Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - CyrusOne Inc. | cyrusone3q16earningspres.htm |

| 8-K - 8-K - CyrusOne Inc. | a3rdqtrpressreleaseoctober.htm |

Exhibit 99.1

CyrusOne Reports Third Quarter 2016 Earnings

Year-over-Year Net Income Growth of $9.7 Million and Adjusted EBITDA Growth of 24%

DALLAS (October 31, 2016) - Global data center service provider CyrusOne Inc. (NASDAQ: CONE), which specializes in providing highly reliable enterprise-class, carrier-neutral data center properties to the Fortune 1000, today announced third quarter 2016 earnings.

Highlights

• | Third quarter net income of $4.4 million increased $9.7 million over third quarter 2015 |

• | Third quarter Adjusted EBITDA of $73.1 million increased 24% over third quarter 2015 |

• | Third quarter Normalized FFO per share of $0.67, including $0.04 from non-recurring income, increased 18% over third quarter 2015 |

• | Third quarter revenue of $143.8 million increased $32.6 million or 29% over third quarter 2015 |

• | Leased 105,000 colocation square feet and 17 megawatts (MW) in the third quarter totaling $27 million in annualized GAAP revenue, our fourth highest leasing quarter ever and more than double the annualized GAAP revenue signed in third quarter 2015 |

• | Subsequent to the end of the quarter, leased up second expansion phase at Chicago - Aurora I facility |

• | Backlog of $68 million in annualized GAAP revenue as of the end of the third quarter, representing nearly $550 million in total contract value |

• | Added three Fortune 1000 companies as new customers in the third quarter, increasing the total number of Fortune 1000 customers to 180 as of the end of the quarter |

• | Added one of the ten largest cloud companies, increasing our total to seven of the ten largest cloud companies |

“2016 continues to be a record-setting year for CyrusOne as we are generating strong financial and operational results driven by robust customer demand across our portfolio,” said Gary Wojtaszek, president and chief executive officer of CyrusOne. “With a backlog of nearly $70 million and more than 75% of the capital in our development pipeline associated with pre-leased projects, we have excellent visibility into future growth and have significantly de-risked the business while continuing to deliver very attractive returns.”

Third Quarter 2016 Financial Results

Net income was $4.4 million for the third quarter, compared to a net loss of $5.3 million in the same period in 2015. Normalized Funds From Operations (Normalized FFO)1 was $54.8 million for the third quarter, compared to $41.2 million in the same period in 2015, an increase of 33%. Net income per diluted common share2 was $0.05 in the third quarter of 2016, compared to a net loss of $0.08 per diluted common share or common share equivalent in the same period in 2015. Normalized FFO per diluted common share2 was $0.67 in the third quarter of 2016, an increase of 18%.

Revenue was $143.8 million for the third quarter, compared to $111.2 million for the same period in 2015, an increase of 29%. The increase in revenue was driven by a 31% increase in leased colocation square feet, additional interconnection services, and equipment sales. Net operating income (NOI)3 was $89.2 million for the third quarter, compared to $69.0 million in the same period in 2015, an increase of 29%. Adjusted EBITDA4 was $73.1 million for the third quarter, compared to $59.0 million in the same period in 2015, an increase of 24%.

Leasing Activity

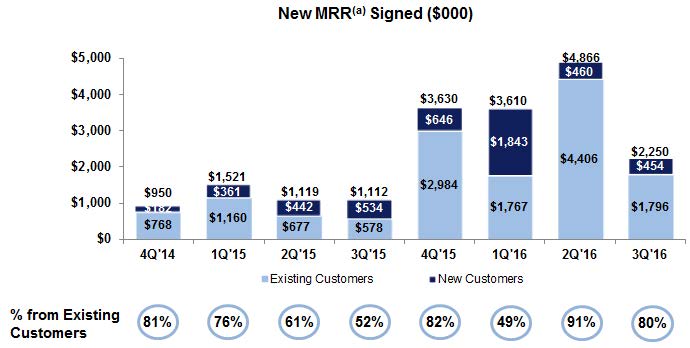

CyrusOne leased approximately 105,000 colocation square feet (CSF) and 17 MW of power in the third quarter, representing $2.3 million in monthly recurring rent inclusive of the monthly impact of installation charges, or approximately $27 million in annualized contracted GAAP revenue5 excluding estimates for pass-through power. The Company added three new Fortune 10006 customers in the third quarter, bringing the total to 180 customers in the Fortune 1000 and 952 customers in total as of September 30, 2016. The weighted average lease term of the new leases based on square footage is 63 months (5.3 years), and the weighted average remaining lease term of CyrusOne’s portfolio is 53 months (taking into account the impact of the backlog), nearly double the weighted average remaining lease term of the portfolio at the time of the Company’s initial public offering. Recurring rent churn7 for the third quarter was 3.8%, including 1.4% initiated by CyrusOne, compared to 0.7% for the same period in 2015.

3

Portfolio Utilization and Development

In the third quarter, the Company completed construction on approximately 49,000 CSF and 11 MW of power capacity in Phoenix and Chicago, increasing total CSF across 35 data centers to approximately 2,055,000 CSF. This represents an increase of 543,000 CSF, or 36%, from September 30, 2015. CSF utilization8 as of the end of the third quarter was 93% for stabilized properties9 and 85% overall. The Company’s Massively Modular® design approach has enabled it to consistently deliver development yields10 ranging from 16% to 19% across the portfolio. The Company has development projects underway in Phoenix, Northern Virginia, San Antonio and Chicago that will add approximately 350,000 CSF and 69 MW of power capacity. During the quarter, CyrusOne acquired 29 acres of land in Phoenix and 23 acres of land in Chicago to support growth in those markets as well as land and shell for development of a fully pre-leased data center in Northern Virginia. The Company has 811,000 square feet of powered shell available for development as well as 269 acres of land across its markets.

Balance Sheet and Liquidity

As of September 30, 2016, the Company had $1,082.4 million of long term debt11, cash and cash equivalents of $11.0 million, and $587.9 million available under its unsecured revolving credit facility. Net debt11 was $1,083.3 million as of September 30, 2016, approximately 21% of the Company's total enterprise value or 3.7x Adjusted EBITDA for the last quarter annualized. Available liquidity12 was $598.9 million as of September 30, 2016.

During the quarter, CyrusOne raised $165 million in net equity proceeds through a public offering in August and an additional $26 million through its at-the-market equity program. Additionally, as part of its August offering, the Company entered into a forward sale agreement for 4.42 million shares which can be cash or net share settled at any time through August 1, 2017, subject to certain adjustments. CyrusOne expects to physically settle the forward sale agreements in full, receiving approximately $214 million in gross proceeds, subject to certain adjustments. Adjusted for the impact of this settlement, net debt as of September 30, 2016 was 3.0x Adjusted EBITDA for the last quarter annualized, and available liquidity was more than $810 million.

Dividend

On August 1, 2016, the Company announced a dividend of $0.38 per share of common stock for the third quarter of 2016. The dividend was paid on October 14, 2016, to stockholders of record at the close of business on September 30, 2016.

Additionally, today the Company is announcing a dividend of $0.38 per share of common stock for the fourth quarter of 2016. The dividend will be paid on January 13, 2017, to stockholders of record at the close of business on December 30, 2016.

Guidance

CyrusOne is increasing its guidance range for full year 2016 Normalized FFO per diluted common share, increasing the lower end of its guidance range for full year 2016 Revenue, and tightening its guidance range for Adjusted EBITDA. The Company is reaffirming its guidance for Capital Expenditures. The annual guidance provided below represents forward-looking statements, which are based on current economic conditions, internal assumptions about the Company's existing customer base and the supply and demand dynamics of the markets in which CyrusOne operates.

CyrusOne does not provide reconciliations for the non-GAAP financial measures included in the annual guidance provided below due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations, including net income (loss) and adjustments that could be made for transaction and acquisition integration costs, legal claim costs, lease exit costs, asset impairments and loss on disposals and other charges in its reconciliation of historic numbers, the amount of which, based on historical experience, could be significant.

Category | Previous 2016 Guidance | Revised 2016 Guidance |

Total Revenue | $520 - 530 million | $523 - 530 million |

Base Revenue | $470 - 475 million | $472 - 476 million |

Metered Power Reimbursements | $50 - 55 million | $51 - 54 million |

Adjusted EBITDA | $270 - 280 million | $275 - 278 million |

Normalized FFO per diluted common share | $2.50 - 2.58 | $2.59 - 2.62 |

Capital Expenditures | $635 - 655 million | $635 - 655 million |

Development | $630 - 646 million | $630 - 646 million |

Recurring | $5 - 9 million | $5 - 9 million |

4

Upcoming Conferences and Events

• | CyrusOne Data Center Campus Tour on November 14 in Phoenix, Arizona |

• | NAREIT’s REITWorld conference on November 15-17 in Phoenix, Arizona |

Conference Call Details

CyrusOne will host a conference call on October 31, 2016, at 11:00 AM Eastern Time (10:00 AM Central Time) to discuss its results for the third quarter of 2016. A live webcast of the conference call will be available under the “Investor Relations” tab in the “Events and Presentations” section of the Company's website at http://investor.cyrusone.com/events.cfm. The U.S. conference call dial-in number is 1-844-492-3731, and the international dial-in number is 1-412-542-4121. A replay will be available one hour after the conclusion of the earnings call on October 31, 2016, through November 14, 2016. The U.S. toll-free replay dial-in number is 1-877-344-7529 and the international replay dial-in number is 1-412-317-0088. The replay access code is 10093535.

