Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FTI CONSULTING, INC | d263845d8k.htm |

FTI Consulting, Inc. Third Quarter 2016 Earnings Conference Call Exhibit 99.1

Cautionary Note About Forward-Looking Statements This presentation includes "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which involve uncertainties and risks. Forward-looking statements include statements concerning our plans, objectives, goals, strategies, future events, future revenues, future results and performance, expectations, plans or intentions relating to acquisitions and other matters, business trends and other information that is not historical, including statements regarding estimates of our future financial results. When used in this presentation, words such as "anticipates," "estimates," "expects," “goals,” "intends," "believes,” "forecasts," “targets,” “objectives” and variations of such words or similar expressions are intended to identify forward-looking statements. All forward-looking statements, including, without limitation, estimates of our future financial results, are based upon our expectations at the time we make them and various assumptions. Our expectations, beliefs, projections and growth targets are expressed in good faith, and we believe there is a reasonable basis for them. However, there can be no assurance that management's expectations, beliefs, estimates or growth targets will be achieved, and the Company's actual results may differ materially from our expectations, beliefs, estimates and growth targets. The Company has experienced fluctuating revenues, operating income and cash flow in prior periods and expects that this will occur from time to time in the future. Other factors that could cause such differences include declines in demand for, or changes in, the mix of services and products that we offer, the mix of the geographic locations where our clients are located or where services are performed, adverse financial, real estate or other market and general economic conditions, which could impact each of our segments differently, the pace and timing of the consummation and integration of past and future acquisitions, the Company's ability to realize cost savings and efficiencies, competitive and general economic conditions, retention of staff and clients and other risks described under the heading "Item 1A Risk Factors" in the Company's most recent Form 10-K filed with the SEC and in the Company's other filings with the SEC, including the risks set forth under "Risks Related to Our Reportable Segments" and "Risks Related to Our Operations.” We are under no duty to update any of the forward-looking statements to conform such statements to actual results or events and do not intend to do so.

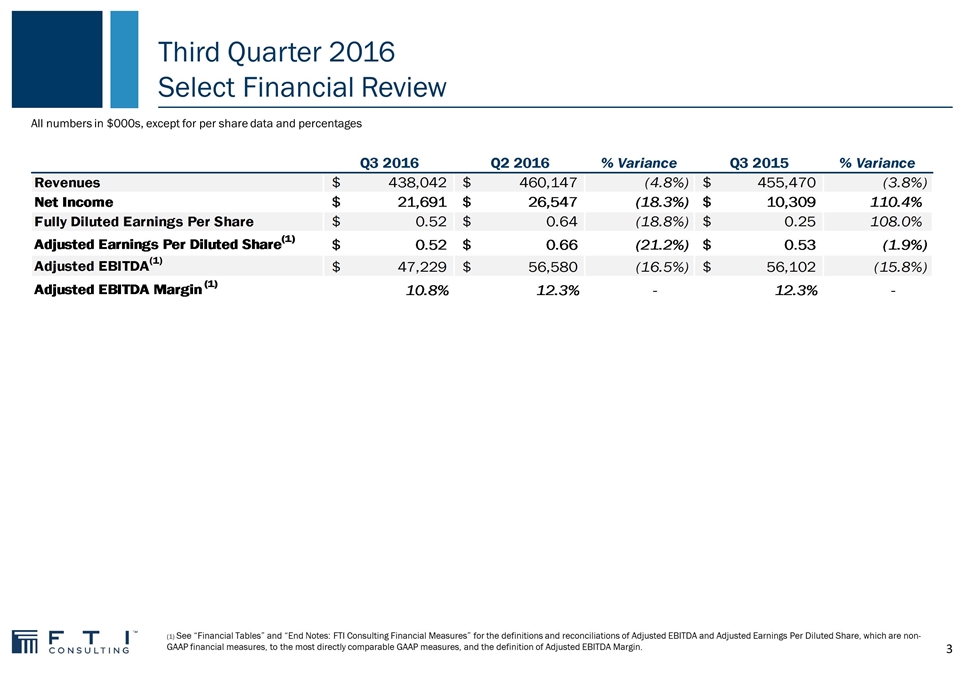

Third Quarter 2016 Select Financial Review All numbers in $000s, except for per share data and percentages (1) See “Financial Tables” and “End Notes: FTI Consulting Financial Measures” for the definitions and reconciliations of Adjusted EBITDA and Adjusted Earnings Per Diluted Share, which are non-GAAP financial measures, to the most directly comparable GAAP measures, and the definition of Adjusted EBITDA Margin.

