Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Prestige Consumer Healthcare Inc. | exhibit991fy17-q2earningsr.htm |

| 8-K - 8-K - Prestige Consumer Healthcare Inc. | a8-kpressreleaseseptember2.htm |

Exhibit 99.2

This presentation contains certain “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, such

as statements regarding the Company’s expected financial performance, including revenue growth, adjusted EPS, and adjusted free cash flow,

expansion of market share for the Company’s Invest for Growth brands, the Company’s investment in digital, product development and

marketing initiatives, the Company’s focus on development of professional marketing, the Company’s ability to execute on the DenTek growth

strategy, and the Company’s ability to de-lever and increase M&A capacity. Words such as “trend,” “continue,” “will,” “expect,” “project,”

“anticipate,” “likely,” “estimate,” “may,” “should,” “could,” “would,” and similar expressions identify forward-looking statements. Such forward-

looking statements represent the Company’s expectations and beliefs and involve a number of known and unknown risks, uncertainties and

other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. These

factors include, among others, general economic and business conditions, regulatory matters, competitive pressures, the impact of the

Company’s digital, product development and marketing initiatives, supplier issues, unexpected costs, and other risks set forth in Part I, Item 1A.

Risk Factors in the Company’s Annual Report on Form 10-K for the year ended March 31, 2016 and in Part II, Item 1A. Risk Factors in the

Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2016. You are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date this presentation. Except to the extent required by applicable law, the Company

undertakes no obligation to update any forward-looking statement contained in this presentation, whether as a result of new information, future

events, or otherwise.

All adjusted GAAP numbers presented are footnoted and reconciled to their closest GAAP measurement in the attached reconciliation schedule

and in our earnings release in the “About Non-GAAP Financial Measures” section.

Agenda for Today's Discussion

I. Performance Highlights

II. Financial Oueruiew

Ill. FY 17 Outloo� and the Road Ahead

Second �u arter FY 17 Results 3

I. Performance Highlights

Dramamine· Co 41BM#@R+

Cli!Gr

eyes®

MONISTAT�

� (§$1,ffl

Debrox�

* Invest for Growth portfolio comprised of Core OTC brands and International; reported on a constant currency basis. Core OTC brands reflect: Monistat (after Q2 FY 16), BC/Goody’s, Clear Eyes, Dramamine, Debrox, Chloraseptic, Luden’s,

Little Remedies, Compound W, Nix (after Q2 FY 16), Beano, Efferdent and The Doctor’s IRI multi-outlet + C-Store retail dollar sales for relevant period. International includes Canadian consumption for leading retailers, and Australia/ROW

shipment data as a proxy for consumption.