Safe Harbor

This release and the documents incorporated by reference herein contain forward-looking statements regarding future events and our future results that are subject to the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, are statements that could be deemed forward-looking statements. These statements are based on current expectations, estimates, forecasts, and projections about the industries in which we operate and the beliefs and assumptions of our management. Words such as "expects," "anticipates," "predicts," "projects," "intends," "plans," "believes," "seeks," "estimates," "continues," "endeavors," "strives," "may," variations of such words and similar expressions are intended to identify such forward-looking statements. In addition, any statements that refer to projections of our future financial performance, our anticipated growth and trends in our businesses, and other characterizations of future events or circumstances are forward-looking statements. Readers are cautioned these forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially and adversely from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this release and those discussed in other documents we file with the Securities and Exchange Commission (SEC). More information on potential risks and uncertainties is available in our recent filings with the SEC, including CyrusOne's Form 10-K report, Form 10-Q reports, and Form 8-K reports. Actual results may differ materially and adversely from those expressed in any forward-looking statements. We undertake no obligation to revise or update any forward-looking statements for any reason.

Use of Non-GAAP Financial Measures

This press release contains certain non-GAAP financial measures that management believes are helpful in understanding the Company's business, as further discussed within this press release. These financial measures, which include Funds From Operations, Normalized Funds From Operations, Adjusted EBITDA, Net Operating Income, Adjusted Net Operating Income, and Net Debt should not be construed as being more important than comparable GAAP measures. Detailed reconciliations of these non-GAAP financial measures to comparable GAAP financial measures have been included in the tables that accompany this release and are available in the Investor Relations section of www.cyrusone.com.

Management uses FFO, Normalized FFO, Adjusted EBITDA, NOI, and Adjusted NOI as supplemental performance measures because they provide performance measures that, when compared year over year, capture trends in occupancy rates, rental rates and operating costs. The Company also believes that, as widely recognized measures of the performance of real estate investment trusts (REITs) and other companies, these measures will be used by investors as a basis to compare its operating performance with that of other companies. Other companies may not calculate these measures in the same manner, and, as presented, they may not be comparable to others. Therefore, FFO, Normalized FFO, NOI, Adjusted NOI, and Adjusted EBITDA should be considered only as supplements to net income as measures of our performance. FFO, Normalized FFO, NOI, Adjusted NOI, and Adjusted EBITDA should not be used as measures of liquidity or as indicative of funds available to fund the Company's cash needs, including the ability to pay dividends. These measures also should not be used as substitutes for cash flow from operating activities computed in accordance with U.S. GAAP.

1Normalized Funds From Operations (Normalized FFO) is defined as Funds From Operations (FFO) plus amortization of customer relationship intangibles, transaction and acquisition integration costs, legal claim costs and lease exit costs, and other special items including loss on extinguishment of debt and severance and management transition costs, as appropriate. FFO is net (loss) income computed in accordance with U.S. GAAP before real estate depreciation and amortization and Asset impairments and loss on disposal. Because the value of the customer relationship intangibles is inextricably connected to the real estate acquired, CyrusOne believes the amortization and impairments of such intangibles is analogous to real estate depreciation and impairments; therefore, the Company adds the customer relationship intangible amortization and impairments back for similar treatment with real estate depreciation and impairments. The Company believes its Normalized FFO calculation provides a comparable measure to that used by others in the industry. However, other REITs may not calculate Normalized FFO in the same manner. Accordingly, the Company’s Normalized FFO may not be comparable to others.

5

2Net income / (loss) per diluted common share and Normalized FFO per diluted common share are defined as net income / (loss) and Normalized FFO, respectively, divided by the average common shares outstanding for the quarter, which were 81,263,332 for the third quarter of 2016.

3Net Operating Income (NOI) is defined as revenue less property operating expenses. Amortization of deferred leasing costs is presented in depreciation and amortization, which is excluded from NOI. CyrusOne has not historically incurred any tenant improvement costs. Our sales and marketing costs consist of salaries and benefits for our internal sales staff, travel and entertainment, office supplies, marketing and advertising costs. General and administrative costs include salaries and benefits of our senior management and support functions, legal and consulting costs, and other administrative costs. Marketing and advertising costs are not property-specific, rather these costs support our entire portfolio. As a result, we have excluded these marketing and advertising costs from our NOI calculation, consistent with the treatment of general and administrative costs, which also support our entire portfolio. From time to time, there may be non-recurring costs in property operating expenses, and as a result the Company may present Adjusted Net Operating Income (Adjusted NOI) to exclude the impacts of those costs.

4Adjusted EBITDA is defined as net income (loss) as defined by U.S. GAAP plus interest expense, income tax (benefit) expense, depreciation and amortization, stock-based compensation, transaction and integration costs, severance and management transition costs, asset impairments and (gain) loss on disposals, lease exit costs, legal claim costs and other special items. Other companies may not calculate Adjusted EBITDA in the same manner. Accordingly, the Company's Adjusted EBITDA as presented may not be comparable to others.

5Annualized GAAP revenue is equal to monthly recurring rent, defined as average monthly contractual rent during the term of the lease plus the monthly impact of installation charges, multiplied by 12. It can be shown both inclusive and exclusive of the Company’s estimate of customer reimbursements for metered power.

6Fortune 1000 customers include subsidiaries whose ultimate parent is a Fortune 1000 company or a foreign or private company of equivalent size.

7Recurring rent churn is calculated as any reduction in recurring rent due to customer terminations, service reductions or net pricing decreases as a percentage of rent at the beginning of the period, excluding any impact from metered power reimbursements or other usage-based billing.

8Utilization is calculated by dividing CSF under signed leases for available space (whether or not the contract has commenced billing) by total CSF. Utilization rate differs from percent leased presented in the Data Center Portfolio table because utilization rate excludes office space and supporting infrastructure net rentable square footage and includes CSF for signed leases that have not commenced billing. Management uses utilization rate as a measure of CSF leased.

9Stabilized properties include data halls that have been in service for at least 24 months or are at least 85% utilized.

10Development yield is calculated by dividing annualized Net Operating Income for the most recent quarter by total investment in real estate (before accumulated depreciation), less construction in progress.

11Long term debt and net debt exclude adjustments for deferred financing costs. Net debt provides a useful measure of liquidity and financial health. The Company defines net debt as long-term debt and capital lease obligations, offset by cash, cash equivalents, and temporary cash investments.

12Liquidity is calculated as cash, cash equivalents, and temporary cash investments on hand, plus the undrawn capacity on CyrusOne's revolving credit facility.

6

About CyrusOne

CyrusOne (NASDAQ: CONE) specializes in highly reliable enterprise-class, carrier-neutral data center properties. The Company provides mission-critical data center facilities that protect and ensure the continued operation of IT infrastructure for more than 950 customers, including nine of the Fortune 20 and 180 of the Fortune 1000 companies.

CyrusOne's data center offerings provide the flexibility, reliability, and security that enterprise customers require and are delivered through a tailored, customer service-focused platform designed to foster long-term relationships. CyrusOne is committed to full transparency in communication, management, and service delivery throughout its 35 data centers worldwide.

# # #

Investor Relations:

Michael Schafer

972-350-0060

investorrelations@cyrusone.com

7

Company Profile

CyrusOne (NASDAQ: CONE) specializes in highly reliable enterprise-class, carrier-neutral data center properties. The Company provides mission-critical data center facilities that protect and ensure the continued operation of IT infrastructure for more than 950 customers, including nine of the Fortune 20 and 180 of the Fortune 1000 companies. CyrusOne's data center offerings provide the flexibility, reliability, and security that enterprise customers require and are delivered through a tailored, customer service-focused platform designed to foster long-term relationships. CyrusOne is committed to full transparency in communication, management, and service delivery throughout its 35 data centers worldwide.

• | Best-in-Class Sales Force |

• | Flexible Solutions that Scale as Customers Grow |

• | Massively Modular® Engineering with Data Hall Builds in 12-16 Weeks |

• | Focus on Operational Excellence and Superior Customer Service |

• | Proven Leading-Edge Technology Delivering Power Densities up to 900 Watts per Square Foot |

• | National IX Replicates Enterprise Data Center Architecture |

Corporate Headquarters | Senior Management | |

1649 West Frankford Road | Gary Wojtaszek, President and CEO | John Hatem, EVP Design, Construction & Operations |

Carrollton, Texas 75007 | Greg Andrews, Chief Financial Officer | Blake Hankins, Chief Information Officer |

Phone: (972) 350-0060 | Kevin Timmons, Chief Technology Officer | Scott Brueggeman, Chief Marketing Officer |

Website: www.cyrusone.com | Tesh Durvasula, Chief Commercial Officer | John Gould, EVP Global Sales |

Kellie Teal-Guess, EVP & Chief People Officer | Brent Behrman, EVP Strategic Sales | |

Robert Jackson, EVP General Counsel & Secretary | Amitabh Rai, Senior VP & Chief Accounting Officer | |

Analyst Coverage

Firm | Analyst | Phone Number |

Bank of America Merrill Lynch | Michael J. Funk | (646) 855-5664 |

Barclays | Amir Rozwadowski | (212) 526-4043 |

Citi | Emmanuel Korchman | (212) 816-1382 |

Cowen and Company | Colby Synesael | (646) 562-1355 |

Deutsche Bank | Vin Chao | (212) 250-6799 |

Gabelli & Company | Sergey Dluzhevskiy | (914) 921-8355 |

Jefferies | Jonathan Petersen | (212) 284-1705 |

J.P. Morgan | Richard Choe | (212) 622-6708 |

KeyBanc Capital Markets | Jordan Sadler | (917) 368-2280 |

Morgan Stanley | Simon Flannery | (212) 761-6432 |

RBC Capital Markets | Jonathan Atkin | (415) 633-8589 |

Raymond James | Frank G. Louthan IV | (404) 442-5867 |

Stephens | Barry McCarver | (501) 377-8131 |

Stifel | Matthew S. Heinz, CFA | (443) 224-1382 |

SunTrust Robinson Humphrey | Greg Miller | (212) 303-4169 |

UBS | John C. Hodulik, CFA | (212) 713-4226 |

Wells Fargo | Eric Luebchow | (312) 630-2386 |

8

CyrusOne Inc.

