Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CHIPOTLE MEXICAN GRILL INC | cmg-20161025x8k.htm |

PRESS RELEASE

Investor Relations:

303-605-1042

Chipotle Mexican Grill, Inc. Announces Third Quarter 2016 Results

Denver, Colorado – (Business Wire) –October 25, 2016– Chipotle Mexican Grill, Inc. (NYSE: CMG) today reported financial results for its third quarter ended September 30, 2016.

Overview for the three months ended September 30, 2016 as compared to the three months ended September 30, 2015:

|

· |

Revenue decreased 14.8% to $1.0 billion |

|

· |

Comparable restaurant transactions decreased 15.2% |

|

· |

Comparable restaurant sales decreased 21.9%, which includes a 0.8% decrease from a revenue deferral related to unredeemed Chiptopia awards |

|

· |

Restaurant level operating margin was 14.1%, a decrease from 28.3%. The Chiptopia revenue deferral negatively impacted restaurant level operating margins by 0.9% |

|

· |

Net income was $7.8 million, a decrease from $144.9 million. Net income includes a $14.5 million non-cash, pretax impairment charge related to ShopHouse and was reduced by an $11.5 million pretax revenue deferral related to Chiptopia |

|

· |

Diluted earnings per share was $0.27, a decrease from $4.59, including $0.29 related to the ShopHouse impairment charge and $0.23 due to the deferral of revenue from Chiptopia |

|

· |

Opened 54 new restaurants, net of one closure |

Overview for the nine months ended September 30, 2016 as compared to the nine months ended September 30, 2015:

|

· |

Revenue decreased 18.1% to $2.9 billion |

|

· |

Comparable restaurant transactions decreased 17.9% |

|

· |

Comparable restaurant sales decreased 24.9% which includes a 0.3% decrease from the revenue deferral related to unredeemed Chiptopia awards |

|

· |

Restaurant level operating margin was 12.5%, a decrease from 27.9% |

|

· |

Net income was $7.0 million, a decrease from net income of $407.7 million |

|

· |

Diluted earnings per share was $0.23, a decrease from $12.92 |

|

· |

Opened 168 new restaurants, net of 3 relocations or closures |

“We continued to make steady progress in our sales recovery during the third quarter. We are earning back our customers’ trust, and our research demonstrates that people are feeling better about our brand, and the quality of our food. While this year has been a year of reinvestment, we are now focused on continuing to further recover sales and improve our economic model to create long-term shareholder value. Today we will share our financial and operational goals for 2017, and our plan to achieve them,” said Steve Ells, founder, chairman and co-CEO of Chipotle.

