Attached files

| file | filename |

|---|---|

| EX-2.1 - EXHIBIT 2.1 - INTERNATIONAL SHIPHOLDING CORP | ex2_1.htm |

| 8-K - INTERNATIONAL SHIPHOLDING CORP 8-K 10-20-2016 - INTERNATIONAL SHIPHOLDING CORP | form8k.htm |

Exhibit 99.1

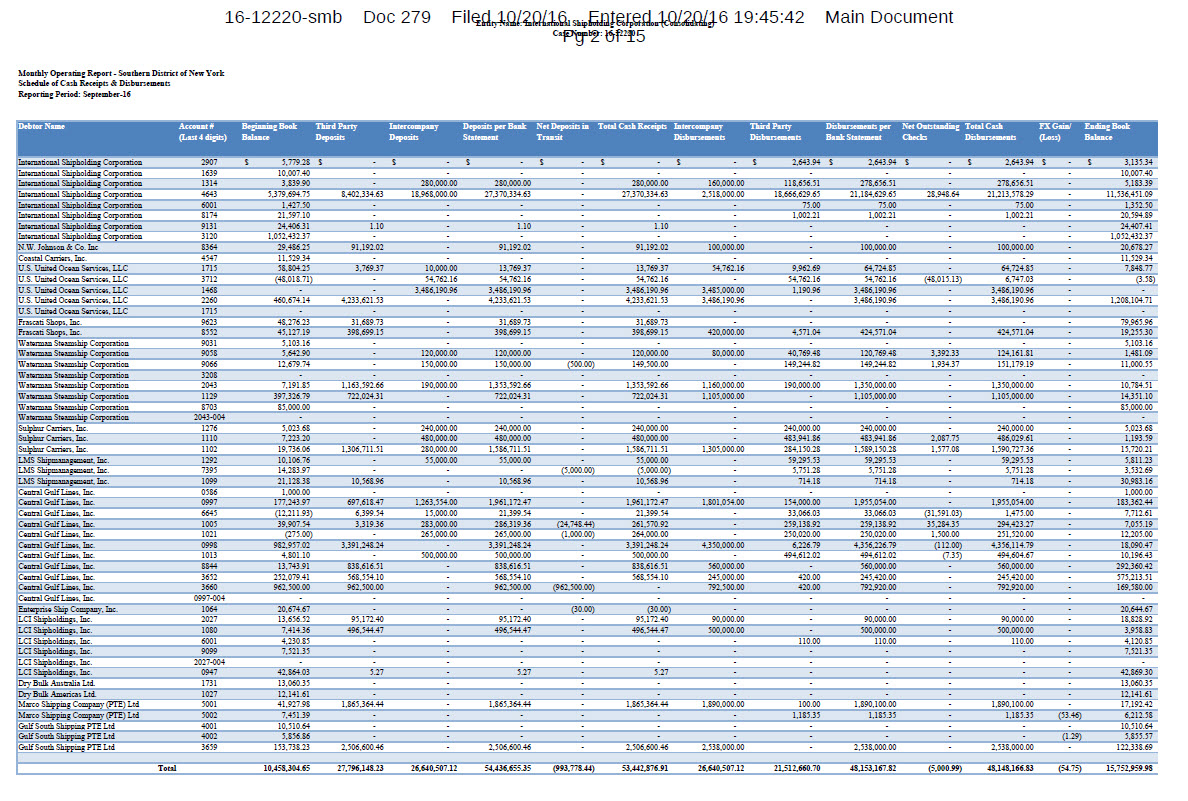

16-12220-smb Doc 279 Filed 10/20/16 Entered 10/20/16 19:45:42 Main DocumentEntity Name: International Shipholding Corporation (Consolidating) CaPg 2 of 1 5 Monthly Operating Report - Southern District of New YorkSchedule of Cash Receipts & Disbursements Reporting Period: September-16 Debtor Name Account # Beginning Book Third Party Intercompany Deposits per Bank Net Deposits in Total Cash Receipts Intercompany Third Party Disbursements per Net Outstanding Total Cash FX Gain/ Ending Book (Last 4 digits) Balance Deposits Deposits Statement Transit Disbursements Disbursements Bank Statement Checks Disbursements (Loss) Balance International Shipholding Corporation 2907 $ 5,779.28 $ - $ - $ - $ - $ - $ - $ 2,643.94 $ 2,643.94 $ - $ 2,643.94 $ - $ 3,135.34 International Shipholding Corporation 1639 10,007.40 - - - - - - - - - - - 10,007.40 International Shipholding Corporation 1314 3,839.90 - 280,000.00 280,000.00 - 280,000.00 160,000.00 118,656.51 278,656.51 - 278,656.51 - 5,183.39 International Shipholding Corporation 4643 5,379,694.75 8,402,334.63 18,968,000.00 27,370,334.63 - 27,370,334.63 2,518,000.00 18,666,629.65 21,184,629.65 28,948.64 21,213,578.29 - 11,536,451.09 International Shipholding Corporation 6001 1,427.50 - - - - - - 75.00 75.00 - 75.00 - 1,352.50 International Shipholding Corporation 8174 21,597.10 - - - - - - 1,002.21 1,002.21 - 1,002.21 - 20,594.89 International Shipholding Corporation 9131 24,406.31 1.10 - 1.10 - 1.10 - - - - - - 24,407.41 International Shipholding Corporation 3120 1,052,432.37 - - - - - - - - - - - 1,052,432.37 N.W. Johnson & Co. Inc 8364 29,486.25 91,192.02 - 91,192.02 - 91,192.02 100,000.00 - 100,000.00 - 100,000.00 - 20,678.27 Coastal Carriers, Inc. 4547 11,529.34 - - - - - - - - - - - 11,529.34 U.S. United Ocean Services, LLC 1715 58,804.25 3,769.37 10,000.00 13,769.37 - 13,769.37 54,762.16 9,962.69 64,724.85 - 64,724.85 - 7,848.77 U.S. United Ocean Services, LLC 3712 (48,018.71) - 54,762.16 54,762.16 - 54,762.16 - 54,762.16 54,762.16 (48,015.13) 6,747.03 - (3.58) U.S. United Ocean Services, LLC 1468 - - 3,486,190.96 3,486,190.96 - 3,486,190.96 3,485,000.00 1,190.96 3,486,190.96 - 3,486,190.96 - - U.S. United Ocean Services, LLC 2260 460,674.14 4,233,621.53 - 4,233,621.53 - 4,233,621.53 3,486,190.96 - 3,486,190.96 - 3,486,190.96 - 1,208,104.71 U.S. United Ocean Services, LLC 1715 - - - - - - - - - - - - - Frascati Shops, Inc. 9623 48,276.23 31,689.73 - 31,689.73 - 31,689.73 - - - - - - 79,965.96 Frascati Shops, Inc. 8552 45,127.19 398,699.15 - 398,699.15 - 398,699.15 420,000.00 4,571.04 424,571.04 - 424,571.04 - 19,255.30 Waterman Steamship Corporation 9031 5,103.16 - - - - - - - - - - - 5,103.16 Waterman Steamship Corporation 9058 5,642.90 - 120,000.00 120,000.00 - 120,000.00 80,000.00 40,769.48 120,769.48 3,392.33 124,161.81 - 1,481.09 Waterman Steamship Corporation 9066 12,679.74 - 150,000.00 150,000.00 (500.00) 149,500.00 - 149,244.82 149,244.82 1,934.37 151,179.19 - 11,000.55 Waterman Steamship Corporation 3208 - - - - - - - - - - - - - Waterman Steamship Corporation 2043 7,191.85 1,163,592.66 190,000.00 1,353,592.66 - 1,353,592.66 1,160,000.00 190,000.00 1,350,000.00 - 1,350,000.00 - 10,784.51 Waterman Steamship Corporation 1129 397,326.79 722,024.31 - 722,024.31 - 722,024.31 1,105,000.00 - 1,105,000.00 - 1,105,000.00 - 14,351.10 Waterman Steamship Corporation 8703 85,000.00 - - - - - - - - - - - 85,000.00 Waterman