Consolidated Statements of Operations

(Dollars in millions, except per share amounts)

(Unaudited)

Three Months | Nine Months | |||||||||||||||||||||

Ended September 30, | Change | Ended September 30, | Change | |||||||||||||||||||

2016 | 2015 | $ | % | 2016 | 2015 | $ | % | |||||||||||||||

Revenue | $ | 143.8 | $ | 111.2 | $ | 32.6 | 29 | % | $ | 391.7 | $ | 286.0 | $ | 105.7 | 37 | % | ||||||

Costs and expenses: | ||||||||||||||||||||||

Property operating expenses | 54.6 | 42.2 | 12.4 | 29 | % | 139.7 | 107.3 | 32.4 | 30 | % | ||||||||||||

Sales and marketing | 4.7 | 3.2 | 1.5 | 47 | % | 12.9 | 8.9 | 4.0 | 45 | % | ||||||||||||

General and administrative | 13.9 | 12.5 | 1.4 | 11 | % | 42.8 | 31.5 | 11.3 | 36 | % | ||||||||||||

Depreciation and amortization | 50.6 | 39.1 | 11.5 | 29 | % | 134.6 | 101.6 | 33.0 | 32 | % | ||||||||||||

Transaction and acquisition integration costs | 1.2 | 1.8 | (0.6 | ) | (33 | )% | 3.9 | 11.5 | (7.6 | ) | (66 | )% | ||||||||||

Asset impairments and loss on disposal | — | 4.9 | (4.9 | ) | n/m | — | 13.5 | (13.5 | ) | (100 | )% | |||||||||||

Total costs and expenses | 125.0 | 103.7 | 21.3 | 21 | % | 333.9 | 274.3 | 59.6 | 22 | % | ||||||||||||

Operating income | 18.8 | 7.5 | 11.3 | n/m | 57.8 | 11.7 | 46.1 | n/m | ||||||||||||||

Interest expense | 13.8 | 12.1 | 1.7 | 14 | % | 37.4 | 29.2 | 8.2 | 28 | % | ||||||||||||

Net income (loss) before income taxes | 5.0 | (4.6 | ) | 9.6 | n/m | 20.4 | (17.5 | ) | 37.9 | n/m | ||||||||||||

Income tax expense | (0.6 | ) | (0.7 | ) | 0.1 | (14 | )% | (1.3 | ) | (1.5 | ) | 0.2 | (13 | )% | ||||||||

Net income (loss) | 4.4 | (5.3 | ) | 9.7 | n/m | 19.1 | (19.0 | ) | 38.1 | n/m | ||||||||||||

Noncontrolling interest in net income (loss) | — | (0.7 | ) | 0.7 | (100 | )% | — | (4.6 | ) | 4.6 | (100 | )% | ||||||||||

Net income (loss) attributed to common stockholders | $ | 4.4 | $ | (4.6 | ) | $ | 9.0 | n/m | $ | 19.1 | $ | (14.4 | ) | $ | 33.5 | n/m | ||||||

Income (loss) per share - basic and diluted | $ | 0.05 | $ | (0.08 | ) | $ | 0.13 | n/m | $ | 0.24 | $ | (0.30 | ) | $ | 0.54 | n/m | ||||||

9

CyrusOne Inc.

Consolidated Balance Sheets

(Dollars in millions)

(Unaudited)

September 30, | December 31, | Change | |||||||||

2016 | 2015 | $ | % | ||||||||

Assets | |||||||||||

Investment in real estate: | |||||||||||

Land | $ | 143.1 | $ | 93.0 | $ | 50.1 | 54 | % | |||

Buildings and improvements | 1,009.3 | 905.3 | 104.0 | 11 | % | ||||||

Equipment | 976.9 | 598.2 | 378.7 | 63 | % | ||||||

Construction in progress | 304.0 | 231.1 | 72.9 | 32 | % | ||||||

Subtotal | 2,433.3 | 1,827.6 | 605.7 | 33 | % | ||||||

Accumulated depreciation | (546.4 | ) | (435.6 | ) | (110.8 | ) | 25 | % | |||

Net investment in real estate | 1,886.9 | 1,392.0 | 494.9 | 36 | % | ||||||

Cash and cash equivalents | 11.0 | 14.3 | (3.3 | ) | (23 | )% | |||||

Rent and other receivables, net | 73.0 | 76.1 | (3.1 | ) | (4 | )% | |||||

Restricted cash | — | 1.5 | (1.5 | ) | (100 | )% | |||||

Goodwill | 455.1 | 453.4 | 1.7 | — | % | ||||||

Intangible assets, net | 155.8 | 170.3 | (14.5 | ) | (9 | )% | |||||

Other assets | 114.5 | 88.0 | 26.5 | 30 | % | ||||||

Total assets | $ | 2,696.3 | $ | 2,195.6 | $ | 500.7 | 23 | % | |||

Liabilities and Equity | |||||||||||

Accounts payable and accrued expenses | $ | 214.6 | $ | 136.6 | $ | 78.0 | 57 | % | |||

Deferred revenue | 72.5 | 78.7 | (6.2 | ) | (8 | )% | |||||

Capital lease obligations | 11.9 | 12.2 | (0.3 | ) | (2 | )% | |||||

Long-term debt, net | 1,065.7 | 996.5 | 69.2 | 7 | % | ||||||

Lease financing arrangements | 141.9 | 150.0 | (8.1 | ) | (5 | )% | |||||

Total liabilities | 1,506.6 | 1,374.0 | 132.6 | 10 | % | ||||||

Equity: | |||||||||||

Preferred stock, $.01 par value, 100,000,000 authorized; no shares issued or outstanding | — | — | — | — | % | ||||||

Common stock, $.01 par value, 500,000,000 shares authorized and 83,524,905 and 72,556,334 shares issued and outstanding at September 30, 2016 and December 31, 2015, respectively | 0.8 | 0.7 | 0.1 | 14 | % | ||||||

Additional paid in capital | 1,408.9 | 967.2 | 441.7 | 46 | % | ||||||

Accumulated deficit | (218.8 | ) | (145.9 | ) | (72.9 | ) | 50 | % | |||

Accumulated other comprehensive loss | (1.2 | ) | (0.4 | ) | (0.8 | ) | n/m | ||||

Total stockholders’ equity | 1,189.7 | 821.6 | 368.1 | 45 | % | ||||||

Total liabilities and equity | $ | 2,696.3 | $ | 2,195.6 | $ | 500.7 | 23 | % | |||

10

CyrusOne Inc.

Consolidated Statements of Operations

(Dollars in millions, except per share amounts)

(Unaudited)

For the three months ended: | September 30, | June 30, | March 31, | December 31, | September 30, | ||||||||||

2016 | 2016 | 2016 | 2015 | 2015 | |||||||||||

Revenue: | |||||||||||||||

Base revenue | $ | 128.8 | $ | 118.2 | $ | 106.5 | $ | 101.2 | $ | 98.7 | |||||

Metered Power reimbursements | 15.0 | 11.9 | 11.3 | 12.1 | 12.5 | ||||||||||

Total revenue | 143.8 | 130.1 | 117.8 | 113.3 | 111.2 | ||||||||||

Costs and expenses: | |||||||||||||||

Property operating expenses | 54.6 | 44.8 | 40.3 | 41.4 | 42.2 | ||||||||||

Sales and marketing | 4.7 | 4.2 | 4.0 | 3.2 | 3.2 | ||||||||||

General and administrative | 13.9 | 14.9 | 14.0 | 15.1 | 12.5 | ||||||||||

Depreciation and amortization | 50.6 | 44.7 | 39.3 | 39.9 | 39.1 | ||||||||||

Transaction and acquisition integration costs | 1.2 | 0.4 | 2.3 | 2.6 | 1.8 | ||||||||||

Asset impairments and loss on disposal | — | — | — | — | 4.9 | ||||||||||

Total costs and expenses | 125.0 | 109.0 | 99.9 | 102.2 | 103.7 | ||||||||||

Operating income | 18.8 | 21.1 | 17.9 | 11.1 | 7.5 | ||||||||||

Interest expense | 13.8 | 11.5 | 12.1 | 12.0 | 12.1 | ||||||||||

Net income (loss) before income taxes | 5.0 | 9.6 | 5.8 | (0.9 | ) | (4.6 | ) | ||||||||

Income tax expense | (0.6 | ) | (0.5 | ) | (0.2 | ) | (0.3 | ) | (0.7 | ) | |||||

Net income (loss) | 4.4 | 9.1 | 5.6 | (1.2 | ) | (5.3 | ) | ||||||||

Noncontrolling interest in net loss | — | — | — | (0.2 | ) | (0.7 | ) | ||||||||

Net income (loss) attributed to common stockholders | $ | 4.4 | $ | 9.1 | $ | 5.6 | $ | (1.0 | ) | $ | (4.6 | ) | |||

Income (loss) per share - basic and diluted | $ | 0.05 | $ | 0.11 | $ | 0.07 | $ | (0.02 | ) | $ | (0.08 | ) | |||

11

CyrusOne Inc.