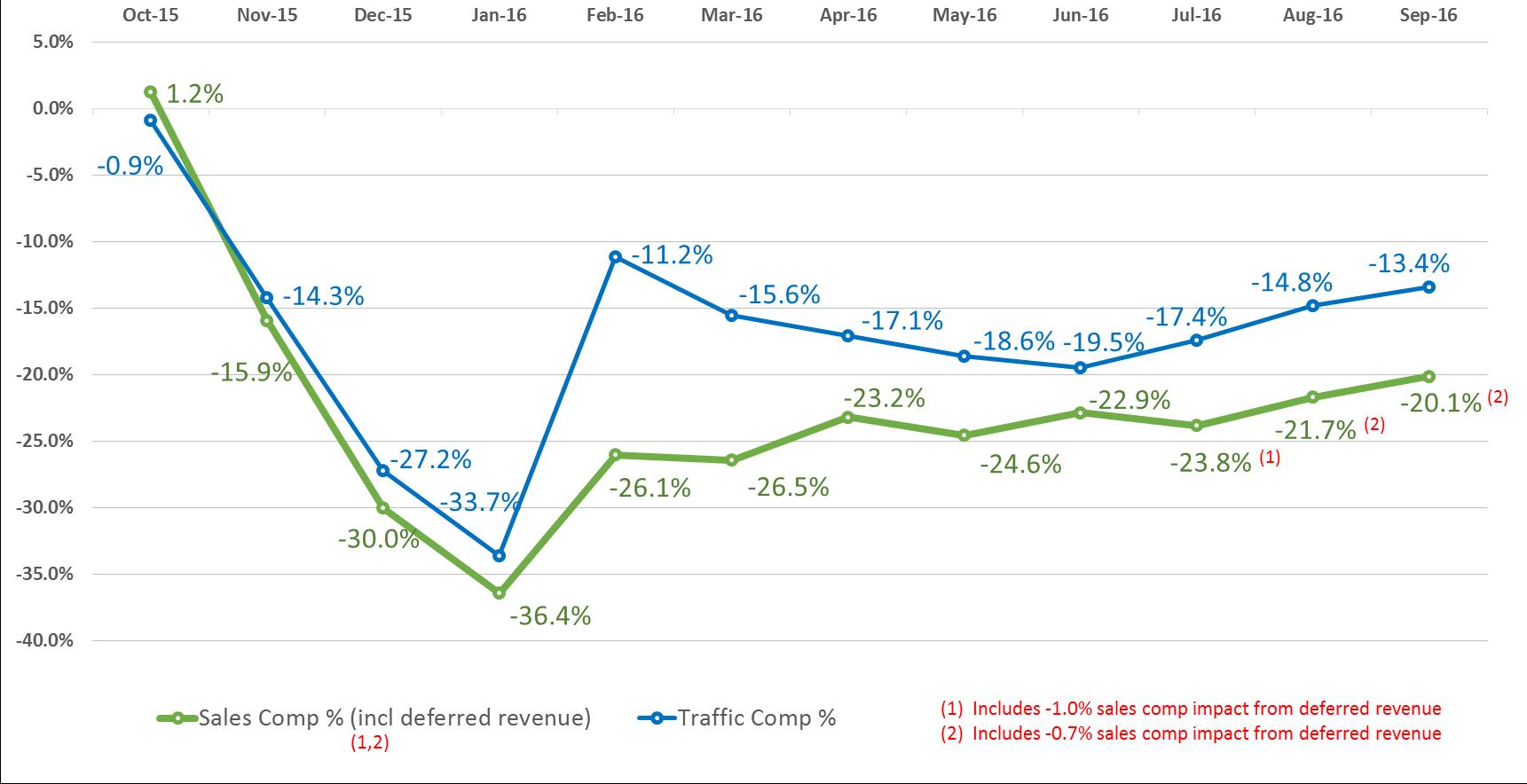

Comparable Restaurant Sales and Transaction Trends

Monthly comparable restaurant sales declines improved 16.3% from a low of 36.4% in January 2016 to 20.1% (net of 0.7% due to the revenue deferral from Chiptopia) in September 2016. Monthly comparable restaurant transaction declines improved 20.3% from a low of 33.7% in January 2016 to 13.4% in September 2016.

“Our restaurant teams are very excited to see more customers return to their restaurants, and are working hard to reward them with an excellent guest experience. After successfully implementing an industry leading food safety program, and as our marketing efforts are driving more people to our restaurants, it is critical that we are prepared to delight customers on every visit. We are confident that we have the leadership and teams in place to do just that,” said Monty Moran, co-CEO.

Third quarter 2016 results

Revenue for the quarter was $1.0 billion, down 14.8% from the third quarter of 2015. The decrease in revenue was driven by a 21.9% decrease in comparable restaurant sales, including a reduction of 0.8% on comparable restaurant sales resulting from deferring $11.5 million of revenue related to unredeemed awards from the Chiptopia Summer Rewards program that ran during the third quarter of 2016, partially offset by sales from new restaurant openings. Comparable restaurant sales declined primarily as a result of a decrease in the number of transactions in our restaurants, and to a lesser extent from a decline in average check.

We opened 54 new restaurants during the quarter, net of one closure, bringing the total restaurant count to 2,178.

Food costs were 35.1% of revenue, an increase of 210 basis points as compared to the third quarter of 2015. The increase was driven by increased waste costs and higher avocado prices, partially offset by relief in beef prices.

Restaurant level operating margin was 14.1% in the quarter, a decrease from 28.3% in the third quarter of 2015. The decrease was driven primarily by sales deleveraging (including 0.9% from the Chipotle revenue deferral) and an increase in marketing and promotional spend which totaled 4.8% of revenue for the third quarter of 2016 compared to 2.4% of revenue in the third quarter of 2015.