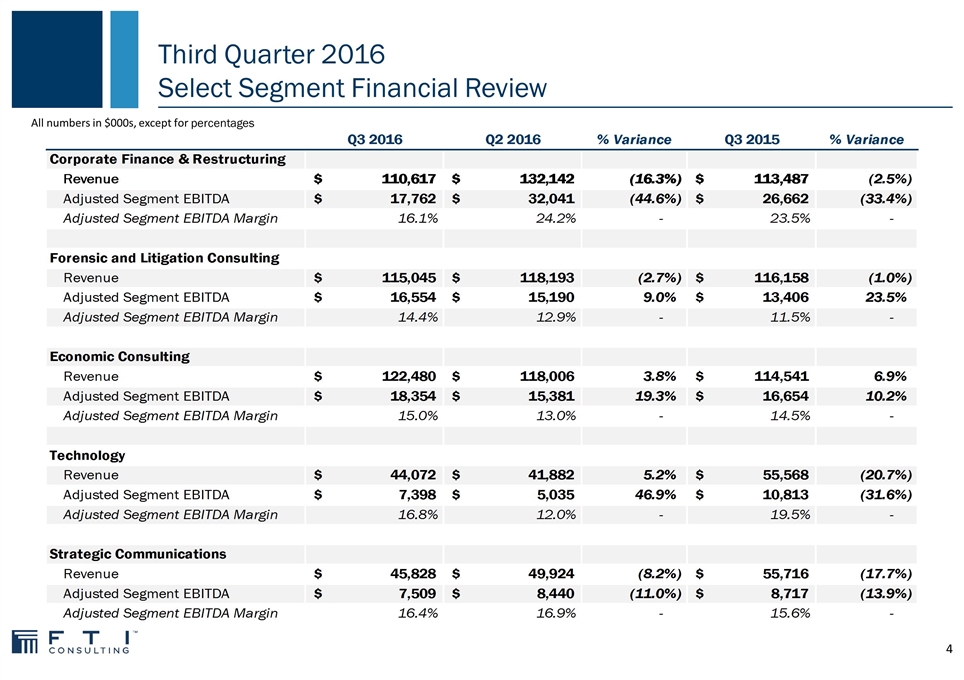

Third Quarter 2016 Select Segment Financial Review All numbers in $000s, except for percentages