Steamship Corporation 2043-004 - - - - - - - - - - - - - Sulphur Carriers, Inc. 1276 5,023.68 - 240,000.00 240,000.00 - 240,000.00 - 240,000.00 240,000.00 - 240,000.00 - 5,023.68 Sulphur Carriers, Inc. 1110 7,223.20 - 480,000.00 480,000.00 - 480,000.00 - 483,941.86 483,941.86 2,087.75 486,029.61 - 1,193.59 Sulphur Carriers, Inc. 1102 19,736.06 1,306,711.51 280,000.00 1,586,711.51 - 1,586,711.51 1,305,000.00 284,150.28 1,589,150.28 1,577.08 1,590,727.36 - 15,720.21 LMS Shipmanagement, Inc. 1292 10,106.76 - 55,000.00 55,000.00 - 55,000.00 - 59,295.53 59,295.53 - 59,295.53 - 5,811.23 LMS Shipmanagement, Inc. 7395 14,283.97 - - - (5,000.00) (5,000.00) - 5,751.28 5,751.28 - 5,751.28 - 3,532.69 LMS Shipmanagement, Inc. 1099 21,128.38 10,568.96 - 10,568.96 - 10,568.96 - 714.18 714.18 - 714.18 - 30,983.16 Central Gulf Lines, Inc. 0586 1,000.00 - - - - - - - - - - - 1,000.00 Central Gulf Lines, Inc. 0997 177,243.97 697,618.47 1,263,554.00 1,961,172.47 - 1,961,172.47 1,801,054.00 154,000.00 1,955,054.00 - 1,955,054.00 - 183,362.44 Central Gulf Lines, Inc. 6645 (12,211.93) 6,399.54 15,000.00 21,399.54 - 21,399.54 - 33,066.03 33,066.03 (31,591.03) 1,475.00 - 7,712.61 Central Gulf Lines, Inc. 1005 39,907.54 3,319.36 283,000.00 286,319.36 (24,748.44) 261,570.92 - 259,138.92 259,138.92 35,284.35 294,423.27 - 7,055.19 Central Gulf Lines, Inc. 1021 (275.00) - 265,000.00 265,000.00 (1,000.00) 264,000.00 - 250,020.00 250,020.00 1,500.00 251,520.00 - 12,205.00 Central Gulf Lines, Inc. 0998 982,957.02 3,391,248.24 - 3,391,248.24 - 3,391,248.24 4,350,000.00 6,226.79 4,356,226.79 (112.00) 4,356,114.79 - 18,090.47 Central Gulf Lines, Inc. 1013 4,801.10 - 500,000.00 500,000.00 - 500,000.00 - 494,612.02 494,612.02 (7.35) 494,604.67 - 10,196.43 Central Gulf Lines, Inc. 8844 13,743.91 838,616.51 - 838,616.51 - 838,616.51 560,000.00 - 560,000.00 - 560,000.00 - 292,360.42 Central Gulf Lines, Inc. 3652 252,079.41 568,554.10 - 568,554.10 - 568,554.10 245,000.00 420.00 245,420.00 - 245,420.00 - 575,213.51 Central Gulf Lines, Inc. 3660 962,500.00 962,500.00 - 962,500.00 (962,500.00) - 792,500.00 420.00 792,920.00 - 792,920.00 - 169,580.00 Central Gulf Lines, Inc. 0997-004 - - - - - - - - - - - - - Enterprise Ship Company, Inc. 1064 20,674.67 - - - (30.00) (30.00) - - - - - - 20,644.67 LCI Shipholdings, Inc. 2027 13,656.52 95,172.40 - 95,172.40 - 95,172.40 90,000.00 - 90,000.00 - 90,000.00 - 18,828.92 LCI Shipholdings, Inc. 1080 7,414.36 496,544.47 - 496,544.47 - 496,544.47 500,000.00 - 500,000.00 - 500,000.00 - 3,958.83 LCI Shipholdings, Inc. 6001 4,230.85 - - - - - - 110.00 110.00 - 110.00 - 4,120.85 LCI Shipholdings, Inc. 9099 7,521.35 - - - - - - - - - - - 7,521.35 LCI Shipholdings, Inc. 2027-004 - - - - - - - - - - - - - LCI Shipholdings, Inc. 0947 42,864.03 5.27 - 5.27 - 5.27 - - - - - - 42,869.30 Dry Bulk Australia Ltd. 1731 13,060.35 - - - - - - - - - - - 13,060.35 Dry Bulk Americas Ltd. 1027 12,141.61 - - - - - - - - - - - 12,141.61 Marco Shipping Company (PTE) Ltd 5001 41,927.98 1,865,364.44 - 1,865,364.44 - 1,865,364.44 1,890,000.00 100.00 1,890,100.00 - 1,890,100.00 - 17,192.42 Marco Shipping Company (PTE) Ltd 5002 7,451.39 - - - - - - 1,185.35 1,185.35 - 1,185.35 (53.46) 6,212.58 Gulf South Shipping PTE Ltd 4001 10,510.64 - - - - - - - - - - - 10,510.64 Gulf South Shipping PTE Ltd 4002 5,856.86 - - - - - - - - - - (1.29) 5,855.57 Gulf South Shipping PTE Ltd 3659 153,738.23 2,506,600.46 - 2,506,600.46 - 2,506,600.46 2,538,000.00 - 2,538,000.00 - 2,538,000.00 - 122,338.69 Total 10,458,304.65 27,796,148.23 26,640,507.12 54,436,655.35 (993,778.44) 53,442,876.91 26,640,507.12 21,512,660.70 48,153,167.82 (5,000.99) 48,148,166.83 (54.75) 15,752,959.98 MOR-1Page 1