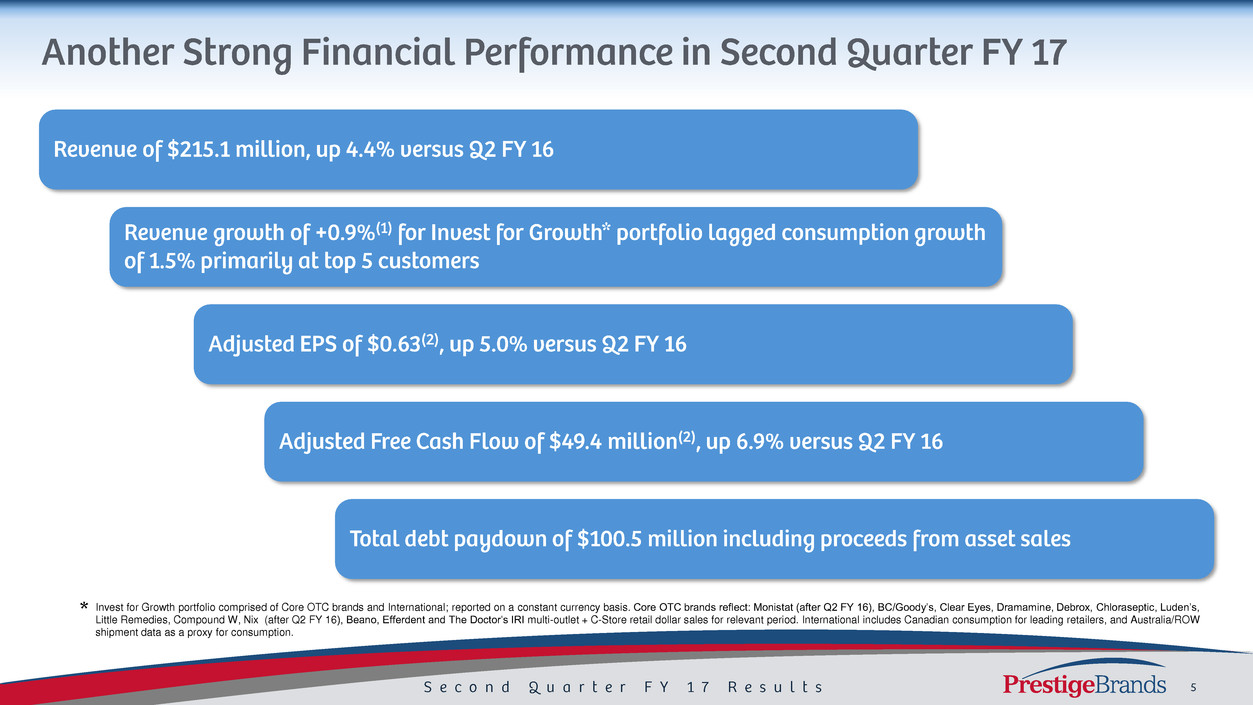

Q2 Revenue of $215.1 million, up 4.4% versus PY Q2

— Organic growth of (0.6%)(1) on a constant currency basis as top 5 retailers reduced inventory levels in the quarter

— Revenue growth of +0.9%(1) for Invest for Growth* portfolio

— DenTek contributed $17.2 million of revenue during the quarter, continuing its strong growth

Q2 consumption growth for Invest for Growth* portfolio of 1.5% outpaced revenue growth

— Consumption growth in-line with category†

International revenue up 8.9% in Q2 with particular strength in Care Pharma

— Revenue in Australia up 8.0% in Q2, and up 6.2% in 1H FY 17

Gross Margin of 57.6% in line with Q1 and expectations

Adjusted EPS of $0.63(2), up 5.0% versus the PY Q2

Strong Adjusted Free Cash Flow of $49.4 million(2), above the PY Q2 of $46.2 million

— Leverage of 4.5x(3) compared to 5.0x at the beginning of FY 17

Focus on enhancing and executing marketing plans for DenTek

Successfully completed transition of three brands divested in July from Manage for Cash portfolio

— Accelerated de-leveraging in first half, building meaningful M&A capacity

Invest for Growth portfolio is comprised of Core OTC brands and International; reported on a constant currency basis. (See slide 5 for additional details.)

IRI MULO period ending 10-2-16.*†

Invest for Growth portfolio is comprised of Core OTC brands and International; reported on a costant currency basis. (See slide 5 for additional details.)*

Source: Data reflects retail dollar sales percentage growth versus prior period for consumption growth and organic revenue growth.

FY 15 and FY 16 data shown as previously presented for Core OTC.

Q1 and Q2 FY 17 data for Invest for Growth portfolio comprised of Core OTC brands and International. (See slide 5 for additional details.)

FY 15

4.1%

8.3%

3.3%

1.5%

3.5%

5.9%

4.4%

0.9%

FY 16

Q1

*

*

Q2

FY 17

1H: 2.4%

1H: 2.6%

Shipments to five largest mass and drug accounts have lagged

consumption over the last six quarters as retailers continue to

manage inventory levels

In Q2 FY 17 alone, consumption in these accounts outpaced

shipments by over $8.2 million

Adjusted for this difference, organic revenue growth for Q2 FY 17 on

a constant currency basis would have been +3.5%

Source: IRI MULO period ending 10-2-16.

($2.8)

$1.0

($4.3)

$0.9 $0.9

($8.2)

Q1 Q2 Q3 Q4 Q1 Q2

FY 16 FY 17

Co

ns

um

ption

>

Sh

ipm

en

ts

Sh

ipm

en

ts

>

Co

ns

um

ptio

n

Expand Domestic And Int’l Distribution

Develop Alternate Channels and E-commerce

Increase Shelf Presence in UK and Germany

Use Digital To Drive Brand Awareness

Target High Value Consumers

Leverage Scale to Drive Efficiencies

Dental Professional Marketing

Secure the Hygienist Recommendation

Increase Sampling to Drive Trial

Grow The Category

New Category and Consumer Insights

Build Basket with Shopper Insights

Innovate With New Products

Pipeline to Deliver Top and Bottom Line Growth

Consumer Insight Innovation

Source: IRI MULO period ending 10-2-16.

