Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Atlantic Capital Bancshares, Inc. | acb-form8xkinvestorpresent.htm |

1

Atlantic Capital Bancshares, Inc. (ACBI)

Investor Presentation

November 3, 2016

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of section 27A of the Securities Act of 1933, as amended, and

section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements reflect our current views with respect

to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of

words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,”

“seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or other comparable of a

future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations,

estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by

their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not

guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe

that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be

materially different from the results expressed or implied by the forward-looking statements.

The following risks, among others, could cause actual results to differ materially from the anticipated results or other expectations

expressed in the forward-looking statements: (1) the expected growth opportunities and cost savings from the transaction with First Security

Group, Inc. (“First Security”) may not be fully realized or may take longer to realize than expected; (2) revenues following the transaction

with First Security and recent branch sales may be lower than expected as a result of deposit attrition, increased operating costs, customer

loss or business disruption; (3) diversion of management time on merger related issues; (4) changes in asset quality and credit risk; (5) the

cost and availability of capital; (6) customer acceptance of the combined company’s products and services; (7) customer borrowing,

repayment, investment and deposit practices; (8) the introduction, withdrawal, success and timing of business initiatives; (9) the impact,

extent, and timing of technological changes; (10) severe catastrophic events in our geographic area; (11) a weakening of the economies in

which the combined company will conduct operations may adversely affect its operating results; (12) the U.S. legal and regulatory

framework, including those associated with the Dodd-Frank Wall Street Reform and Consumer Protection Act could adversely affect the

operating results of the combined company; (13) the interest rate environment may compress margins and adversely affect net interest

income; (14) changes in trade, monetary and fiscal policies of various governmental bodies and central banks could affect the economic

environment in which we operate; (15) our ability to determine accurate values of certain assets and liabilities; (16) adverse behaviors in

securities, public debt, and capital markets, including changes in market liquidity and volatility; (17) our ability to anticipate interest rate

changes correctly and manage interest rate risk presented through unanticipated changes in our interest rate risk position and/or short- and

long-term interest rates; (18) unanticipated changes in our liquidity position, including but not limited to our ability to enter the financial

markets to manage and respond to any changes to our liquidity position; (19) adequacy of our risk management program; (20) increased

costs associated with operating as a public company; (21) competition from other financial services companies in the companies’ markets

could adversely affect operations; and (22) other factors described in Atlantic Capital’s reports filed with the Securities and Exchange

Commission and available on the SEC’s website (www.sec.gov).

2

Non-GAAP Financial Information

Statements included in this presentation include non-GAAP financial measures and should be read long with the accompanying tables,

which provide a reconciliation of non-GAAP financial measures to GAAP financial measures. Atlantic Capital management uses non-GAAP

financial measures, including: (i) operating net income; (ii) operating non-interest expense; (iii) operating provision for loan losses, (iv)

taxable equivalent net interest margin, (v) efficiency ratio (vi) operating return on assets; (vii) operating return on equity: (viii) tangible

common equity and (ix) deposits excluding deposits assumed in branch sales, in its analysis of the Company's performance.

Management believes that non-GAAP financial measures provide a greater understanding of ongoing performance and operations, and

enhance comparability with prior periods. Non-GAAP financial measures should not be considered as an alternative to any measure of

performance or financial condition as determined in accordance with GAAP, and investors should consider Atlantic Capital’s performance

and financial condition as reported under GAAP and all other relevant information when assessing the performance or financial condition of

the Company. Non-GAAP financial measures have limitations as analytical tools, and investors should not consider them in isolation or as a

substitute for analysis of the results or financial condition as reported under GAAP. Non-GAAP financial measures may not be comparable

to non-GAAP financial measures presented by other companies.

3

Proprietary & Confidential

Overview

Atlantic Capital was organized in 2006 and completed an initial equity capital raise of

$125 million in 2007

Focused on banking:

• Small to mid-sized enterprises with revenues up to $250 million

• Highly-select group of institutional caliber commercial real estate developers and

investors

• Principals of our commercial clients, professionals and their practices

Differentiated by providing superior expertise, competitive capabilities, and high

touch service delivery

Completed acquisition of First Security on October 31, 2015

• Public market liquidity and value by listing shares on NASDAQ

• Geographic diversification into Eastern Tennessee

• Business mix diversification

Sold 7 offices in Eastern Tennessee as part of repositioning of First Security’s retail