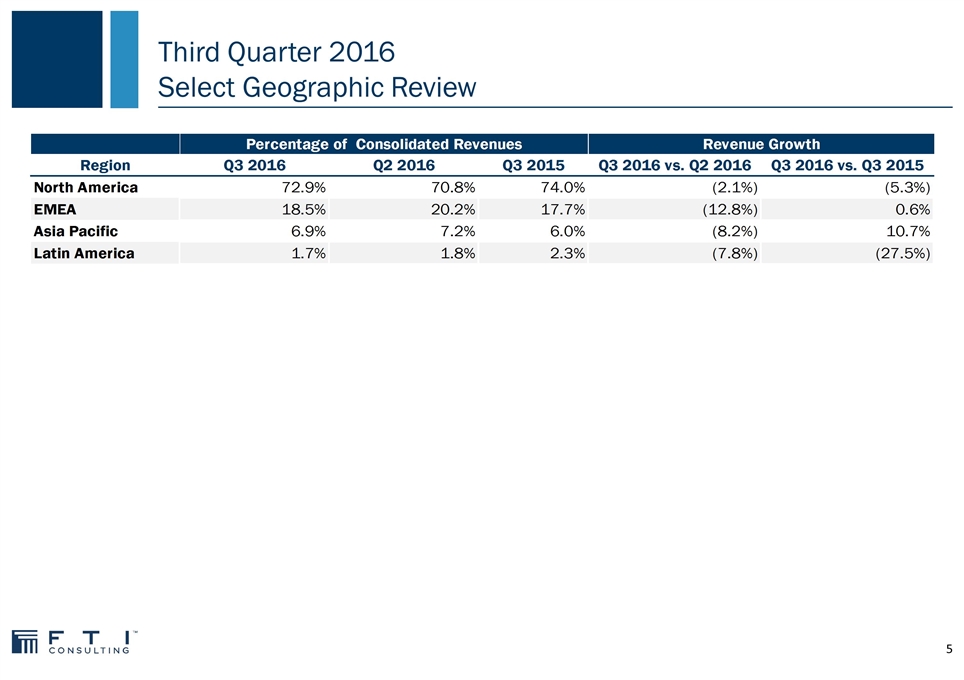

Third Quarter 2016 Select Geographic Review

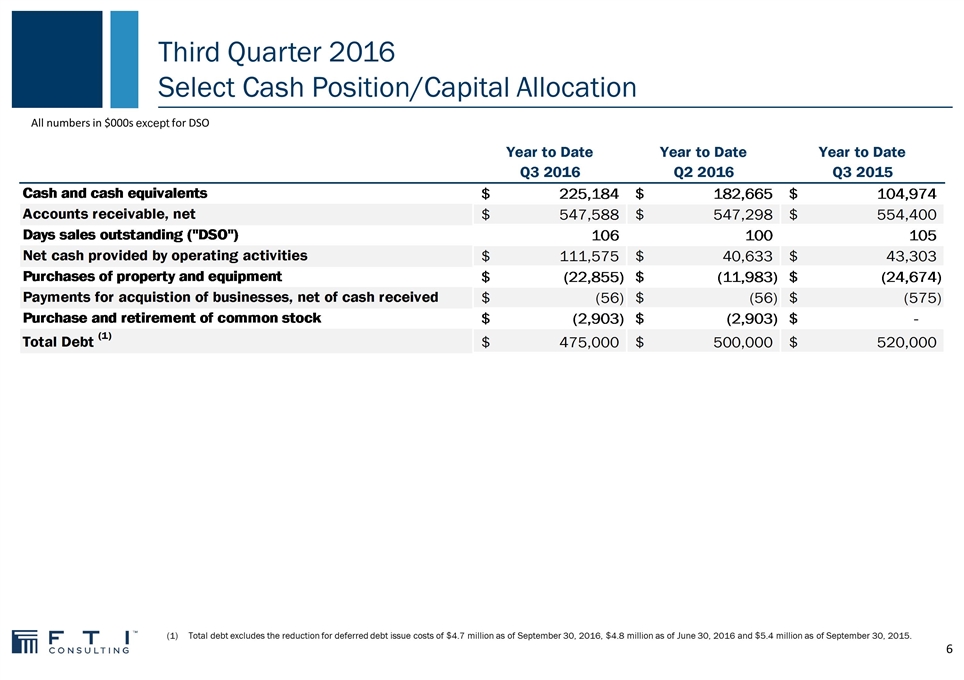

Third Quarter 2016 Select Cash Position/Capital Allocation All numbers in $000s except for DSO Total debt excludes the reduction for deferred debt issue costs of $4.7 million as of September 30, 2016, $4.8 million as of June 30, 2016 and $5.4 million as of September 30, 2015.