Expanding Product Offerings: New Nix Ultra kills a resistant form of Lice called “Super Lice”

Innovative Marketing: Nix partnered with Google and IRI to develop the first ever Lice Tracker. Now

consumers and Healthcare Professionals can get real-time information on lice outbreaks

Digital Consumer Advertising: The first place consumers go to get information is on line. Nix’s new

advertising campaign will reach consumers with information where and when they need it

Strong Results: Latest 12 weeks consumption +53% and gained 7.1% ppts. market share

Dramamine·

II. Financial Oueruiew

Co

41BM#@R+

Cli!Gr

eyes®

MONISTAT�

� (§$1,ffl

Debrox�

Solid overall financial performance in the quarter

− Revenue of $215.1 million, an increase of 4.4%

− Adjusted EPS of $0.63(2), up 5.0%

− Adjusted Free Cash Flow of $49.4 million(2), an increase of 6.9%

$215.1

$78.1

$49.4

$206.1

$75.6

$46.2

Total Revenue Adjusted EBITDA Adjusted EPS Adjusted Free Cash Flow

Q2 FY 17 Q2 FY 16

4.4%

3.3% 5.0% 6.9%

$0.63 $0.60

(2) (2) (2)

Dollar values in millions, except per share data.

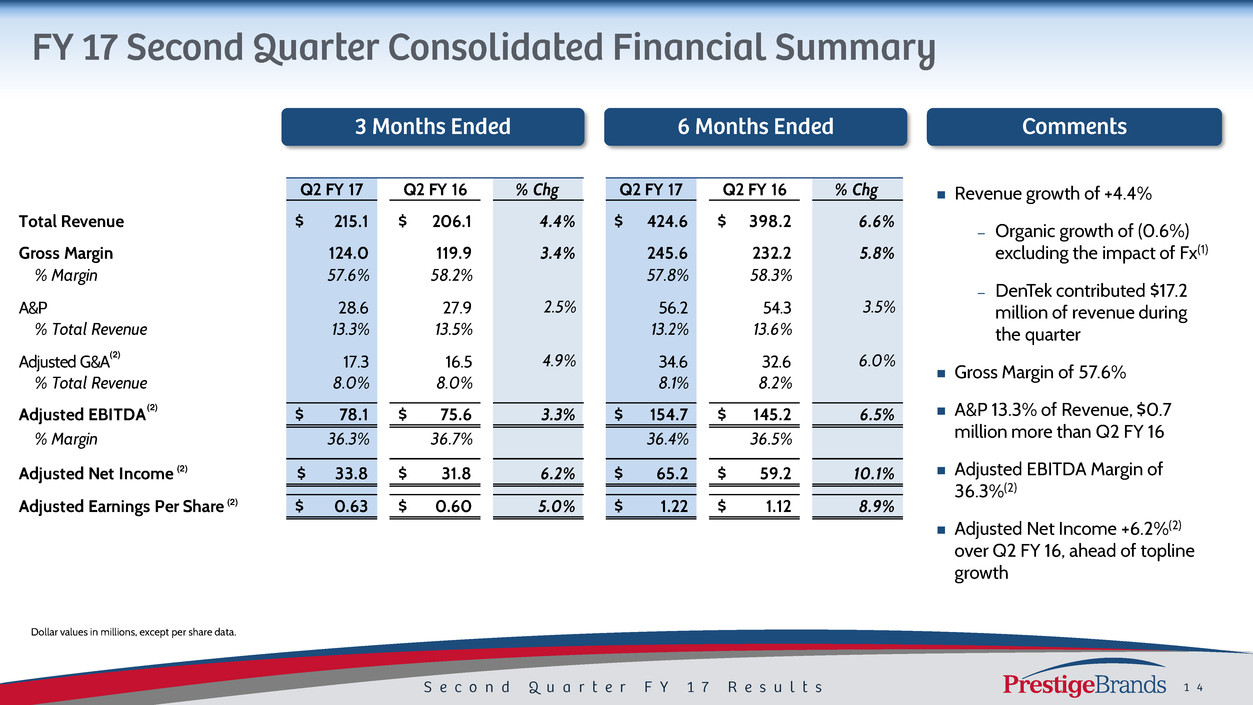

Revenue growth of +4.4%

– Organic growth of (0.6%)

excluding the impact of Fx(1)

– DenTek contributed $17.2

million of revenue during

the quarter

Gross Margin of 57.6%

A&P 13.3% of Revenue, $0.7

million more than Q2 FY 16

Adjusted EBITDA Margin of

36.3%(2)

Adjusted Net Income +6.2%(2)

over Q2 FY 16, ahead of topline

growth

Dollar values in millions, except per share data.