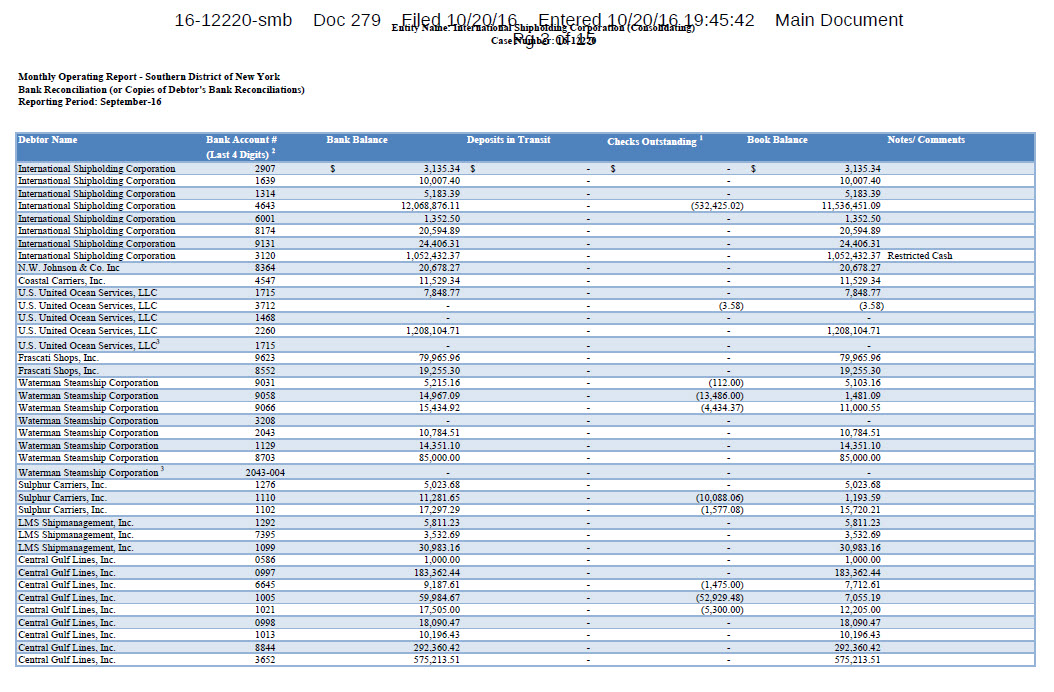

16-12220-smb Doc 279 Monthly Operating Report - Southern District of New YorkBank Reconciliation (or Copies of Debtor's Bank Reconciliations)Reporting Period: September-16 Entity Name: International Shipholding Corporation (Consolidating)Filed 10/20/16 Entered 10/20/16 19:45:42 Main Document CasePg 3 of 15 Debtor Name Bank Account # Bank Balance Deposits in Transit Checks Outstanding 1 Book Balance Notes/ Comments (Last 4 Digits) 2 International Shipholding Corporation 2907 $ 3,135.34 $ - $ - $ 3,135.34 International Shipholding Corporation 1639 10,007.40 - - 10,007.40 International Shipholding Corporation 1314 5,183.39 - - 5,183.39 International Shipholding Corporation 4643 12,068,876.11 - (532,425.02) 11,536,451.09 International Shipholding Corporation 6001 1,352.50 - - 1,352.50 International Shipholding Corporation 8174 20,594.89 - - 20,594.89 International Shipholding Corporation 9131 24,406.31 - - 24,406.31 International Shipholding Corporation 3120 1,052,432.37 - - 1,052,432.37 Restricted Cash N.W. Johnson & Co. Inc 8364 20,678.27 - - 20,678.27 Coastal Carriers, Inc. 4547 11,529.34 - - 11,529.34 U.S. United Ocean Services, LLC 1715 7,848.77 - - 7,848.77 U.S. United Ocean Services, LLC 3712 - - (3.58) (3.58) U.S. United Ocean Services, LLC 1468 - - - - U.S. United Ocean Services, LLC 2260 1,208,104.71 - - 1,208,104.71 U.S. United Ocean Services, LLC3 1715 - - - - Frascati Shops, Inc. 9623 79,965.96 - - 79,965.96 Frascati Shops, Inc. 8552 19,255.30 - - 19,255.30 Waterman Steamship Corporation 9031 5,215.16 - (112.00) 5,103.16 Waterman Steamship Corporation 9058 14,967.09 - (13,486.00) 1,481.09 Waterman Steamship Corporation 9066 15,434.92 - (4,434.37) 11,000.55 Waterman Steamship Corporation 3208 - - - - Waterman Steamship Corporation 2043 10,784.51 - - 10,784.51 Waterman Steamship Corporation 1129 14,351.10 - - 14,351.10 Waterman Steamship Corporation 8703 85,000.00 - - 85,000.00 Waterman Steamship Corporation 3 2043-004 - - - - Sulphur Carriers, Inc. 1276 5,023.68 - - 5,023.68 Sulphur Carriers, Inc. 1110 11,281.65 - (10,088.06) 1,193.59 Sulphur Carriers, Inc. 1102 17,297.29 - (1,577.08) 15,720.21 LMS Shipmanagement, Inc. 1292 5,811.23 - - 5,811.23 LMS Shipmanagement, Inc. 7395 3,532.69 - - 3,532.69 LMS Shipmanagement, Inc. 1099 30,983.16 - - 30,983.16 Central Gulf Lines, Inc. 0586 1,000.00 - - 1,000.00 Central Gulf Lines, Inc. 0997 183,362.44 - - 183,362.44 Central Gulf Lines, Inc. 6645 9,187.61 - (1,475.00) 7,712.61 Central Gulf Lines, Inc. 1005 59,984.67 - (52,929.48) 7,055.19 Central Gulf Lines, Inc. 1021 17,505.00 - (5,300.00) 12,205.00 Central Gulf Lines, Inc. 0998 18,090.47 - - 18,090.47 Central Gulf Lines, Inc. 1013 10,196.43 - - 10,196.43 Central Gulf Lines, Inc. 8844 292,360.42 - - 292,360.42 Central Gulf Lines, Inc. 3652 575,213.51 - - 575,213.51 MOR-1 (Cont.) Page 1

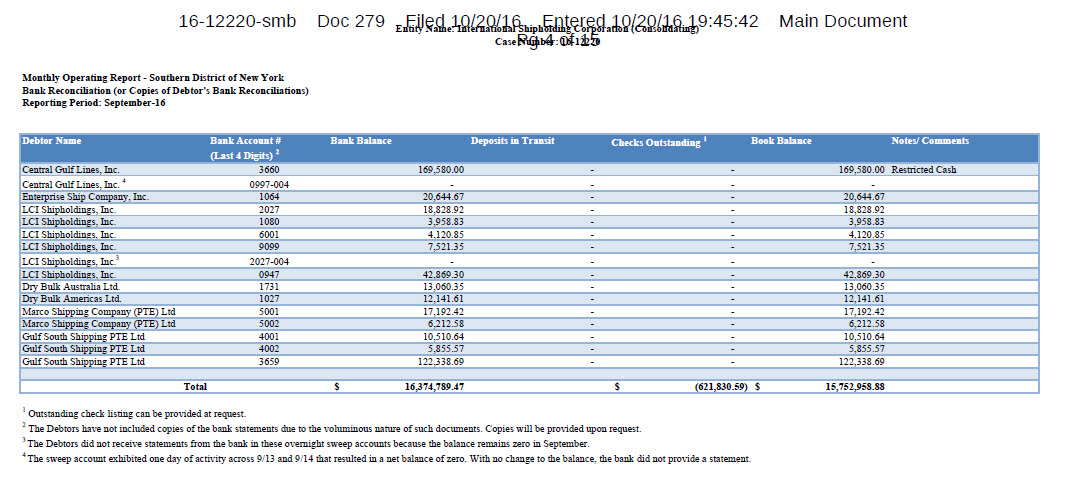

16-12220-smb Doc 279 Monthly Operating Report - Southern District of New YorkBank Reconciliation (or Copies of Debtor's Bank Reconciliations)Reporting Period: September-16 Entity Name: International Shipholding Corporation (Consolidating)Filed 10/20/16 Entered 10/20/16 19:45:42 Main Document CasePg 4 of 15 Debtor Name Bank Account # Bank Balance Deposits in Transit Checks Outstanding 1 Book Balance Notes/ Comments (Last 4 Digits) 2 Central Gulf Lines, Inc. 3660 169,580.00 - - 169,580.00 Restricted Cash Central Gulf Lines, Inc. 4 0997-004 - - - - Enterprise Ship Company, Inc. 1064 20,644.67 - - 20,644.67 LCI Shipholdings, Inc. 2027 18,828.92 - - 18,828.92 LCI Shipholdings, Inc. 1080 3,958.83 - - 3,958.83 LCI Shipholdings, Inc. 6001 4,120.85 - - 4,120.85 LCI Shipholdings, Inc. 9099 7,521.35 - - 7,521.35 LCI Shipholdings, Inc.3 2027-004 - - - - LCI Shipholdings, Inc. 0947 42,869.30 - - 42,869.30 Dry Bulk Australia Ltd. 1731 13,060.35 - - 13,060.35 Dry Bulk Americas Ltd. 1027 12,141.61 - - 12,141.61 Marco Shipping Company (PTE) Ltd 5001 17,192.42 - - 17,192.42 Marco Shipping Company (PTE) Ltd 5002 6,212.58 - - 6,212.58 Gulf South Shipping PTE Ltd 4001 10,510.64 - - 10,510.64 Gulf South Shipping PTE Ltd 4002 5,855.57 - - 5,855.57 Gulf South Shipping PTE Ltd 3659 122,338.69 - - 122,338.69 Total $ 16,374,789.47 $ (621,830.59) $ 15,752,958.88 1 Outstanding check listing can be provided at request. 2 The Debtors have not included copies of the bank statements due to the voluminous nature of such documents. Copies will be provided upon request. 3 The Debtors did not receive statements from the bank in these overnight sweep accounts because the balance remains zero in September. 4 The sweep account exhibited one day of activity across 9/13 and 9/14 that resulted in a net balance of zero. With no change to the balance, the bank did not provide a statement. MOR-1 (Cont.) Page 2

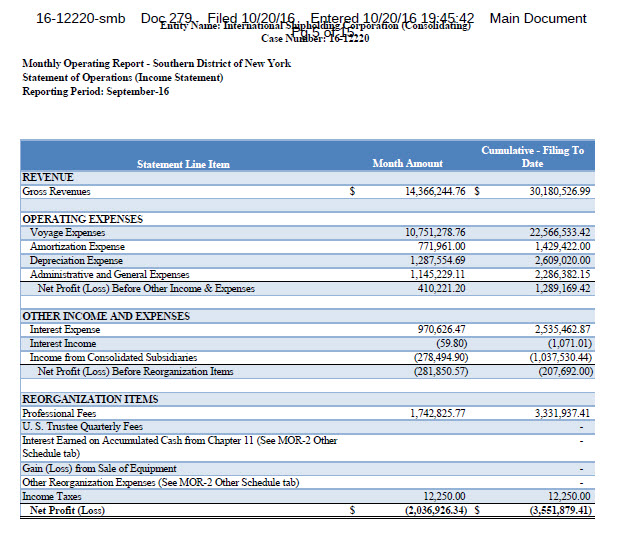

16-12220-smb Doc 279 Filed 10/20/16 Entered 10/20/16 19:45:42 Main Document Entity Name: International Shipholding Corporation (Consolidating) Case Number: 16-12220Pg 5 of 15 Monthly Operating Report - Southern District of New YorkStatement of Operations (Income Statement)Reporting Period: September-16 Cumulative - Filing To Statement Line Item Month Amount Date REVENUE Gross Revenues $ 14,366,244.76 $ 30,180,526.99 OPERATING EXPENSES Voyage Expenses 10,751,278.76 22,566,533.42 Amortization Expense 771,961.00 1,429,422.00 Depreciation Expense 1,287,554.69 2,609,020.00 Administrative and General Expenses 1,145,229.11 2,286,382.15 Net Profit (Loss) Before Other Income & Expenses 410,221.20 1,289,169.42 OTHER INCOME AND EXPENSES Interest Expense 970,626.47 2,535,462.87 Interest Income (59.80) (1,071.01) Income from Consolidated Subsidiaries (278,494.90) (1,037,530.44) Net Profit (Loss) Before Reorganization Items (281,850.57) (207,692.00) REORGANIZATION ITEMS Professional Fees 1,742,825.77 3,331,937.41 U. S. Trustee Quarterly Fees - Interest Earned on Accumulated Cash from Chapter 11 (See MOR-2 Other - Schedule tab) Gain (Loss) from Sale of Equipment - Other Reorganization Expenses (See MOR-2 Other Schedule tab) - Income Taxes 12,250.00 12,250.00 Net Profit (Loss) $ (2,036,926.34) $ (3,551,879.41) MOR-2Page 1