General and administrative expenses were 7.6% of revenue for the third quarter of 2016, an increase of 180 basis points over the third quarter of 2015 primarily as a result of sales deleverage. In dollar terms, general and administrative expenses increased compared to the third quarter of 2015 due to expenses associated with our biennial All Managers’ Conference in September 2016 and higher legal

expense, partially offset by lower non-cash stock based compensation expense.

We recorded a non-cash asset impairment charge of $14.5 million related to our ShopHouse Southeast Asian Kitchen restaurants.

Net income for the third quarter of 2016 was $7.8 million, or $0.27 per diluted share, compared to net income of $144.9 million, or $4.59 per diluted share, in the third quarter of 2015.

Our Board of Directors has also approved the investment of up to an additional $100 million, exclusive of commissions, to repurchase shares of our common stock. This repurchase authorization, in addition to up to approximately $69.2 million available as of September 30, 2016 for repurchases under a previously announced repurchase authorization, may be modified, suspended, or discontinued at any time

Results for the nine months ended September 30, 2016

Revenue for the first nine months of 2016 was $2.9 billion, down 18.1% from the first nine months of 2015. The decrease in revenue was driven by a 24.9% decrease in comparable restaurant sales, including a reduction of 0.3% resulting from deferring $11.5 million of revenue related to accounting for Chiptopia, partially offset by sales from new restaurant openings. Comparable restaurant sales declined primarily as a result of a decrease in the number of transactions in our restaurants, and to a lesser extent from a decline in average check.

We opened 168 new restaurants during the first nine months of 2016, net of 3 relocations or closures, bringing the total restaurant count to 2,178.

Food costs were 34.8% of revenue, an increase of 150 basis points as compared to the first nine months of 2015. The increase was driven by increased waste costs and costs related to new food safety procedures, partially offset by the benefit of menu price increases implemented in select restaurants in the second half of 2015.

Restaurant level operating margin was 12.5% for the nine months ended September 30, 2016, a decrease from 27.9% in the first nine months of 2015. The decrease was driven by sales deleveraging and an increase in marketing and promotional spend which totaled 5.2% of revenue in the nine months ended September 30, 2016, compared with 2.1% of revenue for the nine months ended September 30, 2015.

General and administrative expenses were 7.4% of revenue for the first nine months of 2016, an increase of 160 basis points over the first nine months of 2015 primarily as a result of sales deleverage. In dollar terms, general and administrative costs increased compared to the first nine months of 2015 due to expenses associated with our biennial All Managers’ Conference in September 2016 and higher legal expense, partially offset by lower non-cash stock based compensation expense.

Net income for the first nine months of 2016 was $7.0 million, or $0.23 per diluted share, compared to net income of $407.7 million, or $12.92 per diluted share, for the nine months ended September 30, 2015.

Outlook

For 2016, management expects the following:

|

· |

New restaurant openings for the full year at or above the high end of the previously-disclosed range of 220 to 235 |

|

· |

Comparable restaurant sales declines in the low single-digits for the fourth quarter |

|

· |

An effective full year tax rate of approximately 38.2%, which benefited from the recognition of tax credits earned in prior years |

For 2017, management is targeting the following:

|

· |

195 - 210 new restaurant openings |

|

· |

Comparable restaurant sales increases in the high single-digits |

|

· |

Restaurant level operating margins of 20% |

|

· |

An estimated effective full year tax rate of approximately 39.5%, which will be impacted by volatility due to a recently issued accounting standard that changes how the company accounts for taxes associated with stock-based compensation awards. |

|

· |

$10.00 earnings per diluted share |

Definitions

The following definitions apply to these terms as used throughout this release:

Comparable restaurant sales, or sales comps, represent the change in period-over-period sales for restaurants in operation for at least 13 full calendar months.

Comparable restaurant transactions represent the change in period-over-period transactions, including transactions with no sales dollars due to promotional discounts, for restaurants in operation for at least 13 full calendar months.

Restaurant level operating margin represents total revenue less restaurant operating costs, expressed as a percent of total revenue.

Conference Call

Chipotle will host a conference call to discuss the third quarter 2016 financial results on Tuesday, October 25, 2016 at 4:30 PM Eastern time.

