities, including those represented by a certificate(s) from which the legend has been removed, in compliance with applicable prospectus delivery requirements, if any.

(h) Residency. Each of the HTG Shareholders represents and warrants to the COMPANY that they are not a resident of the United States and will not be a resident of the United States at the time of Closing, and that they were not in the United States at the time this Agreement was signed by such shareholder.

Section 1.16 Elimination of Existing HTG Agreements upon the Exchange. HTG Shareholders acknowledge and understand that upon the Exchange, the Investor Agreements between HTG and HTG Shareholders from whom the COMPANY is acquiring HTG Ordinary Shares shall be eliminated in light of the Exchange (rather than being voided).

ARTICLE II

REPRESENTATIONS, COVENANTS, AND WARRANTIES OF THE COMPANY

As an inducement to, and to obtain the reliance of HTG and the HTG Shareholders, except as set forth in the COMPANY Schedules (as hereinafter defined), the COMPANY represents and warrants, as of the date hereof and as of the Closing Date, as follows:

Section 2.01 Organization. The COMPANY is a corporation duly organized, validly existing, and in good standing under the laws of the State of Delaware and has the corporate power and is duly authorized under all applicable laws, regulations, ordinances, and orders of public authorities to carry on its business in all material respects as it is now being conducted. Attached hereto as Schedule 2.01 are complete and correct copies of the certificate of incorporation and bylaws of the COMPANY as in effect on the date hereof. The execution and delivery of this Agreement does not, and the consummation of the transactions contemplated hereby will not, violate any provision of the COMPANY’s certificate of incorporation or bylaws. The COMPANY has taken all action required by law, its certificate of incorporation, its bylaws, or otherwise to authorize the execution and delivery of this Agreement, and the COMPANY has full power, authority, and legal right and has taken all action required by law, its certificate of incorporation, bylaws, or otherwise to consummate the transactions herein contemplated.

Section 2.02 Capitalization. At Closing, the COMPANY’s authorized capitalization will consist of (a) 300,000,000 shares of common stock, par value $0.0001 per share (“the COMPANY Common Stock”), of which 41,819,724 shares will be issued and outstanding, and (b) 20,000,000 shares of preferred stock, par value $0.0001 per share (“Preferred Stock”), none of which are issued and outstanding and all of which are undesignated. All issued and outstanding shares are legally issued, fully paid, and non-assessable and not issued in violation of the preemptive or other rights of any person.

Section 2.03 Subsidiaries and Predecessor Corporations. The COMPANY does not have any predecessor corporation(s), no subsidiaries, and does not own, beneficially or of record, any shares of any other corporation.

| 9 |

Section 2.04 Information. The information concerning the COMPANY set forth in this Agreement and the COMPANY Schedules is complete and accurate in all material respects and does not contain any untrue statements of a material fact or omit to state a material fact required to make the statements made, in light of the circumstances under which they were made, not misleading. In addition, the COMPANY has fully disclosed in writing to the HTG Shareholders (through this Agreement or the COMPANY Schedules) all information relating to matters involving the COMPANY or its assets or its present or past operations or activities which (i) indicated or may indicate, in the aggregate, the existence of a greater than $10,000 liability, (ii) have led or may lead to a competitive disadvantage on the part of the COMPANY or (iii) either alone or in aggregation with other information covered by this Section, otherwise have led or may lead to a material adverse effect on the COMPANY, its assets, or its operations or activities as presently conducted or as contemplated to be conducted after the Closing Date, including, but not limited to, information relating to governmental, employee, environmental, litigation and securities matters and transactions with affiliates.

Section 2.05 Options or Warrants. There are no options, warrants, convertible securities, subscriptions, stock appreciation rights, phantom stock plans or stock equivalents or other rights, agreements, arrangements or commitments (contingent or otherwise) of any character issued or authorized by the COMPANY relating to the issued or unissued capital stock of the COMPANY (including, without limitation, rights the value of which is determined with reference to the capital stock or other securities of the COMPANY) or obligating the COMPANY to issue or sell any shares of capital stock of, or options, warrants, convertible securities, subscriptions or other equity interests in, the COMPANY. There are no outstanding contractual obligations of the COMPANY to repurchase, redeem or otherwise acquire any shares of the COMPANY Common Stock of the COMPANY or to pay any dividend or make any other distribution in respect thereof or to provide funds to, or make any investment (in the form of a loan, capital contribution or otherwise) in, any person.

Section 2.06 Absence of Certain Changes or Events. Since the date of this Agreement or such other date as provided for herein:

(a) there has not been (i) any material adverse change in the business, operations, properties, assets or condition of the COMPANY or (ii) any damage, destruction or loss to the COMPANY (whether or not covered by insurance) materially and adversely affecting the business, operations, properties, assets or condition of the COMPANY;