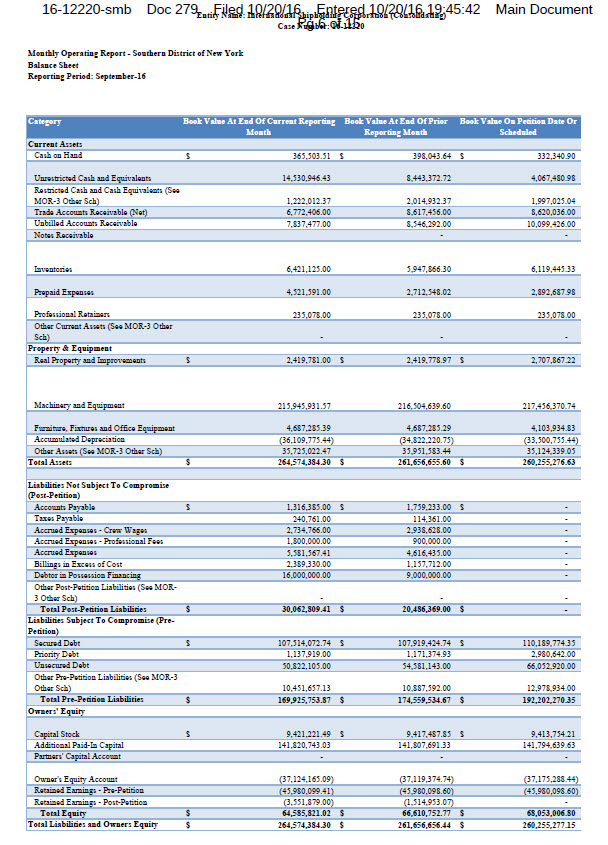

16-12220-smb Doc 279 Filed 10/20/16 Entered 10/20/16 19:45:42 Main DocumentEntity Name: International Shipholding Corporation (Consolidating) Case Number: 16-12220Pg 6 of 15 Monthly Operating Report - Southern District of New YorkBalance Sheet Reporting Period: September-16 Category Book Value At End Of Current Reporting Book Value At End Of Prior Book Value On Petition Date Or Month Reporting Month Scheduled Current Assets Cash on Hand $ 365,503.51 $ 398,043.64 $ 332,340.90 Unrestricted Cash and Equivalents 14,530,946.43 8,443,372.72 4,067,480.98 Restricted Cash and Cash Equivalents (See MOR-3 Other Sch) 1,222,012.37 2,014,932.37 1,997,025.04 Trade Accounts Receivable (Net) 6,772,406.00 8,617,456.00 8,620,036.00 Unbilled Accounts Receivable 7,837,477.00 8,546,292.00 10,099,426.00 Notes Receivable - - Inventories 6,421,125.00 5,947,866.30 6,119,445.33 Prepaid Expenses 4,521,591.00 2,712,548.02 2,892,687.98 Professional Retainers 235,078.00 235,078.00 235,078.00 Other Current Assets (See MOR-3 Other Sch) - - - Property & Equipment Real Property and Improvements $ 2,419,781.00 $ 2,419,778.97 $ 2,707,867.22 Machinery and Equipment 215,945,931.57 216,504,639.60 217,456,370.74 Furniture, Fixtures and Office Equipment 4,687,285.39 4,687,285.29 4,103,934.83 Accumulated Depreciation (36,109,775.44) (34,822,220.75) (33,500,755.44) Other Assets (See MOR-3 Other Sch) 35,725,022.47 35,951,583.44 35,124,339.05 Total Assets $ 264,574,384.30 $ 261,656,655.60 $ 260,255,276.63 Liabilities Not Subject To Compromise (Post-Petition) Accounts Payable $ 1,316,385.00 $ 1,759,233.00 $ - Taxes Payable 240,761.00 114,361.00 - Accrued Expenses - Crew Wages 2,734,766.00 2,938,628.00 - Accrued Expenses - Professional Fees 1,800,000.00 900,000.00 - Accrued Expenses 5,581,567.41 4,616,435.00 - Billings in Excess of Cost 2,389,330.00 1,157,712.00 - Debtor in Possession Financing 16,000,000.00 9,000,000.00 - Other Post-Petition Liabilities (See MOR- 3 Other Sch) - - - Total Post-Petition Liabilities $ 30,062,809.41 $ 20,486,369.00 $ - Liabilities Subject To Compromise (Pre- Petition) Secured Debt $ 107,514,072.74 $ 107,919,424.74 $ 110,189,774.35 Priority Debt 1,137,919.00 1,171,374.93 2,980,642.00 Unsecured Debt 50,822,105.00 54,581,143.00 66,052,920.00 Other Pre-Petition Liabilities (See MOR-3 Other Sch) 10,451,657.13 10,887,592.00 12,978,934.00 Total Pre-Petition Liabilities $ 169,925,753.87 $ 174,559,534.67 $ 192,202,270.35 Owners' Equity Capital Stock $ 9,421,221.49 $ 9,417,487.85 $ 9,413,754.21 Additional Paid-In Capital 141,820,743.03 141,807,691.33 141,794,639.63 Partners' Capital Account - - - Owner's Equity Account (37,124,165.09) (37,119,374.74) (37,175,288.44) Retained Earnings - Pre-Petition (45,980,099.41) (45,980,098.60) (45,980,098.60) Retained Earnings - Post-Petition (3,551,879.00) (1,514,953.07) - Total Equity $ 64,585,821.02 $ 66,610,752.77 $ 68,053,006.80 Total Liabilities and Owners Equity $ 264,574,384.30 $ 261,656,656.44 $ 260,255,277.15 MOR-3Page 1