Consolidated Balance Sheets

(Dollars in millions)

(Unaudited)

September 30, | June 30, | March 31, | December 31, | September 30, | |||||||||||

2016 | 2016 | 2016 | 2015 | 2015 | |||||||||||

Assets | |||||||||||||||

Investment in real estate: | |||||||||||||||

Land | $ | 143.1 | $ | 122.9 | $ | 98.8 | $ | 93.0 | $ | 93.0 | |||||

Buildings and improvements | 1,009.3 | 995.2 | 942.0 | 905.3 | 897.7 | ||||||||||

Equipment | 976.9 | 917.8 | 715.6 | 598.2 | 555.6 | ||||||||||

Construction in progress | 304.0 | 178.9 | 327.7 | 231.1 | 187.1 | ||||||||||

Subtotal | 2,433.3 | 2,214.8 | 2,084.1 | 1,827.6 | 1,733.4 | ||||||||||

Accumulated depreciation | (546.4 | ) | (503.2 | ) | (467.2 | ) | (435.6 | ) | (404.4 | ) | |||||

Net investment in real estate | 1,886.9 | 1,711.6 | 1,616.9 | 1,392.0 | 1,329.0 | ||||||||||

Cash and cash equivalents | 11.0 | 13.2 | 87.7 | 14.3 | 39.8 | ||||||||||

Rent and other receivables, net | 73.0 | 66.4 | 67.1 | 76.1 | 74.5 | ||||||||||

Restricted cash | — | 0.3 | 0.7 | 1.5 | 7.1 | ||||||||||

Goodwill | 455.1 | 453.4 | 453.4 | 453.4 | 453.4 | ||||||||||

Intangible assets, net | 155.8 | 160.6 | 165.5 | 170.3 | 175.7 | ||||||||||

Due from affiliates | — | — | — | — | 1.3 | ||||||||||

Other assets | 114.5 | 105.8 | 92.2 | 88.0 | 82.2 | ||||||||||

Total assets | $ | 2,696.3 | $ | 2,511.3 | $ | 2,483.5 | $ | 2,195.6 | $ | 2,163.0 | |||||

Liabilities and Equity | |||||||||||||||

Accounts payable and accrued expenses | $ | 214.6 | $ | 163.7 | $ | 196.2 | $ | 136.6 | $ | 116.3 | |||||

Deferred revenue | 72.5 | 71.7 | 76.4 | 78.7 | 74.1 | ||||||||||

Due to affiliates | — | — | — | — | 2.7 | ||||||||||

Capital lease obligations | 11.9 | 10.9 | 11.5 | 12.2 | 12.8 | ||||||||||

Long-term debt, net | 1,065.7 | 1,096.2 | 1,010.3 | 996.5 | 964.1 | ||||||||||

Lease financing arrangements | 141.9 | 144.3 | 147.0 | 150.0 | 151.9 | ||||||||||

Total liabilities | 1,506.6 | 1,486.8 | 1,441.4 | 1,374.0 | 1,321.9 | ||||||||||

Equity: | |||||||||||||||

Preferred stock, $.01 par value, 100,000,000 authorized; no shares issued or outstanding | — | — | — | — | — | ||||||||||

Common stock, $.01 par value, 500,000,000 shares authorized and 83,524,905 and 72,556,334 shares issued and outstanding at September 30, 2016 and December 31, 2015, respectively | 0.8 | 0.8 | 0.8 | 0.7 | 0.6 | ||||||||||

Additional paid in capital | 1,408.9 | 1,215.7 | 1,212.0 | 967.2 | 912.3 | ||||||||||

Accumulated deficit | (218.8 | ) | (191.5 | ) | (170.3 | ) | (145.9 | ) | (124.3 | ) | |||||

Accumulated other comprehensive loss | (1.2 | ) | (0.5 | ) | (0.4 | ) | (0.4 | ) | (0.7 | ) | |||||

Total stockholders' equity | 1,189.7 | 1,024.5 | 1,042.1 | 821.6 | 787.9 | ||||||||||

Noncontrolling interest | — | — | — | — | 53.2 | ||||||||||

Total stockholders' equity | 1,189.7 | 1,024.5 | 1,042.1 | 821.6 | 841.1 | ||||||||||

Total liabilities and equity | $ | 2,696.3 | $ | 2,511.3 | $ | 2,483.5 | $ | 2,195.6 | $ | 2,163.0 | |||||

12

CyrusOne Inc.

Consolidated Statements of Cash Flow

(Dollars in millions)

(Unaudited)

Nine Months Ended September 30, 2016 | Nine Months Ended September 30, 2015 | Three Months Ended September 30, 2016 | Three Months Ended September 30, 2015 | |||||||||

Cash flows from operating activities: | ||||||||||||

Net income (loss) | $ | 19.1 | $ | (19.0 | ) | $ | 4.4 | $ | (5.3 | ) | ||

Adjustments to reconcile net income (loss) to net cash provided by operating activities: | ||||||||||||

Depreciation and amortization | 134.6 | 101.6 | 50.6 | 39.1 | ||||||||

Non-cash interest expense | 11.1 | 2.3 | 9.6 | 0.9 | ||||||||

Stock-based compensation expense | 8.5 | 10.5 | 2.3 | 4.3 | ||||||||

Provision for bad debt | 0.9 | 0.3 | 0.2 | 0.1 | ||||||||

Asset impairments and loss on disposal | — | 13.5 | — | 4.9 | ||||||||

Change in operating assets and liabilities: | ||||||||||||

Rent receivables and other assets | (29.0 | ) | (16.9 | ) | (20.1 | ) | (9.1 | ) | ||||

Accounts payable and accrued expenses | 2.6 | 9.9 | 0.9 | 4.5 | ||||||||

Deferred revenues | (6.2 | ) | 0.8 | 0.8 | — | |||||||

Due to affiliates | — | (1.5 | ) | — | 0.4 | |||||||

Net cash provided by operating activities | 141.6 | 101.5 | 48.7 | 39.8 | ||||||||

Cash flows from investing activities: | ||||||||||||

Capital expenditures – purchase of fixed assets | (131.1 | ) | (17.3 | ) | — | — | ||||||

Capital expenditures – other development | (425.4 | ) | (140.9 | ) | (178.3 | ) | (66.7 | ) | ||||

Business acquisition, net of cash acquired | — | (398.4 | ) | — | (398.4 | ) | ||||||

Changes in restricted cash | 1.5 | — | 0.3 | — | ||||||||

Net cash used in investing activities | (555.0 | ) | (556.6 | ) | (178.0 | ) | (465.1 | ) | ||||

Cash flows from financing activities: | ||||||||||||

Issuance of common stock | 448.6 | 799.3 | 192.1 | — | ||||||||

Stock issuance costs | (1.6 | ) | (0.8 | ) | (1.1 | ) | (0.2 | ) | ||||

Acquisition of operating partnership units | — | (596.4 | ) | — | (170.4 | ) | ||||||

Dividends paid | (82.8 | ) | (58.3 | ) | (29.9 | ) | (24.5 | ) | ||||

Borrowings from credit facility | 530.0 | 220.0 | 115.0 | 150.0 | ||||||||

Payments on credit facility | (460.0 | ) | — | (145.0 | ) | — | ||||||

Proceeds from issuance of debt | — | 103.8 | — | 103.8 | ||||||||

Payments on capital leases and lease financing arrangements | (6.8 | ) | (3.8 | ) | (2.4 | ) | (1.7 | ) | ||||

Payment of note payable | (1.5 | ) | — | (1.5 | ) | — | ||||||

Debt issuance costs | (2.1 | ) | (5.4 | ) | — | (5.4 | ) | |||||

Tax payment upon exercise of equity awards | (13.7 | ) | — | (0.1 | ) | — | ||||||

Net cash provided by financing activities | 410.1 | 458.4 | 127.1 | 51.6 | ||||||||

Net increase (decrease) in cash and cash equivalents | (3.3 | ) | 3.3 | (2.2 | ) | (373.7 | ) | |||||

Cash and cash equivalents at beginning of period | 14.3 | 36.5 | 13.2 | 413.5 | ||||||||

Cash and cash equivalents at end of period | $ | 11.0 | $ | 39.8 | $ | 11.0 | $ | 39.8 | ||||

Supplemental disclosures | ||||||||||||

Cash paid for interest, net of amount capitalized | $ | 33.4 | $ | 21.4 | $ | 6.2 | $ | 2.9 | ||||

Cash paid for income taxes | 1.2 | 2.5 | — | 0.6 | ||||||||

Capitalized interest | 6.8 | 4.2 | 1.8 | 1.7 | ||||||||

Non-cash investing and financing activities | ||||||||||||

Acquisition and development of properties in accounts payable and other liabilities | 117.7 | 37.9 | 117.7 | 37.9 | ||||||||

Dividends payable | 33.6 | 23.5 | 33.6 | 23.5 | ||||||||

Debt issuance costs | — | 0.3 | — | 0.3 | ||||||||

13

CyrusOne Inc.

Net Operating Income and Reconciliation of Net Income (Loss) to Adjusted EBITDA

(Dollars in millions)

(Unaudited)

Nine Months Ended | Three Months Ended | ||||||||||||||||||||||||

September 30, | Change | September 30, | June 30, | March 31, | December 31, | September 30, | |||||||||||||||||||

2016 | 2015 | $ | % | 2016 | 2016 | 2016 | 2015 | 2015 | |||||||||||||||||

Net Operating Income | |||||||||||||||||||||||||

Revenue | $ | 391.7 | $ | 286.0 | $ | 105.7 | 37% | $ | 143.8 | $ | 130.1 | $ | 117.8 | $ | 113.3 | $ | 111.2 | ||||||||

Property operating expenses | 139.7 | 107.3 | 32.4 | 30% | 54.6 | 44.8 | 40.3 | 41.4 | 42.2 | ||||||||||||||||

Net Operating Income (NOI) | 252.0 | 178.7 | 73.3 | 41% | 89.2 | 85.3 | 77.5 | 71.9 | 69.0 | ||||||||||||||||

Add Back: Lease exit costs | — | 1.1 | (1.1 | ) | n/m | — | — | — | 0.3 | 0.4 | |||||||||||||||

Adjusted Net Operating Income (Adjusted NOI) | $ | 252.0 | $ | 179.8 | $ | 72.2 | 40% | $ | 89.2 | $ | 85.3 | $ | 77.5 | $ | 72.2 | $ | 69.4 | ||||||||

Adjusted NOI as a % of Revenue | 64.3 | % | 62.9 | % | 62.0 | % | 65.6 | % | 65.8 | % | 63.7 | % | 62.4 | % | |||||||||||

Reconciliation of Net (Loss) Income to Adjusted EBITDA: | |||||||||||||||||||||||||

Net income (loss) | 19.1 | $ | (19.0 | ) | $ | 38.1 | n/m | $ | 4.4 | $ | 9.1 | $ | 5.6 | $ | (1.2 | ) | $ | (5.3 | ) | ||||||

Interest expense | 37.4 | 29.2 | 8.2 | 28% | 13.8 | 11.5 | 12.1 | 12.0 | 12.1 | ||||||||||||||||

Income tax expense | 1.3 | 1.5 | (0.2 | ) | (13)% | 0.6 | 0.5 | 0.2 | 0.3 | 0.7 | |||||||||||||||