(b) the COMPANY has not (i) amended its certificate of incorporation or bylaws except as required by this Agreement; (ii) declared or made, or agreed to declare or make any payment of dividends or distributions of any assets of any kind whatsoever to stockholders or purchased or redeemed, or agreed to purchase or redeem, any of its capital stock; (iii) waived any rights of value which in the aggregate are outside of the ordinary course of business or material considering the business of the COMPANY; (iv) made any material change in its method of management, operation, or accounting; (v) entered into any transactions or agreements other than in the ordinary course of business; (vi) made any accrual or arrangement for or payment of bonuses or special compensation of any kind or any severance or termination pay to any present or former officer or employee; (vii) increased the rate of compensation payable or to become payable by it to any of its officers or directors or any of its salaried employees whose monthly compensation exceed $1,000; or (viii) made any increase in any profit sharing, bonus, deferred compensation, insurance, pension, retirement, or other employee benefit plan, payment, or arrangement, made to, for or with its officers, directors, or employees;

(c) The COMPANY has not (i) granted or agreed to grant any options, warrants, or other rights for its stock, bonds, or other corporate securities calling for the issuance thereof; (ii) borrowed or agreed to borrow any funds or incurred, or become subject to, any material obligation or liability (absolute or contingent) except liabilities incurred in the ordinary course of business; (iii) paid or agreed to pay any material obligations or liabilities (absolute or contingent) other than current liabilities reflected in or shown on the most recent the COMPANY balance sheet and current liabilities incurred since that date in the ordinary course of business and professional and other fees and expenses in connection with the preparation of this Agreement and the consummation of the transaction contemplated hereby; (iv) sold or transferred, or agreed to sell or transfer, any of its assets, properties, or rights (except assets, properties, or rights not used or useful in its business which, in the aggregate have a value of less than $1,000), or canceled, or agreed to cancel, any debts or claims (except debts or claims which in the aggregate are of a value less than $1,000); (v) made or permitted any amendment or termination of any contract, agreement, or license to which it is a party if such amendment or termination is material, considering the business of the COMPANY; or (vi) issued, delivered or agreed to issue or deliver, any stock, bonds or other corporate securities including debentures (whether authorized and unissued or held as treasury stock), except in connection with this Agreement; and

| 10 |

(d) to its knowledge, the COMPANY has not become subject to any law or regulation which materially and adversely affects, or in the future, may adversely affect, the business, operations, properties, assets or condition of the COMPANY.

Section 2.07 Litigation and Proceedings. There are no actions, suits, proceedings or investigations pending or, to the knowledge of the COMPANY after reasonable investigation, threatened by or against the COMPANY or affecting the COMPANY or its properties, at law or in equity, before any court or other governmental agency or instrumentality, domestic or foreign, or before any arbitrator of any kind except as disclosed in the COMPANY Schedules. The COMPANY has no knowledge of any default on its part with respect to any judgment, order, writ, injunction, decree, award, rule or regulation of any court, arbitrator, or governmental agency or instrumentality or any circumstance which after reasonable investigation would result in the discovery of such default.

Section 2.08 Contracts.

(a) The COMPANY is not a party to, and its assets, products, technology and properties are not bound by, any leases, contract, franchise, license agreement, agreement, debt instrument, obligation, arrangement, understanding or other commitments whether such agreement is in writing or oral (“Contracts”).

(b) The COMPANY is not a party to or bound by, and the properties of the COMPANY are not subject to any Contract, agreement, other commitment or instrument; any charter or other corporate restriction; or any judgment, order, writ, injunction, decree, or award; and

(c) The COMPANY is not a party to any oral or written (i) contract for the employment of any officer or employee; (ii) profit sharing, bonus, deferred compensation, stock option, severance pay, pension benefit or retirement plan, (iii) agreement, contract, or indenture relating to the borrowing of money, (iv) guaranty of any obligation, (vi) collective bargaining agreement; or (vii) agreement with any present or former officer or director of the COMPANY.

Section 2.09 No Conflict With Other Instruments. The execution of this Agreement and the consummation of the transactions contemplated by this Agreement will not result in the breach of any term or provision of, constitute a default under, or terminate, accelerate or modify the terms of, any indenture, mortgage, deed of trust, or other material agreement or instrument to which the COMPANY is a party or to which any of its assets, properties or operations are subject.

Section 2.10 Compliance With Laws and Regulations. The COMPANY has complied with all United States federal, state or local or any applicable foreign statute, law, rule, regulation, ordinance, code, order, judgment, decree or any other applicable requirement or rule of law (a “Law”) applicable to the COMPANY and the operation of its business. This compliance includes, but is not limited to, the filing of all reports to date with federal and state securities authorities.

Section 2.11 Approval of Agreement. The Board of Directors of the COMPANY has authorized the execution and delivery of this Agreement by the COMPANY and has approved this Agreement and the transactions contemplated hereby.

| 11 |

Section 2.12 The COMPANY Schedules. COMPANY has delivered to HTG the following schedules, which are collectively referred to as the “COMPANY Schedules” and which consist of separate schedules dated as of the date of execution of this Agreement:

(a) a schedule containing complete and correct copies of the Certificate of Incorporation and Bylaws of the Company, as in effect as of the date of this Agreement (attached hereto as Schedule 2.01);

(b) a schedule setting forth any information, together with any required copies of documents, required to be disclosed in the COMPANY Schedules by Sections 2.01 through 2.11.

COMPANY shall cause the COMPANY Schedules and the instruments and data delivered to HTG hereunder to be promptly updated after the date hereof up to and including the Closing Date.

