Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE DATED NOVEMBER 3, 2016 - AutoWeb, Inc. | ex99-1.htm |

| 8-K - FROM 8-K - AutoWeb, Inc. | abtl8k_nov32016.htm |

EXHIBIT

99.2

AUTOBYTEL

INC.

Moderator:

Sean Mansouri

November

3, 2016

5:00

p.m. ET

Operator:

This

is Conference # 93691416.

Operator:

Good

afternoon, everyone. Thank you for participating in today's

conference call to discuss Autobytel's financial results for the

third quarter ended September 30, 2016.

Joining

us today are Autobytel's President and CEO, Jeff Coats, the

Company's CFO, Kimberly Boren, and the Company's outside Investor

Relations Advisor, Sean Mansouri, with Liolios Group.

Following

their remarks, we'll open the call for your questions.

I

would now like to turn the call over to Mr. Mansouri for some

introductory comments.

Sean Mansouri:

Thank

you, Amber. Before I introduce Jeff, I remind you that during

today's call, including the question-and-answer session, any

projections and forward-looking statements made regarding future

events or Autobytel's future financial performance are covered by

the Safe Harbor statements contained in today's press release, the

slides accompanying this presentation, and the Company's public

filings with the SEC. Actual events may differ materially from

those forward-looking statements.

Specifically,

please refer to the Company's Form 10-Q for the quarter ended

September 30, 2016, which was filed prior to this call, as well as

other filings made by Autobytel with the SEC from time to time.

These filings identify factors that could cause results to differ

materially from those forward-looking statements.

There

are slides included with today's presentation to help illustrate

some of the points being made and discussed during the call. The

slides can be accessed by visiting Autobytel's website at

www.autobytel.com. When there, go to “Investor

Relations” and then click on “Events and

Presentations.”

Please

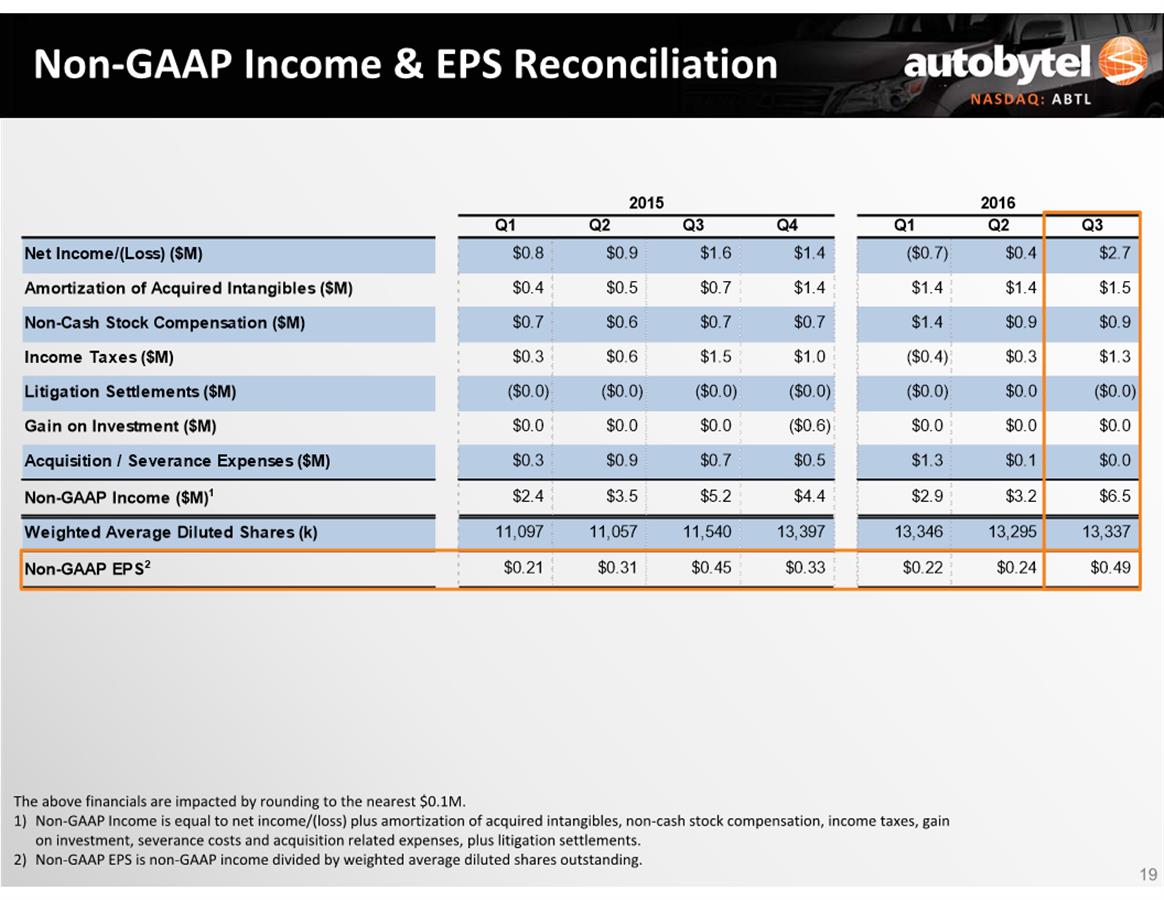

also note that during this call and/or in the accompanying slides,

management will be disclosing non-GAAP income and non-GAAP EPS,

which are non-GAAP financial measures as defined by SEC Regulation

G. Reconciliations of these non-GAAP financial measures to the most

directly comparable GAAP measures are included in today's press

release and/or in the slides, which are posted on the Company's

website.

And

with that, I'll now turn the call over to Jeff.

Jeff Coats:

Thank

you, Sean. Good afternoon, everyone. Thank you for joining us today

to discuss our third-quarter 2016 results. As a reminder to those

of you new to Autobytel, we are a pioneer and the leading provider

of online digital automotive services connecting end market buyers

with our dealer and OEM customers to help them sell more cars and

trucks.

Our

third quarter was highlighted by the strong momentum of our

advertising related click product, which has continued to exceed

our expectation since acquiring AutoWeb in October 2015. For our

new audience, the click product is one that facilitates a visitor

clicking on a web advertisement and being taken to that

advertiser's website. As simple as it may sound,

AutoWeb's click platform allows Autobytel to provide dealers and

OEMs with access to some of the highest intent car shoppers on the

internet.

-1-

At

the end of the quarter, we launched the beta version of our new

lead enhanced product solution on AutoWeb.com. Initial customer

feedback is positive so we will continue to develop similar new

products that will ultimately help our dealer and OEM customers

sell more cars and make the path to purchase easier and more

enjoyable for consumers.

We

also launched a new beta version of our UsedCars.com site. This

revamped website is now fully responsive and mobile friendly. We

are extremely excited about the strength of the UsedCars.com domain

and will continue to invest in it in an effort to make it the

premier used vehicle destination for consumers.

But

before commenting further, I'd like to turn the call over to Kim

and have her take us through the important details of our financial

results. Kim?

Kimberly Boren:

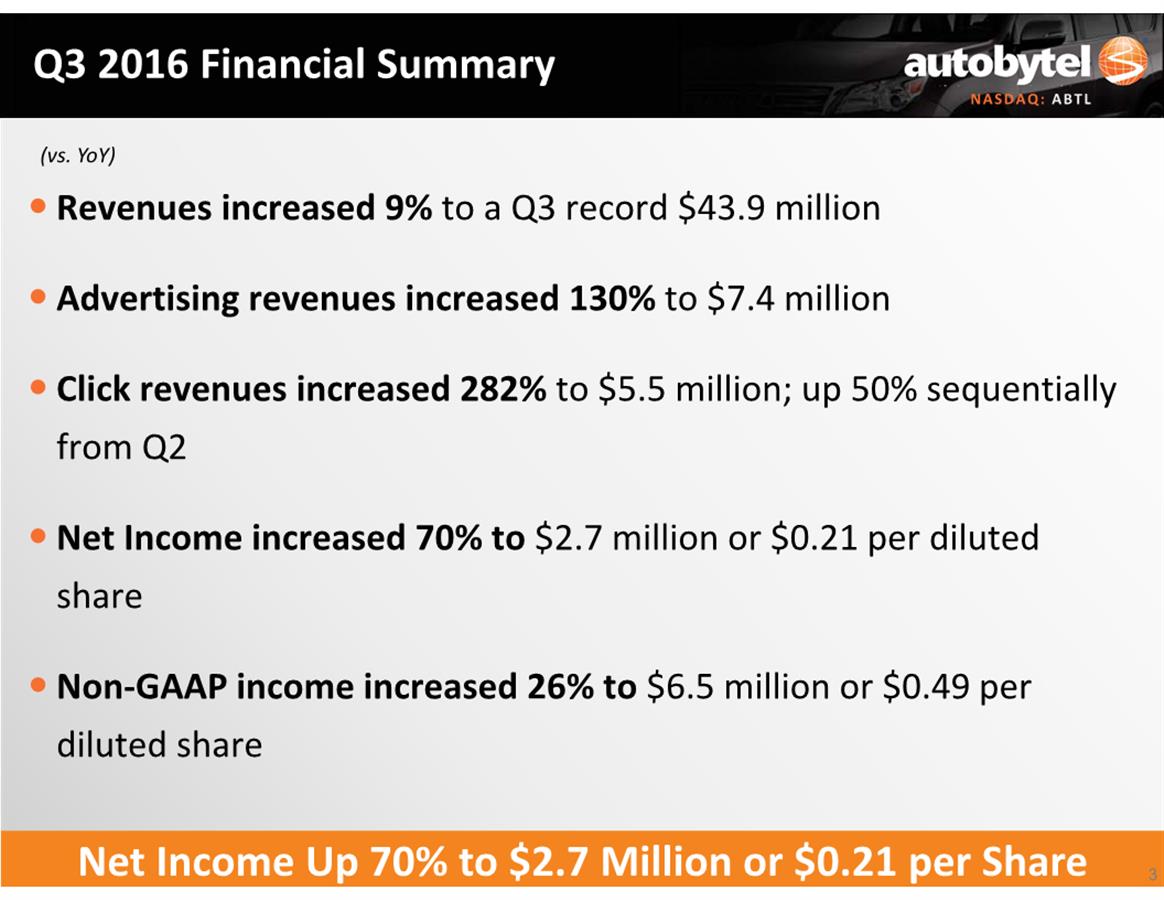

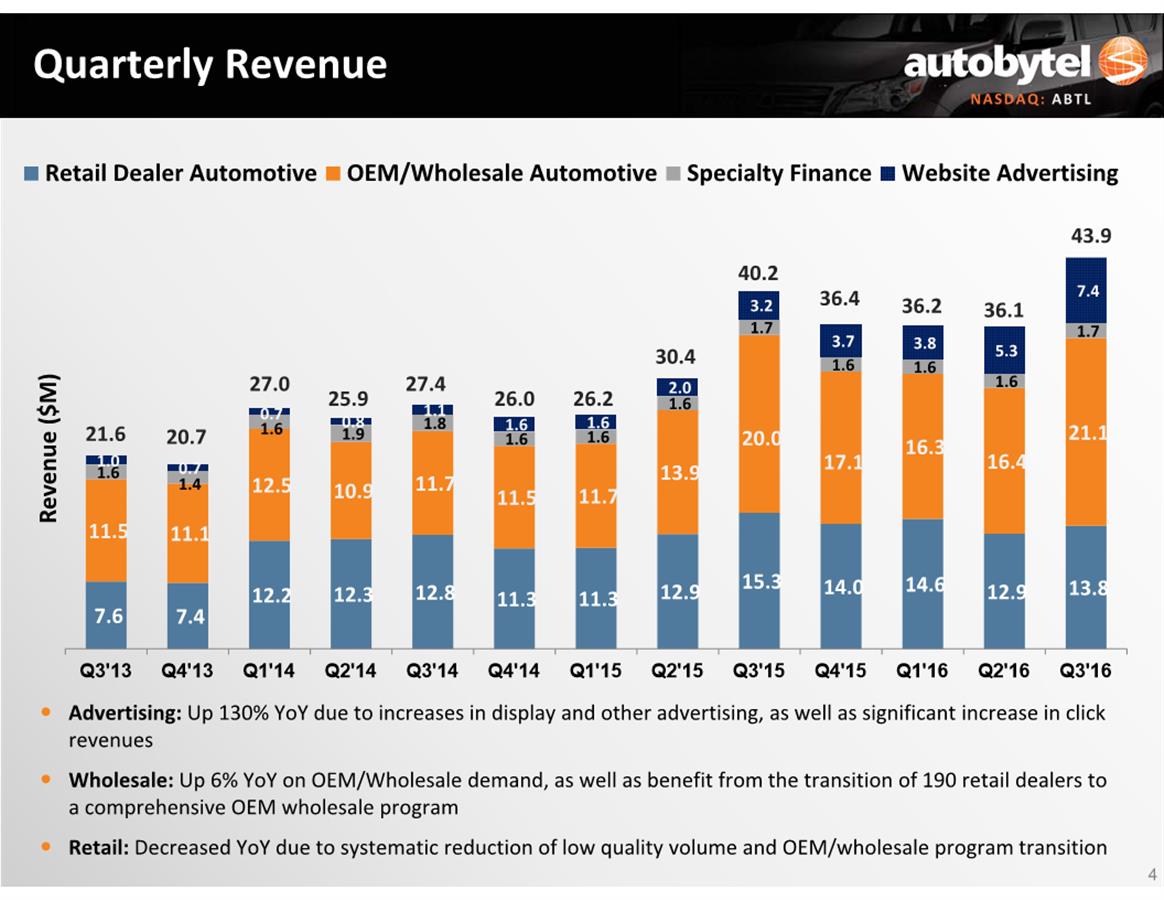

Thanks,

Jeff, and good afternoon, everyone. For those of you following

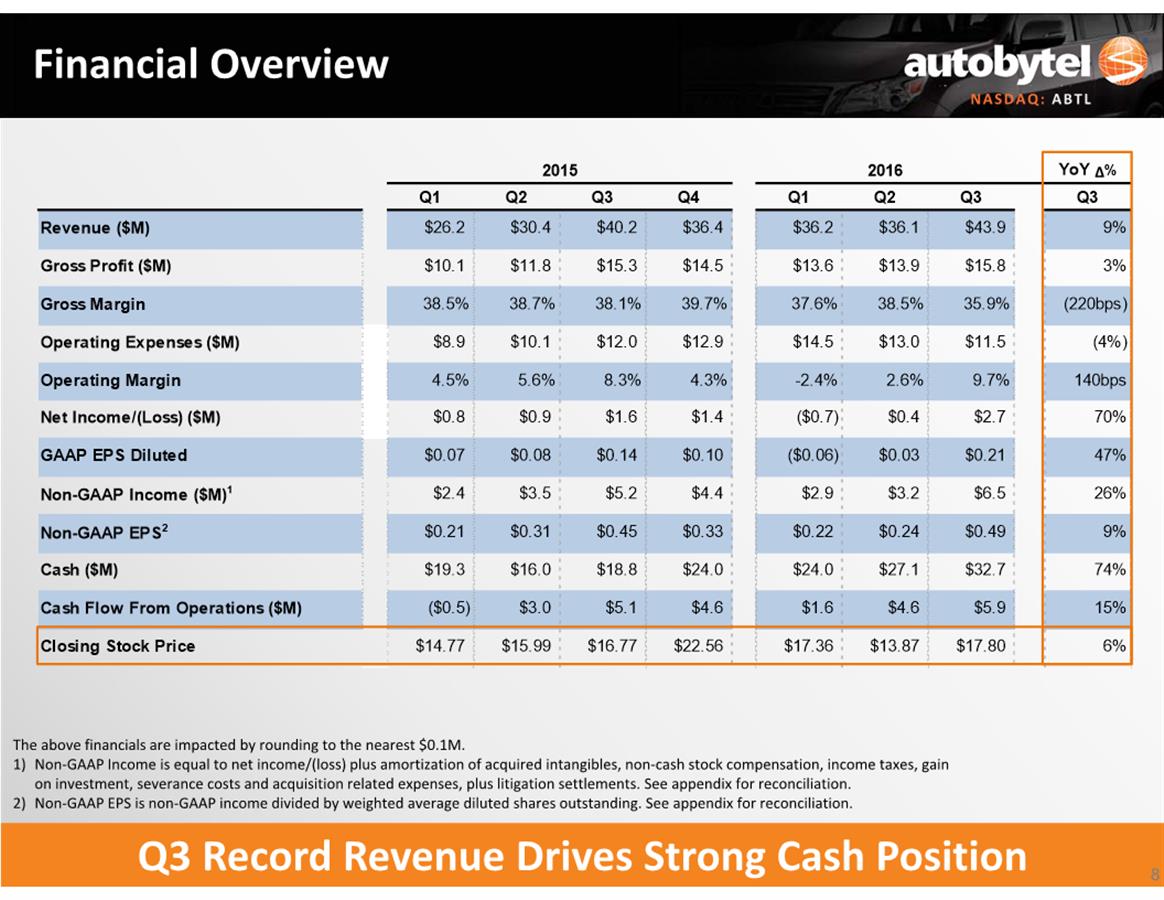

along with our earnings presentation, on slide 4 you can see our

third-quarter revenues increased 9 percent to a Q3 record $43.9

million compared to $40.2 million in the year-ago quarter. The

increase in revenue was driven by growth in continued investment in

our AutoWeb offer as well as the continued expansion of most OEM

programs.

Lead

revenue from automotive dealers (our retail channel) was $13.8

million compared to $15.3 million last year, while lead revenue

from automotive manufacturers and wholesale customers (our

wholesale channel) increased 6 percent to $21.1 million. The

expected decline in retail revenues was driven by the transition of

190 retail dealers into one comprehensive OEM program in the second

quarter of 2016. This transition has proven to be a success as

overall revenues for the program have increased 25

percent.

Additionally,

over the last 12 months, we have systematically reduced lower

quality lead supply which in the short term has impacted both

retail and wholesale revenue. However, longer term, it's providing

positive results. In fact, early indicators such as three and

six-month retail dealer retentions are both up nicely in the most

recent periods. The overall increase in our wholesale channel was

driven by continued strong demand from OEM customers.

Moving

on to advertising, our advertising revenues increased 130 percent

to $7.4 million, compared to $3.2 million in the year-ago quarter.

The increase was both due to growth in display and other

advertising, as well as a significant increase in click

revenues.

