Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - SEACOAST BANKING CORP OF FLORIDA | v452198_ex99-2.htm |

| EX-99.1 - EXHIBIT 99.1 - SEACOAST BANKING CORP OF FLORIDA | v452198_ex99-1.htm |

| 8-K - FORM 8-K - SEACOAST BANKING CORP OF FLORIDA | v452198_8k.htm |

Exhibit 99.3

Acquisition of GulfShore Bank November 4, 2016

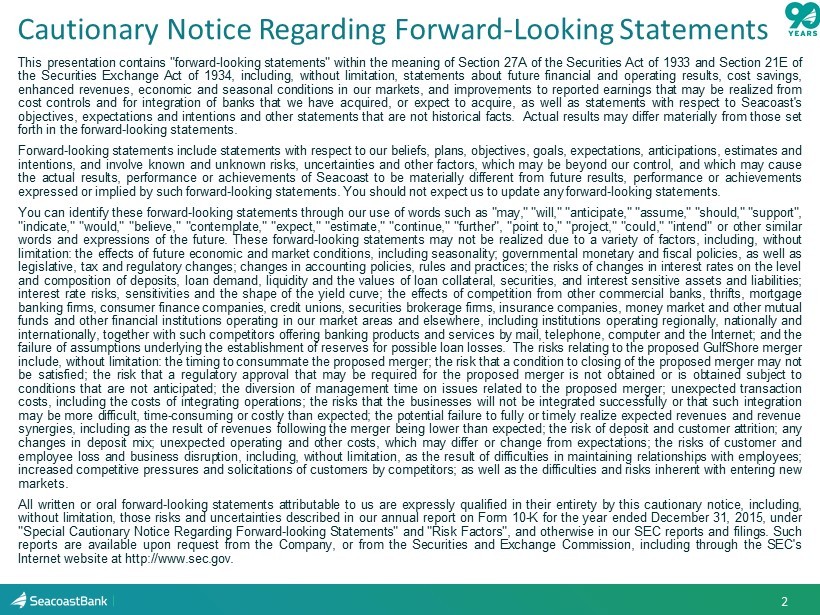

This presentation contains "forward - looking statements" within the meaning of Section 27 A of the Securities Act of 1933 and Section 21 E of the Securities Exchange Act of 1934 , including, without limitation, statements about future financial and operating results, cost savings, enhanced revenues, economic and seasonal conditions in our markets, and improvements to reported earnings that may be realized from cost controls and for integration of banks that we have acquired, or expect to acquire, as well as statements with respect to Seacoast's objectives, expectations and intentions and other statements that are not historical facts . Actual results may differ materially from those set forth in the forward - looking statements . Forward - looking statements include statements with respect to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, and involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the actual results, performance or achievements of Seacoast to be materially different from future results, performance or achievements expressed or implied by such forward - looking statements . You should not expect us to update any forward - looking statements . You can identify these forward - looking statements through our use of words such as "may," "will," "anticipate," "assume," "should," "support", "indicate," "would," "believe," "contemplate," "expect," "estimate," "continue," "further", "point to," "project," "could," "intend" or other similar words and expressions of the future . These forward - looking statements may not be realized due to a variety of factors, including, without limitation : the effects of future economic and market conditions, including seasonality ; governmental monetary and fiscal policies, as well as legislative, tax and regulatory changes ; changes in accounting policies, rules and practices ; the risks of changes in interest rates on the level and composition of deposits, loan demand, liquidity and the values of loan collateral, securities, and interest sensitive assets and liabilities ; interest rate risks, sensitivities and the shape of the yield curve ; the effects of competition from other commercial banks, thrifts, mortgage banking firms, consumer finance companies, credit unions, securities brokerage firms, insurance companies, money market and other mutual funds and other financial institutions operating in our market areas and elsewhere, including institutions operating regionally, nationally and internationally, together with such competitors offering banking products and services by mail, telephone, computer and the Internet ; and the failure of assumptions underlying the establishment of reserves for possible loan losses . The risks relating to the proposed GulfShore merger include, without limitation : the timing to consummate the proposed merger ; the risk that a condition to closing of the proposed merger may not be satisfied ; the risk that a regulatory approval that may be required for the proposed merger is not obtained or is obtained subject to conditions that are not anticipated ; the diversion of management time on issues related to the proposed merger ; unexpected transaction costs, including the costs of integrating operations ; the risks that the businesses will not be integrated successfully or that such integration may be more difficult, time - consuming or costly than expected ; the potential failure to fully or timely realize expected revenues and revenue synergies, including as the result of revenues following the merger being lower than expected ; the risk of deposit and customer attrition ; any changes in deposit mix ; unexpected operating and other costs, which may differ or change from expectations ; the risks of customer and employee loss and business disruption, including, without limitation, as the result of difficulties in maintaining relationships with employees ; increased competitive pressures and solicitations of customers by competitors ; as well as the difficulties and risks inherent with entering new markets . All written or oral forward - looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, including, without limitation, those risks and uncertainties described in our annual report on Form 10 - K for the year ended December 31 , 2015 , under "Special Cautionary Notice Regarding Forward - looking Statements" and "Risk Factors", and otherwise in our SEC reports and filings . Such reports are available upon request from the Company, or from the Securities and Exchange Commission, including through the SEC's Internet website at http : //www . sec . gov . 2 Cautionary Notice Regarding Forward - Looking Statements