(2)

(2)

(2)

(2)

Q2 FY 17 Q2 FY 16 % Chg Q2 FY 17 Q2 FY 16 % Chg

Total Revenue 215.1$ 206.1$ 4.4% 424.6$ 398.2$ 6.6%

Gross Margin 124.0 119.9 3.4% 245.6 232.2 5.8%

% Margin 57.6% 58.2% 57.8% 58.3%

A&P 28.6 27.9 2.5% 56.2 54.3 3.5%

% Total Revenue 13.3% 13.5% 13.2% 13.6%

Adjusted G&A 17.3 16.5 4.9% 34.6 32.6 6.0%

% Total Revenue 8.0% 8.0% 8.1% 8.2%

Adjusted EBITDA 78.1$ 75.6$ 3.3% 154.7$ 145.2$ 6.5%

% Margin 36.3% 36.7% 36.4% 36.5%

Adjusted Net Income 33.8$ 31.8$ 6.2% 65.2$ 59.2$ 10.1%

Adjusted Earnings Per Share 0.63$ 0.60$ 5.0% 1.22$ 1.12$ 8.9%

Net Debt at 9/30/16 of $1,472 million comprised of:

– Cash on hand of $30 million

– $752 million of term loan and revolver

– $750 million of bonds

Leverage ratio(3) of 4.5x

– Leverage below prior year level of 5.0x,

including acquisition of DenTek in Q4 FY 16

Dollar values in millions.

* 1H FY 17 increase in Other Non-Cash Operating Items reflects Q1 FY 17 after tax loss of approximately $35 million related to divestitures.

(4)

(2)

Three Months Ended Six Months Ended

Q2 FY 17 Q2 FY 16 Q2 FY 17 Q2 FY 16

Net Income - As Reported 32.2$ 31.8$ 26.7$ 58.0$

Depreciation & Amortization 6.0 5.7 12.8 11.4

Other Non-Cash Operating Items 3.6 14.4 53.5 31.5

Working Capital 7.7 (4.8) 7.2 (10.3)

Operating Cash Flow 49.5$ 47.1$ 100.3$ 90.6$

Additions to Proper y and Equipment (0.5) (0.9) (1.4) (1.7)

