Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CVR PARTNERS, LP | uan8-kq32016earningspresen.htm |

CVR Partners, LP

3rd Quarter 2016 Earnings Report

October 27, 2016

1

The following presentation contains forward-looking statements based on management’s

current expectations and beliefs, as well as a number of assumptions concerning future

events. The assumptions and estimates underlying forward-looking statements are inherently

uncertain and, although considered reasonable as of the date of preparation by the

management team of our general partner, are subject to a wide variety of significant business,

economic, and competitive risks and uncertainties that could cause actual results to differ

materially from those contained in the prospective information. Accordingly, there can be no

assurance that we will achieve the future results we expect or that actual results will not differ

materially from expectations.

You are cautioned not to put undue reliance on such forward-looking statements (including

forecasts and projections regarding our future performance) because actual results may vary

materially from those expressed or implied as a result of various factors, including, but not

limited to those set forth under “Risk Factors” in CVR Partners, LP’s Annual Report on Form

10-K, Quarterly Reports on Form 10-Q and any other filings CVR Partners, LP makes with the

Securities and Exchange Commission.

CVR Partners, LP assumes no obligation to, and expressly disclaims any obligation to, update

or revise any forward-looking statements, whether as a result of new information, future events

or otherwise, except as required by law.

Safe Harbor Statement

2

Consolidated Selected Financials

(All information in this earnings report is unaudited, except the balance sheet data as of December 31, 2015)

On April 1, 2016, CVR Partners acquired Rentech Nitrogen Partners, LP (now known as CVR Nitrogen, LP ("CVR Nitrogen")) and its general partner,

Rentech Nitrogen GP, LLC (now known as CVR Nitrogen GP, LLC), by merger (referred to herein as the "East Dubuque Merger"). Pursuant to the

East Dubuque Merger, the Partnership acquired a nitrogen fertilizer manufacturing facility located in East Dubuque, Illinois (the "East Dubuque

Facility"). The consolidated financial statements and key operating metrics include the results of the East Dubuque Facility beginning on April 1, 2016,

the date of the closing of the acquisition.

(1) Definition on slide 5

(2) Reconciliation on slide 6

Consolidated Financial Results and Cash Flow Data

(In millions)

9/30/2016 9/30/2015 9/30/2016 9/30/2015

Net Sales 78.5$ 49.3$ 271.4$ 223.2$

Operating Income (Loss) 2.4$ (11.8)$ 25.8$ 48.4$

Net Income (Loss) (13.4)$ (13.5)$ (12.4)$ 43.3$

Adjusted EBITDA

(1)(2)

17.4$ 3.8$ 74.4$ 78.3$

Cash Flow Provided By Operations 18.4$ 1.1$ 47.5$ 57.1$

Cash Flow Provided By (Used In) Investing Activities (6.4)$ (6.4)$ (82.1)$ (12.4)$

Cash Flow Provided By (Used In) Financing Activities (23.0)$ (28.5)$ 49.9$ (91.4)$

Net Increase (Decrease) In Cash and Cash Equivalents (11.0)$ (33.8)$ 15.3$ (46.7)$