business

• Closed in 2nd quarter of 2016

• Closed 2 additional offices in the 3rd quarter of 2016

4

Proprietary & Confidential

Atlantic Capital Strategy

Become a premier southeastern business and

private banking company

Investing in people and

capabilities to accelerate

organic growth and build

profitability

Results are evidence of

meaningful progress

Attractive interest rate risk

position

Completed acquisition of First

Security on October 31, 2015

Ongoing evaluation of new

market expansion through

mergers and acquisitions and

de novo entry

Patient and disciplined

approach with focus on

shareholder value

Accelerated Organic Growth Strategic Expansion

5

Proprietary & Confidential

Atlantic Capital Highlights

Opened in 2007 to serve middle market companies in

southeastern US

Organically grew to $1.4 billion in assets despite market downturn

Well positioned to capitalize on Atlanta market recovery, new

market expansion and higher interest rates

Supplemented by recently completed strategic acquisition of First

Security

Leadership continuity in key markets

Broad experience in all business lines

Focused on small to mid-sized companies and private banking

services to individuals

Initiatives in place to maintain robust top line growth

Operating model will produce enhanced efficiencies going forward

Consistently high asset quality

NPAs/total assets 0.09% as of September 30, 2016

Organic Growth

Story in Desirable

Markets

Experienced

Management Team

Attractive Business

Mix

Strong Growth

Prospects

Disciplined Risk

Management

6

Legacy ACB

Loans Held for Investment

$1,046

$1,791

$1,887

$1,942 $2,008

Financial Highlights

Total loans held for investment increased $66 million, or 3.4%, to $2.01 billion from

June 30, 2016 and 12.1% from December 31, 2015

Total deposits increased $31 million, or 1.4%, to $2.19 billion from June 30, 2016

Dollars in millions

*excluding deposits sold in branch sales. This is a non-GAAP financial measure. Please see “Non-GAAP Reconciliation” on page 21 for more details.

Deposits* Total Assets

7

Combined Bank

$1,382

$2,639 $2,725

$2,808

$2,761

$1,129

$2,049

$2,085

$2,158 $2,189

Q3

2015

Q4

2015

Q1

2016

Q2

2016

Q3

2016

Q3

2015

Q4

2015

Q1

2016

Q2

2016

Q3

2016

Q3

2015

Q4

2015

Q1

2016

Q2

2016

Q3

2016

$0.13

$0.44

$0.38

$0.55

$0.62

$0.14 $0.15 $0.16

Q1 Q2 Q3

2016 2016 2016

Financial Highlights

Dollars in thousands

*Operating noninterest income, operating diluted earnings and efficiency ratio are non-GAAP financial measures that exclude merger-related expenses

and net gain on sale of branches. Please see “Non-GAAP Reconciliation” on page 21 for more details.

$2,797 $2,888

$3,875

$5,342

$9,399

$4,420

$4,995

$4,002

64.2%

73.5% 75.9%

69.1% 68.8%

75.2% 72.0% 71.6%

2011 2012 2013 2014 2015

8

2.99%

2.75% 2.75%

2.85%

2.98%

3.26%

3.05%

3.12%

3.00%

3.12%

3.00%

Q1 Q2 Q3

2016 2016 2016

2011 2012 2013 2014 2015

excludes purchase accounting adjustments

Diluted Earnings Per Share – Operating* Net Interest Margin

Operating Noninterest Income* Efficiency Ratio*

Q1 Q2 Q3

2016 2016 2016

2011 2012 2013 2014 2015

2011 2012 2013 2014 2015

Q1 Q2 Q3

2016 2016 2016

1.43%

-0.32%

0.02%

-0.01%

0.05%

0.35%

0.00% 0.06%

0.71%

0.43%

0.36%

0.12%

0.40%

0.08% 0.07% 0.09%

Financial Highlights

1.39% 1.44%

1.32%

1.10% 1.06%

0.93% 0.95% 0.92%

9

Non-Performing Assets / Total Assets Non-Performing Loans / Total Loans

Net Charge Offs / Total Average Loans Allowance for Loan Losses / Total Loans

0.79%

0.49%

0.36%

0.00%

0.45%

0.02% 0.05% 0.04%

YTD 2016:

