Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ARCTIC CAT INC | d262664d8k.htm |

ARCTIC CAT INC. Fiscal 2017 Second Quarter Results November 9, 2016 Exhibit 99.1

SAFE HARBOR STATEMENT Forward-Looking Statements The Private Securities Litigation Reform Act of 1995 provides a safe harbor for certain forward-looking statements. The company’s Annual Report, as well as the Annual Report on Form 10-K, its Quarterly Reports on Form 10-Q and other filings with the Securities and Exchange Commission, the company’s press releases, investor presentations and oral statements made with the approval of an authorized executive officer, contain forward-looking statements that reflect the company’s current views with respect to future events and financial performance. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or those anticipated. The words “aim,” “believe,” “expect,” “anticipate,” “intend,” “estimate” and other expressions that indicate future events and trends identify forward-looking statements including statements related to our fiscal 2017 outlook, business strategy, strategic partnerships, performance opportunities, expected inventory reductions, product introductions and demand, expected expenses, market position, and the impact of foreign currency exchange rates. Actual future results and trends may differ materially from historical results or those anticipated depending on a variety of factors, including, but not limited to those set forth in the company’s Annual Report on Form 10-K for the year ended March 31, 2016, under heading “Item 1A. Risk Factors” and factors described in the company’s subsequent filings with the Securities and Exchange Commission. The company does not undertake any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Chris Metz President & CEO

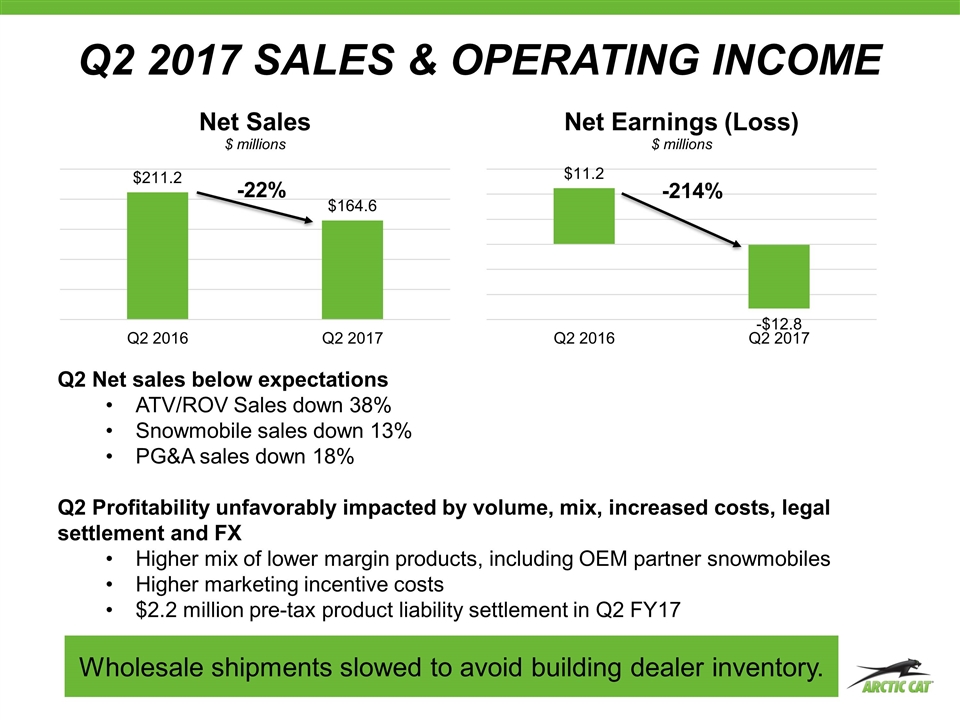

Q2 2017 SALES & OPERATING INCOME -22% Q2 Net sales below expectations ATV/ROV Sales down 38% Snowmobile sales down 13% PG&A sales down 18% Q2 Profitability unfavorably impacted by volume, mix, increased costs, legal settlement and FX Higher mix of lower margin products, including OEM partner snowmobiles Higher marketing incentive costs $2.2 million pre-tax product liability settlement in Q2 FY17 -214% Wholesale shipments slowed to avoid building dealer inventory.