Reconciliation of Non-GAAP Financial Measures

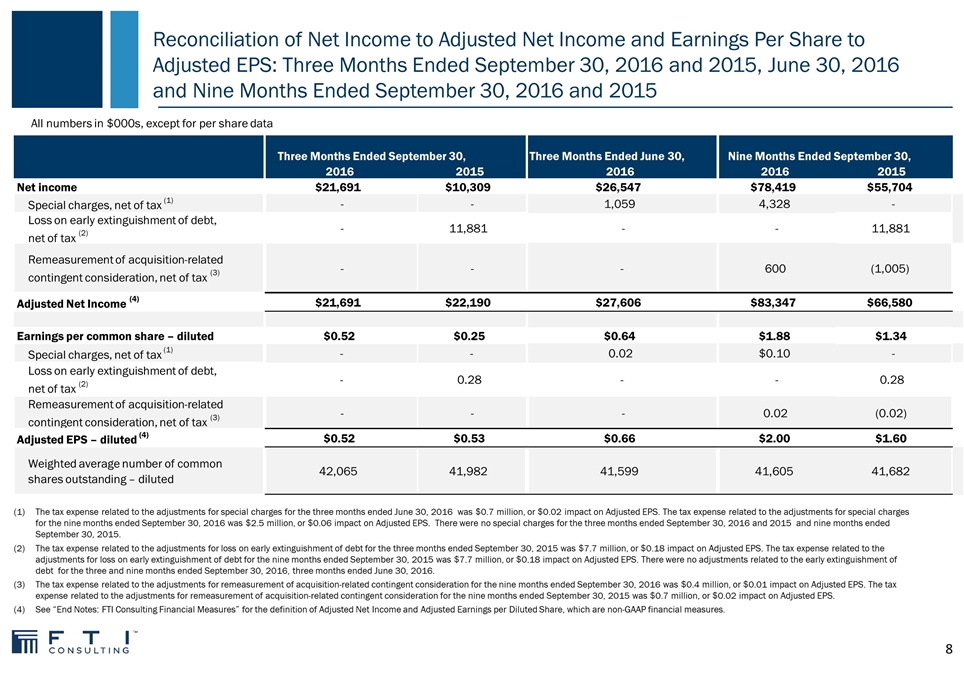

Reconciliation of Net Income to Adjusted Net Income and Earnings Per Share to Adjusted EPS: Three Months Ended September 30, 2016 and 2015, June 30, 2016 and Nine Months Ended September 30, 2016 and 2015 The tax expense related to the adjustments for special charges for the three months ended June 30, 2016 was $0.7 million, or $0.02 impact on Adjusted EPS. The tax expense related to the adjustments for special charges for the nine months ended September 30, 2016 was $2.5 million, or $0.06 impact on Adjusted EPS. There were no special charges for the three months ended September 30, 2016 and 2015 and nine months ended September 30, 2015. The tax expense related to the adjustments for loss on early extinguishment of debt for the three months ended September 30, 2015 was $7.7 million, or $0.18 impact on Adjusted EPS. The tax expense related to the adjustments for loss on early extinguishment of debt for the nine months ended September 30, 2015 was $7.7 million, or $0.18 impact on Adjusted EPS. There were no adjustments related to the early extinguishment of debt for the three and nine months ended September 30, 2016, three months ended June 30, 2016. The tax expense related to the adjustments for remeasurement of acquisition-related contingent consideration for the nine months ended September 30, 2016 was $0.4 million, or $0.01 impact on Adjusted EPS. The tax expense related to the adjustments for remeasurement of acquisition-related contingent consideration for the nine months ended September 30, 2015 was $0.7 million, or $0.02 impact on Adjusted EPS. See “End Notes: FTI Consulting Financial Measures” for the definition of Adjusted Net Income and Adjusted Earnings per Diluted Share, which are non-GAAP financial measures. All numbers in $000s, except for per share data Three Months Ended June 30, 2016 2015 2016 2016 2015 Net income $21,691 $10,309 $26,547 $78,419 $55,704 Special charges, net of tax (1) - - 1,059 4,328 - Loss on early extinguishment of debt, net of tax (2) - 11,881 - - 11,881 Remeasurement of acquisition-related contingent consideration, net of tax (3) - - - 600 (1,005) Adjusted Net Income (4) $21,691 $22,190 $27,606 $83,347 $66,580 Earnings per common share – diluted $0.52 $0.25 $0.64 $1.88 $1.34 Special charges, net of tax (1) - - 0.02 $0.10 - Loss on early extinguishment of debt, net of tax (2) - 0.28 - - 0.28 Remeasurement of acquisition-related contingent consideration, net of tax (3) - - - 0.02 (0.02) Adjusted EPS – diluted (4) $0.52 $0.53 $0.66 $2.00 $1.60 Weighted average number of common shares outstanding – diluted 42,065 41,982 41,599 41,605 41,682 Three Months Ended September 30, Nine Months Ended September 30,