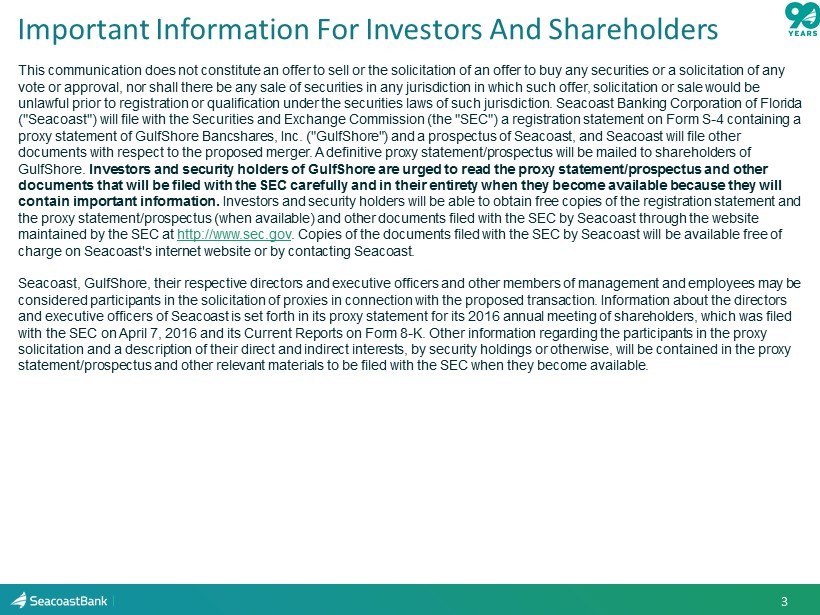

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitati on of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale wou ld be unlawful prior to registration or qualification under the securities laws of such jurisdiction. Seacoast Banking Corporation of Florida ("Seacoast") will file with the Securities and Exchange Commission (the "SEC") a registration statement on Form S - 4 containing a proxy statement of GulfShore Bancshares, Inc. (" GulfShore ") and a prospectus of Seacoast, and Seacoast will file other documents with respect to the proposed merger. A definitive proxy statement/prospectus will be mailed to shareholders of GulfShore . Investors and security holders of GulfShore are urged to read the proxy statement/prospectus and other documents that will be filed with the SEC carefully and in their entirety when they become available because they will contain important information. Investors and security holders will be able to obtain free copies of the registration statement and the proxy statement/prospectus (when available) and other documents filed with the SEC by Seacoast through the website maintained by the SEC at http://www.sec.gov . Copies of the documents filed with the SEC by Seacoast will be available free of charge on Seacoast's internet website or by contacting Seacoast. Seacoast, GulfShore , their respective directors and executive officers and other members of management and employees may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the dir ect ors and executive officers of Seacoast is set forth in its proxy statement for its 2016 annual meeting of shareholders, which was fi led with the SEC on April 7, 2016 and its Current Reports on Form 8 - K. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained i n t he proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. 3 Important Information For Investors And Shareholders

