Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - FIRST FINANCIAL BANCORP /OH/ | a8k3q16earningsreleaseex991.htm |

| 8-K - 8-K - FIRST FINANCIAL BANCORP /OH/ | a8kearningsrelease3q16.htm |

1

Exhibit 99.2

2

This earnings presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. These statements are not based on historical or current facts, but rather on our current beliefs,

expectations, assumptions and projections about our business, the economy and other future conditions. Forward-looking

statements often include words such as ‘‘believes,’’ ‘‘anticipates,’’ “likely,” “expected,” ‘‘intends,’’ “could,” “should,” and other

similar references to future periods. Examples of forward-looking statements include, but are not limited to, statements we

make about (i) our future operating or financial performance, including revenues, income or loss and earnings or loss per

share, (ii) future common stock dividends, (iii) our capital structure, including future capital levels, (iv) our plans, objectives

and strategies, and (v) the assumptions that underlie our forward-looking statements.

As with any forecast or projection, forward-looking statements are subject to inherent uncertainties, risks and changes in

circumstances that may cause actual results to differ materially from those set forth in the forward-looking

statements. Important factors that could cause actual results to differ materially from those in our forward-looking

statements include the following, without limitation: (i) economic, market, liquidity, credit, interest rate, operational and

technological risks associated with the Company’s business; (ii) the effect of and changes in policies and laws or

regulatory agencies, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and other legislation and

regulation relating to the banking industry; (iii) management’s ability to effectively execute its business plans; (iv) mergers

and acquisitions, including cost or difficulties related to the integration of acquired companies; (v) the Company’s ability to

comply with the terms of loss sharing agreements with the FDIC; (vi) the effect of changes in accounting policies and

practices; (vii) changes in consumer spending, borrowing and saving and changes in unemployment; (viii) changes in

customers’ performance and creditworthiness; and (ix) the costs and effects of litigation and of unexpected or adverse

outcomes in such litigation. Additional factors that may cause our actual results to differ materially from those described in

our forward-looking statements can be found in the Company’s Annual Report on Form 10-K for the year ended December

31, 2015, as well as its other filings with the SEC, which are available on the SEC website at www.sec.gov.

Forward-looking statements are meaningful only on the date when such statements are made. We undertake no

obligation to update any forward-looking statement to reflect events or circumstances that may arise after the date on

which a forward-looking statement is made.

Forward Looking Statement Disclosure

3

3Q 2016 Highlights – 104th Consecutive Quarter of Profitability

Total assets increased $58.4 million, to $8.4 billion, compared to the linked quarter.

EOP loans increased $88.3 million, or 6.2% annualized, compared to the linked quarter.

EOP deposits increased $219.1 million, or 14.2% annualized, compared to the linked quarter.

EOP investment securities decreased $35.6 million, or 1.9%, compared to the linked quarter.

Balance Sheet

Profitability

Asset Quality

Net Interest Income

&

Net Interest Margin

Non-Interest Income

&

Non-Interest Expense

Capital

Non-interest income = $16.9 million.

Non-interest expense = $51.1 million.

Efficiency ratio = 59.6%.

Effective tax rate of 30.7%, including seasonal adjustments

Net interest income = $68.8 million, a $1.7 million increase compared to the linked quarter.

Net interest margin was unchanged at 3.61%; decreased by 1bp to 3.66% on a fully tax equivalent basis.

6.1% annualized growth in average earning assets

Net income = $22.9 million or $0.37 per diluted share.

Return on average assets = 1.09%.

Return on average shareholders’ equity = 10.62%.

Return on average tangible common equity = 14.08%.

Provision expense = $1.7 million. Net charge offs = $0.8 million. NCOs / Avg. Loans = 0.05% annualized.

Non-performing Loans / Total Loans = 0.87%. Non-performing Assets / Total Assets = 0.69%.

ALLL / Non-accrual Loans = 314.8%. ALLL / Total Loans = 1.00%.