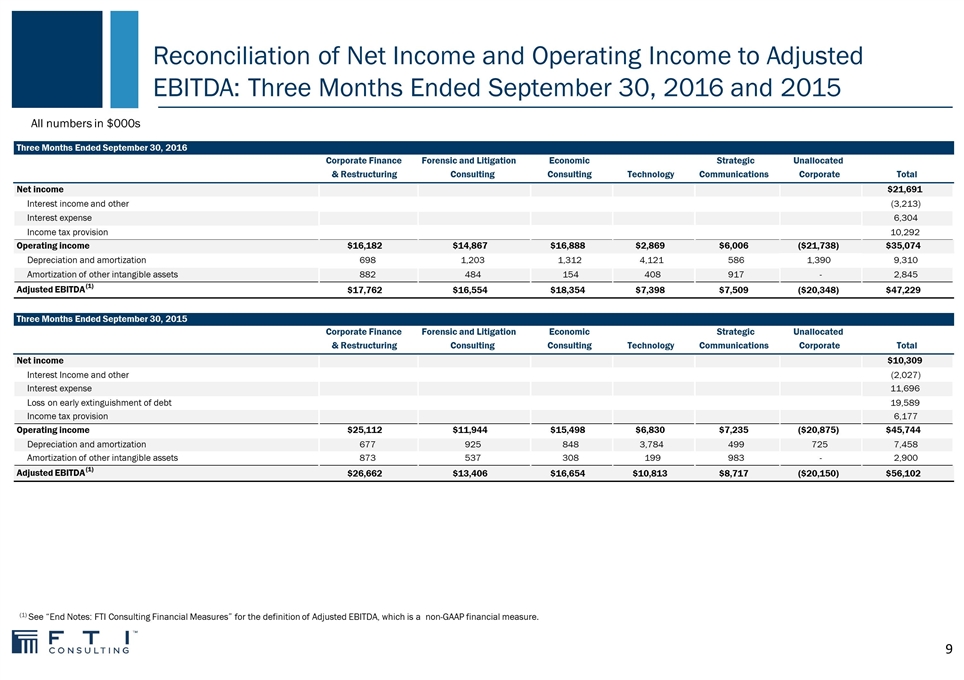

Reconciliation of Net Income and Operating Income to Adjusted EBITDA: Three Months Ended September 30, 2016 and 2015 (1) See “End Notes: FTI Consulting Financial Measures” for the definition of Adjusted EBITDA, which is a non-GAAP financial measure. All numbers in $000s Three Months Ended September 30, 2016 Corporate Finance & Restructuring Forensic and Litigation Consulting Economic Consulting Technology Strategic Communications Unallocated Corporate Total Net income $21,691 Interest income and other (3,213) Interest expense 6,304 Income tax provision 10,292 Operating income $16,182 $14,867 $16,888 $2,869 $6,006 ($21,738) $35,074 Depreciation and amortization 698 1,203 1,312 4,121 586 1,390 9,310 Amortization of other intangible assets 882 484 154 408 917 - 2,845 Adjusted EBITDA (1) $17,762 $16,554 $18,354 $7,398 $7,509 ($20,348) $47,229 Three Months Ended September 30, 2015 Corporate Finance & Restructuring Forensic and Litigation Consulting Economic Consulting Technology Strategic Communications Unallocated Corporate Total Net income $10,309 Interest Income and other (2,027) Interest expense 11,696 Loss on early extinguishment of debt 19,589 Income tax provision 6,177 Operating income $25,112 $11,944 $15,498 $6,830 $7,235 ($20,875) $45,744 Depreciation and amortization 677 925 848 3,784 499 725 7,458 Amortization of other intangible assets 873 537 308 199 983 - 2,900 Adjusted EBITDA (1) $26,662 $13,406 $16,654 $10,813 $8,717 ($20,150) $56,102

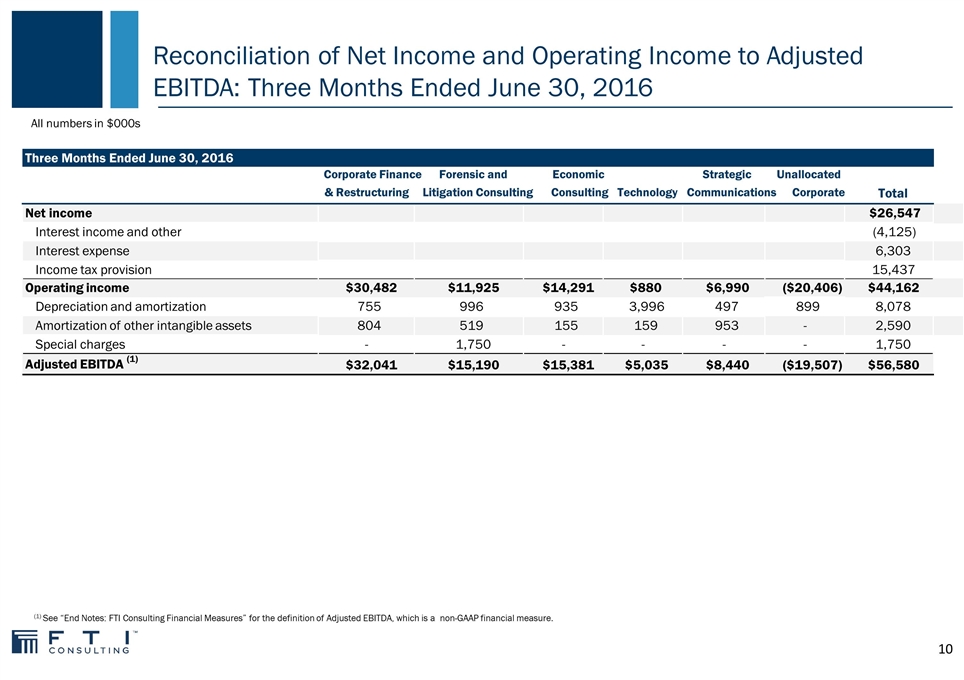

Reconciliation of Net Income and Operating Income to Adjusted EBITDA: Three Months Ended June 30, 2016 (1) See “End Notes: FTI Consulting Financial Measures” for the definition of Adjusted EBITDA, which is a non-GAAP financial measure. All numbers in $000s Three Months Ended June 30, 2016 Corporate Finance & Restructuring Forensic and Litigation Consulting Economic Consulting Technology Strategic Communications Unallocated Corporate Total Net income $26,547 Interest income and other (4,125) Interest expense 6,303 Income tax provision 15,437 Operating income $30,482 $11,925 $14,291 $880 $6,990 ($20,406) $44,162 Depreciation and amortization 755 996 935 3,996 497 899 8,078 Amortization of other intangible assets 804 519 155 159 953 - 2,590 Special charges - 1,750 - - - - 1,750 Adjusted EBITDA (1) $32,041 $15,190 $15,381 $5,035 $8,440 ($19,507) $56,580