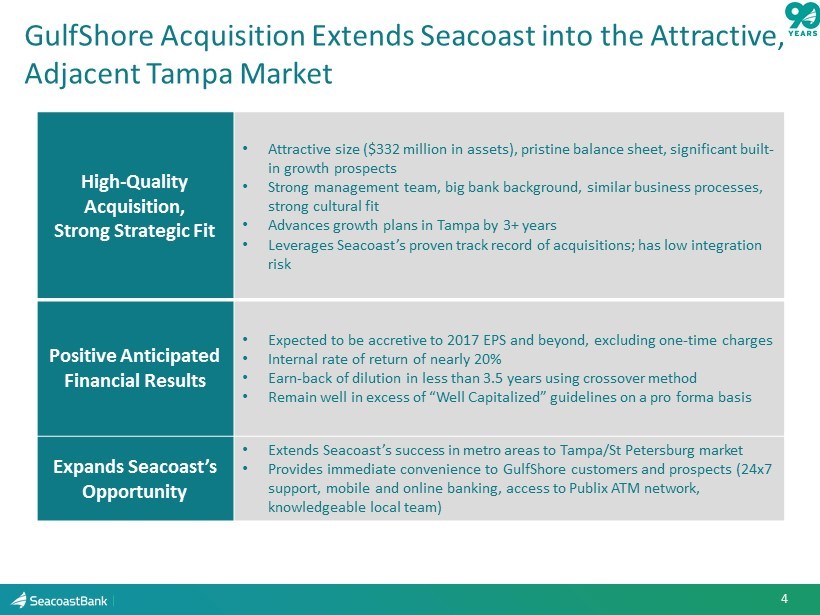

GulfShore Acquisition Extends Seacoast into the Attractive, Adjacent Tampa Market High - Quality Acquisition, Strong Strategic Fit • Attractive size ($332 million in assets), pristine balance sheet, significant built - in growth prospects • Strong management team, big bank background, similar business processes, strong cultural fit • Advances growth plans in Tampa by 3+ years • Leverages Seacoast’s proven track record of acquisitions; has low integration risk Positive Anticipated Financial Results • Expected to be accretive to 2017 EPS and beyond, excluding one - time charges • Internal rate of return of nearly 20% • Earn - back of dilution in less than 3.5 years using crossover method • Remain well in excess of “Well Capitalized” guidelines on a pro forma basis Expands Seacoast’s Opportunity • Extends Seacoast’s success in metro areas to Tampa/St Petersburg market • Provides immediate convenience to GulfShore customers and prospects (24x7 support, mobile and online banking, access to Publix ATM network, knowledgeable local team) 4