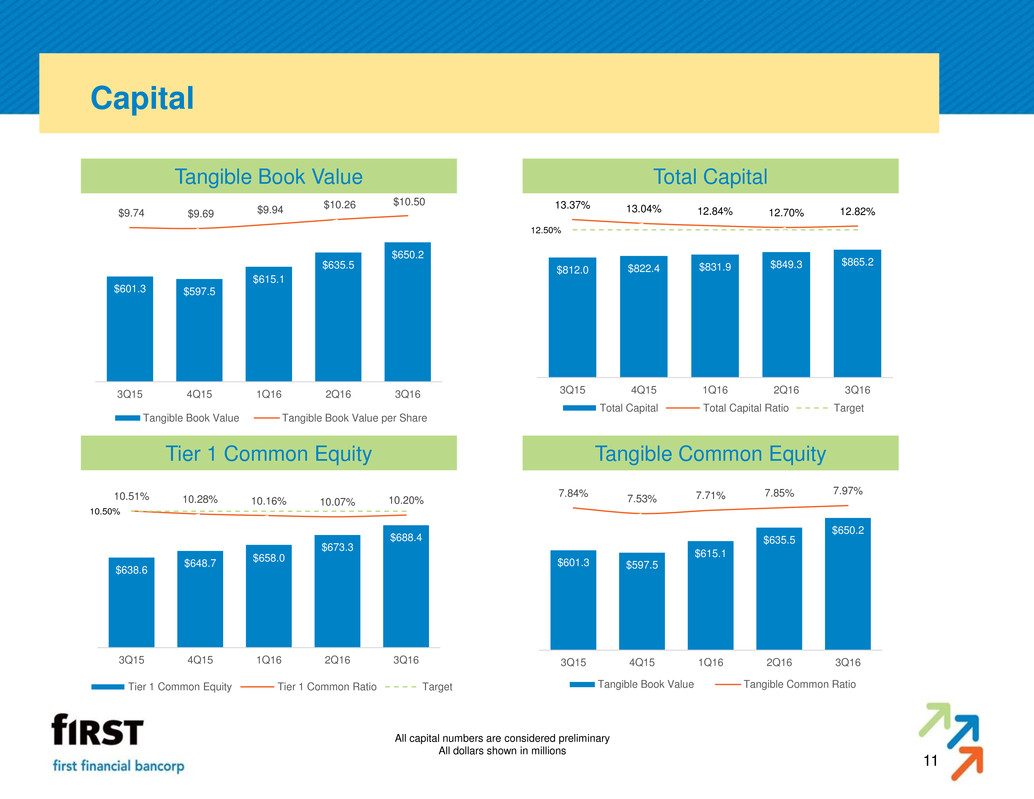

Total capital ratio = 12.82%.

Tier 1 capital ratio = 10.20%.

Tangible common equity ratio = 7.97%.

Tangible book value per share = $10.50.

4

Profitability

Net Income & EPS Return on Average Assets

Return on Tangible Common Equity

All dollars shown in millions

$22.9 $22.6

$19.8 $19.8

$18.7

$0.37 $0.36

$0.32 $0.32

$0.30

3Q162Q161Q164Q153Q15

Net Income EPS

$8,322 $8,204 $8,119

$7,950

$7,611

1.09% 1.11%

0.98% 0.99% 0.97%

3Q162Q161Q164Q153Q15

Average Assets ROAA

$645

$626

$610 $606 $601

14.08% 14.49%

13.06% 12.98%

12.33%

3Q162Q161Q164Q153Q15

Average Tangible Equity ROATCE

5

Adjusted Net Income

Reflects impact to net income from items that do not occur on a regular basis

Earnings Diluted EPS Earnings Diluted EPS

GAAP net income 22,850$ 0.37$ 22,568$ 0.36$

Less: noninterest income adjustments 1,2 (398) (2,164)

Plus: noninterest expense adjustments 3.4 411 162

Subtotal 22,863 20,566

Tax adjustments (4) 843

Adjusted net income 22,859$ 0.37$ 21,409$ 0.35$

3Q 2016 2Q 2016

1

3Q 2016 noninterest income includes $0.4 million in gains on sales of investment securities

3

3Q 2016 adjustments include $0.8 million of severence expense, $0.2 million of gains related to branch consolidation activities and a $0.2 million legal recovery

(Dollars in thousands)

2

2Q 2016 noninterest income includes $2.4 million of previously unrealized income from the redemption of a limited partnship investment during the period and

$0.2 million in losses on sales of investment securities

4

2Q 2016 adjustments include $0.2 million of expenses related to branch consolidation activities

