Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - ALIMERA SCIENCES INC | pressrelease.htm |

| 8-K - 8-K - ALIMERA SCIENCES INC | alim8k.htm |

Third Quarter 2016 Results

Conference Call

Thursday, November 3, 2016

Exhibit 99.2

Safe Harbor Statement

This presentation contains "forward-looking statements," within the meaning of the Private Securities Litigation Reform Act of 1995,

regarding, among other things, the opportunity growth potential of ILUVEN, the adoption of reimbursement coding in the Middle East, the

market size in the Middle East, Alimera’s need for additional financing, and the potential for Alimera to expand geographically, extend the

ILUVIEN label and become cash flow positive. Such forward-looking statements are based on current expectations and involve inherent risks

and uncertainties, including factors that could delay, divert or change any of them, and could cause actual results to differ materially from

those projected in its forward-looking statements. Words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,”

“contemplate,” “predict,” “project,” “target,” “likely,” “potential,” “continue,” “ongoing,” “will,” “would,” “should,” “could,” or the negative

of these terms and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements

contain these identifying words. Such forward-looking statements are based on current expectations and involve inherent risks and

uncertainties, including factors that could delay, divert or change any of them, and could cause actual results to differ materially from those

projected in its forward-looking statements. Meaningful factors which could cause actual results to differ include, but are not limited to

market acceptance and physician awareness of ILUVIEN in the U.S. and Europe, the regulatory environment in the Middle East and

elsewhere, the outcome of future clinical trials, Alimera’s ability to contain its operating expenses, as well as other factors discussed in the

"Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of Alimera's Annual

Report on Form 10-K for the year ended December 31, 2015 and Quarterly Reports on Form 10-Q for the quarters ended March 31, 2016

and June 30, 2016, which are on file with the Securities and Exchange Commission (SEC) and available on the SEC's website at

http://www.sec.gov. Additional factors may also be set forth in those sections of Alimera’s Quarterly Report on Form 10-Q for the nine

months ended September 30, 2016, to be filed with the SEC in the fourth quarter of 2016. In addition to the risks described above and in

Alimera's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings with the SEC, other

unknown or unpredictable factors also could affect Alimera's results. There can be no assurance that the actual results or developments

anticipated by Alimera will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on,

Alimera. Therefore, no assurance can be given that the outcomes stated in such forward-looking statements and estimates will be achieved.

All forward-looking statements contained in this presentation are expressly qualified by the cautionary statements contained or referred to

herein. Alimera cautions investors not to rely too heavily on the forward-looking statements Alimera makes or that are made on its behalf.

These forward-looking statements speak only as of the date of this presentation (unless another date is indicated). Alimera undertakes no

obligation, and specifically declines any obligation, to publicly update or revise any such forward-looking statements, whether as a result of

new information, future events or otherwise.

© 2016 Alimera Sciences, Inc., All Rights Reserved 2

© 2016 Alimera Sciences, Inc., All Rights Reserved 3

Highlights Overall Revenue Growth

3Q15 3Q16

$8.3M

$6.9M

+20% • Grew revenues year over year,

both in the US and international

• Significant progress in obtaining

reimbursement in new markets

• Strengthened balanced sheet

• Amended term loan with

Hercules

© 2016 Alimera Sciences, Inc., All Rights Reserved 4

Real World Evidence - Europe

Location N° of eyes (pts) Follow-up

Medisoft 2nd data extract results (13 sites

in the UK)1

290

Eyes (258 pts)

Up to

722

days

IRISS 2nd data extract

(37 sites in UK, DE, PT)2

328

Eyes (292 pts)