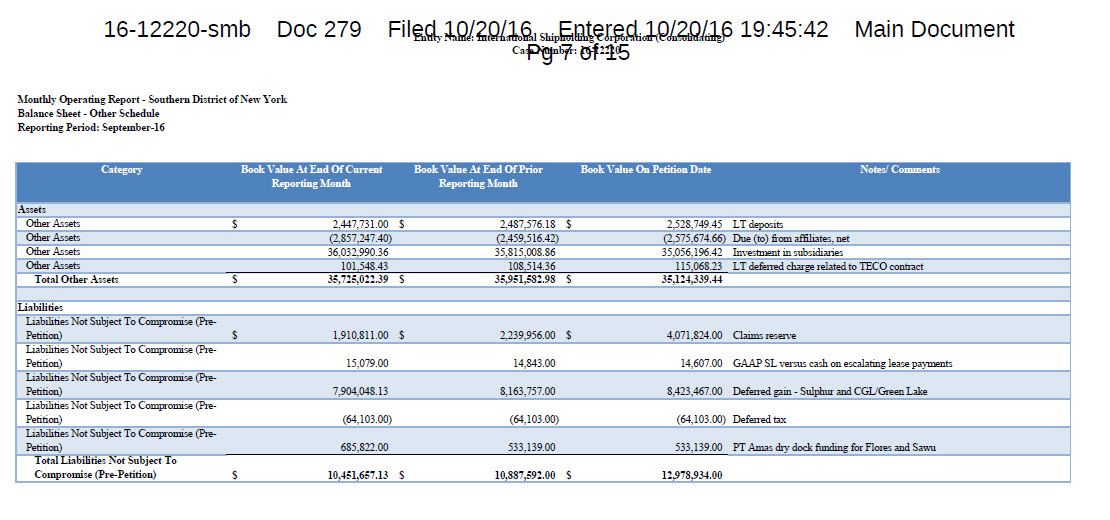

16-12220-smb Doc 279 Filed 10/20/16 Entered 10/20/16 19:45:42 Main DocumentEntity Name: International Shipholding Corporation (Consolidating) CaPg 7 of 1 5 Monthly Operating Report - Southern District of New YorkBalance Sheet - Other Schedule Reporting Period: September-16 Category Book Value At End Of Current Book Value At End Of Prior Book Value On Petition Date Notes/ Comments Reporting Month Reporting Month Assets Other Assets $ 2,447,731.00 $ 2,487,576.18 $ 2,528,749.45 LT deposits Other Assets (2,857,247.40) (2,459,516.42) (2,575,674.66) Due (to) from affiliates, net Other Assets 36,032,990.36 35,815,008.86 35,056,196.42 Investment in subsidiaries Other Assets 101,548.43 108,514.36 115,068.23 LT deferred charge related to TECO contract Total Other Assets $ 35,725,022.39 $ 35,951,582.98 $ 35,124,339.44 Liabilities Liabilities Not Subject To Compromise (Pre- Petition) $ 1,910,811.00 $ 2,239,956.00 $ 4,071,824.00 Claims reserve Liabilities Not Subject To Compromise (Pre- Petition) 15,079.00 14,843.00 14,607.00 GAAP SL versus cash on escalating lease payments Liabilities Not Subject To Compromise (Pre- Petition) 7,904,048.13 8,163,757.00 8,423,467.00 Deferred gain - Sulphur and CGL/Green Lake Liabilities Not Subject To Compromise (Pre- Petition) (64,103.00) (64,103.00) (64,103.00) Deferred tax Liabilities Not Subject To Compromise (Pre- Petition) 685,822.00 533,139.00 533,139.00 PT Amas dry dock funding for Flores and Sawu Total Liabilities Not Subject To Compromise (Pre-Petition) $ 10,451,657.13 $ 10,887,592.00 $ 12,978,934.00 MOR-3b Page 1

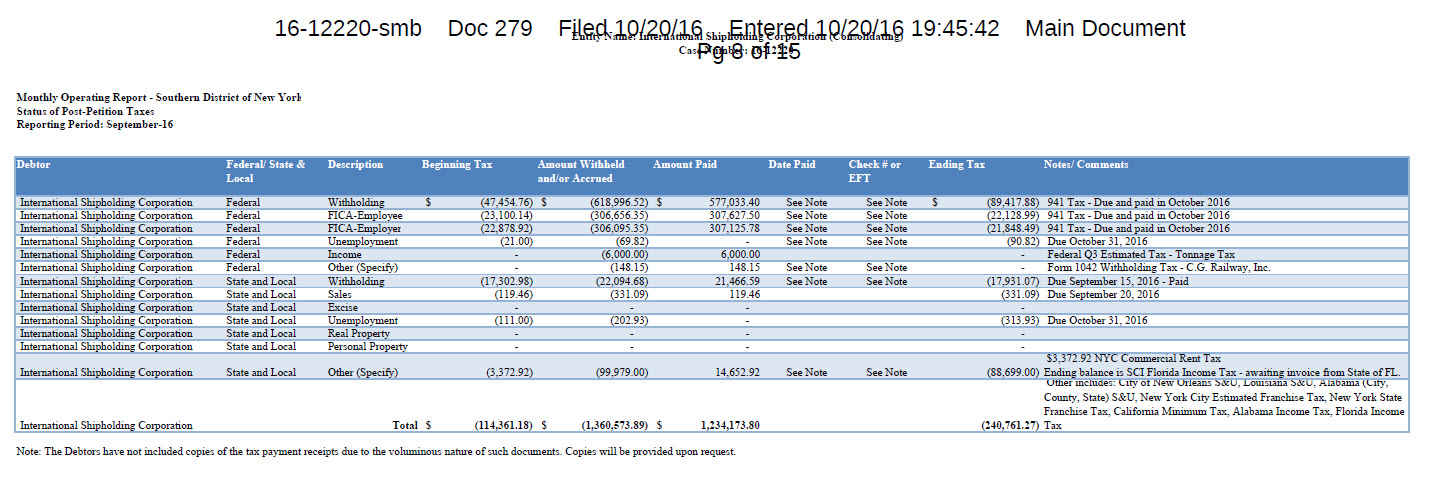

16-12220-smb Doc 279 Filed 10/20/16 Entered 10/20/16 19:45:42 Main DocumentEntity Name: International Shipholding Corporation (Consolidating) CasPg 8 of 15 Monthly Operating Report - Southern District of New YorkStatus of Post-Petition Taxes Reporting Period: September-16 Debtor Federal/ State & Description Beginning Tax Amount Withheld Amount Paid Date Paid Check # or Ending Tax Notes/ Comments Local and/or Accrued EFT International Shipholding Corporation Federal Withholding $ (47,454.76) $ (618,996.52) $ 577,033.40 See Note See Note $ (89,417.88) 941 Tax - Due and paid in October 2016 International Shipholding Corporation Federal FICA-Employee (23,100.14) (306,656.35) 307,627.50 See Note See Note (22,128.99) 941 Tax - Due and paid in October 2016 International Shipholding Corporation Federal FICA-Employer (22,878.92) (306,095.35) 307,125.78 See Note See Note (21,848.49) 941 Tax - Due and paid in October 2016 International Shipholding Corporation Federal Unemployment (21.00) (69.82) - See Note See Note (90.82) Due October 31, 2016 International Shipholding Corporation Federal Income - (6,000.00) 6,000.00 - Federal Q3 Estimated Tax - Tonnage Tax International Shipholding Corporation Federal Other (Specify) - (148.15) 148.15 See Note See Note - Form 1042 Withholding Tax - C.G. Railway, Inc. International Shipholding Corporation State and Local Withholding (17,302.98) (22,094.68) 21,466.59 See Note See Note (17,931.07) Due September 15, 2016 - Paid International Shipholding Corporation State and Local Sales (119.46) (331.09) 119.46 (331.09) Due September 20, 2016 International Shipholding Corporation State and Local Excise - - - - International Shipholding Corporation State and Local Unemployment (111.00) (202.93) - (313.93) Due October 31, 2016 International Shipholding Corporation State and Local Real Property - - - - International Shipholding Corporation State and Local Personal Property - - - - $3,372.92 NYC Commercial Rent Tax International Shipholding Corporation State and Local Other (Specify) (3,372.92) (99,979.00) 14,652.92 See Note See Note (88,699.00) Ending balance is SCI Florida Income Tax - awaiting invoice from State of FL. Other includes: City of New Orleans S&U, Louisiana S&U, Alabama (City, County, State) S&U, New York City Estimated Franchise Tax, New York StateFranchise Tax, California Minimum Tax, Alabama Income Tax, Florida Income International Shipholding Corporation Total $ (114,361.18) $ (1,360,573.89) $ 1,234,173.80 (240,761.27) Tax Note: The Debtors have not included copies of the tax payment receipts due to the voluminous nature of such documents. Copies will be provided upon request. MOR-4 Page 1