0.13%

Q1 Q2 Q3

2016 2016 2016

2011 2012 2013 2014 2015 Q1 Q2 Q3

2016 2016 2016

Q1 Q2 Q3

2016 2016 2016

Q1 Q2 Q3

2016 2016 2016

2011 2012 2013 2014 2015

2011 2012 2013 2014 2015 2011 2012 2013 2014 2015

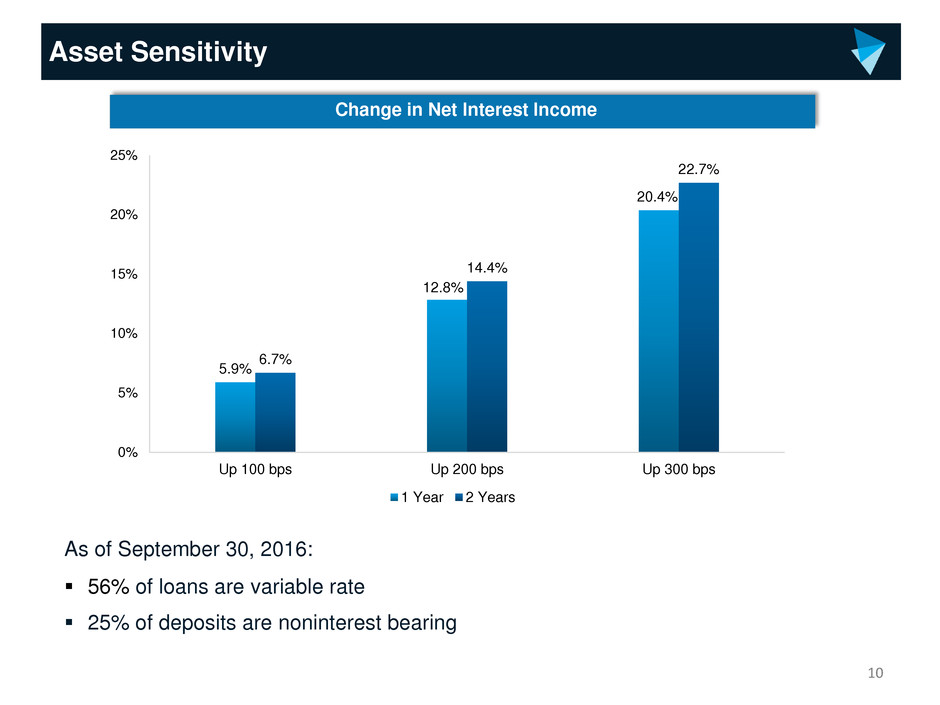

Asset Sensitivity

Change in Net Interest Income

10

5.9%

12.8%

20.4%

6.7%

14.4%

22.7%

0%

5%

10%

15%

20%

25%

Up 100 bps Up 200 bps Up 300 bps

1 Year 2 Years

As of September 30, 2016:

56% of loans are variable rate

25% of deposits are noninterest bearing

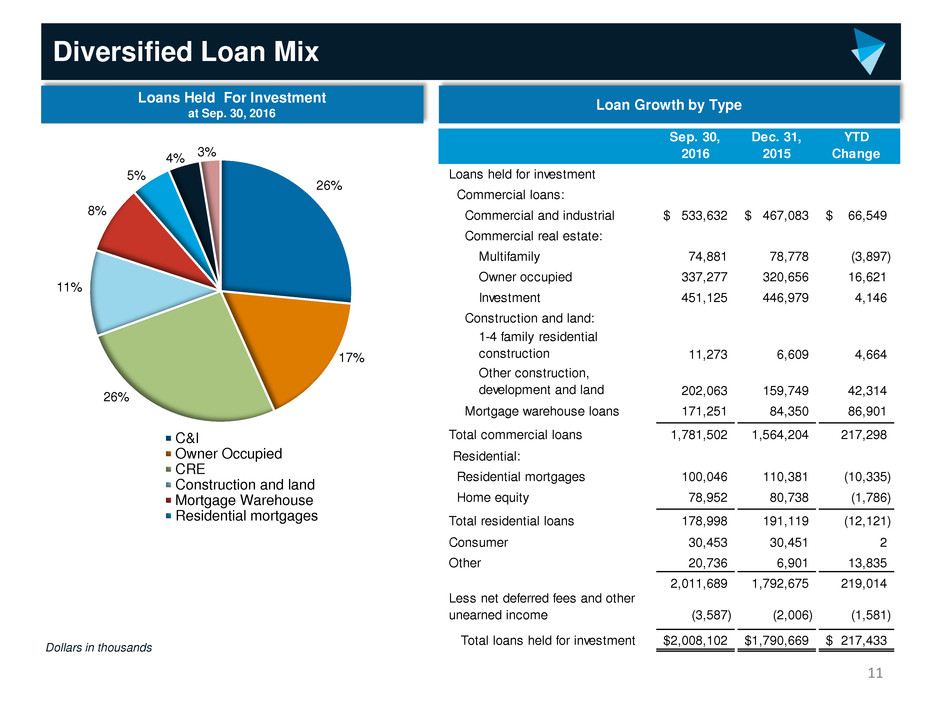

Diversified Loan Mix

Dollars in thousands

Loans Held For Investment

at Sep. 30, 2016

11

Loan Growth by Type

Sep. 30,

2016

Dec. 31,

2015

YTD

Change

Loans held for investment

Commercial loans:

Commercial and industrial 533,632$ 467,083$ 66,549$

Commercial real estate:

Multifamily 74,881 78,778 (3,897)

