Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - CVR PARTNERS, LP | uan201510-kexhibit231.htm |

| EX-31.2 - EX-31.2 - CVR PARTNERS, LP | uan201510-kexhibit312.htm |

| EX-32.1 - EX-32.1 - CVR PARTNERS, LP | uan201510-kexhibit321.htm |

| EX-31.3 - EX-31.3 - CVR PARTNERS, LP | uan201510-kexhibit313.htm |

| EX-10.20 - EX-10.20 - CVR PARTNERS, LP | uan201510-kexhibit1020.htm |

| EX-10.18 - EX-10.18 - CVR PARTNERS, LP | uan201510-kexhibit1018.htm |

| EX-31.1 - EX-31.1 - CVR PARTNERS, LP | uan201510-kexhibit311.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________________

Form 10-K

(Mark One) | |

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015 | |

OR | |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to . | |

Commission file number: 001-35120

_____________________________________________________________

CVR Partners, LP

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 56-2677689 (I.R.S. Employer Identification No.) |

2277 Plaza Drive, Suite 500 Sugar Land, Texas (Address of principal executive offices) | 77479 (Zip Code) |

(281) 207-3200

(Registrant's telephone number, including area code)

_____________________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of each exchange on which registered |

Common units representing limited partner interests | New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 or Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated filer þ | Non-accelerated filer o | Smaller reporting company o |

(Do not check if a smaller reporting company) | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant computed based on the New York Stock Exchange closing price on June 30, 2015 (the last business day of the registrant's second fiscal quarter) was $427,694,729. Common units held by each executive officer and director and by each entity or person that, to the registrant's knowledge, owned 10% or more of the registrant's outstanding common units as of June 30, 2015 have been excluded from this number in that these persons may be deemed affiliates of the registrant. This determination of possible affiliate status is not necessarily a conclusive determination for other purposes.

Class | Outstanding at February 16, 2016 |

Common unit representing limited partner interests | 73,128,269 units |

TABLE OF CONTENTS

Page | ||

1

GLOSSARY OF SELECTED TERMS

The following are definitions of certain terms used in this Annual Report on Form 10-K for the year ended December 31, 2015 (this "Report").

ammonia | Ammonia is a direct application fertilizer and is primarily used as a building block for other nitrogen products for industrial applications and finished fertilizer products. | |

capacity | Capacity is defined as the throughput a process unit is capable of sustaining, either on a calendar or stream day basis. The throughput may be expressed in terms of maximum sustainable, nameplate or economic capacity. The maximum sustainable or nameplate capacities may not be the most economical. The economic capacity is the throughput that generally provides the greatest economic benefit based on considerations such as feedstock costs, product values and downstream unit constraints. | |

catalyst | A substance that alters, accelerates, or instigates chemical changes, but is neither produced, consumed nor altered in the process. | |

Coffeyville Resources or CRLLC | Coffeyville Resources, LLC, the subsidiary of CVR Energy which directly owns our general partner and 38,920,000 common units, or approximately 53% of our common units. | |

common units | Common units representing limited partner interests of CVR Partners, LP. | |

corn belt | The primary corn producing region of the United States, which includes Illinois, Indiana, Iowa, Minnesota, Missouri, Nebraska, Ohio and Wisconsin. | |

CVR Energy | CVR Energy, Inc., a publicly traded company listed on the New York Stock Exchange under the ticker symbol "CVI," which indirectly owns our general partner and the common units owned by CRLLC. | |

CVR Refining | CVR Refining, LP, a publicly traded limited partnership listed on the New York Stock Exchange under the ticker symbol "CVRR," which currently owns and operates a complex full coking medium-sour crude oil refinery with a rated capacity of 115,000 barrels per calendar day (bpcd) in Coffeyville, Kansas, a complex crude oil refinery with a rated capacity of 70,000 bpcd in Wynnewood, Oklahoma and ancillary businesses. | |

ethanol | A clear, colorless, flammable oxygenated hydrocarbon. Ethanol is typically produced chemically from ethylene, or biologically from fermentation of various sugars from carbohydrates found in agricultural crops and cellulosic residues from crops or wood. It is used in the United States as a gasoline octane enhancer and oxygenate. | |

farm belt | Refers to the states of Illinois, Indiana, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, Ohio, Oklahoma, South Dakota, Texas and Wisconsin. | |

feedstocks | Petroleum coke and petroleum products (such as crude oil and natural gas liquids) that are processed and blended into refined products, such as gasoline, diesel fuel and jet fuel, which are produced by a refinery. | |

general partner or CVR GP | CVR GP, LLC, our general partner, which is a wholly-owned subsidiary of Coffeyville Resources. | |

Initial Public Offering | The initial public offering of CVR Partners, LP common units that closed on April 13, 2011. | |

MMbtu | One million British thermal units: a measure of energy. One Btu of heat is required to raise the temperature of one pound of water one degree Fahrenheit. | |

MSCF | One thousand standard cubic feet, a customary gas measurement. | |

netback | Netback represents net sales less freight revenue divided by product sales volume in tons. Netback is also referred to as product pricing at gate. | |

NYSE | The New York Stock Exchange. | |

on-stream | Measurement of the reliability of the gasification, ammonia and UAN units, defined as the total number of hours operated by each unit divided by the total number of hours in the reporting period. | |

2

OSHA | Federal Occupational Safety and Health Act. | |

pet coke | Petroleum coke — a coal-like substance that is produced during the oil refining process. | |

prepaid sales | Represents customer payments under contracts to guarantee a price and supply of fertilizer in quantities expected to be delivered in the next twelve months. Revenue is not recorded for such sales until the product is considered delivered. Prepaid sales are also referred to as deferred revenue. | |

product pricing at gate | Product pricing at gate represents net sales less freight revenue divided by product sales volume in tons. Product pricing at gate is also referred to as netback. | |

recordable incident | An injury, as defined by OSHA. All work-related deaths and illnesses, and those work-related injuries which result in loss of consciousness, restriction of work or motion, transfer to another job, or require medical treatment beyond first aid. | |

Secondary Offering | The registered public offering of 12,000,000 common units of CVR Partners, LP, by CRLLC, which closed on May 28, 2013. | |

slag | A glasslike substance removed from the gasifier containing the metal impurities originally present in pet coke. | |

slurry | Ground pet coke blended with water and a fluxant (a mixture of fly ash and sand). | |

spot market | A market in which commodities are bought and sold for cash and delivered immediately. | |

syngas | Synthesized gas — a mixture of gases (largely carbon monoxide and hydrogen) that results from gasifying carbonaceous feedstock such as pet coke. | |

throughput | The volume processed through a unit. | |

ton | One ton is equal to 2,000 pounds. | |

turnaround | A periodically required standard procedure to refurbish and maintain a facility that involves the shutdown and inspection of major processing units. | |

UAN | UAN is an aqueous solution of urea and ammonium nitrate used as a fertilizer. | |

wheat belt | The primary wheat producing region of the United States, which includes Kansas, North Dakota, Oklahoma, South Dakota and Texas. | |

3

PART I

Item 1. Business

Overview

CVR Partners, LP ("CVR Partners," the "Partnership," "we," "us," or "our") is a Delaware limited partnership formed by CVR Energy to own, operate and grow our nitrogen fertilizer business. Strategically located adjacent to CVR Refining's refinery in Coffeyville, Kansas, our nitrogen fertilizer manufacturing facility is the only operation in North America that utilizes a petroleum coke, or pet coke, gasification process to produce nitrogen fertilizer.