Maintenance Capital Expenditures 3.4$ 3.8$ 8.3$ 7.4$

Growth Capital Expenditures 3.0$ 2.6$ 10.0$ 5.0$

Total Capital Expenditures 6.4$ 6.4$ 18.3$ 12.4$

9/30/2016 12/31/2015

Cash and Cash Equivalents 65.3$ 50.0$

Working Capital 78.2$ 72.7$

Total Assets 1,326.9$ 536.3$

Total Debt, including current portion 624.5$ 124.8$

Partners' Capital 639.5$ 385.6$

Third Quarter Year to Date

Balance Sheet

(In millions) as of

3

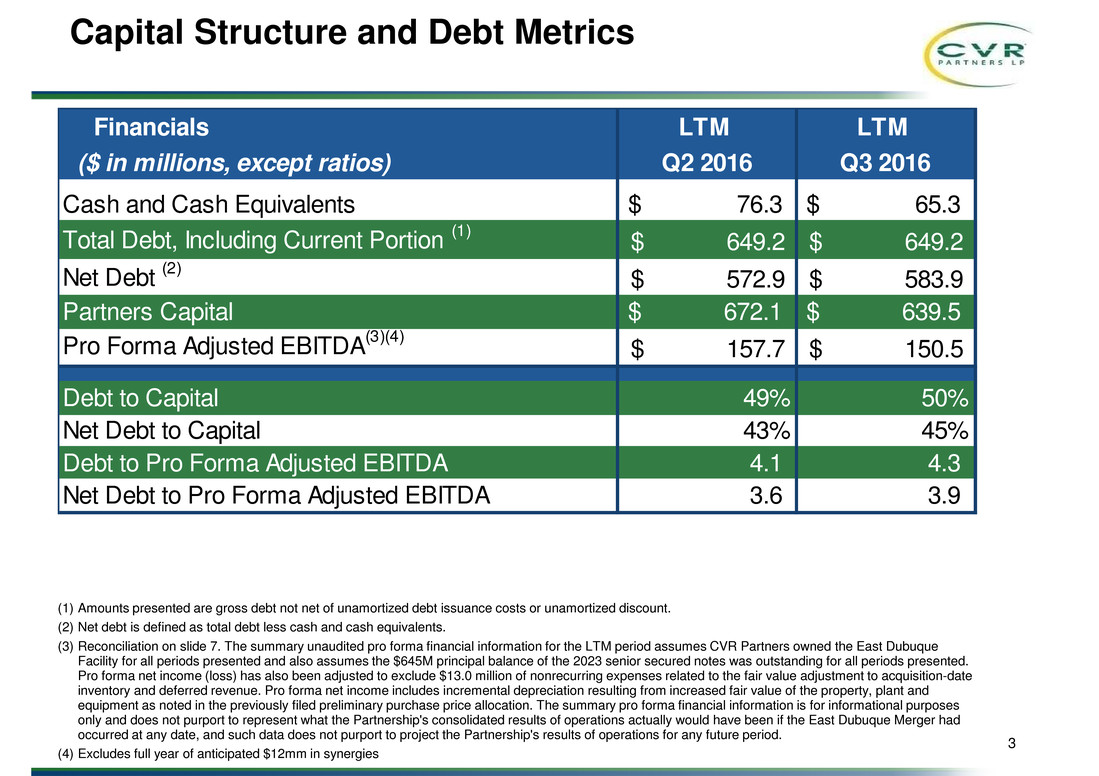

Capital Structure and Debt Metrics

(1) Amounts presented are gross debt not net of unamortized debt issuance costs or unamortized discount.

(2) Net debt is defined as total debt less cash and cash equivalents.

(3) Reconciliation on slide 7. The summary unaudited pro forma financial information for the LTM period assumes CVR Partners owned the East Dubuque

Facility for all periods presented and also assumes the $645M principal balance of the 2023 senior secured notes was outstanding for all periods presented.

Pro forma net income (loss) has also been adjusted to exclude $13.0 million of nonrecurring expenses related to the fair value adjustment to acquisition-date

inventory and deferred revenue. Pro forma net income includes incremental depreciation resulting from increased fair value of the property, plant and

equipment as noted in the previously filed preliminary purchase price allocation. The summary pro forma financial information is for informational purposes

only and does not purport to represent what the Partnership's consolidated results of operations actually would have been if the East Dubuque Merger had

occurred at any date, and such data does not purport to project the Partnership's results of operations for any future period.

(4) Excludes full year of anticipated $12mm in synergies

Financials LTM LTM

Q2 2016 Q3 2016

Cash and Cash Equivalents 76.3$ 65.3$

Total Debt, Including Current Portion

(1)

649.2$ 649.2$

Net Debt

(2)

572.9$ 583.9$

Partners Capital 672.1$ 639.5$

Pro Forma Adjusted EBITDA

(3)(4)

157.7$ 150.5$

Debt to Capital 49% 50%

Net Debt to Capital 43% 45%

Debt to Pro Forma Adjusted EBITDA 4.1 4.3

Net Debt to Pro Forma Adjusted EBITDA 3.6 3.9

($ in millions, except ratios)

Appendix

5

To supplement the actual results in accordance with GAAP for the applicable periods, the

Partnership also uses non-GAAP financial measures as discussed below, which are reconciled

to GAAP-based results. These non-GAAP financial measures should not be considered an

alternative for GAAP results. The adjustments are provided to enhance an overall

understanding of the Partnership’s financial performance for the applicable periods and are

indicators management believes are relevant and useful for planning and forecasting future

periods.

EBITDA and Adjusted EBITDA. EBITDA represents net income before (i) interest expense and

other financing costs, net of interest income, (ii) income tax expense and (iii) depreciation and

amortization. Adjusted EBITDA represents EBITDA adjusted for share-based compensation,

non-cash; major scheduled turnaround expenses; loss on extinguishment of debt; expenses

associated with the East Dubuque Merger and business interruption insurance recovery. We

present Adjusted EBITDA because it is the starting point for our calculation of available cash

for distribution. EBITDA and Adjusted EBITDA are not recognized terms under GAAP and

should not be substituted for net income or cash flow from operations. Management believes

that EBITDA and Adjusted EBITDA enable investors to better understand our ability to make

distributions to our common unitholders, help investors evaluate our ongoing operating results

and allow for greater transparency in reviewing our overall financial, operational and economic

performance. EBITDA and Adjusted EBITDA presented by other companies may not be

comparable to our presentation, since each company may define these terms differently.