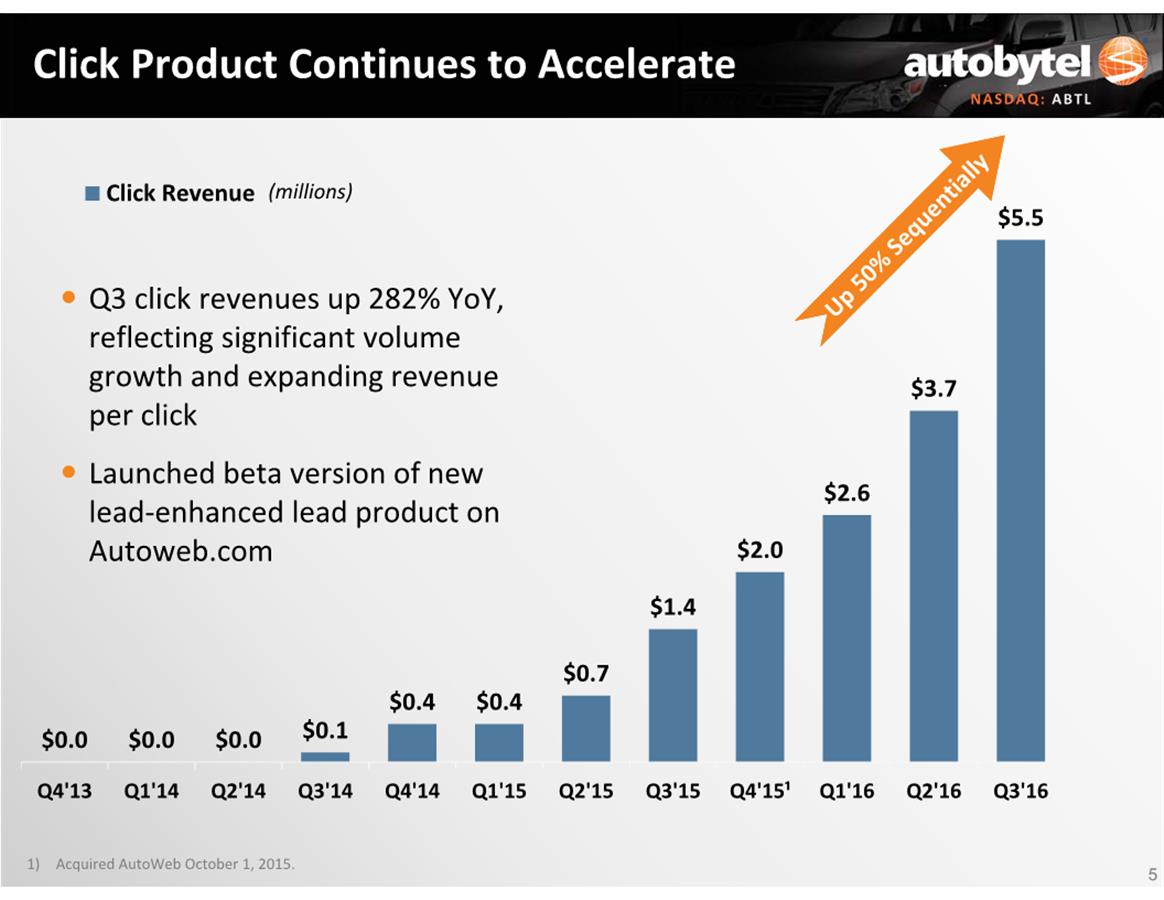

On

slide 5 you'll see click revenues in the third quarter increased

282 percent, to $5.5 million, compared to $1.4 million in the same

period last year. The triple-digit year-over-year increase in click

revenue was driven by continued strong growth in AutoWeb. The

momentum in our click product is further evidenced by the 50

percent sequential increase from Q2.

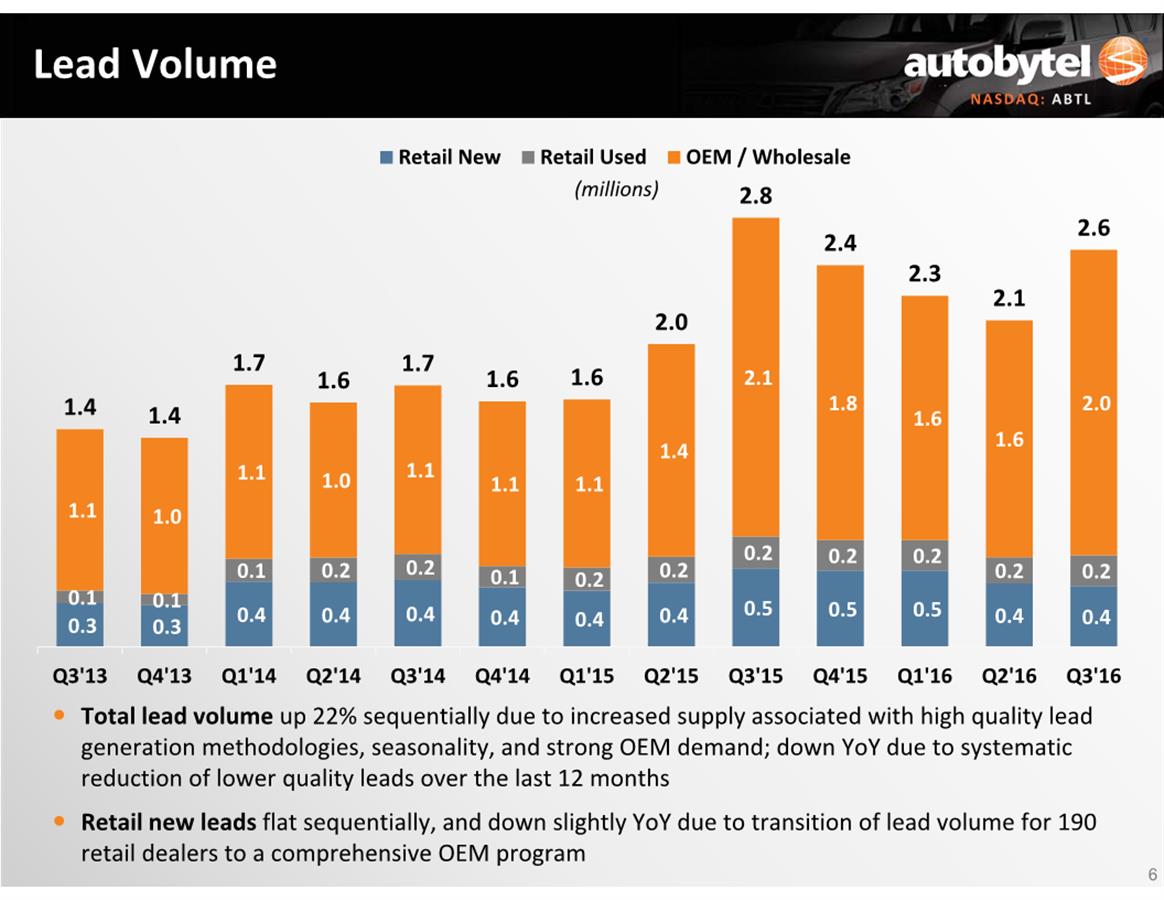

Moving

now to slide 6, you'll see that we delivered approximately 2.6

million automotive leads during the third quarter, compared to 2.8

million last year. Sequentially, lead volume increased 22 percent

as a result of increased lead supply associated with high quality

lead gen methodologies that have begun to replace the low-quality

volume we removed over the last 12 months, together with normal

seasonality and strong OEM demand.

Consistent

with lead revenue, retail new leads were down 9 percent compared to

the prior-year quarter while used leads were flat. 76 percent of

leads were delivered to the wholesale channel, with the remaining

24 percent to the retail channel. Retail new leads invoiced per

dealer remained constant year over year in the third quarter of

2016, and retail used leads invoiced per dealer was up 11

percent.

-2-

We

delivered more than 95,000 specialty finance leads during the

quarter, down 8 percent from the year-ago period. Despite the

decline in leads, specialty finance lead revenue was relatively

flat at $1.7 million compared to last year, reflecting our

successful implementation of price increases.