We produce and distribute nitrogen fertilizer products, which are used primarily by farmers to improve the yield and quality of their crops. Our principal products are UAN and ammonia. These products are manufactured at our facility in Coffeyville, Kansas. Our product sales are heavily weighted toward UAN and all of our products are sold on a wholesale basis.

Our facility includes a 1,300 ton-per-day ammonia unit, a 3,000 ton-per-day UAN unit and a gasifier complex having a capacity of 89 million standard cubic feet per day of hydrogen. Our gasifier is a dual-train facility, with each gasifier able to function independently of the other, thereby providing redundancy and improving our reliability. Subsequent to the completion of the UAN expansion in February 2013, we upgrade substantially all of the ammonia we produce to higher margin UAN fertilizer, an aqueous solution of urea and ammonium nitrate which has historically commanded a premium price over ammonia. In 2015, we produced 928.6 thousand tons of UAN and 385.4 thousand tons of ammonia. Approximately 96% of our produced ammonia tons and the majority of the purchased ammonia were upgraded into UAN.

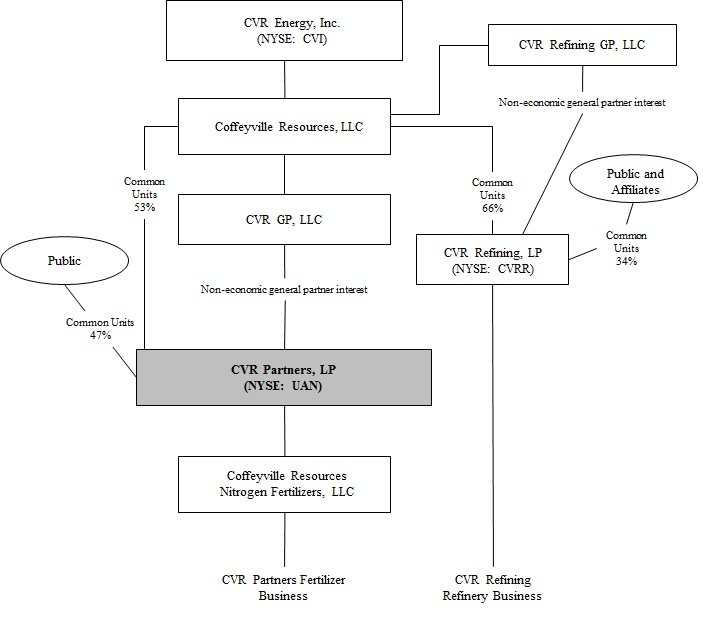

CVR Energy, which indirectly owns our general partner and approximately 53% of our outstanding common units, also indirectly owns the general partner and approximately 66% of the outstanding common units of CVR Refining at December 31, 2015. CVR Refining owns and operates a complex full coking medium-sour crude oil refinery with a rated capacity of 115,000 barrels per calendar day (bpcd) in Coffeyville, Kansas, a complex crude oil refinery with a rated capacity of 70,000 bpcd in Wynnewood, Oklahoma and ancillary businesses.

We intend to continue to expand our existing asset base and utilize the experience of our and CVR Energy's management teams to execute our growth strategy, which includes expanded production of UAN and acquiring and building additional infrastructure and production assets.

We generated net sales of $289.2 million, $298.7 million and $323.7 million and net income of $62.0 million, $76.1 million and $118.6 million for the years ended December 31, 2015, 2014 and 2013, respectively.

The primary raw material feedstock utilized in our nitrogen fertilizer production process is pet coke, which is produced during the crude oil refining process. In contrast, substantially all of our nitrogen fertilizer competitors use natural gas as their primary raw material feedstock. Historically, pet coke has been less expensive than natural gas on a per ton of fertilizer produced basis. Our facility's pet coke gasification process results in a significantly higher percentage of fixed costs than a natural gas-based fertilizer plant. We currently purchase most of our pet coke from CVR Refining pursuant to a long-term agreement having an initial term that ends in 2027, subject to renewal. During the past five years, over 70% of the pet coke consumed by our plant was produced and supplied by CVR Refining’s Coffeyville, Kansas crude oil refinery.

Pending Mergers

On August 9, 2015, CVR Partners entered into an Agreement and Plan of Merger (the "Merger Agreement") with Rentech Nitrogen Partners, L.P. ("Rentech Nitrogen") and Rentech Nitrogen GP, LLC ("Rentech Nitrogen GP"), pursuant to which CVR Partners would acquire Rentech Nitrogen and Rentech Nitrogen GP by merging two newly-created direct wholly-owned subsidiaries of CVR Partners with and into those entities with Rentech Nitrogen and Rentech Nitrogen GP continuing as surviving entities and wholly-owned subsidiaries of CVR Partners (together, the “mergers”). In accordance with accounting principles generally accepted in the United States and in accordance with the Financial Accounting Standards Board’s Accounting Standards Codification Topic 805, Business Combinations, the Partnership anticipates accounting for the mergers as an acquisition of a business with CVR Partners as the acquirer. Refer to Note 1 ("Formation of the Partnership, Organization and Nature of Business") of Part II. Item 8 of this Report for further discussion of the mergers.

4

Organizational Structure and Related Ownership

The following chart illustrates the organizational structure of the Partnership as of the date of this Report. The newly created merger subsidiaries as described in Note 1 ("Formation of the Partnership, Organization and Nature of Business") of Part II. Item 8 of this Report are not included in the chart.

5

Raw Material Supply

The nitrogen fertilizer facility's primary input is pet coke. Pet coke is produced as a byproduct of a refinery's coker unit process. In order to refine heavy or sour crude oil, which are lower in cost and more prevalent than higher quality crude oil, refiners use coker units, which enables refiners to further upgrade heavy crude oil. Our fertilizer plant is located in Coffeyville, Kansas, which is part of the Midwest pet coke market. Our average daily pet coke demand from 2013-2015 was approximately 1,300 tons per day.

During the past five years, over 70% of our pet coke requirements on average were supplied by CVR Refining's adjacent crude oil refinery, pursuant to a renewable long-term agreement. Historically we have obtained the remainder of our pet coke requirements from third parties such as other Midwestern refineries or pet coke brokers at spot-prices. We are party to a pet coke supply agreement with HollyFrontier Corporation. The term of this agreement ends in December 2016. If necessary, the gasification process can be modified to operate on coal as an alternative, which provides an additional raw material source. There are significant supplies of coal within a 60-mile radius of our nitrogen fertilizer plant.

Linde LLC ("Linde") owns, operates, and maintains the air separation plant that provides contract volumes of oxygen, nitrogen, and compressed dry air to our facility for a monthly fee. We provide and pay for all utilities required for operation of the air separation plant. The air separation plant has not experienced any long-term operating problems; however, CVR Energy maintains, for our benefit, contingent business interruption insurance with a $200.0 million limit for any interruption caused by physical damage to the air separation plant that results in a loss of production from an insured peril. The agreement with Linde provides that if our requirements for liquid or gaseous oxygen, liquid or gaseous nitrogen or clean dry air exceed specified instantaneous flow rates by at least 10%, we can solicit bids from Linde and third parties to supply our incremental product needs. We are required to provide notice to Linde of the approximate quantity of excess product that we will need and the approximate date by which we will need it. We and Linde will then jointly develop a request for proposal for soliciting bids from third parties and Linde. The bidding procedures may be limited under specified circumstances. The agreement with Linde expires in 2020.