Owner occupied 337,277 320,656 16,621

Investment 451,125 446,979 4,146

Construction and land:

1-4 family residential

construction 11,273 6,609 4,664

Other construction,

development and land 202,063 159,749 42,314

Mortgage warehouse loans 171,251 84,350 86,901

Total commercial loans 1,781,502 1,564,204 217,298

Residential:

Residential mortgages 100,046 110,381 (10,335)

Home equity 78,952 80,738 (1,786)

Total residential loans 178,998 191,119 (12,121)

Consumer 30,453 30,451 2

Other 20,736 6,901 13,835

2,011,689 1,792,675 219,014

(3,587) (2,006) (1,581)

Total loans held for investment 2,008,102$ 1,790,669$ 217,433$

Less net deferred fees and other

unearned income

C&I

Owner Occupied

CRE

Construction and land

Mortgage Warehouse

Residential mortgages

26%

17%

11%

8%

5%

4%

26%

3%

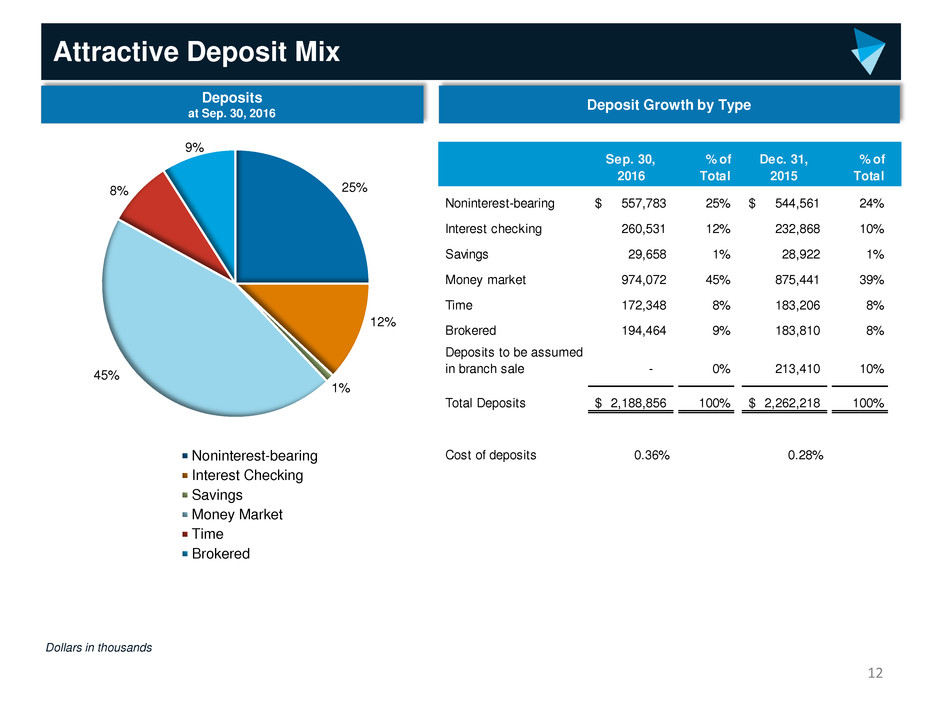

Attractive Deposit Mix

25%

12%

1%

45%

8%

9%

Noninterest-bearing

Interest Checking

Savings

Money Market

Time

Brokered

12

Sep. 30,

2016

% of

Total

Dec. 31,

2015

% of

Total

Noninterest-bearing 557,783$ 25% 544,561$ 24%

Interest checking 260,531 12% 232,868 10%

Savings 29,658 1% 28,922 1%

Money market 974,072 45% 875,441 39%

Time 172,348 8% 183,206 8%

Brokered 194,464 9% 183,810 8%

Deposits to be assumed

in branch sale - 0% 213,410 10%

Total Deposits 2,188,856$ 100% 2,262,218$ 100%

Cost of deposits 0.36% 0.28%

Deposits

at Sep. 30, 2016

Deposit Growth by Type

Dollars in thousands

First Security Acquisition Rationale

NASDAQ listing

Significant new capital including DTA, equity private placement at premium to

TBV, and subordinated notes

More diverse shareholder base

18 offices providing core funding along commercially attractive I-75 corridor

Atlanta: High density of small businesses and commercial enterprises

Chattanooga/Knoxville: Diversified manufacturing and service economies

Atlantic Capital’s Strengths: C&I, CRE and Private Banking; Corporate

Treasury and Private Banking Deposits

First Security’s Strengths: Small Business and Specialty Commercial

Lending; Small Business and Retail Deposit Channel

Integration plan ensures management continuity with local market presence

and significant domain expertise

Significant cost saving and revenue enhancement opportunities

Retains a significant portion of First Security NOLs

Sustains robust loan origination trends and opportunities in strategic markets

Sound credit quality profile limits balance sheet risk

Complementary interest rate risk positions

Public Company

Value and Liquidity

For Shareholders

Geographic

Expansion

Broader Business

Mix

Compelling

Financial

Opportunity

13

Creates a leading middle market commercial bank operating throughout the southeast

