Attached files

| file | filename |

|---|---|

| EX-99.4 - EX-99.4 - Lumen Technologies, Inc. | d272595dex994.htm |

| EX-99.3 - EX-99.3 - Lumen Technologies, Inc. | d272595dex993.htm |

| EX-99.2 - EX-99.2 - Lumen Technologies, Inc. | d272595dex992.htm |

| EX-99.1 - EX-99.1 - Lumen Technologies, Inc. | d272595dex991.htm |

| 8-K - 8-K - Lumen Technologies, Inc. | d272595d8k.htm |

Exhibit 99.5

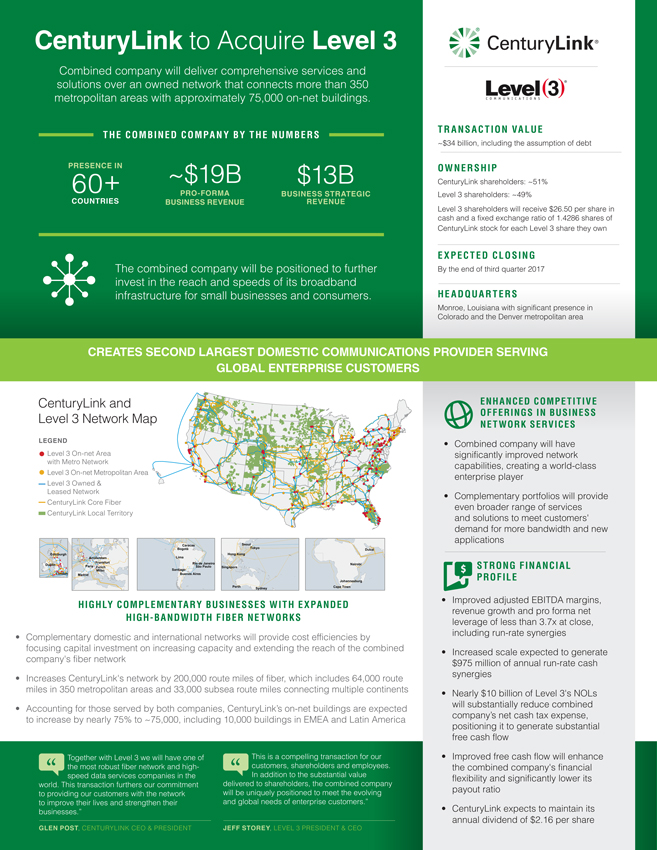

CenturyLink to Acquire Level 3 Combined company will deliver comprehensive services and solutions over an owned network that connects

more than 350 metropolitan areas with approximately 75,000 on-net buildings. THE COMBINED COMPANY BY THE NUMBERS TRANSACTION VALUE ~$34 billion, including the assumption of debt

OWNERSHIP CenturyLink shareholders: ~51% Level 3 shareholders: ~49% Level 3 shareholders will receive $26.50 per share in cash and a fixed exchange ratio of 1.4286 shares of

CenturyLink stock for each Level 3 share they own EXPECTED CLOSING By the end of third quarter 2017 HEADQUARTERS Monroe, Louisiana with significant presence in Colorado and the Denver metropolitan area PRESENCE IN 60+ COUNTRIES ~$19B PRO-FORMA

BUSINESS REVENUE $13B BUSINESS STRATEGIC REVENUE The combined company will be positioned to further invest in the reach and speeds of its broadband infrastructure for small businesses and consumers.

CREATES SECOND LARGEST DOMESTIC COMMUNICATIONS PROVIDER SERVING GLOBAL ENTERPRISE CUSTOMERS 8J6H: 851698_1.wor

ENHANCED COMPETITIVE OFFERINGS IN BUSINESS NETWORK SERVICES Combined company will have significantly improved network capabilities, creating a world-class enterprise player

Complementary portfolios will provide even broader range of services and solutions to meet customers’ demand for more bandwidth and new applications CenturyLink and Level 3 Network Map LEGEND Level 3 On-net Area with Metro Network Level 3

On-net Metropolitan Area Level 3 Owned & Leased Network CenturyLink Core Fiber CenturyLink Local Territory London Paris Frankfurt Dublin Edinburgh Madrid Amsterdam Zurich Milan Hong Kong Singapore Seoul Tokyo Sydney Perth Johannesburg Cape Town

Nairobi Dubai Rio de Janeiro São Paulo Lima Santiago Buenos Aires Caracas Bogotá STRONG FINANCIAL PROFILE Improved adjusted EBITDA margins, revenue growth and pro forma net leverage of less than 3.7x at close, including run-rate synergies

Increased scale expected to generate $975 million of annual run-rate cash synergies Nearly $10 billion of Level 3’s NOLs will substantially reduce combined company’s net cash tax expense, positioning it to generate substantial free cash

flow Improved free cash flow will enhance the combined company’s financial flexibility and significantly lower its payout ratio CenturyLink expects to maintain its annual dividend of $2.16 per share HIGHLY COMPLEMENTARY BUSINESSES WITH EXPANDED