Payments Associ ted with M&A 0.4 - 0.7 -

Adjusted Free Cash Flow 49.4$ 46.2$ 99.6$ 88.9$

*

Ill. FY 17 Outlook and the Road Ahead

Dramamine· Co 41BM#@R+

Cli!Gr

eyes®

MONISTAT�

� (§$1,ffl

Go!'!1f.!-'!!ne Debrox· Ca re

na

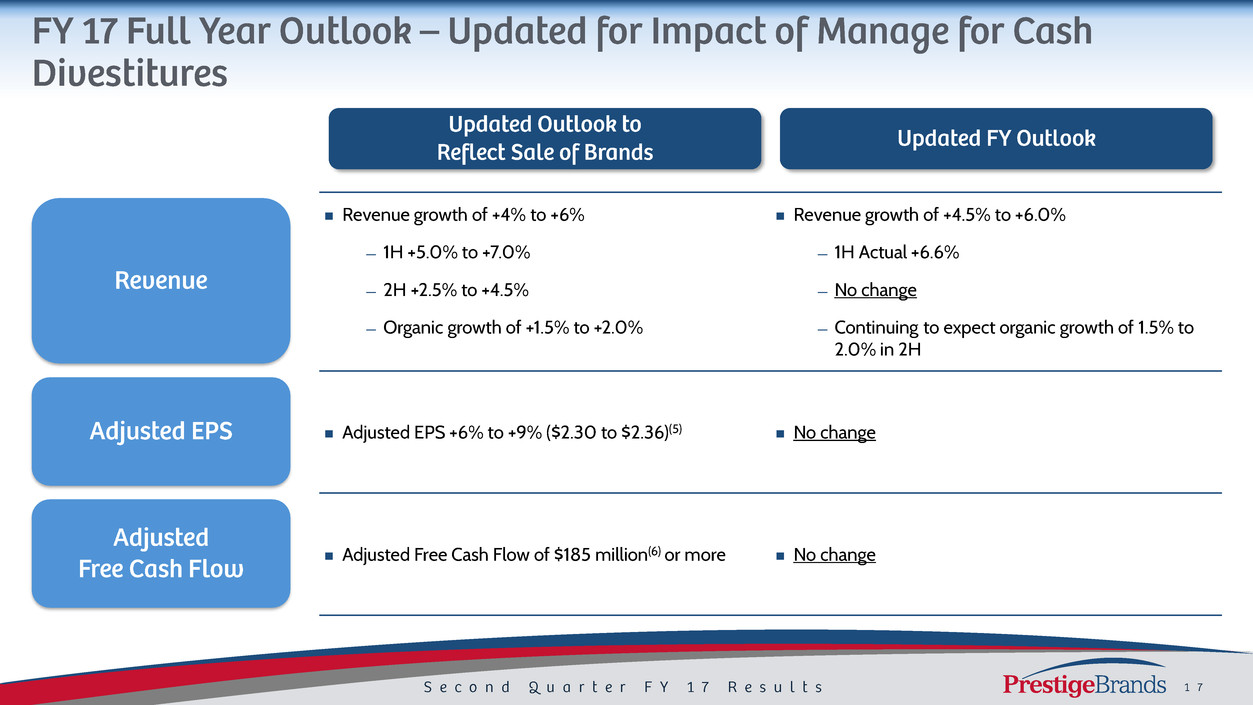

Revenue growth of +4% to +6%

— 1H +5.0% to +7.0%

— 2H +2.5% to +4.5%

— Organic growth of +1.5% to +2.0%

Revenue growth of +4.5% to +6.0%

— 1H Actual +6.6%

— No change

— Continuing to expect organic growth of 1.5% to

2.0% in 2H

Adjusted EPS +6% to +9% ($2.30 to $2.36)(5) No change

Adjusted Free Cash Flow of $185 million(6) or more No change

Portfolio of recognizable brands in

attractive consumer health industry

Established expertise in brand-

building and product innovation

Demonstrated ability to gain market

share long-term

Target revenue contribution from

Core OTC and International brands

from ~80% to ~85%

Strong and consistent cash flow

driven by industry leading EBITDA

margins, capital-lite business model

& significant benefit of deferred taxes

Rapid deleveraging allows for

expanded acquisition capacity and

continued investment in brand

building

Non-core brands’ contribution to

cash flow

Debt repayment reduces cash

interest expense and adds to EPS

Demonstrated track record of 7

acquisitions during the past 6 years

Effective consolidation platform

positioned for consistent pipeline of

opportunities

Proven ability to source from varied

sellers

Fragmented industry and acquisition

activity creates a consistent pipeline

of opportunity

Care

Second Qu arter FY 17 Results �,.

(1) Organic Revenue Growth on a constant currency basis is a Non-GAAP financial measure and is reconciled to its most closely

related GAAP financial measure in our earnings release in the “About Non-GAAP Financial Measures” section.

(2) Adjusted G&A, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted EPS, Adjusted Free Cash Flow are

Non-GAAP financial measures and are reconciled to their most closely related GAAP financial measures in the attached

Reconciliation Schedules and in our earnings release in the “About Non-GAAP Financial Measures” section.

(3) Leverage ratio reflects net debt / covenant defined EBITDA.

(4) Operating cash flow is equal to GAAP net cash provided by operating activities.

(5) Adjusted EPS for FY 17 is a projected Non-GAAP financial measure, is reconciled to projected GAAP EPS in our earnings release

in the “About Non-GAAP Financial Measures” section and is calculated based on projected GAAP EPS of $1.55 to $1.61 plus

$0.08 of costs associated with DenTek integration plus $0.67 of costs associated with the loss on sale of assets, resulting in

$2.30 to $2.36.

(6) Adjusted Free Cash Flow for FY 17 is a projected Non-GAAP financial measure, is reconciled to projected GAAP Net Cash

Provided by Operating Activities in our earnings release in the “About Non-GAAP Financial Measures” section and is calculated

based on projected Net Cash Provided by Operating Activities of $191 million less projected capital expenditures of $4 million

plus payments associated with acquisitions of $3 million.