Section 2.13 Valid Obligation. This Agreement and all agreements and other documents executed by the COMPANY in connection herewith constitute the valid and binding obligation of the COMPANY, enforceable in accordance with its or their terms, except as may be limited by bankruptcy, insolvency, moratorium or other similar laws affecting the enforcement of creditors’ rights generally and subject to the qualification that the availability of equitable remedies is subject to the discretion of the court before which any proceeding therefore may be brought.

ARTICLE III

SHARE EXCHANGE

Section 3.01 The Exchange. On the terms and subject to the conditions set forth in this Agreement, on the Closing Date (as defined in Section 3.02), the HTG Shareholders listed in Composite Exhibit A, representing an aggregate of at least 19,750 and up to 22,025 shares of HTG’s ordinary shares (“HTG Ordinary Shares”) (representing at least 89% and up to 100% of HTG’s issued and outstanding ordinary shares), upon their agreement, shall sell, assign, transfer and deliver to the COMPANY, free and clear of all liens, pledges, encumbrances, charges, restrictions or known claims of any kind, nature, or description, all of the shares of HTG held by them as set forth on Composite Exhibit A; the objective of such purchase (the “Exchange”) being the acquisition by the COMPANY of at least approximately 89% and up to 100% of the issued and outstanding ordinary shares of HTG. In exchange for the transfer of such securities to the COMPANY by the HTG Shareholders as set forth on Composite Exhibit A, the COMPANY shall deliver to each such HTG Shareholder 1,898.7343473325766 shares (the “Exchange Shares”) of the COMPANY’s common stock (“COMPANY Common Stock”) for each share of their HTG Ordinary Shares (an aggregate of at least 37,500,000 and up to 41,819,624 shares of the COMPANY Common Stock). After the Exchange and other transactions set forth herein have been completed, the HTG Shareholders (who also include Sing Wei Lung, the founder of COMPANY, who currently holds 100 shares of the COMPANY Common Stock prior to the Exchange) will own at least 37,500,100 and 41,819,724 restricted shares of COMPANY Common Stock or approximately 100% of the total outstanding shares of COMPANY Common Stock. Upon completion of the issuance of at least 37,500,000 and up to 41,819,624 shares of the COMPANY Common Stock to HTG Shareholders, there will be a total of at least 37,500,100 and up to 41,819,724 shares of the COMPANY Common Stock issued and outstanding. The Exchange Shares are hereinafter referred to as the “Exchange Consideration” or the “Securities”. At the Closing, the HTG Shareholders shall, on surrender of their certificates representing their HTG Ordinary Shares to the COMPANY or its registrar or transfer agent, be entitled to receive a certificate or certificates evidencing their ownership of the Exchange Shares.

Section 3.02 Closing. The closing (“Initial Closing”) of the transactions contemplated by this Agreement shall occur following completion of the conditions set forth in Articles V and VI, and upon delivery of the Exchange Consideration as described in Section 3.01 herein. The Initial Closing shall take place at a mutually agreeable time and place and is anticipated to close by no later than June 7, 2016, but in no event before this Agreement has been signed by HTG Shareholders holding at least 89% of the ordinary shares of HTG outstanding (the “Initial Closing Date”). Subsequent to the Initial Closing Date, the COMPANY may complete one or more additional Closings to complete the exchanges provided for in this Agreement to allow the COMPANY to complete the acquisition of up to 100% of the HTG Ordinary Shares for a period of up to 14 days after the Initial Closing Date (but no later than June 21, 2016). Each closing that occurs after the Initial Closing Date, along with the Initial Closing shall be collectively be referred to as the “Closing” or “Closing Date”.

| 12 |

Section 3.03 Closing Events. At the Closing, the COMPANY, HTG and HTG Shareholders shall execute, acknowledge, and deliver (or shall ensure to be executed, acknowledged, and delivered), any and all certificates, opinions, financial statements, schedules, agreements, resolutions, rulings or other instruments required by this Agreement to be so delivered at or prior to the Closing, together with such other items as may be reasonably requested by the parties hereto and their respective legal counsel in order to effectuate or evidence the transactions contemplated hereby.

Section 3.04 Termination. This Agreement may be terminated by the COMPANY or HTG Shareholders who hold a majority of the issued and outstanding Ordinary Shares of HTG only (a) in the event that HTG or the COMPANY do not meet the conditions precedent set forth in Articles V and VI or (b) if the Initial Closing has not occurred by June 7, 2016. If this Agreement is terminated pursuant to this section, this Agreement shall be of no further force or effect as to any party hereto, and no obligation, right or liability shall arise hereunder.

ARTICLE IV

SPECIAL COVENANTS

Section 4.01 Access to Properties and Records. The COMPANY and HTG will each afford to the officers and authorized representatives of the other full access to the properties, books and records of the COMPANY or HTG, as the case may be, in order that each may have a full opportunity to make such reasonable investigation as it shall desire to make of the affairs of the other, and each will furnish the other with such additional financial and operating data and other information as to the business and properties of the COMPANY or HTG, as the case may be, as the other shall from time to time reasonably request.

Section 4.02 Delivery of Books and Records. At the Closing, HTG shall deliver to the COMPANY, the originals of the corporate minute books, books of account, contracts, records, and all other books or documents of HTG now in the possession of HTG or its representatives.