NORTH AMERICAN RETAIL SALES AND DEALER INVENTORY Q2 Retail Sales challenged ATV/ROV down 4% Snowmobiles up 4% (1% season to date) Lack of innovative new product hurting Wildcat sales Q2 Dealer Inventory slightly higher versus last year ATV/ROV up 2% year over year and down 10% year to date Snowmobile down 4% year over year In challenging environment, we are focused on driving retail sales to make room for new products coming next fiscal year.

DESPITE CURRENT INDUSTRY CONDITIONS, WE CONTINUE TO MAKE PROGRESS Recently signed commitment letter with Bank of America Extends maturity to November 2021 Increases credit limit to $130 million year round Provides runway to execute plan Our strategic initiatives to reinvigorate growth include: Pursuing strategic partnerships Ramping up end-user focused new products Creating a brand marketing powerhouse Improving and expanding our dealer network

PROGRESS AGAINST OUR INITIATIVES IN THE FISCAL 2017 SECOND QUARTER Signed two strategic partnerships Anticipated to contribute meaningfully in fiscal 2018 & beyond New product launches First products from our new product roadmap begin to hit market in second half of this fiscal year Multi-year endeavor and will include “Hero Products” to be introduced in coming years Dealer Show in February 2017 Bringing dealers to Minneapolis to show them what the future holds for Arctic Cat Opportunity to tour our new state-of-the-art R&D expansion in St. Cloud and new corporate headquarters

PROGRESS AGAINST OUR INITIATIVES IN THE FISCAL 2017 SECOND QUARTER Second Wave of our 2017 Model Year ATVs/ROVs unveiled in September Snowmobile line-up one of the most exciting in years Thundercat and King Cat deliver fastest trail and mountain snowmobiles First year our SVX 450 snow bike will be available Brand Marketing Powerhouse Experiential marketing, Arctic Cat 360 virtual reality and demo rides Strengthening and expanding our dealer network Year-to-date added 28 dealers, on top of 15 added in fiscal 2016 fourth quarter

LOOKING AHEAD Fiscal 2017 will remain challenging Soft and increasingly competitive powersports marketplace Continued currency headwinds Positioning Arctic Cat to capitalize on tremendous growth opportunities New product innovation Strategic partnerships Investing to support our strategic initiatives Balanced approach – cutting costs and manufacturing output to improve free cash flow and earnings

Chris Eperjesy Chief Financial Officer

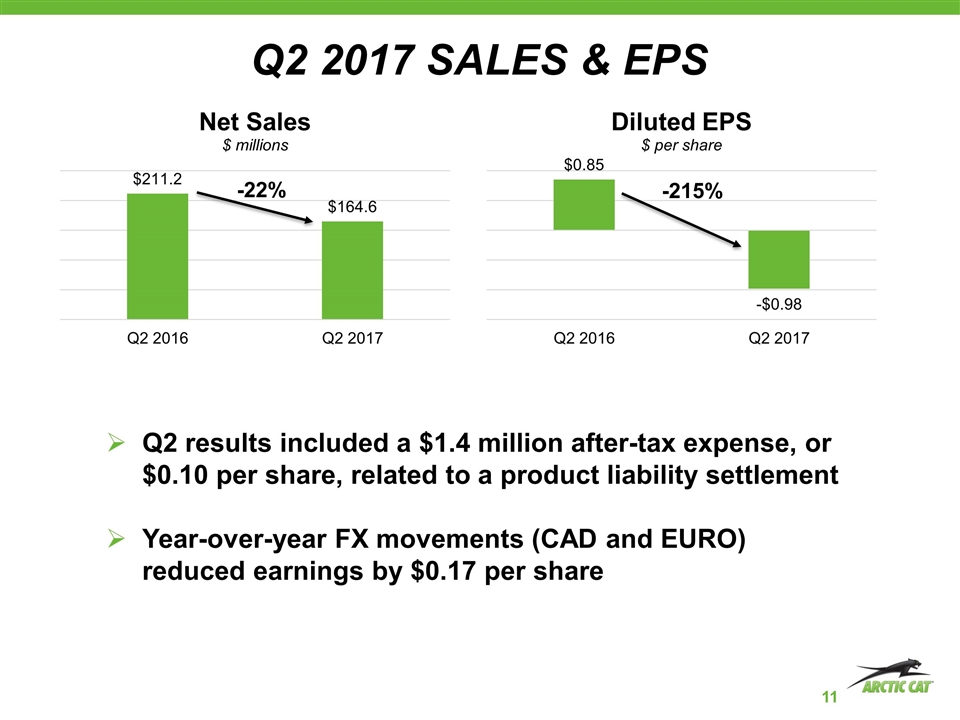

Q2 2017 SALES & EPS -22% -215% Q2 results included a $1.4 million after-tax expense, or $0.10 per share, related to a product liability settlement Year-over-year FX movements (CAD and EURO) reduced earnings by $0.17 per share