Although we have our own boiler that is used to create start-up steam, we also have the ability to import start-up steam for the nitrogen fertilizer plant from CVR Refining's adjacent crude oil refinery and then export steam back to the crude oil refinery once all of our units are in service. We have entered into a feedstock and shared services agreement with a subsidiary of CVR Refining, which regulates, among other things, the import and export of start-up steam between the adjacent refinery and the nitrogen fertilizer plant. Monthly charges and credits are recorded with the steam valued at the natural gas price for the month.

Production Process

Our nitrogen fertilizer plant was built in 2000 with two separate gasifiers to provide redundancy and reliability. It uses a gasification process, licensed from an affiliate of the General Electric Company ("General Electric"), to convert pet coke to high purity hydrogen for subsequent conversion to ammonia. The nitrogen fertilizer plant is capable of producing approximately 1,300 tons per day of ammonia. Substantially all of the ammonia produced is converted to approximately 3,000 tons per day of UAN. Typically, about 0.41 tons of ammonia are required to produce one ton of UAN.

Pet coke is first ground and blended with water and a fluxant (a mixture of fly ash and sand) to form a slurry that is then pumped into the partial oxidation gasifier. The slurry is then contacted with oxygen from the air separation unit. Partial oxidation reactions take place and the synthesis gas, or syngas, consisting predominantly of hydrogen and carbon monoxide, is formed. The mineral residue from the slurry is a molten slag (a glasslike substance containing the metal impurities originally present in pet coke) and flows along with the syngas into a quench chamber. The syngas and slag are rapidly cooled and the syngas is separated from the slag.

Slag becomes a byproduct of the process. The syngas is scrubbed and saturated with moisture. The syngas next flows through a shift reactor unit where the carbon monoxide in the syngas is reacted with the moisture to form hydrogen and CO2. The heat from this reaction generates saturated steam. Most of this steam along with other steam produced in the ammonia and UAN plants is used internally. The excess steam not consumed by the process can be sent to the adjacent crude oil refinery.

After additional heat recovery, the high-pressure syngas is cooled and processed in the acid gas removal unit where carbon dioxide and hydrogen sulfide are removed. The syngas is then fed to a pressure swing adsorption ("PSA") unit, where the remaining impurities are extracted. The PSA unit reduces residual carbon monoxide and CO2 levels to trace levels, and the moisture-free, high-purity hydrogen is sent directly to the ammonia synthesis loop.

The hydrogen is reacted with nitrogen from the air separation unit in the ammonia unit to form the ammonia product. A large portion of the ammonia is converted to UAN. In 2015, we produced 928.6 thousand tons of UAN and 385.4 thousand tons

6

of ammonia. Approximately 96% of our produced ammonia tons and the majority of the purchased ammonia were upgraded into UAN.

We schedule and provide routine maintenance to our critical equipment using our own maintenance technicians. Pursuant to a technical services agreement with General Electric, which licenses the gasification technology to us, General Electric provides technical advice and technological updates from their ongoing research as well as other licensees' operating experiences. The pet coke gasification process is licensed from General Electric pursuant to a perpetual license agreement that is fully paid. The license grants us perpetual rights to use the pet coke gasification process on specified terms and conditions.

Distribution, Sales and Marketing

The primary geographic markets for our fertilizer products are Kansas, Missouri, Nebraska, Iowa, Illinois, Colorado and Texas. We market the ammonia products to industrial and agricultural customers and the UAN products to agricultural customers.

UAN and ammonia are distributed by truck or by railcar. If delivered by truck, products are sold on a freight-on-board basis, and freight is normally arranged by the customer. We lease and own a fleet of railcars for use in product delivery. We incur costs to maintain and repair our railcar fleet that include expenses related to regulatory inspections and repairs. For example, many of our railcars require specific regulatory inspections and repairs due on ten-year intervals. The extent and frequency of railcar fleet maintenance and repair costs are generally expected to change based partially on when regulatory inspections and repairs are due for our railcars under the relevant regulations. We operate eight rail loading and two truck loading racks for UAN. We also operate four rail loading and two truck loading racks for ammonia.

We own all of the truck and rail loading equipment at our nitrogen fertilizer facility. We also utilize two separate UAN storage tanks and related truck and railcar load-out facilities. Each of these facilities, located in Phillipsburg and Dartmouth, Kansas, has a UAN storage tank that has a capacity of two million gallons, or approximately 10,000 tons. The Phillipsburg property that the terminal was constructed on is owned by a subsidiary of CVR Refining, which operates the terminal. The Dartmouth terminal is located on leased property owned by the Pawnee County Cooperative Association, which operates the terminal. The purpose of the UAN terminals is to collectively distribute approximately 40,000 tons of UAN fertilizer annually.

We market agricultural products to destinations that produce strong margins. The UAN market is primarily located near the Union Pacific Railroad lines or destinations that can be supplied by truck. The ammonia market is primarily located near the Burlington Northern Santa Fe or Kansas City Southern Railroad lines or destinations that can be supplied by truck. By securing this business directly, we reduce our dependence on distributors serving the same customer base, which enables us to capture a larger margin and allows us to better control our product distribution. Most of the agricultural sales are made on a competitive spot basis. We also offer products on a prepay basis for in-season demand. The heavy in-season demand periods are spring and fall in the corn belt and summer in the wheat belt. The corn belt is the primary corn producing region of the United States, which includes Illinois, Indiana, Iowa, Minnesota, Missouri, Nebraska, Ohio and Wisconsin. The wheat belt is the primary wheat producing region of the United States, which includes Kansas, North Dakota, Oklahoma, South Dakota and Texas. Most of the industrial sales are spot sales.

We often use forward sales of our fertilizer products to optimize our asset utilization, planning process and production scheduling. These sales are made by offering customers the opportunity to purchase product on a forward basis at prices and delivery dates that we propose. We use this program to varying degrees during the year and between years depending on market conditions. We have the flexibility to decrease or increase forward sales depending on our view as to whether price environments will be increasing or decreasing. Fixing the selling prices of our products months in advance of their ultimate delivery to customers typically causes our reported selling prices and margins to differ from spot market prices and margins available at the time of shipment. As of December 31, 2015 and 2014, we had sold forward 171.6 thousand and 279.8 thousand tons of UAN at an average netback of $223 and $263 per ton over the next six months, respectively. Cash received as a result of prepayments is recognized as deferred revenue on our Consolidated Balance Sheet upon receipt, and revenue and resultant net income and EBITDA are recorded as the product is delivered.

Customers

We sell UAN products to retailers and distributors. In addition, we sell ammonia to agricultural and industrial customers. Some of our larger customers include Crop Production Services, Inc., Gavilon Fertilizer, LLC, Interchem, J.R. Simplot, Inc., MFA and United Suppliers, Inc. Given the nature of our business, and consistent with industry practice, we do not have long-term minimum purchase contracts with our UAN and ammonia customers.

For the year ended December 31, 2015, the top five UAN customers in the aggregate represented 40% of our fertilizer sales. Our top two fertilizer customers on a consolidated basis accounted for approximately 14% and 10%, respectively, of our net sales. While we do have high concentration of customers, we do not believe that the loss of any single customer would have

7

a material adverse effect on our results of operations, financial condition and ability to make cash distributions. Refer to Part I, Item 1A, Risk Factors, Our business depends on significant customers, and the loss of significant customers may have a material adverse effect on our results of operations, financial condition and ability to make cash distributions, of this Report for further discussion.