Section 4.03 Third Party Consents and Certificates. The COMPANY and HTG agree to cooperate with each other in order to obtain any required third party consents to this Agreement and the transactions herein contemplated.

Section 4.04 Covenant to Observe Terms of Investor Agreements between HTG and HTG Shareholders. COMPANY covenants to observe, perform and be bound by all the terms of the Investor Agreements between HTG and the HTG Shareholders from whom the COMPANY is acquiring HTG Ordinary Shares.

Section 4.05 Actions Prior to Closing. From and after the date hereof until the Closing Date and except as set forth in the COMPANY Schedules, if any, or HTG Schedules or as permitted or contemplated by this Agreement, the COMPANY (subject to paragraph (d) below) and HTG, respectively, will each:

(a) carry on its business in substantially the same manner as it has heretofore;

(b) maintain and keep its properties in states of good repair and condition as at present, except for depreciation due to ordinary wear and tear and damage due to casualty;

(c) maintain in full force and effect insurance comparable in amount and in scope of coverage to that now maintained by it;

| 13 |

(d) perform in all material respects all of its obligations under material contracts, leases, and instruments relating to or affecting its assets, properties, and business;

(e) use its best efforts to maintain and preserve its business organization intact, to retain its key employees, and to maintain its relationship with its material suppliers and customers; and

(f) fully comply with and perform in all material respects all obligations and duties imposed on it by all federal and state laws (including without limitation, the federal securities laws) and all rules, regulations, and orders imposed by federal or state governmental authorities.

(g) from and after the date hereof until the Closing Date, except as required by this agreement neither the COMPANY nor HTG will:

(i) make any changes in their charter documents, except as contemplated by this Agreement;

(ii) take any action described in Section 1.08 in the case of HTG or in Section 2.06, in the case of the COMPANY (all except as permitted therein or as disclosed in the applicable party’s schedules);

(iii) enter into or amend any contract, agreement, or other instrument of any of the types described in such party’s schedules, except that a party may enter into or amend any contract, agreement, or other instrument in the ordinary course of business involving the sale of goods or services; or

(iv) sell any assets or discontinue any operations, sell any shares of capital stock or conduct any similar transactions other than in the ordinary course of business.

ARTICLE V

CONDITIONS PRECEDENT TO OBLIGATIONS OF THE COMPANY

The obligations of the COMPANY under this Agreement are subject to the satisfaction (or waiver by the Company), at or before the Closing Date, of the following conditions:

Section 5.01 Accuracy of Representations and Performance of Covenants. The representations and warranties made by HTG and the HTG Shareholders in this Agreement were true when made and shall be true at the Closing Date with the same force and effect as if such representations and warranties were made at and as of the Closing Date (except for changes therein permitted by this Agreement). HTG shall have performed or complied with all covenants and conditions required by this Agreement to be performed or complied with by HTG prior to or at the Closing.

Section 5.02 No Governmental Prohibition. No order, statute, rule, regulation, executive order, injunction, stay, decree, judgment or restraining order shall have been enacted, entered, promulgated or enforced by any court or governmental or regulatory authority or instrumentality which prohibits the consummation of the transactions contemplated hereby.

Section 5.03 Approval by HTG’s Board of Directors and HTG Shareholders. HTG's board of directors and HTG Shareholders, shall have approved the Exchange.

Section 5.04 Minimum HTG Shareholders. This Agreement shall have been signed by the holders of not less than 89% of the issued and outstanding HTG Ordinary Shares, unless a lesser number is agreed to by the Company.

Section 5.05 Consents. All consents, approvals, waivers or amendments pursuant to all contracts, licenses, permits, trademarks and other intangibles in connection with the transactions contemplated herein, or for the continued operation of HTG after the Closing Date on the basis as presently operated shall have been obtained.

| 14 |

ARTICLE VI

CONDITIONS PRECEDENT TO OBLIGATIONS OF HTG

AND THE HTG SHAREHOLDERS

The obligations of HTG and each of the HTG Shareholders under this Agreement are subject to the satisfaction of the COMPANY, (or waiver by HTG or HTG Shareholders, as the case may be), at or before the Closing Date, of the following conditions:

Section 6.01 Accuracy of Representations and Performance of Covenants. The representations and warranties made by the COMPANY in this Agreement were true when made and shall be true as of the Closing Date (except for changes therein permitted by this Agreement) with the same force and effect as if such representations and warranties were made at and as of the Closing Date. Additionally, the COMPANY shall have performed and complied with all covenants and conditions required by this Agreement to be performed or complied with by the COMPANY.

Section 6.02 No Governmental Prohibition. No order, statute, rule, regulation, executive order, injunction, stay, decree, judgment or restraining order shall have been enacted, entered, promulgated or enforced by any court or governmental or regulatory authority or instrumentality which prohibits the consummation of the transactions contemplated hereby.

Section 6.03 Approval by the COMPANY Board of Directors. The COMPANY’s board of directors shall have approved the Exchange.

Section 6.04 Consents. All consents, approvals, waivers or amendments pursuant to all contracts, licenses, permits, trademarks and other intangibles in connection with the transactions contemplated herein, or for the continued operation of the COMPANY after the Closing Date on the basis as presently operated.