Three Months Ended Sept. 30, Six Months Ended Sept. 30,

2016 2015 2016 2015

(In Thousands)

GAAP Total Revenues $ 215,052 $ 206,065 $ 424,627 $ 398,197

Adjustments:

DenTek revenues (17,214) - (33,841) -

Revenues associated with divested brands - (6,922) - (6,922)

Total adjustments (17,214) (6,922) (33,841) (6,922)

Non-GAAP Organic Revenues 197,838 199,143 390,786 391,275

Organic Revenue Growth (Decline) (0.7%) (0.1%)

Impact of foreign currency exchange rates (76) (905)

Non-GAAP Organic Revenues on a constant currency basis $ 197,838 $ 199,067 $ 390,786 $ 390,370

Constant Currency Organic Revenue Growth (0.6%) 0.1%

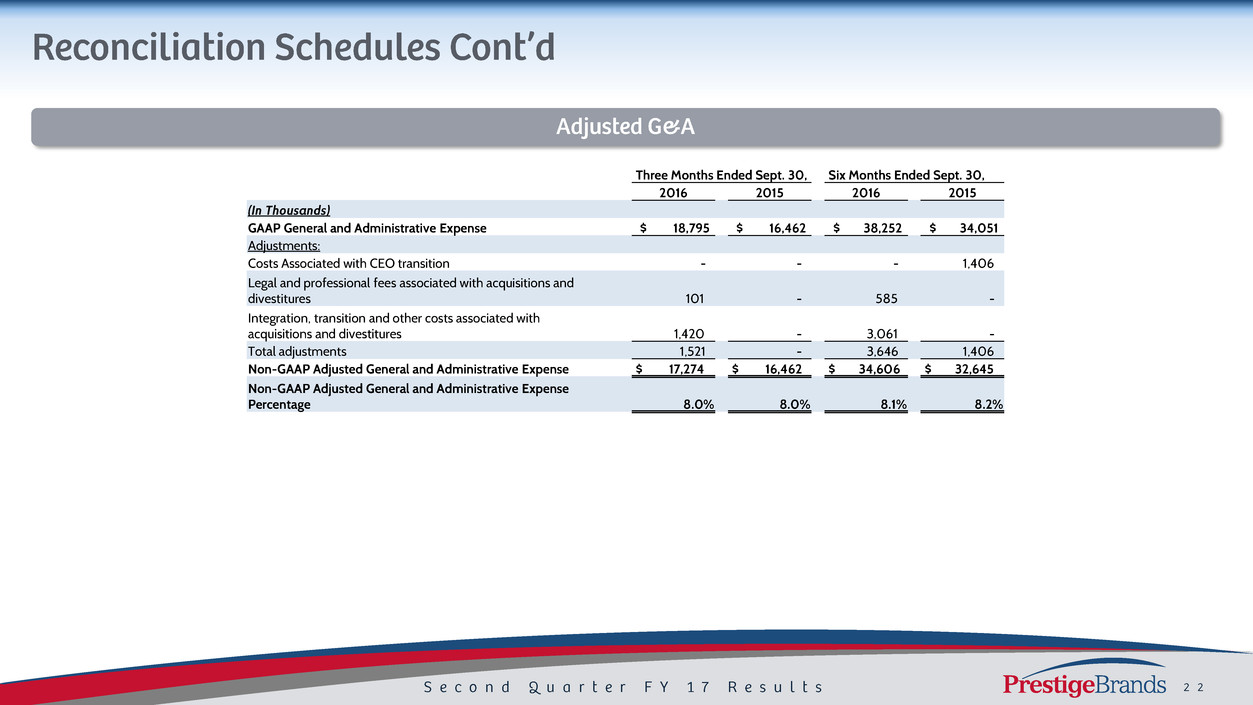

Three Months Ended Sept. 30, Six Months Ended Sept. 30,

2016 2015 2016 2015

(In Thousands)

GAAP General and Administrative Expense $ 18,795 $ 16,462 $ 38,252 $ 34,051

Adjustments:

Costs Associated with CEO transition - - - 1,406

Legal and professional fees associated with acquisitions and

divestitures 101 - 585 -

Integration, transition and other costs associated with

acquisitions and divestitures 1,420 - 3,061 -

Total adjustments 1,521 - 3,646 1,406

Non-GAAP Adjusted General and Administrative Expense $ 17,274 $ 16,462 $ 34,606 $ 32,645