Attractive Market Demographics

Knoxville, TN MSA

• Total Population 2014: Approximately 855,000

• 2014-2019 Population Growth: 3.1% projected

• Median Household Income 2014: $44,405

• Total Deposits in Market: Approximately $14.7 billion

Source: Nielsen, SNL Financial

14

Atlanta-Sandy Springs-Roswell, GA MSA

• Total Population 2014: Approximately 5.6 million

• 2014-2019 Population Growth: 6.4% projected

• Median Household Income 2014: $52,533

• Total Deposits in Market: Approximately $130 billion

Charlotte, NC

• Total Population 2014: Approximately 544,000

• 2014-2019 Population Growth: 4.0% projected

• Median Household Income 2014: $41,704

• Total Deposits in Market: Approximately $8.5 billion

Chattanooga, TN-GA MSA includes Dalton

and Cleveland

• Total Population 2014: Approximately 544,000

• 2014-2019 Population Growth: 4.0% projected

• Median Household Income 2014: $41,704

• Total Deposits in Market: Approximately $8.5 billion

In 3rd quarter of 2016, announced intention

to open a corporate office in Charlotte, NC

2016 Priorities

15

Complete integration of the acquired First Security businesses including the

realization of estimated cost savings

Continue the trajectory of growth and profit improvement in legacy Atlantic

Capital businesses

Reposition legacy First Security businesses for improved performance

Consider further geographic expansion, particularly de novo or team lift-out

opportunities in other attractive metropolitan markets

The New Atlantic Capital

Three attractive growth markets

Focus on corporate, business and private banking

Solid relationship deposit funding

Sound credit quality

Positioned for interest rate increase

Pursuing disciplined strategic expansion

with a focus on shareholder value

Organic

Growth

Strategic

Opportunities

16

APPENDIX

Management Biographies

Name and Title Age Experience

Patrick Oakes

Executive Vice President &

Chief Financial Officer

48 • Former Chief Financial Officer of Square 1 Financial, Inc.

• Former Executive Vice President and Chief Financial Officer of Encore Bancshares, Inc.

• Former Senior Vice President and Treasurer for Sterling Bancshares, Inc.

• Chartered Financial Analyst

Douglas Williams

Chief Executive Officer

58 • Chief Executive Officer of Atlantic Capital since its inception

• Former Managing Director and Head of Wachovia Corporation’s International Corporate Finance Group

• Held numerous roles within Wachovia, including Executive Vice President and Head of the Global

Corporate Banking Division; Chief Risk Officer for all corporate, institutional, and wholesale banking

activities; Executive Vice President and Co-Head of Wachovia’s Capital Markets Division and Executive

Vice President and Head of Wachovia’s US Corporate Banking Division

• Chairman of the Community Depository Institutions Advisory Council (CDIAC) of the Federal Reserve

Bank of Atlanta and its representative to the CDIAC of the Federal Reserve Board of Governors

• Serves on the Boards of the Metro Atlanta Chamber of Commerce, the Georgia Chamber of Commerce,

and the YMCA of Metropolitan Atlanta and the High Museum of Art and is a Member of the Buckhead

Coalition

Michael Kramer

President,

Chief Operating Officer

58 • Chief Executive Officer and President of First Security since December and Chief Executive Officer of

FSGBank since 2011

• Former Managing Director of Ridley Capital Group

• Former Director, Chief Executive Officer and President of Ohio Legacy Corporation

• Former Chief Operating Officer and Chief Technology Officer of Integra Bank Corporation

• Serves on the Boards of Chattanooga Chamber of Commerce, Chattanooga United Way, The

Tennessee Bankers Association and the Chattanooga Young Life Committee

18

ACBI Historical Balance Sheet

19

September 30, June 30, December 31, September 30,

(in thousands, except share and per share data) 2016 2016 2015 2015

ASSETS

Cash and due from banks $ 44,563 $ 40,309 $ 45,848 $ 33,477

Interest-bearing deposits in banks 75,750 239,387 130,900 90,695

Other short-term investments 23,159 20,548 26,137 36,629

Cash and cash equivalents 143,472 300,244 202,885 160,801

Securities available-for-sale 348,484 328,370 346,221 127,168

Other investments 26,370 22,575 8,034 3,011

Loans held for sale 46,600 29,061 95,465 –

Loans held for investment 2,008,102 1,942,137 1,790,669 1,046,437

Less: allowance for loan losses (18,534) (18,377) (18,905) (11,862)