Depreciation and amortization | 134.6 | 101.6 | 33.0 | 32% | 50.6 | 44.7 | 39.3 | 39.9 | 39.1 | ||||||||||||||||

Transaction and acquisition integration costs | 3.9 | 11.5 | (7.6 | ) | (66)% | 1.2 | 0.4 | 2.3 | 2.6 | 1.8 | |||||||||||||||

Legal claim costs | 0.7 | 0.3 | 0.4 | n/m | 0.2 | 0.3 | 0.2 | 0.1 | — | ||||||||||||||||

Stock-based compensation | 8.5 | 9.6 | (1.1 | ) | (11)% | 2.3 | 3.2 | 3.0 | 2.4 | 3.4 | |||||||||||||||

Severance and management transition costs | — | 1.9 | (1.9 | ) | n/m | — | — | — | 4.1 | 1.9 | |||||||||||||||

Lease exit costs | — | 1.1 | (1.1 | ) | n/m | — | — | — | 0.3 | 0.4 | |||||||||||||||

Asset impairments and loss on disposals | — | 13.5 | (13.5 | ) | n/m | — | — | — | — | 4.9 | |||||||||||||||

Adjusted EBITDA | $ | 205.5 | $ | 151.2 | $ | 54.3 | 36% | $ | 73.1 | $ | 69.7 | $ | 62.7 | $ | 60.5 | $ | 59.0 | ||||||||

Adjusted EBITDA as a % of Revenue | 52.5 | % | 52.9 | % | 50.8 | % | 53.6 | % | 53.2 | % | 53.4 | % | 53.1 | % | |||||||||||

CyrusOne Inc.

Reconciliation of Revenue to Net Operating Income to Net Income (Loss)

(Dollars in millions)

(Unaudited)

Three Months Ended | Nine Months Ended | |||||||||||||||||||||

September 30, | Change | September 30, | Change | |||||||||||||||||||

2016 | 2015 | $ | % | 2016 | 2015 | $ | % | |||||||||||||||

Revenue | $ | 143.8 | $ | 111.2 | $ | 32.6 | 29 | % | $ | 391.7 | $ | 286.0 | $ | 105.7 | 37 | % | ||||||

Property operating expenses | 54.6 | 42.2 | 12.4 | 29 | % | 139.7 | 107.3 | 32.4 | 30 | % | ||||||||||||

Net Operating Income | $ | 89.2 | $ | 69.0 | $ | 20.2 | 29 | % | $ | 252.0 | $ | 178.7 | $ | 73.3 | 41 | % | ||||||

Sales and marketing | 4.7 | 3.2 | 1.5 | 47 | % | 12.9 | 8.9 | 4.0 | 45 | % | ||||||||||||

General and administrative | 13.9 | 12.5 | 1.4 | 11 | % | 42.8 | 31.5 | 11.3 | 36 | % | ||||||||||||

Depreciation and amortization | 50.6 | 39.1 | 11.5 | 29 | % | 134.6 | 101.6 | 33.0 | 32 | % | ||||||||||||

Transaction and acquisition integration costs | 1.2 | 1.8 | (0.6 | ) | (33 | )% | 3.9 | 11.5 | (7.6 | ) | (66 | )% | ||||||||||

Asset impairments and loss on disposal | — | 4.9 | (4.9 | ) | — | % | — | 13.5 | (13.5 | ) | (100 | )% | ||||||||||

Interest expense | 13.8 | 12.1 | 1.7 | 14 | % | 37.4 | 29.2 | 8.2 | 28 | % | ||||||||||||

Income tax expense | 0.6 | 0.7 | (0.1 | ) | (14 | )% | 1.3 | 1.5 | (0.2 | ) | (13 | )% | ||||||||||

Net Income (Loss) | $ | 4.4 | $ | (5.3 | ) | $ | 9.7 | n/m | $ | 19.1 | $ | (19.0 | ) | $ | 38.1 | n/m | ||||||

14

CyrusOne Inc.

Reconciliation of Net Income (Loss) to FFO and Normalized FFO

(Dollars in millions)

(Unaudited)

Nine Months Ended | Three Months Ended | |||||||||||||||||||||||||

September 30, | Change | September 30, | June 30, | March 31, | December 31, | September 30, | ||||||||||||||||||||

2016 | 2015 | $ | % | 2016 | 2016 | 2016 | 2015 | 2015 | ||||||||||||||||||

Reconciliation of Net Income (Loss) to FFO and Normalized FFO: | ||||||||||||||||||||||||||

Net income (loss) | $ | 19.1 | $ | (19.0 | ) | $ | 38.1 | n/m | $ | 4.4 | $ | 9.1 | $ | 5.6 | $ | (1.2 | ) | $ | (5.3 | ) | ||||||

Real estate depreciation and amortization | 115.6 | 84.2 | 31.4 | 37 | % | 44.2 | 38.4 | 33.0 | 32.8 | 31.9 | ||||||||||||||||

Asset impairments and loss on disposal | — | 13.5 | (13.5 | ) | n/m | — | — | — | — | 4.9 | ||||||||||||||||

Funds from Operations (FFO) | $ | 134.7 | $ | 78.7 | $ | 56.0 | 71 | % | $ | 48.6 | $ | 47.5 | $ | 38.6 | $ | 31.6 | $ | 31.5 | ||||||||

Amortization of customer relationship intangibles | 14.5 | 12.9 | 1.6 | 12 | % | 4.8 | 4.9 | 4.8 | 5.6 | 5.6 | ||||||||||||||||

Transaction and acquisition integration costs | 3.9 | 11.6 | (7.7 | ) | (66 | )% | 1.2 | 0.4 | 2.3 | 2.5 | 1.9 | |||||||||||||||

Severance and management transition costs | — | 1.9 | (1.9 | ) | n/m | — | — | — | 4.1 | 1.9 | ||||||||||||||||

Legal claim costs | 0.7 | 0.3 | 0.4 | n/m | 0.2 | 0.3 | 0.2 | 0.1 | — | |||||||||||||||||

Lease exit costs | — | 1.1 | (1.1 | ) | n/m | — | — | — | 0.3 | 0.3 | ||||||||||||||||

Normalized Funds from Operations (Normalized FFO) | $ | 153.8 | $ | 106.5 | $ | 47.3 | 44 | % | $ | 54.8 | $ | 53.1 | $ | 45.9 | $ | 44.2 | $ | 41.2 | ||||||||

Normalized FFO per diluted common share or common share equivalent | $ | 1.98 | $ | 1.57 | $ | 0.41 | 26 | % | $ | 0.67 | $ | 0.67 | $ | 0.63 | $ | 0.61 | $ | 0.57 | ||||||||

Weighted Average diluted common share and common share equivalent outstanding | 77.6 | 67.9 | 9.7 | 14 | % | 81.3 | 79.0 | 72.8 | 72.6 | 72.6 | ||||||||||||||||

Additional Information: | ||||||||||||||||||||||||||

Amortization of deferred financing costs | 3.0 | 2.3 | 0.7 | 30 | % | 1.0 | 1.1 | 0.9 | 1.1 | 0.9 | ||||||||||||||||

Stock-based compensation | 8.5 | 9.6 | (1.1 | ) | (11 | )% | 2.3 | 3.2 | 3.0 | 2.4 | 3.5 | |||||||||||||||

Non-real estate depreciation and amortization | 4.5 | 4.5 | — | n/m | 1.6 | 1.4 | 1.5 | 1.5 | 1.6 | |||||||||||||||||

Deferred revenue and straight line rent adjustments | (17.7 | ) | (3.3 | ) | (14.4 | ) | n/m | (10.7 | ) | (5.0 | ) | (2.0 | ) | 1.1 | (1.6 | ) | ||||||||||

Leasing commissions | (8.3 | ) | (3.6 | ) | (4.7 | ) | 131 | % | (3.0 | ) | (3.4 | ) | (1.9 | ) | (3.3 | ) | (1.6 | ) | ||||||||

Recurring capital expenditures | (3.5 | ) | (1.7 | ) | (1.8 | ) | 106 | % | (1.7 | ) | (0.9 | ) | (0.9 | ) | (0.7 | ) | (1.2 | ) | ||||||||

15

CyrusOne Inc.

Market Capitalization Summary, Reconciliation of Net Debt, and Debt Schedule

(Unaudited)

Market Capitalization

(dollars in millions) | Shares or Equivalents Outstanding | Market Price as of September 30, 2016 | Market Value Equivalents (in millions) | |||||

Common shares | 83,524,905 | $ | 47.57 | $ | 3,973.3 | |||

Net Debt | 1,083.3 | |||||||

Total Enterprise Value (TEV) | $ | 5,056.6 | ||||||

Reconciliation of Net Debt

(dollars in millions) | September 30, | June 30, | ||||

2016 | 2016 | |||||

Long-term debt(a) | $ | 1,082.4 | $ | 1,113.9 | ||

Capital lease obligations | 11.9 | 10.9 | ||||

Less: | ||||||

Cash and cash equivalents | (11.0 | ) | (13.2 | ) | ||

Net Debt | $ | 1,083.3 | $ | 1,111.6 | ||

(a)Excludes adjustment for deferred financing costs.

Debt Schedule

(dollars in millions) | ||||||

Long-term debt: | Amount | Interest Rate | Maturity Date | |||

6.375% senior notes due 2022, including bond premium | $ | 477.4 | 6.38 | % | November 2022 | |

Revolving credit facility | 55.0 | L + 170 bps | October 2019(a) | |||

Term loan | 300.0 | 2.19 | % | October 2019 | ||

Term loan | 250.0 | 2.19 | % | September 2021 | ||

Total long-term debt(b) | 1,082.4 | 4.03 | % | |||

Weighted average term of debt: | 4.8 | years | ||||

(a) | Assuming exercise of one-year extension option. |

(b) | Excludes adjustment for deferred financing costs. |

16

CyrusOne Inc.