The conference call can be accessed live over the phone by dialing 1-877-857-6149 or for international callers by dialing 1-719-325-4751. A replay will be available two hours after the call and can be accessed by dialing 1-877-870-5176 or 1-858-384-5517 for international callers; the password to access the replay is 1052659. The replay will be available until November 1, 2016. The call will be webcast live from the company's website at chipotle.com under the investor relations section. An archived webcast will be available approximately one hour after the end of the call.

About Chipotle

Steve Ells, founder, chairman and co-CEO, started Chipotle with the idea that food served fast did not have to be a typical fast food experience. Today, Chipotle continues to offer a focused menu of burritos, tacos, burrito bowls (a burrito without the tortilla) and salads made from fresh, high-quality ingredients, prepared using classic cooking methods and served in a distinctive atmosphere. Through our vision of Food With Integrity, Chipotle is seeking better food from using ingredients that are not only fresh, but that—where possible—are sustainably grown and raised responsibly with respect for the animals, the land, and the farmers who produce the food. In order to achieve this vision, we focus on building a special people culture that is centered on creating teams of top performers empowered to achieve high standards. This people culture not only leads to a better dining experience for our customers, it also allows us to develop future leaders from within. Chipotle opened with a single restaurant in 1993 and operates more than 2,100 restaurants, including 27 Chipotle restaurants outside the U.S. and 15 ShopHouse Southeast Asian Kitchen restaurants, and is an investor in an entity that owns and operates seven Pizzeria Locale restaurants. For more information, visit Chipotle.com.

Forward-Looking Statements

Certain statements in this press release, including statements under the heading “Outlook” of our expected number of new restaurant openings, levels of comparable restaurant sales, effective tax rates, earnings per share, and restaurant level operating margins are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. We use words such as “anticipate”, “believe”, “could”, “should”, “estimate”, “expect”, “intend”, “may”, “predict”, “project”, “target”, and similar terms and phrases, including references to assumptions, to identify forward-looking statements. The forward-looking statements in this press release are based on information available to us as of the date any such statements are made and we assume no obligation to update these forward-looking statements. These statements are subject to risks and uncertainties that could cause actual results to differ materially from those described in the statements. These risks and uncertainties include, but are not limited to, the following: the uncertainty of our ability to achieve expected levels of comparable restaurant sales due to factors such as changes in consumers’ acceptance of and enthusiasm for our brand, including as a result of recent food-borne illness incidents, the impact of competition, including sources outside the restaurant industry, decreased overall consumer spending, or our possible inability to increase menu prices or realize the benefits of menu price increases; the risk of food-borne illnesses and other health concerns about our food or dining out generally; factors that could affect our ability to achieve and manage our planned expansion, such as the availability of a sufficient number of suitable new restaurant sites and the availability of qualified employees; the performance of new restaurants and their impact on existing restaurant sales; increases in the cost of food ingredients and other key supplies or higher food costs due to new supply chain protocols; the potential for increased labor costs or difficulty retaining qualified employees, including as a result of market pressures, enhanced food safety procedures in our restaurants, or new regulatory requirements; risks relating to our expansion into new markets; the impact of federal, state or local government regulations relating to our employees, our restaurant design, or the sale of food or alcoholic beverages; risks associated with our Food With Integrity strategy, including supply shortages and potential liabilities from advertising claims and other marketing activities related to Food With Integrity; security risks associated with the acceptance of electronic payment cards or electronic storage and processing of confidential customer or employee information; risks relating to litigation, including possible governmental actions related to food-borne illness incidents, as well as class action litigation regarding employment laws, advertising claims or other matters; risks relating to our insurance coverage and self-insurance; our dependence on key personnel; risks related to our marketing and advertising strategies, including risks related to our Chiptopia rewards program and other promotional activities; risks regarding our ability to protect our brand and reputation; risks associated with our ability to effectively manage our growth; and other risk factors described from time to time in our SEC reports, including our most recent annual report on Form 10-K and subsequent quarterly reports on Form 10-Q, all of which are

available on the investor relations page of our website at ir.Chipotle.com.

Chipotle Mexican Grill, Inc.