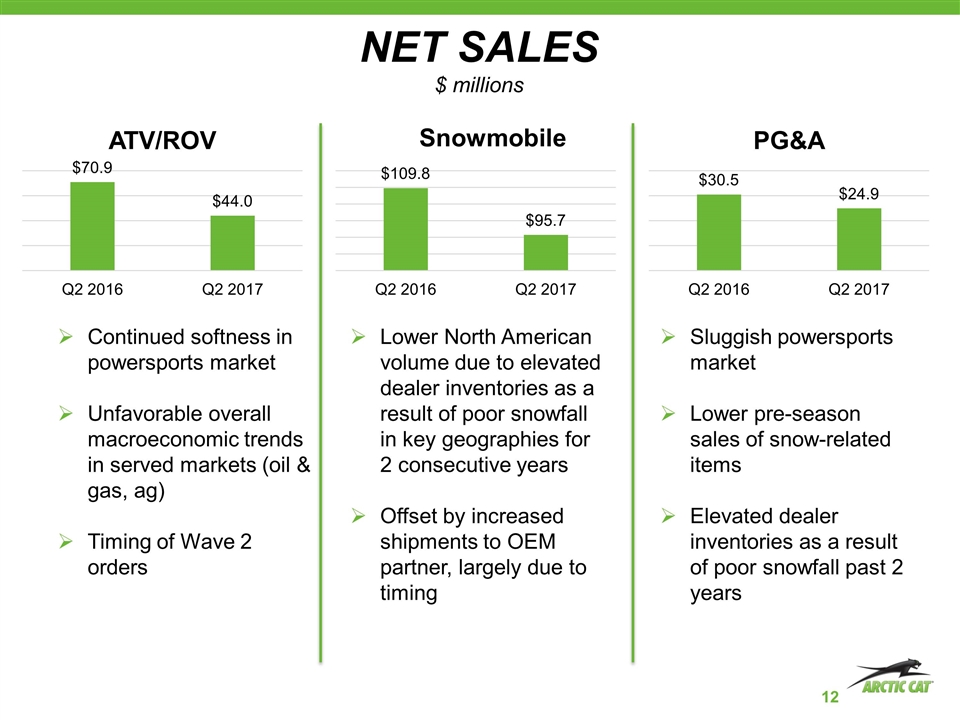

NET SALES $ millions Continued softness in powersports market Unfavorable overall macroeconomic trends in served markets (oil & gas, ag) Timing of Wave 2 orders Lower North American volume due to elevated dealer inventories as a result of poor snowfall in key geographies for 2 consecutive years Offset by increased shipments to OEM partner, largely due to timing Sluggish powersports market Lower pre-season sales of snow-related items Elevated dealer inventories as a result of poor snowfall past 2 years