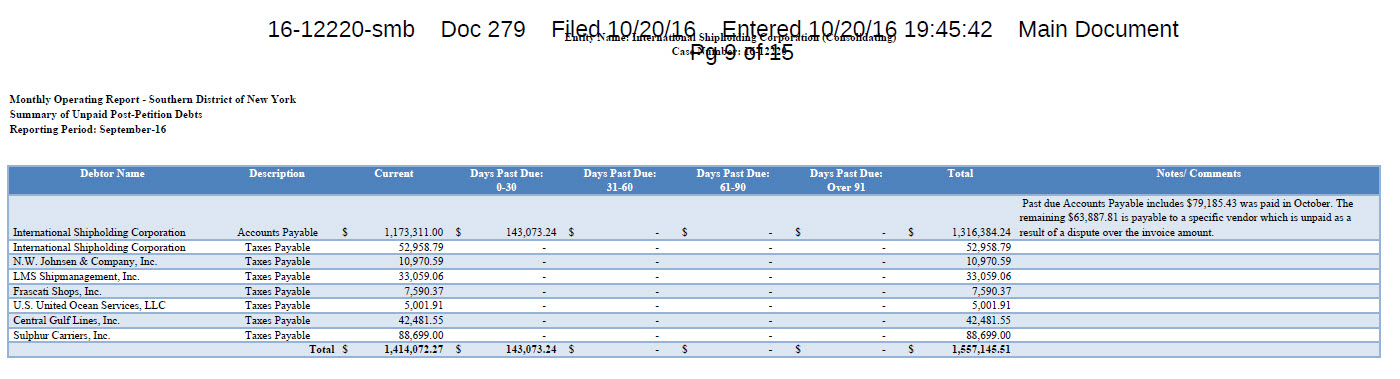

16-12220-smb Doc 279 Filed 10/20/16 Entered 10/20/16 19:45:42 Main DocumentEntity Name: International Shipholding Corporation (Consolidating) CasPg 9 of 15 Monthly Operating Report - Southern District of New YorkSummary of Unpaid Post-Petition Debts Reporting Period: September-16 Debtor Name Description Current Days Past Due: Days Past Due: Days Past Due: Days Past Due: Total Notes/ Comments 0-30 31-60 61-90 Over 91 Past due Accounts Payable includes $79,185.43 was paid in October. The remaining $63,887.81 is payable to a specific vendor which is unpaid as a International Shipholding Corporation Accounts Payable $ 1,173,311.00 $ 143,073.24 $ - $ - $ - $ 1,316,384.24 result of a dispute over the invoice amount. International Shipholding Corporation Taxes Payable 52,958.79 - - - - 52,958.79 N.W. Johnsen & Company, Inc. Taxes Payable 10,970.59 - - - - 10,970.59 LMS Shipmanagement, Inc. Taxes Payable 33,059.06 - - - - 33,059.06 Frascati Shops, Inc. Taxes Payable 7,590.37 - - - - 7,590.37 U.S. United Ocean Services, LLC Taxes Payable 5,001.91 - - - - 5,001.91 Central Gulf Lines, Inc. Taxes Payable 42,481.55 - - - - 42,481.55 Sulphur Carriers, Inc. Taxes Payable 88,699.00 - - - - 88,699.00 Total $ 1,414,072.27 $ 143,073.24 $ - $ - $ - $ 1,557,145.51 MOR-4bPage 1

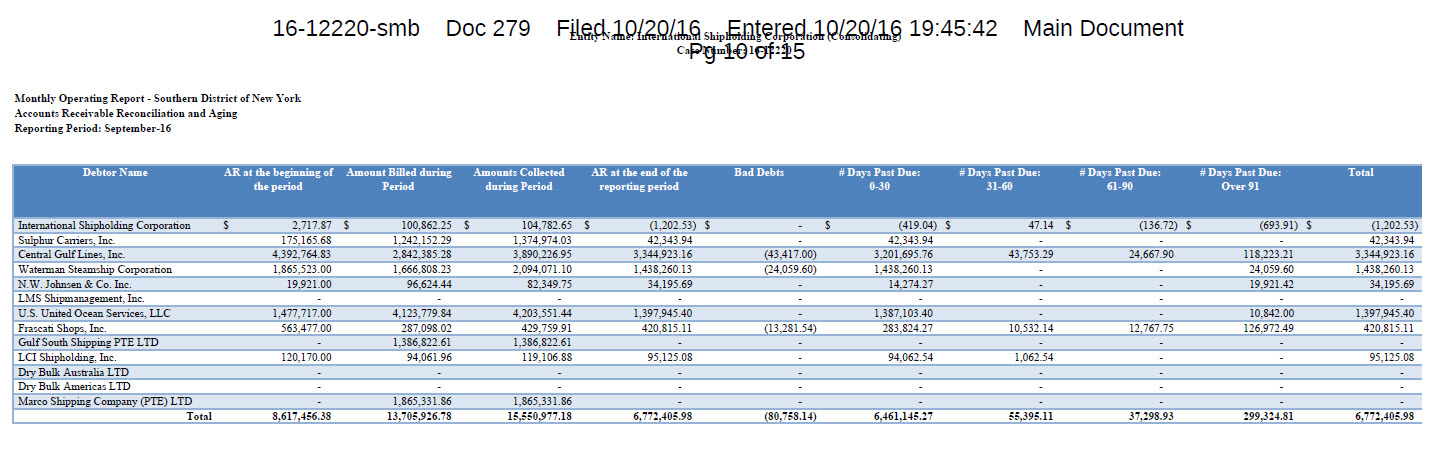

16-12220-smb Doc 279 Filed 10/20/16 Entered 10/20/16 19:45:42 Main DocumentEntity Name: International Shipholding Corporation (Consolidating) CaPg 10 of 1 5 Monthly Operating Report - Southern District of New YorkAccounts Receivable Reconciliation and AgingReporting Period: September-16 Debtor Name AR at the beginning of Amount Billed during Amounts Collected AR at the end of the Bad Debts # Days Past Due: # Days Past Due: # Days Past Due: # Days Past Due: Total the period Period during Period reporting period 0-30 31-60 61-90 Over 91 International Shipholding Corporation $ 2,717.87 $ 100,862.25 $ 104,782.65 $ (1,202.53) $ - $ (419.04) $ 47.14 $ (136.72) $ (693.91) $ (1,202.53) Sulphur Carriers, Inc. 175,165.68 1,242,152.29 1,374,974.03 42,343.94 - 42,343.94 - - - 42,343.94 Central Gulf Lines, Inc. 4,392,764.83 2,842,385.28 3,890,226.95 3,344,923.16 (43,417.00) 3,201,695.76 43,753.29 24,667.90 118,223.21 3,344,923.16 Waterman Steamship Corporation 1,865,523.00 1,666,808.23 2,094,071.10 1,438,260.13 (24,059.60) 1,438,260.13 - - 24,059.60 1,438,260.13 N.W. Johnsen & Co. Inc. 19,921.00 96,624.44 82,349.75 34,195.69 - 14,274.27 - - 19,921.42 34,195.69 LMS Shipmanagement, Inc. - - - - - - - - - - U.S. United Ocean Services, LLC 1,477,717.00 4,123,779.84 4,203,551.44 1,397,945.40 - 1,387,103.40 - - 10,842.00 1,397,945.40 Frascati Shops, Inc. 563,477.00 287,098.02 429,759.91 420,815.11 (13,281.54) 283,824.27 10,532.14 12,767.75 126,972.49 420,815.11 Gulf South Shipping PTE LTD - 1,386,822.61 1,386,822.61 - - - - - - - LCI Shipholding, Inc. 120,170.00 94,061.96 119,106.88 95,125.08 - 94,062.54 1,062.54 - - 95,125.08 Dry Bulk Australia LTD - - - - - - - - - - Dry Bulk Americas LTD - - - - - - - - - - Marco Shipping Company (PTE) LTD - 1,865,331.86 1,865,331.86 - - - - - - - Total 8,617,456.38 13,705,926.78 15,550,977.18 6,772,405.98 (80,758.14) 6,461,145.27 55,395.11 37,298.93 299,324.81 6,772,405.98 MOR-5aPage 1