ARTICLE VII

COVENANTS AFTER CLOSING

Section 7.01 Acquisition of Spa Eternity Pte. Ltd. By October 15, 2016 (subject to extension at the sole discretion of SING WEI LUNG in order to obtain sufficient funding), COMPANY shall acquire 100% of the issued and outstanding ordinary shares of SPA ETERNITY PTE. LTD. from SING WEI LUNG (who holds 100,050 shares) and HONGBO HUANG (who holds 50 shares) in exchange for (i) an aggregate of $400,000 (Singaporean Dollars) paid by the COMPANY to SING WEI LUNG (approximately $399,800 (Singaporean Dollars)) and HONGBO HUANG (approximately $200 (Singaporean Dollars)), provided that the COMPANY raised sufficient funds from investors to fund such acquisition and (ii) the COMPANY’s assumption of any and all indebtedness of SING WEI LUNG to SPA ETERINTY PTE. LTD. outstanding as of the date of the acquisition of SPA ETERNITY PTE. LTD. (which is currently (as of May 31, 2016) approximately $1,600,000 (Singaporean Dollars), subject to increase as more indebtedness may be accrued prior to the date of closing the acquisition of SPA ETERNITY PTE. LTD.).

Section 7.02 Compensation of SING WEI LUNG. SING WEI LUNG shall be paid by the COMPANY as compensation for his services as Chief Executive Officer of the COMPANY:

(a) a monthly salary (up to $25,000 (Singaporean Dollars) per month) equal to five percent (5%) of monthly sales of the COMPANY (which includes the monthly sales of all of the subsidiaries of the Company); provided, however, no compensation will be paid for a month in which such month's sales of the COMPANY were less than $410,000 (Singaporean Dollars); and

| 15 |

(b) a year-end bonus of 3.5% of annual sales of the COMPANY so long as a minimum of $5,000,000 (Singaporean dollars) annual sales (which includes the monthly sales of all of the subsidiaries of the Company) have been achieved; provided, however, the total compensation of monthly salary and bonus shall not exceed $500,000 (Singaporean Dollars).

Future increases (but not decreases) in the compensation of SING WEI LUNG as Chief Executive Officer shall be decided by a compensation committee of the COMPANY (with SING WEI LUNG abstaining from voting on any such increase in his compensation as Chief Executive Officer).

The foregoing terms of compensation shall not apply if SING WEI LUNG resigns from, is removed from or changes to a different officer position from his position as Chief Executive Officer (where he is no longer the Chief Executive Officer) of the COMPANY. The terms of compensation of SING WEI LUNG shall be subject to renegotiation where SING WEI LUNG changes to a different officer position from his position as Chief Executive Officer (where he is no longer the Chief Executive Officer) of the COMPANY.

ARTICLE VIII

MISCELLANEOUS

Section 8.01 Brokers. The COMPANY and HTG agree that there were no finders or brokers involved in bringing the parties together or who were instrumental in the negotiation, execution or consummation of this Agreement. The COMPANY and HTG each agree to indemnify the other against any claim by any third person other than those described above for any commission, brokerage, or finder’s fee arising from the transactions contemplated hereby based on any alleged agreement or understanding between the indemnifying party and such third person, whether express or implied from the actions of the indemnifying party.

Section 8.02 Governing Law. This Agreement shall be governed by, enforced, and construed under and in accordance with the laws of the State of Delaware, without giving effect to the principles of conflicts of law thereunder. Each of the parties (a) irrevocably consents and agrees that any legal or equitable action or proceedings arising under or in connection with this Agreement shall be brought exclusively in the state or federal courts of the United States with jurisdiction in Palm Beach County, Florida. By execution and delivery of this Agreement, each party hereto irrevocably submits to and accepts, with respect to any such action or proceeding, generally and unconditionally, the jurisdiction of the aforesaid courts, and irrevocably waives any and all rights such party may now or hereafter have to object to such jurisdiction.

Section 8.03 Notices. Any notice or other communications required or permitted hereunder shall be in writing and shall be sufficiently given if personally delivered to it or sent by telecopy, overnight courier or registered mail or certified mail, postage prepaid, addressed as follows:

If to HTG, to:

Healing Touch Global Pte. Ltd. Attn: Sing Wei Lung, Director 140 Paya Lebar Road, AZ Building #09-26 Singapore 409015 | If to the COMPANY, to:

It’s Divine, Inc. Attn: Sing Wei Lung, Chief Executive Officer 140 Paya Lebar Road, AZ Building #09-26 Singapore 409015 |

or such other addresses as shall be furnished in writing by any party in the manner for giving notices hereunder, and any such notice or communication shall be deemed to have been given (i) upon receipt, if personally delivered, (ii) on the day after dispatch, if sent by overnight courier, (iii) upon dispatch, if transmitted by telecopy and receipt is confirmed by telephone and (iv) three (3) days after mailing, if sent by registered or certified mail.

| 16 |

Section 8.04 Attorney’s Fees. In the event that either party institutes any action or suit to enforce this Agreement or to secure relief from any default hereunder or breach hereof, the prevailing party shall be reimbursed by the losing party for all costs, including reasonable attorney’s fees, incurred in connection therewith and in enforcing or collecting any judgment rendered therein.