Loans held for investment, net 1,989,568 1,923,760 1,771,764 1,034,575

Branch premises held for sale 5,201 – 7,200 –

Premises and equipment, net 15,213 21,770 23,145 3,138

Bank owned life insurance 61,766 61,378 60,608 30,479

Goodwill and intangible assets, net 30,071 31,674 35,232 1,259

Other real estate owned 1,727 951 1,982 27

Other assets 92,772 88,039 86,244 21,240

Total assets $ 2,761,244 $ 2,807,822 $ 2,638,780 $ 1,381,698

LIABILITIES AND SHAREHOLDERS' EQUITY

Deposits:

Noninterest-bearing demand $ 557,783 $ 592,043 $ 544,561 $ 328,065

Interest-bearing checking 260,531 231,091 232,868 135,350

Savings 29,658 30,839 28,922 321

Money market 974,072 913,094 875,441 550,879

Time 172,348 178,615 183,206 15,434

Brokered deposits 194,464 212,623 183,810 98,559

Deposits to be assumed in branch sale – – 213,410 –

Total deposits 2,188,856 2,158,305 2,262,218 1,128,608

Federal funds purchased and securities sold under agreements to repurchase – 14,047 11,931 –

Federal Home Loan Bank borrowings 170,000 240,000 – 43,000

Long-term debt 49,324 49,281 49,197 49,226

Other liabilities 44,601 42,123 27,442 11,055

Total liabilities 2,452,781 2,503,756 2,350,788 1,231,889

SHAREHOLDERS' EQUITY

Preferred stock, no par value; 10,000,000 shares authorized; no shares issued and outstanding

as of September 30, 2016, June 30, 2016, December 31, 2015, and September 30, 2015 – – – –

Common stock, no par value; 100,000,000 shares authorized;

24,950,099, 24,750,163, 24,425,546, and 13,562,125 shares issued and outstanding as of

September 30, 2016, June 30, 2016, December 31, 2015, and September 30, 2015, 290,835 289,353 286,367 136,941

Retained earnings 14,927 11,219 3,141 11,302

Accumulated other comprehensive income (loss) 2,701 3,494 (1,516) 1,566

Total shareholders’ equity 308,463 304,066 287,992 149,809

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $ 2,761,244 $ 2,807,822 $ 2,638,780 $ 1,381,698

Atlantic Capital Bancshares, Inc.

Consolidated Balance Sheets (unaudited)

ACBI Historical Income Statement

($ in thousands)

20

Atlantic Capital Bancshares, Inc.

Consolidated Statements of Income (unaudited)

(in thousands except per share data)

September

30, 2016

June 30,

2016

March 31,

2016

December

31, 2015

September

30, 2015

September

30, 2016

September

30, 2015

INTEREST INCOME

Loans, including fees $ 20,511 $ 20,282 $ 19,625 $ 16,688 $ 9,423 $ 60,418 $ 27,874

Investment securities - available-for-sale 1,293 1,327 1,601 1,224 664 4,221 2,077

Interest and dividends on other interest‑earning assets 491 507 273 328 247 1,271 776