6

Net Interest Income / Net Interest Margin

Gross loans include loans held for sale & FDIC indemnification asset

All dollars shown in millions

Average Deposits Net Interest Income

Average Securities Average Loans

$68.8

$67.1 $66.6 $66.1

$63.2

3.66% 3.67%

3.68% 3.69%

3.67%

3Q162Q161Q164Q153Q15

Net Interest Income Net Interest Margin (FTE)

$1,811

$1,870

$1,939 $1,934

$1,848

2.50%

2.54% 2.59%

2.44%

2.39%

3Q162Q161Q164Q153Q15

Average Investment Securities Investment Securities Yield

$5,758

$5,584

$5,435

$5,267

$5,053

4.54% 4.55% 4.59%

4.62%

4.52%

3Q162Q161Q164Q153Q15

Gross Loans Loan Yield

23% 23% 23% 22% 23%

23% 24% 23% 23% 21%

33% 32% 32% 32% 34%

21% 21% 23% 23% 23%

$6,201 $6,309 $6,136 $6,247 $5,960

0.36% 0.35% 0.36%

0.33% 0.32%

3Q162Q161Q164Q153Q15

NIB Demand IB Demand Savings

Time Cost of Deposits

7

Non-Interest Income

Non-Interest Income 3Q16 Highlights

* Includes net gain on sale of investment securities & other noninterest income.

All dollars shown in millions

Total other non-interest income

decreased $3.2 million, or 16.1%, on

lower loss share related & other

income

Service charges on deposits

increased $0.6 million, or 13.5%

Gains from sales of mortgage loans

increased $0.2 million, or 11.9%

Loss share related income decreased

$1.4 million, or 111.8%

Other non-interest income decreased

$2.5 million, or 53.5%, due to $2.4

million of income from the redemption

of a limited partnership investment in

2Q

Included $0.4 million in gains on sale

of investment securities

30% 22% 28% 30% 24%

19%

16% 22% 20%

15%

18%

15% 19% 19% 14%

12%

9%

8% 8%

9%

7% 9%

7% 6%

8%

6%

3% 4%

14% 14%

22%

14% 13%

16%

$16.9

$20.2

$15.5 $15.8

$20.4

3Q162Q161Q164Q153Q15

Service Charges Wealth Mgmt

Bankcard Gains from sales of loans

Client derivatives Loss Share Income

Other *

8

Non-Interest Expense

Noninterest Expense 3Q16 Highlights

Efficiency Ratio

All dollars shown in millions

Total non-interest expense increased

$1.7 million, or 3.4%

$2.6 million, or 8.7%, increase in salary

& benefits expense, which includes

$0.8 million of severance costs & YTD

performance based compensation

accruals

$1.1 million, or 18.1%, decline in other

non-interest expense includes $0.4

million of gains related to branch

consolidation activities

Net occupancy expenses include $0.2

million of lease termination costs

related to branch consolidations

63% 60% 58% 58% 52%

37%

40% 42% 42% 48%

$51.1 $49.4 $50.7 $51.3

$53.0

1,402 1,403 1,390 1,400 1,394

3Q162Q161Q164Q153Q15

Personnel Non-Personnel FTE

$51.1

$49.4

$50.7 $51.3

$53.0

59.6%

56.6%

61.8% 62.6%

63.5%

3Q162Q161Q164Q153Q15

NIE Efficiency Ratio

9

Loan Portfolio

Loan Product Mix (EOP) Net Loan Change (Linked Quarter)

* Includes residential mortgage, home equity, installment, & credit card.

All dollars shown in millions

Highlights

32% 33% 34% 33% 33%

14% 14% 14% 15% 15%

29% 28%

27% 27% 27%

7% 7%

6%

6%

5%

18% 19%

19%

20%

20%

$5,790 $5,701

$5,505

$5,389

$5,216

3Q162Q161Q164Q153Q15

Commercial & Leasing Owner Occupied CRE Investor CRE

Construction Consumer Lending*

-$16.0

$1.2

-$4.0

$103.5

$9.4

-$5.8

Commercial & Leasing

Owner Occupied CRE

Owner Occupied Construction

Investor CRE

Investor Construction

Consumer Lending*

-$18.8

Total C&I

Portfolio continues to be well-balanced

3Q impacted by strong ICRE production as well

as elevated C&I prepayment activity

4Q production expected to be biased toward C&I

ICRE & Construction concentration levels of 227%

and 56% of total capital, well below 300%/100%

regulatory guidance.