Colocation Square Footage (CSF) and Utilization

(Unaudited)

As of September 30, 2016 | As of December 31, 2015 | As of September 30, 2015 | ||||||||||

Market | Colocation Space (CSF)(a) | CSF Utilized(b) | Colocation Space (CSF)(a) | CSF Utilized(b) | Colocation Space (CSF)(a) | CSF Utilized(b) | ||||||

Dallas | 431,239 | 83 | % | 350,946 | 89 | % | 350,946 | 88 | % | |||

Cincinnati | 386,508 | 92 | % | 419,589 | 91 | % | 419,589 | 91 | % | |||

Houston | 308,074 | 71 | % | 255,094 | 88 | % | 255,094 | 87 | % | |||

Northern Virginia | 236,911 | 100 | % | 74,653 | 73 | % | 74,653 | 69 | % | |||

Phoenix | 215,892 | 92 | % | 149,620 | 100 | % | 149,620 | 100 | % | |||

Austin | 121,833 | 49 | % | 121,833 | 51 | % | 59,995 | 99 | % | |||

New York Metro | 121,530 | 90 | % | 121,434 | 87 | % | 121,434 | 87 | % | |||

Chicago | 111,660 | 84 | % | 23,298 | 54 | % | 23,298 | 53 | % | |||

San Antonio | 108,064 | 99 | % | 43,843 | 100 | % | 43,843 | 100 | % | |||

International | 13,200 | 81 | % | 13,200 | 80 | % | 13,200 | 80 | % | |||

Total | 2,054,911 | 85 | % | 1,573,510 | 86 | % | 1,511,672 | 89 | % | |||

Stabilized Properties(c) | 1,871,276 | 93 | % | |||||||||

(a) | CSF represents the NRSF at an operating facility that is currently leased or readily available for lease as colocation space, where customers locate their servers and other IT equipment. |

(b) | Utilization is calculated by dividing CSF under signed leases for colocation space (whether or not the lease has commenced billing) by total CSF. |

(c) | Stabilized properties include data halls that have been in service for at least 24 months or are at least 85% utilized. |

17

CyrusOne Inc.

2016 Guidance

Category | Previous 2016 Guidance | Revised 2016 Guidance |

Total Revenue | $520 - 530 million | $523 - 530 million |

Base Revenue | $470 - 475 million | $472 - 476 million |

Metered Power Reimbursements | $50 - 55 million | $51 - 54 million |

Adjusted EBITDA | $270 - 280 million | $275 - 278 million |

Normalized FFO per diluted common share | $2.50 - 2.58 | $2.59 - 2.62 |

Capital Expenditures | $635 - 655 million | $635 - 655 million |

Development | $630 - 646 million | $630 - 646 million |

Recurring | $5 - 9 million | $5 - 9 million |

The annual guidance provided above represents forward-looking statements, which are based on current economic conditions, internal assumptions about the Company's existing customer base and the supply and demand dynamics of the markets in which CyrusOne operates.

CyrusOne does not provide reconciliations for the non-GAAP financial measures included in the annual guidance provided above due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations, including net income (loss) and adjustments that could be made for transaction and acquisition integration costs, legal claim costs, lease exit costs, asset impairments and loss on disposals and other charges in its reconciliation of historic numbers, the amount of which, based on historical experience, could be significant.

18

CyrusOne Inc.

Data Center Portfolio

As of September 30, 2016

(Unaudited)

Operating Net Rentable Square Feet (NRSF)(a) | Powered Shell Available for Future Development (NRSF)(k) | Available Critical Load Capacity (MW)(l) | ||||||||||||||||||||

Stabilized Properties(b) | Metro Area | Annualized Rent(c) | Colocation Space (CSF)(d) | CSF Leased(e) | CSF Utilized(f) | Office & Other(g) | Office & Other Leased (h) | Supporting Infrastructure(i) | Total(j) | |||||||||||||

Dallas - Carrollton | Dallas | $ | 52,120,454 | 235,685 | 91 | % | 91 | % | 33,011 | 96 | % | 89,648 | 358,344 | 164,000 | 26 | |||||||

Houston - Houston West I | Houston | 47,580,745 | 112,133 | 96 | % | 96 | % | 11,163 | 99 | % | 37,243 | 160,539 | 3,000 | 28 | ||||||||

Dallas - Lewisville* | Dallas | 36,850,805 | 114,054 | 95 | % | 95 | % | 11,374 | 89 | % | 54,122 | 179,550 | — | 21 | ||||||||

Cincinnati - 7th Street*** | Cincinnati | 35,592,449 | 178,949 | 93 | % | 93 | % | 5,744 | 100 | % | 167,241 | 351,934 | 74,000 | 13 | ||||||||

Totowa - Madison** | New York Metro | 28,524,198 | 51,290 | 86 | % | 86 | % | 22,477 | 100 | % | 58,964 | 132,731 | — | 6 | ||||||||

Wappingers Falls I** | New York Metro | 25,496,978 | 37,000 | 95 | % | 96 | % | 20,167 | 97 | % | 15,077 | 72,244 | — | 3 | ||||||||

Cincinnati - North Cincinnati | Cincinnati | 24,237,400 | 65,303 | 97 | % | 99 | % | 44,886 | 72 | % | 52,950 | 163,139 | 65,000 | 14 | ||||||||

San Antonio I | San Antonio | 22,317,294 | 43,843 | 98 | % | 99 | % | 5,989 | 83 | % | 45,650 | 95,482 | 11,000 | 12 | ||||||||

Houston - Houston West II | Houston | 22,120,048 | 79,540 | 87 | % | 87 | % | 3,355 | 62 | % | 55,023 | 137,918 | 12,000 | 12 | ||||||||

Chicago - Aurora I | Chicago | 20,191,324 | 88,362 | 92 | % | 92 | % | 34,008 | 100 | % | 220,109 | 342,479 | 27,000 | 65 | ||||||||

Houston - Galleria | Houston | 18,241,371 | 63,469 | 61 | % | 62 | % | 23,259 | 51 | % | 24,927 | 111,655 | — | 14 | ||||||||

Phoenix - Chandler II | Phoenix | 16,938,348 | 74,058 | 100 | % | 100 | % | 5,639 | 38 | % | 25,519 | 105,216 | — | 12 | ||||||||

Northern Virginia - Sterling II | Northern Virginia | 16,674,761 | 158,998 | 100 | % | 100 | % | 8,651 | 100 | % | 55,306 | 222,955 | — | 30 | ||||||||

Florence | Cincinnati | 15,181,390 | 52,698 | 100 | % | 100 | % | 46,848 | 87 | % | 40,374 | 139,920 | — | 9 | ||||||||

Austin II | Austin | 14,096,020 | 43,772 | 94 | % | 94 | % | 1,821 | 100 | % | 22,433 | 68,026 | — | 5 | ||||||||

Northern Virginia - Sterling I | Northern Virginia | 13,109,217 | 77,913 | 98 | % | 99 | % | 5,618 | 77 | % | 48,644 | 132,175 | — | 12 | ||||||||

San Antonio II | San Antonio | 13,026,692 | 64,221 | 100 | % | 100 | % | 11,255 | 100 | % | 41,127 | 116,603 | — | 12 | ||||||||

Phoenix - Chandler I | Phoenix | 12,398,685 | 73,921 | 90 | % | 90 | % | 34,582 | 12 | % | 38,572 | 147,075 | 31,000 | 16 | ||||||||

Stamford - Riverbend** | New York Metro | 11,227,836 | 20,000 | 92 | % | 93 | % | — | — | % | 8,484 | 28,484 | — | 2 | ||||||||

Cincinnati - Hamilton* | Cincinnati | 8,959,404 | 46,565 | 76 | % | 76 | % | 1,077 | 100 | % | 35,336 | 82,978 | — | 10 | ||||||||

Austin I* | Austin | 7,081,149 | 16,223 | 47 | % | 47 | % | 21,476 | — | % | 7,517 | 45,216 | — | 2 | ||||||||

Cincinnati - Mason | Cincinnati | 5,483,580 | 34,072 | 100 | % | 100 | % | 26,458 | 98 | % | 17,193 | 77,723 | — | 4 | ||||||||

Dallas - Midway** | Dallas | 5,449,462 | 8,390 | 100 | % | 100 | % | — | — | % | — | 8,390 | — | 1 | ||||||||

London - Great Bridgewater** | International | 3,840,253 | 10,000 | 100 | % | 100 | % | — | — | % | 514 | 10,514 | — | 1 | ||||||||

Norwalk I** | New York Metro | 3,640,990 | 13,240 | 79 | % | 79 | % | 4,085 | 72 | % | 40,610 | 57,935 | 87,000 | 2 | ||||||||

Dallas - Marsh** | Dallas | 2,508,456 | 4,245 | 100 | % | 100 | % | — | — | % | — | 4,245 | — | 1 | ||||||||

Chicago - Lombard | Chicago | 2,455,739 | 13,516 | 70 | % | 71 | % | 4,115 | 100 | % | 12,230 | 29,861 | 29,000 | 3 | ||||||||

Stamford - Omega** | New York Metro | 1,507,044 | — | — | % | — | % | 18,552 | 87 | % | 3,796 | 22,348 | — | — | ||||||||

Cincinnati - Blue Ash* | Cincinnati | 607,950 | 6,193 | 36 | % | 36 | % | 6,821 | 100 | % | 2,165 | 15,179 | — | 1 | ||||||||

South Bend - Crescent* | Chicago | 551,013 | 3,432 | 42 | % | 43 | % | — | — | % | 5,125 | 8,557 | 11,000 | 1 | ||||||||

Totowa - Commerce** | New York Metro | 542,460 | — | — | % | — | % | 20,460 | 40 | % | 5,540 | 26,000 | — | — | ||||||||

Houston - Houston West III | Houston | 426,849 | — | — | % | — | % | 8,495 | 100 | % | 10,652 | 19,147 | 212,000 | — | ||||||||

South Bend - Monroe | Chicago | 367,815 | 6,350 | 22 | % | 22 | % | — | — | % | 6,478 | 12,828 | 4,000 | 1 | ||||||||