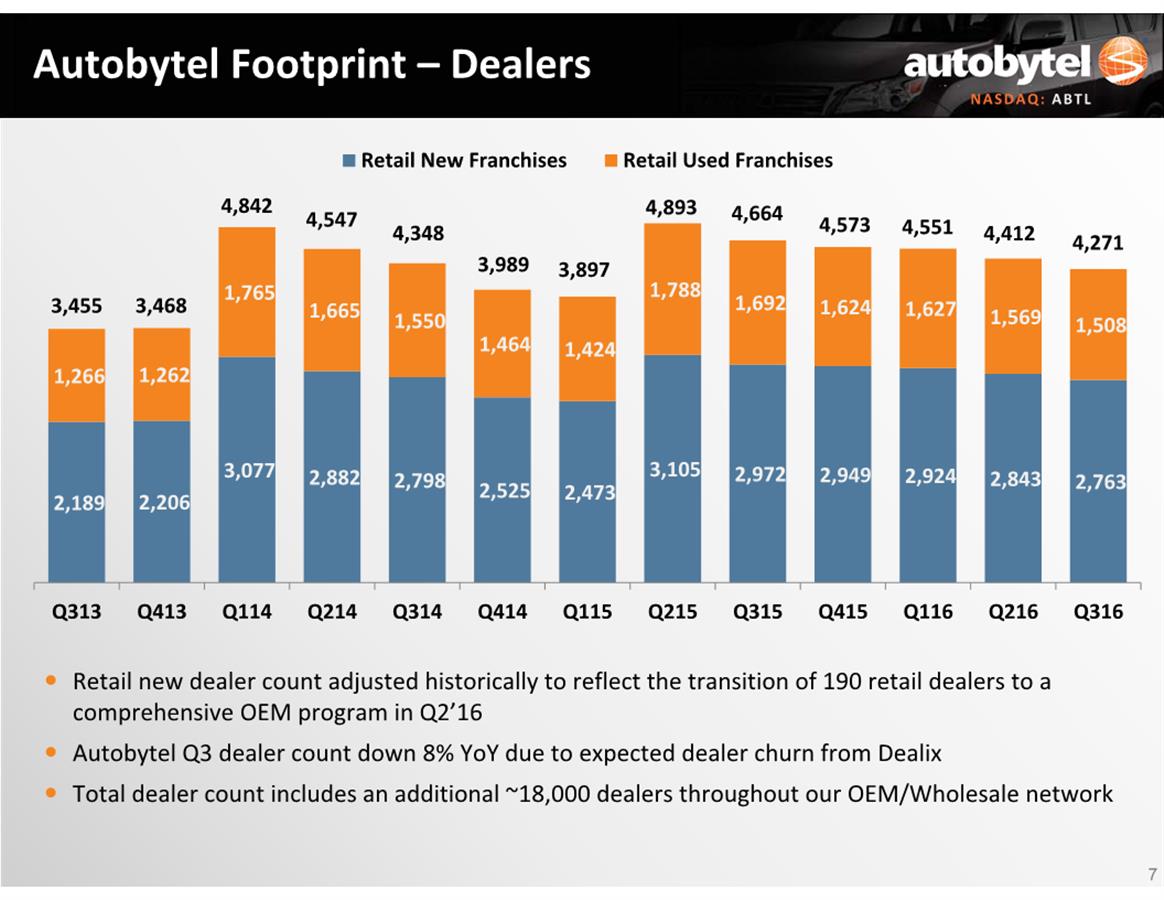

On

slide 7, you'll see we adjusted the dealer count to historically

exclude the aforementioned retail dealers that were transitioned

into a comprehensive OEM program in Q2 2016. As of September 30,

dealer count stood at 4,271, an 8 percent decline over prior year.

The decrease was driven by the expected dealer churn from the

Dealix acquisition as we continue to focus on building stronger

relationships with larger, more profitable dealers. I remind

listeners that this figure does not include the dealers on our OEM

network, which would otherwise be closer to 22,000 dealer

franchises.

Now

moving to slide 8, gross profit during the third quarter increased

3 percent to $15.8 million, and gross margin was 35.9 percent

compared to 38.1 percent in the year-ago quarter. In the third

quarter we made the decision to begin further investing in our

traffic acquisition in order to accelerate the growth of our lead

and click products. The decline in gross margin was due to the

corresponding increase in traffic acquisition costs as we focus

more on accelerated growth and incremental gross profit dollars as

opposed to gross margin percentage.

Gross

margin was also impacted by an increase in amortization of

intangible assets associated with the acquisition of AutoWeb. We

expect gross margin to continue in the mid 30 percent range over

the next several quarters as we invest in our core products to grow

revenues and ultimately profit dollars.

Total

operating expenses in the third quarter were $11.5 million compared

to $12 million in the year-ago quarter. As a percentage of

revenues, total operating expenses were 26.2 percent compared to

29.8 percent in the third quarter of 2015, with the decrease

largely attributable to non-recurring transaction related expenses

in 2015, as well as cost savings from our IT development migration

which was initiated in the first quarter of 2016.

While

we’ve recognized significant cost savings over the course of

the year, we plan to reinvest more going forward and further

accelerate the growth opportunities we see in our

business.

On

a GAAP basis, net income in the third quarter increased 70 percent

to $2.7 million or $0.21 per diluted share on 13.3 million shares.

We expect our diluted share count in the fourth quarter to be

around 13.5 million, and full year 2016 to be 13.4 million,

contingent upon our share price and assuming current outstanding

shares, warrants, options, and convertible debt remain

constant.

For

the third quarter, non-GAAP income, which adds back amortization on

acquired intangibles, non-cash stock-based compensation,

acquisition costs, severance costs, gain on investment, litigation

settlements, and income taxes, increased 26 percent to $6.5 million

or $0.49 per diluted share compared to $5.2 million or $0.45 in the

year-ago quarter. Cash provided by operations for the 2016 third

quarter improved to $5.9 million compared to $5.1 million in the

prior-year quarter.

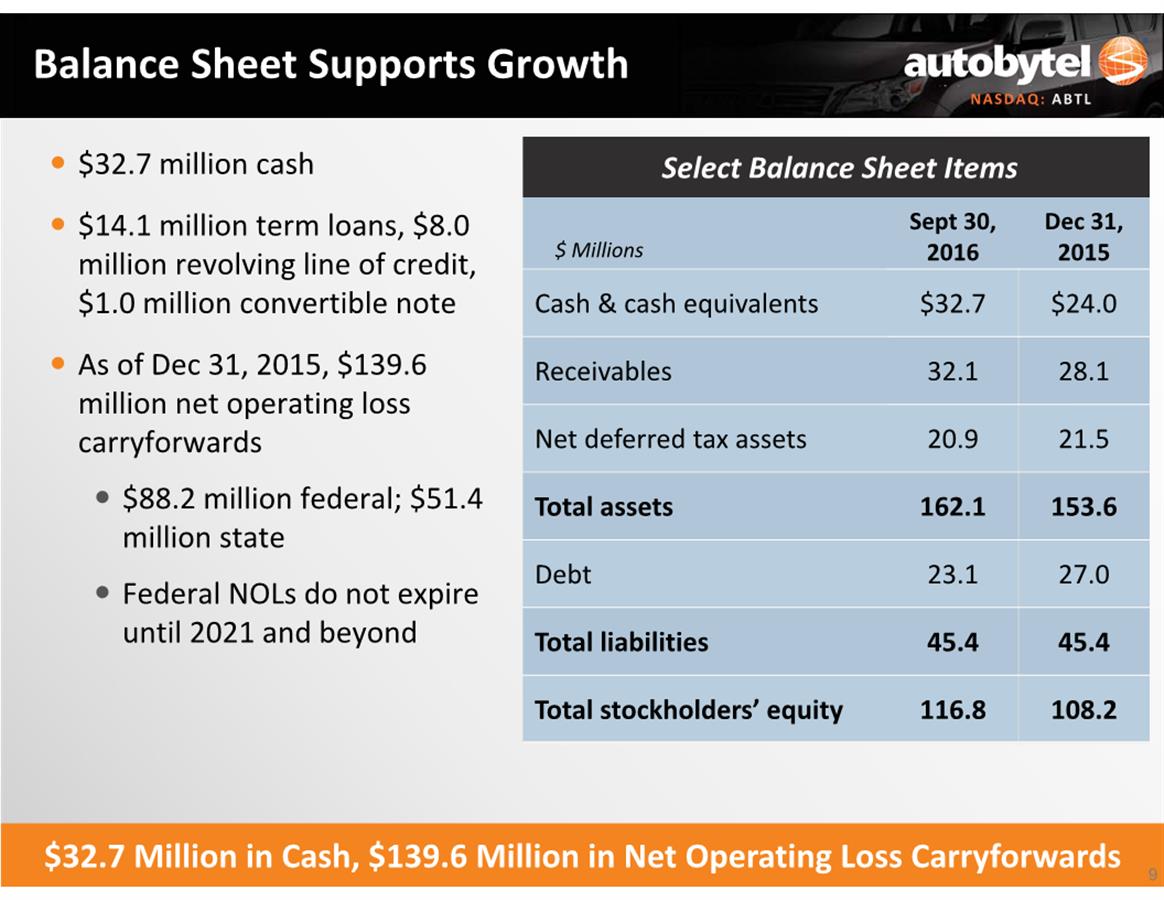

On

slide 9, you'll see that our cash balance remains strong, with cash

and cash equivalents of $32.7 million at September 30, 2016, which

represents a 36 percent increase from December 31, 2015. Total debt

at September 30, 2016, was reduced to $23.1 million compared to $27

million at the end of 2015.

With

that, I'll now turn the call back over to Jeff.

-3-

Jeff Coats:

Thank

you, Kim. As I mentioned earlier, our third quarter was highlighted

by the continued momentum of our click product and strong demand

from most of our OEM customers. In addition, we successfully

completed the beta launch of our new UsedCars.com site and lead

enhanced product solution on AutoWeb.com.

I'll

spend some time covering each of these topics, beginning with

clicks. For those of you new to Autobytel, our click product came

to us through our acquisition of AutoWeb, which is a pay-per-click

programmatic advertising marketplace targeting the auto industry.

This acquisition continues to exceed our expectations as the

AutoWeb platform provides dealers and OEMs with access to some of

the highest-intent car shoppers on the Internet.

As

Kim noted earlier, the growth in AutoWeb's click revenue continues

to accelerate, up 50 percent sequentially to $5.5 million. We are

increasing volumes with existing clients and continue to add OEMs,

large dealer groups, dealer agencies, and Tier II dealer

associations. Additionally, the churn on this product continues to

exceed expectations, well below the industry norms we are

accustomed to.

When

describing advertising spend in the automotive industry, activities

are typically segmented into three tiers. Tier I is OEM national

brand spend. Tier II is regional spend. And Tier III is advertising

at the dealership level. It's important to note that for many OEMs,

the Tier II regional associations have advertising budgets that are

collectively larger than the OEMS national Tier I

budgets.