Competition

We have experienced and expect to continue to meet significant levels of competition from current and potential competitors, many of whom have significantly greater financial and other resources. Refer to Part I, Item 1A, Risk Factors, Nitrogen fertilizer products are global commodities, and we face intense competition from other nitrogen fertilizer producers, of this Report for further discussion.

Competition in our industry is dominated by price considerations. However, during the spring and fall application seasons, farming activities intensify and delivery capacity is a significant competitive factor. We maintain a large fleet of leased and owned railcars and seasonally adjust inventory to enhance our manufacturing and distribution operations.

Our major competitors include Agrium, Inc.; Koch Nitrogen Company, LLC; Potash Corporation of Saskatchewan, Inc.; CF Industries Holdings, Inc. and Terra Nitrogen Company, LP. Domestic competition is intense due to customers' sophisticated buying tendencies and competitor strategies that focus on cost and service. We also encounter competition from producers of fertilizer products manufactured in foreign countries. In certain cases, foreign producers of fertilizer who export to the United States may be subsidized by their respective governments.

Based on Blue Johnson & Associates, Inc. data regarding total U.S. use of UAN and ammonia, we estimate that our UAN capacity in 2015 represented approximately 7% of total U.S. UAN demand and that the net ammonia produced and marketed at our facility represented less than 1% of total U.S. ammonia demand.

Seasonality

Because we primarily sell agricultural commodity products, our business is exposed to seasonal fluctuations in demand for nitrogen fertilizer products in the agricultural industry. As a result, we typically generate greater net sales in the first half of the calendar year, which we refer to as the planting season, and our net sales tend to be lower during the second half of each calendar year, which we refer to as the fill season. In addition, the demand for fertilizers is affected by the aggregate crop planting decisions and fertilizer application rate decisions of individual farmers who make planting decisions based largely on the prospective profitability of a harvest. The specific varieties and amounts of fertilizer they apply depend on factors like crop prices, farmers' current liquidity, soil conditions, weather patterns and the types of crops planted.

Environmental Matters

Our business is subject to extensive and frequently changing federal, state and local, environmental, health and safety laws and regulations governing the emission and release of hazardous substances into the environment, the treatment and discharge of waste water and the storage, handling, use and transportation of our nitrogen fertilizer products. These laws and regulations, their underlying regulatory requirements and the enforcement thereof impact us by imposing:

• | restrictions on operations or the need to install enhanced or additional controls; |

• | the need to obtain and comply with permits and authorizations; |

• | liability for the investigation and remediation of contaminated soil and groundwater at current and former facilities (if any) and off-site waste disposal locations; and |

• | specifications for the products we market, primarily UAN and ammonia. |

Our operations require numerous permits and authorizations. Failure to comply with these permits or environmental laws and regulations generally could result in fines, penalties or other sanctions or a revocation of our permits. In addition, the laws and regulations to which we are subject are often evolving and many of them have become more stringent or have become subject to more stringent interpretation or enforcement by federal and state agencies. The ultimate impact on our business of complying with existing laws and regulations is not always clearly known or determinable due in part to the fact that our operations may change over time and certain implementing regulations for laws, such as the federal Clean Air Act, have not yet been finalized, are under governmental or judicial review or are being revised. These laws and regulations could result in increased capital, operating and compliance costs or result in delays or limits to our operations or growth while attempting to obtain required permits.

The principal environmental risks associated with our business are outlined below.

8

The Federal Clean Air Act

The federal Clean Air Act and its implementing regulations, as well as the corresponding state laws and regulations that regulate emissions of pollutants into the air, affect us through the federal Clean Air Act's permitting requirements and emission control requirements relating to specific air pollutants, as well as the requirement to maintain a risk management program to help prevent accidental releases of certain substances. Some or all of the standards promulgated pursuant to the federal Clean Air Act, or any future promulgations of standards, may require the installation of controls or changes to our nitrogen fertilizer facility in order to comply. If new controls or changes to operations are needed, the costs could be material. These new requirements, other requirements of the federal Clean Air Act, or other presently existing or future environmental regulations could cause us to expend substantial amounts to comply and/or permit our facility to produce products that meet applicable requirements.

The regulation of air emissions under the federal Clean Air Act requires that we obtain various construction and operating permits and incur capital expenditures for the installation of certain air pollution control devices at our operations. Various regulations specific to our operations have been implemented, such as National Emission Standard for Hazardous Air Pollutants, New Source Performance Standards and New Source Review. We have incurred, and expect to continue to have to make substantial capital expenditures to attain or maintain compliance with these and other air emission regulations that have been promulgated or may be promulgated or revised in the future.

Release Reporting

The release of hazardous substances or extremely hazardous substances into the environment is subject to release reporting requirements under federal and state environmental laws. We periodically experience releases of hazardous or extremely hazardous substances from our equipment. Our facility periodically has excess emission events from flaring and other planned and unplanned startup, shutdown and malfunction events. Such releases are reported to the U.S. Environmental Protection Agency (the "EPA") and relevant state and local agencies. From time to time, the EPA has conducted inspections and issued information requests to us with respect to our compliance with release reporting requirements under the Comprehensive Environmental Response, Compensation and Liability Act ("CERCLA") and the Emergency Planning and Community Right-to-Know Act. If we fail to properly report a release, or if the release violates the law or our permits, it could cause us to become the subject of a governmental enforcement action or third-party claims. Government enforcement or third-party claims relating to releases of hazardous or extremely hazardous substances could result in significant expenditures and liability.

Greenhouse Gas Emissions

Refer to Part I, Item 1A, Risk Factors, Climate change laws and regulations could have a material adverse effect on our results of operations, financial condition and ability to make cash distributions, of this Report for further discussion of the Greenhouse Gas ("GHG") Emissions regulations.

Environmental Remediation

Under CERCLA, the Resource Conservation and Recovery Act, and related state laws, certain persons may be liable for the release or threatened release of hazardous substances. These persons can include the current owner or operator of property where a release or threatened release occurred, any persons who owned or operated the property when the release occurred, and any persons who disposed of, or arranged for the transportation or disposal of, hazardous substances at a contaminated property. Liability under CERCLA is strict, and, under certain circumstances, joint and several, so that any responsible party may be held liable for the entire cost of investigating and remediating the release of hazardous substances. As is the case with all companies engaged in similar industries, we face potential exposure from future claims and lawsuits involving environmental matters, including soil and water contamination, personal injury or property damage allegedly caused by hazardous substances that we manufactured, handled, used, stored, transported, spilled, disposed of or released. We cannot assure you that we will not become involved in future proceedings related to our release of hazardous or extremely hazardous substances or that, if we were held responsible for damages in any existing or future proceedings, such costs would be covered by insurance or would not be material.

Environmental Insurance

We are covered by CVR Energy's site pollution legal liability insurance policy with an aggregate limit of $50.0 million per pollution condition, subject to a self-insured retention of $1.0 million. The policy includes business interruption coverage, subject to a 5-day waiting period deductible. This insurance expires on March 1, 2016 and is expected to be renewed without any material changes in terms. The policy insures any location owned, leased, rented or operated by the Partnership, including our nitrogen fertilizer facility. The policy insures certain pollution conditions at, or migrating from, a covered location, certain waste transportation and disposal activities and business interruption.