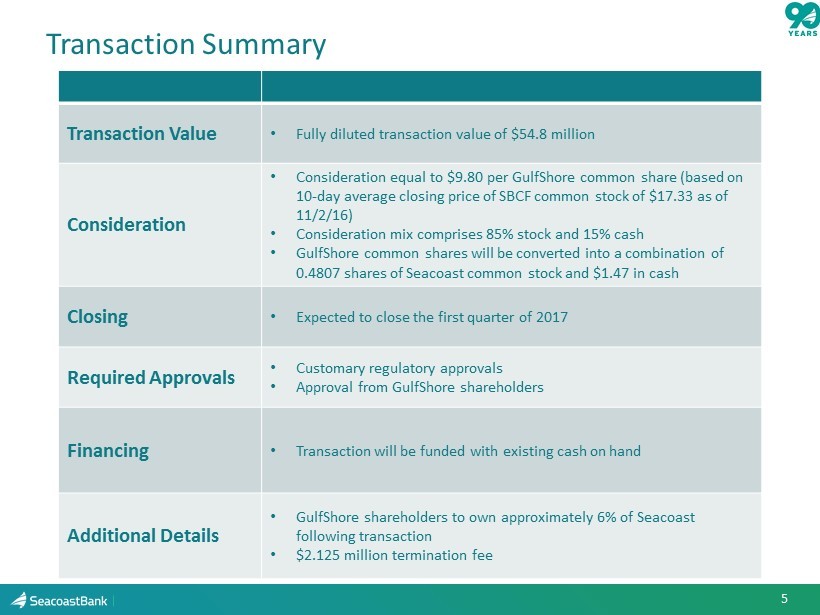

Transaction Summary Transaction Value • Fully diluted transaction value of $54.8 million Consideration • Consideration equal to $9.80 per GulfShore common share (based on 10 - day average closing price of SBCF common stock of $17.33 as of 11/2/16) • Consideration mix comprises 85% stock and 15% cash • GulfShore common shares will be converted into a combination of 0.4807 shares of Seacoast common stock and $1.47 in cash Closing • Expected to close the first quarter of 2017 Required Approvals • Customary regulatory approvals • Approval from GulfShore shareholders Financing • Transaction will be funded with existing cash on hand Additional Details • GulfShore shareholders to own approximately 6% of Seacoast following transaction • $2.125 million termination fee 5

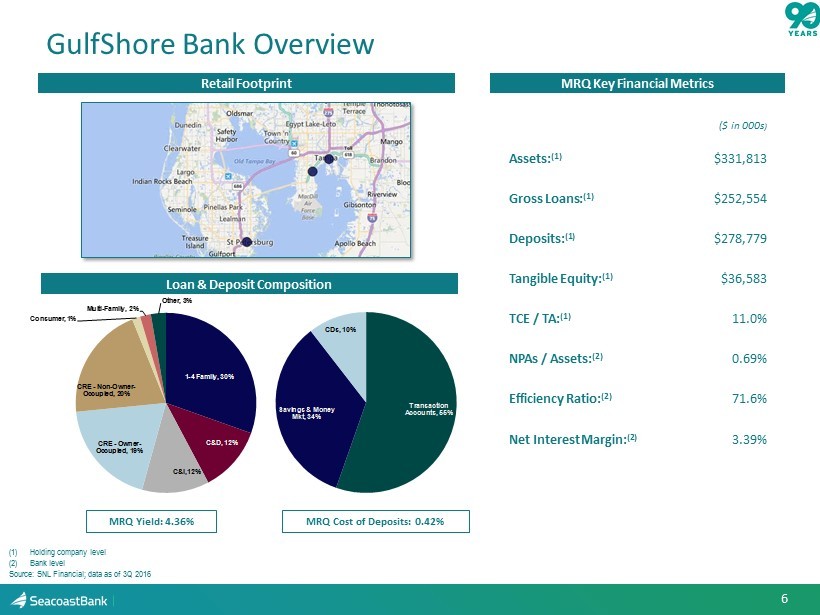

Loan & Deposit Composition ($ in 000s ) Assets: ( 1) $331,813 Gross Loans: (1) $252,554 Deposits: (1) $278,779 Tangible Equity: ( 1) $36,583 TCE / TA: ( 1) 11.0% NPAs / Assets: (2) 0.69% Efficiency Ratio: (2) 71.6% Net Interest Margin: (2) 3.39% Retail Footprint MRQ Key Financial Metrics (1) Holding company level (2) Bank level Source : SNL Financial; data as of 3Q 2016 1 - 4 Family, 30% C&D, 12% C&I, 12% CRE - Owner - Occupied, 19% CRE - Non - Owner - Occupied, 20% Consumer, 1% Multi - Family, 2% Other, 3% MRQ Yield : 4.36% MRQ Cost of Deposits: 0.42 % Transaction Accounts, 55% Savings & Money Mkt, 34% CDs, 10% GulfShore Bank Overview 6