HIGH-BANDWIDTH FIBER NETWORKS Complementary domestic and international networks will provide cost efficiencies by focusing capital investment on increasing capacity and extending the reach of the combined company’s fiber network Increases

CenturyLink’s network by 200,000 route miles of fiber, which includes 64,000 route miles in 350 metropolitan areas and 33,000 subsea route miles connecting multiple continents Accounting for those served by both companies, CenturyLink’s

on-net buildings are expected to increase by nearly 75% to ~75,000, including 10,000 buildings in EMEA and Latin America This is a compelling transaction for our customers, shareholders and employees. In addition to the substantial value delivered

to shareholders, the combined company will be uniquely positioned to meet the evolving and global needs of enterprise customers.” Together with Level 3 we will have one of the most robust fiber network and high-speed data services companies in

the world. This transaction furthers our commitment to providing our customers with the network to improve their lives and strengthen their businesses.” JEFF STOREY, LEVEL 3 PRESIDENT & CEO GLEN POST, CENTURYLINK CEO & PRESIDENT

FORWARD LOOKING STATEMENTS Except for the historical and factual information contained herein, the matters set forth in this document, including statements regarding the expected timing and benefits of the proposed transaction, such as efficiencies, cost savings, enhanced revenues, growth potential, market profile and financial strength, and the competitive ability and position of the combined company, and other statements identified by words such as “will,” “estimates,” “expects,” “projects,” “plans,” “intends” and similar expressions, are forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, many of which are beyond our control. Actual events and results may differ materially from those anticipated, estimated or projected if one or more of these risks or uncertainties materialize, or if underlying assumptions prove incorrect. Factors that could affect actual results include but are not limited to: the ability of the parties to timely and successfully receive the required approvals of regulatory agencies and their respective shareholders; the possibility that the anticipated benefits from the proposed transaction cannot be fully realized or may take longer to realize than expected; the possibility that costs or difficulties related to the integration of Level 3’s operations with those of CenturyLink will be greater than expected; the ability of the combined company to retain and hire key personnel; the effects of competition from a wide variety of competitive providers, including lower demand for CenturyLink’s legacy offerings; the effects of new, emerging or competing technologies, including those that could make the combined company’s products less desirable or obsolete; the effects of ongoing changes in the regulation of the communications industry, including the outcome of regulatory or judicial proceedings relating to intercarrier compensation, interconnection obligations, access charges, universal service, broadband deployment, data protection and net neutrality; adverse changes in CenturyLink’s or the combined company’s access to credit markets on favorable terms, whether caused by changes in its financial position, lower debt credit ratings, unstable markets or otherwise; the combined company’s ability to effectively adjust to changes in the communications industry, and changes in the composition of its markets and product mix; possible changes in the demand for, or pricing of, the combined company’s products and services, including the combined company’s ability to effectively respond to increased demand for high-speed broadband service; the combined company’s ability to successfully maintain the quality and profitability of its existing product and service offerings and to introduce new offerings on a timely and cost-effective basis; the adverse impact on the combined company’s business and network from possible equipment failures, service outages, security breaches or similar events impacting its network; the combined company’s ability to maintain favorable relations with key business partners, suppliers, vendors, landlords and financial institutions; the ability of the combined company to utilize net operating losses in amounts projected; changes in the future cash requirements of the combined company; and other risk factors and cautionary statements as detailed from time to time in each of CenturyLink’s and Level 3’s reports filed with the U.S. Securities and Exchange Commission (the “SEC”). There can be no assurance that the proposed acquisition or any other transaction described above will in fact be consummated in the manner described or at all. You should be aware that new factors may emerge from time to time and it is not possible for us to identify all such factors nor can we predict the impact of each such factor on the proposed transaction or the combined company. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this document. Unless legally required, CenturyLink and Level 3 undertake no obligation and each expressly disclaim any such obligation, to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. ADDITIONAL INFORMATION CenturyLink and Level 3 plan to file a joint proxy statement/prospectus with the SEC. INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. You will be able to obtain the joint proxy statement/prospectus and the filings that will be incorporated by reference in the joint proxy statement/prospectus, as well as other filings containing information about CenturyLink and Level 3, free of charge, at the website maintained by the SEC at www.sec.gov. Copies of the joint proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the joint proxy statement/prospectus can also be obtained, free of charge, by directing a request to CenturyLink, 100 CenturyLink Drive, Monroe, Louisiana 71203, Attention: Corporate Secretary, or to Level 3, 1025 Eldorado Boulevard, Broomfield, Colorado 80021, Attention: Investor Relations. PARTICIPANTS IN THE SOLICITATION The respective directors and executive officers of CenturyLink and Level 3 and other persons may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding CenturyLink’s directors and executive officers is available in its proxy statement filed with the SEC by CenturyLink on April 5, 2016, and information regarding Level 3’s directors and executive officers is available in its proxy statement filed with the SEC by Level 3 on April 7, 2016. These documents can be obtained free of charge from the sources indicated above. Other information regarding the interests of the participants in the proxy solicitation will be included in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.