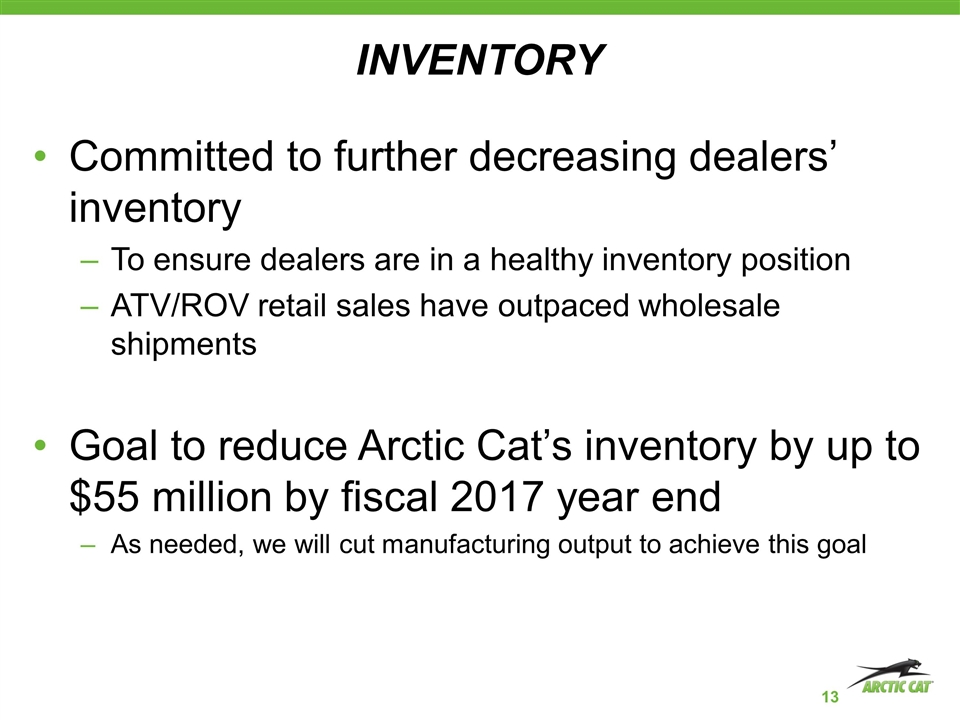

INVENTORY Committed to further decreasing dealers’ inventory To ensure dealers are in a healthy inventory position ATV/ROV retail sales have outpaced wholesale shipments Goal to reduce Arctic Cat’s inventory by up to $55 million by fiscal 2017 year end As needed, we will cut manufacturing output to achieve this goal

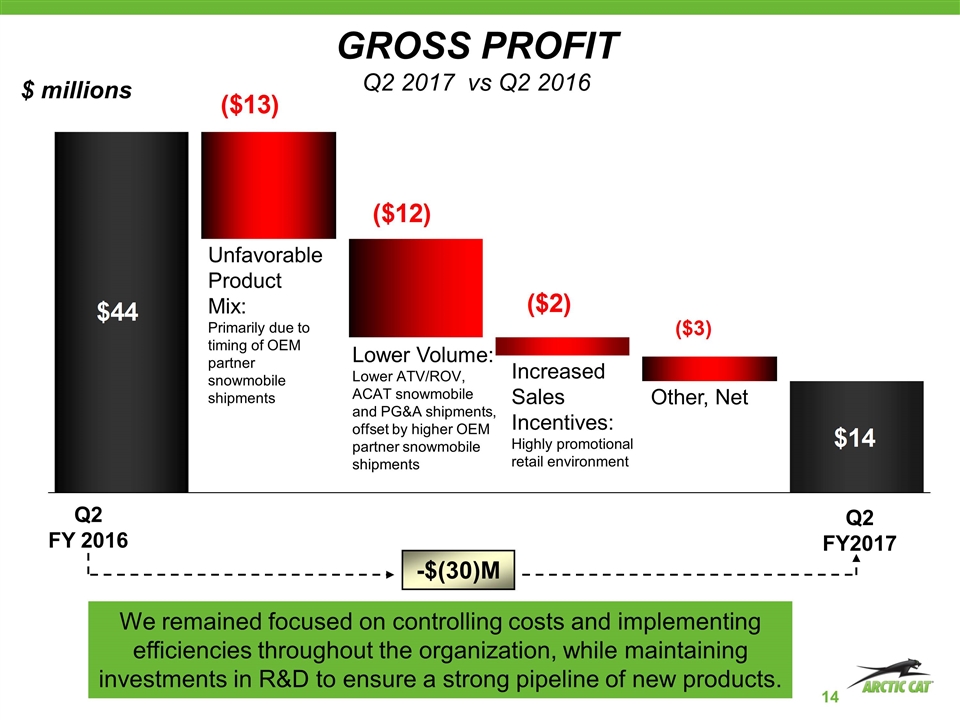

GROSS PROFIT Q2 2017 vs Q2 2016 Q2 FY 2016 Q2 FY2017 -$(30)M $ millions Unfavorable Product Mix: Primarily due to timing of OEM partner snowmobile shipments Lower Volume: Lower ATV/ROV, ACAT snowmobile and PG&A shipments, offset by higher OEM partner snowmobile shipments Increased Sales Incentives: Highly promotional retail environment Other, Net We remained focused on controlling costs and implementing efficiencies throughout the organization, while maintaining investments in R&D to ensure a strong pipeline of new products.