Total interest income 22,295 22,116 21,499 18,240 10,334 65,910 30,727

INTEREST EXPENSE

Interest on deposits 1,956 1,841 1,673 1,355 751 5,470 2,262

Interest on Federal Home Loan Bank advances 133 147 44 7 52 324 283

Interest on federal funds purchased and securities sold under

agreements to repurchase 37 87 67 10 20 191 69

Interest on long-term debt 815 832 810 841 17 2,457 17

Other – – 38 79 – 38 –

Total interest expense 2,941 2,907 2,632 2,292 840 8,480 2,631

NET INTEREST INCOME BEFORE PROVISION FOR LOAN LOSSES 19,354 19,209 18,867 15,948 9,494 57,430 28,096

Provision for loan losses 463 777 368 7,623 (137) 1,608 412

NET INTEREST INCOME AFTER PROVISION FOR LOAN LOSSES 18,891 18,432 18,499 8,325 9,631 55,822 27,684

NONINTEREST INCOME

Service charges 1,270 1,392 1,498 1,265 521 4,160 1,348

Gains on sale of securities available-for-sale – 11 33 – 10 44 10

Gains on sale of other assets 71 31 48 103 – 150 –

Mortgage income 632 447 339 163 – 1,418 –

Trust income 361 386 314 192 – 1,061 –

Derivatives income 69 98 65 89 67 232 215

Bank owned life insurance 424 398 393 365 227 1,215 1,794

SBA lending activities 959 1,204 880 904 745 3,043 2,006

TriNet lending activities – 761 383 – – 1,144 –

Gains on sale of branches – 3,885 – – – 3,885 –

Other noninterest income 216 267 467 379 159 950 566

Total noninterest income 4,002 8,880 4,420 3,460 1,729 17,302 5,939

NONINTEREST EXPENSE

Salaries and employee benefits 10,059 10,420 10,555 9,661 4,859 31,034 14,437

Occupancy 1,235 1,274 1,100 907 419 3,609 1,263

Equipment and software 862 724 686 608 243 2,272 687

Professional services 442 760 748 1,020 208 1,950 613

Postage, printing and supplies 61 159 169 115 21 389 63

Communications and data processing 617 694 916 555 313 2,227 986

Marketing and business development 269 317 267 197 90 853 213

FDIC premiums 415 493 398 273 161 1,306 516

Merger and conversion costs 579 1,210 749 7,172 718 2,538 1,982

Amortization of intangibles 520 668 762 526 – 1,950 –

Other noninterest expense 2,237 2,224 1,916 2,205 639 6,377 1,934

Total noninterest expense 17,296 18,943 18,266 23,239 7,671 54,505 22,694

INCOME (LOSS) BEFORE PROVISION FOR INCOME TAXES 5,597 8,369 4,653 (11,454) 3,689 18,619 10,929

Provision for income taxes 1,889 3,222 1,722 (3,293) 1,463 6,833 4,087

NET INCOME (LOSS) $ 3,708 $ 5,147 $ 2,931 $ (8,161) $ 2,226 $ 11,786 $ 6,842

Net income (loss) per common share‑basic $ 0.15 $ 0.21 $ 0.12 $ (0.40) $ 0.16 $ 0.48 $ 0.51

Net income (loss) per common share‑diluted $ 0.15 $ 0.20 $ 0.12 $ (0.40) $ 0.16 $ 0.47 $ 0.49

Weighted average shares - basic 24,891,822 24,644,755 24,485,900 20,494,895 13,562,125 24,674,953 13,527,195

Weighted average shares - diluted 25,260,280 25,158,694 24,993,597 21,004,577 13,904,395 25,106,250 13,866,312

Nine months endedThree months ended

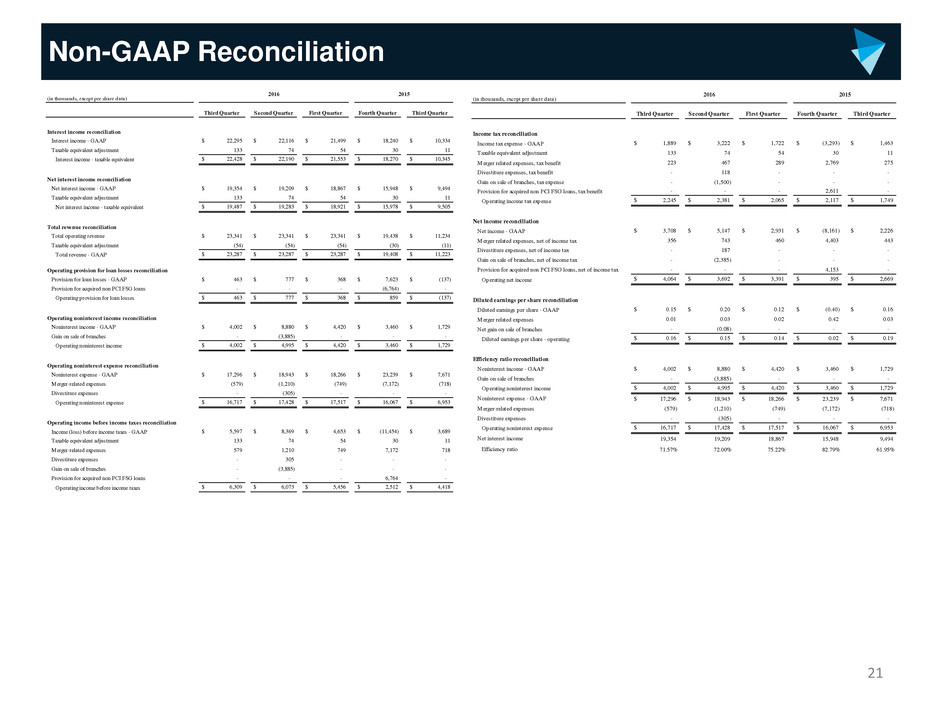

Non-GAAP Reconciliation

21

(in thousands, except per share data)