Section 8.05 Confidentiality. Each party hereto agrees with the other that, unless and until the transactions contemplated by this Agreement have been consummated, it and its representatives will hold in strict confidence all data and information obtained with respect to another party or any subsidiary thereof from any representative, officer, director or employee, or from any books or records or from personal inspection, of such other party, and shall not use such data or information or disclose the same to others, except (i) to the extent such data or information is published, is a matter of public knowledge, or is required by law to be published; or (ii) to the extent that such data or information must be used or disclosed in order to consummate the transactions contemplated by this Agreement. In the event of the termination of this Agreement, each party shall return to the other party all documents and other materials obtained by it or on its behalf and shall destroy all copies, digests, work papers, abstracts or other materials relating thereto, and each party will continue to comply with the confidentiality provisions set forth herein.

Section 8.06 Public Announcements and Filings. Unless required by applicable law or regulatory authority, none of the parties will issue any report, statement or press release to the general public, to the trade, to the general trade or trade press, or to any third party (other than its advisors and representatives in connection with the transactions contemplated hereby) or file any document, relating to this Agreement and the transactions contemplated hereby, except as may be mutually agreed by the parties. Copies of any such filings, public announcements or disclosures, including any announcements or disclosures mandated by law or regulatory authorities, shall be delivered to each party at least one (1) business day prior to the release thereof.

Section 8.07 Schedules; Knowledge. Each party is presumed to have full knowledge of all information set forth in the other party’s schedules delivered pursuant to this Agreement.

Section 8.08 Third Party Beneficiaries. This contract is strictly between the COMPANY, HTG and HTG Shareholders and, except as specifically provided, no director, officer, stockholder (other than the HTG Shareholders), employee, agent, independent contractor or any other person or entity shall be deemed to be a third party beneficiary of this Agreement.

Section 8.09 Expenses. Subject to Section 8.04 above, whether or not the Exchange is consummated, each of the COMPANY and HTG will bear their own respective expenses, including legal, accounting and professional fees, incurred in connection with the Exchange or any of the other transactions contemplated hereby.

Section 8.10 Entire Agreement. This Agreement represents the entire agreement between the parties relating to the subject matter thereof and supersedes all prior agreements, understandings and negotiations, written or oral, with respect to such subject matter.

Section 8.11 Survival; Termination. The representations, warranties, and covenants of the respective parties shall survive the Closing Date and the consummation of the transactions herein contemplated for a period of two years.

Section 8.12 Counterparts. This Agreement may be executed in multiple counterparts, each of which shall be deemed an original and all of which taken together shall be but a single instrument. The execution and delivery of a facsimile or other electronic transmission of a signature to this agreement shall constitute delivery of an executed original and shall be binding upon the person whose signature appears on the transmitted copy.

| 17 |

Section 8.13 Amendment or Waiver. Every right and remedy provided herein shall be cumulative with every other right and remedy, whether conferred herein, at law, or in equity, and may be enforced concurrently herewith, and no waiver by any party of the performance of any obligation by the other shall be construed as a waiver of the same or any other default then, theretofore, or thereafter occurring or existing. At any time prior to the Closing Date, this Agreement may be amended, modified, superseded, terminated or cancelled, and any of the terms, covenants, representations, warranties or conditions hereof may be waived, only by a written instrument executed by the parties hereto. For purposes of this Agreement, each of the HTG Shareholders hereby appoint SING WEI LUNG as his, her or its agent and attorney-in-fact to make and execute and any all such amendments, modifications, supplements, termination and waivers and hereby acknowledge and agree that a decision by SING WEI LUNG shall be final, binding and conclusive on such HTG Shareholders, as the case may be, and that the other parties may rely upon any act, decision, consent or instruction of SING WEI LUNG.

Section 8.14 Best Efforts. Subject to the terms and conditions herein provided, each party of HTG and the COMPANY shall use its best efforts to perform or fulfill all conditions and obligations to be performed or fulfilled by it under this Agreement so that the transactions contemplated hereby shall be consummated as soon as practicable. Each party of HTG and the COMPANY also agrees that it shall use its best efforts to take, or cause to be taken, all actions and to do, or cause to be done, all things necessary, proper or advisable under applicable laws and regulations to consummate and make effective this Agreement and the transactions contemplated herein.

[Signatures on Following Page]

| 18 |

IN WITNESS WHEREOF, the corporate parties hereto have caused this Agreement to be executed by their respective officers, hereunto duly authorized, as of the date first-above written.