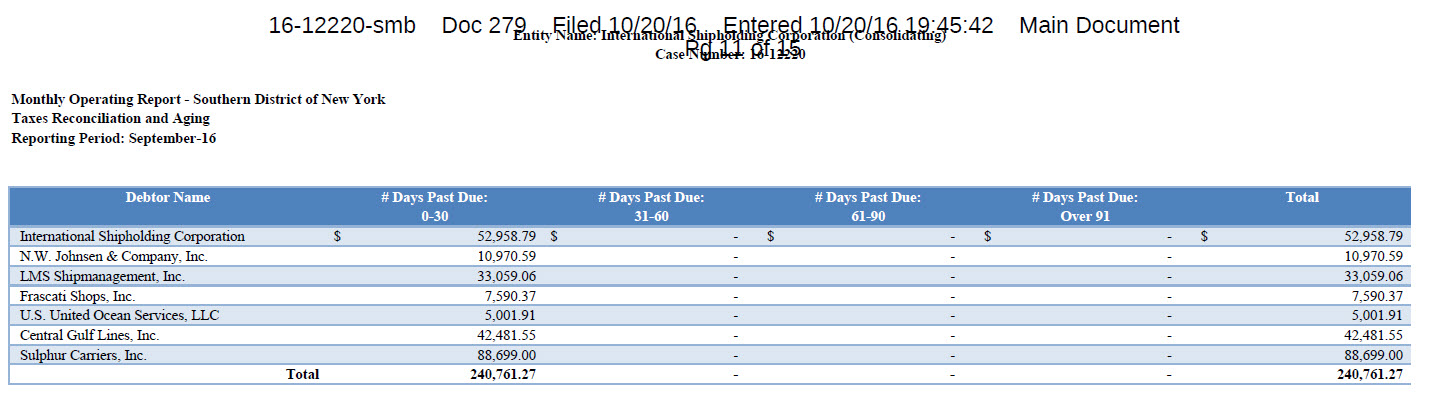

16-12220-smb Doc 279 Filed 10/20/16 Entered 10/20/16 19:45:42 Main Document Entity Name: International Shipholding Corporation (Consolidating) Case Number: 16-12220Pg 11 of 15 Monthly Operating Report - Southern District of New YorkTaxes Reconciliation and Aging Reporting Period: September-16 Debtor Name # Days Past Due: # Days Past Due: # Days Past Due: # Days Past Due: Total 0-30 31-60 61-90 Over 91 International Shipholding Corporation $ 52,958.79 $ - $ - $ - $ 52,958.79 N.W. Johnsen & Company, Inc. 10,970.59 - - - 10,970.59 LMS Shipmanagement, Inc. 33,059.06 - - - 33,059.06 Frascati Shops, Inc. 7,590.37 - - - 7,590.37 U.S. United Ocean Services, LLC 5,001.91 - - - 5,001.91 Central Gulf Lines, Inc. 42,481.55 - - - 42,481.55 Sulphur Carriers, Inc. 88,699.00 - - - 88,699.00 Total 240,761.27 - - - 240,761.27 MOR-5b Page 1

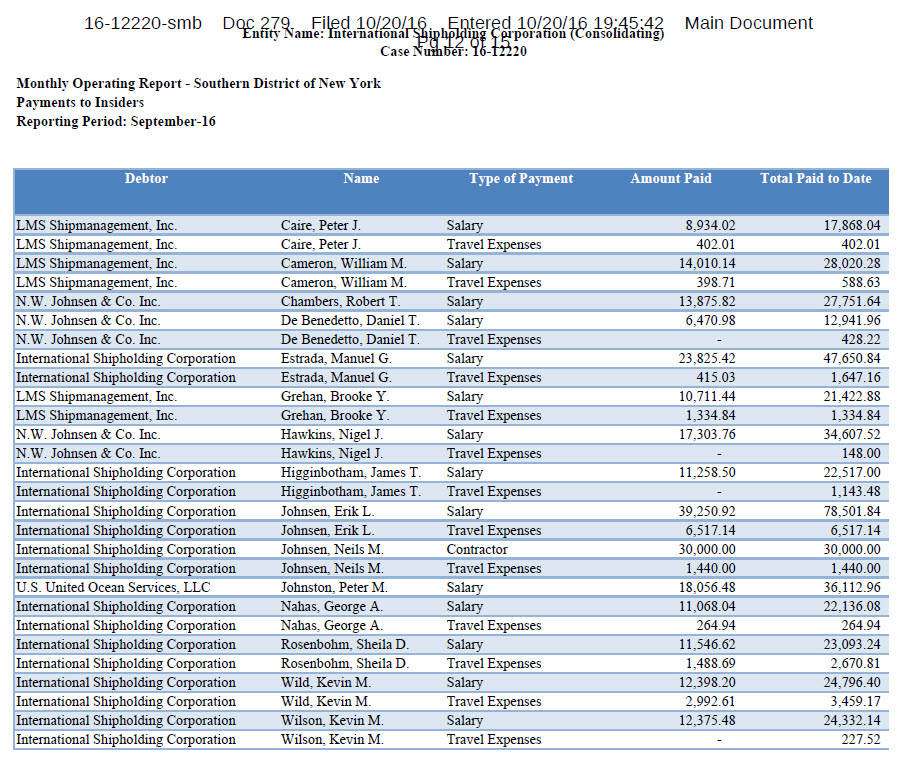

16-12220-smb Doc 279 Filed 10/20/16 Entered 10/20/16 19:45:42 Main Document Entity Name: International Shipholding Corporation (Consolidating) Pg 12 of 15 Case Number: 16-12220 Monthly Operating Report - Southern District of New YorkPayments to Insiders Reporting Period: September-16 Debtor Name Type of Payment Amount Paid Total Paid to Date LMS Shipmanagement, Inc. Caire, Peter J. Salary 8,934.02 17,868.04 LMS Shipmanagement, Inc. Caire, Peter J. Travel Expenses 402.01 402.01 LMS Shipmanagement, Inc. Cameron, William M. Salary 14,010.14 28,020.28 LMS Shipmanagement, Inc. Cameron, William M. Travel Expenses 398.71 588.63 N.W. Johnsen & Co. Inc. Chambers, Robert T. Salary 13,875.82 27,751.64 N.W. Johnsen & Co. Inc. De Benedetto, Daniel T. Salary 6,470.98 12,941.96 N.W. Johnsen & Co. Inc. De Benedetto, Daniel T. Travel Expenses - 428.22 International Shipholding Corporation Estrada, Manuel G. Salary 23,825.42 47,650.84 International Shipholding Corporation Estrada, Manuel G. Travel Expenses 415.03 1,647.16 LMS Shipmanagement, Inc. Grehan, Brooke Y. Salary 10,711.44 21,422.88 LMS Shipmanagement, Inc. Grehan, Brooke Y. Travel Expenses 1,334.84 1,334.84 N.W. Johnsen & Co. Inc. Hawkins, Nigel J. Salary 17,303.76 34,607.52 N.W. Johnsen & Co. Inc. Hawkins, Nigel J. Travel Expenses - 148.00 International Shipholding Corporation Higginbotham, James T. Salary 11,258.50 22,517.00 International Shipholding Corporation Higginbotham, James T. Travel Expenses - 1,143.48 International Shipholding Corporation Johnsen, Erik L. Salary 39,250.92 78,501.84 International Shipholding Corporation Johnsen, Erik L. Travel Expenses 6,517.14 6,517.14 International Shipholding Corporation Johnsen, Neils M. Contractor 30,000.00 30,000.00 International Shipholding Corporation Johnsen, Neils M. Travel Expenses 1,440.00 1,440.00 U.S. United Ocean Services, LLC Johnston, Peter M. Salary 18,056.48 36,112.96 International Shipholding Corporation Nahas, George A. Salary 11,068.04 22,136.08 International Shipholding Corporation Nahas, George A. Travel Expenses 264.94 264.94 International Shipholding Corporation Rosenbohm, Sheila D. Salary 11,546.62 23,093.24 International Shipholding Corporation Rosenbohm, Sheila D. Travel Expenses 1,488.69 2,670.81 International Shipholding Corporation Wild, Kevin M. Salary 12,398.20 24,796.40 International Shipholding Corporation Wild, Kevin M. Travel Expenses 2,992.61 3,459.17 International Shipholding Corporation Wilson, Kevin M. Salary 12,375.48 24,332.14 International Shipholding Corporation Wilson, Kevin M. Travel Expenses - 227.52 MOR-6Page 1

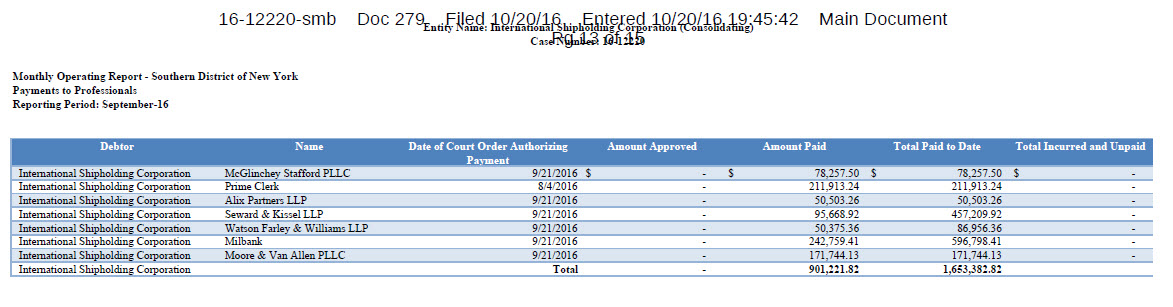

16-12220-smb Doc 279 Filed 10/20/16 Entered 10/20/16 19:45:42 Main DocumentEntity Name: International Shipholding Corporation (Consolidating) Case Number: 16-12220Pg 13 of 15 Monthly Operating Report - Southern District of New YorkPayments to Professionals Reporting Period: September-16 Debtor Name Date of Court Order Authorizing Amount Approved Amount Paid Total Paid to Date Total Incurred and Unpaid Payment International Shipholding Corporation McGlinchey Stafford PLLC 9/21/2016 $ - $ 78,257.50 $ 78,257.50 $ - International Shipholding Corporation Prime Clerk 8/4/2016 - 211,913.24 211,913.24 - International Shipholding Corporation Alix Partners LLP 9/21/2016 - 50,503.26 50,503.26 - International Shipholding Corporation Seward & Kissel LLP 9/21/2016 - 95,668.92 457,209.92 - International Shipholding Corporation Watson Farley & Williams LLP 9/21/2016 - 50,375.36 86,956.36 - International Shipholding Corporation Milbank 9/21/2016 - 242,759.41 596,798.41 - International Shipholding Corporation Moore & Van Allen PLLC 9/21/2016 - 171,744.13 171,744.13 - International Shipholding Corporation Total - 901,221.82 1,653,382.82 MOR-6b Page 1