And

now with AutoWeb, in addition to Tiers I and Tier III, we have an

attractive Tier II product offering for the first time in our

history. These sophisticated clients recognize the flexibility of

our AutoWeb technology and are eager to use it to get incremental

high-intent traffic and to enhance the user experience and the

efficiency of their entire ecosystem of consumer facing

websites.

At

the end of the third quarter, we rolled out the beta version of our

new lead enhanced product solution on AutoWeb.com, where, upon the

completion of a lead form, we are opening a map and/or tabs for

dealers and advertisers to drive consumers to their respective

websites. Though we will continue to test and refine the offer, we

believe this handoff to a dealer or OEM's website will add value to

our core leads product and increase closing rates for our dealer

customers.

As

mentioned earlier in the year, we've migrated our previously

outsourced development resources to our in-house Guatemala

operations. During the quarter we continued to invest in both our

US and Guatemala development resources to further accelerate the

growth of both our click and core leads products and especially our

new UsedCars.com website. We currently plan to continue the

investment in our products and in our development teams throughout

2017.

Moving

on now to our strong lead volumes, in the third quarter, we began

investing heavily in traffic acquisition to accelerate the

replacement of the low-quality lead supply we had removed over the

last 12 months with our own higher quality internally generated

lead supply.

Through

this investment, we were able to sequentially increase lead supply

by 22 percent, more than double the historical seasonal range of 10

percent.

And

as we have mentioned in previous quarters, OEMs tend to be very

selective in their digital marketing spend, and they continue to

demonstrate increasing demand for our high-quality leads. We

believe this is a direct result of our commitment to quality, which

was further reflected by our decision to walk away from low quality

lead-gen methodologies that did not meet our high-quality

requirements.

We

expect to continue investing in our core leads products to continue

to capitalize on the record level demand from our OEM and dealer

customers. This investment will also support additional growth in

our clicks products. Further, I remind listeners that when your

account for leads that we deliver to OEMs, we are actually

delivering leads to approximately 22,000 dealer franchises which

includes our retail dealer network.

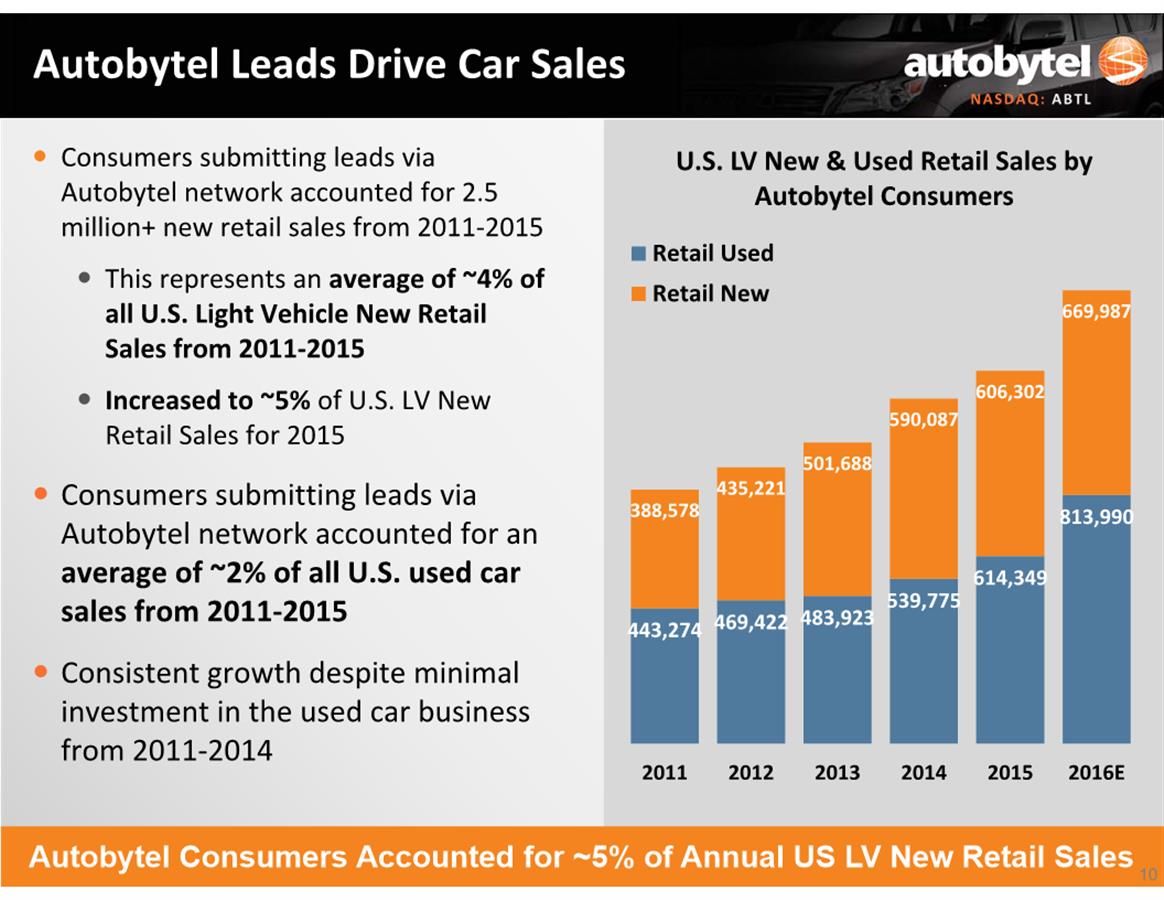

The

breadth of our influence on the auto industry is further

illustrated on slide 10, where you can see that sales from

consumers submitting leads through Autobytel's network accounted

for approximately 5 percent of all new light vehicle retail sales

in the United States in 2015 and approximately 2 percent of all

used car sales. We expect volume to have grown in 2016 and look

forward to receiving the final updated IHS data when it's released

early next year.