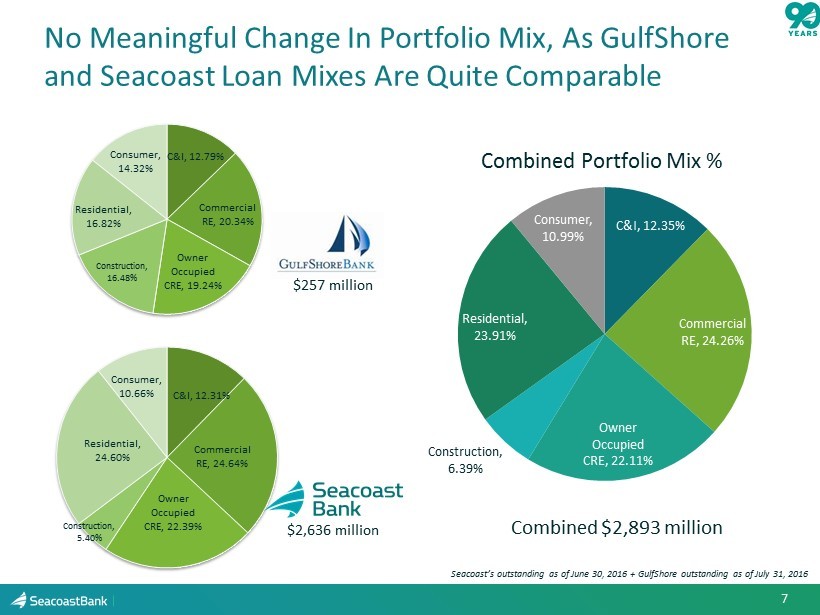

No Meaningful Change In Portfolio Mix, As GulfShore and Seacoast Loan Mixes Are Quite Comparable Seacoast’s outstanding as of June 30, 2016 + GulfShore outstanding as of July 31, 2016 C&I , 12.79% Commercial RE , 20.34% Owner Occupied CRE , 19.24% Construction , 16.48% Residential , 16.82% Consumer , 14.32% C&I , 12.31% Commercial RE , 24.64% Owner Occupied CRE , 22.39% Construction, 5.40% Residential , 24.60% Consumer , 10.66% C&I , 12.35% Commercial RE , 24.26% Owner Occupied CRE , 22.11% Construction , 6.39% Residential , 23.91% Consumer , 10.99% $257 million $2,636 million Combined $2,893 million Combined Portfolio Mix % 7

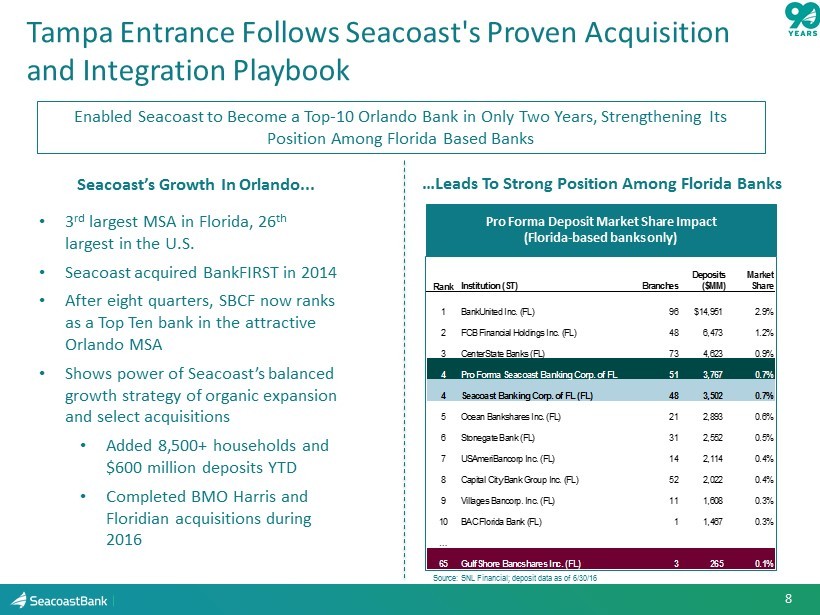

Source: SNL Financial; deposit data as of 6/30/16 Pro Forma Deposit Market Share Impact ( F lorida - based banks only) Rank Institution (ST) Branches Deposits ($MM) Market Share 1 BankUnited Inc. (FL) 96 $14,951 2.9% 2 FCB Financial Holdings Inc. (FL) 48 6,473 1.2% 3 CenterState Banks (FL) 73 4,623 0.9% 4 Pro Forma Seacoast Banking Corp. of FL 51 3,767 0.7% 4 Seacoast Banking Corp. of FL (FL) 48 3,502 0.7% 5 Ocean Bankshares Inc. (FL) 21 2,893 0.6% 6 Stonegate Bank (FL) 31 2,552 0.5% 7 USAmeriBancorp Inc. (FL) 14 2,114 0.4% 8 Capital City Bank Group Inc. (FL) 52 2,022 0.4% 9 Villages Bancorp. Inc. (FL) 11 1,608 0.3% 10 BAC Florida Bank (FL) 1 1,467 0.3% … 65 GulfShore Bancshares Inc. (FL) 3 265 0.1% Tampa Entrance Follows Seacoast's Proven Acquisition and Integration Playbook 8 • 3 rd largest MSA in Florida, 26 th largest in the U.S. • Seacoast acquired BankFIRST in 2014 • After eight quarters, SBCF now ranks as a Top Ten bank in the attractive Orlando MSA • Shows power of Seacoast’s balanced growth strategy of organic expansion and select acquisitions • Added 8,500+ households and $600 million deposits YTD • Completed BMO Harris and Floridian acquisitions during 2016 Enabled Seacoast to Become a Top - 10 Orlando Bank in Only Two Years, Strengthening Its Position Among Florida Based Banks …Leads To Strong Position Among Florida Banks Seacoast’s Growth In Orlando...