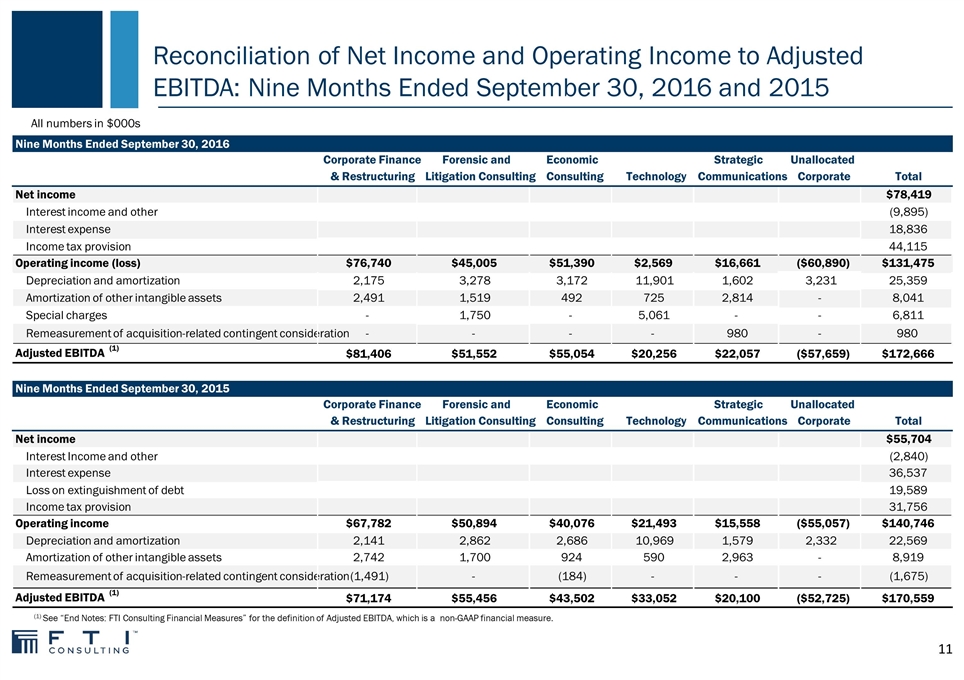

Reconciliation of Net Income and Operating Income to Adjusted EBITDA: Nine Months Ended September 30, 2016 and 2015 (1) See “End Notes: FTI Consulting Financial Measures” for the definition of Adjusted EBITDA, which is a non-GAAP financial measure. All numbers in $000s Nine Months Ended September 30, 2016 Corporate Finance & Restructuring Forensic and Litigation Consulting Economic Consulting Technology Strategic Communications Unallocated Corporate Total Net income $78,419 Interest income and other (9,895) Interest expense 18,836 Income tax provision 44,115 Operating income (loss) $76,740 $45,005 $51,390 $2,569 $16,661 ($60,890) $131,475 Depreciation and amortization 2,175 3,278 3,172 11,901 1,602 3,231 25,359 Amortization of other intangible assets 2,491 1,519 492 725 2,814 - 8,041 Special charges - 1,750 - 5,061 - - 6,811 Remeasurement of acquisition-related contingent consideration - - - - 980 - 980 Adjusted EBITDA (1) $81,406 $51,552 $55,054 $20,256 $22,057 ($57,659) $172,666 Nine Months Ended September 30, 2015 Corporate Finance & Restructuring Forensic and Litigation Consulting Economic Consulting Technology Strategic Communications Unallocated Corporate Total Net income $55,704 Interest Income and other (2,840) Interest expense 36,537 Loss on extinguishment of debt 19,589 Income tax provision 31,756 Operating income $67,782 $50,894 $40,076 $21,493 $15,558 ($55,057) $140,746 Depreciation and amortization 2,141 2,862 2,686 10,969 1,579 2,332 22,569 Amortization of other intangible assets 2,742 1,700 924 590 2,963 - 8,919 Remeasurement of acquisition-related contingent consideration (1,491) - (184) - - - (1,675) Adjusted EBITDA (1) $71,174 $55,456 $43,502 $33,052 $20,100 ($52,725) $170,559