Condensed Consolidated Statement of Income and Comprehensive Income

(in thousands, except per share data)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, |

||||||||||

|

|

2016 |

|

2015 |

||||||||

|

Revenue |

$ |

1,036,982 |

|

100.0 |

% |

|

$ |

1,216,890 |

|

100.0 |

% |

|

Restaurant operating costs (exclusive of depreciation and amortization shown separately below): |

|

|

|

|

|

|

|

|

|

|

|

|

Food, beverage and packaging |

|

363,900 |

|

35.1 |

|

|

|

401,051 |

|

33.0 |

|

|

Labor |

|

286,144 |

|

27.6 |

|

|

|

270,076 |

|

22.2 |

|

|

Occupancy |

|

74,201 |

|

7.2 |

|

|

|

66,391 |

|

5.5 |

|

|

Other operating costs |

|

166,045 |

|

16.0 |

|

|

|

134,879 |

|

11.1 |

|

|

General and administrative expenses |

|

78,405 |

|

7.6 |

|

|

|

70,066 |

|

5.8 |

|

|

Depreciation and amortization |

|

37,434 |

|

3.6 |

|

|

|

33,145 |

|

2.7 |

|

|

Pre-opening costs |

|

4,490 |

|

0.4 |

|

|

|

4,367 |

|

0.4 |

|

|

Loss on disposal and impairment of assets |

|

16,637 |

|

1.6 |

|

|

|

2,156 |

|

0.2 |

|

|

Total operating expenses |

|

1,027,256 |

|

99.1 |

|

|

|

982,131 |

|

80.7 |

|

|

Income from operations |

|

9,726 |

|

0.9 |

|

|

|

234,759 |

|

19.3 |

|

|

Interest and other income, net |

|

672 |

|

0.1 |

|

|

|

1,518 |

|

0.1 |

|

|

Income before income taxes |

|

10,398 |

|

1.0 |

|

|

|

236,277 |

|

19.4 |

|

|

Provision for income taxes |

|

(2,599) |

|

(0.3) |

|

|

|

(91,394) |

|

(7.5) |

|

|

Net income |

$ |

7,799 |

|

0.8 |

% |

|

$ |

144,883 |

|

11.9 |

% |

|

Other comprehensive income, net of income taxes: |

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

(203) |

|

|

|

|

|

(1,718) |

|

|

|

|

Unrealized gain (loss) on investments, net of income taxes of $(346) and $0 |

|

(536) |

|

|

|

|

|

- |

|

|

|

|

Other comprehensive income (loss), net of income taxes |

|

(739) |

|

|

|

|

|

(1,718) |

|

|

|

|

Comprehensive income |

$ |

7,060 |

|

|

|

|

$ |

143,165 |

|

|

|

|

Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.27 |

|

|

|

|

$ |

4.65 |

|

|

|

|

Diluted |

$ |

0.27 |

|

|

|

|

$ |

4.59 |

|

|

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

29,063 |

|

|

|

|

|

31,187 |

|

|

|

|

Diluted |

|

29,171 |

|

|

|

|

|

31,548 |

|

|

|

Chipotle Mexican Grill, Inc.

Condensed Consolidated Statement of Income and Comprehensive Income

(in thousands, except per share data)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine months ended September 30, |

||||||||||

|

|

2016 |

|

2015 |

||||||||

|

Revenue |

$ |

2,869,824 |

|

100.0 |

% |

|

$ |

3,503,716 |

|

100.0 |

% |

|

Restaurant operating costs (exclusive of depreciation and amortization shown separately below): |