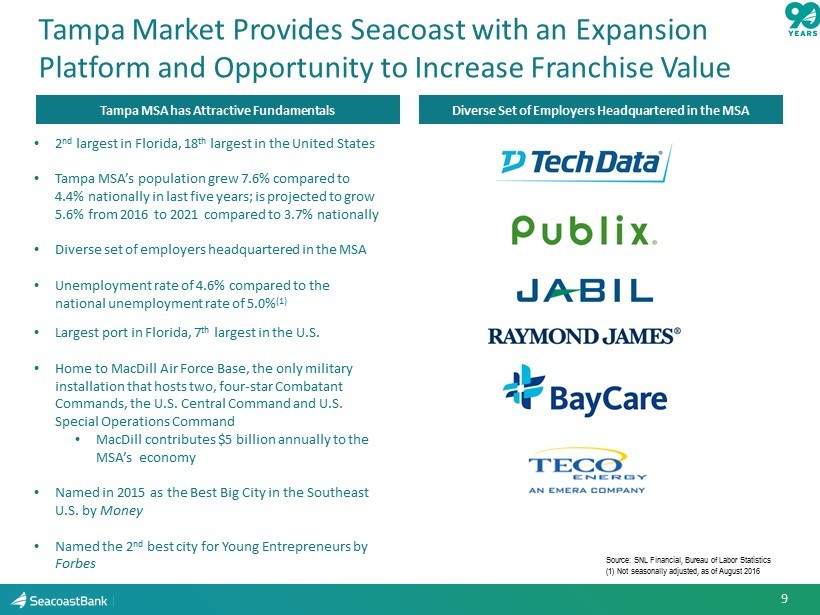

• 2 nd largest in Florida, 18 th largest in the United States • Tampa MSA’s population grew 7.6% compared to 4.4% nationally in last five years; is projected to grow 5.6% from 2016 to 2021 compared to 3.7% nationally • Diverse set of employers headquartered in the MSA • Unemployment rate of 4.6% compared to the national unemployment rate of 5.0% (1 ) • Largest port in Florida, 7 th largest in the U.S. • Home to MacDill Air Force Base, the only military installation that hosts two, four - star Combatant Commands, the U.S. Central Command and U.S. Special Operations Command • MacDill contributes $5 billion annually to the MSA’s economy • Named in 2015 as the Best Big City in the Southeast U.S. by Money • Named the 2 nd best city for Young Entrepreneurs by Forbes Source: SNL Financial, Bureau of Labor Statistics (1) Not seasonally adjusted, as of August 2016 Diverse Set of Employers Headquartered in the MSA Tampa MSA has Attractive Fundamentals Tampa Market Provides Seacoast with an Expansion Platform and Opportunity to Increase Franchise Value 9