10

Asset Quality

Non-Performing Assets / Total Assets Classified Assets / Total Assets

Allowance / Total Loans Net Charge Offs & Provision Expense

All dollars shown in millions

$58.0

$59.6

$64.1

$70.1 $71.1

0.69% 0.72%

0.78%

0.86%

0.90%

3Q162Q161Q164Q153Q15

NPAs NPAs / Total Assets

$57.6 $56.7 $53.7 $53.4 $53.3

1.00% 0.99% 0.98% 0.99% 1.02%

3Q162Q161Q164Q153Q15

Allowance for Loan Losses ALLL / Total Loans

$0.8 $1.1 $1.3 $1.8 $2.2

$1.7

$4.0

$1.7

$1.9

$2.6

0.05% 0.08%

0.10%

0.14% 0.17%

3Q162Q161Q164Q153Q15

NCOs Provision Expense NCOs / Average Loans

$142.2 $143.3

$133.9 $132.4 $130.1

1.70% 1.72%

1.63% 1.63% 1.63%

3Q162Q161Q164Q153Q15

Classified Assets Classified Assets / Total Assets

11

Capital

Tier 1 Common Equity

Tangible Book Value Total Capital

Tangible Common Equity

All capital numbers are considered preliminary

All dollars shown in millions

$650.2

$635.5

$615.1

$597.5 $601.3

$10.50 $10.26 $9.94 $9.69 $9.74

3Q162Q161Q164Q153Q15

Tangible Book Value Tangible Book Value per Share

$865.2 $849.3 $831.9 $822.4 $812.0

12.82% 12.70% 12.84% 13.04%

13.37%

12.50%

3Q162Q161Q164Q153Q15

Total Capital Total Capital Ratio Target

$688.4

$673.3

$658.0

$648.7

$638.6

10.20% 10.07% 10.16% 10.28%

10.51%

10.50%

3Q162Q161Q164Q153Q15

Tier 1 Common Equity Tier 1 Common Ratio Target

$650.2

$635.5

$615.1

$597.5 $601.3

7.97% 7.85% 7.71% 7.53%

7.84%

3Q162Q161Q164Q153Q15

Tangible Book Value Tangible Common Ratio

12

Strategy & Outlook

Focus remains on organic growth & executing our core strategy:

1. Growing loans at risk-appropriate returns

Strong organic growth opportunities resulting from the mix of markets, products & businesses

built over the last five years

Full year 2016 loan growth trending toward high single digits

Stable margin outlook in the near term, similar to year to date results

2. Growing core deposits to fund loan growth & generate fee income

Ever-present focus on growing low cost, core deposits

Continue repositioning our balance sheet - redeploy cash flows from securities to fund

organic loan growth

3. Growing noninterest income to help build & diversify revenue

Strategies focused on product pricing, governance & client penetration

4. Maintaining our focus on efficiency & diligent expense management

Non-interest expense base expected to be approximately $50 million per quarter

Full year effective tax rate of approximately 32.5%

5. Remaining vigilant in our credit oversight

13

Appendix: Non-GAAP to GAAP Reconciliation

Net interest income and net interest margin - fully tax equivalent

Sep. 30, June 30, Mar. 31, Dec. 31, Sep. 30, Sep. 30, Sep. 30,

2016 2016 2016 2015 2015 2016 2015

Net interest income $68,818 $67,132 $66,555 $66,083 $63,159 $202,505 $180,419

Tax equivalent

adjustment 1,028 1,058 1,052 1,046 1,000 3,138 2,971

Net interest income -

tax equivalent $69,846 $68,190 $67,607 $67,129 $64,159 $205,643 $183,390

Average earning assets $7,591,160 $7,475,711 $7,398,013 $7,219,995 $6,938,107 $7,488,670 $6,711,900

Net interest margin* 3.61 % 3.61 % 3.62 % 3.63 % 3.61 % 3.61 % 3.59 %

Net interest margin (fully

tax equivalent)* 3.66 % 3.67 % 3.68 % 3.69 % 3.67 % 3.67 % 3.65 %

Three months ended YTD

* Margins are calculated using net interest income annualized divided by average earning assets.