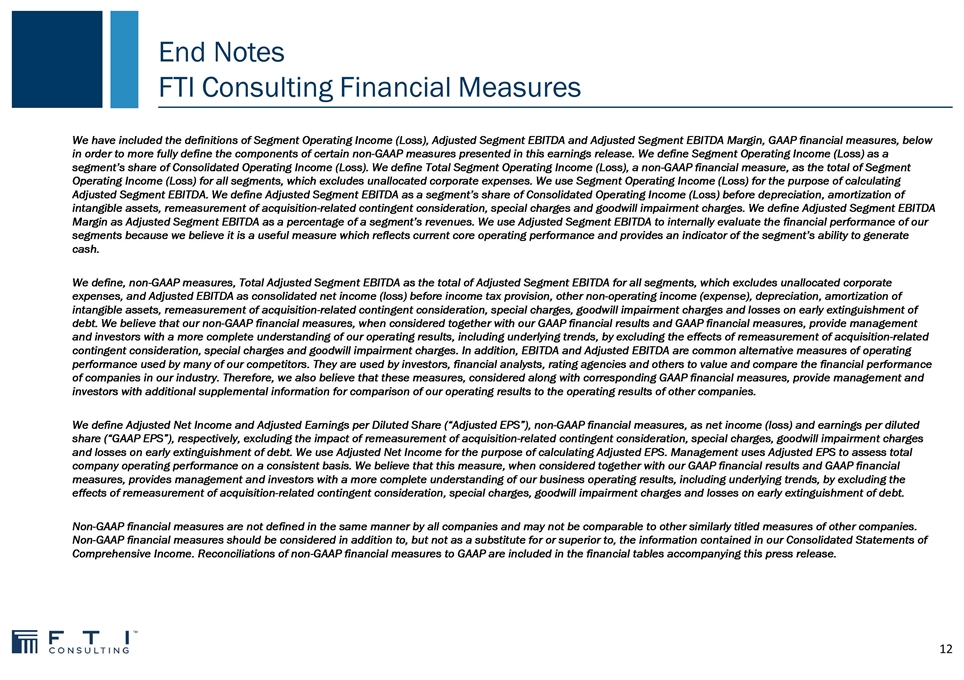

End Notes FTI Consulting Financial Measures We have included the definitions of Segment Operating Income (Loss), Adjusted Segment EBITDA and Adjusted Segment EBITDA Margin, GAAP financial measures, below in order to more fully define the components of certain non-GAAP measures presented in this earnings release. We define Segment Operating Income (Loss) as a segment’s share of Consolidated Operating Income (Loss). We define Total Segment Operating Income (Loss), a non-GAAP financial measure, as the total of Segment Operating Income (Loss) for all segments, which excludes unallocated corporate expenses. We use Segment Operating Income (Loss) for the purpose of calculating Adjusted Segment EBITDA. We define Adjusted Segment EBITDA as a segment’s share of Consolidated Operating Income (Loss) before depreciation, amortization of intangible assets, remeasurement of acquisition-related contingent consideration, special charges and goodwill impairment charges. We define Adjusted Segment EBITDA Margin as Adjusted Segment EBITDA as a percentage of a segment’s revenues. We use Adjusted Segment EBITDA to internally evaluate the financial performance of our segments because we believe it is a useful measure which reflects current core operating performance and provides an indicator of the segment’s ability to generate cash. We define, non-GAAP measures, Total Adjusted Segment EBITDA as the total of Adjusted Segment EBITDA for all segments, which excludes unallocated corporate expenses, and Adjusted EBITDA as consolidated net income (loss) before income tax provision, other non-operating income (expense), depreciation, amortization of intangible assets, remeasurement of acquisition-related contingent consideration, special charges, goodwill impairment charges and losses on early extinguishment of debt. We believe that our non-GAAP financial measures, when considered together with our GAAP financial results and GAAP financial measures, provide management and investors with a more complete understanding of our operating results, including underlying trends, by excluding the effects of remeasurement of acquisition-related contingent consideration, special charges and goodwill impairment charges. In addition, EBITDA and Adjusted EBITDA are common alternative measures of operating performance used by many of our competitors. They are used by investors, financial analysts, rating agencies and others to value and compare the financial performance of companies in our industry. Therefore, we also believe that these measures, considered along with corresponding GAAP financial measures, provide management and investors with additional supplemental information for comparison of our operating results to the operating results of other companies. We define Adjusted Net Income and Adjusted Earnings per Diluted Share (“Adjusted EPS”), non-GAAP financial measures, as net income (loss) and earnings per diluted share (“GAAP EPS”), respectively, excluding the impact of remeasurement of acquisition-related contingent consideration, special charges, goodwill impairment charges and losses on early extinguishment of debt. We use Adjusted Net Income for the purpose of calculating Adjusted EPS. Management uses Adjusted EPS to assess total company operating performance on a consistent basis. We believe that this measure, when considered together with our GAAP financial results and GAAP financial measures, provides management and investors with a more complete understanding of our business operating results, including underlying trends, by excluding the effects of remeasurement of acquisition-related contingent consideration, special charges, goodwill impairment charges and losses on early extinguishment of debt. Non-GAAP financial measures are not defined in the same manner by all companies and may not be comparable to other similarly titled measures of other companies. Non-GAAP financial measures should be considered in addition to, but not as a substitute for or superior to, the information contained in our Consolidated Statements of Comprehensive Income. Reconciliations of non-GAAP financial measures to GAAP are included in the financial tables accompanying this press release.