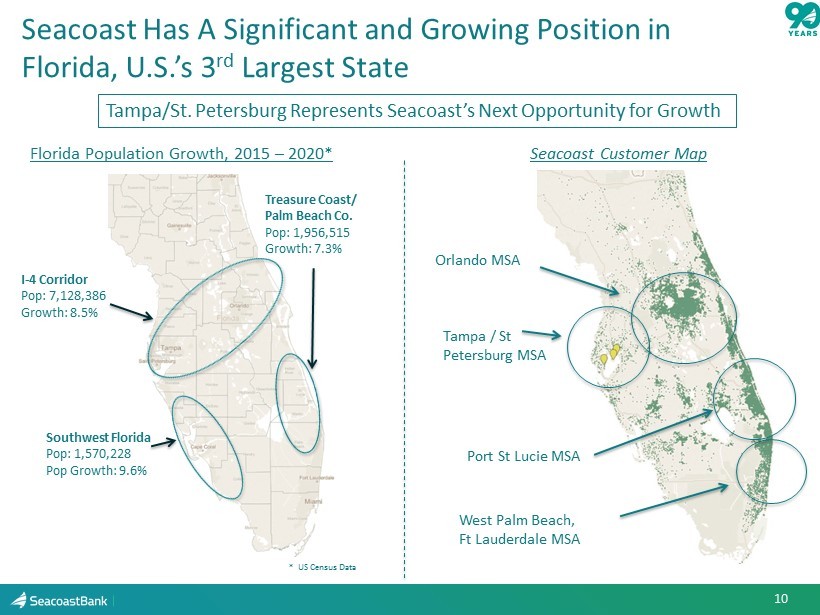

Agenda Seacoast Has A Significant and Growing Position in Florida, U.S.’s 3 rd Largest State Southwest Florida Pop: 1,570,228 Pop Growth : 9.6 % Treasure Coast/ Palm Beach Co. Pop: 1,956,515 Growth : 7.3 % I - 4 Corridor Pop: 7,128,386 Growth: 8.5% Florida Population Growth, 2015 – 2020* * US Census Data Seacoast Customer Map Orlando MSA West Palm Beach, Ft Lauderdale MSA Port St Lucie MSA Tampa / St Petersburg MSA 10 Tampa/St. Petersburg Represents Seacoast’s Next Opportunity for Growth

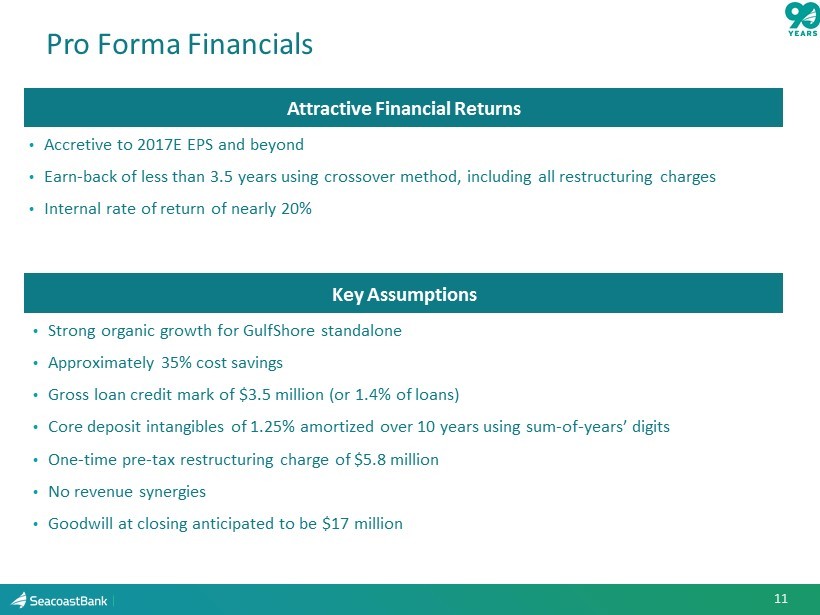

• Accretive to 2017E EPS and beyond • Earn - back of less than 3.5 years using crossover method, including all restructuring charges • Internal rate of return of nearly 20% Pro Forma Financials Attractive Financial Returns • Strong organic growth for GulfShore standalone • Approximately 35% cost savings • Gross loan credit mark of $3.5 million (or 1.4% of loans) • Core deposit intangibles of 1.25% amortized over 10 years using sum - of - years’ digits • One - time pre - tax restructuring charge of $5.8 million • No revenue synergies • Goodwill at closing anticipated to be $17 million Key Assumptions 11

• Expands platform into the attractive, adjacent Tampa MSA, Florida’s 2 nd largest • Accelerates growth timetable, eliminates earnings drag from organic growth • Leverages Seacoast’s proven acquisition and integration capabilities, ability to grow acquired banks • Highly compatible management team, with big bank background, similar business processes, strong cultural fit • Significant growth opportunities in Tampa MSA, beyond this transaction • Strengthens Seacoast’s overall Florida franchise Summary 12