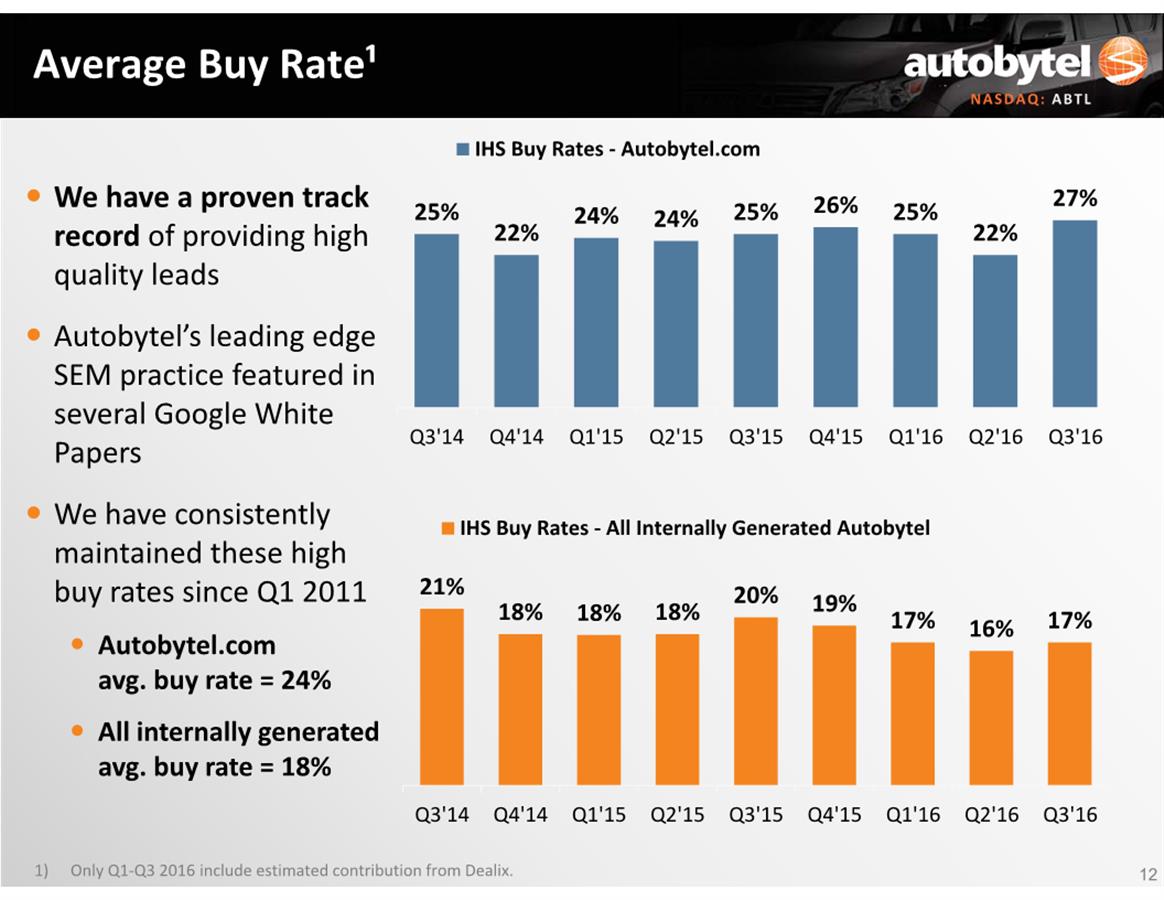

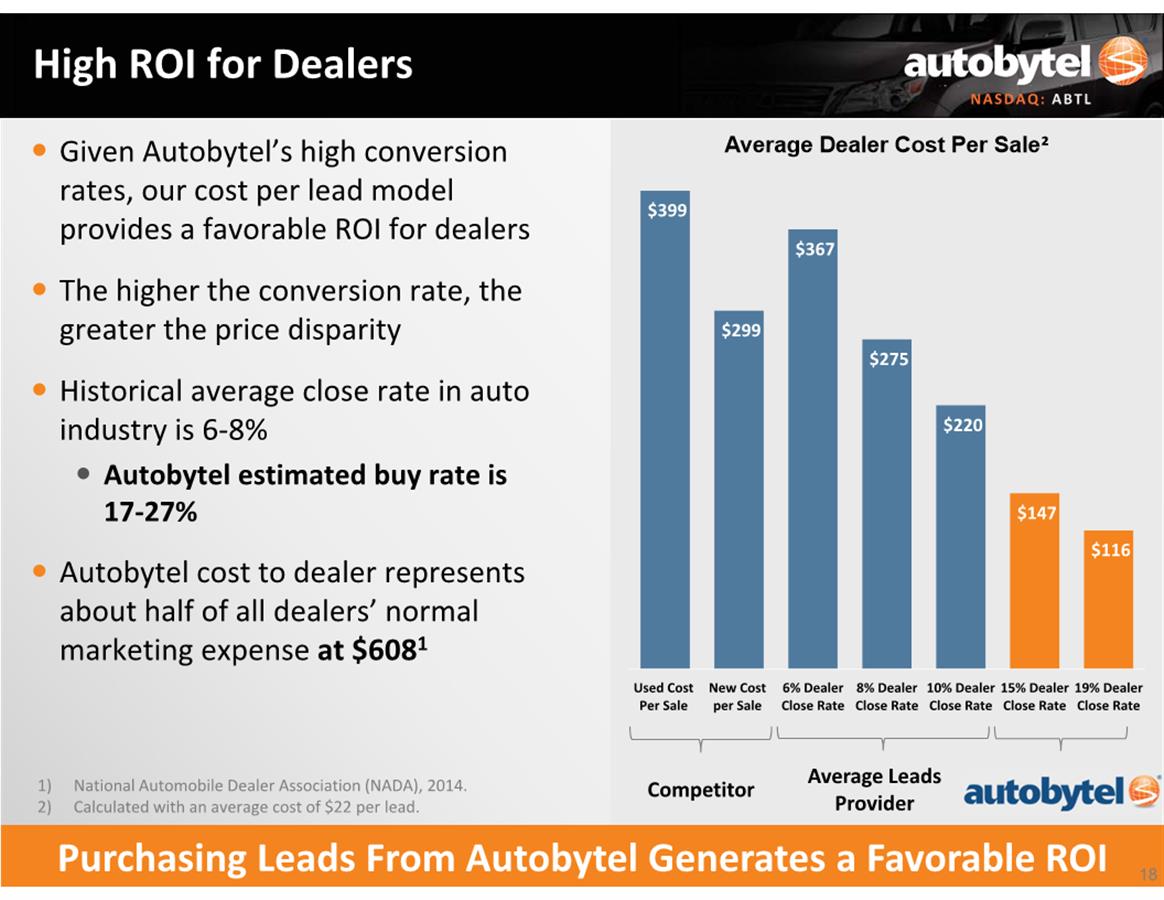

On

slide 11, you'll see that our estimated average buy rate for

internally generated leads in the third quarter was 17 percent.

This figure includes the buy rate from Dealix leads, so we were

pleased with our performance in raising the legacy Dealix lead

quality up to the low end of our targeted range of 16 percent to 24

percent. Because of our ongoing commitment to lead quality, we are

continuing to focus on enhanced methodologies to meaningfully

increase the mix of internally generated leads from the current 80

percent level, while only utilizing volume from a small number of

trusted suppliers who share our commitment to quality.

And

on slide 12, as derived from IHS Automotive Reports, you will note

that these estimated buy rates have remained consistently strong

since Q1 2011, with Autobytel.com generating an average buy rate of

24 percent and all Autobytel internally generated leads at about 18

percent.

Used

car lead revenue in the third quarter was up 5 percent sequentially

to $3.8 million, driven by the strong recovery in quality lead

supply from Dealix in late June. Our used car business remains a

focal point for growth, and we continue to increase the level of

resources dedicated to ramping our used car platforms for internal

lead generation as well as incremental sales and

marketing.

As

noted earlier, we successfully launched the beta version of our new

UsedCars.com site at the end of the third quarter. This new

platform is being powered by our Car.com code base, AutoWeb's data,

and our inventory services, all of which enable a very scalable

operation. We continue to expect realizing more of the benefits of

this new site in 2017.

As

a reminder, retail used car leads still only represent about 7

percent of our total leads business today and approximately 9

percent of revenue, even though used car sales in the United States

are two to three times that of new car sales by volume. We

originally expected to see more growth in the used car product in

2016. However, a disproportional amount of the lower quality lead

volumes we eliminated were used cars. With the launch of the new

UsedCars.com, we expect to return to the originally anticipated

growth levels.

It's

also worth noting that we have seen many dealers begin to increase

the level of investment in their used car businesses. In fact, the

CEO of Auto Nation recently announced a major initiative to focus

on used vehicles and launch used only retail locations. While

several other large dealer groups, including Sonic Automotive, have

also initiated similar strategies. This reinforces our decision to

meaningfully invest in and grow our used car business, which we

continue to view as a major opportunity.