9

In addition to the site pollution legal liability insurance policy, we benefit from umbrella and excess casualty insurance policies maintained by CVR Energy having an aggregate and occurrence limit of $200.0 million, subject to a self-insured retention of $2.0 million. This insurance provides coverage due to named perils for claims involving pollutants where the discharge is sudden and accidental and first commenced at a specific day and time during the policy period. The casualty insurance policies, including umbrella and excess policies, expire on March 1, 2016 and are expected to be renewed or replaced by insurance policies containing materially equivalent sudden and accidental pollution coverage with no reduction in limits.

The site pollution legal liability policy and the pollution coverage provided in the casualty insurance policies contain discovery requirements, reporting requirements, exclusions, definitions, conditions and limitations that could apply to a particular pollution claim, and there can be no assurance such claim will be adequately insured for all potential damages.

Safety, Health and Security Matters

We are subject to a number of federal and state laws and regulations related to safety, including the Occupational Safety and Health Administration Act ("OSHA"), and comparable state statutes, the purpose of which are to protect the health and safety of workers. We also are subject to OSHA Process Safety Management regulations, which are designed to prevent or minimize the consequences of catastrophic releases of toxic, reactive, flammable or explosive chemicals.

We operate a comprehensive safety, health and security program, with participation by employees at all levels of the organization. We have developed comprehensive safety programs aimed at preventing OSHA recordable incidents. Despite our efforts to achieve excellence in our safety and health performance, there can be no assurances that there will not be accidents resulting in injuries or even fatalities. We routinely audit our programs and consider improvements in our management systems.

Process Safety Management. We maintain a process safety management program ("PSM"). This program is designed to address all aspects of OSHA guidelines for developing and maintaining a comprehensive process safety management program. We will continue to audit our programs and consider improvements in our management systems and equipment.

Risk Management Program. We maintain an EPA risk management program. This program is similar to PSM but also includes environmental and worst case scenario protections.

Emergency Planning and Response. We have an emergency response plan that describes the organization, responsibilities and plans for responding to emergencies in our facility. This plan is communicated to local regulatory and community groups. We have on-site warning siren systems and personal radios. We will continue to audit our programs and consider improvements in our management systems and equipment.

Employees

As of December 31, 2015, we had 149 direct employees. As of December 31, 2015, these employees are covered by health insurance, disability and retirement plans established by CVR Energy. None of our employees are unionized, and we believe that our relationship with our employees is good.

We also rely on the services of employees of CVR Energy and its subsidiaries in the operation of our business pursuant to a services agreement. Additionally, the Partnership's general partner manages the Partnership's operations and activities as specified in the partnership agreement and had 5 employees as of December 31, 2015. For more information on these agreements, see Note 14 ("Related Party Transactions") to Part II. Item 8 of this Report.

Available Information

Our website address is www.cvrpartners.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports, are available free of charge through our website under "Investor Relations," as soon as reasonably practicable after the electronic filing of these reports is made with the Securities and Exchange Commission (the "SEC"). In addition, our Corporate Governance Guidelines, Codes of Ethics and the Charter of the Audit Committee and the Compensation Committee of the Board of Directors of our general partner are available on our website. These guidelines, policies and charters are also available in print without charge to any unitholder requesting them. We do not intend for information contained in our website to be part of this Report.

Trademarks, Trade Names and Service Marks

This Report may include our and our affiliates' trademarks, including Coffeyville Resources, the Coffeyville Resources logo, the CVR Partners, LP logo, the CVR Refining, LP logo and the CVR Energy, Inc. logo, each of which is registered or for which we are applying for federal registration with the United States Patent and Trademark Office. This Report may also contain trademarks, service marks, copyrights and trade names of other companies.

10

Item 1A. Risk Factors

You should carefully consider each of the following risks together with the other information contained in this Report and all of the information set forth in our filings with the SEC. If any of the following risks and uncertainties develop into actual events, our business, financial condition, cash flows or results of operations could be materially adversely affected. In that case, we might not be able to pay distributions on our common units, the trading price of our common units could decline, and you could lose all or part of your investment. Although many of our business risks are comparable to those faced by a corporation engaged in a similar business, limited partner interests are inherently different from the capital stock of a corporation and involve additional risks described below.

Risks Related to Our Business

We may not have sufficient cash available to pay any quarterly distribution on our common units. Furthermore, we are not required to make distributions to holders of our common units on a quarterly basis or otherwise, and may elect to distribute less than all of our available cash.

We may not have sufficient cash available each quarter to enable us to pay any distributions to our common unitholders. Furthermore, our partnership agreement does not require us to pay distributions on a quarterly basis or otherwise. Although our general partner's current policy is to distribute all of our available cash on a quarterly basis. Available cash is defined as Adjusted EBITDA reduced for cash needed for (i) net interest expense (excluding capitalized interest) and debt service and other contractual obligations; (ii) maintenance capital expenditures; and (iii) to the extent applicable, major scheduled turnaround expenses, reserves for future operating or capital needs that the board of directors of the general partner deems necessary or appropriate, and expenses associated with the Rentech Nitrogen mergers, if any. Available cash may be increased by the release of previously established cash reserve, if any, at the discretion of the board of directors of our general partner. The board of directors of our general partner may at any time, for any reason, change this policy or decide not to pay cash distributions on a quarterly basis or other basis. The amount of cash we will be able to distribute on our common units principally depends on the amount of cash we generate from our operations, which is directly dependent upon the operating margins we generate, which have been volatile historically. Our operating margins are significantly affected by the market-driven UAN and ammonia prices we are able to charge our customers and our pet coke-based gasification production costs, as well as seasonality, weather conditions, governmental regulation, unscheduled maintenance or downtime at our facilities and global and domestic demand for nitrogen fertilizer products, among other factors. In addition:

• | The amount of distributions we pay, if any, and the decision to make any distribution at all will be determined by the board of directors of our general partner, whose interests may differ from those of our common unitholders. Our general partner has limited fiduciary and contractual duties, which may permit it to favor its own interests or the interests of CVR Energy to the detriment of our common unitholders. |

• | Our credit facility, which matures in April 2016, and any credit facility or other debt instruments we enter into in the future, may limit the distributions that we can make. Our credit facility provides that we can make distributions to holders of our common units, but only if we are in compliance with our leverage ratio and interest coverage ratio covenants on a pro forma basis after giving effect to any distribution, and there is no default or event of default under the facility. In addition, any future credit facility may contain other financial tests and covenants that we must satisfy. Any failure to comply with these tests and covenants could result in the lenders prohibiting distributions by us. |

• | In accordance with the terms of the Merger Agreement, beginning with the distribution for the third quarter of 2015 and until the closing of the mergers, the Partnership may not make or declare distributions in excess of available cash for distribution in respect of any quarter. |

• | The actual amount of available cash depends on numerous factors, some of which are beyond our control, including UAN and ammonia prices, our operating costs, global and domestic demand for nitrogen fertilizer products, fluctuations in our working capital needs, and the amount of fees and expenses incurred by us. |

The amount of our quarterly cash distributions, if any, will vary significantly both quarterly and annually and will be directly dependent on the performance of our business.

We expect our business performance will be more seasonal and volatile, and our cash flows will be less stable, than the business performance and cash flows of most publicly traded partnerships. As a result, our quarterly cash distributions will be volatile and are expected to vary quarterly and annually. Unlike most publicly traded partnerships, we do not have a minimum quarterly distribution or employ structures intended to consistently maintain or increase distributions over time. The amount of our quarterly cash distributions will be directly dependent on the performance of our business, which has been volatile

11

historically as a result of volatile nitrogen fertilizer and natural gas prices, and seasonal and global fluctuations in demand for nitrogen fertilizer products. Because our quarterly distributions will be subject to significant fluctuations, future quarterly distributions paid to our unitholders will vary significantly from quarter to quarter and may be zero.