Appendix

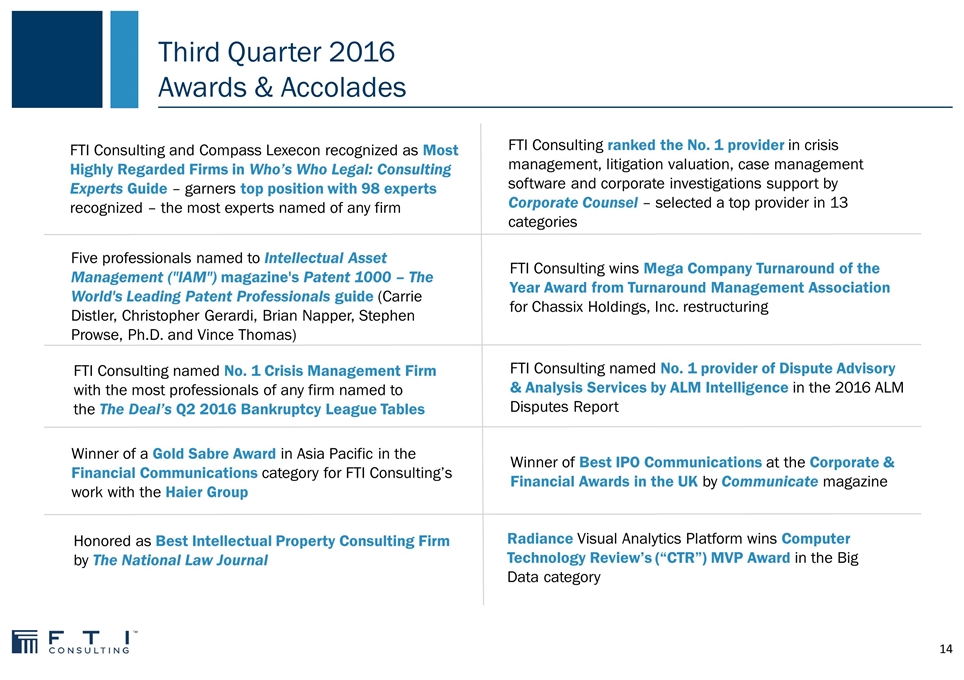

Third Quarter 2016 Awards & Accolades Radiance Visual Analytics Platform wins Computer Technology Review’s (“CTR”) MVP Award in the Big Data category Five professionals named to Intellectual Asset Management ("IAM") magazine's Patent 1000 – The World's Leading Patent Professionals guide (Carrie Distler, Christopher Gerardi, Brian Napper, Stephen Prowse, Ph.D. and Vince Thomas) FTI Consulting and Compass Lexecon recognized as Most Highly Regarded Firms in Who’s Who Legal: Consulting Experts Guide – garners top position with 98 experts recognized – the most experts named of any firm FTI Consulting wins Mega Company Turnaround of the Year Award from Turnaround Management Association for Chassix Holdings, Inc. restructuring Honored as Best Intellectual Property Consulting Firm by The National Law Journal FTI Consulting ranked the No. 1 provider in crisis management, litigation valuation, case management software and corporate investigations support by Corporate Counsel – selected a top provider in 13 categories FTI Consulting named No. 1 provider of Dispute Advisory & Analysis Services by ALM Intelligence in the 2016 ALM Disputes Report FTI Consulting named No. 1 Crisis Management Firm with the most professionals of any firm named to the The Deal’s Q2 2016 Bankruptcy League Tables Winner of a Gold Sabre Award in Asia Pacific in the Financial Communications category for FTI Consulting’s work with the Haier Group Winner of Best IPO Communications at the Corporate & Financial Awards in the UK by Communicate magazine