-4-

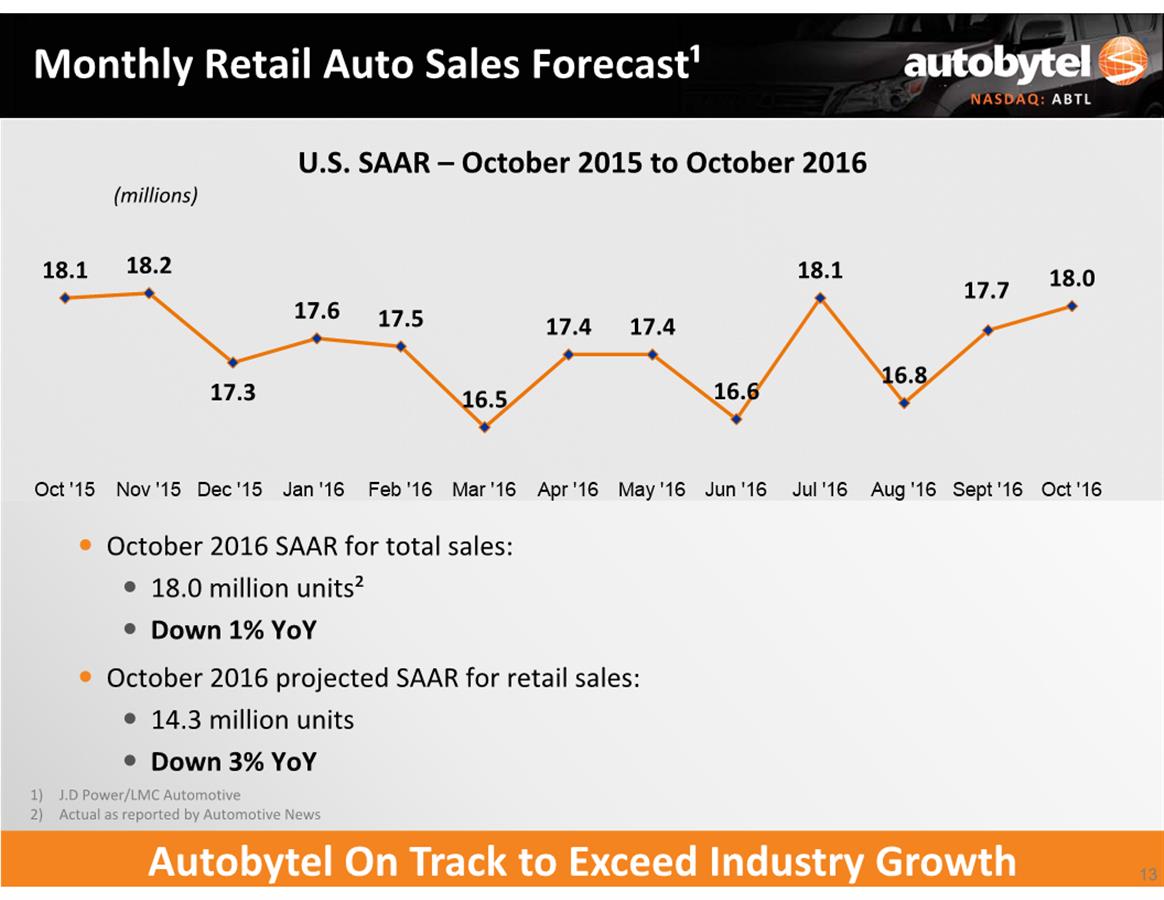

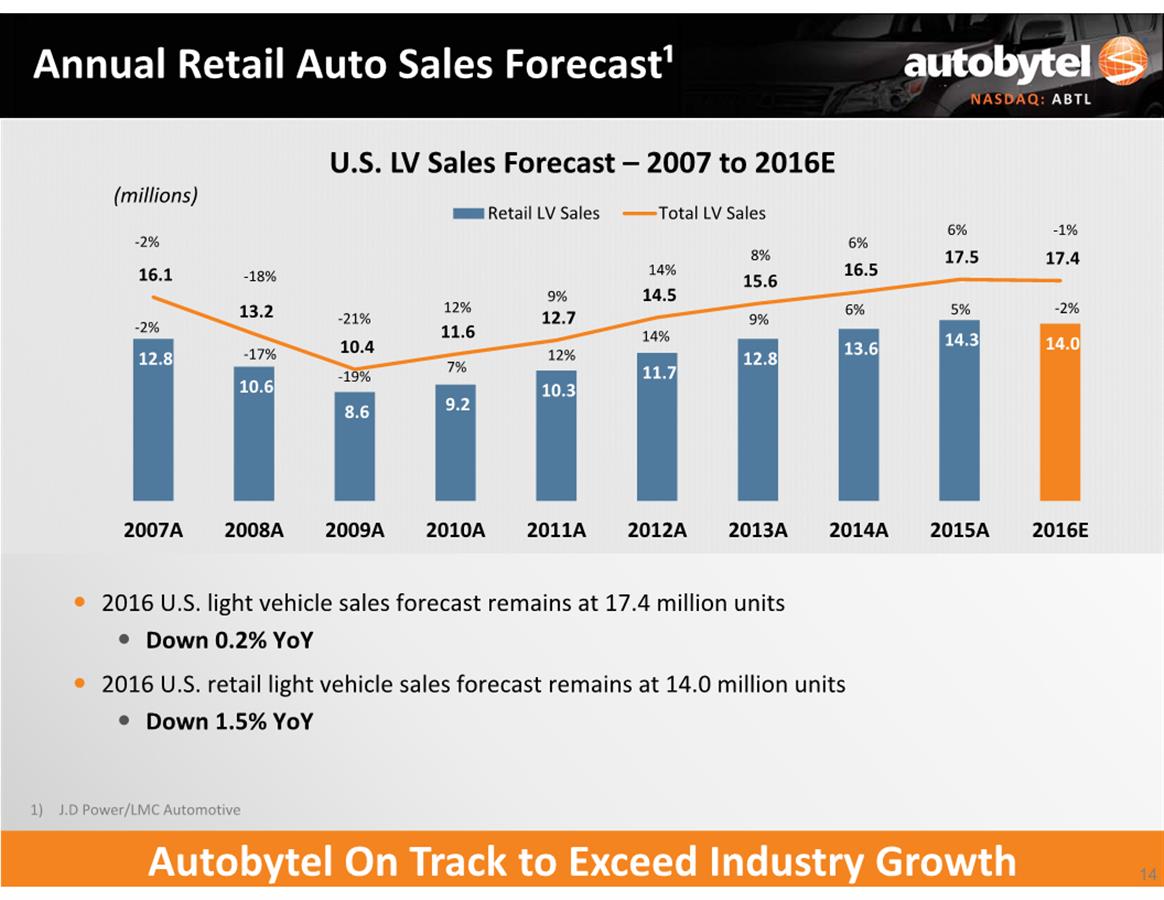

Moving

on to the industry outlook, as you can see on slide 13, Automotive

News has the seasonally adjusted annual run rate, or SAAR, for

total sales at 18 million units for October 2016, slightly down

from 18.1 million units one year ago and up 2 percent compared to

September 2016. And on slide 14 you'll see that in October, LMC

Automotive and J.D. Power maintained their full year total light

vehicle sales forecast at 17.4 million, a 0.2 percent decline from

2015. The forecast for retail light vehicle sales also remains at

14 million units, down 1.5 percent from 2015.

For

listeners who follow the industry at large, you have likely seen

the headlines highlighting October as the sixth monthly decline of

new vehicle retail sales in 2016. Despite these industry dynamics,

we've actually begun to experience increasing demand from our

customers as they are now even more eager to get consumers into

their showrooms to maintain their own top line growth.

Now

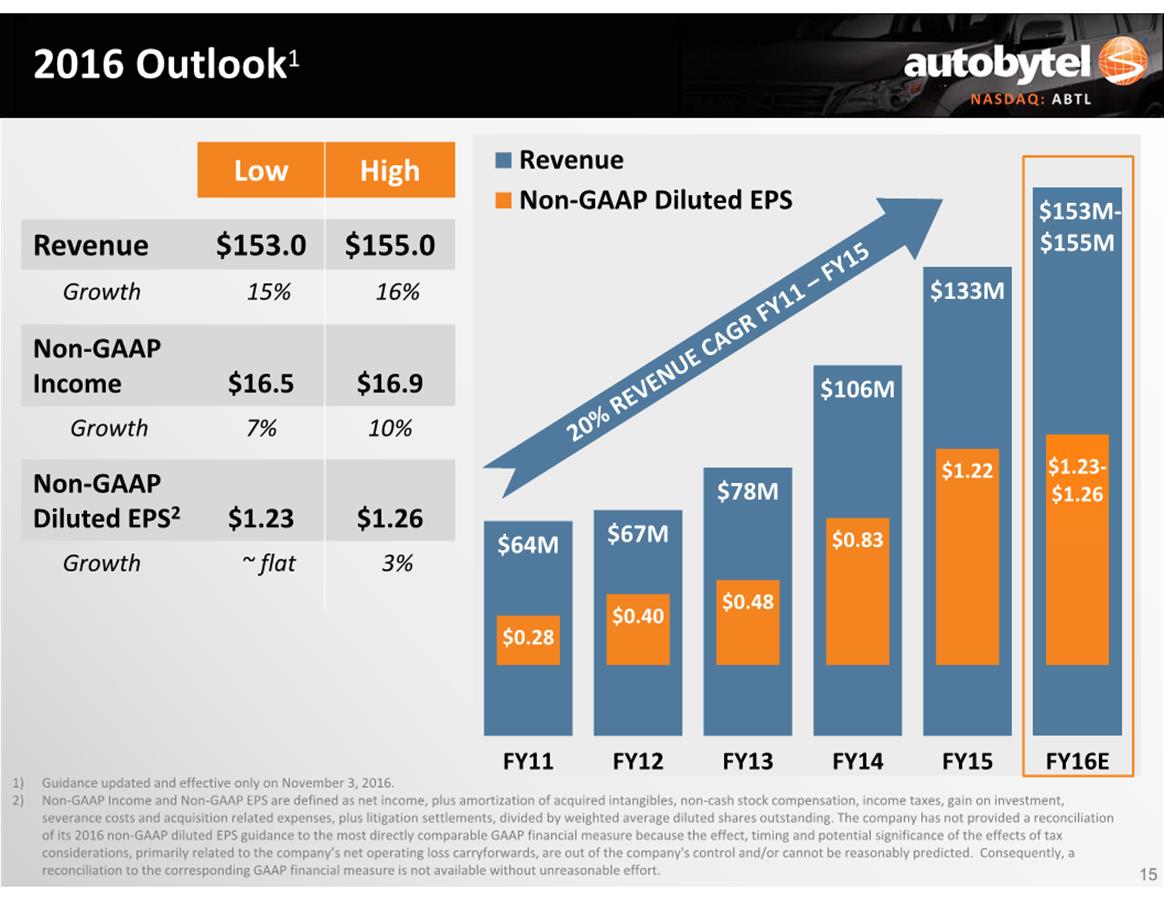

moving on to our 2016 business outlook, highlighted on slide 15, we

now expect 2016 revenue to range between $153 million and $155

million, an increase at the bottom end of our original guidance of

$151 million to $155 million which represents an increase of

approximately 15 percent to 16 percent from 2015. We expect

non-GAAP income to range between $16.5 million and $16.9 million,

representing an increase of approximately 7 percent to 10 percent

with non-GAAP diluted EPS ranging between $1.23 and $1.26 compared

to $1.22 in 2015, down from the original guidance of $1.39 to

$1.43.

I

want to take a moment to reinforce why we made the decision to

moderate our 2016 non-GAAP EPS guidance. Q3 was a precursor for why

we have made this decision to start investing now. Q3 allowed us to

see what was possible from a revenue perspective while allowing

some flexibility in margin.

The

performance in Q3 provided a level of verification that we have the

assets, core products, and talent to drive strong growth. It also

gave us insight into where we needed further investment to fuel our

growth. We are excited about the opportunities on our roadmap and

we feel capitalizing on these opportunities now is the best thing

to do for our business. We believe that adding talent, enhancing

our products, growing traffic, and creating value across the

company's assets will allow us to monetize these

opportunities.

As

we close out another strong year and look ahead to 2017, we'll

continue to focus on providing our dealer and OEM customers with

high quality, high-intent car buyers. Be it through new or used

care leads, clicks, or one of our many value-added product

offerings, we remain committed to helping our customers sell more

cars and trucks.

Operator

will now take questions.

Operator:

Thank

you, sir. Ladies and gentlemen if you have a question at this time,

please press star one on your telephone keypad. If your question

has been answered or you wish to remove yourself from the queue,

please press the pound key. And one moment while callers queue for

their question. And that’s star one for

question.

Your

first question comes from the line of Eric Martinuzzi with Lake

Street Capital.

Eric Martinuzzi:

Thanks.

Congratulations on a strong Q3. I have a question about the Q4

guidance though. I wanted to take a look at it just because this is

I think the first true organic quarter that we get with the

anniversary of the AutoWeb acquisition. If I look at the midpoint

of the guidance, we're at about a 4 percent growth rate. Now I know

there's some cross currents here because you did talk about really

cleansing, the cleansing of the Dealix automotive leads. But when

we kind of anniversary that, and I don't know whether that's Q2 or

Q3, is this a mid-single digit growth story?