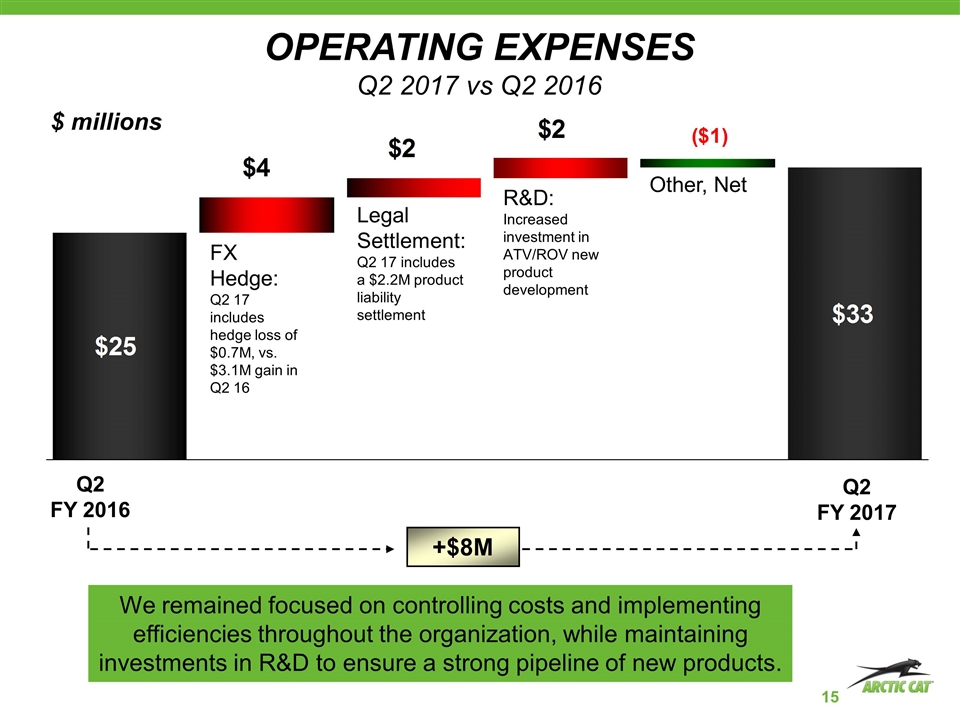

OPERATING EXPENSES Q2 2017 vs Q2 2016 Q2 FY 2016 Q2 FY 2017 +$8M $ millions FX Hedge: Q2 17 includes hedge loss of $0.7M, vs. $3.1M gain in Q2 16 Legal Settlement: Q2 17 includes a $2.2M product liability settlement R&D: Increased investment in ATV/ROV new product development Other, Net We remained focused on controlling costs and implementing efficiencies throughout the organization, while maintaining investments in R&D to ensure a strong pipeline of new products.

BALANCE SHEET & LIQUIDITY Long-term debt increased to $73.9 million Primarily driven by increased inventory levels Expect to reduce inventory by up to $55 million by fiscal 2017 year end Anticipate lowering long-term debt by $25 million to $50 million by fiscal 2017 year end Company continues to make investments in the business to lay foundation for future growth and improve efficiency CAPEX Totaled $6.3 million in fiscal 2017 second quarter Depreciation and amortization was approximately $5.3 million Continue to invest in new product roadmap

NEW BANK AGREEMENT Agreed to new bank facility with Bank of America Extends maturity to November 2021 Increases credit limit to $130 million year round Supports Arctic Cat’s long-term growth initiatives Expect to finalize agreement by December 1, 2016

FISCAL 2017 FULL-YEAR GUIDANCE Lowering FY 2017 Guidance, reflecting … Weakened powersports market Unfavorable macroeconomic trends Unfavorable product mix Highly competitive promotional environment Revised Outlook Net sales: $600 million to $640 million Net earnings: $1.00 loss per to share to $1.40 loss per share Reflects return to profitability in 2nd half of fiscal year Assumptions: ATV/ROV sales flat to down mid-single digits Snowmobile sales flat to down high-single digits PG&A sales flat to up single digits Gross margin in the range of 13.5 percent to 15.0 percent Capital expenditures in the range of $30 million to $35 million