Net interest income-tax equivalent, appears in the tables entitled “Additional Data” at the bottom of the “Consolidated Quarterly Statements of

Income” pages. The tax equivalent adjustment to net interest income recognizes the income tax savings when comparing taxable and tax-

exempt assets and assumes a 35% tax rate. Management believes that it is a standard practice in the banking industry to present net interest

margin and net interest income on a fully tax equivalent basis. Therefore, management believes these measures provide useful information to

investors by allowing them to make peer comparisons. Management also uses these measures to make peer comparisons.

14

Appendix: Non-GAAP to GAAP Reconciliation

Additional non-GAAP ratios

Sep. 30, June 30, Mar. 31, Dec. 31, Sep. 30, Sep. 30, Sep. 30,

(Dollars in thousands, except per share data) 2016 2016 2016 2015 2015 2016 2015

Net income (a) $22,850 $22,568 $19,814 $19,820 $18,673 $65,232 $55,243

Average total shareholders' equity 856,296 837,412 821,588 817,756 812,396 838,497 800,589

Less:

Goodw ill and other intangible (210,888) (211,199) (211,533) (211,865) (211,732) (210,888) (211,732)

Average tangible equity (b) 645,408 626,213 610,055 605,891 600,664 627,609 588,857

Total shareholders' equity 861,137 846,723 826,587 809,376 813,012 861,137 813,012

Less:

Goodw ill (210,888) (211,199) (211,533) (211,865) (211,732) (210,888) (211,732)

Ending tangible equity (c) 650,249 635,524 615,054 597,511 601,280 650,249 601,280

Total assets 8,368,481 8,310,102 8,193,554 8,147,411 7,880,533 8,368,481 7,880,533

Less:

Goodw ill (210,888) (211,199) (211,533) (211,865) (211,732) (210,888) (211,732)

Ending tangible assets (d) 8,157,593 8,098,903 7,982,021 7,935,546 7,668,801 8,157,593 7,668,801

Risk-w eighted assets (e) 6,750,749 6,685,158 6,478,716 6,308,139 6,073,899 6,750,749 6,073,899

Total average assets 8,322,156 8,203,837 8,118,945 7,950,278 7,611,389 8,215,370 7,353,698

Less:

Goodw ill (210,888) (211,199) (211,533) (211,865) (211,732) (210,888) (211,732)

Average tangible assets (f) $8,111,268 $7,992,638 $7,907,412 $7,738,413 $7,399,657 $8,004,482 $7,141,966

Ending shares outstanding (g) 61,952,873 61,959,529 61,855,027 61,641,680 61,713,633 61,952,873 61,713,633

Ratios

Return on average tangible shareholders' equity (a)/(b) 14.08 % 14.49 % 13.06 % 12.98 % 12.33 % 13.88 % 12.54 %

Ending tangible equity as a percent of:

Ending tangible assets (c)/(d) 7.97 % 7.85 % 7.71 % 7.53 % 7.84 % 7.97 % 7.84 %

Risk-w eighted assets (c)/(e) 9.63 % 9.51 % 9.49 % 9.47 % 9.90 % 9.63 % 9.90 %

Average tangible equity as a percent of average tangible

assets (b)/(f) 7.96 % 7.83 % 7.71 % 7.83 % 8.12 % 7.84 % 8.25 %

Tangible book value per share (c)/(g) 10.50$ 10.26$ 9.94$ 9.69$ 9.74$ 10.50$ $9.74

Three months ended YTD

The earnings press release also includes some non-GAAP ratios in the “Consolidated Financial Highlights” page. These ratios are: (1) Return on average tangible shareholders' equity; (2) Ending

tangible shareholders' equity as a percent of ending tangible assets; (3) Ending tangible shareholders' equity as a percent of risk-w eighted assets; (4) Average tangible shareholders' equity as a

percent of average tangible assets; and (5) Tangible book value per share. The Ending tangible shareholders' equity as a percent of ending tangible assets and Average tangible shareholders'

equity as a percent of average tangible assets are also show n in the “Regulatory Capital” section of the “Capital Adequacy” page in the earnings release. The Company considers these critical

metrics w ith w hich to analyze banks. The ratios have been included in the earnings press release to facilitate a better understanding of the Company's capital structure and f inancial condition.

15