The board of directors of our general partner may modify or revoke our cash distribution policy at any time at its discretion, including in such a manner that would result in an elimination of cash distributions regardless of the amount of available cash we generate. Our partnership agreement does not require us to make any distributions at all.

Our general partner's current policy is to distribute all of the available cash we generate each quarter to unitholders of record on a pro rata basis. However, the board of directors of our general partner may change such policy at any time at its discretion and could elect not to make distributions for one or more quarters regardless of the amount of available cash we generate. Our partnership agreement does not require us to make any distributions at all. Any modification or revocation of our cash distribution policy could substantially reduce or eliminate the amounts of distributions to our unitholders.

The nitrogen fertilizer business is, and nitrogen fertilizer prices are, cyclical and highly volatile and have experienced substantial downturns in the past. Cycles in demand and pricing could potentially expose us to significant fluctuations in our operating and financial results, and expose you to substantial volatility in our quarterly cash distributions and material reductions in the trading price of our common units.

We are exposed to fluctuations in nitrogen fertilizer demand in the agricultural industry. These fluctuations historically have had and could in the future have significant effects on prices across all nitrogen fertilizer products and, in turn, our financial condition, cash flows and results of operations, which could result in significant volatility or material reductions in the price of our common units or an inability to make quarterly cash distributions on our common units.

Nitrogen fertilizer products are commodities, the price of which can be highly volatile. The price of nitrogen fertilizer products depend on a number of factors, including general economic conditions, cyclical trends in end-user markets, supply and demand imbalances, governmental policies and weather conditions, which have a greater relevance because of the seasonal nature of fertilizer application. If seasonal demand exceeds the projections on which we base production, our customers may acquire nitrogen fertilizer products from our competitors, and our profitability will be negatively impacted. If seasonal demand is less than we expect, we will be left with excess inventory that will have to be stored or liquidated.

Demand for nitrogen fertilizer products is dependent on demand for crop nutrients by the global agricultural industry. The international market for nitrogen fertilizers is influenced by such factors as the relative value of the U.S. dollar and its impact upon the cost of importing nitrogen fertilizers, foreign agricultural policies, the existence of, or changes in, import or foreign currency exchange barriers in certain foreign markets, changes in the hard currency demands of certain countries and other regulatory policies of foreign governments, as well as the laws and policies of the United States affecting foreign trade and investment. Nitrogen-based fertilizers remain solidly in demand, driven by a growing world population, changes in dietary habits and an expanded use of corn for the production of ethanol. Supply is affected by available capacity and operating rates, raw material costs, government policies and global trade. A decrease in nitrogen fertilizer prices would have a material adverse effect on our business, cash flow and ability to make distributions.

Our internally generated cash flows and other sources of liquidity may not be adequate for our capital needs. As a result, we may not be able to pay any cash distributions to our unitholders and the trading price of our common units may be adversely impacted.

If we cannot generate adequate cash flow or otherwise secure sufficient liquidity to meet our working capital needs or support our short-term and long-term capital requirements, we may be unable to meet our debt obligations, pursue our business strategies or comply with certain environmental standards, which would have a material adverse effect on our business and results of operations. As of December 31, 2015, we had cash and cash equivalents of $50.0 million and $25.0 million available under our revolving credit facility.

The costs associated with operating our nitrogen fertilizer plant are largely fixed. If nitrogen fertilizer prices fall below a certain level, we may not generate sufficient revenue to operate profitably or cover our costs and our ability to make distributions will be adversely impacted.

Unlike our competitors, whose primary costs are related to the purchase of natural gas and whose costs are therefore largely variable, we have largely fixed costs. As a result of the fixed cost nature of our operations, downtime, interruptions or low productivity due to reduced demand, adverse weather conditions, equipment failure, a decrease in nitrogen fertilizer prices or other causes can result in significant operating losses, which would have a material adverse effect on our results of operations, financial condition and ability to make cash distributions.

12

Continued low natural gas prices could impact our relative competitive position when compared to other nitrogen fertilizer producers.

Most nitrogen fertilizer manufacturers rely on natural gas as their primary feedstock, and the cost of natural gas is a large component of the total production cost for natural gas-based nitrogen fertilizer manufacturers. Low natural gas prices benefit our competitors and disproportionately impact our operations by making us less competitive with natural gas-based nitrogen fertilizer manufacturers. Continued low natural gas prices could impair our ability to compete with other nitrogen fertilizer producers who utilize natural gas as their primary feedstock if nitrogen fertilizer pricing drops as a result of low natural gas prices, and therefore have a material adverse impact on the trading price of our common units.

Any decline in U.S. agricultural production or limitations on the use of nitrogen fertilizer for agricultural purposes could have a material adverse effect on the sales of nitrogen fertilizer, and on our results of operations, financial condition and ability to make cash distributions.

Conditions in the U.S. agricultural industry significantly impact our operating results. The U.S. agricultural industry can be affected by a number of factors, including weather patterns and field conditions, current and projected grain inventories and prices, domestic and international population changes, demand for U.S. agricultural products and U.S. and foreign policies regarding trade in agricultural products.

The Agricultural Act of 2014 ("the 2014 Farm Bill") ends direct subsidies to agricultural producers for owning farmland, and funds a new crop insurance program in its place. As part of the conservation title of the 2014 farm bill, agricultural producers must meet a minimum standard of environmental protection in order to receive federal crop insurance on sensitive lands. The 2014 Farm Bill also discourages producers from converting native grasslands to farmland by limiting crop insurance subsidies for the first few years for newly converted lands. These changes may have a negative impact on fertilizer sales and on our results of operations, financial condition and ability to make cash distributions.

State and federal governmental policies, including farm and biofuel subsidies and commodity support programs, as well as the prices of fertilizer products, may also directly or indirectly influence the number of acres planted, the mix of crops planted and the use of fertilizers for particular agricultural applications. Developments in crop technology, such as nitrogen fixation (the conversion of atmospheric nitrogen into compounds that plants can assimilate), could also reduce the use of chemical fertilizers and adversely affect the demand for nitrogen fertilizer. In addition, from time to time various state legislatures have considered limitations on the use and application of chemical fertilizers due to concerns about the impact of these products on the environment. Unfavorable state and federal governmental policies could negatively affect nitrogen fertilizer prices and therefore have a material adverse effect on our results of operations, financial condition ability to make cash distributions.

A major factor underlying the current high level of demand for our nitrogen-based fertilizer products is the production of ethanol. A decrease in ethanol production, an increase in ethanol imports or a shift away from corn as a principal raw material used to produce ethanol could have a material adverse effect on our results of operations, financial condition and ability to make cash distributions.

A major factor underlying the solid level of demand for our nitrogen-based fertilizer products is the production of ethanol in the United States and the use of corn in ethanol production. Ethanol production in the United States is highly dependent upon a myriad of federal statutes and regulations, and is made significantly more competitive by various federal and state incentives and mandated usage of renewable fuels pursuant to the federal renewable fuel standards ("RFS"). To date, the RFS has been satisfied primarily with fuel ethanol blended into gasoline. However, a number of factors, including the continuing "food versus fuel" debate and studies showing that expanded ethanol usage may increase the level of greenhouse gases in the environment as well as be unsuitable for small engine use, have resulted in calls to reduce subsidies for ethanol, allow increased ethanol imports and to repeal or waive (in whole or in part) the current RFS, any of which could have an adverse effect on corn-based ethanol production, planted corn acreage and fertilizer demand. Therefore, ethanol incentive programs may not be renewed, or if renewed, they may be renewed on terms significantly less favorable to ethanol producers than current incentive programs.