|

|

|

|

|

|

|

|

|

|

|

|

Food, beverage and packaging |

|

999,968 |

|

34.8 |

|

|

|

1,166,770 |

|

33.3 |

|

|

Labor |

|

820,751 |

|

28.6 |

|

|

|

785,141 |

|

22.4 |

|

|

Occupancy |

|

217,147 |

|

7.6 |

|

|

|

194,269 |

|

5.5 |

|

|

Other operating costs |

|

473,390 |

|

16.5 |

|

|

|

378,779 |

|

10.8 |

|

|

General and administrative expenses |

|

211,171 |

|

7.4 |

|

|

|

203,339 |

|

5.8 |

|

|

Depreciation and amortization |

|

108,296 |

|

3.8 |

|

|

|

96,228 |

|

2.7 |

|

|

Pre-opening costs |

|

13,044 |

|

0.5 |

|

|

|

11,470 |

|

0.3 |

|

|

Loss on disposal and impairment of assets |

|

22,040 |

|

0.8 |

|

|

|

7,744 |

|

0.2 |

|

|

Total operating expenses |

|

2,865,807 |

|

99.9 |

|

|

|

2,843,740 |

|

81.2 |

|

|

Income from operations |

|

4,017 |

|

0.1 |

|

|

|

659,976 |

|

18.8 |

|

|

Interest and other income, net |

|

3,584 |

|

0.1 |

|

|

|

4,483 |

|

0.1 |

|

|

Income before income taxes |

|

7,601 |

|

0.3 |

|

|

|

664,459 |

|

19.0 |

|

|

Provision for income taxes |

|

(638) |

|

(0.0) |

|

|

|

(256,731) |

|

(7.3) |

|

|

Net income |

$ |

6,963 |

|

0.2 |

% |

|

$ |

407,728 |

|

11.6 |

% |

|

Other comprehensive income, net of income taxes: |

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

961 |

|

|

|

|

|

(4,699) |

|

|

|

|

Unrealized gain (loss) on investments, net of income taxes of $1,185 and $0 |

|

1,866 |

|

|

|

|

|

- |

|

|

|

|

Other comprehensive income (loss), net of income taxes |

|

2,827 |

|

|

|

|

|

(4,699) |

|

|

|

|

Comprehensive income |

$ |

9,790 |

|

|

|

|

$ |

403,029 |

|

|

|

|

Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.24 |

|

|

|

|

$ |

13.10 |

|

|

|

|

Diluted |

$ |

0.23 |

|

|

|

|

$ |

12.92 |

|

|

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

29,387 |

|

|

|

|

|

31,115 |

|

|

|

|

Diluted |

|

29,792 |

|

|

|

|

|

31,556 |

|

|

|

Chipotle Mexican Grill, Inc.

Condensed Consolidated Balance Sheet

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

December 31, |

||

|

|

2016 |

|

2015 |

||

|

|

(unaudited) |

|

|

||

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

154,128 |

|

$ |

248,005 |

|

Accounts receivable, net of allowance for doubtful accounts of $1,275 and $1,176 as of September 30, 2016 and December 31, 2015, respectively |

|

22,103 |

|

|

38,283 |

|

Inventory |

|

18,382 |

|

|

15,043 |

|

Prepaid expenses and other current assets |

|

45,250 |

|

|

39,965 |

|

Income tax receivable |

|

24,013 |

|

|

58,152 |

|

Investments |

|

205,021 |

|

|

415,199 |

|

Total current assets |

|

468,897 |

|

|

814,647 |

|

Leasehold improvements, property and equipment, net |

|

1,278,672 |

|

|

1,217,220 |

|

Long term investments |

|

250,659 |

|

|

622,939 |

|

Other assets |

|

46,866 |

|

|

48,321 |

|

Goodwill |

|

21,939 |

|

|

21,939 |

|

Total assets |

$ |

2,067,033 |

|

$ |

2,725,066 |

|

Liabilities and shareholders' equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

74,682 |

|

$ |

85,709 |

|

Accrued payroll and benefits |

|

97,009 |

|

|

64,958 |

|

Accrued liabilities |

|

107,808 |

|

|

129,275 |

|

Total current liabilities |

|

279,499 |

|

|

279,942 |

|

Deferred rent |

|

279,359 |

|

|

251,962 |

|

Deferred income tax liability |

|

33,862 |

|

|

32,305 |

|

Other liabilities |

|

33,293 |

|

|

32,883 |

|

Total liabilities |

|

626,013 |

|

|

597,092 |

|

Shareholders' equity: |

|

|

|

|

|

|

Preferred stock, $0.01 par value, 600,000 shares authorized, no shares issued as of September 30, 2016 and December 31, 2015, respectively |

|

- |

|

|

- |

|

Common stock $0.01 par value, 230,000 shares authorized, and 35,830 and 35,790 shares issued as of September 30, 2016 and December 31, 2015, respectively |

|

358 |

|

|

358 |

|

Additional paid-in capital |

|

1,223,760 |

|

|

1,172,628 |

|

Treasury stock, at cost, 6,848 and 5,206 common shares at September 30, 2016 and December 31, 2015, respectively |

|

(1,982,488) |

|

|

(1,234,612) |

|

Accumulated other comprehensive income (loss) |

|

(5,446) |

|

|

(8,273) |

|

Retained earnings |

|

2,204,836 |

|

|

2,197,873 |

|

Total shareholders' equity |

|

1,441,020 |

|

|

2,127,974 |

|

Total liabilities and shareholders' equity |

$ |

2,067,033 |

|

$ |

2,725,066 |

Chipotle Mexican Grill, Inc.