Singapore - Inter Business Park** | International | 329,277 | 3,200 | 22 | % | 22 | % | — | — | % | — | 3,200 | — | 1 | ||||||||

Phoenix - Chandler III | Phoenix | 206,828 | 67,913 | 82 | % | 86 | % | 2,440 | — | % | 26,259 | 96,612 | — | 8 | ||||||||

Cincinnati - Goldcoast | Cincinnati | 96,088 | 2,728 | — | % | — | % | 5,280 | 100 | % | 16,481 | 24,489 | 14,000 | 1 | ||||||||

Stabilized Properties - Total | $ | 489,980,372 | 1,871,276 | 91 | % | 93 | % | 449,106 | 75 | % | 1,291,309 | 3,611,692 | 744,000 | 344 | ||||||||

Pre-Stabilized Properties(b) | ||||||||||||||||||||||

Austin III (DH #1) | Austin | 3,912,821 | 61,838 | 15 | % | 18 | % | 15,055 | 44 | % | 20,629 | 97,522 | 67,000 | 3 | ||||||||

Houston - Houston West III (DH #1) | Houston | 651,302 | 52,932 | 5 | % | 5 | % | — | — | % | 23,358 | 76,290 | — | 6 | ||||||||

Dallas - Carrollton (DH #5) | Dallas | — | 68,865 | — | % | 31 | % | — | — | % | 10,539 | 79,404 | — | 6 | ||||||||

All Properties - Total | $ | 494,544,495 | 2,054,911 | 84 | % | 85 | % | 464,161 | 74 | % | 1,345,835 | 3,864,908 | 811,000 | 359 | ||||||||

* | Indicates properties in which we hold a leasehold interest in the building shell and land. All data center infrastructure has been constructed by us and owned by us. |

** | Indicates properties in which we hold a leasehold interest in the building shell, land, and all data center infrastructure. |

*** The information provided for the West Seventh Street (7th St.) property includes data for two facilities, one of which we lease and one of which we own.

19

(a) | Represents the total square feet of a building under lease or available for lease based on engineers' drawings and estimates but does not include space held for development or space used by CyrusOne. |

(b) | Stabilized properties include data halls that have been in service for at least 24 months or are at least 85% utilized. Pre-stabilized properties include data halls that have been in service for less than 24 months and are less than 85% utilized. |

(c) | Represents monthly contractual rent (defined as cash rent including customer reimbursements for metered power) under existing customer leases as of September 30, 2016, multiplied by 12. For the month of September 2016, customer reimbursements were $62.1 million annualized and consisted of reimbursements by customers across all facilities with separately metered power. Customer reimbursements under leases with separately metered power vary from month-to-month based on factors such as our customers' utilization of power and the suppliers' pricing of power. From October 1, 2014 through September 30, 2016, customer reimbursements under leases with separately metered power constituted between 10.6% and 14.2% of annualized rent. After giving effect to abatements, free rent and other straight-line adjustments, our annualized effective rent as of September 30, 2016 was $508.7 million. Our annualized effective rent was greater than our annualized rent as of September 30, 2016 because our positive straight-line and other adjustments and amortization of deferred revenue exceeded our negative straight-line adjustments due to factors such as the timing of contractual rent escalations and customer prepayments for services. |

(d) | CSF represents the NRSF at an operating facility that is currently leased or readily available for lease as colocation space, where customers locate their servers and other IT equipment. |

(e) | Percent leased is determined based on CSF being billed to customers under signed leases as of September 30, 2016 divided by total CSF. Leases signed but not commenced as of September 30, 2016 are not included. |

(f) | Utilization is calculated by dividing CSF under signed leases for colocation space (whether or not the lease has commenced billing) by total CSF. |

(g) | Represents the NRSF at an operating facility that is currently leased or readily available for lease as space other than CSF, which is typically office and other space. |

(h) | Percent leased is determined based on Office & Other space being billed to customers under signed leases as of September 30, 2016 divided by total Office & Other space. Leases signed but not commenced as of September 30, 2016 are not included. |

(i) | Represents infrastructure support space, including mechanical, telecommunications and utility rooms, as well as building common areas. |

(j) | Represents the NRSF at an operating facility that is currently leased or readily available for lease. This excludes existing vacant space held for development. |

(k) | Represents space that is under roof that could be developed in the future for operating NRSF, rounded to the nearest 1,000. |

(l) | Critical load capacity represents the aggregate power available for lease and exclusive use by customers expressed in terms of megawatts. The capacity reported is for non-redundant megawatts, as we can develop flexible solutions to our customers at multiple resiliency levels. Does not sum to total due to rounding. |

20

CyrusOne Inc.

NRSF Under Development

As of September 30, 2016

(Dollars in millions)

(Unaudited)

NRSF Under Development(a) | Under Development Costs(b) | ||||||||||||||||||

Facilities | Metropolitan Area | Estimated Completion Date | Colocation Space (CSF) | Office & Other | Supporting Infrastructure | Powered Shell(b) | Total | Critical Load MW Capacity(c) | Actual to Date(d) | Estimated Costs to Completion(e) | Total | ||||||||

Phoenix - Chandler III | Phoenix | 4Q'16 | — | — | 4,000 | — | 4,000 | 6.0 | $ | 6 | $8-9 | $14-15 | |||||||

Northern Virginia - Sterling IV | Northern Virginia | 4Q'16 | 41,000 | 6,000 | 32,000 | 45,000 | 124,000 | 6.0 | 3 | 35-39 | 38-42 | ||||||||

Northern Virginia - Sterling III | Northern Virginia | 1Q'17 | 79,000 | 7,000 | 34,000 | — | 120,000 | 15.0 | 20 | 61-67 | 81-87 | ||||||||

San Antonio III | San Antonio | 1Q'17 | 132,000 | 9,000 | 43,000 | — | 184,000 | 24.0 | 27 | 94-104 | 121-131 | ||||||||

Chicago - Aurora I | Chicago | 1Q'17 | 25,000 | — | 3,000 | — | 28,000 | 6.0 | — | 11-13 | 11-13 | ||||||||

Phoenix - Chandler IV | Phoenix | 2Q'17 | 73,000 | 3,000 | 27,000 | — | 103,000 | 12.0 | 1 | 50-56 | 51-57 | ||||||||

Phoenix - Chandler V | Phoenix | 2Q'17 | — | — | — | 185,000 | 185,000 | — | — | 19-21 | 19-21 | ||||||||

Total | 350,000 | 25,000 | 143,000 | 230,000 | 748,000 | 69.0 | $ | 57 | $278-309 | $335-366 | |||||||||

(a) | Represents NRSF at a facility for which activities have commenced or are expected to commence in the next 2 quarters to prepare the space for its intended use. Estimates and timing are subject to change. |

(b) | Represents NRSF under construction that, upon completion, will be powered shell available for future development into operating NRSF. |

(c) | Critical load capacity represents the aggregate power available for lease and exclusive use by customers expressed in terms of megawatts. The capacity reported is for non-redundant megawatts, as we can develop flexible solutions to our customers at multiple resiliency levels. Does not sum to total due to rounding. |

(d) | Actual to date is the cash investment as of September 30, 2016. There may be accruals above this amount for work completed, for which cash has not yet been paid. |

(e) | Represents management’s estimate of the total costs required to complete the current NRSF under development. There may be an increase in costs if customers require greater power density. |

CyrusOne Inc.

Land Available for Future Development (Acres)

As of September 30, 2016

(Unaudited)

As of | ||

Market | September 30, 2016 | |

Cincinnati | 98 | |

Dallas | — | |

Houston | 20 | |

Northern Virginia | 40 | |

Austin | 22 | |

Phoenix | 45 | |

San Antonio | 6 | |

Chicago | 38 | |

New York Metro | — | |

International | — | |

Total Available | 269 | |

21

CyrusOne Inc.

Leasing Statistics - Lease Signings

As of September 30, 2016

(Dollars in thousands)

(Unaudited)

Period | Number of Leases(a)(f) | Total CSF Signed(b)(f) | Total kW Signed(c)(f) | Total MRR Signed ($000)(d)(f) | Weighted Average Lease Term(e)(f) |

3Q'16 | 389 | 105,000 | 16,930 | $2,250 | 63 |

Prior 4Q Avg. | 364 | 174,250 | 25,142 | $3,305 | 105 |

2Q'16 | 363 | 282,000 | 40,272 | $4,866 | 112 |

1Q'16 | 375 | 181,000 | 25,468 | $3,610 | 144 |

4Q'15 | 326 | 205,000 | 30,012 | $3,630 | 107 |

3Q'15 | 392 | 29,000 | 4,815 | $1,112 | 57 |

(a) | Number of leases represents each agreement with a customer. A lease agreement could include multiple spaces, and a customer could have multiple leases. |

(b) | CSF represents the NRSF at an operating facility that is leased as colocation space, where customers locate their servers and other IT equipment. |

(c) | Represents maximum contracted kW that customers may draw during lease period. Additionally, we can develop flexible solutions for our customers at multiple resiliency levels, and the kW signed is unadjusted for this factor. |

(d) | Monthly recurring rent is defined as the average monthly contractual rent during the term of the lease. It includes the monthly impact of installation charges of approximately $0.1 million in each quarter. |

(e) | Calculated on a CSF-weighted basis. |

(f) | 1Q'16 includes the CME lease. Non-CME signings represent approximately 60% of total CSF, kW, and MRR signed. |

CyrusOne Inc.

New MRR Signed - Existing vs. New Customers

As of September 30, 2016

(Dollars in thousands)

(Unaudited)

(a) | Monthly recurring rent is defined as the average monthly contractual rent during the term of the lease. It includes the monthly impact of installation charges of approximately $0.1 million in each of 1Q'15-3Q'16. 1Q'16 includes the CME lease, with non-CME signings representing approximately 60% of total MRR signed. |

22

CyrusOne Inc.