Recently, the volume of ethanol required by the RFS standards to be blended into transportation fuel has approached the "blend wall". The blend wall is the maximum amount of ethanol that can be blended into the transportation fuel supply because of limitations like the ability of cars to use higher ethanol blended fuels and limitations on blending and distribution infrastructure. The blend wall is generally considered to be reached when more than 10% ethanol by volume ("E10 gasoline") is blended into transportation fuel. On December 14, 2015, the EPA published in the Federal Register a final rule establishing the renewable fuel volume mandates for 2014, 2015, and 2016, and the biomass-based diesel mandate for 2017. The volumes included in EPA’s final rule increase each year, but are lower, with the exception of the volumes for biomass-based diesel, than the volumes required by the Clean Air Act. EPA used its waiver authority to lower the volumes, but its decision to do so has been challenged in the U.S. Court of Appeals for the District of Columbia Circuit by corn growers and renewable fuels producers. The renewable fuel volume mandate for 2016 is expected to breach the blend wall, forcing higher ethanol fuel blends, including fuels with 15% or 85% ethanol, or non-ethanol renewable fuel that is not constrained by the blend wall. In

13

addition, in the final rule establishing the renewable volume obligations for 2014-2016 and bio-mass based diesel for 2017, the EPA articulated a policy to incentivize additional investments in renewable fuel blending and distribution infrastructure by increasing the price of RINs. Any substantial decrease in future volume obligations under RFS could have a material adverse effect on ethanol production in the United States, which could have a material adverse effect on our results of operations, financial condition and ability to make cash distributions.

Further, while most ethanol is currently produced from corn and other raw grains, such as milo or sorghum, the current RFS federal mandate requires a portion of the overall RFS federal mandate to come from advanced biofuels, including cellulose-based biomass, such as agricultural waste, forest residue, municipal solid waste and energy crops (plants grown for use to make biofuels or directly exploited for their energy content) and biomass-based diesel. In addition, there is a continuing trend to encourage the use of products other than corn and raw grains for ethanol production. If this trend is successful, the demand for corn may decrease significantly, which could reduce demand for our nitrogen fertilizer products and have an adverse effect on our results of operations, financial condition and ability to make cash distributions. This potential impact on the demand for nitrogen fertilizer products; however, could be slightly offset by the potential market for nitrogen fertilizer product usage in connection with the production of cellulosic biofuels.

Nitrogen fertilizer products are global commodities, and we face intense competition from other nitrogen fertilizer producers.

Our business is subject to intense price competition from both U.S. and foreign sources, including competitors operating in the Middle East, the Asia-Pacific region, the Caribbean, Russia and the Ukraine. Fertilizers are global commodities, with little or no product differentiation, and customers make their purchasing decisions principally on the basis of delivered price and availability of the product. Increased global supply may put downward pressure on fertilizer prices. Furthermore, in recent years the price of nitrogen fertilizer in the United States has been substantially driven by pricing in the global fertilizer market. We compete with a number of U.S. producers and producers in other countries, including state-owned and government-subsidized entities. Some competitors have greater total resources and are less dependent on earnings from fertilizer sales, which makes them less vulnerable to industry downturns and better positioned to pursue new expansion and development opportunities. Increased domestic supply may put downward pressure on fertilizer prices. Competitors utilizing different corporate structures may be better able to withstand lower cash flows than we can as a limited partnership. Our competitive position could suffer to the extent we are not able to expand our own resources either through investments in new or existing operations or through acquisitions, joint ventures or partnerships. An inability to compete successfully could result in the loss of customers, which could adversely affect our sales and profitability, and our ability to make cash distributions.

Adverse weather conditions during peak fertilizer application periods may have a material adverse effect on our results of operations, financial condition and ability to make cash distributions, because our agricultural customers are geographically concentrated.

Our sales of nitrogen fertilizer products to agricultural customers are concentrated in the Great Plains and Midwest states and are seasonal in nature. For example, we generate greater net sales and operating income in the first half of the year, which we refer to as the planting season, compared to the second half of the year. Accordingly, an adverse weather pattern affecting agriculture in these regions or during the planting season could have a negative effect on fertilizer demand, which could, in turn, result in a material decline in our net sales and margins and otherwise have a material adverse effect on our results of operations, financial condition and ability to make cash distributions. Our quarterly results may vary significantly from one year to the next due largely to weather-related shifts in planting schedules and purchase patterns. In addition, given the seasonal nature of our business, we expect that our distributions will be volatile and will vary quarterly and annually.

Our business is seasonal, which may result in our carrying significant amounts of inventory and seasonal variations in working capital. Our inability to predict future seasonal nitrogen fertilizer demand accurately may result in excess inventory or product shortages.

Our business is seasonal. Farmers tend to apply nitrogen fertilizer during two short application periods, one in the spring and the other in the fall. The strongest demand for our products typically occurs during the spring planting season. In contrast, we and other nitrogen fertilizer producers generally produce our products throughout the year. As a result, we and our customers generally build inventories during the low demand periods of the year in order to ensure timely product availability during the peak sales seasons. The seasonality of nitrogen fertilizer demand results in our sales volumes and net sales being highest during the North American spring season and our working capital requirements typically being highest just prior to the start of the spring season.

If seasonal demand exceeds our projections, we will not have enough product and our customers may acquire products from our competitors, which would negatively impact our profitability. If seasonal demand is less than we expect, we will be left with excess inventory and higher working capital and liquidity requirements.

14

The degree of seasonality of our business can change significantly from year to year due to conditions in the agricultural industry and other factors. As a consequence of our seasonality, we expect that our distributions will be volatile and will vary quarterly and annually.

Our operations are dependent on third-party suppliers, including Linde, which owns an air separation plant that provides oxygen, nitrogen and compressed dry air to our facility, and the City of Coffeyville, which supplies us with electricity. A deterioration in the financial condition of a third-party supplier, a mechanical problem with the air separation plant, or the inability of a third-party supplier to perform in accordance with its contractual obligations could have a material adverse effect on our results of operations, financial condition and on our ability to make cash distributions.

Our operations depend in large part on the performance of third-party suppliers, including Linde for the supply of oxygen, nitrogen and compressed dry air, and the City of Coffeyville for the supply of electricity. With respect to Linde, our operations could be adversely affected if there were a deterioration in Linde's financial condition such that the operation of the air separation plant located adjacent to our nitrogen fertilizer plant was disrupted. Additionally, this air separation plant in the past has experienced numerous short-term interruptions, causing interruptions in our gasifier operations. With respect to electricity, in 2010 we entered into an amended and restated electric services agreement with the City of Coffeyville, Kansas which gives us an option to extend the term of such agreement through June 30, 2024. Should Linde, the City of Coffeyville or any of our other third-party suppliers fail to perform in accordance with existing contractual arrangements, our operation could be forced to halt. Alternative sources of supply could be difficult to obtain. Any shutdown of our operations, even for a limited period, could have a material adverse effect on our results of operations, financial condition and ability to make cash distributions.

Our results of operations, financial condition and ability to make cash distributions may be adversely affected by the supply and price levels of pet coke. Failure by CVR Refining to continue to supply us with pet coke (to the extent third-party pet coke is unavailable or available only at higher prices), or CVR Refining's imposition of an obligation to provide it with security for our payment obligations, could negatively impact our results of operations.