Non-GAAP Adjusted General and Administrative Expense

Percentage 8.0% 8.0% 8.1% 8.2%

Three Months Ended Sept. 30, Six Months Ended Sept. 30,

2016 2015 2016 2015

(In Thousands)

GAAP Net (Loss) Income $ 32,195 $ 31,803 $ 26,664 $ 57,976

Interest expense, net 20,830 20,667 41,957 42,551

(Benefit) provision for income taxes 18,033 17,428 14,651 31,425

Depreciation and amortization 6,016 5,687 12,848 11,407

Non-GAAP EBITDA 77,074 75,585 96,120 143,359

Adjustments:

Costs associated with CEO transitions - - - 1,406

Legal and professional fees associated with acquisitions and

divestitures 101 - 585 -

Integration, transition and other costs associated with

acquisitions and divestitures 1,420 - 3,061 -

Loss on extinguishment of debt - - - 451

(Gain) loss on sale of assets (496) - 54,957 -

Total adjustments 1,025 - 58,603 1,857

Non-GAAP Adjusted EBITDA $ 78,099 $ 75,585 $ 154,723 $ 145,216

Non-GAAP Adjusted EBITDA Margin 36.3% 36.7% 36.4% 36.5%

Three Months Ended Sept. 30, Six Months Ended Sept. 30,

2016 2015 2016 2015

Net

Income EPS

Net

Income EPS

Net

Income EPS

Net

Income EPS

(In Thousands)

GAAP Net Income $ 32,195 $ 0.60 $ 31,803 $ 0.60 $ 26,664 $ 0.50 $ 57,976 $ 1.09

Adjustments:

Costs associated with CEO transition - - - - - - 1,406 0.03

Legal and professional fees associated with

acquisitions and divestitures 101 - - - 585 0.01 - -

Integration, transition and other costs associated

with acquisitions and divestitures 1,420 0.03 - - 3,061 0.06 -

Accelerated amortization of debt origination costs

due to sale of assets 1,131 0.02 - - 1,131 0.02 -

Loss on extinguishment of debt - - - - - - 451 0.01

(Gain) loss on sale of assets (496) (0.01) - - 54,957 1.03 - -

Tax impact of adjustments (566) (0.01) - - (21,224) (0.40) (657) (0.01)

Total Adjustments 1,590 0.03 - - 38,510 0.72 1,200 0.03

Non-GAAP Adjusted Net Income and Adjusted EPS $ 33,785 $ 0.63 $ 31,803 $ 0.60 $ 65,174 $ 1.22 $ 59,176 $ 1.12

Three Months Ended Sept. 30, Six Months Ended Sept. 30,

2016 2015 2016 2015

(In Thousands)

GAAP Net (Loss) Income $ 32,195 $ 31,803 $ 26,664 $ 57,976

Adjustments:

Adjustments to reconcile net (loss) income to net

cash provided by operating activities as shown in

the Statement of Cash Flows 9,592 20,040 66,388 42,896

Changes in operating assets and liabilities, net of

effects from acquisitions as shown in the

Statement of Cash Flows

7,744 (4,774) 7,230 (10,282)

Total Adjustments 17,336 15,266 73,618 32,614

GAAP Net cash provided by operating activities 49,531 47,069 100,282 90,590

Purchase of property and equipment (509) (903) (1,404) (1,683)

Non-GAAP Free Cash Flow 49,022 46,166 98,878 88,907

Integration, transition and other payments

associated with acquisitions and divestitures 352 - 683 -

Non-GAAP Adjusted Free Cash Flow $ 49,374 $ 46,166 $ 99,561 $ 88,907

2017 Projected EPS

Low High

Projected FY'17 GAAP EPS $ 1.55 $ 1.61

Adjustments:

Costs associated with DenTek integration 0.08 0.08

Loss on sale of assets 0.67 0.67

Total Adjustments 0.75 0.75

Projected Non-GAAP Adjusted EPS $ 2.30 $ 2.36

2017

Projected

Free Cash

Flow

(In millions)

Projected FY'17 GAAP Net Cash provided by operating activities $ 191

Additions to property and equipment for cash (4)

Projected Non-GAAP Free Cash Flow 187

Payments associated with acquisitions 3

Adjusted Non-GAAP Projected Free Cash Flow 190