Non-GAAP Financial Measures

6

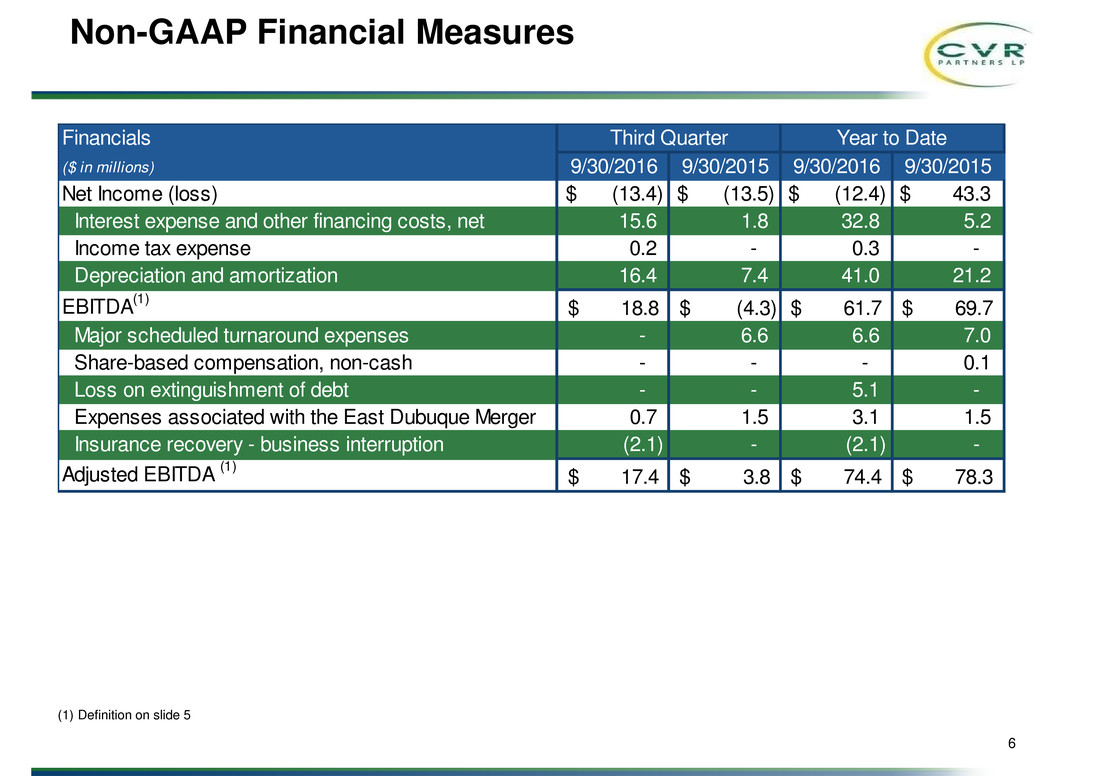

Non-GAAP Financial Measures

(1) Definition on slide 5

Financials

($ in millions) 9/30/2016 9/30/2015 9/30/2016 9/30/2015

Net Income (loss) (13.4)$ (13.5)$ (12.4)$ 43.3$

Interest expense and other financing costs, net 15.6 1.8 32.8 5.2

Income tax expense 0.2 - 0.3 -

Depreciation and amortization 16.4 7.4 41.0 21.2

EBITDA

(1)

18.8$ (4.3)$ 61.7$ 69.7$

Major scheduled turnaround expenses - 6.6 6.6 7.0

Share-based compensation, non-cash - - - 0.1

Loss on extinguishment of debt - - 5.1 -

Expenses associated with the East Dubuque Merger 0.7 1.5 3.1 1.5

Insurance recovery - business interruption (2.1) - (2.1) -

Adjusted EBITDA

(1)

17.4$ 3.8$ 74.4$ 78.3$

Third Quarter Year to Date

7

Non-GAAP Financial Measures

Pro Forma

(1) Definition on slide 5

(2) The summary unaudited pro forma financial information for the LTM period assumes CVR Partners owned the East Dubuque Facility for all periods

presented and also assumes the $645M principal balance of the 2023 senior secured notes was outstanding for all periods presented. Pro forma net income

(loss) has also been adjusted to exclude $13.0 million of nonrecurring expenses related to the fair value adjustment to acquisition-date inventory and

deferred revenue. Pro forma net income includes incremental depreciation resulting from increased fair value of the property, plant and equipment as noted

in the previously filed preliminary purchase price allocation. The summary pro forma financial information is for informational purposes only and does not

purport to represent what the Partnership's consolidated results of operations actually would have been if the East Dubuque Merger had occurred at any

date, and such data does not purport to project the Partnership's results of operations for any future period.

(3) Excludes full year of anticipated $12mm in synergies.

Financials LTM LTM

($ in millions) Q2 2016

(2) Q3 2016(2)

Net Income 7.9$ 11.8$

Interest expense and other financing costs, net 62.7 62.6

Income tax expense 0.1 0.3

Depreciation and amortization 73.2 70.9

EBITDA(1)(3) 143.9$ 145.6$

Major scheduled turnaround expenses 13.2 6.6

Share-based compensation, non-cash 0.6 0.4

Insurance recovery - business interruption - (2.1)

Adjusted EBITDA (1)(3) 157.7$ 150.5$