IT’S DIVINE, INC. A Delaware corporation | |||

| By: | /s/ Sing Wei Lung | ||

| Name: | Sing Wei Lung | |

| Title: | Chief Executive Officer | ||

| HEALING TOUCH GLOBAL PTE. LTD A Singaporean corporation |

| |

|

|

|

|

| By: | /s/ Sing Wei Lung |

|

| Name: | Sing Wei Lung |

|

| Title: | Director |

|

| 19 |

COMPOSITE

EXHIBIT A

HEALING TOUCH GLOBAL PTE. LTD. SHAREHOLDERS SIGNATURE PAGE

| HTG Shareholder Name |

| No. Shares of HTG Ordinary Shares |

|

| % of HTG Ordinary Shares |

|

| No. Shares of the Company’s Common Stock Exchanged |

|

| % of Company’s Outstanding Shares (Assuming 100% HTG Shareholders Exchange) |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1. |

| /S/ SING WEI LUNG |

|

| 19,750 |

|

|

| 89.6708 | % |

|

| 37,500,000 |

|

|

| 89.6708 | % |

|

| SING WEI LUNG

104 PEMIMPIN TERRACE CORAL PARK SINGAPORE (575989) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2. |

| /S/ LIM HUAT AW |

|

| 125 |

|

|

| 0.5675 | % |

|

| 237,342 |

|

|

| 0.5675 | % |

|

| LIM HUAT AW

73 LORONG K TELOK KURAU #01-04 HEJI GARDENS SINGAPORE (425692) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3. |

| /S/ CHIAN HWA LEW |

|

| 125 |

|

|

| 0.5675 | % |

|

| 237,342 |

|

|

| 0.5675 | % |

|

| CHIAN HWA LEW

209A PUNGGOL PLACE #13-1280 PUNGGOL CREST SINGAPORE (821209) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 4. |

| /S/ PHEN LUAN KHWA |

|

| 75 |

|

|

| 0.3405 | % |

|

| 142,405 |

|

|

| 0.3405 | % |

|

| PHEN LUAN KHWA

c/o KATE KHWA 635 CHOA CHU KANG NORTH 6 #10-281 SINGAPORE (680635) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 5. |

| /S/ LEE THONG GERALDINE HO |

|

| 125 |

|

|

| 0.5675 | % |

|

| 237,342 |

|

|

| 0.5675 | % |

|

| LEE THONG GERALDINE HO

34 TELOK BLANGAH WAY #08-1074 SINGAPORE (090034) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 20 |

| 6. |

| /S/ KIA HAI LOW |

|

| 125 |

|

|

| 0.5675 | % |

|

| 237,342 |

|

|

| 0.5675 | % |

|

| KIA HAI LOW

170 LENTOR LOOP #02-01 BULLION PARK SINGAPORE (789099) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 7. |

| /S/ CHENG ANN CHANG |

|

| 250 |

|

|

| 1.1351 | % |

|

| 474,684 |

|

|

| 1.1351 | % |

|

| CHENG ANN CHANG

332 UBI AVENUE 1 #01-757 SINGAPORE (400332) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 8. |

| /S/ SEE WENG WONG |

|

| 125 |

|

|

| 0.5675 | % |

|

| 237,342 |

|

|

| 0.5675 | % |

|

| SEE WENG WONG

No 9 Pinggir Bukit Segar, TMN BKT Segar, 56100 Cheras, Kuala Lumpur, Malaysia |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 9. |

| /S/ LEE FENG WONG |

|

| 125 |

|

|

| 0.5675 | % |

|

| 237,342 |

|

|

| 0.5675 | % |

|

| LEE FENG WONG

531 PASIR RIS DRIVE 1 #01-304 SINGAPORE (510531) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 10. |

| /S/ SI SI HELEN TAN |

|

| 125 |

|

|

| 0.5675 | % |

|

| 237,342 |

|

|

| 0.5675 | % |

|

| SI SI HELEN TAN

781 UPPER CHANGI ROAD EAST #06-06 SUNHAVEN SINGAPORE (486069) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 11. |

| /S/ HONGBO HUANG |

|

| 250 |

|

|

| 1.1351 | % |

|

| 474,684 |

|

|

| 1.1351 | % |

|

| HONGBO HUANG

104 PEMIMPIN TERRACE CORAL PARK SINGAPORE (575989) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 21 |

| 12. |

| /S/ GHEE KWAN TEY |

|

| 125 |

|

|

| 0.5675 | % |

|

| 237,342 |

|

|

| 0.5675 | % |

|

| GHEE KWAN TEY

206C COMPASSVALE LANE #06-99 SINGAPORE (543206) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 13. |

| /S/ HIANG KIAT ALVIN TAN |

|

| 250 |

|

|

| 1.1351 | % |

|

| 474,684 |

|

|

| 1.1351 | % |

|

| HIANG KIAT ALVIN TAN

88 CORPORATION ROAD #12-16 LAKEHOLMZ SINGAPORE (649823) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 14. |

| /S/ HAN WEI LEONARD TAN |

|

| 200 |

|

|

| 0.9081 |

|

|

| 379,747 |

|

|

| 0.9081 |

|

|

| HAN WEI LEONARD TAN

418 FAJAR ROAD #10-429 SINGAPORE (670418) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 15. |

| /S/ CHENG HAO TONG |

|

| 125 |

|

|

| 0.5675 | % |

|

| 237,342 |

|

|

| 0.5675 | % |

|

| CHENG HAO TONG

c/o ZHI XIAN TONG 46 JALAN IKAN MERAH THOMSON PARK SINGAPORE (578075) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 16. |

| /S/ MARK LEE |

|

| 125 |

|

|

| 0.5675 | % |

|

| 237,342 |

|

|

| 0.5675 | % |

|

| as representative of EMSC HOLDINGS LLP

317 OUTRAM ROAD #01-43 CONCORDE SHOPPING CENTRE SINGAPORE (169075) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL: |

|

| 22,025 |

|

|

| 100 | %* |

|

| 41,819,624 |

|

| 100 | %** |

* | 22,025 of 22,025 shares of issued and outstanding common stock of Healing Touch Global Pte. Ltd.. |

** | 41,819,624 of 41,819,724 shares of issued and outstanding common stock of It’s Divine, Inc. |

[Shareholder Signature Page Counterpart]

| 22 |

EXHIBIT B

Non-U.S. Person Certificate

June 16, 2016

It’s Divine, Inc.

c/o Laura E. Anthony, Esq.