Customer Sector Diversification(a)

As of September 30, 2016

(Unaudited)

Principal Customer Industry | Number of Locations | Annualized Rent(b) | Percentage of Portfolio Annualized Rent(c) | Weighted Average Remaining Lease Term in Months(d) | |||||

1 | Information Technology | 6 | $ | 47,640,839 | 9.6 | % | 82.2 | ||

2 | Financial Services | 1 | 20,185,524 | 4.1 | % | 174.0 | |||

3 | Telecommunication Services | 2 | 16,739,685 | 3.4 | % | 23.1 | |||

4 | Information Technology | 2 | 16,081,928 | 3.3 | % | 100.9 | |||

5 | Energy | 1 | 15,077,448 | 3.0 | % | 20.1 | |||

6 | Research and Consulting Services | 3 | 13,721,768 | 2.8 | % | 51.4 | |||

7 | Energy | 5 | 13,073,619 | 2.6 | % | 21.8 | |||

8 | Industrials | 3 | 11,922,690 | 2.4 | % | 18.8 | |||

9 | Telecommunication Services | 7 | 10,387,634 | 2.1 | % | 18.4 | |||

10 | Information Technology | 2 | 10,315,522 | 2.1 | % | 45.9 | |||

11 | Information Technology | 2 | 8,379,597 | 1.7 | % | 10.8 | |||

12 | Energy | 2 | 6,918,962 | 1.4 | % | 15.7 | |||

13 | Financial Services | 1 | 6,600,225 | 1.3 | % | 44.0 | |||

14 | Information Technology | 2 | 5,812,180 | 1.2 | % | 137.4 | |||

15 | Financial Services | 6 | 5,717,823 | 1.2 | % | 48.6 | |||

16 | Telecommunication Services | 5 | 5,714,086 | 1.2 | % | 31.1 | |||

17 | Financial Services | 3 | 5,541,229 | 1.1 | % | 9.2 | |||

18 | Financial Services | 1 | 5,484,917 | 1.1 | % | 62.0 | |||

19 | Consumer Staples | 2 | 4,747,567 | 1.0 | % | 66.5 | |||

20 | Consumer Staples | 4 | 4,491,504 | 0.8 | % | 52.4 | |||

$ | 234,554,747 | 47.4 | % | 61.0 | |||||

(a) | Customers and their affiliates are consolidated. |

(b) | Represents monthly contractual rent (defined as cash rent including customer reimbursements for metered power) under existing customer leases as of September 30, 2016, multiplied by 12. For the month of September 2016, customer reimbursements were $62.1 million annualized and consisted of reimbursements by customers across all facilities with separately metered power. Customer reimbursements under leases with separately metered power vary from month-to-month based on factors such as our customers' utilization of power and the suppliers' pricing of power. From October 1, 2014 through September 30, 2016, customer reimbursements under leases with separately metered power constituted between 10.6% and 14.2% of annualized rent. After giving effect to abatements, free rent and other straight-line adjustments, our annualized effective rent as of September 30, 2016 was $508.7 million. Our annualized effective rent was greater than our annualized rent as of September 30, 2016 because our positive straight-line and other adjustments and amortization of deferred revenue exceeded our negative straight-line adjustments due to factors such as the timing of contractual rent escalations and customer prepayments for services. |

(c) | Represents the customer’s total annualized rent divided by the total annualized rent in the portfolio as of September 30, 2016, which was approximately $494.5 million. |

(d) | Weighted average based on customer’s percentage of total annualized rent expiring and is as of September 30, 2016, assuming that customers exercise no renewal options and exercise all early termination rights that require payment of less than 50% of the remaining rents. Early termination rights that require payment of 50% or more of the remaining lease payments are not assumed to be exercised because such payments approximate the profitability margin of leasing that space to the customer, such that we do not consider early termination to be economically detrimental to us. |

23

CyrusOne Inc.

Lease Distribution

As of September 30, 2016

(Unaudited)

NRSF Under Lease(a) | Number of Customers(b) | Percentage of All Customers | Total Leased NRSF(c) | Percentage of Portfolio Leased NRSF | Annualized Rent(d) | Percentage of Annualized Rent | |||||||

0-999 | 690 | 73 | % | 135,433 | 4 | % | $ | 65,257,967 | 13 | % | |||

1,000-2,499 | 100 | 11 | % | 154,340 | 5 | % | 35,907,473 | 7 | % | ||||

2,500-4,999 | 67 | 7 | % | 235,139 | 7 | % | 44,601,728 | 9 | % | ||||

5,000-9,999 | 30 | 3 | % | 212,019 | 7 | % | 50,715,800 | 10 | % | ||||

10,000+ | 61 | 6 | % | 2,464,583 | 77 | % | 298,061,527 | 61 | % | ||||

Total | 948 | 100 | % | 3,201,514 | 100 | % | $ | 494,544,495 | 100 | % | |||

(a) | Represents all leases in our portfolio, including colocation, office and other leases. |

(b) | Represents the number of customers occupying data center, office and other space as of September 30, 2016. This may vary from total customer count as some customers may be under contract, but have yet to occupy space. |

(c) | Represents the total square feet at a facility under lease and that has commenced billing, excluding space held for development or space used by CyrusOne. A customer’s leased NRSF is estimated based on such customer’s direct CSF or office and light-industrial space plus management’s estimate of infrastructure support space, including mechanical, telecommunications and utility rooms, as well as building common areas. |

(d) | Represents monthly contractual rent (defined as cash rent including customer reimbursements for metered power) under existing customer leases as of September 30, 2016, multiplied by 12. For the month of September 2016, customer reimbursements were $62.1 million annualized and consisted of reimbursements by customers across all facilities with separately metered power. Customer reimbursements under leases with separately metered power vary from month-to-month based on factors such as our customers' utilization of power and the suppliers' pricing of power. From October 1, 2014 through September 30, 2016, customer reimbursements under leases with separately metered power constituted between 10.6% and 14.2% of annualized rent. After giving effect to abatements, free rent and other straight-line adjustments, our annualized effective rent as of September 30, 2016 was $508.7 million. Our annualized effective rent was greater than our annualized rent as of September 30, 2016 because our positive straight-line and other adjustments and amortization of deferred revenue exceeded our negative straight-line adjustments due to factors such as the timing of contractual rent escalations and customer prepayments for services. |

24

CyrusOne Inc.

Lease Expirations

As of September 30, 2016

(Unaudited)

Year(a) | Number of Leases Expiring(b) | Total Operating NRSF Expiring | Percentage of Total NRSF | Annualized Rent(c) | Percentage of Annualized Rent | Annualized Rent at Expiration(d) | Percentage of Annualized Rent at Expiration | |||||||||

Available | 663,393 | 17 | % | |||||||||||||

Month-to-Month | 287 | 28,789 | 1 | % | $ | 13,396,744 | 3 | % | $ | 14,441,739 | 3 | % | ||||

2016 | 602 | 139,272 | 4 | % | 21,402,488 | 4 | % | 21,777,011 | 4 | % | ||||||

2017 | 1,809 | 515,118 | 13 | % | 100,013,961 | 20 | % | 101,825,743 | 18 | % | ||||||

2018 | 1,094 | 366,747 | 9 | % | 107,247,080 | 22 | % | 120,677,719 | 21 | % | ||||||

2019 | 785 | 384,759 | 10 | % | 57,793,982 | 12 | % | 62,156,825 | 10 | % | ||||||

2020 | 310 | 390,193 | 10 | % | 52,812,265 | 11 | % | 58,637,323 | 10 | % | ||||||

2021 | 392 | 200,092 | 5 | % | 34,830,442 | 7 | % | 46,072,381 | 8 | % | ||||||

2022 | 33 | 89,674 | 2 | % | 10,330,256 | 2 | % | 11,320,995 | 2 | % | ||||||

2023 | 57 | 60,512 | 2 | % | 6,122,310 | 1 | % | 8,710,068 | 2 | % | ||||||

2024 | 14 | 87,537 | 2 | % | 15,279,143 | 3 | % | 16,997,019 | 3 | % | ||||||

2025 | 30 | 153,578 | 4 | % | 18,645,995 | 4 | % | 24,151,361 | 4 | % | ||||||

2026 | 10 | 414,662 | 11 | % | 30,352,881 | 6 | % | 50,542,445 | 9 | % | ||||||

2027 - Thereafter | 6 | 370,582 | 10 | % | 26,316,948 | 5 | % | 34,054,935 | 6 | % | ||||||

Total | 5,429 | 3,864,908 | 100 | % | $ | 494,544,495 | 100 | % | $ | 571,365,564 | 100 | % | ||||

(a) | Leases that were auto-renewed prior to September 30, 2016 are shown in the calendar year in which their current auto-renewed term expires. Unless otherwise stated in the footnotes, the information set forth in the table assumes that customers exercise no renewal options and exercise all early termination rights that require payment of less than 50% of the remaining rents. Early termination rights that require payment of 50% or more of the remaining lease payments are not assumed to be exercised. |

(b) | Number of leases represents each agreement with a customer. A lease agreement could include multiple spaces and a customer could have multiple leases. |

(c) | Represents monthly contractual rent (defined as cash rent including customer reimbursements for metered power) under existing customer leases as of September 30, 2016, multiplied by 12. For the month of September 2016, customer reimbursements were $62.1 million annualized and consisted of reimbursements by customers across all facilities with separately metered power. Customer reimbursements under leases with separately metered power vary from month-to-month based on factors such as our customers' utilization of power and the suppliers' pricing of power. From October 1, 2014 through September 30, 2016, customer reimbursements under leases with separately metered power constituted between 10.6% and 14.2% of annualized rent. After giving effect to abatements, free rent and other straight-line adjustments, our annualized effective rent as of September 30, 2016 was $508.7 million. Our annualized effective rent was greater than our annualized rent as of September 30, 2016 because our positive straight-line and other adjustments and amortization of deferred revenue exceeded our negative straight-line adjustments due to factors such as the timing of contractual rent escalations and customer prepayments for services. |

(d) | Represents the final monthly contractual rent under existing customer leases that had commenced as of September 30, 2016, multiplied by 12. |

25