Third Quarter Second Quarter First Quarter Fourth Quarter Third Quarter

Income tax reconciliation

Income tax expense - GAAP $ 1,889 $ 3,222 $ 1,722 $ (3,293) $ 1,463

Taxable equivalent adjustment 133 74 54 30 11

Merger related expenses, tax benefit 223 467 289 2,769 275

Divestiture expenses, tax benefit - 118 - - -

Gain on sale of branches, tax expense - (1,500) - - -

Provision for acquired non PCI FSG loans, tax benefit - - - 2,611 -

Operating income tax expense $ 2,245 $ 2,381 $ 2,065 $ 2,117 $ 1,749

Net income reconciliation

Net income - GAAP $ 3,708 $ 5,147 $ 2,931 $ (8,161) $ 2,226

Merger related expenses, net of income tax 356 743 460 4,403 443

Divestiture expenses, net of income tax - 187 - - -

Gain on sale of branches, net of income tax - (2,385) - - -

Provision for acquired non PCI FSG loans, net of income tax - - - 4,153 -

Operating net income $ 4,064 $ 3,692 $ 3,391 $ 395 $ 2,669

Diluted earnings per share reconciliation

Diluted earnings per share - GAAP $ 0.15 $ 0.20 $ 0.12 $ (0.40) $ 0.16

Merger related expenses 0.01 0.03 0.02 0.42 0.03

Net gain on sale of branches - (0.08) - - -

Diluted earnings per share - operating $ 0.16 $ 0.15 $ 0.14 $ 0.02 $ 0.19

Efficiency ratio reconciliation

Noninterest income - GAAP $ 4,002 $ 8,880 $ 4,420 $ 3,460 $ 1,729

Gain on sale of branches - (3,885) - - -

Operating noninterest income $ 4,002 $ 4,995 $ 4,420 $ 3,460 $ 1,729

Noninterest expense - GAAP $ 17,296 $ 18,943 $ 18,266 $ 23,239 $ 7,671

Merger-related expenses (579) (1,210) (749) (7,172) (718)

Divestiture expenses - (305) - - -

Operating noninterest expense $ 16,717 $ 17,428 $ 17,517 $ 16,067 $ 6,953

Net interest income 19,354 19,209 18,867 15,948 9,494

Efficiency ratio 71.57% 72.00% 75.22% 82.79% 61.95%

2016 2015

(in thousands, except per share data)

Third Quarter Second Quarter First Quarter Fourth Quarter Third Quarter

Interest income reconciliation

Interest income - GAAP $ 22,295 $ 22,116 $ 21,499 $ 18,240 $ 10,334

Taxable equivalent adjustment 133 74 54 30 11

Interest income - taxable equivalent $ 22,428 $ 22,190 $ 21,553 $ 18,270 $ 10,345

Net interest income reconciliation

Net interest income - GAAP $ 19,354 $ 19,209 $ 18,867 $ 15,948 $ 9,494

Taxable equivalent adjustment 133 74 54 30 11

Net interest income - taxable equivalent $ 19,487 $ 19,283 $ 18,921 $ 15,978 $ 9,505

Total revenue reconciliation

Total operating revenue $ 23,341 $ 23,341 $ 23,341 $ 19,438 $ 11,234

Taxable equivalent adjustment (54) (54) (54) (30) (11)

Total revenue - GAAP $ 23,287 $ 23,287 $ 23,287 $ 19,408 $ 11,223

Operating provision for loan losses reconciliation

Provision for loan losses - GAAP $ 463 $ 777 $ 368 $ 7,623 $ (137)

Provision for acquired non PCI FSG loans - - - (6,764) -

Operating provision for loan losses $ 463 $ 777 $ 368 $ 859 $ (137)

Operating noninterest income reconciliation

Noninterest income - GAAP $ 4,002 $ 8,880 $ 4,420 $ 3,460 $ 1,729

Gain on sale of branches - (3,885) - - -

Operating noninterest income $ 4,002 $ 4,995 $ 4,420 $ 3,460 $ 1,729

Operating noninterest expense reconciliation

Noninterest expense - GAAP $ 17,296 $ 18,943 $ 18,266 $ 23,239 $ 7,671

Merger-related expenses (579) (1,210) (749) (7,172) (718)

Divestiture expenses - (305) - - -

Operating noninterest expense $ 16,717 $ 17,428 $ 17,517 $ 16,067 $ 6,953

Operating income before incom taxes reconciliation

Income (loss) before income taxes - GAAP $ 5,597 $ 8,369 $ 4,653 $ (11,454) $ 3,689

Taxable equivalent adjustment 133 74 54 30 11

Merger-related expenses 579 1,210 749 7,172 718

Divestiture expenses - 305 - - -

Gain on sale of branches - (3,885) - - -

Provision for acquired non PCI FSG loans - - - 6,764 -

Operating income before income taxes $ 6,309 $ 6,073 $ 5,456 $ 2,512 $ 4,418

2016 2015