Up to

763

days

1. Bailey C. Alimera Sciences symposium at EURETINA 2015.

2. Chakravarthy U. Alimera Sciences Advisory Board held on March 12 2016 in Paris, France.

© 2016 Alimera Sciences, Inc., All Rights Reserved 5

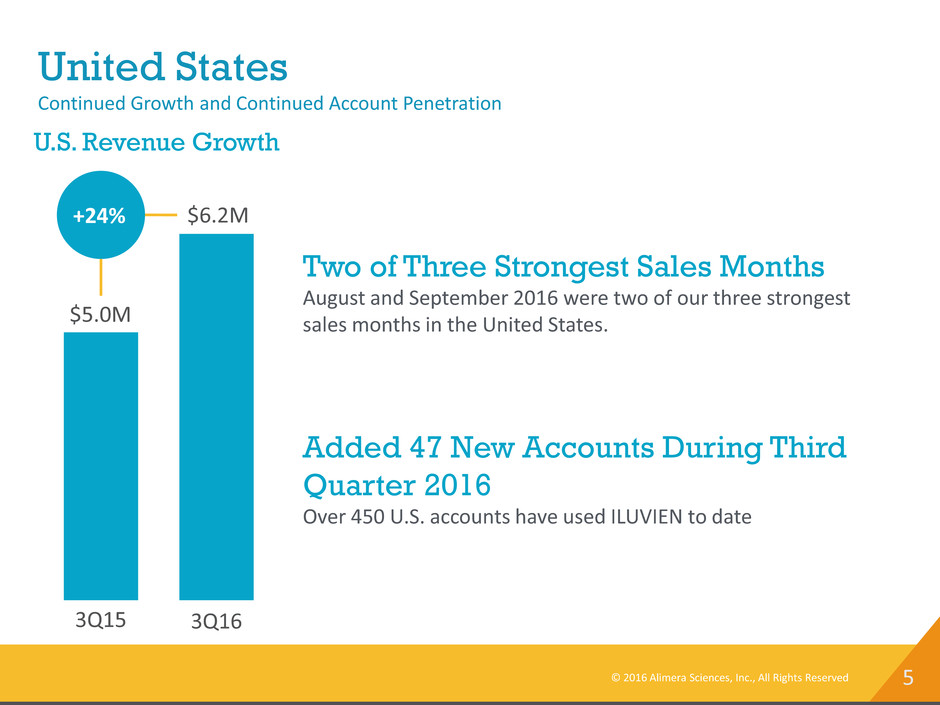

United States

Continued Growth and Continued Account Penetration

3Q15 3Q16

$6.2M

$5.0M

+24%

U.S. Revenue Growth

Two of Three Strongest Sales Months

August and September 2016 were two of our three strongest

sales months in the United States.

Added 47 New Accounts During Third

Quarter 2016

Over 450 U.S. accounts have used ILUVIEN to date

© 2016 Alimera Sciences, Inc., All Rights Reserved 6

Europe

Continued Progress

3Q15 3Q16

$2.1M

$1.9M

+11%

European Revenue

Growth

Germany

Sixth consecutive quarter of unit volume growth, a record high in

terms of ILUVIEN implants sold, despite seasonality

UK

Initiating discussions 4Q16 to amend reimbursement guidelines

Portugal

Strong growth year over year

EURETINA Conference

Strongest ever presence, 23 clinical presentations involving more

than 450 cases of ILUVIEN use

© 2016 Alimera Sciences, Inc., All Rights Reserved 7

Expanding International Footprint

Middle East

Recently announced first sales and usage of ILUVIEN under agreement with MEAgate.

Ireland

Pricing approved in July

Italy

Distribution partner SIFI is in active discussions regarding pricing anticipate a decision by year

end. If achieved, Italy launch anticipated during 2017

Financial Overview

Rick Eiswirth, President & CFO

© 2016 Alimera Sciences, Inc., All Rights Reserved 9

Select Income Statement Data

($000’s)

Three Months Ended

September 30, 2016

Unaudited Results

Three Months Ended

September 30, 2015

Unaudited Results

Revenue $8,298 $6,901

Gross Profit $7,812 $6,267

Gross Margin 94.1% 90.8%

Net (Loss) From

Operations

($7,243) ($8,444)

Net (Loss) Applicable to

Common Stockholders

($9,245) ($1,543)

© 2016 Alimera Sciences, Inc., All Rights Reserved 10

Select Balance Sheet Data

($000’s)

As of September 30, 2016

Unaudited Results

As of December 31, 2015

Cash & Cash Equivalents $33,853 $31,075

Total Current Assets $51,603 $45,159

Total Assets $74,980 $70,484

Total Current Liabilities $42,678 $39,933

Total Stockholder’s Equity $30,032 $26,320

Closing Remarks

Dan Myers, CEO

Third Quarter 2016 Results

Conference Call

Thursday, November 3, 2016