Condensed Consolidated Statement of Cash Flows

(unaudited)

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine months ended September 30, |

||||

|

|

2016 |

|

2015 |

||

|

Operating activities |

|

|

|

|

|

|

Net income |

$ |

6,963 |

|

$ |

407,728 |

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

108,296 |

|

|

96,228 |

|

Deferred income tax (benefit) provision |

|

380 |

|

|

(12,542) |

|

Loss on disposal and impairment of assets |

|

22,040 |

|

|

7,744 |

|

Bad debt allowance |

|

99 |

|

|

(27) |

|

Stock-based compensation expense |

|

48,389 |

|

|

59,725 |

|

Excess tax benefit on stock-based compensation |

|

(1,888) |

|

|

(74,861) |

|

Other |

|

(224) |

|

|

273 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

16,084 |

|

|

10,637 |

|

Inventory |

|

(3,442) |

|

|

(2,212) |

|

Prepaid expenses and other current assets |

|

(5,362) |

|

|

(3,028) |

|

Other assets |

|

1,509 |

|

|

(3,967) |

|

Accounts payable |

|

(11,938) |

|

|

7,101 |

|

Accrued liabilities |

|

36,245 |

|

|

(7,434) |

|

Income tax payable/receivable |

|

36,026 |

|

|

77,858 |

|

Deferred rent |

|

27,319 |

|

|

21,532 |

|

Other long-term liabilities |

|

576 |

|

|

3,808 |

|

Net cash provided by operating activities |

|

281,072 |

|

|

588,563 |

|

Investing activities |

|

|

|

|

|

|

Purchases of leasehold improvements, property and equipment |

|

(192,252) |

|

|

(181,840) |

|

Purchases of investments |

|

- |

|

|

(433,829) |

|

Maturities of investments |

|

45,000 |

|

|

287,450 |

|

Proceeds from sale of investments |

|

540,648 |

|

|

- |

|

Net cash provided by (used in) investing activities |

|

393,396 |

|

|

(328,219) |

|

Financing activities |

|

|

|

|

|

|

Acquisition of treasury stock |

|

(771,354) |

|

|

(147,122) |

|

Excess tax benefit on stock-based compensation |

|

1,888 |

|

|

74,862 |

|

Stock plan transactions and other financing activities |

|

23 |

|

|

(225) |

|

Net cash used in financing activities |

|

(769,443) |

|

|

(72,485) |

|

Effect of exchange rate changes on cash and cash equivalents |

|

1,098 |

|

|

(3,162) |

|

Net change in cash and cash equivalents |

|

(93,877) |

|

|

184,697 |

|

Cash and cash equivalents at beginning of period |

|

248,005 |

|

|

419,465 |

|

Cash and cash equivalents at end of period |

$ |

154,128 |

|

$ |

604,162 |

Chipotle Mexican Grill, Inc.

Supplemental Financial and Other Data

(dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended |

|||||||||||||

|

|

|

Sep. 30, |

|

Jun. 30, |

|

Mar. 31, |

|

Dec. 31, |

|

Sep. 30, |

|||||

|

|

|

2016 |

|

2016 |

|

2016 |

|

2015 |

|

2015 |

|||||

|

Number of restaurants opened |

|

|

55 |

|

|

58 |

|

|

58 |

|

|

79 |

|

|

53 |

|

Restaurant relocations/closures |

|

|

(1) |

|

|

- |

|

|

(2) |

|

|

- |

|

|

- |

|

Number of restaurants at end of period |

|

|

2,178 |

|

|

2,124 |

|

|

2,066 |

|

|

2,010 |

|

|

1,931 |

|

Average restaurant sales |

|

$ |

1,914 |

|

$ |

2,067 |

|

$ |

2,230 |

|

$ |

2,424 |

|

$ |

2,532 |

|

Comparable restaurant sales increase (decrease) |

|

|

(21.9%) |

|

|

(23.6%) |

|

|

(29.7%) |

|

|

(14.6%) |

|

|

2.6% |