-5-

Or,

given the investments that you're making now is this a high single

digit story, potentially double digits? Just some insight there

would be helpful.

Jeff Coats:

Eric,

I would say the investments that we're making will increase the

growth in our top line, accelerate the growth in our top line. We

would normally be, I think, a high single digit grower. These new

investments will, over the course of next year, accelerate that. So

it's possible we would hit something in the higher levels, but what

we would currently plan to do would be on our Q4 call, which will

be in February next year, lay out a more detailed level of guidance

for 2015 as well as some -- I'm sorry, for 2017. As well as provide

some more insight for what the business should look like in the

future.

Eric Martinuzzi:

Okay.

And what is the anniversary of that, the kind of Dealix cleansing?

Was it Q2 you said or was it Q3 for this year?

Kimberly Boren:

So

we took most of it out in Q1. So from a clean quarter perspective,

Eric, that would be Q2 2017.

Eric Martinuzzi:

Okay.

And then you are definitely the engine behind the pay per click

revenue. We're seeing that in the cost of goods kind of the tac

being higher. Is that -- are you finding -- obviously they're

profitable clicks that you're buying and turning into pay per click

leads for your pay per click advertising for your own customers.

Are you finding those available at a constant price or is the tac

rising maybe at a higher cost per click for you? Or is it strictly

a volume issue?

Jeff Coats:

Honestly,

it's probably all over the board. There is no such thing as a

constant price in the way we do business or when you do business

with Google the way we do. It's individual auctions based on

different strings of key words. So it's constantly in flux. You

know, as we've discussed, overall pricing in a lot of these areas

have increased over time.

We've

been very successful with the additional investments we've been

making in our business historically to stay ahead of that by

producing better technology that ultimately yields us stronger

conversion rates. So we are actually yielding more product out of

what we're buying than we used to. So it's a daily struggle in our

business.

Eric Martinuzzi:

Okay.

And then lastly, back to the pay per click business, just

phenomenal growth there, seeing that up 50 percent sequentially.

Could you revisit again, who is the big consumer there? Who is the

customer?

Is

that -- you mentioned the Tier I, Tier II, Tier III, but is this an

OEM buy, is it an agency buy? Who are you selling that

to?

Jeff Coats:

I

would say the largest group currently is at Tier I, it's at the

manufacturer level. We also have some customers in the Tier II

level and then we also have quite a few dealer customers some of

whom we sold it to directly, but many of whom we sold it to through

their agency, their advertising agency. So it's a little bit a

mixed bag there across that.

I

would say the growth prospects are very strong, however, across all

three tiers. And I don't know if we've ever said this out loud like

this before, but we barely scratched the surface on the clicks

business. We have a very, very small number of customers on the

click business right now as compared to the leads business. So just

continuing to roll it out to some of our existing customers over

time gives us a very significant growth opportunity with even

existing customers.

Eric Martinuzzi:

Okay,

thanks for taking my questions.

Operator:

Your

next question comes from the line of Gary Prestopino with

Barrington Research.

-6-

Gary Prestopino:

Good

afternoon. Hi. I'm a little bit fuzzy on what exactly is going on

here, Jeff. And maybe it's my understanding of the business as well

as some of the internet guys, but you say you're increasing your

investment in new products or existing products, and I thought we

kind of went through that investment ramp the first half of this

year.

And

then also you're saying the gross margin is down and should

continue to be down because of your acquisition costs, I guess

whatever you're acquiring to drive AutoWeb growth. But my

understanding of it from you was that the AutoWeb business carries

a very high margin and should maybe mitigate some of what you're

spending here and wouldn't erode the gross margin as much. So can

you help me out on those two things.

Jeff Coats:

Sure.

I think perhaps the misunderstanding is, the kind of business that

we have is a business, being in digital and particularly now in the

clicks business, where we have to constantly reinvest in the

business to stay on the cutting edge of what's going on. So we've

just started to scale up the clicks products. And every time we add

customers, it's a new implementation, there's new development costs

associated with it. As we add new traffic sources, there are new

development costs and implementation costs associated with doing

that. So it's kind of an ongoing -- we never finish the development

work around some of those products.

When

we began with AutoWeb, yes, it was extremely high margin because

initially it was a rev share and everything that we brought into

our P&L before we bought the rest of AutoWeb, was basically at

a very high, almost 100 percent margin because of the rev

share.

Once

we bought them and started accounting for all of the costs, it

looked initially, and was for a period of time, the gross margin

was more in the 50 percent to 55 percent range. As we have

continued to understand the product, expand the product, add new

customers to the product and invest in the product, we have seen

opportunities for continued growth as part of doing

that.

In

the third quarter, throughout the quarter, we were doing a lot of

development experimentation trying to determine the best ways to

generate traffic directly for the clicks product. Not just the

traffic flow coming from the leads products, but new traffic

designed specifically for that. I think I also mentioned to you

that we weren't really sure where the gross margin would end up on

the clicks product because we were looking for ways to accelerate

our growth. And as part of doing that, we might have to moderate

that margin as part of doing it.

We

did make some of those determinations throughout the course of the

third quarter. As we had the results to review moving into the

fourth quarter, we made the decision, as opposed to turning down

certain revenue streams, to maintain a higher margin but slow down

our revenue growth, that we would in fact allow that revenue growth

to continue at the margins that were currently then being

generated.

So

we are continuing to experiment with the growth in the business.

There is a very significant growth opportunity here. And that's

where, that's what we're in the process of trying to lay out and

determine.

Gary Prestopino:

Thanks.

Jeff Coats:

It's

a work in progress.

Operator:

Again,

ladies and gentlemen, if you have a question at this time, simply

press star one on your telephone keypad.

Your

next question comes from the line of John Blackledge with

Cowen.

-7-

John Blackledge:

Great,

thanks. I hopped on a little late, so I apologize if these

questions were asked.

But

if we look out a couple of years, which tiers, OEM, dealer, etc.,

has the highest spend potential for the clicks business? How many

dealers have ramped on the program, the clicks program at this

point? Remind us about the retention.

And

then what do you think the ultimate gross margin for the clicks

business is? And then I have just one follow-up.

Jeff Coats:

Let

me do sort of the last one first. We're not yet sure what the

ultimate gross margin for the clicks business will be. As I was

discussing a moment ago, we're still kind of in the experimentation

phase there. In terms of the other stuff, there are huge budgets at

I'd say the Tier II and Tier I levels. I would expect that most of

our dollar revenue ultimately would probably be at Tier II and Tier

I. I think there is also a significant opportunity at the Tier III

level with dealers, but there are 30,000 franchises across the

United States. You only get to them one by one or through their

agencies, so it will take us longer to get to those in a meaningful

way, but there's still a very large opportunity there.

I

would say in the short term, it's probably Tier I, Tier II and then

Tier III. But ultimately Tier II could prove to be a larger market

for us because those budgets do tend to be larger than the national

advertising budgets for some of the OEMs.

There

are only a couple hundred dealers on the click product currently,

or less than a couple hundred dealers on the click product

currently. Very small slice. Big opportunity to grow for growth

there. And I know there was another one and I'm not remembering

it.

John Blackledge:

The

retention, Jeff, of the dealers.

Jeff Coats:

Oh,

yes. So, normally the churn in our industry is about 5 percent a

month for dealers. Dealers are always looking for new products to

spend their money on. In our core leads business we currently are

below 4 percent after the two acquisitions we did that caused our

own churn to jump up. The churn that we're currently seeing in the

clicks business is well less than 1 percent just to give you an

idea. It's been shockingly low.

But

in the context of what we're hearing from our customers, is the

quality of the traffic that they're buying from us is significantly

higher than the traffic that they're able to find from any of the

other providers out there currently. Which is not a big surprise

because it's the traffic coming off of our lead gen operations

which again is that 14 years of long tail search focused on

identifying signals of intent to buy. So, we're really only trying

to attract end market buyers that are looking to buy a car soon

that we then sell the information to our dealer and manufacturer

customers.

So

I would say the churn profile in clicks is actually one of the most

exciting parts of it so far because we run very hard in the leads

business and you see the dealer churn numbers that we post every

quarter. It's two steps forward some quarters and two steps back.

We don't expect to see that in the clicks side of the business.

We're very excited about it.

John Blackledge:

Yeah.

That's great. Just a follow-up. In terms of the dollars, where are

the dollars coming from---from the OEMs and the dealers? Is it

traditional channels or digital or a mix?

Jeff Coats:

It's

coming from their advertising budgets. I would assume some of it's

coming as they move more offline advertising over, but I'm sure a

portion of it is just being swung over from some of their digital

budgets now. And I’m sure it's also somewhat different

manufacturer to manufacturer.

John Blackledge:

Right.

Thank you very much.

-8-

Operator:

At

this time, this concludes our question and answer session. I would

now like to turn the call back over to Mr. Coats for closing

remarks.

Jeff Coats:

Thank

you. Thanks to everybody for joining us on the call today. And I

also want to thank our team of dedicated employees. I'll be at the

RBC Conference in New York next week, so I look forward to talking

to some of our investors there. Thank you.

Operator:

Ladies

and gentlemen, this does conclude today's teleconference. You may

disconnect your lines at this time. Thank you for your

participation.

END

-9-

-10-

-11-

-12-

-13-

-14-

-15-

-16-

-17-

-18-

-19-

-20-

-21-

-22-

-23-

-24-

-25-

-26-

-27-

-28-

-29-

-30-