Legal & Compliance, LLC

330 Clematis Street, Suite 217

West Palm Beach, FL 33401

Defined terms used but not defined herein shall have the meaning ascribed to such terms in the Share Exchange Agreement (the “Share Agreement”) dated May 31, 2016, among It’s Divine, Inc., a Delaware corporation (the “Company”), Healing Touch Global Pte. Ltd., a Singaporean corporation (“HTG”), and the shareholders of HTG (“HTG Shareholders”) set forth on Composite Exhibit A thereto, whereby HTG Shareholders are acquiring shares of the Company’s common stock (the “Shares”).

1. Each of the undersigned HTG Shareholders hereby represents, warrants and certifies that:

(a) It is not a “U.S. Person” (as such term is defined by Rule 902 of Regulation S under the U.S. Securities Act) and is not acquiring the Shares, directly or indirectly, for the account or benefit of any U.S. person.

Rule 902 under the U.S. Securities Act, defines a “U.S. Person” as:

(A) Any Natural person resident in the United States;

(B) Any partnership or corporation organized or incorporated under the laws of the United States;

(C) Any estate of which any executor or administrator is a U.S. Person;

(D) Any trust of which any trustee is a U.S. Person;

(E) Any agency or branch of a foreign entity located in the United States;

(F) Any non-discretionary account or similar account (other than an estate or trust) held by a dealer or other fiduciary for the benefit or account of a U.S. Person;

(G) Any discretionary account or similar account (other than an estate or trust) held by a dealer or other fiduciary organized, incorporated, or (if an individual) resident in the United States; and

(H) Any partnership or corporation if:

(1) Organized or incorporated under the laws of any foreign jurisdiction; and

(2) Formed by a U.S. Person principally for the purpose of investing in securities not registered under the Securities Act, unless it is organized or incorporated, and owned, by accredited investors (as defined in Rule 501(a) under the Securities Act) who are not natural person, estates or trusts.

| 23 |

The following are not “U.S. Persons:

(A) Any discretionary account or similar account (other than an estate or trust) held for the benefit or account of a Non-U.S. Person by a dealer or other professional fiduciary organized, incorporated, or (if an individual) resident in the United States;

(B) Any estate of which any professional fiduciary acting as executor or administrator is a U.S. Person if:

(1) An executor or administrator of the estate who is not a U.S. Person has sole or shared investment discretion with respect to the assets of the estate; and

(2) The estate is governed by foreign law;

(C) Any trust of which any professional fiduciary acting as trustee is a U.S. Person, if a trustee who is not a U.S. Person has sole or shared investment discretion with respect to the trust assets, and no beneficiary of the trust (and no settler if the trust is revocable) is a U.S. Person;

(D) Any employee benefit established and administered in accordance with the law of a country other than the United States and customary practices and documentation of such country;

(E) Any agency or branch of a U.S. person located outside the United States if:

(1) The agency or branch operates for valid business reasons; and

(2) The agency or branch is engaged in the business of insurance or banking and is subject to substantive insurance or banking regulation, respectively, in the jurisdiction where located; and

(F) The International Monetary Fund, the International Bank for Reconstruction and Development, the Inter-American Development Bank, the Asian Development Bank, the African Development Bank, the United Nations, and their agencies, affiliates and pension plans, and any other similar international organizations, their agencies, affiliates and pension plans.

(b) The offer and scale of the Shares was made in an “offshore transaction” (as defined under Regulation S under the U.S. Securities Act), in that:

(i) The undersigned was outside the United States at the time the buy order for such Shares was originated; and

(ii) The offer to sell the Shares was not made to the undersigned in the United States.

(c) The transaction (i) has not been pre-arranged with a purchaser located inside of the United States or is a U.S. Person, and (ii) is not part of a plan or scheme to evade the registration requirements of the U.S. Securities Act.

2. The undersigned hereby covenants that:

(a) During the period prior to one year after the Closing (the “Restricted Period”) it will not engage in hedging transactions with regard to the Shares unless such transactions are made in compliance with the U.S. Securities Act;

(b) If it decides to offer, sell or otherwise transfer any of the Shares, it will not offer, sell or otherwise transfer any of such Shares directly or indirectly, unless:

(i) The sale is to the Company;

| 24 |

(ii) The sale is made outside the United States in a transaction meeting the requirements of Regulation S under the U.S. Securities Act and in compliance with applicable local laws and regulations; provided, however, that during the period prior to the expiration of the Restrictive Period no sale may be made to any U.S. Person or for the account or benefit of the U.S. person (other than a distributor) and all purchasers of such Shares will be required to execute and deliver to the Company a certificate substantially in the form hereof;