Our profitability is directly affected by the price and availability of pet coke obtained from CVR Refining's Coffeyville, Kansas crude oil refinery pursuant to a long-term agreement and pet coke purchased from third parties, both of which vary based on market prices. Pet coke is a key raw material used by us in the manufacture of nitrogen fertilizer products. If pet coke costs increase, we may not be able to increase our prices to recover these increased costs, because market prices for our nitrogen fertilizer products are not correlated with pet coke prices.

Based on our current output, we obtain most (over 70% on average during the last five years) of the pet coke we need from CVR Refining's adjacent crude oil refinery, and procure the remainder on the open market. The price that we pay CVR Refining for pet coke is based on the lesser of a pet coke price derived from the price we receive for UAN (subject to a UAN-based price ceiling and floor) and a pet coke index price. In most cases, the price we pay CVR Refining will be lower than the price which we would otherwise pay to third parties. Pet coke prices could significantly increase in the future. Should CVR Refining fail to perform in accordance with our existing agreement, we would need to purchase pet coke from third parties on the open market, which could negatively impact our results of operations to the extent third-party pet coke is unavailable or available only at higher prices.

We may not be able to maintain an adequate supply of pet coke. In addition, we could experience production delays or cost increases if alternative sources of supply prove to be more expensive or difficult to obtain. We currently purchase 100% of the pet coke produced by CVR Refining's Coffeyville refinery. Accordingly, if we increase our production, we will be more dependent on pet coke purchases from third-party suppliers at open market prices. We are party to a pet coke supply agreement with HollyFrontier Corporation. The term of this agreement ends in December 2016. There is no assurance that we would be able to purchase pet coke on comparable terms from third parties or at all.

Under our pet coke agreement with CVR Refining, we may become obligated to provide security for our payment obligations if, in CVR Refining's sole judgment, there is a material adverse change in our financial condition or liquidity position or in our ability to pay for our pet coke purchases. See Part III, Item 13 "Certain Relationships and Related Transactions, and Director Independence — Agreements with CVR Energy and CVR Refining — Coke Supply Agreement" of this Report.

15

We rely on third-party providers of transportation services and equipment, which subjects us to risks and uncertainties beyond our control that may have a material adverse effect on our results of operations, financial condition and ability to make distributions.

We rely on railroad and trucking companies to ship finished products to our customers. We also lease railcars from railcar owners in order to ship our finished products. These transportation operations, equipment and services are subject to various hazards, including extreme weather conditions, work stoppages, delays, spills, derailments and other accidents and other operating hazards.

These transportation operations, equipment and services are also subject to environmental, safety and other regulatory oversight. Due to concerns related to terrorism or accidents, local, state and federal governments could implement new regulations affecting the transportation of our finished products. In addition, new regulations could be implemented affecting the equipment used to ship our finished products.

Any delay in our ability to ship our finished products as a result of these transportation companies' failure to operate properly, the implementation of new and more stringent regulatory requirements affecting transportation operations or equipment, or significant increases in the cost of these services or equipment could have a material adverse effect on our results of operations, financial condition and ability to make cash distributions.

Our facility faces significant risks due to physical damage hazards, environmental liability risk exposure, and unplanned or emergency partial or total plant shutdowns resulting in business interruptions. We could incur potentially significant costs to the extent there are unforeseen events which cause property damage and a material decline in production which are not fully insured. Insurance companies that currently insure companies in our industry may limit or curtail coverage, may modify the coverage provided or may substantially increase premiums in the future.

Our operations, located at a single location, are subject to significant operating hazards and interruptions. If our production plant or individual units within our plant, logistics assets, or key suppliers sustain a catastrophic loss and operations are shut down or significantly impaired, it would have a material adverse impact on our operations, financial condition and cash flows and adversely impact our ability to make cash distributions. Moreover, our facility is located adjacent to CVR Refining's Coffeyville refinery, and a major accident or disaster at the refinery could adversely affect our operations. Operations at our nitrogen fertilizer plant could be curtailed or partially or completely shut down, for an extended period of time as a result of unexpected circumstances, which may not be within our control, such as:

• | major unplanned maintenance requirements; |

• | catastrophic events caused by mechanical breakdown, electrical injury, pressure vessel rupture, explosion, contamination, fire, or natural disasters, including flood, windstorm, etc; |

• | labor supply shortages, or labor difficulties that result in a work stoppage or slowdown; |

• | cessation of all or a portion of the operations at our nitrogen fertilizer plant dictated by environmental authorities; |

• | a disruption in the supply of pet coke to our nitrogen fertilizer plant; |

• | a governmental ban or other limitation on the use of nitrogen fertilizer products, either generally or specifically those manufactured at our plant; and |

• | an event or incident involving a large clean-up, decontamination, or the imposition of laws and ordinances regulating the cost and schedule of demolition or reconstruction. Such regulatory oversight can cause significant delays in restoring property to its pre-loss condition. |

We have sustained losses over the past ten-year period at our nitrogen fertilizer plant, which are illustrative of the types of risks and hazards that exit. These losses or events resulted in costs assumed by us that were not fully insured due to policy retentions or applicable exclusions. These events were as follows:

• | June 2007: the flood at CVR Refining's Coffeyville refinery and nitrogen fertilizer plant; and |

• | September 2010: the secondary urea reactor rupture at the nitrogen fertilizer plant. |

The magnitude of the effect on us of any shutdown will depend on the length of the shutdown and the extent of the plant operations affected by the shutdown. Our plant requires a scheduled maintenance turnaround approximately every two to three years, which generally lasts up to three weeks.

16

Currently, we are insured under CVR Energy's casualty, environmental, property and business interruption insurance policies; the property and business interruption coverage has a combined policy limit of $1.25 billion. The property and business interruption insurance policies contain limits and sub-limits which insure our assets as well as CVR Energy's assets. There is a potential for a common occurrence to impact both the fertilizer plant and CVR Refining's Coffeyville refinery, in which case the insurance limitations would apply to all damages combined. Under this insurance program, there is a $2.5 million property damage retention in respect of the nitrogen fertilizer plant. For business interruption losses, the insurance program has a 45-day waiting period retention for any one occurrence. In addition, the insurance policies contain a schedule of the sub-limits which apply to certain specific perils or areas of coverage. Sub-limits which may be of importance depending on the nature and extent of a particular insured occurrence are: flood, earthquake, contingent business interruption insuring key suppliers and customers, debris removal, decontamination, demolition and increased cost of construction due to law and ordinance, and others. Such conditions, limits and sub-limits could materially impact insurance recoveries, and potentially cause us to assume losses which could impair earnings.

The nitrogen fertilizer industry is highly capital intensive, and the entire or partial loss of facilities can result in significant costs to participants, such as us, and their insurance carriers. There are risks associated with the commercial insurance industry, reducing capacity, changing the scope of insurance coverage offered and substantially increasing premiums due to adverse loss experience or other financial circumstances. Factors that impact insurance cost and availability include, but are not limited to: industry wide losses, natural disasters, specific losses incurred by us, and the investment returns earned by the insurance industry. If the supply of commercial insurance is curtailed due to highly adverse financial results, CVR Energy or we may not be able to continue our present limits of insurance coverage or obtain sufficient insurance capacity to adequately insure our risks for property damage or business interruption.

Deliberate, malicious acts, including terrorism, could damage our facilities, disrupt our operations or injure employees, contractors, customers or the public and result in liability to us.