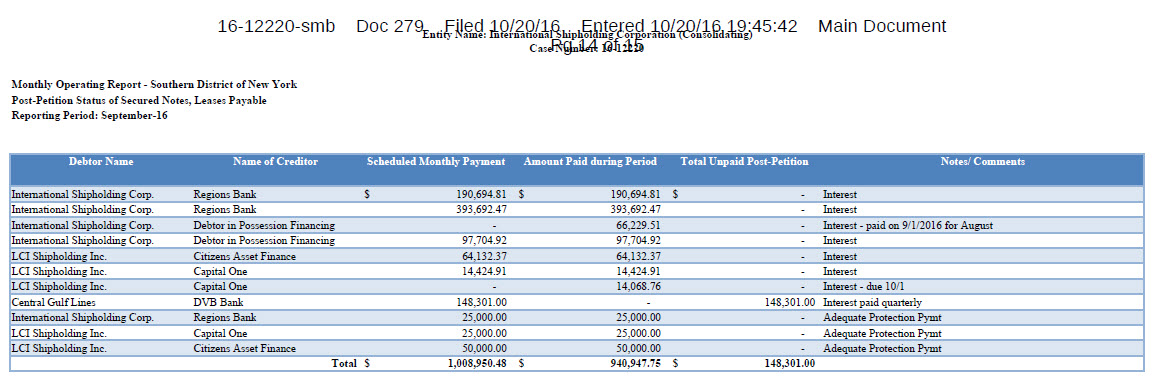

16-12220-smb Doc 279 Filed 10/20/16 Entered 10/20/16 19:45:42 Main DocumentEntity Name: International Shipholding Corporation (Consolidating) Case Number: 16-12220Pg 14 of 15 Monthly Operating Report - Southern District of New YorkPost-Petition Status of Secured Notes, Leases PayableReporting Period: September-16 Debtor Name Name of Creditor Scheduled Monthly Payment Amount Paid during Period Total Unpaid Post-Petition Notes/ Comments International Shipholding Corp. Regions Bank $ 190,694.81 $ 190,694.81 $ - Interest International Shipholding Corp. Regions Bank 393,692.47 393,692.47 - Interest International Shipholding Corp. Debtor in Possession Financing - 66,229.51 - Interest - paid on 9/1/2016 for August International Shipholding Corp. Debtor in Possession Financing 97,704.92 97,704.92 - Interest LCI Shipholding Inc. Citizens Asset Finance 64,132.37 64,132.37 - Interest LCI Shipholding Inc. Capital One 14,424.91 14,424.91 - Interest LCI Shipholding Inc. Capital One - 14,068.76 - Interest - due 10/1 Central Gulf Lines DVB Bank 148,301.00 - 148,301.00 Interest paid quarterly International Shipholding Corp. Regions Bank 25,000.00 25,000.00 - Adequate Protection Pymt LCI Shipholding Inc. Capital One 25,000.00 25,000.00 - Adequate Protection Pymt LCI Shipholding Inc. Citizens Asset Finance 50,000.00 50,000.00 - Adequate Protection Pymt Total $ 1,008,950.48 $ 940,947.75 $ 148,301.00 MOR-6cPage 1

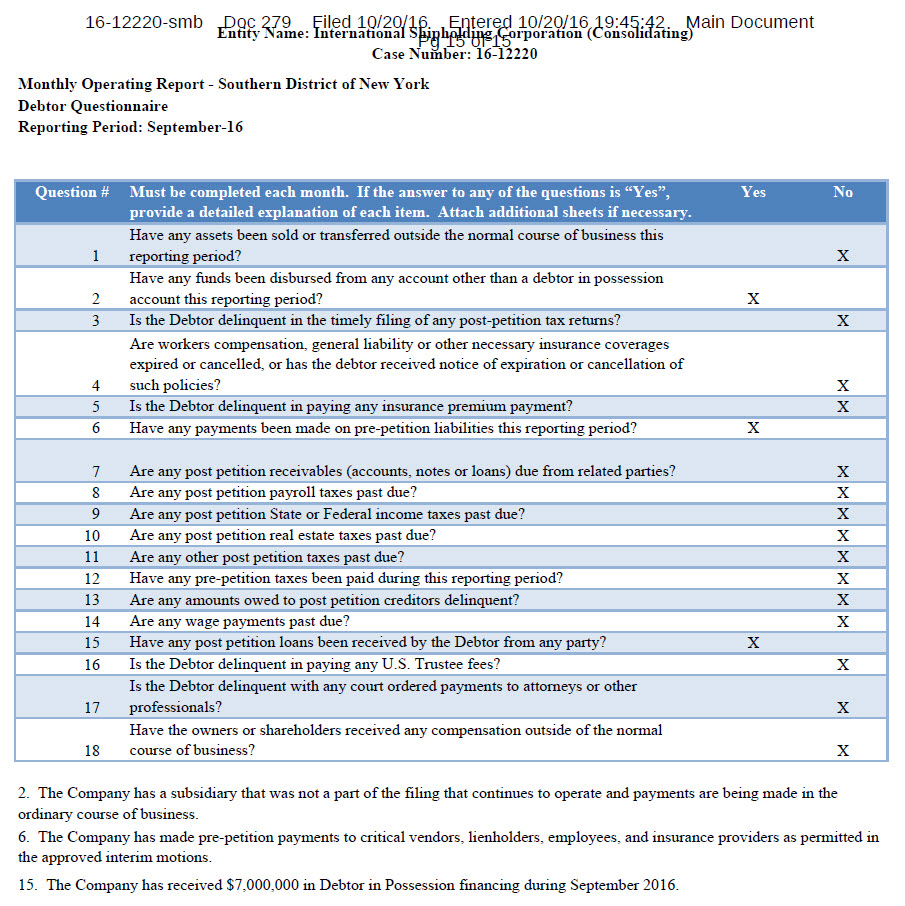

16-12220-smb Doc 279 Filed 10/20/16 Entered 10/20/16 19:45:42 Main Document Entity Name: International Shipholding Corporation (Consolidating) Pg 15 of 15 Case Number: 16-12220 Monthly Operating Report - Southern District of New YorkDebtor Questionnaire Reporting Period: September-16 Question # Must be completed each month. If the answer to any of the questions is “Yes”, Yes No provide a detailed explanation of each item. Attach additional sheets if necessary. Have any assets been sold or transferred outside the normal course of business this 1 reporting period? X Have any funds been disbursed from any account other than a debtor in possession 2 account this reporting period? X 3 Is the Debtor delinquent in the timely filing of any post-petition tax returns? X Are workers compensation, general liability or other necessary insurance coverages expired or cancelled, or has the debtor received notice of expiration or cancellation of 4 such policies? X 5 Is the Debtor delinquent in paying any insurance premium payment? X 6 Have any payments been made on pre-petition liabilities this reporting period? X 7 Are any post petition receivables (accounts, notes or loans) due from related parties? X 8 Are any post petition payroll taxes past due? X 9 Are any post petition State or Federal income taxes past due? X 10 Are any post petition real estate taxes past due? X 11 Are any other post petition taxes past due? X 12 Have any pre-petition taxes been paid during this reporting period? X 13 Are any amounts owed to post petition creditors delinquent? X 14 Are any wage payments past due? X 15 Have any post petition loans been received by the Debtor from any party? X 16 Is the Debtor delinquent in paying any U.S. Trustee fees? X Is the Debtor delinquent with any court ordered payments to attorneys or other 17 professionals? X Have the owners or shareholders received any compensation outside of the normal 18 course of business? X 2. The Company has a subsidiary that was not a part of the filing that continues to operate and payments are being made in theordinary course of business. 6. The Company has made pre-petition payments to critical vendors, lienholders, employees, and insurance providers as permitted inthe approved interim motions. 15. The Company has received $7,000,000 in Debtor in Possession financing during September 2016. MOR-7 Page 1